eScore

pmi.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

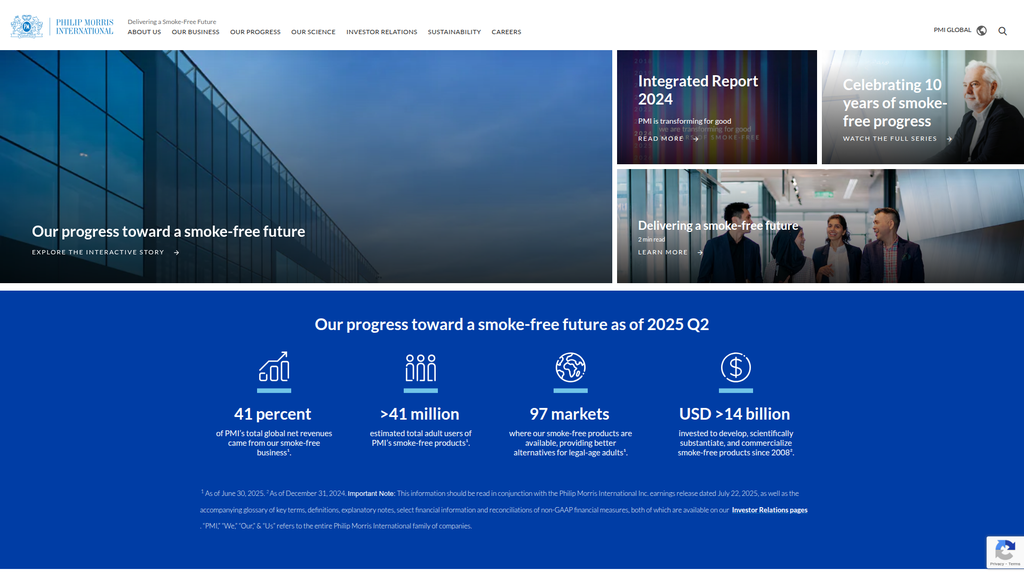

PMI's digital presence is a masterclass in strategic corporate communication, not traditional marketing. Search intent alignment is excellent for its target audiences—investors, regulators, and media—with content heavily focused on financial reports, scientific substantiation, and corporate transformation. The website exhibits high content authority through extensive scientific publications and detailed reporting, reflected in its strong domain authority. Its global reach is clearly defined, with content supporting operations in 97 markets, although it could benefit from more localized corporate content hubs.

Exceptional alignment of content with the specific search intent of high-stakes stakeholders (investors, policymakers), effectively controlling the corporate narrative around 'tobacco harm reduction' and 'smoke-free future'.

Develop region-specific corporate content hubs to more effectively engage local policymakers and media with data and arguments tailored to their specific regulatory and public health contexts.

The company demonstrates extraordinary message discipline and consistency around the 'Delivering a smoke-free future' narrative across all digital assets. Messaging is expertly tailored to distinct audiences, providing financial data for investors, scientific dossiers for regulators, and a transformation story for media and potential talent. Competitive messaging is strong, using the >$14 billion R&D investment as a powerful differentiator against competitors like BAT and JTI.

An exceptionally well-defined and rigorously enforced message hierarchy that positions the 'smoke-free future' as the central organizing principle, effectively reframing the corporate identity.

Address the significant credibility gap by creating a dedicated section that acknowledges the historical context of the tobacco industry more directly, which could enhance the authenticity of the transformation narrative without undermining it.

The website's 'conversion' goal is stakeholder engagement (e.g., report downloads), not sales. While the site is professionally designed and accessible, the user experience suffers from high information density and cognitive load, making it difficult for users to quickly find specific information. Calls-to-action are often understated and styled as simple links, reducing their effectiveness in guiding users to key content. The cross-device experience is solid, but the overall journey lacks clear prioritization for different user personas on the homepage.

Strong accessibility practices, including providing full transcripts for video content, which is crucial for users with impairments and demonstrates a commitment to inclusive design.

Streamline the homepage by creating distinct, clearly signposted pathways for key personas (e.g., 'For Investors', 'Our Science', 'For Media') to reduce cognitive load and guide users to relevant content more efficiently.

PMI builds credibility through a vast repository of scientific research, third-party validation from sustainability ratings (e.g., CDP, Dow Jones Index), and high corporate transparency via its Integrated Reports. Trust signals like data-backed claims and executive thought leadership are prominent. However, the business faces a monumental, inherent credibility risk due to its legacy in tobacco and its continued reliance on cigarette sales, a fact that sophisticated messaging can mitigate but not erase.

Extensive use of data and statistics as social proof, particularly the growing percentage of revenue from smoke-free products (41%) and the >$14 billion R&D investment, which provide tangible metrics of transformation.

Immediately implement a mandatory, site-wide, neutral age-gate. The absence of this standard industry practice presents a significant and unnecessary reputational and regulatory risk, undermining claims of responsible marketing.

PMI's competitive moat is exceptionally strong and sustainable, built on a powerful first-mover advantage with IQOS in the heated tobacco category, which it dominates. This is defended by a massive R&D investment (>$14B) and an extensive patent portfolio, making replication by competitors extremely difficult. The acquisition of Swedish Match for Zyn has fortified its position in the rapidly growing oral nicotine space, creating a dual-engine for growth that competitors struggle to match at a global scale.

A dominant, defensible, and highly sustainable first-mover advantage in the global heated tobacco market with IQOS, creating a brand and ecosystem that is synonymous with the category itself.

Accelerate the diversification of its smoke-free portfolio to reduce long-term dependence on the IQOS platform, particularly by globalizing the Zyn brand to counter BAT's multi-category strength in vaping and oral products.

The business model is highly scalable, leveraging a vast, pre-existing global distribution network to introduce new, higher-margin smoke-free products. Excellent unit economics are demonstrated by smoke-free products having gross margins exceeding 70%, significantly higher than combustibles. Market expansion signals are strong, with smoke-free products available in 97 markets and a clear strategy for US re-entry. The primary constraint on scalability is not operational, but the complex and varied patchwork of global regulations that can slow market entry.

Exceptional operational leverage, utilizing its established global distribution, supply chain, and regulatory affairs infrastructure to launch and scale new smoke-free products with high efficiency and superior margins.

Develop a more robust 'Beyond Nicotine' strategy and business unit. While the ambition exists, a clearer roadmap for entering adjacent wellness and healthcare markets is needed to create a credible long-term growth vector beyond nicotine products.

PMI is executing one of the most audacious business model transformations in corporate history, and it is doing so with remarkable coherence. Resource allocation is laser-focused, with 99% of R&D dedicated to the smoke-free mission. The revenue model is successfully transitioning, with smoke-free products now accounting for 41% of net revenues and growing rapidly. The primary incoherence remains the foundational contradiction of funding a 'smoke-free future' with the profits from a declining, but still massive, cigarette business.

Exceptional strategic focus and disciplined execution. The entire corporate strategy, from capital allocation to public messaging, is rigorously aligned with the single goal of replacing cigarettes with smoke-free alternatives.

Set and communicate clear, aggressive targets for phasing out combustible brands in specific markets to more tangibly demonstrate commitment to the smoke-free vision and address the core business model contradiction.

PMI exhibits immense market power, effectively shaping the entire heated tobacco category, where it holds an approximate 76% volume share. This leadership grants it significant pricing power and leverage with suppliers and distribution partners. The company's massive investment in science and regulatory affairs allows it to influence industry standards and policy discussions on harm reduction to a degree that competitors cannot. While still reliant on a large base of smokers, the rapid growth of its smoke-free user base (>41 million) diversifies this dependency.

The ability to shape market direction and influence regulatory frameworks through its unparalleled investment in scientific substantiation, effectively creating a favorable operating environment for its products.

Establish a dedicated, proactive 'Misinformation Response' platform. This would leverage its market power to directly counter public skepticism and competitor claims, moving from a defensive posture to confidently setting the public record straight.

