eScore

nclhltd.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

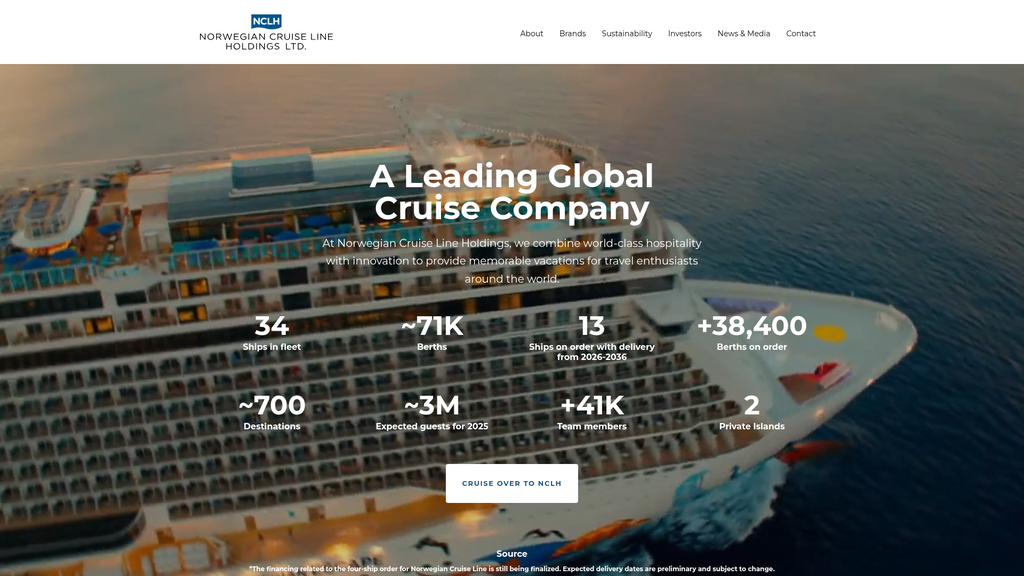

NCLH demonstrates high digital intelligence by precisely tailoring its corporate site to an investor and stakeholder audience, achieving strong search intent alignment for financial and corporate queries. The messaging is consistent with its strategic pillars, such as 'Sail & Sustain'. While its multi-channel presence for this corporate entity is focused rather than broad, its content authority within the financial communications niche is solid, though there's an opportunity to expand its thought leadership content.

The website excels at search intent alignment, perfectly serving the informational needs of investors and financial analysts with dedicated sections for SEC filings, stock data, and corporate governance.

Develop a 'Future of Cruising' thought leadership hub with executive insights on sustainability and innovation to capture a broader range of strategic, non-branded search queries and enhance content authority.

Brand communication is highly effective and laser-focused on its investor audience, clearly articulating a value proposition based on a diversified three-brand portfolio and a defined growth strategy. Messaging around risk mitigation (SailSAFE) and ESG (Sail & Sustain) is clear and addresses key stakeholder concerns. The primary weakness is the lack of messaging tailored to attract top-tier corporate talent, a stated strategic pillar ('People Excellence') not currently supported by the site's communication.

The messaging architecture is exceptionally clear and consistent for investors, with a logical hierarchy that guides them from high-level corporate positioning to detailed financial data and strategic plans.

Build out a comprehensive 'Careers' section that articulates the Employee Value Proposition (EVP) to attract top corporate talent, aligning the website's communication with the 'People Excellence' strategic pillar.

The website provides a low-friction experience for its primary audience to access information, which is the main 'conversion' goal. Key calls-to-action, like 'View Investor Relations,' are prominent and effective. However, a critical conversion point for ongoing engagement—the 'Email Alerts' sign-up—is poorly placed in the footer, creating significant friction and reducing its effectiveness. While the overall cognitive load is light, this key weakness in capturing investor leads lowers the score.

The information architecture is intuitive and the cognitive load is light, allowing the target investor audience to easily navigate to critical information like financial reports and leadership bios with minimal friction.

Elevate the 'Email Alerts' sign-up form from the footer to a dedicated, visually prominent section on the homepage to significantly increase conversions for this key investor relations tool.

NCLH builds strong credibility through a hierarchy of trust signals, including a real-time NYSE stock ticker, detailed leadership bios, and a transparent history of financial milestones. Third-party validation is implied through its public listing and partnerships. The site effectively mitigates perceived risks through prominent programs like 'SailSAFE' (health) and 'Sail & Sustain' (ESG), directly addressing major industry concerns for investors. Customer success is indirectly evidenced by the clear presentation of its three successful cruise brands.

The strategic placement of programs like 'SailSAFE' and 'Sail & Sustain' proactively addresses and mitigates major industry-wide risks for investors concerning public health and environmental responsibility.

Add a dedicated 'Safe Harbor' statement for forward-looking statements directly on the main Investor Relations pages to further mitigate SEC compliance risks and enhance transparency for shareholders.

NCLH's primary competitive moat is its sustainable and differentiated three-brand portfolio (Norwegian, Oceania, Regent), which targets the full market spectrum and is difficult for competitors to replicate precisely. This strategic diversification provides a strong defense against segment-specific downturns. However, as the third-largest operator, it lacks the economies of scale of its larger rivals, Carnival and Royal Caribbean, and carries a high debt load, which tempers the overall strength of its competitive position.

The diversified three-brand portfolio is a highly sustainable competitive advantage, allowing NCLH to capture a wide spectrum of the market while mitigating risk from any single segment.

Develop and promote content that frames NCLH's relatively newer fleet as a competitive advantage in efficiency, environmental performance, and guest experience compared to the older fleets of some competitors.

The company has a clear and aggressive path to scalability through its massive newbuild program, with 13 ships on order, signaling strong expansion potential. The business model has high operating leverage, making growth highly profitable once fixed costs are covered. However, this scalability is heavily constrained by extreme capital intensity, long lead times, and significant operational bottlenecks, most critically the challenge of recruiting and training thousands of crew members for the new fleet.

A robust, long-term fleet expansion plan with 13 ships on order through 2036 provides a clear, tangible roadmap for significant capacity growth and market share expansion.

Develop a strategic, scalable talent pipeline by partnering with global maritime academies to de-risk the single most significant operational barrier to its fleet expansion: crew recruitment and training.

The business model demonstrates exceptional coherence by aligning its multi-brand strategy with distinct, well-defined market segments. Each brand (NCL, Oceania, Regent) has a unique value proposition, pricing strategy, and target audience, yet they benefit from the holding company's operational synergies. The 'Charting the Course' strategy provides a clear, focused narrative that aligns resource allocation with stated goals like guest experience and long-term growth, demonstrating strong stakeholder alignment.

The three-brand portfolio is perfectly coherent, allowing the company to effectively capture revenue and loyalty across the contemporary, upper-premium, and ultra-luxury market segments without brand cannibalization.

Create and market more integrated pre- and post-cruise land packages to capture a larger share of the total customer vacation wallet, further strengthening the existing revenue model.

As the third-largest player in an oligopolistic market, NCLH has significant market presence but limited market power compared to its two larger rivals. Its pricing power is segmented; it is strong in the luxury niche with Regent but faces intense pressure in the contemporary market. The company's ability to influence industry trends is moderate, often positioning itself as a fast follower or innovator in specific niches (e.g., 'Freestyle Cruising') rather than a market-wide trendsetter.

NCLH demonstrates strong pricing power and brand leverage within the high-yield upper-premium and luxury segments through its Oceania and Regent Seven Seas brands.

Avoid direct competition on scale or price; instead, focus on differentiating as the industry's most agile and guest-centric innovator, particularly around flexibility and destination immersion, to build market influence.

