eScore

progressive.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Progressive demonstrates exceptional digital intelligence through a dominant online presence. The website's content, particularly the 'Answers' section, aligns perfectly with user search intent for a vast range of insurance-related queries, establishing high content authority and capturing significant top-of-funnel traffic. Their multi-channel presence is robust and consistent, and they have made significant investments in technology like AI and big data to optimize digital operations. The site also shows strong geographic reach with state-specific content, which is crucial for the US insurance market.

The 'Answers' content hub is a masterclass in establishing topic authority, effectively blanketing the informational landscape of the personal insurance industry to capture users at every stage of their journey.

Elevate thought leadership by publishing proprietary, data-driven reports using anonymized 'Snapshot' telematics data to generate high-authority backlinks and media mentions, further cementing their status as an industry leader.

The brand's communication is highly effective at driving conversions, with a clear, transactional focus on getting a quote and saving money, particularly through bundling. Messaging is logically structured and consistently reinforces tangible benefits like cost savings ('over $800') and social proof ('37 million+ customers'). However, there is a notable disconnect between the highly personable and humorous brand voice of their advertising (e.g., 'Flo') and the more functional, corporate tone of the website, representing a missed opportunity for emotional connection.

Exceptional message clarity and hierarchy on the homepage, which relentlessly funnels users toward the primary call-to-action of getting a quote, directly supporting core business acquisition goals.

Incorporate the well-established brand personality from advertising campaigns into the website's copy to create a more engaging, less transactional user experience and leverage a key brand differentiator.

The website offers a highly optimized conversion experience, scoring first in online user experience in some industry benchmarks. The primary user goal of getting a quote is frictionless and immediately accessible, with a clear information architecture that minimizes cognitive load. The design is clean, mobile-responsive, and effectively uses conversion elements like prominent CTAs and product tabs. While strong, the experience is largely static and could be enhanced with more micro-interactions and dynamic personalization based on user behavior.

The hero section's 'Get a Quote' funnel is laser-focused and highly effective, breaking down the initial steps to reduce friction and maximize user engagement from the moment they land on the page.

Implement dynamic, personalized CTAs that leverage user data (e.g., location, browsing history) to present more relevant offers, such as featuring a motorcycle-themed hero if a user previously viewed that product.

Progressive builds strong credibility through a clear hierarchy of trust signals, including its long history ('Trusted since 1937'), large customer base, and 24/7 support claims. The company demonstrates robust legal and regulatory compliance, particularly with industry-specific laws like GLBA and advertising standards, by providing clear disclosures for its marketing claims. While transparency in pricing is a key part of its messaging, some customer satisfaction studies suggest a gap between the shopping experience and the claims experience, which presents a reputational risk.

Meticulous adherence to advertising regulations (FTC/NAIC) through the prominent and consistent use of disclosures for statistical claims, which mitigates regulatory risk and enhances transparency.

Feature more prominent customer success evidence, such as video testimonials or detailed case studies about positive claims experiences, to counter below-average J.D. Power claims satisfaction scores and build deeper trust.

Progressive's competitive moat is strong and sustainable, built on massive brand recognition from iconic marketing and a highly effective dual-distribution model (direct and agency). A key differentiator has been its pioneering role and vast data collection in telematics with the 'Snapshot' program, enabling more sophisticated risk pricing. However, this telematics advantage is eroding as competitors have launched similar programs, and the company faces a significant disadvantage in customer satisfaction and claims handling compared to market leaders like State Farm.

A powerful and efficient multi-channel distribution model, combining a dominant direct-to-consumer digital platform with a vast network of independent agents, allowing them to capture customers across different purchasing preferences.

Evolve the 'Snapshot' program beyond a simple discount tool into a comprehensive driver safety platform with proactive alerts and coaching to re-establish a defensible moat based on service and engagement, not just data.

The business model is highly scalable, supported by a strong digital infrastructure, significant investments in AI and automation, and efficient direct-to-consumer operations. The company has demonstrated strong unit economics with consistent profitability and a healthy LTV:CAC ratio. Major expansion potential exists in deepening their penetration in homeowners and commercial lines to diversify from the saturated auto market, as well as through new channels like embedded insurance partnerships.

A mature and efficient direct-to-consumer channel, built on decades of investment, allows for profitable scaling of customer acquisition without proportional increases in overhead.

Develop a dedicated 'Insurance-as-a-Service' API platform to aggressively pursue embedded insurance partnerships with auto OEMs and real estate platforms, opening a new, highly scalable customer acquisition channel.

Progressive's business model is exceptionally coherent, tightly aligning its technology-driven, direct-to-consumer strategy with its value proposition of choice, convenience, and competitive pricing. Resource allocation is heavily and effectively focused on marketing and technology, which are the primary drivers of its growth. The dual-channel approach (direct and agent) allows it to serve multiple customer segments effectively, and its pioneering use of data analytics for risk-based pricing is central to its profitability.

The symbiotic relationship between massive marketing spend to build the brand and sophisticated data analytics for underwriting creates a powerful, self-reinforcing flywheel that drives profitable growth.

Increase strategic focus on revenue diversification by aggressively developing and marketing integrated home and commercial products to reduce dependency on the hyper-competitive personal auto market.

As the #2 auto insurer in the U.S., Progressive wields significant market power, with a strong and growing market share trajectory. Its massive scale and sophisticated underwriting give it considerable pricing power, allowing it to remain profitable even in a highly competitive environment. However, its influence is somewhat checked by intense competition from State Farm and GEICO, and its brand suffers from lower customer satisfaction ratings in J.D. Power studies, particularly for claims, limiting its ability to command a premium based on service.

Sustained, high-volume marketing spend has created iconic brand assets and a dominant share of voice, enabling strong customer acquisition and market influence.

Address the persistent gap in J.D. Power customer and claims satisfaction rankings to improve pricing power based on service quality, not just on underwriting precision and convenience.

Business Overview

Business Classification

Direct-to-Consumer (D2C) & Agency-Based Insurance Carrier

Financial Services Marketplace

Insurance

Sub Verticals

- •

Property & Casualty (P&C)

- •

Personal Lines (Auto, Home, Renters)

- •

Commercial Lines (Auto, General Liability)

- •

Recreational Lines (Motorcycle, Boat, RV)

- •

Life Insurance

Mature

Maturity Indicators

- •

Established in 1937, demonstrating long-term market presence.

- •

Over 37 million policies in force, indicating a large, stable customer base.

- •

Consistent profitability with a Q2 2025 net income of $3.175 billion.

- •

Strong brand recognition and significant, sustained marketing spend ($2.5 billion in Q2 2025).

- •

Operations at a national scale with a sophisticated dual distribution model (direct and agency).

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Net Premiums Earned

Description:The primary source of revenue, representing the portion of insurance premiums collected from policyholders that is recognized as revenue during a specific period for providing insurance coverage.

Estimated Importance:Primary

Customer Segment:All Policyholders

Estimated Margin:Medium

- Stream Name:

Net Investment Income

Description:Income generated from Progressive's investment portfolio, which is funded by premiums collected before they are paid out as claims. This is a critical component of profitability.

Estimated Importance:Secondary

Customer Segment:N/A (Corporate Function)

Estimated Margin:High

Recurring Revenue Components

Policy Renewals (Auto, Home, Commercial, etc.)

Pricing Strategy

Risk-Based & Dynamic Pricing

Mid-range

Semi-transparent

Pricing Psychology

- •

Bundling Discounts: Encouraging customers to purchase multiple policies (e.g., auto + home) for a discount.

- •

Usage-Based Incentives: Offering discounts through the 'Snapshot' telematics program for safe driving habits.

- •

Price Comparison: Actively encourages price shopping and provides comparison rates, positioning itself as a value-oriented choice.

