eScore

mohawkind.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

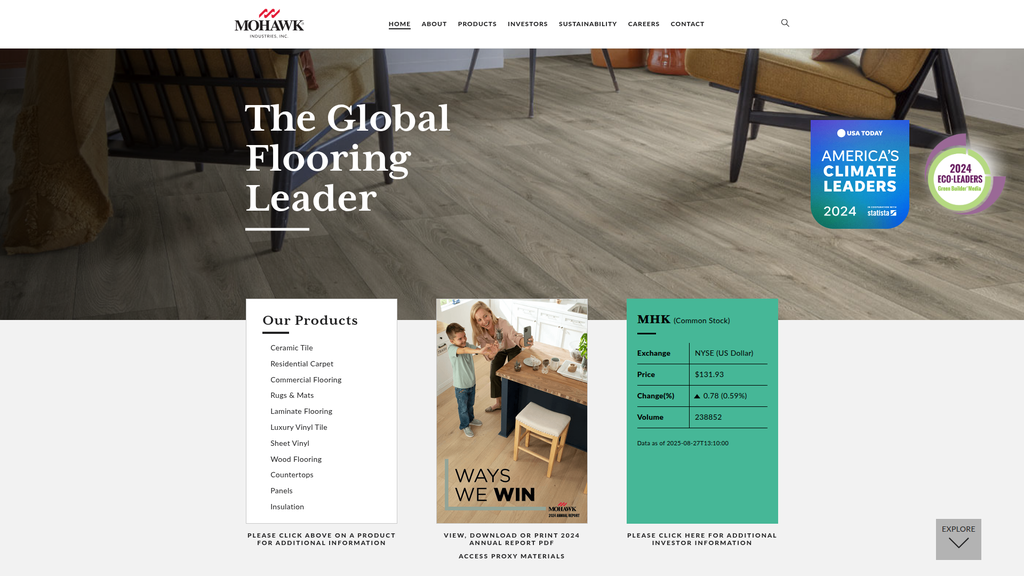

Mohawk's corporate digital presence is highly focused on its investor and B2B partner audience, successfully aligning with their search intent for financial data and corporate information. However, its overall content authority on broader industry topics like design trends or sustainability is underdeveloped, ceding thought leadership to competitors and its own sub-brands. While the site communicates a global reach, it lacks sophisticated local optimization, and voice search optimization is minimal due to the corporate, data-heavy nature of the content.

The website's structure and content are precisely aligned with the search intent of its primary target audience: investors and B2B partners seeking corporate and financial information.

Establish a corporate-level thought leadership hub with content on global design trends, material innovation, and sustainability to capture a wider range of high-value industry search queries beyond branded and financial terms.

Brand communication is exceptionally effective for its primary audience of investors and B2B partners, clearly articulating market leadership and financial strength with supporting data. The messaging successfully differentiates Mohawk on the basis of scale and portfolio breadth. However, it lacks an emotional journey, an employer value proposition to attract talent, and prominent messaging around sustainability, which is a major gap compared to competitors.

Messaging is precisely tailored and highly effective for the investor and B2B partner audiences, using a consistent, authoritative voice to convey market dominance and financial stability.

Create a dedicated and prominent section for ESG (Environmental, Social, and Governance) to elevate the sustainability narrative, making it a core pillar of the corporate brand message to align with key industry trends.

The site's conversion goals are oriented towards information discovery (e.g., downloading reports) rather than sales. While the information architecture is logical, the user experience suffers from significant friction points, such as low-contrast, passive call-to-action buttons that create high cognitive load for users trying to navigate deeper. The cross-device experience is adequate, but text-heavy sections become overly burdensome on mobile, hindering a seamless journey.

The information architecture is logical, with content clearly structured for its primary audiences (Investors, Careers, Products), allowing knowledgeable users to find specific corporate information efficiently.

Redesign all primary and secondary call-to-action buttons from a low-contrast 'ghost button' style to a solid, brand-aligned color to dramatically improve visibility and guide users more effectively.

Mohawk builds immense credibility through a strong hierarchy of trust signals, including prominent display of NYSE ticker data, transparent financial reporting, and a robust portfolio of well-known brands. Third-party validation is evident through its status as the world's largest flooring company. The primary risk factor is a significant legal compliance gap in its cookie consent mechanism, which is not GDPR-compliant and creates exposure to regulatory penalties.

Exceptional transparency with investors, providing direct and easy access to annual reports, SEC filings, and key financial metrics, which builds significant trust and credibility.

Immediately replace the 'implied consent' cookie banner with a GDPR-compliant Consent Management Platform (CMP) that features equally prominent 'Accept' and 'Reject' options to mitigate legal and financial risk.

Mohawk's competitive advantage is exceptionally strong and sustainable, built on a formidable moat of unmatched manufacturing scale and vertical integration. This creates significant economies of scale and cost advantages that are nearly impossible for competitors to replicate. The company's comprehensive product portfolio and 'house of brands' strategy serve as another durable advantage, creating high switching costs for distributors who rely on Mohawk as a single-source supplier.

The company's immense global scale, vertical integration, and the industry's most comprehensive product portfolio create a highly defensible and sustainable competitive moat.

Develop and more aggressively market a unified innovation narrative at the corporate level to shift the brand perception from just the 'biggest' to also the 'most innovative' in areas like sustainability and smart materials.

The business model is highly scalable due to high fixed costs and significant operational leverage from its vertically integrated manufacturing. The company has a proven track record of successful market expansion through acquisitions, demonstrating a mature capability for growth. Future potential lies in geographic expansion into emerging markets and deeper penetration into adjacent surface categories like countertops and panels.

A proven and highly effective growth-by-acquisition strategy has successfully transformed the business into the world's largest flooring company, demonstrating a robust capability for expansion.

Invest in building internal capabilities in data science and digital product management to support a more technologically advanced growth phase focused on channel partner enablement and analytics-driven insights.

Mohawk's business model exhibits exceptional coherence, with all components tightly aligned to support its strategy of market leadership through scale and operational excellence. Its B2B2C model effectively leverages a diverse channel network to reach a broad market, while its revenue streams are diversified across multiple product categories and geographic regions. Strategic focus is clear, centered on manufacturing, distribution, and growth through acquisition.

The business model is powerfully built around its core strengths of vertical integration and a multi-brand portfolio, creating a coherent and highly effective strategy for dominating the global flooring market.

Pilot innovative service-based models, such as 'Flooring-as-a-Service' for commercial clients, to create recurring revenue streams and reduce dependency on cyclical construction markets.

As the world's largest flooring company, Mohawk wields substantial market power, demonstrated by its leading market share in numerous categories and geographies. This scale provides significant leverage over suppliers and distribution channels. Its portfolio of strong brands allows for effective pricing power, catering to various market segments from value to premium.

Holds the definitive position as the world's largest flooring manufacturer, granting it significant pricing power, supplier leverage, and influence over industry standards.

Address the strategic risk of customer dependency on large home improvement retailers (e.g., The Home Depot) by developing digital tools and loyalty programs that strengthen relationships with the independent specialty retailer channel.

Business Overview

Business Classification

Manufacturing (B2B2C)

Wholesale Distribution

Building Materials & Home Furnishings

Sub Verticals

- •

Flooring Manufacturing

- •

Ceramic Tile & Stone

- •

Carpet & Rugs

- •

Laminate & Vinyl Flooring

- •

Wood Flooring

- •

Countertops & Panels

- •

Insulation Products

Mature

Maturity Indicators

- •

Established as the world's largest flooring company.

- •

Extensive global manufacturing and distribution footprint across 19 countries.

