eScore

oreillyauto.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

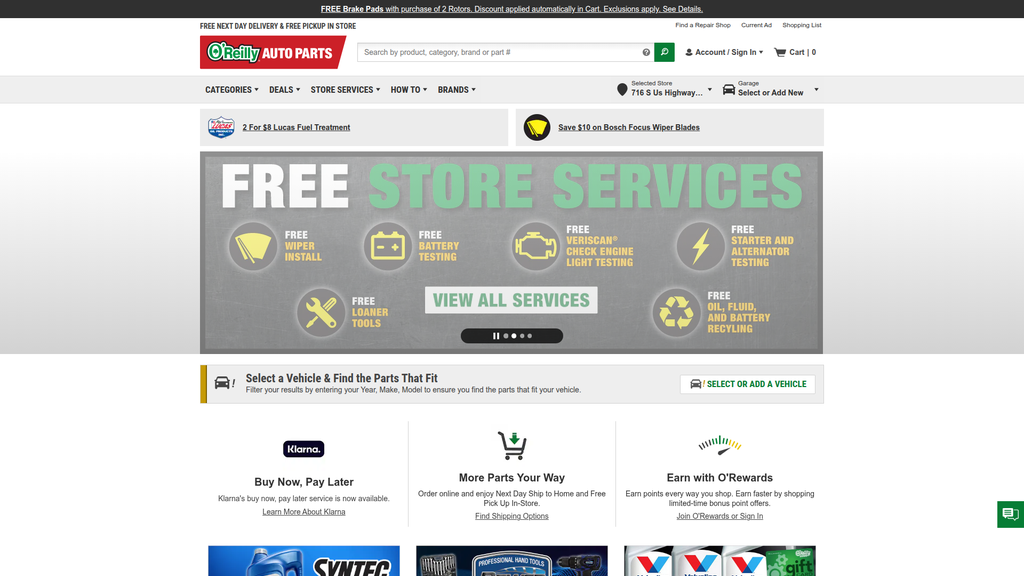

O'Reilly's digital presence excels at capturing bottom-of-funnel, high-intent customers through strong local SEO that leverages its vast store network for in-store pickup. The website's primary function—finding specific parts for a vehicle—is clear and effective. However, the overall digital strategy suffers from a significant lack of top-of-funnel content; it fails to engage users in the awareness and consideration phases of their repair journey, ceding thought leadership to competitors. While functional, the dated website design and high visual clutter create a suboptimal user experience compared to modern e-commerce leaders.

Excellent integration of their extensive physical store network into their digital presence, creating a powerful omnichannel 'clicks-to-bricks' advantage for local product searches and immediate pickup.

Develop a comprehensive 'DIY & Pro University' content hub with how-to videos and repair guides to capture top-of-funnel search traffic, shifting brand perception from just a seller to a trusted advisor.

The brand's messaging is exceptionally consistent and clear in communicating its core value proposition of price, promotions, and parts availability. This transactional focus is effective for a price-sensitive DIY audience but fails to build a deeper brand narrative or emotional connection. The key brand differentiator—the expertise of its 'Professional Parts People'—is a tertiary message that is stated but not substantiated with content, leaving a significant gap in communicating its unique value. Consequently, the brand risks commoditization against competitors who also focus heavily on price.

Unwavering clarity and consistency in promotional messaging, effectively driving transactional behavior through direct calls-to-action for deals, discounts, and loyalty program sign-ups.

Elevate the 'Professional Parts People' narrative from a tagline to a core brand pillar by creating content (expert bios, tech tips, video guides) that demonstrates and proves this expertise, differentiating the brand beyond price.

The conversion path for the primary user task—finding a specific part via the vehicle selector—is well-defined and functional. However, the overall user experience is significantly hampered by high visual clutter, a dated UI, and a flat visual hierarchy that creates cognitive overload for users. These friction points, particularly on mobile where excessive scrolling is required, detract from a seamless journey. The lack of modern persuasive elements like integrated customer reviews or dynamic personalization further weakens the conversion funnel.

The prominence and clarity of the vehicle selector tool effectively address the user's primary need, guiding them quickly to a relevant product set.

Modernize the UI to reduce visual clutter and implement a clear visual hierarchy for calls-to-action. Consolidate competing promotions into cleaner, more organized modules to decrease cognitive load and improve focus on the conversion path.

O'Reilly's credibility is built on its long-standing brand reputation, extensive physical presence of over 6,400 stores, and clear warranty policies. However, its digital credibility is undermined by significant compliance gaps, including the lack of an easily accessible, comprehensive Terms of Service for the main e-commerce site and no visible cookie consent banner. While the company has a detailed privacy policy, the absence of other foundational trust signals like an accessibility statement and integrated customer reviews on product pages creates unmanaged risk and weakens user trust.

A strong brand reputation built over decades, reinforced by a massive physical store footprint that provides a tangible sense of stability and reliability for customers.

Immediately implement a comprehensive 'Terms of Service' for the e-commerce site and deploy a robust cookie consent banner to mitigate high-severity legal risks and align with digital best practices.

O'Reilly's competitive moat is exceptionally strong and sustainable, built on two hard-to-replicate pillars: a highly efficient hub-and-spoke distribution network and a balanced dual-market strategy serving both DIY and professional customers. This logistical prowess ensures superior parts availability—a critical factor for professional clients—while the dual-market approach maximizes asset utilization. While facing threats from online price competition and the long-term EV transition, the combination of its physical footprint and supply chain excellence creates a formidable barrier to entry.

A sophisticated, tiered supply chain and distribution network that provides industry-leading parts availability, which is a decisive competitive advantage, particularly in the time-sensitive professional (DIFM) market.

Proactively invest in building out a comprehensive EV parts catalog and associated training for staff to translate its current distribution dominance into the next generation of automotive technology, mitigating the long-term transition risk.

The business model is highly scalable, demonstrated by a consistent history of profitable growth and new store openings year after year. Strong unit economics, fueled by immense purchasing power and high gross margins, support a self-funding expansion strategy. The company is actively expanding its distribution network to support further growth in untapped domestic and international markets (Mexico, Canada). The primary constraints are the eventual saturation of the domestic market and the need for significant capital investment to modernize its technology stack for digital-first competition.

A proven, repeatable model for organic store growth and market expansion, supported by a powerful and continuously expanding distribution infrastructure.

Accelerate investment in a modern B2B e-commerce platform and a unified Customer Data Platform (CDP) to improve digital scalability and unlock more efficient growth within the high-value professional customer segment.

O'Reilly's business model is remarkably coherent and effective, with a clear focus on its dual-market strategy that aligns its cost structure, key activities, and value proposition. The strategic decision to serve both DIY and professional customers from the same infrastructure is a masterclass in operational leverage and risk mitigation. The model's only significant incoherence is the disconnect between its deeply ingrained culture of expertise (the 'Professional Parts People') and its current digital marketing, which almost exclusively emphasizes price over knowledge.

The highly synergistic dual-market strategy serving both DIY and DIFM customers, which maximizes store and supply chain efficiency and creates a balanced and resilient revenue model.

Align the digital brand messaging with the core business culture by investing in content and tools that showcase expertise, ensuring the value proposition is consistent across both physical and digital channels.

As one of the top two players in the U.S. automotive aftermarket, O'Reilly exercises significant market power. Its massive scale provides substantial leverage over suppliers, contributing to strong margins. The company has demonstrated consistent market share gains in both the DIY and professional segments, showcasing a clear growth trajectory. While intense competition limits absolute pricing power, its operational excellence and superior parts availability allow it to command loyalty beyond just price, particularly in the professional market where speed is paramount.

Sustained ability to gain market share from smaller independents and national rivals through superior execution of its dual-market strategy and supply chain excellence.

