eScore

target.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Target demonstrates exceptional digital intelligence through a dominant online presence that masterfully integrates with its physical footprint. Its SEO strategy captures vast product and category-level keywords, while its 'stores-as-hubs' model turns local search into a powerful driver for omnichannel services like Drive Up. Content is expertly aligned with the mid-to-late customer journey, focusing on conversion through curated collections and promotions, solidifying its authority as a style-setter in the mass market.

Best-in-class integration of their physical store network as localized fulfillment hubs, making 'local search' a primary and highly effective customer acquisition channel.

Develop richer, top-of-funnel content ecosystems around key owned brands (e.g., 'Good & Gather' shoppable recipes) to capture inspirational search traffic and build deeper brand authority.

Target's brand communication is highly effective, consistently reinforcing its 'Expect More. Pay Less.' value proposition with an upbeat, aspirational, and accessible brand voice. The messaging masterfully blends themes of Style, Value, and Convenience across all channels, clearly differentiating itself from Walmart's price focus and Amazon's utility focus. While transactional messaging is world-class, there is a gap in communicating the company's broader mission and corporate values, which could build deeper brand affinity.

Exceptional clarity and consistency in communicating value through seasonal trends and promotions, creating a sense of 'affordable chic' that strongly resonates with its core demographic.

Explicitly integrate messaging around corporate values (sustainability, community giving) and the 'joy of everyday life' mission into the primary commercial experience to build a deeper, values-based customer connection.

Target.com offers a highly optimized conversion experience, characterized by a clean design, intuitive navigation, and a clear visual hierarchy that minimizes cognitive load. Critical conversion elements, like the iconic red 'Add to Cart' button, are prominent and effective, while the cross-device journey is seamless, particularly through its well-regarded mobile app. The platform's commitment to accessibility is strong, further broadening its market reach and reducing friction for all users.

A masterfully designed Product Detail Page (PDP) that provides a clear, frictionless path to conversion with excellent visual hierarchy and prominent calls-to-action.

Mitigate the high information density on the homepage by implementing dynamic personalization, tailoring promotional modules to individual user history to reduce choice paralysis and increase relevance.

Target has a very strong credibility framework, anchored by its powerful brand reputation and comprehensive, accessible legal policies that demonstrate a sophisticated approach to US privacy laws like CCPA. The site is replete with trust signals, from the Target Circle loyalty program to clear fulfillment promises and easy returns, effectively mitigating purchase risk. However, ongoing legal challenges related to in-store data collection and a US-centric approach to cookie compliance (a gap under GDPR) represent moderate, unaddressed risk areas.

A robust and transparent legal compliance framework, particularly for US state privacy laws and web accessibility (ADA), which builds significant customer trust and reduces legal risk.

Implement a geo-targeted cookie consent management platform to display a GDPR-compliant banner to EU users, closing a significant international compliance gap.

Target's competitive moat is wide and sustainable, built on the twin pillars of a powerful portfolio of owned brands and a best-in-class omnichannel experience. Its private labels, like Good & Gather, generate over $30 billion in annual sales, creating exclusivity and higher margins that are difficult for competitors to replicate. The 'stores-as-hubs' strategy leverages its physical footprint to offer unparalleled convenience through services like Drive Up, creating a defensible advantage against online-only players.

A highly differentiated and profitable portfolio of owned brands, which creates product exclusivity, drives customer loyalty, and insulates the company from direct price competition.

Continue to innovate and expand the 'shop-in-shop' model with new strategic partners to further differentiate the in-store and online experience, preventing it from becoming commoditized.

Target is exceptionally well-positioned for scalable growth, underpinned by a proven omnichannel model and strong unit economics driven by high-margin private labels and an efficient 'stores-as-hubs' fulfillment strategy. The company is strategically expanding into high-margin, asset-light revenue streams like its Roundel advertising network and the Target+ marketplace, which show significant growth potential. The primary constraint is its current heavy concentration in the U.S. market, with limited demonstrated expertise in international expansion.

The highly scalable 'stores-as-hubs' strategy, which leverages existing capital assets (stores) to efficiently fulfill a growing volume of digital orders, enabling profitable growth.

Develop an asset-light international expansion strategy, potentially leveraging the Target+ digital marketplace to test demand in new countries before committing to physical locations.

Target's business model is exceptionally coherent, with all components strategically aligned to support its core 'affordable chic' value proposition. The model masterfully integrates its physical stores, digital channels, owned brands, and loyalty program into a self-reinforcing flywheel that drives both growth and profitability. The strategic expansion into high-margin, alternative revenue streams like advertising (Roundel) demonstrates a sophisticated, forward-looking approach to optimizing the overall business model.

The 'stores-as-hubs' strategy is the central, coherent pillar of the business model, brilliantly leveraging physical assets to create a cost-effective and highly convenient omnichannel experience that competitors struggle to match.

Accelerate the strategic, invite-only onboarding of sellers to the Target+ marketplace to broaden online selection without compromising the brand's core tenet of careful product curation.

As a top-tier U.S. retailer, Target wields significant market power, demonstrated by its strong market share trajectory and its ability to influence consumer trends in categories like home goods and apparel. Its pricing power is derived not from being the cheapest, but from the unique value proposition of its stylish owned brands, which gives it leverage over both customers and suppliers. The rapidly growing Roundel media network is a testament to its increasing influence over the broader CPG advertising market.

Substantial pricing power and market influence derived from its portfolio of exclusive owned brands, which command customer loyalty and are not subject to direct price comparison with competitors.

Leverage its vast first-party data from over 100 million Target Circle members more aggressively to build predictive models of market trends, further solidifying its ability to set and shape market direction.

Business Overview

Business Classification

Omnichannel Retail

Third-Party Marketplace

Retail

Sub Verticals

- •

General Merchandise

- •

Grocery & Consumables

- •

Apparel & Accessories

- •

Home Goods & Decor

- •

Electronics

Mature

Maturity Indicators

- •

Established brand with high recognition since 1962.

- •

Extensive physical footprint with over 1,950 stores across the U.S.

- •

Well-developed and efficient supply chain and logistics network.

- •

Consistent revenue generation, exceeding $100 billion annually.

- •

Publicly traded company with a long history on the stock market.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

In-Store & Digital Product Sales

Description:Core revenue from the sale of a wide range of merchandise through physical stores and digital platforms (Target.com and the Target App). This includes a significant contribution from owned/private label brands which have higher margins. Digital sales represent a growing portion, accounting for 18.6% of total sales in 2022.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:Medium

- Stream Name:

Target+ Marketplace Commissions

Description:Fees and commissions from third-party sellers on the curated, invite-only Target+ marketplace. This model expands online assortment without holding inventory.

Estimated Importance:Secondary

Customer Segment:Online Shoppers

Estimated Margin:High

- Stream Name:

Advertising Revenue (Roundel)

Description:Revenue from its retail media network, Roundel, where partner brands pay for advertising placements on Target's digital properties and other platforms, leveraging Target's first-party customer data. Roundel generated $649 million in revenue in 2024.

Estimated Importance:Tertiary

Customer Segment:CPG Brands & Strategic Partners

Estimated Margin:High

- Stream Name:

Credit Card Profit Sharing

Description:Income from a profit-sharing agreement with TD Bank, the issuer of the Target Circle Card (formerly RedCard). This includes interest fees and other revenue related to the credit card program.

Estimated Importance:Tertiary

Customer Segment:Loyal Shoppers

Estimated Margin:High

Recurring Revenue Components

Target Circle 360™ Subscription Fees

Pricing Strategy

Value-Oriented Pricing

Mid-range

Transparent

Pricing Psychology

- •

Weekly Ads & Promotions

- •

Clearance & Sale Pricing

- •

Gift Card with Purchase Incentives (e.g., '$5 Target GiftCard with 4 select personal care')

- •

Buy One, Get One (BOGO) Offers

- •

Loyalty Discounts (Target Circle)

Monetization Assessment

Strengths

- •

Diversified revenue streams beyond direct product sales.