- •

Long history of strategic acquisitions to drive growth and market consolidation (32 since 2013).

- •

Operates as a publicly traded company (NYSE: MHK) with a large market capitalization.

- •

Revenue is substantial and relatively stable, though cyclical with construction and housing markets.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Global Ceramic Product Sales

Description:Sales of ceramic, porcelain, and stone tile products, as well as quartz and porcelain countertops. This is a major global segment with significant market leadership.

Estimated Importance:Primary

Customer Segment:Distributors, Home Centers, Retailers, Builders

Estimated Margin:Medium

- Stream Name:

Flooring North America Product Sales

Description:Sales of carpet, rugs, laminate, vinyl, and wood flooring within the North American market. This segment covers a comprehensive range of soft and hard surfaces for residential and commercial applications.

Estimated Importance:Primary

Customer Segment:Independent Retailers, Home Centers, Mass Merchants, Builders

Estimated Margin:Medium-Low

- Stream Name:

Flooring Rest of the World Product Sales

Description:Sales of laminate, vinyl, wood, carpet, panels, and insulation products in markets outside North America, primarily Europe, Australia, and New Zealand.

Estimated Importance:Primary

Customer Segment:Distributors, Retailers, Commercial Contractors

Estimated Margin:Medium

Recurring Revenue Components

Replacement and renovation sales cycles for residential and commercial properties.

Ongoing business with large-scale commercial clients and home builders.

Pricing Strategy

Channel-Based / Tiered Pricing

Mid-range to Premium

Opaque

Pricing Psychology

- •

Brand portfolio differentiation (e.g., premium Karastan vs. mainstream Mohawk).

- •

Volume-based discounts for large channel partners (distributors, home centers).

- •

Promotional pricing through retail channels.

Monetization Assessment

Strengths

- •

Diversified revenue across multiple product categories and geographic regions reduces risk.

- •

Massive scale provides significant purchasing power and production cost advantages.

- •

Strong brand recognition allows for premium pricing on certain product lines.

Weaknesses

- •

High dependency on the cyclical nature of residential and commercial construction and remodeling.

- •

Vulnerability to volatile raw material and energy costs.

- •

Complex global supply chain susceptible to disruptions.

Opportunities

- •

Growth in high-margin, innovative products like luxury vinyl tile (LVT) and waterproof flooring.

- •

Expansion of value-added services for channel partners, such as digital design tools and logistics support.

- •

Capitalizing on the growing consumer demand for sustainable and eco-friendly products.

Threats

- •

Intense competition from other large players (e.g., Shaw Industries) and low-cost international manufacturers.

- •

Economic downturns reducing consumer discretionary spending on home improvements.

- •

Potential for tariffs and trade disputes impacting global supply chain costs.

Market Positioning

Market Leader & Full-Range Provider

Leading global market share in the flooring industry; holds dominant positions in multiple sub-categories like wood flooring manufacturing in the US.

Target Segments

- Segment Name:

Channel Partners (B2B)

Description:The primary customers are businesses that resell or install Mohawk's products. This includes independent specialty retailers, large home centers (e.g., The Home Depot), distributors, mass merchants, and e-commerce platforms.

Demographic Factors

Varying business sizes from small independent stores to large multinational corporations.

Psychographic Factors

Focused on profitability, inventory turnover, and supply chain reliability.

Value strong supplier relationships and marketing support.

Behavioral Factors

Purchase in large volumes.

Decision-making based on product portfolio breadth, margin potential, and brand pull-through.

Pain Points

- •

Managing complex inventory.

- •

Competing with larger retailers.

- •

Staying current with rapidly changing design trends.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Professional End-Users (B2B)

Description:This segment includes home builders, commercial contractors, architects, and interior designers who specify and install flooring for new construction and commercial projects.

Demographic Factors

Professionals in the construction and design industries.

Psychographic Factors

Value product performance, durability, and compliance with building codes.

Seek innovative solutions and reliable project support.

Behavioral Factors

Specify products based on project requirements and budgets.

Often have long-term relationships with manufacturers and distributors.

Pain Points

- •

Project delays due to product unavailability.

- •

Finding products that meet both aesthetic and performance requirements.

- •

Managing project budgets and timelines.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

End Consumers (B2C - Indirect)

Description:While not a direct customer, the residential homeowner is the ultimate user. Their preferences, driven by trends in home renovation and new construction, heavily influence the purchasing decisions of channel partners.

Demographic Factors

Homeowners across various income levels and life stages.

Psychographic Factors

Value aesthetics, durability, and lifestyle fit.

Increasingly prioritize sustainability and health (low-VOC materials).

Behavioral Factors

Research online but often purchase through physical retail.

Influenced by brand reputation, warranties, and in-store experiences.

Pain Points

- •

Overwhelmed by choice.

- •

Difficulty visualizing products in their space.

- •

Concerned about installation quality and long-term performance.

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Comprehensive Product Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Vertical Integration

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Scale and Distribution Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Portfolio of Recognized Brands

Strength:Strong

Sustainability:Sustainable

- Factor:

Innovation in Product Features (e.g., sustainability, waterproofing)

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To be the comprehensive, single-source global leader for innovative, high-quality, and sustainable flooring and surface solutions, providing channel partners with a diverse brand portfolio and the operational excellence to drive their success.

Good

Key Benefits

- Benefit:

One-Stop Sourcing

Importance:Critical

Differentiation:Unique

Proof Elements

Industry's most extensive product portfolio across all major flooring categories and surfaces.

- Benefit:

Brand Strength and Consumer Demand

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Ownership of highly recognized brands like Mohawk, Pergo, Karastan, and Daltile.

- Benefit:

Supply Chain Reliability

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Vertically integrated operations from manufacturing to distribution.

- Benefit:

Product Innovation and Sustainability

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Commitment to R&D, development of waterproof technologies, and extensive use of recycled materials.

Unique Selling Points

- Usp:

Unmatched global scale and vertical integration, providing cost and quality control advantages.

Sustainability:Long-term

Defensibility:Strong

- Usp:

The industry's most comprehensive portfolio of products and brands, catering to virtually every market segment and price point.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Channel partners need a reliable supplier with a broad product range to simplify their sourcing and inventory management.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Builders and designers require high-performance, aesthetically diverse, and readily available products to meet project deadlines and specifications.

Severity:Major

Solution Effectiveness:Complete

- Problem:

End consumers seek trusted brands that offer durable, stylish, and increasingly sustainable flooring solutions.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The company's focus on scale, product breadth, and innovation aligns well with key market demands for efficiency, choice, and performance.

High

The business model is built around serving the needs of its primary B2B channel partners and professional end-users through a powerful combination of product, brand, and logistics.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Raw material suppliers (clay, lumber, polymers, etc.).

- •

Home improvement retailers (e.g., The Home Depot, Lowe's).

- •

Independent specialty flooring retailers.

- •

Wholesale distributors.

- •

Transportation and logistics providers.

- •

Design and architecture firms.

Key Activities

- •

Manufacturing and production.

- •

Research & Development (product innovation, sustainability).

- •

Global supply chain management and logistics.

- •

Brand management and marketing.

- •

Sales and channel partner relationship management.

- •

Mergers and Acquisitions (M&A).

Key Resources

- •

Global network of manufacturing facilities.

- •

Extensive distribution and logistics infrastructure.

- •

Portfolio of valuable brands.

- •

Intellectual property (patents for technologies like waterproof flooring).

- •

Experienced management team and skilled workforce (~41,900 employees).

Cost Structure

- •

Raw materials and energy.

- •

Manufacturing costs (labor, plant overhead).

- •

Selling, General & Administrative (SG&A) expenses.

