eScore

prudential.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Prudential has immense corporate domain authority, but its digital strategy is fragmented through a hyperlocal, advisor-centric model. This approach is well-suited for capturing bottom-of-funnel, high-intent local search but creates a significant gap in broader, top-of-funnel content authority. The templated nature of advisor pages hinders voice search optimization and creates inconsistent multi-channel messaging, as it relies on individual advisors for execution.

Leveraging high corporate brand authority and trust for hyperlocal market penetration, targeting high-intent local search queries effectively.

Develop a centralized content platform to empower advisors with high-quality, compliance-approved educational articles and tools, transforming their pages from digital business cards into authoritative local resources.

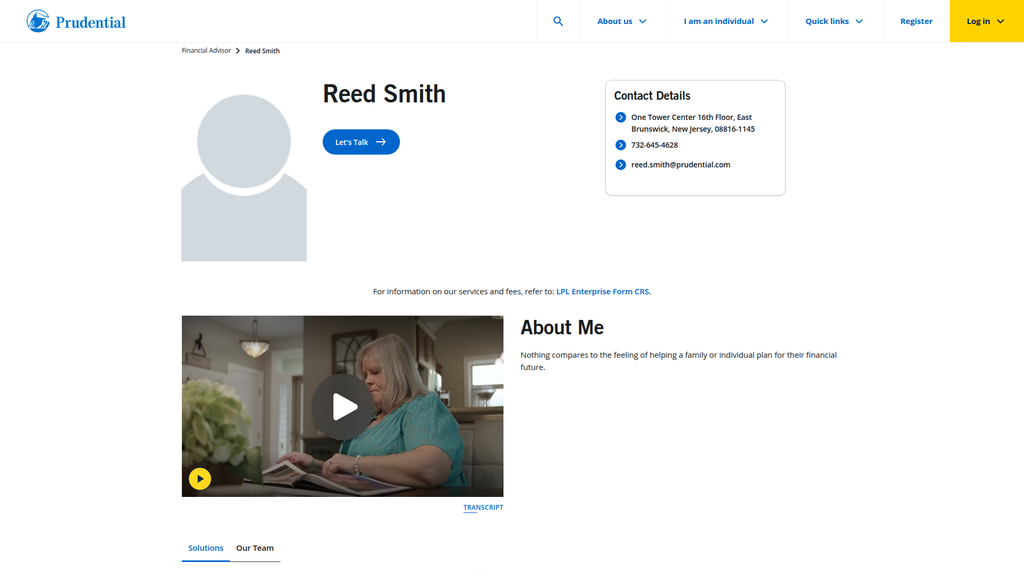

The brand messaging is highly generic, relying almost entirely on the corporate brand's reputation for stability. It fails to differentiate individual advisors or articulate a unique value proposition, making them seem interchangeable. The communication does not effectively map to a customer's emotional journey and lacks persuasive, active calls-to-action, resulting in a passive and impersonal user experience.

The messaging is simple, free of jargon, and consistently organized around core customer needs like retirement and family protection.

Pivot messaging from a product-centric catalog to an advisor-differentiated narrative. Empower advisors to craft a personal 'My Philosophy' section detailing their unique process, client experience, and passion to build a human connection.

The conversion experience is critically flawed due to a major friction point: a profound lack of personalization that breeds distrust. The use of generic placeholder avatars on advisor pages is a significant misstep in a relationship-driven business, creating high cognitive load for users trying to assess advisor credibility. While the mobile experience is technically sound, the absence of trust-building elements and persuasive CTAs severely hinders conversion rates across all devices.

The website demonstrates excellent mobile responsiveness, with a fluid grid system and logical content stacking that ensures usability on any device.

Mandate and facilitate the replacement of all placeholder avatars with professional, high-quality headshots of the financial advisors to immediately build trust and humanize the experience.

Prudential excels in demonstrating credibility through robust, industry-specific compliance and third-party validation. The prominent display of FINRA BrokerCheck links, clear disclosures of the LPL Financial partnership, and state licensing information are significant trust signals. This high degree of transparency and adherence to regulatory standards is a core strength, effectively mitigating regulatory and consumer risk.

Excellent and conspicuous industry-specific disclosures, including direct links to FINRA's BrokerCheck and the SEC's Form CRS, showcase a commitment to transparency.

Consolidate links to the Privacy Notice, Terms, Form CRS, and BrokerCheck into a more prominent 'Compliance & Disclosures' section on advisor pages for enhanced visibility and user accessibility.

Prudential's primary competitive advantage is its iconic brand, built over nearly 150 years, which represents stability and trust—a highly sustainable moat in the financial industry. This is complemented by its massive scale, diversified business model across insurance and asset management (PGIM), and a vast distribution network. While challenged by more agile fintechs, these core strengths are extremely difficult for competitors to replicate.

The 'Rock of Gibraltar' brand is a powerful, long-term asset that conveys enduring strength and financial stability, which is a primary decision factor for risk-averse clients.

Address the strategic disadvantage of being perceived as an 'insurance company' first by leading with a holistic 'financial wellness' message that better integrates its investment and advisory capabilities.

Prudential's business model is mature and highly scalable at the corporate level, with strong unit economics from recurring revenue streams. However, the retail growth model is constrained by the low scalability of its individual advisor-centric structure, where growth is tied to an advisor's personal capacity. The strategic partnership with LPL Financial is a key move to improve operational leverage and technology enablement, signaling a focus on future scalability.

A highly diversified business model with significant recurring revenue from insurance premiums and asset management fees provides a stable foundation for funding expansion and innovation.

Develop and launch a hybrid advice model that combines digital tools with human advisors to profitably serve the mass-affluent market, creating a new, scalable growth engine.

Prudential's business model is exceptionally coherent and resilient, built on the complementary pillars of insurance, retirement services, and global asset management (PGIM). This diversification provides multiple, powerful revenue streams and mitigates risk from any single market segment. The recent strategic partnership with LPL Financial to handle the wealth management platform is a brilliant move that enhances advisor capabilities while improving resource allocation efficiency.

The diversified structure, combining a world-class asset manager (PGIM) with a leading insurance provider, creates a resilient model that is well-aligned with major demographic trends, particularly the need for retirement income.

Accelerate the modernization of core legacy systems for underwriting and policy administration to reduce operational inefficiencies and fully unlock the model's potential.

As one of the largest and most established financial services firms, Prudential wields significant market power, brand recognition, and pricing power. Its diversified model across insurance and investments gives it a strong position against both traditional insurance competitors and pure-play asset managers. While facing intense competition from agile fintechs and large brokerages, its market leadership and influence on industry standards remain formidable.

Prudential's immense scale and market leadership provide significant leverage with partners and the ability to influence industry trends, particularly in the retirement and insurance sectors.

Develop a more formalized competitive strategy to counter the threat from hybrid digital/human advice models offered by firms like Fidelity and Schwab, which are encroaching on Prudential's target market.

Business Overview

Business Classification

Diversified Financial Services

Insurance & Investment Management

Financial Services

Sub Verticals

- •

Life Insurance

- •

Annuities

- •

Retirement Solutions

- •

Asset Management

- •

Group Insurance

Mature

Maturity Indicators

- •

Founded in 1875, demonstrating a long and stable operating history.

- •

Consistently ranked as a Fortune 500 company.

- •

Strong brand recognition symbolized by 'The Rock'.

- •

Operates globally with a significant presence in the U.S., Asia, Europe, and Latin America.

- •

Subject to extensive regulation by national and international financial authorities.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Insurance Premiums & Policy Charges

Description:Revenue generated from premiums paid by individuals and groups for life, disability, and other insurance products, as well as fees charged on policies.

