eScore

pfizer.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Pfizer maintains a world-class digital presence, demonstrating high content authority and a strong, consistent multi-channel strategy. The website's information architecture is robust, aligning well with the search intent of diverse audiences like patients, healthcare professionals (HCPs), and investors. Its global reach is extensive, though the primary .com site is geared towards the U.S., indicating opportunities for deeper localization.

Exceptional content authority, reinforced by transparency initiatives like the 'Funded Initiatives' page, which attracts high-quality backlinks from academic and medical institutions.

Enhance geographic market penetration by developing more dedicated, localized content hubs for key international markets beyond the primary English-language site.

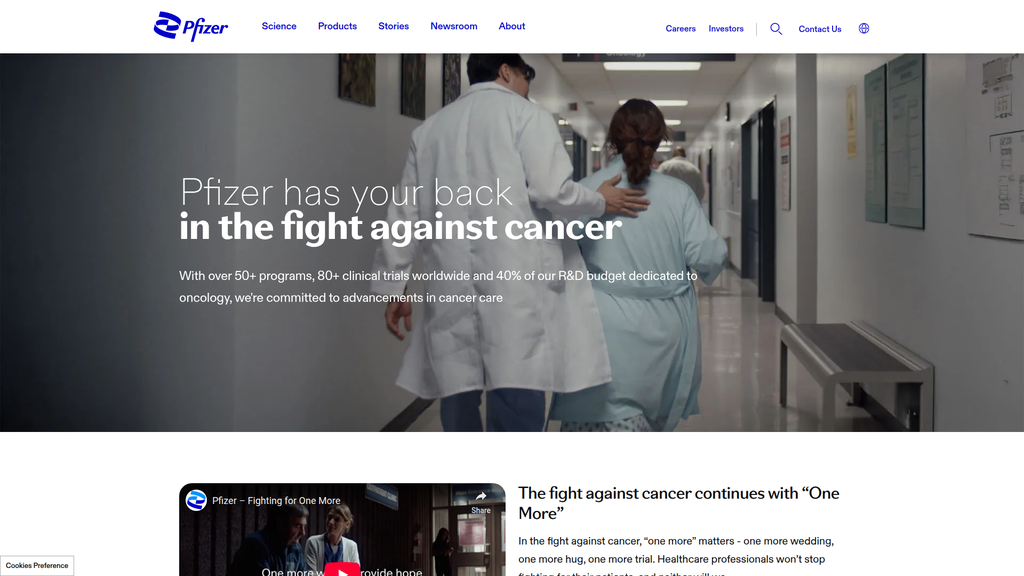

Pfizer's messaging is powerful and effective, particularly its emotive, patient-centric campaign around oncology, which strongly resonates with its target audience. The brand successfully segments its messaging for different personas, from empathetic narratives for patients to data-heavy content for investors and HCPs. However, the intense focus on oncology on the homepage risks overshadowing other key therapeutic areas like vaccines and immunology.

Masterful use of emotional storytelling in its oncology messaging ('one more hug, one more wedding') to build a strong, empathetic connection with patients and caregivers.

Revise the homepage message hierarchy to create a more balanced representation of all core therapeutic areas, preventing the over-focus on oncology from diminishing the perceived importance of other major divisions.

The website provides a clear, low-friction experience for its primary goal: information dissemination to key audiences. Navigation is intuitive, and the cognitive load is generally light, guiding users to relevant content hubs effectively. While traditional e-commerce conversions aren't the goal, micro-conversions like newsletter sign-ups or accessing patient support could be improved with more prominent, action-oriented CTAs.

An intuitive and logical information architecture that allows diverse audiences (patients, HCPs, investors) to self-segment and find relevant information with minimal friction.

Conduct A/B testing on key Calls-to-Action (CTAs) to replace passive language like 'Learn More' with more compelling, action-oriented copy such as 'Discover Our Pipeline' to improve engagement.

Credibility is exceptionally high, built on a foundation of scientific authority, a 175-year history, and robust third-party validation through extensive partnerships. The website features a strong hierarchy of trust signals, including detailed pipeline data and compliance with transparency laws like the Sunshine Act. The company's commitment to data privacy and security is well-documented, mitigating risk for users.

Unparalleled transparency through the 'Funded Initiatives' page, which publicly discloses financial relationships with healthcare professionals, building significant trust and demonstrating compliance.

Publish a formal, easily accessible 'Accessibility Statement' detailing commitment to WCAG 2.1 AA standards to solidify its compliance posture and mitigate legal risk under the ADA.

Pfizer's competitive advantage is deeply entrenched and sustainable, rooted in its massive scale of R&D, global commercial infrastructure, and extensive patent portfolio. The recent acquisition of Seagen has fortified its moat in oncology, providing a proprietary technology platform (ADCs) that is difficult for competitors to replicate. While it faces the constant threat of patent cliffs, its innovation engine is designed to consistently replenish its product portfolio.

The sheer scale of its integrated R&D, manufacturing, and global commercialization network provides a durable competitive advantage that is nearly impossible for new entrants to replicate.

Address the high revenue concentration on a few blockbuster drugs by continuing to aggressively pursue pipeline diversification and successful 'bolt-on' acquisitions to de-risk future patent expirations.

The business model is inherently scalable due to high operating leverage, where high fixed R&D costs are offset by high-margin sales of successful drugs. Pfizer has mature processes for global market expansion and a strong track record of entering new therapeutic areas via M&A. Future scalability is tied to R&D productivity and successfully navigating global regulatory hurdles for its 100+ program pipeline.

A highly efficient capital allocation strategy that balances returning capital to shareholders with aggressive reinvestment in both internal R&D and strategic, large-scale acquisitions to fuel future growth.

Increase investment in internal AI and machine learning capabilities to accelerate drug discovery and shorten clinical trial timelines, reducing a key operational bottleneck for future growth.

Pfizer's business model demonstrates exceptional coherence, with a clear strategic pivot to dominate the high-growth oncology market. The $43B acquisition of Seagen is a decisive resource allocation move that directly supports this strategic focus, aligning its activities, partnerships, and cost structure with its primary goal. This sharpened focus on science-driven breakthroughs ensures strong alignment among stakeholders toward a clear, unified vision for future growth.

A clear and decisive strategic focus on oncology, demonstrated by the massive capital allocation for the Seagen acquisition, which aligns the entire organization towards a single, high-growth objective.

Proactively develop and pilot value-based pricing models with payers to better align the revenue model with the growing global pressure for outcome-based healthcare, mitigating future regulatory risk.

As one of the world's largest pharmaceutical companies, Pfizer wields immense market power, consistently maintaining a top-tier market share and demonstrating significant pricing power for its innovative, patent-protected medicines. Its ability to execute mega-deals like the Seagen acquisition, shape treatment guidelines through extensive clinical data, and influence the direction of medical research gives it substantial market influence. Its global scale also provides considerable leverage with suppliers and partners.

Dominant market position and brand equity, which provide significant pricing power for novel therapies and strong leverage in negotiating with payers, partners, and suppliers globally.

Mitigate customer dependency risk by ensuring the successful launch of multiple new products from the pipeline to offset the ~$17 billion revenue loss expected from patent expirations between 2025-2030.

Business Overview

Business Classification

Biopharmaceutical R&D and Commercialization

Biologics and Advanced Therapies Development

Pharmaceuticals

Sub Verticals

- •

Oncology

- •

Vaccines

- •

Internal Medicine

- •

Inflammation & Immunology

- •

Rare Disease

Mature

Maturity Indicators

- •

Extensive global commercial infrastructure

- •

Long history of operations (founded 1849)

- •

Consistent dividend payments for over 50 years.

- •

Large-scale M&A activity, including the $43B acquisition of Seagen.

- •

Deep and diverse R&D pipeline with over 100 programs.

- •

Significant brand equity and established market presence

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Innovative Medicines & Vaccines (Patented)

Description:Sales of branded, patent-protected prescription drugs and vaccines across key therapeutic areas. Key products include the Prevnar family, Eliquis, Vyndaqel, and oncology drugs like Ibrance and Padcev.

