eScore

odfl.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

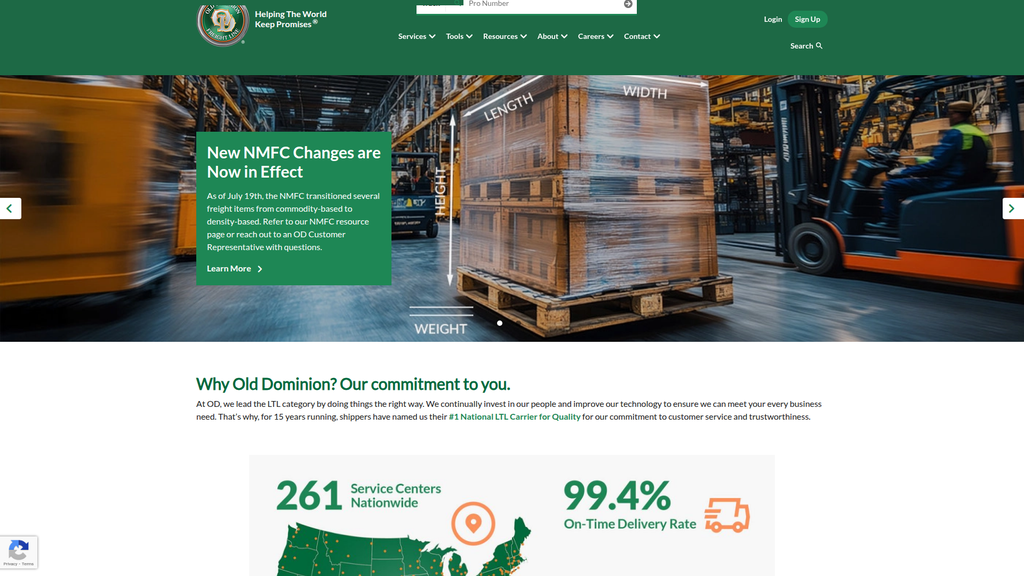

ODFL's digital presence is strong in content authority, leveraging its status as a market leader with resources like white papers and industry insights. The site aligns well with high-intent user tasks like 'Get a Quote' and 'Track Shipment', demonstrating good search intent alignment. However, its multi-channel presence is more traditional, focused on direct traffic and search, while its dated UI and moderate mobile optimization indicate weaknesses in adapting to modern user behaviors like voice search.

Excellent content authority and alignment with core B2B user search intent for transactional queries.

Modernize the UI and improve mobile-first optimization to better capture users on the move and enhance performance in emerging search channels like voice.

The company's brand communication is exceptionally effective, consistently reinforcing its core value proposition of being the #1 carrier for quality and reliability. This message is a powerful differentiator, clearly positioning ODFL against competitors who might compete on price. While the messaging is powerful for its primary audience of logistics managers, it lacks segmentation for other potential personas and misses an opportunity to translate quality into a quantifiable ROI for customers.

Crystal-clear and consistent brand messaging centered on a powerful, third-party-validated differentiator (15-year Mastio Quality Award).

Develop messaging that explicitly frames the financial value and ROI of choosing a premium, reliable carrier to better counter price-focused competitors and appeal to finance-minded decision-makers.

The website is highly functional for its core audience, placing essential tools like quoting and tracking in prominent positions, which is a strength. However, the conversion experience suffers from a dated user interface, high information density, and poor content hierarchy, which create a high cognitive load for users. The analysis data explicitly notes ineffective CTAs like 'Get Started' and a sub-optimal, inconsistent mobile journey, which are significant friction points.

High-priority, task-oriented tools for quotes and tracking are immediately accessible on the homepage, catering effectively to the primary needs of its core B2B audience.

Redesign key forms and the homepage with a mobile-first approach, simplifying the layout, improving visual hierarchy, and replacing generic CTAs with specific, action-oriented language to reduce friction.

ODFL excels in establishing credibility, primarily through the powerful social proof of being the #1 LTL carrier for 15 consecutive years, a dominant trust signal. The company demonstrates transparency through its detailed privacy policies and proactive communications on industry changes. While its US compliance is strong, the analysis notes gaps in international data privacy regulations (GDPR, PIPEDA), which introduces a minor risk given their global service offerings.

Unmatched third-party validation through the 15-year Mastio Quality Award, which serves as the ultimate trust signal and underpins the entire brand promise.

Address the identified gaps in international data privacy compliance (GDPR, PIPEDA) to mitigate regulatory risk and bolster credibility in global markets.

ODFL possesses a deep and sustainable competitive moat built on decades of operational excellence, resulting in superior service quality that is difficult to replicate. This is supported by a dense, company-controlled physical network, which creates high barriers to entry, and a flexible non-union workforce. While competitors are strong, ODFL's singular focus on quality allows it to command premium pricing and maintain industry-leading profitability.

A culturally ingrained, systemic commitment to service quality (99% on-time, 0.1% claims ratio), which creates a nearly insurmountable brand reputation and justifies a premium price point.

More effectively market its technological investments to counter the perception of being a 'legacy' carrier compared to tech-first competitors like XPO.

ODFL is well-positioned for steady expansion, supported by a strong financial position, disciplined capital investment in its network, and excellent unit economics. The company's strategy of maintaining excess capacity allows it to absorb demand surges and gain market share. However, scalability is capital-intensive and constrained by physical assets and the availability of skilled labor, which prevents the kind of exponential growth seen in asset-light models.

A disciplined, counter-cyclical investment strategy in network capacity and technology, which positions the company to capture market share during economic recoveries.

Develop a scalable, digital-first platform to efficiently acquire and serve the long-tail SMB market, which is difficult to reach with the current high-touch sales model.

ODFL's business model is exceptionally coherent and focused, aligning all activities and resources around the singular goal of providing the most reliable LTL service at a premium price. The company's value proposition, pricing strategy, and operational execution are all in perfect sync, leading to industry-best operating margins and a clear market position. The heavy reliance on the core LTL segment is a minor weakness, but the model's focus is its greatest strength.

Superb alignment between a premium pricing strategy and a value proposition of guaranteed quality, which is supported by massive, continuous investment in the network and people.

Diversify revenue streams by productizing its vast operational data into a high-margin logistics intelligence or analytics-as-a-service offering for key customers.

As a top-tier player in an oligopolistic market, ODFL exerts significant market power, particularly in pricing. Its ability to command premium rates without significant customer churn, even during economic downturns, demonstrates strong pricing power derived from its service quality. The company has consistently gained market share and is often cited as the industry benchmark for performance, indicating substantial market influence.

Demonstrated pricing power, enabling the company to maintain industry-leading margins by focusing on yield and the value of its premium service rather than competing on price.

Better leverage its market leadership to shape industry conversations around sustainability and technology, moving from a market participant to a thought leader that sets future standards.

Business Overview

Business Classification

Asset-Based Logistics & Transportation

Value-Added Services Provider

Transportation and Logistics

Sub Verticals

- •

Less-Than-Truckload (LTL) Freight

- •

Expedited Shipping

- •

Truckload Brokerage

- •

Global Freight Forwarding

- •

Supply Chain Consulting

Mature

Maturity Indicators

- •

Established since 1934, demonstrating long-term market presence.

- •

Consistent recognition as #1 National LTL Carrier for 15 consecutive years, indicating sustained market leadership.

- •

Significant, ongoing capital expenditures ($575 million planned for 2025) in network, fleet, and technology.

- •

Operates an extensive network of over 250 service centers.

- •

Strong financial performance with a history of revenue growth and high operating margins.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Less-Than-Truckload (LTL) Services

Description:Core business of consolidating and transporting freight from multiple shippers that do not require a full trailer. This includes regional, inter-regional, and national services across North America. This stream constitutes over 95% of total company revenue.

