eScore

pultegroupinc.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

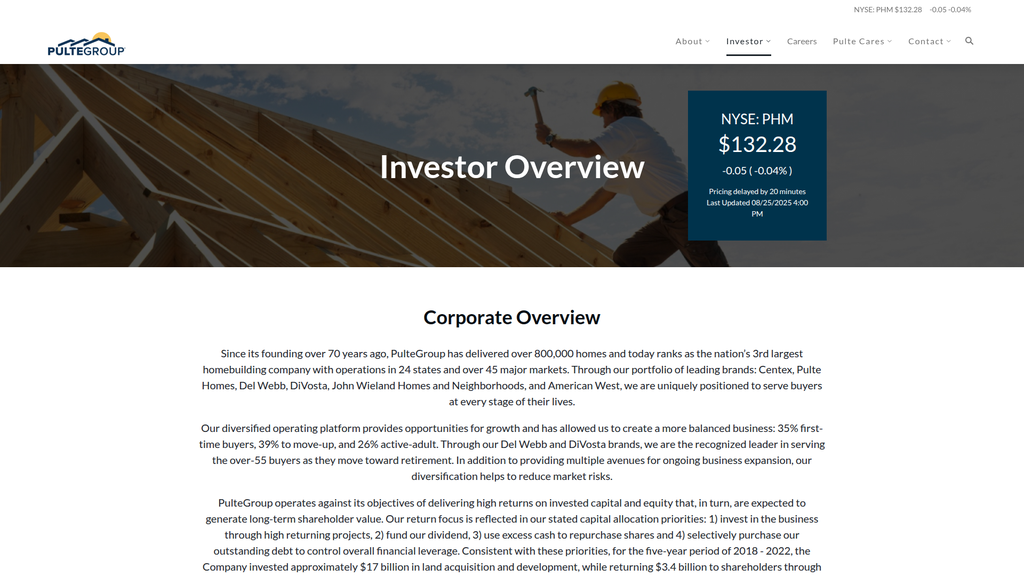

PulteGroup's corporate site excels in search intent alignment for its primary audience: investors and financial analysts, providing direct access to reports and financial data. However, its content authority is narrowly focused, lacking broader thought leadership on housing trends, innovation, or sustainability which limits its reach. While its multi-brand consumer-facing sites (Pulte, Del Webb, etc.) handle geographic reach, the corporate site's digital presence is more of a centralized, functional hub than a proactive authority-building platform.

The website's information architecture is perfectly optimized for an investor's search intent, with clear, easily accessible paths to SEC filings, financial results, and presentations.

Develop a 'Housing Market Insights' hub leveraging proprietary data from its brands to create authoritative content that attracts organic traffic and builds brand equity beyond the financial community.

The brand messaging is exceptionally disciplined and consistent in targeting its investor audience with a clear narrative of financial returns and stability. However, this singular focus creates gaps; messaging around innovation and ESG is underdeveloped, failing to address the values of a broader set of stakeholders like top talent or ESG-focused funds. A glaring weakness is the presence of 'Lorem ipsum' placeholder text in CEO quote blocks, a major professional oversight that temporarily damages credibility.

The core message of delivering high returns on invested capital (ROIC) is communicated with extreme clarity and consistency across the site, effectively positioning the company as a disciplined financial steward.

Immediately replace the placeholder 'Lorem ipsum' text with a compelling, forward-looking CEO message that articulates a strategic vision beyond financial metrics, touching on innovation, sustainability, and the future of housing.

For its target audience, the conversion experience is straightforward and functional, effectively guiding users to download reports or view webcasts. The cognitive load is low due to a clean layout and clear information hierarchy. However, the analysis reveals significant weaknesses in CTA design, with inconsistent and low-contrast buttons that fail to create a clear visual path for key actions, thus limiting engagement and proactive communication.

The website's clean, professional aesthetic and logical content structure create a low-friction environment for users to find specific financial information efficiently.

Implement a hierarchical CTA system with distinct styles for primary (e.g., 'Download Annual Report') and secondary actions to guide user attention and improve conversion on the most critical informational assets.

PulteGroup demonstrates an exceptionally strong and proactive approach to legal and compliance-related risk mitigation, particularly in data privacy (CCPA), accessibility (ADA), and industry-specific regulations (SEC, Fair Housing Act). The site features a robust hierarchy of trust signals, including transparent financial data, third-party awards ('Great Place to Work'), and clear corporate governance information. This high level of transparency and compliance significantly enhances credibility and reduces legal risk.

The company's detailed, state-specific privacy policies and proactive stance on web accessibility, including third-party auditing, represent a best-in-class approach to mitigating digital legal risks.

Conduct a periodic review of the main 'Terms of Use' document (last updated in 2021) to ensure it aligns with the very latest precedents in digital liability and online agreements.

PulteGroup's competitive moat is deep and sustainable, anchored by its multi-brand portfolio that serves diverse buyer segments, mitigating cyclical risk. The Del Webb brand, in particular, is a category-defining asset with a dominant position in the high-growth active adult market. This brand diversification, combined with massive scale and high capital barriers to entry in the homebuilding industry, creates a formidable and lasting competitive advantage.

The diversified brand portfolio (Centex, Pulte, Del Webb) is a powerful and sustainable advantage, allowing the company to hedge against segment-specific downturns and capture demand across the entire homebuyer lifecycle.

More aggressively market the synergy between the brands to create a 'customer for life' pipeline, offering incentives for Centex buyers to become Pulte move-up buyers, and eventually Del Webb residents.

The company is well-positioned for scalable growth, driven by a disciplined focus on unit economics (ROIC) and strong market expansion signals, most notably its strategic entry into the Build-to-Rent (BTR) sector. Initiatives to improve automation and efficiency, such as the expansion of its ICG off-site manufacturing platform and piloting robotic construction, demonstrate a clear strategy to overcome traditional industry bottlenecks like labor shortages. While the core business is capital-intensive, these strategic moves significantly enhance its expansion potential.

The strategic push into the Build-to-Rent (BTR) market via partnerships unlocks a massive institutional customer base, providing a new, scalable, and counter-cyclical revenue stream.

Formalize the BTR initiative from a partnership model into a core business division with dedicated capital allocation and leadership to accelerate its scaling and impact on revenue diversification.

PulteGroup's business model is exceptionally coherent, with a clear alignment between its multi-brand strategy, target customer segments, and financial objectives. The strategic focus on Return on Invested Capital (ROIC) provides a clear North Star for all resource allocation decisions, from land acquisition to capital returns. The vertical integration of financial services (Pulte Mortgage) further strengthens the model by capturing more value per transaction and streamlining the customer journey.

The unwavering strategic focus on maximizing ROIC ensures a high degree of discipline in capital allocation, aligning operations, land acquisition, and shareholder returns into a highly coherent and effective business model.

Develop a 'Homeowner-as-a-Service' platform to introduce high-margin, recurring revenue streams post-sale, evolving the purely transactional model to include long-term customer value.

As the nation's third-largest homebuilder, PulteGroup holds significant market power, evidenced by its scale, strong brand recognition, and geographic reach across over 45 markets. This scale provides considerable leverage with suppliers and partners. Its multi-brand strategy allows for tiered pricing power across different economic segments, from entry-level to luxury, demonstrating an ability to adapt pricing to market conditions without sacrificing its core value propositions.

Its stable position as the #3 builder provides significant economies of scale, negotiating leverage with national suppliers, and the financial strength to strategically acquire land and navigate market cycles.

Increase investment in the Centex brand to more aggressively challenge competitors like D.R. Horton in the high-volume, entry-level segment, which could significantly impact overall market share trajectory.

Business Overview

Business Classification

B2C Production Homebuilder

Financial & Ancillary Services

Real Estate

Sub Verticals

- •

Residential Construction

- •

Land Acquisition & Development

- •

Mortgage Lending

- •

Title Services

Mature

Maturity Indicators

- •

Over 70 years in operation (founded in 1950).