- •

Freight and logistics.

- •

Capital expenditures for plant upgrades and acquisitions.

Swot Analysis

Strengths

- •

Dominant market leadership and global scale.

- •

Highly diversified product portfolio and geographic presence.

- •

Strong vertical integration provides cost and quality control.

- •

Powerful portfolio of well-recognized brands catering to different market segments.

- •

Proven track record of successful growth through strategic acquisitions.

Weaknesses

- •

High sensitivity to economic cycles, particularly in housing and construction.

- •

Significant fixed costs associated with manufacturing assets.

- •

Operational complexity of managing numerous brands and global operations.

- •

Potential for channel conflict between direct sales, distributors, and large retailers.

Opportunities

- •

Growing demand for sustainable, recycled, and circular-economy products.

- •

Expansion into emerging markets with rising construction activity.

- •

Technological integration, such as AR/VR visualization tools for consumers and retailers.

- •

Further expansion into adjacent surface categories (walls, ceilings, exteriors).

- •

Development of service-based revenue models for commercial clients (e.g., flooring lifecycle management).

Threats

- •

Volatility in raw material prices (oil, wood, etc.) and energy costs.

- •

Intense price competition from domestic and international rivals.

- •

Shifts in consumer preferences (e.g., DIY trends, material choices).

- •

Global supply chain disruptions, trade tariffs, and geopolitical instability.

- •

Labor shortages impacting manufacturing and installation.

Recommendations

Priority Improvements

- Area:

Digital Transformation & Channel Enablement

Recommendation:Invest in a best-in-class digital platform for channel partners, offering integrated inventory management, online ordering, co-branded marketing tools, and AR/VR visualization APIs to enhance their sales process.

Expected Impact:High

- Area:

Sustainability as a Core Brand Driver

Recommendation:More aggressively market the company's significant sustainability initiatives (recycled content, circular design) to end consumers to create brand preference and justify premium positioning.

Expected Impact:Medium

- Area:

Service Model Innovation for Commercial Segment

Recommendation:Pilot a 'Flooring-as-a-Service' (FaaS) model for large commercial clients (e.g., hospitality, retail chains), bundling product, installation, maintenance, and replacement into a recurring revenue contract.

Expected Impact:Medium

Business Model Innovation

- •

Develop an integrated 'surface solutions' package for builders, bundling flooring, countertops, and wall panels to streamline their procurement process.

- •

Launch a direct-to-installer platform for smaller contractors, offering professional-grade products, training, and business management tools.

- •

Leverage data analytics from channel partners to forecast trends more accurately and optimize production and inventory on a regional basis.

Revenue Diversification

- •

Expand the high-margin insulation and panels business, especially in regions with growing energy efficiency regulations.

- •

Acquire or partner with companies in the installation services space to capture more of the value chain.

- •

Monetize proprietary data and trend insights by offering subscription-based market intelligence to smaller, non-competing players in the home decor industry.

Mohawk Industries operates a robust and highly defensible business model, anchored by its position as the world's largest flooring manufacturer. Its core strategic advantages are immense scale, vertical integration, a comprehensive product and brand portfolio, and a sophisticated global distribution network. The business model is mature, focusing on operational excellence and growth through strategic acquisitions to consolidate a fragmented market. The primary revenue source is the sale of a wide array of flooring and surface products through a B2B2C channel strategy, targeting distributors, retailers, and professional contractors. This model has proven successful, generating over $10 billion in annual sales.

However, the model's maturity and reliance on the cyclical construction and remodeling markets present challenges for future growth. The company is susceptible to macroeconomic headwinds, raw material price volatility, and intense competition. The key to its strategic evolution lies in moving beyond being just a product manufacturer to becoming a more integrated solutions and service provider.

Significant opportunities exist in digital transformation, sustainability, and service innovation. By enhancing the digital tools and support for its crucial channel partners, Mohawk can deepen its relationships and create a stickier ecosystem. Aggressively leveraging its impressive sustainability credentials as a primary marketing driver can build brand equity with the end consumer. For long-term transformation, innovating the business model to include service-based recurring revenue, particularly in the commercial sector, could provide a hedge against market cyclicality and unlock new value. Future success will be defined by the company's ability to leverage its scale not just for efficiency, but for innovation in how it serves its partners and engages the market.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Investment & Economies of Scale

Impact:High

- Barrier:

Established Distribution Channels & Retail Relationships

Impact:High

- Barrier:

Brand Recognition & Portfolio Breadth

Impact:High

- Barrier:

Manufacturing & Logistics Complexity

Impact:Medium

- Barrier:

Regulatory Compliance (Environmental & Safety)

Impact:Medium

Industry Trends

- Trend:

Sustainability and Circular Economy

Impact On Business:Increasing demand for eco-friendly, low-VOC, recycled, and carbon-neutral materials. This is a key purchasing driver for both commercial specifiers and residential consumers.

Timeline:Immediate

- Trend:

Dominance of Hard Surfaces (LVT/LVP)

Impact On Business:Continued market share gains for Luxury Vinyl Tile (LVT) and Plank (LVP) due to durability, water resistance, and realistic aesthetics, impacting carpet sales.

Timeline:Immediate

- Trend:

Digital Transformation & AI

Impact On Business:Adoption of AI for manufacturing optimization, predictive maintenance, and personalized customer experiences through digital visualization tools is becoming critical for efficiency and sales.

Timeline:Near-term

- Trend:

Product Innovation (Waterproof, Smart Flooring)

Impact On Business:Demand for performance features like waterproof technology in carpet and wood is high. Integration of smart technology (e.g., heated floors, sensors) is an emerging luxury trend.

Timeline:Near-term

- Trend:

Aesthetic Shifts to Bolder Designs

Impact On Business:Move towards wider planks, larger tiles, and bolder geometric patterns like herringbone and chevron, requiring agile design and manufacturing capabilities.

Timeline:Immediate

Direct Competitors

- →

Shaw Industries Group, Inc.

Market Share Estimate:Major US & Global player, often cited as #1 or #2 alongside Mohawk.

Target Audience Overlap:High

Competitive Positioning:Positions as a full-service flooring provider with strong brand recognition and a focus on innovation and design.

Strengths

- •

Strong brand portfolio (Anderson Tuftex, COREtec, Patcraft).

- •

Vertically integrated operations, similar to Mohawk.

- •

Berkshire Hathaway ownership provides significant financial stability.

- •

Recognized leader in carpet and resilient flooring categories.

- •

Strong relationships with dealers and retailers.

Weaknesses

- •

Product differentiation can be challenging in a crowded market.

- •

Expensive logistics and distribution network.

- •

Less geographically diversified in manufacturing compared to Mohawk's extensive European operations.

Differentiators

Pioneering brand in the LVT space with COREtec.

Strong focus on specific innovations like LifeGuard waterproof carpets and R2X stain resistance.

- →

Tarkett S.A.

Market Share Estimate:Significant global player, particularly strong in Europe and in the vinyl and linoleum categories.

Target Audience Overlap:High

Competitive Positioning:Focuses on being the 'easiest, most innovative, and most sustainable' flooring company to work with, heavily emphasizing circular economy principles.

Strengths

- •

Strong European market presence.

- •

Leader in sustainability initiatives and circular economy practices.

- •

Diverse product portfolio including vinyl, linoleum, carpet, and sports surfaces.

- •

Well-established brand with a long history (founded in 1880).

Weaknesses

- •

Less brand recognition in the US residential market compared to Mohawk and Shaw.

- •

Has faced profitability challenges requiring strategic shifts.

- •

Market share in North American carpet is smaller than the industry giants.

