eScore

ropertech.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Roper's digital presence is highly focused but minimalist, serving its primary investor audience with a clean, professional interface. However, it lacks proactive content strategies to attract its other key audience: potential acquisition targets. Content authority is high due to its corporate nature, but multi-channel presence and voice search optimization are virtually nonexistent as they are not priorities for its specific business model.

The website's information architecture is extremely clear and uncluttered, allowing its core investor audience to find relevant information efficiently.

Develop a thought leadership content hub that explains Roper's unique business model to attract and educate founders of potential acquisition targets, a key audience currently underserved by the digital presence.

The brand messaging is exceptionally clear, consistent, and professional, perfectly tailored for investors and founders by emphasizing a decentralized model and disciplined capital allocation. It effectively differentiates Roper from operationally intensive acquirers. The primary weakness is a lack of narrative and emotional connection; the messaging is highly rational and factual but fails to tell a compelling story or substantiate cultural claims with evidence like testimonials.

The core message of being a 'permanent home' with a 'decentralized operating environment' is a powerful and unique value proposition that directly addresses the fears of founders considering an acquisition.

Substantiate claims like 'Trust & mutual respect' with case studies or video testimonials from CEOs of acquired companies to add an emotional, trust-building layer to the purely factual messaging.

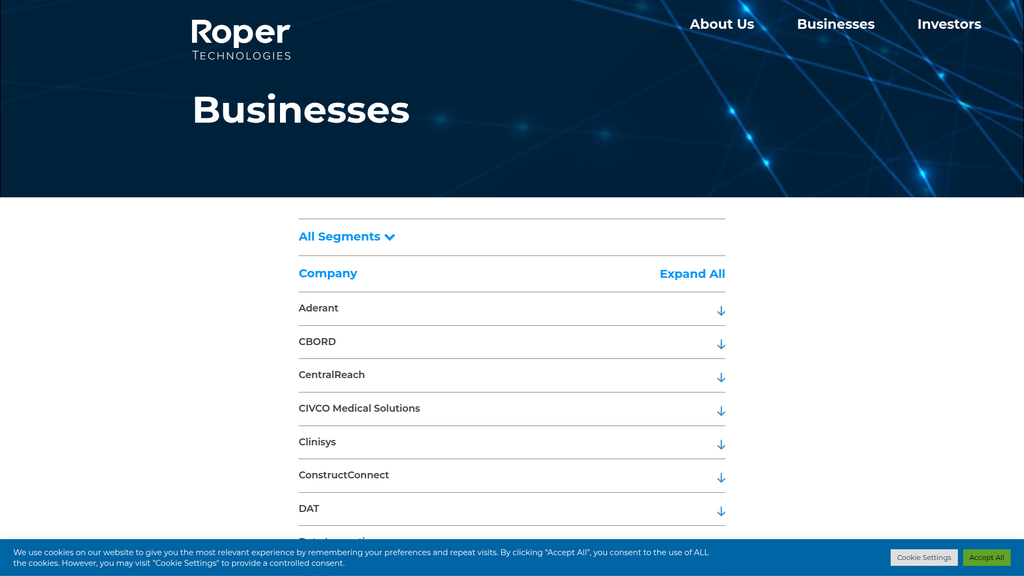

For Roper, 'conversion' is about providing key information to investors or attracting contact from a potential acquisition. While the site is simple to navigate, it suffers from a significant lack of direct calls-to-action (CTAs), forcing users to hunt for information in the footer. The 'Businesses' page, a key portfolio showcase, has poor usability when expanded. The cross-device experience is excellent, but the overall journey for key personas is not actively guided or optimized.

The mobile experience is excellent, with a responsive design that ensures all information is accessible and usable across any device without friction.

Integrate prominent, contextual CTAs on key pages, such as 'View Annual Report' on the Investors page or 'Our Acquisition Criteria' to guide key user journeys and reduce friction.

Credibility is high due to powerful trust signals like inclusion in the S&P 500 and Nasdaq 100, a strong portfolio of market-leading companies, and a clear, disciplined business model. However, the credibility is undermined by significant legal and compliance gaps identified in the analysis. The absence of a Terms of Service, a non-compliant cookie banner, and no accessibility statement create legal and reputational risks incongruous with a company of its stature.

Third-party validation is exceptionally strong, with inclusion in major stock indices (S&P 500, Nasdaq 100) serving as an immediate and powerful trust signal for investors.

Urgently remediate critical legal compliance gaps by publishing a formal Terms of Service, updating the cookie consent banner to be GDPR-compliant, and publishing an Accessibility Statement to mitigate ADA litigation risk.

Roper's competitive advantage, or 'moat,' is exceptionally strong and sustainable. It is built on a highly disciplined, decentralized 'buy and hold forever' model that is deeply embedded in its culture and difficult to replicate. This strategy makes Roper the preferred buyer for founders who prioritize legacy and autonomy over a quick exit, creating a powerful differentiator from private equity firms. The focus on niche, market-leading businesses further insulates it from competition.

The decentralized 'permanent home' philosophy is a highly sustainable competitive advantage that attracts a specific and valuable type of acquisition target who fears the typical private equity model.

Formally brand and articulate the 'Roper Way' operational model, much like Danaher's 'DBS,' to transform it from an implicit strength into an explicit and marketable competitive weapon in the M&A landscape.

The business model is highly scalable due to its decentralized, asset-light nature, allowing Roper to acquire new companies without a proportional increase in corporate overhead. The primary constraint on growth is the availability of suitable acquisition targets at disciplined prices in a competitive M&A market. The company has a proven track record of expansion and generates substantial free cash flow to fund future acquisitions, indicating strong continued potential.

The decentralized operating model provides immense operational leverage, allowing the company to scale its portfolio of businesses without creating a large, costly central bureaucracy.

Develop a proactive M&A sourcing strategy focused on emerging or less competitive international markets to create a proprietary deal pipeline and reduce dependence on competitive domestic auctions.

Roper's business model demonstrates exceptional coherence and strategic focus. Every aspect, from its decentralized structure and disciplined capital allocation to its focus on asset-light, niche software businesses, is perfectly aligned to achieve its goal of compounding free cash flow. The strategy is clear, proven over decades, and consistently executed, showing a high degree of alignment among all stakeholders. The company avoids feature creep by operating as a holding company, allowing subsidiaries to maintain their own strategic focus.

The rigid adherence to a disciplined, process-driven capital allocation strategy focused on cash return on investment (CRI) ensures all resources are efficiently directed toward the single goal of long-term value creation.

Establish a lightweight 'Center of Excellence' to share best practices in areas like AI or cybersecurity, introducing a small degree of positive synergy without compromising the successful decentralized ethos.

Roper wields significant market power within the M&A world for vertical market software. Its reputation, scale, and unique value proposition give it a powerful advantage in sourcing and winning deals. By acquiring #1 or #2 players in niche markets, it effectively buys market power, which translates to strong pricing power and high margins within its subsidiaries. The primary risk is the increasing competition from cash-rich private equity firms, which can drive up acquisition prices and challenge Roper's pricing discipline.

Roper's ability to act as a 'permanent home' gives it significant leverage and negotiating power when competing against time-horizon-limited private equity funds for acquisitions.

Systematically leverage the data assets within its network-based businesses (like DAT and ConstructConnect) to create new data products, thereby increasing market influence and creating new revenue streams.

Business Overview

Business Classification

Diversified Technology Conglomerate

Strategic Holding Company

Vertical Market Software & Niche Technology

Sub Verticals

- •

Healthcare IT

- •

Legal Tech

- •

Transportation & Logistics Software

- •

Construction Tech

- •

Insurance Tech

- •

Education Administration Software

- •

Financial Services Software

- •

Public Sector Software

- •

Technology Enabled Products (Medical Devices, Metering)

Mature

Maturity Indicators

- •

Constituent of the S&P 500, Nasdaq 100, and Fortune 1000.

