eScore

metlife.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

MetLife has a strong authoritative digital presence, anchored by high domain authority and in-depth B2B thought leadership content like its 'Enduring Retirement Model Study'. This positions them as an expert in the employee benefits space. However, their digital presence is heavily skewed towards this B2B audience and existing customers, with a noticeable gap in top-of-funnel content designed to attract individual consumers, forcing a reliance on paid search for B2C acquisition.

High content authority and thought leadership in the B2B employee benefits and retirement sectors, supported by comprehensive, data-driven reports.

Develop a dedicated 'Financial Wellness Hub' with accessible, SEO-optimized content to capture organic traffic from individual consumers at the awareness stage of their journey.

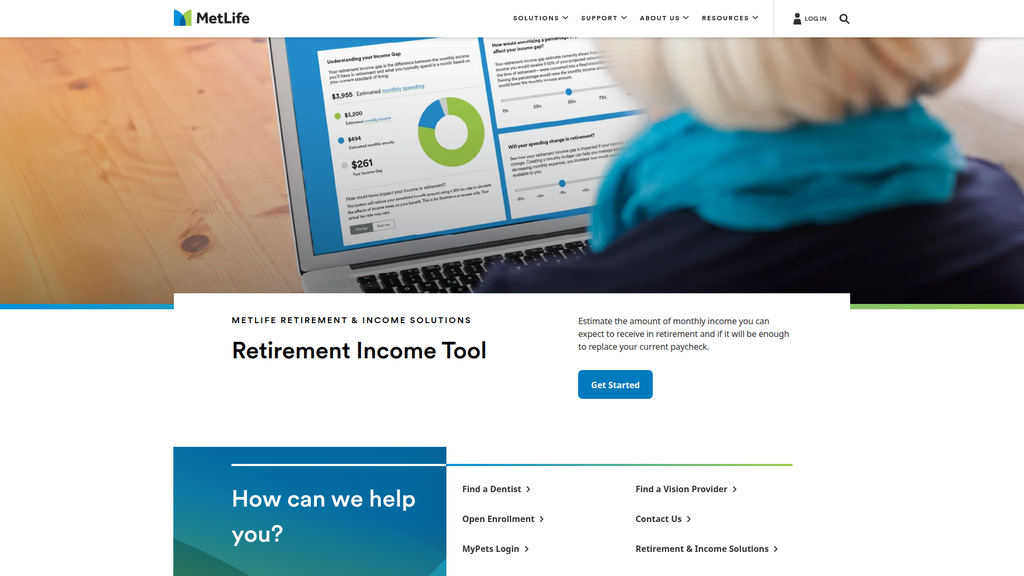

The brand's messaging is fragmented and suffers from an identity crisis, simultaneously trying to be a service portal for existing members, a thought leader for B2B prospects, and a corporate storyteller. This results in a confusing message hierarchy that prioritizes functional tasks (e.g., 'Find a Dentist') over communicating a clear, unique value proposition. The aspirational brand promise of 'building a more confident future' is disconnected from the largely transactional user experience.

Functional communication is very clear; existing members can easily find tools and resources to complete specific tasks.

Overhaul the homepage to lead with a compelling brand value proposition and create distinct, clearly signposted journeys for key audiences (Individuals, Employers, Members) to ensure message relevance.

The website provides a clean, low-cognitive-load experience for task-oriented users, such as finding a provider. However, the conversion paths for new customer acquisition are not well-optimized, especially for individuals. There's a notable lack of prominent, acquisition-focused calls-to-action, and the visual weight of secondary CTAs is too low, potentially reducing engagement with key mid-funnel content.

A clean aesthetic and logical information architecture reduce cognitive load, making it easy for users to navigate and complete simple, known tasks.

Strategically A/B test higher-visibility, primary CTA styles on key product and thought leadership pages to measure and improve the flow of prospective customers into the conversion funnel.

MetLife demonstrates an exceptionally mature and robust approach to credibility and risk management, befitting a major global financial institution. The website features a comprehensive 'Privacy Center' with detailed policies for GLBA and HIPAA, and a public commitment to WCAG 2.1 AA accessibility standards, which is a major risk mitigator. This proactive and transparent stance on legal and regulatory compliance is a significant strategic asset that builds immense trust.

A dedicated, public Accessibility Statement affirming commitment to WCAG 2.1 AA standards, which significantly reduces legal risk from ADA litigation and signals inclusivity.

Enhance the cookie consent banner by adding an equally prominent 'Reject All' button on the first layer to align more closely with the highest global standards for user privacy under GDPR.

MetLife's competitive moat is deep and sustainable, built on over 150 years of brand recognition, immense global scale, and a dominant, entrenched position in the U.S. group benefits market. Serving 90 of the Fortune 100 companies creates extremely high switching costs and a powerful B2B advantage. However, this traditional strength is a disadvantage in terms of agility, making them vulnerable to disruption from more nimble, digital-native Insurtech competitors.

Dominant and deeply entrenched relationships in the U.S. group benefits market, creating high switching costs for large corporate clients.

Address the disadvantage of legacy technology by accelerating digital transformation and potentially launching a separate, digital-first brand to compete directly with Insurtechs on speed and user experience.

As a mature global entity in over 40 countries, MetLife has proven its ability to scale. Its 'New Frontier' strategy clearly targets expansion in high-growth international markets. However, scalability is constrained by legacy IT infrastructure, complex multi-jurisdictional regulations, and a reliance on human-intensive distribution channels, which can slow the pace and cost-efficiency of new market penetration.

A proven and robust global operational footprint with a clear strategic focus on expanding in high-growth markets across Asia and Latin America.

Invest in an API-first 'Insurance-as-a-Service' platform to enable embedded insurance partnerships, creating a new, highly scalable, and lower-cost channel for growth.

MetLife's business model is exceptionally coherent and robust, built on the time-tested pillars of risk pooling (premiums) and long-term investment income. The model is highly diversified across multiple product lines and geographies, reducing risk. The new 'New Frontier' strategy shows strong stakeholder alignment and a clear focus on leveraging core strengths in group benefits and asset management while expanding into adjacent high-growth markets.

Highly diversified and stable recurring revenue streams from both insurance premiums and net investment income, coupled with a massive, global scale.

Accelerate the development of new revenue streams from fee-based, data-driven wellness and preventative care services to reduce sensitivity to interest rate fluctuations on investment income.

MetLife is a market leader with significant pricing power and influence, particularly in the U.S. group benefits sector where it is a top-tier provider. Its strong brand, massive scale, and deep broker relationships create formidable barriers to entry. While its overall market position is stable, recent earnings reports indicate some challenges and missed estimates, suggesting intense competition and margin pressure from both traditional rivals and new Insurtech players.

Significant market power and influence derived from its leadership position in the group benefits space, serving 90 of the Fortune 100 companies.

Counter the perception of being a slow-moving incumbent by publicly increasing partnerships with and investments in Insurtech startups to signal a commitment to innovation and agility.

Business Overview

Business Classification

Insurance & Financial Services

Employee Benefits Provider

Financial Services

Sub Verticals

- •

Life Insurance

- •

Annuities & Retirement Solutions

- •

Group Benefits (Dental, Disability, Vision)

- •

Property & Casualty Insurance

- •

Asset Management

Mature

Maturity Indicators

- •

Established in 1868, demonstrating long-term market presence.

- •

Operates globally in over 40 countries.

- •

Consistently a major player with significant market share in core product lines.

- •

Stable, albeit slow, revenue growth typical of a large incumbent.

- •

Focus on operational efficiency and digital transformation rather than market entry.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Premiums

Description:The primary source of revenue, collected from individuals and group policyholders for life, health, dental, disability, and property & casualty insurance products.