Business Overview

Business Classification

Manufacturing (Consumer Goods)

Technology & Health Innovation

Tobacco & Nicotine Products

Sub Verticals

- •

Combustible Tobacco

- •

Heated Tobacco Products (HTP)

- •

Oral Nicotine (Nicotine Pouches)

- •

E-Vapor Products

Mature

Maturity Indicators

- •

Extensive global brand recognition (Marlboro, IQOS, ZYN).

- •

Dominant market share in multiple categories.

- •

Large-scale, transformative M&A activity (e.g., Swedish Match for $16B, Vectura).

- •

Significant and sustained investment in R&D ($>14 billion since 2008).

- •

Navigating intense and complex global regulatory environments.

- •

Established, vast global distribution and supply chain networks.

Enterprise

Steady (Transformative)

Revenue Model

Primary Revenue Streams

- Stream Name:

Combustible Products (Cigarettes)

Description:The historical core business, involving the manufacturing and sale of traditional cigarettes such as Marlboro (non-US), Parliament, and L&M. While still a majority of revenue, its strategic importance is declining.

Estimated Importance:Primary

Customer Segment:Existing Adult Smokers (Legacy)

Estimated Margin:High

- Stream Name:

Smoke-Free Products: Heated Tobacco (IQOS)

Description:A 'heat-not-burn' system consisting of an electronic device (IQOS) and proprietary tobacco consumables (TEREA/HEETS). This is the flagship of the company's transformation and its largest smoke-free revenue source.

Estimated Importance:Primary

Customer Segment:Existing Adult Smokers (Transitioning)

Estimated Margin:High

- Stream Name:

Smoke-Free Products: Oral Nicotine (ZYN)

Description:Tobacco-free nicotine pouches, a rapidly growing category, particularly in the U.S. market, following the acquisition of Swedish Match. ZYN is a key driver of smoke-free revenue growth.

Estimated Importance:Primary

Customer Segment:Existing Nicotine Users (Smokers & Smokeless)

Estimated Margin:High

- Stream Name:

Smoke-Free Products: E-Vapor (VEEV)

Description:Electronic cigarettes (vapes) and their corresponding liquid pods. This is a smaller but strategically important part of the multi-category approach to provide a full portfolio of alternatives.

Estimated Importance:Secondary

Customer Segment:Existing Adult Smokers & Vapers

Estimated Margin:Medium

Recurring Revenue Components

Sales of consumables for smoke-free systems (TEREA/HEETS for IQOS, ZYN pouches, VEEV pods)

Repeat purchases of cigarette packs and cartons

Pricing Strategy

Hardware + Consumables (Razor-Blade Model)

Premium

Opaque (Set by retailers and local tax regimes)

Pricing Psychology

- •

Premium Branding (associating IQOS with technology and sophistication)

- •

Value-Based Pricing (justifying higher costs through R&D and reduced-risk claims).

- •

Ecosystem Lock-in (proprietary consumables for hardware devices)

Monetization Assessment

Strengths

- •

Highly successful portfolio transformation, with smoke-free products now accounting for ~41% of total net revenues.

- •

Dominant razor-blade model with IQOS creating a sticky customer base.

- •

High-margin, rapidly growing oral nicotine segment with ZYN.

- •

Pricing power derived from strong brand equity and perceived product superiority.

Weaknesses

- •

Continued reliance on the declining combustibles segment for significant cash flow.

- •

High vulnerability to changes in excise tax laws, which can dramatically impact pricing and margins.

- •

Complex and costly R&D and regulatory approval pathways for new products.

Opportunities

- •

Convert the remaining ~60% of revenue from combustibles to smoke-free alternatives, targeting a majority by 2025.

- •

Expand the oral nicotine pouch category into new international markets.

- •

Leverage technology acquisitions (e.g., Vectura) to enter adjacent wellness and therapeutic markets ('Beyond Nicotine' strategy).

Threats

- •

Increased global regulation targeting all forms of nicotine, including flavor bans and marketing restrictions.

- •

Intensifying competition in the heated tobacco space from major rivals like British American Tobacco and Japan Tobacco.

- •

Shifts in public opinion and potential for litigation related to new product categories.

- •

Black market and illicit trade undercutting legitimate, taxed sales.

Market Positioning

Industry Transformation through Scientific Harm Reduction

Global Leader (in both traditional tobacco and the emerging heated-tobacco category).

Target Segments

- Segment Name:

Transitioning Adult Smokers

Description:The core target market: existing adult smokers of combustible cigarettes who are seeking less harmful, yet satisfying, alternatives without quitting nicotine entirely.

Demographic Factors

Legal age smokers (typically 25+)

Established smoking habit

Psychographic Factors

- •

Health-conscious (aware of smoking risks)

- •

Brand-conscious

- •

Seeking social acceptance (dislike smoke odor/ash)

- •

Open to technology and innovation

Behavioral Factors

- •

High brand loyalty

- •

Daily nicotine consumption

- •

Inelastic demand for nicotine

Pain Points

- •

Long-term health risks of combustion.

- •

Social stigma and inconvenience of smoking (odor, ash, smoke bans).

- •

Desire to quit smoking but struggle with nicotine addiction.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Polymodal Nicotine Users

Description:Adults who already use a variety of nicotine products (e.g., vapes, oral nicotine) and are open to trying new, innovative, and potentially more satisfying alternatives.

Demographic Factors

Legal age nicotine users (typically younger adults 21-35)

Psychographic Factors

- •

Variety-seeking

- •

Tech-savvy

- •

Influenced by product novelty and flavors (where legal)

Behavioral Factors

- •

Less brand loyal than traditional smokers

- •

Use multiple product types

- •

Higher price sensitivity

Pain Points

- •

Unsatisfactory experience with current non-combustible products.

- •

Concerns about the quality or safety of unregulated vape products.

- •

Seeking a more premium or reliable brand.

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Regulators & Public Health Stakeholders

Description:Government bodies, regulators, and members of the public health community whom PMI seeks to influence with its harm reduction narrative and scientific data.

Demographic Factors

No itemsPsychographic Factors

- •

Evidence-based

- •

Risk-averse

- •

Focused on population-level health outcomes

Behavioral Factors

Influence public policy and market access

Scrutinize scientific claims

Pain Points

- •

Balancing harm reduction for existing smokers with preventing youth uptake.

- •

Lack of long-term independent data on new products.

- •

Historical distrust of the tobacco industry.

Fit Assessment:Fair

Segment Potential:Medium

Market Differentiation

- Factor:

Scientific Substantiation & R&D Investment

Strength:Strong

Sustainability:Sustainable

- Factor:

First-Mover Advantage and Scale in Heated Tobacco (IQOS)

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Distribution Network & Brand Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Acquisition-led Dominance in Oral Nicotine (ZYN)

Strength:Strong

Sustainability:Sustainable

Value Proposition

For adult smokers who would otherwise continue to smoke, we offer a portfolio of scientifically substantiated, smoke-free products that are a much better choice than continued smoking.

Excellent

Key Benefits

- Benefit:

Reduced Exposure to Harmful Chemicals

Importance:Critical

Differentiation:Unique (vs. Cigarettes)

Proof Elements

Extensive scientific studies and data published on pmi.com

FDA authorization to market IQOS with reduced exposure information

- Benefit:

Nicotine Satisfaction Without Combustion

Importance:Critical

Differentiation:Common (among alternatives)

Proof Elements

High user adoption and switching rates (over 41M users reported)

- Benefit:

Improved Social Convenience (No Ash, Less Smell)

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Product design and user experience

Marketing communications emphasizing cleanliness

Unique Selling Points

- Usp:

The IQOS 'Heat-Not-Burn' system, backed by billions in R&D, offers a tobacco experience distinct from vaping or oral products.

Sustainability:Long-term

Defensibility:Strong (Patents, Scale)

- Usp:

A multi-category portfolio (Heated, Oral, Vapor) providing a comprehensive suite of alternatives to suit different consumer preferences.