Differentiators

- •

Deep expertise in vinyl and linoleum products.

- •

Explicit strategic focus on customer experience ('Be the easiest').

- •

Strong commitment to quantifiable sustainability targets (e.g., CO2 reduction).

- →

Interface, Inc.

Market Share Estimate:Global leader in the commercial modular carpet tile market.

Target Audience Overlap:Medium

Competitive Positioning:Positions as a design-led, sustainability-focused leader, pioneering carbon-neutral and carbon-negative products.

Strengths

- •

Dominant brand in the commercial carpet tile niche.

- •

Pioneer and leader in sustainability, which is a key competitive advantage in the commercial specification market.

- •

Strong global presence and brand recognition among architects and designers.

- •

Innovative product design and commitment to becoming a carbon-negative enterprise.

Weaknesses

- •

More niche focus; less diversified across all flooring categories compared to Mohawk.

- •

Heavily reliant on the commercial office market, which can be cyclical.

- •

Smaller scale and financial resources compared to Mohawk and Shaw.

Differentiators

Specialization and expertise in modular carpet tiles.

'Carbon Neutral Floors' and other aggressive sustainability programs are core to their identity.

- →

AHF Products

Market Share Estimate:Major player in hardwood, and now a significant force in resilient flooring after acquiring Armstrong assets.

Target Audience Overlap:Medium

Competitive Positioning:Leveraging a portfolio of historic and powerful brands (Bruce, Hartco, Armstrong Flooring) to be a leader in both hardwood and resilient categories.

Strengths

- •

Largest hardwood flooring manufacturer in North America.

- •

Acquired the valuable Armstrong Flooring brand name and key manufacturing assets, instantly gaining market share in vinyl.

- •

Strong portfolio of well-known, legacy brands.

- •

Rapidly growing and investing in US-based manufacturing.

Weaknesses

- •

Still integrating the Armstrong assets and navigating brand repositioning.

- •

Less diversified into soft surfaces (carpet, rugs) compared to Mohawk.

- •

Legacy Armstrong brand suffered from years of underinvestment and strategic missteps before the AHF acquisition.

Differentiators

Dominance in the North American hardwood category.

Owner of the highly recognized Armstrong Flooring brand for resilient products.

Indirect Competitors

- →

The Home Depot (LifeProof Brand)

Description:A major home improvement retailer with a powerful private label brand, LifeProof, which is a dominant force in the DIY and DIFM residential flooring market, particularly in LVT.

Threat Level:High

Potential For Direct Competition:They are a primary sales channel for Mohawk, but their private label directly competes for consumer choice on the sales floor.

- →

Lowe's (STAINMASTER Brand)

Description:Another leading home improvement retailer that acquired the STAINMASTER brand, a highly recognized name in carpeting. They leverage this private brand to compete against manufacturer brands.

Threat Level:High

Potential For Direct Competition:Similar to Home Depot, Lowe's is a key distribution partner that also acts as a major competitor through its exclusive and private brands.

- →

Floor & Decor

Description:A rapidly growing specialty retailer with a warehouse-format store, offering a vast, in-stock selection of hard surface flooring. They source directly from manufacturers globally, often bypassing traditional distribution.

Threat Level:Medium

Potential For Direct Competition:They disrupt traditional distribution models and compete for the same end-customer, putting pressure on Mohawk's retailer relationships.

- →

Alternative Surfaces (Polished Concrete, Epoxy)

Description:Contractors and systems that provide seamless flooring solutions like polished concrete or epoxy coatings, which are popular in commercial, industrial, and modern residential spaces.

Threat Level:Low

Potential For Direct Competition:This is a substitute product that competes for the same project budget but is unlikely to be manufactured by Mohawk directly.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Unmatched Manufacturing Scale and Vertical Integration

Sustainability Assessment:Highly sustainable due to significant capital investment and operational efficiencies.

Competitor Replication Difficulty:Hard

- Advantage:

Broadest Product & Brand Portfolio

Sustainability Assessment:Highly sustainable, offering a 'one-stop-shop' for distributors and retailers across all categories and price points.

Competitor Replication Difficulty:Hard

- Advantage:

Extensive Global Distribution Network

Sustainability Assessment:Highly sustainable, built over decades of acquisitions and relationships, creating a significant barrier to entry.

Competitor Replication Difficulty:Hard

- Advantage:

Brand Equity of Portfolio Leaders (e.g., Pergo, Karastan, Daltile)

Sustainability Assessment:Sustainable, as these brands have high consumer and trade recognition built over many years.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Pioneering Specific Patented Technologies (e.g., waterproof wood)', 'estimated_duration': '2-5 years until competitors develop comparable alternatives.'}

{'advantage': 'Current Leadership in a Specific Design Trend', 'estimated_duration': '1-2 years as design trends are cyclical and quickly replicated.'}

Disadvantages

- Disadvantage:

Complexity of Managing a Vast Brand Portfolio

Impact:Major

Addressability:Moderately

- Disadvantage:

Potential for Slower Innovation vs. Nimble Specialists

Impact:Minor

Addressability:Moderately

- Disadvantage:

Perception as a mass-market incumbent rather than a niche, design-forward innovator.

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a unified 'Innovations by Mohawk' marketing campaign highlighting cutting-edge features (sustainability, waterproofing) across key brands.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Enhance digital visualization tools on consumer-facing brand websites, integrating AI for personalized recommendations based on user interactions.

Expected Impact:High

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Rationalize the brand portfolio to clarify positioning for each brand, reduce channel conflict, and focus marketing spend on clear market leaders.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop a direct-to-architect/designer digital platform that provides a seamless specification experience across all commercial brands and products.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in and promote circular economy initiatives, such as product take-back and recycling programs, to compete with sustainability leaders like Tarkett and Interface.

Expected Impact:Medium

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Establish an R&D division focused on 'next-generation surfaces,' including smart flooring, bio-based materials, and 3D-printed flooring solutions.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Strategic acquisition of a technology company specializing in AI, IoT, or visualization to integrate smart capabilities directly into the product ecosystem.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify positioning as the 'Global Leader in Total Surface Solutions,' emphasizing unmatched scale, a comprehensive portfolio from value to luxury, and a commitment to scalable, practical innovation and sustainability.

Differentiate through operational excellence and portfolio breadth. While competitors lead in niche areas (Interface in carpet tile, AHF in hardwood), Mohawk's advantage is its ability to reliably deliver a complete and diverse range of flooring and surface solutions at a global scale for any residential or commercial project.

Whitespace Opportunities

- Opportunity:

Develop a 'Flooring-as-a-Service' (FaaS) model for large commercial clients (e.g., retail chains, hospitality groups), bundling product, installation, maintenance, and replacement for a recurring fee.

Competitive Gap:Moves the business from a transactional to a recurring revenue model, an area largely untapped by major manufacturers.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create a unified digital toolkit for independent specialty retailers, providing them with advanced visualization, CRM, and project management software to help them compete with larger players.

Competitive Gap:Strengthens the crucial independent retailer channel, which is being squeezed by big-box stores and online retailers.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Launch a dedicated brand or sub-brand focused exclusively on 100% sustainable, circular, and carbon-negative products to directly challenge niche leaders like Interface on their home turf.

Competitive Gap:Currently, Mohawk's sustainability story is distributed across many brands; a focused 'halo' brand could capture the most environmentally-conscious segment.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Expansion into adjacent 'finishing' products for residential and commercial spaces, leveraging distribution channels to sell items like wall panels, acoustic solutions, or specialty paints.

Competitive Gap:Leverages existing customer relationships and distribution to increase share-of-wallet on construction and renovation projects.

