eScore

thehartford.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

The Hartford exhibits a masterful digital presence within its core niche, demonstrating exceptional search intent alignment for 'AARP' and senior-focused insurance queries. Its content authority is deeply entrenched, built on a 200+ year history and the powerful AARP endorsement. The company shows sophisticated geographic targeting with state-specific pages, though its absence in major markets like California is a notable limitation. While strong in traditional search, a clearer focus on voice search optimization for its less tech-savvy demographic represents an area for growth.

Exceptional content authority and search intent alignment within the 50+ demographic, creating a deep competitive moat around its AARP partnership.

Develop a specific voice search optimization strategy targeting common, conversational queries from seniors (e.g., 'What is the best car insurance for retired people?') to capture this growing search vertical.

Brand communication for the AARP segment is world-class, with messaging perfectly tailored to the audience's needs for trust, security, and value. However, the website's communication effectiveness plummets for its other major customer segment, small businesses, who are largely ignored in top-of-funnel messaging. While the brand voice is consistent and differentiation via the AARP partnership is clear, this messaging gap for a key revenue-driving audience is a significant flaw preventing a higher score.

Laser-focused and highly effective messaging for the AARP member persona, leveraging trust, exclusivity, and financial security to create a powerful value proposition.

Implement a clear, dual-path messaging strategy on the homepage that immediately segments users into 'Personal Insurance' and 'Business Insurance' funnels, each with its own tailored value proposition and calls-to-action.

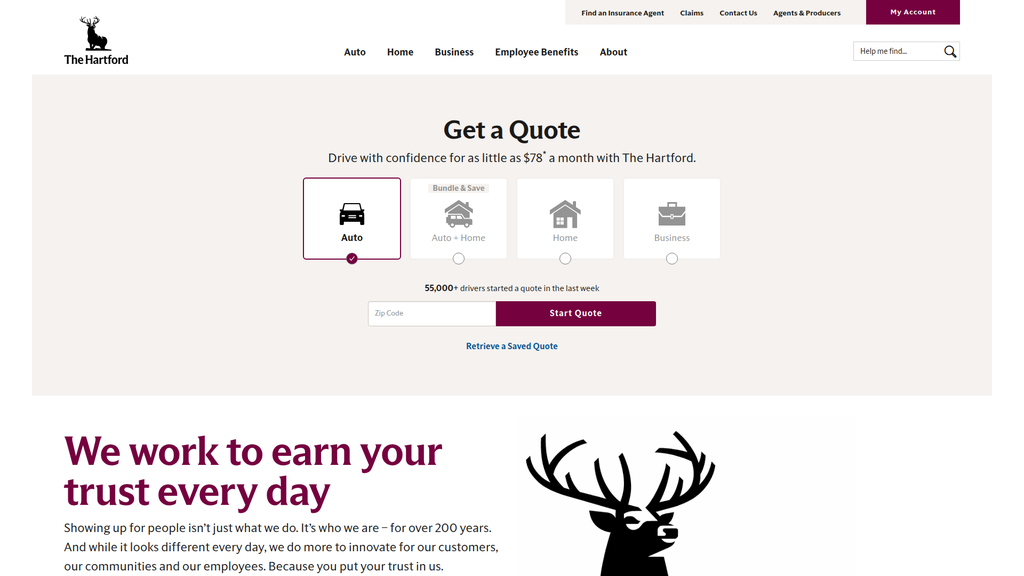

The primary conversion path for 'Get a Quote' is prominent and clear, effectively reducing friction for the main user journey. The site's clean layout and logical architecture contribute to a low cognitive load. However, the analysis reveals inconsistent CTA styling across different pages and low-prominence cross-selling modules, which create minor friction and missed opportunities. While the company has a strong accessibility statement, refining the cross-device journey and standardizing conversion elements would elevate the experience.

A clear, prominent, and low-friction primary user journey on the homepage that immediately funnels target users towards the main conversion goal of starting a quote.

Standardize all CTA components into a consistent design system for primary (solid), secondary (outline), and tertiary (text link) actions to improve user predictability and cognitive fluency across all journeys.

Credibility is The Hartford's greatest asset. Trust signals are expertly layered, from the top-tier AARP endorsement and 200+ year history to prominently displayed customer satisfaction scores and testimonials. The company demonstrates a high degree of transparency through detailed state-specific disclaimers and a best-in-class 'Your Privacy Choices' portal. This comprehensive approach to building trust and mitigating perceived risk is critical in the insurance industry and is executed flawlessly.

The exclusive, long-term AARP endorsement serves as the ultimate third-party validation, providing an unparalleled trust signal that resonates perfectly with their core target demographic.

Enhance brand storytelling by transforming the '200+ years of history' claim into tangible, emotionally resonant proof points (e.g., a visual timeline showcasing insuring Abraham Lincoln's home or bonding the Golden Gate Bridge).

The Hartford's competitive advantage is formidable and highly sustainable, anchored by its exclusive AARP partnership which is secured until at least 2033. This creates an exceptionally deep and defensible moat in the valuable 50+ demographic that is nearly impossible for competitors to replicate. While the company is perceived as a laggard in digital innovation compared to insurtechs, its advantages in brand trust, niche market expertise, and distribution power are profound and long-lasting.

The exclusive AARP endorsement is a highly sustainable, hard-to-replicate competitive advantage that provides direct, trusted access to nearly 38 million members.

Accelerate investment in a 'digital wrapper' around core legacy systems to improve speed-to-market for new products and enhance the digital user experience to better compete with agile insurtech challengers.

The Hartford demonstrates healthy unit economics with strong profitability and premium growth, indicating a scalable core business. However, significant constraints exist, including legacy IT systems that hinder agility, a high dependency on the U.S. market, and brand perception being tightly coupled with an older demographic. While the business model is proven, future expansion relies heavily on modernizing technology and finding ways to replicate its successful affinity partnership model to attract new segments.

A proven and highly successful affinity partnership model (AARP) that provides a repeatable playbook for entering new, large-scale market segments if similar high-quality partners can be secured.

Launch a separate, digital-first sub-brand with a distinct value proposition to target younger demographics without diluting The Hartford's core brand identity.

The Hartford's business model is exceptionally coherent and well-aligned with its target markets. Revenue streams are diversified across personal lines, commercial lines, and group benefits, providing stability. The company demonstrates strong strategic focus by concentrating its personal lines strategy entirely on the AARP niche, avoiding direct price wars with mass-market competitors. This disciplined approach aligns resources with its most significant competitive advantage, leading to strong financial performance.

Excellent strategic focus, leveraging the AARP partnership to dominate a profitable niche, which aligns the entire personal lines business model—from marketing to product—for maximum effectiveness.

Address the strategic incoherence on the website's homepage, where the design and messaging do not align with the business model's heavy reliance on the Small Business segment for revenue.