- •

High-margin private label brands (e.g., Good & Gather, Threshold) contribute over $30 billion in sales annually.

- •

Strong loyalty program (Target Circle) that drives repeat purchases and provides valuable data.

- •

Growing, high-margin advertising business (Roundel).

Weaknesses

- •

Heavy reliance on discretionary spending, making it vulnerable to economic downturns.

- •

Credit card revenue is subject to regulatory risks, such as changes in late fee rules.

- •

Subscription revenue from Target Circle 360 is a new and unproven stream compared to established competitors like Amazon Prime.

Opportunities

- •

Scale the Target+ marketplace to significantly increase commission-based revenue.

- •

Continue to grow the Roundel media network, which is projected to double in value.

- •

Expand the Target Circle 360 subscription base by bundling more exclusive perks and benefits.

- •

Introduce new service-based revenue streams leveraging store footprint (e.g., in-store classes, expanded clinics).

Threats

- •

Intense price competition from Walmart and Amazon, which could compress margins.

- •

Shifts in consumer spending habits away from discretionary goods to essentials.

- •

Potential for declining credit card profitability due to economic pressures on consumers.

Market Positioning

Affordable Chic / Quality & Style at a Value

Major Player (Top 10 US Retailer)

Target Segments

- Segment Name:

The Suburban Family Shopper ('Target Mom')

Description:Middle-to-upper-middle-class suburban families, often led by mothers, who are the primary household decision-makers for groceries, apparel, and home goods.

Demographic Factors

- •

Age 30-55

- •

Household Income $80k+

- •

Married with children

- •

Suburban

Psychographic Factors

- •

Values convenience, quality, and style.

- •

Seeks a pleasant, one-stop shopping experience.

- •

Brand-conscious but also price-sensitive.

- •

Influenced by social trends and recommendations (e.g., Pinterest, Instagram).

Behavioral Factors

- •

Frequent shopper (weekly or bi-weekly).

- •

High usage of omnichannel services like Drive Up and Order Pickup.

- •

Active member of the Target Circle loyalty program.

- •

High basket value, purchasing across multiple categories per trip.

Pain Points

- •

Time-consuming errands at multiple stores.

- •

Finding affordable products that are also stylish and of good quality.

- •

Keeping up with family needs and seasonal trends on a budget.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

The Style-Conscious Millennial/Gen Z

Description:Younger, urban or suburban consumers who are focused on trends in fashion, home decor, and beauty, often without children.

Demographic Factors

- •

Age 18-35

- •

Lower to middle income

- •

Single or in a relationship, no children

- •

Urban/Suburban

Psychographic Factors

- •

Values self-expression through personal style.

- •

Follows social media influencers and viral trends (e.g., TikTok).

- •

Interested in exclusive designer collaborations and unique finds.

- •

Seeks affordability and enjoys the 'thrill of the find' shopping experience.

Behavioral Factors

- •

Shops for specific items or categories (e.g., new apparel line, home decor refresh).

- •

More likely to browse and make impulse purchases.

- •

Engages with Target's social media content.

- •

Shops both online and in-store.

Pain Points

- •

Limited budget for trendy items.

- •

Difficulty finding unique, stylish products at mass retailers.

- •

Fast fashion quality concerns.

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Owned Brands Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Superior Omnichannel Experience (Drive Up)

Strength:Strong

Sustainability:Sustainable

- Factor:

Curated Product Assortment & 'Store-in-a-Store' Partnerships

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Perception and In-Store Ambiance

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To help all families discover the joy of everyday life by offering a curated, one-stop shopping experience with stylish, high-quality, and affordable products, made exceptionally easy and convenient through an industry-leading omnichannel model.

Excellent

Key Benefits

- Benefit:

One-Stop Convenience

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Wide product assortment across grocery, apparel, home, and electronics.

'Store-in-a-Store' concepts like Starbucks, Ulta Beauty, and Disney.

- Benefit:

Affordable Style & Quality

Importance:Critical

Differentiation:Unique

Proof Elements

Portfolio of successful and popular owned brands (e.g., Good & Gather, Cat & Jack, Threshold).

Limited-time designer collaborations.

- Benefit:

Seamless Fulfillment Options

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Highly-rated Drive Up (curbside pickup) service.

- •

In-store Order Pickup.

- •

Same-Day Delivery via Shipt / Target Circle 360.

Unique Selling Points

- Usp:

The 'Target Run': An enjoyable and discovery-driven shopping trip, unlike purely functional shopping at competitors.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Best-in-class curbside pickup service (Drive Up) known for its speed and efficiency.

Sustainability:Medium-term

Defensibility:Moderate

- Usp:

Exclusive access to a portfolio of billion-dollar private label brands that are destinations in their own right.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

The need to visit multiple stores for different needs (groceries, clothing, home goods).

Severity:Major

Solution Effectiveness:Complete

- Problem:

The trade-off between affordability and style/quality in everyday products.

Severity:Major

Solution Effectiveness:Complete

- Problem:

The hassle and time cost of shopping, especially for busy families.

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

Target's value proposition is highly aligned with the needs of modern consumers who demand convenience, value, and a pleasant shopping experience. Its omnichannel strategy effectively bridges the gap between digital and physical retail.

High

The focus on affordable style, quality, and one-stop convenience directly addresses the primary pain points of its core demographic of suburban families and style-conscious shoppers.

Strategic Assessment

Business Model Canvas

Key Partners

- •

TD Bank (Target Circle Card)

- •

Shipt (Same-Day Delivery)

- •

Strategic 'Store-in-a-Store' Brands (Ulta Beauty, Disney, Apple, Starbucks)

- •

Third-Party Sellers on Target+

- •

Designers for exclusive collections

Key Activities

- •

Merchandising and Curation

- •

Supply Chain and Logistics Management

- •

Store Operations and Customer Experience

- •

E-commerce Platform Management

- •

Marketing and Brand Management

- •

Private Label Product Development

Key Resources

- •

Physical Store Network

- •

Distribution and Fulfillment Centers

- •

Owned Brand Portfolio & IP

- •

Loyal Customer Base & First-Party Data

- •

Brand Equity and Reputation

Cost Structure

- •

Cost of Goods Sold

- •

Store Operating Expenses (rent, utilities, labor)

- •

Supply Chain & Logistics Costs

- •

Marketing and Advertising

- •

Technology and E-commerce Infrastructure

Swot Analysis

Strengths

- •

Powerful brand equity and customer loyalty.

- •

Highly successful and profitable portfolio of owned brands driving differentiation and higher margins.

- •

Best-in-class 'stores-as-hubs' omnichannel model, with over 96% of sales fulfilled by stores.

- •

Extensive first-party data from 100M+ Target Circle members, enabling personalization and advertising.

Weaknesses

- •

Lower grocery market share compared to competitors like Walmart, impacting frequency of visits.

- •

Heavy concentration in the U.S. market with limited international presence.

- •

Vulnerability to shifts in discretionary spending patterns.

Opportunities

- •

Aggressive expansion of the curated Target+ third-party marketplace to broaden assortment.

- •

Growth of high-margin alternative revenue streams like the Roundel advertising network.

- •

Scaling the new Target Circle 360 paid loyalty program to compete with Amazon Prime and Walmart+.

- •

Further integration of AI and technology to enhance personalization and operational efficiency.

Threats

- •

Intense price and convenience competition from Amazon and Walmart.

- •

Macroeconomic pressures (inflation, recession) reducing consumer discretionary spending.

- •

Evolving consumer preferences and the rapid pace of technological change.

- •

Potential for supply chain disruptions and rising operational costs.

Recommendations

Priority Improvements

- Area:

Third-Party Marketplace (Target+)

Recommendation:Accelerate the strategic, invite-only onboarding of sellers in key growth categories (e.g., specialty home goods, electronics) to rapidly expand online selection while maintaining brand curation.