Feasibility:Medium

Potential Impact:Medium

Mohawk Industries operates from a position of immense strength as the world's largest flooring manufacturer. Its competitive advantages are deeply entrenched and difficult to replicate, rooted in massive economies of scale, vertical integration, an unparalleled brand and product portfolio, and a dominant global distribution network. The flooring industry is mature and highly competitive, with an oligopolistic structure at the top. Key direct competitors like Shaw Industries, Tarkett, and the newly fortified AHF Products (with the Armstrong brand) challenge Mohawk across different product categories and geographies. Shaw competes directly across the board in North America, Tarkett is a formidable force in Europe with a strong sustainability narrative, and Interface dominates the high-margin commercial carpet tile niche.

The primary competitive threats are not from new manufacturing entrants, as barriers to entry are prohibitively high. Instead, threats come from channel conflict with powerful retailers like Home Depot and Lowe's, whose private label brands compete directly with Mohawk's products on the sales floor. Furthermore, the industry is undergoing significant shifts. Key trends include the unstoppable rise of sustainable and eco-friendly products, the market's preference for hard surface LVT, and the urgent need for digital transformation.

Mohawk's primary weakness is the inherent complexity and potential sluggishness that comes with its size. Managing a vast portfolio of dozens of brands can lead to internal competition, customer confusion, and a dilution of marketing focus. While it innovates, it may be outpaced in specific niches by more focused competitors (e.g., Interface's carbon-negative focus).

Strategic opportunities for Mohawk lie in leveraging its scale to lead in the digital and sustainability arenas. By creating a more unified digital experience for designers and retailers, rationalizing its brand architecture for clarity, and aggressively investing in circular economy initiatives, Mohawk can defend its leadership position. Whitespace opportunities exist in exploring new business models like Flooring-as-a-Service and developing a focused 'halo' brand for ultra-sustainable products. The overarching strategy should be to solidify its identity as the indispensable, one-stop global partner for all flooring and surface needs, differentiated by reliability, breadth of offering, and scalable innovation.

Messaging

Message Architecture

Key Messages

- Message:

Mohawk is 'The Global Flooring Leader' and the 'world’s largest flooring company'.

Prominence:Primary

Clarity Score:High

Location:Homepage, hero section and 'Who Are We?' section

- Message:

Mohawk has a comprehensive and diverse product portfolio for residential and commercial use.

Prominence:Primary

Clarity Score:High

Location:Homepage, grid of 12 product categories

- Message:

Mohawk is a financially strong and growing company with significant global scale.

Prominence:Secondary

Clarity Score:High

Location:About page, prominent display of financial metrics ($10.8B Sales, $1.4B EBITDA, etc.)

- Message:

Vertical integration provides business advantages like quality control, cost management, and sustainability.

Prominence:Tertiary

Clarity Score:Medium

Location:About page, section on vertically integrated operations

The message hierarchy is logical and effective for a corporate website. It correctly prioritizes market leadership ('Global Leader') and breadth of offering on the homepage to establish credibility and scope. Financial performance and operational strengths are appropriately placed on the 'About' page for audiences seeking deeper due diligence, such as investors or potential partners. The flow from high-level branding to specific business segment details is clear.

Messaging is highly consistent across the analyzed pages. The core ideas of global leadership, comprehensive product lines, and operational scale are reinforced in both the homepage introduction and the detailed 'About' page. There are no conflicting messages; the content builds upon a central theme of market dominance and operational excellence.

Brand Voice

Voice Attributes

- Attribute:

Authoritative

Strength:Strong

Examples

- •

Mohawk is the world’s largest flooring company and so much more.

- •

With leading market positions on four continents...

- •

The Global Flooring Leader

- Attribute:

Corporate

Strength:Strong

Examples

- •

View a reconciliation of Non-GAAP financial measures...

- •

Access Proxy Materials

- •

Net Debt to Adjusted EBITDA Ratio

- Attribute:

Descriptive

Strength:Moderate

Examples

- •

...award-winning carpets add warmth and style to any home while offering luxurious softness and superior stain protection.

- •

With realistic surface visuals and textures and a unique water proof construction...

- •

...elegant home fashion crafted with super soft and stain-resistant fibers.

Tone Analysis

Formal and factual

Secondary Tones

Confident

Professional

Tone Shifts

The tone shifts slightly from a high-level corporate and investor-focused voice (stock prices, annual reports) on the upper half of the homepage to a more product-descriptive, benefit-oriented tone in the product category descriptions lower on the page.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

To be the undisputed global leader in flooring, offering an unparalleled portfolio of products and brands, enabled by vertical integration and operational scale, providing a stable and valuable investment.

Value Proposition Components

- Component:

Market Leadership & Scale

Clarity:Clear

Uniqueness:Unique

Examples

- •

The Global Flooring Leader

- •

world's largest flooring company

- •

$10.8B 2024 Worldwide Sales

- •

~180 Countries — Sales

- Component:

Comprehensive Portfolio

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

comprehensive array of fashionable, high performance and sustainable flooring options

A broad range of chipboard, MDF, melamine-faced, HPL panels and mezzanine flooring solutions...

- Component:

Financial Strength

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

- •

Display of NYSE stock ticker data

- •

$1.4B 2024 Adjusted EBITDA

- •

$680M 2024 Free Cash Flow

- Component:

Operational Excellence

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Examples

Vertically integrated operations lead to products with better performance...

End-to-end integration also delivers business advantages such as quality control, cost management and raw material integrity.

Mohawk effectively differentiates itself through the sheer scale of its operations and its explicit claim to be the '#1' global leader. While competitors like Shaw Industries and Tarkett also offer broad portfolios, Mohawk's messaging relentlessly emphasizes its top-tier market position and financial size. This strategy clearly positions it as the dominant, stable incumbent in the industry, which is a powerful differentiator for investors and large-scale B2B partners.

The messaging positions Mohawk at the apex of the industry. Competitors are implicitly positioned as smaller or less comprehensive. The website's focus is not on direct product feature comparisons but on establishing corporate superiority. By presenting a 'house of brands' on its 'About' page, it showcases a strategy of growth through acquisition and market consolidation, reinforcing its position as a powerful holding company.

Audience Messaging

Target Personas

- Persona:

Investors & Financial Analysts

Tailored Messages

- •

Prominently displayed NYSE stock ticker

- •

Links to Annual Report and Proxy Materials

- •

Key financial metrics ($10.8B Sales, $1.4B EBITDA)

- •

Net Debt to Adjusted EBITDA Ratio

Effectiveness:Effective

- Persona:

B2B Customers & Channel Partners (Distributors, Retailers)

Tailored Messages

- •

Showcasing the comprehensive array of product categories

- •

Listing of 'Leading Market Positions' by geography and product

- •

Detailed breakdown of business segments and their associated brands

- •

Mention of diverse Sales Channels (Independent retailers, home centers, distributors, builders)

Effectiveness:Effective

- Persona:

Corporate Media & Potential Acquirers

Tailored Messages

- •

Clear 'About Us' section with key company facts and figures

- •

History of acquisitions ('32 Acquisitions Since 2013')

- •

Overview of global manufacturing and sales footprint

Effectiveness:Somewhat Effective

Audience Pain Points Addressed

- •

For Investors: Need for clear, accessible financial performance data and proof of market stability.

- •

For B2B Partners: Need for a supplier with a comprehensive product catalog to simplify sourcing.

- •

For B2B Partners: Need for a financially stable partner with strong brand recognition and market leadership.

Audience Aspirations Addressed

For Investors: To invest in a market leader with a strong growth trajectory and sound financial management.

For B2B Partners: To align with the largest and most successful player in the industry to enhance their own market credibility and offerings.

