eScore

pgecorp.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

PG&E Corp's digital presence is highly specialized and effective for its core audience of investors and regulators, demonstrating strong search intent alignment for financial and corporate governance queries. The website serves as a centralized hub for reports, filings, and press releases, establishing content authority within its niche. However, its multi-channel presence is limited, and its content strategy is not optimized for broader public engagement or voice search, focusing instead on a narrow, professional audience.

Excellent content authority and search intent alignment for its primary target audience of investors and regulators, providing direct access to critical financial and safety information.

Expand multi-channel presence and optimize key content for conversational/voice search to better control the narrative and engage a broader public audience concerned with safety and energy costs.

The brand's communication is disciplined and effectively segmented for its corporate audience, with clear messaging on wildfire safety and clean energy investments. It successfully differentiates itself by necessity, focusing on risk mitigation unique to its operational reality. The primary weakness is a highly corporate, impersonal tone that struggles to build emotional connection and trust with the general public, a critical gap given past failures and ongoing ratepayer concerns.

Consistent and clear messaging hierarchy that prioritizes the most critical reputational issues (wildfire safety) and strategic initiatives (clean energy) for its investor and regulator audience.

Develop a more empathetic and human-centric brand voice for public-facing communications to rebuild trust and address the significant pain point of energy affordability, which is largely absent from the current messaging.

For its specific goal—guiding sophisticated users to detailed reports and data—the conversion experience is effective. The information architecture is logical, minimizing cognitive load for users who know what they're looking for. However, the site's calls-to-action are understated and lack visual weight, and there is a low level of micro-interaction quality, making the experience functional but not particularly engaging. The cross-device journey is adequate, but not optimized for a seamless mobile-first experience.

A clear and logical information architecture that allows its target audience to efficiently find and download critical documents like annual reports, sustainability reports, and earnings calls.

Enhance the visual prominence of primary calls-to-action (e.g., using solid-filled buttons instead of 'ghost buttons' for key links) to more effectively guide user journeys and increase engagement.

The website demonstrates a strong commitment to transparency through accessible SEC filings, sustainability reports, and detailed wildfire mitigation plans. It leverages third-party validation by showcasing an experienced board of directors and partnerships on innovation projects. However, the company's overall credibility is heavily impacted by significant external risks, primarily catastrophic wildfires and a legacy of public distrust, which proactive communication and operational execution are actively working to mitigate.

High degree of transparency with readily accessible financial reports, regulatory filings, and detailed wildfire mitigation plans, which is crucial for rebuilding trust with investors and regulators.

Incorporate more direct customer success evidence and testimonials related to safety and reliability improvements to better translate corporate actions into tangible benefits for the public.

PG&E's primary competitive advantage is its regulated monopoly on the transmission and distribution grid in a massive, wealthy service area, creating an almost insurmountable moat. This advantage is sustainable and reinforced by the enormous capital required to replicate its infrastructure. While facing competition in energy generation from CCAs and DERs, no competitor can displace its core function as the grid operator, which is a position of significant and enduring strength.

Ownership of the essential transmission and distribution infrastructure creates a natural monopoly with extremely high barriers to entry, making its core business highly defensible.

Proactively develop and scale new services around grid orchestration and DER management to turn the threat of decentralization into a new, defensible competitive advantage.

The company has immense potential for state-mandated and regulator-approved growth driven by California's decarbonization and electrification goals. This growth is not from acquiring new customers but from expanding the regulated asset base through massive investments in grid modernization, wildfire hardening, and supporting new energy loads like data centers and EVs. Recent earnings calls confirm a $63 billion capital plan and a 10-gigawatt data center pipeline, signaling a clear and robust path for expansion.

Growth is directly linked to the state-mandated energy transition, creating a clear, multi-decade pipeline for massive capital investment in grid modernization and electrification, which drives rate base and earnings growth.

Address operational bottlenecks in project execution and permitting to accelerate the deployment of capital and meet the surging demand from new high-value loads like data centers.

The core business model of a regulated rate-of-return utility is coherent and time-tested, providing a clear path to profitability on approved capital investments. Strategic focus is strong, with massive resource allocation efficiently directed toward the dual necessities of wildfire risk mitigation and clean energy transition. The model shows alignment with key stakeholders (investors, regulators) on the need for these investments, though it faces strain regarding alignment with customers on the issue of affordability.

Strong alignment between capital investment strategy, regulatory mandates (wildfire safety, decarbonization), and the primary driver of shareholder return (rate base growth).

Innovate the revenue model by championing Performance-Based Ratemaking (PBR) with regulators to better align financial incentives with customer-centric outcomes like affordability and efficiency, rather than solely rewarding capital deployment.

As the incumbent utility for a vast and critical economic region, PG&E holds dominant market power in energy transmission and distribution. Its pricing power is significant, albeit dictated by regulators rather than market forces, as evidenced by approved rate cases. The company heavily influences state energy policy and sets operational standards, and its central role in enabling the state's energy transition gives it immense leverage with partners and suppliers.

Dominant and exclusive control over the energy grid in its large service territory gives it immense market power and influence over California's energy policy and economic development.

Mitigate customer dependency risk and political backlash from rising rates by increasing operational efficiencies and aggressively pursuing federal funding to offset the cost of capital projects.

Business Overview

Business Classification

Regulated Utility Holding Company

Energy Services Provider

Energy & Utilities

Sub Verticals

- •

Electric Power Generation, Transmission & Distribution

- •

Natural Gas Distribution

- •

Renewable Energy Integration

Mature

Maturity Indicators

- •

Extensive, long-established infrastructure and asset base.

- •

Operates as a regulated monopoly in a defined, large service area.

- •

Subject to extensive, well-established regulatory oversight by the California Public Utilities Commission (CPUC).

- •

Recent history of Chapter 11 bankruptcy and restructuring due to wildfire liabilities, indicating significant operational and financial challenges despite market maturity.

Enterprise

Steady (Regulated Growth)

Revenue Model

Primary Revenue Streams

- Stream Name:

Electricity Sales (Regulated)

Description:Sale of electricity to residential, commercial, industrial, and agricultural customers. Revenue is generated based on CPUC-approved rates designed to cover operating costs and provide a return on capital investments.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:Medium

- Stream Name:

Natural Gas Sales (Regulated)

Description:Sale and transportation of natural gas to residential and commercial customers within its service area, also based on CPUC-approved rates.

Estimated Importance:Secondary

Customer Segment:Residential & Commercial

Estimated Margin:Medium

- Stream Name:

Capital Investment Rate Base Growth

Description:A primary driver of earnings growth, where PG&E makes CPUC-approved capital investments in grid modernization, safety (e.g., wildfire mitigation), and clean energy infrastructure. These investments are added to the 'rate base' on which PG&E earns a regulated rate of return.

Estimated Importance:Primary (Driver of Profitability)

Customer Segment:N/A (Regulatory Mechanism)

Estimated Margin:High (Regulated Return on Equity)

Recurring Revenue Components

Monthly utility payments from millions of customers.

Fixed service charges and fees.

Pricing Strategy

Regulated Rate-of-Return

N/A (Monopoly)

Semi-transparent

Pricing Psychology

- •

Time-of-Use (TOU) Rates

- •

Tiered Pricing

- •

Incentive Programs (e.g., for energy efficiency or EV adoption)

Monetization Assessment

Strengths

- •

Monopoly position in a large, economically significant service area ensures a stable and predictable customer base.

- •

Essential service nature guarantees consistent demand.

- •

Regulated rate-of-return model provides a clear path to profitability on approved capital expenditures.

Weaknesses

- •

Highly susceptible to regulatory risk and political pressure, which can impact rate approvals and profitability.

- •

Inability to dynamically price based on market conditions, limiting revenue optimization.