Within its chosen niche of the 50+ demographic, The Hartford wields immense market power, acting as the industry standard-setter. This allows for significant pricing power based on value and trust rather than cost. The leverage gained from the exclusive AARP partnership is a dominant force. While its overall market share in the broader P&C industry is modest, its trajectory and influence within the small business and AARP segments are exceptionally strong.

Dominant pricing power and market influence within the AARP segment, allowing the company to avoid commoditized, price-driven competition and focus on value-added services and benefits.

Mitigate customer dependency risk by actively seeking and developing new, large-scale affinity partnerships to diversify the personal lines customer base beyond the AARP segment.

Business Overview

Business Classification

Direct-to-Consumer (D2C) & Business-to-Business (B2B) Insurance Provider

Financial Services & Asset Management

Insurance

Sub Verticals

- •

Property & Casualty (P&C) Insurance

- •

Group Benefits

- •

Mutual Funds

- •

Personal Lines (Auto, Home)

- •

Commercial Lines (Small to Mid-Sized Business)

Mature

Maturity Indicators

- •

Over 200 years in operation.

- •

Established brand recognition and strong financial ratings (A.M. Best 'A+', S&P 'AA-').

- •

Long-term strategic partnerships, notably a 40+ year exclusive endorsement from AARP.

- •

Diversified portfolio across personal, commercial, and benefits sectors.

- •

Consistent payment of dividends and strong core earnings ROE.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Insurance Premiums (Commercial Lines)

Description:Revenue generated from underwriting a wide range of commercial insurance policies, including workers' compensation, general liability, commercial auto, and business property. This is the largest revenue segment.

Estimated Importance:Primary

Customer Segment:Small to Mid-Sized Businesses

Estimated Margin:Medium

- Stream Name:

Insurance Premiums (Personal Lines)

Description:Revenue from underwriting personal auto and homeowners insurance policies. A significant portion of this stream is driven by the exclusive partnership with AARP targeting members aged 50+.

Estimated Importance:Secondary

Customer Segment:AARP Members (50+ demographic)

Estimated Margin:Medium-Low

- Stream Name:

Group Benefits Premiums

Description:Revenue from providing group life, disability, and accident insurance to employers for their employees. This segment provides significant revenue diversification.

Estimated Importance:Secondary

Customer Segment:Employers/Businesses

Estimated Margin:Medium

- Stream Name:

Investment Income

Description:Income generated from investing collected premiums (the 'float') into a diverse portfolio of assets before claims are paid out. This is a critical revenue and profit driver for all insurance operations.

Estimated Importance:Primary

Customer Segment:Internal Operations

Estimated Margin:High

- Stream Name:

Fees from Mutual Funds & Asset Management

Description:Fee-based revenue generated from managing mutual funds and other investment products for clients.

Estimated Importance:Tertiary

Customer Segment:Individual & Institutional Investors

Estimated Margin:High

Recurring Revenue Components

Policy Renewals (Annual/Semi-Annual)

Ongoing Asset Management Fees

Pricing Strategy

Dynamic Value-Based Pricing

Mid-range

Opaque

Pricing Psychology

- •

Bundling (e.g., auto and home for significant savings)

- •

Discount Framing (e.g., 'Save up to 10% just for being a member')

- •

Affinity Pricing (special rates for AARP members)

- •

Behavioral Discounts (e.g., 'TrueLane' safe driving program)

Monetization Assessment

Strengths

- •

Diversified revenue across P&C, Group Benefits, and Mutual Funds mitigates risk.

- •

The AARP partnership provides a large, stable, and loyal customer base for personal lines.

- •

Strong brand reputation allows for value-based pricing rather than competing solely on cost.

- •

Effective cross-selling and bundling strategies increase customer lifetime value.

Weaknesses

- •

Personal lines pricing appears higher than competitors like GEICO for non-AARP segments or younger drivers.

- •

Complex, opaque pricing model can be a barrier compared to simpler digital-first competitors.

- •

Revenue growth is steady but susceptible to macroeconomic pressures like inflation and interest rate changes.

Opportunities

- •

Leverage telematics and IoT data for more sophisticated, usage-based insurance (UBI) pricing models.

- •

Develop new affinity partnerships to replicate the success of the AARP model with other large organizations.

- •

Enhance digital self-service tools to offer more transparent, customizable policy options and reduce operational costs.

Threats

- •

Intense price competition from digital-native insurers (insurtechs) and large direct writers (e.g., GEICO, Progressive).

- •

Rising claims costs due to inflation, supply chain issues, and increased frequency/severity of catastrophic weather events.

- •

Regulatory changes impacting pricing models, capital requirements, and data privacy.

Market Positioning

Niche Dominance & Trust-Based Relationship

Top-tier player in specific niches (e.g., #2 in workers' compensation) but a smaller player in the overall P&C market (~2% share).

Target Segments

- Segment Name:

AARP Members (50+ Demographic)

Description:Individuals aged 50 and older who are members of AARP. This is the core target for the personal auto and home insurance lines, representing a significant and loyal customer base.

Demographic Factors

- •

Age: 50+

- •

Life Stage: Pre-retirement, retirement

- •

Often homeowners with established financial assets

Psychographic Factors

- •

Value stability, trust, and customer service over lowest price.

- •

Seek out member benefits and discounts.

- •

Less likely to switch providers frequently if satisfied.

Behavioral Factors

- •

Responsive to direct mail and trusted endorsements.

- •

Increasingly digitally savvy but appreciate phone support.

- •

High likelihood of bundling multiple policies (auto, home).

Pain Points

- •

Feeling that insurance companies don't understand their unique needs as they age.

- •

Concerned about rising insurance costs on a fixed income.

- •

Desire for a simple, hassle-free claims process.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Small & Mid-Sized Businesses (SMBs)

Description:A broad range of small to mid-sized companies requiring commercial insurance, including workers' compensation, general liability, and commercial property. The Hartford is a leading provider in this space.

Demographic Factors

Company Size: Typically 1-100 employees

Industry: Diverse, with a focus on professional services, retail, restaurants, and contractors.

Psychographic Factors

- •

Value reliability and financial stability of the insurer.

- •

Seek comprehensive coverage to protect their livelihood.

- •

Often rely on agents or brokers for advice.

Behavioral Factors

- •

Often purchase bundled policies like a Business Owner's Policy (BOP).

- •

Purchase decisions are driven by a combination of price, coverage, and service.

- •

Long-term relationships with their insurance provider are common.

Pain Points

- •

Complexity of understanding different commercial coverages.

- •

Finding affordable, tailored insurance that grows with their business.

- •

Needing a quick and efficient claims process to minimize business disruption.

