eScore

oracle.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Oracle demonstrates exceptional digital presence with a high-authority domain that is meticulously optimized for a vast array of high-intent enterprise keywords. Its content strategy brilliantly aligns with the B2B customer journey, from educational content in Oracle University to high-value, proof-based customer success stories. Oracle effectively penetrates global markets with a digital strategy that mirrors its expansive physical data center presence, showcasing a sophisticated understanding of both local and global reach.

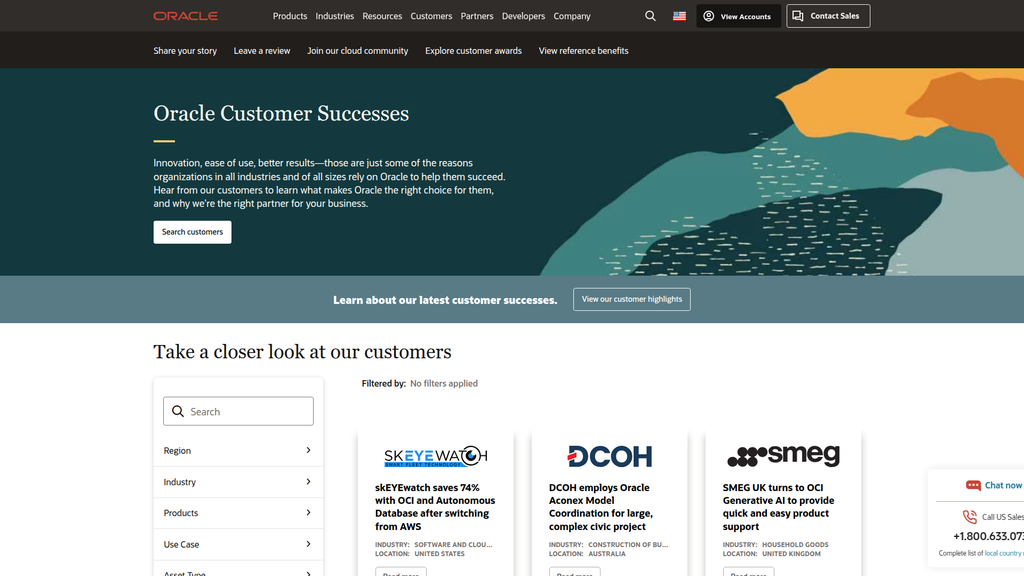

The extensive and filterable library of customer success stories serves as a powerful SEO and content authority asset, perfectly aligning with the search intent of enterprise decision-makers in the consideration and validation stages.

Improve voice search optimization by creating more direct, conversational Q&A content that addresses common enterprise IT challenges, increasing the likelihood of capturing featured snippets for queries like 'What are the benefits of a multi-cloud database?'

Oracle's brand communication is authoritative, confident, and highly effective at segmenting its audience. Messaging is clearly tailored for the C-suite (focusing on ROI and competitive advantage), IT professionals (focusing on skills and certifications), and line-of-business leaders (focusing on operational outcomes). The brand successfully differentiates itself by focusing on its integrated stack and superior performance for mission-critical workloads, directly challenging competitors. While highly professional, the tone can be impersonal and overly corporate, missing opportunities for more human-centric storytelling.

The use of specific, quantifiable results in customer story headlines (e.g., 'saves 74%... after switching from AWS') is a powerful and highly effective form of conversion messaging and competitive differentiation.

Develop a messaging track focused on 'Integrated Simplicity' to proactively counter the market perception of complexity, explaining how Oracle's end-to-end stack reduces vendor management and streamlines processes.

The website provides a clear and logical user journey for its target enterprise audience, with intuitive navigation and well-structured information architecture. The path from discovering a customer success story to contacting sales is straightforward for a high-touch sales model. However, the analysis reveals several friction points, including generic calls-to-action ('Read more') and visually dense content cards that can increase cognitive load. While the site's structure is responsive, the complexity of information presents potential challenges on mobile devices.

The powerful filtering tools on the 'Customer Successes' page, allowing users to find highly relevant proof points by industry, region, and product, is an excellent micro-interaction that significantly reduces friction in the validation stage of the journey.

Overhaul generic CTA microcopy across the site. Instead of 'Read more,' use more compelling, benefit-oriented language like 'See the 74% Savings' or 'Explore [Company]'s Transformation' to increase click-through rates and guide users more effectively.

Oracle's credibility is exceptionally high, built on decades of serving mission-critical enterprise needs. The website masterfully deploys a hierarchy of trust signals, with third-party validation (IDC MarketScape Leader status) and extensive customer success evidence (logos and case studies of global brands) being most prominent. Furthermore, Oracle's proactive and transparent approach to industry-specific compliance (FedRAMP, HIPAA) and accessibility (WCAG 2.2 AA) serves as a powerful risk mitigation indicator for its enterprise clients, turning legal adherence into a strategic asset.

The proactive and extensive compliance with high-stakes, industry-specific regulations like FedRAMP and HIPAA is a core competitive advantage that serves as an undeniable trust signal for government and healthcare sectors.

Simplify the presentation of legal policies. Create a centralized, user-friendly 'Trust Center' that uses layered notices and interactive tools to help users easily understand the specific policies relevant to their relationship with Oracle (e.g., website visitor vs. cloud customer).

Oracle's competitive moat is deep and sustainable, primarily rooted in its massive existing enterprise customer base and the high switching costs associated with its database and application software. Its key differentiator is the ability to offer a complete, integrated technology stack from hardware (Exadata) and infrastructure (OCI) to database and enterprise applications (Fusion), a synergy that cloud-only providers cannot replicate. While it was a late mover in IaaS, its strategic partnerships (e.g., with Microsoft for Database@Azure) and focus on high-performance AI infrastructure are proving to be highly effective innovation indicators.

The integrated technology stack, offering a single vendor for infrastructure, platform, and applications, creates a powerful and defensible competitive advantage, especially for the large enterprise segment that values stability and accountability.

Address the 'legacy vendor perception' disadvantage by more aggressively marketing marquee AI customer wins (e.g., OpenAI, xAI) and expanding developer relations programs to improve mindshare in cloud-native communities.

Oracle's business model is highly scalable, characterized by high-margin, recurring cloud and license support revenue which constitutes the vast majority of its business. The company is demonstrating massive expansion potential, fueled by the surging demand for AI infrastructure, and is investing heavily in capital expenditures to build out global data center capacity. Its market expansion signals are strong, with a rapid rollout of new cloud regions and a multi-cloud strategy that effectively turns competitors' platforms into new sales channels.

The multi-cloud strategy, particularly the 'Oracle Database@Azure' partnership, is a brilliant market expansion signal that unlocks a massive addressable market within a competitor's ecosystem, showcasing high scalability potential.

While excelling in enterprise sales, Oracle needs to build a more robust, self-service, product-led growth (PLG) motion for OCI. This would improve capital efficiency by capturing the developer and SMB markets at a lower customer acquisition cost.

Oracle is executing a highly coherent and successful strategic pivot from an on-premise leader to a cloud-first powerhouse. Resource allocation is strategically focused on the highest growth areas: building out OCI data centers for AI workloads and integrating AI across its Fusion application suite. The company demonstrates strong strategic focus, leveraging its core strengths in database and enterprise applications to create a defensible and profitable cloud business, rather than trying to compete with hyperscalers on every front. This market timing, aligning with the explosion in AI demand, has been exceptionally effective.

The strategic focus on converting the massive on-premise installed base to cloud services is a highly coherent and capital-efficient model, leveraging a key, defensible asset to fuel future growth.

Overhaul and simplify legacy licensing and pricing models. The complexity and opacity of current models contradict a modern, cloud-first approach and can hinder the acquisition of new, cloud-native customers.

