eScore

rockwellautomation.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Rockwell Automation demonstrates a formidable digital presence, characterized by exceptional content authority and depth. The website serves as a comprehensive hub for industrial automation topics, effectively aligning with the high-intent queries of its technical B2B audience. Its global reach is evident through localized and region-specific content, while its strong domain authority is built upon a vast library of expert materials and thought leadership reports.

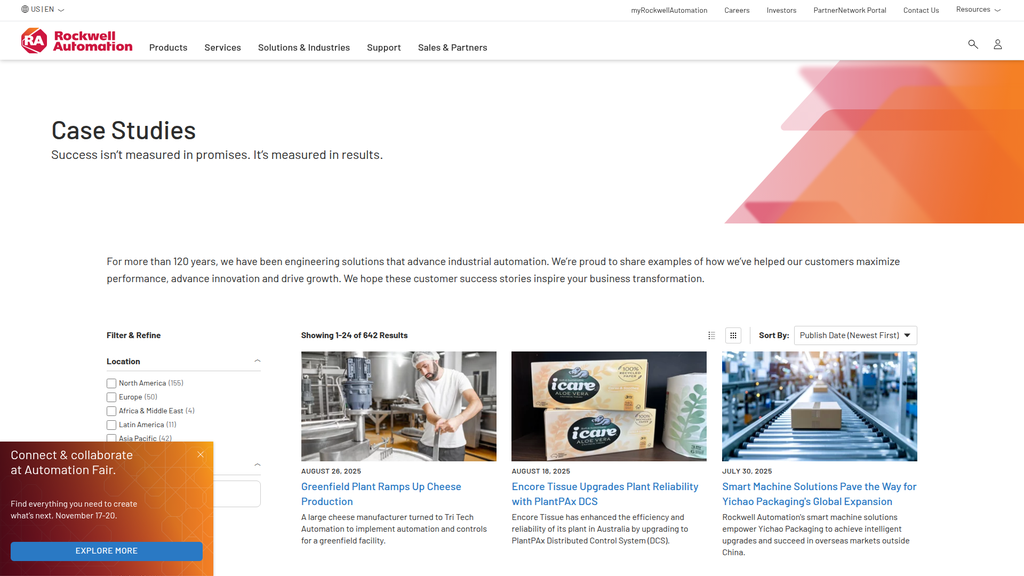

The extensive library of over 640 detailed case studies establishes immense content authority and captures a vast range of specific, long-tail search queries across numerous industries.

Address the competitive gap in interactive and video-based content by developing solution configurators, ROI calculators, or video demonstrations to make complex solutions more tangible and engaging.

The brand's messaging is exceptionally consistent, authoritative, and effectively segmented for different technical and executive personas. It excels at communicating a results-oriented value proposition, backed by overwhelming proof from case studies. However, the communication is highly rational and professional, lacking an immediate emotional connection on the homepage to engage visitors who are new to the brand.

The messaging consistently translates complex technical solutions into tangible business outcomes (e.g., improved efficiency, sustainability, resilience), which resonates strongly with both engineering and C-suite audiences.

Weave a more human-centric narrative into the homepage messaging, potentially featuring a customer video testimonial, to complement the logical appeal with a stronger emotional hook.

The conversion experience is hindered by significant friction points, particularly on pages with advanced filtering tools. The analysis reveals that filter overload and a lack of clear hierarchy create a high cognitive load for users, potentially leading to task abandonment. While individual conversion elements like case study cards are effective, primary lead-generation CTAs are visually understated and lack compelling, action-oriented copy.

The use of a clean, scannable card-based layout for case studies is an effective design pattern for browsing and selecting content.

Redesign the filter panel on the case studies page using collapsible accordion sections to drastically reduce initial cognitive load and make the powerful filtering tools more user-friendly.

Rockwell Automation projects extremely high credibility through its 120-year history, extensive public commitment to accessibility and industry standards (IEC 62443), and a massive repository of customer success evidence. This deep-seated trust is a core asset, turning compliance into a competitive advantage. The primary risk identified is in digital marketing compliance, specifically a 'cookie wall' that presents a high risk under GDPR.

Leveraging compliance with industry-specific operational technology standards (like IEC 62443) as a strategic asset to build trust and gain market access in critical infrastructure sectors.

Immediately remediate the high-risk 'cookie wall' by implementing a GDPR-compliant consent banner that does not block content and provides equally prominent 'accept' and 'reject' options.

The company's competitive moat is deep and sustainable, built upon the powerful brand loyalty of its Allen-Bradley hardware and the massive installed base that creates extremely high switching costs. This advantage is further fortified by an extensive and loyal network of distributors and system integrators. While competitors are strong, displacing Rockwell from its entrenched position, particularly in North America, is exceptionally difficult.

The deeply entrenched installed base of Allen-Bradley hardware, combined with extensive engineer training and parts inventories, creates a powerful and lasting barrier to switching for customers.

Develop more content and marketing strategies to directly address the market perception of being a premium-priced provider, focusing on Total Cost of Ownership (TCO) and long-term ROI.

Rockwell is well-positioned for growth, capitalizing on strong market tailwinds like Industry 4.0 and digital transformation. The business model shows high potential for scaling its high-margin software and recurring services revenue by leveraging its vast hardware install base. However, growth is constrained by the complexity of integrating its vast portfolio and a reliance on a less-scalable, high-touch sales and services model for complex solutions.

The ability to monetize its massive installed hardware base by cross-selling high-margin, highly scalable SaaS solutions (like Plex and FactoryTalk) presents the most significant and efficient path for growth.

Accelerate the technical integration of its software portfolio (Plex, Fiix, FactoryTalk) to create a unified platform, reducing complexity and shortening sales and implementation cycles.

Rockwell's business model is robust, coherent, and strategically aligned with major market trends. The synergistic relationship between its three segments—Intelligent Devices, Software & Control, and Lifecycle Services—is a core strength, creating a flywheel effect where the hardware base fuels software and service sales. The strategic pivot towards recurring software revenue is a logical and necessary evolution of this model.

The business model's synergistic design, where a large installed base of hardware creates a captive market for upselling high-margin software and recurring-revenue services, is a powerful and coherent growth engine.

Innovate the revenue model further by developing and piloting 'Outcome-as-a-Service' offerings, shifting from selling technology to selling guaranteed performance metrics like OEE improvement or energy reduction.

As a top-tier player in an oligopolistic market, Rockwell Automation wields significant market power, particularly in North America. Its strong brand, extensive partner network, and large installed base give it considerable pricing power and the ability to influence industry standards. The company's strategic focus on the 'Connected Enterprise' narrative helps shape market direction towards integrated, holistic solutions.

Market leadership and brand dominance in the North American industrial automation market provide significant pricing power and a strong negotiating position with partners and suppliers.

Implement more aggressive strategies to counter the stronger market position of competitors like Siemens in the European and Asian markets to achieve more balanced global market leadership.

Business Overview

Business Classification

Industrial Technology & Solutions Provider

Professional Services & Consulting

Industrial Automation & Digital Transformation

Sub Verticals

- •

Aerospace

- •

Automotive & Tire

- •

Food & Beverage

- •

Life Sciences

- •

Oil & Gas

- •

Metals & Mining

- •

Power Generation

- •

Water Wastewater

- •

Semiconductor

- •

Chemical

Mature

Maturity Indicators

- •

Over 120 years of company history

- •

Extensive global presence in over 100 countries.

- •

Large, diversified portfolio of hardware, software, and services

- •

Significant installed base providing recurring revenue opportunities.

- •

Strong brand recognition (Rockwell Automation, Allen-Bradley).