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Exclusive AARP Endorsement

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Heritage and Trust (200+ years)

Strength:Strong

Sustainability:Sustainable

- Factor:

Specialized Expertise in the 50+ Market

Strength:Strong

Sustainability:Sustainable

- Factor:

Leading Position in Small Business Insurance

Strength:Strong

Sustainability:Sustainable

- Factor:

High-Quality Claims Service

Strength:Moderate

Sustainability:Temporary

Value Proposition

For mature individuals and small business owners, The Hartford provides trusted, reliable insurance solutions and expert service, backed by over 200 years of experience and an exclusive endorsement from AARP, ensuring you can protect what matters most and prevail through unexpected challenges.

Excellent

Key Benefits

- Benefit:

Exclusive Savings & Benefits for AARP Members

Importance:Critical

Differentiation:Unique

Proof Elements

The only auto and home insurance program endorsed by AARP.

Specific discount percentages mentioned (e.g., up to 10% for membership).

- Benefit:

Reliable and Highly-Rated Claims Service

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

High customer satisfaction ratings for claims (e.g., 4.7/5 for Auto Claims).

Numerous positive customer testimonials on the website.

- Benefit:

Comprehensive Coverage for Small Businesses

Importance:Critical

Differentiation:Common

Proof Elements

Insures over 1.3 million small businesses.

Offers bundled Business Owner's Policies (BOPs).

- Benefit:

Financial Stability and Longevity

Importance:Important

Differentiation:Somewhat unique

Proof Elements

In business for over 214 years.

Strong ratings from A.M. Best and S&P.

Unique Selling Points

- Usp:

The sole AARP-endorsed provider for auto and home insurance, offering unparalleled access and tailored benefits to the 50+ demographic.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Deep specialization and leadership in the small commercial insurance market, particularly in workers' compensation.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Financial loss and disruption from unexpected events (accidents, property damage, lawsuits).

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Feeling that insurance providers are impersonal and don't cater to the specific needs of older adults.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Navigating the complexity of business insurance to ensure adequate protection without overpaying.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition is exceptionally well-aligned with the mature personal lines market and the SMB commercial market, two large and stable segments.

High

The emphasis on trust, reliability, and specialized benefits (especially for AARP members) resonates strongly with the risk-averse nature of its target audiences.

Strategic Assessment

Business Model Canvas

Key Partners

- •

AARP (Exclusive endorsement and marketing channel).

- •

Independent insurance agents and brokers (for commercial lines).

- •

Technology Partners (e.g., Duck Creek for SaaS platform, Tractable for AI claims assessment).

- •

Startupbootcamp (Hartford InsurTech Hub).

Key Activities

- •

Underwriting & Risk Assessment

- •

Claims Processing & Management

- •

Marketing & Distribution (Direct-to-consumer and via agents)

- •

Investment Management

- •

Customer Service & Relationship Management

Key Resources

- •

Exclusive AARP Partnership Agreement

- •

Strong Brand Reputation & Heritage

- •

Significant Financial Capital & Reserves

- •

Vast Customer & Actuarial Data

- •

Distribution Network (Agents & Direct Channels)

Cost Structure

- •

Claims Payouts (Loss & Loss Adjustment Expenses)

- •

Sales & Marketing Expenses (including royalty fees to AARP)

- •

Employee Salaries & Benefits

- •

Technology & IT Infrastructure (including cloud migration and AI investments).

- •

Regulatory & Compliance Costs

Swot Analysis

Strengths

- •

Dominant, defensible niche in the 50+ personal lines market via the exclusive AARP partnership.

- •

Strong, diversified portfolio across personal, commercial, and group benefits, providing stable earnings.

- •

High brand trust and recognition built over 200+ years.

- •

Excellent financial strength and credit ratings, ensuring customer confidence.

Weaknesses

- •

Potential over-reliance on the AARP demographic, creating concentration risk.

- •

Legacy systems can create operational friction and slow down innovation compared to digital-native insurtechs.

- •

Perception of being a higher-cost option for customers outside the core AARP segment.

Opportunities

- •

Accelerate digital transformation by leveraging AI and data analytics for improved underwriting, pricing, and claims processing.

- •

Develop and launch new products tailored to the evolving needs of SMBs and the 'active aging' population.

- •

Form new strategic affinity partnerships to target other large, underserved customer segments.

- •

Expand use of telematics and IoT to create more personalized, usage-based insurance products.

Threats

- •

Aggressive competition from lower-cost direct insurers (GEICO, Progressive) and agile insurtech startups.

- •

Increasing frequency and severity of catastrophic events due to climate change, driving up claims costs.

- •

Evolving customer expectations for seamless, digital-first experiences, driven by other industries.

- •

Economic volatility (inflation, interest rates) impacting investment returns and claims costs.

Recommendations

Priority Improvements

- Area:

Digital Customer Experience

Recommendation:Invest heavily in modernizing the end-to-end digital journey, from quote to claim, to create a seamless, self-service experience that rivals insurtech competitors. Focus on mobile-first design and proactive communication.

Expected Impact:High

- Area:

Data Analytics & AI

Recommendation:Expand the use of AI beyond claims to dynamic pricing and personalized underwriting. Leverage the vast AARP dataset to develop predictive models for risk and customer behavior, enabling more targeted product development.

Expected Impact:High

- Area:

Product Innovation for SMBs

Recommendation:Develop modular, scalable insurance products for SMBs that can be easily customized online. Focus on emerging risks like cybersecurity and business interruption for remote workforces.

Expected Impact:Medium

Business Model Innovation

- •

Launch a 'Digital-First' sub-brand to attract younger demographics with a lower-cost, simplified product offering, without diluting The Hartford's core brand positioning.

- •

Develop an 'Ecosystem' model for SMBs, partnering with payroll, HR, and accounting software providers to offer embedded insurance solutions at the point of need.

- •

Create a 'Preventative Insurance' model using IoT devices (e.g., water leak sensors for homes, telematics for commercial fleets) to help customers mitigate risk, thereby lowering claims frequency and justifying premium discounts.

Revenue Diversification

- •

Expand the Hartford Funds asset management business by targeting the wealth transfer from the baby boomer generation.

- •

Develop new affinity partnerships outside of the retirement space, such as with professional associations, alumni networks, or large credit unions.

- •

Offer fee-based risk management and consulting services to larger commercial clients, leveraging the company's deep expertise in areas like workers' compensation.

The Hartford's business model is a masterclass in mature market positioning and niche dominance. Its foundation is built on two powerful pillars: an exclusive, long-term partnership with AARP for personal lines and a market-leading position in commercial insurance for small to mid-sized businesses. This dual-focus provides significant revenue diversification and stability. The AARP relationship is a powerful competitive moat, delivering a loyal, profitable, and large-scale customer base that values trust and service over pure price, insulating it from the most aggressive price wars in the general auto insurance market. The company's 200+ year history and strong financial ratings are not just marketing points; they are key resources that reinforce its core value proposition of trust and reliability, which resonates deeply with its target segments.

