eScore

pentair.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

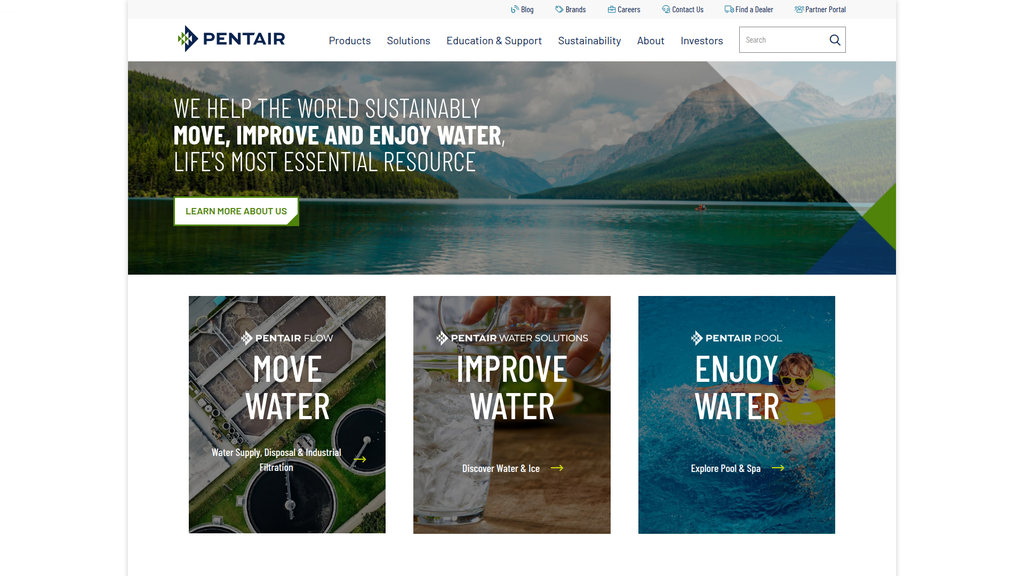

Pentair demonstrates a strong digital presence with high brand authority and a well-structured website that reflects its market leadership. The content is heavily optimized for users already familiar with the brand or in the decision stage, but lacks sufficient top-of-funnel content to capture early-stage, problem-aware searchers. While its physical reach is global, its primary digital presence is U.S.-centric, presenting an opportunity for better internationalization and local market penetration online.

High domain authority and strong brand recognition drive significant direct and branded search traffic, effectively capturing bottom-of-funnel demand.

Develop a robust content strategy focused on educational, problem-solving topics (e.g., 'how to fix cloudy pool water,' 'best filter for well water') to capture top-of-funnel search intent and build a broader audience.

The 'Move, Improve, Enjoy' messaging framework is a world-class method for communicating a complex, multi-segment business with exceptional clarity and consistency. The brand voice is authoritative and effectively positions Pentair as an innovative and sustainable leader, substantiated by numerous third-party awards. However, the communication is heavily weighted toward a corporate and B2B audience, missing opportunities to form a direct emotional connection with residential consumers by focusing on relatable benefits.

The 'Move, Improve, Enjoy' messaging architecture is a powerful and elegant framework that simplifies a diverse portfolio and guides different audience segments effectively.

Incorporate a secondary layer of customer-centric messaging, especially for the 'Improve' and 'Enjoy' segments, that translates corporate achievements into tangible benefits and solutions for homeowner pain points.

The website provides a clean information architecture and an excellent, seamless cross-device experience. However, the conversion strategy is passive, suffering from a weak and undifferentiated call-to-action (CTA) hierarchy, which likely suppresses user engagement and lead generation. While the site is generally usable, it lacks the engaging micro-interactions of a modern digital leader and has identified gaps in full accessibility compliance.

The website's responsive design is flawlessly executed, providing a consistent and intuitive user journey across desktop and mobile devices.

Implement a tiered CTA system: Use prominent, solid-color buttons for primary actions, ghost buttons for secondary actions, and styled links for tertiary ones to create a clear visual hierarchy and guide users to conversion.

Pentair has built a fortress of credibility through a sophisticated legal and compliance framework, extensive use of third-party validation, and transparency as a publicly traded company. The strategic use of industry awards (e.g., ENERGY STAR, Kitchen Innovations) and the publication of detailed sustainability reports provide powerful social proof and mitigate risks like greenwashing. The primary minor gap is the lack of relatable customer testimonials on the homepage to complement the corporate-level achievements.

Excellent and prominent use of third-party awards and detailed Corporate Responsibility Reports provides concrete, verifiable proof of innovation and sustainability claims.

Incorporate a dedicated section for customer testimonials or short case studies on the homepage to add a layer of human-centered social proof and translate technical features into relatable outcomes.

Pentair's competitive moat is deep and sustainable, built upon a diversified portfolio that insulates it from sector-specific downturns, a powerful brand trusted by professionals, and a large installed base that generates recurring revenue. Its extensive distribution network creates a high barrier to entry for new competitors. While innovation in specific products provides temporary advantages, the core strength lies in its scale, brand, and channel access.

The diversified business portfolio across Pool, Water Solutions, and Flow provides significant resilience against market cyclicality, a structural advantage many specialized competitors lack.

Accelerate the development of a unified 'Pentair Home' app that integrates all smart residential products to create a sticky ecosystem, significantly increasing switching costs for homeowners.

As a mature global leader, Pentair has a highly scalable business model with significant operating leverage and a strong financial position. The company is perfectly aligned with major growth tailwinds like sustainability, smart water management, and tightening regulations on contaminants like PFAS. The primary constraint on accelerating growth is the need to acquire and integrate more software, IoT, and direct-to-consumer talent to fully capitalize on these digital opportunities.

The business is strategically positioned at the intersection of powerful, long-term market trends including water scarcity, digitalization, and stricter environmental regulations, ensuring sustained demand.

Establish a dedicated 'Digital & Growth' center of excellence to attract key talent in software development, data science, and e-commerce, and to accelerate the transition to service-based and recurring revenue models.

Pentair's business model is exceptionally coherent and resilient, founded on a diversified portfolio that aligns with its core mission to 'Move, Improve, and Enjoy' water. The company effectively leverages its brand and R&D across residential, commercial, and industrial segments, while a massive installed base provides a stable, high-margin aftermarket revenue stream. The model's value proposition of reliability and innovation strongly justifies its premium pricing and market position.

A large installed base of products creates a significant and predictable recurring revenue stream from high-margin aftermarket parts and consumables, providing financial stability.

Pilot and scale 'Water-as-a-Service' (WaaS) offerings for commercial clients to transition from a purely transactional, capital-expenditure model to a more predictable, recurring service-based revenue stream.

Pentair holds a dominant market position, particularly as one of the 'Big Three' in the lucrative pool and spa segment, which affords it significant pricing power. Its brand is synonymous with quality among professionals, creating substantial leverage within its established distribution channels. The company demonstrates market influence by setting standards with award-winning, energy-efficient products, though it faces formidable competition from giants like Xylem and Fluidra in different segments.

Market leadership in key, high-margin segments like pool equipment provides significant pricing power and brand influence within the professional channel.

Proactively address the strategic threat from smart home platforms by ensuring deep integration with major ecosystems (Google, Amazon, Apple) to avoid being disintermediated from the end customer.

Business Overview

Business Classification

Industrial Manufacturing & Water Solutions Provider

B2B2C (Business-to-Business-to-Consumer)

Water Technology

Sub Verticals

- •

Pool & Spa Equipment

- •

Residential & Commercial Water Treatment

- •

Industrial & Municipal Flow Technologies

Mature

Maturity Indicators

- •

Publicly traded company (NYSE: PNR) with a long operating history since 1966.

- •

Established global presence in over 150 countries.