Business Overview

Business Classification

B2C Services

Leisure & Hospitality

Travel & Tourism

Sub Verticals

Cruise Lines

Resort Destinations

Mature

Maturity Indicators

- •

Established global presence with over 50 years of history

- •

Publicly traded company (NYSE: NCLH) since 2013

- •

Operates a diversified portfolio of three distinct, well-established brands

- •

History of strategic acquisitions (e.g., Prestige Cruises International in 2014)

- •

Long-term, large-scale capital expenditure plans for fleet expansion through 2036

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Passenger Ticket Revenue

Description:Core revenue generated from the sale of cruise fares. Pricing is dynamic and varies by brand, ship, itinerary, cabin type, and booking time. This component often includes accommodation, standard meals, and some onboard entertainment.

Estimated Importance:Primary

Customer Segment:All Segments (Norwegian, Oceania, Regent)

Estimated Margin:Medium

- Stream Name:

Onboard and Other Revenue

Description:High-margin ancillary revenue from guest spending during a voyage. This includes specialty dining, alcoholic beverages, casino gaming, shore excursions, spa services, retail purchases, and internet access.

Estimated Importance:Primary

Customer Segment:All Segments (less applicable to all-inclusive Regent)

Estimated Margin:High

Recurring Revenue Components

Loyalty Programs (Latitudes Rewards, Oceania Club, Regent Seven Seas Society) encouraging repeat bookings

Casino At Sea Rewards program driving repeat cruiser engagement

Pricing Strategy

Value-Based & Tiered Pricing

Multi-Segment (Contemporary, Upper-Premium, Luxury)

Semi-Transparent

Pricing Psychology

- •

Tiered pricing across brands to capture different willingness-to-pay segments

- •

Dynamic pricing to manage yield and occupancy rates

- •

Bundling (e.g., NCL's 'Free at Sea' promotion)

- •

All-Inclusive model for the luxury Regent brand to simplify the value proposition and command a premium.

Monetization Assessment

Strengths

- •

Diversified revenue from both ticket sales and high-margin onboard spending.

- •

Multi-brand strategy allows for targeted pricing and maximization of revenue across different consumer wealth brackets.

- •

Proven ability to generate strong onboard revenue through a wide array of ancillary products and services.

Weaknesses

- •

Revenue is highly sensitive to discretionary consumer spending and macroeconomic conditions.

- •

Complex pricing structures can make it difficult for consumers to compare total vacation costs.

- •

High fixed costs mean that profitability is heavily dependent on maintaining high occupancy rates.

Opportunities

- •

Leverage data analytics to further personalize onboard offers and maximize per-passenger spending.

- •

Expand pre- and post-cruise package offerings (flights, hotels, tours) for a larger share of the total travel wallet.

- •

Introduce new tiers or subscription-like models for frequent cruisers to enhance loyalty and recurring revenue.

Threats

- •

Intense price competition from major rivals like Carnival Corporation and Royal Caribbean Group.

- •

Volatility in fuel prices and currency exchange rates can significantly impact net revenue and profitability.

- •

Negative public perception or health crises can lead to a rapid decline in bookings and widespread discounting.

Market Positioning

Diversified Brand Portfolio

Challenger / #3 Player (Approximately 14-18% of global cruise revenue).

Target Segments

- Segment Name:

Norwegian Cruise Line (Contemporary/Mass Market)

Description:Targets a broad demographic seeking a flexible, resort-style vacation with a wide array of dining, entertainment, and activity options. Appeals to families, couples, and groups.

Demographic Factors

- •

Middle-to-upper-middle income

- •

All age groups, with a focus on 30-60

- •

Families with children

Psychographic Factors

- •

Values freedom and flexibility over traditional, rigid schedules

- •

Seeks variety and excitement in vacation experiences

- •

Social and active

Behavioral Factors

- •

Responds to promotional offers like 'Free at Sea'

- •

Books through both travel agents and online platforms

- •

Participates in a wide range of onboard activities

Pain Points

- •

Restrictive dining times on traditional cruises

- •

Feeling 'nickeled and dimed' for every extra

- •

Lack of activities to satisfy a multi-generational group

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Oceania Cruises (Upper-Premium)

Description:Targets affluent, experienced travelers who prioritize culinary excellence and destination-intensive itineraries on smaller, more intimate ships.

Demographic Factors

- •

Upper-income / High-net-worth

- •

Typically 50+

- •

Couples and solo travelers

Psychographic Factors

- •

Food and wine connoisseurs

- •

Cultural explorers who value destination immersion

- •

Appreciates a relaxed, country-club-like atmosphere

Behavioral Factors

- •

High repeat passenger rate

- •

Values longer, more exotic voyages

- •

Books well in advance

Pain Points

- •

Mediocre food quality on mass-market lines

- •

Crowded mega-ships

- •

Itineraries that are too rushed or visit only major tourist ports

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Regent Seven Seas Cruises (Ultra-Luxury)

Description:Targets the highest end of the market with an all-inclusive, highly personalized luxury experience featuring spacious all-suite accommodations and a very high staff-to-guest ratio.

Demographic Factors

- •

Ultra-high-net-worth

- •

Typically 60+

- •

Often retired executives, entrepreneurs, and seasoned luxury travelers

Psychographic Factors

- •

Values exclusivity, privacy, and impeccable service

- •

Expects a seamless, hassle-free experience

- •

Seeks unique, bucket-list destinations

Behavioral Factors

- •

Extremely loyal customer base

- •

Less price-sensitive

- •

Often books through specialized luxury travel advisors

Pain Points

- •

Inconsistent service levels on other lines

- •

The inconvenience of paying for extras on a premium vacation

- •

Lack of personal space and recognition on larger vessels

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

NCL's 'Freestyle Cruising' Concept

Strength:Strong

Sustainability:Sustainable

- Factor:

Multi-Brand Portfolio Targeting Specific Niches

Strength:Strong

Sustainability:Sustainable

- Factor:

Younger, Modern Fleet Profile

Strength:Moderate

Sustainability:Temporary

- Factor:

Ownership of Private Island Destinations (Great Stirrup Cay, Harvest Caye)

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To be the vacation of choice for everyone around the world by offering a portfolio of distinct cruise brands that deliver exceptional experiences, from flexible and fun-filled to all-inclusive luxury.

Good

Key Benefits

- Benefit:

Choice and Flexibility

Importance:Critical

Differentiation:Unique

Proof Elements

NCL's 'Freestyle Cruising' with no set dining times

Multiple brands catering to different vacation styles and budgets

- Benefit:

Destination Diversity

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Visits approximately 700 destinations globally

- •

Itineraries on all seven continents

- •

Exclusive private island destinations

- Benefit:

Modern Onboard Experience

Importance:Important

Differentiation:Somewhat unique

Proof Elements

One of the youngest fleets in the industry

Continuous investment in new builds and ship refurbishments

- Benefit:

Superior Service and Quality

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Oceania's focus on 'The Finest Cuisine at Sea®'

Regent's all-inclusive model and high staff-to-guest ratio

Unique Selling Points

- Usp:

The only cruise company offering a 'Freestyle Cruising' concept in the contemporary market.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A uniquely segmented portfolio covering contemporary (NCL), upper-premium (Oceania), and ultra-luxury (Regent) markets under one holding company.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

One-size-fits-all vacation planning is stressful and unsatisfying for diverse groups.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Desire for a high-quality, multi-destination vacation without the hassle of constant packing/unpacking and logistical planning.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Finding a vacation that provides value across different price points, from budget-conscious to ultra-luxury.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

The multi-brand strategy effectively aligns with the cruise market's clear segmentation, allowing NCLH to capture demand across various economic and psychographic profiles.