However, the model's maturity is also its primary challenge. The Hartford faces significant threats from two directions: agile, data-driven insurtechs that are redefining customer expectations, and large-scale direct writers like GEICO that compete fiercely on price. The key to future success lies in strategic evolution, not revolution. The company is actively investing in digital transformation, AI, and cloud infrastructure, which is crucial for enhancing operational efficiency and meeting modern customer demands.

For strategic transformation, The Hartford should focus on leveraging its greatest asset—data. The deep insights from its tenured AARP customer base can be used to innovate products and services for the 'active aging' population. For SMBs, evolving from a simple insurance provider to an integrated risk management partner—potentially embedding its services within the software ecosystems SMBs already use—presents a significant growth opportunity. The challenge is to inject digital agility and product innovation into its established framework without alienating its core customer base or compromising the brand equity built on stability and trust. Successfully navigating this evolution will secure its competitive advantage for the decades to come.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

High Capital & Solvency Requirements

Impact:High

- Barrier:

Complex State-by-State Regulatory Licensing

Impact:High

- Barrier:

Brand Recognition and Customer Trust

Impact:High

- Barrier:

Established Agent and Broker Distribution Networks

Impact:Medium

- Barrier:

Economies of Scale in Operations and Marketing

Impact:Medium

Industry Trends

- Trend:

Digital Transformation & AI Implementation

Impact On Business:AI is being leveraged to automate mundane tasks, streamline claims processing, and enhance underwriting, shifting focus to improving customer and agent experiences.

Timeline:Immediate

- Trend:

Rise of Insurtech and Digital-First Models

Impact On Business:Newer, agile competitors are pressuring traditional insurers to innovate faster, improve user experience, and offer more personalized, data-driven products like usage-based insurance.

Timeline:Immediate

- Trend:

Hyper-Personalization through Data Analytics

Impact On Business:Customers increasingly expect tailored coverage and pricing based on their specific behaviors and needs, requiring sophisticated data analysis capabilities.

Timeline:Near-term

- Trend:

Focus on Customer Experience (CX) over Price

Impact On Business:While price remains important, seamless digital self-service, transparent communication, and efficient claims handling are becoming key differentiators and drivers of loyalty.

Timeline:Immediate

Direct Competitors

- →

State Farm

Market Share Estimate:Largest U.S. P&C insurer

Target Audience Overlap:High

Competitive Positioning:Positions as a trusted, relationship-focused insurer with a vast local agent network, emphasizing reliability and personalized service with the tagline, 'Like a good neighbor, State Farm is there.'

Strengths

- •

Strong brand recognition and reputation.

- •

Extensive network of local agents providing personalized service.

- •

Diverse range of insurance and financial products.

- •

High customer satisfaction ratings and user-friendly digital tools.

Weaknesses

- •

Over-dependence on the U.S. market.

- •

Can be slower to innovate than digital-native competitors.

- •

Pricing may be less competitive for some demographics compared to direct-to-consumer models.

Differentiators

Emphasis on the agent-customer relationship for a personal touch.

Bundling of banking and financial services with insurance products.

- →

GEICO

Market Share Estimate:Top 3 U.S. auto insurer

Target Audience Overlap:Medium

Competitive Positioning:Positions as a low-cost leader with a direct-to-consumer model, emphasizing savings and convenience with its famous tagline, '15 minutes could save you 15% or more on car insurance.'

Strengths

- •

Massive advertising budget and extremely high brand recall.

- •

Competitive pricing due to a low-cost, direct sales model.

- •

Strong appeal to budget-conscious and younger, digital-native customers.

- •

Efficient online and mobile app experience for quotes and policy management.

Weaknesses

- •

Limited physical agent locations, offering less in-person service.

- •

Customer service can be perceived as less personal than agent-based models.

- •

Primarily focused on auto insurance, with less emphasis on other lines.

Differentiators

Humorous, memorable, and ubiquitous advertising campaigns.

Direct-to-consumer model that streamlines the purchasing process.

- →

Progressive

Market Share Estimate:Top 3 U.S. auto insurer

Target Audience Overlap:Medium

Competitive Positioning:Positions as an innovator offering choice and transparency, known for its comparison tools and usage-based insurance (Snapshot) to reward safe drivers.

Strengths

- •

Pioneer in technology and data analytics, especially telematics.

- •

Strong brand recognition with its long-running 'Flo' ad campaigns.

- •

Offers a direct-to-consumer model alongside an agent channel, providing customer choice.

- •

Competitive pricing and a wide array of discounts.

Weaknesses

- •

Customer satisfaction ratings can be inconsistent.

- •

Heavy reliance on the competitive auto insurance market.

- •

Brand perception may be more focused on price than on service quality.

Differentiators

Usage-based insurance (Snapshot) for personalized rates.

Name Your Price® tool and comparison rates of competitors.

- →

Allstate

Market Share Estimate:Top 5 U.S. P&C insurer

Target Audience Overlap:High

Competitive Positioning:Positions as a provider of premium protection and quality service, using the tagline 'You're in good hands' to build a brand around trust and reliability.

Strengths

- •

Strong brand name and financial stability.

- •

Diversified product portfolio and effective multi-channel distribution (agents and direct).

- •

Innovative offerings like rideshare insurance and safe driving rewards programs.

- •

Proprietary database for underwriting and pricing risks effectively.

Weaknesses

- •

Average premiums can be higher than competitors.

- •

Customer satisfaction for auto insurance shopping is below average compared to peers.

- •

High dependence on the U.S. market and exposure to catastrophe losses.

Differentiators

Unique coverage options like new car replacement.

Strong agent network combined with robust digital tools.

Indirect Competitors

- →

Lemonade

Description:An insurtech company using AI and a digital-first platform to offer renters, homeowners, and auto insurance. It targets younger, tech-savvy consumers with a focus on ease-of-use, social impact (Giveback program), and a transparent, flat-fee business model.

Threat Level:Medium

Potential For Direct Competition:High, as it expands its product offerings and geographical reach, directly challenging the traditional insurance model.

- →

The Zebra

Description:An insurance comparison marketplace (aggregator) that allows users to compare quotes from multiple insurance companies simultaneously. It acts as an intermediary, generating leads for insurance carriers.

Threat Level:High

Potential For Direct Competition:Low, as its business model is based on partnership with carriers, not underwriting policies. The threat is commoditizing insurance, reducing brand loyalty, and shifting focus solely to price.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Exclusive AARP Endorsement

Sustainability Assessment:Highly sustainable. The partnership has been in place since 1984 and is extended until at least 2033, creating a deep moat in the 50+ demographic.

Competitor Replication Difficulty:Hard

- Advantage:

Brand Trust and 200+ Year History

Sustainability Assessment:Highly sustainable. The long history, including insuring historical figures like Abraham Lincoln, builds a level of trust and stability that is difficult for newer competitors to match.