Develop a dedicated digital ecosystem for professional customers to create higher switching costs, further solidifying its market power and defending against digital-first competitors in this lucrative segment.

Business Overview

Business Classification

Omnichannel Retail

B2B Distribution

Automotive Aftermarket

Sub Verticals

- •

Automotive Parts & Accessories

- •

Do-It-Yourself (DIY) Auto Repair

- •

Professional Installer Supply (DIFM)

Mature

Maturity Indicators

- •

Consistent annual comparable store sales growth (32 consecutive years).

- •

Extensive physical footprint with over 6,400 stores across North America.

- •

Well-established, sophisticated hub-and-spoke distribution network.

- •

Strong brand recognition and established customer loyalty programs.

- •

Publicly traded company with a multi-billion dollar market capitalization.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Do-It-Yourself (DIY) Retail Sales

Description:Sales of automotive parts, tools, and accessories directly to individual consumers through both physical stores and the e-commerce website for personal vehicle maintenance and repair. This segment accounted for approximately 52% of sales in 2024.

Estimated Importance:Primary

Customer Segment:DIY Enthusiast / Everyday Car Owner

Estimated Margin:High

- Stream Name:

Professional Installer (DIFM) Commercial Sales

Description:Sales to professional service providers, such as independent repair shops, service stations, and fleet operators. This includes dedicated services, delivery, and a specialized B2B e-commerce platform (OReillyPro.com). This segment represented about 48% of 2024 sales.

Estimated Importance:Primary

Customer Segment:Professional Mechanic (DIFM)

Estimated Margin:Medium

Recurring Revenue Components

O'Rewards Loyalty Program (drives recurring customer behavior, not direct subscription revenue)

Repeat business from professional installer accounts (implicit recurring revenue)

Pricing Strategy

Competitive & Value-Based Pricing

Mid-range

Transparent

Pricing Psychology

- •

Promotional Pricing (e.g., '2 for $8')

- •

Bundling (e.g., 'Synthetic Oil and Filter Bundle')

- •

Rebates and Gift Card Offers

- •

Loyalty-Based Discounts (O'Rewards)

Monetization Assessment

Strengths

- •

Balanced 'dual-market' strategy mitigates risk and captures a wider market.

- •

Strong private-label product sales, which typically offer higher margins.

- •

Effective promotional cadence drives store traffic and online engagement.

- •

Omnichannel model with in-store pickup captures both online convenience and in-store upsell opportunities.

Weaknesses

- •

High operational costs associated with maintaining a large physical store network compared to online-only rivals.

- •

Margin pressure from frequent promotions and competitive pricing environment.

- •

Dependence on internal combustion engine (ICE) vehicle parts, which are declining in the long term.

Opportunities

- •

Expand product offerings and training for Electric Vehicle (EV) components.

- •

Further international expansion into fragmented markets.

- •

Enhance B2B service offerings to deepen relationships with professional installers (e.g., shop management software integration).

- •

Leverage customer data from O'Rewards for personalized marketing and predictive inventory management.

Threats

- •

Long-term decline in demand for traditional ICE parts due to EV adoption.

- •

Intense competition from AutoZone, Advance Auto Parts, and online retailers like Amazon and RockAuto.

- •

Increasing vehicle complexity (e.g., ADAS) may discourage DIY repairs.

- •

Potential supply chain disruptions and tariff impacts.

Market Positioning

A leading omnichannel provider known for superior product availability, knowledgeable staff ('Professional Parts People'), and a balanced focus on both DIY and professional customers.

Market Leader (Top 2-3 in the U.S. automotive aftermarket).

Target Segments

- Segment Name:

Do-It-Yourself (DIY) Enthusiast

Description:Individuals who perform their own vehicle maintenance and repairs, ranging from basic tasks to complex projects. They are often knowledgeable but may seek advice from store staff.

Demographic Factors

- •

Typically male, though this is broadening

- •

Wide age range, but often 25-60

- •

Middle-income households

Psychographic Factors

- •

Value self-reliance and cost savings

- •

Enjoy hands-on work and problem-solving

- •

Take pride in vehicle ownership and maintenance

Behavioral Factors

- •

Purchases driven by specific repair needs or routine maintenance schedules

- •

Researches products and 'how-to' guides online

- •

Responsive to promotions and loyalty programs

Pain Points

- •

Incorrectly diagnosing a vehicle problem

- •

Getting the wrong part for their specific vehicle

- •

Lacking a specific tool to complete a job

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Professional Mechanic (DIFM)

Description:Owners and technicians at independent auto repair shops, dealerships, and fleet service centers who service vehicles for customers.

Demographic Factors

Vocationally trained and certified professionals

Primarily small-to-medium business owners

Psychographic Factors

Highly focused on efficiency and minimizing vehicle bay downtime

Builds business on trust and reliability

Behavioral Factors

- •

Requires immediate or same-day access to a wide range of parts.

- •

Values relationships with knowledgeable parts suppliers

- •

Loyal to suppliers who provide fast delivery, accurate orders, and easy returns.

Pain Points

- •

Parts unavailability leading to repair delays and lost revenue

- •

Receiving incorrect or low-quality parts

- •

Inefficient ordering and credit processes

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Everyday Car Owner

Description:Vehicle owners with limited mechanical knowledge who purchase basic maintenance and appearance items like wiper blades, fluids, and car wash supplies.

Demographic Factors

Broad demographic, representative of all car owners

Psychographic Factors

- •

Seeks convenience and value

- •

Not typically interested in performing complex repairs

- •

Relies on expert advice for product selection

Behavioral Factors

Makes impulse or needs-based purchases

Highly values free in-store services like battery testing or wiper blade installation

Pain Points

Uncertainty about which product to buy (e.g., type of oil)

Difficulty with simple installations (e.g., changing a headlight bulb)

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Dual-Market Strategy

Strength:Strong

Sustainability:Sustainable

- Factor:

Supply Chain & Logistics

Strength:Strong

Sustainability:Sustainable

- Factor:

Knowledgeable Staff ('Professional Parts People')

Strength:Moderate

Sustainability:Sustainable

- Factor:

Extensive Store Network

Strength:Strong

Sustainability:Sustainable

Value Proposition

Providing professional mechanics and DIY customers with immediate access to a comprehensive selection of trusted auto parts, expert advice, and convenient omnichannel service at competitive prices.

Excellent

Key Benefits

- Benefit:

Product Availability & Selection

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Vast inventory in stores, hub stores, and distribution centers.

Online tool to check local store inventory

- Benefit:

Convenience & Speed

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Free in-store pickup for online orders ('More Parts Your Way')

- •

Extensive network of over 6,400 stores for easy access.

- •

Same-day delivery for professional customers

- Benefit:

Expertise & Service

Importance:Important

Differentiation:Unique

Proof Elements

Branding of 'Professional Parts People'.

Free in-store services (battery testing, wiper installation, etc.)

- Benefit:

Value & Savings

Importance:Important

Differentiation:Common

Proof Elements

- •

Frequent promotions, coupons, and rebates

- •

O'Rewards loyalty program

- •

Competitive pricing strategy

Unique Selling Points

- Usp:

Highly effective dual-market model serving DIY and DIFM from the same infrastructure, maximizing asset utilization.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A sophisticated hub-and-spoke distribution network that enables superior parts availability and speed, crucial for the professional segment.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A deeply ingrained company culture focused on customer service and technical proficiency, creating a key differentiator in a technical sales environment.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Urgent need for a specific auto part to complete a repair and get a vehicle back on the road.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Uncertainty about which part is correct for a specific vehicle make and model.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Lack of specialized tools or knowledge to diagnose or fix a vehicle issue.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition directly addresses the core market needs of availability, speed, and expertise for both DIY and professional segments.