- •

Tiered Offerings: Providing various levels of coverage to fit different budgets and needs.

Monetization Assessment

Strengths

- •

Highly sophisticated and data-driven underwriting allows for precise risk segmentation and competitive pricing.

- •

Massive scale provides a large, diversified risk pool and significant investment float.

- •

Strong direct-to-consumer channel reduces dependency on agent commissions, lowering acquisition costs.

- •

Effective cross-selling and bundling strategy increases customer lifetime value and retention.

Weaknesses

- •

High dependency on the hyper-competitive personal auto insurance market.

- •

Profitability is susceptible to macroeconomic factors like inflation (rising repair costs) and catastrophic weather events.

- •

Significant and rising marketing expenditures are required to maintain brand visibility and customer acquisition momentum.

Opportunities

- •

Expand the 'Marketplace' model by offering a wider array of third-party financial services, generating referral revenue.

- •

Leverage extensive telematics data from 'Snapshot' to develop new, personalized insurance products (e.g., pay-per-mile, behavior-based home insurance).

- •

Deepen penetration in the commercial lines and property insurance markets to diversify premium sources.

Threats

- •

Intense price competition from both legacy insurers (GEICO, State Farm) and new Insurtech startups.

- •

Increasingly frequent and severe weather events driving up claims costs in property lines.

- •

Regulatory changes at the state level can impact pricing models and profitability.

- •

Autonomous vehicle technology could fundamentally alter the auto insurance risk model in the long term.

Market Positioning

Technology-driven innovator focused on providing value, convenience, and choice through a dual direct-to-consumer and agency distribution model.

Progressive is the #2 P&C insurer in the U.S. with a 7.2% market share and the #2 personal auto insurer with a 16.73% market share.

Target Segments

- Segment Name:

The Bundlers ('Robinsons')

Description:Households that own their home and multiple vehicles, seeking the convenience and cost savings of bundling auto and property insurance with a single carrier. They represent the ideal high-lifetime-value customer.

Demographic Factors

- •

Age 31-45+

- •

Homeowners

- •

Multi-car households

- •

Stable income

Psychographic Factors

- •

Values convenience and simplicity

- •

Prefers established, trustworthy brands

- •

Less price-sensitive and more loyal

Behavioral Factors

- •

High retention rates

- •

Purchases multiple policies

- •

Less likely to switch carriers annually

Pain Points

- •

Managing multiple policies from different companies is complex.

- •

Concerned about gaps in coverage between different policies.

- •

Seeking a trusted advisor for their insurance needs.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Digital-Savvy Shoppers

Description:Digitally native consumers who prefer to research, quote, and manage their insurance online or via mobile apps. They are comfortable using technology and are often price-sensitive.

Demographic Factors

- •

Millennials and Gen Z

- •

Tech-savvy individuals of all ages

- •

Urban and suburban dwellers

Psychographic Factors

- •

Values speed and efficiency

- •

Seeks self-service options

- •

Trusts online tools and data

Behavioral Factors

- •

Compares quotes from multiple providers

- •

Prefers digital communication channels

- •

Engages with mobile apps and online portals

Pain Points

- •

Traditional insurance processes are slow and cumbersome.

- •

Lack of transparency in pricing and policy management.

- •

Inconvenience of phone calls and paperwork.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Safe Drivers / Telematics Adopters

Description:Individuals who are confident in their safe driving habits and are willing to share their driving data via telematics (the 'Snapshot' program) in exchange for potential discounts.

Demographic Factors

Varies, but often includes younger drivers looking to lower high premiums and conscientious drivers of all ages.

Psychographic Factors

- •

Cost-conscious

- •

Believes in fairness (paying based on their own risk)

- •

Comfortable with data sharing for a clear benefit

Behavioral Factors

- •

Exhibits safe driving patterns (e.g., limited hard braking, avoids late-night driving)

- •

Engages with the 'Snapshot' app or device

- •

Motivated by financial incentives

Pain Points

- •

Paying high insurance premiums despite being a safe driver.

- •

Feeling that rates are based on unfair demographic generalizations.

- •

Desire for more control over insurance costs.

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Telematics Leadership ('Snapshot')

Strength:Strong

Sustainability:Sustainable

- Factor:

Direct-to-Consumer (D2C) Expertise

Strength:Strong

Sustainability:Sustainable

- Factor:

Iconic Branding and Marketing

Strength:Strong

Sustainability:Sustainable

- Factor:

Dual Distribution Model (Direct & Agency)

Strength:Moderate

Sustainability:Sustainable

Value Proposition

Progressive offers a wide range of competitive and customizable insurance products, made simple and accessible through innovative technology and a seamless multi-channel experience, empowering customers to find the right coverage at the right price.

Excellent

Key Benefits

- Benefit:

Cost Savings & Competitive Pricing

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Claims of average annual savings for new customers.

- •

Discounts for bundling, safe driving (Snapshot), and other factors.

- •

Direct comparison tools integrated into the quoting process.

- Benefit:

Convenience and Accessibility

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

24/7 customer support.

- •

Robust online quoting and policy management platform.

- •

Widely available mobile app with extensive features.

- •

Dual channel access: online/phone direct or through an independent agent.

- Benefit:

Choice and Customization

Importance:Important

Differentiation:Common

Proof Elements

- •

Extensive portfolio of over 30 insurance and financial products.

- •

Ability to customize coverage levels and deductibles.

- •

'Name Your Price' tool (though a marketing feature) reinforces the idea of choice.

Unique Selling Points

- Usp:

Snapshot Program: A pioneering telematics program that personalizes rates based on actual driving behavior, offering a tangible way for safe drivers to lower their costs.

Sustainability:Medium-term

Defensibility:Moderate

- Usp:

Seamless Multi-Channel Experience: The highly effective integration of a dominant direct-to-consumer digital platform with a strong independent agent network caters to diverse customer preferences.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Insurance is expensive and difficult to compare.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

The process of buying and managing insurance is complicated and time-consuming.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Standard insurance rates don't reflect my personal (safe) driving habits.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

Progressive's focus on competitive pricing, digital convenience, and product choice directly addresses the primary demands of the modern insurance consumer.

High

The value proposition is exceptionally well-aligned with digitally-savvy shoppers and value-conscious customers, who form the core of their growth engine.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Independent Insurance Agents & Brokers

- •

Technology Partners (e.g., Microsoft Azure for AI, Zendrive for telematics).

- •

Auto Repair Network Shops

- •

Underwriting Partners for non-core products (e.g., Pets Best for pet insurance)

- •

Affinity Partners (e.g., Credit Karma for lead generation).

Key Activities

- •

Underwriting & Risk Management

- •

Claims Processing & Management

- •

Marketing & Brand Building

- •

Technology & Data Analytics

- •

Customer Service & Support

- •

Investment Management

Key Resources

- •

Strong Brand Equity ('Flo', 'Dr. Rick')

- •

Vast stores of proprietary actuarial and telematics data

- •

Advanced Technology Infrastructure (AI, Machine Learning).

- •

Large Investment Portfolio

- •

Dual Distribution Network (Direct and Agency)

Cost Structure

- •

Losses & Loss Adjustment Expenses (LAE)

- •

Policy Acquisition Costs (Marketing & Agent Commissions)

- •

Operating & Administrative Expenses

- •

Technology & Data Infrastructure Costs

Swot Analysis

Strengths

- •

Dominant brand recognition and highly effective marketing strategies.

- •

Pioneering and scaled advantage in telematics (Snapshot) and data analytics.

- •

Efficient and highly successful direct-to-consumer distribution model.

- •

Strong financial performance with robust premium growth and profitability.

- •

Diversified product portfolio beyond auto insurance.

Weaknesses

- •

Significant revenue concentration in the highly competitive U.S. personal auto market.

- •

Profitability is exposed to catastrophic weather events and inflationary pressures on claim costs.