Oracle wields immense market power, demonstrated by its leadership in the database and cloud ERP markets. While its overall IaaS market share is smaller than hyperscalers, its growth trajectory is significantly faster, and it has established itself as the premier platform for mission-critical enterprise and AI workloads, giving it significant pricing power in that niche. Its ability to forge deep partnerships with giants like Microsoft and NVIDIA demonstrates significant partner leverage and an ability to influence market direction. The company's strategy is clearly shaping a multi-cloud future where its database services are a critical component, even within competitor ecosystems.

Dominant market leadership in the mission-critical database market gives Oracle significant pricing power and leverage, forming the bedrock of its entire cloud strategy and its successful multi-cloud partnerships.

Mitigate customer dependency risk by continuing to diversify its customer base into the startup and AI-native sectors, reducing its historical reliance on traditional large enterprises for new growth.

Business Overview

Business Classification

Cloud & Enterprise Software

Hardware & Professional Services

Technology

Sub Verticals

- •

Cloud Infrastructure (IaaS)

- •

Platform as a Service (PaaS)

- •

Software as a Service (SaaS)

- •

Database Technology

- •

Enterprise Resource Planning (ERP)

- •

Human Capital Management (HCM)

- •

Supply Chain Management (SCM)

- •

Customer Experience (CX)

- •

Engineered Hardware Systems

Mature

Maturity Indicators

- •

Long-established company (founded 1977).

- •

Consistently high revenue and profitability.

- •

Large, global, and deeply embedded enterprise customer base.

- •

Significant history of strategic acquisitions to enter new markets and acquire technology (e.g., Sun, NetSuite, Cerner).

- •

Strong brand recognition in the enterprise technology sector.

- •

Extensive portfolio of products and intellectual property.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Cloud Services and License Support

Description:This is the largest and fastest-growing segment. It includes recurring subscription fees for Oracle's full stack of cloud offerings (IaaS, PaaS, SaaS like Fusion Cloud ERP) and maintenance/support fees for on-premise software licenses.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:High

- Stream Name:

Cloud License and On-Premise License

Description:Revenue from selling new perpetual licenses for on-premise software and cloud-based licenses. This stream is transitioning towards the cloud subscription model.

Estimated Importance:Secondary

Customer Segment:Large Enterprises, Government

Estimated Margin:High

- Stream Name:

Hardware

Description:Sales of Oracle's engineered systems (like Exadata), servers, and storage products. Often sold as part of an integrated solution with software.

Estimated Importance:Tertiary

Customer Segment:Large Enterprises with high-performance computing needs

Estimated Margin:Medium

- Stream Name:

Services

Description:Fees for consulting, implementation, education (Oracle University), and other professional services to help customers deploy and manage Oracle products.

Estimated Importance:Tertiary

Customer Segment:All Segments

Estimated Margin:Low to Medium

Recurring Revenue Components

- •

SaaS Subscriptions (e.g., Oracle Fusion Cloud ERP, NetSuite)

- •

IaaS/PaaS Subscriptions and Consumption (Oracle Cloud Infrastructure)

- •

On-Premise Software Maintenance and Support Contracts

Pricing Strategy

Hybrid (Subscription, Pay-As-You-Go, Perpetual License)

Premium

Opaque

Pricing Psychology

- •

Bundling (Integrating database, infrastructure, and applications)

- •

Tiered Pricing (Different feature sets for different price points)

- •

Contract-Based/Enterprise Agreements (Custom negotiated deals for large clients)

- •

Value-Based Pricing (Tied to performance and business outcomes)

Monetization Assessment

Strengths

- •

Strong base of recurring revenue from cloud subscriptions and license support provides stability.

- •

Deeply entrenched products (especially the Oracle Database) create high switching costs and pricing power.

- •

Ability to bundle hardware, infrastructure, and applications provides significant cross-selling and up-selling opportunities.

Weaknesses

- •

Complex and often opaque pricing models can be a barrier for new customers.

- •

Perception of being a high-cost vendor compared to competitors.

- •

Legacy on-premise licensing models are declining in a cloud-first world.

Opportunities

- •

Aggressively convert the massive on-premise database and application customer base to Oracle Cloud Infrastructure (OCI) and Fusion Apps.

- •

Leverage AI and machine learning to create new premium, consumption-based services.

- •

Expand industry-specific cloud solutions (e.g., Health, Financial Services) with tailored pricing and value propositions.

- •

Simplify pricing for OCI to attract more cloud-native developers and startups.

Threats

- •

Intense price competition from hyperscalers (AWS, Azure, GCP) in the IaaS market.

- •

Rise of cost-effective open-source databases and specialized SaaS competitors.

- •

Customer desire for multi-cloud strategies may reduce reliance on Oracle's full stack.

Market Positioning

Positioned as the premier provider of a fully integrated, high-performance, and secure technology stack for running mission-critical enterprise workloads, from infrastructure to applications, with a focus on superior price-performance for Oracle workloads and deep industry-specific expertise.

Leader in Database and ERP applications. Challenger in the overall cloud infrastructure (IaaS) market behind AWS, Azure, and GCP.

Target Segments

- Segment Name:

The Enterprise C-Suite (CIO, CTO, CFO)

Description:Decision-makers at large, global corporations and government entities responsible for technology strategy, security, and digital transformation.

Demographic Factors

- •

Fortune 500 companies

- •

Public sector agencies

- •

Heavily regulated industries (Finance, Healthcare)

Psychographic Factors

- •

Risk-averse

- •

Focused on security, reliability, and total cost of ownership (TCO)

- •

Values long-term vendor stability and support

Behavioral Factors

- •

Engages in long sales cycles with detailed negotiations

- •

Often has a significant existing investment in Oracle technology

- •

Seeks strategic partnerships rather than just transactional purchases

Pain Points

- •

Complexity of migrating legacy systems to the cloud

- •

Integrating disparate applications and data sources

- •

Ensuring security and compliance across a hybrid IT environment

- •

Controlling IT costs while driving innovation

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Line-of-Business (LOB) Leaders

Description:Heads of departments such as Finance, HR, and Supply Chain who require robust applications to streamline operations and drive business outcomes.

Demographic Factors

Mid-to-large sized companies

Across all industries listed on the website

Psychographic Factors

- •

Results-oriented

- •

Seeks best-in-class functionality for their specific domain

- •

Values ease of use and industry best practices

Behavioral Factors

Influences technology decisions based on business needs

Focuses on feature sets of SaaS applications (ERP, HCM, SCM)

Pain Points

- •

Manual, inefficient business processes

- •

Lack of a single source of truth for business data

- •

Inability to get timely insights for decision-making

- •

Disconnected workflows between departments

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Database Administrators & Developers

Description:Technical professionals responsible for managing, maintaining, and developing on the Oracle Database and related platforms.

Demographic Factors

IT departments within Oracle's customer base

Psychographic Factors

- •

Performance-focused

- •

Detail-oriented

- •

Values technical features, reliability, and automation

Behavioral Factors

- •

Deeply skilled in Oracle technology

- •

Active in technical communities (e.g., Oracle University)

- •

Influences decisions on database upgrades and cloud migration

Pain Points

- •

Time-consuming database administration tasks (patching, tuning, backups)

- •

Ensuring high availability and disaster recovery

- •

Scaling database performance to meet application demand

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Integrated Technology Stack

Strength:Strong

Sustainability:Sustainable

- Factor:

Dominance in the Relational Database Market

Strength:Strong

Sustainability:Sustainable

- Factor:

High-Performance Engineered Systems (e.g., Exadata)

Strength:Strong

Sustainability:Sustainable

- Factor:

Comprehensive Suite of Enterprise SaaS Applications (Fusion)

Strength:Strong

Sustainability:Sustainable

- Factor:

Deep Industry-Specific Vertical Solutions (e.g., Oracle Health)

Strength:Moderate

Sustainability:Medium-term

Value Proposition

Oracle provides a complete, integrated, and high-performance stack of cloud infrastructure and enterprise applications, enabling organizations to run their most critical business operations securely, reliably, and cost-effectively.