- •

Long, proven track record of compounding cash flow through acquisitions.

- •

Highly refined and disciplined capital deployment strategy.

- •

Shifted business model from industrial manufacturing to asset-light, high-margin software.

- •

Consistent revenue and free cash flow growth.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Software Subscriptions, Licensing & Maintenance

Description:The majority of revenue is generated by the portfolio of software companies, primarily through recurring SaaS subscriptions, software licensing, and ongoing maintenance and support contracts. This creates a predictable, high-margin revenue base.

Estimated Importance:Primary

Customer Segment:Enterprises and SMBs in Niche Verticals

Estimated Margin:High

- Stream Name:

Technology-Enabled Product Sales

Description:Revenue from the sale of physical products embedded with proprietary technology, such as medical devices (e.g., Verathon) and water metering systems (e.g., Neptune).

Estimated Importance:Secondary

Customer Segment:Healthcare Providers, Utilities, Industrial

Estimated Margin:Medium

- Stream Name:

Transactional & Service Fees

Description:Revenue generated from usage-based platforms, such as freight matching networks (e.g., DAT Solutions), and professional services for implementation and training.

Estimated Importance:Tertiary

Customer Segment:Logistics Providers, Professional Services Firms

Estimated Margin:Medium

Recurring Revenue Components

- •

SaaS Subscriptions

- •

Software Maintenance Contracts

- •

Long-term Service Agreements

- •

Usage-based Network Fees

Pricing Strategy

Decentralized & Value-Based

Premium

Opaque

Pricing Psychology

- •

Value-Based Pricing (charging based on the high value delivered to niche customers)

- •

Tiered Pricing (within individual software offerings)

- •

Long-Term Contracts (locking in recurring revenue)

Monetization Assessment

Strengths

- •

High percentage of recurring revenue (over two-thirds) provides stability and predictability.

- •

Extreme diversification across numerous non-cyclical niche markets mitigates risk.

- •

Asset-light business model leads to very high free cash flow conversion.

- •

Focus on market-leading companies (#1 or #2 in their niche) allows for strong pricing power.

Weaknesses

- •

Growth is heavily dependent on a continuous pipeline of suitable acquisition targets.

- •

Increasingly high acquisition multiples in the software market could weigh on future returns.

- •

Decentralized model may limit opportunities for cross-portfolio synergies and cost efficiencies.

Opportunities

- •

Further expansion into new, under-digitized vertical software markets (e.g., AgTech, RegTech).

- •

Developing a center of excellence for AI/ML to provide strategic guidance and tools across the portfolio.

- •

Leveraging the vast datasets aggregated by network businesses (like DAT and ConstructConnect) for new data analytics products.

Threats

- •

Increased competition for high-quality software assets from private equity firms, driving up acquisition prices.

- •

A sustained economic downturn could slow organic growth within portfolio companies.

- •

Technological disruption from new entrants could challenge the market leadership of incumbent portfolio companies.

Market Positioning

Niche Market Leadership via Acquisition

Leader within its chosen niche markets.

Target Segments

- Segment Name:

Acquisition Targets: Vertical Market Software Leaders

Description:Roper's primary 'customer' is the privately-held, market-leading vertical software or niche technology company it seeks to acquire. These are asset-light, high-margin, cash-generative businesses with strong management and recurring revenue.

Demographic Factors

Typically founder-led or private-equity backed

Established businesses, not early-stage startups

Psychographic Factors

Seeking a permanent, stable home rather than a quick flip

Value operational autonomy

Behavioral Factors

Demonstrated history of profitable growth

High customer retention rates (e.g., above 95%).

Pain Points

Need for liquidity for founders/early investors

Desire for a strategic partner for the next phase of growth without ceding operational control

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

End-Customers: Professionals in Niche Industries

Description:The end-users of the portfolio companies' products are professionals in highly specific industries who rely on mission-critical software and technology to perform their jobs. Examples include lawyers (Aderant), freight brokers (DAT), construction contractors (ConstructConnect), and hospital administrators (Strata).

Demographic Factors

Professionals in regulated or complex industries

Users in North America, Europe, and Asia

Psychographic Factors

Value reliability and industry-specific functionality over generic solutions

Risk-averse when it comes to core operational software

Behavioral Factors

High switching costs due to deep integration of software into workflows

Willingness to pay a premium for solutions that guarantee compliance and efficiency

Pain Points

- •

Managing complex, industry-specific workflows

- •

Ensuring regulatory compliance

- •

Need for accurate data and analytics for decision-making

- •

Lack of operational efficiency with generic software

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

Decentralized Operating Model

Strength:Strong

Sustainability:Sustainable

- Factor:

Focus on Permanent Ownership ('Buy and Hold')

Strength:Strong

Sustainability:Sustainable

- Factor:

Disciplined Capital Allocation Process (Cash Return on Investment)

Strength:Strong

Sustainability:Sustainable

Value Proposition

For investors: A proven model for compounding cash flow and shareholder value through the disciplined acquisition and long-term holding of market-leading, asset-light niche technology businesses. For acquired companies: A permanent, decentralized home that provides capital and stability while preserving operational autonomy and culture.

Excellent

Key Benefits

- Benefit:

Diversified and Resilient Growth

Importance:Critical

Differentiation:Unique

Proof Elements

Portfolio of dozens of businesses across uncorrelated niches.

History of strong performance through various economic cycles.

- Benefit:

Operational Autonomy for Subsidiaries

Importance:Critical

Differentiation:Unique

Proof Elements

Explicitly stated decentralized operating environment.

Subsidiaries retain their own leadership and brand identity.

- Benefit:

Predictable Cash Flow Generation

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Focus on high-margin, recurring revenue businesses.

Strong free cash flow, surpassing $2.3 billion in 2024.

Unique Selling Points

- Usp:

Decentralized Conglomerate Model for Niche Software

Sustainability:Long-term

Defensibility:Strong

- Usp:

Singular Focus on Cash Return on Investment (CRI) for all Capital Decisions

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Investor need for reliable, long-term capital appreciation with lower volatility than single-product tech companies.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Successful niche software company founders/owners seeking an exit without their company being absorbed, dismantled, or flipped.

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

The model is perfectly aligned with the growing vertical software market, which values industry-specific expertise and mission-critical solutions. Roper's strategy of acquiring leaders in these verticals capitalizes directly on this trend.

High

The value proposition strongly resonates with its two key audiences: long-term, cash-flow-focused investors and business owners who value autonomy and a stable, permanent home for their company.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Investment Banks & M&A Advisors

- •

Private Equity Firms (as sellers)

- •

Legal & Financial Due Diligence Firms

Key Activities

- •

Capital Allocation & M&A Execution.

- •

Strategic Oversight of Portfolio Companies.

- •

Performance Monitoring (focus on organic growth and cash flow).

- •

Talent Management at the Executive Level

Key Resources

- •

Significant Free Cash Flow & Access to Capital Markets.

- •

Experienced Executive Leadership with M&A Expertise

- •

Portfolio of Independent, Cash-Generative Businesses.

- •

Disciplined, Repeatable Acquisition Playbook

Cost Structure

- •

Corporate Overhead (Executive Compensation, G&A)

- •

Interest Expense on Acquisition-Related Debt

- •

Transaction Costs for M&A

Swot Analysis

Strengths

- •

Proven, disciplined acquisition and capital allocation strategy.

- •

Highly diversified portfolio of market-leading businesses in defensible niches.

- •

Asset-light model generates substantial recurring revenue and high free cash flow.

