eScore

statestreet.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

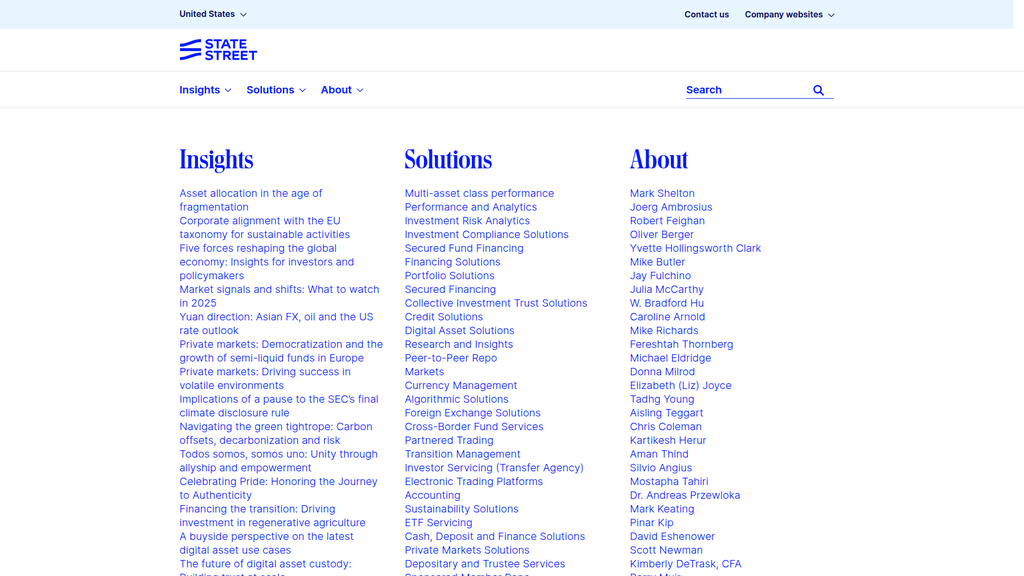

State Street has a formidable digital presence, anchored by a vast repository of expert content that establishes strong content authority and aligns well with the search intent of its sophisticated institutional audience. Its global website structure effectively targets different geographic markets, demonstrating strong international reach. However, the connection between its top-funnel thought leadership and its specific service offerings is not always direct, and there is little evidence of optimization for newer search modalities like voice search.

Exceptional content authority driven by its 'Insights' section, which serves as a powerful tool for demonstrating expertise and attracting its target audience through organic search.

Systematically link 'Insights' articles to relevant 'Solutions' pages with clear, contextual calls-to-action to better guide users from research and awareness to consideration of its services.

The brand's voice is impeccably authoritative, analytical, and consistent, effectively reinforcing credibility. However, the messaging over-indexes on thought leadership at the expense of clearly articulating its core value proposition and solutions on the homepage. While messages are tailored for its institutional audience, there's a lack of strong conversion-focused messaging and clear pathways for prospects to take commercial steps.

The brand voice is exceptionally consistent across all digital content, successfully projecting a tone of expertise, authority, and professionalism that resonates with its target audience.

Redesign the homepage hero section to feature a clear, stable value proposition that answers 'Who we help and how' before diving into content, immediately orienting new visitors.

While the website has a professional design and strong accessibility framework, the user experience is hampered by significant friction points. The desktop mega menu creates a high cognitive load, and dense, text-heavy layouts make content difficult to scan. Key calls-to-action are often styled as low-prominence 'ghost buttons,' diminishing their effectiveness and hindering user guidance toward conversion.

A strong commitment to accessibility, evidenced by a dedicated policy and adherence to WCAG principles, which broadens market access and meets legal requirements.

Redesign the mega menu to reduce cognitive load by introducing visual grouping, subheadings, or iconography, making it easier for users to scan and navigate.

State Street's credibility is world-class, underpinned by its status as a Global Systemically Important Bank and its meticulous approach to legal and regulatory compliance. The website features best-in-class cookie compliance, comprehensive disclosures, and jurisdiction-specific privacy policies, building profound trust. This robust framework serves as a competitive advantage, demonstrating to clients and regulators that its governance is managed with the highest level of rigor.

Exemplary legal and compliance framework, with granular cookie consent and comprehensive, tiered financial disclosures that proactively mitigate risk and build significant stakeholder trust.

While current processes are strong, the primary risk is operational. State Street should continuously reinforce the rigorous internal review process for all web content to ensure ongoing compliance with evolving global marketing rules.

The company's competitive moat is exceptionally strong and sustainable, built on massive economies of scale, high client switching costs, and deep global regulatory expertise. The State Street Alpha platform represents a significant technological advantage, creating a sticky, integrated front-to-back office solution. While legacy technology presents a challenge, the core advantages are deeply entrenched and very difficult for competitors to replicate.

Extremely high switching costs for institutional clients, whose operations are deeply integrated with State Street's platforms, creating highly sustainable and defensible client relationships.

Continue to aggressively invest in modernizing the legacy technology stack and migrating clients to the cloud-native Alpha platform to mitigate the risk of disruption from more agile fintech competitors.

The business model is highly scalable due to high operating leverage, where revenue from asset-based fees grows with minimal increases in operational cost once platforms are established. The company is well-positioned to expand into high-growth areas like digital assets and private markets. The main constraints are the complexity of global regulations and the high capital expenditure required for continuous technological modernization.

A highly scalable, fee-based revenue model built on trillions in assets under custody, allowing for significant revenue growth with marginal increases in operational costs.

Develop a more standardized, tech-driven, lower-cost version of the Alpha platform to tap into the large, underserved market of smaller asset managers and family offices.

State Street's business model is exceptionally coherent and aligned with the needs of its institutional target market. The strategic shift to focus on the State Street Alpha platform as the core value proposition is a direct and effective response to industry trends like fee compression and the demand for data integration. Revenue streams are stable, diversified, and directly tied to its key activities of investment servicing and management.

The strategic focus on the State Street Alpha platform provides a powerful, coherent response to market needs, unifying the company's services into a single, integrated value proposition.

Accelerate the development of new revenue streams by monetizing the Alpha platform's data through a 'Data-as-a-Service' (DaaS) model, diversifying away from traditional asset-based fees.

As one of the top three global custodians, State Street operates in an oligopoly with immense market power and influence. Its designation as a Global Systemically Important Bank (G-SIB) highlights its critical role in the financial ecosystem, affording it significant pricing power, though this is tempered by intense competition. The company's scale and deep client integration give it substantial leverage with partners and a commanding market position.

Its status as a Global Systemically Important Bank (G-SIB) and one of the world's largest custodians provides immense market power, brand credibility, and influence over industry standards.

Shift the competitive narrative to focus marketing efforts on establishing uncontested leadership in 2-3 strategic growth areas, such as tokenization and AI in asset management, to differentiate from broad-based competitors.

Business Overview

Business Classification

Institutional Financial Services

Asset Management

Financial Services

Sub Verticals

- •

Custody Banking

- •

Asset Servicing

- •

Fund Administration

- •

Investment Management

- •

Global Markets & Trading

- •

Securities Lending

Mature

Maturity Indicators

- •

Established in 1792, one of the oldest financial institutions in the U.S.

- •

Designated as a Global Systemically Important Bank (G-SIB), indicating its critical role in the global financial system.

- •

Manages trillions of dollars in assets under custody/administration ($46.6T as of Dec 2024) and assets under management ($4.7T as of Dec 2024).

- •

Extensive global presence, operating in over 100 geographic markets.

