eScore

microsoft.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

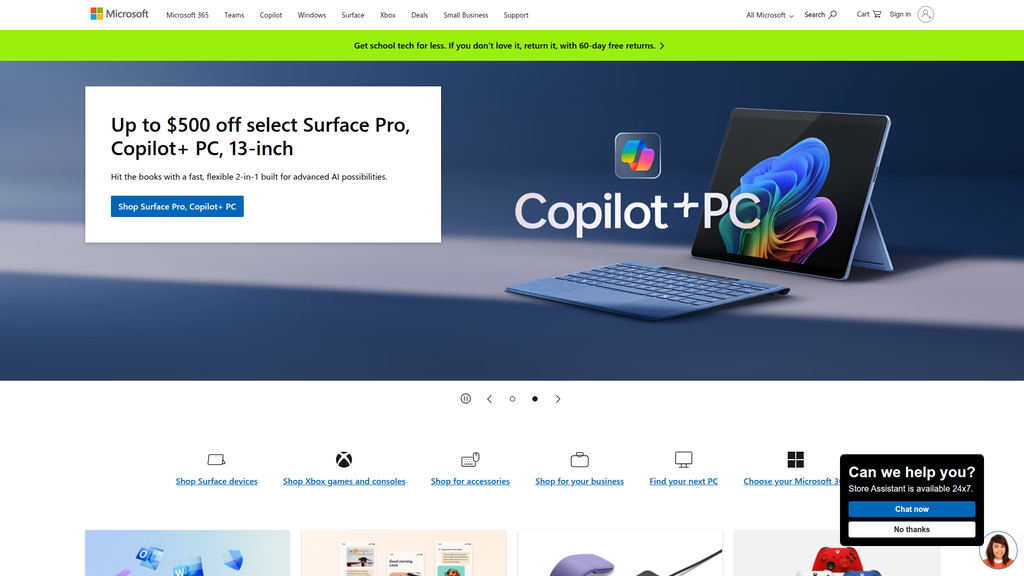

Microsoft demonstrates exceptional digital presence with a high domain authority and a sophisticated, AI-centric content strategy that spans its vast product ecosystem. The website effectively aligns with search intent for its diverse audience segments, from consumers to large enterprises, and maintains a consistent presence across multiple channels. Its global reach is supported by extensive localization, and its content clearly positions it as a thought leader, particularly in AI and cloud computing.

The strategic and consistent integration of the 'Copilot' AI narrative across all digital assets creates a unified, authoritative, and highly relevant presence that captures current market intent.

The homepage's strong B2C focus on hardware sales slightly under-represents the massive B2B (Azure, Dynamics 365) segments. Creating clearer segmentation paths at the top of the user journey would improve intent alignment for high-value enterprise visitors.

Microsoft's brand communication is highly disciplined, with the 'AI-powered productivity' message consistently applied across all segments, from consumer hardware to enterprise cloud solutions. The brand voice is empowering and innovative, and messaging is effectively tailored to different personas, using technical, ROI-focused language for B2B and promotional, lifestyle-oriented language for B2C. The use of customer case studies and analyst reports provides strong validation for business audiences.

Exceptional message discipline around 'Copilot' as the unifying thread that connects a complex product portfolio into a single, cohesive strategic narrative.

The aspirational brand stories (e.g., social impact initiatives) feel disconnected from the product-centric, commercial messaging on the homepage. A stronger narrative bridge is needed to connect the 'why' of the brand to the 'what' of the products.

The website leverages a mature and cohesive design system (Fluent Design) that results in a professional, intuitive, and low-friction user experience. Visual hierarchy is clear, navigation is logical, and CTAs are contextually relevant and effective for segmenting user journeys. While minor inconsistencies in CTA styling exist, the overall architecture is highly optimized for guiding diverse user types toward their respective conversion goals, from a direct hardware purchase to an enterprise demo request.

A mature, large-scale design system ensures a consistent, trustworthy, and highly usable experience that reduces cognitive load and effectively funnels users.

Implementing a 'sticky' main navigation header would improve usability on long-scrolling pages by keeping primary navigation and search functions constantly accessible, reducing friction for users needing to reorient.

Microsoft has established enormous credibility through decades of market leadership, extensive third-party validation (awards, analyst reports), and a deep portfolio of customer success stories. The company is a leader in accessibility and proactively communicates its 'Responsible AI' framework to build trust. However, its credibility is persistently challenged by significant antitrust scrutiny from regulators in the EU and US, which represents a major legal and financial risk.

Proactive and transparent leadership in accessibility and AI ethics, backed by comprehensive compliance documentation (e.g., Azure Trust Center), which serves as a powerful trust signal for enterprise customers.

The primary risk is external, stemming from ongoing antitrust investigations into product bundling. Proactively unbundling offerings like Teams, as proposed to the EU, is a critical step to mitigate this risk and rebuild trust with regulators and competitors.

Microsoft's competitive moat is formidable and sustainable, built on the deep integration of its market-leading products: Windows, Azure, and Microsoft 365. This ecosystem creates extremely high switching costs and an unparalleled distribution channel for new services like Copilot. Their leadership in hybrid cloud with Azure Arc and a vast global partner network are significant, hard-to-replicate advantages that solidify their enterprise dominance.

The deeply integrated software ecosystem, now supercharged with a pervasive AI layer (Copilot), creates a flywheel effect where the value of the platform increases with each new service adopted, locking in customers.

Reduce the strategic vulnerability of the deep partnership with OpenAI by continuing to build and promote proprietary, in-house AI models and capabilities to ensure long-term platform independence and control.

The business model is built for massive scale, with the high fixed costs of R&D and global datacenters offset by the near-zero marginal cost of software, leading to immense operating leverage. The company is demonstrating strong, double-digit revenue growth even at its massive size, driven by the rapidly expanding cloud market. Expansion potential is vast, focused on industry-specific AI clouds, gaming, and further geographic penetration of Azure services.

An extremely efficient financial model with a high percentage of recurring, high-margin revenue from cloud and SaaS, which funds the massive capital expenditures required for AI leadership and global expansion.

Address the physical constraints to growth—namely the global supply of high-performance GPUs and the sustainable energy required to power next-generation data centers—by investing in custom silicon (e.g., Maia AI Accelerator) and renewable energy sources.

Microsoft has executed a masterful pivot from software licensing to a highly coherent and diversified model centered on cloud, subscriptions, and AI. The three core segments (Intelligent Cloud, Productivity, Personal Computing) are synergistic, with Azure providing the foundation for AI-powered services delivered through Microsoft 365 and Windows. This model effectively captures value across the entire technology stack from infrastructure to applications.

The business model's strategic clarity and focus on AI as the unifying growth engine across all segments. The aggressive investment in AI is supported by and reinforces the strength of the core cloud and productivity businesses.

Improve the alignment between the homepage's strategic focus (B2C hardware) and the company's primary revenue drivers (B2B Cloud and Software). A more balanced digital storefront would better reflect the business model's true center of gravity.

Microsoft exerts immense market power, holding a dominant or strong number two position in several critical technology sectors, including operating systems, productivity software, and cloud computing. This position grants it significant pricing power, as seen with the successful rollout of premium-priced Copilot subscriptions, and strong leverage with partners. The company's ability to integrate AI across its entire stack is actively shaping industry trends and forcing competitors to react.

The ability to set de facto industry standards through its massive install base. Embedding Copilot into Windows and Office makes it the default AI assistant for billions of users, creating an immediate and powerful market position.

The company's market power is its greatest asset and greatest liability. It must navigate intense regulatory scrutiny with extreme care, as antitrust actions could be used to blunt its ability to bundle, integrate, and leverage its platform dominance.

Business Overview

Business Classification

Diversified Technology & Cloud Platform

Software as a Service (SaaS), Platform as a Service (PaaS), Infrastructure as a Service (IaaS), Consumer Electronics, Digital Advertising

Technology

Sub Verticals

- •

Cloud Computing

- •

Enterprise Software

- •

Gaming

- •

Computer Hardware

- •

Cybersecurity

- •

Artificial Intelligence

Mature

Maturity Indicators

- •

Sustained global market leadership in multiple core segments (OS, productivity software).