- •

High customer acquisition costs due to intense marketing spend in a competitive environment.

Opportunities

- •

Leverage AI and machine learning to further enhance underwriting precision, claims efficiency, and customer personalization.

- •

Expand into adjacent financial services, evolving into a broader financial wellness destination.

- •

Form strategic partnerships with auto OEMs for embedded insurance solutions.

- •

Further growth in underserved commercial and specialty lines.

Threats

- •

Intense and escalating competition from legacy carriers and agile Insurtech startups.

- •

Increasingly severe and frequent natural catastrophes driven by climate change.

- •

Unfavorable regulatory changes impacting pricing, data usage, or capital requirements.

- •

Long-term disruption from autonomous vehicles and shared mobility models.

Recommendations

Priority Improvements

- Area:

Revenue Diversification

Recommendation:Aggressively accelerate growth in Property and Commercial lines to reduce reliance on the personal auto segment. Develop integrated product bundles that create stickier customer relationships beyond auto insurance.

Expected Impact:High

- Area:

Customer Retention

Recommendation:Evolve the 'Snapshot' program from a simple discount tool to a comprehensive driver safety and vehicle wellness platform. Integrate features like proactive maintenance alerts, crash assistance, and gamified safe-driving rewards to deepen engagement and loyalty.

Expected Impact:Medium

- Area:

Operational Efficiency

Recommendation:Double down on AI investments to automate more of the claims process, from First Notice of Loss (FNOL) to final settlement for standard claims, reducing loss adjustment expenses and improving customer satisfaction.

Expected Impact:High

Business Model Innovation

Shift from 'Repair and Replace' to 'Predict and Prevent': Leverage IoT and telematics data from both vehicles and smart homes to offer proactive risk mitigation services. This transforms the business model from reactive indemnification to a proactive subscription-based risk management partnership with the customer.

Embedded Insurance Ecosystem: Forge deep partnerships with automotive manufacturers, home builders, and online retailers to embed insurance offers directly at the point of sale, capturing customers at their initial moment of need and lowering acquisition costs.

Revenue Diversification

Expand Financial Marketplace: Broaden the 'Progressive Financial' hub to offer a curated selection of third-party products like mortgages, personal loans, and investment services, earning referral fees and becoming a more central part of the customer's financial life.

Data Monetization: Ethically monetize anonymized, aggregated data from the vast telematics and property databases by providing risk insights to municipalities for infrastructure planning or to commercial partners in the logistics and transportation sectors.

Progressive Corporation represents a mature, highly successful incumbent in the U.S. insurance industry that has maintained a growth trajectory by embracing a technology-forward, innovative mindset. The company's core business model, centered on a powerful dual-distribution strategy and sophisticated data analytics, is exceptionally robust. Its primary revenue stream from insurance premiums is stable, supported by a significant secondary stream from investment income, creating a resilient financial foundation as evidenced by strong quarterly earnings.

The company's market positioning is a key strength. It has masterfully cultivated a brand associated with value, choice, and digital convenience, which resonates strongly with key growth demographics. Its leadership in telematics with the 'Snapshot' program provided a first-mover advantage that, while now being emulated by competitors, has furnished it with a deep well of proprietary driving data, reinforcing its underwriting prowess.

However, the business model faces strategic challenges. Its heavy reliance on the U.S. personal auto market places it in a hyper-competitive arena where margin pressure is constant. Furthermore, the entire P&C industry is grappling with existential threats from climate change, which increases the volatility of property claims, and the long-term technological shift toward autonomous vehicles, which could fundamentally reshape auto risk pools.

Strategic Evolution Opportunities:

-

Ecosystem Expansion: The most significant opportunity lies in evolving from a pure insurance provider to a broader 'financial wellness' and 'risk management' ecosystem. The website already lists numerous adjacent products (home loans, credit cards, etc.), but this can be transformed from a simple lead-generation page into an integrated platform. This leverages the trusted brand to capture more of the customer's wallet and creates powerful data feedback loops.

-

Proactive Risk Mitigation: The future of insurance is moving from indemnification (paying after a loss) to mitigation (preventing the loss). Progressive is uniquely positioned with its telematics data to lead this shift. By partnering with smart home and auto-tech companies, it can offer services that actively help customers avoid accidents and property damage, creating a new, subscription-like revenue stream and fundamentally improving the customer relationship.

-

Deepen Commercial and Property Penetration: A deliberate and aggressive strategy to capture more market share in Commercial and Homeowners insurance is critical for long-term risk diversification away from auto. This requires tailoring its technology and direct-marketing expertise to the unique needs of small business owners and homeowners.

In conclusion, Progressive's current business model is a best-in-class example of a digitally transformed incumbent insurer. Its future success and scalability depend on its ability to leverage its core assets—brand, data, and technology—to transcend the traditional boundaries of the insurance product and become a more integrated partner in its customers' financial and physical security.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Regulatory Compliance & Licensing

Impact:High

Description:Navigating complex, state-by-state regulations and obtaining licenses to operate is a significant hurdle for new entrants.

- Barrier:

Capital Requirements

Impact:High

Description:Insurers must hold substantial capital reserves to cover potential claims, a massive financial barrier for startups.

- Barrier:

Brand Trust & Reputation

Impact:High

Description:Insurance is a trust-based product. Established brands like Progressive have decades of reputation that new players struggle to build.

- Barrier:

Distribution Channels & Agent Networks

Impact:Medium

Description:While direct-to-consumer models are growing, established relationships with independent agents remain a powerful sales channel that is difficult to replicate.

Industry Trends

- Trend:

Telematics and Usage-Based Insurance (UBI)

Impact On Business:High - UBI allows for more accurate, personalized pricing based on driving behavior, shifting the competitive basis from demographics to real-time data. Progressive's 'Snapshot' is a key asset here.

Timeline:Immediate

- Trend:

AI in Underwriting and Claims Processing

Impact On Business:High - AI accelerates underwriting, improves risk assessment, and streamlines claims, creating significant operational efficiencies and improving customer experience. Insurtechs are leveraging this heavily.

Timeline:Immediate

- Trend:

Hyper-Personalization and Customer Experience

Impact On Business:Medium - Customers increasingly expect seamless digital experiences and policies tailored to their specific needs, driving investment in CX and flexible product offerings.

Timeline:Immediate

- Trend:

Embedded Insurance

Impact On Business:Medium - The integration of insurance offers at the point of sale (e.g., buying a car) creates new distribution channels but threatens the traditional direct-to-consumer model.

Timeline:Near-term

Direct Competitors

- →

State Farm

Market Share Estimate:Largest U.S. P&C insurer, commanding a significant market share, particularly in auto and home insurance.

Target Audience Overlap:High

Competitive Positioning:Positions as a trustworthy, relationship-focused insurer with personalized service through its vast exclusive agent network.

Strengths

- •

Unmatched exclusive agent network fosters strong customer relationships and loyalty.

- •

Highest brand trust among major P&C carriers.

- •

Strong brand recognition and reputation for reliability.

- •

High customer satisfaction ratings in claims handling.

Weaknesses

- •

Slower to adopt a digital-first model compared to direct competitors.

- •

Agent-based model can lead to higher operational costs and less competitive pricing for some segments.

- •

Less appealing to younger, tech-savvy customers who prefer digital self-service.

- •

Customer satisfaction scores, while high, have seen some decline.

Differentiators

- •

The 'Good Neighbor' agent model for personalized, local service.

- •

Strong focus on bundling policies (auto, home, life).

- •

Consistently high rankings for claims satisfaction.

- →

GEICO (Berkshire Hathaway)

Market Share Estimate:Second-largest U.S. auto insurer, a major force in the direct-to-consumer market.

Target Audience Overlap:High

Competitive Positioning:Low-cost leader, emphasizing savings and convenience through a direct-to-consumer, digitally-focused model.