Estimated Importance:Primary

Customer Segment:Healthcare Providers, Payers, Governments

Estimated Margin:High

- Stream Name:

Oncology Portfolio

Description:A strategic growth pillar, significantly enhanced by the Seagen acquisition, focusing on antibody-drug conjugates (ADCs), small molecules, and bispecific antibodies. The goal is to have at least eight blockbuster cancer drugs by 2030.

Estimated Importance:Primary

Customer Segment:Oncologists, Specialized Cancer Centers, Payers

Estimated Margin:High

- Stream Name:

COVID-19 Franchise (Comirnaty & Paxlovid)

Description:Revenue from the COVID-19 vaccine (Comirnaty) and oral antiviral treatment (Paxlovid). While declining from pandemic peaks, it remains a significant contributor.

Estimated Importance:Secondary

Customer Segment:Governments, Healthcare Systems, Pharmacies

Estimated Margin:Medium

- Stream Name:

Established Medicines & Biosimilars

Description:Sales of off-patent and generic drugs where Pfizer retains brand recognition or manufacturing scale, as well as a growing portfolio of biosimilars.

Estimated Importance:Tertiary

Customer Segment:Pharmacies, Healthcare Providers

Estimated Margin:Low

Recurring Revenue Components

- •

Therapies for chronic conditions (e.g., cardiovascular, immunology)

- •

Long-term government vaccine contracts

- •

Multi-year treatment regimens for oncology

Pricing Strategy

Value-Based & Negotiated Pricing

Premium

Opaque

Pricing Psychology

- •

Justification through clinical superiority data

- •

Value-based arguments to payers

- •

Patient assistance programs to mitigate out-of-pocket costs

Monetization Assessment

Strengths

- •

High margins on patented, innovative products

- •

Diverse portfolio mitigates risk from any single product failure

- •

Strong negotiating power with payers due to market leadership and critical therapies

Weaknesses

- •

Significant revenue loss from patent expirations ('patent cliff')

- •

High and risky R&D investments required to sustain the pipeline

- •

Dependence on a few blockbuster drugs for a large portion of revenue

Opportunities

- •

Expansion of oncology portfolio, leveraging Seagen's ADC technology, to drive future growth.

- •

Growth in biologics and next-generation therapies like mRNA and gene therapy

- •

Penetration into emerging markets with growing healthcare spending

Threats

- •

Increasing pricing pressure from governments and insurers, such as the US Inflation Reduction Act (IRA).

- •

Competition from generic and biosimilar manufacturers post-patent expiry

- •

R&D pipeline failures or delays in regulatory approvals

- •

Increased competition from agile biotech firms and other large pharma companies.

Market Positioning

Science-Driven Innovation Leader

Top-Tier Global Pharmaceutical Company

Target Segments

- Segment Name:

Healthcare Providers (HCPs)

Description:Physicians, specialists (e.g., oncologists, cardiologists), nurses, and hospital systems who prescribe and administer Pfizer's products.

Demographic Factors

Licensed medical professionals

Specialization in therapeutic areas like oncology, immunology, etc.

Psychographic Factors

- •

Driven by clinical data and evidence-based medicine

- •

Seeking best possible outcomes for patients

- •

Value safety, efficacy, and brand reputation

Behavioral Factors

- •

Attend medical conferences

- •

Read peer-reviewed journals

- •

Influenced by Key Opinion Leaders (KOLs) and medical science liaisons

Pain Points

- •

Limited treatment options for complex diseases

- •

Navigating complex reimbursement and payer requirements

- •

Keeping up-to-date with the latest clinical advancements

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Payers & Health Systems

Description:Public and private insurance companies, pharmacy benefit managers (PBMs), and national health systems that manage drug formularies and reimburse costs.

Demographic Factors

Large organizations managing significant healthcare budgets

Psychographic Factors

Focus on cost-effectiveness and budget impact

Value long-term health outcomes and total cost of care reduction

Behavioral Factors

Conduct health technology assessments (HTAs)

Negotiate rebates and pricing based on volume and clinical value

Pain Points

Rising cost of specialty drugs

Managing budgets while ensuring patient access to innovative medicines

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Patients & Caregivers

Description:Individuals with acute or chronic diseases who are the end-users of Pfizer's medicines, and their support networks.

Demographic Factors

Varies widely by disease state (age, gender, etc.)

Psychographic Factors

- •

Seeking hope, improved quality of life, and longevity

- •

Value trust, transparency, and support

- •

Concerned about affordability and side effects

Behavioral Factors

- •

Increasingly research conditions and treatments online

- •

Participate in patient advocacy groups

- •

Respond to Direct-to-Consumer (DTC) advertising

Pain Points

- •

High out-of-pocket costs

- •

Accessing and navigating complex healthcare systems

- •

Managing the physical and emotional burden of illness

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

R&D Scale and Pipeline Depth

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Commercialization & Manufacturing Infrastructure

Strength:Strong

Sustainability:Sustainable

- Factor:

Leadership in Key Technology Platforms (e.g., mRNA, ADCs)

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Equity and Long-Standing Reputation

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To deliver breakthroughs that change patients' lives through pioneering science, a world-class R&D engine, and global commercial reach.

Excellent

Key Benefits

- Benefit:

Novel therapies for unmet medical needs

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Extensive R&D pipeline data

- •

FDA/EMA approvals for new molecular entities

- •

Acquisition of innovative companies like Seagen.

- Benefit:

Clinically proven safety and efficacy

Importance:Critical

Differentiation:Common

Proof Elements

- •

Rigorous multi-phase clinical trial data

- •

Peer-reviewed publications in top medical journals

- •

Regulatory approvals from global health authorities

- Benefit:

Patient access and affordability support

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Pfizer RxPathways program

- •

Co-pay assistance programs

- •

Partnerships with patient advocacy groups

Unique Selling Points

- Usp:

End-to-end integration from discovery to global commercialization

Sustainability:Long-term

Defensibility:Strong

- Usp:

Proprietary Antibody-Drug Conjugate (ADC) technology platform via Seagen

Sustainability:Long-term

Defensibility:Strong

- Usp:

Proven leadership and manufacturing scale in advanced modalities like mRNA vaccines

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Life-threatening diseases with limited or no treatment options (e.g., specific cancers)

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Chronic conditions that impair quality of life (e.g., inflammatory diseases)

Severity:Major

Solution Effectiveness:Partial

- Problem:

Preventable infectious diseases (e.g., pneumonia, COVID-19)

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

Pfizer's focus on high-burden diseases like cancer, cardiovascular conditions, and infectious diseases directly aligns with the most significant unmet needs in global public health.

High

The value proposition of providing effective, life-altering medicines resonates powerfully with patients, prescribers, and health systems alike, addressing their core needs for better health outcomes.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Biotechnology companies (e.g., BioNTech, 3SBio Inc. )

- •

Academic and research institutions

- •

Contract Research Organizations (CROs)

- •

Governments and public health organizations

- •

Other pharmaceutical companies (for co-promotion/development)

Key Activities

- •

Research & Development (Drug Discovery, Clinical Trials)

- •

Manufacturing and Supply Chain Management

- •

Regulatory Affairs and Compliance

- •

Sales, Marketing, and Market Access

- •

Mergers & Acquisitions / Business Development.

Key Resources

- •

Intellectual Property (Patents)

- •

Scientific and technical talent

- •

Global manufacturing and distribution networks

- •

Strong balance sheet and access to capital

- •

Brand reputation and established relationships with stakeholders

Cost Structure

- •

Research & Development (R&D) expenses.

- •

Sales, General & Administrative (SG&A) expenses

- •

Cost of Goods Sold (COGS)

- •

M&A and in-licensing deal costs

Swot Analysis

Strengths

- •

Diversified, high-margin product portfolio.

- •

Industry-leading R&D budget and pipeline.

- •

Unmatched global scale in manufacturing and commercialization

- •

Strong financial position and cash flow

- •

Strategic pivot to oncology with Seagen acquisition doubles pipeline and adds ADC leadership.

