eScore

t-mobile.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

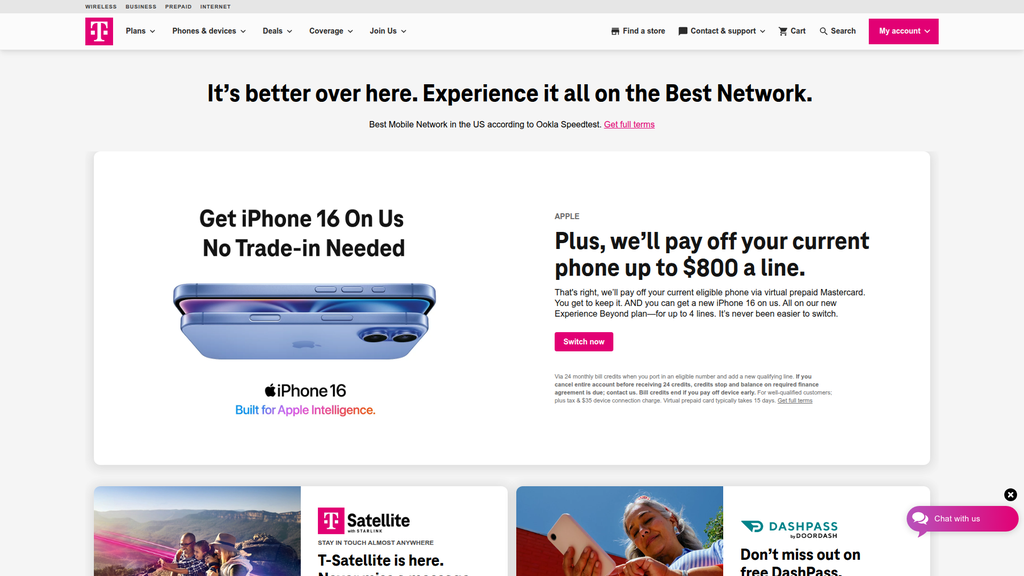

T-Mobile exhibits a masterful digital presence, excelling at aligning its aggressive promotional content with high-intent user search queries for terms like 'iPhone deals' or 'switch carriers.' The brand maintains an energetic and consistent identity across its website, social media, and advertising, reinforcing its 'Un-carrier' persona. Its content authority is exceptionally high, backed by a strong domain, extensive backlink profile, and the constant citation of third-party network awards from firms like Ookla, which it uses as a powerful SEO and marketing tool.

The strategic amplification of third-party network superiority awards (e.g., from Ookla and Opensignal) serves as a powerful content moat, building immense authority and directly fueling marketing and SEO performance.

Develop a more robust top-of-funnel content strategy that addresses broader user problems related to connectivity and technology, moving beyond purely promotional content to capture organic traffic earlier in the customer journey.

Brand communication is laser-focused and highly effective at driving its primary goal: customer acquisition. Messaging for the 'Value-Seeking Switcher' persona is exceptionally clear, with powerful offers designed to remove financial friction. However, this relentless focus on deals sometimes overshadows and even contradicts the core 'Un-carrier' philosophy of simplicity, as offers are often tied to complex terms and conditions. While competitive differentiation is strong, the emotional journey for existing customers is underdeveloped on the main site.

The messaging architecture is exceptionally honed to address the primary pain point of competitor customers: feeling financially trapped. Offers like 'we’ll pay off your current phone' are powerful, direct, and highly effective at driving switching behavior.

The brand promise of 'simplicity' is contradicted by the complex fine print of every major offer. T-Mobile should invest in UX and simplified language (where legally possible) for its disclaimers to reduce this cognitive dissonance and rebuild trust.

The website is a highly optimized conversion engine, featuring a clear visual hierarchy, prominent magenta calls-to-action, and a seamless mobile-first design. The user journey for primary tasks like switching carriers or buying a new phone is direct and minimizes cognitive load in the initial stages. The company also demonstrates a strong commitment to accessibility, with dedicated support channels and compliant website features, which positively impacts market reach. However, the lack of personalization for new visitors and the sheer density of information in deal sections are minor friction points.

The strategic use of the brand's iconic magenta for all primary CTAs creates an unmistakable visual cue, effectively guiding users toward conversion actions throughout the site with exceptional clarity and consistency.

Implement dynamic and personalized hero content for the homepage. Tailoring the primary offer based on user data (e.g., new vs. returning visitor, inferred business user, geolocation) would significantly increase relevance and conversion rates.

T-Mobile presents a significant paradox in credibility. On one hand, it effectively uses trust signals like third-party network awards, partnerships with major brands (Apple, Netflix), and price guarantees. On the other hand, its credibility is severely undermined by a history of major data breaches affecting tens of millions of customers, leading to regulatory fines and eroding consumer trust. While policies are in place, the operational execution of data security remains a high-risk area.

The consistent and prominent use of third-party validation from credible sources like Ookla for network superiority is a powerful and effective trust signal that directly counters competitor claims.

Aggressively implement and, more importantly, publicly communicate a 'Fortress T-Mobile' security transformation program. This is critical to rebuild consumer trust after multiple high-profile data breaches and mitigate the brand's single greatest risk.

T-Mobile's competitive advantage is strong and sustainable, built on the defensible moat of its leading 5G network in terms of speed and coverage. This technical superiority, a result of the strategic Sprint merger and spectrum acquisition, is difficult for competitors to replicate quickly. This is powerfully combined with a disruptive 'Un-carrier' brand identity that has cultivated significant customer loyalty and consistently keeps competitors on the defensive. While some promotional tactics are temporary, the core advantages of network and brand are highly durable.

The multi-year head start in deploying critical mid-band 5G spectrum has created a highly sustainable network performance advantage that forms the foundation of its marketing and growth strategy.

Develop a more robust strategy to counter the growing threat from cable companies (Comcast/Charter) bundling mobile services, potentially by offering more aggressive discounts for its own Home Internet bundle or creating exclusive features unavailable to MVNO partners.

The business model is highly scalable, benefiting from high fixed costs but very low marginal costs to add new customers, creating significant operating leverage. T-Mobile has demonstrated a strong track record of healthy unit economics with industry-leading low postpaid churn and growing revenue per account. There are clear and aggressive expansion signals into high-potential adjacent markets like Fixed Wireless Access (FWA), B2B/IoT, and even fiber, indicating a clear path for future growth.

The successful launch and rapid scaling of its 5G Home Internet (FWA) service leverages the core network asset to attack a massive, adjacent market, creating a powerful new revenue stream and growth engine.

Address the emerging talent gap in key expansion areas. Actively recruit and develop expertise in enterprise sales, fiber optic operations, and IoT solution engineering to successfully execute against growth initiatives in these newer, complex markets.

T-Mobile's business model is exceptionally coherent, with all key activities—from network investment to marketing—strategically aligned with the 'Un-carrier' value proposition. The revenue model is robust, with a strong base of recurring postpaid revenue successfully diversified by the rapid growth in FWA. The company has maintained a strong strategic focus on its core mission, expanding into adjacent markets like broadband that logically leverage its primary network asset. Market timing on 5G deployment was superb, creating a lasting advantage.

The symbiotic relationship between investing in a superior 5G network and monetizing it through a value-centric, customer-friendly proposition is the coherent core of the entire business model, driving both growth and brand equity.

Realign the complexity of promotional offers with the core strategic focus on simplicity. The current approach, while effective for acquisition, creates operational complexity and brand friction that deviates from the original 'Un-carrier' philosophy.

T-Mobile has successfully transitioned from a market challenger to a market leader, holding the largest market share in the U.S. wireless industry. This position grants it significant market power, allowing it to influence industry trends with its 'Un-carrier' moves and forcing competitors to react. Its pricing power is demonstrated by its ability to attract and retain high-value customers on premium plans, while its superior network gives it significant leverage with partners and in setting performance standards.

T-Mobile's ability to set the industry's competitive tempo through its 'Un-carrier' initiatives demonstrates profound market influence, consistently forcing rivals to abandon long-standing practices like contracts and restrictive trade-in policies.