Good

Key Benefits

- Benefit:

Integrated Cloud Suite

Importance:Critical

Differentiation:Unique

Proof Elements

Oracle Fusion Cloud Applications Suite

Seamless integration between IaaS, PaaS, and SaaS offerings

- Benefit:

Superior Performance and Reliability

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Oracle Autonomous Database benchmarks

Exadata and OCI performance case studies

- Benefit:

Enhanced Security

Importance:Critical

Differentiation:Common

Proof Elements

Comprehensive security services on OCI

Compliance certifications

- Benefit:

Reduced Total Cost of Ownership (TCO)

Importance:Important

Differentiation:Common

Proof Elements

Customer testimonials claiming cost savings (e.g., skEYEwatch)

Price-performance comparison reports against competitors

Unique Selling Points

- Usp:

Oracle Autonomous Database

Sustainability:Long-term

Defensibility:Strong

- Usp:

Exadata Cloud@Customer

Sustainability:Long-term

Defensibility:Strong

- Usp:

Comprehensive and integrated Fusion Cloud Applications Suite (ERP, HCM, SCM, CX)

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Managing fragmented and complex IT environments

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Migrating mission-critical Oracle workloads to the cloud

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Unifying disparate business processes (e.g., finance, HR, supply chain) onto a single platform

Severity:Major

Solution Effectiveness:Complete

- Problem:

Ensuring data security, sovereignty, and regulatory compliance

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

Oracle's focus on integrated systems, security, and performance for mission-critical applications aligns perfectly with the primary needs of the large enterprise market.

High

The value proposition resonates strongly with CIOs and LOB leaders at large organizations who are risk-averse and prioritize reliability, integration, and vendor accountability over pure cost savings on commodity services.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Global System Integrators (Accenture, Deloitte).

- •

Technology Partners (NVIDIA, Microsoft, Intel, VMware).

- •

Independent Software Vendors (ISVs)

- •

Oracle PartnerNetwork (Value Added Resellers, Consultants)

Key Activities

- •

Research & Development.

- •

Enterprise Sales & Marketing.

- •

Cloud Infrastructure Management & Operations

- •

Customer Support & Professional Services

- •

Strategic Mergers & Acquisitions.

Key Resources

- •

Extensive Intellectual Property Portfolio

- •

Global Cloud Data Center Infrastructure

- •

Large, Highly-Skilled Global Workforce

- •

Significant Financial Capital

- •

Deeply Entrenched Enterprise Customer Base.

Cost Structure

- •

Research & Development Expenses

- •

Sales and Marketing Costs

- •

Data Center Infrastructure and Operational Costs

- •

Employee Compensation and Benefits

- •

Acquisition-related Costs

Swot Analysis

Strengths

- •

Dominant market share in databases and a leader in ERP applications.

- •

Large, loyal, and highly profitable installed base with high switching costs.

- •

Comprehensive, integrated portfolio from infrastructure to applications.

- •

Strong financial position and cash flow for R&D and strategic acquisitions.

- •

High-performance engineered hardware/software solutions (e.g., Exadata).

Weaknesses

- •

Lagging market share in the IaaS cloud market compared to hyperscalers.

- •

Perception of vendor lock-in and high pricing.

- •

Complex sales processes and product licensing models.

- •

Historically less focus on developer-friendliness compared to cloud-native competitors.

Opportunities

- •

Migrating the extensive on-premise customer base to OCI and Fusion SaaS.

- •

Capitalizing on the demand for AI/ML with high-performance OCI and NVIDIA partnership.

- •

Expanding vertical-specific cloud offerings, particularly in healthcare via the Cerner acquisition.

- •

Growing adoption of multi-cloud strategies where OCI can be a specialized provider (e.g., through Oracle Database@Azure).

- •

Increasing market share in the mid-market with NetSuite.

Threats

- •

Intense competition from hyperscalers (AWS, Azure, GCP) who are rapidly innovating.

- •

Growth of specialized, best-of-breed SaaS competitors (e.g., Salesforce, Workday).

- •

Increasing adoption of open-source databases (e.g., PostgreSQL, MySQL).

- •

Shifts in enterprise buying behavior towards more flexible, consumption-based models.

Recommendations

Priority Improvements

- Area:

Go-to-Market & Pricing

Recommendation:Simplify pricing models and increase transparency for OCI services to lower the barrier to entry for new customers and developers. Create more self-service and frictionless purchasing paths.

Expected Impact:High

- Area:

Developer Ecosystem

Recommendation:Invest heavily in developer relations, open-source tools, and educational resources (beyond Oracle-specific training) to improve mindshare and adoption among cloud-native developers.

Expected Impact:Medium

- Area:

Product Integration

Recommendation:Continue to deepen the seamless integration between acquired companies (e.g., Cerner) and the core Oracle Cloud stack to fully realize the strategic value of these acquisitions.

Expected Impact:High

Business Model Innovation

- •

Launch a 'Cloud Transformation as a Service' model that bundles software, migration services, and managed services into a single, outcome-based subscription for legacy customers.

- •

Develop a robust, monetized data and AI marketplace on Oracle Health Cloud, allowing third parties to build and sell compliant applications and models.

- •

Create an independent, venture-style arm to invest in and nurture startups building exclusively on OCI, fostering a native ecosystem.

Revenue Diversification

- •

Expand Oracle Health services beyond EHR systems into population health management, clinical trial data services, and AI-powered diagnostic tools.

- •

Build out a strategic data and analytics consulting practice that leverages Oracle's deep expertise to help customers become data-driven organizations, independent of specific product sales.

- •

Further develop the 'Oracle Cloud@Customer' model to capture revenue from enterprises with strict data residency or latency requirements that cannot use public cloud.

Oracle is in a pivotal phase of strategic evolution, successfully transitioning its mature, on-premise-dominant business model towards a recurring-revenue, cloud-centric future. The company's core strategy hinges on leveraging its two primary, deeply entrenched strengths: its market-leading database technology and its comprehensive suite of mission-critical enterprise applications (ERP, HCM, SCM). By offering a highly integrated and performant full stack—from IaaS on OCI to SaaS with Fusion Apps—Oracle presents a compelling value proposition to its massive installed base of large enterprises, for whom stability, security, and integration often outweigh the appeal of a multi-vendor, best-of-breed approach.

The business model's strength lies in its high percentage of recurring revenue and the significant switching costs associated with its core database and ERP systems. This provides a stable foundation to fund aggressive investments in cloud infrastructure and strategic acquisitions, such as the transformative purchase of Cerner to establish a commanding position in the healthcare vertical.

However, this evolution is not without significant challenges. In the hyper-competitive IaaS market, Oracle remains a distant challenger to the hyperscalers (AWS, Azure, GCP), which command greater market share and developer mindshare. The company must overcome long-standing market perceptions of high costs and vendor lock-in to attract new cloud-native workloads.

Future success and market positioning will be determined by three key factors:

1. Conversion of the Installed Base: The ability to successfully migrate its vast on-premise customer base to OCI and Fusion Cloud Applications is the single most critical driver of future growth.

2. Winning in Key Verticals: The success of the Oracle Health initiative and other industry-specific clouds will be a key differentiator against more horizontal competitors.

3. Capturing AI Workloads: The strategic partnership with NVIDIA and the build-out of high-performance computing capabilities on OCI are vital to capturing the next wave of cloud growth driven by Artificial Intelligence.

Oracle's strategic transformation is a well-funded, long-term play. The company is not trying to out-compete AWS on every front; instead, it is building a defensible, highly profitable cloud business tailored to the needs of the enterprise, leveraging its undeniable strengths in data and applications. The key to accelerating this evolution will be simplifying its go-to-market strategy, improving its developer ecosystem, and proving a superior price-performance value proposition for mission-critical workloads.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Investment

Impact:High

- Barrier:

High Customer Switching Costs

Impact:High

- Barrier:

Brand Reputation and Trust

Impact:High

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Deep Technical Expertise and Talent

Impact:Medium

- Barrier:

Established Sales and Distribution Channels

Impact:High

Industry Trends

- Trend:

Generative AI Integration

Impact On Business:Critical for enhancing product capabilities, automating complex business processes, and maintaining competitive parity. Oracle is actively embedding AI across its entire stack.