- •

Consistent history of strategic acquisitions to expand portfolio and market reach.

- •

Strong brand equity and reputation for quality and innovation.

- •

49 consecutive years of dividend increases, indicating financial stability.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Pool Segment Sales

Description:Sale of equipment for residential and commercial pools, including pumps, filters, heaters, cleaners, automation systems, and lighting. A significant portion of this revenue is from aftermarket replacements.

Estimated Importance:Primary

Customer Segment:Residential Pool Owners, Commercial Pool Operators, Dealers & Distributors

Estimated Margin:High

- Stream Name:

Water Solutions Segment Sales

Description:Sale of water treatment and filtration products for residential and commercial use, such as water softeners, filtration systems, and commercial ice machines (Manitowoc Ice).

Estimated Importance:Primary

Customer Segment:Homeowners, Foodservice Industry, Commercial Businesses

Estimated Margin:Medium-High

- Stream Name:

Flow Segment Sales

Description:Sale of pumps, valves, and systems for fluid management in industrial, commercial, municipal, and agricultural applications, including fire suppression, wastewater management, and irrigation.

Estimated Importance:Primary

Customer Segment:Industrial Manufacturers, Municipalities, Agricultural Businesses, Engineering Firms

Estimated Margin:Medium

- Stream Name:

Aftermarket Parts and Consumables

Description:Recurring sales of replacement parts, filters, and other consumables for the large installed base of Pentair products across all segments.

Estimated Importance:Secondary

Customer Segment:Existing Customers (Residential, Commercial, Industrial)

Estimated Margin:High

Recurring Revenue Components

Sales of replacement filters and parts for a large installed product base.

Service and maintenance contracts, often delivered through dealer networks.

Pricing Strategy

Value-Based & Tiered Pricing

Premium

Opaque

Pricing Psychology

- •

Brand Prestige

- •

Good-Better-Best Tiering (e.g., standard vs. variable speed pumps)

- •

Focus on Total Cost of Ownership (TCO) and energy savings

Monetization Assessment

Strengths

- •

Strong brand reputation supports premium pricing.

- •

Diverse portfolio across multiple end-markets (residential, commercial, industrial) provides resilience to economic cycles.

- •

Large installed base generates significant, high-margin aftermarket revenue.

- •

Focus on innovation (e.g., energy-efficient pumps) creates value and justifies higher price points.

Weaknesses

- •

Heavy reliance on dealer and distributor channels can limit direct customer relationships and pricing control.

- •

Vulnerability to fluctuations in construction and industrial markets, which constitute a significant portion of revenue.

- •

Exposure to raw material price volatility can impact profit margins.

Opportunities

- •

Develop 'Water-as-a-Service' (WaaS) or subscription models for commercial clients, bundling equipment, monitoring, and maintenance.

- •

Expand direct-to-consumer (D2C) channels for aftermarket parts and consumables to capture more margin and build customer loyalty.

- •

Leverage IoT capabilities in smart products to offer data-driven predictive maintenance and water management services.

- •

Capitalize on growing water scarcity and quality concerns to drive demand for advanced filtration and reuse solutions.

Threats

- •

Intense competition from major players like Xylem, Flowserve, and Hayward.

- •

Economic downturns impacting discretionary spending, particularly in the new pool construction and high-end residential markets.

- •

Potential for commoditization in certain product categories from lower-cost manufacturers.

- •

Evolving environmental regulations and tariffs could increase compliance costs or disrupt supply chains.

Market Positioning

Technology and Sustainability Leadership

Market Leader in key segments, such as residential/commercial water filtration and pool equipment.

Target Segments

- Segment Name:

Residential Homeowners

Description:Owners of single-family homes, particularly those with swimming pools or concerns about water quality.

Demographic Factors

Middle to high-income households

Suburban and rural locations

Psychographic Factors

- •

Value convenience, health, and wellness

- •

Environmentally conscious

- •

Seek long-term value and reliability

Behavioral Factors

- •

Invest in home improvement

- •

Rely on professional installers and dealers for purchase decisions

- •

Increasingly adopt smart home technology

Pain Points

- •

High energy costs from pool equipment

- •

Concerns about water quality and contaminants ('forever chemicals')

- •

Complexity and time commitment of pool and water system maintenance

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Commercial Businesses (Foodservice, Hospitality)

Description:Restaurants, hotels, resorts, and other businesses where water quality is critical for operations and customer experience.

Demographic Factors

Small, medium, and large enterprises in the hospitality sector

Psychographic Factors

Brand reputation is paramount

Focus on operational efficiency and compliance

Behavioral Factors

Purchase based on performance, reliability, and total cost of ownership

Long-term service and support are key considerations

Pain Points

- •

Ensuring consistent water and ice quality to meet health standards

- •

Minimizing equipment downtime

- •

Controlling operational costs (water and energy usage)

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Industrial & Municipal Sectors

Description:Manufacturing plants, food and beverage producers, and municipal water/wastewater utilities requiring robust fluid handling and treatment solutions.

Demographic Factors

Operations in regulated industries

Large-scale infrastructure projects

Psychographic Factors

Risk-averse, prioritizing reliability and compliance

Focused on process efficiency and cost reduction

Behavioral Factors

Long sales cycles involving engineering specifications

Value technical expertise and application support

Pain Points

- •

Meeting stringent environmental discharge regulations

- •

Maintaining aging water infrastructure

- •

Reducing water consumption and associated costs in industrial processes

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Brand Reputation and Trust

Strength:Strong

Sustainability:Sustainable

- Factor:

Technological Innovation and R&D

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive Distribution and Dealer Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Comprehensive Product Portfolio Across the Water Lifecycle

Strength:Strong

Sustainability:Sustainable

Value Proposition

To help the world sustainably move, improve and enjoy water, life's most essential resource, through smart, sustainable solutions.

Excellent

Key Benefits

- Benefit:

Energy and Cost Savings

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Award-winning IntelliFlo3® Variable Speed and Flow Pump

Emphasis on energy-efficient product design

- Benefit:

Enhanced Water Quality and Safety

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Everpure® PFOA/PFOS Reduction Systems

Award-winning filtration technology recognized by the National Restaurant Association

- Benefit:

Reliability and Durability

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Long-standing brand reputation (since 1966)

Large installed base with significant aftermarket activity

- Benefit:

Sustainability

Importance:Important

Differentiation:Common

Proof Elements

Recognition in Newsweek's World's Greenest Companies

Publication of an annual Sustainability Report

Unique Selling Points

- Usp:

Integrated Smart Water Solutions

Sustainability:Long-term

Defensibility:Strong

- Usp:

Leadership in Pool Pump Technology

Sustainability:Medium-term

Defensibility:Moderate

- Usp:

Dominant Position in Foodservice Water Filtration

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

High residential energy consumption from inefficient pool pumps.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Need for reliable, high-quality water and ice in commercial foodservice.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Maintaining and repairing aging municipal water infrastructure without major service disruptions.

Severity:Critical

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition strongly aligns with key market trends, including increasing water scarcity, rising energy costs, demand for sustainable solutions, and the integration of smart technology in homes and businesses.

High

The focus on reliability, efficiency, and quality directly addresses the core pain points of residential, commercial, and industrial customers, justifying its premium market positioning.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Wholesale Distributors

- •

Professional Installers & Dealers

- •

Original Equipment Manufacturers (OEMs)

- •

Engineering, Procurement, and Construction (EPC) firms

- •

Retail Partners

Key Activities

- •

Research & Development (Innovation)

- •

Manufacturing & Supply Chain Management

- •

Brand Marketing & Channel Management

- •

Strategic Mergers & Acquisitions

Key Resources

- •

Strong Brand Equity

- •

Intellectual Property (Patents)

- •

Global Manufacturing Footprint

- •

Extensive Distribution Network

- •

Skilled Engineering Talent

Cost Structure

- •

Cost of Goods Sold (Raw Materials, Labor)

- •

Selling, General & Administrative (SG&A) Expenses

- •

Research & Development (R&D) Investment

- •

Marketing and Advertising Costs

Swot Analysis

Strengths

- •

Dominant brand recognition and reputation for quality.