- •

Established position as the 3rd largest homebuilder in the United States.

- •

Delivery of over 800,000 homes.

- •

Strong brand portfolio with distinct market positioning (Centex, Pulte, Del Webb).

- •

Consistent dividend payments for over a decade.

- •

Well-defined capital allocation strategy focused on ROE and ROIC.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Home Sales

Description:The core revenue driver, generated from the construction and sale of single-family homes, townhouses, and condominiums across a portfolio of brands targeting distinct buyer segments (first-time, move-up, active adult).

Estimated Importance:Primary

Customer Segment:All Segments (First-time, Move-up, Active Adult)

Estimated Margin:Medium

- Stream Name:

Financial Services (Pulte Mortgage)

Description:Origination of mortgage loans for homebuyers, generating revenue from loan origination fees and servicing income. This segment enhances affordability and streamlines the buying process, achieving a high capture rate (86% in Q1 2025).

Estimated Importance:Secondary

Customer Segment:Homebuyers across all brands

Estimated Margin:High

- Stream Name:

Land Sales & Other

Description:Ancillary revenue from the occasional sale of land parcels not intended for immediate development and other miscellaneous income.

Estimated Importance:Tertiary

Customer Segment:Other Developers / Land Investors

Estimated Margin:Variable

Recurring Revenue Components

Largely transactional, with minimal recurring revenue. Potential for future recurring streams through Build-to-Rent (BTR) ventures and 'Home-as-a-Service' models.

Pricing Strategy

Unitary Sale / Project-Based Pricing

Multi-tiered

Semi-transparent

Pricing Psychology

- •

Good-Better-Best Branding (Centex, Pulte, Del Webb)

- •

Price Anchoring ('Starting from...' pricing)

- •

Upselling & Cross-selling (design center upgrades, financing options)

- •

Scarcity (limited lot releases)

Monetization Assessment

Strengths

- •

Vertically integrated model with financial services captures additional value per transaction.

- •

Multi-brand strategy allows for price differentiation and maximization of revenue across diverse economic segments.

- •

Focus on cost control and disciplined pricing supports strong gross margins.

Weaknesses

- •

High dependence on the cyclicality of the for-sale housing market.

- •

Transactional revenue model lacks the stability of recurring income streams.

- •

Vulnerability to interest rate fluctuations which directly impact buyer affordability and demand.

Opportunities

- •

Formalize and scale Build-to-Rent (BTR) operations to create a significant recurring revenue stream.

- •

Expand financial services to include title and homeowners insurance.

- •

Introduce 'Home-as-a-Service' subscription models for maintenance, smart home management, and upgrade packages.

Threats

- •

Sustained high interest rates reducing buyer purchasing power.

- •

Intense competition from other large-scale national builders like D.R. Horton and Lennar.

- •

Volatility in land, labor, and material costs pressuring margins.

Market Positioning

Multi-Segment Brand Diversification

Top Tier (Ranked 3rd Largest in the U.S.)

Target Segments

- Segment Name:

First-Time Buyers (Centex Brand)

Description:This segment consists of individuals and young families, often millennials, purchasing their first home. They are typically price-sensitive and value-oriented.

Demographic Factors

- •

Age 25-40

- •

Millennial and Gen Z cohorts

- •

Moderate income

Psychographic Factors

- •

Seeks to build equity instead of renting.

- •

Desires homeownership but is sensitive to affordability.

- •

Tech-savvy and appreciates smart home features as a standard.

Behavioral Factors

- •

Conducts extensive online research before purchasing.

- •

Responsive to financing incentives and rate buydowns.

- •

Often migrates to suburban areas for better schools and value.

Pain Points

- •

Inability to afford a down payment.

- •

High monthly payments due to interest rates.

- •

Competition in the existing homes market.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Move-Up Buyers (Pulte Homes Brand)

Description:Growing families or established professionals looking for more space, premium features, better locations, and specific community amenities like good schools.

Demographic Factors

- •

Age 35-55

- •

Gen X and older Millennials

- •

Higher household income

Psychographic Factors

- •

Values quality, location, and personalization options.

- •

Seeks a home that reflects their success and accommodates a changing lifestyle.

- •

Less price-sensitive than first-time buyers, but still value-conscious.

Behavioral Factors

- •

Focuses on school districts and community features.

- •

Often has existing home equity to leverage.

- •

Willing to invest in design upgrades and lot premiums.

Pain Points

- •

Finding a home with the right features in the desired location.

- •

Balancing the sale of an existing home with the purchase of a new one.

- •

Limited inventory of new homes that meet specific needs.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Active Adults (Del Webb & DiVosta Brands)

Description:Pre-retirees and retirees (55+) seeking a low-maintenance lifestyle in amenity-rich communities designed for social engagement and recreation.

Demographic Factors

- •

Age 55+

- •

Baby Boomers and older Gen X

- •

Financially established, often downsizing

Psychographic Factors

- •

Prioritizes lifestyle and community over home size.

- •

Seeks social connection and activities.

- •

Values convenience, security, and low-maintenance living.

Behavioral Factors

- •

Makes purchase decisions based on community amenities and lifestyle programming.

- •

Often pays with cash or significant equity from a previous home sale.

- •

Longer consideration phase, often visiting communities multiple times.

Pain Points

- •

Maintaining a larger home than needed.

- •

Social isolation.

- •

Finding a community that matches their desired activity level and lifestyle.

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Dominant Active Adult Brand (Del Webb)

Strength:Strong

Sustainability:Sustainable

- Factor:

Diversified Multi-Brand Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Financial Discipline (Focus on ROE/ROIC)

Strength:Moderate

Sustainability:Sustainable

- Factor:

Operational Scale and Geographic Reach

Strength:Strong

Sustainability:Sustainable

Value Proposition

PulteGroup builds high-quality, consumer-inspired homes and communities for every stage of life, from first-time buyers to active adults, streamlined by integrated financial services and backed by a commitment to operational excellence and long-term value.

Good

Key Benefits

- Benefit:

A Home for Every Life Stage

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Portfolio of distinct brands: Centex, Pulte Homes, Del Webb.

- Benefit:

Quality Construction

Importance:Critical

Differentiation:Common

Proof Elements

70+ year history

Emphasis on operational excellence in corporate messaging.

- Benefit:

Integrated and Simplified Homebuying Process

Importance:Important

Differentiation:Somewhat unique

Proof Elements

In-house Pulte Mortgage division with high capture rates.

- Benefit:

Lifestyle-Oriented Communities

Importance:Important

Differentiation:Unique

Proof Elements

Del Webb brand's focus on amenity-rich, active adult living.

Unique Selling Points

- Usp:

The Del Webb brand is the category leader in active adult communities, offering a powerful and defensible market position.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A multi-brand strategy that effectively insulates the company from demographic shifts and economic downturns by serving diverse buyer segments.

Sustainability:Long-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Lack of affordable, quality new homes for first-time buyers.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Need for more space and features for a growing family in desirable locations.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Desire for a simplified, low-maintenance, and socially-engaging lifestyle in retirement.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

The company's diversified model is well-aligned with key demographic trends, including millennials entering homeownership and baby boomers retiring.

High

Each brand has a clearly defined value proposition that resonates strongly with the specific pain points and desires of its target segment.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Land Sellers & Developers

- •

Subcontractors (Framing, Electrical, Plumbing, etc.)

- •

Building Material Suppliers

- •

Real Estate Brokerages

- •

Municipal Governments (for permitting & zoning)

- •

Institutional Investors (for BTR partnerships, e.g., Invitation Homes).