Persuasion Elements

Emotional Appeals

No itemsSocial Proof Elements

- Proof Type:

Authority/Leadership Claim

Impact:Strong

Examples

'The Global Flooring Leader'

'Mohawk is the world’s largest flooring company'

- Proof Type:

Metrics & Data

Impact:Strong

Examples

- •

'$10.8B 2024 Worldwide Sales'

- •

'~41,900 Employees Worldwide'

- •

'19 Countries — Manufacturing'

- Proof Type:

Brand Portfolio

Impact:Moderate

Examples

Extensive list of well-known brands like Daltile, Pergo, Karastan, Quick-Step, etc.

Trust Indicators

- •

Prominent NYSE stock ticker (MHK)

- •

Direct links to official investor materials (Annual Report, Proxy Materials)

- •

Specific, dated financial figures ('As of December 31, 2024')

- •

Physical headquarters address in Calhoun, Georgia

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Learn More

Location:Homepage (under product categories, 'Who Are We?'), About page (under brand listings)

Clarity:Clear

- Text:

View, download or print 2024 Annual Report PDF

Location:Homepage, below hero section

Clarity:Clear

- Text:

Access Proxy Materials

Location:Homepage, below hero section

Clarity:Clear

- Text:

Please click here for additional investor information

Location:Homepage, under stock ticker

Clarity:Clear

The CTAs are highly effective for the intended audience of this corporate site. They are unambiguous and direct users to the most relevant next steps for investors ('View Annual Report') or those conducting due diligence ('Learn More'). There are no consumer-oriented CTAs like 'Shop Now' or 'Find a Retailer', which correctly maintains the site's B2B and investor focus. The external links to specific brand websites serve as an effective, secondary CTA for those interested in product-level details.

Messaging Gaps Analysis

Critical Gaps

There is very little messaging around corporate culture, talent development, or why Mohawk is a desirable employer, which is a gap for attracting top corporate talent. This is a common focus for competitors like Shaw and Tarkett.

The 'About' page mentions sustainability as a benefit of vertical integration, but there is no dedicated, prominent message about corporate social responsibility (CSR) or broader ESG (Environmental, Social, and Governance) initiatives, a key trend in the industry.

Contradiction Points

No itemsUnderdeveloped Areas

Innovation Messaging: While product descriptions mention 'state-of-the-art manufacturing' and 'advanced technology,' the overarching corporate narrative does not strongly feature innovation as a core pillar of the brand strategy. It's implied but not explicitly championed as a key differentiator.

Storytelling: The content is very factual and data-driven. There is an opportunity to weave a more compelling narrative around the company's history, its growth strategy, and its vision for the future of living and commercial spaces. For example, the mention of '32 Acquisitions Since 2013' could be framed within a story of strategic growth.

Messaging Quality

Strengths

- •

Unwavering clarity about market leadership and scale.

- •

Excellent audience segmentation; the content is precisely tailored for an investor and B2B audience.

- •

Strong use of data and financial metrics to build credibility and trust.

- •

Clean, logical information architecture that guides users effectively.

Weaknesses

- •

Overly factual and dry tone lacks emotional resonance or storytelling.

- •

Weak messaging around corporate culture and employee value proposition.

- •

Sustainability and CSR messaging are present but not prioritized, missing a key industry trend.

- •

The term 'and so much more' in 'world’s largest flooring company and so much more' is vague and could be strengthened with more specific language.

Opportunities

- •

Develop a dedicated 'Careers' or 'Culture' section to attract high-level talent.

- •

Create a prominent 'Sustainability' or 'ESG' section to communicate corporate responsibility efforts, which is a major focus for competitors.

- •

Infuse the brand story with more narrative, highlighting the 'why' behind the company's growth and its impact on global spaces.

- •

Translate the benefits of 'vertical integration' into more tangible outcomes for partners and end-users, such as speed to market or unparalleled quality assurance.

Optimization Roadmap

Priority Improvements

- Area:

Corporate Social Responsibility

Recommendation:Elevate sustainability messaging by creating a dedicated ESG/Sustainability section in the main navigation. Showcase specific goals, progress, and stories related to environmental impact and community engagement.

Expected Impact:High

- Area:

Talent Attraction

Recommendation:Build out a 'Careers' section that details the company culture, values, and employee value proposition. Use this to position Mohawk as an employer of choice, not just a product leader.

Expected Impact:High

- Area:

Brand Narrative

Recommendation:Revise the 'About Us' narrative to be less of a fact sheet and more of a story. Explain the strategy behind the acquisitions and the vision for enhancing global spaces through flooring leadership.

Expected Impact:Medium

Quick Wins

Replace the vague phrase 'and so much more' with a more powerful and specific statement about their comprehensive surface solutions (e.g., '...and the leading provider of surfaces beyond the floor').

Add a short, impactful headline to the 'About' page that summarizes the Mohawk investment thesis, such as 'Leading the World in Surfaces Through Scale, Innovation, and Financial Discipline.'

Long Term Recommendations

Develop a content strategy that includes thought leadership articles or case studies showcasing Mohawk's role in major architectural or design projects, demonstrating the impact of its products in the real world.

Integrate messaging around innovation more centrally into the brand identity, potentially creating a dedicated 'Innovation' section that highlights R&D, new technologies like 'waterproof wood', and design trends.

Mohawk Industries’ corporate website, mohawkind.com, executes its primary communication objective with exceptional discipline and clarity: to project an image of unparalleled market leadership and financial strength to an audience of investors, financial analysts, and high-level B2B partners. The messaging architecture is built on a clear hierarchy, prioritizing its status as the 'Global Flooring Leader' and the 'world's largest flooring company.' This claim is immediately substantiated with a comprehensive product grid and, for those who dig deeper, a formidable wall of financial and operational statistics on the 'About' page. The brand voice is authoritative, corporate, and factual, which is perfectly aligned with its target audience's need for credible, unambiguous information.

The site's value proposition is rooted in scale. It doesn't compete on granular product features but on the strategic advantages of its vertical integration, vast brand portfolio, and dominant market positions across multiple continents. This positions Mohawk as the stable, blue-chip choice in the flooring industry. Persuasion is achieved not through emotional appeals but through overwhelming social proof in the form of market data, financial reporting, and a vast portfolio of acquired brands.

However, this singular focus creates distinct messaging gaps. The website is sterile and lacks a human element. There is a significant opportunity to build out messaging around corporate culture, talent attraction, and the employee value proposition. Furthermore, while sustainability is mentioned, it is under-leveraged. Competitors like Tarkett and Shaw are increasingly centering their corporate narratives on sustainability and human-centric design. Mohawk's messaging feels dated by comparison, focusing purely on economic and operational might. To evolve, the company should develop a richer narrative that incorporates its vision for sustainability and its role as an employer of choice, transforming its image from just a market leader to a thought leader shaping the future of the built environment.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Positioned as the world's largest flooring company with $10.8B in 2024 worldwide sales.

- •

Comprehensive product portfolio covering virtually every flooring category, plus adjacent surfaces like countertops and panels.

- •

Leading market positions in North America, Europe, South America, and Australia/New Zealand across multiple product lines.

- •

Extensive multi-brand strategy (Daltile, Pergo, Karastan, etc.) targeting diverse market segments and price points.

- •

Vertically integrated operations from material sourcing to distribution, providing a significant competitive advantage.

Improvement Areas

- •

Accelerate innovation in high-growth sustainable and recycled materials to capture environmentally conscious consumers.

- •

Develop 'smart flooring' solutions to create a new, high-margin product category and establish first-mover advantage.