- •

High public scrutiny over rates, especially following significant capital projects for wildfire mitigation.

Opportunities

- •

Massive required investments in grid modernization, wildfire hardening (e.g., undergrounding), and EV infrastructure will significantly expand the rate base.

- •

Development of new, non-regulated or performance-based services, such as managing EV fleet charging or orchestrating Vehicle-to-Grid (V2G) services.

- •

Capitalizing on federal and state grants for grid resilience and clean energy projects.

Threats

- •

Increasing adoption of distributed energy resources (DERs) like rooftop solar and battery storage, which can reduce customer reliance on the grid.

- •

Regulatory penalties or disallowed cost recovery for operational failures or imprudent spending.

- •

Catastrophic events, particularly wildfires, leading to immense liabilities that can threaten financial stability.

Market Positioning

Regulated Monopoly & Critical Infrastructure Provider

Dominant (Monopoly)

Target Segments

- Segment Name:

Residential Customers

Description:Approximately 5.5 million households in Northern and Central California requiring electricity and/or natural gas for daily life.

Demographic Factors

Varies widely across urban, suburban, and rural areas within a 70,000-square-mile service territory.

Psychographic Factors

Increasingly concerned with energy costs, reliability, and environmental impact.

High anxiety regarding wildfire risk and Public Safety Power Shutoffs (PSPS).

Behavioral Factors

Adoption of EVs, rooftop solar, and smart home technology is growing.

Subject to Time-of-Use (TOU) rate plans influencing consumption patterns.

Pain Points

- •

High and rising electricity rates.

- •

Power outages due to PSPS or system failures.

- •

Safety concerns related to wildfires and gas infrastructure.

Fit Assessment:Good

Segment Potential:Medium

- Segment Name:

Commercial Customers (SMB & Enterprise)

Description:A diverse range of businesses, from small retailers to large corporations and data centers, requiring reliable and high-quality power for operations.

Demographic Factors

Concentrated in metropolitan areas (Bay Area, Sacramento).

Includes critical, high-growth sectors like technology and data centers.

Psychographic Factors

Focused on operational continuity and managing energy as a significant operating expense.

Behavioral Factors

Seeking partnerships for energy efficiency, demand response programs, and electrification of fleets.

Pain Points

- •

Energy costs impacting profitability.

- •

Need for uninterruptible, high-quality power.

- •

Complexity in navigating rates and energy management programs.

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Industrial & Agricultural Customers

Description:Large-scale energy users in manufacturing, processing, and agriculture who depend on consistent energy for production and irrigation.

Demographic Factors

Geographically dispersed, often in rural or specific industrial zones.

Psychographic Factors

Highly sensitive to rate changes and service reliability.

Behavioral Factors

Often have sophisticated energy management practices and may engage in self-generation.

Pain Points

High energy consumption costs are a primary competitive factor.

Vulnerability to service disruptions during critical operational periods.

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

Regulated Monopoly Status

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive Physical Infrastructure

Strength:Strong

Sustainability:Sustainable

- Factor:

Central Role in California's Energy Transition

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To deliver safe, reliable, affordable, and clean energy to customers and communities in Northern and Central California, while actively working to mitigate wildfire risk and build a climate-resilient grid for the future.

Good

Key Benefits

- Benefit:

Universal Energy Access

Importance:Critical

Differentiation:Unique (within service area)

Proof Elements

Vast network of over 100,000 miles of electric distribution lines.

- Benefit:

Enabling the Clean Energy Transition

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Delivering electricity that is 95% greenhouse gas-free.

Leading in rooftop solar interconnections and grid-scale battery storage.

- Benefit:

Improving Safety and Reliability

Importance:Critical

Differentiation:Common (Industry Expectation)

Proof Elements

Multi-billion dollar Wildfire Mitigation Plans.

Commitment to underground 10,000 miles of power lines in high-risk areas.

Unique Selling Points

- Usp:

Exclusive provider of electric transmission and distribution services in its territory.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Unmatched scale and experience in integrating large-scale renewables and distributed energy resources into the grid.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Need for consistent, reliable power for homes and businesses.

Severity:Critical

Solution Effectiveness:Partial

- Problem:

Lack of infrastructure to support widespread adoption of electric vehicles and other clean energy technologies.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Heightened risk of catastrophic wildfires caused by utility equipment.

Severity:Critical

Solution Effectiveness:Partial

Value Alignment Assessment

Medium

The core value proposition is aligned with market needs, but historical performance issues, particularly around safety and reliability, have created a gap between the stated proposition and customer experience.

Medium

While providing an essential service, the target audience is increasingly frustrated by high costs and reliability concerns, indicating a misalignment that the company is actively trying to address through its safety and modernization investments.

Strategic Assessment

Business Model Canvas

Key Partners

- •

California Public Utilities Commission (CPUC) & other regulators.

- •

Technology providers (e.g., The Mobility House, Ford, GM for V2G).

- •

Renewable energy developers.

- •

Equipment manufacturers (e.g., GE, Siemens).

- •

State and local governments.

Key Activities

- •

Grid operation, maintenance, and modernization.

- •

Wildfire risk mitigation and vegetation management.

- •

Regulatory filings and compliance.

- •

Capital project planning and execution.

- •

Customer service and billing.

Key Resources

- •

Extensive transmission and distribution infrastructure.

- •

Skilled workforce (engineers, lineworkers, etc.).

- •

State-granted utility franchise.

- •

Access to capital markets.

- •

Power generation assets (hydro, nuclear, gas).

Cost Structure

- •

Capital expenditures for infrastructure projects (undergrounding, grid upgrades).

- •

Operational and maintenance expenses.

- •

Wildfire mitigation and liability costs.

- •

Purchased power agreements.

- •

Significant debt service.

Swot Analysis

Strengths

- •

Regulated monopoly with a captive customer base and predictable revenue model.

- •

Essential service provider critical to the functioning of California's economy.

- •

Significant and growing rate base driven by necessary investments in safety and clean energy.

- •

Pivotal role in achieving California's aggressive decarbonization goals.

Weaknesses

- •

Damaged public trust and reputation due to past safety failures, including catastrophic wildfires and the San Bruno pipeline explosion.

- •

High levels of debt and financial leverage.

- •

Massive, aging infrastructure vulnerable to climate change impacts, especially wildfires.

- •

Complex and often adversarial regulatory environment.

Opportunities

- •

Lead the transition to a decentralized, bi-directional grid (V2G, DERs).

- •

Leverage AI and advanced technologies for predictive maintenance and improved grid operations.

- •

Massive investment opportunities in grid modernization and electrification (EVs, buildings) driving rate base growth.

- •

Rebuild brand reputation through demonstrated improvements in safety and operational excellence.

Threats

- •

Continued risk of catastrophic wildfires leading to massive financial liabilities and potential for further regulatory action.

- •

Climate change exacerbating weather-related risks (drought, heatwaves, storms).

- •

Regulatory lag or disallowance of costs, impacting financial recovery.

- •

Cybersecurity threats to critical grid infrastructure.

- •

Economic downturn impacting customer ability to pay rising utility rates.

Recommendations

Priority Improvements

- Area:

Operational Excellence & Risk Mitigation

Recommendation:Continue aggressive execution of the Wildfire Mitigation Plan, focusing on undergrounding and system hardening, while using advanced analytics and AI to optimize risk reduction efforts and cost-effectiveness.

Expected Impact:High

- Area:

Customer Trust & Rate Affordability

Recommendation:Enhance transparency and communication around rate changes, clearly linking investments to tangible benefits in safety and reliability. Aggressively pursue federal funding and operational efficiencies to mitigate the full impact of capital costs on customer bills.