- •

Diversified portfolio across multiple segments (Pool, Water Solutions, Flow) balances market cyclicality.

- •

Extensive and loyal distribution network provides a significant barrier to entry.

- •

Strong focus on innovation and R&D, leading to premium, high-margin products.

- •

Solid financial performance with strong free cash flow and a history of dividend growth.

Weaknesses

- •

Dependence on third-party distributors can create distance from the end customer and limit data collection.

- •

Vulnerability to economic downturns, particularly in new construction and discretionary spending sectors.

- •

Complex global supply chain exposed to geopolitical risks and raw material price fluctuations.

- •

Historically, the industrial segment has shown softer performance compared to the Pool segment.

Opportunities

- •

Expansion into high-growth emerging markets with increasing needs for water infrastructure.

- •

Growth of IoT and smart home integration to create connected water management ecosystems and recurring revenue services.

- •

Increasing global focus on water sustainability, conservation, and reuse presents a massive addressable market.

- •

Strategic acquisitions to enter adjacent markets or acquire new technologies, such as the recent Hydra-Stop deal.

Threats

- •

Intense competition from established players (e.g., Xylem, Hayward, Flowserve) and new market entrants.

- •

Changes in government regulations related to water quality and energy efficiency could require costly product redesigns.

- •

Disruptive technologies or business models (e.g., D2C) could challenge the traditional distributor-based approach.

- •

Global economic instability and trade tariffs impacting costs and customer demand.

Recommendations

Priority Improvements

- Area:

Digital Transformation & Customer Experience

Recommendation:Invest in a unified digital platform that better serves both channel partners (dealers, distributors) and end-users. Develop a D2C channel for high-velocity replacement parts (e.g., filters) to build direct relationships and capture data.

Expected Impact:High

- Area:

Service Model Innovation

Recommendation:Pilot and scale 'Water-as-a-Service' (WaaS) offerings, particularly in the commercial and industrial segments. Leverage IoT data from smart devices to offer predictive maintenance, performance optimization, and water management subscriptions.

Expected Impact:High

- Area:

Portfolio Optimization

Recommendation:Continue to actively manage the business portfolio, divesting slower-growth or lower-margin product lines while pursuing strategic, high-margin acquisitions in growth areas like water reuse and advanced infrastructure solutions.

Expected Impact:Medium

Business Model Innovation

Transition from a purely product-centric model to a hybrid 'Product-as-a-Service' model. This involves leasing smart, connected equipment (e.g., for a commercial kitchen) bundled with a subscription for monitoring, consumables, and guaranteed uptime.

Create a data monetization strategy by aggregating anonymized data from IoT-enabled devices to provide benchmarking insights, water usage forecasts, and efficiency recommendations to large commercial or municipal clients.

Revenue Diversification

- •

Expand further into the municipal water infrastructure market, leveraging the Hydra-Stop acquisition to offer a broader range of solutions for aging infrastructure.

- •

Develop integrated solutions for residential and light-commercial water reuse and rainwater harvesting, capitalizing on drought trends and sustainability demands.

- •

Build out a professional services and consulting arm focused on helping industrial clients design and implement comprehensive water stewardship programs.

Pentair's business model is that of a mature, successful, and resilient market leader in the water technology space. Its strength is founded on a diversified portfolio that strategically addresses the full lifecycle of water use under the clear 'Move, Improve, Enjoy' framework. This diversification provides a natural hedge against cyclicality in any single end-market. The company's primary revenue driver is the sale of premium-priced, innovative equipment through a deeply entrenched B2B2C distribution network, which is both a significant competitive advantage and a potential strategic weakness. The model's future success hinges on its ability to evolve beyond pure product sales into a more integrated, service-oriented ecosystem. The key strategic opportunity lies in leveraging its massive installed base and the increasing connectivity of its products (IoT) to build direct customer relationships and introduce high-margin, recurring revenue streams through service subscriptions and data-driven solutions. While facing threats from intense competition and macroeconomic headwinds, Pentair is well-positioned to capitalize on the enduring global trends of water scarcity, quality concerns, and the push for sustainability. Strategic acquisitions remain a core competency and will be critical for entering new high-growth adjacencies and acquiring innovative technologies. The primary recommendation is to accelerate the transition to a hybrid model that combines best-in-class manufacturing with a robust, digitally-enabled service offering, thereby creating a more defensible and scalable platform for future growth.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Brand Recognition & Trust

Impact:High

- Barrier:

Established Distribution Channels

Impact:High

- Barrier:

Manufacturing Scale & Supply Chain

Impact:High

- Barrier:

R&D and Patent Portfolio

Impact:Medium

- Barrier:

Regulatory Compliance & Certifications

Impact:Medium

Industry Trends

- Trend:

Sustainability & Energy Efficiency

Impact On Business:Positive, aligns with Pentair's messaging and product innovation (e.g., variable speed pumps). Creates demand for eco-friendly solutions.

Timeline:Immediate

- Trend:

IoT & Smart Water Management

Impact On Business:Critical for all segments (pool automation, leak detection, smart filtration). Requires significant R&D investment to create a seamless, integrated user experience.

Timeline:Immediate

- Trend:

Health & Wellness (PFAS/Contaminant Removal)

Impact On Business:Major opportunity, particularly for the 'Improve' segment. Heightened consumer awareness drives demand for advanced filtration solutions.

Timeline:Immediate

- Trend:

Decentralized Water Treatment

Impact On Business:Opportunity for modular and point-of-use/point-of-entry systems for residential and commercial applications, reducing reliance on large municipal infrastructures.

Timeline:Near-term

- Trend:

Market Consolidation

Impact On Business:Both a threat and an opportunity. Competitors are merging (e.g., Fluidra/Zodiac, Xylem/Evoqua), creating larger, more formidable rivals. Presents opportunities for Pentair to make strategic acquisitions.

Timeline:Near-term

Direct Competitors

- →

Fluidra (Zodiac, Jandy, Polaris)

Market Share Estimate:Leading competitor in the pool & spa segment. The merger of Fluidra and Zodiac created a global powerhouse.

Target Audience Overlap:High

Competitive Positioning:Global leader in the pool and wellness equipment market, offering a comprehensive product portfolio across numerous well-known brands.

Strengths

- •

Dominant market share in the pool and spa industry.

- •

Extensive portfolio of highly recognized brands (Zodiac, Jandy, Polaris, etc.).

- •

Large global footprint and distribution network across 45+ countries.

- •

Significant resources for R&D and innovation post-merger.

Weaknesses

- •

Complexity in managing a vast portfolio of merged brands.

- •

Less diversified outside of the pool and wellness space compared to Pentair.

- •

Potential for channel conflicts between different brands within the portfolio.

Differentiators

Breadth of pool-specific brands catering to different market tiers.

Strong focus and specialization solely on the pool and wellness market.

- →

Xylem Inc.

Market Share Estimate:A major player in the global water technology market, particularly strong in utility and industrial applications.

Target Audience Overlap:Medium

Competitive Positioning:A leading global water technology company focused on solving water challenges through intelligent solutions for transport, treatment, and testing, primarily for utilities and industrial clients.

Strengths

- •

End-to-end solutions for the entire water cycle.

- •

Strong focus on digital solutions and smart water infrastructure (digital revenue is a key growth area).

- •

Significant presence in large-scale municipal and industrial projects.