Expected Impact:High

- Area:

Grocery Offering

Recommendation:Enhance the fresh food and private label grocery (Good & Gather) assortment and supply chain to increase basket size and shopping frequency, better competing with traditional grocers.

Expected Impact:High

- Area:

Personalization Engine

Recommendation:Leverage Target Circle data more aggressively with AI to deliver hyper-personalized promotions and product recommendations, increasing conversion rates and customer lifetime value.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Store-as-a-Service' offering, leveraging store footprint for localized fulfillment, returns, and showrooming for direct-to-consumer brands that align with Target's image.

- •

Expand into adjacent wellness services beyond the CVS partnership, such as optical services or mental wellness resources, to deepen engagement with the core family demographic.

- •

Pilot smaller, highly-curated urban store formats focused on convenience, pickup, and a limited assortment of best-selling items to penetrate dense city centers.

Revenue Diversification

- •

Grow the Roundel retail media network by offering more sophisticated advertising products and expanding off-site programmatic capabilities to capture a larger share of partner ad budgets.

- •

Create exclusive subscription boxes curated from owned brands (e.g., a quarterly 'Favorite Day' snack box or 'Threshold' home decor box) to build a new recurring revenue stream.

- •

Monetize supply chain and logistics expertise by offering fulfillment services to select Target+ partners.

Target's business model is a masterclass in modern omnichannel retail, successfully blending a vast physical footprint with a robust and rapidly growing digital presence. The company's 'stores-as-hubs' strategy is a core competitive advantage, enabling efficient and popular fulfillment options like Drive Up, which leverages existing assets to meet consumer demand for convenience at a lower cost. The strategic pillar of a powerful and profitable owned-brand portfolio (e.g., Good & Gather, Threshold, Cat & Jack) is a key differentiator. These brands not only drive higher margins but also create a 'destination' status, drawing customers specifically for products they cannot find elsewhere, which insulates Target from direct price competition.

The evolution of its business model is evident in the strategic focus on growing alternative, high-margin revenue streams. The expansion of the curated Target+ marketplace, the growth of the Roundel advertising network, and the launch of the Target Circle 360 paid subscription service represent a clear strategy to diversify beyond traditional retail sales. This evolution positions Target to capture value across the entire retail ecosystem—from product sale to partner advertising and customer loyalty. However, the model is not without its challenges. Its reliance on discretionary categories makes it susceptible to economic headwinds, and it faces relentless competition from giants like Amazon and Walmart. Future success will depend on its ability to aggressively scale its new revenue streams, deepen personalization through its rich first-party data, and continue innovating the customer experience to defend its position as the preferred destination for its core demographic of American families.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Supply Chain & Logistics Infrastructure

Impact:High

- Barrier:

Brand Recognition & Customer Loyalty

Impact:High

- Barrier:

High Capital Investment (Real Estate & Technology)

Impact:High

- Barrier:

Control of Key Resources & Supplier Relationships

Impact:Medium

Industry Trends

- Trend:

Omnichannel Integration (BOPIS, Drive Up, Same-Day Delivery)

Impact On Business:Critical for meeting customer expectations for convenience and flexibility. Target is a leader in this area, particularly with its Drive Up service.

Timeline:Immediate

- Trend:

Growth of Retail Media Networks (RMNs)

Impact On Business:Creates a high-margin revenue stream by monetizing first-party customer data. Target's RMN, Roundel, is a key growth area.

Timeline:Immediate

- Trend:

Rise of Private Label Brands

Impact On Business:Drives customer loyalty and higher profit margins. Target's portfolio of owned brands is a core strategic advantage.

Timeline:Immediate

- Trend:

Personalization & AI-Driven Customer Experiences

Impact On Business:Enhances customer engagement and increases conversion rates by offering tailored recommendations and promotions.

Timeline:Near-term

- Trend:

Sustainability & Ethical Sourcing

Impact On Business:Increasingly important for brand reputation and attracting environmentally and socially conscious consumers.

Timeline:Near-term

Direct Competitors

- →

Walmart

Market Share Estimate:Largest US retailer by revenue.

Target Audience Overlap:High

Competitive Positioning:Price leadership with the slogan 'Save Money. Live Better.' Focuses on being a one-stop shop for budget-conscious consumers.

Strengths

- •

Unmatched economies of scale, leading to superior pricing power.

- •

Extensive store footprint, particularly in rural and suburban areas.

- •

Dominant grocery business driving frequent foot traffic.

- •

Growing e-commerce and third-party marketplace.

- •

Strong and growing retail media network (Walmart Connect).

Weaknesses

- •

Lower brand perception in terms of style and quality compared to Target.

- •

In-store experience can be inconsistent and less pleasant.

- •

Slower to innovate in certain digital and omnichannel areas compared to Target.

- •

Weaker position with higher-income, urban demographics.

Differentiators

- •

Everyday Low Prices (EDLP) strategy.

- •

Massive supercenter format offering an extensive range of goods and services.

- •

Sam's Club membership warehouse as a parallel business.

- →

Amazon

Market Share Estimate:Dominant in US e-commerce, projected to surpass Walmart in total sales by 2026.

Target Audience Overlap:High

Competitive Positioning:The 'Everything Store' focused on vast selection, convenience, and fast delivery, primarily through its Prime membership.

Strengths

- •

Unparalleled logistics and fulfillment network.

- •

Massive product selection through first-party and third-party sellers.

- •

Prime ecosystem creates a powerful lock-in effect and customer loyalty.

- •

Leader in cloud computing (AWS) which funds retail innovation.

- •

Highly sophisticated data analytics and personalization capabilities.

Weaknesses

- •

Limited physical store presence for most product categories.

- •

Increasing costs of Prime membership and shipping.

- •

Challenges with counterfeit products and quality control on its third-party marketplace.

- •

Less curated and often overwhelming shopping experience.

Differentiators

- •

Prime membership program (free shipping, video, music, etc.).

- •

Digital-native with a focus on technology and automation.

- •

Largest and most mature retail media network.

- →

Costco Wholesale

Market Share Estimate:Leading membership-based warehouse retailer.

Target Audience Overlap:Medium

Competitive Positioning:Offers high-quality, bulk-sized products at low prices to its members, creating a 'treasure hunt' shopping experience.

Strengths

- •

Strong customer loyalty driven by the membership model.

- •

Excellent value proposition and high-quality private label (Kirkland Signature).

- •

Efficient, low-overhead warehouse model.

- •

High sales volume per store.

- •

Appeals to affluent, suburban families.

Weaknesses

- •

Limited product selection (fewer SKUs) compared to Target.

- •

Requires paid membership, which is a barrier for some.

- •

Less developed e-commerce and omnichannel capabilities.

- •

Fewer store locations, often not in dense urban centers.

Differentiators

- •

Membership-only business model.

- •

Bulk product sizes.

- •

Constantly rotating, limited-time product offers (the 'treasure hunt').

Indirect Competitors

- →

The TJX Companies (TJ Maxx, Marshalls, HomeGoods)

Description:Off-price retailer of apparel and home fashions, offering branded goods at a discount.

Threat Level:Medium

Potential For Direct Competition:Low

- →

Kroger

Description:One of the largest grocery-focused retailers in the US, which also offers a growing selection of general merchandise.

Threat Level:Medium

Potential For Direct Competition:Medium

- →

Best Buy

Description:Specialty retailer for consumer electronics.

Threat Level:Medium

Potential For Direct Competition:Low

- →

The Home Depot

Description:Leading home improvement retailer that competes with Target's home goods and seasonal categories.

Threat Level:Low

Potential For Direct Competition:Low

- →

Ulta Beauty

Description:Specialty beauty retailer. Note: This is also a strategic partner via 'Ulta Beauty at Target' shop-in-shops, making the relationship complex.