- •

Decentralized structure fosters accountability and agility within subsidiaries.

Weaknesses

- •

Growth is highly dependent on the continuous availability of suitable acquisition targets.

- •

Decentralized model limits potential for operational synergies across the portfolio.

- •

Acquisition of larger businesses increases execution risk and financial leverage.

Opportunities

- •

Accelerating digital transformation in traditionally underserved industries creates new acquisition verticals.

- •

Apply AI and advanced analytics across the portfolio to enhance product value and drive organic growth.

- •

Continue geographic expansion by acquiring niche software leaders outside of North America.

Threats

- •

Intense competition for high-quality software assets from PE firms, leading to higher valuation multiples and potentially lower returns.

- •

A major cybersecurity incident at one of the portfolio companies could cause significant reputational and financial damage.

- •

Rising interest rates could increase the cost of capital for future acquisitions.

- •

Disruptive new technologies could erode the market leadership of incumbent portfolio companies.

Recommendations

Priority Improvements

- Area:

Post-Acquisition Value Creation

Recommendation:Establish a lightweight, optional 'Center of Excellence' to share best practices in key areas like AI implementation, cybersecurity, and digital marketing, providing value to portfolio companies without violating the decentralized ethos.

Expected Impact:Medium

- Area:

Capital Allocation Strategy

Recommendation:Systematically review and potentially divest underperforming or non-strategic assets to recycle capital into higher-growth vertical software opportunities, further refining the portfolio's quality.

Expected Impact:High

- Area:

Talent Development

Recommendation:Formalize a leadership development program to rotate high-potential managers between portfolio companies, fostering a stronger internal pipeline of future presidents and executives familiar with the Roper model.

Expected Impact:Medium

Business Model Innovation

Develop a 'Roper Ventures' arm to take minority stakes in earlier-stage, high-potential vertical software companies, creating a proprietary pipeline for future platform acquisitions.

Explore opportunities for data monetization by creating anonymized, aggregated data products from network-effect businesses like DAT, ConstructConnect, and iTradeNetwork, creating a new high-margin revenue stream.

Revenue Diversification

The business model is already exceptionally diversified. The key is to continue diversifying into new, defensible niche verticals to maintain resilience.

Prioritize acquisitions in verticals with non-cyclical demand and high regulatory complexity, such as environmental compliance (RegTech), agricultural technology (AgTech), and government technology (GovTech).

Roper Technologies operates not as a conventional technology company, but as a highly sophisticated and disciplined capital allocator. Its business model is that of a strategic holding company, focused on acquiring and permanently holding a diversified portfolio of market-leading, asset-light businesses in defensible niche markets. The transition from an industrial manufacturer to a vertical software and technology powerhouse has been remarkably successful, driven by a rigid adherence to a decentralized operating philosophy and a singular focus on compounding free cash flow.

The core strength and primary differentiator of the model is its decentralization. By allowing acquired companies to operate with significant autonomy, Roper attracts founders seeking a stable, long-term home and preserves the entrepreneurial culture and customer intimacy that made the businesses successful. This contrasts sharply with typical private equity models centered on financial engineering and a predetermined exit timeline.

Future growth is inextricably linked to the continued execution of its M&A strategy. The primary challenge will be navigating an increasingly competitive M&A landscape where valuations for premium software assets are high. Sustaining its historical rate of return will require exceptional discipline to avoid overpaying and an ability to unearth opportunities in less crowded market segments. Strategic evolution should focus on enhancing post-acquisition value through shared intelligence and creating an early-stage investment pipeline, all while carefully preserving the decentralized model that is the foundation of its enduring success.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Significant Capital for Acquisitions

Impact:High

- Barrier:

Deal Sourcing and M&A Execution Expertise

Impact:High

- Barrier:

Reputation as a 'Permanent Home' for Acquired Businesses

Impact:Medium

- Barrier:

Disciplined Capital Allocation Framework

Impact:High

Industry Trends

- Trend:

Increased Competition for VMS Assets from Private Equity

Impact On Business:Drives up acquisition multiples, making it harder to find deals that meet Roper's stringent ROI criteria.

Timeline:Immediate

- Trend:

Digital Transformation in Niche Industries

Impact On Business:Expands the total addressable market and pool of potential acquisition targets as more industries rely on mission-critical software.

Timeline:Immediate

- Trend:

Integration of AI and Machine Learning in Vertical Software

Impact On Business:Creates opportunities for organic growth within the existing portfolio but also requires investment to maintain a competitive edge.

Timeline:Near-term

- Trend:

Shift to SaaS and Recurring Revenue Models

Impact On Business:Increases the quality and predictability of cash flows, which is highly aligned with Roper's business model.

Timeline:Immediate

Direct Competitors

- →

Danaher Corporation

Market Share Estimate:N/A (Operates in different, but structurally similar, end markets)

Target Audience Overlap:Low (Different end markets but competes for M&A talent and investor capital)

Competitive Positioning:A science and technology conglomerate that applies a rigorous continuous improvement methodology (Danaher Business System - DBS) to drive performance in acquired companies, primarily in life sciences and diagnostics.

Strengths

- •

World-renowned Danaher Business System (DBS) for operational excellence.

- •

Proven track record of large, successful acquisitions and integrations.

- •

Strong focus on high-growth, resilient markets like life sciences and biopharma.

- •

Deeply entrenched in customer R&D and workflows, creating high switching costs.

Weaknesses

- •

More centralized operational approach compared to Roper's decentralized model, which may be less attractive to some founders.

- •

Focus on life sciences and diagnostics makes them less of a direct competitor for pure software assets.

- •

Higher integration complexity and risk with their platform-driven strategy.

Differentiators

The Danaher Business System (DBS) is a unique, proprietary operational methodology.

Focus on science and technology verticals (biotech, diagnostics) rather than a primary focus on software.

- →

Constellation Software Inc.

Market Share Estimate:High (in the VMS acquisition space)

Target Audience Overlap:High

Competitive Positioning:A highly disciplined, decentralized holding company exclusively focused on acquiring, managing, and building a diverse portfolio of vertical market software (VMS) businesses for the long term.

Strengths

- •

Extremely disciplined and prolific acquirer, especially of small to medium-sized VMS businesses.

- •

Highly decentralized model that empowers acquired management teams, making them an attractive buyer.

- •

Long and successful track record of compounding shareholder value.

- •

Strong focus on mission-critical software with recurring revenue streams and high retention.

Weaknesses

- •

Historically focused on smaller acquisitions, though this is changing.

- •

Minimal focus on driving organic growth, which averages very low single digits.

- •

Increased competition has made it harder to find deals at their historically low valuation multiples.

Differentiators

- •

Pure-play focus on VMS acquisitions across a vast number of verticals.

- •

Decentralized capital allocation, pushing M&A decisions down to the operating group level.

- •

'Buy and hold forever' philosophy is a core part of their identity.

- →

Fortive Corporation

Market Share Estimate:N/A (Operates in different, but structurally similar, end markets)

Target Audience Overlap:Medium (Competes for industrial technology and software assets)

Competitive Positioning:A provider of essential technologies for connected workflow solutions, spun off from Danaher and utilizing a similar operational excellence model (Fortive Business System - FBS).

Strengths

- •

Inherited the Danaher DNA with the Fortive Business System (FBS) driving continuous improvement.

- •

Strong positions in industrial tech, intelligent operating solutions, and precision technologies.

- •

Increasing focus on recurring revenue and software-enabled workflows.

- •

Disciplined M&A strategy focused on bolt-on acquisitions.

Weaknesses

- •

Still undergoing strategic transformation post-spin-offs to become more software-focused.