Estimated Importance:Primary

Customer Segment:B2B Shippers (All Segments)

Estimated Margin:High

- Stream Name:

Expedited Freight Services

Description:Premium, time-sensitive shipping solutions, including guaranteed delivery windows, on-demand services, and weekend deliveries, monitored 24/7.

Estimated Importance:Secondary

Customer Segment:Industries with Just-in-Time (JIT) supply chains (e.g., manufacturing, retail, healthcare)

Estimated Margin:High

- Stream Name:

Value-Added & Specialized Services

Description:Includes a portfolio of specialized services such as truckload brokerage, container drayage, trade show logistics, and special product rollouts.

Estimated Importance:Tertiary

Customer Segment:Specific B2B niches (e.g., event marketers, retailers with product launches)

Estimated Margin:Medium

- Stream Name:

Global Freight Services

Description:International freight forwarding for less-than-container load (LCL) and full-container load (FCL) shipments via ocean and air, facilitated through strategic alliances.

Estimated Importance:Tertiary

Customer Segment:B2B Shippers with international supply chains

Estimated Margin:Medium

Recurring Revenue Components

Contractual agreements with high-volume B2B shippers

High customer retention due to superior service levels and integrated technology tools

Pricing Strategy

Value-Based & Dynamic Pricing

Premium

Opaque

Pricing Psychology

Prestige Pricing (justified by #1 quality awards and service metrics)

Tiered Pricing (offering different service levels like Standard LTL vs. Expedited)

Monetization Assessment

Strengths

- •

Strong pricing discipline, focusing on profitability over volume, leading to industry-best operating margins.

- •

Premium service offering justifies higher price points.

- •

Diverse portfolio of value-added services creates opportunities for upselling.

Weaknesses

Premium pricing may deter highly cost-sensitive customers.

Revenue is heavily reliant on the core LTL segment, making it susceptible to economic downturns impacting freight volumes.

Opportunities

- •

Further develop and monetize data analytics services for customers (e.g., predictive insights, supply chain optimization).

- •

Expand and promote supply chain consulting as a higher-margin, strategic service.

- •

Introduce sustainability-focused shipping options as a new premium tier.

Threats

- •

Intense price competition from other carriers during periods of economic softness.

- •

Economic recessions leading to decreased freight demand and pressure on rates.

- •

Volatility in fuel prices, although mitigated by surcharges, can impact margins and customer costs.

Market Positioning

Service and Quality Leadership

Major Player (Top 5 LTL Carrier)

Target Segments

- Segment Name:

Logistics & Supply Chain Managers

Description:Professionals at mid-to-large enterprises responsible for managing complex supply chains and transportation budgets.

Demographic Factors

Corporate role

Manages significant freight spend

Psychographic Factors

- •

Risk-averse

- •

Values reliability and predictability

- •

Data-driven

Behavioral Factors

- •

Seeks long-term carrier partnerships

- •

Utilizes digital tools for tracking, quoting, and analytics

- •

Focuses on Total Cost of Ownership (TCO), not just freight rate

Pain Points

- •

Shipment delays disrupting production/sales

- •

Damaged freight leading to financial loss and customer dissatisfaction

- •

Lack of visibility into shipment status

- •

Managing complex carrier relationships and billing

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Small to Medium-Sized Businesses (SMBs)

Description:Business owners or operations managers who handle shipping as one of many responsibilities and require straightforward, reliable service.

Demographic Factors

Owner/Operator or small operations team

Psychographic Factors

- •

Time-constrained

- •

Values simplicity and ease-of-use

- •

Seeks trustworthy partners

Behavioral Factors

- •

May have less frequent but critical shipping needs

- •

Less negotiating power than large enterprises

- •

Relies on carrier's reputation and customer service

Pain Points

- •

Navigating complex freight classification (NMFC) systems

- •

Unexpected fees and billing errors

- •

Lack of dedicated logistics expertise

- •

Difficulty getting responsive customer support

Fit Assessment:Good

Segment Potential:Medium

- Segment Name:

Retail & E-commerce Shippers

Description:Businesses requiring precise, on-time delivery for seasonal promotions, new product launches, and inventory replenishment to stores or distribution centers.

Demographic Factors

Retail, CPG, or E-commerce industries

Psychographic Factors

Deadline-driven

Brand image-conscious

Behavioral Factors

Requires specialized services like 'Special Rollouts'

High demand for shipment visibility and proactive communication

Pain Points

- •

Late deliveries leading to missed sales opportunities

- •

Product damage impacting brand perception

- •

Coordinating complex, multi-location deliveries

- •

Managing reverse logistics/returns

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Service Quality (On-Time & Damage-Free)

Strength:Strong

Sustainability:Sustainable

- Factor:

Single, Integrated Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Union-Free Workforce Model

Strength:Moderate

Sustainability:Sustainable

- Factor:

Investment in Technology & Infrastructure

Strength:Strong

Sustainability:Sustainable

Value Proposition

Old Dominion provides the most reliable, on-time, and damage-free Less-Than-Truckload (LTL) shipping service in North America, powered by continuous investment in its integrated network, modern fleet, and proprietary technology, ensuring shipments arrive as promised.

Excellent

Key Benefits

- Benefit:

Superior Service Reliability

Importance:Critical

Differentiation:Unique

Proof Elements

- •

99% on-time delivery rate.

- •

Industry-low cargo claims ratio of 0.1%.

- •

Named #1 National LTL Carrier by Mastio for 15 consecutive years.

- Benefit:

Operational Control & Visibility

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Operates as a single, integrated organization.

- •

Website offers comprehensive tools for tracking, quotes, and document management.

- •

Heavy investment in proprietary technology platforms.

- Benefit:

Comprehensive North American Coverage

Importance:Important

Differentiation:Common

Proof Elements

Extensive network of service centers across the continental U.S.

Service to/from Canada and Mexico through strategic alliances.

Unique Selling Points

- Usp:

Union-free operating model, providing greater operational flexibility and cost control compared to unionized competitors.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Consistent, industry-leading performance metrics (on-time, claims ratio) that are unmatched in the sector.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Proactive investment strategy to maintain significant excess network capacity (e.g., 30%), ensuring service quality is not compromised during demand surges.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Financial and reputational losses from damaged freight.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Supply chain disruptions caused by late or missed deliveries.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Operational inefficiency from managing multiple regional carriers.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Lack of real-time information on shipment location and status.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

The value proposition of reliability and quality is perfectly aligned with the market's increasing demand for resilient and predictable supply chains, especially in the wake of recent global disruptions.

High

The proposition directly addresses the primary pain points of logistics managers and business owners, who prioritize Total Cost of Ownership (where reliability reduces hidden costs) over the lowest upfront shipping price.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Strategic alliance carriers (for non-domestic North American coverage).

- •

Technology providers (e.g., Samsara, Descartes, Adobe, Google).

- •

Equipment manufacturers (e.g., Freightliner, Peterbilt).

- •

Third-Party Logistics (3PL) providers and freight brokers

Key Activities

- •

Network Operations (Pickup & Delivery, Line Haul)

- •

Freight Consolidation (Hub-and-Spoke Model).

- •

Customer Service & Support

- •

Technology Development & Maintenance

- •

Fleet Management & Maintenance

Key Resources

- •

Dense network of over 250 service centers and hubs.

- •

Modern fleet of over 11,000 tractors and thousands of trailers.

- •

Proprietary technology and data analytics platforms.

- •

Skilled, non-union workforce of over 22,000 employees.