Threat Level:Low

Potential For Direct Competition:Low

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Strong Brand Equity & 'Masstige' Positioning

Sustainability Assessment:Highly sustainable. The 'Target' brand is associated with style, quality, and value, which is difficult for competitors like Walmart to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Differentiated Private Label Brands

Sustainability Assessment:Highly sustainable. Brands like Good & Gather, Cat & Jack, and Threshold drive over $30 billion in sales, create exclusivity, and offer higher margins.

Competitor Replication Difficulty:Hard

- Advantage:

Best-in-Class Omnichannel Execution

Sustainability Assessment:Sustainable. Target's Drive Up, Order Pickup, and Shipt-powered same-day delivery are seamlessly integrated and highly rated by consumers, creating a key convenience advantage.

Competitor Replication Difficulty:Medium

- Advantage:

Curated 'Shop-in-Shop' Partnerships

Sustainability Assessment:Sustainable. Exclusive partnerships with brands like Ulta Beauty, Disney, and Apple elevate the in-store experience and attract new customer segments.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Exclusive Designer Collaborations', 'estimated_duration': 'Short-term (per collection). These create significant buzz and drive traffic for limited periods.'}

{'advantage': "Viral 'TikTok' Products", 'estimated_duration': 'Short-term. The ability to capitalize on social media trends provides temporary sales boosts for specific items.'}

Disadvantages

- Disadvantage:

Price Perception vs. Walmart

Impact:Major

Addressability:Difficult

- Disadvantage:

Smaller Scale Compared to Walmart and Amazon

Impact:Major

Addressability:Difficult

- Disadvantage:

Limited International Presence

Impact:Minor

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted campaigns emphasizing the value and quality of owned brands, especially in essentials and groceries, to counter the 'more expensive' perception.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Amplify social commerce efforts by creating dedicated landing pages for viral products to streamline the path from discovery to purchase.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Expand the 'shop-in-shop' model to new categories like home improvement or outdoor gear with strategic brand partners.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest further in the personalization engine for the Target Circle loyalty program, offering unique, individualized promotions beyond category-wide discounts.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Grow the Roundel retail media network by offering more sophisticated ad products and self-service tools to attract a wider range of advertisers.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Continue expansion of small-format stores in dense urban areas and near college campuses to capture new customer segments.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore asset-light international expansion through a digital-only or marketplace model, leveraging the strength of owned brands.

Expected Impact:Medium

Implementation Difficulty:Difficult

Reinforce and amplify the 'affordable joy' positioning. Differentiate not on being the absolute cheapest (Walmart) or fastest (Amazon), but on providing the best overall value through a combination of style, quality, price, and a superior shopping experience, both digitally and in-store.

Hyper-focus on exclusivity through owned brands and curated partnerships. Win on the end-to-end customer experience, making Target the most pleasant and convenient place to shop across all channels.

Whitespace Opportunities

- Opportunity:

Enhanced Subscription Services

Competitive Gap:While Amazon has 'Subscribe & Save', Target can offer curated, personalized subscription boxes featuring its owned brands in categories like beauty, snacks, or baby products.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Integration of In-Home Services

Competitive Gap:Competitors like Best Buy (Geek Squad) and Amazon have in-home services. Target could leverage its Shipt network to pilot services like holiday decorating, product assembly, or home organization.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Sustainable Product Marketplace

Competitive Gap:There is no dominant, trusted mass-market retailer for sustainable and ethically sourced goods. Target could curate a dedicated section of its marketplace for third-party sellers who meet stringent sustainability criteria.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Personalized Health & Wellness Programs

Competitive Gap:Leverage the in-store CVS partnership and Good & Gather's healthy food lines to create personalized wellness plans and shopping lists through the Target app, integrating health and grocery shopping.

Feasibility:Medium

Potential Impact:High

Target operates in the mature and highly competitive general merchandise retail industry, which is an oligopoly dominated by itself, Walmart, and Amazon. The barriers to entry are exceptionally high due to massive economies of scale, established supply chains, and strong brand loyalty, making it difficult for new large-scale competitors to emerge.

Target's primary direct competitors are Walmart and Amazon. Walmart competes aggressively on price, leveraging its immense scale to be the low-cost leader. Target differentiates itself by cultivating a brand image of being a more stylish and pleasant place to shop, targeting a demographic that is typically younger, more urban/suburban, and has a slightly higher household income than Walmart's core customer base. Amazon represents the biggest digital threat, competing on convenience, selection, and the power of its Prime ecosystem. While Target cannot match Amazon's e-commerce scale, it effectively leverages its physical stores as fulfillment hubs, creating a best-in-class omnichannel experience with services like 'Drive Up' that Amazon cannot easily replicate.

Target's most sustainable competitive advantages are its strong brand equity and its powerful portfolio of owned brands. These private labels, such as Good & Gather and Cat & Jack, drive significant revenue (over $30 billion annually), command higher margins, and create a unique product assortment that fosters customer loyalty and cannot be found elsewhere. This strategy is a key defense against both Walmart's price pressure and Amazon's endless aisle.

The key strategic challenge for Target is navigating the space between its two larger rivals. It must continually justify its value proposition against Walmart's lower prices and Amazon's convenience. Strategic recommendations should focus on doubling down on its core differentiators: enhancing the curated, stylish product assortment through owned brands and partnerships, and perfecting its pleasant, convenient omnichannel shopping experience. Whitespace opportunities exist in expanding into services and creating deeper, more personalized digital engagement through its Target Circle loyalty program, particularly in high-growth areas like health and wellness and sustainable goods.

Messaging

Message Architecture

Key Messages

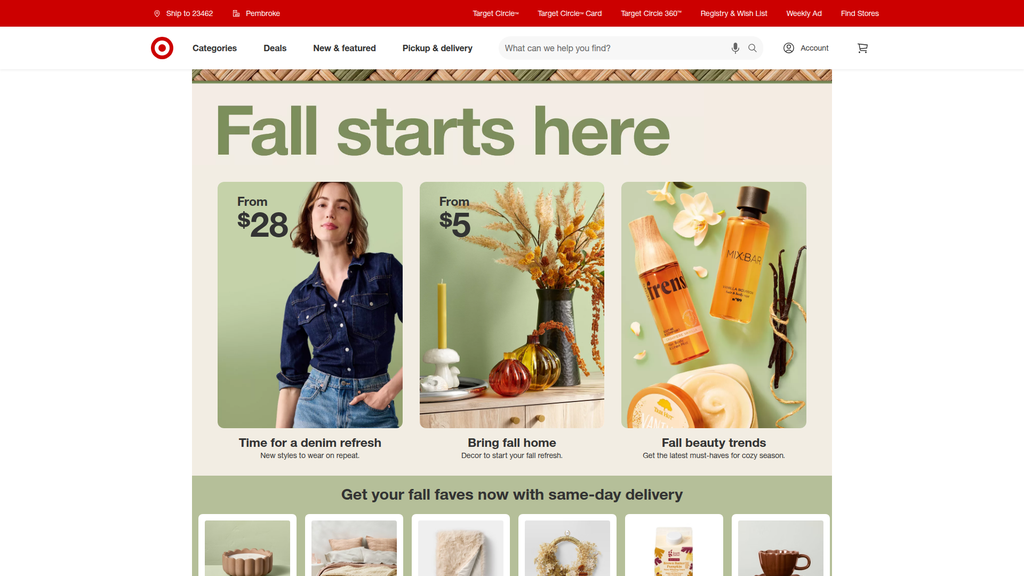

- Message:

Seasonal trends and affordable style updates ('Time for a denim refresh', 'Bring fall home').

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banners

- Message:

Value through deals, sales, and category-specific promotions ('BOGO 20% off', 'Up to 40% off kids’ & toddler clothing').

Prominence:Primary

Clarity Score:High

Location:Homepage 'Can't-miss savings' and Sponsored Sections

- Message:

Convenience with same-day delivery and pickup options ('Get your fall faves now with same-day delivery').