- •

Stable, albeit slow-growing, revenue streams characteristic of a mature, large-cap company.

Global Systemically Important Bank (G-SIB)

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Investment Servicing Fees (Servicing Fees)

Description:Core revenue driver, comprising fees for custody, fund administration, accounting, and related services. Fees are primarily based on a percentage of client Assets Under Custody and Administration (AUC/A). This segment accounts for the vast majority of company revenue (approx. 81-84%).

Estimated Importance:Primary

Customer Segment:Institutional Asset Managers, Asset Owners

Estimated Margin:Medium

- Stream Name:

Investment Management Fees (Management Fees)

Description:Generated by State Street Global Advisors (SSGA), this stream includes fees based on a percentage of Assets Under Management (AUM) for providing investment strategies, including ETFs (like the SPDR S&P 500 ETF), index funds, and active management.

Estimated Importance:Primary

Customer Segment:Institutional and Retail Investors (via funds)

Estimated Margin:Medium

- Stream Name:

Global Markets Revenue

Description:Revenue from foreign exchange (FX) trading services, securities lending, and electronic trading platforms. Generated through spreads, commissions, and fee-sharing agreements on securities lending activities.

Estimated Importance:Secondary

Customer Segment:Institutional Asset Managers, Asset Owners

Estimated Margin:Medium

- Stream Name:

Net Interest Income (NII)

Description:Generated from the spread between the interest earned on assets (like loans and investments) and the interest paid out on liabilities (like client deposits). Highly sensitive to global interest rate fluctuations.

Estimated Importance:Secondary

Customer Segment:All deposit-holding clients

Estimated Margin:Variable

Recurring Revenue Components

- •

Asset-based servicing fees (AUC/A)

- •

Asset-based management fees (AUM)

- •

Software and data licensing fees

- •

Net Interest Income

Pricing Strategy

Asset-based Fees & Spread-based

Premium

Opaque

Pricing Psychology

- •

Relationship Pricing

- •

Tiered Pricing (based on AUC/A and service complexity)

- •

Bundling (integrated front-to-back office solutions via Alpha platform)

Monetization Assessment

Strengths

- •

Highly stable and predictable revenue from servicing and management fees on massive asset bases.

- •

Diversified streams across servicing, management, trading, and net interest income.

- •

Deeply entrenched client relationships create high switching costs, ensuring revenue stickiness.

Weaknesses

- •

Significant fee compression in the core custody and asset management businesses due to intense competition.

- •

High sensitivity of Net Interest Income to volatile interest rate environments.

- •

Revenue is closely tied to global market valuations; a significant downturn would reduce asset-based fees.

Opportunities

- •

Monetizing the State Street Alpha platform through data-as-a-service (DaaS) and analytics offerings.

- •

Developing new revenue streams from digital asset servicing (custody, tokenization, administration).

- •

Expanding value-added services in high-growth areas like private markets and ESG solutions.

Threats

- •

Aggressive price competition from other large custodians like BNY Mellon, JPMorgan, and Citi.

- •

Disruption from fintech companies offering more agile or lower-cost point solutions.

- •

Increased regulatory capital requirements that could constrain balance-sheet-intensive activities like securities finance and FX services.

Market Positioning

Scale, Trust, and Technology-driven Partnership

Top-tier Global Custodian (typically ranked among the top 3 globally alongside BNY Mellon and JPMorgan Chase).

Target Segments

- Segment Name:

Institutional Asset Managers

Description:Large, global investment firms (e.g., mutual funds, hedge funds, ETF providers) that require end-to-end operational support.

Demographic Factors

Global or regional presence

High Assets Under Management (AUM)

Psychographic Factors

Focused on alpha generation and operational efficiency

Seeking to reduce total cost of ownership

Behavioral Factors

- •

Requires integrated front-to-back office solutions

- •

High demand for data and analytics

- •

Values long-term, stable partnerships

Pain Points

- •

Fragmented data and technology systems

- •

Increasing operational and regulatory complexity

- •

Fee pressure from their own clients

- •

Scaling operations for new asset classes (e.g., private markets, digital assets)

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Asset Owners

Description:Institutions that own the assets being managed, such as pension funds, sovereign wealth funds, endowments, and foundations.

Demographic Factors

Large, long-term investment horizons

Often public or quasi-public entities

Psychographic Factors

Highly risk-averse

Focused on fiduciary duty and long-term performance

Behavioral Factors

Requires robust risk analytics, performance measurement, and compliance monitoring

Increasingly focused on ESG and sustainability mandates

Pain Points

- •

Gaining a holistic view of multi-asset class portfolios

- •

Meeting complex regulatory and stakeholder reporting requirements

- •

Managing liquidity and risk in volatile markets

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Insurance Companies

Description:Global insurance firms requiring specialized accounting, custody, and investment management services for their general and separate accounts.

Demographic Factors

Global operations

Highly regulated entities

Psychographic Factors

Conservative investment philosophy

Focus on liability-driven investment (LDI)

Behavioral Factors

Requires specialized statutory accounting and reporting (e.g., PAM platform mentioned on website)

Seeks yield optimization while managing risk

Pain Points

- •

Complex asset-liability management

- •

Navigating stringent, jurisdiction-specific regulations

- •

Managing data for risk and capital adequacy reporting

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

State Street Alpha Platform

Strength:Strong

Sustainability:Sustainable

- Factor:

Massive Scale and Global Reach

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand and Reputation (Trust)

Strength:Strong

Sustainability:Sustainable

- Factor:

Integrated Service Model

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To be the essential partner for the world's institutional investors by providing an integrated front-to-back platform (State Street Alpha) that delivers data-driven insights, operational efficiency, and access to global markets, enabling clients to achieve their growth objectives.

Good

Key Benefits

- Benefit:

Operational Efficiency and Cost Reduction

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

State Street Alpha platform's single source of truth.

- •

Automation of middle and back-office functions.

- •

Outsourcing solutions for trading and operations.

- Benefit:

Enhanced Decision Making through Data & Analytics

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Alpha Data Platform provides near real-time front office data.

- •

Extensive 'Insights' section on the website showcasing proprietary research.

- •

AI-powered tools for error detection and analysis.

- Benefit:

Risk Mitigation and Regulatory Compliance

Importance:Critical

Differentiation:Common

Proof Elements

- •

Status as a highly regulated G-SIB.

- •

Decades of experience navigating global regulations.

- •

Investment compliance monitoring solutions.

- Benefit:

Access to New and Emerging Asset Classes

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Dedicated Digital Asset Solutions and strategy.

- •

Partnerships for private market capabilities.

- •

Recent launch of custody for tokenized debt on JPMorgan's platform.

Unique Selling Points

- Usp:

State Street Alpha: The industry's first single front-to-back platform from one provider, integrating Charles River Development's front office with State Street's middle and back-office capabilities.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Pioneering role in the ETF market, having launched the first-ever ETF (SPY) and providing comprehensive servicing for ETF issuers.

Sustainability:Long-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Managing fragmented data silos across front, middle, and back offices.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

High operational costs and inefficiencies from legacy technology systems.

Severity:Critical

Solution Effectiveness:Partial

- Problem:

Navigating complex and evolving global regulatory reporting requirements.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Gaining operational readiness to invest in new, complex asset classes like digital assets.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition directly addresses the industry's key trends: the need for data integration, operational efficiency to combat fee compression, and the demand for multi-asset class solutions.