- •

Established and extensive partner and distributor network.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Intelligent Devices (Hardware)

Description:Sale of industrial automation hardware components, including PLCs, drives, sensors, motors, and safety systems under brands like Allen-Bradley. This forms the foundational layer of their offerings.

Estimated Importance:Primary

Customer Segment:OEMs, System Integrators, Large Enterprise Manufacturers

Estimated Margin:Medium

- Stream Name:

Software & Control

Description:Licensing and subscription sales for software platforms such as FactoryTalk Suite, Plex MES/ERP, and Arena simulation software. This is a key growth area, driving digital transformation.

Estimated Importance:Secondary

Customer Segment:Large Enterprise Manufacturers, Mid-Market Manufacturers

Estimated Margin:High

- Stream Name:

Lifecycle Services

Description:Comprehensive support and professional services including consulting, system integration, maintenance contracts, cybersecurity assessments, and workforce training. This stream generates recurring revenue and deepens customer relationships.

Estimated Importance:Secondary

Customer Segment:Large Enterprise Manufacturers, Complex Operations

Estimated Margin:Medium

Recurring Revenue Components

- •

Software-as-a-Service (SaaS) subscriptions (e.g., Plex, FactoryTalk cloud offerings)

- •

Annual maintenance and support contracts for hardware and software

- •

Managed services (e.g., cybersecurity, remote monitoring)

Pricing Strategy

Value-Based & Solution Selling

Premium

Opaque

Pricing Psychology

- •

Bundling (hardware, software, and service packages)

- •

Tiered Offerings (especially for software and support levels)

- •

Solution Selling (focusing on ROI, TCO, and business outcomes)

Monetization Assessment

Strengths

- •

Diversified revenue across hardware, software, and services reduces dependency on any single stream.

- •

Large installed hardware base creates a captive market for high-margin software and services.

- •

High customer switching costs due to deep integration and specialized employee training.

- •

Growing base of recurring revenue from software and services provides stability and predictability.

Weaknesses

- •

Revenue is susceptible to cyclical industrial capital expenditure trends.

- •

Complex and long sales cycles for large-scale integrated solutions.

- •

Potential for channel conflict between direct sales and system integrator partners.

Opportunities

- •

Accelerate the transition to SaaS and subscription models to increase recurring revenue.

- •

Expand service offerings in high-growth areas like industrial cybersecurity, sustainability, and AI/ML-driven analytics.

- •

Develop 'outcome-as-a-service' models, selling guaranteed performance metrics instead of products.

- •

Leverage generative AI to improve software development and create new value-added services.

Threats

- •

Intense competition from large industrial conglomerates (Siemens, Schneider Electric, ABB) and agile, software-focused startups.

- •

Global economic downturns impacting manufacturing investment.

- •

Cybersecurity vulnerabilities in connected industrial products could damage brand reputation.

- •

Rapid technological shifts requiring continuous, significant R&D investment.

Market Positioning

Integrated Solutions Leader for Industrial Automation & Digital Transformation

Top-tier player, often cited as a market leader in key segments like PLCs in North America.

Target Segments

- Segment Name:

Large Enterprise Manufacturer

Description:Global corporations operating multiple plants, often in regulated industries like life sciences or automotive, seeking to standardize operations, improve global visibility, and drive enterprise-wide digital transformation.

Demographic Factors

- •

Fortune 500 / Global 2000 companies

- •

Multi-site, international operations

- •

High capital expenditure budgets

Psychographic Factors

- •

Focused on ROI, total cost of ownership (TCO), and shareholder value

- •

Risk-averse, valuing reliability and long-term partnerships

- •

Seeking strategic advantage through technology

Behavioral Factors

- •

Long, complex procurement cycles

- •

Top-down decision-making process involving C-level executives

- •

Purchase comprehensive solutions, not just point products

Pain Points

- •

Integrating legacy OT systems with modern IT infrastructure

- •

Ensuring cybersecurity across a global footprint

- •

Lack of real-time visibility into production performance

- •

Meeting complex regulatory and sustainability reporting requirements

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Original Equipment Manufacturer (OEM)

Description:Companies that design and build industrial machinery for various end-users (e.g., packaging, textiles, material handling). They embed automation technology into their products.

Demographic Factors

- •

Small to large enterprises

- •

Specialized in a specific machine type or industry

- •

Global customer base

Psychographic Factors

- •

Value performance, reliability, and ease of integration

- •

Seek to differentiate their machines through advanced features

- •

Need strong technical support from vendors

Behavioral Factors

- •

Component-based purchasing decisions

- •

Long-term relationships with preferred automation suppliers

- •

Sensitive to engineering and development time

Pain Points

- •

Reducing machine development and commissioning time

- •

Providing remote support and diagnostics for their machines

- •

Ensuring their machines meet diverse global safety and performance standards

- •

Controlling bill-of-materials (BOM) cost

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

System Integrator (SI)

Description:Engineering firms that design, build, and implement control and automation systems for end-users. They are a critical channel partner, providing project-based solutions.

Demographic Factors

- •

Typically small-to-medium-sized businesses (SMBs)

- •

Often specialized by industry or application

- •

Geographically focused

Psychographic Factors

- •

Value strong partnerships and technical support

- •

Seek reliable and flexible technology platforms

- •

Profitability is tied to project efficiency

Behavioral Factors

- •

Purchase hardware and software on a per-project basis

- •

Require training and certification on vendor products

- •

Act as trusted advisors to end-user clients

Pain Points

- •

Access to quality technical support and training

- •

Ease of programming and system configuration

- •

Competitive pricing and product availability

- •

Integration challenges between multi-vendor products

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

Integrated Portfolio ('The Connected Enterprise')

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Reputation and Reliability

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive Partner Ecosystem

Strength:Strong

Sustainability:Sustainable

- Factor:

Large Installed Customer Base

Strength:Strong

Sustainability:Sustainable

Value Proposition

Rockwell Automation is the global leader in industrial automation and digital transformation, uniting human ingenuity with machine potential to expand what's possible. We deliver an integrated portfolio of industry-leading hardware, software, and services to make your operations more productive, resilient, and sustainable.

Excellent

Key Benefits

- Benefit:

Optimize Production

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Case Study: Hexcel reduces downtime by 80%

Case Study: Jay Industries increases OEE

- Benefit:

Accelerate Digital Transformation

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Case Study: Maple Leaf Foods leverages AR and digital twins for a competitive edge

Comprehensive FactoryTalk and Plex software suites

- Benefit:

Build Resilience

Importance:Important

Differentiation:Common

Proof Elements

Cybersecurity solutions to reduce threat response time

Case Study: Encore Tissue upgrades plant reliability with PlantPAx DCS

- Benefit:

Drive Sustainability

Importance:Important

Differentiation:Common

Proof Elements

Case Study: Advancing Sustainability Through Smart Manufacturing at their own facility

Energy monitoring hardware and optimization solutions

Unique Selling Points

- Usp:

The 'Connected Enterprise' vision provides a holistic, integrated roadmap from the plant floor to the enterprise level.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A single-vendor, tightly integrated hardware (Allen-Bradley) and software (FactoryTalk) ecosystem, ensuring compatibility and simplified support.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Plex cloud-native smart manufacturing platform offers a scalable, multi-tenant SaaS solution for MES and ERP, differentiating from traditional on-premise offerings.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Operational Inefficiency and Downtime

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Lack of Real-Time Data and Visibility

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Cybersecurity Risks in OT Environments

Severity:Major

Solution Effectiveness:Partial

- Problem:

Difficulty Scaling Operations and New Product Introductions

Severity:Major

Solution Effectiveness:Complete

- Problem:

Pressure to Meet Sustainability Goals

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition directly addresses the core market drivers of Industry 4.0, digital transformation, supply chain resilience, and sustainability.