Expected Impact:High

- Area:

Strategic Innovation Scaling

Recommendation:Transition successful pilot programs, especially in Vehicle-to-Grid (V2G) and Distributed Energy Resource Management Systems (DERMS), into scalable, revenue-generating services through new rate design proposals to the CPUC.

Expected Impact:Medium

Business Model Innovation

Evolve from a commodity provider to an 'Energy Platform Orchestrator': Develop a business model focused on managing a complex, two-way grid. This involves creating platforms and markets for services from distributed assets (EVs, home batteries, smart appliances), earning revenue from transaction fees or performance-based incentives rather than solely from capital investment.

Develop a Non-Regulated Services Arm: Create a subsidiary focused on providing energy consulting, data analytics, and EV fleet management services to large commercial and industrial customers, leveraging the utility's deep expertise to create new revenue streams outside the traditional regulatory framework.

Revenue Diversification

Performance-Based Ratemaking (PBR): Propose new PBR mechanisms to the CPUC that reward the company for achieving specific outcomes (e.g., reduced wildfire ignitions, faster renewable interconnections, peak demand reduction) rather than just for capital deployed.

Grid Data Monetization: Offer anonymized, aggregated energy consumption data and grid capacity analytics to third parties like city planners, EV charging network developers, and real estate developers to inform their investment decisions.

Pacific Gas and Electric Company (PG&E) operates a classic, mature, regulated monopoly business model that is currently undergoing a forced and rapid evolution due to immense external pressures. Its core business of selling electricity and natural gas provides a stable, recurring revenue stream, but its profitability and strategic direction are fundamentally dictated by the regulatory environment and the absolute necessity of mitigating catastrophic wildfire risk.

The primary strategic challenge and opportunity for PG&E is transforming its business model from a 20th-century unidirectional power provider to a 21st-century platform orchestrator for a decarbonized, decentralized, and resilient energy system. The massive, state-mandated investments in wildfire hardening, grid modernization, and clean energy integration are the primary drivers of its financial model, as they expand the rate base upon which it earns a regulated return. However, this strategy is creating significant pressure on customer affordability, posing a major political and regulatory risk.

Strategic evolution is not a choice but a necessity. The company is showing signs of this transformation through its proactive engagement in Vehicle-to-Grid (V2G) pilot programs and its R&D focus on grid innovation. The long-term success of PG&E will depend on its ability to execute its massive capital programs safely and efficiently, regain public and regulatory trust, and successfully transition its business model to one that values and monetizes orchestration, flexibility, and data, in addition to traditional infrastructure assets. The key to unlocking future value lies in shaping a regulatory framework that rewards performance and innovation, not just capital expenditure, allowing PG&E to diversify its value creation beyond the confines of the traditional rate-of-return model.

Competitors

Competitive Landscape

Mature

Regulated Monopoly with emerging competition

Barriers To Entry

- Barrier:

Massive capital investment for infrastructure (generation, transmission, distribution networks).

Impact:High

- Barrier:

Complex and lengthy regulatory and permitting processes at federal, state, and local levels.

Impact:High

- Barrier:

Economies of scale enjoyed by incumbent utilities in a defined service territory.

Impact:High

- Barrier:

Established rights-of-way and ownership of the physical grid.

Impact:High

Industry Trends

- Trend:

Decarbonization & Clean Energy Transition

Impact On Business:Requires massive investment in renewable generation, grid modernization for intermittent resources, and retirement of fossil fuel assets. Creates opportunities for leadership in green energy but also significant capital expenditure and operational challenges.

Timeline:Immediate

- Trend:

Grid Modernization and Resilience

Impact On Business:Driven by climate change-induced extreme weather (wildfires, storms), necessitating investments in grid hardening (e.g., undergrounding), smart grid technology, and automation to improve reliability and safety.

Timeline:Immediate

- Trend:

Electrification of Transportation and Buildings

Impact On Business:Creates significant new load growth and revenue opportunities but requires substantial investment in distribution grid upgrades and EV charging infrastructure to support increased demand.

Timeline:Near-term

- Trend:

Growth of Distributed Energy Resources (DERs)

Impact On Business:Proliferation of rooftop solar, battery storage, and microgrids challenges the traditional centralized utility model, reducing energy sales and requiring a shift to a platform operator role that integrates these resources.

Timeline:Near-term

- Trend:

Rise of Community Choice Aggregators (CCAs)

Impact On Business:Directly competes for the electricity generation portion of the business, leading to a significant loss of generation load for PG&E and shifting its role more towards transmission and distribution services.

Timeline:Immediate

Direct Competitors

- →

Southern California Edison (SCE)

Market Share Estimate:Major IOU in Southern, Central, and Coastal California, serving over 15 million people.

Target Audience Overlap:Low (Operates in a distinct, adjacent service territory)

Competitive Positioning:Positions as a major utility investing in grid modernization and clean energy to power Southern California.

Strengths

- •

Strong financial backing from parent company Edison International.

- •

Diverse energy generation portfolio.

- •

Significant investments in grid modernization and wildfire mitigation.

- •

Active in policy and regulatory arenas, shaping the future of California's energy market.

Weaknesses

- •

Also faces significant wildfire risk and associated liabilities.

- •

Subject to the same complex and stringent California regulatory environment.

- •

Customer satisfaction can be low, with complaints about outages and the complexity of billing.

- •

Faces competition from CCAs within its service territory.

Differentiators

Primary service provider for a different major economic hub (Southern California vs. Northern/Central for PG&E).

Specific large-scale clean energy and grid projects unique to their territory.

- →

San Diego Gas & Electric (SDG&E)

Market Share Estimate:Investor-owned utility for San Diego and southern Orange counties, serving ~3.7 million people.

Target Audience Overlap:Low (Operates in a distinct service territory)

Competitive Positioning:Positions as an innovative and reliable utility, often highlighting its leadership in grid technology, wildfire safety, and clean energy adoption.

Strengths

- •

Recognized leader in wildfire mitigation and grid resilience technologies.

- •

Strong focus on innovation, including microgrids and advanced metering infrastructure.

- •

Generally higher customer satisfaction ratings compared to other California IOUs in some surveys.

- •

Proactive in deploying energy storage solutions.

Weaknesses

- •

Operates in a high-cost area, leading to some of the highest electricity rates in the nation.

- •

Smaller scale compared to PG&E and SCE.

- •

Faces public and regulatory scrutiny over high rates and new infrastructure costs.

- •

Actively competes with CCAs on rates and clean energy offerings.

Differentiators

Reputation for being a technology-forward and innovative utility.

Aggressive and often industry-leading stance on safety and grid hardening measures.

- →

Community Choice Aggregators (CCAs)

Market Share Estimate:Collectively serve over 11 million customers in California, capturing a significant portion (projected to be ~38% by 2022) of the generation load within IOU territories.

Target Audience Overlap:High (Operate within PG&E's service territory)

Competitive Positioning:Local, not-for-profit energy providers offering customers a choice for cleaner energy at competitive or lower rates than the incumbent utility.

Strengths

- •

Often provide electricity with a higher renewable content at a lower cost.

- •

Local governance structure can foster stronger community ties and responsiveness.

- •

Reinvest revenues into local programs and initiatives.

- •

Agile in procuring power from new renewable projects.

Weaknesses

- •

Reliant on PG&E's transmission and distribution infrastructure and billing services.

- •

Newer entities, may lack the long-term operational experience and financial stability of an IOU.

- •

Susceptible to volatility in energy markets for power procurement.

- •

Customers are often auto-enrolled and may not fully understand the model.

Differentiators

- •

Local control and public, not-for-profit status.

- •

Focus on offering greener energy portfolios as a default option.

- •

Directly compete on the price of electricity generation.

Indirect Competitors

- →

Sunrun

Description:Leading US residential solar, battery storage, and energy services company. Offers solar leases, Power Purchase Agreements (PPAs), and system ownership.