Estimated Importance:Primary

Customer Segment:Individuals & Corporate Clients

Estimated Margin:Medium

- Stream Name:

Net Investment Income

Description:Significant income generated from investing the vast pool of premiums (the 'float') into a diversified portfolio of fixed-income securities, equities, real estate, and other assets.

Estimated Importance:Primary

Customer Segment:Corporate (Investment Operations)

Estimated Margin:High

- Stream Name:

Fees & Other Revenues

Description:Fees earned from administrative services, asset management, record-keeping for retirement plans, and other financial services that do not fall under premiums.

Estimated Importance:Secondary

Customer Segment:Corporate Clients & High-Net-Worth Individuals

Estimated Margin:Medium

- Stream Name:

Annuity Considerations

Description:Revenue from the sale of annuity products, which are contracts that provide a steady income stream, typically for retirees.

Estimated Importance:Secondary

Customer Segment:Individuals (Pre-retirees/Retirees)

Estimated Margin:Medium

Recurring Revenue Components

- •

Insurance policy premiums (monthly, quarterly, annually)

- •

Group benefits contract fees

- •

Asset management fees

- •

Annuity payments and fees

Pricing Strategy

Actuarial & Risk-Based Pricing

Mid-range to Premium

Opaque

Pricing Psychology

- •

Tiered Offerings (e.g., PDP vs. PDP Plus dental networks)

- •

Bundling (group benefits for employers)

- •

Value-Based Pricing (linking products to financial security and peace of mind)

Monetization Assessment

Strengths

- •

Highly diversified revenue streams across products and geographies reduce risk.

- •

Massive scale of investment portfolio generates substantial and stable income.

- •

Strong brand recognition allows for premium pricing power in certain segments.

Weaknesses

- •

Profitability is highly sensitive to interest rate fluctuations.

- •

Complex and often opaque pricing models can be a friction point for individual customers.

- •

Legacy systems can create operational inefficiencies and higher costs.

Opportunities

- •

Develop new revenue streams from data-driven wellness and preventative care services integrated with insurance products.

- •

Expand fee-based advisory and financial planning services to deepen customer relationships.

- •

Leverage technology to create more transparent, on-demand, and usage-based insurance products for new market segments.

Threats

- •

Sustained low-interest-rate environments compressing investment margins.

- •

Increasing competition from agile, digital-native 'Insurtech' startups.

- •

Regulatory changes that could impact capital requirements or product offerings.

Market Positioning

Trusted Global Leader

Market Leader (Top 3 in many core US and international markets).

Target Segments

- Segment Name:

Corporate & Institutional Clients

Description:Large to mid-sized corporations, including 90 of the Fortune 500, seeking to provide comprehensive benefits packages (dental, vision, disability, life) to their employees.

Demographic Factors

- •

Company size (typically 100+ employees)

- •

Industry type

- •

Geographic footprint

Psychographic Factors

- •

Prioritizes employee well-being and retention

- •

Seeks to be an 'employer of choice'

- •

Values stability and brand reputation in partners

Behavioral Factors

- •

Procurement through brokers and consultants

- •

Long sales cycles and relationship-based purchasing

- •

Focus on plan administration efficiency and cost containment

Pain Points

- •

Rising healthcare and benefits costs.

- •

Administrative complexity of managing multiple benefit plans.

- •

Need for benefits that attract and retain a diverse, multi-generational workforce.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Individual Consumers & Families

Description:Individuals seeking financial security through life insurance, long-term savings and retirement products (annuities), and other personal protection policies.

Demographic Factors

- •

Middle to high-income households

- •

Age 35-65 (peak earning and family-building years)

- •

Significant life events (marriage, home purchase, childbirth)

Psychographic Factors

- •

Values long-term financial security and planning

- •

Seeks peace of mind for their family's future

- •

Risk-averse

Behavioral Factors

- •

Purchases through financial advisors, agents, or workplace programs

- •

Responds to marketing emphasizing trust, legacy, and dependability

- •

Increasingly expects digital tools for policy management

Pain Points

- •

Complexity of financial products

- •

Uncertainty about retirement savings adequacy

- •

Protecting assets and providing for dependents in case of unforeseen events

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Brand Recognition & Trust

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Scale & Diversified Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Distribution Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Digital Customer Experience

Strength:Moderate

Sustainability:Temporary

Value Proposition

MetLife provides comprehensive and reliable insurance, retirement, and employee benefit solutions to individuals and institutions, building a more confident future through financial security.

Good

Key Benefits

- Benefit:

Financial Risk Mitigation

Importance:Critical

Differentiation:Common

Proof Elements

- •

Long history of paying claims

- •

Strong financial strength ratings

- •

Broad portfolio of insurance products (life, disability, etc.)

- Benefit:

Retirement Income Security

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Wide range of annuity products

- •

Retirement income planning tools and resources

- •

Expertise in managing large pension plans

- Benefit:

Competitive Employee Benefits

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Serves 90 of the Fortune 500 companies

- •

Extensive provider networks (e.g., dental, vision)

- •

Thought leadership and research on workforce trends

Unique Selling Points

- Usp:

Global presence combined with local market expertise, offering tailored solutions across 40+ countries.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A multi-channel distribution model combining a vast network of agents and brokers with expanding digital platforms.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Protecting family's financial future against premature death or disability.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Ensuring a stable income stream throughout retirement.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

For employers: Attracting and retaining top talent with a competitive benefits package.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

MetLife's core offerings of security and risk management are perpetually relevant and align with fundamental market needs for financial protection.

High

The value proposition strongly resonates with the core needs of both institutional clients (managing employee welfare) and individuals (securing personal/family finances).

Strategic Assessment

Business Model Canvas

Key Partners

- •

Insurance Brokers & Consultants

- •

Financial Advisors & Independent Agents

- •

Corporate HR Departments

- •

Technology Partners (e.g., AI, Cloud providers)

- •

Insurtech Startups & Venture Capital Funds.

- •

Healthcare Provider Networks (Dental, Vision)

Key Activities

- •

Underwriting & Risk Assessment

- •

Claims Processing & Management

- •

Investment & Asset Management

- •

Product Development & Innovation

- •

Sales & Distribution Channel Management

- •

Regulatory Compliance

Key Resources

- •

Strong Brand & Reputation

- •

Massive Capital Reserves & Financial Strength

- •

Global Distribution Network

- •

Actuarial Expertise & Data Analytics Capabilities

- •

Diversified Investment Portfolio

Cost Structure

- •

Policyholder Benefits & Claims Payouts

- •

Employee Compensation & Commissions

- •

Technology & Operations Infrastructure

- •

Marketing & Advertising

- •

Regulatory & Compliance Costs

Swot Analysis

Strengths

- •

Dominant brand recognition and a 150+ year history fostering trust.

- •

Globally diversified business model, reducing dependency on any single market.

- •

Massive scale provides significant cost advantages and investment opportunities.

- •

Extensive and deeply entrenched distribution network of agents and brokers.

Weaknesses

- •

Legacy technology systems can hinder agility and increase operational costs.

- •

Large size can lead to slow decision-making and resistance to change.

- •

Perceived as a traditional, less innovative player compared to new market entrants.

Opportunities

- •

Accelerate digital transformation to enhance customer experience and operational efficiency.

- •

Leverage AI and big data for more personalized products, dynamic pricing, and predictive underwriting.

- •

Expand into adjacent wellness and preventative health services, creating new value streams.

- •

Form strategic partnerships with Insurtech startups to rapidly acquire new capabilities.