High

The messaging and solutions are tailored to the specific pain points of key segments, from OEMs needing reliable components to large enterprises requiring scalable, integrated systems.

Strategic Assessment

Business Model Canvas

Key Partners

- •

System Integrators & Solution Partners.

- •

Technology Alliance Partners (e.g., Microsoft, Cisco, PTC).

- •

Authorized Distributors.

- •

OEMs

Key Activities

- •

Research & Development (Hardware & Software).

- •

Manufacturing of control systems and hardware.

- •

Solution Engineering & System Integration

- •

Global Sales & Marketing

- •

Customer Support, Training & Lifecycle Services

Key Resources

- •

Intellectual Property (Patents, Software)

- •

Strong Brand Equity (Rockwell, Allen-Bradley)

- •

Global Sales and Distribution Network.

- •

Skilled Engineering and Technical Workforce

- •

Large Installed Customer Base

Cost Structure

- •

Cost of Goods Sold (Manufacturing)

- •

Selling, General & Administrative (SG&A) Expenses

- •

Research & Development (R&D) Investment

- •

Employee Salaries and Benefits

Swot Analysis

Strengths

- •

Market leadership and strong brand recognition.

- •

Comprehensive, integrated portfolio of hardware, software, and services.

- •

Large, loyal installed base with high switching costs.

- •

Extensive global presence and partner network.

Weaknesses

- •

High dependence on cyclical manufacturing and industrial capital spending.

- •

Perception of being a high-cost, premium provider.

- •

Complexity in integrating a vast portfolio and transitioning the sales force to a solution-selling model.

- •

Potential for slower growth compared to smaller, more agile competitors.

Opportunities

- •

Massive market growth in IIoT, smart manufacturing, and Industry 4.0 adoption.

- •

Expansion of high-margin SaaS and recurring revenue services.

- •

Growing demand for industrial cybersecurity and sustainability solutions.

- •

Leveraging AI and machine learning to create smarter, more autonomous control systems.

Threats

- •

Intense competition from industrial giants like Siemens, ABB, and Emerson.

- •

Emergence of disruptive, cloud-native IIoT software companies.

- •

Global economic slowdown or recession impacting customer budgets.

- •

Increasingly sophisticated cybersecurity threats targeting industrial control systems.

Recommendations

Priority Improvements

- Area:

Go-to-Market Strategy

Recommendation:Further streamline the go-to-market motion for integrated solutions. Create bundled, outcome-based packages that simplify the buying process for customers seeking a full 'Connected Enterprise' solution, reducing friction between hardware, software, and service sales.

Expected Impact:High

- Area:

Software User Experience (UX)

Recommendation:Continue investing heavily in the UX/UI of the FactoryTalk suite and other software products to ensure they are as intuitive and easy to use as modern enterprise SaaS platforms. This will accelerate adoption and reduce the need for extensive training.

Expected Impact:Medium

- Area:

Partner Enablement

Recommendation:Develop advanced training and certification programs for system integrators focused on software, cybersecurity, and cloud solutions. This ensures the partner channel can effectively sell and deliver the next generation of Rockwell's offerings.

Expected Impact:Medium

Business Model Innovation

- •

Develop an 'Outcome-as-a-Service' offering, where customers pay a recurring fee for guaranteed results (e.g., % OEE improvement, % reduction in energy consumption) rather than purchasing the underlying technology.

- •

Launch a 'Data-as-a-Service' (DaaS) product that provides customers with anonymized, aggregated industry benchmark data for key performance indicators, allowing them to compare their operational efficiency against peers.

- •

Create a dedicated 'Digital Twin Marketplace' where Rockwell and its partners can sell pre-built simulation models and digital twin components to accelerate development for customers.

Revenue Diversification

- •

Formalize and expand the OT Cybersecurity consulting and managed services division into a standalone business unit to capture the significant market demand for securing industrial environments.

- •

Build a dedicated Sustainability Solutions Group that packages hardware (energy monitors, sensors) and software (analytics platforms) into a comprehensive solution to help customers achieve and report on their ESG goals.

- •

Further invest in industry-specific software applications, potentially through acquisition, to deepen penetration in high-growth verticals like life sciences, electric vehicles, and renewable energy.

Rockwell Automation has successfully navigated a critical transformation from a premier industrial hardware manufacturer to a comprehensive industrial automation and digital solutions provider. The company's business model is robust, built on the synergistic strength of its three core segments: Intelligent Devices, Software & Control, and Lifecycle Services. This integrated portfolio, marketed under the 'Connected Enterprise' vision, represents its primary and most sustainable competitive advantage. The large, loyal installed base of Allen-Bradley hardware creates significant barriers to entry and high switching costs, providing a fertile ground for upselling high-margin software and recurring-revenue services.

The strategic shift towards software, particularly with the acquisition of Plex and the expansion of the FactoryTalk suite, is pivotal for future growth. It positions Rockwell to capitalize on the secular trends of Industry 4.0, cloud adoption, and data analytics. However, this evolution is not without challenges. The core business remains tied to cyclical industrial capital spending, and the company faces intense competition from both legacy giants like Siemens and agile, cloud-native software startups.

The primary strategic opportunity lies in accelerating the transition to a more recurring, outcome-based revenue model. By simplifying the customer journey to adopt integrated solutions and innovating with 'as-a-service' models, Rockwell can enhance revenue predictability and deepen customer entrenchment. Continued investment in high-growth adjacencies like cybersecurity and sustainability will be crucial for diversification. The company's future success will be defined by its ability to fully integrate its vast portfolio into seamless, scalable solutions and to evolve its sales and partner channels to effectively deliver the full value of the Connected Enterprise to a market in the midst of profound digital transformation.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Initial Capital Investment

Impact:High

- Barrier:

Strong Brand Loyalty and High Switching Costs

Impact:High

- Barrier:

Extensive Distribution and Partner Networks

Impact:High

- Barrier:

Deep Technological Expertise and Patent Portfolios

Impact:High

- Barrier:

Complex Regulatory and Standards Compliance

Impact:Medium

Industry Trends

- Trend:

Digital Transformation (Industry 4.0/Smart Manufacturing)

Impact On Business:Drives demand for Rockwell's software (FactoryTalk, Plex) and integrated hardware. Creates opportunities for higher-margin consulting and service revenue.

Timeline:Immediate

- Trend:

Industrial Internet of Things (IIoT) and Edge Computing

Impact On Business:Increases the need for connected hardware and software to collect, process, and analyze data at the source. Rockwell's FactoryTalk Edge Gateway is a direct response to this.

Timeline:Immediate

- Trend:

Artificial Intelligence (AI) and Machine Learning (ML)

Impact On Business:AI/ML is being integrated for predictive maintenance, quality control, and process optimization, creating a new battleground for software-defined value.

Timeline:Near-term

- Trend:

Sustainability and Energy Efficiency

Impact On Business:Customers demand solutions to monitor and reduce energy consumption and emissions, opening a market for Rockwell's energy monitoring hardware and sustainability-focused solutions.

Timeline:Near-term

- Trend:

Cybersecurity for Operational Technology (OT)

Impact On Business:The convergence of IT and OT expands the attack surface for manufacturers, driving significant demand for specialized OT cybersecurity services and solutions, an area of growth for Rockwell.

Timeline:Immediate

Direct Competitors

- →

Siemens

Market Share Estimate:Major global player, often cited as #1 or #2 with Rockwell.

Target Audience Overlap:High

Competitive Positioning:Positions as a global leader in electrification, automation, and digitalization with a highly integrated technology portfolio (Totally Integrated Automation - TIA Portal).

Strengths

- •

Dominant market position in Europe and Asia.