Strengths

- •

Extremely strong brand recognition through massive, sustained advertising spend (Gecko mascot).

- •

Highly competitive pricing, often the lowest-cost option for many drivers.

- •

Efficient and user-friendly digital platform (website and mobile app) for quotes and policy management.

- •

Strong financial stability backed by Berkshire Hathaway.

Weaknesses

- •

Limited in-person service options, which can be a drawback for complex issues.

- •

Fewer coverage options and less policy customization compared to competitors like Progressive.

- •

Customer service can be perceived as less personal than agent-based models.

- •

Below-average scores on claims satisfaction surveys.

Differentiators

- •

Iconic and ubiquitous marketing presence.

- •

Core value proposition is centered almost exclusively on price savings ('15 minutes could save you 15% or more').

- •

Streamlined, direct-to-consumer model that minimizes overhead.

- →

Allstate

Market Share Estimate:One of the top 5 P&C insurers in the U.S.

Target Audience Overlap:High

Competitive Positioning:Positions as a provider of premium protection and service, with a hybrid distribution model of local agents and strong digital tools.

Strengths

- •

Strong brand recognition with its 'You're in good hands' slogan.

- •

Robust telematics program (Drivewise) and significant investment in technology.

- •

Broad product portfolio, including extensive options for bundling.

- •

Hybrid model with both local agents and strong online capabilities.

Weaknesses

- •

Often has higher average premiums compared to GEICO and Progressive.

- •

Customer satisfaction and claims handling scores are typically average, not market-leading.

- •

Can be caught in the middle between the low-cost direct model of GEICO and the high-touch agent model of State Farm.

Differentiators

- •

Telematics program (Drivewise) is a key feature in its marketing and pricing.

- •

Focus on innovative products and technology integration.

- •

Strong agent network that provides a more personal touch than purely direct insurers.

Indirect Competitors

- →

Lemonade

Description:An insurtech company using AI, chatbots, and a mobile-first platform to offer renters, homeowners, pet, and auto insurance with a focus on ease-of-use and social good (donating unused premiums).

Threat Level:Medium

Potential For Direct Competition:High. Already competes directly in auto and home insurance, and its tech-first model is highly disruptive and appealing to younger demographics.

- →

Tesla Insurance

Description:An OEM (Original Equipment Manufacturer) insurer that leverages real-time telematics data directly from its vehicles to offer usage-based insurance, potentially providing highly accurate and competitive rates for Tesla drivers.

Threat Level:Medium

Potential For Direct Competition:Medium. While currently limited to Tesla vehicles, it represents the broader threat of embedded insurance from automakers who have proprietary access to vehicle data, bypassing traditional insurers.

- →

Root Insurance

Description:A mobile-first insurtech that bases insurance rates primarily on a driver's behavior during a 'test drive' period, tracked via their smartphone app. This model heavily penalizes bad driving and rewards good driving.

Threat Level:Low

Potential For Direct Competition:Medium. Competes directly in auto insurance, but its strict underwriting model limits its addressable market compared to Progressive.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Brand Recognition & Marketing Prowess

Sustainability Assessment:Highly sustainable. Decades of investment in memorable characters (Flo, Dr. Rick) have built a powerful brand asset that is difficult and expensive to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Advanced Pricing and Underwriting Analytics

Sustainability Assessment:Moderately sustainable. Progressive has a long history of sophisticated data analysis to segment risk and price accurately. This provides a persistent edge, though competitors and insurtechs are closing the gap with AI.

Competitor Replication Difficulty:Medium

- Advantage:

Multi-Channel Distribution Network

Sustainability Assessment:Highly sustainable. Progressive effectively operates through both direct-to-consumer channels (online/phone) and a large network of independent agents, allowing it to capture customers with different buying preferences.

Competitor Replication Difficulty:Hard

- Advantage:

Early Mover in Telematics (Snapshot)

Sustainability Assessment:Moderately sustainable. Being an early pioneer with 'Snapshot' provided a massive dataset and brand association with UBI. However, most competitors now have similar offerings, eroding the initial advantage.

Competitor Replication Difficulty:Easy

Disadvantages

- Disadvantage:

Customer Satisfaction and Trust Lag

Impact:Major

Addressability:Moderately

Description:J.D. Power studies consistently show Progressive lagging behind leaders like State Farm in overall customer satisfaction, claims handling, and trust. This is a significant vulnerability, especially when trust is a key driver of retention.

- Disadvantage:

Legacy Technology Burden

Impact:Major

Addressability:Difficult

Description:Compared to nimble insurtechs built on modern tech stacks, Progressive must manage and integrate complex legacy systems, which can slow innovation and increase operational costs.

- Disadvantage:

Price-Focused Positioning

Impact:Minor

Addressability:Moderately

Description:While a strength, focusing heavily on price makes Progressive vulnerable in a price war with GEICO and susceptible to losing customers who prioritize service over small cost savings.

Strategic Recommendations

Quick Wins

- Recommendation:

Optimize the Digital Claims Experience

Expected Impact:High

Implementation Difficulty:Moderate

Details:Invest heavily in the UI/UX of the mobile app's claims submission process to mirror the speed and simplicity of insurtechs like Lemonade. This directly addresses a key area of customer dissatisfaction.

- Recommendation:

Launch a Marketing Campaign Focused on Trust and Resolution

Expected Impact:Medium

Implementation Difficulty:Easy

Details:Leverage the existing brand characters to create campaigns that specifically highlight claims satisfaction stories and the company's commitment to being there for customers, directly countering the negative J.D. Power perceptions.

Medium Term Strategies

- Recommendation:

Evolve UBI Beyond Discounts

Expected Impact:High

Implementation Difficulty:Difficult

Details:Use Snapshot data with advanced AI to offer proactive safety alerts, preventative maintenance suggestions, and personalized coaching, shifting the value proposition from a simple discount to a comprehensive driver safety service.

- Recommendation:

Develop Hyper-Personalized, Modular Insurance Products

Expected Impact:Medium

Implementation Difficulty:Difficult

Details:Create flexible insurance packages where customers can easily add or remove specific coverages (e.g., rideshare, custom equipment) through the mobile app, catering to the demand for customized policies.

Long Term Strategies

- Recommendation:

Build an Embedded Insurance Ecosystem

Expected Impact:High

Implementation Difficulty:Difficult

Details:Forge strategic partnerships with auto manufacturers, dealerships, and real estate platforms to offer Progressive insurance seamlessly at the point of sale, capturing customers before they shop the open market.

- Recommendation:

Invest in Proactive Risk Mitigation Services

Expected Impact:High

Implementation Difficulty:Difficult

Details:Expand into services that prevent loss. For home insurance, this could mean partnering with smart home device companies to offer discounts for water leak sensors or security systems, fundamentally changing the business model from claim payment to risk prevention.

Shift from being a 'fast follower' in technology to a 'customer experience innovator.' While maintaining competitive pricing, elevate the brand promise to include superior digital service and proactive support, creating a moat that isn't purely based on price.

Differentiate through 'Pragmatic Innovation.' Instead of chasing every insurtech trend, focus on leveraging the massive scale and data advantage to deliver tangible, easy-to-use digital tools and UBI enhancements that provide clear value and improve the customer lifecycle, especially during the claims process.

Whitespace Opportunities

- Opportunity:

Integrated Insurance for the Gig Economy

Competitive Gap:Traditional personal auto policies often don't cover commercial activities like ridesharing or delivery. Competitors offer separate rideshare policies, but no one offers a truly seamless, integrated product that automatically adjusts coverage and premiums based on when a driver is working.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Proactive Risk Mitigation for Homeowners

Competitive Gap:Most insurers are reactive, paying claims after a loss. There is a significant gap in providing services and leveraging IoT (smart home) data to proactively prevent losses (e.g., water leaks, fires, break-ins) and rewarding customers for it.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Financial Wellness and Insurance Bundling

Competitive Gap:Insurers are not typically seen as partners in overall financial health. There is an opportunity to bundle insurance with other financial products (like credit monitoring, ID theft protection, or even high-yield savings accounts through partners) to create a stickier, more valuable customer relationship.