- •

Massive and consistent revenue and profitability.

- •

Extensive global datacenter infrastructure.

- •

High brand recognition and strong brand equity, consistently ranked as one of the most valuable in the world.

- •

Successful strategic pivot from a software licensing model to a cloud-first, subscription-based model.

- •

Significant investment in R&D and strategic acquisitions to fuel future growth, particularly in AI and gaming.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Intelligent Cloud (Azure & Server Products)

Description:Revenue from public, private, and hybrid cloud services (Azure), including IaaS and PaaS, as well as server products like Windows Server and SQL Server. This is Microsoft's largest and fastest-growing segment, driven by enterprise adoption of cloud computing and AI services.

Estimated Importance:Primary

Customer Segment:Enterprises, SMBs, Developers, Startups

Estimated Margin:High

- Stream Name:

Productivity and Business Processes (Microsoft 365, LinkedIn, Dynamics)

Description:Subscription-based revenue from Microsoft 365 (formerly Office 365) for commercial and consumer segments, revenue from LinkedIn (premium subscriptions, advertising), and Dynamics 365 (cloud-based ERP/CRM solutions).

Estimated Importance:Primary

Customer Segment:Enterprises, SMBs, Consumers, Professionals

Estimated Margin:High

- Stream Name:

More Personal Computing (Windows, Devices, Gaming, Search)

Description:Revenue from Windows OEM licensing, Surface device sales, Xbox consoles, content, and services (including Game Pass subscriptions), and search/news advertising (Bing). While a mature segment, gaming provides significant growth.

Estimated Importance:Secondary

Customer Segment:Consumers, OEMs, Enterprises

Estimated Margin:Medium

Recurring Revenue Components

- •

Microsoft 365 Subscriptions (Commercial & Consumer)

- •

Azure Consumption-Based Services

- •

Dynamics 365 Subscriptions

- •

Xbox Game Pass Subscriptions

- •

LinkedIn Premium Subscriptions

Pricing Strategy

Hybrid (Subscription, Consumption-Based, One-Time Purchase, Advertising)

Premium/Mid-range

Semi-transparent

Pricing Psychology

- •

Tiered Pricing (e.g., Microsoft 365 Business Basic, Standard, Premium)

- •

Bundling (Microsoft 365 bundles multiple applications and services)

- •

Pay-As-You-Go (Azure cloud services)

- •

Freemium (e.g., LinkedIn basic vs. premium)

Monetization Assessment

Strengths

- •

Highly diversified revenue streams across multiple strong business segments reduce risk.

- •

Strong shift to a predictable, high-margin, recurring revenue model through subscriptions (Azure, M365).

- •

Powerful ecosystem effect locks in customers and creates significant cross-selling and up-selling opportunities (e.g., adding Copilot AI to an M365 subscription).

- •

Massive scale in cloud operations provides significant cost advantages.

Weaknesses

- •

The 'More Personal Computing' segment is susceptible to fluctuations in the PC market and consumer spending.

- •

Complexity in Azure pricing can be a barrier for some customers.

- •

Monetization of some consumer services, like Bing search, significantly lags behind competitors like Google.

Opportunities

- •

Monetizing Generative AI through premium add-ons like Microsoft 365 Copilot presents a massive new revenue opportunity.

- •

Expanding industry-specific cloud solutions (e.g., for healthcare, finance) to capture more enterprise value.

- •

Continued growth of the Xbox Game Pass subscription base and expansion into cloud gaming.

- •

Further integration of LinkedIn's professional data graph into Dynamics and M365 for unique business insights.

Threats

- •

Intense price competition in the cloud computing market from AWS and Google Cloud.

- •

Regulatory scrutiny and potential antitrust actions in the US and EU could limit future acquisitions and business practices.

- •

The rise of open-source software as a viable, low-cost alternative to some of Microsoft's enterprise products.

- •

Potential saturation in core markets like PC operating systems and office productivity suites.

Market Positioning

Ecosystem Integration and AI Leadership

Market Leader or Strong Contender in Multiple Segments

Target Segments

- Segment Name:

Enterprise & Large Business

Description:Global corporations, public sector organizations, and large enterprises requiring scalable, secure, and integrated IT infrastructure, cloud services, and productivity tools.

Demographic Factors

- •

Organizations with >1000 employees

- •

Global or multi-national operations

- •

Significant IT budgets

Psychographic Factors

- •

Prioritizes security, compliance, and reliability

- •

Seeks to leverage technology for digital transformation

- •

Values long-term vendor relationships and support

Behavioral Factors

- •

Deeply embedded in the Microsoft ecosystem (Windows, Office)

- •

Makes purchasing decisions through IT departments and C-suite executives

- •

Engages in long-term enterprise agreements

Pain Points

- •

Managing complex hybrid and multi-cloud environments

- •

Ensuring data security and regulatory compliance

- •

Increasing employee productivity and collaboration

- •

Scaling IT infrastructure efficiently to meet business demand

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Small & Medium Business (SMB)

Description:Businesses that need cost-effective, easy-to-manage solutions for productivity, collaboration, and business operations without a large dedicated IT staff.

Demographic Factors

Organizations with <1000 employees

Psychographic Factors

- •

Values simplicity and ease of use

- •

Cost-conscious

- •

Seeks to adopt modern technology to compete with larger players

Behavioral Factors

- •

Prefers subscription-based models (SaaS)

- •

Often purchases through partners or directly online

- •

Adopts cloud solutions to reduce capital expenditure on hardware

Pain Points

- •

Limited IT resources and expertise

- •

Need for enterprise-grade tools on a small business budget

- •

Securing company data against cyber threats

- •

Enabling remote and hybrid work effectively

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Developers & IT Professionals

Description:Individuals and teams who build, deploy, and manage applications and IT infrastructure.

Demographic Factors

Technical roles (e.g., software engineer, cloud architect, DevOps engineer)

Psychographic Factors

- •

Values powerful tools, open standards, and robust documentation

- •

Seeks to innovate and build new solutions

- •

Active in online technical communities

Behavioral Factors

- •

Utilizes platforms like Azure, Visual Studio, and GitHub

- •

Adopts new technologies and programming languages

- •

Influences technology purchasing decisions within their organizations

Pain Points

- •

Complexity of modern application development and deployment

- •

Need for scalable and reliable infrastructure

- •

Pressure to accelerate development cycles (DevOps)

- •

Keeping up with rapid technological change

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

General Consumers & Gamers

Description:Individuals and households using technology for personal productivity, communication, and entertainment.

Demographic Factors

Broad demographic, with a focus on ages 16+

Students, professionals, and families

Psychographic Factors

- •

Seeks convenience and user-friendly experiences

- •

Values entertainment and social connectivity

- •

Brand-conscious and influenced by lifestyle trends

Behavioral Factors

- •

Purchases PCs, Surface devices, and Xbox consoles

- •

Subscribes to services like Microsoft 365 Family and Xbox Game Pass

- •

Uses Windows OS and Bing search

Pain Points

- •

Need for reliable and secure personal computing devices

- •

Access to high-quality entertainment and gaming content

- •

Tools to manage personal/family life and schoolwork

- •

Affordability of hardware and software

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Integrated Ecosystem

Strength:Strong

Sustainability:Sustainable

- Factor:

Leadership in Generative AI

Strength:Strong

Sustainability:Sustainable

- Factor:

Enterprise Channel & Relationships

Strength:Strong

Sustainability:Sustainable

- Factor:

Hybrid Cloud Leadership (Azure)

Strength:Strong

Sustainability:Sustainable

- Factor:

Gaming Content & Subscription Service (Xbox/Activision)

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To empower every person and every organization on the planet to achieve more through an integrated ecosystem of intelligent cloud platforms, productivity suites, business applications, and personal computing devices, all infused with cutting-edge AI.

Excellent

Key Benefits

- Benefit:

Enhanced Productivity and Collaboration

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Seamless integration between Microsoft 365 apps (Teams, Outlook, Word).