Weaknesses

- •

High vulnerability to patent expirations for key blockbusters (e.g., Eliquis, Ibrance).

- •

Recent clinical trial setbacks in some areas.

- •

Post-pandemic revenue decline from COVID-19 products creates growth pressure.

Opportunities

- •

Become a dominant leader in oncology, projected to be the largest growth driver in global medicine.

- •

Leverage AI and machine learning to accelerate drug discovery and reduce R&D costs.

- •

Expand into new high-growth therapeutic areas like obesity and rare diseases

- •

Further growth in emerging markets

Threats

- •

Intensifying government price controls and rebate pressures (e.g., US Inflation Reduction Act).

- •

Increasing cost and complexity of bringing new drugs to market

- •

Heightened competition from both large pharma rivals and innovative biotech firms.

- •

Potential for major litigation and regulatory scrutiny

Recommendations

Priority Improvements

- Area:

Oncology Integration & Execution

Recommendation:Aggressively execute on the Seagen integration to accelerate the development of its ADC pipeline and achieve the goal of 8+ oncology blockbusters by 2030. Ensure seamless commercial integration to maximize the value of acquired assets.

Expected Impact:High

- Area:

R&D Productivity and Pipeline Prioritization

Recommendation:Continue disciplined R&D spending by focusing investments on high-potential modalities (ADCs, biologics) and therapeutic areas. Utilize AI and real-world evidence to improve clinical trial success rates and shorten timelines.

Expected Impact:High

- Area:

Navigating the Post-Patent Cliff Environment

Recommendation:Develop and execute a clear lifecycle management and business development strategy to offset the ~$17B in revenue expected to be lost to patent expirations between 2025-2030.

Expected Impact:High

Business Model Innovation

- •

Develop 'Beyond the Pill' integrated solutions, combining therapeutics with digital health tools, diagnostics, and patient support services to create a comprehensive care ecosystem, particularly in oncology.

- •

Expand outcome-based and value-based pricing agreements with payers, tying reimbursement directly to the clinical effectiveness of high-cost therapies.

- •

Establish a more agile, semi-autonomous biotech-like R&D unit focused on high-risk, high-reward science to foster faster innovation, separate from the core commercial engine.

Revenue Diversification

- •

Strategically invest in or acquire companion diagnostics companies to create integrated treatment paradigms, ensuring the right patients are identified for Pfizer's targeted therapies.

- •

Build out a dedicated Contract Development and Manufacturing Organization (CDMO) service to leverage Pfizer's world-class manufacturing capacity, especially for complex biologics and ADCs.

- •

Explore ethical monetization of anonymized real-world data and clinical trial data to provide insights to the broader healthcare community, creating a new high-margin revenue stream.

Pfizer is a mature, top-tier biopharmaceutical enterprise at a critical strategic inflection point. Its business model, traditionally reliant on developing and commercializing a diverse portfolio of blockbuster small-molecule drugs and vaccines, is evolving to navigate the immense pressure of impending patent cliffs and a changing regulatory landscape. The company's future growth trajectory is now unequivocally centered on becoming a dominant force in oncology. The $43 billion acquisition of Seagen is the cornerstone of this strategic pivot, transforming Pfizer's pipeline and positioning it as a leader in the highly promising field of Antibody-Drug Conjugates (ADCs). This move is a clear effort to shift its revenue base towards more durable, higher-margin biologics, which are less susceptible to traditional generic competition. While the post-pandemic decline in COVID-19 product revenues has created short-term growth headwinds, the company's core business remains robust, and its deep pipeline of over 100 programs provides multiple opportunities for future blockbusters. The primary challenge for Pfizer's business model is execution: it must seamlessly integrate Seagen, accelerate its oncology pipeline, and effectively manage the significant loss of exclusivity for key products. Success will depend on enhancing R&D productivity, maintaining disciplined cost management, and strategically deploying capital to further bolster its innovation engine. The evolution from a diversified pharmaceutical giant to a more focused, science-driven oncology leader is the central narrative that will define its market position and financial performance through 2030.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Research & Development (R&D) Costs

Impact:High

- Barrier:

Stringent Regulatory Approval (e.g., FDA, EMA)

Impact:High

- Barrier:

Intellectual Property (Patents)

Impact:High

- Barrier:

Complex Manufacturing and Supply Chains

Impact:High

- Barrier:

Established Distribution Networks and Market Access

Impact:Medium

Industry Trends

- Trend:

Rise of Artificial Intelligence in Drug Discovery

Impact On Business:Potential to significantly shorten R&D timelines and reduce costs, creating opportunities for nimbler, tech-focused competitors.

Timeline:Immediate

- Trend:

Personalized Medicine and Cell/Gene Therapies

Impact On Business:Shifts focus from blockbuster drugs for large populations to highly targeted, high-value treatments, requiring new manufacturing and commercialization models.

Timeline:Near-term

- Trend:

Patent Cliff and Growth of Biosimilars

Impact On Business:Increasing revenue erosion from key products as they lose exclusivity, necessitating a robust and innovative R&D pipeline to compensate.

Timeline:Immediate

- Trend:

Increased Pricing Pressure and Regulatory Scrutiny

Impact On Business:Margin pressure from governments and payers demanding more value, affecting profitability and forcing greater operational efficiency.

Timeline:Immediate

- Trend:

Digital Transformation and Patient-Centricity

Impact On Business:Competition is shifting from 'Share-of-Voice' with physicians to engaging patients directly through digital channels and data-driven services.

Timeline:Near-term

Direct Competitors

- →

Johnson & Johnson (Innovative Medicine)

Market Share Estimate:High

Target Audience Overlap:High

Competitive Positioning:Diversified global leader in pharmaceuticals, medical devices, and consumer health, emphasizing broad-spectrum innovation.

Strengths

- •

Extremely diversified portfolio across multiple healthcare segments.

- •

Strong global brand recognition and trust.

- •

Dominant positions in immunology (e.g., Stelara) and oncology.

- •

Robust supply chain and global distribution network.

Weaknesses

- •

Facing significant patent expirations on key blockbuster drugs like Stelara.

- •

Large size can lead to slower adaptation to new technologies compared to smaller biotechs.

- •

Ongoing litigation risks in various business segments.

Differentiators

- •

Synergies between pharmaceutical, MedTech, and consumer health divisions.

- •

Aggressive M&A strategy to acquire innovation.

- •

Long-standing history and established relationships with healthcare systems worldwide.

- →

Merck & Co., Inc.

Market Share Estimate:High

Target Audience Overlap:High

Competitive Positioning:Research-intensive biopharmaceutical company with a strong focus on oncology and vaccines.

Strengths

- •

Market leadership in immuno-oncology with blockbuster drug Keytruda.

- •

Strong portfolio of vaccines (e.g., Gardasil).

- •

Deep R&D expertise and a history of scientific breakthroughs.

- •

Efficient and focused commercial organization.

Weaknesses

- •

High revenue concentration on Keytruda, creating significant risk around its eventual patent expiration.

- •

Less diversified therapeutic area focus compared to J&J or Roche.

- •

Facing increased competition in the oncology space.

Differentiators

- •

Pioneering position in immuno-oncology.

- •

Legacy of leadership in vaccine development.

- •

Strategic focus on developing foundational therapies that can be used across many cancer types.

- →

Novartis AG

Market Share Estimate:High

Target Audience Overlap:High

Competitive Positioning:A 'pure-play' innovative medicines company focused on high-growth therapeutic areas like cardiovascular, immunology, and oncology.

Strengths

- •

Strong portfolio of high-growth, in-market brands like Entresto and Cosentyx.

- •

Leadership in advanced therapy platforms like cell and gene therapy.

- •

Strategic shift to focus solely on innovative medicines after spinning off Sandoz (generics).

- •

Robust R&D pipeline with a stated goal for new medicines to have >$2 billion peak sales potential.

Weaknesses

- •

Faces a significant patent cliff starting around 2026.

- •

Increased risk profile by divesting the more stable generics business.

- •

Historically lagged some competitors in the immuno-oncology space.