High

The company effectively tailors its services and marketing to the distinct pain points of DIYers (cost, advice) and professionals (speed, availability).

Strategic Assessment

Business Model Canvas

Key Partners

- •

Automotive Parts Manufacturers (e.g., Bosch, Valvoline, Sylvania)

- •

Logistics & Freight Carriers

- •

Professional Installer Networks (e.g., Certified Auto Repair program).

- •

Financial Service Providers (e.g., Klarna)

Key Activities

- •

Inventory Management & Supply Chain Logistics

- •

Retail Store Operations

- •

E-commerce Platform Management

- •

Commercial Sales & B2B Relationship Management

- •

Marketing & Promotions

Key Resources

- •

Extensive Network of Physical Stores & Distribution Centers.

- •

Large and Diverse Inventory (SKUs)

- •

Trained & Knowledgeable Employees ('Professional Parts People').

- •

Strong Brand Reputation & Customer Loyalty.

- •

Proprietary B2B E-commerce Platform (OReillyPro.com)

Cost Structure

- •

Cost of Goods Sold (Inventory Purchase)

- •

Employee Salaries & Benefits

- •

Real Estate Leases & Store Operating Costs

- •

Logistics, Warehousing & Transportation

- •

Marketing & Advertising Expenses

Swot Analysis

Strengths

- •

Market-leading dual-segment (DIY/DIFM) strategy.

- •

Highly efficient hub-and-spoke supply chain ensuring parts availability.

- •

Massive physical store footprint creates a powerful competitive moat.

- •

Strong brand reputation and a culture of customer service.

- •

Consistent financial performance and history of growth.

Weaknesses

- •

High overhead costs of physical retail infrastructure.

- •

Potential for inconsistent customer service experiences across thousands of stores.

- •

Slower to adapt to digital-native consumer trends compared to online-only players.

Opportunities

- •

Capitalize on the growing demand for EV aftermarket parts and services.

- •

Expand international presence, especially in Mexico and Canada.

- •

Further develop high-margin private label product lines.

- •

Enhance data analytics to personalize customer experiences and optimize inventory.

- •

Grow professional services through partnerships and technology integration.

Threats

- •

The long-term transition to EVs, which have fewer traditional replacement parts.

- •

Intense competition from national chains (AutoZone, Advance Auto Parts) and e-commerce giants (Amazon, RockAuto).

- •

Increasing complexity of modern vehicles, potentially reducing the scope of DIY repairs.

- •

Economic downturns impacting consumer discretionary spending on non-essential repairs.

- •

Consolidation among parts suppliers could increase purchasing costs.

Recommendations

Priority Improvements

- Area:

Digital Customer Experience

Recommendation:Invest in enriching the online platform with advanced technical resources, including interactive diagrams, vehicle-specific repair guides, and integrated video tutorials to better support complex DIY projects.

Expected Impact:Medium

- Area:

Professional Services Technology

Recommendation:Deepen integration with popular Shop Management Systems (SMS) used by professional mechanics to streamline their parts ordering process directly from within their workflow, increasing loyalty and order volume.

Expected Impact:High

- Area:

Data Utilization

Recommendation:Leverage O'Rewards data to create highly personalized promotions and predictive product recommendations based on a customer's vehicle and past purchase history, moving beyond generic offers.

Expected Impact:Medium

Business Model Innovation

- •

Develop a dedicated EV & Advanced Diagnostics service tier within stores, offering specialized tools, parts, and certified expertise for hire, turning a threat into a new revenue stream.

- •

Pilot a subscription model for routine maintenance kits (e.g., 'Annual Oil Change & Filter Box') tailored to a customer's vehicle, creating predictable, recurring revenue.

- •

Form strategic partnerships with mobile mechanic services, using O'Reilly stores as dispatch hubs for parts, thereby creating a new 'Do-It-For-Me-At-Home' service ecosystem.

Revenue Diversification

- •

Expand into adjacent vehicle markets with greater velocity, such as parts and accessories for powersports (ATVs, UTVs), marine, and recreational vehicles.

- •

Offer paid, in-depth diagnostic services and tool rental programs for highly specialized or expensive equipment that DIYers and small shops cannot afford to purchase.

- •

Monetize in-store expertise by offering paid, hands-on training workshops for common DIY repairs (e.g., brake jobs, sensor replacements).

O'Reilly Auto Parts has a robust, mature, and highly defensible business model, built upon a best-in-class dual-market strategy and a formidable omnichannel infrastructure. The company's core strengths—its extensive physical footprint, sophisticated supply chain, and culture of employee expertise—create a significant competitive moat that is difficult for both online-only and traditional competitors to replicate. The balanced revenue from DIY and professional (DIFM) customers provides stability and maximizes the utility of its assets.

The primary strategic challenge facing O'Reilly is the long-term technological shift in the automotive industry, specifically the transition to electric vehicles (EVs). EVs have fundamentally different maintenance needs and fewer traditional replacement parts, posing a direct threat to the company's core revenue streams. Future success will be contingent on the ability to evolve its business model from a traditional parts supplier to a comprehensive solutions provider for next-generation vehicles.

Strategic evolution should focus on three key pillars: 1) Proactively investing in EV-specific inventory, technician training, and diagnostic equipment to become a leader in the EV aftermarket. 2) Deepening the integration with the professional installer market through enhanced technology and value-added services, solidifying its position as an indispensable partner to repair shops. 3) Leveraging its vast customer data to personalize the retail experience and drive loyalty in an increasingly competitive market. By embracing these strategic shifts, O'Reilly can navigate the industry's transformation and sustain its market leadership position for the long term.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Extensive Physical Store Network

Impact:High

- Barrier:

Complex Supply Chain & Logistics

Impact:High

- Barrier:

Brand Recognition & Trust

Impact:High

- Barrier:

Capital Investment for Inventory

Impact:High

- Barrier:

Relationships with Professional Installers (DIFM)

Impact:Medium

Industry Trends

- Trend:

Vehicle Electrification (EVs)

Impact On Business:Long-term threat to traditional parts (e.g., engine, exhaust) but creates new opportunities in EV-specific components (batteries, cooling systems). Requires investment in new inventory and technician training.

Timeline:Long-term

- Trend:

Growth of E-commerce

Impact On Business:Increases competition from online-only players like Amazon and RockAuto. Requires significant investment in digital user experience, fast delivery, and omnichannel services like 'Buy Online, Pick-up In-Store'.

Timeline:Immediate

- Trend:

Increasing Vehicle Complexity (ADAS, etc.)

Impact On Business:Drives more consumers from DIY to DIFM (Do-It-For-Me) due to the need for specialized tools and knowledge. Strengthens the importance of the professional customer segment.

Timeline:Near-term

- Trend:

Aging Vehicle Fleet

Impact On Business:Positive driver for the aftermarket. Older cars are typically out of warranty and require more repairs and maintenance, increasing demand for parts for both DIY and DIFM segments.

Timeline:Immediate

- Trend:

Right to Repair Movement

Impact On Business:Potential long-term benefit, ensuring independent repair shops and DIYers have access to necessary parts, tools, and information, thereby sustaining the customer base.

Timeline:Medium-term

Direct Competitors

- →

AutoZone

Market Share Estimate:Leading market share in terms of store visits (approx. 32-40%).

Target Audience Overlap:High

Diy Vs Difm Focus:Historically strong in DIY, with a growing focus on the professional (DIFM) market.

Competitive Positioning:Positions as the go-to, convenient neighborhood store for DIYers with a strong brand for its private label products (Duralast).

Strengths

- •

Largest store network in the U.S.

- •

Strong brand recognition and customer loyalty, especially in the DIY segment.

- •

Robust private-label brand (Duralast) with a lifetime warranty on many parts.