Estimated Importance:Primary

Customer Segment:Individuals, Families, and Corporate Clients

Estimated Margin:Medium

- Stream Name:

Net Investment Income

Description:Income earned from investing the large pool of capital (float) collected from insurance premiums before it is paid out as claims. Performance is sensitive to interest rates and market conditions.

Estimated Importance:Primary

Customer Segment:Corporate Investment Function

Estimated Margin:Variable

- Stream Name:

Asset Management Fees

Description:Fees earned by Prudential's global investment management arm, PGIM, for managing assets for institutional and retail clients. Typically calculated as a percentage of assets under management (AUM).

Estimated Importance:Primary

Customer Segment:Institutional Investors, High-Net-Worth Individuals, Retail Investors

Estimated Margin:High

- Stream Name:

Annuity & Retirement Fees

Description:Fees from a range of retirement-related services and products, such as 401(k) plans and variable/fixed annuities. This includes administrative fees and charges on retirement assets.

Estimated Importance:Secondary

Customer Segment:Individuals and Employers

Estimated Margin:Medium

Recurring Revenue Components

- •

Insurance Premiums

- •

Asset Management Fees (AUM-based)

- •

Retirement Plan Administration Fees

Pricing Strategy

Actuarial & Asset-Based

Mid-range to Premium

Opaque

Pricing Psychology

- •

Prestige Pricing (leveraging brand trust and stability)

- •

Risk-Based Pricing (actuarial models for insurance)

- •

Bundling (offering integrated insurance and investment solutions)

Monetization Assessment

Strengths

- •

Highly diversified revenue streams across insurance, investments, and retirement, reducing dependency on any single market segment.

- •

Significant recurring revenue from premiums and asset management fees provides stable cash flow.

- •

Strong earnings from Net Investment Income due to a massive capital float.

- •

High-margin asset management business (PGIM) is a key growth driver.

Weaknesses

- •

Profitability, especially from Net Investment Income, is highly sensitive to interest rate fluctuations.

- •

Intense fee pressure in the asset management industry can compress margins.

- •

Complex product structures can make value propositions and pricing difficult for consumers to understand.

Opportunities

- •

Growing demand for retirement income solutions from the aging 'Peak 65' demographic.

- •

Expanding PGIM's offerings in high-growth alternative asset classes (private credit, real estate, infrastructure).

- •

Leveraging data analytics for more sophisticated, personalized pricing and underwriting.

- •

Developing digital-first, simplified products for direct-to-consumer channels.

Threats

- •

A prolonged low-interest-rate environment would negatively impact investment income.

- •

Competition from low-cost ETFs and robo-advisors in the wealth management space.

- •

Increasingly stringent regulatory oversight and capital requirements.

- •

Insurtech startups are unbundling traditional products and challenging established distribution models.

Market Positioning

A trusted, stable, and comprehensive provider of financial security and wealth management for all life stages.

Market Leader

Target Segments

- Segment Name:

Individuals & Families

Description:Mass-middle to affluent households seeking financial protection and long-term savings solutions.

Demographic Factors

Age 35-65

Households with annual income over $50,000

Psychographic Factors

- •

Value financial security and stability

- •

Seek professional guidance for complex financial decisions

- •

Planners for major life events (marriage, home purchase, retirement)

Behavioral Factors

- •

Prefers working with a financial advisor

- •

Responsive to established, trusted brands

- •

Long-term investment horizon

Pain Points

- •

Fear of outliving retirement savings

- •

Concern about protecting dependents financially in case of death or disability

- •

Complexity of navigating investment and insurance options

- •

Need for tax-efficient savings strategies

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Institutional Clients

Description:Pension funds, corporations, endowments, foundations, and other institutions requiring sophisticated asset management and risk transfer solutions.

Demographic Factors

- •

Corporate pension plan sponsors

- •

Insurance companies

- •

Sovereign wealth funds

- •

Non-profit endowments

Psychographic Factors

- •

Highly sophisticated

- •

Risk-averse

- •

Focused on fiduciary duty and long-term returns

Behavioral Factors

- •

Engages in rigorous due diligence

- •

Values long-term track records and manager expertise

- •

Makes decisions based on detailed RFPs and consultant recommendations

Pain Points

- •

Meeting long-term liability obligations (e.g., pension payouts)

- •

Generating sufficient returns in a volatile market

- •

Accessing specialized or alternative asset classes

- •

Managing portfolio risk and regulatory compliance

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Employers (Group Benefits)

Description:Businesses of all sizes that provide employee benefits such as group life, disability, and voluntary insurance products.

Demographic Factors

- •

Small to large corporations

- •

Professional associations

- •

Affinity groups

Psychographic Factors

- •

Desire to attract and retain talent

- •

Focus on employee well-being and productivity

- •

Concerned with managing costs and administrative burden

Behavioral Factors

- •

Typically works through benefits brokers or consultants

- •

Purchasing cycles are often annual during benefits renewal

- •

Values ease of administration and strong employee support

Pain Points

- •

Complexity of managing employee leave and benefits administration

- •

Rising healthcare and benefits costs

- •

Ensuring competitive benefits packages to attract top talent

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Brand Strength and Trust

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Asset Management Expertise (PGIM)

Strength:Strong

Sustainability:Sustainable

- Factor:

Diversified Business Model

Strength:Strong

Sustainability:Sustainable

- Factor:

Multi-Channel Distribution Network

Strength:Moderate

Sustainability:Sustainable

- Factor:

Financial Strength and High Credit Ratings

Strength:Strong

Sustainability:Sustainable

Value Proposition

To provide individuals and institutions with long-term financial security and peace of mind through a comprehensive suite of high-quality insurance, retirement, and investment solutions, backed by decades of financial strength, stability, and expertise.

Good

Key Benefits

- Benefit:

Guaranteed Lifetime Income

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Annuity product offerings

Strong claims-paying ability ratings

- Benefit:

Family and Asset Protection

Importance:Critical

Differentiation:Common

Proof Elements

Wide range of life and disability insurance products

Long history of paying claims

- Benefit:

Access to Professional Investment Management

Importance:Important

Differentiation:Unique

Proof Elements

PGIM's global scale and performance track record

Expertise across public and private markets.

Unique Selling Points

- Usp:

The 'Rock of Gibraltar' symbol, representing enduring strength and stability for nearly 150 years.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A powerful, multi-manager global investment engine (PGIM) that provides institutional-grade asset management to a wide range of clients.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A hybrid distribution model combining a captive advisor force with strategic partnerships (e.g., LPL Financial) to broaden market reach and capabilities.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Longevity Risk: The risk of outliving one's retirement savings.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Market Volatility: The need for portfolio growth while managing downside risk.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Financial Complexity: The difficulty of coordinating insurance, retirement, and investment planning.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

The value proposition is well-aligned with major demographic trends, particularly the aging population's need for retirement income and wealth transfer solutions.

High

Prudential's focus on security, stability, and professional guidance strongly resonates with its core target segments of risk-averse individuals and fiduciary-minded institutions.

Strategic Assessment

Business Model Canvas

Key Partners

- •

LPL Financial (Wealth Management Platform & Broker-Dealer Services).

- •

Independent Financial Advisors & Brokers.

- •

Corporate Benefits Consultants

- •

Technology and Cloud Providers (e.g., Microsoft Azure, Salesforce).

- •

Reinsurance Companies (e.g., Munich Re, Swiss Re).

Key Activities

- •

Risk Underwriting & Management

- •

Global Investment Management

- •

Product Development & Innovation

- •

Sales, Marketing & Distribution

- •

Regulatory Compliance & Reporting

- •

Customer Service & Claims Processing

Key Resources

- •

Massive Financial Capital & Strong Balance Sheet.