Differentiators

- •

Clear strategic focus on innovative, high-value medicines.

- •

Strong presence in complex and cutting-edge technology platforms.

- •

Aggressive in portfolio transformation through M&A and divestitures.

- →

Roche Holding AG

Market Share Estimate:High

Target Audience Overlap:High

Competitive Positioning:Global leader in pharmaceuticals and diagnostics, pioneering personalized healthcare.

Strengths

- •

Unmatched leadership in oncology and in-vitro diagnostics.

- •

Synergy between pharmaceutical and diagnostics divisions enables a strong personalized medicine strategy.

- •

Extensive portfolio of blockbuster biologic drugs (e.g., Herceptin, Avastin), though many now face biosimilar competition.

- •

Considered a leader in AI implementation for drug discovery and diagnostics.

Weaknesses

- •

Significant revenue loss due to biosimilar competition for its older oncology drugs.

- •

Pipeline has faced some high-profile setbacks in recent years.

- •

Competition is intensifying in its core areas of oncology and neurology.

Differentiators

- •

Integrated 'Pharma + Diagnostics' business model is a core strategic advantage.

- •

Decades of dominance and data in oncology.

- •

Heavy investment in data science and genomics to drive future growth.

Indirect Competitors

- →

Biotech Companies (e.g., Moderna, BioNTech)

Description:Innovators focused on novel technology platforms like mRNA. They are often partners (as BioNTech is with Pfizer) but also represent a disruptive force, capable of developing new therapeutic classes independently.

Threat Level:Medium

Potential For Direct Competition:High, as they build out their own pipelines and commercial capabilities.

- →

Generic & Biosimilar Manufacturers (e.g., Sandoz, Teva, Amgen)

Description:These companies compete on price by marketing equivalent versions of originator drugs after patent expiry, directly eroding the revenue of Pfizer's established products.

Threat Level:High

Potential For Direct Competition:They do not compete with innovative/patented products, but are a direct competitor to off-patent assets.

- →

AI Drug Discovery Companies (e.g., Insilico Medicine, Exscientia)

Description:Technology companies using AI and machine learning to dramatically accelerate the identification and design of new drug candidates. While often partners, they are changing the R&D landscape and could eventually develop their own assets.

Threat Level:Low

Potential For Direct Competition:Medium in the long-term, as their platforms mature.

- →

Big Tech (e.g., Google/Verily, NVIDIA)

Description:Entering the healthcare space by leveraging massive datasets, computational power, and AI to transform clinical trials, diagnostics, and drug discovery, posing a long-term disruptive threat.

Threat Level:Low

Potential For Direct Competition:Low for developing and selling drugs, but high for disrupting the value chain.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Massive Scale of R&D Operations

Sustainability Assessment:High

Competitor Replication Difficulty:Hard

- Advantage:

Extensive Global Commercial Infrastructure and Distribution Network

Sustainability Assessment:High

Competitor Replication Difficulty:Hard

- Advantage:

Broad and Diversified Patent Portfolio

Sustainability Assessment:Medium to High

Competitor Replication Difficulty:Hard

- Advantage:

Strong Brand Recognition and Trust among Healthcare Professionals and Patients

Sustainability Assessment:High

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Market Exclusivity on Blockbuster Drugs', 'estimated_duration': 'Varies by patent expiration dates (e.g., Eliquis, Ibrance).'}

{'advantage': 'First-Mover Advantage in a New Therapeutic Class (e.g., mRNA vaccines)', 'estimated_duration': '2-4 years before competitors launch similar products.'}

Disadvantages

- Disadvantage:

Dependence on a few blockbuster drugs for a significant portion of revenue.

Impact:Major

Addressability:Difficult

- Disadvantage:

Public and political pressure on drug pricing.

Impact:Major

Addressability:Difficult

- Disadvantage:

Large corporate structure can slow down innovation and adaptation compared to smaller, more agile biotechs.

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Enhance digital content for Healthcare Professionals (HCPs) by creating dedicated microsites for key products with easily accessible clinical data, trial results, and prescribing information, moving beyond general corporate messaging.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch targeted social media campaigns highlighting patient stories and outcomes related to key therapeutic areas (like oncology, as emphasized on the homepage) to build brand sentiment and patient trust.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Aggressively pursue 'bolt-on' acquisitions of mid-stage biotech companies with promising assets in Pfizer's core therapeutic areas to de-risk the R&D pipeline and fill potential revenue gaps from patent expirations.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Establish a formal 'Digital Therapeutics' division to develop and partner on FDA-approved software and digital tools that complement Pfizer's existing drug portfolio, creating integrated treatment solutions.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand the 'Accord for a Healthier World' initiative into a broader educational platform for HCPs in emerging markets, building long-term brand equity and market access.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Invest heavily in internal AI and machine learning capabilities to institutionalize accelerated drug discovery, aiming to reduce the average time from target identification to clinical trials.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Diversify into new, high-science therapeutic modalities (e.g., expanding beyond mRNA into areas like CRISPR-based therapies) to create the next wave of sustainable competitive advantages.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify Pfizer's position as the leader in 'Science-Driven Breakthroughs for Patients.' This moves beyond a general pharma identity to a more focused narrative emphasizing cutting-edge R&D (pipeline size, investment) and its direct impact on patient lives (as shown in homepage messaging).

Differentiate through 'Integrated Patient Support.' While competitors focus on the drug, Pfizer can win by owning the patient journey. This means scaling programs like RxPathways and integrating digital health tools, patient education, and support communities to improve outcomes and build loyalty beyond the pill.

Whitespace Opportunities

- Opportunity:

Digital Health and Therapeutics Integration

Competitive Gap:Most large pharma companies have been slow to integrate regulated digital therapeutics (DTx) with their drug offerings. There is a gap in providing a combined 'drug + digital' package to improve adherence and outcomes.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Building Branded Patient Communities

Competitive Gap:Competitor websites are largely corporate-facing. A significant opportunity exists to create secure, valuable, disease-specific online communities for patients, fostering direct engagement and gathering real-world evidence.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Proactive Value-Based Care Partnerships

Competitive Gap:While many talk about value-based care, few have implemented large-scale partnerships with payers and health systems that tie drug reimbursement to patient outcomes. Leading in this area would be a powerful differentiator.

Feasibility:Low

Potential Impact:High

- Opportunity:

AI-Powered Clinical Trial Recruitment

Competitive Gap:All pharma companies struggle with slow and inefficient clinical trial recruitment. Investing in and scaling an AI platform to identify and enroll patients faster could become a significant operational advantage, speeding all products to market.

Feasibility:Medium

Potential Impact:High

Pfizer operates within a mature, oligopolistic biopharmaceutical industry characterized by intense competition, high barriers to entry, and transformative technological shifts. The primary competitive arena is a race of innovation, where companies battle to develop and commercialize novel, patent-protected drugs to offset inevitable revenue losses from patent expirations—the so-called 'patent cliff.'

Direct competition is fierce, with global giants like Johnson & Johnson, Merck, Novartis, and Roche vying for market share across key therapeutic areas, particularly oncology, immunology, and vaccines. Each competitor possesses unique strengths: Merck's dominance in immuno-oncology with Keytruda, Roche's integrated diagnostics and pharma model, and Novartis's focused innovation strategy. Pfizer's competitive strength lies in its immense scale, deep R&D pipeline (as highlighted on its website), and global commercial reach. However, like its peers, it faces the constant threat of revenue erosion from biosimilars and generic drugs.

The competitive landscape is being reshaped by powerful external trends. The rise of AI in drug discovery threatens to shorten R&D cycles, potentially leveling the playing field for smaller, tech-savvy players. Simultaneously, the move toward personalized medicine demands new capabilities in diagnostics and targeted therapies. Indirect competitors, from agile biotech firms to data-centric tech giants, are further disrupting the traditional value chain.