Threats

- •

Disruption from agile, tech-first Insurtech companies with lower overhead.

- •

Evolving customer expectations for seamless, digital-first interactions.

- •

Macroeconomic pressures, especially persistent low-interest rates, impacting investment returns.

- •

Increasingly stringent data privacy and cybersecurity regulations and threats.

Recommendations

Priority Improvements

- Area:

Digital Customer Experience

Recommendation:Invest heavily in a unified, omni-channel customer platform that simplifies policy management, claims submission, and access to financial planning tools. Focus on a 'high-tech, high-touch' approach.

Expected Impact:High

- Area:

Operational Efficiency

Recommendation:Aggressively modernize core legacy systems by leveraging cloud infrastructure and RPA to automate manual processes in underwriting, claims, and administration, reducing costs and errors.

Expected Impact:High

- Area:

Product Innovation

Recommendation:Develop and pilot more personalized, data-driven insurance products, such as those integrated with wearable tech data or offering modular, on-demand coverage to appeal to younger demographics.

Expected Impact:Medium

Business Model Innovation

- •

Transition from a 'repair and replace' model to a 'predict and prevent' model by integrating wellness programs and data analytics to proactively reduce risk and claims.

- •

Launch a 'Digital Direct-to-Consumer' sub-brand for simpler, standardized products to compete with Insurtechs without disrupting existing agent channels.

- •

Develop an 'Insurance-as-a-Service' platform, offering underwriting, claims processing, and regulatory expertise to smaller companies or partners.

Revenue Diversification

- •

Build out a fee-based financial wellness and advisory service for corporate clients, helping their employees with holistic financial planning beyond just the provided benefits.

- •

Monetize anonymized data insights by providing trend reports and risk modeling services to other industries (e.g., healthcare, automotive).

- •

Expand asset management services to a broader base of institutional and high-net-worth clients globally.

MetLife operates a classic, mature, and highly successful insurance business model, built on the foundational pillars of risk pooling, long-term investment of premiums, and extensive distribution. Its key strengths—a globally recognized brand, immense scale, and a diversified portfolio—create a formidable competitive moat. The business model is robust, generating stable, recurring revenue from a loyal base of both institutional and individual clients.

However, the model faces significant evolutionary pressure. Its reliance on traditional channels and legacy systems creates vulnerabilities to more agile, digital-first competitors. Profitability is perpetually exposed to macroeconomic factors, particularly interest rates. The primary strategic imperative for MetLife is therefore not a fundamental overhaul of its core business, but a rapid and comprehensive digital transformation layered on top of its existing strengths. The evolution must focus on shifting from a product-centric to a customer-centric operating model. This involves leveraging data and AI to create personalized experiences, enhance underwriting precision, and improve operational efficiency. Future growth and sustained market leadership will be determined by MetLife's ability to innovate at scale, integrating technology to not only defend its current position but also to create new value propositions in adjacent areas like preventative health and holistic financial wellness.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital & Solvency Requirements

Impact:High

- Barrier:

Complex Regulatory & Licensing Hurdles

Impact:High

- Barrier:

Brand Recognition & Trust

Impact:High

- Barrier:

Extensive Distribution Networks (Brokers, Agents)

Impact:Medium

- Barrier:

Legacy Technology & Data Integration

Impact:Medium

Industry Trends

- Trend:

Digital Transformation & AI Integration

Impact On Business:Legacy systems can hinder agility. Investment in AI for underwriting, claims processing, and customer service is crucial to remain competitive and improve efficiency.

Timeline:Immediate

- Trend:

Rise of InsurTech & Embedded Insurance

Impact On Business:InsurTechs are both potential competitors and partners, offering innovative solutions for specific parts of the value chain. This creates pressure to innovate and opportunities for collaboration.

Timeline:Immediate

- Trend:

Demand for Personalized & Holistic Financial Wellness

Impact On Business:Customers, especially employers, expect integrated benefits and financial planning tools, not just siloed insurance products. This requires a shift from product-centric to customer-centric models.

Timeline:Near-term

- Trend:

Increased Regulatory Scrutiny & ESG Focus

Impact On Business:Growing pressure to comply with complex regulations and demonstrate commitment to Environmental, Social, and Governance (ESG) principles, impacting investment strategies and corporate reporting.

Timeline:Near-term

Direct Competitors

- →

Prudential Financial

Market Share Estimate:Major

Target Audience Overlap:High

Competitive Positioning:Global financial wellness leader with a strong focus on retirement, investment management (PGIM), and life insurance.

Strengths

- •

Strong global brand recognition and 140+ years of experience.

- •

Highly diversified business model across insurance, retirement, and asset management.

- •

Powerful asset management arm (PGIM) with over $1.5 trillion AUM.

- •

Extensive distribution network including financial advisors and institutional partnerships.

Weaknesses

- •

Complex organizational structure can lead to inefficiencies.

- •

High sensitivity to market volatility and interest rate fluctuations.

- •

Faces challenges in adapting to rapid technological advancements and changing customer preferences.

Differentiators

PGIM provides a significant and distinct revenue stream and thought leadership.

Strong focus on financial wellness and retirement solutions as a core brand pillar.

- →

Aflac

Market Share Estimate:Major (in supplemental insurance)

Target Audience Overlap:Medium

Competitive Positioning:Market leader in supplemental health insurance (e.g., accident, cancer, critical illness) sold primarily at the worksite.

Strengths

- •

Exceptional brand recognition, largely due to iconic advertising campaigns.

- •

Dominant market position in the supplemental insurance niche.

- •

Strong agent network and relationships with employers.

- •

High customer satisfaction and a reputation for paying claims quickly.

Weaknesses

- •

Less diversified product portfolio compared to MetLife or Prudential.

- •

Business model is heavily reliant on worksite sales and broker relationships.

- •

Some online customer reviews mention issues with claims processing speed, despite their marketing promises.

- •

Relatively lower investment in R&D and new technologies compared to some competitors.

Differentiators

Specialization and deep expertise in supplemental insurance products.

Cash-benefit model that pays policyholders directly, supplementing major medical coverage.

- →

New York Life Insurance Company

Market Share Estimate:Major

Target Audience Overlap:High

Competitive Positioning:The largest mutual life insurer in the U.S., emphasizing financial strength, integrity, and its career agency system.

Strengths

- •

Mutual company structure aligns interests with policyholders, fostering trust.

- •

Industry-leading career agency force provides a powerful distribution channel.

- •

Strong financial ratings and a reputation for stability.

- •

Investing heavily in data, AI, and digital transformation to modernize the agent and customer experience.

Weaknesses

- •

Historically reliant on a traditional, agent-driven sales model, which can be slower to adapt.

- •

Legacy technology platforms present modernization challenges.

- •

Less emphasis on group benefits compared to MetLife.

Differentiators

Mutual ownership structure is a key marketing and trust-building tool.

Pioneering use of electronic health records (EHR) and AI to accelerate and simplify underwriting.

- →

The Hartford

Market Share Estimate:Significant

Target Audience Overlap:Medium

Competitive Positioning:A leader in property & casualty (P&C) insurance, group benefits, and mutual funds, with a strong focus on small businesses and AARP members.

Strengths

- •

Long-standing, reputable brand founded in 1810.

- •

Market leader in small business insurance and a strong group benefits provider.

- •

Exclusive partnership with AARP for auto and home insurance provides access to a large, stable demographic.

- •

Diversified portfolio across P&C and group benefits.

Weaknesses

- •

Faces intense competition in both P&C and group benefits sectors.

- •

Exposure to catastrophe losses in its P&C business.

- •

Less global presence compared to MetLife.