- •

Effective loyalty program (AutoZone Rewards).

Weaknesses

- •

Some customer reviews suggest a focus on sales over in-depth technical expertise at the store level.

- •

Slightly smaller professional (DIFM) business compared to O'Reilly and NAPA.

- •

Website and online experience have been cited as less user-friendly than some competitors.

Differentiators

- •

Strongest DIY-focused brand identity among the major chains.

- •

Aggressive marketing and high brand visibility.

- •

Extensive tool loaner program.

- →

Advance Auto Parts

Market Share Estimate:Third largest in terms of store visits (approx. 18%).

Target Audience Overlap:High

Diy Vs Difm Focus:Balanced focus, but historically stronger in the professional (DIFM) segment, bolstered by its acquisition of Carquest.

Competitive Positioning:Positions as a solutions provider for both DIY and professional customers, emphasizing quality parts and expert advice.

Strengths

- •

Strong presence in the professional (DIFM) market through its Carquest brand.

- •

Leads competitors in 'share of wallet' metrics, indicating strong customer loyalty for future visits.

- •

Often runs aggressive online promotions and discounts.

Weaknesses

- •

Lower revenue and fewer stores compared to O'Reilly and AutoZone.

- •

Has faced operational challenges and performance inconsistencies in recent years.

- •

Customer service and website usability have been cited as areas for improvement by some customers.

Differentiators

- •

Owns Worldpac, a leading importer and distributor of original equipment parts for foreign vehicles, giving it an edge in that segment.

- •

Integration of the DieHard battery brand.

- •

Strong focus on professional installers.

- →

NAPA Auto Parts (Genuine Parts Company)

Market Share Estimate:Fourth largest in terms of store visits (approx. 9%).

Target Audience Overlap:Medium

Diy Vs Difm Focus:Primarily focused on the professional (DIFM) market, servicing independent and NAPA-affiliated repair shops.

Competitive Positioning:Positions as the trusted source for high-quality, professional-grade parts, leveraging its long history and association with service centers.

Strengths

- •

Highest-rated for customer trust among major retailers.

- •

Extensive distribution network and strong relationships with professional repair shops.

- •

Perceived as offering higher-quality parts by many industry professionals.

- •

Strong brand equity and a long-standing reputation.

Weaknesses

- •

Less focused on the DIY customer, resulting in a less retail-centric store experience in some locations.

- •

Smaller share of foot traffic compared to the other 'big three'.

- •

Prices can be higher than competitors, reflecting their professional focus.

Differentiators

- •

Franchise model with locally-owned stores, which can foster strong community ties.

- •

Deep integration with the professional service industry via NAPA AutoCare Centers.

- •

Emphasis on 'NAPA Know How' and professional expertise.

- →

RockAuto

Market Share Estimate:Significant online player, but market share is difficult to quantify against brick-and-mortar.

Target Audience Overlap:High

Diy Vs Difm Focus:Almost exclusively focused on price-sensitive DIY customers and independent mechanics who can wait for shipping.

Competitive Positioning:The low-price leader with the most extensive online catalog of parts.

Strengths

- •

Extremely competitive pricing, often significantly lower than physical retailers.

- •

Vast and comprehensive online catalog with multiple brand options for a single part, from economy to OEM.

- •

Lean, online-only business model results in low overhead.

- •

Excellent website functionality for finding specific parts.

Weaknesses

- •

No physical stores for immediate part needs, returns, or in-person advice.

- •

Shipping costs can sometimes offset price advantages, especially for multiple parts from different warehouses.

- •

Customer service and returns can be more challenging to navigate than at a physical store.

- •

No services like tool loans or battery testing.

Differentiators

- •

Pure-play e-commerce model focused on price and selection.

- •

Sourcing from closeouts and liquidations allows for deep discounts.

- •

Minimalist, function-over-form website that is highly effective for its target audience.

Indirect Competitors

- →

Amazon (Amazon Automotive)

Description:A massive online marketplace offering a vast selection of automotive parts and accessories from various sellers, leveraging its Prime delivery network.

Threat Level:High

Potential For Direct Competition:Amazon is already a direct competitor in the online space and its threat is growing. It is aggressively expanding its automotive parts business, gaining market share.

- →

Walmart

Description:Mass-market retailer with a significant physical and online presence, offering common maintenance items, tires, batteries, and basic accessories. Many locations have an attached Auto Care Center.

Threat Level:Medium

Potential For Direct Competition:A strong competitor for common DIY items like oil, wipers, and car care products. Its partnership with Advance Auto Parts for an online specialty store signals a deeper interest in the category.

- →

eBay Motors

Description:An online marketplace for new, used, and remanufactured parts sold by a wide range of sellers, from individuals to large distributors.

Threat Level:Medium

Potential For Direct Competition:A major online competitor, especially for hard-to-find, used, or specialty parts. The marketplace model creates intense price competition.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Dual-Market Strategy (DIY & DIFM)

Sustainability Assessment:O'Reilly has a highly effective and balanced strategy of serving both DIYers and professional installers from the same store and supply chain, maximizing asset utilization.

Competitor Replication Difficulty:Hard

- Advantage:

Efficient Hub-and-Spoke Distribution Network

Sustainability Assessment:A sophisticated logistics network with numerous distribution centers and hub stores ensures high parts availability and rapid delivery to stores and professional customers, a key differentiator for the DIFM segment.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Company Culture and Employee Expertise

Sustainability Assessment:The 'Professional Parts People' culture emphasizes knowledgeable staff, which is crucial for a technical product line and builds trust with both DIY and DIFM customers. This is difficult to replicate at scale.

Competitor Replication Difficulty:Medium

- Advantage:

Expansive and Strategically Located Store Footprint

Sustainability Assessment:With over 6,000 stores, O'Reilly has a massive physical presence that provides convenience and enables omnichannel services, creating a significant barrier to entry for online-only players.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Specific Promotions and Rebates', 'estimated_duration': 'Short-term (weeks to months)'}

{'advantage': "O'Rewards Bonus Point Offers", 'estimated_duration': 'Short-term (cyclical)'}

Disadvantages

- Disadvantage:

Price Competition from Online Retailers

Impact:Major

Addressability:Moderately

- Disadvantage:

Long-Term Threat from EV Transition

Impact:Critical

Addressability:Difficult

- Disadvantage:

Brand Perception Among Younger, Digital-Native DIYers

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted digital marketing campaigns highlighting in-store services (battery testing, tool loans) that online competitors cannot offer.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Enhance the O'Rewards program with personalized offers based on purchase history and vehicle type to increase customer lifetime value.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Optimize the website's mobile user experience for faster part look-up and checkout, reducing friction for on-the-go customers.

Expected Impact:High

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Develop a comprehensive EV parts and accessories catalog, starting with common items like tires, cabin air filters, and charging equipment.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Create in-store and online educational content (videos, guides) for common repairs on both ICE and hybrid/electric vehicles to capture the growing, cost-conscious DIY audience.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Expand digital tools for professional customers, such as integration with shop management systems and enhanced B2B ordering portals.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Invest in training programs to certify store employees as EV parts specialists to maintain a knowledge advantage.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore strategic partnerships with independent EV repair shops or charging network providers to create new service-based revenue streams.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Diversify into adjacent markets that are less susceptible to the EV transition, such as parts for powersports, marine, or heavy-duty vehicles.

Expected Impact:Medium

Implementation Difficulty:Difficult

Solidify O'Reilly's position as the most reliable and knowledgeable omnichannel auto parts supplier for both DIY and professional customers. Leverage the physical store network as a key differentiator against online pure-plays, emphasizing immediate availability, expert advice, and hands-on services.