Sustainability:Long-term

Defensibility:Strong (Capital, M&A capability)

Customer Problems Solved

- Problem:

The desire to continue using nicotine while mitigating the primary health risks associated with burning tobacco.

Severity:Critical

Solution Effectiveness:Partial (Reduces harm, does not eliminate risk)

- Problem:

The social and physical inconvenience of traditional smoking (e.g., odor, ash, secondhand smoke).

Severity:Major

Solution Effectiveness:Complete (relative to cigarettes)

Value Alignment Assessment

High

The value proposition is highly aligned with the global macro-trend of harm reduction and consumer demand for alternatives to traditional, high-risk products.

High

The proposition directly addresses the primary pain points of its core target audience (health concerns, social stigma) while delivering the core benefit they seek (nicotine satisfaction).

Strategic Assessment

Business Model Canvas

Key Partners

- •

Tobacco Farmers & Agricultural Suppliers

- •

Electronics Manufacturers & Technology Partners

- •

Global Logistics & Distribution Companies (e.g., DHL)

- •

Wholesalers & Retail Chains

- •

Scientific & Research Institutions

Key Activities

- •

Research & Development (Smoke-free technologies)

- •

Global Manufacturing & Supply Chain Management

- •

Brand Marketing & Sales (heavily regulated)

- •

Government Affairs & Regulatory Engagement

- •

Mergers & Acquisitions

Key Resources

- •

Global brands (IQOS, Marlboro, ZYN)

- •

Extensive patent portfolio for smoke-free technology

- •

Vast global distribution network

- •

Substantial financial capital for investment and M&A

- •

Scientific and R&D talent

Cost Structure

- •

Manufacturing & Raw Materials (tobacco, electronics)

- •

Research & Development Expenses

- •

Marketing, Advertising & Administration

- •

Excise Taxes (a significant portion of product cost)

- •

Litigation & Regulatory Compliance Costs

Swot Analysis

Strengths

- •

Market leadership and scale in both legacy and next-gen categories.

- •

Strong portfolio of globally recognized brands with high consumer loyalty.

- •

Proven R&D capabilities and a deep innovation pipeline.

- •

Significant financial resources to fund transformation and withstand market pressures.

- •

Extensive and efficient global distribution infrastructure.

Weaknesses

- •

Persistent negative public perception and ESG concerns associated with the tobacco industry.

- •

Revenue is still heavily weighted towards the declining combustible cigarette category.

- •

Ethical ambiguity in promoting new addictive products as a solution to problems caused by legacy ones.

- •

Complex operational transition from a simple agricultural product to complex electronics manufacturing.

Opportunities

- •

Massive untapped market of adult smokers globally to convert to smoke-free alternatives.

- •

Shape a more favorable regulatory environment based on harm reduction principles.

- •

Expand into new geographies where smoke-free adoption is low.

- •

Long-term diversification into 'Beyond Nicotine' wellness and therapeutic categories through strategic acquisitions.

Threats

- •

Draconian government regulations, including outright bans on product categories (e.g., flavors, online sales).

- •

Intensifying competition from both large tobacco rivals and smaller, agile players in the vape market.

- •

Public health campaigns that successfully reduce overall nicotine consumption.

- •

Geopolitical instability impacting supply chains and market access.

Recommendations

Priority Improvements

- Area:

Stakeholder & Regulatory Engagement

Recommendation:Intensify proactive engagement with public health communities and regulators, using robust scientific data to advocate for risk-proportionate regulations that encourage smokers to switch while preventing youth access. This is critical for long-term license to operate.

Expected Impact:High

- Area:

Portfolio Acceleration

Recommendation:Accelerate the transition of marketing and commercial investment from combustible to smoke-free products. Set clear, aggressive internal targets for phasing out combustible brands in specific markets to demonstrate commitment to the smoke-free vision.

Expected Impact:High

- Area:

Digital Transformation

Recommendation:Develop a more robust direct-to-consumer digital ecosystem around IQOS and other RRPs (where legally permissible) to build direct relationships, improve user experience, and gather valuable market data.

Expected Impact:Medium

Business Model Innovation

- •

Explore subscription-based models for smoke-free consumables (e.g., 'TEREA Club') to enhance customer lifetime value and create predictable, recurring revenue streams.

- •

Develop a platform strategy that integrates wellness tracking or coaching services with smoke-free products, beginning the pivot towards a broader health and wellness company.

- •

Invest in circular economy initiatives for electronic devices (e.g., device recycling, refurbishment programs) to address ESG concerns and build brand trust.

Revenue Diversification

- •

Aggressively scale the oral nicotine category (ZYN) globally, leveraging the Swedish Match infrastructure and expertise as a key growth pillar independent of inhalation products.

- •

Continue strategic, disciplined M&A in the 'Beyond Nicotine' space, focusing on inhaled therapeutics and wellness products that leverage core competencies in aerosol science and regulatory management.

- •

Develop and monetize intellectual property related to smoke-free technologies by licensing to partners in non-competing markets or industries.

Philip Morris International is executing one of the most audacious and challenging business model transformations in modern corporate history. The company is actively cannibalizing its highly profitable, yet socially and medically condemned, core business of combustible cigarettes with a portfolio of technologically advanced, smoke-free alternatives. This strategic pivot from a traditional tobacco manufacturer to a science and technology-driven 'harm reduction' leader is both a necessity for survival and a significant growth opportunity.

The current business model is a hybrid, leveraging the immense cash flows from its legacy cigarette business to fund the massive R&D, manufacturing, and marketing investments required to build the smoke-free future. The success of this transition is evident in the numbers, with smoke-free products now comprising a substantial and rapidly growing portion of net revenue. The acquisitions of Swedish Match (for ZYN) and Vectura signal a clear, two-pronged strategy: 1) Dominate the future of nicotine with a multi-category portfolio (Heated, Oral, Vapor), and 2) Build a long-term growth engine 'Beyond Nicotine' in adjacent wellness and therapeutic areas.

Scalability is strong, predicated on converting hundreds of millions of existing smokers worldwide. The key challenge is not technological but regulatory and social. The company's future success hinges on its ability to convince regulators and the public of its harm reduction mission, thereby creating a predictable and favorable environment for its new products. The primary strategic imperative is to accelerate the transition to a majority smoke-free business, as this will not only align the company with future market trends but also mitigate its most significant ESG and business risks. The evolution from a B2B2C commodity producer to a more tech-oriented, consumer-centric company is well underway, but navigating the complex web of global regulations and public mistrust remains the most critical variable in its long-term success.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Stringent Regulatory Hurdles

Impact:High

- Barrier:

Massive Capital Investment

Impact:High

- Barrier:

Global Distribution Networks

Impact:High

- Barrier:

Brand Loyalty and Proliferation

Impact:High

- Barrier:

Economies of Scale in Manufacturing

Impact:High

- Barrier:

Advertising and Marketing Restrictions

Impact:Medium

Industry Trends

- Trend:

Shift to Reduced-Risk Products (RRPs)

Impact On Business:This is the core of PMI's transformation. Success hinges on converting smokers to smoke-free alternatives like IQOS.

Timeline:Immediate

- Trend:

Increasingly Strict Global Regulations

Impact On Business:Navigating a complex web of regulations, including flavor bans and marketing restrictions, is a major challenge and a significant cost.

Timeline:Immediate

- Trend:

Growth of Oral Nicotine Pouches

Impact On Business:This fast-growing category represents both an opportunity and a threat, with competitors like Swedish Match (ZYN) and BAT (Velo) having strong positions.

Timeline:Immediate

- Trend:

Consumer Health Consciousness

Impact On Business:Drives the decline of combustible cigarettes but fuels demand for perceived safer alternatives, aligning with PMI's smoke-free mission.