- •

Highly integrated hardware and software ecosystem (TIA Portal) is powerful for complex projects.

- •

Strong portfolio in process automation (Simatic PCS 7) and digital twin software (Xcelerator).

- •

Significant R&D investment and a broad industrial footprint beyond just automation.

Weaknesses

- •

Perceived as more complex to program and implement for smaller applications compared to Rockwell.

- •

Less dominant market share in the North American discrete manufacturing sector.

- •

Can be slower to navigate as a large, complex organization.

Differentiators

Totally Integrated Automation (TIA) Portal provides a unified engineering environment for PLCs, HMIs, and drives.

Comprehensive 'Digital Twin' capabilities, spanning product design, production planning, and performance.

- →

Schneider Electric

Market Share Estimate:Significant global player, particularly strong in energy management and industrial software.

Target Audience Overlap:High

Competitive Positioning:Focuses on energy management and automation, with its EcoStruxure platform as a key differentiator for IIoT and open connectivity.

Strengths

- •

Strong focus on energy efficiency and sustainability solutions.

- •

EcoStruxure platform is designed to be open and interoperable across different vendors.

- •

Significant software portfolio, including AVEVA for industrial software.

- •

Strong presence in building automation and energy infrastructure, which can be leveraged for industrial clients.

Weaknesses

- •

Historically less dominant in high-end PLC control for complex discrete automation compared to Rockwell and Siemens.

- •

Brand recognition in the pure factory automation space can be lower than Allen-Bradley in North America.

- •

Portfolio can be perceived as less integrated than Siemens' TIA Portal.

Differentiators

EcoStruxure: An open, interoperable, IoT-enabled system architecture.

Strong emphasis on connecting OT with IT through their open platform.

- →

ABB

Market Share Estimate:Major global player, especially strong in robotics, electrification, and process automation.

Target Audience Overlap:High

Competitive Positioning:Positions as a technology leader in electrification, robotics, automation, and motion, with the ABB Ability™ digital platform connecting their portfolio.

Strengths

- •

Global leader in industrial robotics.

- •

Strong portfolio in process automation (DCS) and electrification.

- •

ABB Ability™ is a comprehensive digital offering for connecting devices and systems.

- •

Extensive global footprint and service network.

Weaknesses

- •

Discrete automation controller (PLC) market share is smaller than Rockwell and Siemens.

- •

The integration of their various acquisitions into a single cohesive digital platform can be complex.

- •

Less penetration in the North American mid-market for factory automation.

Differentiators

World-leading industrial and collaborative robotics portfolio.

ABB Ability™ platform for industry-specific digital solutions.

- →

Emerson Electric

Market Share Estimate:Strong player, particularly in process automation.

Target Audience Overlap:Medium

Competitive Positioning:Focuses heavily on process automation industries (Chemical, Oil & Gas, Power, Life Sciences) with a portfolio of software, control systems, and instrumentation.

Strengths

- •

Market leader in process automation with its DeltaV distributed control system (DCS).

- •

Strong portfolio of measurement and control instrumentation.

- •

Deep domain expertise in specific process industries.

- •

Growing software business (AspenTech) focused on asset performance management and optimization.

Weaknesses

- •

Significantly smaller presence in the discrete and factory automation markets compared to Rockwell.

- •

Brand is not as synonymous with PLCs and motion control.

- •

Their offerings are more specialized, targeting fewer of Rockwell's core industries.

Differentiators

Deep focus on process control and instrumentation.

Plantweb digital ecosystem for asset performance management.

Indirect Competitors

- →

Amazon Web Services (AWS)

Description:Provides a suite of cloud services (AWS IoT) that enable industrial companies to connect devices, collect data, and build IIoT applications, competing with Rockwell's cloud software offerings.

Threat Level:Medium

Potential For Direct Competition:Low (in hardware), High (in industrial cloud/analytics software)

- →

Microsoft Azure

Description:Offers the Azure IoT platform, a direct competitor to AWS IoT and Rockwell's cloud-based software and analytics. Rockwell also partners with Microsoft, creating a complex relationship.

Threat Level:Medium

Potential For Direct Competition:Low (in hardware), High (in industrial cloud/analytics software)

- →

SAP

Description:Provides Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) software that competes directly with Rockwell's Plex and FactoryTalk MES offerings.

Threat Level:Medium

Potential For Direct Competition:Medium (in the software layer)

- →

Accenture

Description:As a global systems integrator and consulting firm, Accenture competes with Rockwell's consulting and digital transformation services, often advising clients on which technology platforms (including competitors') to adopt.

Threat Level:Low

Potential For Direct Competition:Low

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Brand Strength and Installed Base of Allen-Bradley

Sustainability Assessment:The Allen-Bradley brand is deeply entrenched, especially in North America. The large installed base creates high switching costs due to hardware investment, engineer training, and spare parts inventory.

Competitor Replication Difficulty:Hard

- Advantage:

Extensive Partner and Distributor Network

Sustainability Assessment:Rockwell's well-established network of system integrators (PartnerNetwork) and distributors provides significant sales reach, local support, and customer intimacy that is difficult to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Comprehensive Portfolio from Hardware to Cloud

Sustainability Assessment:The ability to offer an integrated solution from controllers on the plant floor (Logix) to MES/ERP in the cloud (Plex) provides a single-vendor advantage that simplifies procurement and integration for customers.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'First-mover features in specific software releases', 'estimated_duration': '12-24 months'}

{'advantage': 'Exclusive partnerships for specific technologies or integrations', 'estimated_duration': '24-36 months'}

Disadvantages

- Disadvantage:

Perception as a Premium-Priced Provider

Impact:Major

Addressability:Moderately

- Disadvantage:

Stronger Competition in European and Asian Markets

Impact:Major

Addressability:Difficult

- Disadvantage:

Competition from IT and Cloud-Native Companies in the Software Space

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns showcasing the ROI of integrated Rockwell hardware and Plex MES, focusing on mid-market manufacturers.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Develop and promote pre-configured, industry-specific solution packages for high-growth areas like EV battery manufacturing or life sciences.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Increase content marketing (blogs, webinars, whitepapers) directly comparing the benefits of FactoryTalk software against Siemens TIA Portal's perceived complexity for common tasks.

Expected Impact:Low

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Expand the cybersecurity services portfolio to offer more proactive threat hunting and managed OT security services, differentiating from competitors' product-focused security.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Deepen integration with major cloud providers (AWS, Azure) to offer more seamless hybrid cloud solutions, countering the threat of pure-play software competitors.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in developing a 'low-code/no-code' layer for the FactoryTalk suite to empower non-programmers and operational staff, reducing the skills gap barrier.

Expected Impact:Medium

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Pursue strategic acquisitions of AI/ML software companies specializing in industrial analytics and predictive modeling to accelerate innovation and capture talent.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Establish a venture capital arm to invest in startups developing next-generation manufacturing technologies, providing early access to innovation and potential acquisition targets.

Expected Impact:Medium

Implementation Difficulty:Difficult

- Recommendation:

Drive the evolution of the core Logix platform to be more software-defined and cloud-native, ensuring long-term relevance against software-first competitors.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify positioning as the premier provider of integrated, end-to-end industrial automation and digital transformation solutions for the North American market, while strategically growing software and services revenue globally.

Differentiate through the unparalleled depth of the Allen-Bradley installed base and engineer loyalty, combined with the strategic value of the integrated Plex cloud platform, offering a unique hardware-to-cloud solution that is both reliable and scalable.

Whitespace Opportunities

- Opportunity:

Develop 'Automation-as-a-Service' models for Small and Medium-sized Businesses (SMBs).