Differentiate through superior service and operational excellence. This includes having the most knowledgeable staff, the best in-stock availability through the hub-and-spoke system, and the most seamless integration between online and in-store experiences.

Whitespace Opportunities

- Opportunity:

EV Maintenance Kits for DIYers

Competitive Gap:No major competitor currently offers curated kits for common EV maintenance tasks (e.g., brake fluid flush, cabin filter replacement, battery coolant). This targets a new and growing vehicle segment.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Subscription Service for Consumables

Competitive Gap:A subscription model for items like oil, filters, and wiper blades is largely untapped. This would increase recurring revenue and customer loyalty.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Advanced Diagnostics as a Service

Competitive Gap:While basic code reading is offered, there's an opportunity to offer more advanced, paid diagnostic services for complex vehicle systems (like ADAS calibration checks), catering to DIYers who are hitting the limits of their expertise.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Certified Remanufactured EV Components

Competitive Gap:The market for remanufactured EV parts (like battery modules or inverters) is nascent. Establishing an early leadership position in sourcing and certifying these parts could be a major long-term advantage.

Feasibility:Low

Potential Impact:High

O'Reilly Auto Parts operates within a mature, oligopolistic automotive aftermarket industry, a sector projected to reach $435 billion in 2025. The company's primary strength and sustainable competitive advantage lies in its expertly executed dual-market strategy, serving both the Do-It-Yourself (DIY) and Do-It-For-Me (DIFM) professional segments with remarkable balance. This is underpinned by a formidable physical footprint of over 6,000 stores and a highly efficient 'hub-and-spoke' distribution network that competitors find difficult to replicate.

The competitive landscape is dominated by three other major players: AutoZone, Advance Auto Parts, and NAPA. AutoZone is O'Reilly's closest rival, leading in store visits and commanding strong brand loyalty among DIY customers. Advance Auto Parts, while smaller, has a strong foothold in the professional market, and NAPA is the most trusted brand among professional mechanics, albeit with a smaller retail focus. The most significant disruptive threat comes not from these traditional rivals, but from e-commerce. Online-only retailer RockAuto competes aggressively on price and selection, while e-commerce giant Amazon is rapidly gaining market share in the auto parts category, presenting a high-level, long-term threat.

Key industry trends present both opportunities and threats. The aging vehicle fleet in the U.S. provides a consistent tailwind, as older cars require more repairs. However, the accelerating shift to Electric Vehicles (EVs) poses a critical long-term risk. EVs have fewer moving parts and require less traditional maintenance, which will inevitably reduce demand for a significant portion of O'Reilly's current product catalog. Another major trend is the increasing complexity of modern vehicles, which pushes more consumers from the DIY to the DIFM camp, reinforcing the importance of O'Reilly's strong professional business.

O'Reilly's current strategy, as evidenced by its website, focuses on promotions, a loyalty program (O'Rewards), and in-store services to drive traffic and build loyalty. To maintain its market leadership, O'Reilly must leverage its key differentiators—in-person expertise and immediate product availability—against the price and convenience of online competitors. Strategic imperatives include investing in EV-specific inventory and training, enhancing its digital platform for both B2C and B2B customers, and exploring new service-based revenue streams. The key whitespace opportunities lie in catering to the emerging EV aftermarket and creating more sophisticated digital tools and services that bridge the gap between their physical and online presence.

Messaging

Message Architecture

Key Messages

- Message:

Find the right parts for your specific vehicle.

Prominence:Primary

Clarity Score:High

Location:Homepage, top section

- Message:

Save money through specific, time-sensitive deals and promotions.

Prominence:Primary

Clarity Score:High

Location:Homepage (Carousel, banners, product listings), Coupons & Promotions Page

- Message:

Earn rewards and get exclusive offers with the O'Rewards loyalty program.

Prominence:Secondary

Clarity Score:High

Location:Homepage, Coupons & Promotions Page

- Message:

Get your parts conveniently with options like 'Next Day Ship to Home' and 'Free Pick Up In-Store'.

Prominence:Secondary

Clarity Score:High

Location:Homepage ('More Parts Your Way' section)

- Message:

In-store services and expert help are available from 'Parts Professionals'.

Prominence:Tertiary

Clarity Score:Medium

Location:Homepage (bottom section)

The message hierarchy is overwhelmingly focused on transactional and promotional content. The primary message is 'save money on parts now'. While effective for immediate sales, this de-emphasizes higher-level brand messages like expertise, quality, or long-term value. The core function of 'finding the right part' is prominent, but the brand's 'why'—its expertise and service culture—is a tertiary, almost footnote-level message.

Messaging is highly consistent across the homepage and promotions page. Both pages are heavily focused on deals, discounts, and specific product offers. There is no shift in tone or messaging priorities between these sections, creating a uniform, transaction-driven user experience.

Brand Voice

Voice Attributes

- Attribute:

Promotional

Strength:Strong

Examples

- •

2 For $8 Lucas Fuel Treatment

- •

Save $10 on Bosch Focus Wiper Blades

- •

Get a $15 Gift Card

- Attribute:

Direct

Strength:Strong

Examples

- •

Select a Vehicle & Find the Parts That Fit

- •

Shop SYNTEC Full Synthetic Motor Oil

- •

Join O'Rewards

- Attribute:

Transactional

Strength:Strong

Examples

- •

Buy Now, Pay Later

- •

Discount applied automatically in Cart

- •

Must purchase 2 or more for sale price.

- Attribute:

Helpful

Strength:Weak

Examples

Our Parts Professionals are here to Help

Learn More About Our Store Services

Tone Analysis

Urgent & Price-Focused

Secondary Tones

Informational

Action-Oriented

Tone Shifts

The tone briefly shifts from promotional to service-oriented in the 'Store Services' section at the bottom of the homepage, but this is an exception to the dominant transactional tone.

Voice Consistency Rating

Excellent

Consistency Issues

The voice is exceptionally consistent in its focus on promotions and direct calls-to-action. While consistent, this uniformity is a strategic weakness as it lacks personality and fails to build a deeper brand narrative.

Value Proposition Assessment

O'Reilly provides a wide selection of auto parts with numerous opportunities to save money through deals, rewards, and promotions, available for convenient pickup or delivery.

Value Proposition Components

- Component:

Price & Savings

Clarity:Clear

Uniqueness:Common

- Component:

Convenience (Online ordering, in-store pickup, shipping)

Clarity:Clear

Uniqueness:Common

- Component:

Loyalty & Rewards (O'Rewards Program)

Clarity:Clear

Uniqueness:Common

- Component:

Expertise & Service ('Parts Professionals')

Clarity:Unclear

Uniqueness:Somewhat Unique

The website messaging fails to effectively differentiate O'Reilly from its key competitors like AutoZone and Advance Auto Parts, who also heavily promote price, convenience, and loyalty programs. The most unique potential differentiator—the expertise of its 'Professional Parts People'—is the least developed and communicated value proposition on the site. The current messaging creates a commodity perception, positioning the brand primarily on price rather than superior value or expertise.

The messaging positions O'Reilly as a price-competitive, mass-market retailer. It is a direct competitor for the deal-seeking DIY customer but does little to establish a premium or expert positioning that would appeal to customers willing to pay for guaranteed quality, advice, and service. This price-first strategy risks a race-to-the-bottom and erodes loyalty beyond transactional rewards.

Audience Messaging

Target Personas

- Persona:

Price-Conscious DIY Mechanic

Tailored Messages

- •

Mix & Match – 2 for $7

- •

FREE Brake Pads with the Purchase of Two Brake Rotors

- •

Get a $15 Gift Card

Effectiveness:Effective

- Persona:

Professional Mechanic / Installer

Tailored Messages

Lifetime Warranty When you purchase any Power Torque hand tools.