- •

Strategic acquisitions to bolster portfolio (e.g., Evoqua).

Weaknesses

- •

Less brand recognition in the residential consumer space (pool, home filtration) compared to Pentair.

- •

Business is heavily weighted towards utility and industrial end markets, which can have long sales cycles.

- •

Complex global supply chain and dependence on municipal contracts.

Differentiators

- •

Expertise in large-scale water infrastructure and utility-grade technology.

- •

Advanced digital and data analytics capabilities for water management.

- •

Focus on solving systemic water challenges like scarcity and infrastructure resilience.

- →

A. O. Smith

Market Share Estimate:A leading manufacturer in water heating and a growing, significant competitor in water treatment.

Target Audience Overlap:Medium

Competitive Positioning:A global leader in water heating and water treatment solutions for residential and commercial applications, known for reliability and a strong distribution network.

Strengths

- •

Dominant market share in North American water heaters, providing strong brand leverage.

- •

Strong and established professional distribution channels (plumbers, contractors).

- •

Growing focus and investment in the water treatment segment through R&D and acquisitions.

- •

High degree of recurring revenue from replacement-driven business model.

Weaknesses

- •

Lacks a pool and spa equipment portfolio, limiting its scope in the total water space compared to Pentair.

- •

Brand is more synonymous with water heating than filtration, requiring marketing investment to shift perception.

- •

Faces intense price competition in its core markets.

Differentiators

Deep specialization and brand authority in water heating technology.

Strong focus on the professional installer channel for both heating and treatment.

- →

Culligan International

Market Share Estimate:A major player in residential and commercial water treatment, with a strong service-based model.

Target Audience Overlap:Medium

Competitive Positioning:A global leader in water treatment solutions, focusing on a dealer-based, service-oriented model for filtration, softening, and drinking water systems.

Strengths

- •

Highly recognized consumer brand with a long history.

- •

Extensive franchise/dealer network providing local sales, installation, and service.

- •

Recurring revenue model through salt delivery, filter changes, and equipment rental.

- •

Aggressive growth through acquisition, consolidating a fragmented market.

Weaknesses

- •

Business model is heavily reliant on its dealer network, leading to potential inconsistencies in customer experience.

- •

Less emphasis on the DIY retail channel where Pentair has a presence.

- •

Does not compete in the pool & spa or industrial flow segments.

Differentiators

- •

Direct-to-consumer service relationship through its dealer network.

- •

Focus on subscription and service-based revenue streams.

- •

Broad portfolio of water softening and drinking water solutions for home and office.

Indirect Competitors

- →

Smart Home Platforms (e.g., Google, Amazon, Apple)

Description:These tech giants provide the smart home ecosystems (voice assistants, hubs, apps) that could potentially control and manage smart water devices, disintermediating device manufacturers from the user interface.

Threat Level:Medium

Potential For Direct Competition:Low, but high potential for partnership or integration pressure.

- →

DIY Retail Brands (e.g., EcoPure, Rheem at Home Depot)

Description:Private label or exclusive brands sold through big-box retailers that compete on price and accessibility for DIY homeowners.

Threat Level:Medium

Potential For Direct Competition:They are already direct competitors in the residential water improvement space, but indirectly compete with Pentair's professional channels.

- →

Leak Detection Startups (e.g., Phyn, Flo by Moen)

Description:Technology-focused companies specializing in smart leak detection and water monitoring, which can be a gateway to controlling a homeowner's entire water system.

Threat Level:Low

Potential For Direct Competition:Medium, as they could expand into filtration or be acquired by larger players.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Diversified Portfolio Across Water Segments

Sustainability Assessment:Highly sustainable. Presence in Pool, Residential/Commercial Filtration, and Industrial Flow provides resilience against market cyclicality in any single segment.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Brand Reputation & Channel Access

Sustainability Assessment:Sustainable. Pentair is a trusted, premium brand among professionals (pool builders, plumbers), which is a significant barrier to entry.

Competitor Replication Difficulty:Hard

- Advantage:

Large Installed Base

Sustainability Assessment:Highly sustainable. A large installed base of equipment creates a recurring revenue stream from replacement parts, maintenance, and upgrades.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Award-Winning Products (e.g., IntelliFlo3 Pump)', 'estimated_duration': '1-2 years. Provides a strong marketing and sales advantage until competitors launch comparable technology.'}

{'advantage': 'First-Mover on Specific Contaminant Solutions (e.g., PFAS Reduction Systems)', 'estimated_duration': '1-3 years. Creates a window of opportunity based on current events and consumer concerns before competitors achieve similar certifications and market their own solutions.'}

Disadvantages

- Disadvantage:

Lack of a Unified Smart Home Ecosystem

Impact:Major

Addressability:Moderately

- Disadvantage:

Complex Portfolio & Brand Architecture

Impact:Minor

Addressability:Moderately

- Disadvantage:

Potential for Channel Conflict

Impact:Minor

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted digital marketing campaign focused on PFAS 'forever chemical' removal, leveraging the Everpure Kitchen Innovations Award.

Expected Impact:High

Implementation Difficulty:Easy

- Recommendation:

Create bundled solution packages for professional installers (e.g., 'Total Home Water Package' with filtration, softener, and pool pump) to increase share-of-wallet.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Develop and promote educational content (webinars, videos) for consumers on the benefits of variable speed pumps and smart pool automation to build brand preference.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop a unified 'Pentair Home' mobile app that integrates control and monitoring of all smart residential products (pool, spa, water treatment, pumps).

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Introduce a subscription service for replacement filters and media, potentially with IoT-enabled automatic reordering.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand direct engagement with residential and commercial end-users through enhanced digital tools and support, while still fulfilling through the professional channel.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Invest in or acquire technologies related to AI-powered predictive maintenance and water usage analytics to create smarter, more resilient systems.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore expansion into adjacent 'water as a service' (WaaS) models, especially for commercial and industrial customers.

Expected Impact:Medium

Implementation Difficulty:Difficult

- Recommendation:

Lead the industry in developing next-generation sustainable water solutions, focusing on water reuse, recycling, and energy-neutral treatment.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify Pentair's position as the premium provider of smart, sustainable, and fully integrated water solutions for the entire home and business ecosystem.

Differentiate through a holistic, integrated system approach ('The Pentair Ecosystem') rather than just individual product performance. Emphasize the seamless interaction between pool, filtration, and flow products under a single, intelligent platform, backed by superior sustainability credentials and professional-grade reliability.

Whitespace Opportunities

- Opportunity:

Unified Residential Smart Water Management Platform

Competitive Gap:No single competitor offers a deeply integrated platform that manages pool/spa, whole-home filtration, softeners, and pressure pumps in one seamless user experience.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Subscription-Based Consumables for Water Treatment

Competitive Gap:While service-based models exist (Culligan), a product-centric company like Pentair could leverage its IoT capabilities to create an automated, direct-to-consumer/pro replenishment model for filters and media.

Feasibility:High

Potential Impact:High

- Opportunity:

Water-as-a-Service (WaaS) for Commercial Clients

Competitive Gap:There is an emerging need for commercial clients (restaurants, hotels) to outsource their water quality management. Pentair could leverage its product strength (Everpure, Manitowoc) to offer a comprehensive service and monitoring solution.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Enhanced Focus on Water Reuse and Recycling Solutions for Residential

Competitive Gap:Most competitors are focused on filtration for consumption or recreation. There is a gap for residential-scale greywater recycling or advanced rainwater harvesting systems, which aligns with Pentair's sustainability focus.