- •

Strong brand reputation and customer loyalty

Cost Structure

- •

Salaries, wages, and employee benefits

- •

Fuel and petroleum-based products

- •

Depreciation of fleet and real estate assets

- •

Capital expenditures for network expansion, fleet replacement, and technology.

- •

Maintenance and repair costs

Swot Analysis

Strengths

- •

Industry-leading brand reputation for quality and reliability.

- •

Superior operating metrics (on-time percentage, low claims ratio) create a strong competitive moat.

- •

Highly efficient, integrated hub-and-spoke network.

- •

Strong financial position with high profitability and robust cash flow.

- •

Operational flexibility from a union-free workforce.

Weaknesses

- •

Premium pricing model may be a disadvantage in cost-sensitive market segments or during economic downturns.

- •

High fixed costs associated with an asset-heavy model (fleet, service centers).

- •

Heavy dependence on the North American LTL market, exposing the company to regional economic fluctuations.

Opportunities

- •

Continued growth of e-commerce, increasing demand for reliable LTL services.

- •

Leverage data analytics to offer advanced, value-added services to customers.

- •

Further consolidation in the LTL market, allowing for market share gains (e.g., fallout from Yellow's exit).

- •

Expand higher-margin logistics and supply chain consulting services.

Threats

- •

Economic recessions or slowdowns that reduce overall freight volume.

- •

Intensifying competition and pricing pressure from other major LTL carriers (e.g., Saia, XPO, ArcBest).

- •

Significant volatility in fuel costs.

- •

Increasingly stringent environmental regulations.

- •

Chronic driver shortages impacting capacity and labor costs across the industry.

Recommendations

Priority Improvements

- Area:

Digital Customer Experience

Recommendation:Invest in a more personalized customer portal that uses AI to provide predictive analytics on shipping patterns, potential delays, and cost-saving opportunities.

Expected Impact:High

- Area:

Service Portfolio Marketing

Recommendation:More aggressively market and bundle value-added services (e.g., supply chain consulting, truckload brokerage) to existing LTL customers to increase revenue per customer.

Expected Impact:Medium

- Area:

SMB Customer Onboarding

Recommendation:Develop a simplified 'LTL for Small Business' digital platform that demystifies freight classification and pricing to better capture the long-tail of the market.

Expected Impact:Medium

Business Model Innovation

Develop a 'Sustainability as a Service' offering, providing customers with certified low-emission shipping options and detailed carbon footprint reporting at a premium price point.

Explore a 'Guaranteed Capacity' model for key accounts, offering contractual, priority access to network capacity during peak seasons for a recurring fee, evolving from transactional to more predictable revenue.

Revenue Diversification

Formally expand the Supply Chain Consulting practice to become a standalone, high-margin revenue stream, leveraging the company's vast operational data and expertise.

Invest in or partner with final-mile delivery providers to offer end-to-end e-commerce fulfillment solutions, capturing a larger share of the customer's logistics spend.

Old Dominion Freight Line (ODFL) has masterfully executed a business model centered on service and quality leadership within the highly competitive Less-Than-Truckload (LTL) market. The company's strategy is not to be the cheapest option, but the most reliable, a value proposition validated by an unparalleled 15-year streak as the #1 National LTL Carrier and industry-leading metrics for on-time delivery (99%) and cargo claims (0.1%). This focus has allowed ODFL to command premium pricing and achieve superior profitability and operating margins.

The model's resilience is built on a foundation of strategic, long-term investments. Key pillars include a single, integrated network of over 250 service centers, a modern company-owned fleet, a flexible union-free workforce, and a proactive approach to technology adoption. A core strategic differentiator is the practice of maintaining significant excess capacity (around 30%), which enables the company to uphold its service promise even during demand surges, thereby capturing market share from competitors who cannot.

However, this asset-heavy, premium-service model is not without risks. Its high fixed-cost structure and dependence on the cyclical domestic economy make it vulnerable to volume declines during recessions. The primary strategic challenge for ODFL is to sustain its premium position against competitors who may engage in aggressive price wars during periods of soft demand.

Future evolution should focus on two fronts: deepening the technological moat and diversifying into higher-margin, asset-light services. By transforming its vast operational data into predictive analytics and consulting services for customers, ODFL can further embed itself into their supply chains. Expanding services like supply chain consulting and exploring adjacencies like final-mile delivery represent logical pathways to diversify revenue and leverage the immense brand equity ODFL has built as the gold standard in LTL transportation. This strategic pivot will be critical to sustaining its steady growth trajectory and market leadership.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Investment

Impact:High

- Barrier:

Network Density and Infrastructure

Impact:High

- Barrier:

Brand Reputation and Service Reliability

Impact:Medium

- Barrier:

Technological Integration and Scale

Impact:Medium

- Barrier:

Regulatory and Safety Compliance

Impact:Low

Industry Trends

- Trend:

Digitalization and FreightTech Adoption

Impact On Business:Requires continuous investment in visibility tools, APIs, and data analytics to meet customer expectations and compete with digital-native brokers. ODFL's stated investment of $575M in 2025 is a direct response to this.

Timeline:Immediate

- Trend:

E-commerce Growth and Final-Mile Complexity

Impact On Business:Increases demand for LTL services but also adds complexity with more residential deliveries and higher customer expectations for speed and transparency.

Timeline:Immediate

- Trend:

Sustainability and ESG Demands

Impact On Business:Growing pressure from customers and investors to invest in alternative fuel vehicles, reduce emissions, and provide transparent ESG reporting, leading to increased capital expenditure.

Timeline:Near-term

- Trend:

Driver and Labor Shortages

Impact On Business:Increases operating costs, constrains capacity, and emphasizes the importance of company culture and retention. ODFL's non-union status may be a strategic advantage in flexibility and labor relations.

Timeline:Immediate

- Trend:

Dynamic and Data-Driven Pricing

Impact On Business:Shift from static tariffs to dynamic pricing models requires sophisticated data analytics capabilities to optimize profitability and network efficiency.

Timeline:Near-term

Direct Competitors

- →

FedEx Freight

Market Share Estimate:Leading

Target Audience Overlap:High

Competitive Positioning:Integrated global logistics provider offering both premium (Priority) and economy (Economy) LTL services.

Strengths

- •

Unmatched brand recognition and global network.

- •

Seamless integration with FedEx's parcel and express services, offering a one-stop-shop for shippers.

- •

Significant capital resources for investment in technology and fleet.

- •

Strong e-commerce and residential delivery capabilities through the broader FedEx network.

Weaknesses

- •

Higher operating costs associated with a unionized driver workforce in some areas.

- •

Can be perceived as less singularly focused on LTL excellence compared to pure-play carriers like ODFL.

- •

Service quality can be less consistent than ODFL, which specializes in premium service.

- •

Complex corporate structure may lead to slower decision-making.

Differentiators

Cross-service integration (parcel, freight, express).

Extensive global reach beyond North America.

- →

XPO, Inc.

Market Share Estimate:Significant

Target Audience Overlap:High

Competitive Positioning:Technology-focused LTL carrier with a strong emphasis on its proprietary digital freight marketplace and network optimization.

Strengths

- •

Strong focus on technology and data analytics (e.g., XPO Connect platform).

- •

Well-established and expansive North American LTL network.

- •

Investment in terminal automation and network efficiency.

- •

Offers a range of services including last mile and expedited.

Weaknesses

- •

History of corporate restructuring and spin-offs may create uncertainty for some customers.

- •

Customer service perception is often cited as a step below premium carriers like ODFL.

- •

Higher operating ratio compared to ODFL, indicating lower profitability and efficiency.

- •

Brand reputation is more associated with financial engineering than operational excellence.

Differentiators

Proprietary digital platform for visibility and booking.