Differentiators

Deep expertise and brand equity in the small commercial insurance market.

Strategic partnership with AARP is a unique and powerful distribution channel.

Indirect Competitors

- →

Gusto / Zenefits

Description:HR and payroll platforms that offer integrated benefits administration, simplifying the process for small and medium-sized businesses to select and manage insurance plans.

Threat Level:Medium

Potential For Direct Competition:Low, but they can disintermediate insurers from the client relationship, commoditizing the underlying products.

- →

InsurTech Startups (e.g., Lemonade, Ladder)

Description:Technology-first companies offering streamlined, direct-to-consumer insurance products (primarily P&C and term life) with a focus on user experience and AI-driven processes.

Threat Level:Medium

Potential For Direct Competition:High, as they can acquire insurance carriers or expand their product lines into group benefits and retirement.

- →

Asset Management Firms (e.g., Fidelity, Vanguard)

Description:Large financial services firms that are direct competitors in the retirement and annuities space, often with strong direct-to-consumer brands and extensive workplace retirement plan businesses.

Threat Level:High

Potential For Direct Competition:Already direct competitors in the retirement solutions market.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Brand Recognition & Reputation

Sustainability Assessment:Highly sustainable due to over 150 years of history and significant marketing spend.

Competitor Replication Difficulty:Hard

- Advantage:

Dominant Position in U.S. Group Benefits

Sustainability Assessment:Sustainable due to deep, long-standing relationships with large corporations and brokers, creating high switching costs.

Competitor Replication Difficulty:Hard

- Advantage:

Scale and Diversification

Sustainability Assessment:Sustainable, as global scale provides capital efficiency, risk diversification, and the ability to serve multinational clients.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Specific Product Innovations or Features', 'estimated_duration': '12-24 months before competitors can replicate or offer alternatives.'}

{'advantage': 'Thought Leadership from Proprietary Research', 'estimated_duration': '6-12 months until insights become mainstream or are countered by competitor research.'}

Disadvantages

- Disadvantage:

Legacy Technology & Complexity

Impact:Major

Addressability:Difficult

- Disadvantage:

Perception as a Traditional, Slow-Moving Incumbent

Impact:Major

Addressability:Moderately

- Disadvantage:

Dependence on Broker-led Distribution

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Optimize and promote digital self-service tools like the 'Retirement Income Tool' via targeted social media campaigns to capture high-intent leads.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch a content marketing series specifically for HR leaders on 'The Future of Employee Wellness', repurposing existing research into webinars, infographics, and articles.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop API-driven partnerships with leading HR tech platforms (like Gusto, Rippling) to embed MetLife products directly into their benefits administration workflows.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in a unified digital platform for employees to view and manage all their MetLife benefits (dental, vision, life, disability, retirement) in one place, enhancing user experience and cross-selling opportunities.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Launch a dedicated suite of products and services tailored for the small-to-medium business (SMB) market, leveraging digital channels for acquisition and service.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Aggressively modernize core policy administration and claims systems by migrating to cloud-native platforms to increase agility, reduce operational costs, and enable faster product innovation.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Build out an advanced data analytics and AI competency to create hyper-personalized product recommendations, dynamic pricing models, and proactive risk management for clients.

Expected Impact:High

Implementation Difficulty:Difficult

Reposition from a traditional insurer to a tech-enabled leader in holistic employee well-being and financial confidence. The messaging should focus on the seamless integration of benefits, data-driven insights for employers, and personalized guidance for employees throughout their careers and into retirement.

Differentiate through a superior, integrated digital experience for both employers and employees. While competitors have strong brands or agent networks, MetLife can win by making the complex world of benefits simple, intuitive, and accessible through technology, backed by its trusted brand and comprehensive product suite.

Whitespace Opportunities

- Opportunity:

Integrated Financial Wellness Platform for Employees

Competitive Gap:While competitors offer retirement or insurance products, few provide a truly integrated platform that combines benefits management with financial coaching, budgeting tools, and student loan assistance programs.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Benefits Solutions for the Gig Economy & Freelancers

Competitive Gap:This large and growing workforce segment is underserved by traditional group benefits models. Offering portable, individual-based benefits packages (health, disability, retirement) could capture a new market.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Data-Driven Benefits Consulting for SMBs

Competitive Gap:Large corporations have access to benefits consultants, but SMBs are often left to navigate complex choices alone. MetLife could offer a 'lite' digital advisory service, using data to help SMBs design optimal, cost-effective benefits packages.

Feasibility:High

Potential Impact:Medium

MetLife operates as a dominant force within a mature, oligopolistic insurance and financial services industry. Its primary competitive advantages are its formidable brand recognition, immense scale, and entrenched position in the U.S. group benefits market, serving as a trusted partner to a majority of Fortune 500 companies. This creates significant barriers to entry and a stable foundation of revenue.

The competitive landscape is defined by large, diversified incumbents like Prudential, which competes intensely across retirement and life insurance, and specialists like Aflac, which dominates the supplemental health niche. New York Life's mutual structure and powerful agency force represent a traditional, trust-based competitive threat, which it is actively modernizing with significant investments in AI and data analytics.

However, the most significant long-term threats are asymmetrical. Indirect competitors, such as HR tech platforms (Gusto, Zenefits), are disintermediating the client relationship, potentially reducing insurers to interchangeable product providers. Simultaneously, agile InsurTech startups are setting new standards for digital customer experience, putting pressure on MetLife's legacy systems and traditional business processes.

MetLife's core strategic challenge is to leverage its incumbent strengths—scale, data, and trust—while accelerating its digital transformation to fend off these nimble disruptors. The website content reflects a strategic focus on retirement and employee benefits, positioning MetLife as a thought leader for employers. Opportunities exist to deepen this position by creating a truly integrated, seamless digital ecosystem for both employers and their employees. Whitespace can be found in underserved markets like the gig economy and by developing data-driven advisory services for the SMB sector. Ultimately, future success will be determined by MetLife's ability to transition from a product-centric insurance provider to a customer-centric, tech-enabled financial wellness partner.

Messaging

Message Architecture

Key Messages

- Message:

We provide tools and resources for you to access and manage your existing benefits.

Prominence:Primary

Clarity Score:High

Location:Homepage 'How can we help you?' section, 'Register online' module.

- Message:

MetLife offers expert insights for employers on crucial topics like disability insurance and retirement benefits.

Prominence:Secondary

Clarity Score:High

Location:Homepage featured articles ('The critical role for disability insurance...', '2025 Enduring Retirement Model Study').

- Message:

We are a global community helping people build a more confident future.

Prominence:Tertiary

Clarity Score:Medium

Location:Featured Story ('Meet real people making real impact').

The message hierarchy is fragmented and prioritizes existing customer service over brand building or new customer acquisition. The most prominent messaging is tactical and functional (e.g., 'Find a Dentist'), which positions the homepage as a support portal rather than a strategic brand asset. Broader, more compelling brand messages are buried in secondary content modules.

Consistency is poor. The homepage simultaneously addresses existing individual members, prospective B2B clients (employers), and individual policyholders without a clear, unifying narrative. This creates a disjointed user experience where the primary brand message is unclear, shifting from a service tool to a B2B thought leader to a corporate storyteller from one section to the next.

Brand Voice

Voice Attributes

- Attribute:

Transactional

Strength:Strong

Examples

- •

Find a Dentist

- •

Register for MyBenefits

- •

Access

- •

MyPets Login

- Attribute:

Corporate

Strength:Strong

Examples

The critical role for disability insurance and paid leave...

MetLife's 2025 Enduring Retirement Model Study

- Attribute:

Helpful

Strength:Moderate

Examples

How can we help you?