- •

Brand Reputation & Trust

- •

Global Investment Talent (PGIM)

- •

Extensive Distribution Network (Prudential Advisors, LPL).

- •

Proprietary Actuarial and Customer Data

Cost Structure

- •

Policyholder Benefits & Claims Payouts

- •

Commissions to Sales Agents & Advisors

- •

Employee Compensation & Benefits

- •

Technology & Infrastructure Investment

- •

Marketing & Brand Advertising

- •

Interest on Corporate Debt

Swot Analysis

Strengths

- •

Iconic brand synonymous with financial strength and stability.

- •

Highly diversified business across insurance, retirement, and asset management reduces cyclical risk.

- •

World-class global investment manager (PGIM) provides a significant competitive advantage and high-margin revenue.

- •

Strong capital position and high financial strength ratings.

Weaknesses

- •

Significant exposure to interest rate and equity market fluctuations.

- •

Potential for operational inefficiencies due to legacy technology systems.

- •

The complexity of products can lead to a long sales cycle and customer confusion.

- •

Perceived as a traditional, slower-moving incumbent compared to agile insurtech startups.

Opportunities

- •

Massive demographic tailwind from baby boomers entering retirement and seeking income solutions.

- •

Strategic partnership with LPL Financial to modernize the advisor platform and accelerate wealth management growth.

- •

Leverage AI and data analytics to enhance underwriting, personalize customer experiences, and improve efficiency.

- •

Expand PGIM's footprint in high-growth alternative investments and ESG-focused strategies.

Threats

- •

Intensifying competition from insurtechs, fintechs, and asset management firms with lower-cost models.

- •

Evolving regulatory landscape, including potential changes to fiduciary standards and capital requirements.

- •

Macroeconomic volatility and geopolitical risks impacting global investment markets.

- •

Shifting consumer preferences towards digital-first, self-service financial solutions, especially among younger generations.

Recommendations

Priority Improvements

- Area:

Digital Customer Experience

Recommendation:Accelerate investment in a unified, omni-channel customer portal that provides a holistic view of all Prudential products (insurance, retirement, investments) and enables seamless self-service.

Expected Impact:High

- Area:

Advisor Technology & Enablement

Recommendation:Fully leverage the LPL partnership to equip advisors with advanced financial planning tools, data analytics, and AI-powered insights to deliver more personalized and efficient advice.

Expected Impact:High

- Area:

Operational Efficiency

Recommendation:Aggressively modernize core legacy systems for underwriting and policy administration, using cloud technology and AI to reduce manual processes, lower costs, and speed up cycle times.

Expected Impact:Medium

Business Model Innovation

- •

Develop a direct-to-consumer (D2C) platform for simpler, standardized products (e.g., term life, basic annuities) to capture the digitally-native customer segment.

- •

Explore 'Insurance-as-a-Service' models, embedding Prudential's products into third-party ecosystems (e.g., HR tech platforms, wellness apps, digital banks).

- •

Create subscription-based financial wellness services that offer ongoing advice and planning for a recurring fee, decoupling revenue from product sales.

Revenue Diversification

- •

Further expand PGIM's capabilities in private markets (private equity, venture capital, infrastructure) to capture higher management fees and appeal to institutional clients seeking yield.

- •

Develop and monetize data-driven risk management and advisory services for corporate clients, leveraging Prudential's vast actuarial expertise.

- •

Invest in or acquire insurtech firms that offer innovative products or distribution models to tap into new customer segments and technologies.

Prudential's business model is a fortress of diversification, built on the complementary pillars of insurance and asset management. Its mature, stable profile is underpinned by a powerful brand, a massive balance sheet, and the formidable global investment engine of PGIM. The core strategy of leveraging insurance float for investment income, while generating fee-based revenue from asset management and retirement services, creates a resilient and well-balanced financial structure. However, this traditional strength also presents its primary challenge: vulnerability to disruption. The model's evolution hinges on its ability to navigate the digital transformation imperative. The strategic partnership with LPL Financial is a critical and intelligent move to modernize its wealth management arm, offloading capital-intensive technology development while enhancing its advisor value proposition. Future success will be defined by Prudential's ability to pivot from a product-centric behemoth to a customer-centric, digitally-enabled ecosystem. Key strategic opportunities lie in capitalizing on the immense demographic shift towards retirement income, expanding the high-margin PGIM alternatives business, and innovating with direct-to-consumer models to engage the next generation of clients. The primary threats are not from traditional competitors like MetLife or AIG, but from the cumulative impact of agile fintech and insurtech startups that are eroding the value chain. Therefore, the strategic imperative is to accelerate technological adoption and foster a culture of innovation to protect its market leadership and unlock new avenues for growth.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Regulatory Compliance and Licensing

Impact:High

- Barrier:

Brand Recognition and Trust

Impact:High

- Barrier:

High Capital and Solvency Requirements

Impact:High

- Barrier:

Established Distribution Networks

Impact:Medium

Industry Trends

- Trend:

Digital Transformation and AI Integration

Impact On Business:Requires significant investment in technology to personalize client experiences and improve advisor efficiency. Failure to adapt poses a significant competitive threat from fintechs and digitally native firms.

Timeline:Immediate

- Trend:

Holistic Financial Wellness

Impact On Business:Clients increasingly expect integrated advice covering investments, insurance, tax, and estate planning, moving beyond product-specific sales.

Timeline:Immediate

- Trend:

Fee Compression and Transparency

Impact On Business:Pressure from low-cost robo-advisors and discount brokerages is forcing traditional firms to justify their value proposition and be more transparent about fees.

Timeline:Near-term

- Trend:

The Great Wealth Transfer

Impact On Business:Firms must adapt service models and digital capabilities to attract and retain younger, tech-centric heirs who may not stay with their parents' advisors.

Timeline:Near-term

- Trend:

Increased Demand for Annuities

Impact On Business:Rising interest rates and market volatility have increased client demand for annuities that provide guaranteed income, creating a significant sales opportunity.

Timeline:Immediate

Direct Competitors

- →

Northwestern Mutual

Market Share Estimate:Largest U.S. individual life insurance provider.

Target Audience Overlap:High

Competitive Positioning:Positions itself as a provider of holistic financial security through a highly-trained, exclusive career agency force. Emphasizes its mutual company structure and consistently high financial strength ratings.

Strengths

- •

Strong brand reputation and highest financial strength ratings.

- •

Exclusive and productive career agency force seen as a key competitive advantage.

- •

Mutual company structure aligns interests with policyholders, leading to high dividend payouts.

- •

Highly integrated approach combining insurance and investment planning.

Weaknesses

- •

Exclusive agent model may be perceived as less objective than independent advisors.

- •

Can be viewed as more traditional and slower to adopt new technologies compared to fintechs.

- •

Product focus can sometimes be perceived as insurance-first.

Differentiators

Emphasis on mutual ownership and policyholder dividends.

Exclusivity of its financial advisors and proprietary products.

- →

New York Life

Market Share Estimate:One of the largest mutual life insurance companies in the U.S.

Target Audience Overlap:High

Competitive Positioning:Leverages its long history (since 1845) and mutual company status to build trust. Positions advisors to provide holistic advice across insurance, wealth management, and estate planning through its Eagle Strategies RIA.

Strengths

- •

Strong brand heritage and reputation for stability.

- •

Mutual company structure fosters policyholder trust.

- •

Large network of agents with strong training and development programs.

- •

Comprehensive product suite including insurance, annuities, and investment products.

Weaknesses

- •

Pace of digital innovation may lag behind more agile competitors.