Key Activities

- •

Land Acquisition & Entitlement

- •

Community Planning & Development

- •

Home Construction

- •

Sales & Marketing

- •

Mortgage Origination & Financial Services

Key Resources

- •

Land Inventory (owned and optioned)

- •

Portfolio of Strong Brands

- •

Access to Capital

- •

Supply Chain and Subcontractor Relationships

- •

Skilled Management & Labor

Cost Structure

- •

Land Acquisition & Development Costs

- •

Direct Construction Costs (Labor & Materials)

- •

Sales, General & Administrative (SG&A) Expenses

- •

Financing & Interest Costs

Swot Analysis

Strengths

- •

Diversified business model across multiple customer segments mitigates risk.

- •

Strong brand recognition, particularly the category-leading Del Webb brand.

- •

Large operational scale provides purchasing power and efficiencies.

- •

Solid financial position with a disciplined focus on high returns (ROE).

- •

Vertically integrated financial services arm (Pulte Mortgage) improves profitability and customer experience.

Weaknesses

- •

High sensitivity to macroeconomic factors, especially interest rates and employment.

- •

Capital-intensive business model with significant investment in land inventory.

- •

Transactional revenue model lacks the stability of recurring income.

- •

Potential for geographical concentration risk in certain markets.

Opportunities

- •

Structural undersupply of housing in the U.S. provides a long-term demand tailwind.

- •

Expand the Build-to-Rent (BTR) segment via strategic partnerships (e.g., Invitation Homes) to generate recurring revenue.

- •

Integrate sustainable building practices and smart home technology as a key differentiator.

- •

Leverage off-site construction and manufacturing to improve efficiency and address labor shortages, as seen with the ICG acquisition.

Threats

- •

Rising interest rates that erode affordability for all buyer segments.

- •

Persistent labor shortages and supply chain disruptions increasing costs and extending cycle times.

- •

Intense competition from other large national homebuilders (e.g., D.R. Horton, Lennar).

- •

Changes in land use regulations and environmental policies increasing development costs.

Recommendations

Priority Improvements

- Area:

Digital Customer Experience

Recommendation:Invest heavily in an end-to-end digital home buying platform, from immersive virtual tours and online design centers to fully digital mortgage and closing processes.

Expected Impact:Medium

- Area:

Supply Chain Modernization

Recommendation:Accelerate the integration of off-site/modular construction (via ICG) across more divisions to standardize components, reduce waste, and mitigate on-site labor dependencies.

Expected Impact:High

Business Model Innovation

- •

Formalize and Scale Build-to-Rent (BTR) as a Core Division: Transition the BTR strategy from opportunistic partnerships to a dedicated business unit with its own land acquisition, product development, and institutional capital strategy. This provides a counter-cyclical hedge and creates a valuable, long-term recurring revenue stream.

- •

Develop a 'Home-as-a-Service' (HaaS) Platform: Post-sale, offer subscription services for home maintenance, landscaping, smart home upgrades, and energy management. This fosters long-term customer relationships and adds a high-margin, recurring revenue layer.

- •

Invest in PropTech Ventures: Establish a corporate venture arm to invest in and pilot emerging technologies in construction (e.g., 3D printing, robotics), materials science, and real estate finance to secure future competitive advantages.

Revenue Diversification

- •

Expand Ancillary Services: Broaden the financial services portfolio to include title, homeowners insurance, and potentially home warranty services to capture more of the homeownership value chain.

- •

Community & Asset Management: Develop a fee-based service to manage the HOAs and amenities of completed communities, creating a stable, long-term revenue stream.

- •

Monetize Land Assets Strategically: Beyond homebuilding, explore developing parcels for complementary uses such as small-scale commercial or mixed-use projects within larger master-planned communities.

PulteGroup's business model is a mature, robust, and highly disciplined operation that has proven resilient. Its core strength lies in its multi-brand diversification strategy, which allows it to expertly target and serve the three primary segments of the U.S. housing market: first-time, move-up, and active adult buyers. This segmentation, particularly the market-defining dominance of the Del Webb brand, provides a significant competitive advantage and a hedge against shifts in demographic demand. The company's vertical integration into financial services via Pulte Mortgage is a critical component, enhancing both profitability and the customer journey.

The primary strategic challenge and opportunity for evolution lies in its dependence on a transactional, cyclical business model. The U.S. housing market is undergoing a structural shift with persistent affordability challenges, which elevates the strategic importance of the rental market. PulteGroup's nascent steps into the Build-to-Rent (BTR) space with partners like Invitation Homes is the most critical avenue for future business model evolution. A strategic pivot to formalize BTR as a core division would introduce a much-needed recurring revenue stream, provide a counter-cyclical buffer, and position the company to serve customers across the full spectrum of housing needs—renting and owning. Further innovation in 'Home-as-a-Service' offerings and deeper integration of off-site manufacturing represent the next frontiers for enhancing efficiency, building long-term customer value, and ensuring sustainable growth in an evolving industry.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Capital Intensity & Access to Financing

Impact:High

- Barrier:

Land Acquisition & Entitlement

Impact:High

- Barrier:

Labor & Subcontractor Relationships

Impact:High

- Barrier:

Regulatory & Permitting Complexity

Impact:Medium

- Barrier:

Brand Reputation & Trust

Impact:Medium

- Barrier:

Economies of Scale in Procurement

Impact:Medium

Industry Trends

- Trend:

Housing Affordability Crisis

Impact On Business:Pressures margins and shifts demand towards smaller, entry-level homes. Requires focus on cost control and value engineering.

Timeline:Immediate

- Trend:

Rise of Build-to-Rent (BTR)

Impact On Business:Creates a new, large-scale customer segment and diversifies revenue streams away from individual homebuyers.

Timeline:Immediate

- Trend:

Adoption of Construction Technology (ConTech)

Impact On Business:Drives efficiency gains through modular construction, AI-powered automation, and improved project management, potentially lowering costs and build times.

Timeline:Near-term

- Trend:

Demand for Sustainable & Energy-Efficient Homes

Impact On Business:Requires investment in green building practices and materials, which can be a key differentiator for environmentally conscious buyers.

Timeline:Near-term

- Trend:

Demographic Shifts (Millennial Buyers & Aging Population)

Impact On Business:Fuels demand for both first-time homes and active adult communities, aligning well with PulteGroup's diversified brand portfolio.

Timeline:Immediate

Direct Competitors

- →

D.R. Horton

Market Share Estimate:~13.6% (by closings)

Target Audience Overlap:High

Competitive Positioning:America's largest homebuilder, focused on volume and affordability across a wide geographic footprint.

Strengths

- •

Market leader in closings, providing significant economies of scale.

- •

Strong focus on the entry-level market with its Express Homes brand.

- •

Extensive geographic diversification across the U.S.

- •

Efficient operational model and strong financial performance.

- •

Vertically integrated with in-house mortgage and title services.

Weaknesses

- •

High susceptibility to economic downturns and interest rate volatility.

- •

Reliance on subcontractors can lead to quality control inconsistencies.

- •

Lower trust/customer satisfaction scores compared to some competitors.

- •

Brand perception is more focused on volume and value than on premium quality or design.

Differentiators

Unmatched scale and volume.

Deep penetration in the affordable, first-time homebuyer segment.

- →

Lennar Corporation

Market Share Estimate:~11.7% (by closings)

Target Audience Overlap:High

Competitive Positioning:Positions as a provider of value and simplicity with its 'Everything's Included' approach.

Strengths

- •

Strong brand recognition and market share.

- •

'Everything's Included' package simplifies the buying process and adds perceived value.

- •

Diversified product offerings for various lifestyles including multigenerational homes (Next Gen).

- •

Strong focus on technology and innovation to improve efficiency and customer experience.

- •

Vertically integrated business model including financial services.

Weaknesses

- •

Faces similar cyclical risks as other large builders.

- •

Customer service can be inconsistent across different divisions.

- •

Mid-tier ranking in customer trust studies.