Solidify its weaker position in the large enterprise segment, where competitors like AT&T and Verizon have historically had stronger relationships. Building a more credible and specialized B2B sales and solutions engine is the key to capturing this high-margin market.

Business Overview

Business Classification

Telecommunications Service Provider

Consumer Electronics Retailer

Telecommunications

Sub Verticals

- •

Wireless Communications

- •

Internet Service Provider (ISP)

- •

Internet of Things (IoT) Connectivity

- •

MVNO (Mobile Virtual Network Operator) Enabler

Mature

Maturity Indicators

- •

Extensive nationwide 5G network infrastructure.

- •

Large and established subscriber base (132.8 million total connections).

- •

Focus on customer acquisition from direct competitors (e.g., 'we'll pay off your phone').

- •

Significant M&A activity to consolidate market share and acquire new capabilities (Sprint, UScellular assets, Mint Mobile).

- •

Strong brand recognition as the 'Un-carrier'.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Postpaid Mobile Services

Description:Core monthly recurring revenue from individual and family mobile phone plans. This is the largest revenue segment, with revenues of $14.1 billion in Q2 2025, a 9% year-over-year growth.

Estimated Importance:Primary

Customer Segment:Consumers, Families, Businesses

Estimated Margin:High

- Stream Name:

5G Home & Business Internet

Description:Fixed Wireless Access (FWA) service providing broadband internet to homes and businesses over the 5G network. A key growth area with 7.3 million customers as of Q2 2025 and a target of 12 million by 2028.

Estimated Importance:Primary

Customer Segment:Residential & Small Business Internet Users

Estimated Margin:Medium

- Stream Name:

Equipment Sales & Financing

Description:Revenue from the sale of smartphones, tablets, watches, and other connected devices. Devices are often sold on 24-month financing plans, creating a predictable revenue stream and customer stickiness. Equipment revenues were $3.43 billion in Q2 2025.

Estimated Importance:Secondary

Customer Segment:All mobile subscribers

Estimated Margin:Low

- Stream Name:

Prepaid Mobile Services

Description:Pay-as-you-go and monthly prepaid mobile services, including through its Metro by T-Mobile brand and recently acquired Mint Mobile. Net sales were $2.64 billion in Q2 2025.

Estimated Importance:Secondary

Customer Segment:Budget-Conscious Individuals

Estimated Margin:Medium

- Stream Name:

Wholesale & B2B Services

Description:Includes revenue from leasing network access to MVNOs and providing IoT connectivity, Fixed Wireless, and failover services for businesses.

Estimated Importance:Tertiary

Customer Segment:MVNOs, Enterprise IoT, Business Continuity

Estimated Margin:Medium

- Stream Name:

Value-Added Services & Insurance

Description:Add-on services such as device protection plans ('Protection 360'), international calling packages, and emerging services like T-Satellite.

Estimated Importance:Tertiary

Customer Segment:All mobile subscribers

Estimated Margin:High

Recurring Revenue Components

- •

Monthly Postpaid Plan Subscriptions

- •

Monthly Prepaid Plan Subscriptions

- •

5G Home Internet Subscriptions

- •

Device Financing Installments (EIP)

- •

Device Protection/Insurance Premiums

Pricing Strategy

Subscription & Tiered-Value

Value-Leader

Semi-transparent

Pricing Psychology

- •

Bundling (e.g., 'Netflix On Us', Apple TV+).

- •

Promotional Pricing ('On Us' devices via 24-month bill credits).

- •

Price Anchoring (highlighting per-line savings on multi-line plans).

- •

Urgency Tactics ('Limited time offer').

Monetization Assessment

Strengths

- •

Strong base of high-margin postpaid recurring service revenue.

- •

Successful value-added bundling strategy increases customer stickiness and perceived value.

- •

Rapidly growing 5G Home Internet service diversifies revenue beyond mobile.

- •

Device financing plans lock customers into the ecosystem for 24 months.

Weaknesses

- •

High dependency on aggressive promotional offers ('free' phones) to attract switchers, which can impact margins.

- •

Complexity of offers (bill credits, trade-ins, specific plan requirements) can lead to customer confusion.

- •

Prepaid segment has a higher churn rate (2.65%) compared to postpaid (0.90%).

Opportunities

- •

Aggressive expansion of the 5G Home Internet addressable market, including through fiber joint ventures.

- •

Scaling the B2B IoT and wholesale business by leveraging 5G network capabilities.

- •

Monetizing new technologies like T-Satellite for consumer and enterprise use cases in remote areas.

- •

Increasing Average Revenue Per Account (ARPA) through upselling to premium plans with more bundled services.

Threats

- •

Intense price and promotional competition from AT&T and Verizon.

- •

Market saturation in the core U.S. wireless market, making net-new growth challenging.

- •

Aggressive moves by cable companies (Comcast/Xfinity, Charter/Spectrum) bundling mobile services with their home internet.

- •

Potential regulatory scrutiny over market concentration following M&A activity.

Market Positioning

Positions itself as the 'Un-carrier,' a customer-centric disruptor offering the best 5G network, superior value through bundled perks, and a simplified experience compared to traditional carriers.

Market Leader, with approximately 35% of the U.S. mobile market as of late 2024, slightly ahead of Verizon (34%) and AT&T (27%).

Target Segments

- Segment Name:

Value-Seeking Families & Multi-Line Accounts

Description:Households and groups looking for cost-effective plans for multiple devices, where per-line savings and bundled entertainment (Netflix, Hulu, Apple TV+) are major draws.

Demographic Factors

Multiple age groups within a household

Middle to upper-middle income

Psychographic Factors

- •

Value-conscious

- •

Seek convenience and bundled deals

- •

Heavy consumers of streaming media

Behavioral Factors

- •

High data usage across multiple devices

- •

Likely to be on a family plan

- •

Responsive to promotional offers for entertainment

Pain Points

- •

High cost of individual plans

- •

Managing multiple subscriptions separately

- •

Feeling nickel-and-dimed by competitors' fees

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Competitor Switchers

Description:Existing AT&T and Verizon customers who are dissatisfied with their current price, network, or customer service. T-Mobile aggressively targets this segment with offers to pay off their existing device financing.

Demographic Factors

Varies widely

Psychographic Factors

- •

Price-sensitive

- •

Frustrated with current provider

- •

Actively seeking better deals

Behavioral Factors

- •

Actively comparison shopping

- •

Likely to have a financed device with a competitor

- •

Responsive to high-value switching incentives

Pain Points

- •

Feeling 'stuck' in a device payment plan

- •

Perceived poor value for money

- •

Lack of flexibility or perks from current carrier

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Broadband-Challenged Households

Description:Consumers in suburban and rural areas with limited or expensive choices for high-speed home internet. This is the primary target for the 5G Home Internet product.

Demographic Factors

Suburban and rural residents

Varies by income

Psychographic Factors

- •

Frustrated with cable/DSL monopolies

- •

Seeking simple, self-install solutions

- •

Value transparent pricing without long-term contracts

Behavioral Factors

Currently using slower DSL or satellite internet

Paying high prices for cable internet

Pain Points

- •

Lack of competitive broadband options

- •

Slow, unreliable internet service

- •

High monthly internet bills with annual price hikes

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

5G Network Leadership

Strength:Strong

Sustainability:Sustainable

- Factor:

'Un-carrier' Brand Ethos & Value Proposition

Strength:Strong

Sustainability:Sustainable

- Factor:

Bundled Value-Added Services

Strength:Moderate

Sustainability:Sustainable

- Factor:

Aggressive Customer Acquisition Tactics

Strength:Strong

Sustainability:Temporary

Value Proposition

We deliver the best 5G network, the best value, and the best experience, so customers never have to compromise.

Excellent

Key Benefits

- Benefit:

Superior 5G Network Coverage and Speed

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Third-party awards from Ookla and others.

Coverage maps showing extensive 5G reach.

- Benefit:

Bundled Entertainment & Lifestyle Perks

Importance:Important

Differentiation:Unique

Proof Elements

Specific offers for Netflix, Apple TV+, Hulu.