Competitor Replication Difficulty:Hard

- Advantage:

Expertise in the 50+ Market

Sustainability Assessment:Sustainable. Through its Center for Mature Market Excellence, The Hartford has developed deep institutional knowledge, products (like RecoverCare), and services tailored to its core demographic.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Specific Discount Campaigns', 'estimated_duration': 'Short-term (1-2 years)'}

Disadvantages

- Disadvantage:

Niche Market Perception

Impact:Major

Addressability:Moderately

- Disadvantage:

Dependence on AARP Partnership

Impact:Major

Addressability:Difficult

- Disadvantage:

Potentially Slower Digital Innovation vs. Insurtechs

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted digital campaigns highlighting the value of bundling and specific AARP benefits beyond the initial discount to increase policyholder stickiness.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Optimize the online quote-to-bind process by reducing the number of steps and pre-filling information where possible, improving conversion rates.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Invest in an enhanced telematics program (TrueLane) with more engaging feedback and gamification to attract and retain safe drivers and better price risk.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop a 'digital concierge' service for AARP members, integrating insurance needs with other relevant services for the 50+ demographic (e.g., retirement planning, home safety modifications).

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Explore creating a sub-brand or distinct product line targeted at the children of AARP members (40-50 age group) to build a future customer pipeline.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Form strategic partnerships with companies in the health and wellness, smart home technology, and financial planning sectors to create an integrated ecosystem of protection for the mature market.

Expected Impact:High

Implementation Difficulty:Difficult

Reinforce and modernize the position as the undisputed insurance leader for the 50+ demographic. Shift messaging from being just 'for seniors' to being the 'expert partner for navigating life's second half' with tailored products, unmatched service, and holistic protection.

Differentiate through hyper-specialization. Go beyond standard insurance to offer proactive, data-driven services that cater to the unique lifestyle and risks of the mature demographic, leveraging the deep trust established through the AARP partnership.

Whitespace Opportunities

- Opportunity:

Develop specialized insurance products for 'pre-retirees' (ages 55-65) that bundle home, auto, and umbrella coverage with features that adapt as they transition from work to retirement (e.g., reduced premiums for less driving).

Competitive Gap:Most competitors offer generic products. A tailored, life-stage product would resonate strongly with The Hartford's core audience.

Feasibility:High

Potential Impact:High

- Opportunity:

Offer proactive risk mitigation services for homeowners, using smart home (IoT) device data to prevent claims (e.g., discounts for water leak sensors, smart smoke detectors) and provide peace of mind.

Competitive Gap:Insurtechs are exploring this, but no legacy carrier has claimed a dominant position in this space for the mature market.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create a digital community and resource hub for AARP members that provides valuable content on topics like financial planning, fraud prevention, and healthy aging, embedding insurance as a key component of overall well-being.

Competitive Gap:Competitors focus solely on selling policies. This builds a deeper, more loyal relationship beyond the transaction.

Feasibility:Medium

Potential Impact:Medium

The Hartford occupies a powerful and unique position in the U.S. insurance market, built upon a foundation of a 200+ year history and, most critically, its exclusive and long-standing endorsement from AARP. This partnership provides a formidable competitive advantage, granting direct access and inherent trust with the valuable 50+ demographic. The company's primary strategy is to leverage this relationship by offering tailored products, exclusive discounts, and specialized services that cater to the needs of this market segment. Its key strengths are brand trust, deep market expertise, and a loyal customer base.

However, The Hartford faces a multi-front competitive challenge. Direct competitors like State Farm and Allstate compete on the basis of broad product offerings and strong agent networks, appealing to a similar, if wider, customer base. Meanwhile, price-aggressive, direct-to-consumer giants like GEICO and Progressive threaten to peel off price-sensitive customers, even within the 50+ segment. The most significant emerging threat comes from indirect competitors. Insurtechs like Lemonade are redefining customer expectations with seamless digital experiences, while aggregators like The Zebra commoditize the market, eroding brand loyalty and focusing competition solely on price.

The Hartford's primary disadvantage is its deep concentration on a single demographic, which could be perceived as a vulnerability if that segment's preferences rapidly shift toward digital-first models where The Hartford is not the leader. Furthermore, its fortunes are inextricably linked to the AARP partnership; any change to that relationship would be an existential threat.

Strategic opportunities for The Hartford lie in deepening its specialization while modernizing its delivery. The company should double down on its identity as the expert for the mature market, expanding beyond reactive insurance products to offer a proactive ecosystem of protection and planning services. This includes integrating smart home technology for risk prevention, developing life-stage-specific products for pre-retirees, and building a digital community that adds value beyond the policy. To secure its future, The Hartford must successfully bridge its legacy of trust with the digital innovation necessary to meet the evolving expectations of its increasingly tech-savvy core market.

Messaging

Message Architecture

Key Messages

- Message:

Exclusive benefits, savings, and endorsements for AARP members.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero, Car Insurance Page Hero, Throughout all content

- Message:

Save money by getting a quote and bundling auto and home insurance.

Prominence:Primary

Clarity Score:High

Location:Homepage banners, Car Insurance page, CTA sections

- Message:

A trusted and enduring company with over 200 years of experience.

Prominence:Secondary

Clarity Score:High

Location:Homepage 'We work to earn your trust' section, 'Doing Right Since Day One'

- Message:

We provide excellent, highly-rated customer and claims service.

Prominence:Tertiary

Clarity Score:High

Location:Homepage claims ratings, Car Insurance page testimonials and service descriptions

The messaging hierarchy is exceptionally well-defined and effective for its primary target audience. The top-level message is a powerful combination of affiliation (AARP) and savings ('Get a Quote'). This immediately qualifies the audience and provides a compelling reason to engage. Trust and reliability messages are used as secondary support to reinforce the decision, creating a logical and persuasive flow from initial interest to deeper consideration.

Messaging is remarkably consistent across the homepage and the specialized car insurance page. The core themes of the AARP partnership, savings, and trust are woven into every section. This disciplined repetition reinforces the value proposition and creates a seamless, trustworthy brand experience.

Brand Voice

Voice Attributes

- Attribute:

Trustworthy

Strength:Strong

Examples

- •

We work to earn your trust every day.

- •

Doing Right Since Day One.

- •

For over 200 years.

- •

We never take the trust you have in us for granted.

- Attribute:

Supportive

Strength:Strong

Examples

- •

We're ready to do right by you.

- •

Showing up for people isn’t just what we do. It’s who we are.

- •

The representative was so very kind to help me through it!

- •

Their compassion, competence and efficiency.

- Attribute:

Authoritative

Strength:Moderate

Examples

- •

The only auto and home insurance program endorsed by AARP.

- •

For over 40 years, The Hartford has served as the exclusive provider...

- •

We understand what matters most to people age 50+.