Threat Level:High

Potential For Direct Competition:Already a direct competitor for customer energy supply. Potential to become a larger threat by networking homes into virtual power plants (VPPs).

- →

Tesla Energy

Description:Provides solar panels, Solar Roofs, and the Powerwall battery storage system. Focuses on creating an integrated home energy ecosystem.

Threat Level:High

Potential For Direct Competition:Directly competes for energy supply and home energy management. Tesla's strong brand and integrated product suite (EVs, storage, solar) create a powerful alternative to traditional utility services.

- →

Distributed Energy Resource (DER) Aggregators

Description:Companies that aggregate residential and commercial solar, batteries, smart thermostats, and EV chargers to provide grid services, effectively competing with utility-owned generation assets.

Threat Level:Medium

Potential For Direct Competition:High, as they can bid aggregated resources into energy markets, displacing the need for traditional power plants.

- →

Energy Efficiency & Smart Home Companies (e.g., Google Nest, Ecobee)

Description:Providers of technology that reduces overall energy consumption, thereby lowering customer demand for PG&E's core product.

Threat Level:Low

Potential For Direct Competition:Low in the traditional sense, but they erode the utility's revenue base by reducing electricity sales.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Ownership of Transmission & Distribution Infrastructure

Sustainability Assessment:Highly sustainable, as this is a natural monopoly with extremely high barriers to replication.

Competitor Replication Difficulty:Hard

- Advantage:

Vast, Established Service Territory

Sustainability Assessment:Highly sustainable due to regulatory framework granting exclusive rights to serve ~16 million people.

Competitor Replication Difficulty:Hard

- Advantage:

Deep Regulatory and Operational Expertise

Sustainability Assessment:Sustainable, built over decades of operating within California's complex energy landscape.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Exclusive Access to Certain Large-Scale Generation Assets', 'estimated_duration': '5-15 years, until assets are retired or contracts expire.'}

{'advantage': 'Current Approved Rate Structures', 'estimated_duration': '3-5 years, subject to change in the next General Rate Case (GRC) proceeding.'}

Disadvantages

- Disadvantage:

Negative Public Perception and Brand Damage

Impact:Critical

Addressability:Difficult

- Disadvantage:

High Operating Costs

Impact:Major

Addressability:Moderately

- Disadvantage:

Aging Infrastructure in Certain Areas

Impact:Major

Addressability:Moderately

- Disadvantage:

Perceived as a Monopoly Unresponsive to Customers

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted communication campaigns showcasing tangible grid safety improvements (e.g., miles of lines undergrounded) in high-risk communities to rebuild trust.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Simplify and promote enrollment in customer programs like budget billing and energy efficiency rebates through digital channels to improve customer satisfaction and reduce bill volatility.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Highlight community investments and partnerships, like the scholarship programs and V2G school bus projects mentioned on the corporate site, to improve local sentiment.

Expected Impact:Low

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Accelerate investments in grid automation and DER management systems (DERMS) to transition from a simple energy provider to a sophisticated grid operator, enabling and profiting from the growth of DERs.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop and propose innovative rate designs that incentivize beneficial electrification (EV charging, heat pumps) during off-peak hours, creating new revenue streams and improving grid stability.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Form strategic partnerships with indirect competitors like solar installers and smart home companies to offer joint solutions (e.g., utility-supported battery programs), turning a threat into an opportunity.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Lead the development of a framework for a multi-sided platform market, where PG&E facilitates transactions between energy consumers, DERs, CCAs, and wholesale markets, earning a service fee.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Pursue large-scale infrastructure projects that are difficult for competitors to replicate, such as offshore wind development or major transmission upgrades to support statewide clean energy goals.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in green hydrogen production and distribution infrastructure as a long-term play to decarbonize hard-to-abate sectors and create a new regulated revenue stream.

Expected Impact:High

Implementation Difficulty:Difficult

Shift from a defensive, incident-driven posture to a proactive position as the indispensable 'Architect of California's Clean and Resilient Energy Future.' Emphasize the unique role PG&E plays in operating the core infrastructure that enables all other market players (CCAs, solar, etc.) to function.

Differentiate not on the price of the energy commodity, but on unparalleled reliability, safety, and the enablement of customer choice. Focus on becoming the trusted operator and integrator of a complex, decentralized grid, a role no other competitor can fill at scale.

Whitespace Opportunities

- Opportunity:

Resilience-as-a-Service for Communities

Competitive Gap:CCAs and solar installers focus on generation, but few can offer comprehensive, grid-integrated resilience solutions like community microgrids for high-fire-threat areas.

Feasibility:Medium

Potential Impact:High

- Opportunity:

EV Fleet Charging Infrastructure and Management Services

Competitive Gap:While many companies offer EV chargers, few can provide the end-to-end service of grid upgrades, charger installation, and managed charging software required by large commercial and municipal fleets.

Feasibility:High

Potential Impact:High

- Opportunity:

Data Monetization and Grid Analytics Platform

Competitive Gap:PG&E possesses an unparalleled amount of granular grid and customer energy usage data. Packaging this data into anonymized analytics products for CCAs, researchers, and DER providers is a largely untapped market.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Carbon and Clean Energy Tracking-as-a-Service

Competitive Gap:Develop a certified platform for businesses to track and verify their 24/7 use of clean energy, leveraging PG&E's direct insight into generation sources and grid flow.

Feasibility:Medium

Potential Impact:Medium

Pacific Gas and Electric Company (PG&E) operates in a mature, highly regulated energy industry that is undergoing a period of profound transformation. While it maintains a natural monopoly over its extensive transmission and distribution network—its core sustainable advantage—its traditional business model is being systematically challenged on multiple fronts.

Direct competition, once non-existent, is now fierce in the electricity generation market due to the rapid growth of Community Choice Aggregators (CCAs). CCAs have successfully captured a large portion of PG&E's former generation customers by offering greener, often cheaper, power. While PG&E still serves these customers through its 'poles and wires,' this trend fundamentally shifts its role and erodes a traditional revenue stream. PG&E's primary direct competitors remain other California Investor-Owned Utilities like SCE and SDG&E, though they compete in adjacent territories. The true competition here is for regulatory favor, operational excellence, public trust, and leadership in navigating California's aggressive clean energy mandates.

The more disruptive threat comes from indirect and emergent competitors. Distributed Energy Resources (DERs), led by rooftop solar and battery storage providers like Sunrun and Tesla Energy, are creating a decentralized energy landscape. This 'behind-the-meter' competition not only reduces electricity sales but also challenges the necessity of the centralized grid in its current form. The ultimate threat is the disintermediation of the utility as customers achieve greater energy independence.

PG&E's most significant competitive disadvantage is its damaged public perception, stemming from past safety failures, including catastrophic wildfires, and subsequent bankruptcy. This has resulted in rock-bottom customer satisfaction scores and a deep-seated public distrust that competitors, particularly local CCAs, leverage effectively. The company's strategic communications, as seen on its website, rightly focus on wildfire safety, clean energy investments (V2G buses), and community engagement (scholarships) in an attempt to rebuild this trust.

Strategic opportunities for PG&E lie in embracing its role as the central grid operator. Instead of fighting the tide of decentralization, the company can position itself as the indispensable platform that enables and integrates all these new energy resources. Whitespace opportunities like 'Resilience-as-a-Service,' EV fleet management, and grid data analytics platforms represent a shift from selling kilowatt-hours to selling high-value services that only the owner of the grid can provide. Success will require a monumental shift in culture, technology, and regulatory strategy—from a 20th-century commodity provider to a 21st-century network architect and operator.