Timeline:Immediate

- Trend:

Multi-Cloud and Hybrid Cloud Adoption

Impact On Business:Customers are avoiding vendor lock-in and choosing best-of-breed services. Oracle's strategy to make its database and services available on other clouds (e.g., Azure, AWS) is a direct response and crucial for growth.

Timeline:Immediate

- Trend:

Industry-Specific Cloud Solutions

Impact On Business:Demand for tailored, vertical-specific solutions is increasing. Oracle's acquisitions (e.g., Cerner for healthcare) and industry application development are key to capturing this market.

Timeline:Near-term

- Trend:

Data Sovereignty and Compliance

Impact On Business:Stricter data regulations (like GDPR) necessitate sovereign cloud solutions. Oracle's EU Sovereign Cloud and Dedicated Region Cloud@Customer offerings directly address this, providing a competitive advantage.

Timeline:Near-term

- Trend:

Shift to Data Lakehouse Architecture

Impact On Business:Competitors like Databricks and Snowflake are challenging traditional data warehousing. Oracle must position its Autonomous Data Warehouse and data platform to compete with these modern, flexible architectures.

Timeline:Immediate

Direct Competitors

- →

Microsoft

Market Share Estimate:Azure holds ~23-25% of the cloud infrastructure market.

Target Audience Overlap:High

Competitive Positioning:Positions as the leading enterprise and hybrid cloud provider, leveraging its massive existing enterprise software footprint (Windows Server, Office 365) to drive Azure adoption.

Strengths

- •

Dominant enterprise relationships and sales channels.

- •

Seamless integration with Microsoft's vast software ecosystem (Office 365, Dynamics 365, Windows).

- •

Strong hybrid cloud capabilities (Azure Arc).

- •

Aggressive investment and leadership in enterprise AI (via OpenAI partnership).

- •

Extensive global data center footprint.

Weaknesses

- •

Complex pricing structure can lead to unexpected costs.

- •

Perceived as less flexible than AWS for certain developer-centric use cases.

- •

Can have a steep learning curve due to the vast array of services.

Differentiators

- •

Unmatched integration with the Microsoft software stack.

- •

Strong focus on hybrid cloud solutions.

- •

Leading position in enterprise generative AI through its partnership with OpenAI.

- →

Amazon Web Services (AWS)

Market Share Estimate:The clear market leader with ~31-32% of the cloud infrastructure market.

Target Audience Overlap:High

Competitive Positioning:Positions as the most mature, comprehensive, and broadly adopted cloud platform, emphasizing its vast service portfolio and operational experience.

Strengths

- •

First-mover advantage and longest track record in the cloud market.

- •

Most extensive and diverse portfolio of cloud services.

- •

Largest market share and brand recognition in cloud computing.

- •

Strong developer community and rich partner ecosystem.

- •

Reputation for high reliability and scalability.

Weaknesses

- •

Complex and often confusing pricing and billing.

- •

Cost management can be a significant challenge for customers.

- •

The sheer number of services can be overwhelming for new users, creating a steep learning curve.

Differentiators

- •

Breadth and depth of services are unmatched.

- •

Strong reputation for reliability and operational excellence.

- •

Largest and most mature ecosystem of partners and developers.

- →

Google Cloud Platform (GCP)

Market Share Estimate:~12-13% of the cloud infrastructure market, but growing rapidly.

Target Audience Overlap:Medium

Competitive Positioning:Positions as a leader in data analytics, machine learning, AI, and cloud-native technologies like Kubernetes, appealing to data-driven and tech-forward companies.

Strengths

- •

Excellence in AI, machine learning, and data analytics (BigQuery).

- •

Leadership in containerization and open-source (Kubernetes).

- •

High-performance global network infrastructure.

- •

Strong brand association with innovation and data.

- •

Increasingly enterprise-focused sales efforts.

Weaknesses

- •

Smaller market share compared to AWS and Azure.

- •

Perception of having a less comprehensive enterprise feature set than competitors.

- •

Complex pricing can be difficult for customers to manage.

- •

Smaller global data center footprint than AWS and Azure.

Differentiators

- •

Best-in-class data analytics and AI/ML services.

- •

Deep expertise and leadership in open-source and cloud-native technologies.

- •

Leverages Google's global private network for performance.

- →

SAP

Market Share Estimate:A leading competitor in the ERP SaaS market.

Target Audience Overlap:High

Competitive Positioning:Positions as the leader in intelligent enterprise resource planning, focusing on helping large enterprises run their core business processes in the cloud with S/4HANA Cloud.

Strengths

- •

Deeply entrenched in the world's largest companies for core ERP functions.

- •

Strong brand and reputation in the enterprise software market.

- •

Large, loyal customer base and extensive partner ecosystem.

- •

Industry-specific expertise and solutions.

Weaknesses

- •

Complex and costly migrations from legacy SAP systems to S/4HANA Cloud.

- •

Perceived as less agile and more complex than newer cloud-native competitors.

- •

Slower to pivot to a fully cloud-native architecture compared to Oracle's Fusion Apps.

- •

Licensing models can be rigid and expensive.

Differentiators

- •

Dominant position in core manufacturing and supply chain ERP.

- •

RISE with SAP offering provides a guided path to the cloud for existing customers.

- •

Strong focus on integrating business processes end-to-end.

- →

Salesforce

Market Share Estimate:Dominant leader in the CRM market with ~19.5% share.

Target Audience Overlap:High

Competitive Positioning:Positions as the #1 AI CRM, focusing on customer-centric applications that cover sales, service, marketing, and commerce, all on a unified platform.

Strengths

- •

Market-leading brand and dominant position in CRM.

- •

Extensive AppExchange marketplace with thousands of third-party integrations.

- •

User-friendly interface and strong user community.

- •

Strong focus on innovation, particularly around AI (Einstein).

- •

Comprehensive suite of customer-facing applications.

Weaknesses

- •

Lacks a native, fully-integrated ERP or HCM solution, relying on partners.

- •

Can be expensive, especially as more features and customizations are added.

- •

Acquisition-heavy strategy can lead to a less-than-seamless product portfolio.

- •

Core platform can be complex to customize and maintain.

Differentiators

- •

Unrivaled leadership and mindshare in the CRM space.

- •

The AppExchange ecosystem provides unparalleled extensibility.

- •

Focus on creating a single, unified view of the customer across all touchpoints.

Indirect Competitors

- →

Snowflake

Description:A cloud-native data platform that provides a data warehouse-as-a-service. It separates compute and storage, offering flexibility and scalability that challenges traditional database architectures.

Threat Level:High

Potential For Direct Competition:Already a direct competitor in the cloud data warehouse and analytics space, eroding Oracle's traditional database dominance.

- →

Databricks

Description:Provides a unified data analytics platform built on Apache Spark, pioneering the 'Data Lakehouse' paradigm which combines the benefits of data lakes and data warehouses. It competes directly with Oracle's analytics and data platform offerings.

Threat Level:High

Potential For Direct Competition:Directly competes for analytics, AI, and machine learning workloads, with a higher market share in Big Data Analytics than Oracle.

- →

Workday

Description:A leading provider of cloud-native SaaS for financial management (ERP) and human capital management (HCM). It is a major competitor to Oracle Fusion Cloud ERP and HCM.

Threat Level:High

Potential For Direct Competition:Is already a primary direct competitor in the HCM and Financials SaaS markets, often competing head-to-head for large enterprise deals.

- →

ServiceNow

Description:A cloud platform that helps automate IT, employee, and customer workflows. While not a direct ERP or infrastructure competitor, it encroaches on business application workloads that might otherwise run on Oracle's platform.