Pfizer's digital presence, as seen on its website, effectively communicates its core purpose of 'breakthroughs that change patients' lives,' with a strong emphasis on its oncology pipeline and patient support programs like RxPathways. This narrative is crucial in an era where competition is shifting from a pure 'share of voice' with physicians to a more patient-centric model. The key strategic challenge for Pfizer is to leverage its scale and R&D engine to consistently produce high-value innovations while becoming more agile to embrace new technologies and digital patient engagement models. Future success will be defined not just by the next blockbuster drug, but by the ability to build an integrated ecosystem of treatments, digital support, and data-driven insights to deliver superior patient outcomes.

Messaging

Message Architecture

Key Messages

- Message:

Pfizer has your back in the fight against cancer.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section

- Message:

Breakthroughs that change patients' lives.

Prominence:Primary

Clarity Score:High

Location:Implied through multiple headings and company mission

- Message:

We're not waiting for breakthroughs - we're working to create them.

Prominence:Secondary

Clarity Score:High

Location:Homepage Content Section

- Message:

Powered by science and advanced technologies, we are committed to rapidly advancing novel combinations and next-generation biologics.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage Content Section

- Message:

Where people live shouldn’t impact the quality of their healthcare and income shouldn’t determine health outcomes.

Prominence:Tertiary

Clarity Score:High

Location:Homepage 'An Accord for a Healthier World' Section

The message hierarchy on the homepage is exceptionally clear, with a dominant, primary focus on oncology. This is a deliberate strategic choice to position Pfizer as a leader in a high-profile, critical disease area. While effective, this strong focus risks overshadowing Pfizer's significant work in other key areas like vaccines, internal medicine, and immunology, which are relegated to secondary navigation elements.

Messaging is largely consistent in its core themes of scientific innovation and patient impact. The tone, however, shifts significantly from the emotive, patient-centric language on the homepage to a highly technical and formal tone on interior pages like 'Funded Initiatives'. This is appropriate for the different audiences but creates a somewhat disjointed brand experience.

Brand Voice

Voice Attributes

- Attribute:

Authoritative

Strength:Strong

Examples

Every product is the result of 1,500 scientists overseeing more than 500,000 lab tests and over 36 clinical trials before the first prescription.

Pipeline Snapshot as of August 5, 2025

- Attribute:

Hopeful & Empathetic

Strength:Strong

Examples

- •

In the fight against cancer, “one more” matters - one more wedding, one more hug, one more trial.

- •

We're committed to advancements in cancer care.

- •

So that people with cancer can live better and longer lives.

- Attribute:

Scientific & Technical

Strength:Strong

Examples

- •

Advancing Cancer Care with Cutting-Edge Science

- •

We look for treatments that provide more than just symptom relief, in order to address the root cause of chronic inflammatory diseases at a molecular level

- •

Pfizer will publish full proposals of funded initiatives...

- Attribute:

Corporate & Formal

Strength:Moderate

Examples

Pfizer's Global Health Fellows Program: Leveraging Colleagues’ Expertise to Help Improve Healthcare Access Around the World

The 'Funded Initiatives' page is entirely formal and data-driven.

Tone Analysis

Scientific Authority

Secondary Tones

- •

Empathetic

- •

Aspirational

- •

Formal

Tone Shifts

Shifts from an emotional, patient-focused tone on the homepage's cancer sections to a more corporate and informational tone in the 'Latest Articles' and 'About' sections.

A significant shift to a dense, technical, and formal tone on the 'Funded Initiatives' page, appropriate for its target audience of researchers and healthcare professionals.

Voice Consistency Rating

Good

Consistency Issues

The primary inconsistency is the sharp contrast between the highly emotional and narrative-driven voice of the main marketing pages and the very dry, functional voice of the corporate/data sections. While audience-appropriate, a stronger brand through-line could bridge this gap.

Value Proposition Assessment

Pfizer leverages its unparalleled scale, scientific expertise, and relentless R&D investment to deliver medical breakthroughs that significantly improve and extend patients' lives.

Value Proposition Components

- Component:

Leadership in Oncology

Clarity:Clear

Uniqueness:Somewhat Unique

Details:The homepage heavily promotes Pfizer's commitment to cancer research (50+ programs, 40% of R&D budget), positioning it as a primary focus.

- Component:

Massive R&D Pipeline

Clarity:Clear

Uniqueness:Unique

Details:Quantified with a 'Pipeline Snapshot' (108 total programs), demonstrating the sheer scale of its innovation engine, a key competitive advantage.

- Component:

Commitment to Global Health Equity

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Details:Communicated through 'An Accord for a Healthier World,' though its specifics are less prominent than the oncology message.

- Component:

Patient Financial Assistance

Clarity:Clear

Uniqueness:Common

Details:Clearly articulated through 'Pfizer RxPathways,' addressing a key patient pain point, although similar programs are common among competitors.

Pfizer differentiates primarily through the scale of its operations and R&D pipeline. While competitors also focus on innovation, Pfizer’s messaging emphasizes vast numbers (50+ programs, 108 total pipeline projects, 1500 scientists) to project an image of unmatched resources and commitment. The heavy, emotive focus on oncology is a strategic choice to claim leadership in a highly visible and critical therapeutic area.

The messaging positions Pfizer as a dominant, research-driven biopharmaceutical leader that tackles the most challenging diseases. It aims to build trust through scientific authority, historical legacy (since 1849), and a demonstrated commitment to patient outcomes, particularly in cancer care. This positions them against other large pharma companies like Merck, Johnson & Johnson, and Novartis by focusing on the breadth and depth of their R&D pipeline.

Audience Messaging

Target Personas

- Persona:

Patients & Caregivers

Tailored Messages

- •

Pfizer has your back in the fight against cancer.

- •

In the fight against cancer, “one more” matters - one more wedding, one more hug, one more trial.

- •

Pfizer RxPathways connects eligible patients to a range of assistance programs...

Effectiveness:Effective

- Persona:

Healthcare Professionals (HCPs)

Tailored Messages

- •

Learn More at Let’sOutdoCancer.com/HCP

- •

Browse All Products

- •

Explore the Product Pipeline

Effectiveness:Somewhat Effective

- Persona:

Investors & Research Community

Tailored Messages

- •

Pipeline Snapshot as of August 5, 2025 (with detailed phase breakdowns)

- •

Download Complete Pipeline PDF

- •

Funded Initiatives (page with detailed grant information)

Effectiveness:Effective

- Persona:

General Public & Policymakers

Tailored Messages

- •

An Accord for a Healthier World

- •

Pfizer's Global Health Fellows Program...

- •

Starting with Charles Pfizer inventing...in 1849, our people have always been innovators...

Effectiveness:Somewhat Effective

Audience Pain Points Addressed

- •

Fear and uncertainty of a serious diagnosis (e.g., cancer)

- •

Need for life-extending treatments and hope for the future

- •

Financial burden of medications (addressed by RxPathways)

- •

Need for credible, scientifically-backed information on treatments

Audience Aspirations Addressed

- •

Living a longer, healthier life

- •

Experiencing more of life's important moments ('one more wedding, one more hug')

- •

Access to cutting-edge, innovative medical care

- •

A more equitable world for healthcare access

Persuasion Elements

Emotional Appeals

- Appeal Type:

Hope

Effectiveness:High

Examples

The fight against cancer continues with “One More”

A cancer breakthrough isn’t one moment. It’s decades of research...all with the hope of challenging what’s possible.

- Appeal Type:

Trust through Authority/Legacy

Effectiveness:High

Examples

Starting with Charles Pfizer inventing an almond-flavored antiparasite medicine in 1849...

Every product is the result of 1,500 scientists overseeing more than 500,000 lab tests...

- Appeal Type:

Social Responsibility/Altruism

Effectiveness:Medium

Examples

An Accord for a Healthier World

Pfizer's Global Health Fellows Program...

Social Proof Elements

- Proof Type:

Expert Proof (via Institutions)

Impact:Strong

Details:The 'Funded Initiatives' page lists collaborations with and grants to renowned institutions like The Children's Hospital of Philadelphia, Montefiore Medical Center, and Mount Sinai, reinforcing scientific credibility.