Messaging

Message Architecture

Key Messages

- Message:

Investing in a Clean Energy Future

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Commitment to Community Wildfire Safety

Prominence:Primary

Clarity Score:High

Location:Homepage, directly below hero

- Message:

Corporate Sustainability and Responsibility

Prominence:Secondary

Clarity Score:High

Location:Homepage, linked via Sustainability Report

- Message:

Financial Performance and Investor Relations

Prominence:Secondary

Clarity Score:High

Location:Homepage, linked via Annual Report and Earnings

- Message:

Community Support and Development

Prominence:Tertiary

Clarity Score:Medium

Location:News/Press Release Section (e.g., Scholarships)

- Message:

Innovation in Energy (e.g., Vehicle-to-Grid)

Prominence:Tertiary

Clarity Score:Medium

Location:News/Press Release Section (e.g., V2G School Bus Fleet)

The message hierarchy is logical for a corporate holding company website. It correctly prioritizes forward-looking themes like 'Clean Energy' to position the company for the future, while immediately addressing the most critical reputational issue, 'Wildfire Safety'. Financial and sustainability reporting is given appropriate secondary prominence, targeting key investor and regulatory audiences. Community and innovation stories are tertiary, serving as proof points for the broader corporate strategy.

Messaging is highly consistent across the provided content. The themes of safety, clean energy, and community are reinforced in the press releases. For example, the V2G school bus project is framed as contributing to a 'cleaner, smarter energy future,' directly supporting the primary headline message. The scholarship story reinforces community support. This creates a cohesive, albeit very formal, narrative.

Brand Voice

Voice Attributes

- Attribute:

Corporate

Strength:Strong

Examples

- •

PG&E Corporation Earnings

- •

2023 Joint Annual Report to Shareholders

- •

PG&E Corporation is a holding company headquartered in Oakland, California.

- Attribute:

Formal

Strength:Strong

Examples

- •

The PG&E Corporation Foundation is awarding 54 students...

- •

Pacific Gas and Electric Company (PG&E), in partnership with...

- •

PG&E Awards More Than 50 Scholarships to Students Across Northern and Central California Helping Ease College Costs for Families

- Attribute:

Forward-looking

Strength:Moderate

Examples

Investing in a Clean Energy Future

This project is a shining example of how innovation creates a cleaner, smarter energy future

- Attribute:

Community-Oriented

Strength:Moderate

Examples

PG&E Awards More Than 50 Scholarships to Students...

Learn about our Community Wildfire Safety Program

Tone Analysis

Informational

Secondary Tones

Reassuring

Official

Tone Shifts

The tone shifts slightly to be more celebratory and community-focused in the press releases about scholarships and the V2G bus project, using phrases like 'immense gift' and 'shining example'.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

For investors and regulators, PG&E Corporation positions itself as a responsible, forward-looking, and stabilized utility actively addressing its risks (wildfire safety) while investing in a sustainable and profitable future (clean energy, grid modernization).

Value Proposition Components

- Component:

Risk Mitigation & Safety

Clarity:Clear

Uniqueness:Somewhat Unique

Details:The prominent 'Community Wildfire Safety Program' link directly addresses the company's single largest risk and reputational challenge, signaling proactive management. This is a unique and necessary focus given PG&E's specific history.

- Component:

Clean Energy Transition Leadership

Clarity:Clear

Uniqueness:Common

Details:The 'Investing in a Clean Energy Future' headline aligns with industry-wide trends. It's a common value proposition for utilities, but PG&E uses specific projects like V2G buses to provide tangible proof.

- Component:

Financial Stability & Governance

Clarity:Clear

Uniqueness:Common

Details:Direct links to earnings reports and annual reports, alongside a detailed page on the highly credentialed Board of Directors, communicate stability and strong governance to the financial community.

- Component:

Community Partnership

Clarity:Somewhat Clear

Uniqueness:Common

Details:Communicated through news stories like scholarships. It positions PG&E as a positive corporate citizen, a common strategy for large regional employers.

PG&E's messaging differentiates primarily through its intense and necessary focus on wildfire safety. While other utilities focus on reliability and clean energy, PG&E's safety message is a direct response to its recent history of catastrophic wildfires and bankruptcy, making it a unique and critical part of its narrative to rebuild trust. The emphasis on vehicle-to-grid innovation also provides a specific, forward-looking differentiator.

As a regulated monopoly, PG&E doesn't compete for customers directly. Its messaging is designed to compete for investor confidence, regulatory approval, and public trust. It positions the corporation as a reformed entity that is tackling its unique, California-specific challenges head-on while aligning with broader, positive industry trends like decarbonization.

Audience Messaging

Target Personas

- Persona:

Investors & Financial Analysts

Tailored Messages

- •

2023 Joint Annual Report to Shareholders

- •

PG&E Corporation Earnings

- •

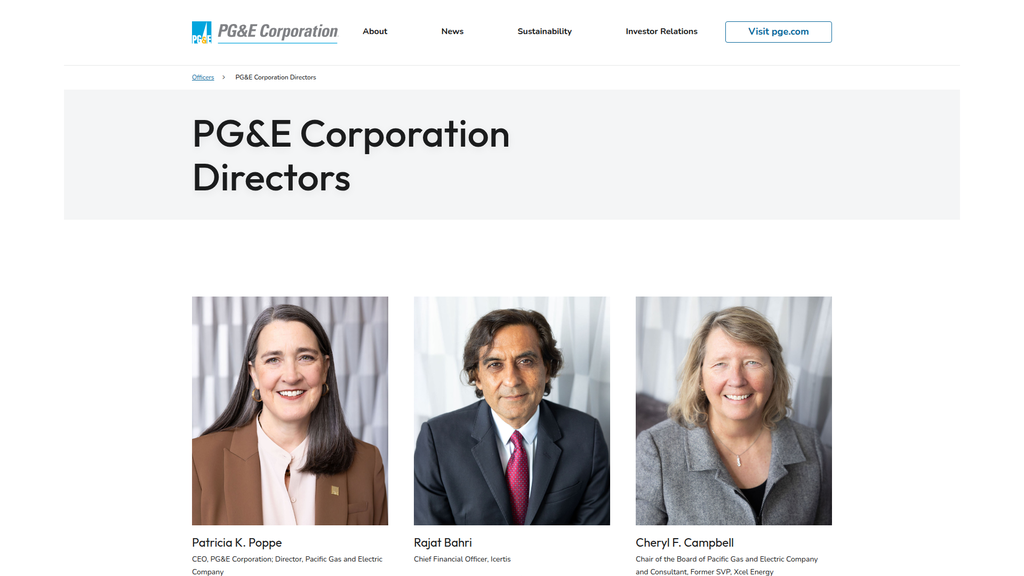

The detailed 'PG&E Corporation Directors' page, showcasing a board with extensive experience in finance, risk management, and energy.

- •

Press releases highlighting financial performance and operational efficiency.

Effectiveness:Effective

- Persona:

Regulators & Government Stakeholders

Tailored Messages

- •

Learn about our Community Wildfire Safety Program

- •

Corporate Sustainability Report 2025

- •

Press release on V2G bus project with Fremont Unified School District, demonstrating public-private partnership and grid innovation.

Effectiveness:Effective

- Persona:

Media & General Public

Tailored Messages

- •

Get the latest news

- •

Press release on student scholarships

- •

National 811 Day safety reminder

Effectiveness:Somewhat Effective

Audience Pain Points Addressed

- •

Investor/Regulator concern over wildfire liability (addressed by 'Community Wildfire Safety Program').

- •

Public and regulatory desire for cleaner energy (addressed by 'Investing in a Clean Energy Future').

- •

Need for corporate accountability and strong governance post-bankruptcy (addressed by highlighting the Board of Directors and transparent financial reporting).

Audience Aspirations Addressed

Desire for a sustainable, carbon-neutral energy grid in California.