Feasibility:Low

Potential Impact:Medium

Comprehensive Competitive Landscape Analysis: Progressive Corporation

Progressive operates within the mature and highly concentrated U.S. P&C insurance industry, an oligopoly dominated by a few key players. The market is characterized by formidable barriers to entry, including stringent state-by-state regulations, massive capital requirements, and the paramount importance of brand trust, which incumbents have cultivated over decades.

Direct Competitive Dynamics

Progressive's primary competitive set includes State Farm, GEICO, and Allstate. The strategic positioning among these giants is distinct:

- State Farm competes on the basis of relationship and trust. Its core strength is its massive network of exclusive agents providing personalized service, which resonates well with customers who value human interaction and guidance. This has consistently placed them at the top for brand trust and claims satisfaction. Their primary weakness is a slower adoption of the digital-first, direct-to-consumer model that defines their main rivals.

- GEICO is the archetypal low-cost leader. Backed by Berkshire Hathaway, its business model is built on massive advertising spend to drive customers to an efficient, low-overhead, direct-to-consumer digital platform. Their strength is highly competitive pricing, but this comes at the cost of less personalized service and fewer coverage options.

- Progressive strategically positions itself between these two poles. It has successfully built a powerful direct-to-consumer brand fueled by iconic marketing (

Flo,Dr. Rick), while also maintaining a robust network of independent agents. Its key advantage has been its pioneering role in data analytics for pricing and its early adoption of telematics withSnapshot. However, a critical vulnerability persists: customer satisfaction and trust scores consistently lag behind the leaders. While Progressive excels at customer acquisition, J.D. Power data suggests a weaker performance in retention-driving areas like claims handling and problem resolution.

The Insurtech Disruption

Indirect competition is increasingly coming from agile, tech-native companies. Insurtechs like Lemonade are reshaping customer expectations with a mobile-first approach, AI-powered chatbots, and near-instant claims processing. They target younger, tech-savvy demographics who prioritize convenience and transparency over established brand names.

A more potent long-term threat comes from Original Equipment Manufacturers (OEMs) like Tesla. By leveraging proprietary, real-time data directly from the vehicle, they can offer hyper-accurate, usage-based insurance, potentially disintermediating traditional insurers entirely for their customer base. This represents a fundamental shift from demographic proxies to precise, individualized risk assessment.

Assessment of Progressive's Competitive Advantage

Progressive's advantages are formidable but not unassailable.

- Sustainable Strengths: Its brand equity and multi-channel distribution model are deeply entrenched and difficult to replicate. Decades of data have also given it a sophisticated understanding of risk segmentation.

- Eroding Strengths: Its early-mover advantage in telematics is diminishing as UBI becomes table stakes across the industry.

- Clear Disadvantages: The primary competitive disadvantage is the gap in customer service and claims satisfaction. In an industry where trust is the ultimate currency, this is a major liability. Furthermore, like all incumbents, Progressive faces the challenge of innovating while managing a complex legacy technology stack, a hurdle that startups do not face.

Strategic Recommendations & Whitespace Opportunities

To secure its market-leading position, Progressive must pivot its strategic focus from being a leader in pricing and acquisition to a leader in digital customer experience and retention.

-

Fortify the Core: The most pressing need is to address the customer satisfaction gap. This requires significant investment in streamlining the digital claims process to match insurtech speed and simplicity. The goal should be to make the claims experience—the ultimate moment of truth—a key brand differentiator.

-

Evolve Telematics: The future of UBI is not just about discounts; it's about engagement and safety. Progressive should leverage its vast

Snapshotdataset to offer value-added services like proactive safety alerts, accident detection, and vehicle maintenance reminders, transforming the user relationship from a transactional one to a protective partnership. -

Explore Strategic Whitespace: Significant opportunities exist in underserved or emerging segments. Developing a seamless, integrated insurance product for the gig economy (e.g., rideshare and delivery drivers) addresses a clear market need. Furthermore, shifting the home insurance model from reactive claim payment to proactive risk mitigation through IoT and smart home partnerships could create a new, highly defensible market position.

In conclusion, while Progressive is in a position of strength, the competitive landscape is being reshaped by technology and evolving customer expectations. Its future success will depend on its ability to defend its pricing and marketing advantages while aggressively closing the gap on customer experience and leveraging its data assets to innovate beyond the traditional insurance model.

Messaging

Message Architecture

Key Messages

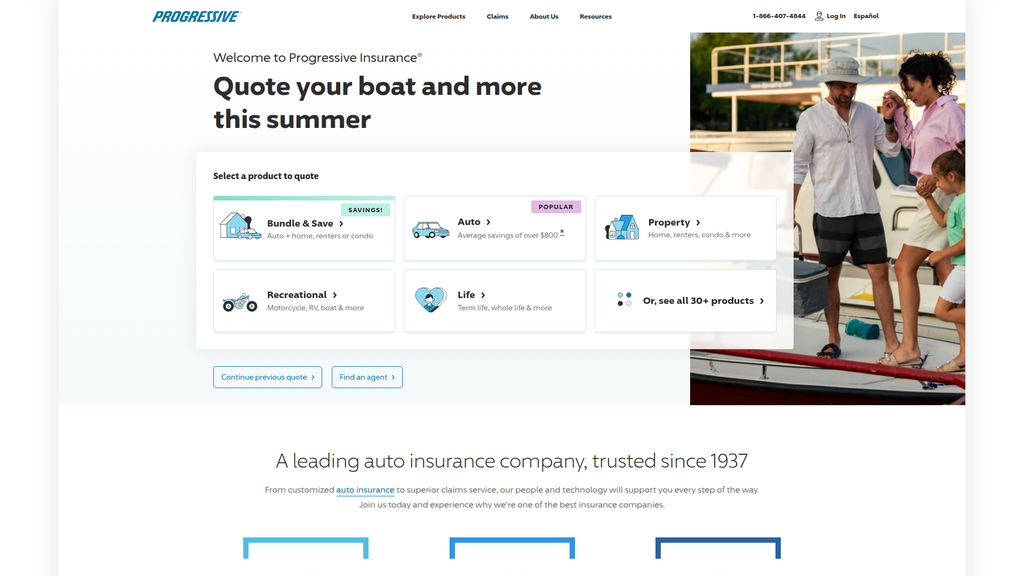

- Message:

Quote your boat and more this summer

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Bundle & Save (Auto + home, renters or condo)

Prominence:Primary

Clarity Score:High

Location:Product Selection Tool

- Message:

Average savings of over $800 for drivers who switch to Progressive and save.

Prominence:Secondary

Clarity Score:High

Location:Homepage, below product selector

- Message:

A leading auto insurance company, trusted since 1937

Prominence:Secondary

Clarity Score:High

Location:Homepage Mid-section

- Message:

24/7/365 Day or night customer support

Prominence:Secondary

Clarity Score:High

Location:Homepage Mid-section (Support Pillar)

- Message:

We're the #1 motorcycle insurance company in the U.S.

Prominence:Tertiary

Clarity Score:High

Location:Product Description Snippet

The message hierarchy is exceptionally clear and commercially focused. The primary real estate is dedicated to initiating a quote, with the most prominent messages centered on 'quoting' and 'bundling to save.' Secondary messages effectively build trust and reinforce the value proposition through large, quantifiable claims (savings, customer numbers) and key features (24/7 support). The hierarchy successfully guides the user from a broad entry point toward a specific, high-value action.