High

The focus on solving the core operational and data challenges of large, complex institutional investors is precisely aligned with the needs of their target segments.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Technology Providers (e.g., Snowflake, Microsoft Azure for Alpha Platform)

- •

Fintech Companies (e.g., Taurus, Galaxy Asset Management for digital assets)

- •

Market Infrastructure (Exchanges, Clearing Houses)

- •

Strategic Asset Management Partners (e.g., Apollo, Bridgewater)

Key Activities

- •

Asset Servicing (Custody, Accounting, Administration)

- •

Investment Management (SSGA)

- •

Trading and Securities Finance

- •

Technology Platform Development & Management (Alpha)

- •

Regulatory Compliance and Reporting

Key Resources

- •

State Street Alpha Platform

- •

Global Custody Network & Infrastructure

- •

Regulatory Licenses & G-SIB Status

- •

Vast Proprietary Datasets

- •

Specialized Human Capital

Cost Structure

- •

Employee Compensation and Benefits

- •

Technology & Software Development/Maintenance

- •

Regulatory Compliance and Legal Costs

- •

Global Office Infrastructure

- •

Interest Expense

Swot Analysis

Strengths

- •

Immense scale with trillions in AUC/A and AUM, creating significant barriers to entry.

- •

The proprietary State Street Alpha platform provides a strong technological moat and integrated value proposition.

- •

Strong brand reputation and entrenched, 'sticky' relationships with the world's largest institutional investors.

- •

Global operational footprint and deep regulatory expertise across jurisdictions.

Weaknesses

- •

Vulnerability to global market downturns, which directly impact asset-based fee revenue.

- •

High fixed operational costs and complexity inherent in a global, highly regulated entity.

- •

Potential for organizational inertia and slower adaptation to market shifts compared to smaller fintech rivals.

- •

Revenue concentration in the mature and highly competitive investment servicing segment.

Opportunities

- •

Becoming a market leader in servicing digital assets (tokenization, custody) as the market matures.

- •

Expanding the Alpha platform's reach and monetizing its data and analytics capabilities as a standalone service.

- •

Growth in private markets, providing fund administration and financing solutions for alternative asset managers.

- •

Leveraging AI to dramatically improve operational efficiency and create new analytical products.

Threats

- •

Intense and persistent fee and pricing pressure from direct competitors (BNY Mellon, JPMorgan, Citi).

- •

Cybersecurity breaches, which pose significant financial and reputational risk.

- •

Disruptive fintech firms unbundling the value chain with specialized, low-cost solutions.

- •

Adverse changes in financial regulations (e.g., higher capital requirements) or geopolitical instability.

Recommendations

Priority Improvements

- Area:

Digital Asset Service Evolution

Recommendation:Aggressively build out and operationalize a full suite of digital asset services, from custody to tokenization-as-a-service, to capture first-mover advantage among institutional clients as regulatory clarity emerges.

Expected Impact:High

- Area:

Alpha Platform Monetization

Recommendation:Develop modular, API-driven access to the Alpha Data Platform, creating a 'Platform-as-a-Service' (PaaS) revenue stream targeting smaller institutions that cannot afford the full front-to-back solution.

Expected Impact:High

- Area:

Operational Efficiency through AI

Recommendation:Double down on investment in Generative and Predictive AI across back-office operations to automate manual processes, reduce operational risk, and combat fee compression by lowering the cost-to-serve.

Expected Impact:Medium

Business Model Innovation

- •

Launch a 'Data & Analytics as a Service' (DAaaS) offering, providing anonymized, aggregated market flow and sentiment data to a wider range of clients, including corporations and consulting firms.

- •

Create a dedicated 'Private Markets Operating System' by acquiring or partnering with a leading technology provider in the space, fully integrating it into the Alpha ecosystem to dominate this high-growth segment.

- •

Evolve into a network orchestrator for the digital asset ecosystem, facilitating interoperability between different blockchain networks and traditional finance rails for institutional clients.

Revenue Diversification

- •

Expand the outsourced trading (Partnered Trading) solution to a broader set of mid-sized asset managers, leveraging scale to offer a compelling cost-benefit.

- •

Build a strategic consulting arm focused on helping clients navigate complex regulatory changes, ESG integration, and digital transformation, leveraging in-house expertise.

- •

Increase focus on high-margin financing solutions, particularly within private credit and for clients using digital assets as collateral.

State Street Corporation represents a mature, systemically critical institution at a pivotal juncture. Its business model, historically anchored in the immense scale of its investment servicing operations, faces the dual threats of fee compression and technological disruption. The company's strategic response, the State Street Alpha platform, is a robust and necessary evolution, shifting the value proposition from traditional asset servicing to being an integrated, data-centric technology partner. This front-to-back platform is the cornerstone of its competitive defensibility and future growth, creating significant client stickiness and a platform for launching new data-driven services.

The most significant opportunity for business model evolution lies in the nascent digital asset and private markets sectors. State Street's proactive investments and partnerships in tokenization and digital custody position it to become a foundational infrastructure provider for the institutional adoption of these new asset classes. Capturing this market could create a high-margin revenue stream that diversifies its reliance on traditional securities servicing. However, this transformation requires balancing its legacy as a risk-averse, regulated entity with the agility needed to innovate in rapidly evolving markets. The primary challenge will be to accelerate this technological and cultural transformation to outpace both traditional competitors, who are pursuing similar strategies, and nimble fintech disruptors, all while navigating a complex global macroeconomic and regulatory landscape. The success of this strategic shift from a traditional custodian to a technology platform will ultimately determine its long-term market leadership and profitability.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Massive Capital Requirements & Economies of Scale

Impact:High

- Barrier:

Complex Regulatory Compliance (Global)

Impact:High

- Barrier:

Established Client Relationships & High Switching Costs

Impact:High

- Barrier:

Brand Reputation and Trust

Impact:High

- Barrier:

Advanced Technology Infrastructure

Impact:Medium

Industry Trends

- Trend:

Digital Transformation and Data Analytics

Impact On Business:Requires significant investment in platforms like State Street Alpha to provide data-driven insights, moving beyond traditional custody. This is a primary competitive battleground.

Timeline:Immediate

- Trend:

Growth of Digital Assets and Tokenization

Impact On Business:Creates both a threat to traditional custody models and a major growth opportunity. State Street is actively investing in digital asset solutions to capture this market.

Timeline:Near-term

- Trend:

Expansion into Private Markets (Credit, Equity)

Impact On Business:Drives demand for specialized fund administration and data services for complex, illiquid assets, an area of focus for State Street and its competitors.

Timeline:Immediate

- Trend:

Fee Compression and Margin Pressure

Impact On Business:Increases pressure to automate, improve operational efficiency, and offer higher-margin, value-added services like analytics and outsourced trading.

Timeline:Immediate

- Trend:

Increased Focus on ESG

Impact On Business:Requires providing clients with data, analytics, and reporting solutions to meet their sustainability goals and regulatory obligations.

Timeline:Near-term

Direct Competitors

- →

BNY Mellon

Market Share Estimate:Leading; often cited as the world's largest custodian bank by Assets Under Custody and/or Administration (AUC/A).

Target Audience Overlap:High

Competitive Positioning:Positions itself as a global investments company with a long history, focused on managing and servicing financial assets throughout the investment lifecycle.

Strengths

- •

Unmatched scale in assets under custody.

- •

Strong brand reputation and long operating history (founded 1784).

- •

Comprehensive suite of services covering the entire investment lifecycle.

- •

Early mover in digital asset custody platforms.

Weaknesses

- •

Legacy technology systems can create integration challenges and high maintenance costs.

- •

Large size can lead to slower adaptation compared to smaller, more agile competitors.