Hope for a safer, more resilient infrastructure that can withstand climate change impacts.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Hope / Optimism

Effectiveness:Medium

Examples

Investing in a Clean Energy Future

This project is a shining example of how innovation creates a cleaner, smarter energy future

- Appeal Type:

Security / Safety

Effectiveness:Medium

Examples

Learn about our Community Wildfire Safety Program

August 11 is National 811 Day--A Reminder to Call 811 Before Any Digging Project

- Appeal Type:

Community Pride / Goodwill

Effectiveness:Low

Examples

PG&E Awards More Than 50 Scholarships to Students...

Social Proof Elements

- Proof Type:

Expertise (Authority)

Impact:Strong

Details:The 'Corporation Directors' page lists former CEOs, a retired Admiral, and former heads of major international firms, signaling deep expertise and robust governance.

- Proof Type:

Partnerships

Impact:Moderate

Details:Highlighting collaborations with 'Fremont Unified School District' and 'The Mobility House' lends credibility to their innovation claims.

Trust Indicators

- •

Transparency through accessible financial reports (Annual Report, Earnings).

- •

Proactive communication on safety issues (Wildfire Safety Program, 811 Day).

- •

Showcasing an experienced and independent Board of Directors.

- •

Publishing a detailed Corporate Sustainability Report.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Visit wildfire safety

Location:Homepage

Clarity:Clear

- Text:

Explore the Report

Location:Homepage (for Sustainability Report)

Clarity:Clear

- Text:

Download the Report

Location:Homepage (for Annual Report)

Clarity:Clear

- Text:

Visit the Earnings Report

Location:Homepage

Clarity:Clear

- Text:

Read the...press release

Location:Homepage News Section

Clarity:Clear

The CTAs are highly effective for the site's purpose. They are clear, direct, and action-oriented verbs ('Visit', 'Explore', 'Download'). They efficiently guide the primary audiences (investors, regulators, media) to the detailed information they seek, functioning as navigational signposts rather than conversion tools.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of Empathy and Human Tone: The voice is sterile and corporate. For a company needing to rebuild public trust after major failures, the messaging lacks a human, empathetic touch. It 'tells' about safety and community but doesn't 'show' it in a relatable way.

- •

Direct Acknowledgment of Past Failures: The messaging is entirely forward-looking ('clean energy future', 'safer future'), which can feel like an attempt to sidestep direct accountability for the past events that necessitated these changes.

- •

Affordability for Customers: There is no messaging that addresses the significant public pain point of high energy costs, which is a major factor in public perception.

Contradiction Points

No itemsUnderdeveloped Areas

Employee-centric Storytelling: The 23,000+ employees are the face of the company, yet their stories of working to build a safer, more reliable system are absent. This is a missed opportunity to humanize the corporation.

Customer-centric Narratives: Beyond being recipients of scholarships, the stories of the 16 million people served are not present. Messaging could be strengthened by showing the tangible, positive impact of a stable and clean grid on a family or small business.

Messaging Quality

Strengths

- •

Clear audience segmentation: The site effectively serves distinct information paths for its key corporate audiences.

- •

Strong message discipline: Key themes of safety, sustainability, and financial stability are consistently reinforced.

- •

Use of proof points: Claims are backed up with links to reports, projects, and press releases, lending credibility.

- •

Strategic prioritization: The messaging hierarchy correctly elevates the most critical issues facing the corporation.

Weaknesses

- •

Overly corporate and impersonal voice, which is a barrier to rebuilding broad public trust.

- •

Avoidance of past issues may undermine the authenticity of forward-looking promises for some audiences.

- •

Ignores the key customer concern of affordability, creating a disconnect with the general public's experience.

Opportunities

- •

Introduce a more empathetic, human-centric tone to complement the formal corporate voice.

- •

Develop a narrative around 'making it right' that briefly acknowledges the past as the motivation for current and future actions.

- •

Create content that features the stories of employees and customers to build an emotional connection and demonstrate impact.

- •

Proactively address affordability concerns, even if just to explain the cost drivers and long-term value of current investments.

Optimization Roadmap

Priority Improvements

- Area:

Brand Voice & Tone

Recommendation:Develop and integrate a secondary brand voice that is more human, empathetic, and direct. This could be used in community-focused content and leadership messages to soften the formal corporate edge.

Expected Impact:High

- Area:

Narrative Strategy

Recommendation:Craft a core strategic narrative that bridges the past and future. It should acknowledge the challenges that prompted the transformation as the foundation for the company's commitment to safety and innovation, thereby increasing authenticity.

Expected Impact:High

- Area:

Content Strategy

Recommendation:Launch a content series featuring employee and community stories. Focus on the 'why' behind the work—the people dedicated to safety, the families benefiting from scholarships, the businesses powered by a more reliable grid.

Expected Impact:Medium

Quick Wins

- •

Rewrite news headlines to be more benefit-driven and less descriptive. E.g., 'PG&E Scholarship Helps Local Student Pursue Clean Energy Dream' instead of the current formal title.

- •

Add a brief CEO message on the homepage that speaks directly and humbly about the company's commitment to earning back the trust of Californians.

- •

Incorporate key data points about improved safety and reliability directly on the homepage, rather than only in reports.

Long Term Recommendations

- •

Develop a dedicated messaging track that directly addresses energy affordability, explaining investments and efficiency programs.

- •

Conduct audience research (focus groups, surveys) with the general public to test new messaging and better understand trust drivers beyond safety statistics.

- •

Integrate the 'making it right' narrative across all corporate communications, from investor calls to public statements, ensuring consistency.

The strategic messaging on pgecorp.com is executed with precision for its primary audiences: investors and regulators. It presents a disciplined, coherent narrative of a corporation in transformation, focusing squarely on the critical pillars of safety, sustainability, and financial stability. The message architecture is logical, prioritizing the key reputational challenge of wildfire safety while positioning the company as a leader in the clean energy transition. The use of proof points like financial reports, a highly credentialed board, and specific innovation projects effectively substantiates its claims for a discerning corporate audience.

However, this disciplined focus creates a significant messaging gap when it comes to the broader public and the crucial goal of rebuilding trust. The brand voice is exclusively corporate, formal, and impersonal, lacking the empathy and humanity needed to reconnect with communities affected by past failures. By completely avoiding any acknowledgment of its difficult history, the forward-looking messaging can feel hollow to a skeptical public. Furthermore, the complete omission of the customer affordability issue creates a major disconnect from the daily concerns of its 16 million users. To move from a state of managed corporate reputation to genuine public trust, PG&E must enrich its messaging strategy by weaving in a more human, empathetic narrative that acknowledges its past, tells the stories of its people, and addresses the economic realities of its customers.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Operates as a regulated monopoly in a defined, large, and economically significant service area (Northern and Central California), serving 16 million people.

- •

Essential service provider of electricity and natural gas, ensuring constant demand.

- •

Core service offerings are non-discretionary for residential, commercial, and industrial customers.

- •

Regulatory framework provides a guaranteed rate of return on capital investments, creating a stable, albeit constrained, business environment.

Improvement Areas

- •

Improving public trust and customer satisfaction, which has been severely damaged by past events like wildfires and bankruptcy.

- •

Enhancing grid reliability and safety to reduce the frequency and impact of Public Safety Power Shutoffs (PSPS).

- •

Addressing the affordability of rates, which are among the highest in the nation and face upward pressure from massive capital investment needs.

Market Dynamics

U.S. utility sector revenue is growing at a CAGR of 2.7% (2020-2025), with electricity demand projected to grow 1-2% annually due to electrification and data centers.

Mature

Market Trends

- Trend:

Electrification & Demand Growth

Business Impact:Surging electricity demand from data centers (AI), electric vehicles, and building electrification creates a massive opportunity for rate base growth through grid expansion and modernization investments.