Timeline:Immediate

- Trend:

Technological Innovation in Nicotine Delivery

Impact On Business:Continuous R&D is crucial to maintain a competitive edge. Competitors are actively developing new heated tobacco and vaping technologies.

Timeline:Near-term

Direct Competitors

- →

British American Tobacco (BAT)

Market Share Estimate:Second largest global player after PMI (excluding CNTC).

Target Audience Overlap:High

Competitive Positioning:Aggressively pursuing a multi-category approach to become a 'predominantly smokeless business' with a target of 50% revenue from non-combustibles by 2035.

Strengths

- •

Strong global leader in the vaping category with its 'Vuse' brand.

- •

Significant presence in the heated tobacco market with 'glo'.

- •

Growing share in the modern oral nicotine pouch market with 'Velo'.

- •

Robust global distribution network for both combustible and smoke-free products.

Weaknesses

- •

Slower start in the heated tobacco category, trailing PMI's IQOS significantly in market share.

- •

Vaping category faces intense regulatory scrutiny and flavor ban threats.

- •

Legacy combustible business still represents the vast majority of revenue and profit.

Differentiators

Stronger emphasis on vaping as a key pillar of its reduced-risk strategy compared to PMI's HTP-first approach.

Multi-category portfolio is more balanced across vaping, heated tobacco, and oral nicotine.

- →

Japan Tobacco International (JTI)

Market Share Estimate:A major global player, particularly strong in Asia and Europe.

Target Audience Overlap:High

Competitive Positioning:Positioned as a follower in the RRP space, but investing significantly to catch up with its 'Ploom' heated tobacco products and 'Logic' e-cigarettes.

Strengths

- •

Strong market share in traditional cigarettes in many key markets.

- •

Investing heavily in R&D and marketing for its Ploom HTPs to challenge IQOS.

- •

Established logistics and distribution channels that can be leveraged for new products.

- •

Aggressively pursuing US market entry and expansion.

Weaknesses

- •

Late entrant to the heated tobacco market, significantly lagging behind PMI.

- •

Ploom has struggled to gain the same level of market penetration as IQOS.

- •

Less diversified smoke-free portfolio compared to BAT and PMI.

- •

Does not expect its RRPs to break even until 2027.

Differentiators

Focus on the unique 'HeatFlow™' technology in their Ploom devices.

Strategy appears more focused on capturing value in combustible cigarettes while gradually building its RRP presence.

- →

Altria Group

Market Share Estimate:Leading tobacco company in the United States, formerly the parent company of PMI.

Target Audience Overlap:High

Competitive Positioning:Focused on 'Moving Beyond Smoking' within the US market by building a portfolio of smoke-free alternatives.

Strengths

- •

Dominant market share in the US combustible cigarette market with Marlboro.

- •

Growing presence in oral nicotine with its 'on!' brand.

- •

Acquisition of NJOY gives it a foothold in the e-vapor market with FDA-authorized products.

- •

Exclusive US partnership with JTI to market and commercialize the Ploom heated tobacco system.

Weaknesses

- •

Limited to the US market; no international presence.

- •

Previous large investment in JUUL resulted in significant financial losses and reputational damage.

- •

Currently lacks a proprietary, market-leading heated tobacco product.

- •

Highly dependent on the US regulatory environment, which is notoriously strict.

Differentiators

US-only focus allows for highly tailored domestic strategies.

Portfolio approach that includes partnerships (JTI) and acquisitions (NJOY) to quickly build its smoke-free presence.

Indirect Competitors

- →

Swedish Match

Description:A leader in the oral nicotine market, particularly with its ZYN brand of nicotine pouches, which is the #1 pouch in the US. While traditionally a smokeless tobacco company, its nicotine pouches compete for the same nicotine users looking for alternatives to smoking. Acquired by PMI.

Threat Level:Medium

Potential For Direct Competition:Now part of PMI, it's a key asset rather than a competitor. However, the success of ZYN sets a high bar and creates intense competition in the oral nicotine space for other players like BAT.

- →

Pharmaceutical Companies (e.g., Pfizer, Johnson & Johnson)

Description:Manufacturers of smoking cessation products like nicotine replacement therapies (patches, gums) and prescription medications (Chantix). Their goal is total nicotine cessation, not harm reduction via switching.

Threat Level:Medium

Potential For Direct Competition:Low. Their business model is fundamentally different (cessation vs. alternative nicotine delivery). However, they compete for the 'share of mind' of smokers looking to quit.

- →

Public Health and Anti-Smoking Organizations

Description:Government agencies and NGOs that actively campaign against all forms of nicotine and tobacco use. Their influence on public perception and regulation is a significant indirect threat.

Threat Level:High

Potential For Direct Competition:Low. They act as a powerful force shaping the market environment rather than as a commercial competitor. Their opposition can lead to stricter regulations and outright bans.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

First-Mover Advantage & Brand Dominance in HTP

Sustainability Assessment:Highly sustainable in the near to medium term. IQOS is synonymous with the heated tobacco category, creating a strong moat.

Competitor Replication Difficulty:Hard

- Advantage:

Extensive R&D and Patent Portfolio

Sustainability Assessment:Sustainable, backed by over $14 billion in investment. This scientific foundation is difficult to replicate and is used to engage with regulators.

Competitor Replication Difficulty:Hard

- Advantage:

Global Distribution & Commercial Infrastructure

Sustainability Assessment:Highly sustainable. Decades of experience in distributing tobacco products globally provides unparalleled market access for new products.

Competitor Replication Difficulty:Hard

- Advantage:

Financial Resources

Sustainability Assessment:Highly sustainable. Strong cash flows from the legacy business fund the massive investments required for R&D, marketing, and regulatory affairs in the smoke-free transition.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Specific Product Iterations (e.g., IQOS ILUMA)', 'estimated_duration': '1-3 years. Competitors are constantly working on similar technologies like induction heating, which will erode the initial technological advantage.'}

Disadvantages

- Disadvantage:

Negative Public Perception and Legacy

Impact:Major

Addressability:Difficult

- Disadvantage:

Complex and Inconsistent Regulatory Landscape

Impact:Critical

Addressability:Difficult

- Disadvantage:

Dependence on IQOS Success

Impact:Major

Addressability:Moderate

Strategic Recommendations

Quick Wins

- Recommendation:

Amplify Scientific Communication on Corporate Channels

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch Targeted Digital Campaigns for Investor and Policy Audiences

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Accelerate Diversification in the Oral Nicotine Category

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Proactively Engage with Regulators with Scientific Dossiers

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand into lower-priced tiers of the HTP market to counter competitors.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Invest in 'Beyond Nicotine' Wellness Products

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Establish a Digital Ecosystem for Harm Reduction

Expected Impact:High

Implementation Difficulty:Difficult

Solidify positioning as the undisputed science and technology leader in tobacco harm reduction, using the rigor of its research as the primary differentiator against all competitors.

Differentiate through superior technology and comprehensive scientific substantiation for the IQOS platform, while strategically expanding the oral nicotine portfolio to build a multi-category leadership position.

Whitespace Opportunities

- Opportunity:

Personalized Harm Reduction Journeys

Competitive Gap:No competitor currently offers a truly personalized digital platform that helps users transition from smoking, manage nicotine intake, and potentially step down their usage over time.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Building a Certified Carbon-Neutral Nicotine Brand

Competitive Gap:While sustainability is mentioned by all major players, none have made a strong, consumer-facing brand built entirely around environmental responsibility, which could appeal to younger adult demographics.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Expansion into Low- and Middle-Income Markets (LMICs) with Affordable RRPs

Competitive Gap:Most next-generation products are priced for developed markets. A tiered portfolio with more accessible RRPs could capture significant volume in emerging economies where smoking rates are high.

Feasibility:Low

Potential Impact:High

Philip Morris International (PMI) is navigating a seismic shift in the tobacco industry, a transformation it is actively leading with its mission to 'deliver a smoke-free future.' The competitive landscape is no longer defined solely by traditional cigarette market share but by the race to dominate the Reduced-Risk Products (RRPs) category. The industry is a mature oligopoly, controlled by a few major players, with exceptionally high barriers to entry.