Emphasis on data science for network management.

- →

Estes Express Lines

Market Share Estimate:Significant

Target Audience Overlap:High

Competitive Positioning:The largest privately-owned LTL carrier in the U.S., positioning itself on reliability, stability, and comprehensive coverage.

Strengths

- •

Reputation for stability and long-term customer relationships as a family-owned company.

- •

Comprehensive network coverage across all 50 states.

- •

Strong company culture and employee loyalty.

- •

Diversified service offerings, including Time Critical and Final Mile.

Weaknesses

- •

May be perceived as slower to adopt cutting-edge technology compared to XPO or digital brokers.

- •

Brand is less globally recognized than FedEx.

- •

Lacks the public market capital access of its competitors for massive strategic investments.

Differentiators

Privately-owned status, emphasizing stability and a customer-first approach over shareholder demands.

Long-standing reputation for dependable, if not always the fastest, service.

- →

Saia LTL Freight

Market Share Estimate:Growing

Target Audience Overlap:Medium

Competitive Positioning:Service-quality focused carrier aggressively expanding its national footprint and terminal network.

Strengths

- •

Strong reputation for quality service and low cargo claims, often competing with ODFL on service metrics.

- •

Aggressive and successful network expansion into new regions, particularly the Northeast.

- •

Modern fleet and a strong focus on safety.

Weaknesses

- •

Smaller overall network and market share compared to the top three competitors.

- •

Less comprehensive international capabilities.

- •

Brand recognition is not as strong outside of its established regions.

Differentiators

Focus on organic growth and opening new terminals to provide direct service coverage.

A direct competitor to ODFL's high-service model.

Indirect Competitors

- →

Digital Freight Brokers (e.g., C.H. Robinson, Uber Freight, Convoy)

Description:Technology platforms that act as intermediaries, connecting shippers with a vast network of carriers (including LTL) through a digital interface. They compete on price, convenience, and visibility.

Threat Level:Medium

Potential For Direct Competition:They are already a competitive channel, disintermediating direct relationships between shippers and carriers. They are unlikely to build their own physical LTL networks.

- →

Full Truckload (FTL) Carriers (e.g., Knight-Swift, J.B. Hunt)

Description:Carriers that handle shipments large enough to fill an entire trailer. Customers with sufficient volume may choose to consolidate multiple LTL shipments into one FTL shipment to reduce cost.

Threat Level:Low

Potential For Direct Competition:Low. The operational models for LTL (hub-and-spoke) and FTL (point-to-point) are fundamentally different.

- →

Parcel Carriers (e.g., UPS, FedEx Ground)

Description:Specialize in smaller packages, but the line between heavy parcels and light LTL shipments is blurring, especially with the growth of e-commerce.

Threat Level:Low

Potential For Direct Competition:Medium. UPS and FedEx already have LTL divisions, but their core parcel networks could be adapted to handle heavier, multi-piece shipments, encroaching on the lower end of the LTL market.

- →

Amazon Logistics

Description:Amazon's massive and growing logistics and fulfillment network. While primarily focused on its own marketplace, it has the technology, capital, and infrastructure to become a major B2B logistics player.

Threat Level:Medium

Potential For Direct Competition:High. Amazon could leverage its fulfillment centers as a de facto LTL network and offer services to third-party shippers, becoming a major market disruptor.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Premium Service Quality and Reliability

Sustainability Assessment:Highly sustainable. This reputation is built over decades of consistent performance, as evidenced by the 15-year Mastio #1 LTL Carrier award. It is culturally ingrained and difficult for competitors to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Dense, Efficient, Company-Controlled Network

Sustainability Assessment:Highly sustainable. The physical network of over 250 service centers is a massive capital moat that would take billions of dollars and many years for a new entrant to build.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Company Culture and Non-Union Workforce

Sustainability Assessment:Moderately sustainable. Provides operational flexibility and a potential cost advantage. However, it is susceptible to evolving labor market dynamics and unionization efforts.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Pricing Power in a Capacity-Constrained Market', 'estimated_duration': '1-3 Years. This advantage is cyclical and dependent on broader economic conditions and overall freight market capacity. In a recessionary environment, pricing power will diminish.'}

Disadvantages

- Disadvantage:

Premium Price Point

Impact:Major

Addressability:Moderately. This is a strategic choice tied to their value proposition. They could introduce tiered services but risk brand dilution. The main mitigation is to constantly prove the value-for-money through superior service.

- Disadvantage:

Potential Perception as a 'Legacy' Carrier

Impact:Minor

Addressability:Easily. ODFL is actively addressing this by investing heavily in technology and marketing its digital tools. The challenge is one of marketing and perception more than technology gaps.

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted digital marketing campaign highlighting ODFL's technology suite (APIs, tracking, data analytics) to directly counter the narrative of tech-first disruptors.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Feature customer testimonials and case studies on the website that quantify the business impact of ODFL's reliability (e.g., reduced inventory costs, avoided stock-outs).

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop a dedicated, branded service for e-commerce shippers, offering specialized solutions for B2B fulfillment and residential delivery of oversized goods.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Pilot a 'Logistics-as-a-Service' offering, leveraging internal data to provide paid supply chain consulting for key customers, strengthening relationships beyond transactional freight.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Become the industry leader in LTL sustainability by investing in and publicly piloting a significant electric or alternative fuel fleet in key corridors.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in robotics and automation within service centers to mitigate long-term labor risks, improve sorting efficiency, and reduce transit times.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify the position as the 'Gold Standard' for LTL. The core message should be: 'Best-in-class reliability, powered by leading technology.' This framing defends the premium price point while neutralizing the 'tech' advantage of disruptors.

Focus on 'Total Experience Ownership'. Differentiate not just on on-time, damage-free delivery, but on the entire customer journey: effortless quoting and booking, proactive communication, transparent tracking, and simplified invoicing. Every touchpoint should reflect the premium quality of the core service.

Whitespace Opportunities

- Opportunity:

Integrated LTL Solutions for E-commerce Platforms

Competitive Gap:While carriers offer APIs, few provide seamless, plug-and-play apps for platforms like Shopify, BigCommerce, or Magento that allow merchants to easily quote and manage LTL shipments for oversized goods.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Dedicated, High-Value Vertical Service Offerings

Competitive Gap:There is a lack of branded, white-glove LTL services for sensitive verticals like medical device transport, data center logistics, or high-end retail rollouts. ODFL's reputation for quality is a perfect fit for this.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Sustainability-as-a-Service Reporting

Competitive Gap:No LTL carrier is effectively providing customers with detailed, certified carbon footprint and ESG reporting for their specific shipments, which is a growing need for large public companies.

Feasibility:High

Potential Impact:Medium

Old Dominion Freight Line (ODFL) operates in a mature, oligopolistic LTL freight market. The company has carved out an enviable position as the undisputed leader in service quality and reliability, a status consistently validated by industry awards. This operational excellence, combined with a dense, company-controlled network and a flexible non-union workforce, forms a set of highly sustainable competitive advantages. Its primary strategic challenge is defending its premium price point in a market with intense competition from both legacy carriers like FedEx Freight and Estes, and technology-focused players like XPO.

The key competitive threats are twofold. First, traditional competitors who compete fiercely on price and can leverage broader logistics networks (FedEx) or deep-rooted stability (Estes). Second, the rise of digital freight brokers and potential market entry by tech giants like Amazon, who threaten to disintermediate customer relationships and compete on digital experience and convenience. ODFL's significant investments in technology are a necessary defensive move to ensure parity. The strategic path forward is to double down on its 'gold standard' service positioning while more aggressively marketing its technological capabilities. The greatest opportunities lie in leveraging its sterling reputation to create specialized, high-margin services for growing verticals like e-commerce and high-tech, and in leading the industry's transition towards sustainability.