'Magenta Status' and 'T-Mobile Tuesdays' loyalty programs.

- Benefit:

Freedom from Traditional Carrier Hassles

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

No annual service contracts.

- •

Offers to pay off competitor device plans.

- •

'Scam Shield' to block spam calls.

- Benefit:

Connectivity Beyond the Core Network

Importance:Nice-to-have

Differentiation:Unique

Proof Elements

- •

T-Satellite service for off-grid messaging.

- •

Generous international data roaming plans.

- •

In-flight Wi-Fi benefits.

Unique Selling Points

- Usp:

The 'Un-carrier' model, which systematically dismantles common consumer pain points in the wireless industry (contracts, overages, hidden fees).

Sustainability:Long-term

Defensibility:Strong

- Usp:

America's largest and often fastest 5G network, a direct result of strategic spectrum acquisition and the Sprint merger.

Sustainability:Medium-term

Defensibility:Moderate

- Usp:

A comprehensive and evolving suite of bundled perks ('Magenta Status') including premium streaming services, travel benefits, and weekly deals.

Sustainability:Long-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Exorbitant and confusing mobile phone bills from competitors.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Feeling trapped by a carrier due to device financing or service contracts.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Poor or non-existent high-speed home internet options.

Severity:Critical

Solution Effectiveness:Partial

- Problem:

Lack of mobile coverage in remote areas or during travel.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

T-Mobile's focus on value, network quality, and customer-friendly policies directly addresses the primary frustrations consumers have with the telecommunications industry, positioning them well against competitors.

High

The value proposition strongly resonates with its target segments, particularly value-conscious families and frustrated competitor customers, by offering clear financial incentives and lifestyle perks.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Device Manufacturers (Apple, Samsung, Google).

- •

Network Infrastructure Partners (Nokia, Ericsson).

- •

Media & Content Partners (Netflix, Apple, MLB).

- •

Technology & Service Partners (SpaceX/Starlink, DoorDash).

- •

MVNO & Wholesale Partners.

- •

Retail & Distribution Partners

Key Activities

- •

Network buildout, management, and optimization.

- •

Marketing, sales, and customer acquisition.

- •

Customer service and support.

- •

Device procurement and supply chain management.

- •

Strategic partnership and ecosystem development.

- •

Research & Development in new technologies (AI-RAN, Satellite).

Key Resources

- •

Vast spectrum licenses (critical, finite asset).

- •

Nationwide 5G network infrastructure.

- •

Strong 'Un-carrier' brand equity and customer loyalty.

- •

Extensive retail footprint and digital sales channels.

- •

Large subscriber base and associated data.

Cost Structure

- •

Network capital expenditures (CapEx) and operating expenses.

- •

Spectrum acquisition costs.

- •

Cost of equipment and device subsidies.

- •

Sales, General & Administrative (SG&A), including marketing spend.

- •

Customer service and retail operations.

- •

Debt servicing costs.

Swot Analysis

Strengths

- •

Leading 5G network coverage and speed.

- •

Strong brand identity and customer-centric 'Un-carrier' reputation.

- •

Proven ability to acquire and retain customers, leading to strong subscriber growth.

- •

Successful and sticky service bundling strategy.

- •

Rapidly growing and diversifying revenue stream from 5G Home Internet.

Weaknesses

- •

Reliance on heavy promotional spending and device subsidies to drive growth.

- •

Relatively high customer churn in the prepaid segment.

- •

Historical data breaches have raised cybersecurity concerns.

- •

4G network coverage lags behind Verizon and AT&T in some rural areas.

Opportunities

- •

Capture significant market share in the home broadband market, displacing cable and DSL.

- •

Expand high-margin enterprise and B2B services, particularly in IoT and private 5G networks.

- •

Leverage satellite partnership (Starlink) to create a new, defensible advantage in universal coverage.

- •

Further acquisitions and partnerships to enter adjacent markets like fiber internet.

Threats

- •

Intensifying price competition from established rivals Verizon and AT&T.

- •

Cable companies (Comcast, Charter) aggressively bundling mobile with their dominant home internet services.

- •

Saturated U.S. wireless market limits organic growth potential.

- •

Potential for increased regulatory oversight due to market consolidation.

- •

Need for continuous, massive capital investment to maintain network leadership.

Recommendations

Priority Improvements

- Area:

Offer Simplification & Transparency

Recommendation:Streamline the complex web of device promotions, bill credits, and plan-specific requirements. Develop clearer communication tools to help customers understand the true cost and terms of their agreements, reducing confusion and improving trust.

Expected Impact:Medium

- Area:

Cybersecurity & Data Protection

Recommendation:Invest heavily in next-generation cybersecurity infrastructure and publicly communicate these efforts to rebuild customer trust following past data breaches. Offer more robust identity protection services as a standard feature on premium plans.

Expected Impact:High

- Area:

Customer Service Experience

Recommendation:Continue to invest in onshore, highly-trained customer support teams ('Team of Experts' model) and empower them with AI tools to resolve issues faster and more effectively, creating a key differentiator in a commoditized market.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Connectivity-as-a-Service' platform for enterprise clients, combining mobile, fixed wireless, satellite, and private 5G networks into a single, managed solution with predictable pricing.

- •

Evolve the 'T-Life' app into a central 'super-app' for managing not just the T-Mobile account, but also bundled services (Netflix, etc.), travel perks, and potentially new financial services tied to device financing and insurance.

- •

Introduce dynamic, usage-based pricing models for IoT solutions to capture the long tail of the market, from small businesses to large-scale industrial deployments.

Revenue Diversification

- •

Accelerate the push into the home broadband market by combining 5G FWA with strategic fiber acquisitions, creating a multi-pronged challenge to incumbent cable providers.

- •

Build a dedicated enterprise solutions group focused on selling vertical-specific IoT and 5G network slicing solutions to industries like logistics, manufacturing, and healthcare.

- •

Explore monetization strategies for the T-Satellite service beyond a simple add-on, such as offering dedicated data plans for remote workers, RVs, and maritime use cases.

T-Mobile has successfully evolved from a market challenger to a market leader by architecting a business model around its disruptive 'Un-carrier' strategy. The core of this model is a symbiotic relationship between network leadership and perceived value. The multi-billion dollar investment in building a leading 5G network, accelerated by the Sprint merger, serves as the foundational asset. This network superiority is then monetized not through premium pricing, but through a value-centric proposition that attracts and retains customers via aggressive promotions, service bundling, and customer-friendly policies.

The business model is now entering a new phase of evolution. Having largely won the 5G mobile battle, T-Mobile is leveraging its core network asset to attack adjacent, high-value markets. The most significant strategic evolution is the aggressive push into the residential and business broadband market with its 5G Home Internet service. This transforms T-Mobile from purely a mobile carrier into a diversified connectivity provider, creating substantial new revenue streams and challenging entrenched cable monopolies. Future growth vectors are clearly aimed at further diversification, including a deeper push into the B2B/IoT space and nascent opportunities in satellite-to-mobile connectivity, which could provide a long-term, defensible moat.

The primary challenge and strategic imperative moving forward will be to balance this aggressive growth with profitability and sustainability. The model's reliance on high-cost promotions for customer acquisition is a potential vulnerability in a saturated market. The key to future success will be transitioning customers acquired through promotions into loyal, high-ARPA subscribers, successfully scaling the new broadband and IoT businesses to reduce reliance on the hyper-competitive mobile market, and maintaining its brand differentiation as it increasingly behaves like the market incumbent it has become.

Competitors

T-Mobile has successfully leveraged its 'Un-carrier' strategy to disrupt the mature U.S. wireless telecommunications market, shifting from a challenger to a market leader. The competitive landscape is a classic oligopoly, dominated by T-Mobile, Verizon, and AT&T. T-Mobile's primary competitive advantages are its superior mid-band 5G network coverage and speed, a strong value proposition that bundles popular streaming services, and an aggressive, customer-centric brand identity. Analysis of T-Mobile's website reveals a clear focus on acquiring new customers through aggressive promotions, such as paying off switcher's phones and offering new devices 'On Us.' This strategy directly targets the pain points of switching carriers and aims to overcome customer inertia.