Differentiators

Signature 'Everything's Included' value proposition.

Innovative floor plans like 'Next Gen' for multigenerational living.

- →

NVR, Inc. (Ryan Homes, NVHomes)

Market Share Estimate:~3.3% (by closings)

Target Audience Overlap:Medium

Competitive Positioning:A highly disciplined and financially conservative builder with a unique 'asset-light' business model.

Strengths

- •

Unique 'land-light' strategy using lot purchase options, which minimizes risk and capital outlay.

- •

Industry-leading financial performance, including high returns on equity and consistent profitability, even during downturns.

- •

Strong market share in its core geographies along the East Coast.

- •

Disciplined and efficient homebuilding process with a short cash conversion cycle.

Weaknesses

- •

Less geographic diversity compared to D.R. Horton and Lennar.

- •

Business model is less scalable nationally as it relies on strong relationships with local land developers.

- •

May miss out on land appreciation gains during market upswings.

- •

Brand recognition (Ryan Homes, NVHomes) is strong regionally but not as dominant nationally.

Differentiators

Asset-light business model is fundamentally different from all major competitors.

Exceptional financial resilience and profitability through housing cycles.

Indirect Competitors

- →

Existing/Resale Home Market

Description:The largest source of competition, representing the vast majority of homes available for sale at any given time.

Threat Level:High

Potential For Direct Competition:N/A

- →

Single-Family Rental (SFR) Operators

Description:Companies like Invitation Homes and American Homes 4 Rent that acquire existing homes or partner with builders for new 'build-to-rent' communities, competing for potential first-time buyers.

Threat Level:Medium

Potential For Direct Competition:Low (They are often customers/partners)

- →

Custom & Regional Homebuilders

Description:Smaller, local, or regional builders that offer more customization and may have strong local reputations.

Threat Level:Medium

Potential For Direct Competition:Low (Operate at a different scale)

- →

Modular & Prefabricated Home Companies

Description:Companies focused on factory-built homes that promise faster build times and potentially lower costs. While still a niche, this sector represents a potential long-term disruption to traditional stick-built construction.

Threat Level:Low

Potential For Direct Competition:Medium

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Diversified Brand Portfolio

Sustainability Assessment:PulteGroup's portfolio (Centex, Pulte, Del Webb, etc.) allows it to target distinct buyer segments—from first-time to luxury and active adult—insulating it from downturns in any single segment.

Competitor Replication Difficulty:Hard

- Advantage:

Leadership in Active Adult Segment

Sustainability Assessment:The Del Webb brand is the market leader and most recognized name in the 55+ community space, a strong demographic tailwind with aging Baby Boomers.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Financial Discipline

Sustainability Assessment:A stated focus on high returns on invested capital and equity, coupled with a disciplined capital allocation strategy, ensures long-term financial health.

Competitor Replication Difficulty:Medium

- Advantage:

Scale and Geographic Reach

Sustainability Assessment:As the #3 builder, PulteGroup benefits from national scale in procurement, marketing, and access to capital, creating a significant advantage over smaller players.

Competitor Replication Difficulty:Hard

Temporary Advantages

- Advantage:

Current Land Positions

Estimated Duration:2-5 years

Description:Strategic land holdings acquired at favorable prices provide a near-term margin advantage, but this is cyclical and depends on continuous successful land acquisition.

Disadvantages

- Disadvantage:

Lower Market Share in Entry-Level Segment

Impact:Major

Addressability:Moderately

Description:While the Centex brand serves first-time buyers, D.R. Horton is significantly more dominant in this high-volume segment, potentially limiting Pulte's overall market share growth.

- Disadvantage:

Mid-Tier Customer Trust Ranking

Impact:Minor

Addressability:Moderately

Description:In recent Lifestory Research studies, Pulte Homes ranks in the middle of the pack for trust, below competitors like Taylor Morrison and Toll Brothers.

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted digital marketing campaigns highlighting Del Webb's leadership in the active adult segment.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Enhance the online homebuyer journey with more robust virtual tour and design personalization tools to compete with leaders like Taylor Morrison.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Strategically expand the Centex brand footprint in high-growth markets to capture more of the entry-level demand.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop a formal 'Build-to-Rent' partnership program to create a consistent revenue stream from institutional investors.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in a customer experience initiative to improve homeowner satisfaction scores and climb the rankings in national trust surveys.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Invest in or partner with ConTech/modular construction startups to pilot more efficient and sustainable building methods.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Establish a distinct sub-brand or product line focused exclusively on sustainability and net-zero energy homes as a premium offering.

Expected Impact:Medium

Implementation Difficulty:Difficult

Solidify PulteGroup's position as the 'Builder for Every Life Stage' by more aggressively marketing the synergy between its brands. Emphasize the ability to serve a customer from their first home (Centex) to their move-up (Pulte) and retirement (Del Webb).

Differentiate through superior segmentation and customer lifecycle management. Leverage the brand portfolio to build lifetime customer relationships, a feat that more singularly focused competitors cannot easily replicate. Double down on the Del Webb brand's dominance as a key differentiator.

Whitespace Opportunities

- Opportunity:

Integrated 'Smart & Healthy Home' Packages

Competitive Gap:While competitors offer smart home features (Lennar's 'Everything's Included'), a holistic package combining smart tech with wellness features (e.g., air/water purification, circadian lighting) is not a primary focus for any major builder.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Branded, Tech-Enabled Homeowner Services

Competitive Gap:No major builder currently offers a comprehensive, subscription-based post-purchase service platform for maintenance, repairs, and upgrades, representing an untapped recurring revenue stream.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Develop 'Affordable Luxury' Niche

Competitive Gap:There is a gap between high-volume, value-focused builders (D.R. Horton) and high-end luxury builders (Toll Brothers). Pulte could position its core 'Pulte Homes' brand more firmly in this 'affordable luxury' space, offering premium design and finishes at a more accessible price point.

Feasibility:Medium

Potential Impact:High

PulteGroup, Inc. operates as the third-largest homebuilder in a mature and moderately concentrated U.S. market. The industry is characterized by high barriers to entry, including immense capital requirements, land acquisition challenges, and the need for scale. PulteGroup's primary competitive strength lies in its multi-brand strategy, which allows it to serve a diverse range of homebuyers, from first-time (Centex) and move-up (Pulte) to the lucrative active adult segment (Del Webb). This diversification provides a significant hedge against segment-specific market downturns and is a key differentiator from its top competitors, D.R. Horton and Lennar. Its Del Webb brand, in particular, is a sustainable advantage, holding a dominant position in the growing 55+ market.

The main direct competitors, D.R. Horton and Lennar, focus on volume and value. D.R. Horton's undisputed leadership in closings is driven by its aggressive focus on the entry-level market, an area where PulteGroup is present but less dominant. Lennar competes effectively with its 'Everything's Included' value proposition, which simplifies the buying process. A notable competitor, NVR, operates with a unique and highly resilient 'asset-light' model that avoids land ownership risk, resulting in superior financial metrics but limiting its geographic scale.

Key industry trends influencing the landscape include persistent housing affordability issues, the rise of the build-to-rent sector, and the growing importance of technology and sustainability. While PulteGroup is well-positioned to capitalize on demographic shifts toward both millennial buyers and retirees, it faces challenges in capturing a larger share of the price-sensitive, entry-level market and improving its mid-tier customer satisfaction ratings.

Strategic opportunities for PulteGroup include leveraging its brand portfolio to create lifetime customer value, expanding its presence in the high-growth entry-level segment, and innovating in areas like sustainable building and post-purchase homeowner services. By reinforcing its identity as the builder for every life stage and doubling down on the strength of its individual brands, PulteGroup can defend and enhance its competitive position.

Messaging

Message Architecture

Key Messages

- Message:

PulteGroup delivers high returns on invested capital and equity (ROIC/ROE) to generate long-term shareholder value.