- •

AI-powered assistance from Copilot to automate tasks and generate content.

- •

Cloud-based file sharing and real-time co-authoring.

- Benefit:

Scalable and Secure Cloud Infrastructure

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Global network of Azure data centers.

- •

Comprehensive portfolio of cloud services (compute, storage, AI/ML).

- •

Industry-leading investment in cybersecurity and compliance certifications.

- Benefit:

Unified and Integrated Platform

Importance:Important

Differentiation:Unique

Proof Elements

- •

Single identity management across services (Azure AD).

- •

Integration between Dynamics 365, Microsoft 365, and Power Platform.

- •

Consistent user experience across devices and applications.

- Benefit:

Leadership in AI Innovation

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Strategic partnership with and investment in OpenAI.

- •

Infusion of Copilot AI across the entire product stack.

- •

Advanced AI/ML services available on the Azure platform.

Unique Selling Points

- Usp:

The 'Copilot' AI Companion: A single, pervasive AI assistant integrated across the entire Microsoft stack, from the OS (Windows) to productivity apps (M365) and business platforms (Dynamics).

Sustainability:Long-term

Defensibility:Strong

- Usp:

The most comprehensive hybrid cloud solution (Azure Arc), allowing organizations to manage on-premises, edge, and multi-cloud environments from a single control plane.

Sustainability:Medium-term

Defensibility:Moderate

- Usp:

A fully integrated enterprise software stack, combining the world's leading productivity suite (M365), a top-tier cloud platform (Azure), professional network (LinkedIn), and business applications (Dynamics).

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Operational inefficiency and disconnected workflows in the workplace.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Inability to scale IT infrastructure to meet dynamic business demands.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

High costs and complexity of managing on-premises data centers.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Difficulty in leveraging business data to generate actionable insights and harness AI.

Severity:Critical

Solution Effectiveness:Partial

Value Alignment Assessment

High

Microsoft's focus on cloud, AI, and digital transformation aligns perfectly with the primary strategic imperatives of nearly every modern organization. The shift to subscription and consumption models also matches current market preferences.

High

The value proposition is tailored to address the specific, critical pain points of its core enterprise, SMB, and developer segments, focusing on security, scalability, productivity, and innovation.

Strategic Assessment

Business Model Canvas

Key Partners

- •

OpenAI (Critical strategic partner for generative AI)

- •

PC OEMs (Dell, HP, Lenovo)

- •

Cloud Solution Providers (CSPs) and Managed Service Providers (MSPs)

- •

Independent Software Vendors (ISVs)

- •

NVIDIA (For AI hardware)

- •

Oracle (Recent partnership for cloud capacity)

Key Activities

- •

Research & Development (especially in AI, cloud, and quantum computing)

- •

Software Development & Engineering

- •

Global Cloud Infrastructure Management & Operations

- •

Enterprise Sales & Marketing

- •

Strategic Acquisitions & Partnerships

Key Resources

- •

Extensive Intellectual Property Portfolio (patents, software code)

- •

Global Datacenter Infrastructure (Azure)

- •

Highly Skilled Workforce (engineering, research, sales)

- •

Strong Brand and Reputation

- •

Vast Customer Base and Enterprise Relationships

Cost Structure

- •

Datacenter Construction and Operating Costs

- •

Research & Development Expenses

- •

Sales and Marketing Costs

- •

Employee Salaries and Compensation

- •

Costs of Revenue (e.g., hardware manufacturing for Surface/Xbox)

Swot Analysis

Strengths

- •

Dominant market position in key enterprise software categories (OS, productivity).

- •

Highly diversified and profitable business segments.

- •

Strong competitive position in cloud computing (Azure is a strong #2).

- •

Powerful ecosystem and high switching costs for customers.

- •

Early and aggressive strategic investment in generative AI (OpenAI partnership).

Weaknesses

- •

Lagging position in key consumer markets like search (Bing) and mobile operating systems.

- •

Perception of being a 'fast follower' rather than a 'first mover' in some innovation areas.

- •

Potential for instability in the key OpenAI partnership.

- •

High capital expenditure required to compete in the cloud and AI infrastructure race.

Opportunities

- •

Cementing AI leadership by deeply integrating Copilot to create an indispensable productivity layer.

- •

Expanding cloud market share, particularly in high-growth AI workloads.

- •

Growth in the gaming market through the Activision Blizzard acquisition and cloud gaming expansion.

- •

Capitalizing on enterprise cybersecurity needs as a core part of its platform offering.

Threats

- •

Intense and accelerating competition in cloud and AI from AWS and Google.

- •

Global regulatory and antitrust scrutiny, which could impact future growth and acquisitions.

- •

Significant cybersecurity threats targeting its vast infrastructure and customer base.

- •

Macroeconomic downturns impacting enterprise IT spending.

Recommendations

Priority Improvements

- Area:

AI Monetization & Integration

Recommendation:Accelerate the development of role-specific Copilots and advanced AI agents to move beyond general assistance to indispensable, high-value workflow automation, justifying premium pricing and solidifying the AI moat.

Expected Impact:High

- Area:

Strategic Partnership Management

Recommendation:Mitigate the strategic risk of over-reliance on OpenAI by continuing to build in-house AI capabilities (via Microsoft AI division) and diversifying partnerships with other AI model providers, ensuring long-term flexibility and competitive leverage.

Expected Impact:High

- Area:

Consumer Market Strategy

Recommendation:Re-evaluate the consumer strategy to focus on integrating AI in a differentiated way through Bing, Windows, and Edge to gain incremental market share, rather than attempting to compete with Google and Apple on their own terms.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Copilot as a Platform' model, allowing third-party developers to build and monetize specialized AI agents on top of Microsoft's foundational models and data graph, creating a new ecosystem.

- •

Introduce consumption-based pricing tiers for Microsoft 365, allowing businesses to pay for advanced AI features on a per-use basis, lowering the barrier to entry for widespread adoption.

- •

Expand the 'AI Data Center as a Service' offering, allowing large enterprises to co-invest in or lease dedicated AI infrastructure, securing long-term, high-margin revenue.

Revenue Diversification

- •

Build out the cybersecurity business as a more distinct and heavily marketed pillar, leveraging its unique data insights from processing trillions of daily threat signals to offer premium, predictive security services.

- •

Further expand into industry-specific cloud platforms with tailored data models, workflows, and AI solutions for verticals like healthcare, finance, and manufacturing.

- •

Double down on cloud gaming by expanding Xbox Game Pass content and device accessibility, positioning it as the 'Netflix for games' to a global audience beyond console owners.

Microsoft has successfully executed one of the most significant business model evolutions in corporate history, transitioning from a software licensing giant to a dominant force in cloud computing and subscription services. The current business model is robust, diversified, and exceptionally well-positioned for the next wave of technological change driven by Artificial Intelligence. The strategic linchpin of this model is the 'intelligent ecosystem.' By weaving its products—Azure, Microsoft 365, Dynamics, LinkedIn, and Windows—into an integrated platform, Microsoft creates substantial switching costs and powerful network effects. The introduction of 'Copilot' as a pervasive AI layer across this ecosystem represents the next phase of this evolution. It is not merely a new product but a strategic lever designed to deepen customer dependency, drive significant up-sell revenue, and establish a formidable competitive moat against rivals. The company's primary revenue drivers have decisively shifted to high-margin, recurring streams from its Intelligent Cloud and Productivity segments, providing financial stability and predictable growth. While the 'More Personal Computing' segment is less central than in the past, it remains a critical channel for reaching consumers and showcasing the integrated hardware/software experience, with gaming now representing its most significant growth engine. The key strategic challenge and opportunity for Microsoft is managing the immense capital expenditure required for AI infrastructure while successfully monetizing its AI investments at scale. The company must navigate intense competition from other tech giants, growing regulatory pressures, and the inherent risks of its deep partnership with OpenAI. The success of its business model hinges on its ability to convince enterprises that the productivity gains from its AI-infused ecosystem justify the premium pricing, thereby transforming AI from a technological feature into a primary driver of enterprise value and Microsoft's future growth.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Massive Capital Investment & R&D Scale

Impact:High

- Barrier:

Brand Recognition and Trust

Impact:High

- Barrier:

Existing Ecosystems & High Switching Costs

Impact:High

- Barrier:

Global Distribution & Partner Channels

Impact:High

- Barrier:

Network Effects (especially in Cloud and Productivity)

Impact:High

Industry Trends

- Trend:

Generative AI Integration Across All Platforms

Impact On Business:Central to Microsoft's strategy with 'Copilot' being integrated into Windows, Office 365, Azure, and Dynamics 365. This is a primary growth driver.