- •

Less established track record as a standalone entity compared to Danaher or Roper.

- •

More exposed to industrial cyclicality than a pure-play software conglomerate.

Differentiators

Application of the FBS methodology.

Focus on a hybrid of hardware, software, and services for industrial and healthcare operational workflows.

Indirect Competitors

- →

Private Equity Firms (e.g., Thoma Bravo, Vista Equity Partners, Bain Capital)

Description:These firms raise capital to acquire software companies with the goal of improving them operationally and financially, then selling them within a 5-10 year timeframe. They are the most significant competitors for software acquisitions.

Threat Level:High

Potential For Direct Competition:They are already direct competitors in the M&A market for software assets.

- →

Other Diversified Technology Companies (e.g., AMETEK, IDEX)

Description:Conglomerates that, like Roper, have a history of acquiring niche technology and industrial product businesses. While their focus may be less on software, their acquisition models are similar.

Threat Level:Medium

Potential For Direct Competition:High, if they decide to pivot more aggressively into vertical software acquisitions.

- →

Large Strategic Acquirers (e.g., Oracle, Salesforce, Microsoft)

Description:Major technology companies that acquire businesses to fill gaps in their product portfolios or enter new markets. They typically target larger assets than Roper but can compete for strategic niche software.

Threat Level:Low

Potential For Direct Competition:Low, as their strategic rationale for acquisitions (integration) differs fundamentally from Roper's (decentralized operation).

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Decentralized 'Permanent Home' Model

Sustainability Assessment:Highly sustainable. This is a key differentiator from Private Equity's 'buy and sell' model and is very attractive to founders who care about their company's legacy.

Competitor Replication Difficulty:Medium

- Advantage:

Disciplined, Process-Driven Capital Allocation

Sustainability Assessment:Highly sustainable. This process, focused on cash return on investment (CROI), is deeply embedded in the corporate culture and prevents overpaying for assets, ensuring long-term value creation.

Competitor Replication Difficulty:Hard

- Advantage:

Diversified Portfolio of Niche Leaders

Sustainability Assessment:Highly sustainable. Operating across many uncorrelated, defensible niche markets provides resilience against downturns in any single industry.

Competitor Replication Difficulty:Hard

Temporary Advantages

No itemsDisadvantages

- Disadvantage:

Heavy Reliance on Acquisitions for Growth

Impact:Major

Addressability:Difficult

- Disadvantage:

Lack of Operational Synergies

Impact:Minor

Addressability:Difficult

- Disadvantage:

Potential for High Acquisition Valuations

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted digital marketing campaign aimed at VMS founders, explicitly contrasting Roper's 'permanent home' philosophy with the typical Private Equity model.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Develop and publish case studies or testimonials from acquired company CEOs on the benefits of Roper's decentralized operating model.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Establish a formal, opt-in center of excellence for portfolio companies to share best practices on key trends like AI integration, SaaS transitions, and digital marketing without compromising autonomy.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Systematically explore acquisitions in adjacent niche, asset-light technology sectors beyond pure software, such as data-as-a-service or tech-enabled B2B information services.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Develop a dedicated strategy for geographic expansion, targeting niche VMS leaders in less competitive M&A markets like Europe and Asia-Pacific.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Create a program for smaller, 'bolt-on' acquisitions within the existing portfolio companies, empowering them to act as mini-Ropers in their own niches.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify and amplify the positioning as the premier, permanent capital partner for market-leading vertical software businesses. Emphasize the unique combination of founder autonomy (like Constellation Software) with a focus on long-term, sustainable cash flow growth (a hallmark of the Roper model).

Differentiate primarily on the 'hands-off' post-acquisition model and the 'permanent hold' philosophy. This contrasts sharply with both operationally intensive acquirers like Danaher and the fund-based timeline of Private Equity competitors.

Whitespace Opportunities

- Opportunity:

Target VMS for ESG and Sustainability

Competitive Gap:The market for software that helps companies manage and report on sustainability and ESG metrics is growing rapidly and remains fragmented. Few large acquirers have a dedicated focus here.

Feasibility:High

Potential Impact:High

- Opportunity:

Acquire Tech-Enabled Services and Convert to SaaS

Competitive Gap:Many niche industries have tech-enabled service providers with deep domain expertise and sticky customer relationships, but lack the DNA to build a true SaaS product. This is a playbook few acquirers have perfected.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Focus on 'Unfashionable' but Critical Industries

Competitive Gap:While Private Equity chases high-growth, glamorous tech sectors, significant value exists in acquiring dominant software providers in less-sexy but essential industries (e.g., waste management, specialized manufacturing, public sector compliance).

Feasibility:High

Potential Impact:Medium

Roper Technologies operates a unique and highly successful business model as a diversified acquirer of niche, market-leading vertical software and technology companies. The company's core strategy is not to build a single, integrated technology platform, but to act as a holding company that provides permanent capital and a decentralized operating environment for its collection of independent businesses.

Competitive Landscape:

The competitive environment for Roper exists almost entirely in the M&A marketplace rather than in end-user product markets. Its primary competitors are other entities that seek to acquire high-quality, vertically-focused software companies.

-

Direct Competitors: The most direct competitors are other 'serial acquirers' with similar decentralized, long-term hold philosophies. Constellation Software is the closest peer, sharing a near-identical focus on VMS and a 'buy-and-hold' strategy, though it traditionally focused on smaller deals. Danaher and its spin-off Fortive are philosophically similar in their focus on acquiring niche leaders and applying a disciplined operational framework, but their end markets are more focused on science, technology, and industrial products rather than pure software.

-

Indirect Competitors: The most significant competitive threat comes from Private Equity firms like Thoma Bravo and Vista Equity Partners. They are highly active in the software M&A market, which increases competition and drives up purchase prices. This directly challenges Roper's ability to find acquisitions that meet its strict financial discipline for cash return on investment.

Competitive Advantages & Sustainability:

Roper's key sustainable advantage is its decentralized, 'permanent home' model. This is a powerful differentiator when competing against Private Equity buyers who have a mandated exit timeline. Founders looking to secure the long-term future and culture of their business find Roper's proposition highly attractive. This is coupled with a deeply ingrained, disciplined capital allocation process that has consistently generated strong cash flow and shareholder returns. The high diversification across numerous niche markets provides significant resilience against economic cycles.

The primary disadvantage is a heavy reliance on M&A for growth. In a competitive M&A environment with high valuations, finding suitable targets becomes increasingly difficult and could slow future growth.

Opportunities & Recommendations:

The strategic whitespace for Roper lies in leveraging its unique model in less-crowded spaces. This includes a more concerted effort in international markets, targeting VMS leaders where PE competition may be less intense. There is also a significant opportunity in emerging verticals like ESG & sustainability software, which are currently fragmented.

Strategically, Roper should amplify its core differentiator: being the ideal long-term home for a founder's life's work. By creating a center of excellence for sharing best practices on SaaS transitions and AI integration on an opt-in basis, Roper can add value to its portfolio companies without violating its core tenet of autonomy. This would further strengthen its value proposition to potential sellers and help drive organic growth, mitigating the risk of an over-reliance on M&A.

Messaging

Message Architecture

Key Messages

- Message:

We are a portfolio of market-leading businesses in defensible niche markets.

Prominence:Primary

Clarity Score:High

Location:About Us

- Message:

Our strategy is centered on a decentralized operating environment and process-driven capital deployment.

Prominence:Primary

Clarity Score:High

Location:About Us

- Message:

Roper has a proven, long-term track record of compounding cash flow and shareholder value.

Prominence:Secondary

Clarity Score:High

Location:About Us

- Message:

We acquire high-quality, asset-light software and technology-enabled businesses.