Competitive Gap:Most top-tier competitors focus on large enterprises. SMBs are often underserved by comprehensive but affordable and scalable automation solutions.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create industry-specific digital twin solutions that are tightly integrated with the Logix control environment.

Competitive Gap:While Siemens is strong in digital twins, a Rockwell-native solution that simplifies the creation and deployment of twins based on existing Logix code would be a powerful differentiator for its installed base.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Expand workforce development and training programs focused on modern software like FactoryTalk Optix and Plex.

Competitive Gap:There is a significant industrial skills gap. By becoming the primary educator for the next generation of automation professionals on modern platforms, Rockwell can build long-term loyalty and competitive insulation.

Feasibility:High

Potential Impact:Medium

Rockwell Automation operates in a mature, oligopolistic industrial automation market, defined by intense competition with a few global giants: Siemens, Schneider Electric, and ABB. The industry is currently being reshaped by the powerful trend of digital transformation (Industry 4.0), which is shifting the basis of competition from hardware capabilities to software, data, and services.

Rockwell's primary competitive advantage is its dominant market position in North America, built on the legacy and loyalty of its Allen-Bradley brand and Logix control systems. This large installed base creates significant switching costs and a loyal community of engineers, a moat that is difficult for competitors to breach. The company's strategy to build on this foundation by acquiring Plex Systems and expanding its FactoryTalk software suite is sound, allowing it to offer a compelling, integrated stack from the factory floor to the cloud.

However, Rockwell faces significant challenges. Siemens is a formidable global competitor with a highly integrated hardware/software portfolio and a stronger foothold in Europe and Asia. Schneider Electric competes effectively on energy management and open, IoT-enabled architectures with its EcoStruxure platform. ABB remains a leader in robotics and process automation. Furthermore, the industry is being disrupted by indirect competitors. Cloud providers like AWS and Microsoft are commoditizing the IIoT platform space, while specialized software vendors in MES, analytics, and AI are introducing best-of-breed solutions.

The key strategic imperative for Rockwell is to leverage its core strength—the installed base—to drive adoption of its higher-margin software and services. The company must accelerate the integration of its portfolio, particularly Plex MES, to deliver tangible, out-of-the-box value that is simpler to implement than competitor offerings. Opportunities exist in better serving the mid-market with scalable solutions, expanding cybersecurity services, and developing more advanced AI and digital twin capabilities that are native to the Rockwell ecosystem. Long-term success will depend on Rockwell's ability to evolve from a hardware-centric company to a more software- and outcome-focused partner for its customers' digital transformation journeys.

Messaging

Message Architecture

Key Messages

- Message:

Global leaders in Digital Transformation and Industrial Automation

Prominence:Primary

Clarity Score:High

Location:Homepage, below the fold

- Message:

We meet you where you are in your journey with market leading hardware, software, and services to make you more resilient, agile, and sustainable.

Prominence:Primary

Clarity Score:High

Location:Homepage, sub-headline

- Message:

Success isn’t measured in promises. It’s measured in results.

Prominence:Secondary

Clarity Score:High

Location:Case Studies page, headline

- Message:

Data that does more good. Achieve productivity and sustainability goals with our data-driven solutions.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage, promotional block

- Message:

Working together, we'll drive better outcomes and achieve results.

Prominence:Tertiary

Clarity Score:High

Location:Homepage, footer section

The messaging hierarchy is logical but could be strengthened. The primary message establishing Rockwell as a 'Global leader' is clear but positioned below the fold and temporary event banners, slightly diminishing its impact. The supporting message, 'We meet you where you are,' effectively communicates a customer-centric partnership approach. The secondary messages on results and data are strong but compete with numerous other content blocks, potentially fragmenting the user's focus.

Messaging is highly consistent across the analyzed pages. The core themes of leadership, results-driven transformation, partnership, and achieving outcomes like resilience and sustainability are woven throughout the homepage and the case studies section. This creates a cohesive and credible narrative about the company's identity and value.

Brand Voice

Voice Attributes

- Attribute:

Expert & Authoritative

Strength:Strong

Examples

- •

Global leaders in Digital Transformation and Industrial Automation

- •

For more than 120 years, we have been engineering solutions...

- •

Benchmark your digital strategy, explore global best practices...

- Attribute:

Results-Oriented

Strength:Strong

Examples

- •

Success isn’t measured in promises. It’s measured in results.

- •

Redefining What’s Possible and Achieving Results

- •

Jay Industries Achieves Major Savings, Increases OEE

- Attribute:

Technical & Professional

Strength:Strong

Examples

- •

Encore Tissue Upgrades Plant Reliability with PlantPAx DCS

- •

Introduction to Containerization: Bridging IT and OT

- •

PowerFlex 755TR drives

- Attribute:

Collaborative & Supportive

Strength:Moderate

Examples

- •

We meet you where you are in your journey...

- •

Working together, we'll drive better outcomes...

- •

Region of Waterloo partnered with Brock Solutions...

Tone Analysis

Confident and Informative

Secondary Tones

- •

Pragmatic

- •

Professional

- •

Slightly Formal

Tone Shifts

The tone remains remarkably consistent, even shifting from high-level homepage messaging to specific case study descriptions. There are no jarring or inappropriate shifts in tone.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Rockwell Automation is a comprehensive partner for industrial enterprises, providing market-leading automation and digital transformation solutions (hardware, software, services) to drive measurable business outcomes such as improved productivity, agility, resilience, and sustainability.

Value Proposition Components

- Component:

Comprehensive Portfolio (Hardware, Software, Services)

Clarity:Clear

Uniqueness:Somewhat Unique

Comment:The breadth of offerings is a key differentiator, though major competitors like Siemens and ABB have similarly comprehensive portfolios.

- Component:

Proven Results & Expertise

Clarity:Clear

Uniqueness:Unique

Comment:The sheer volume (642+) and specificity of case studies provide powerful, unique proof of their ability to deliver results across countless industries.

- Component:

Partnership & Support

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Comment:Phrases like 'We meet you where you are' and 'Working together' communicate partnership, a common claim in B2B, but their extensive partner network adds credibility.

- Component:

Future-Proofing Operations (Sustainability, Resilience)

Clarity:Clear

Uniqueness:Common

Comment:Addressing modern business challenges like sustainability and resilience is crucial but has become a standard message for top-tier industrial automation firms.

Rockwell's primary differentiation in its messaging is not a single unique feature but the overwhelming evidence of its success. While competitors offer similar solutions, the website's heavy emphasis on 'results' and the massive, easily searchable library of case studies create a powerful argument for their proven expertise and reliability. The message is less 'we can do it' and more 'here is the evidence of us doing it, repeatedly, for companies like yours.'

The messaging positions Rockwell Automation as an established, premium, and reliable leader in the industrial automation space. They are not positioned as a disruptor or a low-cost alternative but as the partner of choice for complex, large-scale digital transformation journeys where proven experience and measurable outcomes are paramount. This directly challenges other industry giants like Siemens, ABB, and Schneider Electric.