High

Each brand has a well-defined value proposition that resonates strongly with its specific target audience, from families seeking flexibility to luxury travelers demanding all-inclusive perfection.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Global travel agencies and consortia

- •

Online Travel Agencies (OTAs)

- •

Shipbuilders (e.g., Fincantieri)

- •

Port authorities and destination management companies

- •

Suppliers of fuel, food & beverage, and hotel supplies

- •

Airline partners

Key Activities

- •

Fleet management and maritime operations

- •

Itinerary planning and destination development

- •

Sales, marketing, and brand management

- •

Guest services and onboard hospitality

- •

Supply chain and logistics management

- •

Capital planning and fleet renewal

Key Resources

- •

Fleet of 34 modern cruise ships (capital intensive assets)

- •

Global brand recognition and reputation

- •

Experienced crew and shoreside employees (~41,000+)

- •

Owned private destinations (Great Stirrup Cay, Harvest Caye)

- •

Loyal customer base and booking databases

Cost Structure

- •

Ship operating expenses (fuel, crew payroll, food, maintenance)

- •

Selling, General & Administrative (SG&A) expenses (marketing, commissions)

- •

Depreciation and amortization of vessels

- •

High interest expense due to significant debt load

- •

Capital expenditures for newbuilds and ship refurbishments

Swot Analysis

Strengths

- •

Diversified portfolio of three strong, distinct brands catering to a wide market spectrum.

- •

History of product innovation, most notably the 'Freestyle Cruising' concept.

- •

Aggressive fleet modernization and expansion plan, ensuring a young and efficient fleet.

- •

Strong post-pandemic demand recovery with high occupancy rates and record revenue.

Weaknesses

- •

Significant debt burden and high leverage, a persistent challenge post-pandemic.

- •

Smaller market share compared to industry giants Carnival and Royal Caribbean.

- •

High sensitivity to economic downturns which impact discretionary travel spending.

Opportunities

- •

Expansion into underpenetrated and growing cruise markets, such as Asia-Pacific.

- •

Capitalize on the growing demand for smaller, luxury, and expedition cruising.

- •

Further investment in private island infrastructure to create premium, controlled guest experiences.

- •

Leverage technology and data to enhance guest personalization and drive ancillary revenue.

Threats

- •

Intense competition from larger cruise operators and land-based vacation alternatives.

- •

Geopolitical instability, which can disrupt itineraries and increase security costs.

- •

Increasingly stringent environmental regulations (e.g., decarbonization) requiring significant capital investment.

- •

Volatility in fuel prices, a major component of operating costs.

Recommendations

Priority Improvements

- Area:

Financial Strategy

Recommendation:Aggressively pursue the stated 'Charting the Course' strategy to reduce the Net Leverage ratio to mid-four turns by 2026, enhancing financial resilience against economic shocks.

Expected Impact:High

- Area:

Guest Experience & Ancillary Revenue

Recommendation:Invest in a unified digital platform across brands to streamline booking, personalize onboard experiences with AI-driven recommendations, and maximize high-margin ancillary revenue capture.

Expected Impact:Medium

- Area:

Operational Efficiency

Recommendation:Accelerate investment in sustainable technologies (e.g., shore power, alternative fuels) for the existing fleet to mitigate future regulatory risk and reduce long-term fuel costs.

Expected Impact:High

Business Model Innovation

- •

Develop a 'Cruise-as-a-Service' model for corporate clients, offering private charters or dedicated ship sections for meetings, incentives, conferences, and exhibitions (MICE).

- •

Explore dynamic, tiered all-inclusive packages for the Norwegian brand to better compete with land-based all-inclusive resorts and simplify the value proposition for certain segments.

- •

Launch a brand extension into land-based hospitality, creating branded resorts or exclusive clubs in key embarkation ports to capture a greater share of guest vacation time and spending.

Revenue Diversification

- •

Expand retail and themed experiences on private islands (Great Stirrup Cay, Harvest Caye) to transform them into significant, high-margin profit centers.

- •

Create premium pre- and post-cruise curated land tours, leveraging the Oceania and Regent brands' destination expertise to sell high-value packages.

- •

Establish strategic partnerships with luxury retail, beverage, and entertainment brands to create exclusive 'ship-within-a-ship' sponsored experiences, generating new advertising and licensing revenue.

Norwegian Cruise Line Holdings Ltd. has established a robust and defensible position in the global cruise industry through a sophisticated multi-brand strategy. By operating three distinct brands—Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises—NCLH effectively segments the market from contemporary to ultra-luxury, mitigating dependency on any single consumer group and maximizing yield across the demographic spectrum. The company's core strengths lie in its history of innovation, particularly NCL's 'Freestyle Cruising' concept, and its commitment to maintaining a modern fleet, evidenced by its aggressive newbuild program extending to 2036.

The current business model is well-aligned for growth in a post-pandemic travel environment characterized by strong pent-up demand. The primary revenue drivers remain passenger tickets and high-margin onboard spending, a model proven effective across the industry. However, the model's primary vulnerability is its high fixed-cost base and significant debt load, which exerts considerable pressure on financial performance and makes the company susceptible to economic downturns and external shocks like fuel price volatility or geopolitical instability.

Strategic evolution should be centered on three key pillars: financial discipline, technological integration, and sustainable operations. The 'Charting the Course' strategy, with its clear targets for deleveraging and margin expansion, is a critical step toward enhancing financial resilience. Future revenue optimization will depend on leveraging guest data to personalize the onboard experience and drive ancillary sales. Scalability is capital-intensive and defined by fleet expansion; the planned addition of eight new ships will be a primary driver of long-term growth but also requires disciplined capital management. Finally, proactive investment in sustainability is not merely a matter of compliance but a strategic imperative to de-risk the business from future regulation and appeal to an increasingly environmentally-conscious consumer base. NCLH is well-positioned to continue its growth trajectory, but its long-term success will be determined by its ability to execute its deleveraging plan while simultaneously investing in the fleet and guest experience to maintain its competitive edge against larger rivals.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Investment

Impact:High

- Barrier:

Brand Recognition and Loyalty

Impact:High

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Limited Shipbuilding Capacity

Impact:Medium

- Barrier:

Regulatory Compliance (Safety & Environmental)

Impact:Medium

Industry Trends

- Trend:

Increased Focus on Sustainability and ESG

Impact On Business:Requires significant investment in greener technologies (e.g., alternative fuels, waste management) to meet regulations and growing consumer demand for responsible travel. NCLH's 'Sail & Sustain' program is a direct response.

Timeline:Immediate

- Trend:

Personalization and Onboard Technology

Impact On Business:Drives need for investment in mobile apps, AI-driven recommendations, and high-speed connectivity to enhance guest experience and create new revenue streams.

Timeline:Immediate

- Trend:

Growth in Expedition and Niche Cruising

Impact On Business:Creates opportunities for smaller, more agile brands like Oceania and Regent Seven Seas to offer unique, destination-focused itineraries that larger mass-market lines cannot.

Timeline:Near-term

- Trend:

Younger Demographics (Millennials & Gen X)

Impact On Business:Shifts marketing focus to digital channels, experiential travel, and onboard activities that appeal to a more active and diverse customer base. NCL's 'Freestyle Cruising' is well-positioned for this trend.

Timeline:Immediate

- Trend:

Demand for Immersive and Authentic Experiences

Impact On Business:Pushes for longer port stays, more unique shore excursions, and itineraries that go beyond traditional tourist hubs, aligning well with the upper-premium and luxury segments.

Timeline:Near-term

Direct Competitors

- →

Carnival Corporation & plc

Market Share Estimate:Largest (~42-48%)

Target Audience Overlap:High

Competitive Positioning:The global leader with a vast portfolio of brands targeting every market segment, from contemporary (Carnival) to luxury (Seabourn), often competing on scale and value.

Strengths

- •

Largest market share and fleet size, providing significant economies of scale.

- •

Highly diversified brand portfolio catering to a wide range of price points and demographics.

- •

Strong brand recognition, particularly in the mass-market contemporary segment.

- •

Extensive global presence and itinerary options.