Prominence:Secondary

Clarity Score:Medium

Location:Implicit across 'About Us' and 'Businesses' sections

The messaging hierarchy is clear and logical for its primary audiences. The top-level messages on the 'About Us' page effectively communicate the core business model and investment philosophy (portfolio of leaders, decentralized operations, capital strategy). This directly addresses the key concerns of investors and potential acquisition targets. The 'Businesses' page then serves as proof, showcasing the high-quality assets that result from this strategy.

Messaging is highly consistent across the provided content. The themes of market leadership, niche focus, and a disciplined, decentralized approach are implicitly reinforced by the descriptions of the individual businesses, even though the corporate-level keywords aren't repeated in each description. The overall narrative is cohesive and uniform.

Brand Voice

Voice Attributes

- Attribute:

Corporate & Professional

Strength:Strong

Examples

Roper Technologies is a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

Roper utilizes a disciplined, analytical, and process-driven approach to redeploy its excess capital.

- Attribute:

Confident & Authoritative

Strength:Strong

Examples

Roper has a proven, long-term track record of compounding cash flow and shareholder value.

The Company operates market leading businesses...

- Attribute:

Concise & Factual

Strength:Moderate

Examples

- •

Market-leading businesses in defensible niches

- •

Decentralized operating environment

- •

Process-driven capital deployment

- Attribute:

Understated

Strength:Moderate

Examples

The language avoids hyperbole and focuses on process and results rather than expressive adjectives. The bullet points under the key pillars ('Trust & mutual respect', 'Keep it simple') are stated plainly without elaboration.

Tone Analysis

Institutional

Secondary Tones

- •

Financial

- •

Strategic

- •

Formal

Tone Shifts

There are no significant tone shifts. The tone remains consistently corporate and professional across the 'About Us' and 'Businesses' pages, which is appropriate for the target audience.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

For investors and business owners, Roper is a superior steward of capital that acquires and grows market-leading, niche technology businesses through a decentralized, trust-based model to deliver long-term, compounding shareholder value.

Value Proposition Components

- Component:

Decentralized Operations

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Disciplined Capital Deployment

Clarity:Clear

Uniqueness:Common

- Component:

Focus on Defensible Niche Markets

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Long-Term Value Compounding

Clarity:Clear

Uniqueness:Common

Roper's messaging effectively differentiates itself from more operationally integrated conglomerates by heavily emphasizing its 'Decentralized operating environment' and values like 'Trust & mutual respect' and 'Keep it simple'. While competitors like Danaher have a highly structured 'Danaher Business System' (DBS) that is a core part of their identity , Roper positions itself as a more hands-off, trust-based parent company. This is a powerful differentiator for founders of potential acquisition targets who fear losing autonomy.

The messaging positions Roper as a stable, disciplined, and reliable compounder of shareholder value. It is not positioned as a fast-moving disruptor or a deeply integrated operational powerhouse. Instead, it projects an image of a prudent, long-term capital allocator that buys and holds great, independent businesses. This positions it as a safe harbor for both investor capital and for the legacy of acquired companies.

Audience Messaging

Target Personas

- Persona:

Investor / Financial Analyst

Tailored Messages

- •

Roper has a proven, long-term track record of compounding cash flow and shareholder value.

- •

constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

- •

Process-driven capital deployment

- •

Cash return on investment

Effectiveness:Effective

- Persona:

Founder / CEO of a Potential Acquisition Target

Tailored Messages

- •

Decentralized operating environment

- •

Trust & mutual respect

- •

Keep it simple

- •

The entire 'Businesses' page, which showcases a portfolio of strong, independent brands.

Effectiveness:Effective

Audience Pain Points Addressed

For Investors: The fear of poor capital allocation and the desire for consistent, long-term growth over short-term hype.

For Founders: The fear of being micromanaged, having their company culture dismantled, or their business being stripped for parts after an acquisition.

Audience Aspirations Addressed

For Investors: To partner with a proven vehicle for compounding wealth steadily and reliably.

For Founders: To find a permanent, stable home for their business that respects their autonomy and legacy, while providing capital for growth.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Stability

Effectiveness:High

Examples

- •

proven, long-term track record

- •

defensible niche markets

- •

minimize risk

- Appeal Type:

Trust

Effectiveness:Medium

Examples

Trust & mutual respect

Social Proof Elements

- Proof Type:

Portfolio of Leading Brands

Impact:Strong

- Proof Type:

Inclusion in Major Stock Indexes

Impact:Strong

- Proof Type:

Specific Subsidiary Metrics (e.g., Aderant's retention rate and NPS score)

Impact:Moderate

Trust Indicators

- •

Being a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

- •

The comprehensive and impressive list of market-leading businesses in its portfolio.

- •

The use of clear, process-oriented language ('disciplined, analytical, and process-driven approach').

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Visit Website

Location:Businesses (for each subsidiary)

Clarity:Clear

- Text:

Expand All/Close All

Location:Businesses

Clarity:Clear

The CTAs are functionally effective but strategically limited. The 'Visit Website' links appropriately direct traffic to the subsidiary companies, which is a primary goal of the portfolio page. However, the corporate site itself lacks prominent CTAs for its key audiences. There are no clear, direct calls-to-action for investors (e.g., 'View Investor Deck', 'Annual Reports') or potential sellers (e.g., 'Our Acquisition Criteria', 'Contact Our Corporate Development Team'). This forces key audiences to search for information rather than being guided.

Messaging Gaps Analysis

Critical Gaps

- •

Audience-specific navigation and CTAs are missing, particularly for investors and business owners looking to be acquired.

- •

There is no corporate narrative or storytelling. The messaging is highly factual and strategic but lacks a compelling story about Roper's history, evolution, or the collective impact of its businesses.

- •

Lack of content that brings the 'decentralized' model to life. Testimonials from acquired company leaders or case studies on post-acquisition success are absent.

Contradiction Points

No itemsUnderdeveloped Areas

The cultural pillar of 'Trust & mutual respect' is stated but not demonstrated. Without examples or stories, it remains an assertion rather than a proven aspect of the brand.

The concept of the 'high-performance culture' is mentioned but not defined or elaborated upon, leaving its meaning open to interpretation.

Messaging Quality

Strengths

- •

Exceptional clarity and conciseness in communicating its core strategy and value proposition.

- •

Highly effective and professional brand voice that resonates with its financial and corporate audiences.

- •

Strong use of social proof through its portfolio and index inclusions to build credibility instantly.

Weaknesses

- •

Overly reliant on rational, factual statements, which makes the brand feel impersonal and dry.

- •

Lack of clear user journeys and calls-to-action for key personas on the corporate site.

- •

Absence of storytelling and proof points (beyond the list of companies) to substantiate cultural claims.

Opportunities

- •

Develop a dedicated 'Our Approach' or 'Why Partner With Us' section to elaborate on the decentralized model with case studies or CEO testimonials.

- •

Create distinct pathways on the homepage for 'Investors' and 'Business Owners' to guide them to tailored content.

- •

Craft a corporate narrative that frames the portfolio not just as a collection of assets, but as a community of niche leaders powered by Roper's unique philosophy.

Optimization Roadmap

Priority Improvements

- Area:

Audience Navigation

Recommendation:Add two prominent buttons or links on the homepage/main navigation: 'For Investors' and 'For Business Owners'. These should lead to dedicated landing pages with relevant content and CTAs.

Expected Impact:High

- Area:

Value Proposition Substantiation

Recommendation:Create a new content section detailing the acquisition and partnership philosophy. Feature 1-2 short video testimonials or written case studies with CEOs from acquired companies discussing the benefits of the decentralized model.