Prominence:Primary

Clarity Score:High

Location:Corporate Overview, Why Invest section

- Message:

A diversified operating platform and multi-brand portfolio (Centex, Pulte, Del Webb, etc.) serves all buyer segments and reduces market risk.

Prominence:Primary

Clarity Score:High

Location:Corporate Overview, PulteGroup Profile

- Message:

A disciplined and clear capital allocation strategy prioritizes high-return investments and shareholder returns (dividends, buybacks).

Prominence:Secondary

Clarity Score:High

Location:Corporate Overview

- Message:

PulteGroup is a large, stable, and experienced leader in the homebuilding industry (3rd largest, 70+ years, 800,000+ homes).

Prominence:Secondary

Clarity Score:High

Location:Corporate Overview, PulteGroup Profile

- Message:

The company has a strong corporate culture and is a 'Great Place to Work'.

Prominence:Tertiary

Clarity Score:Medium

Location:Press Releases, CEO Quote, Careers section

The messaging hierarchy is exceptionally clear and well-aligned with a corporate/investor relations function. Financial performance, shareholder value, and strategic stability are consistently prioritized above all else. Messages about company culture and employee benefits are present but correctly subordinated for this specific audience.

Messaging is highly consistent across the analyzed pages. The core themes of financial returns, diversified brands, and capital discipline are repeated in the 'Corporate Overview', 'Why Invest', and 'PulteGroup Profile' sections, reinforcing their strategic importance.

Brand Voice

Voice Attributes

- Attribute:

Formal & Corporate

Strength:Strong

Examples

- •

PulteGroup operates against its objectives of delivering high returns on invested capital and equity...

- •

Our defined approach for running our business emphasizes operational excellence, asset efficiency...

- •

Consistent with these priorities, for the five-year period of 2018 - 2022...

- Attribute:

Data-Driven & Analytical

Strength:Strong

Examples

- •

35% first-time buyers, 39% to move-up, and 26% active-adult.

- •

27.5% 2024 ROE *

- •

invested approximately $17 billion in land acquisition and development, while returning $3.4 billion to shareholders...

- Attribute:

Confident & Authoritative

Strength:Moderate

Examples

- •

...we are uniquely positioned to serve buyers at every stage of their lives.

- •

...we are the recognized leader in serving the over-55 buyers...

- •

Driving Dramatic Gains in Income and Profitability

- Attribute:

Aspirational (Corporate)

Strength:Weak

Examples

...committed to building incredible places where people can live their dreams.

Tone Analysis

Financial

Secondary Tones

Professional

Factual

Tone Shifts

A slight shift to a more employee-centric and community-focused tone occurs in the 'Pulte Cares' and 'Careers' sections, using words like 'dedicated individuals' and 'unique lifestyles'.

Voice Consistency Rating

Excellent

Consistency Issues

The presence of 'Lorem ipsum' placeholder text in two CEO quote blocks on the 'About' page is a major professional oversight that undermines the otherwise consistent and authoritative voice.

Value Proposition Assessment

For investors, PulteGroup is a stable, large-scale homebuilder with a disciplined, multi-brand strategy that mitigates risk and is relentlessly focused on generating high returns on capital and long-term shareholder value.

Value Proposition Components

- Component:

Superior Financial Returns (ROIC/ROE)

Clarity:Clear

Uniqueness:Somewhat Unique

Comment:The relentless focus on ROIC/ROE as a key driver is a specific strategic stance that offers some differentiation from competitors who may focus more on sheer volume or market share.

- Component:

Market Risk Mitigation via Diversification

Clarity:Clear

Uniqueness:Common

Comment:Serving first-time, move-up, and active adult segments is a common strategy among large builders like D.R. Horton and Lennar, but PulteGroup communicates it very effectively.

- Component:

Operational Excellence & Asset Efficiency

Clarity:Clear

Uniqueness:Common

Comment:This is a key claim for most large, publicly-traded companies in the sector. PulteGroup supports it with data on income and return gains since 2011.

- Component:

Scale and Stability

Clarity:Clear

Uniqueness:Common

Comment:Being the '3rd largest' is a clear position but shared with other top-tier competitors.

PulteGroup's messaging effectively differentiates itself not by what it does (building homes across segments), but by how it measures success. The intense, repeated focus on 'high returns on invested capital and equity' as the primary objective is the sharpest point of differentiation. While competitors also seek profit, PulteGroup frames it as their central operating principle, which is a powerful message for a financial audience.

The messaging positions PulteGroup as the disciplined, financially astute choice among the top-tier homebuilders. It forgoes overt emotional or product-focused language in favor of a clear, data-backed narrative of financial stewardship and strategic risk management. This positions them as a potentially safer, more predictable investment compared to competitors who might be perceived as focusing more aggressively on growth at any cost.

Audience Messaging

Target Personas

- Persona:

Institutional Investor / Financial Analyst

Tailored Messages

- •

Our stated objective of delivering high returns on invested capital and equity over the housing cycle.

- •

Our return focus is reflected in our stated capital allocation priorities...

- •

2024 Stats: +31,219 Home Closings, $18B Total Revs, 27.5% 2024 ROE

- •

Links to Webcasts, Quarterly Filings, and Presentations are prominent.

Effectiveness:Effective

- Persona:

Potential Corporate Employee / Executive Talent

Tailored Messages

- •

PulteGroup Earns 2025 Great Place To Work Certification™

- •

Comprehensive, Flexible and Affordable Healthcare Coverage Options

- •

Paid Parental Leave and Adoption Benefits

- •

A strong corporate culture that ranks us among Fortune’s 100 Best Companies to Work For®.

Effectiveness:Somewhat Effective

- Persona:

Media / Business Journalist

Tailored Messages

- •

Latest Press Releases section is clearly visible and updated.

- •

Clear statistics and corporate overview for easy fact-checking.

- •

Investor Relations contact information is accessible.

Effectiveness:Effective

Audience Pain Points Addressed

- •

Investor concern about market volatility (addressed by 'diversification helps to reduce market risks').

- •

Investor demand for capital discipline (addressed by 'stated capital allocation priorities').

- •

Investor desire for predictable returns (addressed by focus on ROIC/ROE).

Audience Aspirations Addressed

Investor aspiration for long-term value creation and wealth generation.

Potential employee aspiration for stable employment with good benefits at a reputable company.

Persuasion Elements

Emotional Appeals

No itemsSocial Proof Elements

- Proof Type:

Scale & Market Leadership

Impact:Strong

Examples

ranks as the nation’s 3rd largest homebuilding company

delivered over 800,000 homes

- Proof Type:

Awards & Recognition

Impact:Moderate

Examples

PulteGroup Earns 2025 Great Place To Work Certification™

Fortune’s 100 Best Companies to Work For®

- Proof Type:

Longevity & Experience

Impact:Moderate

Examples

Since its founding over 70 years ago...

Trust Indicators

- •

Prominently displayed financial data (+31,219 Home Closings, $18B Revs, 27.5% ROE).

- •

Direct links to official financial reports, presentations, and SEC filings.

- •

Named executives in press releases and quotes (when not Lorem ipsum).

- •

Clear articulation of business strategy and capital allocation priorities.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

View all news

Location:Investor Overview, About Overview

Clarity:Clear

- Text:

Download (opens in new window)

Location:Featured Presentation section

Clarity:Clear

- Text:

Webcast (opens in new window)

Location:Latest Events, Latest Financial Results

Clarity:Clear

- Text:

Learn More

Location:Why Invest section

Clarity:Clear

- Text:

View Open Positions

Location:Careers section

Clarity:Clear

The calls-to-action are highly effective for the target audience. They are direct, unambiguous, and guide users to the precise information an investor, analyst, or job seeker would need (e.g., reports, webcasts, job listings). There is no marketing fluff, which aligns perfectly with the site's corporate purpose.