- Attribute:

Promotional

Strength:Moderate

Examples

- •

You could save over $800 when you bundle auto and home.

- •

Drive with confidence for as little as $78 a month.

- •

Exclusive benefits and discounts for AARP members.

Tone Analysis

Reassuring

Secondary Tones

- •

Dependable

- •

Caring

- •

Practical

Tone Shifts

The tone shifts from broadly reassuring and trust-focused on the homepage's narrative sections to a more direct, promotional, and benefit-driven tone in the 'Get a Quote' sections and on the product-specific pages.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

The Hartford is the only insurance provider exclusively endorsed by AARP, offering trusted, affordable, and specially designed auto and home insurance for people aged 50 and over.

Value Proposition Components

- Component:

Exclusive AARP Endorsement & Benefits

Clarity:Clear

Uniqueness:Unique

- Component:

Significant Cost Savings & Discounts

Clarity:Clear

Uniqueness:Common

- Component:

200+ Years of Stability & Trust

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Highly-Rated Claims Service

Clarity:Clear

Uniqueness:Common

The Hartford's differentiation strategy is a masterclass in market segmentation and partnership marketing. While competitors focus broadly on price or service, The Hartford's exclusive, long-term partnership with AARP creates a formidable competitive moat. This isn't just a discount program; it's a deep integration that positions them as the default, trusted choice for AARP's nearly 38 million members, a highly valuable demographic. This single element transforms the conversation from a commoditized price war to one of affiliation, trust, and tailored benefits.

The Hartford positions itself not as a general insurer for everyone, but as a specialized provider for the 50+ demographic. This positions them against giants like GEICO, Progressive, and State Farm by carving out a specific, loyal niche. They don't try to out-meme or out-spend competitors in the mass market; instead, they leverage the immense brand equity and trust of AARP to acquire customers with a higher lifetime value in a more targeted, efficient manner.

Audience Messaging

Target Personas

- Persona:

AARP Member (Age 50+)

Tailored Messages

- •

The only auto and home insurance program endorsed by AARP.

- •

Exclusive benefits and discounts for AARP members.

- •

We know that insurance needs change as you get older...

- •

For over 40 years, The Hartford has served as the exclusive provider of auto insurance designed for AARP members.

Effectiveness:Effective

- Persona:

Small Business Owner

Tailored Messages

Safeguard your business and employees with The Hartford.

1.3MM+ Small Businesses Insured.

Effectiveness:Ineffective

Audience Pain Points Addressed

- •

Feeling that insurance companies are impersonal and don't understand their needs as they age.

- •

Worrying about financial security and finding the best value on a fixed or limited income.

- •

The stress and complexity of filing a claim after an accident or loss.

- •

Fear of being taken advantage of or not getting a fair deal.

Audience Aspirations Addressed

- •

Making smart, informed financial decisions.

- •

Having peace of mind to enjoy life and retirement without worry.

- •

Being associated with trusted, reputable organizations (AARP).

- •

Feeling cared for and supported by the companies they do business with.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Trust/Security

Effectiveness:High

Examples

- •

Doing Right Since Day One.

- •

I feel 'safe' with you!!

- •

You have so much to protect. And we never take the trust you have in us for granted.

- Appeal Type:

Belonging/Exclusivity

Effectiveness:High

Examples

- •

The only auto and home insurance program endorsed by AARP.

- •

Exclusive benefits and savings for AARP members.

- •

AARP membership is required for Program eligibility in most states.

- Appeal Type:

Financial Savviness

Effectiveness:Medium

Examples

- •

You could save over $800 when you bundle auto and home.

- •

Average Car Insurance Savings $577

- •

Great Rates and Rewards on Car Insurance.

Social Proof Elements

- Proof Type:

Authority (Endorsement)

Impact:Strong

Examples

The only auto and home insurance program endorsed by AARP.

- Proof Type:

Customer Ratings & Reviews

Impact:Strong

Examples

- •

4.7/5 for Auto Claims (26597 reviews)

- •

4.6/5 for Home Claims (9714 reviews)

- •

Numerous customer testimonials with names.

- Proof Type:

Wisdom of the Crowd

Impact:Moderate

Examples

55,000+ drivers started a quote in the last week.

1.3MM+ Small Businesses Insured.

Trust Indicators

- •

Prominent AARP branding and co-messaging.

- •

Displaying specific, large numbers of customer reviews.

- •

Highlighting the company's 200+ year history.

- •

Detailed, readily accessible disclaimers for all savings claims.

- •

Showcasing specific, positive customer testimonials.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Start Quote

Location:Homepage Hero, Secondary Banners, Car Insurance Page Hero

Clarity:Clear

- Text:

Get a Quote

Location:Homepage Banners, Car Insurance Page Banners

Clarity:Clear

- Text:

Retrieve a Saved Quote

Location:Homepage Hero, Car Insurance Page Hero

Clarity:Clear

The CTAs are highly effective. They are consistently placed, use clear and direct action-oriented language, and are visually prominent. The inclusion of 'Retrieve a Saved Quote' is a particularly smart feature that acknowledges the considered purchase cycle of insurance and reduces friction for returning visitors, likely improving conversion rates for this demographic.

Messaging Gaps Analysis

Critical Gaps

There is a significant messaging gap for the Small Business audience. While mentioned with data points like '1.3MM+ Small Businesses Insured,' there is no compelling narrative, value proposition, or clear user journey for this persona on the homepage, which is overwhelmingly dominated by the AARP personal lines messaging.

Contradiction Points

No itemsUnderdeveloped Areas

The 'Doing Right Since Day One' and '214 Years' heritage messaging could be much more powerful. Instead of just stating the number, the site could tell a short, compelling story (e.g., insuring Abraham Lincoln's home, bonding the Golden Gate Bridge) to make the history tangible and emotionally resonant.

The message 'we do more to innovate for our customers' is an unsupported claim. There are no examples of technological or product innovation highlighted, which is a key trend in the current insurance market.

Messaging Quality

Strengths

- •

Exceptional audience-message fit for the target AARP demographic.

- •

Powerful and seamless integration of the AARP partnership as the core differentiator.

- •

Superb use of multiple layers of social proof (endorsement, ratings, testimonials, crowd numbers).

- •

Clear, consistent, and benefit-oriented messaging hierarchy.

- •

Trust-building voice and tone that resonates with the target audience.

Weaknesses

- •

The dominant focus on AARP personal lines effectively renders the business insurance messaging invisible on the homepage, potentially alienating or losing business prospects.

- •

Reliance on generic claims like 'innovation' without providing specific proof points.

- •

The historical significance of the company is stated but not demonstrated through storytelling.

Opportunities

- •

Create a dedicated messaging stream or interactive element on the homepage for business owners to guide them to relevant value propositions.

- •

Develop content that tells the story of The Hartford's history to deepen the emotional connection to the brand's longevity and trustworthiness.