Expected Impact:High

- Area:

Call-to-Action Implementation

Recommendation:On the new 'Investors' page, add clear CTAs for 'View Annual Reports,' 'SEC Filings,' and 'Events & Presentations.' On the 'Business Owners' page, add 'Our Criteria' and a clear contact path to the corporate development team.

Expected Impact:Medium

Quick Wins

- •

Add a direct 'Investor Relations' link to the main navigation or footer.

- •

Rephrase the 'About Us' headline to be more narrative, e.g., 'A Unique Home for Market-Leading Technology Businesses.'

- •

On the 'Businesses' page, add a brief introductory paragraph that frames the portfolio as the result of their stated strategy.

Long Term Recommendations

- •

Develop a comprehensive brand narrative that tells the story of Roper's evolution and its unique place in the market.

- •

Build out a library of content (articles, videos) that showcases the innovation and leadership within the portfolio companies, reinforcing the 'market-leading' claim.

- •

Consider a 'Culture' section that provides tangible examples of how 'Trust & mutual respect' and 'Keep it simple' are implemented in practice.

Roper Technologies' website messaging is a masterclass in clarity, discipline, and audience-appropriateness. The communication strategy is perfectly calibrated for its primary audiences: investors and potential acquisition targets. The brand voice is corporate, confident, and professional, effectively building credibility and trust through direct, fact-based statements. The core value proposition—a decentralized holding company that acquires and grows niche market leaders to compound long-term value—is communicated with exceptional precision on the 'About Us' page and substantiated by the impressive portfolio on the 'Businesses' page.

The key differentiator in Roper's messaging is the strong emphasis on its 'decentralized operating environment'. This, combined with stated values like 'Trust & mutual respect', positions the company as an attractive alternative to more operationally-intensive acquirers, a critical message for founders weighing their exit options.

However, the messaging's greatest strength—its rational, no-frills professionalism—is also its primary weakness. The strategy is so logically articulated that it becomes emotionally sterile. The website is missing a compelling narrative; it explains the 'what' and 'how' of its business model but not the 'why' or the human story behind it. Critical claims about its culture of trust are asserted but not demonstrated, representing a significant missed opportunity to build deeper connection and affinity.

Furthermore, the user experience lacks strategic guidance. There are no clear pathways or calls-to-action for the very audiences the messaging is designed for. An investor or a business owner lands on the site and must navigate themselves to relevant information. This functional gap undermines the strategic effectiveness of the messaging.

In summary, Roper has an exceptionally strong messaging foundation. The immediate opportunity is to enhance this foundation with narrative elements, substantiating proof points (like testimonials), and clear, audience-centric navigation to transform a static corporate brochure into a more engaging and persuasive strategic communications platform.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Roper's core 'product' is its acquisition and capital deployment strategy, which has a strong, demonstrated fit in the market for niche, asset-light vertical software and technology businesses.

- •

The company has a long-term track record of compounding cash flow and shareholder value, indicating the success of its acquisition thesis.

- •

High recurring revenue bases (approaching 87% in vertical SaaS) and strong customer retention within its portfolio companies (e.g., Aderant's 95% retention) validate the product-market fit of the individual businesses it acquires.

- •

Consistently strong financial performance, with Q2 2025 revenues up 13.2% year-over-year, driven by both organic growth (7%) and acquisitions (6%), reaffirms the model's effectiveness.

Improvement Areas

Systematize the identification of emerging, high-growth niche markets to stay ahead of competition from private equity.

Develop a more formal playbook for sharing best practices (e.g., sales strategies, talent development) across its decentralized portfolio companies to unlock synergistic value.

Market Dynamics

11-15% CAGR (Vertical Software Market)

Mature

Market Trends

- Trend:

Increased competition for high-quality software assets from private equity and other strategic acquirers.

Business Impact:Potential for higher acquisition multiples, requiring even greater discipline in capital deployment to meet Cash Return on Investment (CRI) targets.

- Trend:

Rapid adoption of AI, IoT, and data analytics within niche industries.

Business Impact:Presents an opportunity to acquire businesses with strong AI/data moats and a threat if portfolio companies do not innovate to keep pace.

- Trend:

Ongoing digital transformation in traditionally under-digitized sectors (e.g., legal, construction, faith-based organizations).

Business Impact:Creates a continuous pipeline of potential acquisition targets and organic growth opportunities within the existing portfolio.

- Trend:

Shift to cloud-native, SaaS-based solutions in all verticals.

Business Impact:Favors Roper's focus on asset-light, high-recurring-revenue business models and requires continued investment in cloud capabilities within its portfolio.

Favorable. Despite a mature M&A market, the underlying trend of digitization in niche verticals provides a sustained, long-term tailwind for Roper's acquisition-led growth model.

Business Model Scalability

High

Highly scalable, asset-light model. Corporate overhead (fixed cost) is minimal relative to the revenue and cash flow of the entire portfolio. Growth comes from acquiring new variable revenue streams.

High at the corporate level. The decentralized operating structure allows Roper to add new businesses to its portfolio without a proportional increase in central management costs.

Scalability Constraints

Availability of high-quality acquisition targets that meet Roper's strict financial and strategic criteria.

The bandwidth of the corporate executive team to source, diligence, and oversee a growing number of acquisitions and portfolio companies.

Team Readiness

Exceptional. The executive team's core competency is disciplined capital allocation and M&A execution, which is central to the company's value creation strategy.

Highly suitable. A decentralized structure empowers the leadership of acquired businesses to operate autonomously and efficiently, which is a key selling point for founders and crucial for managing a diverse portfolio.

Key Capability Gaps

Formalized capability for driving cross-portfolio synergies; the decentralized model may inhibit the sharing of technology and go-to-market best practices.

Dedicated internal team for sourcing opportunities in emerging technology areas (e.g., GenAI, quantum computing) before they become mainstream and highly competitive.

Growth Engine

Acquisition Channels

- Channel:

Proprietary M&A Sourcing & Execution

Effectiveness:High

Optimization Potential:Medium

Recommendation:Develop a dedicated 'emerging tech' sourcing function to identify and build relationships with potential targets in future high-growth niches before they come to market.

Customer Journey

The 'customer' is the acquisition target. The journey involves: Target Identification -> Relationship Building -> Due Diligence -> Valuation & Negotiation -> Acquisition -> Integration & Value Creation.

Friction Points

Maintaining valuation discipline in a competitive M&A market with high multiples.

Ensuring cultural alignment post-acquisition to retain key talent within the acquired companies.

Journey Enhancement Priorities

{'area': 'Post-Acquisition Value Creation', 'recommendation': "Formalize a 'First 100 Days' playbook focused on integrating Roper's financial discipline and CRI framework while preserving the operational autonomy of the acquired business."}

Retention Mechanisms

- Mechanism:

Decentralized Operational Autonomy for Portfolio Companies

Effectiveness:High

Improvement Opportunity:Create a 'Roper CEO Council' for leaders of portfolio companies to share best practices and solve common challenges collaboratively, fostering a sense of community without imposing central control.

- Mechanism:

Long-Term, Performance-Based Incentives for Subsidiary Leadership

Effectiveness:High

Improvement Opportunity:Introduce metrics tied to inter-company collaboration or adoption of shared best practices to encourage synergistic behavior.

Revenue Economics

Exceptional. The model is built on acquiring businesses with high gross margins, strong recurring revenue, and asset-light operations, leading to excellent unit economics that generate substantial free cash flow.

Not directly applicable; the analogous metric is Cash Return on Investment (CRI) for acquisitions, which is the core performance metric and is rigorously managed to be high.

High. The company consistently converts revenue to free cash flow at a very high rate, with FCF margins often exceeding 25-30%.