- Proof Type:

Data & Numbers

Impact:Strong

Details:Frequent use of large numbers to demonstrate scale and impact: '50+ programs', '80+ clinical trials', '108 Total' pipeline projects, '1,500 scientists'.

Trust Indicators

- •

Explicitly stating R&D investment figures and pipeline data.

- •

Transparency through the publication of 'Funded Initiatives' and downloadable pipeline PDFs.

- •

Highlighting the company's long history (since 1849).

- •

Showcasing partnerships with reputable medical and academic institutions.

Scarcity Urgency Tactics

None observed; this is appropriate for the industry and brand, which focuses on building long-term trust rather than immediate conversion.

Calls To Action

Primary Ctas

- Text:

Learn More at Let’sOutdoCancer.com

Location:Homepage, Oncology Section

Clarity:Clear

- Text:

Explore Pfizer Oncology

Location:Homepage, Oncology Section

Clarity:Clear

- Text:

Browse All Products

Location:Homepage, Products Section

Clarity:Clear

- Text:

Sign up now

Location:Homepage, Newsletter Section

Clarity:Clear

- Text:

Explore the Product Pipeline

Location:Homepage, Pipeline Section

Clarity:Clear

The CTAs are clear and logically placed, guiding users to relevant, deeper content. However, they are generally passive (e.g., 'Learn More,' 'Explore'). While functional, they could be more impactful by using more active, benefit-oriented language (e.g., 'See Our Pipeline of Breakthroughs,' 'Find Support for Your Prescription'). The 'Sign up now' CTA is the most direct and action-oriented.

Messaging Gaps Analysis

Critical Gaps

- •

The homepage messaging is heavily skewed towards oncology. While a strategic focus, it fails to adequately represent the breadth and importance of Pfizer's other major divisions, such as Vaccines and Internal Medicine, to a general visitor.

- •

There is a lack of a clear, prominent value proposition for potential employees or talent. The messaging is externally focused on patients and HCPs, missing an opportunity to attract top scientific talent.

- •

Messaging addressing public trust issues in the pharmaceutical industry is absent. The communication is uniformly positive, which may not resonate with a skeptical audience. Past campaigns like 'Science Will Win' successfully built trust during a crisis, and elements of that approach could be integrated.

Contradiction Points

No direct contradictions were found. However, the intense emotional appeal of the 'One More' cancer narrative could feel misaligned with the sterile, corporate presentation of other parts of the site.

Underdeveloped Areas

Storytelling around the 'people behind the science' is underdeveloped on the homepage. While the 'About' section mentions innovators, bringing the stories of the 1,500 scientists to the forefront could humanize the brand significantly.

The 'Accord for a Healthier World' is a powerful concept but its messaging feels like a secondary corporate initiative rather than a core part of the brand narrative.

Messaging Quality

Strengths

- •

Excellent use of emotional storytelling in the oncology campaign to create a powerful connection with patients and caregivers.

- •

Effectively uses data and scale (pipeline size, R&D investment) as a key differentiator and trust signal.

- •

Strong message clarity and hierarchy on the homepage, leaving no doubt about the current strategic focus on cancer.

- •

Transparently provides detailed scientific and pipeline information, reinforcing its authority and credibility with professional audiences.

Weaknesses

- •

Over-focus on oncology on the homepage diminishes the perceived importance of other multi-billion dollar business areas.

- •

The brand voice, while consistent within sections, lacks a unifying thread between the highly emotive marketing content and the formal corporate content.

- •

Calls-to-action are functional but lack persuasive, benefit-driven language.

- •

The patient journey, outside of oncology and financial assistance, is not clearly represented in the primary messaging.

Opportunities

- •

Create a more balanced homepage narrative that elevates other key focus areas (e.g., Immunology, Vaccines) alongside Oncology, perhaps through a rotating or modular hero section.

- •

Develop a content pillar around the 'Innovators at Pfizer,' featuring stories of individual scientists and researchers to humanize the R&D process.

- •

Integrate messaging around public trust and transparency more proactively, building on the legacy of campaigns like 'Science Will Win'.

- •

Segment homepage content more explicitly for different key audiences (Patients, HCPs, Investors) to create more direct and relevant user journeys from the first click.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Message Hierarchy

Recommendation:Revise the homepage layout to create a more balanced representation of Pfizer's core focus areas. Feature a dynamic content block that showcases recent breakthroughs or patient stories from Oncology, Vaccines, and Immunology.

Expected Impact:High

- Area:

Brand Storytelling

Recommendation:Launch a dedicated content series, 'The People Behind the Breakthroughs,' with video interviews and articles about Pfizer scientists. Integrate these stories across the site and social channels to humanize the brand.

Expected Impact:High

- Area:

Audience Segmentation

Recommendation:Add a small, persistent navigation element or entry-point module on the homepage that explicitly directs key audiences ('For Patients', 'For Healthcare Professionals', 'For Investors') to tailored content hubs.

Expected Impact:Medium

Quick Wins

- •

A/B test CTA copy. Change passive phrases like 'Learn More' to more compelling, active phrases like 'Discover Our Science' or 'See Our Latest Research'.

- •

Elevate the 'Pfizer RxPathways' link to a more prominent position on the homepage to immediately address the critical patient need for financial assistance.

- •

Add a 'Careers' or 'Join Our Mission' link with a compelling message in the main navigation or footer to better attract scientific talent.

Long Term Recommendations

- •

Develop a comprehensive messaging framework that establishes a consistent, overarching brand voice—balancing scientific authority with human empathy—that can be adapted across all communications, from emotive campaigns to technical data sheets.

- •

Invest in interactive content to explain the drug development pipeline, making it more engaging and understandable for a broader audience, thereby increasing trust and transparency.

- •

Create a dedicated 'Trust & Transparency' section on the website that proactively addresses common questions and concerns about the pharmaceutical industry, drug pricing, and clinical trials.

Pfizer's strategic messaging on its corporate website is a powerful, though narrowly focused, vehicle for asserting its market leadership. The homepage executes a clear and deliberate strategy to position Pfizer as the dominant force in oncology, using a masterful blend of emotional storytelling ('one more hug') and data-driven authority ('50+ programs'). This effectively differentiates the brand through the sheer scale of its commitment. The messaging architecture is robust for its intended audiences, providing deep, transparent data for investors and the scientific community while offering empathetic narratives for patients. However, this intense focus on oncology comes at a cost, significantly overshadowing other vital, revenue-driving areas like vaccines and internal medicine. The brand voice, while effective within its context, shifts jarringly from highly empathetic to starkly corporate, indicating an opportunity to weave a more consistent narrative thread. Key gaps exist in messaging targeted at potential talent and in proactively addressing public skepticism about the pharmaceutical industry. To optimize, Pfizer should evolve its homepage to present a more balanced portfolio of its core strengths, humanize its scientific prowess by spotlighting the people behind the breakthroughs, and adopt more direct, action-oriented language to guide user journeys more effectively. The foundation is strong, but the messaging must broaden to fully reflect the scope and impact of the entire Pfizer enterprise.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established portfolio of blockbuster drugs (e.g., Eliquis, Vyndaqel family) with significant global market share and robust sales.

- •

Strong recent performance, with a 10% year-over-year operational revenue increase in Q2 2025, beating expectations.

- •

Leadership in key therapeutic areas like oncology, internal medicine, vaccines, and inflammation, addressing large and persistent patient needs.

- •

Massive R&D pipeline with 108 projects, indicating a continuous effort to meet current and future market demands.

- •

Strategic acquisitions, like the $43 billion Seagen deal, have doubled the oncology pipeline to 60 programs, demonstrating a commitment to leading in high-growth areas.

Improvement Areas

- •

Mitigating the impact of the upcoming 'patent cliff,' with key drugs like Ibrance, Vyndaqel, and Eliquis facing loss of exclusivity between 2027-2029.

- •

Ensuring the successful integration of Seagen and the realization of its projected $10B+ revenue by 2030 to justify the significant investment.

- •

Improving R&D productivity to ensure the robust pipeline translates into a consistent cadence of new blockbuster approvals to offset revenue losses from expiring patents.