Direct competitors Verizon and AT&T are responding with different strategies. Verizon continues to position itself as the premium, most reliable network, a perception that persists despite T-Mobile's documented 5G superiority. AT&T is focused on a converged connectivity strategy, bundling its wireless services with its expanding fiber broadband network to increase customer lifetime value and reduce churn. The most significant emerging threat comes from indirect competitors, specifically cable companies like Comcast (Xfinity Mobile) and Charter (Spectrum Mobile). By leveraging their existing broadband customer relationships and offering attractively priced mobile plans (as MVNOs), they are capturing a significant share of new postpaid subscribers. T-Mobile's strategic imperatives are to defend its market share gains against these cable MVNOs, solidify its network leadership perception in the minds of all consumers (especially in rural areas), and continue to innovate on value-added services to prevent the market from devolving into a pure price war.

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Expenditure for Network Infrastructure

Impact:High

- Barrier:

Licensed Radio Spectrum Acquisition

Impact:High

- Barrier:

Regulatory Hurdles and Compliance (FCC)

Impact:High

- Barrier:

Established Brand Recognition and Customer Loyalty

Impact:Medium

- Barrier:

Economies of Scale in Operations and Marketing

Impact:High

Industry Trends

- Trend:

5G Network Expansion and Monetization

Impact On Business:Core to T-Mobile's strategy; provides a key differentiator in speed and coverage and enables new revenue streams like Fixed Wireless Access (FWA).

Timeline:Immediate

- Trend:

Growth of Fixed Wireless Access (FWA) for Home Internet

Impact On Business:A major growth area for T-Mobile, directly competing with traditional cable and fiber broadband providers.

Timeline:Immediate

- Trend:

Bundling of Services (Mobile, Internet, Streaming)

Impact On Business:Essential for customer retention and increasing ARPU (Average Revenue Per User). T-Mobile leads in bundling third-party streaming services.

Timeline:Immediate

- Trend:

Integration of AI in Customer Service and Network Operations

Impact On Business:Opportunity to reduce operational costs and enhance customer experience through personalization and efficiency.

Timeline:Near-term

- Trend:

Satellite-to-Mobile Connectivity

Impact On Business:A new frontier for T-Mobile to eliminate dead zones and offer a unique value proposition, especially for rural and remote customers.

Timeline:Near-term

Direct Competitors

- →

Verizon Wireless

Market Share Estimate:34% (as of Dec 2024)

Target Audience Overlap:High

Competitive Positioning:Positions itself as the most reliable, premium network with superior overall coverage, particularly strong in rural 4G.

Strengths

- •

Strong brand reputation for network reliability and quality.

- •

Extensive 4G LTE coverage, often perceived as better in rural areas.

- •

High customer loyalty in the postpaid segment.

- •

Strong position in the business and enterprise market.

Weaknesses

- •

Significantly lagging T-Mobile in 5G coverage and median speeds.

- •

Higher price points for premium plans.

- •

Consecutive quarters of postpaid phone subscriber losses, indicating retention challenges.

- •

Less aggressive with value-added perks compared to T-Mobile.

Differentiators

Focus on network quality as a premium offering.

Aggressive expansion of Fixed Wireless Access and fiber to create bundled home/mobile solutions.

- →

AT&T Mobility

Market Share Estimate:27% (as of Dec 2024)

Target Audience Overlap:High

Competitive Positioning:Focuses on a converged connectivity strategy, bundling extensive fiber broadband with wireless services for a sticky customer ecosystem.

Strengths

- •

Largest 4G LTE network by landmass coverage.

- •

Strong and rapidly growing fiber internet footprint, enabling effective bundling.

- •

Established brand with a large, diverse customer base including strong enterprise relationships.

- •

Balanced and stable financial performance.

Weaknesses

- •

5G network performance and coverage trails T-Mobile.

- •

Brand perception can be viewed as more traditional or legacy compared to T-Mobile's 'Un-carrier' image.

- •

Historically complex plan structures and pricing, though they are working to simplify.

- •

Less emphasis on bundled entertainment perks compared to T-Mobile's peak.

Differentiators

Primary focus on the fiber and wireless bundle to lock in customers.

Historically integrated media assets, though now divested, have left a legacy of content-focused strategies.

Indirect Competitors

- →

Cable Companies (Comcast Xfinity Mobile, Charter Spectrum Mobile)

Description:Cable providers operating as Mobile Virtual Network Operators (MVNOs), primarily on Verizon's network. They bundle mobile services with their home internet and TV packages at a significant discount.

Threat Level:High

Potential For Direct Competition:Increasingly direct. They are capturing a majority of new postpaid mobile subscriber growth by leveraging their existing broadband customer base.

- →

Value MVNOs (Mint Mobile, Google Fi, Consumer Cellular)

Description:Price-focused providers that lease network access from major carriers (many from T-Mobile itself) and compete with leaner, often digital-first, operating models.

Threat Level:Medium

Potential For Direct Competition:They compete for the same value-conscious customers but lack the scale and network control of T-Mobile. T-Mobile's acquisition of Mint Mobile internalizes some of this competition.

- →

Dish Network (Boost Mobile)

Description:Positioned as the fourth national facilities-based carrier, but still in the process of building out its own 5G network. Currently operates largely as an MVNO on AT&T and T-Mobile's networks.

Threat Level:Low

Potential For Direct Competition:Medium (Long-term). If Dish successfully builds a competitive standalone 5G network, it could become a significant direct competitor, but it faces major financial and operational hurdles.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Leading 5G Network Performance and Coverage

Sustainability Assessment:Highly sustainable due to a multi-year head start in deploying critical mid-band spectrum acquired from the Sprint merger.

Competitor Replication Difficulty:Hard

- Advantage:

Strong 'Un-carrier' Brand Identity

Sustainability Assessment:Sustainable. The brand is built on a decade of pro-consumer moves that differentiate it from the more traditional images of Verizon and AT&T.

Competitor Replication Difficulty:Medium

- Advantage:

Value-Added Service Ecosystem (Streaming Perks, T-Mobile Tuesdays)

Sustainability Assessment:Moderately sustainable. While competitors can copy individual perks, T-Mobile has built an expectation and broad package that is difficult to replicate without undermining premium pricing models.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': "Aggressive Switching Promotions (e.g., 'Phone Payoff')", 'estimated_duration': 'Short-term (per promotional period). Competitors often match or counter with similar aggressive offers, leading to cyclical promotional wars.'}

{'advantage': 'Exclusive Device Deals', 'estimated_duration': 'Short-term. Device promotions are a standard competitive lever in the industry and are frequently matched by rivals.'}

Disadvantages

- Disadvantage:

Lagging Network Perception in Some Segments

Impact:Major

Addressability:Moderately

- Disadvantage:

Weaker Rural 4G Coverage Compared to Verizon/AT&T

Impact:Major

Addressability:Moderately

- Disadvantage:

Customer Service Scalability Issues

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted marketing campaign focused on debunking outdated network perceptions, using third-party data (e.g., Ookla, Opensignal) to highlight 5G dominance in specific regions, including improving rural areas.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Simplify the presentation of plan benefits and pricing on the website. While offers are strong, the detailed terms and conditions are complex and can create friction for potential customers.

Expected Impact:Low

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop a specific competitive strategy to counter cable MVNOs, potentially by offering more aggressive discounts for bundling T-Mobile Home Internet or creating exclusive features not available to MVNO partners.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand the 'Magenta Status' loyalty program with more exclusive partnerships and benefits to increase customer stickiness beyond bundled streaming, making it harder for customers to switch for a small price difference.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Aggressively market and integrate T-Satellite services into higher-tier plans to create a unique selling proposition for customers in rural and underserved areas where competitors have traditionally been stronger.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Invest heavily in expanding the wholesale and IoT business units, creating new B2B revenue streams that are less susceptible to consumer market price competition.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore strategic partnerships in adjacent connected industries (e.g., automotive, smart home, health tech) to embed T-Mobile connectivity as a core component of those ecosystems.