Threat Level:Medium

Potential For Direct Competition:Low likelihood of becoming a direct IaaS or core ERP competitor, but will continue to compete for enterprise workflow and application budget.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Vast Existing Enterprise Customer Base

Sustainability Assessment:Oracle's database and on-premises applications are deeply embedded in thousands of large enterprises, creating high switching costs and a massive base for cloud migration.

Competitor Replication Difficulty:Hard

- Advantage:

Integrated Technology Stack

Sustainability Assessment:Oracle is one of the few vendors that can offer a complete, integrated stack from hardware (Exadata) and infrastructure (OCI) to database, middleware, and enterprise applications (Fusion, NetSuite).

Competitor Replication Difficulty:Hard

- Advantage:

Mission-Critical Database Leadership

Sustainability Assessment:Oracle Database is the gold standard for high-performance, mission-critical transactional workloads. This reputation provides a strong foundation for its cloud database services.

Competitor Replication Difficulty:Medium

- Advantage:

Strong Direct Sales Force and Enterprise DNA

Sustainability Assessment:Oracle's sales organization has deep relationships and expertise in selling complex, high-value solutions to large enterprises, a skill that is difficult to replicate.

Competitor Replication Difficulty:Medium

Temporary Advantages

- Advantage:

OCI Price-Performance for Oracle Workloads

Estimated Duration:1-3 Years

Advantage Description:Oracle aggressively markets OCI as offering significantly better price-performance than other clouds, especially for running Oracle's own database and applications. This advantage may diminish as competitors optimize.

- Advantage:

Free GenAI in Fusion Applications

Estimated Duration:1-2 Years

Advantage Description:Oracle is not currently upcharging for GenAI features embedded in its SaaS applications, which could drive adoption. Competitors are likely to follow similar pricing strategies over time.

Disadvantages

- Disadvantage:

Legacy Vendor Perception and Brand Tax

Impact:Major

Addressability:Difficult

- Disadvantage:

Late Mover in Cloud Infrastructure

Impact:Major

Addressability:Moderate

- Disadvantage:

Complex Licensing and Aggressive Audit Tactics

Impact:Major

Addressability:Moderate

- Disadvantage:

Weaker Developer Mindshare

Impact:Minor

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns showcasing successful migrations from AWS/Azure to OCI with clear cost savings.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Simplify and promote free certification programs for OCI and Autonomous Database to build developer skills and goodwill.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Create bundled, easy-to-understand OCI starter packs for mid-market customers new to Oracle.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Double down on the multi-cloud strategy by expanding database services and integrations on AWS, Azure, and GCP.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Acquire innovative AI companies that specialize in specific industry verticals to accelerate the development of industry clouds.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Overhaul licensing models for key on-premises products to create a smoother, more transparent path to the cloud.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Invest heavily in building a vibrant open-source and developer relations program to compete for mindshare with Google and AWS.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Position Oracle as the premier platform for sovereign AI, leveraging its dedicated region and sovereign cloud capabilities for governments and regulated industries.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Evolve into a 'business process' company, selling outcomes powered by its integrated AI and application suite, rather than just technology components.

Expected Impact:High

Implementation Difficulty:Difficult

Position Oracle as the most performant, secure, and cost-effective platform for running mission-critical enterprise workloads—from infrastructure to applications—with a seamless, integrated AI-powered experience.

Differentiate on the unique ability to provide a fully integrated hardware, IaaS, PaaS, and SaaS stack, optimized end-to-end for performance and security, particularly for data-intensive and AI-driven business processes.

Whitespace Opportunities

- Opportunity:

Sovereign AI for Governments

Competitive Gap:While all major clouds offer government regions, Oracle's ability to deploy a complete, disconnected 'Dedicated Region Cloud@Customer' provides a stronger data sovereignty and security story that is hard for competitors to match.

Feasibility:High

Potential Impact:High

- Opportunity:

Integrated ERP/SCM/HCM for the Underserved Mid-Market

Competitive Gap:The mid-market is often served by disparate point solutions. A fully integrated, pre-configured suite based on NetSuite or a scaled-down Fusion, with industry templates, could be highly disruptive. Competitors like SAP and Workday are primarily focused upmarket.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Multi-Cloud Mission-Critical Database as a Service

Competitive Gap:While competitors offer their own databases, none have the brand recognition of Oracle for mission-critical OLTP. By aggressively expanding Oracle Database@Azure and @AWS, Oracle can capture the high-end database market even within competitor clouds.

Feasibility:High

Potential Impact:High

- Opportunity:

AI-Powered Clinical Trial Management

Competitive Gap:Leveraging the Cerner acquisition, Oracle can build an end-to-end platform for life sciences that integrates clinical data (EHR) with trial management and AI-powered analytics. This creates a data moat that competitors in the life sciences space lack.

Feasibility:Medium

Potential Impact:High

Oracle's competitive landscape is defined by a multi-front war against formidable opponents. In cloud infrastructure, it is the challenger, trailing the hyperscale oligopoly of AWS, Microsoft Azure, and Google Cloud. Its primary strategy here is to leverage its dominance in the database market, offering superior price-performance for mission-critical Oracle workloads on OCI and pursuing a unique multi-cloud strategy that places its database services directly within competitor data centers.

In the SaaS arena, Oracle competes head-to-head with best-of-breed giants. Its Fusion Cloud Applications suite contends with SAP in ERP, Salesforce in CRM/CX, and Workday in HCM. Oracle's key advantage is its ability to offer a broad, deeply integrated suite of enterprise applications, increasingly infused with AI, arguing for a lower total cost of ownership and a more unified data model compared to managing multiple vendors. The acquisition of Cerner signals a deep commitment to verticalization, aiming to build defensible moats in specific industries like healthcare.

Indirectly, Oracle faces a significant threat from modern data platforms like Snowflake and Databricks, which are rapidly capturing mindshare and workloads in the analytics and AI space with their flexible, cloud-native architectures. This challenges Oracle's traditional data warehouse dominance and forces it to innovate its own data platform offerings.

Oracle's most sustainable advantages are its massive, embedded enterprise customer base, high switching costs, and the unique completeness of its technology stack from hardware to applications. Its primary disadvantages are a lingering perception as a complex, expensive legacy vendor and its late start in the IaaS market. Future success hinges on its ability to successfully execute its multi-cloud strategy, drive OCI adoption by proving its performance and cost advantages, and seamlessly integrate AI to deliver tangible business outcomes through its application suites.

Messaging

Message Architecture

Key Messages

- Message:

Oracle drives customer success and tangible business results through innovation, ease of use, and a comprehensive technology stack.

Prominence:Primary

Clarity Score:High

Location:Customer Success landing page (Headline and opening paragraph)

- Message:

Oracle University empowers individuals and organizations with the skills and certifications needed for modern technologies like AI, OCI, and multicloud.

Prominence:Primary

Clarity Score:High

Location:Oracle University landing page

- Message:

Oracle technology delivers concrete, quantifiable outcomes, such as significant cost savings and performance improvements.

Prominence:Secondary

Clarity Score:High

Location:Customer story headlines (e.g., 'skEYEwatch saves 74% with OCI', 'Federal Bank improves development by 3X')

- Message:

Oracle offers a vast and specialized portfolio of solutions for nearly every industry and business function.

Prominence:Tertiary

Clarity Score:Medium

Location:Implied through the extensive filtering options on the Customer Success page.

The messaging hierarchy is highly effective on a page-by-page basis. The 'Customer Successes' page rightly prioritizes proof and outcomes, immediately establishing credibility. The 'Oracle University' page effectively funnels users towards strategic growth areas like AI and OCI certifications. The overarching hierarchy places customer success as the ultimate outcome of engaging with Oracle's products and educational ecosystem.

Messaging is remarkably consistent across the analyzed sections. The theme of 'enabling success' is the core thread, whether it's the success of a multinational enterprise saving millions or an individual developer earning a career-boosting certification. The product names (OCI, Autonomous Database, Fusion Cloud) are consistently used, reinforcing the integrated nature of the Oracle ecosystem.