Market Dynamics

Approximately 5-6% CAGR, with the global pharmaceutical market projected to grow from ~$1.77 trillion in 2025 to ~$3.03 trillion by 2034.

Mature

Market Trends

- Trend:

Rise of Personalized and Precision Medicine

Business Impact:Drives the need for advanced diagnostic capabilities and targeted therapies, a key rationale for the Seagen (ADC technology) acquisition.

- Trend:

Increasing Use of AI and Machine Learning in R&D

Business Impact:Opportunity to accelerate drug discovery, shorten clinical trial timelines, and reduce R&D costs.

- Trend:

Intensifying Pricing Pressure and Regulatory Scrutiny

Business Impact:Increased pressure on margins and the need for strong health economics and real-world evidence to justify pricing to payers and governments.

- Trend:

Focus on High-Growth Therapeutic Areas

Business Impact:Strategic imperative to invest heavily in areas like oncology, immunology, and rare diseases, which Pfizer is actively pursuing.

- Trend:

Expansion into Emerging Markets

Business Impact:Significant growth vector, requiring tailored market access and commercial strategies for regions like Asia and Latin America.

Favorable, but urgent. The market is rewarding innovation in key areas where Pfizer is investing (e.g., oncology). However, the impending patent cliff creates a clear and urgent timeline for the pipeline and recent acquisitions to deliver results.

Business Model Scalability

High

Characterized by extremely high, front-loaded fixed costs (R&D, clinical trials) and relatively low variable costs for manufacturing small-molecule drugs, enabling massive operating leverage upon commercial success.

High. Once a drug is approved and commercialized, the marginal cost of producing additional units is low, leading to high-profit margins that fund future R&D.

Scalability Constraints

- •

Navigating complex, country-specific regulatory approval processes for new drugs and indications.

- •

Scaling complex manufacturing for biologics, cell, and gene therapies, which is significantly more challenging than for small molecules.

- •

Global supply chain complexity, subject to geopolitical risks and logistical challenges.

- •

Market access and reimbursement negotiations with national health systems and private payers.

Team Readiness

Very Strong. Experienced leadership team with a proven track record of executing large-scale M&A, managing a global organization, and navigating complex regulatory environments.

Pfizer is structured around key therapeutic business units (e.g., Oncology, Vaccines) which allows for focused expertise. The primary challenge is maintaining agility and fostering innovation within a massive global bureaucracy while integrating large acquisitions like Seagen.

Key Capability Gaps

- •

Deep expertise in AI/ML application for drug discovery and clinical trial optimization to compete with more digitally-native biotechs.

- •

Talent in digital therapeutics (DTx) and patient-centric digital services to create value 'beyond the pill'.

- •

Specialized manufacturing talent for next-generation modalities like cell and gene therapies.

Growth Engine

Acquisition Channels

- Channel:

Physician & Hospital Sales Force (Detailing)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Integrate digital tools (e.g., remote detailing, data analytics for targeting) to enhance efficiency and effectiveness of the field force. Shift from product-focus to value-based discussions with healthcare providers.

- Channel:

Medical Science Liaisons (MSLs) & Key Opinion Leader (KOL) Engagement

Effectiveness:High

Optimization Potential:High

Recommendation:Leverage MSLs to gather real-world evidence and insights that inform R&D and market access strategies, positioning them as scientific partners rather than just educators.

- Channel:

Direct-to-Consumer Advertising (DTCA)

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Focus DTCA on new launches in competitive markets to build patient awareness and drive conversations with physicians. Utilize digital and social media channels for more targeted and measurable campaigns.

- Channel:

Payer & Formulary Access Teams

Effectiveness:High

Optimization Potential:High

Recommendation:Develop more sophisticated value propositions supported by robust health economics and outcomes research (HEOR) data to combat increasing pricing pressure and secure favorable formulary placement.

Customer Journey

The 'customer' is a complex ecosystem (Patient, Physician, Payer). The path is: Patient experiences symptoms -> Visits Physician -> Physician diagnoses and prescribes Pfizer product -> Patient gets prescription filled -> Payer provides reimbursement. Pfizer's success depends on influencing the Physician's choice and ensuring Payer access.

Friction Points

- •

Payer restrictions such as prior authorizations and step-edits.

- •

High patient co-pays or out-of-pocket costs.

- •

Competition from generics/biosimilars influencing physician and payer choice.

- •

Lack of patient awareness or education about specific conditions and treatments.

Journey Enhancement Priorities

{'area': 'Patient Support Services', 'recommendation': 'Expand and digitize patient support programs like Pfizer RxPathways to simplify access, assist with co-pays, and provide adherence support, thereby improving patient retention and outcomes.'}

{'area': 'Physician Education', 'recommendation': 'Deliver personalized, omnichannel educational content to physicians, moving beyond traditional sales calls to include webinars, digital platforms, and peer-to-peer learning to demonstrate clinical value. '}

Retention Mechanisms

- Mechanism:

Treatment for Chronic Conditions

Effectiveness:High

Improvement Opportunity:Develop and promote patient adherence programs using digital tools (apps, reminders) to improve long-term outcomes and secure recurring revenue streams.

- Mechanism:

Expanding Drug Indications

Effectiveness:High

Improvement Opportunity:Systematically pursue label expansions for existing blockbuster drugs to treat new patient populations or earlier stages of disease, thereby extending the product lifecycle and market reach.

- Mechanism:

Patient Assistance & Support Programs

Effectiveness:Medium

Improvement Opportunity:Increase awareness and ease-of-use of these programs to reduce patient drop-off due to financial barriers and build long-term patient and physician loyalty.

Revenue Economics

Extremely Favorable. For patented drugs, the price per unit is high while the marginal cost of production is low, leading to very high gross margins (reported at ~76% in Q2 2025). The primary economic challenge is recouping massive upfront R&D and clinical trial investments.

Not directly applicable in the traditional SaaS sense. A proxy would be 'Lifecycle Revenue per Drug' vs. 'Total R&D and Commercialization Cost per Drug'. For a blockbuster drug, this ratio is exceptionally high.

High, but facing pressure. Pfizer demonstrates strong revenue generation from its portfolio, but faces the constant threat of patent expiry which erases revenue streams that must be replaced by new, innovative products.

Optimization Recommendations

- •

Accelerate time-to-market for pipeline drugs to maximize the duration of patent-protected revenue generation.

- •

Optimize R&D spend by leveraging AI and partnerships to improve the success rate of clinical trials and terminate unpromising candidates earlier.

- •

Implement strategic pricing and market access initiatives to maximize revenue per product in the face of global pricing pressures.

Scale Barriers

Technical Limitations

- Limitation:

R&D Pipeline Failures

Impact:High

Solution Approach:Diversify the R&D portfolio across multiple therapeutic modalities (small molecules, biologics, ADCs, vaccines). Utilize AI and advanced analytics to improve target selection and predict trial outcomes. Pursue strategic M&A to acquire de-risked, late-stage assets.

- Limitation:

Manufacturing Complexity for Biologics

Impact:Medium

Solution Approach:Invest in 'smart manufacturing' facilities and digital supply networks to improve efficiency and mitigate operational risks for complex therapies. Partner with specialized contract development and manufacturing organizations (CDMOs) where necessary.

Operational Bottlenecks

- Bottleneck:

Global Regulatory and Reimbursement Approvals

Growth Impact:Slows down global product launches and revenue ramp-up.

Resolution Strategy:Build deep, local expertise in regulatory affairs and market access for key markets. Engage with regulators and payers early in the development process to align on evidence requirements.

- Bottleneck:

Post-Merger Integration

Growth Impact:Failure to effectively integrate large acquisitions like Seagen can lead to loss of key talent, cultural clashes, and failure to realize synergistic value.

Resolution Strategy:Establish a dedicated integration management office with clear governance and milestones. Prioritize retaining key scientific and commercial talent from the acquired company and align cultures around a shared scientific mission.