Expected Impact:Medium

Implementation Difficulty:Difficult

Solidify T-Mobile's position as the 'Smart Choice Leader,' evolving from the 'Un-carrier' challenger to the established leader in overall value. This positioning combines superior 5G network performance, transparent and competitive pricing, and an unmatched bundle of value-added services.

Continue to differentiate on a superior 5G network and a compelling ecosystem of value-added perks. While competitors focus on a single differentiator (Verizon on reliability, AT&T on fiber convergence), T-Mobile's strength lies in its powerful combination of network, value, and customer-centric branding.

Whitespace Opportunities

- Opportunity:

Develop specialized plans for high-demand niches like mobile gaming (optimized for low latency) or the gig economy (flexible data, business tools).

Competitive Gap:Competitors offer generic unlimited plans. Niche-specific plans could attract high-value, loyal customer segments.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Create a truly integrated 'Connected Life' bundle that goes beyond discounts, offering unified security, device management, and data sharing between mobile and home internet services.

Competitive Gap:Competitor bundles are primarily financial discounts. A deeply integrated technical solution would be a stronger differentiator.

Feasibility:Low

Potential Impact:High

- Opportunity:

Expand into personalized digital security services, leveraging the core network position to offer enhanced identity theft protection, parental controls, and secure VPN services as a premium add-on.

Competitive Gap:Carriers offer basic scam protection, but a comprehensive digital security suite is a largely untapped market for telcos.

Feasibility:Medium

Potential Impact:Medium

Messaging

Message Architecture

Key Messages

- Message:

It’s better over here. Experience it all on the Best Network.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Plus, we’ll pay off your current phone up to $800 a line.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Shop our best deals.

Prominence:Secondary

Clarity Score:High

Location:Homepage Mid-section

- Message:

T-Satellite is here. Never miss a message.

Prominence:Secondary

Clarity Score:High

Location:Homepage Mid-section

- Message:

Great benefits from the brands you love.

Prominence:Secondary

Clarity Score:High

Location:Homepage Benefits Section

- Message:

Innovative solutions to level up your business plan.

Prominence:Tertiary

Clarity Score:Medium

Location:Wholesale Page

The message hierarchy is heavily skewed towards customer acquisition, specifically targeting switchers from competitors. Primary messages are extremely clear, focusing on the two most compelling reasons to switch: a better network and financial incentives (paying off old phones, free new phones). Secondary messages support this by highlighting a constant stream of new device deals and value-added benefits. The core brand promise of being the 'Un-carrier' is implied through these aggressive offers rather than stated explicitly on the homepage. Messaging for existing customers or deeper brand values is tertiary at best.

Messaging is highly consistent in its focus on 'value' and 'deals' across the consumer-facing homepage. Every major section reinforces the idea that T-Mobile offers more for less. However, there is a significant tone and message shift on the B2B/Wholesale pages, which appropriately move from consumer-focused deals to business-focused solutions like reliability, IoT, and platform capabilities. The one area of inconsistency is the tension between the 'simple' Un-carrier ethos and the highly complex, jargon-filled fine print required for every offer.

Brand Voice

Voice Attributes

- Attribute:

Energetic & Confident

Strength:Strong

Examples

- •

It’s better over here.

- •

That's right, we’ll pay off your current eligible phone...

- •

Hot tech at prices that make the grade.

- Attribute:

Direct & Assertive

Strength:Strong

Examples

- •

Switch now

- •

Shop now

- •

Get Pixel 10 On Us on most plans. No trade-in needed.

- Attribute:

Value-Oriented

Strength:Strong

Examples

- •

FREE select smartphones.

- •

iPhone 14 On Us.

- •

With over $40/month in streaming benefits on us...

- Attribute:

Rebellious / Challenger

Strength:Moderate

Examples

It’s better over here.

Experience it all on the Best Network.

- Attribute:

Technical & Corporate

Strength:Weak

Examples

We offer simple, turnkey wholesale business solutions and platform capabilities.

Utilize our dedicated teams and future-ready network to help achieve your vision for smart devices.

Tone Analysis

Promotional

Secondary Tones

- •

Urgent

- •

Confident

- •

Reassuring

Tone Shifts

The tone shifts dramatically from energetic and promotional in the headlines to dense and legalistic in the fine print for each offer.

The tone becomes more corporate and solution-oriented on the 'Wholesale' page, moving away from consumer-focused hype.

Voice Consistency Rating

Good

Consistency Issues

The primary voice of the 'Un-carrier'—simple, transparent, and customer-first—is sometimes undermined by the sheer volume of complex, conditional offers and the requisite legal disclaimers. The simplicity gets lost in the details.

Value Proposition Assessment

T-Mobile positions itself as the 'Un-carrier,' offering the best network, the best value, and the best experience, fundamentally challenging the status quo to eliminate customer pain points like contracts, high costs, and poor service.

Value Proposition Components

- Component:

Superior Network Quality

Clarity:Clear

Uniqueness:Somewhat Unique

Details:Communicated via claims like 'Best Mobile Network in the US according to Ookla Speedtest' and innovative features like 'T-Satellite'. This is a direct challenge to Verizon's historical dominance in network perception.

- Component:

Aggressive Financial Value & Deals

Clarity:Clear

Uniqueness:Unique

Details:Messages like 'we’ll pay off your current phone up to $800' and 'Get Pixel 10 On Us... No trade-in needed' are extremely direct and designed to remove the financial friction of switching carriers. This is a core differentiator.

- Component:

Abundant Lifestyle Perks

Clarity:Clear

Uniqueness:Somewhat Unique

Details:Benefits like 'Apple TV+ On Us', 'free DashPass', and 'T-Mobile Tuesdays' are bundled to add tangible, everyday value beyond just the core phone service, framing the plan as a lifestyle membership ('Magenta Status').

- Component:

Customer-Friendly Policies

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Details:Communicated through offerings like '5-Year Price Guarantee' and phone upgrade programs ('upgrade your phone every year'). While a key part of the 'Un-carrier' identity, this is less prominent on the homepage than the immediate deals.

T-Mobile's messaging effectively differentiates it as the high-value challenger to incumbents like Verizon and AT&T. While competitors often focus on network reliability or bundled home services, T-Mobile's strategy is a multi-pronged assault on customer pain points: cost, restrictive contracts, and lack of perks. The combination of a top-tier network claim (backed by Ookla) with aggressive, tangible financial incentives and a suite of valuable lifestyle benefits creates a powerful and distinct market position.

The messaging positions T-Mobile as the industry growth leader and innovator that forces competitors to react. By calling itself the 'Un-carrier,' it frames Verizon and AT&T as the old, broken 'carriers.' The focus on paying off competitors' phones directly targets entrenched customers, aiming to neutralize the lock-in effect that has historically benefited rivals. The constant barrage of 'On Us' deals for the latest phones positions T-Mobile as the most affordable way to stay current with technology.

Audience Messaging

Target Personas

- Persona:

The Value-Seeking Switcher

Tailored Messages

- •

Plus, we’ll pay off your current phone up to $800 a line.

- •

iPhone 16 on us.

- •

Get Pixel 10 On Us on most plans. No trade-in needed.

Effectiveness:Effective

- Persona:

The Tech-Savvy Early Adopter

Tailored Messages

- •

T-Satellite is here. Never miss a message.

- •

iPhone 16e. On Us. Built for Apple Intelligence.

- •

Get up to $800 off the new Galaxy Z Flip7.

Effectiveness:Effective

- Persona:

The Multi-Line Family/Group

Tailored Messages

- •

Essentials - $30/mo. per phone line for 3 lines...

- •

Experience More - $46.67/month per line for 3 phone lines...

- •

With over $40/month in streaming benefits on us on our best plan...

Effectiveness:Somewhat Effective

- Persona:

Business & Wholesale Partners (IoT, MVNOs)

Tailored Messages

- •

Innovative solutions to level up your business plan.

- •

Reliable connectivity with primary access.