Our Parts Professionals are here to Help

Effectiveness:Ineffective

Audience Pain Points Addressed

- •

Finding the correct part for a specific vehicle.

- •

The high cost of car maintenance and parts.

- •

Needing parts quickly to complete a repair.

Audience Aspirations Addressed

- •

Saving money on vehicle repairs.

- •

The satisfaction of completing a DIY project successfully.

- •

Keeping a vehicle running reliably.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Financial Security / Savings (Logos)

Effectiveness:High

Examples

- •

Save $10

- •

2 for $8

- •

FREE Brake Pads

- Appeal Type:

Convenience / Ease

Effectiveness:Medium

Examples

More Parts Your Way

Order online and enjoy Next Day Ship to Home and Free Pick Up In-Store.

Social Proof Elements

{'proof_type': 'None Present', 'impact': 'Weak'}

Trust Indicators

- •

Lifetime Warranty on Power Torque hand tools

- •

Nationwide availability of stores ('Store Services Available Nationwide')

- •

Established brand name (O'Reilly Auto Parts)

Scarcity Urgency Tactics

Limited Time Offers

Offer valid until September 23rd

Calls To Action

Primary Ctas

- Text:

Shop [Product/Brand Name]

Location:Homepage and Promotions Page

Clarity:Clear

- Text:

Join O'Rewards

Location:Homepage

Clarity:Clear

- Text:

Find Shipping Options

Location:Homepage

Clarity:Clear

- Text:

Select or Add a Vehicle

Location:Homepage

Clarity:Clear

The CTAs are clear, direct, and consistently transactional. They effectively guide users toward purchasing specific products or joining the loyalty program. However, they lack creativity and fail to engage the user on a level beyond the immediate transaction. There are no CTAs for engagement-oriented actions like 'Read Our Expert Tips' or 'Watch a DIY Tutorial'.

Messaging Gaps Analysis

Critical Gaps

- •

Brand Story & Purpose: There is no messaging that communicates who O'Reilly is beyond a parts retailer. The company's long history (since 1957) and employee-focused culture are completely absent.

- •

Expertise Narrative: The message 'Our Parts Professionals are here to Help' is stated but not supported. There are no bios, articles, videos, or content to demonstrate this expertise, making it an empty claim.

- •

Social Proof: The website lacks customer testimonials, reviews, ratings, or user-generated content, which are critical for building trust and validating purchase decisions.

- •

Community Building: There is no messaging aimed at building a community for car enthusiasts, a key segment of their DIY audience.

Contradiction Points

There are no direct contradictions in the messaging. The focus is so consistently on price that it doesn't create space for conflicting messages about quality or service to emerge.

Underdeveloped Areas

- •

Value of Service: The 'Store Services' section is a bullet point, not a value proposition. Messaging could be developed around the specific benefits of services like free battery testing or wiper installation.

- •

O'Rewards Value Proposition: Beyond 'Earn points', the messaging doesn't articulate the deeper benefits or exclusivity of the rewards program.

- •

Professional Persona Messaging: The site messaging is almost exclusively tailored to the retail DIY customer, missing a significant opportunity to speak directly to the needs of professional installers, a core part of their dual-market strategy.

Messaging Quality

Strengths

- •

Exceptional clarity on promotions and discounts.

- •

Strong, direct calls-to-action that drive transactional behavior.

- •

Simple, functional messaging for finding specific parts.

Weaknesses

- •

Over-reliance on price, leading to brand commoditization.

- •

Lack of emotional connection and brand personality.

- •

Weak differentiation from major competitors.

- •

Absence of trust-building elements like social proof and demonstrated expertise.

Opportunities

- •

Elevate the 'Professional Parts People' narrative to build a brand pillar around expertise and trustworthy advice.

- •

Develop content (blogs, videos, how-to guides) that provides value beyond the transaction, establishing O'Reilly as a helpful partner in vehicle maintenance.

- •

Incorporate customer stories and reviews to build social proof and community.

- •

Tell the O'Reilly brand story to create an emotional connection and differentiate on heritage and values.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Messaging Hierarchy

Recommendation:Introduce a primary brand statement above the fold that establishes a value proposition beyond deals (e.g., 'The Professional Parts People You Can Trust'). Subordinate the promotional carousel slightly to balance brand and price messaging.

Expected Impact:High

- Area:

Value Proposition

Recommendation:Develop a dedicated content section for 'Store Services' and 'Our Experts'. Feature short videos, expert tips, and explain the tangible benefits of these services, transforming them from features into reasons to choose O'Reilly.

Expected Impact:High

- Area:

Social Proof

Recommendation:Integrate a customer review and rating system directly on product pages. Feature positive customer testimonials prominently on the homepage and category pages.

Expected Impact:High

Quick Wins

- •

Rewrite the 'Store Services' headline from 'Our Parts Professionals are here to Help' to a more benefit-driven statement like 'Expert Advice to Get the Job Done Right'.

- •

Add a 'Why O'Reilly?' section to the homepage footer that briefly mentions their history, expertise, and commitment to service.

- •

Incorporate trust badges like 'Lifetime Warranty Available' and 'Free In-Store Services' more visibly near the top of the homepage.

Long Term Recommendations

- •

Invest in a content marketing strategy focused on DIY tutorials, vehicle maintenance tips, and expert interviews to build authority and community.

- •

Develop a distinct messaging track and dedicated portal for professional mechanics, addressing their specific needs for speed, parts availability, and business support.

- •

Launch a brand campaign that tells the O'Reilly story, focusing on its culture and the expertise of its team members to build an emotional connection with customers.

The strategic messaging on O'Reilly Auto Parts' website is hyper-focused on short-term customer acquisition through aggressive price-based promotions. The message architecture is clear and effective at driving immediate, transactional behavior, particularly for a price-sensitive DIY audience. However, this singular focus comes at a significant strategic cost. The brand voice is transactional and lacks personality, failing to build any meaningful emotional connection or brand loyalty beyond a points-based rewards program.

The most critical messaging gap is the failure to substantiate and differentiate on its key potential advantage: the expertise of its 'Professional Parts People.' While O'Reilly's official mission statement and internal culture emphasize service and expertise, this is nearly invisible in its primary customer-facing communication. As a result, the brand is positioned as a commodity, indistinguishable from competitors like AutoZone and Advance Auto Parts in the eyes of the consumer.

To improve market positioning and defend against price erosion, the messaging strategy must evolve. The optimization roadmap should prioritize building a brand narrative around trust and expertise. By elevating the 'Professional Parts People' from a bullet point to a core brand pillar and incorporating social proof, O'Reilly can shift its value proposition from simply 'the right part at the right price' to 'the right part, with the right advice, for long-term success.' This will create a more defensible market position, attract a less price-sensitive customer segment, and build a brand that customers trust, not just transact with.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

O'Reilly operates over 6,400 stores across North America, indicating widespread market acceptance and demand.

- •

The company effectively serves two distinct, large customer segments: Do-It-Yourself (DIY) enthusiasts and professional Do-It-For-Me (DIFM) service providers.

- •

Consistent revenue and comparable store sales growth demonstrate sustained demand for its products and services.

- •

The business model has proven resilient through various economic cycles, as vehicle maintenance is often non-discretionary.

Improvement Areas

- •

Enhancing the digital experience to match the convenience of online-only competitors.

- •

Developing specialized product lines and expertise for the growing electric vehicle (EV) market.

- •

Further personalizing the customer experience for high-value professional clients.

Market Dynamics

3-5% annually

Mature

Market Trends

- Trend:

Increasing Average Vehicle Age

Business Impact:Positive: The average age of U.S. vehicles is projected to reach 12.8 years in 2025, driving sustained demand for replacement parts and maintenance items.