- •

Brand can be perceived as conservative or old-fashioned by younger demographics.

- •

Navigating the different corporate entities (NYL, NYLIFE Securities, Eagle Strategies) can be confusing for clients.

Differentiators

Strong focus on legacy and intergenerational wealth planning.

Emphasis on agent training and development through programs like 'NYLIC U'.

- →

MassMutual

Market Share Estimate:A leading U.S. mutual life insurance company.

Target Audience Overlap:High

Competitive Positioning:Positions itself as a partner for long-term wealth preservation and growth, emphasizing its mutual structure and prudent investment strategy. Offers an open architecture investment platform to its advisors.

Strengths

- •

Mutual company structure focused on long-term value for policyholders.

- •

Diversified investment approach and strong portfolio of strategic businesses.

- •

Open architecture platform provides advisors with a wide array of investment solutions, enhancing objectivity.

- •

Strong focus on the high-net-worth market with tailored wealth and estate planning services.

Weaknesses

- •

Brand recognition in wealth management may be less prominent than insurance.

- •

Faces similar challenges as other large incumbents in terms of digital agility.

- •

Less emphasis on an 'exclusive' agent force compared to Northwestern Mutual, which could dilute brand identity.

Differentiators

Open architecture investment platform for advisors.

A stated focus on serving high-net-worth households with complex needs.

Indirect Competitors

- →

Fidelity Investments

Description:A massive financial services corporation offering brokerage, retirement planning, and wealth management services. Offers a spectrum of advice from digital-only to dedicated high-net-worth teams.

Threat Level:High

Potential For Direct Competition:Is already a direct competitor, especially for affluent clients. Fidelity Private Wealth Management targets clients with $2M+ invested and $10M+ in assets, directly competing with Prudential's target market.

- →

Charles Schwab

Description:A leading brokerage and financial advisory firm that provides a full range of services, from self-directed investing to dedicated financial consultants and wealth advisors.

Threat Level:High

Potential For Direct Competition:Is a direct competitor. Their hybrid model, combining robust digital platforms with access to CFP professionals, appeals to a wide range of investors and directly challenges the traditional advisor model.

- →

Robo-Advisors (e.g., Betterment, Wealthfront)

Description:Fintech platforms offering automated, algorithm-driven portfolio management with low fees. They primarily target younger, tech-savvy investors who are often underserved by traditional advisors.

Threat Level:Medium

Potential For Direct Competition:High. These platforms are increasingly adding human advisors and more complex financial planning services, creating a 'hybrid' model that encroaches on the traditional advisory space.

- →

Independent Registered Investment Advisors (RIAs)

Description:A highly fragmented but large group of advisors who operate under a fiduciary standard, often on a fee-only basis. They appeal to clients seeking objective, personalized advice without product sales pressure.

Threat Level:High

Potential For Direct Competition:They are a primary and direct form of competition, attracting clients who are wary of the potential conflicts of interest in commission-based or insurance-first models.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Brand Heritage and Trust

Sustainability Assessment:Highly sustainable. The Prudential brand, built over more than a century, conveys stability and reliability, which is difficult for new entrants to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Scale and Distribution Network

Sustainability Assessment:Sustainable. The existing national network of advisors provides significant reach, although it is costly to maintain and challenged by digital-first models.

Competitor Replication Difficulty:Hard

- Advantage:

Integrated Insurance and Investment Capabilities

Sustainability Assessment:Moderately sustainable. The ability to provide both insurance protection and investment growth is a key differentiator from investment-only firms, though major competitors offer similar integration.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Strong Position in the Annuities Market', 'estimated_duration': '1-3 years. The current economic environment of higher interest rates and market uncertainty has boosted annuity sales, benefiting established players like Prudential. This advantage may wane if market conditions change. '}

Disadvantages

- Disadvantage:

Legacy Technology and Processes

Impact:Major

Addressability:Difficult

- Disadvantage:

Perception as an 'Insurance Company' First

Impact:Major

Addressability:Moderate

- Disadvantage:

Complex Advisor Affiliation Models (e.g., LPL Partnership)

Impact:Minor

Addressability:Moderate

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns highlighting the value of annuities and guaranteed income in the current economic climate.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Simplify the value proposition on advisor websites, clearly articulating the benefit of the Prudential brand and the investment capabilities brought by partners like LPL.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Invest in a unified client portal that seamlessly integrates insurance policies, annuities, and investment accounts to deliver a holistic financial view.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop a formal hybrid advice model that combines digital tools for mass-affluent clients with dedicated human advisors for more complex needs, directly competing with Schwab and Fidelity.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Modernize core technology infrastructure to enable greater advisor efficiency, data analytics, and AI-powered personalization at scale.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Establish a venture arm or strategic partnership program to invest in or acquire fintech startups that can accelerate digital capabilities and tap into new client segments.

Expected Impact:High

Implementation Difficulty:Moderate

Reposition Prudential Advisors from a product-centric, insurance-led model to a client-centric, holistic financial wellness provider. The messaging should emphasize long-term partnership and the unique ability to both protect and grow wealth through an integrated platform.

Differentiate by becoming the leading provider of financial planning for 'pre-retirees' (age 50-65). This involves creating specialized tools, content, and advisor training focused on the complex transition into retirement, leveraging Prudential's core strengths in income planning, annuities, and life insurance.

Whitespace Opportunities

- Opportunity:

Financial Wellness as an Employer-Sponsored Benefit

Competitive Gap:While many firms offer retirement plans (401ks), few provide comprehensive, personalized financial planning as a workplace benefit. Prudential can leverage its existing group insurance relationships to offer this service.

Feasibility:High

Potential Impact:High

- Opportunity:

Integrated Advice for the 'Mass Affluent'

Competitive Gap:This segment is often underserved by traditional advisors (who focus on HNWIs) and not fully served by robo-advisors (who lack a human touch). A scalable, tech-enabled hybrid model could capture this large market.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Specialized Planning for the Gig Economy

Competitive Gap:Freelancers and gig workers have unique financial needs (variable income, self-employment taxes, solo 401ks) that are poorly addressed by traditional financial planning models. Developing a specialized offering could create a new market.

Feasibility:Medium

Potential Impact:Medium

Prudential operates in the mature and moderately concentrated financial advisory and insurance industry. Its primary competitive advantages are its century-old brand recognition, which fosters trust, and its vast scale and distribution network. The company's strength lies in its ability to offer integrated solutions that encompass both insurance-based protection and investment growth, a capability that pure-play investment firms lack. Key direct competitors like Northwestern Mutual, New York Life, and MassMutual share a similar profile, leveraging mutual company structures and large agent forces to command significant market share. They primarily compete on brand trust, financial strength, and the quality of their advisor relationships.

The most significant threats to Prudential come from two fronts. First, large brokerage firms like Fidelity and Charles Schwab have successfully blended technology with human advice to offer comprehensive wealth management at scale, posing a high-level threat. They attract clients with strong digital platforms and a wider perception of being investment-led rather than insurance-led. Second, fintech disruptors and robo-advisors are fundamentally changing client expectations, driving demand for greater transparency, lower fees, and seamless digital experiences. While currently targeting a younger demographic, their expansion into hybrid models represents a serious long-term challenge.

Prudential's key vulnerability lies in its reliance on legacy systems and a traditional business model, which can slow innovation and create a disjointed customer experience. The strategic partnership model, such as the one with LPL Financial, is a pragmatic way to offer broad investment services but can dilute the brand and complicate the client-advisor relationship if not managed carefully.