Optimization Recommendations

Continue to refine the CRI model to account for changing market dynamics, such as higher interest rates or evolving software valuation multiples.

Systematically analyze the portfolio to identify and divest underperforming or non-strategic assets to redeploy capital into higher-return opportunities.

Scale Barriers

Technical Limitations

- Limitation:

Portfolio-wide Data & Analytics Infrastructure

Impact:Medium

Solution Approach:Invest in a centralized (but optional for subsidiaries) data platform to identify cross-sell opportunities and benchmark operational KPIs across the portfolio.

Operational Bottlenecks

- Bottleneck:

M&A Due Diligence Bandwidth

Growth Impact:Could limit the number of deals that can be evaluated simultaneously, potentially causing Roper to miss opportunities.

Resolution Strategy:Expand the corporate development team and leverage AI-powered due diligence tools to increase efficiency and throughput.

- Bottleneck:

Integration of Newly Acquired Leadership into the Roper Culture

Growth Impact:Misalignment on capital allocation philosophy or reporting could slow down value creation post-acquisition.

Resolution Strategy:Develop a structured onboarding and mentorship program for new leaders, pairing them with experienced Group Executives.

Market Penetration Challenges

- Challenge:

Intensifying Competition in M&A Market

Severity:Critical

Mitigation Strategy:Double down on being the 'acquirer of choice' for founders who value operational autonomy, and leverage deep industry expertise to identify unique assets that private equity may overlook.

- Challenge:

Soaring Valuations for SaaS Companies

Severity:Major

Mitigation Strategy:Maintain strict valuation discipline based on CRI targets, even if it means walking away from popular or 'hot' deals. Focus on niches with less hype and more durable, predictable cash flows.

Resource Limitations

Talent Gaps

Succession planning for key Group Executive roles who are crucial for coaching and overseeing portfolio companies.

Specialized M&A talent with expertise in emerging tech sectors like AI, cybersecurity, and sustainability software.

Low to Medium. The business model is self-funding through strong free cash flow generation. However, a 'mega-deal' would require leveraging the balance sheet and capital markets.

Infrastructure Needs

Enhanced internal systems for managing a growing and complex M&A pipeline.

A more robust internal knowledge management system to facilitate the sharing of best practices across the portfolio.

Growth Opportunities

Market Expansion

- Expansion Vector:

Acquisition of companies in new, adjacent vertical software markets (e.g., ESG & sustainability compliance, specialized FinTech, InsurTech).

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Start with a smaller, 'beachhead' acquisition to learn the new market dynamics before making larger capital commitments.

- Expansion Vector:

Geographic expansion through acquisition of market-leading vertical software businesses in Europe and Asia-Pacific.

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Prioritize geographies with stable regulatory environments and a mature software ecosystem. Partner with local M&A advisors.

Product Opportunities

- Opportunity:

Develop a 'Roper Edge' platform offering optional, best-in-class shared services (e.g., cybersecurity, AI development toolkit, talent acquisition) to portfolio companies.

Market Demand Evidence:All software companies face similar challenges in these areas; providing a high-quality, centralized resource could accelerate their growth and improve efficiency.

Strategic Fit:Enhances the value proposition of being a Roper company without violating the core principle of decentralized operations.

Development Recommendation:Pilot with a small group of volunteer portfolio companies to prove value and refine the offering.

Channel Diversification

- Channel:

Strategic relationships with Venture Capital firms

Fit Assessment:Good

Implementation Strategy:Establish Roper as a preferred, long-term strategic buyer for maturing, profitable portfolio companies of VC firms seeking an exit.

Strategic Partnerships

- Partnership Type:

Technology Platform Partnerships

Potential Partners

Major Cloud Providers (AWS, Azure, Google Cloud)

AI Platform Companies (e.g., OpenAI, Anthropic)

Expected Benefits:Gain preferential access to new technologies and expertise that can be leveraged across the portfolio; potentially negotiate portfolio-wide preferred pricing.

Growth Strategy

North Star Metric

Cash Return on Investment (CRI)

This is the company's self-proclaimed core metric. It perfectly aligns with the business model of acquiring and growing cash-generative businesses and is the ultimate measure of successful capital deployment.

Maintain top-quartile CRI performance on all new acquisitions and drive year-over-year CRI improvement within the existing portfolio.

Growth Model

Acquisition-Led Compounding

Key Drivers

- •

Disciplined capital deployment into new acquisitions.

- •

Sustained organic growth of the existing business portfolio.

- •

Generation of substantial free cash flow to fund future acquisitions.

Continue the disciplined, process-driven approach to M&A. Systematically identify new niche markets and refine the post-acquisition playbook to accelerate cash flow growth.

Prioritized Initiatives

- Initiative:

Launch a strategic initiative to identify and acquire a platform company in the AI-powered regulatory/compliance tech space.

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 Months

First Steps:Commission a market map of the RegTech landscape and assign a corporate development lead to build relationships with key players.

- Initiative:

Establish a cross-portfolio 'AI Center of Excellence' to share best practices and accelerate AI adoption.

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6-9 Months

First Steps:Survey portfolio companies to identify current AI leaders and use cases. Appoint a respected technology leader from within the portfolio to champion the initiative.

- Initiative:

Refine capital allocation strategy to include opportunistic divestitures of slower-growth or non-strategic assets.

Expected Impact:Medium

Implementation Effort:Low

Timeframe:Ongoing

First Steps:Institute an annual strategic review of the bottom 10% of the portfolio based on growth and CRI metrics.

Experimentation Plan

High Leverage Tests

- Test Name:

Minority Investment Pilot

Hypothesis:Taking a minority stake in an earlier-stage, high-growth company can provide a strategic entry point into a new market at a lower capital cost.

Success Metric:Successful conversion to a full acquisition within 24-36 months at a pre-agreed valuation framework.

For strategic experiments, measure success based on learnings, strategic options created, and the financial return on the pilot investment over a multi-year horizon.

One strategic pilot/experiment per 12-18 months, focusing on new market entry or partnership models.

Growth Team

The 'Growth Team' is the Corporate Development & Strategy Group. Structure should be organized by industry vertical clusters, with dedicated teams for sourcing, execution, and post-acquisition monitoring.

Key Roles

- •

Head of Corporate Strategy (focused on identifying new market verticals)

- •

Managing Director, M&A Sourcing

- •

Director, Post-Acquisition Integration & Performance

Actively recruit M&A talent with deep software and technology expertise. Implement a rotational program for high-potential leaders from portfolio companies to spend 12 months on the corporate development team.

Roper Technologies represents a masterclass in disciplined, acquisition-led growth. The company's foundation is exceptionally strong, built on a highly scalable, decentralized holding company model that acquires and nurtures market-leading vertical software businesses. Their 'product'—a process-driven capital deployment strategy focused on Cash Return on Investment (CRI)—has an undeniable fit in a market characterized by increasing digitization. The company's growth engine is not a traditional marketing funnel but a sophisticated M&A machine that consistently identifies and integrates asset-light, high-margin, cash-generative businesses.

The primary barriers to future growth are external: intense competition and soaring valuations in the M&A market, driven by private equity and other strategic acquirers. This puts immense pressure on Roper's core competency of valuation discipline. Internally, the key challenge will be scaling the corporate team's bandwidth to manage an ever-larger portfolio and avoiding the complacency that can accompany long-term success.

Significant growth opportunities lie in expanding their acquisition aperture to new, emerging vertical software markets (such as AI-driven compliance and ESG reporting software) and geographies. There is also untapped potential in fostering more deliberate, structured collaboration and knowledge sharing across their portfolio without compromising the decentralized ethos that makes them successful.