- •

Showcase specific examples of technology or service innovation (e.g., a streamlined claims app, unique coverage options) to substantiate claims of being a modern, innovative insurer.

Optimization Roadmap

Priority Improvements

- Area:

Audience Segmentation

Recommendation:Implement a dynamic content block on the homepage that clearly addresses the two primary audiences: 'Personal Insurance for AARP Members' and 'Insurance for Business Owners'. Provide distinct value propositions and CTAs for each.

Expected Impact:High

- Area:

Brand Storytelling

Recommendation:In the 'Doing Right Since Day One' section, replace the generic text with a short, rotating carousel of 'Proof Points' from the company's history with tangible stories and images.

Expected Impact:Medium

Quick Wins

- •

Add a specific subheading under 'Business Insurance' on the homepage tab that says something like 'Protecting Over 1 Million Small Businesses Like Yours.'

- •

Feature a customer testimonial from a small business owner on the homepage.

- •

A/B test the primary 'Start Quote' CTA with more benefit-oriented language like 'Get My AARP Savings'.

Long Term Recommendations

Develop a content marketing hub targeted at the 50+ demographic that addresses broader topics of financial wellness, retirement planning, and safety, further cementing The Hartford's role as a trusted advisor, not just an insurer.

Create a distinct messaging architecture and value proposition for the business insurance segment that is as compelling as the AARP personal lines messaging.

The Hartford's strategic messaging for its personal lines is a textbook example of successful niche marketing. By building its entire communication strategy around the exclusive AARP endorsement, the company effectively bypasses the hyper-competitive, price-driven mass market. The messaging is disciplined, consistent, and laser-focused on the emotional needs of its target 50+ demographic: trust, security, and smart financial management. The brand voice is perfectly calibrated to be reassuring and supportive, while the heavy use of social proof—from the AARP endorsement itself to tens of thousands of reviews—creates a powerful and persuasive case for choosing The Hartford.

The primary strategic weakness is the near-total neglect of the business insurance audience in its top-of-funnel messaging. A potential business customer landing on the homepage receives no compelling reason to engage further, as the experience is overwhelmingly tailored to an AARP member seeking auto or home insurance. To drive growth and capitalize on its strong brand, The Hartford must develop a parallel messaging strategy that gives the business segment a clear and compelling journey from the first click. Overall, the current messaging is highly effective at driving its primary business objective—acquiring and retaining AARP members—but leaves significant opportunity on the table for other business lines.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established history of over 200 years, indicating long-term market trust and stability.

- •

Exclusive 41-year partnership with AARP, demonstrating deep penetration and fit with the 50+ demographic.

- •

Insured over 1.3 million small businesses, showing significant traction and product fit in the commercial SME segment.

- •

High customer satisfaction ratings for claims (e.g., 4.7/5 for Auto, 4.7/5 for Business), suggesting the core product delivery meets customer expectations.

- •

Consistently strong financial performance, with a core earnings ROE of 17% and a 10% growth in P&C earned premiums in Q2 2025, validating the value of their offerings.

Improvement Areas

- •

Developing products and marketing strategies for younger demographics (under 50) who are not AARP members.

- •

Expanding digital self-service capabilities beyond quotes to include more complex policy management and claims initiation.

- •

Innovating product offerings to cover emerging risks like cyber threats for small businesses and personal data protection for individuals.

Market Dynamics

Moderate. Forecasts for US P&C direct premiums written (DPW) growth are around 5%-6.8% for 2025.

Mature

Market Trends

- Trend:

Digital Transformation & Insurtech Adoption

Business Impact:Pressure to modernize legacy systems, enhance digital customer experiences (quote, bind, claim), and leverage AI/ML for underwriting and claims processing to remain competitive.

- Trend:

Increased Customer Demand for Personalization

Business Impact:Shift from one-size-fits-all policies to usage-based insurance (UBI) like their TrueLane program and tailored bundles.

- Trend:

Social Inflation and Rising Claims Costs

Business Impact:Increased cost of litigation and higher jury awards are driving up liability claims costs, necessitating disciplined underwriting and advanced pricing strategies.

- Trend:

Heightened Competition

Business Impact:Intense competition from both established players (Geico, Progressive) and new digital-first entrants is putting pressure on pricing and market share.

Favorable for tech-driven growth. While the market is mature, the industry is at an inflection point where incumbents with the resources to invest in digital transformation and data analytics can capture market share and improve profitability.

Business Model Scalability

Medium

High fixed costs associated with regulatory compliance, technology infrastructure, and brand marketing. Variable costs include agent commissions, claims payouts, and claims processing personnel.

Moderate. Growth in premiums can be highly profitable if underwriting discipline is maintained (i.e., low loss ratios). Digitalization of quoting and claims processing can significantly improve operational leverage.

Scalability Constraints

- •

State-by-state regulatory complexity creates overhead for national expansion or product changes.

- •

Legacy IT systems can hinder rapid product development and integration with modern digital platforms.

- •

Dependence on human capital for complex underwriting and claims adjustment can create bottlenecks during rapid growth.

Team Readiness

Experienced leadership with a proven track record of managing a large, complex insurance organization and delivering consistent financial results.

Likely a traditional, siloed structure (Personal Lines, Business Insurance, Group Benefits) which can slow down cross-functional growth initiatives. A shift towards a more agile, customer-centric model may be needed.

Key Capability Gaps

- •

Digital Product Management: Expertise in creating seamless, end-to-end digital customer journeys.

- •

Data Science & AI/ML Engineering: Talent to build and deploy advanced analytics for pricing, underwriting, and fraud detection.

- •

Growth Marketing: Expertise in performance marketing, SEO/SEM, and lifecycle marketing for demographics outside the core AARP segment.

Growth Engine

Acquisition Channels

- Channel:

Strategic Partnership (AARP)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Deepen the integration with AARP's digital channels. Co-develop new products or benefits tailored to emerging needs of the 50+ demographic (e.g., cyber fraud protection, insurance for gig-economy work in retirement).

- Channel:

Direct-to-Consumer (Online)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Implement a full-funnel analytics platform to identify drop-off points in the quote process. Use A/B testing on calls-to-action, form fields, and value proposition messaging to improve quote completion rates.

- Channel:

Small Commercial (Agent/Broker)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Enhance the digital portal for independent agents to make quoting and binding faster and more efficient. Use data analytics to identify cross-sell opportunities for agents to pursue.

Customer Journey

The primary digital path is a prominent 'Get a Quote' call-to-action leading to a multi-step form. The journey is straightforward but could be lengthy for users without all information readily available.

Friction Points

- •

Length and complexity of the online quote form may lead to high abandonment rates.

- •

Lack of transparent pricing comparison tools on-site may cause users to leave to compare quotes elsewhere.