Prominence:Secondary

Clarity Score:High

Location:Homepage Sub-headings and Navigation Bar

- Message:

Inspiration for life's moments and holidays ('Get game-day ready', 'Go all out for Halloween').

Prominence:Secondary

Clarity Score:High

Location:Themed Homepage Sections

The message hierarchy is exceptionally clear and commercially driven. It prioritizes immediate conversion triggers: seasonal relevance and price-based promotions are most prominent. Functional benefits like 'same-day delivery' are used to support these primary purchasing drivers. The overarching brand mission of 'joy' is communicated implicitly through the curated products and lifestyle imagery rather than explicit text.

Messaging is highly consistent across the homepage. The core pillars of Style, Value, and Convenience are seamlessly integrated into every product carousel and promotional block. Whether it's groceries, apparel, or home decor, the language consistently reinforces the idea of getting trendy, desirable items easily and at a good price.

Brand Voice

Voice Attributes

- Attribute:

Upbeat and Positive

Strength:Strong

Examples

- •

Win every weekend

- •

Savor every last summer bite

- •

Can’t-miss savings

- Attribute:

Aspirational yet Accessible

Strength:Strong

Examples

- •

Bring fall home

- •

Fall charm from Threshold™

- •

The 'affordable chic' positioning is evident throughout.

- Attribute:

Helpful and Direct

Strength:Moderate

Examples

- •

Get your fall faves now with same-day delivery

- •

Get game-day ready

- •

Add to cart

- Attribute:

Trendy and Current

Strength:Strong

Examples

- •

Fall beauty trends

- •

Viral recommendations

- •

Campus style from Wild Fable™

Tone Analysis

Promotional

Secondary Tones

- •

Inspirational

- •

Urgent

- •

Seasonal

Tone Shifts

The tone is remarkably consistent. The only subtle shift is on product detail pages (like the ViewSonic monitor), where the tone becomes more functional and feature-focused, which is appropriate for that context.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Target is the preferred one-stop-shop for families to find affordable, on-trend products for their home and life, delivered with an easy and inspiring shopping experience.

Value Proposition Components

- Component:

Curated Style & Quality

Clarity:Clear

Uniqueness:Unique

Evidence:Prominent featuring of exclusive and well-designed in-house brands like 'Hearth & Hand™ with Magnolia' and 'Threshold™ designed with Studio McGee'.

- Component:

Affordability & Value

Clarity:Clear

Uniqueness:Somewhat Unique

Evidence:Constant 'Sale', 'Clearance', and 'BOGO' offers, plus the 'Target Circle™' loyalty program. The brand promise is 'Expect More. Pay Less.'.

- Component:

Shopping Convenience

Clarity:Clear

Uniqueness:Common

Evidence:Emphasis on 'same-day delivery,' 'Pickup & delivery' in the main navigation, and making the app 'The easiest way to shop & save'.

- Component:

Discovery & Inspiration

Clarity:Somewhat Clear

Uniqueness:Unique

Evidence:Sections like 'Viral recommendations' and themed collections ('Win every weekend') encourage browsing and impulse buys, embodying the 'joy of discovery'.

Target effectively differentiates itself by occupying the 'upscale discounter' or 'affordable chic' space. Unlike Walmart's pure low-price focus, Target integrates style and design into its value proposition. Compared to Amazon's endless aisle, Target offers a more curated, less overwhelming selection that feels like a discovery experience. This blend of style, value, and convenience is their key differentiator.

The messaging positions Target as a more enjoyable and trend-forward alternative to mass-market rivals like Walmart, and a more convenient, instantly gratifying alternative to online-only players like Amazon, thanks to its omnichannel fulfillment options. The focus on exclusive brand partnerships (e.g., Magnolia) and stylish private labels creates a product assortment that cannot be directly price-shopped elsewhere, protecting margins and reinforcing its unique market position.

Audience Messaging

Target Personas

- Persona:

The Style-Conscious Family Shopper

Tailored Messages

- •

Bring fall home

- •

Up to 40% off kids’ & toddler clothing

- •

The mission to 'help all families discover the joy of everyday life' directly targets this persona.

Effectiveness:Effective

- Persona:

The Young, Trend-Aware Consumer

Tailored Messages

- •

Time for a denim refresh

- •

Campus style from Wild Fable™

- •

Viral recommendations

Effectiveness:Effective

- Persona:

The Holiday & Seasonal Decorator

Tailored Messages

- •

Go all out for Halloween

- •

Get game-day ready

- •

Fall charm from Threshold™

Effectiveness:Effective

Audience Pain Points Addressed

- •

Feeling that stylish home decor and clothing is unaffordable.

- •

Lacking time for in-store shopping trips.

- •

The hassle of shopping at multiple stores for different needs (groceries, apparel, home).

- •

Feeling overwhelmed by too many choices at other retailers.

Audience Aspirations Addressed

- •

Creating a beautiful and comfortable home.

- •

Feeling fashionable and on-trend without overspending.

- •

Making holidays and special occasions fun and memorable for the family.

- •

Enjoying the process of shopping and discovering new things.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Aspiration

Effectiveness:High

Examples

Beautifully styled imagery of home interiors and apparel.

Bring fall home

- Appeal Type:

Joy & Fun

Effectiveness:Medium

Examples

- •

Win every weekend

- •

Go all out for Halloween

- •

Savor every last summer bite

- Appeal Type:

Sense of Smartness/Savviness

Effectiveness:High

Examples

- •

Can’t-miss savings

- •

BOGO 25% off

- •

Clearance

Social Proof Elements

- Proof Type:

Wisdom of the Crowd

Impact:Strong

Examples

Bestseller tags on products

The 'Viral recommendations' section

- Proof Type:

User Ratings

Impact:Moderate

Examples

Highly rated tags on products

Trust Indicators

- •

Prominent loyalty programs: 'Target Circle™', 'Target Circle™ Card'

- •

Clear fulfillment promises: 'Arrives by Fri, Aug 29'

- •

Established and trusted brand name

- •

Easy navigation to policies like 'Free & easy returns'

Scarcity Urgency Tactics

Time-limited offers: 'Ends 8/30'

Price-based urgency: 'Sale', 'Clearance', 'New lower price'

Calls To Action

Primary Ctas

- Text:

Add to cart

Location:Product listings on homepage and product pages

Clarity:Clear

- Text:

Shop all

Location:Featured categories section

Clarity:Clear

- Text:

Get started

Location:Target Circle 360 promotional banner

Clarity:Clear

The CTAs are highly effective due to their simplicity, consistent design (the red button), and placement. They are overwhelmingly transactional, designed to move users efficiently from discovery to purchase. The language is direct and unambiguous, leaving no doubt about the desired action.

Messaging Gaps Analysis

Critical Gaps

The core brand purpose ('help all families discover the joy of everyday life') is not explicitly stated on the homepage. It is implied through imagery and product selection but lacks a strong, direct narrative anchor.

There is minimal messaging around corporate values such as sustainability, community giving (despite giving 5% of profits), or ethical sourcing on the main commercial pages. This is a missed opportunity to build deeper brand affinity.

Contradiction Points

No itemsUnderdeveloped Areas

Storytelling around the 'owned brands' (e.g., Good & Gather, Universal Thread) is underdeveloped. Messaging could go beyond the product name to tell a story about the quality, design inspiration, or value, further differentiating them from national brands.

Personalization in messaging feels limited. While there are 'Viral recommendations,' the homepage messaging is largely universal and doesn't appear to dynamically adapt to user browsing behavior or purchase history.

Messaging Quality

Strengths

- •

Exceptional clarity in communicating value and promotions.

- •

Strong alignment between visual merchandising and textual messaging.

- •

Masterful use of seasonal and cultural moments to create relevance and urgency.

- •

Consistent and appealing brand voice that reinforces the 'affordable chic' positioning.

Weaknesses

- •

Over-reliance on transactional and promotional messaging can overshadow deeper brand-building narratives.