Timeline:Immediate

- Trend:

Hybrid and Multi-Cloud Adoption

Impact On Business:Strengthens Azure's position through services like Azure Arc, which allows management of multi-cloud and on-premises environments, a key differentiator against AWS.

Timeline:Immediate

- Trend:

Increased Regulatory & Antitrust Scrutiny

Impact On Business:Poses significant risk to M&A strategies and bundling practices (e.g., Teams with Office 365), potentially forcing changes to business models.

Timeline:Near-term

- Trend:

Cybersecurity as a Core Business Function

Impact On Business:Creates a massive opportunity for Microsoft's security, compliance, and identity solutions (e.g., Sentinel, Defender) to be integrated across its product suite.

Timeline:Immediate

Direct Competitors

- →

Amazon (AWS)

Market Share Estimate:30-31% in Cloud Infrastructure (IaaS/PaaS).

Target Audience Overlap:High

Competitive Positioning:The dominant market leader in cloud infrastructure, known for its vast service portfolio, maturity, and scalability. Positions itself as the reliable, developer-first choice.

Strengths

- •

First-mover advantage and market share leader in cloud.

- •

Extensive and mature service portfolio.

- •

Strong reputation for scalability and reliability.

- •

Large, established developer ecosystem and community.

Weaknesses

- •

Less integrated with enterprise productivity software compared to Microsoft.

- •

Limited hybrid cloud solutions relative to Azure Arc.

- •

Pricing can be complex and perceived as more expensive for similar services.

- •

Weaker presence in the SaaS (Productivity/CRM) space.

Differentiators

- •

Breadth and depth of IaaS/PaaS services.

- •

Market incumbency and widespread adoption.

- •

Strong focus on developer-centric AI/ML tools.

- →

Google (Alphabet)

Market Share Estimate:~12-13% in Cloud Infrastructure (GCP).

Target Audience Overlap:High

Competitive Positioning:Positions itself as the innovation leader, leveraging its strengths in data analytics, AI/ML, and open-source technologies. 'Google for Work' aims to reinvent enterprise technology.

Strengths

- •

Leader in AI, machine learning, and data analytics (BigQuery, Vertex AI).

- •

Strong open-source heritage (Kubernetes) appeals to developers.

- •

Dominant in search (Google Search) and mobile OS (Android).

- •

Google Workspace is a strong competitor to Microsoft 365.

Weaknesses

- •

Third-place in cloud market share, lacking the scale of AWS and Azure.

- •

Enterprise sales and support perception lags behind Microsoft and AWS.

- •

Fragmented enterprise strategy in the past, though improving.

- •

Limited presence in on-premises enterprise software.

Differentiators

- •

Best-in-class AI/ML and data analytics services.

- •

Deep integration with Google's massive data ecosystem.

- •

Focus on open-source and multi-cloud environments.

- →

Apple

Market Share Estimate:~15% in Desktop OS (macOS).

Target Audience Overlap:Medium

Competitive Positioning:Premium consumer brand focused on tightly integrated hardware, software, and services. Emphasizes user experience, design, and privacy.

Strengths

- •

Extremely high brand loyalty and customer satisfaction.

- •

Seamlessly integrated hardware/software ecosystem (iPhone, Mac, iPad, iCloud).

- •

Leader in the premium hardware segment.

- •

Strong privacy and security narrative.

Weaknesses

- •

Significantly smaller footprint in the enterprise software market.

- •

Closed ecosystem ('walled garden') can be a deterrent for some business users.

- •

Lack of a major public cloud infrastructure offering.

- •

Productivity suite (iWork) has low enterprise adoption compared to Microsoft 365.

Differentiators

- •

Hardware and software vertical integration.

- •

Superior brand image and design.

- •

Focus on consumer privacy.

- •

Strong foothold in the creator/developer community.

- →

Sony (PlayStation)

Market Share Estimate:~45% of the console market.

Target Audience Overlap:High

Competitive Positioning:Premium, innovative gaming platform focused on high-quality, exclusive, narrative-driven games and cutting-edge hardware.

Strengths

- •

Market leader in the current console generation.

- •

Strong portfolio of critically acclaimed exclusive game franchises (e.g., God of War, The Last of Us).

- •

High brand recognition and a large, loyal user base.

- •

Reputation for technological innovation and high-performance hardware.

Weaknesses

- •

Game Pass competitor (PlayStation Plus) is perceived as having a less compelling day-one release library.

- •

Slower to embrace cloud gaming compared to Microsoft's xCloud.

- •

Over-reliance on exclusive content can be a risk.

- •

Higher game prices compared to the value proposition of subscription services.

Differentiators

- •

Library of high-quality, exclusive, first-party games.

- •

Focus on delivering a premium, single-player, narrative experience.

- •

Innovative hardware features like the DualSense controller.

- →

Salesforce

Market Share Estimate:Leading market share in CRM.

Target Audience Overlap:High

Competitive Positioning:The undisputed leader in cloud-based CRM, positioning itself as a comprehensive 'Customer 360' platform for sales, service, and marketing.

Strengths

- •

Dominant market position in the CRM space.

- •

Extensive AppExchange ecosystem with thousands of third-party integrations.

- •

Strong brand recognition and enterprise customer base.

- •

Highly customizable and flexible platform.

Weaknesses

- •

Lacks a native ERP solution, often requiring integration with partners.

- •

Pricing is considered premium and can be complex.

- •

Less comprehensive portfolio compared to Microsoft's end-to-end business solutions (ERP, Productivity, Cloud).

- •

Primary focus is on front-office applications.

Differentiators

- •

CRM-centric, 'customer 360' approach.

- •

Massive and mature third-party application marketplace (AppExchange).

- •

Trailhead learning platform for user training and adoption.

Indirect Competitors

- →

Slack

Description:A channel-based messaging platform that competes directly with Microsoft Teams, chipping away at the collaboration pillar of the Microsoft 365 suite.

Threat Level:Medium

Potential For Direct Competition:Already a direct competitor in collaboration, but threat is mitigated by its acquisition by Salesforce, which has a narrower enterprise scope than Microsoft.

- →

Zoom

Description:A video communications company that competes with Microsoft Teams in the video conferencing space. Its brand became synonymous with video calls during the pandemic.

Threat Level:Medium

Potential For Direct Competition:High, as it continues to expand its platform to include more collaboration and office suite features, encroaching further on Microsoft's territory.

- →

Oracle

Description:A major player in enterprise databases and ERP systems (NetSuite, Fusion). Competes with Dynamics 365 and Azure's database services.

Threat Level:High

Potential For Direct Competition:Already a direct competitor in business applications and a growing competitor in cloud infrastructure.

- →

Nintendo

Description:A major console gaming competitor with a differentiated focus on family-friendly content, innovative hardware (e.g., Switch), and iconic intellectual property (e.g., Mario, Zelda).

Threat Level:Medium

Potential For Direct Competition:Direct competitor in gaming, but its target audience and strategy are sufficiently different to be considered less direct than Sony.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Integrated Ecosystem

Sustainability Assessment:The deep integration of Windows, Azure, Microsoft 365, and Dynamics 365 creates a powerful, unified platform with high switching costs. The addition of Copilot AI across this stack significantly deepens this moat.

Competitor Replication Difficulty:Hard

- Advantage:

Massive Enterprise Install Base

Sustainability Assessment:Decades-long relationships with enterprises, governments, and educational institutions provide an unparalleled channel for upselling new services like Azure and AI.