Weaknesses

- •

Complex management due to the large number of distinct brands.

- •

Older average fleet age in some of its core brands compared to competitors.

- •

Can be perceived as less innovative in the contemporary segment compared to Royal Caribbean.

Differentiators

- •

Unmatched scale and market penetration.

- •

Focus on 'Fun Ship' concept for its flagship Carnival brand.

- •

Strong presence in both North American and European markets.

- →

Royal Caribbean Group

Market Share Estimate:Second largest (~25-28%)

Target Audience Overlap:High

Competitive Positioning:Positions itself as the innovator in the industry, focusing on large, state-of-the-art 'destination' ships with extensive onboard activities and features.

Strengths

- •

Reputation for innovation and building the world's largest, most amenity-rich ships (Oasis and Icon classes).

- •

Modern and technologically advanced fleet.

- •

Strong brand loyalty, particularly among families and adventure-seeking travelers.

- •

High-quality private island destination (Perfect Day at CocoCay) that drives premium pricing.

Weaknesses

- •

Higher operational costs associated with mega-ships.

- •

Less brand diversity in the mid-market compared to Carnival.

- •

Can be perceived as more expensive than mass-market competitors.

Differentiators

- •

Focus on 'wow' factor with unique onboard attractions (e.g., surf simulators, indoor skydiving).

- •

Leadership in ship size and technological advancement.

- •

Highly-rated private island experiences.

Indirect Competitors

- →

All-Inclusive Land-Based Resorts

Description:Offer a similar value proposition to cruising: a single upfront price for lodging, meals, drinks, and activities, but in a fixed, land-based location.

Threat Level:High

Potential For Direct Competition:Low (business models are fundamentally different), but they compete intensely for the same customer's vacation budget.

- →

Land-Based Tour Operators & Escorted Tours

Description:Provide multi-destination vacation packages that compete with the itinerary-driven nature of cruises, often appealing to travelers seeking deep cultural immersion.

Threat Level:Medium

Potential For Direct Competition:Low

- →

DIY Vacation Planners

Description:Travelers who use online travel agencies (OTAs), Airbnb, and flight aggregators to build their own custom vacations. This segment is growing, particularly among younger, independent travelers.

Threat Level:Medium

Potential For Direct Competition:Low

- →

Themed Entertainment Destinations

Description:Large-scale resort complexes that offer a wide array of lodging, dining, and entertainment options in a single location, competing for the family and entertainment-focused vacationer.

Threat Level:Medium

Potential For Direct Competition:Low (though Disney operates its own cruise line, making it a direct competitor as well).

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Diversified Three-Brand Portfolio

Sustainability Assessment:The distinct positioning of Norwegian (Contemporary), Oceania (Upper-Premium), and Regent Seven Seas (Luxury) allows NCLH to capture a wide spectrum of the market and cross-promote effectively.

Competitor Replication Difficulty:Hard

- Advantage:

Established 'Freestyle Cruising' Concept

Sustainability Assessment:A long-standing and well-recognized differentiator that appeals to modern travelers who prefer flexibility and choice over traditional, rigid cruise schedules.

Competitor Replication Difficulty:Medium

- Advantage:

Younger, Modern Fleet Profile

Sustainability Assessment:Operating a relatively modern fleet generally leads to better fuel efficiency, lower maintenance costs, and the ability to offer the latest amenities, which is attractive to customers.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'New Ship Launches', 'estimated_duration': '12-24 months per launch'}

{'advantage': 'Exclusive or Unique Itineraries', 'estimated_duration': '6-18 months (until competitors can replicate)'}

Disadvantages

- Disadvantage:

Smaller Market Share and Scale

Impact:Major

Addressability:Difficult

- Disadvantage:

High Debt Load

Impact:Major

Addressability:Moderately

- Disadvantage:

Brand Awareness in Luxury/Premium Segments

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted digital marketing campaigns aggressively highlighting the 'Freestyle Cruising' concept's benefits (flexibility, choice) versus the more traditional dining and activity structures of competitors.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Leverage social media influencers in the luxury travel space to showcase the unique, destination-intensive experiences on Oceania and Regent Seven Seas, differentiating them from mass-market offerings.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Optimize website and booking funnels with a focus on mobile experience, as cruise research on mobile is growing significantly faster than other travel sectors.

Expected Impact:High

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Invest further in onboard and shoreside technology to create a more seamless, personalized guest journey, from pre-booking to post-cruise engagement, using data analytics to tailor offers and experiences.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand unique itineraries to less-trafficked, 'off-the-beaten-path' destinations, particularly for the Oceania and Regent brands, to appeal to experienced cruisers seeking novelty.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop and acquire more exclusive private destinations, similar to Royal Caribbean's CocoCay, to create unique, controllable, and high-margin guest experiences.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Position NCLH as the industry leader in sustainability by accelerating investment in alternative fuels and net-zero emissions technology, turning a regulatory pressure point into a powerful brand differentiator.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Strategically plan the next generation of ships to be more efficient and adaptable to niche markets, rather than solely competing on size, to maintain differentiation from the 'mega-ship' focus of competitors.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore strategic partnerships with non-travel luxury brands (e.g., high-end automotive, fashion, culinary) to create unique themed voyages and co-branded experiences that elevate the brand perception of Oceania and Regent.

Expected Impact:Medium

Implementation Difficulty:Moderate

Solidify NCLH's position as the 'innovator of choice,' leveraging the 'Freestyle' concept in the contemporary market while positioning its premium/luxury brands as the go-to for deep, destination-focused travel. Avoid direct competition on ship size with Royal Caribbean and on price with Carnival; instead, compete on the quality and flexibility of the overall vacation experience.

Focus on a dual-pronged differentiation: 1) For the Norwegian brand, emphasize superior flexibility and a more resort-like atmosphere. 2) For Oceania and Regent, champion the identity of 'destination specialists,' offering more immersive itineraries and authentic cultural experiences than any competitor.

Whitespace Opportunities

- Opportunity:

Develop hyper-personalized cruise packages driven by AI, allowing guests to pre-build their ideal vacation by bundling specialty dining, shore excursions, and onboard activities based on their preferences.

Competitive Gap:While personalization is a trend, no cruise line currently offers a truly dynamic, AI-driven packaging and itinerary-building experience from the point of booking.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Launch a dedicated 'Wellness and Digital Detox' cruise concept, potentially as a sub-brand or themed voyage, catering to the growing demand for restorative and mindful travel.

Competitive Gap:Competitors offer spa facilities, but none have fully committed to a ship-wide, holistic wellness concept that includes curated menus, mindfulness workshops, and tech-free zones.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Create 'work-from-sea' packages targeting the rise of digital nomads and remote workers, offering long-term cruises with premium internet, co-working spaces, and networking events.

Competitive Gap:Some lines offer long cruises, but none are specifically packaged and marketed to the professional remote worker, a growing and affluent demographic.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Pioneer 'farm-to-ship' dining as a core brand pillar for Oceania Cruises, establishing exclusive partnerships with local suppliers in key ports to offer verifiably fresh and authentic regional cuisine.

Competitive Gap:All luxury lines focus on cuisine, but none have built a core marketing identity around sustainable, hyper-local sourcing as a primary differentiator.

Feasibility:Medium

Potential Impact:High

The global cruise industry is a mature oligopoly, dominated by three major players: Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings Ltd. (NCLH). Competition is intense and multifaceted, revolving around brand identity, price, itinerary, fleet quality, and onboard experience. NCLH is firmly positioned as the third-largest player, successfully carving out a significant market share through a differentiated strategy.