Messaging is highly consistent across the homepage. The core themes of Savings, Choice (30+ products), and Support are repeated in various formats—from headline claims to detailed product blurbs. For example, the 'Bundle and save' message appears as a primary option, a standalone section, and is reiterated within specific product details, reinforcing the benefit consistently.

Brand Voice

Voice Attributes

- Attribute:

Direct and Action-Oriented

Strength:Strong

Examples

- •

Select a product to quote

- •

Enter ZIP Code

- •

Quote now to get started.

- Attribute:

Helpful and Reassuring

Strength:Moderate

Examples

- •

Your easy guide to insurance and more

- •

we'll help pay for your temporary living expenses

- •

we've built our business around understanding what you need

- Attribute:

Promotional and Confident

Strength:Strong

Examples

- •

A leading auto insurance company, trusted since 1937

- •

Join us today and experience why we're one of the best insurance companies.

- •

Ride with the #1 bike insurer

- Attribute:

Simple and Accessible

Strength:Moderate

Examples

- •

Bundle with Progressive and save more — it's that easy!

- •

We break down insurance so you don't have to.

- •

Give your family the safety net they deserve

Tone Analysis

Transactional

Secondary Tones

Reassuring

Educational

Tone Shifts

The tone shifts significantly from the direct, sales-focused homepage to the more educational and neutral tone of the 'Answers' section, which is appropriate for the content's purpose.

Voice Consistency Rating

Good

Consistency Issues

The helpful, personable voice of the brand's famous ad campaigns (featuring characters like Flo) is largely absent from the website copy. The site's voice is more functional and corporate, creating a slight disconnect from the broader brand personality that many consumers know.

Value Proposition Assessment

Progressive offers a wide range of affordable and customizable insurance options, making it easy to save money, especially by bundling policies, all backed by decades of experience and 24/7 support.

Value Proposition Components

- Component:

Cost Savings

Clarity:Clear

Uniqueness:Common

Examples

Average savings of over $800

Bundle and save an average of 5% on auto!

- Component:

Product Breadth (Choice)

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

Or, see all 30+ products›

- Component:

Convenience & Ease

Clarity:Clear

Uniqueness:Common

Examples

get a quote in just a few minutes

with both policies under one roof, you can update or make changes to your insurance with ease

- Component:

Trust and Reliability

Clarity:Clear

Uniqueness:Common

Examples

- •

trusted since 1937

- •

37 million+ People trust us

- •

24/7/365...customer support

- Component:

Educational Resources

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

Find insurance information and other resources you need to confidently navigate every stage of life

Progressive's messaging differentiates itself primarily through the combination of quantifiable savings claims (e.g., 'over $800') and an exceptionally broad product portfolio ('30+ products'). While competitors like Geico also focus heavily on savings ('15 minutes could save you 15% or more') , Progressive pushes the 'one-stop-shop' angle more aggressively on its homepage. It doesn't lean into a single emotional anchor like State Farm's 'good neighbor' community focus or Allstate's 'good hands' protection promise , instead opting for a more rational, price-and-convenience-driven position.

The messaging positions Progressive as the practical, efficient, and cost-effective choice for a broad range of insurance needs. It competes directly on price and convenience, aiming to win customers who are actively shopping and comparing rates. The positioning is less about building a deep emotional relationship and more about demonstrating tangible value through savings and comprehensive options.

Audience Messaging

Target Personas

- Persona:

The Bundler ('The Robinsons')

Tailored Messages

- •

Savings! Bundle & Save›

- •

Combine home and auto insurance for more savings.

- •

you'll enjoy the convenience of having both policies under the same roof.

Effectiveness:Effective

Notes:This persona, which Progressive internally calls 'the Robinsons,' is a core target representing households that bundle home and auto policies for long-term value. The messaging is highly effective and prominent.

- Persona:

The Price-Driven Shopper

Tailored Messages

Average savings of over $800

You can instantly compare rates and coverages from multiple companies side-by-side

Effectiveness:Effective

Notes:This is a primary target for acquisition. The messaging is direct and focuses on the key motivator: cost.

- Persona:

The Recreational Vehicle Owner

Tailored Messages

- •

Recreational› Motorcycle, RV, boat & more

- •

Ride with the #1 bike insurer starting at $75/year

- •

Hit the highway with the coverage you need for peace of mind.

Effectiveness:Effective

Notes:Progressive clearly targets this niche with specific product categories and claims of market leadership.

- Persona:

The Information Seeker / First-Time Buyer

Tailored Messages

- •

Your easy guide to insurance and more

- •

We break down insurance so you don't have to.

- •

Common insurance terms, coverages, & requirements

Effectiveness:Somewhat

Notes:The 'Answers' section effectively caters to this persona, but the connection between this educational content and the primary sales funnel could be stronger.

Audience Pain Points Addressed

- •

Insurance is too expensive ('Average savings of over $800')

- •

The process is complicated ('We break down insurance so you don't have to.')

- •

Comparing options is difficult ('You can instantly compare rates and coverages from multiple companies side-by-side')

- •

I might not have enough coverage ('Buckle up with protection you can rely on.')

- •

I need help at inconvenient times ('24/7/365 Day or night customer support')

Audience Aspirations Addressed

- •

Financial security ('Give your family protection and long-lasting financial security.')

- •

Peace of mind ('enjoy the open road without worry.')

- •

Freedom and enjoyment ('enjoy the freedom of the open road')

- •

Making smart financial decisions ('Bundle with Progressive and save more — it's that easy!')

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Peace of Mind

Effectiveness:High

Examples

- •

Buckle up with protection you can rely on.

- •

Give your family the safety net they deserve

- •

safeguard your business from the unexpected.

- Appeal Type:

Financial Gain (Savings)

Effectiveness:High

Examples

Average savings of over $800

you could earn a multi-policy discount.

- Appeal Type:

Freedom & Enjoyment

Effectiveness:Medium

Examples

If you enjoy the freedom of the open road, then you'll love the freedom of choice we give you...

Hit the highway with the coverage you need for peace of mind.

Social Proof Elements

- Proof Type:

Customer Volume

Impact:Strong

Examples

37 million+ People trust us to insure what's important to them.

- Proof Type:

Market Leadership

Impact:Moderate

Examples

we're the #1 motorcycle insurance company in the U.S.

Join a leading RV insurer

- Proof Type:

Third-Party Endorsement

Impact:Weak

Examples

Join one of Fortune's 100 Best Companies to Work For.

Trust Indicators

- •

Longevity: 'trusted since 1937'

- •

Availability: '24/7/365...customer support'

- •

Guarantees: 'We guarantee repairs for as long as you own or lease your vehicle...'

- •

Transparency: Frequent use of disclosure symbols (*, Δ, §) to substantiate claims, although this can also create visual clutter.

Scarcity Urgency Tactics

The messaging does not heavily rely on scarcity or urgency, which is appropriate for the industry. The primary driver is the implied urgency of being uninsured or overpaying for current insurance.

Calls To Action

Primary Ctas

- Text:

Select a product to quote

Location:Homepage, primary quoting tool

Clarity:Clear

- Text:

Enter ZIP Code

Location:Homepage, primary quoting tool (once product is selected)

Clarity:Clear

- Text:

Continue previous quote›

Location:Homepage, below product selector

Clarity:Clear

- Text:

Explore our products

Location:Homepage, mid-page

Clarity:Clear

- Text:

Learn more about [product]

Location:Product detail modals

Clarity:Clear

The CTAs are extremely effective in their clarity and placement. The user journey is unambiguously funneled towards getting a quote. The language is simple, direct, and action-oriented. There is no confusion about the next step a user should take to engage with the company's primary business function.