Competitor Replication Difficulty:Hard

- Advantage:

Hybrid Cloud Leadership

Sustainability Assessment:Azure Arc is a significant differentiator, catering to the reality that most large enterprises operate in a hybrid/multi-cloud environment. This pragmatic approach is difficult for cloud-native competitors to match.

Competitor Replication Difficulty:Medium

- Advantage:

Global Partner Ecosystem

Sustainability Assessment:A vast network of resellers, service providers, and system integrators gives Microsoft a distribution and implementation scale that is extremely difficult to replicate.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'First-Mover in Comprehensive AI Integration (Copilot)', 'estimated_duration': "12-24 months. Competitors like Google are rapidly deploying their own AI models (Gemini) across their ecosystems, but Microsoft's breadth of deployment is currently ahead."}

{'advantage': 'Exclusive Gaming Content via Acquisitions (e.g., Activision Blizzard)', 'estimated_duration': '24-48 months. Provides a significant boost to Xbox Game Pass value, but competitors can and will pursue their own content acquisitions.'}

Disadvantages

- Disadvantage:

Consumer Brand Perception

Impact:Major

Addressability:Difficult

- Disadvantage:

Antitrust and Regulatory Pressure

Impact:Major

Addressability:Difficult

- Disadvantage:

Legacy System Complexity

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Harmonize the 'Copilot' branding across all consumer and business products to create a clear, unified message about Microsoft's AI capabilities.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch aggressive marketing campaigns highlighting the cost and efficiency benefits of the integrated Microsoft stack (e.g., Azure + M365 + Dynamics 365) versus a multi-vendor approach.

Expected Impact:High

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Leverage the Activision Blizzard acquisition to make Xbox Game Pass the undisputed 'Netflix for games' by ensuring all major new titles are day-one releases on the service.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop and market industry-specific Copilot solutions (e.g., Copilot for Healthcare, Copilot for Finance) that are pre-trained on relevant data and workflows.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Continue to invest heavily in Azure Arc to solidify leadership in hybrid/multi-cloud management, making it the de facto control plane for enterprise IT.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Establish a dominant position in the AI developer platform space, making Azure the premier cloud for building, training, and deploying next-generation AI models, moving beyond just providing AI-powered apps.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand the Surface hardware line into new form factors to challenge Apple's ecosystem dominance, potentially exploring AI-centric personal devices beyond traditional PCs.

Expected Impact:Medium

Implementation Difficulty:Difficult

Position as the 'Pragmatic AI Powerhouse for Business and Productivity'. Emphasize enterprise-grade security, seamless integration, and tangible productivity gains, differentiating from Google's 'innovation-first' and Apple's 'consumer-centric' approaches.

Differentiate through the unparalleled breadth and depth of AI integration across a ubiquitous, pre-existing software stack. No competitor can match the reach of deploying AI from the operating system (Windows) to productivity (M365) to business apps (Dynamics) and cloud infrastructure (Azure).

Whitespace Opportunities

- Opportunity:

AI-Powered Business Suite for SMBs

Competitive Gap:While competitors focus on either enterprise (Salesforce, Oracle) or point solutions (HubSpot), there is a gap for a truly integrated, AI-native operating system for small businesses that combines CRM, ERP, productivity, and marketing.

Feasibility:High

Potential Impact:High

- Opportunity:

Next-Generation AI-Augmented Collaboration

Competitive Gap:Current tools like Teams, Slack, and Zoom are still fundamentally chat and video platforms. A new platform built from the ground up around AI agents that can summarize, take action, and manage projects within a collaborative space is a significant opportunity.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Ethical AI and Compliance-as-a-Service

Competitive Gap:As AI regulation increases, businesses will need tools to ensure compliance, transparency, and ethical use of AI. Microsoft can leverage its enterprise trust to offer a suite of services that manage AI governance, a gap not yet filled by competitors.

Feasibility:Medium

Potential Impact:Medium

Microsoft's competitive landscape is a multi-front war against the largest technology companies in the world. The company is in a unique position, competing directly with Amazon and Google in the cloud, Apple in personal computing, Sony and Nintendo in gaming, and Salesforce and Oracle in business applications. The core of Microsoft's current strategy, as evidenced by its website and product announcements, is a massive, company-wide pivot to artificial intelligence, unified under the 'Copilot' brand. This is not just a new product line but a foundational layer being integrated into every significant asset, from the Windows OS to the Azure cloud.

The company's primary sustainable advantage is its deeply entrenched enterprise ecosystem. No other competitor possesses the same combination of a dominant desktop operating system (Windows), the default enterprise productivity suite (Microsoft 365), and a top-tier cloud platform (Azure). This trifecta creates immense customer inertia and provides an unparalleled distribution channel for new AI services. Microsoft's key strategic challenge is to leverage this incumbent advantage to win the AI platform war before competitors can build equally compelling, integrated offerings.

In the cloud, Microsoft Azure is successfully positioned as the best choice for hybrid environments, a pragmatic strategy that resonates with large enterprises and differentiates it from market-leader AWS. In gaming, the acquisition of Activision Blizzard is a direct assault on Sony's content-driven dominance, aiming to shift the value proposition from exclusive titles to an all-you-can-eat subscription model with Xbox Game Pass. In business applications, Dynamics 365, while not the market leader, is a growing threat to Salesforce and Oracle precisely because it is natively integrated with the rest of the Microsoft stack.

The primary threats are significant: Google's raw AI research prowess and massive data advantage, Apple's unshakeable brand loyalty in the high-end consumer market, and increasing antitrust scrutiny that could limit its ability to bundle and integrate its products. Strategic whitespace exists in providing a truly integrated, AI-first business platform for the underserved SMB market and in defining the next generation of AI-native collaboration tools. Microsoft's future success will depend on its ability to execute this ambitious AI integration strategy faster and more cohesively than its rivals, solidifying its ecosystem as the essential, intelligent backbone for the modern enterprise.

Messaging

Message Architecture

Key Messages

- Message:

AI, primarily through Copilot, is integrated into our core products to enhance productivity and creativity.

Prominence:Primary

Clarity Score:High

Location:Homepage hero banner pop-up, secondary content blocks ('Achieve the extraordinary'), 'For business' section, and the entire Dynamics 365 blog post.

- Message:

Purchase our latest Surface 'Copilot+ PC' devices for an optimized AI experience and significant savings.

Prominence:Primary

Clarity Score:High

Location:Homepage hero slideshow ('Save up to $500 on select Surface Laptop').

- Message:

Microsoft provides a comprehensive ecosystem for both personal and business needs (M365, Xbox, Surface, Dynamics 365, Visual Studio).

Prominence:Secondary

Clarity Score:Medium

Location:Homepage content blocks below the hero section.

- Message:

Microsoft's technology empowers real-world positive impact and innovation.

Prominence:Tertiary

Clarity Score:Medium

Location:Human-interest stories section at the bottom of the homepage (NFL, YMCA, Trevor Noah).

The message hierarchy on the homepage is heavily skewed towards B2C hardware sales, specifically the new Surface Copilot+ PCs. The overarching strategic message about AI leadership is present but is primarily used as a feature to drive this hardware sale. Messaging for the vast B2B and developer ecosystems is relegated to a secondary 'For business' section, which underrepresents its massive contribution to Microsoft's business. The Dynamics 365 blog, in contrast, has a perfectly clear and focused hierarchy for its target business audience.

The core message of 'AI-powered productivity' via Copilot is exceptionally consistent across all analyzed content. It is the central thread connecting consumer hardware (Surface), personal productivity apps (M365), and complex business solutions (Dynamics 366). This demonstrates a strong, unified strategic direction. The core brand mission to 'empower...to achieve more' is also a consistent undercurrent.

Brand Voice

Voice Attributes

- Attribute:

Helpful

Strength:Strong

Examples

- •

Copilot is your AI companion

- •

Always by your side, ready to support you whenever and wherever you need it.

- •

We show customers we're on their side. We anticipate their real needs and offer great information at just the right time.