The primary opportunity for Prudential is to leverage its core strength in retirement and income planning and repackage it for a modern, digitally-savvy consumer. By investing in a unified technological platform and developing a robust hybrid advisory model, Prudential can effectively defend its market share against traditional rivals and better compete with the more agile brokerage and fintech firms. Focusing on a specific, underserved demographic, such as pre-retirees or the mass affluent, could provide a clear path to differentiated growth.

Messaging

Message Architecture

Key Messages

- Message:

Helping a family or individual plan for their financial future.

Prominence:Primary

Clarity Score:High

Location:About Me

- Message:

Life Happens. Being prepared makes all the difference.

Prominence:Primary

Clarity Score:High

Location:Main Headline

- Message:

Protect your family and assets through various life stages with insurance products.

Prominence:Secondary

Clarity Score:High

Location:Protecting Your Family and Greatest Assets

- Message:

Create income and save for retirement using annuities, 401(k)s, and IRAs.

Prominence:Secondary

Clarity Score:High

Location:Living in Retirement / Saving for Retirement

The message hierarchy is logical but lacks strategic impact. It leads with a broad, relatable concept ('Life Happens') and then segments content by financial need (Retirement, Protection). However, it fails to elevate a unique value proposition for the advisor himself, making the structure feel like a generic product catalog rather than a personalized advisory service.

Messaging is thematically consistent across the page, focusing on preparation for life events. The tone and language are uniform. However, there is a structural inconsistency in the 'Meet Our Professional Team' section, which lists products instead of people, creating a disconnect with the headline.

Brand Voice

Voice Attributes

- Attribute:

Professional

Strength:Strong

Examples

Discover how our annuity options can help you create income for retirement...

Securities and investment advisory services offered through LPL Enterprise...

- Attribute:

Traditional

Strength:Strong

Examples

Whether you are recently married, buying a house, taking care of a loved one...

A Traditional or Roth IRA can also be an option to help you save for the future...

- Attribute:

Reassuring

Strength:Moderate

Examples

Being prepared makes all the difference.

You have options when it comes to your financial future...

- Attribute:

Impersonal

Strength:Strong

Examples

The content is written in a generic, non-specific manner that could apply to any financial advisor.

The 'About Me' section contains only one sentence, offering no personal insight, philosophy, or reason to connect with the advisor.

Tone Analysis

Informative

Secondary Tones

Conservative

Safe

Tone Shifts

The shift from the main marketing copy to the dense, legalistic disclosure text at the bottom is abrupt and can be jarring for a user, potentially eroding the sense of simplicity and trust built earlier.

Voice Consistency Rating

Good

Consistency Issues

The single sentence in the 'About Me' section ('Nothing compares to the feeling of helping...') attempts a personal, empathetic tone that is not carried through anywhere else on the page, making it feel isolated and ineffective.

Value Proposition Assessment

An advisor representing the established Prudential brand can provide standard financial products (insurance, annuities, IRAs) to help you prepare for major life events and retirement.

Value Proposition Components

- Component:

Financial Preparedness for Life Events

Clarity:Clear

Uniqueness:Common

- Component:

Retirement Income Planning

Clarity:Clear

Uniqueness:Common

- Component:

Family & Asset Protection

Clarity:Clear

Uniqueness:Common

- Component:

Brand Trust (via Prudential)

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

The messaging fails to differentiate Reed Smith from thousands of other financial advisors. The primary differentiator is the Prudential brand, but the page does not articulate what 'The Prudential Difference' is. There is no mention of the advisor's specific expertise, planning philosophy, or unique approach, making the value proposition generic. The messaging does not answer the prospect's real question: 'What makes you different?'.

The page positions Reed Smith as a traditional, safe choice backed by a major brand. It competes on the basis of brand recognition and stability rather than on personalized service, specialized expertise, or a unique client experience. This positions him squarely in a crowded market of generalist advisors from large firms.

Audience Messaging

Target Personas

- Persona:

Pre-Retirees (Ages 50-65)

Tailored Messages

Get help reaching your retirement goals on your terms with an annuity, 401(k) or IRA.

Effectiveness:Somewhat

- Persona:

Retirees (Ages 65+)

Tailored Messages

Discover how our annuity options can help you create income for retirement...

Effectiveness:Somewhat

- Persona:

Families in Key Life Stages (e.g., marriage, home purchase)

Tailored Messages

Whether you are recently married, buying a house...Ensure you’re protected with life, auto, home...insurance.

Effectiveness:Effective

Audience Pain Points Addressed

- •

Uncertainty about the future

- •

Need for retirement income

- •

Protecting loved ones and assets during life changes

Audience Aspirations Addressed

- •

Financial preparedness

- •

Achieving retirement goals 'on your terms'

- •

Financial security

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Peace of Mind

Effectiveness:Medium

Examples

Being prepared makes all the difference.

Ensure you’re protected with life, auto, home, long-term care and disability insurance.

- Appeal Type:

Empathy

Effectiveness:Low

Examples

Nothing compares to the feeling of helping a family or individual plan for their financial future.

Social Proof Elements

- Proof Type:

Brand Authority

Impact:Moderate

Details:The use of the Prudential brand and logo is the strongest form of social proof, implying stability and trust.

- Proof Type:

Awards/Recognition

Impact:Weak

Details:The 'Prudential Difference' section links to an awards page and an article about being a 'World's Most Ethical Company', but fails to present this information directly on the page, severely diminishing its impact.

Trust Indicators

- •

Association with the Prudential brand

- •

Display of a physical office address

- •

Link to FINRA's BrokerCheck

- •

Detailed legal disclosures about the LPL Financial relationship

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Telephone: 732-645-4628

Location:Contact Details (Top)

Clarity:Clear

- Text:

Address: One Tower Center...

Location:Contact Details (Top)

Clarity:Clear

Effectiveness is low. The CTAs are passive and informational ('Here is my contact info') rather than active and persuasive ('Schedule a free consultation now'). They lack a compelling verb or a clear value exchange that would motivate a user to take immediate action. This creates significant friction in the customer acquisition funnel.

Messaging Gaps Analysis

Critical Gaps

- •

Advisor Differentiation: The messaging completely fails to explain why a client should choose Reed Smith over any other advisor. There is no personal story, investment philosophy, or description of a unique process.

- •

The 'Why': Beyond a single generic sentence, the page doesn't communicate the advisor's passion or purpose, which is critical for building a personal connection.

- •

Client Experience: The page describes products but not the experience of working with Reed Smith. What can a client expect?

- •

Social Proof: There are no testimonials, case studies, or success stories (compliance permitting) to build credibility for the individual advisor.

- •

Clarity on 'The Prudential Difference': This section is just links, forcing the user to navigate away to understand a key value proposition. The benefit is not communicated on the page itself.

Contradiction Points

The heading 'Meet Our Professional Team' is immediately contradicted by a list of licenses and products, not people. This creates confusion and undermines credibility.

Underdeveloped Areas

The 'About Me' section is critically underdeveloped, consisting of a single sentence.

The value proposition for Prudential itself ('The Prudential Difference') is not articulated, only linked to.

Messaging Quality

Strengths

- •

Language is simple, clear, and free of jargon.

- •

Content is well-organized around common customer needs (retirement, protection).

- •

Clearly states the geographic areas served (licenses).

Weaknesses

- •

Messaging is highly generic and impersonal.

- •

Fails to build a personal brand for the advisor.

- •

Lacks a differentiated value proposition.

- •

Calls-to-action are passive and ineffective.

- •

Over-reliance on the corporate brand without articulating the brand's specific benefits.

- •

The complex Prudential/LPL relationship is disclosed but not explained in a simple, trust-building way.

Opportunities

- •

Develop a personal brand for Reed Smith that complements the Prudential brand.

- •

Articulate a clear, unique service philosophy or process.