Messaging

Message Architecture

Key Messages

- Message:

OD is the #1 National LTL Carrier for Quality for 15 years running, signifying trustworthiness and superior customer service.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section

- Message:

Each OD service is backed by our on-time, damage-free promise.

Prominence:Secondary

Clarity Score:High

Location:Shipping Services Overview

- Message:

OD offers a comprehensive range of freight transportation services for businesses.

Prominence:Secondary

Clarity Score:High

Location:Shipping Services Overview

- Message:

We continually invest in our people and improve our technology to ensure we can meet your every business need.

Prominence:Tertiary

Clarity Score:Medium

Location:Homepage Hero Section

The message hierarchy is effective and logical. The most powerful differentiator—the #1 LTL Carrier award for 15 consecutive years—is the primary headline, immediately establishing credibility and market leadership. Supporting messages about the service promise and comprehensive offerings are placed logically below, providing substance to the primary claim. The hierarchy successfully guides the user from a high-level differentiator to specific service benefits.

Messaging is highly consistent across the homepage. The core themes of quality, reliability ('on-time, damage-free'), and comprehensive service are repeated and reinforced in the hero section, the service overview, and the 'Featured Services' callouts (e.g., 'Ensure fast, reliable, and on-time deliveries'). This repetition effectively drills down the core value proposition.

Brand Voice

Voice Attributes

- Attribute:

Authoritative

Strength:Strong

Examples

- •

At OD, we lead the LTL category by doing things the right way.

- •

shippers have named us their #1 National LTL Carrier for Quality

- •

Trust the Trade Show Experts with Your Next Show

- Attribute:

Reliable

Strength:Strong

Examples

- •

Each OD service is backed by our on-time, damage-free promise.

- •

be confident you’ll have a successful product rollout.

- •

Ensure fast, reliable, and on-time deliveries

- Attribute:

Professional

Strength:Strong

Examples

- •

We continually invest in our people and improve our technology to ensure we can meet your every business need.

- •

Access shipping resources and industry insights from OD, a leading LTL freight company.

- •

Partner with a carrier that helps you navigate the NMFC system.

- Attribute:

Customer-Centric

Strength:Moderate

Examples

- •

Our commitment to you.

- •

we offer a range of freight transportation services for businesses across the United States, Canada, Mexico, and beyond.

- •

find the best option for your needs.

Tone Analysis

Corporate and Confident

Secondary Tones

Informative

Reassuring

Tone Shifts

The tone shifts to be more technical and educational in the 'Recent Insights' and 'White Paper' sections, which is appropriate for the content.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Old Dominion is the most reliable and highest-quality LTL freight carrier in the nation, offering a comprehensive suite of services backed by an on-time, damage-free promise and 15 years of industry-recognized excellence.

Value Proposition Components

- Component:

Award-Winning Quality & Trustworthiness

Clarity:Clear

Uniqueness:Unique

Details:The claim of being the '#1 National LTL Carrier for Quality' for 15 years is a powerful and highly unique differentiator that is communicated with high clarity.

- Component:

On-Time, Damage-Free Service Promise

Clarity:Clear

Uniqueness:Somewhat Unique

Details:While many carriers claim reliability, OD frames it as a concrete 'promise,' which is more impactful than a simple statement. The high on-time delivery percentage (often cited as >99%) reinforces this.

- Component:

Comprehensive Service Offerings

Clarity:Clear

Uniqueness:Common

Details:The website clearly outlines a wide range of services (LTL, Expedited, Global, etc.). This is a common offering for large carriers, making it a point of parity rather than a key differentiator.

- Component:

Investment in Technology and People

Clarity:Somewhat Clear

Uniqueness:Common

Details:This is mentioned but not deeply substantiated on the homepage. The 'How Data Analytics is Reshaping Shipping' white paper supports the technology claim, but the 'people' aspect is less developed.

ODFL's messaging strategy for differentiation is exceptionally effective and hinges almost entirely on the repeated, prominent display of the Mastio '#1 National LTL Carrier for Quality' award. This transforms a generic concept ('quality service') into a quantifiable, third-party-validated fact. This single proof point elevates them above competitors who may offer similar services but cannot claim the same level of consistent, recognized excellence. The 'on-time, damage-free promise' further reinforces this quality-focused position.

The messaging positions ODFL as the premium, best-in-class operator in the LTL market. They are not competing on price but on value, reliability, and peace of mind. The strategy is to attract B2B customers for whom the cost of a late or damaged shipment far outweighs any potential savings from a lower-cost carrier. They are the 'safe choice' for critical logistics needs.

Audience Messaging

Target Personas

- Persona:

Logistics/Supply Chain Manager at a Mid-to-Large Enterprise

Tailored Messages

- •

Our commitment to you.

- •

1 National LTL Carrier for Quality for our commitment to customer service and trustworthiness.

- •

Each OD service is backed by our on-time, damage-free promise.

- •

How Data Analytics is Reshaping Shipping

- •

Avoid freight class surprises and get back to your day-to-day business operations.

Effectiveness:Effective

Audience Pain Points Addressed

- •

Fear of damaged products during shipping.

- •

Anxiety over late deliveries disrupting supply chains or retail rollouts.

- •

Frustration with complex freight classification systems (NMFC changes).

- •

Risk of partnering with an unreliable carrier, leading to business disruption.

- •

Difficulty in tracking and managing shipments.

Audience Aspirations Addressed

- •

Achieving smooth, predictable supply chain operations.

- •

Ensuring successful and on-time product launches ('Special Rollouts').

- •

Having confidence and peace of mind in their logistics partner.

- •

Improving operational efficiency through data and technology.

- •

Working with a carrier that is an expert and can proactively solve problems.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Trust & Security

Effectiveness:High

Examples

- •

Our commitment to you.

- •

trustworthiness

- •

on-time, damage-free promise

- •

be confident you’ll have a successful product rollout

- Appeal Type:

Authority & Expertise

Effectiveness:High

Examples

- •

for 15 years running, shippers have named us their #1 National LTL Carrier for Quality

- •

Trust the Trade Show Experts

- •

Master NMFC Classes with Carrier Partnership

- •

White Paper: How Data Analytics is Reshaping Shipping

Social Proof Elements

- Proof Type:

Industry Awards

Impact:Strong

Details:The '#1 National LTL Carrier for Quality' for 15 years is the most powerful piece of social proof and is used as the core message.

- Proof Type:

Expert Content

Impact:Moderate

Details:The presence of white papers and insightful blog posts positions OD as an industry thought leader, building credibility.

Trust Indicators

- •

Prominent display of the 15-year quality award.

- •

The specific 'on-time, damage-free promise'.

- •

Clear, professional website design and information architecture.

- •

Investment announcements ('$575 Million Investment to Elevate LTL Network').

- •

Detailed and transparent Privacy Policy.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Learn More

Location:Homepage sliders, Featured Services

Clarity:Clear

- Text:

Get Started

Location:Shipping Services table, 'Create an Account' section

Clarity:Somewhat Clear

- Text:

Access Tools

Location:Freight Shipping Tools section

Clarity:Clear

- Text:

Read More / Read Now

Location:White Paper and Recent Insights sections

Clarity:Clear

- Text:

Sign Up

Location:Newsletter section

Clarity:Clear

The CTAs are generally effective and contextually appropriate. They are action-oriented and guide users to the next logical step, whether it's learning about a service, reading content, or using a tool. The 'Get Started' CTA could be more specific (e.g., 'Explore LTL Services' or 'Request a Quote') to better set user expectations, but its placement within the service grid provides necessary context.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of customer testimonials or case studies on the homepage. The #1 award is powerful, but voice-of-the-customer evidence would make the reliability claims more tangible and relatable.