NCLH's primary competitive advantage lies in its unique three-brand portfolio, which allows it to target distinct market segments without significant internal cannibalization. The Norwegian Cruise Line brand competes in the high-volume contemporary market with its pioneering 'Freestyle Cruising' concept, a powerful differentiator that appeals to modern travelers' desire for flexibility. This directly counters the more traditional, scheduled experiences often found on competitor ships. In the lucrative upper-premium and luxury segments, its Oceania Cruises and Regent Seven Seas Cruises brands compete effectively by focusing on destination immersion, culinary excellence, and smaller, more intimate ships. This focus on experience over scale is a key point of differentiation from its larger rivals.

Its direct competitors, Carnival and Royal Caribbean, leverage enormous scale. Carnival competes primarily on value and its massive, multi-brand reach, while Royal Caribbean dominates the innovation narrative with the world's largest and most feature-packed ships. NCLH's path to success is not to out-scale them, but to outmaneuver them by being more agile, guest-centric, and focused on delivering a higher quality, more flexible experience across its targeted segments.

Key challenges for NCLH include its smaller scale, which can limit pricing power and marketing spend, and a significant debt load accrued during the industry-wide shutdown. However, significant opportunities exist. The growing demand for sustainable travel, personalized experiences, and niche/expedition cruising aligns perfectly with the strengths of its smaller, more specialized brands. By doubling down on its 'Freestyle' ethos, positioning itself as a leader in sustainability, and leveraging technology to enhance guest personalization, NCLH can fortify its competitive position and continue to drive profitable growth in a highly competitive market.

Messaging

Norwegian Cruise Line Holdings Ltd.'s (NCLH) corporate website, nclhltd.com, executes its messaging strategy with the precision of a seasoned investment banker. The communication is unequivocally tailored to its primary audience: investors, financial analysts, and corporate stakeholders, not prospective cruise passengers. The messaging architecture is built on a foundation of financial stability, strategic growth, and responsible governance. Key themes like the 'Charting the Course' strategy, the diversified three-brand portfolio, and commitments to sustainability (Sail & Sustain) and safety (SailSAFE) are consistently reinforced to address potential investor concerns about market volatility, ESG criteria, and operational risks. The brand voice is professional, confident, and data-driven, effectively positioning NCLH as a stable and forward-looking leader in the competitive cruise industry. However, this singular focus creates distinct gaps. The messaging lacks a compelling narrative for potential top-tier talent, failing to articulate a strong Employee Value Proposition (EVP). Furthermore, while the value proposition for investors is clear, the storytelling that connects the corporate strategy to the unique, tangible guest experiences aboard its three distinct cruise brands could be significantly more vivid and persuasive. The site successfully builds trust and credibility for a financial audience but misses the opportunity to create a richer, more holistic corporate brand narrative.

Message Architecture

Key Messages

- Message:

We are a leading global cruise company with a portfolio of three award-winning brands.

Prominence:Primary

Clarity Score:High

Location:Homepage, About Page Hero

- Message:

Our 'Charting the Course' strategy is a bold vision to 'Vacation Better. Experience More' and drive long-term growth.

Prominence:Primary

Clarity Score:Medium

Location:About Page

- Message:

Commitment to sustainability through our global 'Sail & Sustain' program.

Prominence:Secondary

Clarity Score:High

Location:Homepage, About Page

- Message:

Health and safety are paramount, managed through our comprehensive 'SailSAFE' program.

Prominence:Secondary

Clarity Score:High

Location:Homepage

- Message:

A robust growth profile with 13 ships on order through 2036.

Prominence:Tertiary

Clarity Score:High

Location:About Page ('At a Glance' stats)

The messaging hierarchy is logical and effective for its target audience. The homepage prioritizes investor-centric information: financial data (stock ticker), corporate responsibility (Sustainability), and risk mitigation (Health and Safety). The 'About' page then provides the strategic narrative, detailing the business model, brand portfolio, leadership, and growth metrics. This structure successfully funnels a stakeholder audience from high-level positioning to strategic depth.

Messaging is highly consistent across the provided website sections. Core concepts like 'Sail & Sustain,' the three-brand portfolio structure, and the company's leadership in the industry are repeated verbatim or with minimal variation, reinforcing the corporate narrative effectively. There are no noticeable contradictions.

Brand Voice

Voice Attributes

- Attribute:

Corporate & Professional

Strength:Strong

Examples

- •

We are a leading global cruise company with a portfolio of three award-winning brands...

- •

Our leadership team is comprised of accomplished executives with strong entrepreneurial spirits...

- •

In January 2013, we completed our initial public offering and listed on the NASDAQ stock exchange...

- Attribute:

Confident & Authoritative

Strength:Strong

Examples

We set ourselves apart with our young modern fleet, robust growth profile and innovative, best-in-class product offerings.

Our future is bright, and we will be introducing twelve new ships across our three brands through 2036.

- Attribute:

Data-driven & Factual

Strength:Moderate

Examples

- •

~71K Berths

- •

~700 Destinations visited globally

- •

~3M Expected guests carried in 2025

- Attribute:

Responsible & Reassuring

Strength:Moderate

Examples

To protect our guests, crew and communities we visit, we’ve enhanced our commitment to health and safety...

We are deeply committed to driving a positive impact on society and the environment...

Tone Analysis

Formal

Secondary Tones

Informative

Financial

Tone Shifts

The tone shifts slightly on the 'History' section to become more narrative and story-oriented, though it remains formal.

The 'SailSAFE' and 'Sustainability' sections adopt a more reassuring and socially conscious tone.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

For investors and stakeholders, NCLH represents a premier, well-managed investment in the global travel sector, differentiated by a diversified portfolio of three distinct, award-winning cruise brands, a clear strategy for long-term growth, and a commitment to responsible operations.

Value Proposition Components

- Component:

Diversified Brand Portfolio (Norwegian, Oceania, Regent)

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Strategic Growth Plan ('Charting the Course')

Clarity:Somewhat Clear

Uniqueness:Common

- Component:

Commitment to ESG (Sail & Sustain)

Clarity:Clear

Uniqueness:Common

- Component:

History of Innovation ('Freestyle Cruising')

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Experienced Leadership Team

Clarity:Clear

Uniqueness:Common

NCLH's primary point of differentiation is its multi-brand strategy, covering the contemporary, upper-premium, and luxury market segments. The website communicates this by outlining the different experiences offered ('unparalleled freedom, immersive sensory experiences, or all-inclusive luxury'). This portfolio approach positions NCLH as a diversified player, mitigating risk associated with any single market segment. While competitors like Carnival Corporation and Royal Caribbean Group also have multiple brands, NCLH's messaging focuses on a curated, distinct portfolio of three, implying a more focused and deliberate strategy.

The messaging positions NCLH as a top-tier industry leader, on par with its main competitors Carnival Corporation and Royal Caribbean Group. It uses language like 'leading global cruise company' and backs it up with scale metrics (fleet size, destinations, guests) and a forward-looking growth plan. The emphasis on innovation and a modern fleet is intended to position it as a more progressive and dynamic choice within the industry's top echelon.

Audience Messaging

Target Personas

- Persona:

Investor / Financial Analyst

Tailored Messages

- •

The prominent stock ticker on the homepage.

- •

The 'At a Glance' section with key metrics like 'Ships on order' and 'Berths on order'.

- •

The explicit outline of the 'Charting the Course' strategy with its four pillars.

- •

The detailed corporate history including IPO and acquisition milestones.

Effectiveness:Effective

- Persona:

Media / Press

Tailored Messages

- •

'A Leading Global Cruise Company' positioning statement.

- •

'A History of Cruising Innovations' narrative.

- •

Information on sustainability and safety programs ('Sail & Sustain', 'SailSAFE').

Effectiveness:Somewhat

- Persona:

Potential Corporate Partner

Tailored Messages

Metrics showcasing scale: '~700 Destinations visited globally', '~3M Expected guests'.

Description of 'World-renowned Cruise Brands'.

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

ESG Concerns: The 'Sail & Sustain' messaging directly addresses investor focus on environmental and social governance.