Audience Messaging

Target Personas

- Persona:

Plant Manager / Operations Lead

Tailored Messages

- •

Optimize Production

- •

Encore Tissue Upgrades Plant Reliability with PlantPAx DCS

- •

Hexcel Modernization Reduces Downtime by 80%

Effectiveness:Effective

- Persona:

C-Suite Executive (CEO, COO, CSO)

Tailored Messages

- •

Drive Sustainability

- •

Build Resilience

- •

10th Annual State of Smart Manufacturing

Effectiveness:Effective

- Persona:

IT/OT Engineer / Technical Lead

Tailored Messages

- •

Introduction to Containerization: Bridging IT and OT

- •

Simplify Engineering, Accelerate Projects: How Logix SIS Helps Streamlines Implementation

- •

Successful Turnkey DCS Migration for Corteva Agriscience

Effectiveness:Effective

Audience Pain Points Addressed

- •

Production downtime and reliability issues

- •

Operational inefficiency

- •

Legacy system modernization challenges

- •

Pressure to meet sustainability goals

- •

Navigating complex digital transformation projects

- •

Security threats in OT environments

Audience Aspirations Addressed

- •

Achieving 'smart manufacturing' status

- •

Gaining a competitive edge through technology

- •

Creating a more resilient and agile supply chain

- •

Empowering the workforce with better tools and data

- •

Expanding into new markets

Persuasion Elements

Emotional Appeals

- Appeal Type:

Achievement & Success

Effectiveness:High

Examples

- •

Success isn’t measured in promises. It’s measured in results.

- •

Redefining What’s Possible and Achieving Results

- •

Smart Machine Solutions Pave the Way for Yichao Packaging's Global Expansion

- Appeal Type:

Security & Confidence

Effectiveness:High

Examples

- •

For more than 120 years, we have been engineering solutions...

- •

Global leaders in Digital Transformation...

- •

Leading Power Company Reduces Threat Response Time

Social Proof Elements

- Proof Type:

Case Studies & Success Stories

Impact:Strong

Comment:The entire 'Case Studies' section with 642 filterable results is the most powerful persuasion tool on the site, demonstrating vast experience and proven success.

- Proof Type:

Expert Reports & Insights

Impact:Moderate

Comment:The '10th Annual State of Smart Manufacturing' report positions them as thought leaders and data-driven experts in the industry.

- Proof Type:

Event Authority

Impact:Moderate

Comment:Promoting a major industry event like 'Automation Fair' with '10,000+ peers' reinforces their central role and influence in the market.

Trust Indicators

- •

Longevity ('For more than 120 years')

- •

Specific, quantifiable results in case study headlines ('Reduces Downtime by 80%')

- •

Breadth of industry coverage (extensive filter options)

- •

Publication of in-depth industry reports and technical blogs

- •

Professional website design and clear navigation

Scarcity Urgency Tactics

The messaging does not rely on scarcity or urgency tactics, which is appropriate for the long sales cycles and considered purchases typical of this industry. The focus is on building long-term trust and demonstrating capability.

Calls To Action

Primary Ctas

- Text:

Get the Report

Location:Homepage

Clarity:Clear

- Text:

Read More

Location:Homepage (Insights), Case Studies page

Clarity:Clear

- Text:

Learn more

Location:Homepage (Automation Fair banner)

Clarity:Clear

- Text:

See how we do it

Location:Homepage

Clarity:Somewhat Clear

The CTAs are generally effective and align with a content-led, informational user journey. They primarily guide users to consume more proof points (case studies, reports, blogs) rather than pushing for immediate contact. This builds credibility and qualifies leads. The CTA 'See how we do it' is slightly vague compared to the others and could be more specific (e.g., 'Explore Our Solutions'). Overall, the strategy is well-suited for a B2B audience that conducts extensive research before engaging.

Messaging Gaps Analysis

Critical Gaps

Lack of a clear, concise 'Why Rockwell Automation?' statement on the homepage that synthesizes the value proposition beyond the 'Global leaders' tagline.

Absence of human-centric storytelling on the homepage. While case studies are effective, featuring a customer's personal story or a Rockwell engineer's perspective more prominently could build a stronger emotional connection.

Contradiction Points

No itemsUnderdeveloped Areas

The partnership message ('Working together') could be substantiated more directly on the homepage, perhaps by highlighting their partner ecosystem or consulting approach more visibly.

The messaging around 'Empower People' is listed as a key interest but is less developed on the homepage compared to themes of production, resilience, and sustainability.

Messaging Quality

Strengths

- •

Overwhelming Credibility: The use of extensive, specific, and quantifiable case studies is a masterclass in building trust and proving capability.

- •

Clarity and Consistency: The brand voice and core messages are exceptionally consistent, reinforcing their position as an authoritative expert.

- •

Excellent Audience Segmentation: The content is clearly structured to appeal to different personas and industries, from the C-suite to the plant floor engineer.

- •

Focus on Outcomes: The messaging consistently translates technical solutions into tangible business results (e.g., efficiency, savings, reliability).

Weaknesses

- •

Low Emotional Connection: The messaging is highly rational and professional, but it lacks an immediate emotional hook on the homepage to draw in less-informed visitors.

- •

Potentially Overwhelming: The sheer volume of products, solutions, and industries can be intimidating for a new visitor. The path to a simple solution for a specific problem isn't immediately obvious.

- •

Homepage Hierarchy: The most important brand messages are positioned below event banners and other rotating content, slightly weakening their initial impact.

Opportunities

- •

Create a homepage narrative that walks a visitor through a simplified problem -> solution -> outcome journey, using a compelling customer story as the vehicle.

- •

Develop a more prominent messaging track around workforce enablement and human-centric automation, a key industry trend and a stated area of focus.

- •

Synthesize the key differentiators into a visually engaging 'Why Us' section to provide a quick summary for time-constrained visitors.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Messaging Hierarchy

Recommendation:Elevate the core value proposition ('Global leaders in Digital Transformation...') and the partnership message ('We meet you where you are...') to a more prominent, static position above the fold, independent of temporary event banners.

Expected Impact:High

- Area:

Value Proposition Communication

Recommendation:Introduce a concise 'Why Rockwell?' section on the homepage that summarizes the key differentiators: 1) Unmatched Proof of Results, 2) Comprehensive End-to-End Solutions, and 3) Collaborative Partnership.

Expected Impact:High

- Area:

Emotional Appeal

Recommendation:Feature a hero section with a compelling customer video or narrative that focuses on the human impact of a transformation, complementing the existing data-heavy proof points.

Expected Impact:Medium

Quick Wins

Change the CTA 'See how we do it' to a more specific, action-oriented phrase like 'Explore Our Solutions' or 'View Our Capabilities'.

Add a sub-headline to the 'Case Studies' page intro: 'Success isn’t measured in promises. It’s measured in results. Explore over 600 examples of how we deliver for customers like you.'

Long Term Recommendations

Develop a more personalized website experience where users can self-identify their role or industry early on to see a more curated set of messages, case studies, and solutions.

Create more thought-leadership content that tells a broader story about the future of manufacturing, positioning Rockwell not just as a solutions provider but as a visionary shaping the industry.

Rockwell Automation's strategic messaging is a textbook example of B2B marketing excellence, built on a foundation of authority, expertise, and overwhelming social proof. The core strategy is to position the company as the undisputed, results-proven leader in industrial automation and digital transformation. This is not a brand that needs to shout; its messaging is confident, professional, and lets the evidence—primarily in the form of over 600 detailed case studies—do the talking.

The brand voice is consistently authoritative and results-oriented, speaking directly to a knowledgeable audience of engineers, operations managers, and executives. The messaging architecture is logical, successfully segmenting content for different audiences and their distinct pain points, from optimizing production on the plant floor to driving sustainability in the boardroom. The value proposition is clear: Rockwell is a comprehensive, long-term partner capable of guiding complex enterprises through their entire digital transformation journey, reducing risk and delivering measurable outcomes. This is powerfully differentiated through the sheer volume of tangible success stories.