- •

No direct messaging about the total cost of ownership (TCO) or return on investment (ROI) of choosing a premium carrier. The messaging focuses on quality but doesn't explicitly frame it as a way to avoid the higher costs associated with shipping failures.

- •

Limited human element. The brand feels very corporate and machine-like; there's no storytelling around the 'people' they invest in.

Contradiction Points

No itemsUnderdeveloped Areas

- •

The 'Investment in people' message is stated but not shown. Featuring skilled drivers or logistics experts could humanize the brand.

- •

Sustainability messaging. While ODFL is part of the EPA SmartWay program, this is not mentioned on the homepage, a missed opportunity as sustainability becomes a more significant factor in corporate vendor selection.

- •

Technology benefits. The site mentions technology investment but could do more to explain how specific technologies (like data analytics) directly benefit the customer with improved visibility, predictability, and efficiency.

Messaging Quality

Strengths

- •

Crystal-clear differentiation through the '15 years as #1' award.

- •

Strong, consistent messaging around the core values of quality and reliability.

- •

Authoritative and trustworthy brand voice that aligns with a premium market position.

- •

Effective use of content marketing (insights, white papers) to build credibility.

Weaknesses

- •

Overly corporate and impersonal tone, lacking emotional connection.

- •

Absence of customer stories or testimonials to back up claims with relatable proof.

- •

Value proposition is heavily reliant on a single award, which could be a risk if their ranking changes.

- •

Missed opportunities to connect with audience values like sustainability.

Opportunities

- •

Incorporate a 'Customer Success Stories' or 'Client Spotlight' section on the homepage.

- •

Develop content (e.g., an ROI calculator) that helps prospects quantify the financial benefits of reliability and the costs of shipping failures.

- •

Launch a brand campaign focused on the expertise and dedication of ODFL employees to humanize the 'investment in people' message.

- •

Integrate sustainability messaging into the core value proposition to appeal to environmentally conscious enterprise clients.

Optimization Roadmap

Priority Improvements

- Area:

Social Proof

Recommendation:Add a dedicated 'Customer Stories' module to the homepage featuring short, impactful quotes or mini-case studies from recognizable clients that directly support the 'on-time, damage-free' promise.

Expected Impact:High

- Area:

Value Proposition

Recommendation:Develop messaging that frames ODFL's premium service as a smart financial decision. Create a blog post or downloadable guide titled 'The True Cost of Cheap Shipping: Why Reliability is Your Best ROI'.

Expected Impact:High

- Area:

Brand Voice

Recommendation:Introduce storytelling elements that feature ODFL employees. A short video series on 'The People Behind the Promise' could effectively humanize the brand and add an emotional layer to the reliability message.

Expected Impact:Medium

Quick Wins

- •

Add the EPA SmartWay Partner logo to the website footer to immediately signal a commitment to sustainability.

- •

Test more benefit-oriented CTA language, such as changing 'Get Started' to 'Secure Reliable Shipping'.

- •

In the hero section, add a sub-headline under the '#1 Carrier' claim, such as: 'The peace of mind that comes from our on-time, damage-free promise.'

Long Term Recommendations

- •

Build a comprehensive resource center with industry-specific case studies demonstrating how ODFL solved complex logistics challenges.

- •

Develop an interactive online tool that allows potential customers to estimate the potential financial impact of shipping delays or damages on their specific business, positioning ODFL as the solution.

- •

Launch a targeted content marketing campaign around supply chain optimization, moving beyond just freight shipping to position ODFL as a strategic logistics partner.

Old Dominion Freight Line's strategic messaging is a masterclass in leveraging a single, powerful differentiator to achieve a premium market position. The entire homepage is architected around the core claim of being the '#1 National LTL Carrier for Quality' for 15 consecutive years. This message is clear, credible, and consistently reinforced. The brand voice is authoritative and reliable, perfectly aligning with its B2B target audience of logistics managers who prioritize risk mitigation and predictability over low cost.

The value proposition of unparalleled reliability is communicated effectively through the 'on-time, damage-free promise.' This directly addresses the primary pain points of the target audience. However, the messaging is highly rational and lacks an emotional or human connection. It relies heavily on the award as proof, but there is a significant opportunity to supplement this with authentic customer stories and testimonials. While the messaging successfully establishes ODFL as the quality leader, it fails to fully articulate the financial value of that quality, leaving a gap in connecting their premium service to a clear ROI for the customer.

To evolve, ODFL should focus on two key areas: first, humanizing the brand by telling the stories of the people who deliver on the promise of quality, and second, shifting the conversation from 'quality' to 'value' by creating content and tools that demonstrate how their reliability translates into a lower total cost of ownership and a stronger bottom line for their clients. This will defend their premium position and create deeper, more resilient customer relationships.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Awarded "#1 National LTL Carrier for Quality" for 15 consecutive years, indicating consistent customer satisfaction and service excellence.

- •

High profitability and operating margins compared to competitors, suggesting a strong value proposition that commands fair pricing.

- •

Comprehensive service portfolio including domestic LTL, expedited services, global freight, and specialized logistics, meeting a wide range of B2B customer needs.

- •

Maintains a 99% on-time service performance and a very low 0.1% cargo claims ratio, which are critical metrics for logistics customers.

Improvement Areas

Enhance the digital user experience for small to medium-sized businesses (SMBs) to simplify quoting, booking, and management.

Develop more industry-specific solutions to deepen penetration in high-growth verticals like healthcare, technology, and e-commerce.

Market Dynamics

Global LTL market projected to grow at a CAGR of 5.3% to 6.8% between 2025 and 2034.

Mature

Market Trends

- Trend:

Increased adoption of technology (AI, data analytics, automation).

Business Impact:Opportunity to differentiate on service and efficiency. ODFL's planned $50M+ technology investment is well-timed.

- Trend:

Growth of e-commerce and demand for faster, more frequent, smaller shipments.

Business Impact:Increases demand for core LTL services and creates opportunities in last-mile and time-definite delivery.

- Trend:

Industry consolidation (e.g., Yellow Corp. shutdown) is rebalancing capacity and pricing power.

Business Impact:Opportunity for well-capitalized carriers like ODFL to gain market share and maintain pricing discipline.

- Trend:

Focus on sustainability and green logistics.

Business Impact:Growing customer demand and regulatory pressure require investment in eco-friendly fleets and operations.

Excellent. The market is rebounding from a freight recession, and industry consolidation provides opportunities for strong players. ODFL's strategy of maintaining excess capacity and investing during the downturn positions it well for the recovery.

Business Model Scalability

Medium

High fixed costs associated with service centers, fleet, and labor. Scalability is capital-intensive and requires significant upfront investment.

High. Once fixed costs are covered, incremental volume can be highly profitable, but downturns can significantly impact margins due to deleveraging effects.

Scalability Constraints

- •

Physical capacity of service centers and network density.

- •

Availability of tractors, trailers, and other equipment.

- •

Recruitment and retention of qualified drivers and dockworkers.

- •

Significant capital required for real estate and fleet expansion.

Team Readiness

Strong. The leadership team demonstrates a clear long-term strategy, financial discipline, and a focus on service quality, as evidenced by consistent performance and strategic investments.

Proven and effective for the current scale, with a strong focus on operational excellence and a consistent company culture.

Key Capability Gaps

- •

Digital Marketing & E-commerce Sales: Need for specialized talent to build out digital acquisition channels for smaller customers.

- •

Data Science & Analytics: Potential need to augment the team to develop advanced analytics products and further optimize internal operations.