My primary recommendation is to evolve the growth strategy from being purely opportunistic to being more proactive and thematic. This involves dedicating resources to map and cultivate relationships in the 'next wave' of niche software markets before they become competitive auctions. Furthermore, formalizing a light-touch 'Center of Excellence' for critical capabilities like AI, cybersecurity, and go-to-market strategy could significantly enhance the value provided to portfolio companies and accelerate their organic growth, thereby compounding value for Roper even more effectively.

Legal Compliance

A Privacy Policy is present and accessible via a link on the company's website. It was last updated in June 2022. The policy outlines the types of data collected, including information provided directly by users, data collected automatically via cookies and other trackers (IP address, browser, geolocation, activity), and information combined from third-party or public sources. It explicitly mentions that personal data is shared with Roper's divisions, subsidiaries, and third-party service providers. The policy addresses the California Consumer Privacy Act (CCPA) by stating it will not discriminate against consumers for exercising their rights and provides an email address ([email protected]) and a physical address for privacy inquiries. This demonstrates an awareness of major US data privacy regulations. However, the policy lacks specific details regarding GDPR, such as the legal bases for processing data, data subject rights specific to the EU (e.g., portability, restriction of processing), and information on a Data Protection Officer (DPO) or EU representative, which is a significant gap for a company with a substantial global presence through its subsidiaries.

A dedicated, easily accessible 'Terms of Service' or 'Terms of Use' document for the public-facing corporate website ropertech.com could not be located through website navigation or web searches. While SEC filings and other documents mention various internal policies and agreements (like a Code of Ethics and Supplier Code of Conduct), these do not serve the purpose of governing public use of the corporate website. The absence of explicit Terms of Service creates legal ambiguity regarding website use, intellectual property rights, disclaimers of liability, and governing law for disputes arising from the website itself. This is a notable oversight for a Fortune 1000, publicly-traded company.

The website utilizes a cookie consent banner that appears upon visiting. The banner informs users about the use of cookies and provides two primary options: 'Accept All' and 'Cookie Settings'. This approach is a positive step towards compliance. The 'Cookie Settings' option allows for granular control, enabling users to consent to different categories of cookies (Functional, Performance, Analytics, Advertisement, Others), which aligns with GDPR principles. However, the mechanism has a key compliance flaw: there is no explicit 'Reject All' or 'Decline' button that is as easy to access as the 'Accept All' button. Under GDPR, the process to reject non-essential cookies must be as simple as the process to accept them. The current design nudges users towards acceptance, which is a practice regulators like the French CNIL have fined companies for. Non-essential cookies should not be placed until affirmative consent is given.

Roper Technologies demonstrates a foundational level of data protection awareness through its Privacy Policy and cookie management tool. The policy details what data is collected and for what purposes. The company provides contact points for privacy-related queries, which is a crucial component of accountability under modern data protection laws. As a holding company for businesses in highly regulated sectors like healthcare (HIPAA) and finance, Roper's overall strategic posture on data protection is critical for investor confidence. Their corporate responsibility statement mentions a commitment to legal and ethical business practices. However, the public-facing documentation on the corporate website lacks the specificity and robustness expected of a global technology leader, particularly concerning international data transfer mechanisms and detailed GDPR-specific rights, which are highly relevant given their European business operations.

There is no readily available Accessibility Statement on the ropertech.com website. A manual check reveals potential issues common to websites without a dedicated accessibility focus, such as a lack of clear keyboard navigation cues and potential reliance on mouse-based interactions. For a large US-based public company, this poses a direct risk of litigation under the Americans with Disabilities Act (ADA), which has been consistently interpreted by US courts to apply to websites as places of public accommodation. Compliance with Web Content Accessibility Guidelines (WCAG) 2.1 Level AA is the de facto standard to mitigate this risk. The absence of a public commitment or statement on accessibility is a significant strategic and legal deficiency.

As a holding company, ropertech.com itself does not directly offer services that fall under stringent industry-specific regulations like HIPAA or financial services compliance. However, its portfolio is heavily weighted in these areas (e.g., Verathon, CIVCO in medical; iPipeline, Vertafore in insurance/finance). The corporate website's primary function is investor relations and brand positioning. From a strategic legal standpoint, the site's compliance posture serves as a signal of the parent company's overall governance and risk management maturity. The current gaps (no Terms of Service, weak cookie consent, no accessibility statement) project a weaker governance image than would be ideal for a company whose value is tied to sophisticated, regulated technology businesses. Furthermore, as a publicly-traded company on the Nasdaq, Roper is subject to SEC regulations regarding corporate governance and risk disclosures.

Compliance Gaps

- •

Absence of a publicly accessible Terms of Service or Terms of Use document for the corporate website.

- •

The cookie consent banner lacks a clear and equally prominent 'Reject All' option, which is a common requirement for GDPR compliance.

- •

The Privacy Policy lacks specific details required by GDPR, such as the lawful basis for processing, data transfer mechanisms for international data, and details of an EU representative or DPO.

- •

No visible Accessibility Statement or clear commitment to WCAG standards, creating significant legal risk under the ADA.

- •

Insufficient detail on data protection practices for a company overseeing subsidiaries in high-risk sectors like healthcare and finance.

Compliance Strengths

- •

A clear and accessible Privacy Policy is present.

- •

The cookie consent mechanism offers granular control over different categories of cookies ('Cookie Settings').

- •

The Privacy Policy explicitly acknowledges CCPA rights and provides contact information for privacy inquiries.

- •

The company maintains and publishes other key governance documents like a Code of Ethics and Supplier Code of Conduct.

Risk Assessment

- Risk Area:

Accessibility (ADA)

Severity:High

Recommendation:Immediately engage a third-party expert to conduct a WCAG 2.1 AA audit of the website. Based on the audit, remediate all identified issues and publish an Accessibility Statement detailing the company's commitment to digital accessibility for people with disabilities.

- Risk Area:

Privacy (GDPR)

Severity:High

Recommendation:Update the cookie consent banner to include an equally prominent 'Reject All' button. Revise the Privacy Policy to include all GDPR-required elements, appoint an EU representative if necessary, and clarify the legal basis for processing and international data transfers.

- Risk Area:

General Legal/Contractual

Severity:Medium

Recommendation:Draft and publish a comprehensive Terms of Service document for the website. This should include clauses on limitation of liability, intellectual property, acceptable use, and governing law.

- Risk Area:

Reputation & Investor Confidence

Severity:Medium

Recommendation:Enhance all public-facing legal and compliance documentation to reflect the high standards of governance expected from a Fortune 1000 technology leader operating in regulated markets. This demonstrates robust risk management to investors and potential acquisition targets.

High Priority Recommendations

- •

Implement a Compliant Cookie Consent Banner: Add a 'Reject All' button with equal prominence to the 'Accept All' button to align with GDPR standards.

- •

Publish an Accessibility Statement and Remediate Issues: Commission a WCAG 2.1 AA audit and begin remediation to mitigate ADA litigation risk.

- •

Update the Privacy Policy for GDPR: Enhance the privacy policy to include specific provisions required by GDPR, including lawful bases for processing, data subject rights, and information on international data transfers.

- •

Create and Post Website Terms of Service: Develop and make accessible a formal Terms of Service document to govern the use of the corporate website and limit liability.

Roper Technologies' corporate website, ropertech.com, presents a mixed but strategically weak legal compliance posture. While it has foundational elements like a Privacy Policy and a cookie management tool, it suffers from critical omissions and implementation flaws that are incongruous with its status as a large-cap, publicly-traded global technology company. The most severe risks stem from the lack of an accessibility framework, creating exposure to ADA lawsuits, and a non-compliant cookie consent mechanism, which poses a direct risk of GDPR enforcement actions. The complete absence of a Terms of Service document is a fundamental governance oversight.