The descriptions below may help you identify your dental network.

- Attribute:

Aspirational

Strength:Weak

Examples

Meet real people making real impact

See how our people go above and beyond each day to help build a more confident future for all.

Tone Analysis

Informational

Secondary Tones

Transactional

Formal

Tone Shifts

Shifts abruptly from the functional, task-oriented tone of the benefits tools to the formal, expert tone of the B2B research articles.

A noticeable, but isolated, shift to an emotive, human-centric tone in the 'Featured Story' section.

Voice Consistency Rating

Fair

Consistency Issues

The voice lacks a consistent personality, oscillating between a functional tool, a corporate entity, and a storyteller.

The aspirational voice ('building a more confident future') feels disconnected from the predominantly transactional user experience.

Value Proposition Assessment

The core value proposition is not explicitly stated. Based on the content, it is implied to be: 'MetLife is a comprehensive provider of employee benefits and retirement solutions with the tools to manage them.' The official mission ('Always with you, building a more confident future') is not effectively translated into a customer-facing value proposition on the site.

Value Proposition Components

- Component:

Convenient access to manage benefits

Clarity:Clear

Uniqueness:Common

- Component:

Wide network of providers (Dental/Vision)

Clarity:Clear

Uniqueness:Common

- Component:

Data-driven insights for employers

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

- Component:

Retirement income planning

Clarity:Somewhat Clear

Uniqueness:Common

The website messaging does a poor job of differentiating MetLife from its competitors like Prudential, Aflac, or AIG. The focus on functional, 'table-stakes' benefits like finding a dentist or logging in fails to communicate a unique value or reason to choose MetLife over others. The B2B thought leadership content is a potential differentiator but is not positioned prominently enough to define the brand for that key audience.

The messaging positions MetLife as a large, established, and functional administrator of benefits. It does not effectively position the company as an innovative, strategic, or empathetic partner for either individuals or businesses.

Audience Messaging

Target Personas

- Persona:

Existing Plan Member (Employee)

Tailored Messages

- •

Find a Dentist

- •

Find a Vision Provider

- •

Register for MyBenefits

Effectiveness:Effective

- Persona:

HR / Benefits Manager (B2B Prospect)

Tailored Messages

The critical role for disability insurance and paid leave in demonstrating employee care

MetLife's 2025 Enduring Retirement Model Study

Effectiveness:Somewhat Effective

- Persona:

Individual Policyholder

Tailored Messages

Bought a life, annuity or long-term care policy from an agent?

Effectiveness:Ineffective

Audience Pain Points Addressed

- •

Uncertainty about how much income is needed for retirement.

- •

Difficulty in finding an in-network healthcare provider.

- •

Employers' challenge to enhance employee loyalty through benefits.

Audience Aspirations Addressed

Achieving a confident, secure retirement.

Building a caring and supportive workplace culture.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Peace of Mind

Effectiveness:Medium

Examples

Retirement Income Tool

The critical role for disability insurance...

- Appeal Type:

Empathy & Human Connection

Effectiveness:Low

Examples

Meet real people making real impact

Social Proof Elements

- Proof Type:

Expertise / Authority (via Research)

Impact:Moderate

Examples

According to our newest research...

MetLife surveyed 255 plan sponsors...

Trust Indicators

- •

Longevity and brand recognition of 'MetLife'

- •

Secure login portals ('MyBenefits')

- •

Publication of detailed research and studies.

Scarcity Urgency Tactics

None observed, which is appropriate for the industry.

Calls To Action

Primary Ctas

- Text:

Get Started

Location:Retirement Income Tool

Clarity:Clear

- Text:

Find A Dentist

Location:How can we help you? section

Clarity:Clear

- Text:

Access

Location:Register for MyBenefits section

Clarity:Clear

- Text:

Explore More

Location:Disability insurance article

Clarity:Somewhat Clear

The CTAs are clear and effective for directing users to specific, functional tasks. However, they are overwhelmingly service-oriented. There is a significant lack of primary, acquisition-focused CTAs that would guide a new prospect (either B2C or B2B) through a consideration and purchase journey, such as 'Explore Solutions,' 'Why MetLife,' or 'Get a Quote'.

Messaging Gaps Analysis

Critical Gaps

- •

A clear, overarching value proposition that answers 'Why MetLife?'.

- •

A coherent brand story that connects MetLife's purpose to its products and customers.

- •

Effective messaging for prospective individual customers (not just those who already have a policy).

- •

A clear user path that segments audiences (e.g., members vs. prospects) from the homepage.

Contradiction Points

The website's primary function as a transactional portal for existing members contradicts its secondary attempts to be a brand-building and thought-leadership platform. This creates a muddled identity.

The warm, human-centric tone of the 'real people' story feels disconnected and inconsistent with the cold, functional nature of the rest of the homepage content.

Underdeveloped Areas

- •

Emotional storytelling that demonstrates customer impact.

- •

Brand differentiation messaging.

- •

Messaging that clearly defines and speaks to different stages of the customer journey.

Messaging Quality

Strengths

- •

Clarity in functional communication; users looking to complete a specific task (like finding a dentist) can do so easily.

- •

Credibility-building through data-driven reports and studies targeted at B2B audiences.

- •

The brand mission ('building a more confident future') is positive and provides a strong foundation, even if poorly executed on the site.

Weaknesses

- •

Lack of a unifying, primary message creates a confusing and forgettable brand impression.

- •

Over-emphasis on functional tasks alienates and fails to engage prospective customers.

- •

Poorly defined audience hierarchy on the homepage, leading to a 'one-size-fits-none' messaging approach.

- •

Weak emotional resonance and a failure to build a human connection with the user.

Opportunities

- •

Redesign the homepage information architecture to create distinct journeys for key personas (Individuals, Employers, Members).

- •

Elevate the 'confident future' brand promise into a tangible, customer-centric value proposition.

- •

Utilize customer stories and testimonials to build trust and emotional connection, bridging the gap between the brand's purpose and its products.

- •

Develop dedicated landing experiences for B2B prospects that focus purely on employer pain points and MetLife's differentiated solutions.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Message Hierarchy

Recommendation:Overhaul the homepage to lead with a clear, compelling brand value proposition. Create distinct navigational pathways or sections for 'Individuals,' 'For Businesses,' and 'Member Login' to immediately segment traffic and tailor the messaging.

Expected Impact:High

- Area:

Value Proposition Communication

Recommendation:Develop and prominently feature a unique value proposition headline that goes beyond product categories. It should answer 'Why MetLife?' in a way that resonates emotionally and highlights differentiation.

Expected Impact:High

- Area:

Audience Segmentation

Recommendation:Create dedicated, high-value content hubs for B2B decision-makers that are separate from the member-focused tools, establishing MetLife as a clear thought leader and strategic partner.

Expected Impact:Medium

Quick Wins

- •

Rewrite the headlines for the featured B2B articles to be more benefit-driven and compelling.

- •

Add a clear 'Why MetLife?' or 'About Us' section to the primary navigation to provide a home for brand storytelling.

- •

Introduce a simple headline above the 'How can we help you?' section like 'Already a member? Let's get you what you need.' to clarify its intended audience.

Long Term Recommendations

- •

Invest in creating a robust library of customer success stories and testimonials to use as social proof.

- •

Conduct a comprehensive brand voice and messaging overhaul to ensure consistency and emotional resonance across all digital touchpoints.

- •

Develop a personalized web experience that serves different content based on user data or self-identification, ensuring prospects and members see the most relevant information.