Feasibility:Low

Potential Impact:High

Pentair operates in the mature and moderately concentrated water solutions industry, where it has carved out a strong position through a uniquely diversified portfolio spanning pool & spa, residential/commercial filtration, and industrial flow technologies. This diversification is a core sustainable advantage, providing stability and cross-selling opportunities that more specialized competitors lack. Key industry trends such as sustainability, smart IoT integration, and health-driven demand for contaminant removal are playing directly into Pentair's strategic messaging and product development, as evidenced by its award-winning energy-efficient pumps and PFAS reduction systems.

In the high-value pool and spa market, Pentair faces its most direct and formidable competitor in Fluidra, a global giant formed by the merger of Zodiac and Fluidra. While Fluidra has immense scale and brand depth in pools, Pentair's key differentiator is its ability to extend its brand and technology into the rest of the home's water ecosystem. In the industrial and municipal space, Xylem is a powerhouse, but its focus is on large-scale infrastructure, leaving Pentair a strong position in more commercial and residential flow applications. In the residential water improvement market, A. O. Smith and Culligan are significant competitors. A. O. Smith leverages its dominance in water heating to push into filtration, while Culligan's strength lies in its direct-to-consumer service model via a vast dealer network.

The most significant competitive gap and strategic opportunity for Pentair is the creation of a truly unified smart water ecosystem for the home. While competitors offer smart devices, none have seamlessly integrated the management of a pool, whole-home filter, softener, and leak detection into a single, intelligent platform. Achieving this would provide a powerful moat and a compelling value proposition that no competitor can currently match. Further opportunities exist in building recurring revenue through subscription services for consumables and leveraging its sustainability focus to pioneer residential water reuse solutions. Pentair's primary challenge is to shift from a company that sells excellent individual products to one that delivers an integrated, intelligent, and sustainable water experience.

Messaging

Message Architecture

Key Messages

- Message:

We help the world sustainably move, improve and enjoy water, life's most essential resource.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Sustainability

Prominence:Secondary

Clarity Score:High

Location:Dedicated 'Sustainability Spotlight' section, news items, and report links.

- Message:

Innovation

Prominence:Secondary

Clarity Score:High

Location:Dedicated 'Innovation Spotlight' section and product award highlights.

- Message:

A Purpose Driven Company

Prominence:Tertiary

Clarity Score:Medium

Location:Careers Section

The messaging hierarchy is exceptionally clear and effective. The primary brand promise, 'move, improve and enjoy water,' is presented first and serves as the primary organizational framework for the entire homepage. This is immediately followed by the key strategic pillars of Sustainability and Innovation, which are given significant visual real estate. This structure successfully communicates the company's core function and its key differentiators in a logical, digestible flow.

Messaging is highly consistent across the homepage. The 'Move, Improve, Enjoy' framework is the central, unifying theme. The supporting messages of sustainability and innovation are woven throughout multiple sections, from dedicated spotlights to news releases and product highlights, reinforcing these as core tenets of the Pentair brand.

Brand Voice

Voice Attributes

- Attribute:

Professional & Corporate

Strength:Strong

Examples

Pentair Announces Definitive Agreement to Acquire Hydra-Stop

mySüdmo is a product configurator that helps you to choose the right Pentair Südmo Hygienic Process Valve

- Attribute:

Innovative & Leading-Edge

Strength:Strong

Examples

- •

Driving Pool Innovation with an Award-Winning Pump

- •

Everpure and Manitowoc Ice Honored with Kitchen Innovations Awards

- •

Innovation Is Our Trade

- Attribute:

Purpose-Driven & Sustainable

Strength:Strong

Examples

- •

We help the world sustainably move, improve and enjoy water

- •

making an impact with award-winning sustainability strategy

- •

create a better world for people and the planet

Tone Analysis

Informative

Secondary Tones

Aspirational

Authoritative

Tone Shifts

The tone shifts from a broad, aspirational corporate message in the hero section to a more technical and product-focused tone in the 'Innovation Spotlight'.

The 'Careers' section adopts a more personal and purpose-oriented tone to attract talent.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Pentair provides smart, sustainable, and innovative solutions for the entire lifecycle of water, from industrial movement and filtration to residential enjoyment, positioning itself as a comprehensive leader in water technology.

Value Proposition Components

- Component:

Comprehensive Portfolio ('Move, Improve, Enjoy')

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Commitment to Sustainability

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Proven Innovation (Award-Winning Products)

Clarity:Clear

Uniqueness:Unique

Pentair effectively differentiates itself through its emphasis on proven innovation, heavily leveraging recent awards for its pumps, ice machines, and filtration systems. While many competitors also claim to be sustainable and have broad portfolios, Pentair's use of specific, timely, and third-party-validated awards (e.g., 'Kitchen Innovations Award', 'Pool Nation Awards™') provides concrete evidence of leadership and sets it apart. The 'Move, Improve, Enjoy' framework is a unique and memorable way to articulate its comprehensive market coverage.

The messaging positions Pentair as a premium, forward-thinking market leader. It competes not just on product features but on higher-order values like sustainability and innovation. This strategy elevates the brand above competitors who may focus solely on product specs or price, appealing to customers who prioritize environmental impact and technological advancement. Competitors in the industrial space include Xylem and Evoqua Water Technologies, while residential competitors include Hayward. The strong focus on awards and sustainability is a clear attempt to secure a leadership position.

Audience Messaging

Target Personas

- Persona:

Industrial/Commercial Buyer (The 'Move' & 'Improve' Audience)

Tailored Messages

- •

Water Supply, Disposal & Industrial Filtration

- •

NEW MYSÜDMO APP PUTS CUSTOMERS FIRST

- •

Everpure and Manitowoc Ice Honored with Kitchen Innovations Awards

Effectiveness:Effective

- Persona:

Residential Pool & Spa Owner (The 'Enjoy' Audience)

Tailored Messages

Explore Pool & Spa

Driving Pool Innovation with an Award-Winning Pump

Effectiveness:Somewhat Effective

- Persona:

Homeowner (Water Filtration - The 'Improve' Audience)

Tailored Messages

Discover Water & Ice

Everpure’s (PFOA/PFOS) Reduction Systems were awarded...

Effectiveness:Somewhat Effective

- Persona:

Potential Employee / Investor

Tailored Messages

- •

A PURPOSE DRIVEN COMPANY

- •

News Releases

- •

2024 Sustainability Report

Effectiveness:Effective

Audience Pain Points Addressed

- •

Need for energy efficiency (e.g., energy-efficient pool pump).

- •

Concern about 'forever chemicals' like PFAS in water.

- •

Complexity in selecting industrial components (addressed by mySüdmo app).

Audience Aspirations Addressed

- •

Desire to make environmentally responsible choices (sustainability messaging).

- •

Goal of creating a 'better world for people and the planet'.

- •

Aspiration to use the latest, award-winning technology in their home or business.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Appeal to a Higher Purpose (Stewardship)

Effectiveness:High

Examples

We help the world sustainably move, improve and enjoy water, life's most essential resource.

create a better world for people and the planet

- Appeal Type:

Pride in Innovation & Leadership

Effectiveness:High

Examples

Pentair Named to Newsweek's World's Greenest Companies 2025

Driving Pool Innovation with an Award-Winning Pump

Social Proof Elements

- Proof Type:

Third-Party Awards & Recognition

Impact:Strong

Examples

- •

Business Intelligence Group 2025 Sustainability Awards

- •

Newsweek's World's Greenest Companies 2025

- •

2025 Kitchen Innovations Award

- •

Pool Nation Awards™

- Proof Type:

Media Mentions / News

Impact:Moderate

Examples

News Releases section with links to investor relations site.

Trust Indicators

- •

Publication of detailed Sustainability Reports.

- •

Formal news releases about acquisitions and grants.