PMI's primary competitive advantage is its dominant first-mover position in the Heated Tobacco Products (HTP) segment with IQOS. This is not just a product lead but a technological and scientific one, backed by massive R&D investment. This focus has allowed PMI to capture significant market share and build a strong brand association with the category. However, this strength is also a potential weakness, creating a heavy reliance on the success of a single product line.

Direct competition is fierce and strategic. British American Tobacco (BAT) poses the most significant threat with a more diversified multi-category approach, leading in the global vaping market with 'Vuse' and aggressively competing in HTPs ('glo') and oral nicotine ('Velo'). Japan Tobacco International (JTI) is a determined follower, investing heavily to close the gap with its 'Ploom' HTP. In the crucial US market, Altria is leveraging partnerships and acquisitions to build its own smoke-free portfolio.

The primary industry trend is the undeniable pivot to RRPs, driven by consumer health awareness and regulatory pressure. This is a double-edged sword, creating the very market PMI aims to lead while also attracting intense and varied regulatory scrutiny globally, from flavor bans to marketing restrictions. The rapid growth of the oral nicotine pouch market, led by brands like ZYN (now owned by PMI), represents another key battleground.

Indirectly, PMI competes with pharmaceutical smoking cessation products and, more broadly, the powerful global anti-tobacco movement, which shapes public opinion and influences policy. These forces create a challenging operating environment that necessitates a proactive, science-led engagement strategy.

Strategic opportunities for PMI lie in leveraging its scientific leadership, diversifying its RRP portfolio to mitigate its reliance on IQOS, and exploring digital ecosystems that can support smokers in their transition journey. The long-term vision of evolving into a broader wellness company is ambitious but necessary to ensure future growth beyond nicotine. Ultimately, PMI's success will depend on its ability to out-innovate competitors, navigate the complex global regulatory maze, and convince consumers, investors, and regulators that its 'smoke-free future' is not just a marketing slogan but a viable corporate transformation.

Messaging

Message Architecture

Key Messages

- Message:

Delivering a smoke-free future.

Prominence:Primary

Clarity Score:High

Location:Homepage hero, repeated throughout content and videos.

- Message:

Our smoke-free products are a much better choice than continued smoking.

Prominence:Secondary

Clarity Score:High

Location:Homepage, Our Progress, Our Science sections.

- Message:

We have invested >$14 billion in science and technology to develop these alternatives.

Prominence:Secondary

Clarity Score:High

Location:Homepage data callouts, Our Science section.

- Message:

The problem is burning, not nicotine.

Prominence:Tertiary

Clarity Score:Medium

Location:Our Science section, informational videos.

- Message:

We are a transforming, responsible, and sustainable business.

Prominence:Tertiary

Clarity Score:Medium

Location:Sustainability reports, In the News, Investor Relations.

The message hierarchy is exceptionally well-defined and rigorously enforced. The primary message of 'Delivering a smoke-free future' is the central organizing principle for the entire site. It is immediately presented and consistently reinforced by secondary messages about scientific investment, harm reduction ('better choice'), and business transformation. This creates a clear, albeit controversial, narrative.

Messaging is highly consistent across all corporate communication channels on the site. From investor relations to sustainability reports and career pages, the 'smoke-free' transformation narrative is woven into every aspect. The language is tightly controlled, consistently using phrases like 'adult smokers who would otherwise continue to smoke' and 'better alternatives' to frame the company's new product portfolio.

Brand Voice

Voice Attributes

- Attribute:

Scientific

Strength:Strong

Examples

- •

USD >14 billion invested to develop, scientifically substantiate, and commercialize smoke-free products...

- •

Cutting-edge research and technology

- •

Applying rigorous standards to the science supporting our smoke-free products is vital...

- Attribute:

Corporate

Strength:Strong

Examples

- •

PMI is transforming for good

- •

Philip Morris International Reports 2025 Second Quarter & First Six-Months Results...

- •

PMI’s Integrated Report 2023 demonstrates clear progress on our smoke-free journey

- Attribute:

Forward-Looking

Strength:Strong

Examples

- •

Our progress toward a smoke-free future

- •

It's time to make smoking history

- •

The smoke-free vision guiding us forward.

- Attribute:

Definitional

Strength:Moderate

Examples

- •

What is tobacco harm reduction?

- •

The role of nicotine

- •

Why burning is the main problem

Tone Analysis

Authoritative

Secondary Tones

- •

Progressive

- •

Educational

- •

Optimistic

Tone Shifts

The tone shifts from highly corporate and financial in the 'Investor Relations' sections to more educational and scientific in the 'Our Science' area.

In sections like 'Leaders of Change' and 'Careers', the tone becomes more inspirational and people-focused ('Make history with us').

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

For investors, regulators, and society, Philip Morris International is leading the global tobacco industry's transformation by heavily investing in a scientifically-validated portfolio of reduced-harm, smoke-free products to replace cigarettes, thereby creating a sustainable, long-term business model that aligns with evolving public health expectations.

Value Proposition Components

- Component:

Harm Reduction

Clarity:Clear

Uniqueness:Somewhat Unique

Explanation:Clearly articulated as 'a better choice than continued smoking.' While the concept is used by competitors like BAT , PMI's massive investment and singular focus give it a unique weight.

- Component:

Scientific Leadership

Clarity:Clear

Uniqueness:Unique

Explanation:The >$14 billion investment figure is a powerful and unique differentiator, framing PMI as the R&D leader in the category.

- Component:

Business Transformation & Sustainability

Clarity:Clear

Uniqueness:Somewhat Unique

Explanation:Positioned as a fundamental shift in business strategy, not just a new product line. This narrative of corporate metamorphosis is central to their ESG and investor appeal.

- Component:

Shareholder Value

Clarity:Clear

Uniqueness:Common

Explanation:Financial performance, dividends, and growth from new product categories are clearly communicated to investors. This is a common value prop for any publicly traded company.

PMI's messaging differentiates itself not by claiming its products are safe, but by framing the transition to them as a responsible and scientifically-backed corporate mission. The key differentiator is the scale of their commitment, both financially (>$14B investment) and rhetorically ('replace cigarettes with smoke-free products'). This positions them as the primary driver of industry change, rather than a follower. Competitors also talk about harm reduction , but PMI's messaging is more totalizing, suggesting a complete corporate identity shift.

The messaging positions PMI as the vanguard of the 'post-cigarette' era. It implicitly frames legacy tobacco companies that aren't transforming as obsolete and new entrants (e.g., vape-only companies) as lacking the scientific rigor, global scale, and regulatory experience of PMI. The narrative aims to make PMI 'part of the solution' , a bold position designed to engage regulators and shape policy in their favor.

Audience Messaging

Target Personas

- Persona:

Investors / Financial Analysts

Tailored Messages

- •

41 percent of PMI’s total global net revenues came from our smoke-free business.

- •

We are investing behind innovation and delivering sustainable growth...

- •

Press releases on quarterly results, dividends, and full-year guidance.

Effectiveness:Effective

- Persona:

Regulators / Policymakers

Tailored Messages

- •

What is tobacco harm reduction?

- •

Applying rigorous standards to the science supporting our smoke-free products...

- •

Our marketing standards are, in many places, higher than those of some governments.

- •

PMI calls for commonsense to prevail in global regulatory approaches...

Effectiveness:Effective

- Persona:

Media / Public Affairs

Tailored Messages

- •

Our progress toward a smoke-free future

- •

PMI’s Integrated Report 2023 demonstrates clear progress...

- •

In the news

- •

Subscribe to the PMI corporate newsletter

Effectiveness:Effective

- Persona:

Potential Employees (especially in STEM)

Tailored Messages

- •

Make history with us

- •

Our team of more than 400 world-class scientists, engineers and technicians...