MetLife's website messaging suffers from a fundamental identity crisis. It is strategically positioned as a functional service portal for existing plan members, but tactically attempts to serve as a brand-building platform for B2B prospects and a storyteller for the public. This results in a fragmented, inconsistent, and ultimately confusing message hierarchy. The most prominent messages are transactional and commoditized (e.g., 'Find a Dentist'), which fails to build brand equity or differentiate MetLife in a competitive financial services market. While the company possesses strong assets for trust-building (research, longevity) and a positive underlying mission ('building a more confident future'), these elements are buried beneath a layer of utilitarian functionality. To improve market positioning and support customer acquisition, the messaging strategy must pivot from being service-first to being brand-first. This requires a complete rethinking of the homepage architecture to clearly segment audiences, elevate the core value proposition, and weave a consistent, emotionally resonant narrative that answers the critical question for any new visitor: 'Why should I choose MetLife?'

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Over 150 years in operation, indicating sustained market demand and adaptation.

- •

Serves over 90 million customers in more than 40 countries, demonstrating a massive, global customer base.

- •

Strong brand recognition and financial stability, fostering trust with individual and institutional clients.

- •

Diversified portfolio including insurance, annuities, and employee benefits, catering to a wide range of financial needs.

- •

Trusted partner for 90 of the Fortune 100 companies for employee benefit solutions, signifying deep integration into the corporate ecosystem.

Improvement Areas

- •

Enhancing digital product offerings to meet the expectations of younger, digital-native demographics.

- •

Developing more flexible and personalized products for non-traditional workers (e.g., gig economy).

- •

Improving the user experience of customer portals and mobile applications to reduce friction and increase self-service adoption.

Market Dynamics

Moderate (Life premiums in advanced markets expected to increase 1.5% through 2025; higher in emerging markets at 5.7-7.2%).

Mature

Market Trends

- Trend:

Digital Transformation (Insurtech)

Business Impact:Disruption of traditional models by tech-driven startups, forcing incumbents to innovate in areas like AI-powered underwriting, automated claims processing, and digital customer engagement.

- Trend:

Focus on Holistic Wellness

Business Impact:Growing demand for integrated benefits packages that include mental and financial wellness programs, not just traditional insurance products.

- Trend:

Personalization and Data Analytics

Business Impact:Customers expect tailored products and communication based on their data, requiring significant investment in data analytics and CRM capabilities.

- Trend:

Growth in Emerging Markets

Business Impact:Saturated developed markets are pushing insurers to seek growth in Latin America and Asia, where a rising middle class is increasing demand for insurance.

Challenging but opportune. The market is ripe for disruption; established players like MetLife must leverage their scale and brand trust to innovate and capture new growth vectors before agile competitors do.

Business Model Scalability

Medium

High fixed costs associated with regulatory compliance, legacy systems, and actuarial infrastructure, but variable costs per new policy are relatively low, especially for digital products.

Medium. While digital distribution and automated processing can increase leverage, the business model still relies on significant human capital for sales (agents/brokers) and complex claims management.

Scalability Constraints

- •

Complex and varied regulatory environments across dozens of countries increase compliance costs and slow product rollouts.

- •

Legacy IT infrastructure can hinder the rapid development and integration of new digital products and services.

- •

Dependence on traditional, human-intensive distribution channels (agents, brokers) can limit the pace and cost-efficiency of scaling.

Team Readiness

Experienced leadership with a proven track record of managing a global, complex organization and executing multi-year strategies like 'Next Horizon' and the new 'New Frontier' plan.

Traditional, likely siloed by product line and geography, which can impede cross-functional agility and rapid innovation required for digital transformation.

Key Capability Gaps

- •

Agile product development and user experience (UX) design for creating intuitive, digital-first customer journeys.

- •

Advanced data science and AI/ML talent for hyper-personalization, dynamic pricing, and predictive analytics.

- •

Change management expertise to drive cultural shifts towards a more innovative, tech-forward mindset across a large, established organization.

Growth Engine

Acquisition Channels

- Channel:

B2B Group Benefits Sales (Direct & Broker-led)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Develop a 'financial wellness as a service' platform to deepen relationships with existing corporate clients and increase employee participation and cross-sell opportunities.

- Channel:

Agent & Financial Advisor Network

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip agents with better digital tools for remote consultation, personalized product recommendations based on data analytics, and streamlined application processing.

- Channel:

Direct-to-Consumer (DTC) Digital

Effectiveness:Low

Optimization Potential:High

Recommendation:Launch simplified, digitally-native insurance products (e.g., term life, pet insurance) with a focus on a seamless, mobile-first purchase experience to attract younger demographics.

- Channel:

Strategic Partnerships (e.g., Banks, Retail)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand 'embedded insurance' offerings by partnering with fintech platforms, lenders, and e-commerce sites to offer relevant insurance products at the point of need.

Customer Journey

Fragmented. The journey for a group benefits employee is vastly different from an individual annuity buyer. Digital entry points (e.g., tools, calculators) often lead to offline, agent-assisted conversions, creating potential friction.

Friction Points

- •

Handoffs between digital self-service tools and human agents.

- •

Complex application processes for traditional insurance products requiring extensive paperwork and underwriting.

- •

Navigating different portals and logins for various MetLife products (e.g., dental vs. retirement).

Journey Enhancement Priorities

{'area': 'Unified Customer View', 'recommendation': 'Invest in a master data management and CRM platform to create a single view of the customer across all product lines, enabling personalized service and relevant cross-sell offers. '}

{'area': 'Digital Onboarding', 'recommendation': 'Automate and simplify the application and underwriting process for key retail products using AI and data pre-fill to reduce completion time from weeks to minutes. '}

Retention Mechanisms

- Mechanism:

High Switching Costs

Effectiveness:High

Improvement Opportunity:While effective for products like whole life insurance, this can breed complacency. Proactively add value through regular policy reviews and financial wellness content to build loyalty beyond lock-in.

- Mechanism:

Employer Relationship (Group Benefits)

Effectiveness:High

Improvement Opportunity:Engage directly with employees through personalized communication and mobile apps to build a direct brand relationship, making the benefits more tangible and valued.

- Mechanism:

Product Bundling & Cross-selling

Effectiveness:Medium

Improvement Opportunity:Utilize data analytics to proactively identify and recommend relevant products (e.g., pet insurance for a family with a new group life policy) through personalized digital campaigns.

Revenue Economics

Strong. As a mature insurer, MetLife has a deep understanding of actuarial science, enabling profitable underwriting and pricing. The primary challenge is margin compression from competition and low interest rates.

High (Inherently high LTV for long-term insurance and retirement products).

Good, but with significant potential for improvement through operational efficiency gains from digital transformation and automation of manual processes.

Optimization Recommendations

- •

Reduce operational costs by automating underwriting and claims processing for simple, high-volume products.

- •

Shift acquisition mix towards lower-cost digital DTC channels for specific market segments.

- •

Increase revenue per customer (LTV) by implementing a more systematic and data-driven cross-selling and up-selling strategy.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Core Systems

Impact:High

Solution Approach:Adopt a two-speed IT architecture. Maintain stable legacy systems for core policy administration while building a flexible, API-driven microservices layer on top to support rapid development of new digital customer-facing applications.

- Limitation:

Siloed Data Architecture

Impact:High

Solution Approach:Implement a cloud-based data lakehouse to consolidate data from across the organization, enabling a unified customer view and powering advanced analytics and AI initiatives.

Operational Bottlenecks

- Bottleneck:

Manual Underwriting & Claims Processing

Growth Impact:Slows customer acquisition, increases operational costs, and leads to inconsistent customer experiences.

Resolution Strategy:Deploy AI and machine learning models to automate underwriting for standard-risk policies and to triage and process simple claims instantly, freeing up human experts for complex cases.