Brand Voice

Voice Attributes

- Attribute:

Authoritative

Strength:Strong

Examples

Oracle University provides a comprehensive portfolio of training, certification, and digital adoption solutions...

Innovation, ease of use, better results—those are just some of the reasons organizations...rely on Oracle to help them succeed.

- Attribute:

Results-Oriented

Strength:Strong

Examples

- •

skEYEwatch saves 74% with OCI and Autonomous Database after switching from AWS

- •

Federal Bank improves development by 3X with Oracle APEX and Autonomous Database

- •

HBL cuts hiring and performance review time with Oracle Fusion Cloud HCM

- Attribute:

Expert

Strength:Strong

Examples

Learn directly from Oracle product experts, build practical AI agent skills, and earn a globally recognized credential...

Showcase your DBA expertise in using advanced AI-powered features...

- Attribute:

Empowering

Strength:Moderate

Examples

- •

Take your AI skills to the next level...

- •

Advance your career by building new skills...

- •

Empower your team to gain more confidence in the cloud...

Tone Analysis

Professional and Confident

Secondary Tones

Results-Driven

Educational

Tone Shifts

The tone shifts from being highly corporate and results-focused on the 'Customer Successes' page to more empowering and aspirational on the 'Oracle University' page, which is appropriate for the respective audiences.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Oracle provides a comprehensive, secure, and integrated stack of cloud applications and infrastructure, engineered to deliver superior performance and tangible business outcomes for complex enterprises.

Value Proposition Components

- Component:

Comprehensive and Integrated Portfolio

Clarity:Clear

Uniqueness:Somewhat Unique

Explanation:The messaging strongly implies a 'one-stop-shop' for enterprise needs, from database and infrastructure (OCI) to applications (Fusion, NetSuite). The integration is a key differentiator against acquiring point solutions.

- Component:

Superior Performance and Cost Savings

Clarity:Clear

Uniqueness:Somewhat Unique

Explanation:This is a direct competitive message, most notably with headlines like 'saves 74%...after switching from AWS'. It positions OCI not just as an alternative but as a superior choice for performance- and cost-sensitive workloads.

- Component:

Enterprise-Grade Expertise and Security

Clarity:Clear

Uniqueness:Unique

Explanation:Oracle's long history with large enterprises is a core, often unstated, part of its value. Messaging about specific industry solutions and showcasing major corporations as customers reinforces this deep domain expertise.

- Component:

Ecosystem and Skills Development

Clarity:Clear

Uniqueness:Somewhat Unique

Explanation:Oracle University's offerings, especially free certifications in strategic areas, create a value proposition that extends to the customer's workforce, promising to keep them skilled on the latest technologies.

Oracle effectively differentiates itself from hyperscalers like AWS and Azure by focusing on the integrated stack and its deep expertise in enterprise applications and databases. The message isn't just 'we also have a cloud,' but 'we have a cloud specifically engineered to run enterprise workloads—especially Oracle workloads—better and more cost-effectively.' The direct competitive call-out ('switching from AWS') is an aggressive and confident differentiation tactic.

The messaging positions Oracle as a premium, powerful, and complete enterprise partner. It targets organizations with complex needs that value integration, security, and performance over the commodity cloud services offered by competitors. It is also aggressively repositioning itself as a leader in AI and cloud infrastructure, competing directly for market share with AWS, Azure, and Google Cloud.

Audience Messaging

Target Personas

- Persona:

C-Suite / IT Decision-Maker (e.g., CIO, CTO, CFO)

Tailored Messages

- •

skEYEwatch saves 74% with OCI and Autonomous Database after switching from AWS

- •

South Yorkshire Police trims admin work with Oracle Fusion Cloud ERP, HCM

- •

Oracle is a Leader in the IDC MarketScape for Worldwide Public Cloud Infrastructure as a Service.

Effectiveness:Effective

- Persona:

IT Professional / Developer / DBA

Tailored Messages

- •

Free certification on OCI, AI, multicloud, and data services

- •

Take your AI skills to the next level with new Oracle AI Agent Studio training and certification

- •

Get certified as an Oracle Database 23ai Administration Professional

Effectiveness:Effective

- Persona:

Line-of-Business Manager (e.g., Head of HR, Head of Supply Chain)

Tailored Messages

- •

Northwell Health taps Oracle Cloud HCM and AI capabilities to support employees

- •

Morrisons supports 100,000-person retail workforce using Oracle Fusion Cloud HCM

- •

Retraced powers supplier lifecycle management on Oracle Autonomous Database 23ai

Effectiveness:Effective

Audience Pain Points Addressed

- •

High cloud infrastructure costs

- •

Administrative overhead and slow processes

- •

Managing complex, disjointed IT systems

- •

Need for better data security and disaster recovery

- •

Skills gaps within technical teams

Audience Aspirations Addressed

- •

Driving business innovation

- •

Achieving better operational efficiency

- •

Unlocking insights from data

- •

Personal career advancement and skill validation

- •

Future-proofing the organization's technology stack

Persuasion Elements

Emotional Appeals

- Appeal Type:

Confidence / Security

Effectiveness:High

Examples

- •

The sheer volume of global brands featured as customer successes.

- •

Messaging around disaster recovery and security.

- •

The authoritative and expert tone of the copy.

- Appeal Type:

Aspiration / Achievement

Effectiveness:Medium

Examples

- •

Join the Race to Certification 2025 to enhance your expertise...

- •

Advance your career by building new skills...

- •

Take your AI skills to the next level...

Social Proof Elements

- Proof Type:

Customer Success Stories

Impact:Strong

Details:The entire 'Customer Successes' page is a massive engine of social proof, with dozens of filterable case studies from global brands.

- Proof Type:

Quantifiable Results

Impact:Strong

Details:Using specific, metric-driven headlines (e.g., 'saves 74%', 'improves development by 3X') provides concrete proof of value.

- Proof Type:

Large User Community

Impact:Moderate

Details:'Connect with over a million like-minded professionals' in the Oracle University Learning Community.

Trust Indicators

- •

Logos of well-known global companies (Morrisons, Northwell Health, SMEG)

- •

Detailed, industry-specific case studies

- •

Emphasis on certifications and learning from 'Oracle product experts'

- •

Formal, professional brand voice

Scarcity Urgency Tactics

The 'Race to Certification 2025' has a time limit ('Now through October 31'), creating urgency for the free certification offer.

Calls To Action

Primary Ctas

- Text:

[Customer Story Headline], Read more

Location:Customer Successes page

Clarity:Clear

- Text:

Join the race

Location:Oracle University page (Free Certification banner)

Clarity:Clear

- Text:

Get started

Location:Oracle University page (AI Agent Studio training)

Clarity:Clear

- Text:

Join now

Location:Oracle University page (Learning Community)

Clarity:Clear

The CTAs are highly effective because they are direct, use action-oriented language, and are contextually relevant to the surrounding content. They guide users logically, whether it's to learn more about a specific success story or to begin a training course. The language is unambiguous and sets clear expectations for the user's next step.

Messaging Gaps Analysis

Critical Gaps

Simplicity and Ease of Onboarding: Oracle's reputation for complexity is not proactively addressed. The messaging focuses on the power and comprehensiveness of the solutions, but lacks a strong narrative around how Oracle simplifies IT, reduces complexity, or makes adoption easy for new customers.

Human-Centric Storytelling: The messaging is heavily focused on corporate entities and business outcomes. There is a gap in telling the stories of the individual people—the developers, the managers, the end-users—whose work is improved by Oracle technology.

Contradiction Points

The stated benefit of 'ease of use' in the /customers intro is subtly contradicted by the overwhelming complexity presented in the product filter list, which contains hundreds of specific, technical product names.

Underdeveloped Areas

Mission Statement Integration: The mission 'to help people see data in new ways, discover insights, unlock endless possibilities' is aspirational but not well-integrated into the product and success story messaging, which is more pragmatic and focused on cost and efficiency.