Messaging Gaps Analysis

Critical Gaps

Lack of a compelling, forward-looking strategic narrative beyond financial metrics. There is little messaging about innovation, future of housing, sustainability strategy (ESG), or technological advancements which are becoming key investor considerations.

The CEO's voice is literally missing due to the shocking use of 'Lorem ipsum' placeholder text. This is a significant credibility gap and a failure of basic website management.

Contradiction Points

The site claims a 'strong corporate culture' and being a 'great place to work', but the placeholder CEO quotes signal a lack of attention to detail and care at the highest level of corporate communication, which contradicts the claim.

Underdeveloped Areas

Sustainability and ESG Messaging: While a 'Pulte Cares' section is mentioned, the core investor narrative is devoid of any meaningful discussion of environmental, social, and governance factors, which is a major missed opportunity for appealing to modern investment criteria.

Brand Storytelling: The story of Bill Pulte's 'entrepreneurial spirit' is mentioned once but not developed. A stronger narrative could add a layer of humanity and vision to the data-heavy content without undermining the corporate tone.

Messaging Quality

Strengths

- •

Exceptional clarity and focus on the primary investor audience.

- •

Strong use of data and financial metrics to substantiate claims.

- •

Highly consistent messaging and logical information architecture.

- •

Professional, authoritative voice that builds credibility with a financial audience.

Weaknesses

- •

Glaringly unprofessional placeholder text ('Lorem ipsum') in key quote sections severely damages credibility.

- •

Overly reliant on financial jargon, potentially alienating other stakeholders like high-level talent or corporate partners.

- •

Lack of a compelling vision for the future beyond continued financial performance.

- •

Underdeveloped messaging around ESG, innovation, and corporate social responsibility.

Opportunities

- •

Develop and integrate a clear ESG strategy into the core investor narrative to attract a broader base of capital.

- •

Craft a compelling CEO message that outlines a forward-looking vision for the company and the future of homebuilding.

- •

Use the 'Pulte Cares' section to tell more impactful stories about community involvement and sustainability, supported by data.

- •

Create a dedicated 'Innovation' or 'Technology' section to showcase advancements in building processes or smart home features, appealing to both investors and talent.

Optimization Roadmap

Priority Improvements

- Area:

CEO Messaging

Recommendation:Immediately remove the 'Lorem ipsum' placeholder text. Replace it with a powerful, forward-looking quote from the CEO that articulates the company's strategic vision beyond just financial returns, touching on innovation, customer value, and long-term industry leadership.

Expected Impact:High

- Area:

ESG Narrative

Recommendation:Develop a dedicated section or integrate into the 'Why Invest' page key messages about PulteGroup's ESG strategy. Highlight metrics related to energy efficiency, sustainable building practices, employee diversity, and community investment.

Expected Impact:High

- Area:

Value Proposition Nuance

Recommendation:Expand the 'Why Invest' narrative to include innovation and technology as drivers of future returns and competitive advantage, moving beyond the sole focus on capital discipline.

Expected Impact:Medium

Quick Wins

- •

Remove 'Lorem ipsum' text immediately.

- •

Add a headline to the 'Pulte Cares' section on the About page that summarizes its core mission (e.g., 'Building Stronger Communities').

- •

Ensure all executive quotes are authentic and provide strategic insight.

Long Term Recommendations

- •

Conduct a strategic review of how ESG and innovation are communicated across all investor-facing materials, including annual reports and earnings calls, to create a consistent, forward-looking narrative.

- •

Develop a more robust 'About Us' section that tells the PulteGroup story more dynamically, using video or an interactive timeline to engage audiences beyond investors.

- •

Create tailored content hubs for different stakeholders (e.g., 'Why Work at PulteGroup', 'Our Commitment to Sustainability') to provide depth without cluttering the primary investor journey.

The strategic messaging on PulteGroup's corporate website (pultegroupinc.com) is a masterclass in disciplined communication targeted at a single, high-value audience: the financial community. The message architecture is clear, consistent, and relentlessly focused on the drivers of shareholder value—high returns on capital, risk mitigation through diversification, and disciplined capital allocation. The brand voice is appropriately formal, data-driven, and authoritative, effectively building credibility with investors and analysts.

However, this singular focus creates both strengths and weaknesses. The site successfully positions PulteGroup as a financially astute and stable investment, a key differentiator in a cyclical industry. The logical flow of information and direct access to financial data serve this audience perfectly. The primary business objective of attracting and retaining capital is well-supported.

The most significant failure is the presence of 'Lorem ipsum' placeholder text in CEO quote blocks, an unforced error that severely undermines the site's professionalism and contradicts its claims of operational excellence. Furthermore, the messaging is underdeveloped in areas of growing importance to modern investors, namely ESG (Environmental, Social, and Governance) strategy and forward-looking innovation. The narrative is about past performance and current discipline, but largely silent on a vision for the future of housing. This creates a strategic gap, leaving value on the table by not appealing to a broader set of investor criteria and failing to fully engage other key audiences like top-tier executive talent. The immediate priority is to fix the glaring content errors, followed by a strategic initiative to weave a more forward-looking and ESG-conscious narrative into the core investor value proposition.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established as the 3rd largest homebuilder in the U.S. with over 800,000 homes delivered.

- •

Diversified portfolio of six distinct brands (Centex, Pulte, Del Webb, etc.) serving multiple buyer segments: first-time (35%), move-up (39%), and active-adult (26%).

- •

Consistent financial performance, with $18B in 2024 revenue and a strong 27.5% Return on Equity (ROE).

- •

Broad geographic footprint, operating in 25 states and over 45 major markets.

- •

Demonstrated ability to navigate market cycles for over 70 years.

Improvement Areas

- •

Further integration of sustainable materials and energy-efficient designs as standard features to meet growing consumer demand.

- •

Enhanced personalization and customization options through digital tools (virtual tours, 3D walkthroughs) early in the buyer journey.

- •

Accelerate adoption of smart home technology as a core offering across all brands.

Market Dynamics

Moderately Positive. The residential construction market is expected to rebound in 2025, with some forecasts predicting up to 12% growth after a period of decline, driven by stabilizing interest rates and persistent housing shortages. However, other forecasts are more tempered, suggesting a slight decline in 2025 before a stronger rebound.

Mature

Market Trends

- Trend:

Persistent Housing Undersupply

Business Impact:Sustained baseline demand for new construction. The U.S. has an estimated housing shortage of millions of units, providing a long-term tailwind for large-scale builders.

- Trend:

Affordability Crisis & Elevated Interest Rates

Business Impact:High mortgage rates and home prices are sidelining many potential buyers, particularly in the first-time segment. This increases the importance of mortgage rate buydowns and other incentives, potentially compressing margins.

- Trend:

Growth of Build-to-Rent (BTR) Sector

Business Impact:Emergence of a significant new customer segment (institutional investors) and a business model that can provide more predictable revenue streams and large-scale projects.

- Trend:

Demand for Sustainability and Energy Efficiency

Business Impact:Increasing buyer preference for green building materials, net-zero homes, and energy-efficient features, requiring investment in new construction techniques and materials.

- Trend:

Rise of PropTech and ConTech

Business Impact:Opportunity to improve operational efficiency, customer experience, and reduce costs through technologies like off-site manufacturing, AI-powered design, and digital sales platforms.

Favorable. While macroeconomic headwinds like interest rates pose a challenge, the fundamental long-term housing shortage creates a strong underlying demand. PulteGroup's scale and diversified product mix position it well to capture demand as market conditions stabilize.

Business Model Scalability

Medium

High fixed and semi-variable costs related to land holdings, labor, and materials. Scalability is capital-intensive and subject to market cycles.

High. Small changes in home prices or construction costs can have a significant impact on profitability due to high operating leverage.