- •

Enhance digital visualization and selection tools to support customers in their pre-purchase journey, even if the final transaction is through a channel partner.

Market Dynamics

Approximately 5.7% - 6.8% CAGR forecasted globally between 2025 and 2032.

Mature

Market Trends

- Trend:

Dominance of Sustainable and Eco-Friendly Materials

Business Impact:Increasing consumer and regulatory demand for products made from renewable, recycled, and low-VOC materials is shifting product development priorities.

- Trend:

Rapid Growth of Luxury Vinyl Tile (LVT)

Business Impact:LVT continues to gain market share from other categories due to its durability, water resistance, and aesthetic versatility, requiring continued investment in LVT innovation and capacity.

- Trend:

Digital Transformation and Channel Consolidation

Business Impact:The industry is moving towards fewer, larger players with technological advantages. A strong digital presence and tools to support channel partners are becoming critical for maintaining market leadership.

- Trend:

Economic Headwinds and Housing Market Dependency

Business Impact:High interest rates are slowing existing-home sales, a key driver of flooring replacement. Growth is currently dependent on new construction and pent-up replacement demand, which is expected to recover as rates ease.

Favorable for a market leader. While the market is mature, Mohawk is well-positioned to capitalize on consolidation trends and invest in innovation (sustainability, LVT) to capture growth pockets and gain share from slower competitors.

Business Model Scalability

High

High fixed costs associated with manufacturing and vertical integration, which provides significant operating leverage as volume increases. This structure is a barrier to entry for smaller competitors.

High. The vertically integrated model allows for significant cost control and margin expansion when production capacity is highly utilized.

Scalability Constraints

- •

Complexity of managing a global supply chain, making it vulnerable to geopolitical and logistical disruptions.

- •

Capital intensity required for building new manufacturing facilities or acquiring new technologies.

- •

Integrating the operations and cultures of the 32+ companies acquired since 2013 presents ongoing complexity.

Team Readiness

Proven leadership team with extensive experience in managing a large, global manufacturing enterprise and a successful track record of M&A integration.

A segmented structure (Global Ceramic, Flooring NA, Flooring RoW) is appropriate for managing a diverse global business. This allows for regional specialization while leveraging global scale.

Key Capability Gaps

- •

Deep expertise in Direct-to-Consumer (D2C) e-commerce strategy and execution.

- •

Data science and analytics to derive insights from market data and optimize supply chain and marketing.

- •

Digital product management for developing customer-facing software tools (visualizers, project estimators).

Growth Engine

Acquisition Channels

- Channel:

Distributors & Independent Specialty Retailers

Effectiveness:High

Optimization Potential:Medium

Recommendation:Develop a digital partner portal with co-op marketing tools, real-time inventory data, and online training modules to become the easiest manufacturer to do business with.

- Channel:

Home Centers & Mass Merchants (e.g., Home Depot)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Collaborate on exclusive product lines and leverage their data to understand consumer trends and optimize in-store and online merchandising.

- Channel:

Builders & Commercial Specifiers

Effectiveness:High

Optimization Potential:High

Recommendation:Create a dedicated digital platform for architects and designers with easy access to specs, BIM models, and sustainability certifications to drive specification.

- Channel:

E-commerce (Direct & Partner)

Effectiveness:Low-Medium

Optimization Potential:High

Recommendation:Pilot a D2C strategy for a specific, high-potential brand (e.g., Mohawk Home rugs) to build direct customer relationships and gather data without disrupting primary channels.

Customer Journey

Primarily an offline, partner-led journey. Customers research online, but the final decision and purchase typically happen in a physical retail store or through a contractor.

Friction Points

- •

Difficulty visualizing how different flooring options will look in their own space.

- •

Lack of transparent pricing until they engage with a retailer or contractor.

- •

Navigating the vast number of product options and brands can be overwhelming for consumers.

Journey Enhancement Priorities

{'area': 'Online Visualization Tools', 'recommendation': 'Invest in best-in-class AR-powered room visualizer tools that are easy to use on mobile and can be embedded on partner websites.'}

{'area': 'Product Sampling Program', 'recommendation': 'Develop a streamlined, user-friendly online sample ordering system that quickly ships samples to consumers, helping them move from consideration to decision.'}

Retention Mechanisms

- Mechanism:

Brand Reputation and Quality

Effectiveness:High

Improvement Opportunity:Amplify messaging around warranties, durability, and sustainable manufacturing processes to reinforce quality perception.

- Mechanism:

Channel Partner Loyalty Programs

Effectiveness:Medium

Improvement Opportunity:Implement a tiered loyalty program for contractors and retailers based on volume, training completion, and advocacy, offering rewards, rebates, and lead generation.

- Mechanism:

Product Warranties

Effectiveness:High

Improvement Opportunity:Simplify the warranty registration and claims process through a fully digital, user-friendly portal.

Revenue Economics

Strong. As a vertically integrated manufacturer with immense scale, Mohawk likely has superior unit economics compared to non-integrated competitors, with significant purchasing power and production efficiencies.

Not directly applicable for a B2B2C manufacturer. The equivalent would be the lifetime value of a channel partner relationship versus the cost to acquire and support that partner, which is presumed to be very high.

High. The company's large free cash flow ($680M in 2024) and stable EBITDA margins indicate a highly efficient revenue engine.

Optimization Recommendations

- •

Increase focus on higher-margin product categories like LVT and premium, sustainable products.

- •

Leverage data analytics to optimize pricing across the vast portfolio of brands and SKUs.

- •

Invest in automation and smart manufacturing to further reduce production costs and mitigate labor shortages.

Scale Barriers

Technical Limitations

- Limitation:

Manufacturing Technology for Advanced Materials

Impact:Medium

Solution Approach:Continued R&D investment and potential acquisition of smaller, innovative companies specializing in sustainable materials or smart flooring technology.

Operational Bottlenecks

- Bottleneck:

Global Supply Chain Volatility

Growth Impact:Fluctuations in raw material costs and shipping delays can compress margins and impact product availability.

Resolution Strategy:Further diversify raw material sourcing, increase investment in domestic manufacturing where feasible, and use advanced analytics for demand forecasting and inventory optimization.

- Bottleneck:

Skilled Labor Shortage

Growth Impact:Shortages of manufacturing talent and, critically, flooring installers can constrain the entire industry's ability to meet demand.

Resolution Strategy:Invest in automation in manufacturing. Partner with trade schools and industry associations to fund and promote installer training programs.

Market Penetration Challenges

- Challenge:

Defending Share in Mature Markets

Severity:Major

Mitigation Strategy:Drive innovation with new features, designs, and materials to create upgrade cycles. Utilize the multi-brand strategy to cover all price points and prevent niche competitors from gaining a foothold.

- Challenge:

Economic Sensitivity

Severity:Critical

Mitigation Strategy:Maintain a balanced portfolio across residential replacement, new construction, and commercial sectors to hedge against downturns in any single end-market. The company's low debt-to-EBITDA ratio provides resilience during economic slumps.

Resource Limitations

Talent Gaps

- •

Digital Marketing & E-commerce Leadership

- •

Data Scientists & Analysts

- •

Sustainability & Circular Economy Experts

Low constraint. The company generates strong free cash flow and has a healthy balance sheet (1.1x Net Debt to Adjusted EBITDA), providing ample capacity for strategic investments and acquisitions.

Infrastructure Needs

- •

Upgrades to manufacturing facilities to handle recycled materials and circular production processes.

- •

Investment in a modern, unified data analytics platform across all business segments.