- •

Links to investor relations portal, signaling transparency and corporate stability.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Water Supply, Disposal & Industrial Filtration

Location:Homepage 'Move' section

Clarity:Clear

- Text:

Discover Water & Ice

Location:Homepage 'Improve' section

Clarity:Clear

- Text:

Explore Pool & Spa

Location:Homepage 'Enjoy' section

Clarity:Clear

- Text:

Get the Details

Location:Sustainability and Innovation sections

Clarity:Clear

- Text:

See the Pump of the Year

Location:Innovation Spotlight

Clarity:Clear

The primary CTAs on the homepage are highly effective at segmenting the audience. By using the 'Move, Improve, Enjoy' framework, they guide different user types (industrial, commercial, residential) to the most relevant section of the site immediately. The supporting CTAs are clear and action-oriented (e.g., 'Read the Report', 'Select Your Valve Now'), effectively directing users to take the next step in their information-gathering journey. The language is direct and unambiguous.

Messaging Gaps Analysis

Critical Gaps

Lack of direct problem/solution messaging for residential customers on the homepage. A homeowner concerned about hard water might not immediately connect with the high-level 'Improve Water' message.

No clear customer testimonials or case studies featured on the homepage to translate corporate achievements into relatable customer benefits.

Contradiction Points

No itemsUnderdeveloped Areas

The link between 'sustainability' and the 'Enjoy Water' (Pool & Spa) category is underdeveloped. While they highlight an 'energy-efficient' pump, the broader message of promoting a water-intensive luxury could be more proactively addressed with messaging around overall water conservation technologies for pools.

The benefits of 'smart' technology are mentioned in the careers section ('smart, sustainable water solutions') but not clearly demonstrated or explained in the main product or innovation sections on the homepage.

Messaging Quality

Strengths

- •

The 'Move, Improve, Enjoy' framework is a powerful and elegant messaging architecture that simplifies a complex, multi-segment business.

- •

Excellent and prominent use of social proof (awards, recognition) to build credibility and claim a leadership position.

- •

The deep integration of sustainability as a core brand pillar is consistent and well-supported with evidence (reports, awards).

- •

Clarity and consistency of the brand voice are exceptionally high.

Weaknesses

- •

The homepage messaging is heavily weighted towards a corporate/B2B audience, potentially alienating or confusing B2C customers looking for a specific product solution.

- •

Over-reliance on corporate achievements rather than customer-centric benefits and outcomes.

- •

The emotional connection for the 'Enjoy Water' segment is weak; it focuses on product innovation rather than the emotional benefits of pool ownership (family, fun, relaxation).

Opportunities

- •

Incorporate customer-centric language by adding subheadings under 'Improve' and 'Enjoy' that address specific pain points (e.g., 'For Pure, Great-Tasting Water at Home' or 'Create Your Perfect Backyard Oasis').

- •

Develop a dedicated case study or customer story section to showcase the real-world impact of Pentair's solutions for different personas.

- •

Create more content that explicitly links 'smart' technology to tangible benefits for the end-user, such as cost savings, convenience, and control.

Optimization Roadmap

Priority Improvements

- Area:

Audience-Message Fit (Residential)

Recommendation:Add a secondary layer of messaging below the main 'Improve' and 'Enjoy' headings that speaks directly to residential pain points. For example, under 'Improve Water', add 'Solve hard water, remove contaminants, and enjoy better-tasting water from every tap.'

Expected Impact:High

- Area:

Persuasion Elements

Recommendation:Incorporate short, impactful customer testimonials or logos of key B2B clients into the homepage design to add a layer of human-centered social proof alongside the corporate awards.

Expected Impact:Medium

- Area:

Value Proposition Communication

Recommendation:Create a small 'How We Innovate' section that explicitly defines what 'smart' means in the context of their products (e.g., 'IoT connectivity for remote monitoring, AI for predictive maintenance, sensors for ultimate efficiency').

Expected Impact:Medium

Quick Wins

Rewrite the 'Explore Pool & Spa' headline to be more benefit-driven, such as 'Enjoy a Cleaner, More Efficient Pool'.

Add a 'For Your Home' and 'For Your Business' sub-navigation or button early on the page to provide an even faster segmentation path for users.

Long Term Recommendations

Develop distinct landing pages or microsites for the core B2B (Flow) and B2C (Pool, Residential Water Solutions) segments that are linked from the corporate homepage but have unique messaging strategies tailored to each audience.

Invest in creating a library of video case studies that tell the story of customer success and the positive environmental impact of Pentair's solutions.

Pentair's strategic messaging is exceptionally well-structured and disciplined. The core architectural framework of 'Move, Improve, Enjoy' is a world-class solution to the complex challenge of communicating a diverse portfolio to multiple audience segments—from industrial engineers to residential homeowners. This framework provides immediate clarity and intuitive navigation.

The brand's positioning as an innovative and sustainable leader is not just claimed; it is substantiated with a powerful and continuous stream of third-party awards and recognitions, which serves as its primary persuasion tool. The brand voice is consistent, professional, and authoritative, effectively conveying expertise and corporate stability.

The primary weakness lies in its audience-message fit for the B2C segment. The homepage functions as an excellent corporate portal but a less effective direct-to-consumer storefront. The messaging is heavily focused on the 'what' (products, awards, corporate actions) and the high-level 'why' (sustainability), but it often misses the customer-centric 'how'—how do these innovations solve a specific homeowner's problem or enhance their life? Residential users seeking solutions for hard water or a new pool pump must translate the high-level corporate messaging into personal benefits, adding cognitive load to their journey.

Overall, the messaging strategy is highly effective for positioning the corporate brand, attracting talent, and engaging B2B customers. The key opportunity for optimization is to introduce a more customer-centric messaging layer, particularly for the residential audience, to bridge the gap between corporate achievements and tangible, relatable end-user value.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established global brand with a long operating history since 1966, indicating sustained market relevance.

- •

Trailing twelve-month revenue of approximately $4.1 billion, demonstrating significant market demand and scale.

- •

Diverse product portfolio across three core segments: Pool (~35-42%), Flow (~35-37%), and Water Solutions (~27-28%), catering to residential, commercial, and industrial markets.

- •

High percentage of recurring revenue (~75% of products are for replacement), creating a stable demand base.

- •

Frequent industry awards for product innovation, such as the 'Pump of the Year' and 'Kitchen Innovations' awards, validating product leadership.

Improvement Areas

- •

Unified digital customer experience across disparate segments (e.g., Pool, Industrial Flow) to improve cross-selling and brand cohesion.

- •

Deeper integration of IoT and smart home capabilities across the entire product portfolio to create a more cohesive ecosystem.

- •

Simplification of the product portfolio and branding to enhance clarity for end-users and channel partners.

Market Dynamics

Water Treatment Market CAGR of ~7.0-8.1%; Smart Water Management CAGR of ~11-13%; Pool & Spa Market CAGR of ~5-6%.

Mature

Market Trends

- Trend:

Increasingly Stringent Water Quality Regulations

Business Impact:Creates significant demand for advanced filtration solutions, particularly for 'forever chemicals' like PFAS. The US EPA has finalized new national standards, driving municipal and residential treatment upgrades.

- Trend:

Digitalization and IoT in Water Management ('Smart Water')

Business Impact:Drives demand for connected devices, remote monitoring, and data analytics to improve efficiency and reduce water loss. This is a high-growth segment (~12% CAGR) that shifts the business model from hardware sales to recurring service revenue.

- Trend:

Sustainability and Water Scarcity

Business Impact:Boosts demand for energy-efficient products (like variable speed pumps) and water reuse/recycling technologies, aligning with Pentair's core mission and ESG focus.

- Trend:

Growth of the 'Wellness' and 'Outdoor Living' Economy

Business Impact:Sustains the Pool & Spa market, with a focus on smart, automated, and energy-efficient systems that enhance the home leisure experience.