- •

Post-Pandemic Safety Fears: The 'SailSAFE' program is designed to reassure stakeholders of the company's commitment to mitigating health risks.

- •

Market Volatility: The emphasis on a diversified portfolio of three distinct brands implicitly addresses the risk of downturns in a single market segment.

- •

Lack of a Clear Future Strategy: The 'Charting the Course' section explicitly lays out a strategic plan to counter concerns about future direction and growth.

Audience Aspirations Addressed

- •

Investing in a Market Leader: The messaging consistently reinforces NCLH's position as a 'leading' company in the industry.

- •

Achieving Long-Term Growth: The focus on new ships on order and a clear strategic plan appeals to investors looking for future returns.

- •

Associating with an Innovator: The historical timeline highlighting innovations like 'Freestyle Cruising' and the first private island caters to a desire to be part of a forward-thinking company.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Trust & Credibility

Effectiveness:High

Examples

- •

Mention of 'leading public health and scientific experts' for SailSAFE.

- •

Showcasing an experienced management team and board of directors.

- •

A detailed historical timeline demonstrating longevity and experience.

- Appeal Type:

Confidence & Security

Effectiveness:High

Examples

- •

Highlighting the 'robust growth profile' and number of ships on order.

- •

Displaying real-time stock market data.

- •

The structured, four-pillar 'Charting the Course' strategy implies a well-managed organization.

Social Proof Elements

{'proof_type': 'Proof by Numbers / Scale', 'impact': 'Strong'}

{'proof_type': 'Authority (Expert Guidance)', 'impact': 'Moderate'}

Trust Indicators

- •

Real-time NYSE stock ticker

- •

Detailed management and board of directors pages

- •

Specific, named corporate programs (SailSAFE, Sail & Sustain)

- •

A detailed corporate history timeline

- •

Explicit mention of acquisitions and IPO, demonstrating financial milestones

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

View Investor Relations

Location:Homepage

Clarity:Clear

- Text:

Sign Up Today

Location:Homepage (for Email Alerts)

Clarity:Clear

- Text:

Learn About SailSAFE

Location:Homepage

Clarity:Clear

- Text:

Explore Our Cruise Brands

Location:About Page

Clarity:Clear

- Text:

Meet Our Management Team

Location:About Page

Clarity:Clear

The CTAs are highly effective for the intended audience. They are directive, non-transactional, and guide users toward deeper informational content relevant to corporate stakeholders (e.g., investor relations, sustainability reports, brand strategy). The language is professional and aligns perfectly with the site's overall purpose.

Messaging Gaps Analysis

Critical Gaps

- •

Employee Value Proposition (EVP): There is no messaging aimed at attracting top talent. Despite 'People Excellence' being a strategic pillar, the site lacks a 'Careers' section or content that communicates why NCLH is a desirable place to work.

- •

Customer Voice / Testimonials: While inappropriate for the corporate context, there's no bridge to show how the corporate strategy results in stellar guest experiences. A section showcasing brand-level awards or accolades could serve as a proxy.

- •

The 'Why' Behind the Strategy: The site presents the 'Charting the Course' strategy but does not deeply articulate the market insights or consumer trends driving this vision. It tells the 'what' but not enough of the 'why'.

Contradiction Points

No itemsUnderdeveloped Areas

- •

Brand Portfolio Storytelling: The site states there are three distinct brands but does little to illustrate their unique personalities or how they complement each other strategically. It's a missed opportunity to showcase the portfolio's synergistic strength.

- •

Innovation Narrative: The narrative heavily relies on past innovations like 'Freestyle Cruising'. The messaging about future innovation is generic and could be strengthened with more specific details about what's next in terms of technology, guest experience, or sustainability.

- •

Sustainability Proof Points: The 'Sail & Sustain' message is prominent but lacks depth in the provided content. Linking to detailed sustainability reports, data, and specific goals would add significant credibility.

Messaging Quality

Strengths

- •

Audience Specificity: The messaging is laser-focused on the investor and stakeholder audience, avoiding consumer-facing language that would dilute its purpose.

- •

Clarity and Professionalism: The language is clear, professional, and confident, establishing credibility and authority.

- •

Strong Information Hierarchy: Content is structured logically, guiding the user from high-level positioning to detailed strategic information.

- •

Consistent Reinforcement: Key strategic messages are consistently repeated across the site, ensuring they are absorbed.

Weaknesses

- •

Overly Formal Tone: The voice is professional but also dry and lacks emotional resonance, even for a corporate audience.

- •

Lack of a Human Element: The messaging is very corporate and lacks stories about the people behind the company (employees) or the people it serves (guests).

- •

Static, Backward-Looking Feel: The focus on history is strong, but the forward-looking vision feels underdeveloped and less compelling in comparison.

Opportunities

- •

Develop a Talent-Focused Narrative: Create a dedicated careers section that articulates the EVP and showcases the culture, aligning with the 'People Excellence' pillar.

- •

Bridge Corporate Strategy to Guest Experience: Create content (e.g., case studies, videos) that shows how NCLH's vision and investments translate into award-winning vacations on each of its three brands.

- •

Humanize the Leadership: Go beyond formal bios to include thought leadership articles or messages from executives to provide a more personal and visionary perspective.

Optimization Roadmap

Priority Improvements

- Area:

Talent Attraction Messaging

Recommendation:Build out a comprehensive 'Careers' section detailing the EVP, company culture, values, and growth opportunities. Feature employee stories that align with the 'People Excellence' strategic pillar.

Expected Impact:High

- Area:

Strategic Narrative

Recommendation:Flesh out the 'Charting the Course' section with more detail on the market insights driving the strategy and provide tangible examples of how the vision of 'Vacation Better. Experience More.' will be realized.

Expected Impact:High

- Area:

Brand Portfolio Story

Recommendation:Create a more dynamic 'Our Brands' section that uses richer media and descriptions to bring the unique personality and target audience of Norwegian, Oceania, and Regent to life, emphasizing their collective strength.

Expected Impact:Medium

Quick Wins

- •

Add a sub-headline on the homepage that succinctly summarizes the three-brand strategy (e.g., 'Three Distinct Brands. One Vision for Unforgettable Vacations.').

- •

Incorporate key data points from the latest sustainability report directly onto the 'Sustainability' landing page to immediately add credibility.

- •

Add a 'Key Awards' or 'Industry Recognition' section to the 'About' page to serve as third-party validation of the company's success.

Long Term Recommendations

- •

Develop a thought leadership content strategy featuring executives discussing the future of travel, sustainability, and innovation to position NCLH as a true industry visionary.

- •

Create an integrated annual report that is not just a financial document but a compelling narrative of the company's strategy, performance, and impact, using rich storytelling and visuals.

- •

Launch a corporate blog or newsroom that provides regular updates and stories from across the NCLH portfolio, reinforcing the connection between the holding company and its successful brands.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Operates a diversified portfolio of three distinct, award-winning brands (Norwegian, Oceania, Regent Seven Seas) targeting different market segments from contemporary to ultra-luxury.

- •

High repeat customer rate, with 82% of cruisers planning to cruise again, indicating strong satisfaction.

- •

Projected to carry ~3 million guests in 2025, demonstrating significant market demand.

- •

Long-term, aggressive fleet expansion with orders for new, innovative ships across all three brands through 2036 signals strong confidence in future demand.

- •

Historical innovation with concepts like 'Freestyle Cruising' which fundamentally changed the industry.

Improvement Areas

- •

Deepen personalization across the entire customer journey, from booking to onboard experience, using data analytics.

- •

Further integrate pre- and post-cruise land experiences to capture a larger share of the total vacation wallet.

- •

Enhance the digital experience through mobile apps and onboard technology to meet the expectations of younger demographics.