- •

Sustainability & ESG Leadership: Growing importance requires dedicated expertise to lead green initiatives.

Growth Engine

Acquisition Channels

- Channel:

Direct Sales & National Accounts

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip the sales team with advanced analytics tools to identify and target high-potential accounts in growing industry sectors. Focus on selling value-added services beyond standard freight.

- Channel:

Content Marketing & SEO

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand content beyond operational topics (like NMFC changes) to address strategic supply chain challenges for specific personas (e.g., CFO, Logistics Director). Optimize the website for higher-intent keywords related to 'reliable LTL' and 'specialized freight services'.

- Channel:

Third-Party Logistics (3PL) Partnerships

Effectiveness:High

Optimization Potential:Medium

Recommendation:Strengthen API integrations and service-level agreements (SLAs) with key 3PL partners to become their preferred carrier for high-value freight.

Customer Journey

The journey for large accounts is high-touch and relationship-based. The website serves as a primary tool for existing customers (tracking, documents) and an initial entry point for new leads via quote requests and account creation.

Friction Points

- •

Complexity of freight classification (NMFC) can be a barrier for new or inexperienced shippers.

- •

The online quote and booking process may be less intuitive for SMBs compared to digitally-native freight platforms.

- •

Onboarding process for new accounts could be lengthy for those not engaging with a direct sales representative.

Journey Enhancement Priorities

{'area': 'Online Quoting Tool', 'recommendation': 'Develop a simplified quoting interface for less experienced users, with built-in guides and wizards for determining freight class.'}

{'area': 'Customer Onboarding', 'recommendation': 'Create a digital, self-service onboarding flow for smaller businesses to accelerate account setup and first shipment.'}

Retention Mechanisms

- Mechanism:

Superior Service Quality

Effectiveness:High

Improvement Opportunity:Leverage service quality data (99% on-time, 0.1% claims) proactively in marketing and account reviews to reinforce value and justify premium pricing.

- Mechanism:

Technology Integration (APIs, EDI)

Effectiveness:High

Improvement Opportunity:Develop a partner program to encourage deeper integration with customer ERP and TMS systems, creating higher switching costs.

- Mechanism:

Customer Service & Dedicated Reps

Effectiveness:High

Improvement Opportunity:Empower customer service representatives with more data-driven insights to provide proactive advice on supply chain optimization for their clients.

Revenue Economics

Highly favorable. ODFL consistently achieves industry-leading operating ratios and net margins, indicating strong profitability per shipment and efficient cost management.

Estimated to be very high for enterprise accounts acquired through direct sales, given long contract durations and high shipping volumes. Likely lower but still healthy for smaller customers.

High. The company's disciplined pricing strategy and focus on yield management ensure that revenue growth translates directly to profitability.

Optimization Recommendations

- •

Continue to focus on a profitable freight mix, avoiding low-margin freight even when chasing volume.

- •

Develop tiered service offerings to capture more value from customers who require premium, guaranteed services.

- •

Use technology to further reduce operational costs (e.g., route optimization, dock automation) to improve margins.

Scale Barriers

Technical Limitations

- Limitation:

Legacy System Modernization

Impact:Medium

Solution Approach:Continue the planned $50M+ annual investment in technology, prioritizing a cloud-native, microservices-based architecture for core logistics systems to improve agility and data accessibility.

Operational Bottlenecks

- Bottleneck:

Driver and Labor Shortages

Growth Impact:Limits network capacity and can increase labor costs, constraining the ability to handle demand spikes.

Resolution Strategy:Invest in driver training programs, competitive compensation packages, and a positive company culture to be an employer of choice. Explore yard and dock automation to improve labor productivity.

- Bottleneck:

Service Center Throughput

Growth Impact:Physical limitations at key hubs can create delays and limit regional growth.

Resolution Strategy:Continue strategic real estate investment ($210M+ planned for 2025) to expand and modernize service centers in high-growth corridors.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Major

Mitigation Strategy:Continue to differentiate on service quality and reliability rather than price. Build a brand associated with being the premium, 'no-fail' option in the LTL market. Key competitors include FedEx Freight, XPO, Saia, and ArcBest.

- Challenge:

Economic Cyclicality

Severity:Major

Mitigation Strategy:Maintain a strong, flexible balance sheet to invest during downturns. Diversify customer base across various industries to mitigate the impact of a slowdown in any single sector.

Resource Limitations

Talent Gaps

- •

Commercial Drivers (CDL-A)

- •

Data Scientists / AI Specialists

- •

Digital Product Managers

High. The company's growth is directly tied to significant capital expenditures ($450M-$575M planned for 2025) for real estate, fleet, and technology.

Infrastructure Needs

- •

Expansion of service center network into new geographic areas.

- •

Investment in charging infrastructure for future electric vehicle fleets.

- •

Upgrades to dock and yard management systems to increase throughput.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deeper Vertical Specialization

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Develop and market tailored logistics solutions for high-growth, high-value verticals such as life sciences/healthcare, high-tech manufacturing, and retail rollouts. Create dedicated sales and support teams for these sectors.

- Expansion Vector:

Cross-Border North America

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Strengthen partnerships and integrations with carriers in Mexico and Canada to provide a more seamless, single-invoice cross-border service, leveraging rising nearshoring trends.

Product Opportunities

- Opportunity:

Supply Chain Analytics as a Service

Market Demand Evidence:Shippers are increasingly seeking data to optimize their supply chains. The website's white paper on data analytics confirms this focus.

Strategic Fit:High. Leverages ODFL's vast operational data to provide premium, value-added services to customers, strengthening retention.

Development Recommendation:Pilot a premium analytics dashboard for top-tier customers, providing insights on lane optimization, cost-to-serve, and transit time variability.

- Opportunity:

Enhanced Final-Mile Delivery Services

Market Demand Evidence:Growth of e-commerce and B2B delivery to non-traditional locations (e.g., construction sites, retail stores) creates demand for specialized final-mile services.

Strategic Fit:Medium. Complements the existing LTL network but requires different operational capabilities (e.g., smaller trucks, different driver skill sets).

Development Recommendation:Launch pilot programs in key metropolitan areas, potentially through partnership or acquisition of a regional final-mile specialist.

Channel Diversification

- Channel:

Digital Self-Service Portal for SMBs

Fit Assessment:High

Implementation Strategy:Invest in a dedicated product team to build a frictionless, end-to-end digital experience for smaller businesses, from quoting and booking to payment and support.

- Channel:

API-first Partner Integrations

Fit Assessment:High

Implementation Strategy:Create a world-class developer portal and partner program to make it easy for e-commerce platforms, TMS providers, and software companies to integrate ODFL's services directly into their platforms.

Strategic Partnerships

- Partnership Type:

Technology & Software Vendors

Potential Partners

- •

Major ERP providers (SAP, Oracle)

- •

Supply Chain Management (SCM) platforms

- •

E-commerce platforms (Shopify Plus, BigCommerce)

Expected Benefits:Deeper integration into customer workflows, increased stickiness, and creation of a new, embedded acquisition channel.

- Partnership Type:

International Freight Forwarders

Potential Partners

- •

Kuehne + Nagel

- •

DHL Global Forwarding

- •

DSV

Expected Benefits:Enhance the global service offering by providing a premier domestic LTL partner for the North American leg of international shipments.

Growth Strategy

North Star Metric

Revenue Per Hundredweight (Yield)

This metric balances volume with profitability, aligning directly with the company's strategy of providing superior service at a fair price. It ensures that growth is high-quality and margin-accretive, preventing the pursuit of empty-calorie revenue.