- Trend:

Decarbonization & Renewable Mandates

Business Impact:California's aggressive renewable portfolio standard (60% by 2030, 100% clean energy by 2045) mandates huge investments in renewable generation, energy storage, and grid modernization, forming the core of PG&E's growth strategy.

- Trend:

Grid Modernization & Resilience

Business Impact:The need to prevent wildfires and adapt to extreme weather necessitates significant capital expenditure on grid hardening (e.g., undergrounding power lines), smart grid technology, and cybersecurity, which expands the regulated asset base.

- Trend:

Distributed Energy Resources (DERs)

Business Impact:Growth of rooftop solar, behind-the-meter batteries, and microgrids presents both a challenge (reduced load) and an opportunity (grid services, new business models like VPPs).

Excellent. PG&E is at the epicenter of the energy transition, with regulatory mandates and market forces (electrification) compelling the largest capital investment cycle in its history. This provides a clear, long-term pathway for regulated growth.

Business Model Scalability

Medium

Extremely high fixed costs associated with building and maintaining a vast transmission and distribution network. This provides significant operational leverage but requires immense, ongoing capital investment.

High, once infrastructure is in place, the marginal cost of delivering an additional kWh is low. However, growth is not achieved through customer acquisition but through capital-intensive rate base expansion approved by regulators.

Scalability Constraints

- •

Regulatory Approval: All major investments and rate increases must be approved by the California Public Utilities Commission (CPUC), a lengthy and uncertain process.

- •

Capital Intensity: Growth is directly tied to the ability to raise and deploy tens ofbillions of dollars in capital for infrastructure projects.

- •

Supply Chain: Long lead times for critical components like transformers can delay grid modernization projects.

- •

Geographic Limitation: Growth is confined to a specific service territory.

Team Readiness

Strong. The board of directors and executive team are comprised of seasoned professionals from the energy, finance, regulatory, and technology sectors, equipped to navigate a complex operating environment.

Traditional, hierarchical structure typical of a large utility. Must continue to foster agility within its innovation and strategic project divisions to capitalize on new energy technologies.

Key Capability Gaps

- •

Large-Scale Project Execution: A demonstrated need to improve efficiency and cost control in executing massive, multi-year infrastructure projects like undergrounding.

- •

Digital Transformation & Data Analytics: Need for advanced capabilities to manage a more complex, DER-integrated grid and optimize asset management.

- •

Customer Experience & Public Relations: Rebuilding trust requires a fundamental shift in communication and customer service capabilities, moving beyond a traditional utility mindset.

Growth Engine

Acquisition Channels

- Channel:

New Customer Hookups (Residential/Commercial)

Effectiveness:High

Optimization Potential:Low

Recommendation:This is a function of economic and population growth in the service area, not a marketing effort. Focus should be on streamlining the connection process for new builds, especially for large loads like data centers. PG&E is ramping up to 20,000 new customer connections per year by 2030.

Customer Journey

Not applicable in a traditional sense. The 'journey' is about service initiation, program enrollment (e.g., EV rates, energy efficiency), and issue resolution.

Friction Points

- •

Complex billing and rate structures.

- •

Navigating processes for solar interconnection and new service connections.

- •

Frustration and lack of clear communication during Public Safety Power Shutoffs (PSPS) events.

Journey Enhancement Priorities

{'area': 'Digital Self-Service Tools', 'recommendation': 'Invest in user-friendly mobile and web platforms for bill payment, outage reporting, and enrollment in new programs like EV charging and demand response.'}

{'area': 'Proactive Outage Communication', 'recommendation': 'Enhance proactive, multi-channel communication before, during, and after PSPS events and unplanned outages to manage customer expectations and build trust.'}

Retention Mechanisms

- Mechanism:

Regulated Monopoly

Effectiveness:High

Improvement Opportunity:While customers cannot easily switch electricity delivery providers, they can reduce reliance through rooftop solar or defect generation load to Community Choice Aggregators (CCAs). PG&E must improve service reliability and price competitiveness to mitigate this.

Revenue Economics

Defined by regulatory rate cases, not per-customer acquisition costs. Growth is driven by increasing the 'rate base' (value of capital assets) on which PG&E earns a regulated return.

Not Applicable. CAC is effectively zero.

Medium. Revenue is stable and predictable due to regulation, but efficiency is hampered by high operating costs for wildfire mitigation and infrastructure maintenance.

Optimization Recommendations

- •

Aggressively pursue CPUC approval for capital investment plans in grid modernization, electrification, and renewables to grow the rate base. The company has a ~$63 billion capital plan through 2028.

- •

Control operating and maintenance (O&M) costs to improve profitability within approved rate structures. PG&E is targeting a 2% non-fuel O&M reduction.

- •

Develop new revenue streams from non-regulated or incentive-based services, such as EV charging infrastructure management and grid services from DERs.

Scale Barriers

Technical Limitations

- Limitation:

Aging Infrastructure

Impact:High

Solution Approach:Systematic, risk-based replacement and modernization of legacy grid components. This is the core of the multi-billion dollar General Rate Case proposal.

- Limitation:

DER Integration Complexity

Impact:Medium

Solution Approach:Deployment of an Advanced Distribution Management System (ADMS) and other smart grid technologies to manage bidirectional power flows and maintain grid stability.

Operational Bottlenecks

- Bottleneck:

Wildfire Mitigation & Response

Growth Impact:This is the single largest operational and financial risk, diverting massive capital and operational focus, and carrying immense liability.

Resolution Strategy:Continue and accelerate the multi-pronged strategy of undergrounding lines, vegetation management, grid hardening, and deploying advanced monitoring technologies.

- Bottleneck:

Permitting and Project Execution Timelines

Growth Impact:Slow permitting processes for new transmission lines and renewable projects can delay the deployment of capital and impede progress towards state mandates.

Resolution Strategy:Work proactively with state and local agencies to streamline permitting. Adopt more efficient project management methodologies for large-scale construction.

Market Penetration Challenges

- Challenge:

Community Choice Aggregators (CCAs)

Severity:Major

Mitigation Strategy:CCAs procure electricity generation for customers, leaving PG&E with only transmission and distribution revenue for those clients. To compete, PG&E must focus on superior reliability, customer service, and ensuring its own generation portfolio is clean and cost-effective, while also serving as an indispensable delivery partner to CCAs.

- Challenge:

Public and Political Opposition

Severity:Critical

Mitigation Strategy:Historic failures have created intense public and regulatory scrutiny. PG&E must execute flawlessly on safety and reliability commitments, increase transparency, and demonstrate that rate increases directly translate to tangible community benefits (e.g., fewer wildfires, better service) to rebuild trust.

Resource Limitations

Talent Gaps

- •

Skilled labor (lineworkers, engineers) for large-scale infrastructure build-out.

- •

Data scientists and software engineers for grid modernization and analytics.

- •

Regulatory and policy experts to navigate complex state and federal energy landscapes.

Extremely High. The company requires tens of billions in ongoing capital to fund its grid modernization, wildfire mitigation, and clean energy transition plans, necessitating continuous access to capital markets.

Infrastructure Needs

- •

Expanded high-voltage transmission capacity to connect new renewable energy zones.

- •

Grid-scale battery storage systems to ensure reliability with intermittent renewables.

- •

A ubiquitous and robust EV charging infrastructure network.

Growth Opportunities

Market Expansion

- Expansion Vector:

Data Center Energy Supply

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Proactively partner with data center developers to plan and build the required substation and transmission infrastructure. PG&E's data center pipeline has already grown to 10 gigawatts, with each gigawatt potentially reducing bills for all customers.