- •

PMI’s culture of excellence celebrated with four Stevie Awards

Effectiveness:Somewhat Effective

Audience Pain Points Addressed

- •

For Investors: The existential threat to the traditional tobacco business model and the need for a viable growth alternative.

- •

For Regulators: The public health crisis caused by smoking and the demand for harm reduction strategies.

- •

For Employees: The desire to work for an innovative company with a positive purpose, mitigating the stigma of 'Big Tobacco'.

Audience Aspirations Addressed

- •

For Investors: Being part of a high-margin, sustainable, and market-leading growth story.

- •

For Regulators: Making tangible progress on public health goals by phasing out combustibles.

- •

For Employees: Being on the cutting edge of science and business transformation to solve a major global problem.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Appeal to Progress/Modernity

Effectiveness:High

Examples

- •

Our progress toward a smoke-free future

- •

PMI is transforming for good

- •

Celebrating 10 years of smoke-free progress

- Appeal Type:

Appeal to Authority/Reason

Effectiveness:High

Examples

- •

Our Science

- •

USD >14 billion invested...

- •

Applying rigorous standards to the science...

- Appeal Type:

Appeal to Responsibility

Effectiveness:Medium

Examples

- •

It’s our responsibility to market our products responsibly.

- •

We respect the law.

- •

The standards we uphold

Social Proof Elements

- Proof Type:

Awards & Recognition

Impact:Moderate

Examples

- •

PMI’s culture of excellence celebrated with four Stevie Awards

- •

PMI receives fourth consecutive CDP 'triple-A' rating for its sustainability leadership

- •

Philip Morris International included in Dow Jones Sustainability World Index for the first time

- Proof Type:

Data & Statistics

Impact:Strong

Examples

- •

41 percent of... net revenues came from our smoke-free business

- •

>41 million estimated total adult users

- •

97 markets where our smoke-free products are available

- Proof Type:

Leadership Authority

Impact:Moderate

Examples

CEO Jacek Olczak underlined the need for commonsense regulations...

PMI’s thought leaders share their insights and expertise

Trust Indicators

- •

Extensive 'Our Science' section detailing research.

- •

Publication of an 'Integrated Report' combining financial and sustainability metrics.

- •

A dedicated page on 'Marketing Standards' outlining self-imposed rules.

- •

Explicit disclaimers: 'This site is not operated for advertising or marketing purposes.'

- •

Consistent use of footnotes and references to official financial releases.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Read more

Location:Ubiquitous across news items, articles, and reports.

Clarity:Clear

- Text:

Learn more

Location:Homepage hero section

Clarity:Clear

- Text:

Watch the full series / Watch video

Location:Video sections

Clarity:Clear

- Text:

Subscribe

Location:Newsletter sign-up form

Clarity:Clear

- Text:

Investor Relations

Location:Footer, financial data sections

Clarity:Clear

The CTAs are clear, consistent, and well-aligned with the website's primary function as a corporate information hub. They effectively guide different audience segments (investors, media, regulators) toward deeper, more detailed content relevant to their interests. The actions prompted are informational (Read, Learn, Watch) rather than transactional, which is appropriate for the site's purpose.

Messaging Gaps Analysis

Critical Gaps

- •

There is no direct acknowledgment or apology for the historical public health damage caused by the company's core product (cigarettes). The focus is entirely on the future, which can feel evasive.

- •

The voice of the actual adult user who has switched is completely absent. While this is likely due to regulatory constraints, its absence makes the narrative feel sterile and corporate rather than human-centric.

- •

The messaging does not substantively address the high addictiveness of nicotine itself, focusing almost exclusively on the harms of combustion. The phrase 'not risk-free' is used but not deeply explored.

Contradiction Points

The core contradiction is promoting a 'smoke-free future' while simultaneously deriving the majority of revenue from selling cigarettes. The messaging frames this as a necessary transition phase , but the inherent conflict creates a significant credibility challenge.

Promoting 'Good conversion practices for PMI’s smoke-free products' while the business model still relies on the existence of a massive base of existing smokers of its combustible products.

Underdeveloped Areas

The 'Wellness and Healthcare' ambition, a stated part of their long-term strategy , is barely mentioned on the site. This represents a missed opportunity to flesh out the 'beyond nicotine' future of the company.

The messaging could be more direct in comparing the risk profile of its products to traditional cigarettes, though this is heavily constrained by global regulations. The current language ('better choice') is directional but vague.

Messaging Quality

Strengths

- •

Extraordinary message discipline and consistency around the 'smoke-free future' narrative.

- •

Effective use of data and large numbers (e.g., $14B investment, 41M users) to substantiate claims and project market leadership.

- •

Sophisticated framing of a controversial product pivot as a positive, science-led corporate transformation.

- •

Excellent audience segmentation, with clear messaging paths for investors, regulators, and potential employees.

Weaknesses

- •

The highly corporate and sanitized language can come across as disingenuous and lacking authenticity, given the company's history.

- •

The inherent credibility gap is immense. The messaging attempts to bridge it with science and data, but skepticism from public health communities and the general public remains a major hurdle.

- •

Over-reliance on jargon like 'scientifically substantiate' and 'harm reduction' which may not be fully understood or trusted by a broader audience.

Opportunities

- •

Create more content around the 'problem' of misinformation in the public health debate, positioning PMI as a source of evidence-based information.

- •

Develop more thought leadership content from their scientists and engineers to humanize the R&D investment.

- •

Build out a dedicated section on the company's long-term vision for wellness and healthcare to make the transformation narrative more credible and forward-looking.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Narrative

Recommendation:Restructure the top of the homepage to more explicitly state the problem-solution narrative: 'The world has a smoking problem. Burning is the enemy. We are investing everything to solve it with science-backed alternatives. Here is our progress.' This tackles the core contradiction head-on.

Expected Impact:High

- Area:

Trust & Transparency

Recommendation:Create a dedicated 'Addressing the Past, Building the Future' section that acknowledges the historical context of the tobacco industry more directly, without apology, to build credibility for the transformation story. This could include a timeline of the company's shift.

Expected Impact:Medium

- Area:

Humanizing the Mission

Recommendation:Feature more in-depth profiles and interviews with the scientists, engineers, and strategists leading the transformation. Focus on their personal motivations to 'make history' and solve this challenge.

Expected Impact:Medium

Quick Wins

- •

Add a 'Key Facts & Figures' infographic to the homepage hero that summarizes the core data points (investment, revenue share, user numbers) for immediate impact.

- •

Create short, shareable video explainers for key concepts like 'The Problem with Burning' and 'Tobacco Harm Reduction' aimed at a lay audience.

- •

Make the 'Integrated Report' more prominent on the homepage as a primary trust indicator.

Long Term Recommendations

- •

Develop a multi-year content strategy to establish PMI as a leading voice on innovation, responsible business transformation, and the role of science in solving societal problems, broadening the narrative beyond just tobacco.

- •

As regulations permit, explore ways to incorporate anonymized, aggregated data on smoker conversion rates and public health impacts in markets where smoke-free products have significant share.

- •

Invest in building out the 'Wellness & Healthcare' messaging to provide a tangible proof point for the company's long-term vision beyond nicotine.

Philip Morris International's corporate website is a masterclass in disciplined, strategic messaging designed to navigate an incredibly challenging business transformation. The entire communication strategy is built around a single, powerful idea: 'Delivering a smoke-free future.' This narrative attempts to reframe the company from a purveyor of a harmful product into a science-driven, innovative leader that is part of the public health solution.

The messaging architecture is flawless in its execution. Key messages about scientific investment, harm reduction, and corporate progress are repeated relentlessly, creating a coherent and persuasive, if controversial, argument. The brand voice is intentionally corporate, authoritative, and scientific, aiming to project stability, expertise, and control over a complex issue. This is a deliberate choice to build credibility with the site's primary audiences: investors who need to see a viable future beyond cigarettes, and regulators who need to be convinced of the company's scientific rigor and responsible intentions.