However, the messaging's greatest strength—its rational, evidence-based approach—also creates its primary weakness: a lack of immediate emotional connection. The homepage is an encyclopedia of capabilities rather than a compelling narrative. While highly effective for a qualified audience already deep in the research phase, it may fail to capture and inspire a new visitor less familiar with the brand. The key opportunity for optimization lies in weaving a more human-centric story into the top-level messaging, thereby complementing the powerful logical appeal with an equally strong emotional one. By creating a clearer, more engaging narrative on the homepage and elevating its core value proposition, Rockwell Automation can further solidify its market position, making its message not only credible but also compelling from the very first click.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Extensive library of 642 customer case studies across a wide array of industries including Automotive, Food & Beverage, Life Sciences, and Energy, demonstrating broad applicability and success.

- •

Over 120 years of company history, indicating deep industry expertise and sustained market relevance.

- •

Global presence serving customers in over 100 countries, with a significant installed base that provides recurring revenue opportunities.

- •

Strong brand recognition, particularly with the Allen-Bradley line, which is synonymous with quality in industrial control hardware.

- •

Comprehensive portfolio of hardware (Intelligent Devices), software (FactoryTalk, Plex), and services (LifecycleIQ) that addresses the full spectrum of industrial automation needs.

Improvement Areas

- •

Improve the integration and user experience across its vast and complex portfolio, especially between legacy hardware and newly acquired cloud-native software (e.g., Plex, Fiix).

- •

Simplify the customer journey on the website to help prospects navigate the extensive product catalog and find solutions tailored to their specific industry and challenges.

- •

Further develop the 'Connected Enterprise' narrative to articulate a clearer, unified value proposition from the combined hardware and software offerings.

Market Dynamics

8-10% CAGR for the Industrial Automation market, with the Smart Manufacturing sub-segment growing even faster at ~15.9% CAGR.

Mature but Evolving

Market Trends

- Trend:

Adoption of Industrial IoT (IIoT) and Edge Computing

Business Impact:Drives demand for connected devices, sensors, and data analytics platforms. Rockwell is well-positioned with its hardware and software but faces pressure to ensure interoperability and real-time data processing capabilities.

- Trend:

AI and Machine Learning in Manufacturing

Business Impact:Creates significant opportunities for solutions in predictive maintenance, process optimization, and quality control. Requires Rockwell to invest in AI/ML talent and integrate these capabilities into its software suites like FactoryTalk.

- Trend:

Digital Twins and Simulation

Business Impact:Increases demand for software that can create virtual models of products and processes, a key growth area. Rockwell's partnership with Ansys and its Emulate3D software are direct plays into this trend.

- Trend:

Cybersecurity for Operational Technology (OT)

Business Impact:As factories become more connected, cybersecurity becomes a critical customer requirement. This is a major growth opportunity for Rockwell's service and software offerings.

- Trend:

Sustainability and Energy Efficiency

Business Impact:Growing customer and regulatory focus on sustainability drives demand for solutions that monitor and reduce energy consumption and waste, aligning with Rockwell's stated mission.

Excellent. The manufacturing sector is under intense pressure to digitize (Industry 4.0) to increase resilience, efficiency, and sustainability. Rockwell is a recognized leader in a market with strong tailwinds.

Business Model Scalability

Medium-High

Hybrid model with scalable software (high margin, low variable cost) and less scalable hardware (subject to COGS, supply chain) and services (people-intensive). Growth is tied to shifting the revenue mix more towards software and recurring services.

Moderate. Significant operational leverage exists in the software segment. However, the large direct sales force, system integration services, and hardware manufacturing limit overall leverage compared to a pure-software business.

Scalability Constraints

- •

Dependence on a highly skilled, and expensive, direct sales and engineering workforce for complex projects.

- •

Hardware manufacturing is subject to supply chain constraints and has lower margins than software.

- •

Integration complexity of its diverse product portfolio can slow down deployment and scaling for customers.

Team Readiness

Strong. As a long-standing public company and market leader, the leadership team is experienced in managing a large, global enterprise.

Complex. Likely a matrixed global organization structured by product lines, geography, and industry verticals. This can be powerful but may create silos that hinder the cross-selling of integrated solutions.

Key Capability Gaps

- •

Deep talent in cloud-native software development and product management to compete with modern SaaS companies.

- •

Agile, digitally-focused sales and marketing teams to drive growth for SaaS products, complementing the traditional enterprise hardware sales motion.

- •

Specialized talent in high-growth areas like AI/ML and industrial cybersecurity to maintain a competitive edge.

Growth Engine

Acquisition Channels

- Channel:

Direct Enterprise Sales

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip the sales force with better training and tools to sell integrated digital transformation solutions (hardware + software + services) rather than individual products.

- Channel:

System Integrator & Distributor Partnerships

Effectiveness:High

Optimization Potential:Medium

Recommendation:Develop specialized certification programs for partners focused on high-growth software and cybersecurity solutions to scale expertise.

- Channel:

Content Marketing & Thought Leadership (Reports, Blogs, Webinars)

Effectiveness:High

Optimization Potential:High

Recommendation:Personalize content delivery based on user's industry and position in the buying journey. Gate high-value content like the 'State of Smart Manufacturing' report for lead generation.

- Channel:

Industry Events (e.g., Automation Fair)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Integrate a robust digital follow-up and nurturing sequence for event leads to maximize conversion from in-person engagement.

Customer Journey

Long and complex, typical for high-value B2B enterprise sales. It involves multiple touchpoints: initial research via content, engagement with sales, technical deep-dives, solution design, and executive buy-in.

Friction Points

- •

Navigating the vast and complex product portfolio on the website to identify the right solution.

- •

Understanding how different Rockwell products (e.g., a PLC, an HMI, and Plex MES) integrate to solve a specific business problem.

- •

Long sales cycles can lead to prospect fatigue or shifting priorities.

Journey Enhancement Priorities

{'area': 'Website Experience', 'recommendation': "Develop interactive, solution-focused journeys on the website. For example, a 'wizard' that guides a user based on their industry, challenge (e.g., improve OEE), and scale to a curated set of products and case studies."}

{'area': 'Sales Enablement', 'recommendation': "Create pre-packaged 'solution bundles' for common problems (e.g., 'Predictive Maintenance Starter Kit') to simplify the sales process and shorten the sales cycle."}

Retention Mechanisms

- Mechanism:

High Switching Costs

Effectiveness:High

Improvement Opportunity:Increase stickiness by integrating Rockwell's software layer (e.g., FactoryTalk, Plex) more deeply into the customer's core operational processes.

- Mechanism:

Lifecycle Services & Support Contracts

Effectiveness:High

Improvement Opportunity:Bundle proactive services like cybersecurity monitoring and predictive analytics consulting into support tiers to create more value and drive recurring revenue.

- Mechanism:

Software Subscriptions (SaaS)

Effectiveness:Medium-High

Improvement Opportunity:Drive adoption of SaaS offerings like Plex and Fiix within the existing hardware customer base through targeted cross-sell campaigns and bundled offerings.

Revenue Economics

Strong. The long-term nature of industrial equipment and deep integration leads to a very high customer lifetime value (LTV).

Undeterminable from public data, but expected to be healthy given the high retention and expansion revenue from a large installed base.

High. The business model is proven and profitable. The key to improving efficiency is increasing the mix of high-margin, recurring software revenue relative to hardware and services.

Optimization Recommendations

- •

Focus on a 'land-and-expand' strategy: win initial hardware deals and systematically upsell high-margin software and analytics subscriptions.

- •

Develop more self-service and digital sales channels for simpler software products to lower the Customer Acquisition Cost (CAC) for the mid-market.

- •

Optimize pricing and packaging of software suites to encourage broader adoption and platform commitment.

Scale Barriers

Technical Limitations

- Limitation:

Portfolio Integration Complexity

Impact:High

Solution Approach:Invest heavily in R&D to create a unified data platform and common user experience across the entire product suite, particularly integrating recent acquisitions like Plex, Fiix, and Clearpath.