Messaging Gaps Analysis

Critical Gaps

Brand Personality Integration: The well-known, quirky, and helpful brand personality established by characters like Flo and Dr. Rick is almost entirely absent from the website copy. This is a significant missed opportunity to leverage a major brand asset to build rapport and differentiate from the more functional tone of competitors.

Mission Statement Connection: The company mission 'to help people move forward and live fully' is not reflected in the transactional, price-focused messaging. The copy doesn't connect the product (insurance) to this higher-level human benefit.

Contradiction Points

No itemsUnderdeveloped Areas

Community and Social Responsibility: Beyond a tertiary link to 'Diversity & Inclusion,' there is little messaging about Progressive's role in the community. Competitors like State Farm use the 'good neighbor' concept to build trust and emotional connection.

Storytelling: The site lacks narrative or customer storytelling elements. It presents facts and figures but misses the opportunity to tell stories about how Progressive has helped customers in moments of need, which would add a powerful emotional layer to the trust indicators.

Messaging Quality

Strengths

- •

Exceptional Clarity: The primary messages are simple, direct, and focused on the core user goal of getting a quote and saving money.

- •

Strong Value Quantification: Using specific numbers like 'over $800' and '37 million+ customers' provides concrete proof points that are more persuasive than generic statements.

- •

Comprehensive Product Showcase: The website effectively communicates the vast range of products, reinforcing the 'one-stop-shop' value proposition.

- •

Logical Message Flow: The information architecture guides users seamlessly from broad value propositions to specific product actions.

Weaknesses

- •

Overly Transactional Tone: The intense focus on quoting and saving makes the messaging feel less relational and more like a utility.

- •

Lack of Emotional Resonance: The copy is highly rational and lacks the emotional warmth or humor that characterizes the brand's successful advertising campaigns.

- •

Generic 'Why Progressive?' Reasons: The 'Why Progressive?' callouts in the product modals often state features (e.g., 'We offer a variety of discounts') rather than unique, compelling benefits.

Opportunities

- •

Inject Brand Voice: Rewrite key headlines and body copy to reflect the helpful, confident, and sometimes humorous personality of the brand icons (Flo, etc.).

- •

Show, Don't Just Tell: Replace generic claims with short customer vignettes or testimonials that illustrate the benefits of 24/7 support or guaranteed repairs.

- •

Bridge Content and Commerce: More effectively integrate the 'Answers' content into the sales funnel by linking relevant articles directly from product pages to address common customer questions at the point of consideration.

Optimization Roadmap

Priority Improvements

- Area:

Brand Voice & Personality

Recommendation:Conduct a copy audit to infuse the established brand personality (personified by 'Flo') into the website. Focus on headlines, sub-headlines, and CTA buttons to make the experience more engaging and less transactional.

Expected Impact:High

- Area:

Value Proposition

Recommendation:Strengthen the 'Why Progressive?' sections with more unique and compelling differentiators. Instead of 'We offer discounts,' try 'Our loyalty program rewards you from day one.'

Expected Impact:Medium

- Area:

Emotional Connection

Recommendation:Integrate customer stories or testimonials that align with the mission of 'helping people move forward.' Showcase real-world examples of how Progressive provided peace of mind, not just a low price.

Expected Impact:High

Quick Wins

- •

Rewrite the main H2 headline 'A leading auto insurance company, trusted since 1937' to be more benefit-oriented, e.g., 'Protection You Can Trust, Savings You Can See.'

- •

Add a small, personable welcome message on the homepage that reflects the brand's friendly persona.

- •

A/B test CTA button copy to include more personality, e.g., 'Let's Find Your Rate' vs. 'Get Quote'.

Long Term Recommendations

- •

Develop persona-based content journeys that guide users from the 'Answers' section to tailored product recommendations, nurturing them with helpful content before pushing a quote.

- •

Create a dedicated 'Social Impact' or 'Community' section to build brand affinity beyond the product transaction, detailing D&I efforts and community involvement.

- •

Integrate interactive tools or calculators that provide value beyond a simple price quote, such as a 'Coverage Recommender' based on lifestyle inputs.

Progressive's website messaging is a masterclass in transactional efficiency and clarity. It is expertly designed to convert users who are actively seeking insurance by focusing relentlessly on the core drivers of that decision: price, convenience, and choice. The message architecture is logical and powerful, funneling users toward the primary business objective of generating a quote. The use of large, specific numbers for savings ('over $800') and social proof ('37 million+ customers') serves as a highly effective rational persuasion tactic.

However, the strategy's greatest strength is also its most significant weakness. The messaging is so hyper-focused on the transaction that it largely abandons the powerful brand personality Progressive has spent billions to build through its iconic advertising characters like Flo. The voice on the website is functional and corporate, not the quirky, helpful, and reassuring persona consumers associate with the brand. This creates a messaging gap and a missed opportunity to leverage a key differentiator that competitors cannot easily replicate.

While the current messaging is likely very effective for customer acquisition, particularly with price-sensitive shoppers, it does little to build long-term brand loyalty or emotional connection. It positions Progressive as a utility rather than a partner. The optimization roadmap should focus on bridging this gap: infusing the website's copy with the brand's well-known personality, weaving in narrative elements that connect to its mission, and better articulating its unique differentiators beyond just price and a long list of products. By doing so, Progressive can evolve its digital messaging from being merely efficient at conversion to being truly effective at building a lasting, differentiated brand.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established market leader, ranking as the #2 or #3 auto insurer in the U.S. with a significant market share of around 15.3%.

- •

Large and growing customer base of over 37 million policies in force, demonstrating widespread adoption and trust.

- •

Broad and diversified product portfolio covering auto, property, recreational, life, and commercial insurance, catering to a wide array of customer needs.

- •

Long-standing brand presence since 1937, indicating sustained market relevance and customer trust.

- •

Consistent growth in policies and net premiums written, with a 21% increase in net premiums to $74.4 billion in 2024 and the addition of 1.3 million policies in Q1 2025.

Improvement Areas

- •

Enhance customer experience to compete with digital-native insurtechs, focusing on seamless, personalized digital journeys.

- •

Deepen the integration of its diverse product lines to provide a more holistic and unified customer experience, moving beyond simple bundling.

- •

Leverage data from its 37M+ customers to create more sophisticated, personalized products and pricing models.

Market Dynamics

Moderate. The US P&C insurance market is projected to grow by approximately 5-6.8% in 2025.

Mature

Market Trends

- Trend:

Rise of Insurtech and AI

Business Impact:Increased competition from agile, tech-focused startups. Creates an urgent need for incumbents like Progressive to accelerate digital transformation, particularly in AI-driven underwriting, claims processing, and customer service to improve efficiency and personalization.

- Trend:

Telematics and Usage-Based Insurance (UBI)

Business Impact:Significant growth opportunity. The global insurance telematics market is projected to grow at a CAGR of over 18%. Progressive's 'Snapshot' program is a key asset, allowing for more accurate risk assessment and personalized pricing, which can attract safer drivers and improve underwriting margins.

- Trend:

Embedded Insurance

Business Impact:A major channel diversification opportunity. The embedded insurance market is forecasted to grow from ~$211 billion in 2025 to over $950 billion by 2030. This opens new, lower-cost acquisition channels through partnerships with auto manufacturers, real estate platforms, and e-commerce sites.

- Trend:

Customer-Centric Digital Platforms

Business Impact:Shifts customer expectations towards seamless, on-demand, and highly personalized digital experiences. Insurers must invest in modern, user-friendly platforms for quoting, policy management, and claims to retain customers.

Excellent. While the market is mature, the rapid pace of technological change creates significant opportunities for well-capitalized incumbents like Progressive to innovate and capture market share from slower-moving competitors.

Business Model Scalability

High

The insurance model has high upfront fixed costs in technology and marketing, but scales efficiently as variable costs per policy (servicing, some underwriting) are relatively low. Digital channels further improve this scalability.