Consistently grow yield above the rate of inflation and operational cost increases (e.g., 3-5% annually).

Growth Model

Hybrid: Quality-Led Enterprise Sales & Inbound Marketing

Key Drivers

- •

Superior service metrics (on-time %, low claims ratio) driving retention and pricing power.

- •

Direct sales force effectiveness in landing and expanding large accounts.

- •

Network expansion and density creating operational efficiencies.

- •

Content and digital presence attracting new SMB customers.

Continue to invest heavily in the service quality that fuels the enterprise sales engine. Simultaneously, build a dedicated digital growth team to scale the inbound model, targeting the underserved SMB segment with a self-service product.

Prioritized Initiatives

- Initiative:

Launch 'ODFL Analytics Premier' for Enterprise Customers

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Form a cross-functional team of sales, product, and data science. Interview 20 top customers to identify their most critical supply chain data needs and define the pilot feature set.

- Initiative:

Develop a Digital Self-Service Onboarding and Booking Portal

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Hire a Head of Digital Product. Conduct user experience (UX) research with SMB shippers to map their journey and identify key friction points. Develop a phased MVP roadmap.

- Initiative:

Targeted Vertical Sales & Marketing Campaign

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6 months

First Steps:Analyze internal data to identify the top 2-3 most profitable and fastest-growing industry verticals. Create industry-specific case studies and sales collateral. Launch a targeted digital advertising and outbound sales campaign.

Experimentation Plan

High Leverage Tests

{'experiment': 'Dynamic Pricing Pilot', 'hypothesis': 'Test AI-driven dynamic pricing for spot quotes on the website to optimize yield and conversion based on real-time network capacity and demand.'}

{'experiment': 'Value-Added Service Bundling', 'hypothesis': 'A/B test different bundles of services (e.g., Guaranteed Delivery + Inside Delivery) during the online quoting process to increase average revenue per order.'}

Utilize an A/B testing platform for web experiments. Track key metrics including quote-to-book conversion rate, revenue per shipment, and customer lifetime value. For operational pilots, track on-time performance, cost-per-shipment, and customer satisfaction (CSAT) scores.

Run continuous A/B tests on the digital platform with a monthly review cycle. Conduct larger operational pilots on a quarterly basis.

Growth Team

A centralized Growth Team focused on new market and product opportunities, working alongside dedicated digital acquisition and enterprise sales teams. The team should have a direct line to leadership and P&L responsibility for new initiatives.

Key Roles

- •

Head of Growth (oversees strategy and experimentation)

- •

Digital Product Manager (owns the SMB self-service experience)

- •

Growth Marketing Manager (focuses on digital acquisition channels)

- •

Supply Chain Solutions Architect (designs new service offerings)

Invest in training for the existing sales and marketing teams on data analysis and digital tools. Hire external talent with experience in SaaS product management and growth marketing to inject new skills into the organization.

Old Dominion Freight Line (ODFL) is in an exceptionally strong position for sustained growth. The company has built a formidable growth foundation based on a best-in-class product-market fit, evidenced by its unparalleled 15-year streak as the #1 LTL carrier for quality. This reputation for reliability and low damage claims (99% on-time, 0.1% claims ratio) is a powerful competitive moat in the mature and cyclical LTL industry, allowing ODFL to maintain pricing discipline and achieve superior financial results.

The company's timing is excellent. The LTL market is emerging from a downturn, and the recent failure of a major competitor (Yellow Corp.) has created a significant market share opportunity. ODFL’s counter-cyclical investment strategy—aggressively expanding capacity and technology during the slowdown—positions it to capture a disproportionate share of the rebounding demand. The planned $450M-$575M in 2025 capital expenditures will further solidify its network advantage.

The primary growth engine is a traditional, highly effective enterprise sales model built on service quality and relationships. However, the most significant untapped opportunity lies in digital transformation. While the current website serves its purpose for established customers, it lags behind digitally-native platforms in acquiring and serving the long tail of small and medium-sized businesses. A focused strategy to build a frictionless, self-service digital channel represents the largest vector for new customer acquisition.

Key barriers to scale are inherent to the asset-heavy nature of the business: capital intensity, labor availability (especially drivers), and the physical constraints of its service center network. ODFL is actively and effectively mitigating these through its disciplined investment strategy.

Recommended Growth Strategy:

The strategic imperative is to 'Protect the Core and Grow the Edge.'

1. Protect the Core: Double down on the service excellence and operational efficiency that drives the profitable enterprise business. The recommended North Star Metric, 'Revenue Per Hundredweight (Yield)', will maintain this focus on profitable, quality growth.

2. Grow the Edge: Aggressively invest in two key areas:

* Digital Customer Experience: Launch a dedicated initiative to build a world-class, self-service digital portal to capture the SMB market.

* Value-Added Services: Evolve from a freight carrier to a logistics intelligence partner by productizing its vast operational data into a premium 'Supply Chain Analytics' offering.

By executing this dual strategy, ODFL can reinforce its market leadership with large enterprises while simultaneously building a new, scalable growth engine for the future, ensuring its next decade of growth is as successful as its last.

Legal Compliance

Old Dominion Freight Line (ODFL) provides a comprehensive, well-structured, and recently updated (January 10, 2024) Privacy Policy. It is easily accessible from the website footer. The policy excels in its detailed disclosures, particularly for California residents under the CCPA/CPRA, using a clear table format to outline categories of personal information collected, sources, and business purposes. It explicitly states that ODFL does not 'sell' or 'share' personal information for cross-context behavioral advertising, a key compliance point. However, the policy lacks specific language addressing the General Data Protection Regulation (GDPR) of the EU or Canada's Personal Information Protection and Electronic Documents Act (PIPEDA). Given that the company offers 'Global' and 'Worldwide' services, including to Europe and Canada, this omission represents a significant legal gap. While it provides robust mechanisms for US residents to exercise their rights, it fails to outline specific processes or rights for data subjects in the EU or Canada, which differ from US law.

The Privacy Policy references and links to a 'Terms & Conditions' document, confirming its presence. Although the content was not provided for this analysis, for a Less-Than-Truckload (LTL) carrier like ODFL, this document is a critical strategic asset. It would govern service agreements, liability limitations for cargo (crucial under regulations like the Carmack Amendment in the U.S.), dispute resolution, payment terms, and disclaimers for service guarantees. The enforceability and clarity of these terms are paramount to managing risk in freight transportation, where disputes over lost or damaged goods are common. The legal positioning of the company hinges on a robust and clear Terms of Service.

The Privacy Policy discloses the use of cookies and similar technologies for analytics and advertising, specifically naming Adobe and Google Analytics. It provides links to a separate Cookie Policy and a 'Cookie Settings' button within the policy page itself, which is a strong practice for granular user control. However, the initial user interaction upon visiting the website lacks a prominent, GDPR-compliant cookie consent banner that requires affirmative, opt-in consent before non-essential cookies are placed. The current approach, which relies on users finding the settings within the privacy policy, does not meet the standards of jurisdictions requiring explicit prior consent, creating a compliance risk for engagement with users from regions like the EU.

ODFL demonstrates a strong data protection posture for its U.S. operations, with exemplary detail regarding CCPA/CPRA compliance. The policy clearly defines Personal and Sensitive Personal Information and provides specific consumer rights request mechanisms, including a toll-free number and an online form. Security measures are described at a high level, stating the implementation of 'commercially reasonable administrative, technical, and physical safeguards.' The primary weakness is the geographic scope. The lack of explicit mention of GDPR or PIPEDA principles, such as detailing the lawful basis for processing EU data or specific cross-border data transfer mechanisms, leaves the company exposed to regulatory risk as its business operations include services to Canada, Mexico, and other global regions.