- Expansion Vector:

Transportation Electrification

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Expand programs to support residential, commercial fleet, and public EV charging infrastructure. This not only grows electricity sales but also builds the foundation for future Vehicle-to-Grid (V2G) services. PG&E plans to prepare the grid for 3 million EVs by 2030.

Product Opportunities

- Opportunity:

Vehicle-to-Grid (V2G) Services

Market Demand Evidence:The U.S. V2G market is projected to grow at a CAGR of over 30%. California legislation is paving the way for V2G mandates, creating a massive potential market of EVs acting as distributed batteries.

Strategic Fit:Excellent. Leverages PG&E's role as grid operator and its investments in EV infrastructure. It turns a potential liability (high charging demand) into a grid-stabilizing asset.

Development Recommendation:Launch and scale pilot programs (like the Fremont school bus project) to develop the technology, tariffs, and operational capabilities to manage V2G as a significant grid resource.

- Opportunity:

Community Microgrid Development

Market Demand Evidence:Demand for resilience is high in communities prone to outages from wildfires or storms. PG&E is already leveraging a statewide incentive program to fund new microgrids.

Strategic Fit:Strong. Microgrids can provide reliability, reduce the need for expensive line maintenance in remote areas, and integrate more local renewables.

Development Recommendation:Systematically identify vulnerable communities and partner with them to develop and operate microgrids as a 'resilience-as-a-service' offering, funded through approved resilience investments.

Channel Diversification

No itemsStrategic Partnerships

- Partnership Type:

Technology & Software Companies

Potential Partners

- •

Siemens

- •

Schneider Electric

- •

Oracle (Utilities)

- •

AI/ML firms

Expected Benefits:Access to cutting-edge smart grid software (ADMS), IoT sensors, and AI-powered predictive analytics for vegetation management, asset failure prediction, and grid optimization.

- Partnership Type:

EV Automakers & Charging Networks

Potential Partners

- •

Tesla

- •

Ford

- •

GM

- •

Electrify America

- •

EVgo

Expected Benefits:Collaboration on V2G technology standards, managed charging programs, and streamlined infrastructure build-out to support the rapid growth of EVs in their service territory.

Growth Strategy

North Star Metric

Annual Regulated Rate Base Growth ($)

For a regulated utility, sustainable growth is achieved by responsibly investing capital in infrastructure that serves customers and is approved by regulators for a return. This metric directly aligns the company's financial growth with its mandate to build a safer, more reliable, and cleaner energy system for California.

Achieve a compound annual growth rate of ~10% in the weighted average rate base, in line with company projections through 2028.

Growth Model

Regulatory & Capital-Led Growth

Key Drivers

- •

Successful General Rate Case (GRC) applications.

- •

Efficient and on-budget execution of large-scale capital projects (e.g., undergrounding, grid modernization).

- •

Alignment of investment strategy with California's decarbonization and electrification policies.

Develop a rolling multi-year investment plan that anticipates future grid needs, aligns with state policy, and provides a clear, data-driven justification for investments to regulators and stakeholders.

Prioritized Initiatives

- Initiative:

Accelerate Grid Modernization for Data Center & EV Growth

Expected Impact:High

Implementation Effort:High

Timeframe:Ongoing (3-5 years)

First Steps:Establish a dedicated team to streamline the interconnection process for large-load customers like data centers. Secure CPUC approval for proactive grid investments in anticipated high-growth corridors.

- Initiative:

Scale V2G and Demand Response Programs

Expected Impact:High

Implementation Effort:Medium

Timeframe:2-4 years

First Steps:Develop and file new tariffs with the CPUC that create compelling financial incentives for customers to participate in V2G and other demand response programs. Expand partnerships with EV manufacturers.

- Initiative:

Execute Wildfire Mitigation Capital Plan

Expected Impact:Critical (Risk Reduction)

Implementation Effort:Very High

Timeframe:Ongoing (5-10 years)

First Steps:Continue the disciplined execution of the undergrounding and grid hardening plan, focusing on the highest-risk areas first. Publicize progress and safety improvements to rebuild public trust.

Experimentation Plan

High Leverage Tests

{'area': 'Dynamic Rate Design', 'experiment': 'Pilot new time-of-use (TOU) and real-time pricing plans that more accurately reflect grid conditions to incentivize load shifting away from peak hours.'}

{'area': 'Non-Wires Alternatives (NWA)', 'experiment': 'In a targeted, grid-constrained area, deploy a portfolio of DERs (solar, storage, energy efficiency) to defer or avoid a costly substation upgrade, and measure the cost-effectiveness.'}

Evaluate experiments based on a combination of financial metrics (ROI, net present value of avoided costs), operational metrics (peak load reduction, reliability indices), and customer metrics (program adoption, satisfaction).

Run 2-3 significant pilot programs annually, focusing on key strategic areas like V2G, microgrids, and NWA.

Growth Team

A centralized 'Grid of the Future' or 'Strategic Innovation' group, working cross-functionally with core operational, regulatory, and financial departments. This team would not be a traditional 'growth marketing' team but a strategic unit focused on developing and incubating new, regulated and non-regulated business opportunities.

Key Roles

- •

Head of Grid Innovation

- •

Electrification Strategy Lead (EVs & Buildings)

- •

DER & Microgrid Program Manager

- •

Regulatory Strategist (New Business Models)

Build capabilities through a combination of hiring experts from the technology and clean energy sectors, strategic partnerships with national labs and universities, and creating a corporate venture arm to invest in promising energy startups.

Pacific Gas and Electric Company (PG&E) is at a pivotal juncture where its immense challenges are intrinsically linked to its greatest growth opportunities. As a regulated utility, its growth is not driven by traditional customer acquisition but by the scale of its capital investment in the energy grid—its 'rate base.' The company's growth readiness is strong, underpinned by a clear, multi-decade mandate from the state of California to decarbonize the energy supply, enhance grid resilience against catastrophic wildfires, and support massive new electricity demand from the electrification of transport, buildings, and a burgeoning data center industry.

The primary growth engine for PG&E is its ability to successfully secure regulatory approval for and execute on a massive ~$63 billion, five-year capital plan. This plan directly addresses the company's most significant barriers: aging infrastructure and extreme wildfire risk. Initiatives like undergrounding power lines, while operationally complex and expensive, directly reduce risk and simultaneously expand the rate base upon which PG&E earns a return. Therefore, its risk mitigation strategy is its growth strategy.

Key growth opportunities lie in positioning PG&E as the essential platform for California's clean energy future. The most promising vectors are:

1. Enabling Electrification: Proactively building the grid infrastructure to support millions of EVs and the power-hungry data centers driving the AI boom. This turns a potential grid strain into a major source of regulated growth.

2. Harnessing Distributed Energy: Moving beyond pilot projects to scale Vehicle-to-Grid (V2G) services and microgrids. This transforms EVs and local power systems from grid edge complications into valuable, revenue-generating assets for grid stability and resilience.

However, significant barriers persist. The memory of past bankruptcies and devastating wildfires creates intense public and regulatory scrutiny, making rate increases politically challenging. Competition from Community Choice Aggregators in the energy generation market erodes a portion of the traditional revenue model. Success hinges on flawless operational execution, rebuilding public trust through demonstrated safety and reliability improvements, and proving to regulators that its investments are prudent and beneficial for all Californians.

Recommendation: PG&E's strategic focus must be on 'Regulatory and Capital-Led Growth.' The North Star Metric should be 'Annual Regulated Rate Base Growth,' as this perfectly aligns its financial success with its public mandate. The highest priority initiatives must be the aggressive execution of its wildfire safety plan and the proactive build-out of grid capacity for EVs and data centers. By mastering the execution of these large-scale, regulated infrastructure projects, PG&E can navigate its challenges and solidify its role as a critical engine of California's economic and environmental future, driving sustainable, long-term growth.

Legal Compliance