- Attribute:

Innovative

Strength:Strong

Examples

- •

Bring ideas to life with Copilot

- •

Join the era of AI

- •

A new chapter in business AI innovation

- Attribute:

Promotional

Strength:Strong

Examples

- •

Save up to $500 on select Surface Laptop, Copilot+ PC

- •

Get school tech for less.

- •

Plus, get extra cashback and a 3-month trial...

- Attribute:

Authoritative

Strength:Moderate

Examples

- •

Microsoft named a Leader in the 2025 Gartner® Magic Quadrant™...

- •

IDC predicts that global spending on AI solutions will reach more than USD500 billion by 2027.

- •

The messaging often emphasizes collaboration and expert guidance...

Tone Analysis

Empowering

Secondary Tones

- •

Aspirational

- •

Promotional

- •

Consultative

Tone Shifts

The tone shifts from highly promotional and consumer-focused on the homepage hero section to more aspirational and benefit-oriented in the mid-page content ('Achieve the extraordinary').

A significant shift occurs between the general homepage and the Dynamics 365 blog, moving from a broad, consumer-friendly tone to a professional, data-driven, and consultative tone for business decision-makers.

Voice Consistency Rating

Good

Consistency Issues

While the tone shifts are largely appropriate for the audience, the homepage's heavy emphasis on direct-to-consumer sales promotions can momentarily dilute the broader brand voice of an innovative, empowering technology leader, making it feel more like a retail electronics site.

Value Proposition Assessment

Microsoft empowers every person and organization to achieve more by embedding intelligent, AI-driven assistance (Copilot) across a deeply integrated and familiar ecosystem of software, hardware, and cloud services.

Value Proposition Components

- Component:

AI-Powered Productivity

Clarity:Clear

Uniqueness:Somewhat Unique

Comment:The 'Copilot' branding is clear and consistently applied. The uniqueness comes not from AI itself, but from its native integration into the widely-used M365 and Windows ecosystem.

- Component:

Integrated Ecosystem

Clarity:Somewhat Clear

Uniqueness:Unique

Comment:The homepage shows the pieces (Surface, M365, Xbox) but doesn't strongly articulate the unique value of their seamless integration. The power of this ecosystem is a key differentiator that could be more explicit.

- Component:

Business Transformation

Clarity:Clear

Uniqueness:Somewhat Unique

Comment:The Dynamics 365 blog clearly articulates this value for a business audience, focusing on streamlining operations, making insightful decisions, and elevating customer experiences.

Microsoft's key differentiator is the breadth and depth of AI integration across its pre-existing, market-leading ecosystem. While competitors have strong AI offerings, none have natively embedded an AI assistant across the dominant office productivity suite (M365), the leading desktop OS (Windows), and a top-tier cloud platform (Azure). This message of a unified, intelligent platform is a powerful competitive advantage.

The messaging positions Microsoft as the practical, integrated AI leader for the masses, from students to enterprises. The focus is less on having the most advanced theoretical AI model and more on delivering tangible AI benefits within the workflows users already have. This positions them as an enabler of immediate productivity gains, contrasting with competitors who may be perceived as offering more siloed or future-facing AI tools.

Audience Messaging

Target Personas

- Persona:

Consumer / Prosumer (e.g., Students, Families)

Tailored Messages

- •

Save up to $500 on select Surface Laptop, Copilot+ PC

- •

Study smarter with an AI-powered companion

- •

Get school tech for less. If you don’t love it, return it...

- •

Xbox Game Pass Ultimate

Effectiveness:Effective

- Persona:

Business Decision Maker

Tailored Messages

- •

Streamline operations: Transform CRM and ERP systems from siloed applications into a unified, automated ecosystem...

- •

Empower insightful decisions: Provide all employees with AI-powered natural language analysis...

- •

Save time and focus on the things that matter most with AI in Microsoft 365 for business.

Effectiveness:Effective

- Persona:

Developer / IT Professional

Tailored Messages

- •

Get the most comprehensive IDE for .NET and C++ developers on Windows...

- •

Download Visual Studio 2022

- •

Join the era of AI. Create, communicate, and code with the latest Microsoft AI solutions.

Effectiveness:Somewhat Effective

Comment:While there are direct messages, they are minimal on the homepage. This audience likely navigates directly to more technical sub-domains, but their presence on the main page feels like an afterthought.

Audience Pain Points Addressed

- •

Information overload / Too much data (addressed by AI summaries and insights)

- •

Inefficient, manual workflows (addressed by automation in Dynamics 365)

- •

Siloed business applications (addressed by a 'unified, automated ecosystem')

- •

Pressure to innovate and adopt AI (addressed by 'Join the era of AI' messaging)

Audience Aspirations Addressed

- •

Achieving more with less effort ('Achieve the extraordinary')

- •

Bringing creative ideas to life

- •

Gaining a competitive edge in business

- •

Being more productive and efficient in daily work

Persuasion Elements

Emotional Appeals

- Appeal Type:

Empowerment

Effectiveness:High

Examples

- •

Achieve the extraordinary

- •

Bring ideas to life with Copilot

- •

Power your dreams.

- Appeal Type:

Aspiration / Inspiration

Effectiveness:Medium

Examples

Exploring the impact of AI... using AI for the greater good

Teamwork and tech power Tomorrow Academies

Social Proof Elements

- Proof Type:

Customer Case Studies

Impact:Strong

Examples

- •

Avanade... accelerated sales productivity by empowering its consultants with Microsoft Copilot for Sales.

- •

Domino’s Pizza UK & Ireland Ltd. helped ensure exceptional customer experiences... with AI-powered predictive analytics...

- •

The Greater Austin YMCA met a critical need for child care...

- Proof Type:

Expert/Analyst Validation

Impact:Strong

Examples

Gartner® Hype Cycle™ for Artificial Intelligence, 2023

Forrester Research, businesses that invest in enterprise AI initiatives will boost productivity...

- Proof Type:

Influencer/Celebrity Association

Impact:Moderate

Examples

Trevor Noah travels the world to meet experts who are using AI...

Explore how Copilot helps NFL coaches and players...

Trust Indicators

- •

Explicitly referencing a commitment to 'responsible AI principles'.

- •

Use of specific data points and statistics from reputable third-party sources (IDC, Forrester).

- •

Featuring well-known, trusted brands as customers (Domino's, NFL).

Scarcity Urgency Tactics

Time-limited offers are implied through sales messaging ('Up to $500 off...'), creating a soft sense of urgency for consumer purchases.

Calls To Action

Primary Ctas

- Text:

Shop Surface Laptop, Copilot+ PC

Location:Homepage Hero Section

Clarity:Clear

- Text:

Learn more

Location:Business Sections (M365 Copilot, Dynamics 365 Blog)

Clarity:Clear

- Text:

Download the Copilot app

Location:Homepage Mid-section

Clarity:Clear

- Text:

Join now

Location:Xbox Game Pass Ultimate Section

Clarity:Clear

- Text:

Read the story

Location:Human-interest and AI exploration sections

Clarity:Clear

The CTAs are highly effective due to their clarity, simplicity, and contextual relevance. They use strong, action-oriented verbs. The website effectively separates transactional CTAs ('Shop', 'Join') for consumer products from informational CTAs ('Learn more', 'Read the story') for business and brand-level content, guiding different user journeys appropriately.

Messaging Gaps Analysis

Critical Gaps

The homepage messaging fails to convey the sheer scale and importance of Microsoft's cloud infrastructure (Azure). While AI is highlighted, its foundational reliance on the cloud is an unstated, missed opportunity to reinforce their enterprise dominance.

There is a weak narrative connection between the high-level, inspirational brand stories (YMCA, Trevor Noah) and the product-centric, sales-driven messaging that dominates the page. The 'why' behind the brand feels disconnected from the 'what' they are selling.

Contradiction Points

There are no major contradictions. However, the mission to 'empower every person' can feel slightly at odds with the premium pricing of the flagship hardware being promoted so heavily on the homepage.