- •

Incorporate storytelling to connect with prospects on an emotional level.

- •

Target messaging more precisely to the specific pain points of identified client personas.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition & Differentiation

Recommendation:Expand the 'About Me' section into a 'My Philosophy' or 'My Approach' section. Detail Reed Smith's specific process for working with clients, his core beliefs on financial planning, and what makes his service unique.

Expected Impact:High

- Area:

Calls-to-Action

Recommendation:Replace passive contact info with active, benefit-oriented CTAs. For example, add buttons like 'Schedule a No-Obligation Introductory Call' or 'Download My Guide to Retirement Planning'.

Expected Impact:High

- Area:

Social Proof

Recommendation:If compliance allows, add anonymized client case studies or testimonials that highlight specific problems solved. If not, quote the key takeaways from the 'Awards' links directly on the page under 'The Prudential Difference' to immediately convey value.

Expected Impact:Medium

Quick Wins

- •

Change the 'Meet Our Professional Team' headline to something accurate like 'Products & Licenses'.

- •

Expand the 'About Me' section with 2-3 more sentences about who Reed Smith serves and why he is passionate about his work.

- •

Summarize the key points from the 'Prudential Difference' links directly on the page so users don't have to click away.

Long Term Recommendations

- •

Develop a content strategy around key client pain points (e.g., blog posts or short videos explaining concepts like annuities) to showcase expertise and build trust over time.

- •

Create persona-specific landing pages that speak more directly to the unique needs of retirees vs. young families.

- •

Clarify the Prudential/LPL relationship with a simple, one-sentence explanation at the top of the disclosure to proactively build trust (e.g., 'I am proud to be a Prudential Advisor, with the securities and investment side of my business supported by the robust platform of LPL Financial.').

This webpage functions as a basic digital business card but fails as a strategic marketing asset. Its core weakness is a profound lack of differentiation. The messaging relies entirely on the Prudential brand's perceived stability, but does nothing to build a brand or convey unique value for the advisor, Reed Smith. The content is a generic catalog of financial products and life stages that could be found on any competitor's website. As a result, it is unlikely to be effective at customer acquisition because it provides no compelling reason for a prospect to choose this specific advisor over another. The calls-to-action are passive, placing the onus entirely on the visitor to initiate contact without providing a clear, value-driven incentive to do so. Critical gaps in personal branding, storytelling, and social proof leave the visitor with no sense of who Reed Smith is, what he believes, or what the experience of working with him is like. To drive business outcomes, the messaging strategy must pivot from a generic, product-focused approach to a client-centric, advisor-differentiated narrative that answers the fundamental question: 'Why should I, the client, trust you, Reed Smith, with my financial future?'

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

The core offerings—retirement planning (annuities, IRAs, 401(k)s) and insurance (life, disability, LTC)—directly address the primary financial concerns of the large, aging Baby Boomer demographic.

- •

There is significant market demand for financial guidance due to increasing complexities in retirement decumulation, market volatility, and longer lifespans.

- •

The services provided are fundamental to key life events (marriage, home purchase, retirement), indicating a persistent and recurring need across a broad client base.

- •

The dual branding with Prudential and affiliation with LPL Financial provides a combination of brand recognition and independent product access, which can appeal to a wide range of clients.

Improvement Areas

- •

The current value proposition is broad and undifferentiated. Developing a niche focus (e.g., retirement income planning for small business owners, financial planning for women in transition) would strengthen PMF with a specific, high-value audience.

- •

Lack of specialized services like ESG investing or holistic financial wellness, which are growing in demand, particularly with younger generations.

- •

The service offering appears reactive to life events rather than proactively guiding clients through a defined, long-term financial journey.

Market Dynamics

The U.S. financial advisory services market is projected to grow at a CAGR of 5.5% to 8.12% from 2023 to 2032.

Mature

Market Trends

- Trend:

Demographic Shift: The 'Peak 65' wave of Baby Boomers is creating unprecedented demand for retirement income strategies.

Business Impact:High positive impact. This is the primary target market for the current service offerings, creating a significant tailwind for growth.

- Trend:

Technology & Fintech Integration: Increased adoption of AI, data analytics, and digital client platforms is becoming standard for enhancing personalization and efficiency.

Business Impact:Moderate risk/opportunity. Failure to adopt technology will lead to competitive disadvantage and operational inefficiency. Proactive adoption can be a key growth lever.

- Trend:

Demand for Hyper-Personalization: Clients expect tailored advice beyond generic portfolio management, focusing on holistic financial wellness.

Business Impact:High opportunity. Moving from product-based solutions to a deeply personalized, planning-first approach can create a strong competitive advantage.

- Trend:

Regulatory Complexity: Evolving compliance and fiduciary standards increase administrative burden.

Business Impact:Moderate risk. As a solo practitioner, compliance is a major time sink that detracts from growth activities. The LPL affiliation likely provides significant support here.

Excellent. The confluence of the massive Baby Boomer retirement wave and market uncertainty creates a prime environment for trusted financial advisors to capture significant market share.

Business Model Scalability

Low

Primarily variable costs (payouts to broker-dealer) with low fixed costs (office, software), which is favorable. However, revenue is directly capped by the advisor's personal time and capacity.

Very Low. As a solo practitioner, every new client adds a near-linear increase in workload. Operational leverage can only be achieved by delegating tasks, which requires hiring staff.

Scalability Constraints

- •

Time capacity of the sole advisor is the single largest constraint on growth.

- •

Lack of documented, repeatable processes for client onboarding, financial plan creation, and reviews prevents efficient delegation.

- •

Manual, non-systematized client acquisition relying on personal networks and referrals, which is not predictable or scalable.

- •

The current technology stack (or lack thereof) does not appear to automate administrative or client-facing tasks.

Team Readiness

Unclear. As a solo practitioner, Reed Smith's readiness for scale depends on his willingness to transition from a 'doer' to a 'manager and business owner'.

Solo Practitioner. This structure is not scalable beyond a certain client capacity (typically 75-125 clients).

Key Capability Gaps

- •

Operational Support: A paraplanner or client service associate is needed to handle administrative tasks, meeting prep, and client follow-up, freeing up advisor time for revenue-generating activities.

- •

Marketing & Business Development: No dedicated resource for creating and executing a systematic marketing and lead generation plan.

- •

Technical Expertise: Lack of a dedicated resource to implement and manage a modern tech stack (CRM, financial planning software, marketing automation).

Growth Engine

Acquisition Channels

- Channel:

Referrals (from existing clients)

Effectiveness:Unclear (Assumed Medium)

Optimization Potential:High

Recommendation:Implement a structured referral program. Proactively ask for introductions at key points in the client relationship instead of passively waiting.

- Channel:

Website (Prudential Profile Page)

Effectiveness:Low

Optimization Potential:High

Recommendation:Develop a personal, standalone website with valuable content (blog posts, guides), clear calls-to-action (schedule a consultation), and lead capture forms to move beyond a digital business card.

- Channel:

Local Networking / Community Involvement

Effectiveness:Unclear (Assumed Medium)

Optimization Potential:Medium

Recommendation:Focus networking efforts by establishing formal partnerships with Centers of Influence (COIs) like CPAs and estate planning attorneys to create a systematic referral pipeline.

Customer Journey

Highly manual and high-friction. The path is: find the static webpage -> find contact info -> initiate contact (phone/email) -> wait for response -> manual follow-up and scheduling.

Friction Points

- •

No immediate way to schedule a meeting or consultation online.

- •

Lack of educational content to build trust and demonstrate expertise before a potential client must reach out.

- •

No clear value proposition or description of the client experience on the webpage.