Scalability Constraints

- •

Land Acquisition: Access to and cost of entitled land is a primary constraint on growth.

- •

Labor Availability: Shortages of skilled construction labor can delay projects and increase costs.

- •

Supply Chain Disruptions: Volatility in the price and availability of building materials impacts timelines and margins.

- •

Regulatory Hurdles: Zoning laws and permitting processes can create significant delays.

Team Readiness

Strong. The company has a stable leadership team with a stated focus on financial discipline (ROIC/ROE) and long-term shareholder value.

Well-established. A decentralized operational structure with division presidents in key markets allows for local market responsiveness, supported by centralized corporate functions.

Key Capability Gaps

- •

Data Science for Land Acquisition: Need for deeper expertise in predictive analytics to identify and underwrite land deals more effectively.

- •

Construction Technology Integration: Requires skilled personnel to implement and manage off-site manufacturing (like their ICG platform) and other ConTech solutions.

- •

Digital Marketing & Sales: Expertise in creating seamless, end-to-end digital homebuying experiences.

Growth Engine

Acquisition Channels

- Channel:

Digital Presence (Company Website, SEO, SEM)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest heavily in SEO to capture high-intent searches. Develop rich content (blogs, guides) around the homebuying process. Implement more sophisticated virtual and 3D tours to improve online engagement.

- Channel:

Real Estate Portals (Zillow, Redfin, etc.)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Ensure premium placement and dynamic, accurate listings. Utilize portal analytics to understand buyer behavior and optimize community marketing spend.

- Channel:

Realtor/Broker Partnerships

Effectiveness:High

Optimization Potential:Medium

Recommendation:Develop a formalized loyalty and incentive program for realtors who consistently bring clients. Host exclusive events and provide dedicated support for the realtor community.

- Channel:

Model Homes & On-site Sales Centers

Effectiveness:High

Optimization Potential:Medium

Recommendation:Integrate digital tools within the model home experience (e.g., AR for visualizing options). Use visitor data to inform targeted digital remarketing campaigns.

Customer Journey

Lengthy and complex, involving multiple stages from online research and model home visits to financing, design selection, construction, and closing. The path is non-linear and highly emotional.

Friction Points

- •

Financing and Affordability Uncertainty: Securing mortgages in a high-interest-rate environment.

- •

Construction Delays: Communication gaps and unforeseen delays during the build process.

- •

Decision Paralysis: Overwhelming number of choices in design centers.

- •

Lack of Transparency: Buyers often feel disconnected from the actual construction progress.

Journey Enhancement Priorities

- Area:

Digital Pre-Qualification & Financing

Recommendation:Enhance the Pulte Mortgage digital platform to provide a seamless, transparent, and quick pre-qualification and application process.

- Area:

Construction Progress Visibility

Recommendation:Develop a customer portal or app that provides regular, automated updates with photos and key milestones during the construction phase.

- Area:

Virtual Design & Configuration

Recommendation:Invest in high-fidelity online tools that allow buyers to visualize and select finishes and upgrades from home, reducing in-person appointment time and improving decision confidence.

Retention Mechanisms

- Mechanism:

Brand Loyalty Across Life Stages

Effectiveness:High

Improvement Opportunity:Create a formal 'Move-Up' program that offers incentives for existing Centex or Pulte homeowners to purchase a Del Webb or John Wieland home, facilitating seamless transitions through their life stages.

- Mechanism:

Customer Referral Programs

Effectiveness:Medium

Improvement Opportunity:Digitize and promote the referral program more actively post-closing. Offer tiered rewards or unique experiences instead of just cash incentives to increase participation.

- Mechanism:

Home Warranty & Customer Service

Effectiveness:Moderate

Improvement Opportunity:Invest in a proactive, rather than reactive, post-closing customer service model. Use technology for easier scheduling of warranty work and provide homeowners with a digital hub for all their home's information and maintenance needs.

Revenue Economics

Strong. The company's stated focus on high ROIC and ROE, coupled with its disciplined land investment and capital allocation strategy, indicates healthy project-level and overall profitability.

Not Applicable (Adapted: Return on Invested Capital). PulteGroup's strategic focus is on maximizing ROIC, which they report as a key driver of shareholder value. Their disciplined land investment is central to this.

High. As a top-3 builder, PulteGroup leverages its scale for purchasing materials, labor, and land, driving significant revenue from its capital and operational base.

Optimization Recommendations

- •

Expand off-site manufacturing (ICG platform) to more markets to reduce construction cycle times, improve quality, and lower waste/labor costs.

- •

Utilize more land option agreements to reduce capital intensity and improve balance sheet efficiency, aligning with their long-term goal of 70% optioned lots.

- •

Implement dynamic pricing models based on real-time demand, inventory levels, and local market analytics.

Scale Barriers

Construction And Supply Chain

- Limitation:

Off-site Manufacturing Capacity

Impact:Medium

Solution Approach:Continue executing the strategic plan to expand the Innovative Construction Group (ICG) platform to 6-8 plants nationwide to serve more divisions, thereby reducing reliance on on-site framing labor and shortening cycle times.

- Limitation:

Supply Chain Volatility

Impact:High

Solution Approach:Deepen partnerships with national suppliers for priority access and pricing. Diversify sourcing for critical materials and invest in warehousing for key components to buffer against disruptions.

Operational Bottlenecks

- Bottleneck:

Land Entitlement and Permitting

Growth Impact:This is a primary constraint on the pace of new community openings, directly impacting revenue growth.

Resolution Strategy:Invest in dedicated, in-house entitlement teams with deep local relationships. Utilize technology to track and manage the complex permitting process across hundreds of municipalities.

- Bottleneck:

Skilled Labor Shortages

Growth Impact:Increases cycle times, raises construction costs, and can impact build quality.

Resolution Strategy:Expand partnerships with trade schools and develop internal training programs. Strengthen relationships with subcontractors to become their 'builder of choice'. Increase adoption of labor-saving technologies like ICG.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Compete on operational excellence, build quality, and customer experience rather than just price. Leverage the diversified brand portfolio to target specific niches (e.g., active adult) where competition may be less direct. Key competitors include D.R. Horton and Lennar.

- Challenge:

Economic Sensitivity

Severity:Major

Mitigation Strategy:Maintain a strong balance sheet with prudent leverage. Flexibly use mortgage buydowns and other incentives to manage demand in volatile rate environments. The diversified buyer segments (first-time, move-up, active adult) provide a natural hedge against downturns affecting a single group.

- Challenge:

Land Availability in Desirable Locations

Severity:Major

Mitigation Strategy:Employ a disciplined, data-driven land acquisition strategy focusing on long-term value. Increase the use of land option contracts to control lots without significant upfront capital investment, improving flexibility.

Resource Limitations

Talent Gaps

- •

Construction Technologists & Automation Specialists

- •

Data Scientists (for land, pricing, and marketing)

- •

Digital Customer Experience Designers

High and ongoing. Growth is directly tied to capital investment in land acquisition and development. The current capital allocation strategy appears robust and well-funded through operations.

Infrastructure Needs

Expansion of ICG off-site manufacturing facilities.

Investment in a unified digital platform connecting sales, design, construction, and customer service.

Growth Opportunities

Market Expansion

- Expansion Vector:

Build-to-Rent (BTR) Institutional Sales

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Formalize and expand the BTR division beyond existing partnerships (like the one with Invitation Homes). Dedicate design, land acquisition, and construction resources to serve institutional capital, creating a new, large-scale revenue channel amid housing affordability challenges.

- Expansion Vector:

Deeper Penetration in High-Growth Sun Belt Markets

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Double down on land acquisition and community development in markets like Texas, Florida, and Arizona, where demographic trends favor long-term housing demand, even with current market cooling.