- Bottleneck:

Multi-jurisdictional Regulatory Compliance

Growth Impact:Increases time-to-market for new products and adds significant overhead.

Resolution Strategy:Invest in 'RegTech' (Regulatory Technology) solutions to automate compliance monitoring and reporting. Design products on modular platforms to allow for easier adaptation to local regulations.

Market Penetration Challenges

- Challenge:

Intense Competition from Incumbents & Insurtechs

Severity:Critical

Mitigation Strategy:Leverage brand trust and scale while building a dual strategy: innovate core products for existing segments and launch a separate, digitally-native brand or product line to compete directly with Insurtechs for new segments.

- Challenge:

Customer Apathy and Brand Perception

Severity:Major

Mitigation Strategy:Shift marketing from product-centric to customer-centric, focusing on financial wellness, education, and life-stage-based solutions. Use content marketing and digital tools to build engagement outside of the purchase/claim cycle.

Resource Limitations

Talent Gaps

- •

Data Scientists & AI/ML Engineers

- •

Digital Product Managers

- •

UX/UI Designers

- •

Cybersecurity Specialists

Capital is not a primary constraint; the challenge is the strategic allocation of capital to long-term digital transformation initiatives versus short-term shareholder returns.

Infrastructure Needs

Modern cloud-based infrastructure (IaaS/PaaS) to replace legacy data centers.

Enterprise-wide API management platform to enable seamless data exchange between internal systems and external partners.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in Emerging Markets (Asia, Latin America)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Pursue a mix of organic growth and strategic acquisitions of local players to gain market access and regulatory know-how. Focus on mobile-first distribution models.

- Expansion Vector:

Demographic Expansion to Millennials & Gen Z

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Develop simple, affordable, and fully digital products (e.g., micro-insurance, subscription-based coverage) distributed through social and mobile channels.

- Expansion Vector:

Small and Medium-Sized Enterprises (SMEs)

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Create a scalable, self-service platform for SMEs to purchase and manage group benefits, a market segment currently underserved by traditional high-touch sales models.

Product Opportunities

- Opportunity:

Financial Wellness as a Service Platform

Market Demand Evidence:Increasing employee demand for financial wellness benefits beyond retirement plans, such as budgeting tools, student loan assistance, and financial coaching.

Strategic Fit:Deepens the B2B relationship with group benefits clients and creates a direct engagement channel with millions of employees.

Development Recommendation:Acquire or partner with a leading financial wellness fintech to accelerate time-to-market.

- Opportunity:

Data-driven Personalized Insurance

Market Demand Evidence:Growing consumer acceptance of telematics and wearable data exchange for personalized pricing and services.

Strategic Fit:Aligns with the industry trend towards proactive risk management and personalization; improves underwriting accuracy.

Development Recommendation:Launch pilot programs in specific product lines (e.g., disability or health) that use wearable data to offer wellness incentives and premium discounts.

Channel Diversification

- Channel:

Embedded Insurance

Fit Assessment:High

Implementation Strategy:Develop an API-first platform ('Insurance-as-a-Service') that allows third-party digital platforms (e.g., mortgage lenders, travel sites, HR software) to seamlessly integrate MetLife's insurance products into their customer journeys.

- Channel:

Digital-First Advisory Model

Fit Assessment:High

Implementation Strategy:Launch a hybrid advisory service that combines a user-friendly robo-advisor platform for basic financial planning with on-demand access to human financial advisors for more complex needs, targeting the mass affluent market.

Strategic Partnerships

- Partnership Type:

Insurtech/Fintech Collaboration

Potential Partners

- •

Lemonade

- •

Hippo (for technology)

- •

SoFi

- •

Chime

Expected Benefits:Access to innovative technology, agile development talent, new customer segments, and accelerated digital product development.

- Partnership Type:

Health Tech Integration

Potential Partners

- •

Apple (HealthKit)

- •

Fitbit/Google

- •

Teladoc

- •

Headspace

Expected Benefits:Integrate health and wellness data to enhance underwriting, offer preventative care benefits, and create more engaging group health and disability products.

Growth Strategy

North Star Metric

Number of Multi-Product Households/Clients

This metric shifts focus from single policy sales to building deeper, more valuable customer relationships. It directly measures success in cross-selling and customer centricity, which are key to long-term, profitable growth.

Increase the percentage of clients with 2+ products by 15% over the next 3 years.

Growth Model

Hybrid: Retain Sales-Led Growth and build a Product-Led Growth (PLG) Engine

Key Drivers

- •

Enterprise Sales & Broker Channels (Core B2B engine)

- •

Digital Acquisition (for simple DTC products)

- •

Cross-sell & Upsell (driven by data analytics)

- •

Customer Engagement (via financial wellness platform)

Maintain and enhance the existing sales-led model for complex B2B and high-net-worth markets. Simultaneously, create an independent growth team to build and scale a PLG model for new, digital-first products targeting individuals and SMEs.

Prioritized Initiatives

- Initiative:

Launch 'MetLife Digital': A Simplified, Fully Digital Insurance Offering

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Assemble a dedicated, cross-functional team. Conduct market research to identify the initial product (e.g., 5-year term life). Develop a minimum viable product (MVP) for a single state.

- Initiative:

Develop an Integrated Financial Wellness Platform for Group Benefits Clients

Expected Impact:High

Implementation Effort:Medium

Timeframe:12 months

First Steps:Evaluate build vs. buy vs. partner options. Conduct pilot programs with 3-5 key enterprise clients to refine the offering.

- Initiative:

Unified Customer Data Platform Implementation

Expected Impact:High

Implementation Effort:High

Timeframe:24-36 months

First Steps:Conduct a full audit of existing data sources and systems. Develop a master data governance strategy. Select a technology partner and begin with integrating data for one key business line.

Experimentation Plan

High Leverage Tests

- Area:

Digital Acquisition Funnel

Experiment:A/B test different value propositions and calls-to-action on landing pages for DTC products.

- Area:

Product Personalization

Experiment:Test the impact of offering personalized coverage recommendations based on user-provided data vs. standard packages.

- Area:

Channel Mix

Experiment:Run geo-targeted experiments to measure the impact of digital advertising spend on agent-generated leads in specific territories.

Utilize a standard framework like ICE (Impact, Confidence, Ease) for prioritizing tests. Track key metrics including conversion rates, cost per acquisition (CPA), customer lifetime value (LTV), and engagement.

Bi-weekly sprint cycles for the digital growth team; quarterly reviews for larger strategic experiments.

Growth Team

A centralized 'Growth & Innovation' team that operates with a hub-and-spoke model. The central team focuses on high-level strategy, new ventures, and shared platforms, while 'spokes' (embedded growth specialists) work within key business units to drive initiatives.

Key Roles

- •

Head of Growth

- •

Growth Product Manager

- •

Data Scientist/Analyst

- •

Performance Marketing Manager

- •

UX Researcher

A combination of hiring external talent with digital/growth expertise and upskilling high-potential internal employees through dedicated training programs, rotational assignments in the growth team, and partnerships with innovation consultancies.

MetLife stands as a formidable incumbent in the mature global financial services industry, possessing a strong foundation built on brand trust, a massive customer base, and a diversified product portfolio. Its Product-Market Fit is undeniable. However, its future growth hinges not on maintaining the status quo, but on its ability to navigate the significant disruption brought by digital transformation and changing customer expectations. The company's recently announced 'New Frontier' strategy correctly identifies key growth areas: leadership in Group Benefits, expansion in asset management, and targeting high-growth international markets.