- •

The 'joy' element of the mission statement feels more like a potential outcome for the customer rather than an integrated part of the website's messaging strategy.

- •

Lack of visible messaging about corporate social responsibility initiatives.

Opportunities

- •

Integrate user-generated content (UGC) more prominently to provide authentic social proof and illustrate the 'joy' of using Target products.

- •

Develop richer content hubs around key lifestyle themes (e.g., decorating, hosting, family activities) that blend storytelling with commerce.

- •

Explicitly message the benefits and quality of owned brands to build them as standalone 'destination' brands within Target.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Hero Messaging

Recommendation:A/B test a primary hero banner that explicitly connects to the 'joy of everyday life' mission, linking it to a seasonal theme. For example: 'Find a little more joy this fall. Starts with a cozy home, from $5.'

Expected Impact:Medium

- Area:

Owned Brand Storytelling

Recommendation:On category pages and in promotional carousels, add a short sub-headline explaining the value of owned brands. E.g., for Good & Gather: 'Quality ingredients, amazing prices. Your new pantry favorite.'

Expected Impact:High

- Area:

Value Proposition Reinforcement

Recommendation:Create a small, persistent messaging bar near the header or footer that rotates through key value props: 'Free & easy returns', 'Save 5% with Circle Card', 'Same-day delivery available'.

Expected Impact:High

Quick Wins

Add a 'Why Target?' or 'Our Promise' module on the homepage that briefly touches on the key pillars: Style, Value, Convenience, and Joy.

Incorporate 'Bestseller' and 'Highly Rated' tags more frequently across all product carousels to increase social proof.

Long Term Recommendations

Invest in a more personalized homepage messaging experience that surfaces categories and themes based on a user's known affinities (e.g., baby, home decor, electronics).

Develop an integrated content strategy that uses the 'Target Finds' blog or a similar platform to tell deeper stories about product design, brand partnerships, and community impact, and then syndicate that content onto relevant shopping pages.

Target's website messaging is a masterclass in effective, commercially-driven retail communication. The strategy is built on a clear and consistent foundation of three core pillars: accessible Style, compelling Value, and seamless Convenience. This is executed flawlessly through a vibrant, upbeat, and aspirational brand voice that perfectly captures their 'affordable chic' market position. The message architecture is exceptionally well-prioritized, placing immediate conversion drivers—seasonal trends and promotions—at the forefront to maximize customer acquisition and sales velocity.

The key strength of Target's messaging lies in its ability to create a sense of discovery and inspiration (the 'joy') within a value-driven framework. Sections like 'Viral recommendations' and curated lifestyle themes such as 'Game Day' transform a simple shopping trip into an experience, encouraging impulse purchases and building brand affinity beyond mere price comparison. This positions Target effectively against Walmart's pure price play and Amazon's utilitarian, search-driven experience.

However, the strategy reveals a significant opportunity gap. The brand's powerful mission—'to help all families discover the joy of everyday life'—and its substantial community contributions are largely absent from the primary commercial messaging. The communication is overwhelmingly transactional. While effective for driving short-term sales, it misses the chance to build a deeper, values-based connection with its audience. By not telling the story of its exclusive owned brands or its corporate citizenship, Target is leaving brand equity on the table.

The recommended roadmap focuses on closing this gap. By weaving the 'joy' narrative more explicitly into homepage messaging, enriching the storytelling around its unique owned brands, and making its core value propositions (like Circle savings) more persistent, Target can enhance its brand differentiation. Long-term investment in personalization and content-commerce integration will be crucial to evolving from a top-tier transactional website into a true lifestyle destination, fully delivering on the promise of its mission and solidifying its competitive moat in the crowded retail landscape.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Consistent high revenue and brand recognition as a top U.S. retailer.

- •

Strong customer loyalty, exemplified by the 'Tar-jay' phenomenon, which positions the brand as 'cheap-chic'.

- •

Successful portfolio of owned brands (e.g., Good & Gather, Threshold) that drive over $30 billion in annual sales and differentiate Target from competitors.

- •

High adoption of its loyalty program, Target Circle, which enrolled over 13 million new members in 2024.

- •

Sustained foot traffic and digital engagement, with 75% of the U.S. population living within 10 miles of a Target store, underpinning its omnichannel success.

Improvement Areas

- •

Continued differentiation against Amazon's convenience and Walmart's price leadership.

- •

Enhancing the in-store experience to avoid cannibalization by its own successful e-commerce and pickup services, which can lead to messy aisles and employee burnout.

- •

Further personalizing offers and experiences for Target Circle members to deepen loyalty beyond transactional benefits.

Market Dynamics

2.7% to 3.7% in 2025 for overall US retail sales, with e-commerce growing faster at 7% to 9%.

Mature

Market Trends

- Trend:

Omnichannel Integration

Business Impact:Essential for survival. Target's 'stores-as-hubs' model is a key competitive advantage, fulfilling the vast majority of online orders from stores, which cuts fulfillment costs.

- Trend:

Growth of Private Labels

Business Impact:A major differentiator and profit driver. Target's owned brands boost margins and create a unique product assortment that fosters customer loyalty.

- Trend:

Retail Media Networks (RMNs)

Business Impact:High-margin revenue growth opportunity. Target's RMN, Roundel, is a significant growth engine, expected to double in size by 2030.

- Trend:

Third-Party Marketplaces

Business Impact:Asset-light model for assortment expansion. Target+ is a curated, invite-only marketplace, focusing on quality to complement its core offerings, with ambitious growth targets.

- Trend:

Economic Caution and Value Seeking

Business Impact:Consumers are balancing affordability with small splurges. Target's 'Expect More. Pay Less.' value proposition is well-positioned, but faces intense price competition from Walmart and Aldi.

Favorable, but highly competitive. Target's strategic investments in omnichannel, owned brands, and new revenue streams position it well to capture growth despite the mature and challenging retail landscape.

Business Model Scalability

High

Proven and highly scalable 'stores-as-hubs' strategy, which leverages existing physical assets to efficiently fulfill digital orders.

High. Continuous investment in sortation centers ($100M through 2026), AI for inventory management, and last-mile delivery capabilities are enhancing speed and reducing costs.

Scalability Constraints

- •

Dependence on physical store footprint for fulfillment, which requires significant capital expenditure for remodels and new builds.

- •

Managing the complexity of last-mile delivery logistics and costs at scale.

- •

Maintaining a curated experience on the Target+ marketplace while pursuing aggressive growth targets could create tension.

Team Readiness

Strong and experienced leadership team with a clear, long-term growth strategy focused on omnichannel, owned brands, and new ventures.

Well-suited for growth, with dedicated focus on key growth pillars like digital, supply chain, and brand management. Investments in technology and AI are integrated into core operations.

Key Capability Gaps

- •

International expansion expertise; currently, operations are confined to the U.S.

- •

Scaling the curated Target+ marketplace without losing its brand identity will require new skills in vendor management and platform governance.

- •

Deepening data science and AI capabilities to further personalize the customer journey across all touchpoints.

Growth Engine

Acquisition Channels

- Channel:

Physical Stores & Weekly Ads

Effectiveness:High

Optimization Potential:Medium

Recommendation:Continue store remodels and opening of small-format urban stores. Digitize the weekly ad experience within the Target App for better personalization.

- Channel:

Target.com & App (Organic & Paid Search)

Effectiveness:High

Optimization Potential:High

Recommendation:Optimize SEO for owned-brand keywords and 'buy online, pick up in store' terms. Use AI to further personalize search results and product recommendations in-app.

- Channel:

Social Commerce (TikTok, Instagram)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand shoppable content featuring exclusive brand collaborations and owned brands. Leverage user-generated content to build social proof and drive traffic.

- Channel:

Email & Push Notifications

Effectiveness:High

Optimization Potential:High

Recommendation:Implement more advanced segmentation based on Target Circle data to deliver hyper-personalized offers and content, moving beyond broad promotions.