- •

Development of a robust digital infrastructure to support enhanced partner tools and potential D2C initiatives.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in Emerging Markets

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Focus on Asia-Pacific, the largest and fastest-growing regional market. Pursue a strategy of acquiring established local players to gain immediate market access and manufacturing capabilities.

- Expansion Vector:

Deeper Penetration into Commercial Segments

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Develop specialized flooring solutions for high-growth commercial sub-sectors like healthcare and logistics. Create dedicated sales and specification teams for these verticals.

Product Opportunities

- Opportunity:

Expansion of Sustainable Product Lines

Market Demand Evidence:Strong consumer and commercial demand for eco-friendly, low-VOC, and recycled materials.

Strategic Fit:High. Aligns with their vertical integration model and enhances brand reputation.

Development Recommendation:Launch a flagship 'eco-brand' or 'eco-collection' across multiple flooring categories. Invest in R&D for bio-based polymers and advanced recycling technologies.

- Opportunity:

Countertops and other 'Beyond the Floor' Surfaces

Market Demand Evidence:The website already lists countertops, panels, and insulation, indicating an existing strategy to leverage brand and distribution into adjacent surface categories.

Strategic Fit:High. Leverages existing manufacturing expertise (ceramics, panels) and B2B channel relationships.

Development Recommendation:Aggressively market these products as part of an integrated 'Total Surface Solution' for builders and remodelers. Explore acquisitions to bolster market share in these categories.

Channel Diversification

- Channel:

Strategic Direct-to-Consumer (D2C)

Fit Assessment:Medium. High potential but carries risk of channel conflict.

Implementation Strategy:Launch a pilot with a non-core, easily shippable product line like area rugs (Mohawk Home). Focus on building a brand connection, gathering consumer data, and testing digital marketing, not on replacing retail partners.

- Channel:

Digital Enablement as a Channel

Fit Assessment:High. Strengthens existing channels rather than competing with them.

Implementation Strategy:Build a world-class suite of digital tools (visualizers, estimators, lead generation) and offer it to retail partners to make selling Mohawk products seamless and more profitable for them.

Strategic Partnerships

- Partnership Type:

Technology & Smart Home Integration

Potential Partners

- •

Google Nest

- •

Amazon Alexa

- •

Samsung SmartThings

Expected Benefits:Co-develop 'smart flooring' with integrated sensors for climate control, security, or health monitoring, creating a new, high-value product category.

- Partnership Type:

High-End Design & Architectural Firms

Potential Partners

- •

Gensler

- •

HOK

- •

Perkins&Will

Expected Benefits:Collaborate on exclusive product lines and ensure Mohawk brands are specified in major commercial and hospitality projects globally, driving large-volume sales.

Growth Strategy

North Star Metric

Revenue from 'Sustainable Innovation' Products

This metric aligns the entire organization—from R&D to marketing and sales—around the most significant trend in the market. It drives innovation in high-demand categories, enhances brand equity, and likely corresponds with higher margins.

Increase the percentage of total revenue from products with certified sustainable attributes by 15% annually.

Growth Model

Ecosystem & Innovation-Led Growth (Layered on existing Sales/M&A model)

Key Drivers

- •

Channel Partner Enablement: Providing digital tools that make partners more successful.

- •

Product Innovation: Launching new products in high-growth segments (sustainability, LVT).

- •

Strategic Acquisitions: Continuing to acquire companies in new geographies or complementary product categories.

- •

Specification Wins: Driving demand from the top down via architects and designers.

Maintain the successful M&A and sales-led foundation while building a new 'Growth' function focused on digital transformation and launching innovative product lines.

Prioritized Initiatives

- Initiative:

Launch a 'Circular' Flooring Collection

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Establish a cross-functional team to define sustainability criteria. Identify initial product candidates (e.g., LVT or carpet tile with high recycled content) for a pilot launch.

- Initiative:

Develop a 'Partner Success' Digital Toolkit

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Survey key retail and contractor partners to identify their biggest pain points. Develop a product roadmap for a portal that includes a visualizer, lead management, and training.

- Initiative:

Expand Countertop & Surfaces Market Share

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Launch a targeted marketing campaign to existing flooring channel partners, highlighting the benefits of sourcing multiple surfaces from a single supplier.

Experimentation Plan

High Leverage Tests

{'test': "A/B test different messaging for sustainable products (e.g., 'eco-friendly' vs. 'made with recycled materials' vs. 'healthier for your home') to find the most resonant value proposition.", 'metric': 'Click-through rate and sample orders'}

{'test': 'Pilot a mobile AR room visualizer with a select group of 50 retailers to measure its impact on sales conversion rates and average order value.', 'metric': 'Close rate and average ticket size for pilot group vs. control group'}

Utilize a combination of digital analytics (for online tests), partner surveys, and sales data analysis to measure the direct and indirect impact of experiments.

Quarterly review of a prioritized roadmap of experiments, with smaller digital marketing tests running on a bi-weekly sprint basis.

Growth Team

Centralized 'Growth & Innovation Hub' that functions as an internal consultancy to the three main business segments. This team would not own a P&L but would be responsible for piloting new technologies, channels, and products.

Key Roles

- •

Head of Growth & Digital Transformation

- •

Director of Sustainability Innovation

- •

Lead Data Scientist

- •

Channel Partner Technology Manager

A combination of hiring external talent for key digital and data roles and creating an internal upskilling program to train existing product and marketing managers in growth methodologies.

Mohawk Industries exhibits a formidable growth foundation as the world's largest flooring manufacturer. Its strengths—unmatched scale, vertical integration, a vast brand portfolio, and proven M&A capabilities—provide a deep competitive moat in a mature industry. Product-market fit is exceptionally strong, validated by its market leadership and $10.8B in annual sales.

The primary growth challenge is not finding fit, but rather driving meaningful growth in a large, mature market that is sensitive to economic cycles, particularly housing market fluctuations. The current growth engine, historically reliant on M&A and a traditional B2B2C sales model, needs to evolve. The key scale barriers are external—supply chain volatility and market dependency—rather than internal operational capacity.

The most significant growth opportunities lie in aligning the company's immense resources with the definitive market trends: sustainability and digitalization. Mohawk is well-positioned to lead the industry's shift to eco-friendly and circular products, turning a compliance issue into a powerful brand differentiator and revenue driver. Furthermore, while avoiding disruption to its critical channel partners, there is a massive opportunity to use digital tools to enhance the partner ecosystem, making Mohawk the easiest and most profitable brand for them to sell.

Strategic Recommendation:

The recommended growth strategy is to layer an 'Innovation and Ecosystem' model on top of the company's existing operational strengths. The focus should shift from purely gaining scale to creating new value. The North Star Metric should be re-centered on 'Revenue from Sustainable Innovation Products' to drive this transformation. Key initiatives should prioritize developing circular product lines, building a digital toolkit to empower sales partners, and aggressively expanding into adjacent 'total surface' categories. By leveraging its scale to invest in these future-facing opportunities, Mohawk can not only defend its market leadership but also define the next era of the flooring industry.

Legal Compliance

Business Analysis

Mohawk Industries, Inc.

Publicly Traded Global Manufacturing (B2B/B2B2C)

Flooring and Building Materials

Key Business Operations

- •

Global manufacturing and distribution of flooring products (carpet, tile, vinyl, wood, laminate).

- •

Sales through a diverse network including independent retailers, home centers, distributors, and builders.

- •

Operations spanning North America, Europe, Australia, and South America.

- •

Publicly traded on the NYSE (MHK), requiring compliance with SEC regulations.

Target Audience

- •

Investors and Shareholders

- •

Business Partners (Distributors, Retailers)

- •

Commercial Clients (Builders, Architects)

- •

Corporate Media and Public Relations