- •

Perceived as more traditional, which could be a weakness when competing for clients focused on cutting-edge technology.

Differentiators

Pure-play focus on asset servicing and investment management without a large commercial or retail banking arm.

Pershing subsidiary provides clearing and custody services to broker-dealers and RIAs, a distinct market segment.

- →

J.P. Morgan Chase (Securities Services)

Market Share Estimate:Major; a top-tier global custodian with significant market share.

Target Audience Overlap:High

Competitive Positioning:Leverages the "fortress balance sheet" and integrated services of a universal bank to provide secure, comprehensive solutions from custody to prime brokerage.

Strengths

- •

Massive balance sheet and financial strength of the parent company.

- •

Ability to offer integrated services across commercial banking, investment banking, and securities services.

- •

Strong brand and reputation for innovation and client service, often ranking high in customer satisfaction.

- •

Investing heavily in data analytics and cloud-native platforms like Fusion.

Weaknesses

- •

Potential for conflicts of interest due to the universal banking model.

- •

Custody and securities services are part of a much larger organization, potentially leading to less dedicated focus compared to pure-play custodians.

- •

Complexity of the organization can be challenging for clients to navigate.

Differentiators

'One-stop-shop' value proposition for clients who also need investment banking, treasury, and other corporate banking services.

Strong capabilities in prime brokerage, creating a powerful bundled offering for hedge funds.

- →

Northern Trust

Market Share Estimate:Significant; a top 5 player in the global custody space.

Target Audience Overlap:Medium

Competitive Positioning:Positions as a leader in serving corporations, institutional investors, and ultra-high-net-worth individuals with a focus on exceptional service, expertise, and integrity.

Strengths

- •

Strong reputation for high-touch client service and expertise.

- •

Significant presence in wealth management and serving affluent families, which can be a source of institutional business.

- •

Leader in developing value-added services like risk management tools and alternative asset administration.

- •

Focused business model on asset servicing and asset management.

Weaknesses

- •

Smaller scale in terms of total AUC/A compared to giants like BNY Mellon and State Street.

- •

Less global brand recognition outside of North America and specific European markets.

- •

May not be able to compete on price with larger, more scaled competitors for commoditized services.

Differentiators

Deep expertise in serving asset owners, particularly pension funds, foundations, and endowments.

Stronger integration between its institutional servicing and high-net-worth wealth management businesses.

- →

BlackRock

Market Share Estimate:Dominant in asset management; Technology competitor via Aladdin.

Target Audience Overlap:High

Competitive Positioning:The world's largest asset manager and a technology provider aiming to be the central operating system for the investment industry through its Aladdin platform.

Strengths

- •

Aladdin platform is the industry-leading front-to-back investment management and risk analytics platform, a direct competitor to State Street Alpha.

- •

Dominant market share in ETFs (iShares) and overall asset management creates immense scale and data advantages.

- •

Extremely strong global brand and deep relationships with institutional investors, who are also State Street's target clients.

- •

Aggressively acquiring technology (e.g., eFront) to build a 'whole portfolio' view, including private assets.

Weaknesses

- •

Potential conflict of interest, as they are both a client of custodians like State Street and a direct competitor in technology and asset management.

- •

Aladdin is a closed ecosystem, which some clients may resist in favor of more open-architecture solutions.

- •

High cost of the Aladdin platform can be a barrier for some firms.

Differentiators

- •

Technology-first approach to investment management and servicing.

- •

Unparalleled data and analytics capabilities derived from its massive AUM.

- •

Positioned as a partner for technology and risk management, not just a service provider.

Indirect Competitors

- →

Fintech & Specialized Service Providers (e.g., Apex Group, Alter Domus, Addepar)

Description:Firms offering unbundled, technology-driven solutions for specific parts of the value chain, such as fund administration for private equity, or data aggregation and reporting for wealth managers.

Threat Level:Medium

Potential For Direct Competition:Low for full-service custody, but high for specific, profitable service lines. They can erode margins by offering superior, cheaper point solutions.

- →

Technology Platform Providers (e.g., FIS, Broadridge, SimCorp)

Description:Provide the underlying software and infrastructure for investment operations. They compete with State Street's own platform offerings (Alpha) and could move up the value chain.

Threat Level:Medium

Potential For Direct Competition:Medium. As they build out their platforms, they could begin to offer more comprehensive Business-Process-as-a-Service (BPaaS) models.

- →

Digital Asset Native Custodians (e.g., Anchorage Digital, Fireblocks, Coinbase Prime)

Description:Specialized, regulated firms built specifically for the custody of cryptocurrencies and other digital assets. They offer deep technical expertise that traditional custodians are still developing.

Threat Level:Low

Potential For Direct Competition:Medium. While currently focused on native digital assets, they could expand into tokenized traditional assets, directly competing with State Street's future offerings.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Economies of Scale

Sustainability Assessment:Highly sustainable. The massive volume of assets under custody/administration provides a significant cost advantage that is nearly impossible for new entrants to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Deep, Entrenched Client Relationships

Sustainability Assessment:Highly sustainable due to extremely high switching costs (operational complexity, risk, cost) for institutional clients.

Competitor Replication Difficulty:Hard

- Advantage:

Global Regulatory Expertise and Footprint

Sustainability Assessment:Highly sustainable. Navigating the complex web of financial regulations in over 100 markets is a core competency built over decades.

Competitor Replication Difficulty:Hard

- Advantage:

Proprietary Data Insights

Sustainability Assessment:Sustainable and growing. Access to vast, anonymized data on institutional investor flows provides a unique source for generating value-added research and analytics.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'First-mover in a specific technology or product (e.g., a new AI-powered analytics tool)', 'estimated_duration': '1-2 years before competitors develop similar offerings.'}

Disadvantages

- Disadvantage:

Legacy Technology Infrastructure

Impact:Major

Addressability:Difficult

- Disadvantage:

Organizational Complexity

Impact:Minor

Addressability:Moderately

- Disadvantage:

Perception as a Traditional Incumbent

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns highlighting State Street Alpha's open-architecture as a key differentiator against BlackRock's Aladdin.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Amplify thought leadership on complex, emerging topics like AI in private markets and tokenization, leveraging the 'Insights' section of the website.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Acquire or partner with a leading fintech in the private markets data and analytics space to accelerate capabilities and fill gaps.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Deepen the integration of ESG data and analytics tools directly into the core Alpha platform, making it a seamless part of the investment workflow.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop a modular, 'plug-and-play' service offering for mid-sized asset managers who may not need or cannot afford the full front-to-back Alpha platform.

Expected Impact:Medium

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Become the industry standard for institutional-grade custody and servicing of tokenized real-world assets (RWAs).

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Evolve the business model from asset-centric (charging based on AUC) to data-centric, monetizing the unique insights generated from proprietary data flows.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify State Street's position as the premier 'front-to-back' technology and service partner for institutional investors. Shift the narrative from being a custodian that uses technology to a technology firm that provides expert financial services, directly challenging BlackRock's Aladdin.

Differentiate through a commitment to an open-architecture platform (State Street Alpha) that offers clients choice and flexibility, in contrast to the more closed ecosystems of competitors. Emphasize the unique, actionable insights derived from proprietary institutional flow data as a value-add that no other competitor can perfectly replicate.