- Expansion Vector:

Entry into Adjacent, Underserved Tier-2 Markets

Potential Impact:Medium

Implementation Complexity:High

Recommended Approach:Conduct rigorous market analysis to identify smaller but growing markets adjacent to current operations. Enter via smaller, targeted land acquisitions or by acquiring a small local builder to establish a foothold.

Product Opportunities

- Opportunity:

Standardized Sustainable/Net-Zero Home Packages

Market Demand Evidence:Growing consumer and regulatory pressure for energy efficiency and reduced carbon footprints.

Strategic Fit:Strong. Aligns with ESG goals and positions brands as premium and forward-thinking. PulteGroup has already stated a goal for new homes to be ENERGY STAR certified.

Development Recommendation:Develop tiered 'Green Packages' as options, eventually moving to a 'Sustainable Standard' for certain brands or communities. Highlight long-term cost savings for homeowners.

- Opportunity:

Development of More Attainable/Affordable Housing

Market Demand Evidence:Significant market gap due to the national housing affordability crisis.

Strategic Fit:Excellent, particularly for the Centex brand.

Development Recommendation:Leverage off-site manufacturing (ICG) and value engineering to develop a new line of smaller, more efficiently designed homes. Explore partnerships with municipalities on zoning for higher-density projects.

- Opportunity:

Smart Home & Connected Community Services

Market Demand Evidence:Increasing consumer expectation for homes to be tech-enabled.

Strategic Fit:Strong. Enhances the value proposition and creates potential for recurring revenue.

Development Recommendation:Forge a strategic partnership with a leading smart home platform (e.g., Google Home, Amazon Alexa) for deep integration. Pilot community-wide connectivity services (e.g., high-speed internet, security) as a recurring revenue stream in Del Webb communities.

Channel Diversification

- Channel:

End-to-End Digital Homebuying Platform

Fit Assessment:High

Implementation Strategy:Invest in or acquire a PropTech company to build a platform that allows customers to select lots, configure homes, secure financing, and sign contracts entirely online, streamlining the process and attracting digitally native buyers.

- Channel:

Institutional Sales Channel for BTR

Fit Assessment:High

Implementation Strategy:Create a dedicated sales and business development team focused on building relationships with large institutional investors (pension funds, REITs) in the single-family rental space.

Strategic Partnerships

- Partnership Type:

Technology & Smart Home Integration

Potential Partners

- •

Google

- •

Amazon

- •

Apple

- •

Leading home security providers

Expected Benefits:Offer fully integrated, move-in ready smart homes as a key differentiator. Potential for preferential pricing and co-marketing opportunities.

- Partnership Type:

Sustainable Technology & Materials

Potential Partners

- •

Tesla (Solar Roof, Powerwall)

- •

Manufacturers of advanced insulation and sustainable materials

- •

Water conservation tech companies

Expected Benefits:Accelerate progress toward sustainability goals, enhance brand reputation, and provide homeowners with lower utility costs.

- Partnership Type:

Construction Technology (ConTech) Startups

Potential Partners

- •

Robotics and automation firms

- •

Project management software platforms

- •

Drone survey and inspection companies

Expected Benefits:Gain early access to innovative technologies that can reduce costs, shorten cycle times, and improve job site safety. Potential for corporate venture capital investments.

Growth Strategy

North Star Metric

Return on Invested Capital (ROIC)

This metric is already central to PulteGroup's stated strategy and aligns perfectly with a capital-intensive business. It ensures that growth is not pursued at the expense of profitability and efficient use of capital, balancing land investment, construction costs, and sales velocity.

Sustain top-quartile ROIC performance relative to the public homebuilder peer group while increasing annual home closings by 5-7%.

Growth Model

Scale & Efficiency-Led Growth

Key Drivers

- •

Disciplined Land Acquisition & Development

- •

Operational Efficiency (Cycle Time Reduction)

- •

Brand Portfolio Management

- •

Strategic Capital Allocation

A continuous flywheel of acquiring land in high-growth markets, using scale and technology (ICG) to build efficiently, marketing through a diversified brand portfolio to capture various buyer segments, and redeploying the generated capital into the next wave of high-return land investments.

Prioritized Initiatives

- Initiative:

Launch a Formalized Build-to-Rent (BTR) Division

Expected Impact:High

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Appoint a leader for the BTR division. Expand relationships with institutional investors beyond existing partners. Allocate capital specifically for BTR land acquisition.

- Initiative:

Accelerate ICG (Off-site Manufacturing) Expansion

Expected Impact:High

Implementation Effort:High

Timeframe:24-36 months

First Steps:Finalize site selection for the next two ICG plants based on divisional construction volume and labor market analysis. Secure capital for plant development.

- Initiative:

Develop a Fully Digital Home Configuration & Sales Platform

Expected Impact:Medium

Implementation Effort:High

Timeframe:18-24 months

First Steps:Map the entire customer journey to identify key digitalization opportunities. Evaluate build vs. buy vs. partner options for the core technology platform. Launch a pilot program in a single market.

- Initiative:

Pilot 'Attainable Housing' Product Line with Centex

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12 months

First Steps:Initiate a design sprint focused on value engineering and smaller-footprint homes. Identify land parcels suitable for higher-density products. Engage with municipalities on zoning.

Experimentation Plan

High Leverage Tests

- Test:

Dynamic Pricing Pilot

Hypothesis:Implementing real-time, data-driven price adjustments in a high-velocity community will increase overall margin by 50 basis points without significantly impacting sales pace.

- Test:

Virtual Reality Design Center

Hypothesis:Offering a VR-based design selection process in one sales center will decrease the average design appointment time by 30% and increase customer satisfaction scores by 15%.

- Test:

Targeted Incentives Experiment

Hypothesis:A/B testing different incentive packages (e.g., rate buydown vs. closing cost credit vs. design studio credit) will reveal which offer has the highest conversion rate for the first-time buyer segment.

Utilize a combination of operational KPIs (sales velocity, cycle time), financial metrics (gross margin, ROIC), and customer metrics (Net Promoter Score, customer satisfaction) to evaluate experiment outcomes.

Quarterly review of ongoing experiments and prioritization of the next testing cycle, managed by a central growth or strategy team.

Growth Team

A centralized 'Strategic Growth & Innovation' team that works cross-functionally with division leaders. This team would be responsible for identifying and piloting new initiatives (BTR, PropTech), managing the experimentation process, and scaling successful programs across the organization.

Key Roles

- •

Head of Growth & Innovation

- •

Director of Build-to-Rent Strategy

- •

Construction Technology Manager

- •

Customer Experience (CX) Strategist

- •

Data Scientist

Acquire key talent externally for new domains like data science and BTR. Develop internal talent through rotational programs that expose high-potential employees to growth initiatives. Foster a culture of experimentation by celebrating learning from both successful and failed tests.

PulteGroup possesses a formidable growth foundation built on strong product-market fit, a diversified brand portfolio, and a disciplined financial strategy. As one of the nation's largest homebuilders, its core business is robust and well-positioned to capitalize on the long-term, fundamental undersupply of housing in the United States. The company has a mature, scalable operational model, though its growth is inherently constrained by the capital-intensive nature of land development and external factors like labor availability and supply chain stability.

The primary barriers to accelerated growth are macroeconomic headwinds, particularly interest rate sensitivity and housing affordability, along with intense competition from other large-scale builders. Internally, operational bottlenecks in land entitlement and skilled labor shortages represent the most significant constraints on increasing production velocity.

Significant growth opportunities lie in adapting to major market shifts rather than simply expanding the current model. The most promising vector is the rapidly growing Build-to-Rent (BTR) sector. By formalizing and scaling a division dedicated to building entire communities for institutional rental owners, PulteGroup can unlock a massive, counter-cyclical revenue stream that is less sensitive to individual mortgage rate fluctuations. This represents the single largest strategic opportunity for durable, long-term growth.