- •

Capture the value of IoT with our advanced network.

Effectiveness:Effective

Audience Pain Points Addressed

- •

Feeling trapped by a competitor's device payment plan ('we’ll pay off your current phone').

- •

High cost of new flagship smartphones ('iPhone 16 on us').

- •

Fear of losing connectivity in remote areas ('T-Satellite is here').

- •

Annoyance of scam calls ('Help block scam calls').

- •

Complexity and high cost of international roaming ('Stay connected in 215+ countries').

Audience Aspirations Addressed

- •

Getting the latest technology without paying a premium ('Preorder now', 'On Us').

- •

Maximizing value and getting free perks ('free DashPass', 'Apple TV+ On Us').

- •

Having a simple, worry-free mobile experience ('It’s better over here').

- •

Feeling like a VIP with exclusive benefits ('Magenta Status').

Persuasion Elements

Emotional Appeals

- Appeal Type:

Relief & Liberation

Effectiveness:High

Examples

It’s better over here.

Plus, we’ll pay off your current phone up to $800 a line.

Details:This messaging taps into the frustration customers feel with other carriers, promising a better, financially unburdened experience.

- Appeal Type:

Excitement & Desire

Effectiveness:High

Examples

Get the new Revvl 8 FREE.

iPhone 16e. On Us.

Details:Focuses on the powerful allure of getting a brand new, highly desired piece of technology for free.

- Appeal Type:

Security & FOMO (Fear Of Missing Out)

Effectiveness:Medium

Examples

Don’t miss out on free DashPass.

T-Satellite is here. Never miss a message.

Details:Creates a sense that not being with T-Mobile means missing out on valuable perks and critical connectivity.

Social Proof Elements

- Proof Type:

Third-Party Award/Validation

Impact:Strong

Details:Repeatedly citing 'Best Mobile Network in the US according to Ookla Speedtest' provides credible, external validation for their primary network quality claim.

Trust Indicators

- •

Third-party validation (Ookla Speedtest)

- •

Explicit guarantees ('5-Year Price Guarantee')

- •

Partnerships with major, trusted brands (Apple, Google, Samsung, DoorDash)

Scarcity Urgency Tactics

- •

Limited time offers ('Limited time. Redeem 1 year free DashPass in T-Life within 30 days...').

- •

Pre-order messaging ('Preorder now') for new devices to create urgency around launch dates.

- •

Time-sensitive language ('Hurry—you have 30 days to redeem').

Calls To Action

Primary Ctas

- Text:

Switch now

Location:Hero banner, Plan comparison section

Clarity:Clear

- Text:

Shop now

Location:Multiple device deal sections

Clarity:Clear

- Text:

Preorder now

Location:New device announcement (Google Pixel)

Clarity:Clear

- Text:

Check availability

Location:Home Internet section

Clarity:Clear

- Text:

Submit

Location:Wholesale 'Connect with us' form

Clarity:Clear

The CTAs are highly effective due to their clarity, directness, and consistent placement. They use strong, action-oriented verbs ('Switch', 'Shop', 'Get', 'Check') that leave no ambiguity about the desired next step. The sheer frequency and prominence of CTAs ensure that a user is never far from a conversion point, aggressively driving the customer acquisition goal.

Messaging Gaps Analysis

Critical Gaps

- •

Weak 'Why' Narrative: The website is overwhelmingly focused on 'what' you get (deals, phones, perks) but lacks a strong, easily digestible narrative on why T-Mobile is the 'Un-carrier.' The founding philosophy of challenging a broken industry gets lost beneath the mountain of promotions.

- •

Limited Messaging for Existing Customers: The homepage is almost exclusively geared towards attracting new customers. There is very little messaging that acknowledges, thanks, or provides value specifically for the existing loyal customer base, which could impact long-term retention.

- •

Clarity on Plan Differentiation: While the plans are laid out, the core differences between 'Essentials', 'Experience More', and 'Experience Beyond' could be communicated more clearly with a visual, at-a-glance comparison chart that highlights the key trade-offs and benefits for different user types.

Contradiction Points

'Simplicity' vs. 'Complexity': The core brand promise of being the simple, transparent 'Un-carrier' is directly contradicted by the wall of fine print and complex eligibility requirements associated with every single promotional offer. This creates a cognitive dissonance where the headline promises simplicity, but the details deliver complexity.

'Best Value' vs. 'Plus Taxes and Fees': For the higher-tier 'Experience' plans, the price is listed as 'plus taxes and fees,' which was a major pain point the original 'Un-carrier' moves (with Magenta plans) sought to eliminate. This can feel like a step back from their core disruptive promise.

Underdeveloped Areas

Magenta Status Narrative: The concept of 'Magenta Status' is mentioned but not fully developed as a cohesive loyalty program. It feels more like a marketing wrapper for various benefits rather than a compelling, unified status that customers would aspire to.

Storytelling: There is a significant lack of human-centric storytelling. Featuring real customer stories about how switching saved them money or how the network benefits improved their lives would add a powerful emotional layer that is currently missing.

Messaging Quality

Strengths

- •

Laser-Focused on Acquisition: The messaging is exceptionally well-honed to drive one primary business outcome: acquiring new customers from competitors.

- •

High-Impact Value Propositions: The key offers ('we'll pay off your phone', 'new phone on us') are powerful, easy to understand, and directly address major barriers to switching.

- •

Strong Use of Proof Points: Using the Ookla award as a consistent proof point for network quality is a smart and effective way to build credibility.

- •

Clear, Action-Oriented Language: Headlines and CTAs are direct, confident, and leave no room for misinterpretation.

Weaknesses

- •

Overwhelming & Cluttered: The sheer number of different deals on the homepage can lead to choice paralysis and make the overall value proposition feel fragmented and confusing.

- •

Brand Dilution: The heavy emphasis on short-term deals and promotions overshadows the long-term brand narrative of being the 'Un-carrier.' The 'why' is lost in the 'what.'

- •

Undermines Trust with Fine Print: The stark contrast between the bold, simple headline offers and the complex, lengthy disclaimers can erode the trust the 'Un-carrier' brand aims to build.

Opportunities

- •

Create a Dedicated 'Un-carrier' Hub: Develop a section of the site that tells the T-Mobile story, explains the philosophy, and showcases the history of customer-friendly moves. This would strengthen the brand beyond just deals.

- •

Develop a Loyalty-Focused Content Stream: Create messaging and content specifically for existing customers, highlighting how they can maximize their benefits and reinforcing their decision to choose T-Mobile.

- •

Simplify Offer Presentation: Use interactive tools or clearer comparison tables to help users understand which of the many available offers is best for them, aligning the user experience more closely with the brand promise of simplicity.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Message Hierarchy

Recommendation:Streamline the homepage to feature a primary 'Switcher' offer and a secondary 'Why T-Mobile?' block that explains the Un-carrier philosophy. Move the myriad of individual phone deals to a dedicated 'Deals' page to reduce clutter.

Expected Impact:High

- Area:

Value Proposition Clarity

Recommendation:Develop an interactive plan comparison tool that clearly visualizes the differences in price, perks, and features between plans, helping users self-select the best option instead of just showing price points.

Expected Impact:High

- Area:

Brand Storytelling

Recommendation:Incorporate a customer story/testimonial section on the homepage and key plan pages. Use short video clips or quotes to add social proof and emotional resonance to the data-driven claims.

Expected Impact:Medium

Quick Wins

- •

Make the 'Ookla Best Network' award a more prominent and persistent visual element on the page.

- •

Add a 'For Existing Customers' link in the main navigation to show appreciation for the current user base.

- •

Test simplifying the headline copy to focus on a single, powerful benefit rather than combining multiple offers in one block.

Long Term Recommendations

- •

Invest in a content marketing strategy that tells the 'Un-carrier' story through articles, videos, and customer features, building brand equity beyond price.

- •

Overhaul the presentation of terms and conditions, using dropdowns, tooltips, and simplified language (where legally possible) to make them less intimidating and more aligned with the brand's promise of transparency.