Small and Medium Business (SMB) Messaging: While Oracle serves SMBs (especially through NetSuite), the primary messaging on these pages feels heavily skewed towards large, complex enterprises, potentially alienating smaller businesses.

Messaging Quality

Strengths

- •

Masterful Use of Social Proof: The customer success page is a world-class example of leveraging case studies to build credibility and address specific audience needs.

- •

Effective Audience Segmentation: Messaging is clearly and effectively tailored to different personas, from C-suite executives focused on ROI to developers focused on skills.

- •

Strong Link to Business Outcomes: Messaging consistently connects technology features to measurable business results like cost savings, efficiency gains, and faster processing times.

- •

Strategic Alignment: The emphasis on AI and OCI in training and success stories directly supports Oracle's strategic business goals of competing and winning in the cloud market.

Weaknesses

- •

Overly Corporate and Impersonal Tone: The voice, while professional, lacks warmth and emotion, which can make the brand feel distant and purely transactional.

- •

Information Overload: The sheer breadth of products and industries can be overwhelming for a visitor trying to get a simple understanding of Oracle's core value.

- •

Relies on Jargon: The messaging assumes a high level of technical and business knowledge from the audience, which could be a barrier for some.

Opportunities

- •

Create a 'Simplicity' Narrative: Develop a messaging track focused on how Oracle's integrated stack reduces complexity and total cost of ownership, directly countering market perceptions.

- •

Humanize the Brand: Feature more video testimonials and stories that focus on the personal impact on employees and customers, not just the corporate impact.

- •

Elevate the 'Possibilities' Narrative: Create a campaign that shows, rather than just tells, how Oracle helps customers 'unlock endless possibilities,' connecting back to the core mission statement.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition Communication

Recommendation:Develop and integrate a clear messaging pillar around 'Integrated Simplicity.' This involves creating content (blogs, whitepapers, videos) that explicitly explains how Oracle's end-to-end stack reduces vendor management complexity, streamlines processes, and lowers TCO.

Expected Impact:High

- Area:

Brand Storytelling

Recommendation:Launch a content series focusing on the 'Innovators at Oracle Customers.' Instead of a case study about a company, tell the story of a specific developer, HR manager, or scientist who used Oracle tools to achieve a breakthrough.

Expected Impact:High

- Area:

Audience Engagement

Recommendation:Create interactive 'Solution Finder' tools. Instead of forcing users to navigate complex filter menus, guide them with a few simple questions (e.g., 'What is your industry?', 'What is your primary goal?') to surface the most relevant success stories and product information.

Expected Impact:Medium

Quick Wins

- •

On the Customer Success page, add a visually distinct section at the top that highlights 3-4 of the most compelling customer quotes with headshots, adding a human touch.

- •

On the Oracle University page, add a sub-headline under 'Free certification' that says 'Validate your skills and advance your career in high-demand areas like AI and Cloud.' to make the personal benefit more explicit.

- •

Create short (under 60 seconds) video summaries of the top 5 customer success stories for social media and for embedding on the page.

Long Term Recommendations

- •

Conduct a comprehensive brand voice and messaging refresh to inject more warmth and humanity into the copy, moving from purely 'Authoritative' to 'Authoritative and Approachable.'

- •

Develop a distinct messaging strategy for the SMB segment that feels less enterprise-focused and highlights the specific benefits of solutions like NetSuite for growing businesses.

- •

Invest in a brand-level advertising campaign that brings the mission statement to life through emotional, story-driven narratives about 'unlocking endless possibilities,' moving beyond purely product- and feature-focused marketing.

Oracle's strategic messaging is that of a confident, established, and highly competent enterprise technology leader aggressively pivoting to a cloud-first world. The core strength lies in its masterful and extensive use of social proof, leveraging an impressive roster of global clients to deliver powerful, metric-driven evidence of its value proposition. The messaging is exceptionally well-segmented, speaking directly to the distinct needs and motivations of C-suite executives, IT professionals, and line-of-business managers. The communication strategy for Oracle University is a key pillar, effectively creating an ecosystem and driving adoption of strategic products like OCI and AI by lowering the barrier to entry with free certifications.

However, the messaging is not without its weaknesses. It heavily reinforces Oracle's image as a complex, corporate behemoth. The tone is professional and authoritative but lacks warmth and a human element, potentially making the brand feel impersonal and distant. While it effectively communicates power and comprehensiveness, it fails to proactively address the market's perception of Oracle as complicated and difficult to adopt. The primary opportunity for optimization is to build a parallel narrative around 'integrated simplicity'—demonstrating how its comprehensive stack can actually reduce complexity for customers. Humanizing the brand by shifting from purely corporate success stories to highlighting the individuals behind those successes would add a much-needed emotional layer and better connect with the aspirational part of its mission statement.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Extensive customer success story library across dozens of industries (Automotive, Finance, Healthcare, Government, etc.) and global regions, demonstrating broad market adoption.

- •

Comprehensive product suite including Oracle Cloud Infrastructure (OCI), Fusion Cloud Applications (ERP, HCM, SCM), and NetSuite, catering to a wide range of business needs and sizes.

- •

Strong financial performance, particularly in cloud services, with Cloud Infrastructure (IaaS) revenue growing 45% and total cloud services revenue up 21% in Q1 FY2025.

- •

High Remaining Performance Obligations (RPO) of $99 billion, up 53% year-over-year, indicating strong future revenue commitments from customers.

- •

Successful penetration into specific high-growth verticals, such as the major acquisition of Cerner to deepen presence in healthcare IT.

Improvement Areas

- •

Overcoming the market perception of being a legacy, on-premises database company to attract more cloud-native businesses and developers.

- •

Simplifying licensing and pricing models to reduce friction for new customer adoption and compete with more flexible pay-as-you-go models from competitors.

- •

Enhancing the developer ecosystem and open-source community engagement to increase adoption among startups and tech-forward companies.

Market Dynamics

The global cloud computing market is projected to grow from ~$738 billion in 2025 to ~$1.6 trillion by 2030, a CAGR of ~17.2%. Other estimates suggest a CAGR of 12-21%.

Mature

Market Trends

- Trend:

Pervasive AI Integration

Business Impact:Massive demand for AI/ML infrastructure and AI-embedded enterprise applications is Oracle's primary growth driver. Their strategy to embed GenAI into Fusion Applications and offer high-performance OCI for AI model training directly addresses this.

- Trend:

Multi-Cloud and Hybrid Cloud Adoption

Business Impact:Enterprises are avoiding vendor lock-in by using multiple cloud providers. Oracle's strategic partnerships with Microsoft Azure and AWS to allow seamless integration of Oracle Database services are critical for capturing this market segment.

- Trend:

Industry-Specific Cloud Solutions

Business Impact:Demand for tailored solutions for verticals like healthcare, finance, and retail is increasing. Oracle's acquisition of Cerner and its broad portfolio of industry applications position it well to capitalize on this trend.

- Trend:

Data Sovereignty and Compliance

Business Impact:Growing regulations require data to be stored in specific geographic locations. Oracle's ongoing global expansion of data centers is essential to meet these requirements for enterprise and government clients.

Excellent. The surge in demand for generative AI has created a massive new wave of demand for high-performance cloud infrastructure, playing directly to Oracle's strengths and revitalizing its growth trajectory.

Business Model Scalability

High

High fixed costs associated with global data center infrastructure ($25B+ in projected capex for FY26) but very low variable costs for delivering software and cloud services to each additional customer.

High. As cloud revenue grows, the recurring, high-margin nature of the business (Cloud services and license support is 77% of revenue) is expected to drive significant profit margin expansion.

Scalability Constraints

- •

Massive capital expenditure required to build and equip data centers to compete with hyperscalers.

- •

Supply chain for high-demand components like NVIDIA GPUs can be a bottleneck for AI infrastructure expansion.

- •

Complexity of integrating large acquisitions like Cerner, which can delay revenue synergies and create operational drag.