Market Penetration Challenges

- Challenge:

Patent Cliff & Generic/Biosimilar Competition

Severity:Critical

Mitigation Strategy:Aggressively defend intellectual property, develop next-generation follow-on products, and execute a robust M&A and pipeline strategy to ensure new product launches can offset the ~$200 billion industry-wide revenue at risk by 2030.

- Challenge:

Intense Competition in Key Therapeutic Areas

Severity:Major

Mitigation Strategy:Differentiate products based on clinical superiority, safety profiles, or novel mechanisms of action. Focus commercial efforts on demonstrating superior value to both clinicians and payers. Competitors include Novartis, Roche, Merck, and J&J.

- Challenge:

Drug Pricing Controls and Payer Pressure

Severity:Major

Mitigation Strategy:Generate and effectively communicate compelling real-world evidence and health economic data to prove the value of innovative medicines and justify premium pricing.

Resource Limitations

Talent Gaps

- •

Top-tier data scientists and AI/ML engineers with pharmaceutical R&D experience.

- •

Experts in cell and gene therapy manufacturing and regulation.

- •

Commercial leaders with experience in launching digital health solutions.

Significant. While generating strong cash flow, Pfizer requires immense capital for mega-deals (like the $43B Seagen acquisition), funding dozens of late-stage clinical trials simultaneously, and global product launches.

Infrastructure Needs

- •

Expansion of specialized manufacturing capacity for antibody-drug conjugates (ADCs) and other biologics.

- •

Advanced data infrastructure to support AI-driven R&D and real-world evidence analysis.

- •

Modernized, resilient global supply chain infrastructure.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in Emerging Markets

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop tiered pricing and access strategies for key emerging markets like China, India, and Brazil. Partner with local players to navigate regulatory and distribution complexities.

- Expansion Vector:

Label Expansion for Oncology Portfolio

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Systematically conduct clinical trials to move approved cancer therapies into earlier lines of treatment (e.g., adjuvant settings) and new cancer types, significantly increasing the eligible patient population.

Product Opportunities

- Opportunity:

Leadership in Antibody-Drug Conjugates (ADCs)

Market Demand Evidence:Strong clinical data and high M&A activity in the ADC space. The Seagen acquisition positions Pfizer as a potential leader in this next-generation cancer treatment modality.

Strategic Fit:Excellent. Combines Seagen's leading ADC technology with Pfizer's global development and commercialization capabilities.

Development Recommendation:Prioritize and accelerate the development of the 12 ADCs in the combined pipeline. Explore novel ADC targets and payloads to build a sustainable long-term platform.

- Opportunity:

Obesity and Metabolic Diseases

Market Demand Evidence:Massive and rapidly growing market with high unmet need, as demonstrated by the success of competitors' GLP-1 agonists.

Strategic Fit:Aligns with the Internal Medicine focus area.

Development Recommendation:Aggressively advance pipeline candidates like danuglipron to compete in this multi-billion dollar market, focusing on differentiation (e.g., oral administration, safety profile, alternative mechanisms).

- Opportunity:

Next-Generation Vaccines (e.g., mRNA technology)

Market Demand Evidence:Proven success of mRNA platform with COVID-19 vaccines.

Strategic Fit:Core to the Vaccines business unit.

Development Recommendation:Leverage the BNTX partnership and internal mRNA expertise to develop new vaccines for infectious diseases (e.g., RSV, shingles, flu) and explore therapeutic applications in oncology and rare diseases.

Channel Diversification

- Channel:

Digital Therapeutics (DTx)

Fit Assessment:High

Implementation Strategy:Develop or acquire DTx solutions that act as companion products to key drugs (especially in oncology and immunology) to improve patient adherence, monitor side effects, and provide supportive care, creating a stickier ecosystem.

- Channel:

Direct-to-Consumer (DTC) Telehealth Platform

Fit Assessment:Medium

Implementation Strategy:Following the launch of its DTC platform, selectively expand offerings for specific conditions where patient awareness and access are key barriers. Partner with established telehealth providers to streamline the patient-physician interaction.

Strategic Partnerships

- Partnership Type:

AI/ML Drug Discovery Collaborations

Potential Partners

- •

Schrödinger

- •

Recursion Pharmaceuticals

- •

Insitro

Expected Benefits:Accelerate identification of novel drug targets and optimize molecule design, potentially reducing R&D timelines and improving the probability of success for early-stage assets.

- Partnership Type:

Early-Stage Biotech Licensing & Acquisition

Potential Partners

Numerous private and public biotech companies with promising assets in Pfizer's core therapeutic areas.

Expected Benefits:Continuously replenish the early-to-mid-stage pipeline by accessing external innovation, which is a core component of the biopharma growth model.

Growth Strategy

North Star Metric

Number of Patients Treated with New Molecular Entities (NMEs) Launched in the Last 5 Years

This metric directly measures the success of the R&D and M&A engine in delivering novel, impactful medicines to patients. It aligns with the mission of 'breakthroughs that change patients' lives' and is a leading indicator of future revenue growth, crucial for offsetting patent cliffs. Pfizer has stated a goal to double the number of patients treated with its cancer medicines by 2030.

Increase metric by 20% annually over the next five years, driven by successful launches from the Seagen acquisition and the internal pipeline.

Growth Model

Innovation-Driven Growth, Fueled by Strategic M&A

Key Drivers

- •

R&D Productivity & Pipeline Advancement

- •

Successful Integration and Commercialization of Acquired Assets (especially Seagen)

- •

Maximizing Lifecycle Value of Existing Blockbusters through Label Expansion

- •

Securing Global Market Access and Reimbursement

A dual-pronged approach: 1) Invest heavily in internal R&D in core areas of expertise (e.g., small molecules, vaccines). 2) Aggressively pursue business development and M&A to acquire new technologies and late-stage assets to fill portfolio gaps and counteract patent expirations.

Prioritized Initiatives

- Initiative:

Accelerate and Integrate the Seagen Oncology Portfolio

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months for full integration and pipeline acceleration

First Steps:Finalize integrated R&D and commercial leadership teams. Harmonize clinical trial protocols for key ADC assets. Develop a unified commercial launch strategy for late-stage candidates.

- Initiative:

Advance Key Late-Stage Pipeline Assets Outside of Oncology

Expected Impact:High

Implementation Effort:Medium

Timeframe:12-36 months to key clinical readouts/regulatory filings

First Steps:Fully fund and staff pivotal Phase 3 trials for promising candidates in immunology, obesity, and vaccines. Engage with regulatory agencies to align on endpoints and filing requirements.

- Initiative:

Launch Enterprise-Wide AI in R&D Program

Expected Impact:Medium-High (long-term)

Implementation Effort:High

Timeframe:24+ months to see significant impact on pipeline velocity

First Steps:Appoint a Head of AI for R&D. Identify 2-3 high-impact pilot projects in drug discovery or clinical trial design. Secure partnerships with leading AI technology firms.

Experimentation Plan

High Leverage Tests

- Area:

Commercial Model Innovation

Experiment:Pilot an outcome-based pricing model with a regional payer for a new high-cost therapy.

- Area:

Digital HCP Engagement

Experiment:Run an A/B test comparing the impact of a fully digital engagement model vs. traditional sales rep model for a mature product in a specific geography.

- Area:

Clinical Trial Recruitment

Experiment:Utilize a decentralized clinical trial (DCT) platform for a Phase 2 study to measure impact on recruitment speed and patient diversity.

For commercial tests, track physician prescribing behavior, market share, and ROI. For R&D experiments, track metrics like cycle time, cost per patient, and data quality.

Continuous experimentation in commercial models; project-based for clinical trial innovations.

Growth Team

Decentralized 'Asset-Centric' Growth Teams. Each major drug or late-stage asset should have a dedicated, cross-functional team comprising R&D, Medical Affairs, Market Access, Commercial, and Regulatory leads empowered to drive the asset's global strategy and execution.

Key Roles

- •

Global Asset Lead (overall accountability for the drug's lifecycle)

- •

Head of Health Economics & Outcomes Research (to build the value story)

- •

Digital Marketing & Patient Engagement Lead

- •