Customer Journey

Highly effective omnichannel path. Customers seamlessly move between app, website, and physical stores for discovery, purchase (pickup, drive-up, delivery), and returns.

Friction Points

- •

Out-of-stock items for in-store pickup, causing frustration.

- •

In-store experience degradation (e.g., messy aisles, long lines) due to stores also functioning as high-volume fulfillment centers.

- •

Different fulfillment options for first-party vs. third-party (Target+) items can create confusion and disjointed experiences.

Journey Enhancement Priorities

- Area:

Drive Up Service

Recommendation:Continue to enhance the Drive Up experience by adding features like returns and the ability to add a Starbucks order, further differentiating from competitors.

- Area:

Target+ Integration

Recommendation:Explore options for Target to handle fulfillment for some Target+ sellers to offer a more consistent and faster delivery promise, akin to Amazon's FBA.

- Area:

Personalization

Recommendation:Use Target Circle data to create a more curated homepage and app experience, surfacing relevant products and deals proactively.

Retention Mechanisms

- Mechanism:

Target Circle (Loyalty Program)

Effectiveness:High

Improvement Opportunity:Increase adoption of the paid 'Target Circle 360' tier by adding more exclusive benefits and partnerships to compete directly with Amazon Prime and Walmart+.

- Mechanism:

Target Circle Card (formerly RedCard)

Effectiveness:High

Improvement Opportunity:Continue to promote the 5% daily discount as a clear and compelling value proposition. Integrate card offers more seamlessly into the app.

- Mechanism:

Owned Brands & Exclusive Partnerships

Effectiveness:High

Improvement Opportunity:Accelerate the launch of new owned brands and high-profile designer collaborations to create recurring 'treasure hunt' shopping occasions.

Revenue Economics

Strong. The combination of high-margin owned brands, an efficient 'stores-as-hubs' fulfillment model, and growing revenue from the high-margin retail media network (Roundel) creates a robust economic model.

Focus on Same-Store Sales Growth, Average Transaction Value, and Growth in Digital Sales. Recent performance has shown modest overall growth, but strength in key digital and same-day services.

High

Optimization Recommendations

- •

Aggressively scale the Roundel retail media network, as it provides a very high-margin revenue stream.

- •

Increase the penetration of owned brands in shoppers' baskets to improve overall margin mix.

- •

Drive adoption of Target Circle 360 to increase purchase frequency and lock in customer loyalty.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Systems Integration

Impact:Medium

Solution Approach:Continued investment in modernizing core systems, particularly for inventory management, using AI-powered solutions to improve real-time accuracy across the network.

Operational Bottlenecks

- Bottleneck:

Last-Mile Delivery Costs & Complexity

Growth Impact:Limits profitability of e-commerce growth.

Resolution Strategy:Expand the network of sortation centers to batch deliveries more efficiently and reduce reliance on more expensive third-party carriers.

- Bottleneck:

In-Store Fulfillment Strain

Growth Impact:Degrades in-store customer experience and can lead to employee burnout.

Resolution Strategy:Invest in store remodels that create dedicated space and workflows for order fulfillment, separating those activities from the main shopping floor.

Market Penetration Challenges

- Challenge:

Intense Price Competition

Severity:Critical

Mitigation Strategy:Double down on the 'cheap-chic' value proposition through stylish owned brands and exclusive partnerships, which are less susceptible to direct price comparisons with Walmart and Amazon.

- Challenge:

E-commerce Dominance of Amazon

Severity:Major

Mitigation Strategy:Focus on the omnichannel advantage that Amazon cannot replicate: convenient same-day pickup, drive-up, and easy in-store returns.

- Challenge:

U.S. Market Saturation

Severity:Major

Mitigation Strategy:Focus growth on small-format stores in dense urban areas and college towns, and drive more revenue per existing customer through loyalty and expanded services.

Resource Limitations

Talent Gaps

- •

Data scientists and AI/ML engineers to scale personalization and supply chain optimization.

- •

International logistics and market entry specialists, should global expansion become a priority.

- •

Platform and marketplace management talent to scale Target+ effectively.

Significant and ongoing. Target plans annual capital expenditures of $4-5 billion for store remodels, new stores, and investments in supply chain and technology.

Infrastructure Needs

Continued expansion of the sortation center network to support next-day delivery.

Technology infrastructure to support the growth of the Roundel media network and Target+ marketplace.

Growth Opportunities

Market Expansion

- Expansion Vector:

Small-Format Store Rollout

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Continue strategically opening smaller footprint stores in urban centers and near college campuses to reach new demographic segments and serve as hyper-local fulfillment hubs.

- Expansion Vector:

International Expansion (Long-Term)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Begin with a digital-first strategy, potentially leveraging the Target+ marketplace to test product demand in markets like Canada or Mexico before committing to physical stores.

Product Opportunities

- Opportunity:

Scale Target+ Marketplace

Market Demand Evidence:Target aims to grow GMV from ~$1B to over $5B by 2030, indicating strong internal targets and initial traction.

Strategic Fit:High

Development Recommendation:Maintain the curated, invite-only approach to protect brand integrity while scaling through partnerships (e.g., Shopify) to accelerate seller onboarding.

- Opportunity:

Expand Owned Brands into New Categories

Market Demand Evidence:The existing ~$30B owned brand portfolio demonstrates a strong customer appetite for Target's private labels.

Strategic Fit:High

Development Recommendation:Launch new owned brands or extend existing ones into wellness, premium food, and sustainable home goods categories.

- Opportunity:

Grow In-Store Services (e.g., Ulta Beauty, Disney, Apple)

Market Demand Evidence:The success of existing 'store-in-a-store' concepts drives significant foot traffic and adds a differentiated experience.

Strategic Fit:High

Development Recommendation:Actively pursue new, complementary service partners in areas like health clinics, financial services, or optical centers.

Channel Diversification

- Channel:

Retail Media Network (Roundel)

Fit Assessment:Excellent

Implementation Strategy:Continue investing heavily in Roundel's capabilities, particularly in AI-driven offsite campaign optimization and new in-store digital advertising formats to capture more ad spend.

- Channel:

Live Shopping / Social Commerce

Fit Assessment:Good

Implementation Strategy:Pilot live shopping events hosted by influencers featuring exclusive product drops from owned brands or designer collaborations to create urgency and drive impulse buys.

Strategic Partnerships

- Partnership Type:

Store-in-a-Store

Potential Partners

- •

Warby Parker (announced)

- •

Marriott Bonvoy (announced for Circle 360)

- •

Additional health and wellness providers

Expected Benefits:Drives incremental foot traffic, enhances the one-stop-shop value proposition, and generates rental income.

- Partnership Type:

Marketplace Enablement

Potential Partners

Shopify (existing)

Expected Benefits:Accelerates onboarding of high-quality, digitally native brands to the Target+ marketplace, increasing assortment with lower operational lift.

Growth Strategy

North Star Metric

Omnichannel Customer Lifetime Value (ocLTV)

This metric captures the total value of a customer across all touchpoints (in-store, digital, services). It aligns the entire organization around increasing both purchase frequency and basket size, driven by loyalty (Target Circle) and convenience (omnichannel fulfillment), which are Target's core strategic pillars.

Increase ocLTV by 15% over the next 24 months.

Growth Model

Omnichannel-Led Retention & Expansion

Key Drivers

- •

Loyalty Program Engagement (Target Circle)

- •

Omnichannel Convenience (Drive Up, Same-Day Delivery)

- •

Product Differentiation (Owned Brands & Partnerships)

- •

High-Margin Revenue Streams (Roundel, Target+)

Focus on a flywheel where a superior, convenient shopping experience (Drive Up) drives traffic and loyalty enrollment (Circle), which provides data for personalization and product development (Owned Brands), creating a virtuous cycle that locks in customers.