Whitespace Opportunities

- Opportunity:

Integrated TradFi-DeFi Servicing

Competitive Gap:There is a significant gap in the market for a single, trusted institutional partner that can seamlessly service both traditional assets (equities, bonds) and a wide range of digital assets (tokenized funds, securities, etc.) on one platform.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Data-as-a-Service (DaaS) for Private Markets

Competitive Gap:The private markets ecosystem is notoriously data-poor and fragmented. A platform that can securely aggregate, standardize, and provide analytics on private asset data would be highly valuable.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Outsourced Chief Data Officer Function

Competitive Gap:Many mid-sized asset managers struggle with data management, governance, and strategy. State Street could offer a bundled service that outsources these functions, leveraging its own data expertise and infrastructure.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Predictive Risk Analytics for Geopolitical Events

Competitive Gap:While many offer risk analytics, few can combine proprietary investor positioning data with geopolitical risk models to offer clients forward-looking scenarios and hedging strategies. This aligns with the thought leadership content on their website.

Feasibility:Medium

Potential Impact:Medium

State Street Corporation operates in the mature, oligopolistic market of institutional financial services. The competitive landscape is dominated by a handful of global players, including BNY Mellon, J.P. Morgan, and Northern Trust, who compete on scale, reputation, and service breadth. Barriers to entry are exceptionally high due to immense capital requirements, regulatory complexity, and entrenched client relationships, making direct disruption by new entrants unlikely. The primary competitive battleground has shifted from traditional custody—now largely commoditized—to the provision of integrated, data-driven, front-to-back office platforms. Here, State Street's Alpha platform is in a head-to-head battle with BlackRock's dominant Aladdin platform. BlackRock represents a unique 'frenemy': a major client in some areas but a formidable competitor in the high-margin technology and asset management spaces. The key industry trends shaping the landscape are the digitization of everything, the rise of alternative investments (particularly private markets), and the nascent but critical emergence of digital assets and tokenization. State Street's website content, with its heavy emphasis on 'Digital Digest', AI, and private markets, reflects a clear strategic alignment with these trends. State Street's sustainable advantages are its immense scale, global footprint, and trusted brand. However, like its direct peers, it faces the challenge of modernizing legacy technology while investing in innovation. The most significant opportunity—and threat—is the evolution of financial market infrastructure through tokenization. While indirect competitors like native digital asset custodians currently pose a low threat, their expertise in this new paradigm could become a major advantage. Strategic whitespace exists in bridging the gap between traditional and decentralized finance (TradFi/DeFi) for institutions, providing standardized data solutions for the opaque private markets, and further monetizing its unique proprietary data flows. To win, State Street must successfully position itself not just as a custodian, but as an indispensable technology and data partner, differentiating through an open and flexible platform architecture that contrasts with more closed ecosystems.

Messaging

Message Architecture

Key Messages

- Message:

We provide data-driven research, industry insights, and strategic partnerships to help institutional investors identify risks, formulate growth strategies, and make better-informed decisions.

Prominence:Primary

Clarity Score:High

Location:Homepage ('Our latest thinking', 'Solutions for today’s markets'), Insights Section

- Message:

We offer comprehensive solutions across investment servicing, markets, financing, and management to help clients unlock growth, gain efficiencies, and seize opportunities.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage ('Solutions for today’s markets'), Solutions Section

- Message:

We help you adapt, evolve, and lead with confidence and clarity in a complex global market.

Prominence:Tertiary

Clarity Score:Medium

Location:Homepage ('Agility when it matters most')

- Message:

We are committed to fostering an inclusive and diverse team that reflects the clients, people, and markets we serve.

Prominence:Tertiary

Clarity Score:High

Location:Homepage ('Inclusion and diversity'), About Section

The messaging hierarchy heavily prioritizes thought leadership ('Insights') over direct communication of its service offerings ('Solutions'). The homepage leads with article headlines, positioning State Street as a research-first institution. While this establishes expertise, it obscures the primary value proposition for a visitor seeking to understand what the company does. The 'Solutions' are presented as a secondary layer, requiring a click to understand the core business.

Messaging is highly consistent across the website. The formal, expert-driven tone established in the 'Insights' section is carried through to the 'Solutions' and 'About' pages. There is a unified focus on serving a sophisticated, institutional audience, with no major deviations in language or positioning.

Brand Voice

Voice Attributes

- Attribute:

Authoritative

Strength:Strong

Examples

Our latest article reveals why the dollar’s dominance now hinges on policy precision.

We outline the role of US Treasuries as the global risk-free asset amid rising fiscal concerns...

- Attribute:

Analytical

Strength:Strong

Examples

Institutional investors are entering the third quarter with conviction not seen since the COVID-19 vaccine breakthrough — signaling a bold shift in sentiment...

We examine the strategic trajectory of the digital euro within a fragmented global financial landscape...

- Attribute:

Institutional

Strength:Strong

Examples

- •

Solutions for today’s markets

- •

Identify risks, formulate growth strategies and make better-informed investment decisions...

- •

The right back-office servicing model can help you...

- Attribute:

Forward-looking

Strength:Moderate

Examples

- •

Shaping a secure finance-tech ecosystem

- •

Private markets: Driving success in volatile environments

- •

What to watch in 2025

Tone Analysis

Formal and expert

Secondary Tones

- •

Academic

- •

Global

- •

Corporate

Tone Shifts

The tone shifts to be more aspirational and people-focused in the 'Inclusion and diversity' and 'About' sections, using phrases like 'Fostering impact' and 'Inspiring a more inclusive world'.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

State Street is a trusted, full-service partner for the world's most sophisticated institutional investors, leveraging its global scale, deep expertise, and data-driven insights to help them navigate complex markets and create better outcomes.

Value Proposition Components

- Component:

Proprietary Research & Data Insights

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Comprehensive Investment Servicing

Clarity:Somewhat Clear

Uniqueness:Common

- Component:

Global Market Access & Financing

Clarity:Somewhat Clear

Uniqueness:Common

- Component:

Innovative Technology & Platforms

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

State Street's primary differentiator, as communicated through its website, is the depth and breadth of its data-driven research and insights. While competitors like BNY Mellon and Northern Trust offer similar custody and servicing solutions, State Street's messaging is heavily skewed towards demonstrating its intellectual capital. The value of its actual services (the 'how') is communicated less effectively than its market knowledge (the 'what' and 'why'). The emphasis on innovation, such as the State Street Alpha platform, is a key differentiator but is not prominently featured in the top-level messaging.

The messaging positions State Street as the thought leader among its institutional finance peers. It competes not just on its ability to service assets, but on its ability to provide the strategic intelligence required to manage them effectively. This positions the brand at a higher strategic level than a pure operations/servicing provider, aiming to be a strategic partner rather than a vendor.

Audience Messaging

Target Personas

- Persona:

Institutional Asset Managers & Owners (e.g., pension funds, mutual funds, sovereign wealth funds)

Tailored Messages

- •

The great repricing: Are US Treasuries still a safe haven?

- •

Private markets: Driving success in volatile environments

- •

Unlocking the next wave of ETF growth in Europe

- •

Enabling a whole-of-fund view for Canadian pensions to accelerate data-driven insights

Effectiveness:Effective

- Persona:

Insurance Companies & Official Institutions (e.g., central banks)

Tailored Messages

- •

The digital euro and the US dollar: Strategic evolution in a fragmented global financial order

- •

Investment Compliance Solutions

- •

Insurance Investment Accounting (PAM)

Effectiveness:Somewhat Effective

Audience Pain Points Addressed

- •

Navigating market uncertainty and volatility

- •

Managing regulatory complexity (e.g., T+1 settlement, SEC mandates)

- •

Accessing and interpreting complex data for decision-making

- •

Achieving operational efficiency and scale

- •

Identifying new sources of growth and alpha

Audience Aspirations Addressed

- •

Gaining a competitive edge through superior insights

- •

Making better-informed investment decisions

- •

Successfully expanding into new markets and asset classes (e.g., digital assets, private markets)

- •

Partnering with a stable, experienced global leader

Persuasion Elements

Emotional Appeals

- Appeal Type:

Confidence & Security

Effectiveness:High

Examples

- •

Proven partnership in times of turmoil

- •

Agility when it matters most

- •

We help you adapt, evolve, and lead with confidence and clarity.