- Trend:

Growth of E-commerce

Business Impact:Opportunity/Threat: The online auto parts market is growing rapidly, with projections showing significant expansion by 2030. This creates a new sales channel but also intensifies competition from digital-native players.

- Trend:

Electrification of Vehicles (EVs)

Business Impact:Long-Term Threat/Opportunity: EVs have fewer moving parts, require less traditional maintenance, and will eventually reduce demand for core product categories like engine oil and spark plugs. This necessitates a strategic pivot to EV-specific components and services.

- Trend:

Increasing Vehicle Complexity

Business Impact:Positive (DIFM Shift): As vehicles become more complex with systems like ADAS, more consumers are shifting from DIY to professional (DIFM) repairs, a segment O'Reilly is strategically targeting.

Favorable. The market fundamentals, particularly the aging vehicle fleet, provide a stable foundation for growth. However, the timing is critical for investing in digital and EV capabilities to preempt long-term disruption.

Business Model Scalability

High

High fixed costs associated with a vast network of physical stores and distribution centers, but this infrastructure provides significant operating leverage as sales volume increases.

High. The sophisticated 'hub-and-spoke' supply chain and distribution network are a core competitive advantage, enabling efficient inventory management and high product availability, which is difficult for competitors to replicate.

Scalability Constraints

- •

Physical store network saturation in some domestic markets.

- •

Complexity of international expansion, requiring adaptation to new regulatory and market environments.

- •

Maintaining a high-quality, knowledgeable workforce at scale.

Team Readiness

Strong. The leadership team has a proven track record of managing a large-scale retail and distribution operation, executing strategic acquisitions, and delivering consistent financial performance.

Well-established for current operations. The structure supports a vast network of stores and a complex supply chain. For future growth, it may need to incorporate more agile, cross-functional teams focused on digital innovation and new market entry.

Key Capability Gaps

- •

Deep expertise in electric vehicle parts and service ecosystems.

- •

Digital product management and user experience (UX) design to compete with online-first retailers.

- •

Data science and analytics for advanced personalization, pricing, and inventory forecasting.

Growth Engine

Acquisition Channels

- Channel:

Physical Store Network

Effectiveness:High

Optimization Potential:Medium

Recommendation:Optimize store layouts to feature emerging categories like EV charging and advanced diagnostic tools. Enhance in-store services (e.g., battery testing, tool rental) to drive foot traffic and differentiate from online retailers.

- Channel:

Professional Sales Force (DIFM)

Effectiveness:High

Optimization Potential:High

Recommendation:Equip the professional sales team with a modern B2B e-commerce platform and CRM tools to streamline ordering, manage relationships, and provide tailored pricing for high-volume accounts.

- Channel:

Search Engine Optimization (SEO) & Paid Search (SEM)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest in technical SEO to improve the user experience of the online parts finder. Develop content marketing around complex repairs and vehicle maintenance to capture top-of-funnel search traffic from DIY customers.

- Channel:

Promotions and Sales Ads

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Utilize purchase history from the O'Rewards program to deliver personalized, dynamic offers via email and the mobile app, moving beyond generic weekly ads.

Customer Journey

Primarily utilitarian, focused on finding a specific part for a specific vehicle. The website's 'Select a Vehicle' feature is a critical first step. The journey often bridges online and offline, with customers researching online and purchasing in-store.

Friction Points

- •

Difficulty for novice DIYers to identify the correct part among many options.

- •

Lack of real-time, store-specific inventory visibility early in the online journey.

- •

Clunky checkout process compared to modern e-commerce standards.

- •

Disconnect between online cart and in-store experience for professional customers.

Journey Enhancement Priorities

{'area': 'Online Parts Identification', 'recommendation': 'Integrate AI-powered visual search or guided diagnostic tools to help users accurately identify needed parts.'}

{'area': 'Omnichannel Experience', 'recommendation': "Develop a robust mobile app that saves user vehicle information, tracks loyalty points, stores receipts, and facilitates seamless 'Buy Online, Pick Up In Store' orders."}

Retention Mechanisms

- Mechanism:

O'Rewards Loyalty Program

Effectiveness:Medium

Improvement Opportunity:Move from a points-for-purchase model to a tiered system with experiential benefits, personalized offers based on vehicle type and purchase history, and exclusive access to technical content or clinics.

- Mechanism:

Knowledgeable In-Store Staff ('Professional Parts People')

Effectiveness:High

Improvement Opportunity:Invest in continuous training programs, especially for emerging technologies like EVs and ADAS, to maintain this key differentiator. Create a system for customers to book time with expert staff for complex issues.

- Mechanism:

Product Availability & Delivery Speed

Effectiveness:High

Improvement Opportunity:Further invest in last-mile logistics to reduce delivery times for professional customers, potentially offering guaranteed 1-hour delivery for common parts in dense urban areas.

Revenue Economics

Strong. As a market leader, O'Reilly benefits from immense purchasing power, an efficient supply chain, and a mix of private-label and branded products, leading to healthy gross margins (consistently over 50%).

Undeterminable from public data, but likely very healthy due to the recurring, non-discretionary nature of auto repair and strong retention of professional customers.

High

Optimization Recommendations

- •

Increase penetration of high-margin private label brands.

- •

Develop subscription-based services for professional customers (e.g., unlimited delivery, premium tech support).

- •

Bundle products and services (e.g., 'brake job in a box' with pads, rotors, and cleaner) to increase average order value.

Scale Barriers

Technical Limitations

- Limitation:

Legacy E-commerce Platform

Impact:Medium

Solution Approach:Migrate to a modern, headless commerce architecture to enable faster feature development, better mobile experience, and seamless integration of new services.

- Limitation:

Fragmented Customer Data

Impact:Medium

Solution Approach:Implement a Customer Data Platform (CDP) to unify online and in-store purchase data, enabling true personalization across all touchpoints.

Operational Bottlenecks

- Bottleneck:

Supply Chain Vulnerability

Growth Impact:Disruptions can lead to stock-outs of critical parts, damaging credibility with time-sensitive professional customers.

Resolution Strategy:Continue to diversify the supplier base, invest in predictive analytics for demand forecasting, and increase direct importing capabilities to gain more control over the supply chain.

- Bottleneck:

Last-Mile Delivery for DIFM

Growth Impact:Slower-than-competitor delivery to professional garages can result in lost market share.

Resolution Strategy:Expand the 'hub' store network and explore partnerships with gig-economy delivery services for rapid, on-demand fulfillment.

Market Penetration Challenges

- Challenge:

Electric Vehicle Transition

Severity:Critical

Mitigation Strategy:Proactively build a comprehensive EV parts catalog (batteries, chargers, thermal management systems). Develop training programs for staff and professional customers on EV repair. Partner with EV service centers.

- Challenge:

Intense Competition

Severity:Major

Mitigation Strategy:Double down on the core value proposition of superior service and parts availability. Compete by creating a best-in-class B2B platform for professional customers, an area where competitors like AutoZone and Advance Auto Parts are also focused.

- Challenge:

Domestic Market Saturation

Severity:Minor

Mitigation Strategy:Focus on strategic international expansion (as initiated in Mexico and Canada) and continue to gain market share from smaller, independent players in the highly fragmented US market.

Resource Limitations

Talent Gaps

- •

Technicians and store staff with certified EV knowledge.

- •

Data scientists and machine learning engineers to optimize inventory, pricing, and marketing.

- •

E-commerce product managers and UX/UI designers.

Moderate. Continued capital will be required for new store openings, distribution center upgrades, and significant investment in technology modernization (e-commerce platform, CDP, AI tools).

Infrastructure Needs

- •

Expansion of distribution centers to support store growth and improve service in untapped regions.

- •

Modernization of in-store point-of-sale (POS) systems to better integrate with online channels.