- •

The complex Prudential/LPL affiliation may be confusing to prospects without a clear explanation.

Journey Enhancement Priorities

- Area:

Initial Engagement

Recommendation:Integrate an online scheduling tool (e.g., Calendly) on the website to allow prospects to book an introductory call instantly.

- Area:

Lead Nurturing

Recommendation:Create a simple lead magnet (e.g., '5 Key Questions for NJ Retirees') to capture email addresses and build an email list for automated, value-driven follow-up campaigns.

- Area:

Onboarding

Recommendation:Develop a structured, digital onboarding process using a CRM and client portal to streamline data gathering and create a professional first impression.

Retention Mechanisms

- Mechanism:

Personal Relationship & Trust

Effectiveness:High (Assumed)

Improvement Opportunity:Systematize client communication (e.g., scheduled quarterly updates, monthly newsletters) to maintain connection beyond ad-hoc meetings and ensure no client is overlooked.

- Mechanism:

Periodic Reviews

Effectiveness:Medium (Assumed)

Improvement Opportunity:Structure reviews around a consistent, repeatable agenda that reinforces the value delivered in all areas of financial planning, not just investment performance.

Revenue Economics

Potentially strong but highly inefficient. Financial advisory has high LTV due to recurring revenue and long client tenures. However, CAC is likely high and unpredictable due to a non-scalable acquisition model, and the cost-to-serve per client is high due to a lack of operational leverage.

Indeterminable, but likely favorable if clients are retained long-term. The key challenge is the high, non-financial cost (time) of acquisition.

Low. Revenue is directly tied to the advisor's personal hours. Significant time is likely spent on low-value administrative tasks instead of client acquisition and high-value strategic advice.

Optimization Recommendations

- •

Implement a tiered service model to align advisor time with client revenue/complexity.

- •

Leverage technology to automate routine tasks (scheduling, reporting, basic communication), reducing the cost-to-serve per client.

- •

Focus on scalable acquisition channels (content marketing, digital ads) to create a more predictable and cost-effective lead flow.

Scale Barriers

Technical Limitations

- Limitation:

Lack of a Centralized CRM

Impact:High

Solution Approach:Implement an industry-specific CRM (e.g., Wealthbox, Redtail) to centralize client data, track interactions, and automate workflows.

- Limitation:

Absence of Marketing Automation

Impact:High

Solution Approach:Utilize an email marketing platform (e.g., Mailchimp, ConvertKit) integrated with a new website to build an email list and nurture leads systematically.

- Limitation:

Manual Financial Planning Process

Impact:Medium

Solution Approach:Leverage modern financial planning software (e.g., eMoney, RightCapital) to its fullest extent, including client portals for collaboration and data aggregation.

Operational Bottlenecks

- Bottleneck:

Advisor Time as the Sole Resource

Growth Impact:This is the primary ceiling on growth, affecting client service capacity, business development, and strategic planning.

Resolution Strategy:Hire a paraplanner or client service associate to delegate all non-advisor tasks. This is the single most critical step to enabling scale.

- Bottleneck:

Manual & Repetitive Administrative Tasks

Growth Impact:Consumes valuable advisor time that could be spent with clients or on prospecting, directly limiting revenue growth.

Resolution Strategy:Conduct a time audit to identify all repetitive tasks (scheduling, follow-ups, paperwork) and aggressively automate or delegate them.

- Bottleneck:

Inconsistent Client Service Processes

Growth Impact:Creates an inefficient, chaotic workflow that is impossible to scale and leads to variable client experiences.

Resolution Strategy:Document and standardize all core processes (onboarding, plan delivery, review meetings) into a firm playbook.

Market Penetration Challenges

- Challenge:

Undifferentiated Generalist Positioning

Severity:Critical

Mitigation Strategy:Develop and clearly market a specialization or niche. This allows for focused marketing, deeper expertise, and the ability to attract ideal clients instead of chasing everyone.

- Challenge:

Lack of Digital Presence and Thought Leadership

Severity:Major

Mitigation Strategy:Launch a professional website with a blog and build a presence on LinkedIn, consistently sharing content relevant to the chosen niche to build authority and attract inbound leads.

- Challenge:

Over-reliance on Referrals

Severity:Major

Mitigation Strategy:Diversify lead generation by adding 1-2 new, scalable channels, such as local SEO, educational webinars, or strategic partnerships with COIs.

Resource Limitations

Talent Gaps

Paraplanner / Client Service Associate

Marketing/Business Development Expertise (can be outsourced/fractional)

Moderate. Capital will be needed for hiring the first employee, investing in a modern tech stack, and funding initial marketing initiatives (e.g., website development, content creation).

Infrastructure Needs

A robust, integrated technology stack (CRM, Planning Software, Marketing Automation).

A professional, independent website designed for lead generation.

Growth Opportunities

Market Expansion

- Expansion Vector:

Niche Demographic Targeting

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Select a specific client profile (e.g., executives at a major local employer, small business owners in a specific industry, women nearing retirement) and re-orient all marketing and service offerings to address their unique needs.

- Expansion Vector:

Geographic Digital Expansion

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:While licensed in NJ, PA, MD, leverage virtual meetings to serve clients across these entire states, not just the local East Brunswick area. Market digitally with state-specific content to attract clients beyond the immediate geographic vicinity.

Product Opportunities

- Opportunity:

Holistic Financial Wellness & Coaching

Market Demand Evidence:Growing trend of clients seeking advice that integrates financial health with overall well-being.

Strategic Fit:High. Evolves the relationship from product sales to a deeper, more valuable advisory role, increasing client loyalty.

Development Recommendation:Incorporate goal-setting and cash flow planning as a foundational, non-negotiable part of the client engagement before discussing investment or insurance products.

- Opportunity:

Specialized Retirement Income Planning

Market Demand Evidence:The massive influx of Baby Boomers entering decumulation creates a critical need for expertise in Social Security optimization, tax-efficient withdrawals, and income layering.

Strategic Fit:Excellent. Directly builds upon existing product licenses (annuities, investments) and aligns with the primary market driver.

Development Recommendation:Develop a proprietary, branded process for creating a retirement income plan. Market this process heavily through educational content and webinars.

Channel Diversification

- Channel:

Content Marketing & SEO

Fit Assessment:Excellent. Positions the advisor as an expert, builds trust, and generates high-quality inbound leads over the long term.

Implementation Strategy:Start a blog on a new personal website answering common financial questions for the chosen niche. Focus on local SEO terms (e.g., 'retirement planning in Middlesex County, NJ').

- Channel:

Educational Webinars

Fit Assessment:High. Allows for one-to-many engagement, demonstrates expertise, and generates qualified leads in a scalable format.

Implementation Strategy:Host a quarterly webinar on a timely topic for the target niche (e.g., 'Navigating Your 401(k) in a Volatile Market'). Promote it through social media and local online groups.

- Channel:

LinkedIn Professional Networking

Fit Assessment:High. Ideal for connecting with other professionals for COI relationships and for engaging with potential clients in specific industries or roles.

Implementation Strategy:Optimize personal LinkedIn profile, connect strategically with local CPAs and attorneys, and regularly share valuable content and insights.

Strategic Partnerships

- Partnership Type:

Centers of Influence (COIs)

Potential Partners

- •

CPAs / Accountants

- •

Estate Planning Attorneys

- •

Divorce Lawyers

Expected Benefits:Creation of a steady, high-quality stream of qualified client referrals.

- Partnership Type:

Local Business Alliances

Potential Partners

- •

Local Banks / Credit Unions

- •

Real Estate Agencies

- •

Large local employers (for financial wellness workshops)

Expected Benefits:Access to a large pool of potential clients and enhanced credibility within the local community.