- Appeal Type:

Authority & Expertise

Effectiveness:High

Examples

- •

The sheer volume and depth of the 'Insights' section, with over 150 articles listed.

- •

Our 2025 survey reveals the latest trends in data use...

- •

Backed by 20+ years of experience, our indicators, models and publications...

Social Proof Elements

{'proof_type': 'Expert Authority', 'impact': 'Strong'}

{'proof_type': 'Scale & Longevity', 'impact': 'Strong'}

Trust Indicators

- •

Data-driven reports and surveys (e.g., 'Institutional Investor Indicators')

- •

Named experts and leadership profiles in the 'About' section

- •

Explicit statements of history and scale ('232 Years of experience', '100+ Markets')

- •

Presence at major global financial forums (e.g., World Economic Forum, Milken Institute)

- •

Detailed regulatory and compliance content

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Learn more

Location:Homepage (Hero, Insights, Solutions, Diversity sections)

Clarity:Clear

- Text:

Read more

Location:Homepage (In focus section)

Clarity:Clear

- Text:

Unlock all insights

Location:Homepage (Below 'Our latest thinking')

Clarity:Clear

- Text:

Find your best solution

Location:Homepage (Below 'Solutions for today’s markets')

Clarity:Clear

The CTAs are clear, low-friction, and consistent with the brand's educational, non-salesy approach. They are effective at driving deeper engagement with content. However, they lack a clear path for a prospective client to take a commercial step, such as 'Contact an expert' or 'Discuss your needs'. The primary business goal appears to be education and establishing thought leadership, with lead generation being a distant secondary objective.

Messaging Gaps Analysis

Critical Gaps

- •

A clear, concise articulation of the overarching brand value proposition on the homepage. The page immediately dives into content, forcing the user to infer the brand's purpose.

- •

A strong 'Why State Street?' message that explicitly connects their thought leadership to the tangible benefits of their solutions.

- •

Clear conversion pathways for prospects. After reading an insight, there is no direct CTA to connect with a solutions expert in that domain.

Contradiction Points

No itemsUnderdeveloped Areas

- •

The connection between 'Insights' and 'Solutions' is underdeveloped. For example, an article on private markets should have a prominent, embedded link or module showcasing State Street's 'Private Markets Solutions'.

- •

Client-centric messaging. The content is very focused on markets and topics ('what we know') rather than on client challenges and outcomes ('how we help you solve').

- •

Benefit-oriented headlines for solutions. The solution names are descriptive (e.g., 'Fund Administration') but not persuasive or benefit-driven.

Messaging Quality

Strengths

- •

Successfully establishes credibility and authority through a vast library of high-quality thought leadership.

- •

Brand voice is exceptionally consistent, projecting professionalism and expertise.

- •

Content is well-aligned with the interests and intellectual level of a sophisticated institutional audience.

- •

Effectively uses data and research as a cornerstone of its content strategy.

Weaknesses

- •

Fails to clearly communicate its core business offerings and value proposition on the homepage.

- •

Over-indexes on thought leadership at the expense of solution-oriented messaging.

- •

Lacks clear and effective calls-to-action for business development or lead generation.

- •

Messaging does not sufficiently differentiate its core servicing offerings from key competitors.

Opportunities

- •

Integrate 'Insights' and 'Solutions' more effectively to create clear customer journeys from education to consideration.

- •

Develop more client-centric messaging that frames solutions in terms of outcomes and benefits.

- •

Use case studies or client success stories to provide tangible proof of value, moving beyond theoretical insights.

- •

Create a stronger top-level brand narrative that encapsulates the 'Why State Street' message beyond just being a source of research.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Messaging

Recommendation:Redesign the homepage hero section to feature a clear, concise brand value proposition. Replace the rotating article headline with a stable message that answers 'Who we are, who we help, and how we help them.'

Expected Impact:High

- Area:

Content-to-Solution Pathway

Recommendation:Implement a 'Related Solutions' component on all 'Insights' article pages. This component should dynamically feature 1-2 of State Street's services that directly address the topic of the article.

Expected Impact:High

- Area:

Call-to-Action Strategy

Recommendation:Introduce softer conversion CTAs on key pages, such as 'Speak with our specialists' or 'Request a consultation,' to provide a clear next step for interested prospects.

Expected Impact:Medium

Quick Wins

- •

Rewrite the 'Solutions for today’s markets' headlines on the homepage to be more benefit-oriented.

- •

Add a 'Contact Us' or 'Speak to an Expert' link within the main navigation menu for easier access.

- •

Feature a short 'Who We Help' section on the homepage to immediately orient key personas.

Long Term Recommendations

- •

Develop persona-based content journeys that map audience pain points to a curated sequence of insights and relevant solutions.

- •

Invest in creating client success stories and case studies to add a layer of proof and relatability to the brand's expertise.

- •

Conduct A/B testing on calls-to-action to optimize language for lead generation without compromising the brand's authoritative tone.

State Street's digital messaging strategy expertly positions the firm as a premier thought leader in the institutional financial services industry. The brand voice is impeccably authoritative, analytical, and consistent, creating a strong foundation of trust and credibility. The 'Insights' section is a powerful asset, demonstrating deep expertise on a wide range of complex topics relevant to its sophisticated target audience of asset managers, owners, and official institutions.

However, the strategy suffers from a significant imbalance: it prioritizes demonstrating expertise over articulating its core value proposition and solutions. The website functions more like a high-end financial journal than a platform for a multi-trillion dollar investment servicing and management firm. The homepage messaging fails to quickly answer a fundamental question for a new visitor: 'What does State Street do?' By leading with ephemeral article headlines, it buries its core business offerings and forces users to work to understand its services.

The primary messaging gap lies in the weak connection between its acclaimed 'Insights' and its 'Solutions.' The current structure creates a dead end for potential clients; a visitor can become highly impressed with State Street's analysis of private markets but is not given a clear path to engage with their Private Markets Solutions team. The calls-to-action are passive and content-focused ('Learn More'), lacking any mechanism to capture commercial intent.

To improve business outcomes, the messaging strategy must evolve to bridge this gap. The brand's thought leadership should be leveraged not as an end in itself, but as the primary vehicle for demonstrating the value of its solutions. By rebalancing the message hierarchy to elevate the core value proposition, creating explicit pathways from content to commerce, and adopting more client-centric language, State Street can more effectively convert its well-earned reputation as an expert into tangible business growth.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

State Street is one of the world's largest custodian banks, with $46.7 trillion in assets under custody/administration (AUC/A) and $4.7 trillion in assets under management (AUM) as of Q1 2025.

- •

The company has a long-standing history dating back to 1792 and serves a sophisticated institutional client base including asset managers, asset owners, insurance companies, and central banks.

- •

The website's extensive 'Insights' section, filled with deep analysis on complex financial topics like digital assets, AI, and macroeconomic trends, is tailored perfectly to its institutional audience.