- •

EV charging stations at select store locations to signal market leadership.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deeper Penetration of the Professional (DIFM) Market

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Launch a dedicated B2B e-commerce portal with features like schematic-based ordering, account management tools, and integration with shop management software. Offer loyalty tiers and volume discounts for professional accounts.

- Expansion Vector:

International Expansion

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Continue the current strategy of disciplined expansion into adjacent international markets like Canada and Mexico through strategic acquisitions and organic growth, adapting the store model and inventory to local vehicle fleets.

Product Opportunities

- Opportunity:

Comprehensive EV Aftermarket Program

Market Demand Evidence:The number of EVs on the road is growing, creating a future demand for replacement batteries, charging hardware, and specialized tools.

Strategic Fit:Critical for long-term relevance and future-proofing the business model.

Development Recommendation:Establish a dedicated business unit for EVs. Form strategic sourcing partnerships with EV component manufacturers. Develop an 'O'Reilly EV Certified' training program for employees and professional technicians.

- Opportunity:

Expansion of Private Label Offerings

Market Demand Evidence:Customers, especially in the DIY segment, are often price-sensitive. A 'Good-Better-Best' strategy with strong private labels has proven effective.

Strategic Fit:High. Improves gross margins and offers customers exclusive product tiers.

Development Recommendation:Identify new high-volume product categories for private label expansion, such as advanced sensors, EV-specific fluids, and specialty tools.

Channel Diversification

- Channel:

Enhanced Mobile Application

Fit Assessment:High. A mobile-first approach is essential for both DIY and professional customers who are often working in the garage, not at a desk.

Implementation Strategy:Develop a native mobile app focused on utility: VIN scanning for vehicle identification, integrated loyalty card, order tracking, technical video tutorials, and a 'click-to-chat' with a parts professional.

- Channel:

B2B E-commerce Portal

Fit Assessment:Critical. Professional customers require a more robust and efficient procurement experience than a B2C website can offer.

Implementation Strategy:Build or acquire a dedicated B2B platform with features for managing multiple vehicles, recurring orders, and business credit lines. Integrate with popular shop management systems.

Strategic Partnerships

- Partnership Type:

Shop Management Software Integration

Potential Partners

- •

Mitchell 1

- •

Shop-Ware

- •

Tekmetric

Expected Benefits:Streamline the parts ordering process for professional shops, embedding O'Reilly directly into their workflow and increasing customer stickiness.

- Partnership Type:

EV Service & Training

Potential Partners

- •

EV manufacturers (for certified parts)

- •

Technical colleges

- •

Automotive technician training companies

Expected Benefits:Establish O'Reilly as a credible leader in the emerging EV aftermarket, providing both the parts and the know-how for this new vehicle category.

Growth Strategy

North Star Metric

Share of Wallet from Professional Customers

This metric shifts focus from transactional volume to long-term value and market penetration within the most lucrative customer segment. Growth in this metric indicates success in becoming the primary, indispensable supplier for professional repair shops.

Increase share of wallet by 15% over the next 24 months.

Growth Model

Hybrid: Compounding & Expansion-Led Growth

Key Drivers

- •

New store openings in untapped markets.

- •

Increasing average ticket value and purchase frequency from existing customers (compounding).

- •

Systematically capturing a larger share of the professional (DIFM) market (expansion).

Continue disciplined organic store growth while launching a dedicated strategic initiative to build the technology and sales infrastructure required to dominate the professional market.

Prioritized Initiatives

- Initiative:

Develop and Launch a Dedicated B2B E-commerce Platform

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Form a cross-functional team of sales, technology, and UX leaders. Conduct in-depth interviews with top professional customers to map their procurement journey and define key platform features.

- Initiative:

Establish an 'EV Center of Excellence'

Expected Impact:High (Long-term)

Implementation Effort:Medium

Timeframe:12 months

First Steps:Hire a director of EV strategy. Begin establishing sourcing agreements for EV components and develop a pilot training curriculum for a select group of store managers and professional customers.

- Initiative:

Personalize the O'Rewards Loyalty Program

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Implement a Customer Data Platform (CDP) to unify customer data. Analyze purchase patterns to identify key customer segments and develop targeted promotional tests for each.

Experimentation Plan

High Leverage Tests

- Test:

Dynamic Pricing for B2B Customers

Hypothesis:Offering tailored volume-based discounts in real-time on the B2B platform will increase average order value and loyalty.

Metrics:Average Order Value, Purchase Frequency, Customer Churn.

- Test:

Subscription Service Pilot for DIYers

Hypothesis:A subscription (e.g., '$50/year') offering free shipping, a 10% discount on private label brands, and one free tool rental per quarter will increase customer LTV.

Metrics:Adoption Rate, Purchase Frequency, LTV.

Utilize a standard A/B testing framework, tracking a primary conversion metric and a set of secondary guardrail metrics for each experiment to ensure no negative unintended consequences.

A continuous, bi-weekly sprint cycle for digital experiments. A quarterly review cycle for in-store or operational pilots.

Growth Team

A centralized Growth Team reporting to the Chief Marketing or Chief Strategy Officer, with dedicated pods focused on key areas: 1) Professional (DIFM) Growth, 2) DIY Digital Experience, and 3) New Market Initiatives (e.g., EV).

Key Roles

- •

Head of B2B Growth

- •

Senior Product Manager, E-commerce

- •

Director of EV Strategy

- •

Data Scientist, Customer Analytics

A combination of hiring external talent for specialized digital and EV roles, and aggressive internal upskilling programs to train the existing, loyal workforce on new technologies and market dynamics.

O'Reilly Auto Parts possesses a formidable growth foundation built on strong product-market fit, a mature but resilient market, and a highly scalable, best-in-class distribution network. The company's dual-market strategy, serving both DIY and professional (DIFM) customers, provides stability and a significant competitive moat. The primary tailwind for near-term growth is the consistently rising average age of vehicles in the U.S., which ensures sustained demand for the company's core replacement parts. However, the company is at a critical inflection point. The long-term threats of vehicle electrification and the immediate challenge from agile, digital-first competitors require a decisive strategic pivot. While the current growth engine is robust, it relies heavily on the physical store footprint. Future growth will be contingent on transforming the digital customer experience and aggressively capturing a larger share of the professional (DIFM) market. The most significant scale barrier is not operational but strategic: the cultural and technical shift required to compete in a digital-first and, eventually, electric world. The primary growth opportunity lies in leveraging its distribution prowess to build an unbeatable, digitally-enabled service platform for professional customers. This represents the largest and most profitable vector for market share gains. A parallel, forward-looking investment in an EV aftermarket strategy is not an option, but a necessity for long-term viability. The recommended growth strategy is to defend and optimize the core business while simultaneously launching dedicated initiatives to win the professional market and prepare for the EV transition. This requires focused investment in technology (B2B platform, mobile app) and talent (EV experts, data scientists), transforming O'Reilly from a best-in-class retailer into a true omnichannel automotive solutions provider.

Legal Compliance

O'Reilly Auto Parts provides a comprehensive Privacy Policy that is readily accessible. It details the types of personal information collected both online and in-store, including transaction details, contact information, and data from website interactions like social media and customer service chats. The policy explicitly states that it does not knowingly collect information from minors and that it does not sell customer information. It clearly outlines how data is used for purposes such as processing transactions, marketing, and complying with legal obligations. The policy also covers consumer rights under the CCPA/CPRA, providing a clear mechanism for California residents to exercise their rights, including the right to request, correct, or delete their data, and to use an authorized agent. The 45-day response window for such requests is compliant with CCPA guidelines. The policy's scope is broad, covering website visits, in-store transactions, loyalty programs, and even security footage from physical stores. It also mentions the collection of data via third-party partners and ads.