Market Dynamics

Strong. The global cruise market is projected to grow at a CAGR of 8% to 12.9% between 2025 and 2030.

Mature

Market Trends

- Trend:

Demographic Shift to Younger Cruisers

Business Impact:Cruise passengers are getting younger, with Gen X and Millennials becoming a dominant force, driving demand for more experiential, tech-integrated, and shorter, immersive itineraries.

- Trend:

Sustainability and Environmental Responsibility

Business Impact:Increasing regulatory pressure and consumer demand for eco-friendly travel necessitates significant investment in sustainable technologies like LNG, advanced wastewater treatment, and emissions reduction.

- Trend:

Personalization and Technology Integration

Business Impact:Guests expect seamless digital experiences, from booking to onboard services. AI, smart ships, and data analytics are becoming key competitive differentiators for personalizing the journey.

- Trend:

Experiential and Expedition Cruising

Business Impact:Travelers seek more immersive cultural experiences and unique destinations, driving growth in expedition cruises and itineraries that feature less-visited ports.

Excellent. The market is in a strong post-pandemic recovery phase with high consumer demand. NCLH's 'Charting the Course' strategy and fleet expansion are well-timed to capitalize on this growth trajectory.

Business Model Scalability

Medium

Extremely high fixed-cost model. Ships represent massive capital expenditures, and operational costs (crew, fuel, maintenance) are largely fixed regardless of occupancy. Profitability is highly sensitive to occupancy rates and onboard revenue.

Very high. Once breakeven occupancy is reached, each additional passenger contributes significantly to the bottom line, especially through high-margin ancillary onboard revenue.

Scalability Constraints

- •

Massive capital investment required for new ship construction, with long lead times (financing for some NCL ships is still subject to approval).

- •

Shipbuilding capacity constraints at specialized shipyards like Fincantieri.

- •

Port infrastructure limitations in popular destinations.

- •

Scaling human capital, specifically recruiting and training thousands of skilled crew members for each new vessel.

Team Readiness

Strong. The leadership team is described as highly experienced in the cruise, travel, and hospitality industries, and has articulated a clear growth strategy ('Charting the Course').

Effective. A brand-segmented structure (NCL, Oceania, Regent) allows for targeted market focus, while the holding company structure enables operational and financial synergies.

Key Capability Gaps

- •

Advanced Data Science & AI: To fully leverage guest data for hyper-personalization and dynamic pricing across the fleet.

- •

Digital Transformation Leadership: A dedicated C-level role may be needed to drive the complex integration of digital technologies across legacy systems and new builds.

- •

Global Talent Acquisition & Development: Scaling recruitment and retention programs to staff the massive newbuild pipeline will be a critical challenge.

Growth Engine

Acquisition Channels

- Channel:

Travel Advisors (B2B)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Empower travel advisors with better technology platforms for seamless booking, real-time inventory access, and co-branded marketing tools to deepen this crucial partnership.

- Channel:

Direct-to-Consumer (Website/Call Center)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest in a best-in-class, personalized web experience. Use data to tailor offers and streamline the complex booking funnel to increase direct, higher-margin sales.

- Channel:

Paid Digital Marketing (Search, Social, Display)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Shift from brand-level searches to capturing high-intent, category-level searches (e.g., 'alaska cruise'). Utilize first-party data for sophisticated retargeting and lookalike audiences for each brand's target demographic.

- Channel:

Organic Search & Content Marketing

Effectiveness:Low

Optimization Potential:High

Recommendation:Develop a robust content strategy around destinations, experiences, and cruise education to capture early-funnel prospects and reduce reliance on paid acquisition.

Customer Journey

Complex and multi-touchpoint, often spanning months from initial research to final booking. It frequently involves both online (research, reviews) and offline (travel agent consultation) steps.

Friction Points

- •

Choice Overload: The sheer number of ships, itineraries, and cabin types can be overwhelming for new cruisers.

- •

Price Complexity: Navigating base fares, taxes, port fees, gratuities, and onboard packages is often confusing.

- •

Disconnected Experience: Journey data is often siloed between the website, call center, and travel agent partners.

Journey Enhancement Priorities

{'area': 'Simplified Booking Funnel', 'recommendation': "Implement an AI-powered 'cruise finder' tool that guides users to the right brand and itinerary based on a simple questionnaire. Offer transparent, bundled pricing options."}

{'area': 'Unified Customer Profile', 'recommendation': 'Invest in a Customer Data Platform (CDP) to create a single view of the customer across all touchpoints, enabling personalized communication and a seamless journey.'}

Retention Mechanisms

- Mechanism:

Brand-Specific Loyalty Programs (e.g., NCL's Latitudes Rewards)

Effectiveness:High

Improvement Opportunity:Enhance personalization within the programs. Offer loyalty members exclusive access to new itineraries, tailored onboard perks, and surprise-and-delight moments based on their past behavior.

- Mechanism:

Onboard Experience & Future Cruise Credits

Effectiveness:High

Improvement Opportunity:Optimize the onboard sales process for future cruises with dedicated lounges and exclusive offers. Use data to present guests with their 'next best cruise' recommendation while they are still on board.

Revenue Economics

Highly favorable once fixed costs are covered. The key is maximizing Total Revenue per Passenger Cruise Day (RPCD), which is a combination of ticket revenue and high-margin ancillary onboard revenue (specialty dining, excursions, spa, casino, etc.).

Unclear from public data, but likely very high for loyal, repeat customers. A single new-to-brand customer acquisition can lead to decades of high-margin bookings.

Strong

Optimization Recommendations

- •

Implement dynamic pricing for onboard packages and services, adjusting based on demand and passenger segment.

- •

Leverage the mobile app for personalized, real-time offers for onboard experiences to increase ancillary spend.

- •

Focus marketing efforts on acquiring new-to-brand customers in the higher-yield Oceania and Regent segments.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Technology Stack

Impact:High

Solution Approach:Adopt a phased modernization approach, prioritizing the development of a central Customer Data Platform (CDP) and API-first architecture to connect disparate systems without a full rip-and-replace.

- Limitation:

Siloed Data Across Brands

Impact:Medium

Solution Approach:Create a centralized analytics and data science team at the holding company level to build models and insights that can be leveraged by all three brands, without losing brand-specific autonomy.

Operational Bottlenecks

- Bottleneck:

Crew Recruitment, Training, and Retention at Scale

Growth Impact:This is the most significant operational barrier to scaling the fleet. A shortage of qualified crew can delay ship launches and compromise service quality.

Resolution Strategy:Establish strategic partnerships with global maritime academies. Invest heavily in employee well-being, career pathing, and competitive compensation to become the employer of choice in the industry.

- Bottleneck:

Dry Dock and Maintenance Capacity

Growth Impact:As the fleet grows, scheduling required maintenance and refurbishments becomes increasingly complex and can take ships out of revenue service.

Resolution Strategy:Long-term strategic planning and partnerships with shipyards globally to secure dry dock slots years in advance. Invest in predictive maintenance technologies to optimize service intervals.

- Bottleneck:

Supply Chain for New Builds and Operations

Growth Impact:Reliance on a few key suppliers (e.g., shipyards, engine manufacturers) creates risk. Global supply chain disruptions can delay ship delivery and impact onboard product availability.

Resolution Strategy:Diversify suppliers where possible. Build stronger, more integrated long-term partnerships with critical suppliers to gain priority and better visibility into their supply chains.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Double down on brand differentiation. NCL focuses on 'Freestyle' flexibility, Oceania on culinary excellence, and Regent on all-inclusive luxury. Avoid competing on price alone and emphasize the unique value proposition of each brand.

- Challenge:

Geopolitical Instability and Economic Headwinds

Severity:Major

Mitigation Strategy:Maintain a diversified global itinerary portfolio to allow for rapid redeployment of ships if a region becomes unstable. Offer a range of price points across the three brands to cater to different economic sensitivities.