- •

Record-high AUC/A of $49 trillion and AUM of $5.1 trillion reported in Q2 2025 earnings presentations indicate strong client trust and continued demand for their services.

Improvement Areas

- •

Accelerate the integration of digital asset services into core offerings to meet evolving client demand and capture market share in this nascent field.

- •

Enhance the client onboarding experience for the State Street Alpha platform to reduce friction and speed up time-to-value.

- •

Continue to build out self-service data and analytics capabilities to empower clients and reduce reliance on manual, bespoke reporting.

Market Dynamics

7.2% CAGR forecasted for the Asset Servicing market, expected to reach $1.89 trillion by 2029.

Mature

Market Trends

- Trend:

Digital Transformation and Tokenization

Business Impact:Creates demand for new services like digital asset custody and administration, driving a critical need to innovate beyond traditional offerings.

- Trend:

Growth in Private Markets

Business Impact:Institutional investors are increasing allocations to private assets, creating a significant growth opportunity for specialized fund administration and data management services.

- Trend:

Focus on Data and AI

Business Impact:Clients demand sophisticated data analytics for alpha generation and operational efficiency, making platforms like State Street Alpha a key competitive differentiator.

- Trend:

Regulatory Complexity and T+1 Settlement

Business Impact:Increased regulatory burdens and shorter settlement cycles create demand for expert servicing partners who can manage complexity and ensure compliance, acting as a competitive moat.

- Trend:

Fee Compression in Core Services

Business Impact:Pressure on traditional custody fees necessitates a shift towards higher-margin, value-added services like data analytics, outsourced trading, and multi-asset class solutions.

Crucial. The market is at an inflection point where incumbents must rapidly adopt new technologies (AI, blockchain) to fend off fintech challengers and capture the next wave of growth in digital assets and private markets.

Business Model Scalability

High

High fixed costs associated with technology infrastructure, compliance, and global operations. Variable costs are relatively low per incremental asset, leading to high operating leverage once scale is achieved.

High. The fee-based revenue model (based on AUC/A) allows for significant revenue growth with marginal increases in operational costs once technology platforms are established.

Scalability Constraints

- •

Navigating disparate and evolving global regulatory frameworks.

- •

The complexity and cost of migrating clients from legacy systems to modern platforms like State Street Alpha.

- •

High capital expenditure required for continuous technology modernization and cybersecurity.

- •

Talent acquisition in specialized, high-demand areas like AI/ML and blockchain engineering.

Team Readiness

Strong. The leadership team listed on the website demonstrates deep industry experience across financial services, technology, and global markets.

Complex. As a Global Systemically Important Bank (G-SIB), the structure is necessarily vast and siloed to manage risk and regulatory requirements, which can hinder agility.

Key Capability Gaps

- •

Agile Product Development: Traditional banking structures can slow down the rapid iteration required to compete with fintechs.

- •

Digital Asset Expertise: Requires ongoing investment in talent with deep knowledge of blockchain technology, tokenization, and DeFi.

- •

Data Science and AI/ML Talent: Critical for developing the next generation of analytics and operational efficiency tools.

Growth Engine

Acquisition Channels

- Channel:

Direct Enterprise Sales & RFPs

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip sales teams with modular, platform-based solutions (centered on Alpha) rather than selling siloed products. Focus on consultative selling around business outcomes like operational alpha and data monetization.

- Channel:

Thought Leadership & Content Marketing

Effectiveness:High

Optimization Potential:High

Recommendation:Leverage the extensive 'Insights' content to create targeted, persona-based nurturing campaigns for prospective clients, moving from broad market analysis to specific solution-oriented content.

- Channel:

Strategic Partnerships

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand the ecosystem of fintechs and data providers integrated with State Street Alpha. Proactively partner with emerging technology firms to co-develop solutions, as seen with the J.P. Morgan Digital Debt Service collaboration.

- Channel:

Cross-sell / Up-sell to Existing Clients

Effectiveness:High

Optimization Potential:High

Recommendation:Systematically map the existing client base to identify opportunities for migrating to the full Alpha front-to-back platform and for introducing private market and digital asset solutions.

Customer Journey

A long, complex, and relationship-driven sales cycle involving multiple stakeholders, extensive due diligence, and bespoke solutioning. The website serves as a crucial resource for research and establishing credibility.

Friction Points

- •

Lengthy and complex client onboarding and data migration processes.

- •

Integration challenges between client's legacy systems and State Street's platforms.

- •

Navigating complex, multi-product contract negotiations.

Journey Enhancement Priorities

{'area': 'Onboarding', 'recommendation': 'Invest in templated, API-driven onboarding workflows and dedicated migration teams to accelerate time-to-value for new clients on the Alpha platform.'}

{'area': 'Digital Experience', 'recommendation': 'Develop a unified digital portal for clients to access all their services, data, and insights, moving away from fragmented system access.'}

Retention Mechanisms

- Mechanism:

High Switching Costs

Effectiveness:High

Improvement Opportunity:Deepen the integration of the State Street Alpha platform into clients' core workflows, making it the central operating system for their investment lifecycle and further increasing operational dependency.

- Mechanism:

Integrated Service Offerings

Effectiveness:High

Improvement Opportunity:Bundle core custody with higher-value services like data analytics, ESG reporting, and digital asset administration to create a comprehensive, indispensable solution.

- Mechanism:

Long-Term Contracts & Relationships

Effectiveness:High

Improvement Opportunity:Move from a vendor to a strategic partner role by proactively providing data-driven insights and co-developing solutions to meet clients' future needs.

Revenue Economics

Characterized by extremely high lifetime value (LTV) per institutional client, often lasting decades. Customer acquisition cost (CAC) is also very high due to the long, high-touch sales process. Profitability is driven by achieving scale and cross-selling higher-margin services.

Qualitatively High. While not publicly reported, the long-term nature and deep integration with institutional clients suggest a very favorable LTV to CAC ratio.

Strong. The company reported a 9% year-over-year increase in total revenue in Q2 2025, with fee revenue surging 12%, indicating effective revenue generation.

Optimization Recommendations

- •

Focus on increasing 'share of wallet' with existing clients by expanding their use of the Alpha platform.

- •

Develop scalable, lower-touch service models for smaller institutional clients to expand the addressable market.

- •

Increase the proportion of revenue from high-margin services like software, data analytics, and private markets administration.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Technology Stack

Impact:High

Solution Approach:Continue the strategic migration of clients and services to modern, cloud-native platforms like State Street Alpha. Utilize a phased, modular approach to de-risk the transition.

- Limitation:

Data Silos

Impact:Medium

Solution Approach:Leverage the Alpha Data Platform as the central, unified data fabric for the organization, breaking down internal silos to provide a single source of truth for clients.

Operational Bottlenecks

- Bottleneck:

Manual Processes in Bespoke Client Servicing

Growth Impact:Limits scalability and erodes margins on smaller clients.

Resolution Strategy:Aggressively adopt robotic process automation (RPA) and AI for routine tasks in fund administration and reporting. Standardize service offerings where possible.

- Bottleneck:

Complex Client Onboarding and Migration

Growth Impact:Slows down revenue recognition from new client wins.

Resolution Strategy:Create dedicated, cross-functional onboarding 'SWAT' teams and invest in data migration automation tools to streamline the process.

Market Penetration Challenges

- Challenge:

Intense Competition from Large Incumbents

Severity:Critical

Mitigation Strategy:Differentiate through a superior, integrated technology platform (State Street Alpha) and deep expertise in growth areas like digital assets and private markets. Key competitors include BNY Mellon, JPMorganChase, Citi, and BlackRock.