Team Readiness

Very Strong. Experienced leadership team that has successfully navigated a massive strategic pivot from on-premise software to a cloud-first model.

Mature, but complex. The organization is a massive global enterprise structured by product lines and geography. The key challenge is maintaining agility and a unified go-to-market strategy, especially when integrating large acquisitions.

Key Capability Gaps

- •

Developer Relations and Open-Source Advocacy to build credibility with cloud-native communities.

- •

User Experience (UX) Design for enterprise applications, which often lag behind consumer-grade experiences.

- •

Agile Product Management practices to accelerate innovation cycles and respond to nimble, cloud-native competitors.

Growth Engine

Acquisition Channels

- Channel:

Direct Enterprise Sales

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip the sales force with specific training on selling AI-driven business outcomes rather than just technical features. Focus on migrating the massive existing on-premise customer base to OCI and Fusion Applications.

- Channel:

Strategic Partnerships (e.g., Microsoft, AWS, Google, NVIDIA)

Effectiveness:High

Optimization Potential:High

Recommendation:Deepen the technical and go-to-market integration with Microsoft Azure to make 'Oracle Database@Azure' a default choice for Azure customers. Expand partnerships with other hyperscalers and key AI players.

- Channel:

Partner Network (System Integrators & ISVs)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Incentivize partners to build and market industry-specific solutions on OCI. Streamline the ISV onboarding process for the Oracle Cloud Marketplace to foster a richer application ecosystem.

- Channel:

Digital Marketing & Content

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest in content marketing that showcases OCI's price-performance advantages and AI capabilities, targeting technical decision-makers and developers who may have a negative legacy perception of Oracle.

Customer Journey

Dominated by a high-touch, long-cycle enterprise sales process involving RFPs, demos, and extensive negotiations. A secondary, lower-touch path exists for OCI's free tier and pay-as-you-go services.

Friction Points

- •

Complex and often opaque pricing and licensing structures can deter new customers and complicate the sales process.

- •

Perceived difficulty of migrating complex, legacy Oracle databases to the cloud.

- •

User adoption challenges for complex new systems like Oracle Cloud ERP post-implementation.

Journey Enhancement Priorities

{'area': 'Onboarding & Training', 'recommendation': "Leverage Oracle University more aggressively as a sales and adoption tool. The free certification campaigns are a strong start; expand guided learning paths ('Oracle Guided Learning') to simplify initial user experience and accelerate time-to-value."}

{'area': 'Migration Services', 'recommendation': 'Develop and prominently market automated tools and expert professional services to de-risk and simplify the migration of on-premise databases to OCI and Autonomous Database.'}

Retention Mechanisms

- Mechanism:

High Switching Costs & Vendor Lock-in

Effectiveness:High

Improvement Opportunity:Data and application integration are naturally sticky. Oracle can deepen this by ensuring its Fusion applications (ERP, HCM) are best-in-class when run on OCI, creating a powerful performance incentive to stay within the ecosystem.

- Mechanism:

Ecosystem & Training (Oracle University)

Effectiveness:High

Improvement Opportunity:Create a virtuous cycle where Oracle-certified professionals prefer to work with Oracle products, increasing the talent pool for customers and further embedding Oracle technology within the enterprise workforce. The 'Oracle University Learning Community' is key to fostering this.

- Mechanism:

Expansion Revenue (Cross-sell/Up-sell)

Effectiveness:High

Improvement Opportunity:Systematically target the existing database and on-premise application customer base for migration to OCI. Use the introduction of AI features in Fusion Apps as a compelling event to drive upgrades and adoption of new modules.

- Mechanism:

Long-term contracts (RPO)

Effectiveness:High

Improvement Opportunity:Continue to secure multi-year cloud contracts, as evidenced by the rapidly growing $99B+ RPO, which provides significant revenue predictability and stability.

Revenue Economics

Highly Favorable. The shift to cloud subscription models provides high-margin, recurring revenue. The primary challenge is the high upfront capital expenditure for data centers, but once built, the incremental margin on each new cloud customer is very high.

Indeterminate externally, but expected to be very high for enterprise customers due to long contract durations, high switching costs, and significant expansion revenue opportunities.

Strong. Operating cash flow was $20.8 billion for fiscal year 2025, up 12%, demonstrating strong profitability and cash generation from the business model.

Optimization Recommendations

- •

Focus sales efforts on driving cloud consumption (IaaS) and adding new SaaS modules to the large, existing customer base, as this is the most capital-efficient path to growth.

- •

Optimize data center utilization and energy efficiency to manage the high fixed costs of the cloud infrastructure business.

- •

Continue shifting the revenue mix towards cloud services and away from lower-margin hardware and services to improve overall corporate profitability.

Scale Barriers

Technical Limitations

- Limitation:

Integration of Heterogeneous Acquired Technologies

Impact:High

Solution Approach:Aggressively re-platform acquired technologies (like Cerner) onto OCI and the Fusion middleware stack. This is a multi-year effort but is critical for creating a seamless user experience and achieving cost synergies.

Operational Bottlenecks

- Bottleneck:

Data Center Provisioning and GPU Supply

Growth Impact:Ability to meet the surging demand for AI training infrastructure is constrained by the speed of data center construction and the global supply of GPUs.

Resolution Strategy:Continue strategic partnerships and large-scale purchase agreements with key suppliers like NVIDIA. Employ hybrid build/lease data center strategies to accelerate capacity expansion.

- Bottleneck:

Complex Enterprise Sales and Contracting Cycles

Growth Impact:Long sales cycles can slow revenue growth, particularly when competing against more self-service-oriented cloud providers.

Resolution Strategy:Streamline contracting for standard cloud services. Empower field sales with more flexible pricing and bundling options to accelerate deal closure.

Market Penetration Challenges

- Challenge:

Intense Competition from Hyperscalers (AWS, Azure, GCP)

Severity:Critical

Mitigation Strategy:Focus on a differentiated strategy: 1) Superior price-performance for specific workloads (Database, AI). 2) Multi-cloud strategy via partnerships to meet customers where they are. 3) Leverage the massive existing on-premise customer base as a captive market for cloud migration.

- Challenge:

Legacy Brand Perception

Severity:Major

Mitigation Strategy:Aggressive marketing and rebranding efforts, such as renaming the main conference from 'CloudWorld' to 'AI World', to shift market perception. Emphasize marquee customer wins (e.g., OpenAI, xAI) to build credibility as a leading AI infrastructure provider.

- Challenge:

Smaller Developer and Startup Ecosystem

Severity:Major

Mitigation Strategy:Invest heavily in developer advocacy programs, free tiers, and startup credits. Simplify OCI tooling and APIs to be more intuitive for developers accustomed to other cloud platforms.

Resource Limitations

Talent Gaps

- •

Cloud-Native and AI/ML Engineering Talent to accelerate product innovation.

- •

Developer Relations and Community Managers to build a grassroots ecosystem.

- •

User Experience (UX) and Product Design experts for enterprise software.

Extremely high and ongoing. Requires tens of billions in annual capital expenditures for data center construction to compete at scale.

Infrastructure Needs

Continued rapid global expansion of cloud regions and data centers to improve performance, meet data sovereignty laws, and support AI workloads.

Investment in next-generation interconnects and networking to support distributed AI and multi-cloud architectures.

Growth Opportunities

Market Expansion

- Expansion Vector:

Leveraging Multi-Cloud as a Trojan Horse

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Aggressively expand the 'Oracle Database@Azure' and '@AWS' offerings. Use the best-in-class database as a wedge to land within competitor clouds, then expand by showcasing the performance and cost benefits of moving adjacent workloads to OCI.

- Expansion Vector:

Targeting the Public Sector and Regulated Industries

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Invest in achieving government and industry-specific certifications (e.g., FedRAMP, HIPAA). Develop sovereign cloud offerings that guarantee data residency and isolation to win large government and defense contracts.

Product Opportunities