Excellent. Pentair is well-positioned at the intersection of three major tailwinds: tightening environmental regulations, digital transformation of industrial processes, and consumer demand for wellness and sustainability.

Business Model Scalability

High

Mature industrial model with significant operating leverage. Transformation programs and strategic pricing are being used to expand margins, indicating a scalable cost structure.

High. As a large-scale manufacturer, incremental volume can be produced at lower marginal costs. The business model includes a mix of product sales, aftermarket parts, and services.

Scalability Constraints

- •

Supply chain complexity for a global manufacturing footprint.

- •

Integration of acquired companies and their disparate systems and cultures.

- •

Capital intensity of manufacturing and R&D for new product lines.

Team Readiness

Strong. Experienced leadership team of a publicly traded company with a clear strategy around margin expansion and bolt-on acquisitions.

Mature divisional structure (Pool, Water Solutions, Flow). This is effective for managing distinct business lines but may create silos that hinder cross-segment innovation and integrated solution selling.

Key Capability Gaps

- •

Software and IoT product management talent to accelerate the transition to connected solutions.

- •

Direct-to-Consumer (D2C) marketing and e-commerce expertise.

- •

Data science and analytics capabilities to leverage data from connected devices for new services and insights.

Growth Engine

Acquisition Channels

- Channel:

B2B2C Distributor & Dealer Networks (e.g., Pool Professionals)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Develop a unified digital portal for partners to streamline ordering, training, marketing support, and co-op fund management. Enhance loyalty programs with performance analytics.

- Channel:

Industrial & Commercial Direct Sales

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip sales teams with advanced digital tools like the 'mySüdmo' configurator across all product lines. Implement a more robust CRM for key account management and cross-selling.

- Channel:

Digital (SEO, Content Marketing, Paid Search)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest in content marketing targeting engineers, facility managers, and homeowners researching solutions for specific problems (e.g., 'PFAS removal for home'). Optimize the website for lead capture from these professional and prosumer segments.

- Channel:

Mergers & Acquisitions

Effectiveness:High

Optimization Potential:Medium

Recommendation:Continue disciplined 'bolt-on' acquisition strategy to acquire new technology (e.g., Hydra-Stop), enter adjacent markets, and consolidate share. Focus on post-merger integration to realize synergies faster.

Customer Journey

Highly varied and often indirect. The path for an industrial buyer specifying a valve is vastly different from a homeowner replacing a pool pump. The website acts as a broad entry point, directing users to different solution areas.

Friction Points

- •

Navigating a complex website with thousands of SKUs to find the right product.

- •

Difficulty in understanding which products form an integrated 'solution'.

- •

Inconsistent digital experience between different brand microsites and applications.

- •

Hand-off from online research to finding a qualified local dealer/installer can be disjointed.

Journey Enhancement Priorities

{'area': 'Solution-Based Navigation', 'recommendation': "Restructure parts of the website around customer problems (e.g., 'Make My Pool Smart & Efficient', 'Ensure My Restaurant's Water is Safe') rather than just product categories."}

{'area': 'Channel Partner Locator', 'recommendation': "Enhance the 'find a dealer' tool with more qualification data, reviews, and direct appointment-setting capabilities."}

Retention Mechanisms

- Mechanism:

Aftermarket Sales (Filters, Parts, Consumables)

Effectiveness:High

Improvement Opportunity:Implement a subscription model for consumables like replacement filters, creating a recurring revenue stream and direct customer relationship.

- Mechanism:

Product Ecosystem & Interoperability

Effectiveness:Medium

Improvement Opportunity:Deepen the integration of smart products through a unified app (e.g., Pentair Home App). Create network effects where adding more Pentair devices enhances the value for the customer, increasing switching costs.

- Mechanism:

Channel Partner Loyalty

Effectiveness:High

Improvement Opportunity:Leverage data to provide partners with insights on local market trends, installation best practices, and opportunities for upselling maintenance services.

Revenue Economics

Strong. As an established manufacturer with significant scale, Pentair likely has favorable unit economics. The focus on margin expansion through transformation programs confirms a solid foundation.

Not Directly Calculable (B2B2C Model). The equivalent would be 'Channel Profitability' or 'Customer Lifetime Value,' which is high due to the long product lifespan and recurring aftermarket revenue.

High. The company generates substantial revenue ($4.1B) and free cash flow ($693M in 2024), indicating an efficient revenue engine.

Optimization Recommendations

- •

Increase the mix of higher-margin, software-enabled smart products.

- •

Develop direct-to-consumer subscription services for items like filters.

- •

Utilize digital marketing to lower the cost of lead generation for channel partners.

Scale Barriers

Technical Limitations

- Limitation:

Fragmented IoT/Software Platform

Impact:Medium

Solution Approach:Invest in a unified software platform and API strategy to ensure all new 'smart' products work seamlessly together, regardless of business unit. Prioritize a single, best-in-class mobile app experience.

Operational Bottlenecks

- Bottleneck:

Post-Acquisition Integration

Growth Impact:Slows synergy realization and can distract leadership. Integrating different manufacturing processes, ERP systems, and company cultures is a significant undertaking.

Resolution Strategy:Develop a standardized M&A integration playbook and a dedicated integration management office (IMO) to streamline the process.

- Bottleneck:

Global Supply Chain Volatility

Growth Impact:Impacts product availability, input costs, and margins. This is an ongoing challenge for any global manufacturer.

Resolution Strategy:Continue to diversify the supplier base, increase regionalization of supply chains, and invest in better demand forecasting technology.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Major

Mitigation Strategy:Compete on innovation (smart/sustainable products), brand trust, and the strength of the distribution channel. Key competitors include Xylem, Hayward, Evoqua (now Xylem), and A.O. Smith.

- Challenge:

Channel Conflict

Severity:Minor

Mitigation Strategy:Carefully manage any D2C initiatives (e.g., filter subscriptions) to avoid alienating the critical distributor and dealer network. Implement strategies like 'buy online, pick up at dealer' or dealer-managed service subscriptions.

- Challenge:

Navigating Global Regulatory Diversity

Severity:Major

Mitigation Strategy:Maintain a strong regulatory affairs team to monitor and influence evolving standards (e.g., for water quality, energy efficiency) in key markets, turning compliance into a competitive advantage.

Resource Limitations

Talent Gaps

- •

IoT/Embedded Systems Engineers

- •

Cloud Software Developers & UX/UI Designers

- •

Digital Marketing & E-commerce Specialists

Moderate. Continued capital needed for strategic acquisitions, R&D in smart technologies, and upgrading manufacturing facilities for higher efficiency.

Infrastructure Needs

Investment in a unified cloud data platform to ingest and analyze data from connected devices.

Modernization of ERP and CRM systems to create a single view of the customer and supply chain.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in Water-Stressed Regions

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Target Asia-Pacific and the Middle East, which are experiencing rapid urbanization and water scarcity. Adapt products for local needs and regulations, potentially through partnerships or acquisitions.

- Expansion Vector:

Deeper Penetration into Commercial Foodservice

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Leverage the Manitowoc Ice acquisition to cross-sell a complete 'water-in, water-out' solution for restaurants, including filtration, ice making, and wastewater management.

Product Opportunities

- Opportunity:

Water-as-a-Service (WaaS) / Subscription Models

Market Demand Evidence:Growing trend in B2B and B2C for outcome-based pricing and hassle-free service. Digital solutions for optimized PFAS management are a key opportunity.

Strategic Fit:Strong. Shifts revenue from capex to opex, creating a predictable, recurring stream. Aligns with digital transformation.

Development Recommendation:Launch a pilot program for commercial clients offering 'guaranteed water quality' for a monthly fee, including equipment, monitoring, and maintenance.