- Challenge:

Fee Compression on Core Custody Services

Severity:Major

Mitigation Strategy:Shift the value proposition from safekeeping to data-driven insights and operational efficiency. Bundle custody with indispensable front- and middle-office services.

- Challenge:

Disruption from Fintech Innovators

Severity:Major

Mitigation Strategy:Embrace a 'co-opetition' model by partnering with and investing in fintechs that provide complementary technologies, integrating them into the Alpha ecosystem.

Resource Limitations

Talent Gaps

- •

Blockchain & Digital Asset Specialists

- •

AI/ML Engineers and Data Scientists

- •

Cloud Infrastructure Architects

- •

Agile Product Managers with deep financial services expertise

Significant and ongoing capital investment required for technology transformation, acquisitions of tech firms, and maintaining regulatory capital reserves.

Infrastructure Needs

Continued build-out of cloud-native infrastructure to support the Alpha platform's data and analytics capabilities.

Development of institutional-grade digital asset custody and servicing infrastructure.

Growth Opportunities

Market Expansion

- Expansion Vector:

Servicing Smaller Institutional and Wealth Management Tiers

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop a more standardized, tech-driven version of the Alpha platform with a lower-cost service model to tap into the large, underserved market of smaller asset managers and family offices.

- Expansion Vector:

Geographic Expansion in APAC and Emerging Markets

Potential Impact:Medium

Implementation Complexity:High

Recommended Approach:Pursue strategic acquisitions of regional service providers and build partnerships with local financial institutions to navigate complex regulatory landscapes. The acquisition of Mizuho's non-Japan custody business is a good example.

Product Opportunities

- Opportunity:

Full-Service Digital Asset Ecosystem

Market Demand Evidence:Growing institutional interest in tokenized assets and cryptocurrencies. State Street's own website features extensive content on digital assets and partnerships in the space.

Strategic Fit:High - A natural extension of their core custody and administration capabilities.

Development Recommendation:Accelerate the build-out of institutional-grade custody, staking, and fund administration services for a wide range of digital assets. Partner with leading DeFi protocols in a compliant manner.

- Opportunity:

Expanded Private Markets Solutions

Market Demand Evidence:Surveys show a continued rotation from public to private assets by institutional investors, with strong demand for private credit and infrastructure.

Strategic Fit:High - Leverages existing client relationships and addresses their top allocation priorities.

Development Recommendation:Enhance the Alpha platform with specialized data models and analytics for private assets. Acquire or partner with technology providers specializing in private market data and workflow automation.

- Opportunity:

Data-as-a-Service (DaaS) and AI-Powered Analytics

Market Demand Evidence:Clients are seeking to leverage their data for better investment decisions and operational efficiency.

Strategic Fit:High - Monetizes the vast repository of data State Street processes, moving up the value chain.

Development Recommendation:Develop a suite of subscription-based data products and predictive analytics tools powered by AI/ML, delivered via the Alpha platform, to help clients with risk management, portfolio construction, and market intelligence.

Channel Diversification

- Channel:

Platform Ecosystem / Marketplace

Fit Assessment:Excellent

Implementation Strategy:Position State Street Alpha as an open platform with APIs that allow third-party fintechs, data providers, and even competitors to integrate their services, creating a marketplace effect and making the platform stickier.

Strategic Partnerships

- Partnership Type:

Fintech Integration

Potential Partners

- •

Specialized AI/ML analytics firms

- •

Private market data providers (e.g., Preqin, PitchBook)

- •

Digital asset technology providers (e.g., Fireblocks, Anchorage Digital)

Expected Benefits:Accelerates time-to-market for new capabilities, enhances the value of the Alpha platform, and fosters innovation without having to build everything in-house.

- Partnership Type:

Cloud and Technology Infrastructure

Potential Partners

- •

Microsoft Azure

- •

Amazon Web Services (AWS)

- •

Snowflake

Expected Benefits:Ensures scalability, security, and access to cutting-edge cloud, data, and AI services, forming the foundation of the digital transformation strategy.

Growth Strategy

North Star Metric

Share of Client Assets on the State Street Alpha Platform

This metric measures not just client growth (assets) but also the success of the strategic shift to an integrated, front-to-back, higher-margin platform. It aligns sales, product, and operations around a single goal that represents the future of the business.

Increase the percentage of total AUC/A managed on the full Alpha platform by 20% year-over-year.

Growth Model

Ecosystem-Led Growth

Key Drivers

- •

State Street Alpha platform adoption

- •

Breadth of integrated third-party services

- •

Client data network effects

- •

Cross-selling of new products (Digital Assets, Private Markets)

Focus sales and marketing on the holistic value of the Alpha platform, not individual products. Create a dedicated team to manage and grow the third-party partner ecosystem. Use platform data to identify and drive cross-sell opportunities.

Prioritized Initiatives

- Initiative:

Launch Comprehensive Digital Asset Custody & Administration Services

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Finalize regulatory approvals, complete pilot programs with key clients (as done with J.P. Morgan), and build out a dedicated digital assets product and engineering team.

- Initiative:

Accelerate Alpha Platform Migration for Top 100 Clients

Expected Impact:High

Implementation Effort:Medium

Timeframe:Ongoing (18 months for key cohort)

First Steps:Establish dedicated, high-touch migration teams for strategic accounts. Develop financial incentives for early adoption and create compelling business cases based on operational savings and enhanced data insights.

- Initiative:

Develop a Scalable 'Alpha for Private Markets' Solution

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Acquire or partner with a leading private market software provider. Integrate their capabilities into the Alpha Data Platform and launch a pilot program with 5-10 strategic clients.

Experimentation Plan

High Leverage Tests

{'test': "Pilot a 'Data-as-a-Service' subscription model with a cohort of Alpha clients, offering premium anonymized market flow data.", 'hypothesis': 'Clients will pay a premium for unique data insights, creating a new high-margin revenue stream.'}

{'test': "Offer a 'lite' version of Alpha to a segment of smaller institutional investors to test viability of market expansion.", 'hypothesis': 'A lower-cost, standardized offering can attract a new client segment currently served by smaller, less-capable competitors.'}

Utilize A/B testing for new feature adoption within Alpha. Track metrics such as client engagement with new modules, conversion rates for new service offerings, and impact on client retention (churn reduction).

Quarterly review of a prioritized roadmap of growth experiments, managed by a dedicated growth team.

Growth Team

A centralized 'Strategic Growth Office' reporting to the Chief Product Officer, with embedded pods focused on key growth vectors: Digital Assets, Private Markets, and Platform Ecosystem.

Key Roles

- •

Head of Strategic Growth

- •

Head of Digital Assets Strategy

- •

Head of Private Markets Solutions

- •

Head of Platform Partnerships

A combination of aggressive external hiring for specialized roles and internal upskilling programs focused on data science, agile methodologies, and digital asset technologies.

State Street Corporation possesses a robust growth foundation, anchored by its immense scale, strong product-market fit within the institutional finance sector, and a highly scalable business model. The company is correctly positioned at the center of several enduring market trends, including the institutionalization of digital assets, the shift to private markets, and the critical need for data-driven insights. Its primary growth engine for the next decade is the State Street Alpha platform, which successfully shifts the company's value proposition from a commoditized custodian to an indispensable technology and data partner.

The primary barriers to accelerated growth are internal and market-based. Internally, the organization must overcome the inertia of its legacy technology and complex structure to become more agile. Externally, it faces intense competition and fee pressure in its core business. Growth is therefore contingent on the successful execution of its platform strategy.