High. Investments in AI for underwriting and claims automation can dramatically reduce processing costs and time, significantly improving margins as policy volume grows.

Scalability Constraints

- •

Regulatory compliance across 50 states, which can slow down new product rollouts and create administrative overhead.

- •

Maintaining high-quality customer service and claims processing at scale, requiring significant investment in talent and technology.

- •

Intense price competition in a mature market can limit margin expansion during scaling.

Team Readiness

Strong. The company's consistent growth, profitability (combined ratio improving to 86.9% in May 2025), and market leadership indicate a highly capable and experienced leadership team.

Functional and established. While effective for a large corporation, it may pose challenges to the agility required to compete with insurtech startups. A shift towards more cross-functional, agile teams may be needed for new growth initiatives.

Key Capability Gaps

- •

Top-tier AI/ML talent to compete with tech firms for developing next-generation underwriting and claims models.

- •

Partnership and ecosystem development expertise to build and scale an embedded insurance strategy.

- •

User Experience (UX) and product management talent focused on creating seamless, digital-first customer journeys.

Growth Engine

Acquisition Channels

- Channel:

Direct-to-Consumer (Website/App)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Implement AI-powered personalization in the quoting funnel to dynamically adjust offers and streamline the process. A/B test different user flows to reduce friction and improve conversion rates.

- Channel:

Paid Advertising (TV, Digital)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Shift more budget towards highly-targeted digital channels. Use customer data to create more granular audience segments for programmatic advertising to lower the average Customer Acquisition Cost (CAC).

- Channel:

Agent Network

Effectiveness:High

Optimization Potential:High

Recommendation:Develop a suite of digital tools for independent agents to improve their productivity, streamline quoting for complex policies, and enhance lead management, making Progressive the preferred carrier for agents.

- Channel:

Content Marketing/SEO

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand the 'Answers' content hub to include more interactive tools (calculators, simulators) and video content. Focus SEO strategy on high-intent keywords related to life events (e.g., 'buying a first home', 'new car insurance requirements') to capture users earlier in their journey.

Customer Journey

Primarily focused on a direct 'Get a Quote' funnel. The path is clear but can be lengthy given the amount of information required for an accurate quote.

Friction Points

- •

Length and complexity of quote forms, potentially leading to high drop-off rates.

- •

Difficulty for consumers in comparing complex coverage options and understanding policy jargon.

- •

Siloed experience between different product lines (e.g., starting a new quote for each product instead of a unified profile).

Journey Enhancement Priorities

- Area:

Quote Funnel Simplification

Recommendation:Use data pre-fill APIs and progressive disclosure design to simplify the quote form. Show fewer fields initially and only ask for more information as needed.

- Area:

Unified Customer Profile

Recommendation:Develop a single customer view that allows users to see all their products, get pre-filled quotes for new lines of insurance, and receive personalized bundling recommendations seamlessly.

- Area:

Claims Experience

Recommendation:Invest heavily in a digital-first claims process, including AI-powered damage assessment from photos, automated status updates, and digital payments to create a superior post-purchase experience.

Retention Mechanisms

- Mechanism:

Bundling Discounts

Effectiveness:High

Improvement Opportunity:Move beyond static discounts to dynamic, personalized bundling offers. Use AI to recommend the 'next best product' for a customer based on their profile and life events, creating a stickier, multi-policy relationship.

- Mechanism:

Claims Service

Effectiveness:Moderate

Improvement Opportunity:Transform the claims process from a necessary evil into a competitive advantage. A fast, transparent, and empathetic digital claims experience can be a powerful driver of loyalty and positive word-of-mouth.

- Mechanism:

Telematics (Snapshot Program)

Effectiveness:High

Improvement Opportunity:Evolve Snapshot from a discount tool into an ongoing engagement platform. Offer safe driving tips, rewards, and gamification to create a continuous positive feedback loop with the customer, reinforcing brand loyalty.

Revenue Economics

Strong. As a mature, profitable insurer, Progressive has demonstrated a long-term ability to price risk effectively and manage costs, leading to healthy per-policyholder economics.

Estimated to be well above the healthy 3:1 benchmark for the industry, given high retention rates for bundled policies and a focus on operational efficiency.

High. The company's impressive growth in net premiums written and strong underwriting performance (low combined ratio) indicate a highly efficient revenue engine.

Optimization Recommendations

- •

Focus on increasing Customer Lifetime Value (CLV) by deepening relationships through cross-selling and upselling, making it a key corporate metric.

- •

Reduce CAC by optimizing ad spend and scaling lower-cost channels like SEO and embedded insurance partnerships.

- •

Improve retention by investing in a superior, proactive customer experience, as retaining customers is 7-9 times cheaper than acquiring new ones in the insurance industry.

Scale Barriers

Technical Limitations

- Limitation:

Potential Legacy Core Systems

Impact:High

Solution Approach:Adopt a two-speed IT architecture. Maintain stable legacy systems for core policy administration while building a modern, API-driven layer on top for new digital products, partnerships, and customer-facing applications.

Operational Bottlenecks

- Bottleneck:

Claims Processing at Scale

Growth Impact:A slow or inefficient claims process can damage brand reputation and increase customer churn, negating acquisition efforts.

Resolution Strategy:Aggressively invest in AI and automation for claims intake, fraud detection, and damage assessment. Empower claims handlers with better digital tools to focus on complex cases and customer communication.

- Bottleneck:

Onboarding and Supporting Independent Agents

Growth Impact:A cumbersome agent experience can lead them to favor competitors, reducing a critical distribution channel's effectiveness.

Resolution Strategy:Develop a best-in-class digital agent portal with instant quoting, automated commission tracking, and co-brandable marketing resources to become the easiest insurer for agents to work with.

Market Penetration Challenges

- Challenge:

Intense Competition and Price Sensitivity

Severity:Critical

Mitigation Strategy:Differentiate beyond price. Focus on superior digital experience, innovative products (e.g., advanced telematics), and building a trusted brand. Use data to price risk more accurately than competitors, allowing for competitive rates for target segments without sacrificing profitability.

- Challenge:

Market Saturation in Core Auto Insurance

Severity:Major

Mitigation Strategy:Focus on wallet share over market share. Drive growth by cross-selling other insurance products (home, renters, life) to the existing auto customer base, leveraging bundling and a unified customer experience.

Resource Limitations

Talent Gaps

- •

Data Scientists and AI/ML Engineers

- •

Digital Product Managers

- •

Partnership and Business Development Managers (for embedded insurance)

- •

Cybersecurity Experts

Low. As a large, profitable public company, Progressive has ample capital to fund growth initiatives.

Infrastructure Needs

Cloud-native platforms to support AI/ML workloads and real-time data processing.

Robust API gateway to facilitate secure and scalable partnerships with third-party platforms for embedded insurance.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deeper Penetration into Homeowners Insurance

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Leverage the massive auto insurance customer base as a primary channel. Develop proprietary home insurance products that integrate smart home technology (IoT) for risk mitigation and discounts, creating a differentiated offering.

- Expansion Vector:

Small and Medium Business (SMB) Commercial Lines

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop a digital-first, self-service platform for common SMB insurance needs (e.g., Business Owner's Policy, Commercial Auto). Partner with fintechs and software platforms that serve SMBs (e.g., payroll, accounting) to embed insurance offerings.

Product Opportunities

- Opportunity:

Integrated Financial Wellness Platform

Market Demand Evidence:Growing consumer interest in integrated financial services and managing financial security holistically.

Strategic Fit:Expands the relationship beyond risk transfer to financial partnership, significantly increasing customer lifetime value.

Development Recommendation:Partner with or acquire fintech companies to integrate services like financial planning, automated savings, and credit monitoring alongside insurance products within a single Progressive app.

- Opportunity:

Advanced Telematics-Based Products