- •

Develop a more robust and clearly defined 'Magenta Status' loyalty program with tiered benefits to increase customer lifetime value and reduce churn.

T-Mobile's strategic messaging is a masterclass in aggressive customer acquisition. The website is a finely tuned conversion engine, relentlessly focused on dismantling the primary barriers for customers looking to switch from competitors Verizon and AT&T. The core messages are built on a powerful, easily digestible formula: our network is the best (proof: Ookla) and we will make it financially irresistible for you to switch (proof: we'll pay off your old phone AND give you a new one). This strategy is brutally effective at driving top-line subscriber growth.

However, this intense focus on acquisition comes at the cost of brand depth. The original, disruptive 'Un-carrier' ethos—a movement built on challenging industry norms and prioritizing customer-centric simplicity—is largely sublimated. The website's current messaging positions T-Mobile less as a consumer champion and more as a relentless deal machine. This creates a significant strategic tension: the 'Un-carrier' brand promises simplicity and transparency, but the user experience is one of overwhelming choice and complex, fine-print-laden offers that feel very much like the 'carrier' behavior it once defined itself against.

The B2B messaging on the wholesale page is clear and appropriately tailored, but the main consumer site struggles to balance its dual identity. It successfully leverages persuasion tactics like social proof and urgency to drive conversions. Yet, it misses key opportunities in storytelling and reinforcing its core brand narrative, which could lead to a brand perception based solely on price rather than a deeper customer relationship. The immediate business objective of customer acquisition is being met, but the long-term strategic objective of building an unassailable, beloved brand requires a better balance between the 'what' (the deals) and the 'why' (the Un-carrier philosophy).

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Consistent industry leadership in postpaid customer net additions, indicating successful customer acquisition and market share gains.

- •

The 'Un-carrier' value proposition, which eliminates contracts and adds value-added services (e.g., streaming bundles), directly addresses major consumer pain points in the telecom industry.

- •

High rankings in customer satisfaction for key growth products like 5G Home Internet, suggesting the product resonates well with its target market.

- •

Successful expansion into new market segments, including rural areas, business customers, and Fixed Wireless Access (FWA), demonstrating the adaptability of the core product.

- •

Strong financial performance with record service revenues and industry-leading growth, reflecting high market demand.

Improvement Areas

- •

Further differentiating the value proposition beyond price and perks as competitors like Verizon and AT&T adopt similar bundling strategies.

- •

Improving network perception in historically weaker areas to attract high-value 'network seeker' customers who prioritize coverage and speed above all else.

- •

Simplifying the increasingly complex plan and promotion structure to maintain the 'Un-carrier' promise of transparency.

Market Dynamics

Steady growth, with a projected CAGR of 3.42% to 6.8% for the US telecom market through 2029.

Mature

Market Trends

- Trend:

5G Network Expansion and Adoption

Business Impact:This is the primary driver of growth, enabling new services like FWA and enhanced mobile broadband. T-Mobile's recognized leadership in 5G coverage and speed provides a significant competitive advantage.

- Trend:

Fixed Wireless Access (FWA) as a Broadband Alternative

Business Impact:FWA is a major growth engine, allowing T-Mobile to compete directly with cable and fiber incumbents and capture significant broadband market share. T-Mobile has been a leader in FWA customer additions.

- Trend:

Growth of Internet of Things (IoT) and Enterprise Solutions

Business Impact:Represents a substantial revenue diversification opportunity beyond the consumer segment, leveraging the 5G network for business-specific applications like fleet management and asset tracking.

- Trend:

Direct-to-Cell Satellite Connectivity

Business Impact:Partnership with SpaceX (Starlink) to eliminate dead zones creates a unique value proposition for rural and remote customers, a key growth segment.

- Trend:

Intense Competition and Market Saturation

Business Impact:Growth primarily comes from taking market share from competitors (AT&T, Verizon, and cable companies), requiring aggressive marketing and strong retention strategies.

Excellent. T-Mobile's current leadership in 5G network deployment positions it perfectly to capitalize on the major growth trends of FWA, IoT, and satellite connectivity.

Business Model Scalability

High

High fixed costs associated with network infrastructure and spectrum licenses, but very low marginal cost to add a new subscriber to the existing network, leading to high potential for operating leverage.

High. As subscriber density increases on the existing network footprint, profitability per customer improves significantly. Growth in high-margin services like FWA and enterprise IoT further enhances this leverage.

Scalability Constraints

- •

Network capacity and congestion, particularly for data-intensive services like FWA, which may require ongoing, capital-intensive upgrades.

- •

Spectrum availability, which is a finite resource and requires significant capital investment at auctions.

- •

Ability to maintain high-quality customer service as the subscriber base grows across multiple product lines (mobile, internet, business).

Team Readiness

Proven. The leadership team has successfully executed a disruptive market strategy, managed the massive integration of Sprint, and established T-Mobile as the market leader in customer growth.

Agile for its size. The 'Un-carrier' ethos appears to foster a culture of challenging industry norms and moving quickly on new initiatives. The creation of distinct business groups (Consumer, Business, Wholesale) allows for focused growth efforts.

Key Capability Gaps

- •

Deepening enterprise sales and solution engineering expertise to effectively compete with incumbents like AT&T and Verizon for large corporate accounts.

- •

Developing expertise in the fiber broadband market, a new area of expansion through acquisitions like Lumos and a joint venture for Metronet.

- •

Scaling partnership management capabilities to capitalize on the growing wholesale, MVNO, and IoT ecosystems.

Growth Engine

Acquisition Channels

- Channel:

Promotional Offers (Device Subsidies, Switching Incentives)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Continuously test and refine offers to balance subscriber growth with profitability (ARPU). Utilize data analytics to target promotions to the most valuable customer segments and reduce churn risk.

- Channel:

Digital (Website, App, Paid Search)

Effectiveness:High

Optimization Potential:High

Recommendation:Enhance the online switching and onboarding process to be completely seamless. Implement more advanced personalization on the website to surface the most relevant plans and deals based on user behavior.

- Channel:

Retail Stores

Effectiveness:High

Optimization Potential:Medium

Recommendation:Transform retail locations into 'experience centers' that showcase the ecosystem of connected devices (phones, home internet, IoT) to drive multi-line accounts and higher ARPU.

- Channel:

Business-to-Business (B2B) Sales

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest heavily in expanding the direct sales force and channel partnerships focused on enterprise. Develop industry-specific solutions (e.g., for logistics, retail, healthcare) to move beyond selling basic connectivity.

Customer Journey

The online conversion path is heavily optimized for 'switching' from competitors, with clear CTAs like 'Switch now' and upfront offers to pay off existing phones. The path is direct and promotion-driven.

Friction Points

- •

Complexity and fine print associated with promotional offers (e.g., 24-monthly bill credits, qualifying plans).

- •

Uncertainty about network coverage in specific, hyperlocal areas despite overall network leadership claims.

- •

Analysis paralysis from multiple plan tiers ('Essentials', 'Experience More', 'Experience Beyond') with varying benefits.

Journey Enhancement Priorities

{'area': 'Plan Selection', 'recommendation': 'Develop an interactive tool or guided questionnaire to help potential customers easily identify the optimal plan based on their usage, desired benefits (streaming, travel), and budget.'}

{'area': 'Onboarding', 'recommendation': 'Create a more robust post-purchase digital onboarding experience that educates new customers on activating all their benefits (Netflix, Apple TV+, Magenta Status) to maximize perceived value from day one.'}

Retention Mechanisms

- Mechanism:

Value-Added Bundling (Netflix, Apple TV+, Hulu)

Effectiveness:High

Improvement Opportunity:Explore exclusive content partnerships or gaming-related bundles to appeal to younger demographics and further increase switching costs.

- Mechanism:

Magenta Status Loyalty Program

Effectiveness:High

Improvement Opportunity:Personalize Magenta Status perks based on customer tenure and value. Introduce tiered loyalty levels (e.g., Silver, Gold, Platinum) to further reward long-term customers and incentivize plan upgrades.