- Challenge:

Negative Environmental Perception

Severity:Major

Mitigation Strategy:Lead the industry in sustainability. Proactively communicate investments and progress on environmental goals through the 'Sail & Sustain' program. Go beyond regulatory requirements to build brand trust.

Resource Limitations

Talent Gaps

- •

Data Scientists and AI/ML Engineers

- •

Digital Product Managers

- •

Cybersecurity Experts

- •

Specialized Maritime Engineers (for new fuel technologies)

Extremely high. The newbuild program represents a multi-billion dollar investment over the next decade. Securing favorable financing for all planned ships is a critical dependency.

Infrastructure Needs

Development and enhancement of private destinations (e.g., the new pier at Great Stirrup Cay) to accommodate larger ships and improve guest experience.

Investment in port infrastructure globally, often in partnership with local governments, to secure berthing rights for new and larger vessels.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in Asia-Pacific

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Establish a dedicated regional headquarters. Develop itineraries and onboard experiences specifically tailored to the preferences of Asian travelers, and build strong relationships with local travel trade partners.

- Expansion Vector:

Demographic Targeting of Solo Travelers

Potential Impact:Medium

Implementation Complexity:Low

Recommended Approach:Expand the inventory of solo-occupancy cabins (like NCL's successful Studio staterooms). Create dedicated programming and pricing models for solo travelers to eliminate the 'single supplement' penalty.

- Expansion Vector:

Shorter 'Micro-Cruise' Itineraries (3-4 nights)

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Deploy older, refurbished ships from homeports near major population centers to offer long-weekend 'taster' cruises, acting as a powerful new-to-cruise acquisition tool.

Product Opportunities

- Opportunity:

Themed and Affinity Group Cruises

Market Demand Evidence:Growing trend for niche travel experiences focused on interests like wellness, music, or culinary arts.

Strategic Fit:High. Can be layered on top of existing itineraries and leverages onboard venues. Highly marketable and can command premium pricing.

Development Recommendation:Create a dedicated team to partner with brands and influencers to develop and market full-ship charters or group blocks for specific themes.

- Opportunity:

Integrated Pre/Post-Cruise Land Packages

Market Demand Evidence:Guests often book hotels and tours independently before or after their cruise. There's a clear demand for a seamless, single-purchase vacation.

Strategic Fit:High. Increases total revenue per guest and strengthens control over the end-to-end travel experience.

Development Recommendation:Develop a 'Land & Sea' product division. Form strategic partnerships with hotel chains and tour operators in key embarkation/debarkation ports to offer curated, bundled packages.

Channel Diversification

- Channel:

Corporate Meetings & Incentives (MICE)

Fit Assessment:Excellent. Ships are self-contained venues with meeting spaces, accommodations, dining, and entertainment.

Implementation Strategy:Build a dedicated MICE sales team focused on full-ship charters and large corporate groups. Develop pre-packaged meeting solutions and market the unique value proposition of a corporate event at sea.

- Channel:

Strategic Airline Partnerships

Fit Assessment:Strong. Many passengers fly to their port of embarkation.

Implementation Strategy:Form deep partnerships with major airline alliances to offer bundled 'Air & Sea' packages. Integrate loyalty programs (e.g., earn/burn airline miles for cruises) to create a powerful cross-promotional engine.

Strategic Partnerships

- Partnership Type:

Luxury Brand Collaborations

Potential Partners

- •

Michelin-starred chefs

- •

Luxury spa brands (e.g., Canyon Ranch)

- •

High-end retail brands (e.g., LVMH)

Expected Benefits:Enhances the premium and luxury positioning of the Oceania and Regent brands, provides unique marketing content, and drives high-margin ancillary revenue.

- Partnership Type:

Technology & AI

Potential Partners

Leading AI/ML firms (e.g., Google, Salesforce)

Guest experience technology providers

Expected Benefits:Accelerates the development of personalization engines, improves operational efficiency through predictive analytics, and enhances the digital guest experience.

Growth Strategy

North Star Metric

Booked Passenger Cruise Days

This single metric encapsulates volume (number of passengers), duration (length of cruise), and future demand (booked). It directly measures the utilization of the company's primary assets (the ships) and is the ultimate driver of both ticket and onboard revenue. Growing this metric is the most direct path to long-term growth.

Achieve a 10-15% year-over-year increase, driven by new ship introductions and higher occupancy on the existing fleet.

Growth Model

Capacity-Led Growth & Lifetime Value Maximization

Key Drivers

- •

New Ship Deployment (Capacity Expansion)

- •

Occupancy Rate (Yield Management)

- •

Ancillary Revenue Per Passenger (Onboard Spend)

- •

Repeat Booking Rate (Customer Loyalty)

The growth model is a flywheel: 1) Introduce new, innovative ships which creates marketing buzz and expands capacity. 2) Drive high occupancy through a multi-channel sales strategy. 3) Maximize onboard revenue via personalized experiences. 4) Deliver an exceptional vacation that drives repeat bookings and referrals, creating demand for the next wave of new ships.

Prioritized Initiatives

- Initiative:

Unified Guest Profile Project (CDP Implementation)

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Appoint a project lead. Conduct an audit of all existing customer data sources. Select a Customer Data Platform (CDP) vendor and begin a pilot project with one brand.

- Initiative:

Dynamic Onboard Revenue Engine

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Create a cross-functional team of revenue management, F&B, and digital leaders. Pilot dynamic pricing for specialty dining on a single ship, using the mobile app as the primary interface.

- Initiative:

Travel Advisor Technology Upgrade

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Conduct focus groups with top travel agent partners to identify key pain points. Develop a roadmap for a new agent portal with enhanced booking and marketing capabilities.

Experimentation Plan

High Leverage Tests

- Area:

Booking Funnel

Experiment:A/B test a simplified, '3-click' booking path against the traditional, multi-step process for specific itineraries.

- Area:

Onboard Offers

Experiment:Test personalized push notifications for spa discounts vs. general offers to see the impact on booking rates and revenue.

- Area:

Acquisition Messaging

Experiment:Run ad campaigns targeting younger demographics that focus on 'experiences and adventure' versus traditional messaging focused on 'relaxation and destinations'.

Utilize an A/B testing platform (e.g., Optimizely, VWO) for digital experiments. Track key metrics like Conversion Rate, Average Order Value, Onboard Ancillary Spend per Passenger, and Customer Acquisition Cost.

Run a bi-weekly 'Growth Sprint' where new experiment ideas are proposed, prioritized, and launched. Review results quarterly with senior leadership.

Growth Team

A centralized 'Growth & Guest Experience' Center of Excellence that supports the marketing and commercial teams of the three distinct brands.

Key Roles

- •

VP of Guest Analytics & Data Science

- •

Director of Digital Acquisition & Growth Marketing

- •

Head of Loyalty & CRM

- •

Director of Ancillary Revenue & Onboard Experience

Invest in continuous training for the commercial teams on data analytics, experimentation, and digital marketing. Hire experienced talent from outside the travel industry (e.g., from e-commerce, tech) to bring in new perspectives.

Norwegian Cruise Line Holdings Ltd. (NCLH) is in a formidable position for sustained growth, underpinned by a strong product-market fit across its three distinct brands and favorable market dynamics. The company's aggressive and strategic fleet expansion through 2036 is a clear, decisive bet on the future of cruising and serves as the primary engine of its capacity-led growth model. The 'Charting the Course' strategy provides a coherent framework for this expansion, focusing on guest experience and operational excellence to drive shareholder value.

The primary growth foundation is solid, with high repeat-customer rates and clear brand differentiation catering to multiple market segments. However, the business model's scalability is constrained by its immense capital intensity and long lead times for new vessels. The key to profitable growth lies not just in filling these new ships, but in maximizing the lifetime value of each acquired guest.