Growth Strategy

North Star Metric

Number of New Comprehensive Financial Plans Delivered per Quarter

This metric shifts the focus from product sales or AUM gathering to the core value proposition of providing holistic advice. It is a leading indicator of future AUM, insurance sales, and long-term client relationships. It directly measures the primary growth activity.

Increase from an estimated 1-2 per quarter to 5+ per quarter within 12 months.

Growth Model

Hybrid: Niche Content-Led + Partnership-Led Model

Key Drivers

- •

Establishing expertise in a specific niche (e.g., retirement planning for pharmaceutical professionals in NJ).

- •

Consistent creation of high-value, niche-specific content (blog posts, articles, videos).

- •

Building a formal referral network with 5-10 high-quality COI partners.

- •

Systematizing the conversion of leads from content and partners into financial planning clients.

Phase 1: Define the niche. Phase 2: Build the digital foundation (website, content). Phase 3: Actively build COI relationships. This moves the practice from a reactive, referral-based model to a proactive, authority-based growth engine.

Prioritized Initiatives

- Initiative:

Hire a Client Service Associate / Paraplanner

Expected Impact:High

Implementation Effort:High

Timeframe:0-3 Months

First Steps:Define the role and responsibilities, create a job description, and begin recruiting through industry channels.

- Initiative:

Define a Target Niche and Revamp Value Proposition

Expected Impact:High

Implementation Effort:Medium

Timeframe:0-3 Months

First Steps:Analyze current client base to identify commonalities. Research local demographics and industries to select a viable niche. Rewrite marketing messaging to speak directly to this niche.

- Initiative:

Launch Independent Professional Website with Content Hub (Blog)

Expected Impact:High

Implementation Effort:Medium

Timeframe:3-6 Months

First Steps:Select a website developer specializing in financial advisors. Write the first five core blog posts addressing the primary pain points of the chosen niche.

- Initiative:

Implement a CRM and Systematize Client Processes

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:3-6 Months

First Steps:Select and subscribe to an industry-specific CRM. Document the current client onboarding and review process, then build it out as a workflow/template within the CRM.

Experimentation Plan

High Leverage Tests

- Test:

Test different lead magnet offers on the new website (e.g., 'Retirement Checklist' vs. 'Guide to Tax-Efficient Withdrawals').

Metric To Watch:Conversion rate of website visitor to email subscriber.

- Test:

Run a small, geo-targeted LinkedIn ad campaign promoting an educational webinar to the defined niche.

Metric To Watch:Cost per webinar registration and cost per qualified lead.

- Test:

Experiment with different outreach strategies for connecting with potential COI partners (e.g., direct email vs. LinkedIn outreach vs. introduction).

Metric To Watch:Number of introductory meetings booked with potential COIs.

Utilize a simple spreadsheet or CRM dashboard to track the key metric for each experiment on a weekly basis. Focus on leading indicators (e.g., leads generated, meetings booked) rather than lagging revenue.

Run one primary experiment per quarter, focusing on a single channel or hypothesis to ensure clear learnings.

Growth Team

Phase 1 (0-12 months): Advisor + 1 Client Service Associate (CSA). Phase 2 (12-24 months): Advisor + CSA + Paraplanner. Outsource marketing functions.

Key Roles

- •

Client Service Associate (First Hire): Handles all administrative tasks, scheduling, paperwork, and basic client inquiries.

- •

Paraplanner (Second Hire): Assists with financial plan construction, research, and meeting preparation.

- •

Fractional CMO / Marketing Agency: Manages website, SEO, content creation, and digital advertising.

The advisor must focus on transitioning from a practitioner to a CEO, focusing on vision, strategy, and business development. Invest in coaching or mastermind groups for solo advisors focused on practice management and growth.

The financial advisory practice of Reed Smith is built on a strong foundation of product-market fit within a favorable market environment, driven by the significant demographic tailwind of retiring Baby Boomers. The association with Prudential and LPL Financial provides brand credibility and a robust platform. However, the practice's current state is that of a lifestyle business, not a scalable enterprise. Growth is fundamentally constrained by the advisor's personal time capacity. The core challenge is a severe lack of operational leverage, stemming from a solo practitioner model, manual processes, and an underdeveloped technology stack. The client acquisition engine is reliant on traditional, non-scalable methods like referrals, and the practice's digital presence is minimal, functioning as a passive business card rather than an active lead generation tool. The primary barrier to scale is operational, not market-based. The path to growth is clear and requires a fundamental shift in mindset from being a financial advisor to being a business owner. The highest priority is to create leverage by hiring administrative support, which will free up the advisor's time to focus on high-value, revenue-generating activities. Concurrently, the practice must move from a generalist approach to a focused niche, which will enable effective and efficient marketing. By developing a specialized expertise, building a digital platform to showcase that expertise, and systematizing both client service and acquisition processes, the practice can transition from a linear, time-bound model to a scalable, authority-driven business with significant potential for sustained growth.

Legal Compliance

Prudential provides a comprehensive 'US Consumer Privacy Notice' accessible via the website's footer. This notice is robust, detailing the types of personal information collected (e.g., contact info, financial data, medical information), its uses for business purposes, and data sharing practices. It clearly addresses requirements under the Gramm-Leach-Bliley Act (GLBA) by explaining how consumer financial information is protected and shared. The policy also contains specific provisions for residents of states with advanced privacy laws like California, indicating an awareness of CCPA/CPRA obligations. However, the link to this global policy is in the footer of the main website and not directly referenced on the individual advisor page, potentially reducing its visibility to a client focused solely on that page's content.

The 'Terms & Conditions' are available in the website footer. They are detailed and cover standard clauses such as limitations of liability, intellectual property rights, and governing law. The terms are clearly written but are lengthy, which is typical for a large financial institution. From a strategic perspective, they establish a clear legal framework for the use of the website and its content, which is crucial for risk management. The enforceability is standard, but like the privacy policy, its direct accessibility from the advisor's specific page is passive, relying on the user navigating to the site-wide footer.

Upon visiting prudential.com, a cookie consent banner appears, providing users with the option to accept or manage their cookie preferences. This mechanism is a key component for compliance with ePrivacy directives (in the EU) and state-level privacy laws in the US that require opt-in or opt-out choices for non-essential cookies. The banner is noticeable and offers granular controls, which is a compliance strength. It also links to a detailed cookie policy that explains the different types of cookies used (strictly necessary, performance, targeting), demonstrating transparency.

Prudential's data protection posture appears strong, anchored by its detailed privacy notices and adherence to the GLBA Safeguards Rule, which mandates the protection of nonpublic personal information (NPI). The privacy notice outlines the maintenance of 'physical, electronic, and procedural safeguards'. The company also provides specific notices for consumer health data, indicating a sophisticated, layered approach to data protection based on sensitivity. Their global privacy policy mentions compliance with GDPR and other international frameworks, suggesting a mature data governance program. A 2022 class action lawsuit regarding the alleged use of session-replay software ('wiretapping') on their quote forms highlights a potential risk area in the implementation of third-party marketing technologies, even with strong policies in place.

Prudential's website includes an 'Accessibility' link in the footer, indicating a commitment to digital inclusion. The accessibility statement outlines efforts to conform to the Web Content Accessibility Guidelines (WCAG), which is the recognized standard for complying with the Americans with Disabilities Act (ADA) for digital properties. The site employs standard accessibility features like 'Skip to main section' links. Financial institutions are a frequent target for ADA-related lawsuits, making a stated commitment and clear accessibility features a critical risk mitigation strategy. The overall structure appears to be designed with accessibility in mind, though a full audit would be needed to confirm conformance.