Underdeveloped Areas

The value proposition of the integrated Microsoft ecosystem could be more powerfully articulated. The page presents a collection of products rather than a cohesive, synergistic platform where the whole is greater than the sum of its parts.

The 'For business' section is a static, small part of the homepage. Given that B2B is a massive part of Microsoft's revenue, this messaging could be more dynamic and prominent, perhaps with a toggle to switch between 'Personal' and 'Business' views.

Messaging Quality

Strengths

- •

Exceptional clarity and consistency in the central 'AI/Copilot' message across all audience segments and content types.

- •

Effective audience segmentation, with a clear distinction in tone, evidence, and calls-to-action between consumer and business messaging.

- •

Strong use of social proof, particularly in B2B content, leveraging customer stories and analyst data to build credibility and trust.

Weaknesses

- •

Over-emphasis on B2C hardware sales on the primary corporate homepage, which underrepresents the company's status as a dominant enterprise and cloud provider.

- •

The brand narrative and storytelling elements feel disconnected from the primary commercial CTAs.

- •

The immense value of the integrated ecosystem is an under-leveraged message on the homepage.

Opportunities

- •

Create a more dynamic homepage experience that allows users to self-segment (e.g., Personal, Business, Developer, Student) to receive a more tailored messaging journey from the first click.

- •

Develop integrated campaign narratives that more clearly link the aspirational 'empowerment' stories to the tangible benefits of the products being sold.

- •

Elevate the messaging around Azure on the homepage, positioning it as the intelligent cloud foundation that powers the AI experiences featured so prominently.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Message Hierarchy

Recommendation:Restructure the homepage to create a more balanced representation of B2C and B2B offerings. Introduce a dynamic hero banner or clear segmentation path (e.g., 'For Home' vs. 'For Business') at the very top of the page.

Expected Impact:High

- Area:

Value Proposition Narrative

Recommendation:Develop a dedicated content module on the homepage that explicitly communicates the value of Microsoft's integrated ecosystem. Use visuals and concise copy to show how Surface, Windows, M365, and Cloud services work together seamlessly.

Expected Impact:High

- Area:

Storytelling Integration

Recommendation:Revise the human-interest story sections to include clearer narrative bridges to relevant products. For example, after the YMCA story, add a sub-heading like 'Empowering non-profits with Microsoft 365' followed by a CTA.

Expected Impact:Medium

Quick Wins

- •

Add a more prominent link to Azure and the full Microsoft Cloud offering within the main navigation or top-level 'For business' section on the homepage.

- •

In the 'Achieve the extraordinary' M365 section, add a bullet point that explicitly mentions its integration with Surface hardware and Windows.

- •

Test CTA button copy to be more benefit-oriented (e.g., 'Shop a smarter way to study' vs. 'Shop Surface Laptop').

Long Term Recommendations

Invest in a personalization strategy for the homepage that serves different content based on user data (e.g., past site behavior, referral source) to automatically surface the most relevant messaging for enterprise vs. consumer visitors.

Launch a major brand campaign focused on the theme of 'One Microsoft,' designed to educate the market on the power and security of its fully integrated, AI-powered ecosystem.

Microsoft's strategic messaging is disciplined and highly effective at communicating its central, top-down priority: leadership in the era of AI. The 'Copilot' brand is the golden thread that masterfully ties together a vast and complex portfolio, creating a unified narrative of AI-powered productivity for everyone from students to Fortune 500 companies. The messaging is skillfully segmented, shifting from promotional and lifestyle-oriented language for consumers to a consultative, ROI-focused dialect for business leaders. This is particularly evident in the contrast between the hardware-centric homepage and the thought leadership-driven Dynamics 365 blog, which uses social proof like customer stories and analyst reports to build deep credibility.

However, the current execution on the primary microsoft.com homepage presents a messaging hierarchy that is misaligned with the company's actual business structure. It functions more as a direct-to-consumer retail storefront for Surface devices than as the portal for a global technology titan whose revenue is dominated by cloud and enterprise software. This over-rotation on B2C hardware sales messaging creates a significant gap, under-communicating the scale and strategic importance of its Azure cloud and broader business solutions. While the AI message is consistent, the vehicle for that message on the homepage is predominantly a consumer laptop, which doesn't fully capture the transformative impact Microsoft is having in the enterprise space. The core opportunity for optimization is to rebalance this hierarchy, creating clearer pathways for different audience segments and more effectively articulating the unique, holistic value proposition of its deeply integrated, AI-powered ecosystem.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Microsoft Cloud revenue reached $46.7 billion in Q4 FY25, growing 27% year-over-year, indicating massive enterprise demand.

- •

Azure, the core of the Intelligent Cloud segment, surpassed $75 billion in annual revenue with 34% growth, demonstrating market leadership in a key growth sector.

- •

Productivity and Business Processes segment (including Microsoft 365) grew 16% to $33.1 billion, showing sustained demand for its core software suite.

- •

The new strategic focus on AI, specifically Copilot, is showing rapid adoption, with the number of customers growing over 60% quarter-over-quarter and daily usage nearly doubling in the same period.

Improvement Areas

- •

Clearly articulating the ROI of Copilot at its $30/user/month price point to accelerate adoption beyond early adopters and justify the significant cost increase on E3/E5 licenses.

- •

Improving the consumer value proposition for AI PCs (Copilot+ PCs) to stimulate a hardware refresh cycle, as initial market reception has been tempered by high costs and unclear use cases.

- •

Streamlining the complex enterprise licensing agreements to reduce friction and improve customer experience, especially when bundling new AI services.

Market Dynamics

The global cloud computing market is projected to grow at a CAGR of over 20% between 2025 and 2030, reaching well over $2 trillion.

Mature/Re-inventing

Market Trends

- Trend:

Pervasive Enterprise AI Integration

Business Impact:This is Microsoft's primary growth catalyst. Over 80% of enterprises are expected to deploy generative AI by 2026, creating massive demand for Azure AI services and Copilot-infused applications.

- Trend:

Hybrid and Multi-Cloud Adoption

Business Impact:Azure's strength in hybrid cloud environments is a key differentiator. Strategic partnerships, like with Oracle, further enhance its multi-cloud appeal, meeting enterprise demand for flexibility.

- Trend:

Shift to AI-Capable PCs

Business Impact:Microsoft is driving the 'Copilot+ PC' category to create a new hardware upgrade cycle and embed its AI services at the OS level, though adoption may take time to ramp up.

- Trend:

Heightened Regulatory and Antitrust Scrutiny

Business Impact:Like other tech giants, Microsoft faces increasing legal and regulatory challenges in the US and EU, which could impact future acquisitions, partnerships, and business practices.

Excellent. Microsoft's aggressive pivot to generative AI aligns perfectly with the surge in enterprise demand, positioning them to capture a significant share of this transformative market.

Business Model Scalability

High

Dominated by high fixed costs (R&D, global data center infrastructure) and extremely low marginal variable costs for software and cloud services, enabling immense operating leverage.

Extremely high. Each additional software license or cloud subscription adds almost pure profit, as demonstrated by their strong operating income growth of 23-24%.

Scalability Constraints

Global supply chain for high-performance GPUs and other AI-specific hardware needed for data center expansion.

Energy availability and sustainability for powering massive data centers required for AI model training and inference at scale.

Team Readiness

Exceptional. CEO Satya Nadella has successfully navigated multiple technological shifts and has instilled a clear, cohesive AI-first vision across the entire company.

Mature but complex. The primary challenge is ensuring seamless collaboration and strategic alignment across massive, historically siloed divisions (Windows, Azure, Office, Xbox) to deliver a unified Copilot experience.

Key Capability Gaps

Specialized AI Ethicists and Governance Experts to navigate complex regulatory landscapes and build trust at a global scale.

Quantum Computing talent to maintain a long-term competitive edge in next-generation computing, a strategic area of investment for Microsoft.

Growth Engine

Acquisition Channels

- Channel:

Enterprise Direct Sales & Partner Ecosystem

Effectiveness:High

Optimization Potential:Medium

Recommendation:Deepen partner training on selling value-based AI outcomes rather than just features. Incentivize partners to build specialized, industry-specific Copilot extensions and Azure AI solutions.