- Limitation:

Interoperability with Legacy and Third-Party Systems

Impact:Medium

Solution Approach:Continue to build on open standards (e.g., OPC UA) and develop robust APIs to ensure Rockwell solutions can easily integrate into heterogeneous factory environments.

Operational Bottlenecks

- Bottleneck:

Long Sales and Implementation Cycles

Growth Impact:Slows revenue velocity and increases cost of sales.

Resolution Strategy:Standardize solutions for common industry problems, create pre-configured bundles, and leverage system integrator partners more effectively for implementation.

- Bottleneck:

Hardware Supply Chain

Growth Impact:Potential for revenue delays and customer dissatisfaction if hardware components are unavailable.

Resolution Strategy:Diversify supplier base, improve demand forecasting by integrating sales and operational planning, and explore more software-defined hardware solutions.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Differentiate beyond hardware by focusing on the integrated software and analytics capabilities of the 'Connected Enterprise'. Compete on business outcomes (e.g., OEE improvement, energy reduction) rather than component specs. Key competitors include Siemens, ABB, Schneider Electric, and Emerson.

- Challenge:

Displacing Entrenched Competitors

Severity:Major

Mitigation Strategy:Employ a 'wrap-and-extend' strategy, offering software and analytics solutions that can work with competitor's hardware, providing a wedge to later expand the Rockwell footprint.

- Challenge:

Mid-Market Adoption

Severity:Minor

Mitigation Strategy:Develop lighter, more affordable, and easier-to-deploy solutions, potentially sold through a digital or inside-sales channel, to cater to the needs and budgets of small to medium-sized manufacturers.

Resource Limitations

Talent Gaps

- •

Software Engineers with expertise in AI/ML, Cloud Computing, and Cybersecurity.

- •

Growth Marketers with experience in product-led growth (PLG) for SaaS offerings.

- •

Solution Sales Specialists who can architect and sell complex, multi-product digital transformation deals.

Low. As a profitable, publicly-traded company, Rockwell has sufficient capital for organic growth and strategic acquisitions.

Infrastructure Needs

- •

A robust cloud infrastructure to support the growing portfolio of SaaS solutions.

- •

Digital sales and marketing platforms to enable more efficient customer acquisition for software products.

- •

Advanced R&D labs for testing integrated hardware/software solutions and emerging technologies like autonomous robotics.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deeper Penetration in High-Growth Verticals

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Develop industry-specific solution blueprints and marketing campaigns for booming sectors like life sciences, battery manufacturing, and renewable energy.

- Expansion Vector:

Geographic Expansion in Asia-Pacific

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Invest in local partnerships and tailor solutions to address regional manufacturing initiatives like 'Made in China 2025' and India's industrial growth.

Product Opportunities

- Opportunity:

Unified Industrial Cloud Platform

Market Demand Evidence:Strong industry trend towards cloud-based platforms for centralizing data, analytics, and remote operations management.

Strategic Fit:High - This is the ultimate expression of the 'Connected Enterprise' vision.

Development Recommendation:Accelerate the integration of Plex, FactoryTalk, and Fiix into a single, cohesive SaaS platform with a unified data model and user interface.

- Opportunity:

AI-Powered Predictive Analytics Suite

Market Demand Evidence:Manufacturers are actively seeking AI solutions to move from reactive to predictive maintenance and process control.

Strategic Fit:High - Leverages Rockwell's deep domain expertise and access to machine data.

Development Recommendation:Develop and acquire AI/ML models trained on specific industrial assets and processes, and offer them as subscription add-ons to the core software platform.

- Opportunity:

Autonomous Mobile Robots (AMRs) for Production Logistics

Market Demand Evidence:The market for AMRs in manufacturing is projected to grow ~30% annually, addressing major inefficiencies in material handling.

Strategic Fit:High - The recent acquisition of Clearpath/OTTO Motors directly addresses this.

Development Recommendation:Deeply integrate OTTO Motors' fleet management software with Rockwell's MES (Plex) and automation controllers to offer end-to-end autonomous production logistics.

Channel Diversification

- Channel:

Cloud Marketplaces (AWS, Azure)

Fit Assessment:High

Implementation Strategy:List Rockwell's SaaS offerings on major cloud marketplaces to simplify procurement and deployment for enterprise IT departments and leverage co-selling programs.

- Channel:

IT Consulting & Advisory Firms (e.g., Accenture, Deloitte)

Fit Assessment:High

Implementation Strategy:Strengthen strategic alliances to have these firms lead digital transformation engagements where Rockwell's technology is the recommended OT/manufacturing platform.

Strategic Partnerships

- Partnership Type:

Technology Integration

Potential Partners

- •

NVIDIA (for AI/simulation)

- •

CrowdStrike (for OT cybersecurity)

- •

SAP (for deeper ERP-to-MES integration)

Expected Benefits:Fill capability gaps, accelerate time-to-market for new solutions, and provide customers with best-of-breed, pre-validated technology stacks.

Growth Strategy

North Star Metric

Annual Recurring Revenue (ARR)

This metric shifts focus from one-time, cyclical hardware sales to the more predictable and higher-margin software and services business. It directly measures the success of the company's strategic transition to a digital transformation leader.

Increase ARR as a percentage of total revenue by 15-20% annually for the next 3 years.

Growth Model

Hybrid: Enterprise Sales-Led & Product-Led

Key Drivers

- •

Cross-selling SaaS into the massive existing hardware install base.

- •

Landing new enterprise accounts with comprehensive digital transformation solutions.

- •

Enabling easier trial and adoption of specific software modules (PLG) to seed future enterprise deals.

Maintain the high-touch enterprise sales model for large accounts while building a separate, digitally-enabled growth team to experiment with PLG tactics for specific software products aimed at smaller customers or individual plants.

Prioritized Initiatives

- Initiative:

Project Unify: Accelerate Software Platform Integration

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Establish a cross-functional task force with executive sponsorship from recently acquired companies and core business units. Define the unified architecture and create a public-facing integration roadmap.

- Initiative:

Install Base Monetization Program

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Analyze customer data to identify top accounts for SaaS cross-sell opportunities. Develop targeted marketing campaigns and sales plays with compelling ROI calculations.

- Initiative:

Launch Mid-Market Digital Sales Channel

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12 months

First Steps:Pilot an inside sales team focused on selling a specific, easy-to-deploy software bundle (e.g., Fiix CMMS) to manufacturers with under 500 employees.

Experimentation Plan

High Leverage Tests

{'test': 'Test different pricing and packaging bundles for the FactoryTalk software suite to increase adoption of multiple modules.', 'hypothesis': "A 'good-better-best' pricing model will increase the average number of software modules per customer."}

{'test': "Run a pilot program offering a free 'Cybersecurity OT Assessment' to key enterprise accounts.", 'hypothesis': 'This value-add service will generate a significant pipeline for high-margin cybersecurity services.'}

Utilize an A/B testing framework for digital initiatives. For strategic pilots, measure success based on pipeline generated, initial customer adoption rates, and qualitative feedback.

Monthly review of digital marketing experiments; quarterly review of strategic growth pilots and initiatives.

Growth Team

A centralized 'Digital Growth Office' that works with the existing business units. This team should have its own P&L for new digital offerings to ensure focus and autonomy, while also being tasked with driving cross-sell initiatives through the traditional sales channels.

Key Roles

- •

Head of Digital Growth

- •

Growth Product Manager (SaaS)

- •

SaaS Marketing Automation Specialist

- •

Partner Alliance Manager (Cloud & IT)

- •

Industrial Data Scientist

Acquire talent from enterprise SaaS companies to inject new DNA into the organization. Implement a continuous training program for the existing sales force on how to sell value and business outcomes, not just technical features.