- Opportunity:

Expand Portfolio for Emerging Contaminants

Market Demand Evidence:Heightened public awareness and new EPA regulations for PFAS are creating a multi-billion dollar treatment market.

Strategic Fit:Excellent. Directly leverages core competency in filtration and positions Pentair as a key solution provider for a major public health issue.

Development Recommendation:Accelerate R&D and marketing for certified PFAS-reduction systems for both point-of-entry and point-of-use applications, targeting municipal and residential markets.

- Opportunity:

Unified Smart Water Home Ecosystem

Market Demand Evidence:The smart home market is mature, and consumers expect seamless integration. Hayward, a key competitor, highlights its IoT-enabled app.

Strategic Fit:Excellent. Creates a competitive moat through network effects and increases customer lifetime value.

Development Recommendation:Create a roadmap to integrate all residential products (pool pumps, water softeners, leak detectors, filters) into a single, intelligent mobile app that automates water management and conservation.

Channel Diversification

- Channel:

Direct-to-Consumer E-commerce (for consumables)

Fit Assessment:Good, with caution. Ideal for standardized products like replacement filters and test kits.

Implementation Strategy:Launch a branded online store focused on subscriptions for recurring-need items. Use a 'dealer affiliate' model to share revenue on leads generated online but fulfilled locally.

Strategic Partnerships

- Partnership Type:

Smart Home Platforms

Potential Partners

- •

Google Home

- •

Amazon Alexa

- •

Apple HomeKit

Expected Benefits:Increases convenience for homeowners and makes Pentair products part of the broader smart home ecosystem, enhancing brand visibility and user experience.

- Partnership Type:

Municipal & Utility Technology Providers

Potential Partners

SCADA system providers

Smart meter companies

Expected Benefits:Integrate Pentair's treatment and flow technologies into larger smart water grid projects, opening up new sales channels for large-scale infrastructure deals.

Growth Strategy

North Star Metric

Number of Connected Water Devices

This metric aligns the entire organization—from product development to sales—around the strategic shift to smart, connected, and service-oriented solutions. It directly measures progress in creating a high-margin, sticky customer ecosystem and serves as a leading indicator for future recurring revenue.

Increase the number of connected devices by 50% year-over-year for the next three years.

Growth Model

Hybrid: Channel-Led & Product-Led Growth

Key Drivers

- •

Channel Enablement (empowering dealers with better digital tools)

- •

Product Innovation (launching more connected, high-margin products)

- •

Ecosystem Cross-Sell (driving adoption of multiple Pentair products per customer)

- •

Strategic M&A (acquiring technology and market access)

Maintain and strengthen the channel-led model for core products while layering on a product-led growth model for smart devices, where the product experience itself (via the app) drives user engagement, upsells, and subscription adoption.

Prioritized Initiatives

- Initiative:

Launch 'PFAS-Free Water' Residential Solution Bundle

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Consolidate marketing for existing PFAS-certified products. Develop a bundled 'point-of-entry + drinking water' package. Launch a targeted digital marketing campaign to homeowners in regions with known contamination.

- Initiative:

Develop Unified 'Pentair Home' App v2.0

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Form a dedicated cross-functional mobile app team. Define a unified API strategy for all smart product lines. Prioritize integration of the highest-volume products (pool pumps, water softeners).

- Initiative:

Pilot 'Filter-as-a-Service' D2C Subscription

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6 months

First Steps:Select a popular filter product line for the pilot. Build a simple e-commerce portal for subscriptions. Test pricing and marketing messaging in a limited geographic area.

Experimentation Plan

High Leverage Tests

{'test': 'Test different pricing models for Water-as-a-Service (flat fee vs. usage-based) with a small cohort of commercial customers.', 'hypothesis': "A flat-fee, 'all-inclusive' service model will have a higher adoption rate for commercial customers seeking budget predictability."}

{'test': "A/B test different value propositions in digital ads for smart pool pumps (e.g., 'Energy Savings' vs. 'Total Control from Your Phone').", 'hypothesis': "Messaging focused on 'Total Control and Convenience' will generate a higher click-through rate than cost savings alone."}

Use an OKR (Objectives and Key Results) framework. For each experiment, define a clear objective (e.g., Validate demand for WaaS) and key results (e.g., 10 pilot customers signed, 80% satisfaction score, churn rate <5%).

Run monthly growth experiments within the digital marketing team and quarterly strategic pilots for new business models.

Growth Team

A centralized 'Digital & Growth' Center of Excellence that supports the existing business units. This team would not own the full P&L but would be responsible for developing and scaling new digital products, channels, and business models across the organization.

Key Roles

- •

Head of Digital Growth

- •

IoT Product Manager

- •

Subscription Business Manager

- •

Data Scientist

A combination of hiring external talent for key digital roles and upskilling existing product and marketing teams through training on agile methodologies, digital marketing analytics, and service-based business models.

Pentair possesses a formidable growth foundation, characterized by a strong brand, established market leadership across its core segments (Pool, Water Solutions, Flow), and a highly resilient business model with significant recurring revenue from its large installed base. The company is strategically positioned to capitalize on powerful, long-term market tailwinds, including tightening global water quality regulations (especially concerning PFAS), the rapid digitalization of water management ('Smart Water'), and sustained consumer focus on sustainability and wellness.

The primary growth vector for Pentair lies in accelerating its transformation from a traditional industrial hardware manufacturer to a provider of smart, connected, and sustainable water solutions. While its current growth engine is robust and driven by a powerful channel network and strategic acquisitions, the most significant future value will be unlocked by deepening its product-led growth capabilities. This involves creating a seamless, integrated digital ecosystem for customers—particularly in the residential space—where the value of adding more Pentair devices increases exponentially. This strategy will build a significant competitive moat and create new, high-margin recurring revenue streams through subscriptions and services.

Key barriers to this transformation are primarily internal: overcoming organizational silos to foster cross-segment innovation, acquiring and integrating critical software and data science talent, and carefully managing channel relationships while exploring direct-to-consumer models. The immediate priorities should be to aggressively target the emerging PFAS treatment market, unify the smart product portfolio under a single best-in-class mobile application, and begin experimenting with service-based models like 'Water-as-a-Service.' By focusing on the 'Number of Connected Water Devices' as a North Star Metric, Pentair can align its considerable resources to build the next-generation platform for water management, ensuring continued market leadership and profitable growth.

Legal Compliance

Pentair's Privacy Notice is comprehensive and centrally located, indicating a structured approach to data privacy. It explicitly references GDPR by mentioning the Regulation of 27 April 2016 and is governed by Belgian privacy law, reflecting its European operational footprint. The policy details the types of personal data collected (e.g., registration data, device information), the purposes for processing, and outlines user rights such as access, correction, deletion, and the right to object. It clearly identifies Pentair Management Company as the data controller. The notice also acknowledges data transfers outside the EEA and states that measures are in place to ensure data protection. For U.S. customers, it provides specific rights under CCPA/CPRA, including a 'Do Not Sell Or Share My Personal Information' link and a toll-free number for requests, demonstrating a robust framework for handling diverse regulatory requirements.

Pentair maintains separate 'Terms of Use' for its website and 'Terms & Conditions of Sale' for its products, which is a sound practice. The website's Terms of Use are standard, covering intellectual property, user conduct, and disclaimers of liability. A key strength is the explicit integration of the Privacy Notice within the terms, ensuring users acknowledge it. The Terms & Conditions of Sale are detailed and tailored to B2B transactions, covering orders, payment, liability, and confidential information. Crucially, they include a 'Relationship Data & Privacy' clause that references the main Privacy Notice, ensuring data protection compliance extends to commercial relationships. The terms also reserve the right to refuse orders that could violate applicable laws, a critical clause for a global manufacturer dealing with complex trade regulations.