The core business challenge is the immense credibility gap stemming from the company's history and its continued reliance on cigarette sales for the majority of its revenue. The messaging strategy does not ignore this, but rather attempts to overwhelm it with forward-looking data and a narrative of profound change. The heavy emphasis on the '$14 billion' R&D investment and the growing percentage of revenue from smoke-free products are the central pillars supporting this argument. They are tangible metrics of transformation that directly support the value proposition for investors and stakeholders.

However, the strategy has significant gaps. The complete avoidance of the past and the absence of any human element (the voice of the converted smoker) makes the messaging feel sterile and defensive. The central contradiction—funding a 'smoke-free' future with cigarette profits—is managed but not resolved. For the target audiences of investors and policymakers, this highly controlled, data-driven approach is likely effective. But for a broader public, the messaging may lack the authenticity and humility needed to truly reshape the company's reputation. The optimization roadmap should focus on carefully and strategically addressing this credibility gap without undermining the core message of progress and transformation.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Smoke-free products (SFPs), led by IQOS and ZYN, now account for over 41% of total net revenues, demonstrating significant market adoption.

- •

Estimated >41 million adult users of PMI's smoke-free products globally, with a high conversion rate of users abandoning cigarettes.

- •

Dominant market share in the heated tobacco (HTP) category, with IQOS holding a ~77% share of the global HTU market.

- •

Sustained double-digit organic growth in the smoke-free business segment, with net revenues growing over 20% and gross profit over 33% in Q1 2025.

- •

Strong market penetration in key regions like Japan and Europe, with IQOS achieving a record 32.2% market share in Japan.

Improvement Areas

- •

Enhance product-market fit in markets with strong vape competition by clearly differentiating the user experience and value proposition of heated tobacco.

- •

Address consumer confusion regarding the relative harm of HTPs versus e-cigarettes to better attract adult smokers seeking alternatives.

- •

Continue innovation in the product pipeline to address user experience friction points and offer a wider range of sensory experiences to accelerate smoker conversion.

Market Dynamics

Heated Tobacco Products (HTP) market projected to grow at a CAGR of over 22% (some estimates as high as 63.2%) through 2030, while the traditional cigarette market is in structural decline.

Growing

Market Trends

- Trend:

Shift to Harm Reduction: Growing consumer and regulatory interest in scientifically substantiated, less harmful alternatives to combustible cigarettes.

Business Impact:This is the primary tailwind for PMI's growth, validating their massive investment and strategic pivot to smoke-free products.

- Trend:

Increasingly Stringent Global Regulation: Governments are implementing stricter rules on all nicotine products, including potential flavor bans, marketing restrictions, and taxation.

Business Impact:Navigating a fragmented and often hostile regulatory landscape is a primary business risk and a critical function for enabling growth.

- Trend:

Competition from Vaping/E-cigarettes: The e-cigarette market is also experiencing rapid growth (projected 30.6% CAGR), representing a major alternative to HTPs for smokers looking to switch.

Business Impact:PMI must compete not only with other tobacco companies but also with a vast and fragmented vaping market, requiring distinct marketing and product strategies.

- Trend:

Corporate Diversification into Wellness: Tobacco companies are strategically acquiring assets in adjacent wellness and healthcare sectors to create long-term growth avenues 'Beyond Nicotine'.

Business Impact:This represents a long-term growth vector but also introduces integration challenges and reputational risk, as seen with the Vectura acquisition.

Excellent. PMI is a first-mover at scale in the heated tobacco category, capitalizing on the convergence of declining smoking rates and the search for viable alternatives. Their timing allows them to shape the category and regulatory frameworks.

Business Model Scalability

High

High fixed costs in R&D and manufacturing provide significant operating leverage as smoke-free product volume scales. Gross margins for SFPs exceed 70%, significantly higher than traditional cigarettes.

Extremely high. PMI leverages its existing global distribution, supply chain, and regulatory affairs infrastructure to launch and scale new products efficiently.

Scalability Constraints

- •

Complex and varied regulatory approval processes in different countries can slow down market entry and expansion.

- •

Manufacturing scale-up for new, technologically advanced devices and consumables requires significant capital investment and lead time.

- •

Public and governmental opposition to a tobacco company entering the wellness/healthcare space can create significant friction and block strategic moves.

Team Readiness

Strong. The leadership team has successfully orchestrated a massive corporate transformation, shifting the company's focus and capital allocation towards a smoke-free future.

Evolving. The company is transitioning from a traditional CPG structure to one that more closely resembles a technology and life sciences organization, with heavy investment in R&D, clinical science, and digital engagement.

Key Capability Gaps

- •

Deep expertise in rapid, agile consumer technology development to compete with the fast-moving vape market.

- •

Credibility and talent in the pharmaceutical and wellness sectors to successfully execute the 'Beyond Nicotine' strategy.

- •

Digital marketing and community-building capabilities, constrained by heavy advertising regulations.

Growth Engine

Acquisition Channels

- Channel:

Retail Distribution (B2B2C)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage data analytics to optimize retail placement and sales force effectiveness. Develop best-in-class retailer training programs to ensure proper consumer education at the point of sale.

- Channel:

Owned Retail (IQOS Stores)

Effectiveness:High

Optimization Potential:High

Recommendation:Expand the owned retail footprint in key urban centers to act as brand experience hubs. Use these locations for user onboarding, support, and gathering direct consumer feedback for product development.

- Channel:

Regulatory & Public Affairs

Effectiveness:High

Optimization Potential:High

Recommendation:Continue proactive engagement with regulators to secure favorable excise and marketing frameworks for HTPs. Frame advocacy around data-driven, harm-reduction principles to differentiate from combustible cigarettes.

- Channel:

Digital (Controlled Platforms)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest in building out a robust, compliant CRM and digital ecosystem for registered adult users to foster loyalty and enable direct communication where legally permissible.

Customer Journey

Focused on converting existing adult smokers to smoke-free alternatives. The journey involves awareness (often via retail), education on harm reduction, product trial, and full conversion (abandoning cigarettes).

Friction Points

- •

Initial cost of the device can be a barrier to trial for some smokers.

- •

User learning curve for the device and rituals compared to the simplicity of a cigarette.

- •

Consumer confusion and skepticism about the health claims and benefits of switching.

Journey Enhancement Priorities

{'area': 'Onboarding & Trial', 'recommendation': 'Develop innovative trial programs (e.g., extended money-back guarantees, guided digital onboarding) to reduce the perceived risk and effort of switching.'}

{'area': 'Post-Purchase Support', 'recommendation': 'Implement proactive customer support programs to help new users overcome initial challenges and reinforce their decision to switch, thereby preventing relapse to smoking.'}

Retention Mechanisms

- Mechanism:

Product Ecosystem (Device + Consumables)

Effectiveness:High

Improvement Opportunity:Continuously innovate on both devices (e.g., IQOS ILUMA's blade-free technology) and consumables (new flavors where permitted, different nicotine strengths) to maintain user engagement and prevent switching to competitors.

- Mechanism:

Brand Loyalty & Community

Effectiveness:Medium

Improvement Opportunity:Foster a sense of community among adult users through exclusive events, loyalty programs, and digital platforms where regulations allow, reinforcing the brand's premium positioning.

Revenue Economics

Excellent. Smoke-free products boast gross margins exceeding 70%, which is significantly higher than traditional cigarettes, creating a powerful engine for profitability and reinvestment into growth.

Not directly calculable in a traditional SaaS sense, but implied to be very high. The model relies on converting existing, high-LTV combustible users to a new, higher-margin platform with strong retention.

High. The company is demonstrating strong organic revenue growth (6-8% forecast) and even stronger operating income growth (10.5-12.5% forecast), indicating efficient scaling.

Optimization Recommendations

- •

Optimize the product mix towards higher-margin consumables.

- •

Implement data-driven pricing strategies tailored to market-specific purchasing power and regulatory environments.