- Channel:

Self-Service/Web (SMB & Consumer)

Effectiveness:High

Optimization Potential:High

Recommendation:Use AI-powered personalization on the website to create tailored journeys for different user segments (developer, business user, gamer), guiding them to the most relevant products (e.g., Visual Studio, Dynamics 365, Game Pass).

- Channel:

OEM Partnerships (Windows & Copilot+ PCs)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Co-invest with OEM partners in marketing campaigns that clearly demonstrate unique, compelling use cases for on-device AI in Copilot+ PCs to accelerate consumer adoption.

Customer Journey

Enterprise journeys are long sales cycles involving multiple touchpoints (content, sales demos, partner consultations). Consumer journeys are more direct through online stores or retail partners. The website acts as a central hub for discovery and initial engagement for all segments.

Friction Points

- •

Complexity and opacity of enterprise volume licensing, especially with the addition of new AI SKUs.

- •

Demonstrating tangible productivity gains to justify the per-seat cost of M365 Copilot during trial periods.

- •

Navigating the vast portfolio of Azure services can be overwhelming for new customers without guided assistance.

Journey Enhancement Priorities

{'area': 'Enterprise Trial-to-Paid Conversion', 'recommendation': 'Develop and promote industry-specific Copilot trial templates and ROI calculators to help businesses build a strong internal case for wider deployment.'}

{'area': 'Azure Onboarding', 'recommendation': "Enhance the AI-driven 'Azure Advisor' to provide more proactive, personalized onboarding paths and cost-optimization recommendations for new users based on their stated goals."}

Retention Mechanisms

- Mechanism:

Ecosystem Lock-In & High Switching Costs

Effectiveness:High

Improvement Opportunity:Strengthen the integration points between key platforms (e.g., Dynamics 365 data surfacing seamlessly in Teams via Copilot, LinkedIn Sales Navigator data enriching Dynamics records) to make the ecosystem indispensable.

- Mechanism:

Subscription Model (Microsoft 365, Azure, Game Pass)

Effectiveness:High

Improvement Opportunity:Increase the perceived value of subscriptions by consistently adding new AI-powered features, ensuring customers see continuous innovation for their recurring investment.

- Mechanism:

Consumption-Based Revenue (Azure)

Effectiveness:High

Improvement Opportunity:Proactively use AI to help customers optimize their Azure spend, building trust and encouraging them to migrate more workloads to the platform with confidence in cost management.

Revenue Economics

Extremely strong. For SaaS products like M365, the incremental cost of a new user is near zero. In the Azure business, Microsoft benefits from long-term, high-value contracts with significant expansion revenue as clients migrate more workloads to the cloud.

While a precise figure is indeterminable externally, the LTV to CAC for enterprise customers is exceptionally high due to deep integration, high switching costs, and significant up-sell/cross-sell opportunities across the portfolio (e.g., from M365 to Dynamics to Azure).

High. The company's ability to consistently grow revenue (18% YoY) and operating income (23% YoY) at such a massive scale demonstrates remarkable efficiency.

Optimization Recommendations

- •

Drive adoption of higher-tier licenses (e.g., M365 E5) by making exclusive Copilot features a key value driver.

- •

Bundle services strategically (e.g., M365, Teams, Dynamics, and Power Platform) to increase average revenue per user (ARPU) and deepen customer dependency.

- •

Focus expansion revenue efforts on Azure AI services, which command premium pricing and drive significant compute consumption.

Scale Barriers

Technical Limitations

- Limitation:

AI Compute and Infrastructure Capacity

Impact:High

Solution Approach:Continue massive capital investment ($80B+ planned) in next-generation data centers, while also investing in custom chip design (e.g., Maia AI Accelerator) to reduce reliance on third-party hardware and optimize performance.

Operational Bottlenecks

- Bottleneck:

Cross-Divisional Strategy Alignment

Growth Impact:Ensuring a consistent and integrated AI experience across the entire product portfolio (Windows, Office, Azure, GitHub) requires unprecedented levels of internal coordination.

Resolution Strategy:Establish a centralized AI/Copilot governance council with executive authority to mandate standards, resolve product conflicts, and align roadmaps across all major business units.

Market Penetration Challenges

- Challenge:

Intense Competition in Cloud Computing

Severity:Critical

Mitigation Strategy:Differentiate Azure not just on IaaS but as the premier platform for enterprise AI development and deployment, leveraging the exclusive OpenAI partnership and deep integration with Microsoft's full software stack. Continue gaining market share (now at ~25% vs AWS's ~31%).

- Challenge:

Global Regulatory and Antitrust Scrutiny

Severity:Major

Mitigation Strategy:Proactively engage with regulators, champion responsible AI principles, and invest heavily in data privacy and security infrastructure to build trust. Architect partnerships (like with OpenAI) to be defensible against antitrust claims.

- Challenge:

Enterprise AI Adoption Hurdles

Severity:Major

Mitigation Strategy:Microsoft's success depends on its customers' success with AI. Address common adoption barriers like poor data quality, skills gaps, and integration complexity by investing in consulting services, partner training, and user-friendly tools (like Power Platform) to ease implementation.

Resource Limitations

Talent Gaps

Top-tier AI researchers and engineers, who are in extremely high demand globally.

Cloud solution architects with deep expertise in specialized, high-growth industries like healthcare and finance.

Effectively unlimited. Microsoft's strong profitability and cash flow can fund the massive, ongoing investments required for global AI infrastructure leadership.

Infrastructure Needs

Continued global expansion of Azure data center regions, especially in emerging markets with high growth potential.

Investment in sustainable energy sources to power the exponential growth in compute demand.

Growth Opportunities

Market Expansion

- Expansion Vector:

Industry-Specific AI Clouds

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Build on existing 'Microsoft Cloud for...' initiatives (e.g., Healthcare, Retail) by developing pre-trained, industry-specific AI models and Copilots that solve high-value, sector-specific problems, creating a strong competitive moat.

- Expansion Vector:

Geographic Cloud Expansion (e.g., India, Southeast Asia)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Continue significant investment in local data center infrastructure and form strategic partnerships with national governments and large enterprises to build sovereign cloud capabilities and drive AI adoption.

Product Opportunities

- Opportunity:

Ubiquitous Copilot Integration and Extension

Market Demand Evidence:Rapid early adoption and a 60% QoQ increase in customer numbers demonstrate strong market pull.

Strategic Fit:Core to the company's entire growth strategy.

Development Recommendation:Transition from embedding Copilot into existing apps to building new, AI-native applications. Create a robust API and marketplace for third-party developers to build and monetize 'Skills' or extensions for Copilot, creating a network effect.

- Opportunity:

Gaming and AI Intersection (Activision Blizzard)

Market Demand Evidence:The gaming market is massive and growing, projected to approach $200 billion. Gamers are early adopters of new technology.

Strategic Fit:Leverages the recent Activision Blizzard acquisition and Xbox's strong market position.

Development Recommendation:Use generative AI to revolutionize game development (e.g., AI-generated assets, dialogue, and worlds) and create new in-game experiences (e.g., intelligent NPCs, AI-powered guides). Integrate Game Pass more deeply into the broader Microsoft ecosystem.

Channel Diversification

- Channel:

Specialized AI Consulting and Implementation Partners

Fit Assessment:Excellent

Implementation Strategy:Create a new, elite tier in the partner program for firms specializing in AI strategy, data readiness, and custom model development. Provide them with advanced training, co-marketing funds, and direct access to Microsoft's AI engineering teams.

Strategic Partnerships

- Partnership Type:

Foundational AI Model Provider

Potential Partners

OpenAI

Expected Benefits:Continued exclusive access to cutting-edge AI models, deep technical collaboration, and a powerful marketing narrative. This partnership is a cornerstone of Azure's competitive differentiation.

- Partnership Type:

Multi-Cloud/Interoperability

Potential Partners

- •

Oracle

- •

SAP

- •

Other major enterprise software providers