The primary scale barrier is internal: a reliance on legacy technology and traditional operational models that inhibit agility and the rapid deployment of customer-centric digital solutions. The competition is no longer just other insurance giants like Prudential and AIG, but a swarm of nimble Insurtech startups unburdened by legacy systems.

The most significant growth opportunities lie in bridging the gap between their traditional, sales-led model and the emerging digital-first world. This involves three core strategic thrusts:

1. Digital Reinvention: Launching simplified, fully digital products to capture younger demographics and underserved markets like SMEs. This requires a dedicated product-led growth engine, separate from the core business, to foster innovation without being stifled by existing processes.

2. Deepening B2B Relationships: Evolving from a benefits provider to a holistic 'wellness partner' for corporate clients. By offering an integrated platform for financial, mental, and physical wellness, MetLife can increase employee engagement, create new revenue streams, and build a powerful moat against competitors.

3. Data as a Core Asset: Undertaking a fundamental re-architecting of their data infrastructure to create a unified customer view. This is the foundational investment that will unlock hyper-personalization, improve underwriting efficiency, and power a sophisticated cross-selling engine, turning their North Star Metric of 'Multi-Product Households' into a reality.

Executing this will require a significant cultural shift towards experimentation and agility, supported by a dedicated growth team and strategic talent acquisition in digital and data science. Success will be defined by MetLife's ability to operate as both a stable, trusted institution and a nimble, innovative technology company.

Legal Compliance

MetLife provides a comprehensive and centrally located 'Privacy Center' accessible from the website footer. This center offers multiple, granular privacy policies tailored to different regulations and products, such as a main 'MetLife Privacy Statement,' specific 'HIPAA Notices of Privacy Practices,' and a 'U.S. Consumer Privacy Policy' that addresses GLBA requirements. The policies clearly detail the types of personal information collected, how it is used and shared, and the purposes for sharing (e.g., processing claims, preventing fraud, complying with the law). Crucially, for a financial services company, the policy aligns with the Gramm-Leach-Bliley Act (GLBA) by explaining how consumer financial information is protected. It also provides clear opt-out mechanisms for marketing communications and certain types of data sharing with affiliates, which is a key requirement of GLBA. The structure is robust, though the sheer number of separate policies could be slightly confusing for an average user trying to find a single, all-encompassing document.

MetLife's 'Legal Notices' or 'Terms of Use' are accessible from the website footer. The terms are comprehensive, covering user responsibilities, proprietary rights, and disclaimers of liability. The language clearly states that the website is controlled from the USA and governed by the laws of the State of New York. A key strength is the explicit restriction on unauthorized use by third parties, such as financial advisors, to protect account owner privacy and security. The terms include a standard but strong limitation of liability clause, disclaiming responsibility for any direct or indirect damages from website use, which is a critical risk management component for a financial institution. The enforceability appears standard for a large corporation, though like most terms of service, it is dense and may not be read thoroughly by most users.

Upon visiting the MetLife website, a cookie consent banner appears at the bottom of the screen. The banner provides a link to the 'MetLife U.S. Cookie Policy' and has buttons for 'Accept All Cookies' and 'Cookie Settings'. This two-layer approach is a best practice, allowing for more granular control than a simple accept/reject banner. The ability to adjust settings before accepting indicates a move towards compliance with stricter privacy laws like GDPR, which require affirmative and specific consent. The dedicated Cookie Policy clearly explains the types of cookies used (e.g., strictly necessary, performance, functional, targeting). This mechanism demonstrates a sophisticated approach to cookie compliance, positioning MetLife well against evolving regulatory expectations.

MetLife's data protection posture is heavily influenced by its status as a global financial and insurance provider. The primary US regulation governing its data protection is the Gramm-Leach-Bliley Act (GLBA), which mandates the protection of nonpublic personal information (NPI). MetLife's privacy notices explicitly address GLBA requirements, detailing their security measures and explaining consumer rights. For its health-related products, MetLife provides separate HIPAA notices, demonstrating a segmented and compliant approach to different types of sensitive data. Given its headquarters in New York, MetLife is also subject to the stringent NYDFS Cybersecurity Regulation (23 NYCRR 500), which requires a robust, risk-based cybersecurity program, incident response plans, and regular assessments. Its global presence in over 40 markets, including Europe, necessitates adherence to GDPR, which is reflected in its granular cookie controls and privacy notices that discuss data subject rights. The overall strategy shows a mature, multi-faceted approach to data protection tailored to specific regulatory regimes.

As a major financial services firm, MetLife is subject to the Americans with Disabilities Act (ADA), which courts have consistently applied to websites as places of public accommodation. The website appears to follow many Web Content Accessibility Guidelines (WCAG) principles, which are the de facto standard for ADA compliance online. For example, the site has logical heading structures, clickable elements are generally well-defined, and there is a visible focus indicator for keyboard navigation. A formal Accessibility Statement is available via the footer, which outlines MetLife's commitment to digital accessibility and references WCAG 2.1 Level AA standards. This public statement is a critical strength, as it provides a clear point of contact for users with disabilities and demonstrates a proactive compliance stance, reducing legal risk from accessibility-related lawsuits which are common in the financial sector.

MetLife's compliance framework is exceptionally complex due to its industry. In the U.S., insurance is regulated at the state level, meaning MetLife must comply with the insurance laws and regulations of all 50 states, overseen by state insurance departments. The National Association of Insurance Commissioners (NAIC) develops model laws that influence state regulations, covering solvency, market conduct, and data security. As a provider of investment-related products like variable annuities, MetLife is also regulated by the SEC and FINRA. The website's legal notices include disclaimers that products may not be available in all jurisdictions, reflecting state-by-state licensing requirements. Furthermore, its New York headquarters places it under the direct and stringent oversight of the New York State Department of Financial Services (NYDFS), a leading financial regulator. The website's content and disclosures reflect a deep understanding of this multi-layered regulatory environment.

Compliance Gaps

The segmentation of privacy policies into multiple documents ('Privacy Statement', 'U.S. Consumer Privacy Policy', 'HIPAA Notice', etc.) could potentially create confusion for users trying to understand their rights comprehensively, although it is legally precise.

While the cookie banner offers a 'Cookie Settings' option, the initial layer's prominent 'Accept All' button without an equally prominent 'Reject All' could be viewed as nudging users towards acceptance, a practice scrutinized under GDPR.

Compliance Strengths

- •

Presence of a comprehensive 'Privacy Center' that provides jurisdiction- and regulation-specific policies (GLBA, HIPAA, GDPR).

- •

Strong adherence to financial services regulations like the GLBA Safeguards Rule and the NYDFS Cybersecurity Regulation.

- •

A dedicated and public Accessibility Statement affirming commitment to WCAG 2.1 AA standards, which is a significant risk mitigator for ADA litigation.

- •

Robust and multi-layered legal disclaimers and terms of use that are appropriate for a global financial institution.

- •

Implementation of a two-layer cookie consent mechanism that allows for granular user control, demonstrating awareness of global privacy standards.

Risk Assessment

- Risk Area:

GDPR Cookie Consent

Severity:Low

Recommendation:Modify the initial cookie banner to include an equally prominent 'Reject All' or 'Decline' button alongside the 'Accept All' button. This will strengthen GDPR compliance by ensuring user consent is freely given and unambiguous.

- Risk Area:

Privacy Policy User Experience

Severity:Low

Recommendation:Create a user-friendly summary or an interactive guide within the Privacy Center that helps visitors easily navigate to the specific policy relevant to their product and location, reducing potential confusion from the multiple legal documents.

- Risk Area:

Ongoing Accessibility Maintenance

Severity:Medium