- •

Continue to invest in manufacturing automation and supply chain efficiencies to protect and expand gross margins.

Scale Barriers

Technical Limitations

- Limitation:

Pace of R&D for Next-Generation Products

Impact:Medium

Solution Approach:Increase investment in parallel R&D streams for both incremental improvements and breakthrough innovations in heating technology and battery life to stay ahead of competitors.

Operational Bottlenecks

- Bottleneck:

Navigating Disparate and Evolving Global Regulations

Growth Impact:This is the single largest operational challenge, dictating market access, product features, and marketing strategies.

Resolution Strategy:Maintain a world-class, in-house regulatory and public affairs function with deep local expertise in all target markets. Proactively engage with policymakers with scientific evidence to shape future regulations.

- Bottleneck:

Global Supply Chain for Electronic Devices

Growth Impact:Susceptible to geopolitical risks, chip shortages, and logistics disruptions, which can impact product availability.

Resolution Strategy:Diversify manufacturing and supplier base across multiple geographies. Build strategic inventory reserves for critical components.

Market Penetration Challenges

- Challenge:

Intense Competition from Other Tobacco Giants and Vape Brands

Severity:Critical

Mitigation Strategy:Differentiate through scientific substantiation, premium branding (e.g., IQOS), and a superior user experience. Compete with British American Tobacco's 'glo' and JTI's 'Ploom' through continuous innovation and strong retail execution.

- Challenge:

Public Health Opposition and Consumer Misinformation

Severity:Critical

Mitigation Strategy:Systematically counter misinformation with transparent scientific communication and third-party validation. Emphasize the harm reduction continuum and target messaging exclusively to existing adult smokers.

- Challenge:

Restrictive Marketing and Advertising Laws

Severity:Major

Mitigation Strategy:Focus on compliant channels: point-of-sale marketing, owned retail experiences, and age-gated digital platforms for registered adult users. Leverage PR and corporate communications to convey the harm reduction message.

- Challenge:

Threat of Youth Uptake and Subsequent Regulatory Backlash

Severity:Major

Mitigation Strategy:Implement and enforce stringent youth access prevention programs. Proactively engage with regulators to demonstrate responsible stewardship and avoid policies (like flavor bans) that could stifle adult switching.

Resource Limitations

Talent Gaps

- •

Scientists and toxicologists with expertise in inhalation and aerosol science.

- •

Digital product managers and data scientists experienced in regulated industries.

- •

Regulatory affairs specialists with experience in FDA and EMA submissions for novel products.

Substantial and ongoing. Capital is required for large-scale R&D, clinical studies, global manufacturing build-out, M&A in the wellness sector, and marketing.

Infrastructure Needs

Expansion of manufacturing capacity for heated tobacco sticks and nicotine pouches to meet projected 12-14% volume growth.

Investment in a global, compliant digital infrastructure for customer relationship management.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion into New Markets

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Prioritize markets with a large smoking population and a regulatory environment that is at least neutral-to-positive on tobacco harm reduction. Develop a market-entry playbook that can be adapted to local regulations.

- Expansion Vector:

Deeper Penetration in Existing Markets (e.g., USA)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Aggressively build out the commercial infrastructure for IQOS in the U.S. following its re-entry. Leverage learnings from ZYN's successful market capture to accelerate IQOS adoption.

- Expansion Vector:

Expansion into 'Beyond Nicotine' Wellness Sector

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Pursue strategic M&A and partnerships to acquire capabilities in areas like respiratory drug delivery and self-care wellness, leveraging PMI's expertise in inhalation technology. This is a long-term play that requires careful execution to manage reputational risks.

Product Opportunities

- Opportunity:

Next-Generation Heated Tobacco Devices

Market Demand Evidence:User feedback on existing products and competitor moves indicate demand for longer battery life, faster charging, and more advanced features.

Strategic Fit:Core to the business strategy of maintaining technological leadership.

Development Recommendation:Maintain a robust R&D pipeline focused on improving the core user experience and reducing manufacturing costs.

- Opportunity:

Expanded Portfolio of Oral Nicotine Pouches

Market Demand Evidence:Rapid growth of the nicotine pouch category, particularly ZYN in the US, demonstrates strong consumer demand for smoke-free, tobacco-leaf-free alternatives.

Strategic Fit:Strengthens the multi-category portfolio of smoke-free alternatives, capturing users who prefer oral products.

Development Recommendation:Invest in expanding flavor profiles (where permitted), nicotine strengths, and production capacity to defend and grow market share.

- Opportunity:

Wellness & Healthcare Products

Market Demand Evidence:Growing global market for self-care, wellness, and respiratory therapies.

Strategic Fit:Long-term diversification strategy ('Beyond Nicotine') that leverages core competencies in inhalation science and clinical research.

Development Recommendation:Establish a semi-autonomous business unit to pursue these opportunities, potentially through joint ventures or partnerships to mitigate reputational and execution risks.

Channel Diversification

- Channel:

Subscription Services

Fit Assessment:High

Implementation Strategy:Pilot a subscription model for consumables (heated tobacco sticks, nicotine pouches) in mature markets to enhance customer lifetime value and create a recurring revenue stream.

- Channel:

Strategic E-commerce Partnerships

Fit Assessment:Medium

Implementation Strategy:Where regulations permit, partner with specialized, age-verified e-commerce platforms to expand reach beyond owned digital channels.

Strategic Partnerships

- Partnership Type:

Technology & Engineering

Potential Partners

- •

Battery technology companies

- •

Medical device manufacturers

- •

Consumer electronics firms

Expected Benefits:Accelerate product development cycles, improve device performance and reliability, and reduce costs through shared innovation.

- Partnership Type:

Scientific & Research Collaboration

Potential Partners

- •

Contract Research Organizations (CROs)

- •

Academic institutions

- •

Public health bodies open to harm reduction

Expected Benefits:Enhance the credibility and robustness of scientific evidence supporting smoke-free products. Generate independent data to support regulatory submissions and public discourse.

Growth Strategy

North Star Metric

Number of Adult Smokers Fully Switched to PMI's Smoke-Free Products

This metric directly aligns with the company's stated mission of 'delivering a smoke-free future'. It captures not just user acquisition but successful conversion away from the core problem (combustible cigarettes), which is the foundation of the entire business transformation and long-term value creation.

Achieve a consistent 15-20% year-over-year growth in fully switched adult users.

Growth Model

Category Transformation & Market Access Growth Model

Key Drivers

- •

Scientific Substantiation & Innovation (R&D)

- •

Regulatory Engagement & Approval (Public Affairs)

- •

Global Commercialization & Distribution (Sales & Marketing)

- •

Strategic Acquisitions (Corporate Development)

A multi-pronged approach where scientific validation unlocks regulatory pathways, which in turn enables commercial investment to drive smoker conversion and market share gains from combustibles.

Prioritized Initiatives

- Initiative:

Accelerate US Commercialization of IQOS

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Finalize the organizational structure for the US launch team, secure initial supply chain and distribution agreements, and develop the launch marketing plan in full compliance with FDA regulations.

- Initiative:

Launch Next-Generation Oral Nicotine Pouch Platform

Expected Impact:Medium-High

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Complete consumer research to identify desired product attributes (flavor, format, nicotine delivery). Finalize manufacturing process and begin regulatory filings in key markets.

- Initiative:

Secure 'Beyond Nicotine' Strategic Partnership

Expected Impact:High (Long-term)

Implementation Effort:High

Timeframe:Ongoing

First Steps:Clarify the strategic focus for the wellness/healthcare division post-Vectura sale. Engage investment banking partners to identify and vet potential partners for JVs or co-development in targeted therapy areas.

Experimentation Plan

High Leverage Tests

{'area': 'Pricing & Trial Offers', 'experiment': "A/B test different device price points and 'try-before-you-buy' models in select markets to measure impact on new user acquisition rates."}