- Mechanism:

Device Upgrade Programs

Effectiveness:High

Improvement Opportunity:Promote the 'Yearly Upgrade' feature more heavily as a key differentiator for premium plans, simplifying the trade-in process to feel seamless and guaranteed.

- Mechanism:

Price Guarantees ('5-Year Price Guarantee')

Effectiveness:Medium

Improvement Opportunity:Increase the visibility and clarity of this guarantee in marketing communications to address consumer fatigue with competitor price hikes.

Revenue Economics

Strong. Industry-leading low churn (around 0.90% postpaid) combined with a focus on acquiring multi-line accounts and upselling to premium plans suggests a high Lifetime Value (LTV). Aggressive acquisition spending is a key factor, but appears to be effective.

Estimated to be healthy and likely above the industry average, driven by low churn and increasing Average Revenue Per Account (ARPA).

High. The company demonstrates strong operational efficiency, translating industry-leading customer growth into record financial results and free cash flow.

Optimization Recommendations

- •

Drive adoption of T-Mobile Home Internet and other services to existing mobile customers to increase ARPA and customer stickiness.

- •

Focus on growing the higher-margin Business and Wholesale segments to diversify revenue and improve overall profitability.

- •

Optimize promotional spending by using analytics to identify the most cost-effective offers for acquiring high-value, low-churn customers.

Scale Barriers

Technical Limitations

- Limitation:

Fixed Wireless Network Capacity

Impact:High

Solution Approach:Actively manage network resources and potentially throttle heavy users during congestion. Continue aggressive investment in 5G Advanced technologies and mid-band spectrum to increase network capacity and spectral efficiency.

- Limitation:

Satellite Service Capabilities

Impact:Medium

Solution Approach:Manage customer expectations around the initial limitations (texting only) of the T-Satellite service. Follow a phased rollout plan, moving to voice and data as the technology matures and the satellite constellation is built out.

Operational Bottlenecks

- Bottleneck:

Integration of Acquired Companies

Growth Impact:Acquisitions of UScellular, Lumos, and Mint Mobile create operational complexity in integrating networks, billing systems, and company cultures.

Resolution Strategy:Establish dedicated integration teams with clear mandates and timelines. Prioritize a seamless customer experience during the transition. Over-invest in communication to all stakeholders.

- Bottleneck:

Customer Support Scalability

Growth Impact:Rapid growth in new, distinct service lines (Home Internet, Fiber, B2B) requires specialized support teams, which can be a bottleneck to providing a consistent, high-quality customer experience.

Resolution Strategy:Invest in AI-powered customer service tools and chatbots for common inquiries. Develop specialized 'Team of Experts' for each product line to ensure deep product knowledge and effective problem resolution.

Market Penetration Challenges

- Challenge:

Maturity and Saturation of the US Mobile Market

Severity:Critical

Mitigation Strategy:Focus on growth vectors beyond traditional mobile, such as FWA, Business/Enterprise, and IoT. Continue the 'Un-carrier' strategy of identifying and attacking competitor weaknesses to drive subscriber churn in T-Mobile's favor.

- Challenge:

Aggressive Competition from Cable Companies (Comcast, Charter)

Severity:Major

Mitigation Strategy:Leverage FWA to attack cable's core broadband business directly. Emphasize the value of bundled mobile and internet plans with aggressive pricing to create a superior value proposition.

- Challenge:

Entrenched Relationships of Competitors in the Enterprise Segment

Severity:Major

Mitigation Strategy:Build a credible enterprise offering by developing industry-specific solutions and leveraging the 5G network for advanced use cases (e.g., private networks, edge computing). Pursue strategic acquisitions to gain market share and talent.

Resource Limitations

Talent Gaps

- •

Enterprise B2B Sales Executives with deep industry-specific knowledge.

- •

Fiber Optic Network Engineers and Operations specialists.

- •

Data Scientists and AI/ML engineers to optimize network performance and personalize marketing.

Significant and ongoing capital is required for 5G network densification, spectrum acquisitions at auction, and fiber network buildouts. Maintaining a strong balance sheet and free cash flow is critical.

Infrastructure Needs

- •

Continued buildout of mid-band 5G spectrum for capacity and coverage.

- •

Expansion of fiber backhaul to support increased 5G network traffic.

- •

Integration of acquired network assets (UScellular, Lumos) into a unified T-Mobile network.

Growth Opportunities

Market Expansion

- Expansion Vector:

Fixed Wireless Access (Home & Business Internet)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Continue aggressive rollout to eligible households, targeting dissatisfied cable customers. Develop tiered service plans based on speed and data to capture a wider range of the market.

- Expansion Vector:

Business and Enterprise Segment

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Double down on the goal to reach 20% market share by building a dedicated enterprise sales force, developing tailored 5G solutions (like private networks), and forming strategic partnerships with enterprise tech providers.

- Expansion Vector:

Rural and Underserved Areas

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Leverage the combination of an expanding terrestrial 5G network and the new T-Satellite service to create a superior connectivity offering for rural markets, a historical weak point for wireless carriers.

- Expansion Vector:

Fiber Broadband Market

Potential Impact:Medium

Implementation Complexity:High

Recommended Approach:Pursue a targeted fiber strategy through acquisitions and joint ventures in key markets, offering a premium alternative to FWA and creating a powerful multi-technology connectivity portfolio.

Product Opportunities

- Opportunity:

Expansion of IoT Platform and Services

Market Demand Evidence:The global IoT market is projected to have over 50 billion connected devices by 2025, creating massive demand for connectivity and management solutions.

Strategic Fit:High. Leverages the core 5G network asset to generate high-margin, recurring revenue from business customers.

Development Recommendation:Develop vertical-specific, ready-to-deploy IoT solutions (e.g., smart agriculture, fleet telematics, smart city infrastructure) in partnership with IoT hardware and software specialists.

- Opportunity:

Direct-to-Cell Satellite Services (Voice and Data)

Market Demand Evidence:Significant market of consumers, businesses, and government agencies operating in areas with no terrestrial coverage.

Strategic Fit:High. Creates a powerful and unique network differentiator that competitors cannot easily replicate.

Development Recommendation:Continue the phased rollout with SpaceX, moving from messaging to voice and data capabilities. Explore B2B applications for industries like shipping, logistics, and energy.

- Opportunity:

Enhanced Connected Home/Life Ecosystem

Market Demand Evidence:Growing consumer demand for integrated smart home, entertainment, and security services.

Strategic Fit:Medium. Extends the customer relationship beyond the phone and into the home, increasing stickiness.

Development Recommendation:Leverage the 'Protection 360™ HomeTech' offering as a starting point. Explore partnerships with smart home device manufacturers and security service providers to create bundled 'Connected Life' packages.

Channel Diversification

- Channel:

Expanded Wholesale and MVNO Platform

Fit Assessment:Excellent. T-Mobile already has a strong wholesale business and can further monetize its network asset by enabling a new generation of MVNOs and IoT solution providers.

Implementation Strategy:Continue investing in the wholesale platform to make it easy for partners to provision and manage services. Develop a 'Wireless-as-a-Service' offering that allows partners to easily embed connectivity into their products.

- Channel:

Digital-Only Sub-Brands

Fit Assessment:Good. Allows for targeting specific market segments (e.g., ultra-price-sensitive, youth) without diluting the core T-Mobile brand.

Implementation Strategy:Leverage the recent acquisition of Mint Mobile as a template. Evaluate opportunities for other targeted, digital-first brands that operate on the T-Mobile network with a lower cost to serve.

Strategic Partnerships

- Partnership Type:

Technology and Infrastructure

Potential Partners

- •

SpaceX (current)

- •

NVIDIA (AI-RAN)

- •

Major cloud providers (AWS, Google Cloud, Microsoft Azure)

Expected Benefits:Accelerate innovation in core network capabilities (satellite, AI-optimized RAN), and co-develop advanced enterprise solutions like private 5G and mobile edge computing.

- Partnership Type:

Content and Media

Potential Partners

- •

Netflix, Apple, Hulu (current)

- •

Spotify

- •

Xbox (Microsoft)

- •

YouTube Premium