Prioritized Initiatives

- Initiative:

Scale Target Circle 360 Membership

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-12 Months

First Steps:Launch a targeted marketing campaign to existing high-value Circle members highlighting the value of free same-day delivery. Secure and announce one new major partnership benefit (e.g., streaming service, travel perks).

- Initiative:

Accelerate Roundel AI & Offsite Capabilities

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 Months

First Steps:Acquire or partner with an ad-tech firm to fast-track the development of AI-powered optimization tools. Pilot new in-store digital ad formats in 50 top stores.

- Initiative:

Expand 'Store-in-a-Store' Partnerships

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:Ongoing

First Steps:Create a dedicated business development team to identify and negotiate with potential partners in the health, wellness, and lifestyle service categories.

Experimentation Plan

High Leverage Tests

- Test:

Dynamic Pricing for Same-Day Delivery

Hypothesis:Offering variable, time-sensitive pricing for delivery slots can smooth demand and increase fulfillment efficiency.

- Test:

AI-Powered Personalization in Weekly Ad

Hypothesis:Customizing the digital weekly ad for each Target Circle user based on past purchases will increase click-through rates and basket size.

- Test:

New Drive Up Service Add-ons

Hypothesis:Allowing customers to add a limited selection of impulse items (e.g., drinks, snacks) to their Drive Up order upon arrival will increase average transaction value.

Utilize A/B testing platforms to measure impact on key metrics like conversion rate, average order value, and customer satisfaction (NPS). Track cohorts of users exposed to tests to measure long-term impact on LTV.

Run weekly sprints for digital experiments (app, website) and quarterly pilots for in-store or operational experiments.

Growth Team

A centralized Omnichannel Growth team reporting to the Chief Growth Officer, with cross-functional pods dedicated to key growth levers.

Key Roles

- •

Head of Omnichannel Growth

- •

Loyalty & Retention Lead (Target Circle)

- •

Product Manager, Same-Day Services

- •

Director of Marketplace Growth (Target+)

- •

Head of Retail Media Innovation (Roundel)

Invest in internal training and external hiring for data science, AI/ML, and platform management. Foster a culture of rapid experimentation and data-driven decision-making.

Target is in a powerful position for sustained growth, built upon a strong foundation of product-market fit and a highly scalable, integrated omnichannel business model. The company's 'stores-as-hubs' strategy is a masterclass in leveraging physical assets to create a digital advantage, driving both customer convenience and operational efficiency. The primary growth engines—the Target Circle loyalty program, a formidable portfolio of owned brands, and the burgeoning Roundel retail media network—are not only effective but also create a defensible moat against competitors.

However, growth is not without its challenges. The primary scale barriers are operational and competitive. The immense pressure on stores to serve as both retail spaces and fulfillment centers risks degrading the in-store experience, a core part of Target's brand appeal. Furthermore, intense price pressure from Walmart and the sheer scale of Amazon's e-commerce machine represent persistent threats that require constant innovation to counter.

The most significant growth opportunities lie in scaling asset-light, high-margin businesses. The strategic push to grow the Target+ marketplace to $5 billion and double the size of the Roundel media business are the right priorities. These initiatives diversify revenue streams and are less capital-intensive than building new stores. Expanding 'store-in-a-store' partnerships with brands like Ulta and Apple remains a proven strategy to drive traffic and differentiate the in-store experience.

To unlock the next phase of growth, the recommended strategy is to double down on the omnichannel flywheel. The North Star Metric should be 'Omnichannel Customer Lifetime Value (ocLTV),' focusing the entire organization on deepening relationships with existing customers. Key initiatives must center on scaling the paid Target Circle 360 membership to lock in high-value shoppers, aggressively expanding the high-margin Roundel ad business, and continuing to innovate the same-day services that are a clear differentiator from pure-play e-commerce rivals. By focusing on loyalty, convenience, and a curated assortment, Target is well-positioned to not just compete, but to lead in the modern retail landscape.

Legal Compliance

Target demonstrates a mature and robust approach to privacy by providing multiple, easily accessible privacy policies in the website footer. This includes a main 'Privacy Policy', a specific 'CA Privacy Rights' policy, a dedicated 'Health Privacy Policy', and a policy for 'Interest Based Ads'. This layered approach allows for clear and specific information tailored to different regulatory requirements and business functions. The main policy covers data collection, use, and sharing practices. The presence of a separate Health Privacy Policy is a critical compliance measure, likely designed to address the stringent requirements of the Health Insurance Portability and Accountability Act (HIPAA) related to its pharmacy and clinic services. The segregation of policies enhances clarity and demonstrates a sophisticated understanding of its complex legal obligations.

The 'Terms' link is prominently placed in the website footer, ensuring accessibility for users. This document outlines the legal agreement between Target and its users, covering aspects like website use, intellectual property, and limitations of liability. For an e-commerce platform of this scale, having clear and enforceable terms is fundamental to managing legal risk, defining user obligations, and handling disputes. The ready availability of these terms is a standard but essential component of a strong legal compliance posture.

Target's approach to cookie compliance appears heavily focused on US regulations, particularly the CCPA/CPRA. The 'Your Privacy Choices' link in the footer serves as the primary mechanism for users to opt out of the sale or sharing of their personal information, a key requirement of California law. However, the website does not appear to feature an upfront, affirmative consent banner before placing non-essential cookies. This methodology is a significant compliance gap under the GDPR, which requires explicit, opt-in consent from users in the European Union before tracking cookies are deployed. While compliant for its primary US market, this could pose a legal risk if the site receives significant traffic from the EU.

Target's data protection strategy is clearly aligned with the complex patchwork of US state privacy laws. The explicit 'CA Privacy Rights' link and the 'Your Privacy Choices' portal are direct evidence of a well-defined process for handling consumer rights requests under the CCPA/CPRA, such as the right to know, delete, and opt-out of data sales. The privacy policy also mentions state-specific rights, acknowledging the growing number of states with their own privacy legislation. However, the company faces ongoing legal challenges, including class-action lawsuits related to the alleged collection of biometric data in stores without consent under Illinois's BIPA, indicating that data governance is a continuous and high-stakes effort. While website disclosures are strong, compliance with data collection practices across all company operations remains a critical risk area.

The website demonstrates a solid commitment to digital accessibility, a crucial aspect of ADA compliance for e-commerce sites. Key features like 'skip to main content' and 'skip to footer' links are implemented, which are vital for users relying on screen readers. The use of semantic HTML (headings like <h2>) for structuring content is also evident from the scraped data. These features suggest a proactive approach to conforming with Web Content Accessibility Guidelines (WCAG), which is the standard for ensuring websites are usable by people with disabilities. This not only reduces the risk of ADA-related litigation, a common issue for retailers, but also expands market access to all potential customers.

Target's legal positioning is strengthened by its attention to numerous industry-specific regulations. The 'CA Supply Chain' link directly addresses the California Transparency in Supply Chains Act, which requires large retailers to disclose their efforts to eradicate slavery and human trafficking. The 'Health Privacy Policy' is essential for HIPAA compliance concerning its pharmacy operations, governing the use and protection of sensitive patient health information. Furthermore, the website employs clear disclaimers for promotions and pricing, adhering to FTC guidelines that prohibit deceptive advertising practices. The clear identification of third-party sellers (e.g., 'Sold & shipped by ViewSonic Corporation') is another important consumer disclosure that manages liability and aligns with FTC expectations for online marketplaces.

Compliance Gaps

- •

Lack of an explicit, opt-in cookie consent banner, which presents a GDPR compliance gap for users accessing the site from the European Union.

- •

Potential for inadequate disclosure regarding in-store data collection technologies (e.g., video surveillance with facial recognition), as suggested by recent BIPA litigation.

- •

Privacy policy scope and updates could be more prominently displayed at the top of the page for enhanced transparency, as recommended by privacy experts.

Compliance Strengths

- •

Comprehensive and easily accessible legal documents in the website footer, including Terms and multiple specialized Privacy Policies.