- •

The handoff between online quoting and offline assistance (if needed) may not be seamless.

Journey Enhancement Priorities

{'area': 'Quote Funnel', 'recommendation': "Implement a 'save and resume' feature for quotes. Use data pre-fill services to reduce manual entry. Offer a 'quick estimate' with fewer questions before the full quote."}

{'area': 'Onboarding', 'recommendation': 'Develop a personalized digital onboarding sequence for new policyholders that confirms coverage, explains benefits, and introduces self-service tools.'}

Retention Mechanisms

- Mechanism:

Bundling Discounts (Auto + Home)

Effectiveness:High

Improvement Opportunity:Proactively identify and market bundling opportunities to existing single-policy customers using data analytics. Experiment with bundling other products like small business and personal auto for entrepreneurs.

- Mechanism:

Affinity Partnership (AARP)

Effectiveness:High

Improvement Opportunity:Leverage the AARP relationship to create exclusive loyalty benefits beyond initial discounts, such as specialized content, services, or enhanced coverage options.

- Mechanism:

Usage-Based Insurance (TrueLane Program)

Effectiveness:Moderate

Improvement Opportunity:Increase adoption by more prominently featuring the potential savings. Evolve the program from just a discount mechanism to a platform for driver safety feedback and services.

Revenue Economics

Strong. The company has demonstrated strong profitability with improved combined ratios and a 17% core earnings ROE, indicating healthy per-policy economics.

Undeterminable from public data, but likely healthy given the high retention within the AARP segment and the focus on bundling.

High. The ability to grow earned premiums by 10% while improving underwriting margins points to an efficient revenue engine.

Optimization Recommendations

- •

Invest in AI-driven underwriting to price risk more accurately and improve loss ratios.

- •

Automate portions of the claims process to reduce loss adjustment expenses (LAE).

- •

Systematically target existing customers for cross-selling and up-selling additional coverages (e.g., umbrella policies, specialty vehicle insurance).

Scale Barriers

Technical Limitations

- Limitation:

Legacy Core Systems

Impact:High

Solution Approach:Adopt a phased modernization strategy. Use APIs to 'wrap and extend' core systems for new digital front-ends, while gradually migrating policy administration and claims to modern, cloud-native platforms.

- Limitation:

Siloed Data Architecture

Impact:Medium

Solution Approach:Develop a centralized customer data platform (CDP) to create a single view of the customer across all product lines (personal, business, benefits), enabling better personalization and cross-selling.

Operational Bottlenecks

- Bottleneck:

Manual Claims Processing

Growth Impact:Limits ability to handle claim volume surges (e.g., after catastrophes) and increases operational costs.

Resolution Strategy:Implement AI-powered claims triage and damage estimation (photogrammetry) to automate simple claims and flag complex ones for expert review.

- Bottleneck:

Complex Underwriting for Specialty Commercial Lines

Growth Impact:Slows down quote-to-bind times, potentially losing business to more agile competitors.

Resolution Strategy:Develop an expert system or augmented intelligence tools that guide underwriters with data-driven insights and automate routine data gathering.

Market Penetration Challenges

- Challenge:

Brand Perception Tied to Older Demographics

Severity:Major

Mitigation Strategy:Consider launching a separate digital-first brand or a targeted marketing campaign focused on the unique needs of younger consumers (e.g., renters insurance, insurance for side hustles) with a distinct voice and value proposition.

- Challenge:

Intense Competition from Digital Natives

Severity:Critical

Mitigation Strategy:Compete on trust, service, and breadth of products, while investing heavily in digital user experience to close the gap on convenience. Leverage the AARP partnership as a unique, defensible moat.

- Challenge:

Exclusion from Major Markets (e.g., CA, FL for new business)

Severity:Major

Mitigation Strategy:Re-evaluate the risk models and pricing strategies for these states. Explore partnerships with tech-forward MGAs (Managing General Agents) that have specialized underwriting capabilities for high-risk regions.

Resource Limitations

Talent Gaps

- •

Data Scientists

- •

Cloud Infrastructure Engineers

- •

Digital User Experience (UX) Designers

- •

Growth Product Managers

Sufficient capital for operations and typical growth. Significant investment will be required for a full-scale technology modernization, likely funded from operating cash flow.

Infrastructure Needs

- •

Cloud-based data warehousing and analytics platform.

- •

Modern API gateway for connecting to Insurtech partners and new distribution channels.

- •

Customer Relationship Management (CRM) system that spans all business units.

Growth Opportunities

Market Expansion

- Expansion Vector:

Younger Demographics (Millennials & Gen Z)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop a multi-channel digital marketing strategy focusing on products like renters insurance, entry-level auto policies, and small business insurance for freelancers. Potentially launch a sub-brand to avoid brand dilution.

- Expansion Vector:

Expanding Small Commercial Appetite

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Continuously add new business classes to the BOP policy eligibility. Develop tailored products for high-growth industries like tech services, e-commerce, and renewable energy.

Product Opportunities

- Opportunity:

Small Business Cyber Insurance

Market Demand Evidence:Increasing frequency of cyber-attacks on small businesses and growing awareness of the risk creates strong demand for accessible cyber policies.

Strategic Fit:High. Leverages existing relationships with 1.3M+ small business customers.

Development Recommendation:Partner with a specialized cyber Insurtech to quickly bring a product to market, leveraging their underwriting expertise and threat intelligence capabilities.

- Opportunity:

Embedded Insurance Products

Market Demand Evidence:Consumers increasingly expect insurance to be offered at the point of sale for a related product or service (e.g., travel insurance with a flight booking).

Strategic Fit:Medium. Represents a new business model but aligns with core insurance capabilities.

Development Recommendation:Pilot a program by creating an API-first insurance product and partnering with an online retailer or service provider to offer it at checkout.

- Opportunity:

Parametric Insurance for Weather Events

Market Demand Evidence:Increasing climate volatility creates a need for faster, more transparent insurance payouts for businesses impacted by events like hurricanes or freezes.

Strategic Fit:Medium. Fits within the commercial property line but requires new data sources and claims models.

Development Recommendation:Launch a pilot product in a specific region and for a specific peril, targeting an industry heavily affected by that risk (e.g., parametric hurricane insurance for hospitality businesses in the Southeast).

Channel Diversification

- Channel:

Other Affinity Partnerships

Fit Assessment:High. The AARP model is proven. This could be replicated with other large membership organizations (e.g., alumni associations, professional groups, credit unions).

Implementation Strategy:Create a dedicated partnership team to identify and negotiate with potential affinity groups that have demographics complementary to the AARP segment.

- Channel:

Digital Brokerages/Aggregators

Fit Assessment:Medium. Provides access to a new customer segment but can lead to price-based competition.

Implementation Strategy:Develop a robust set of APIs to allow for seamless integration with leading online insurance marketplaces. Focus on providing a superior product that stands out on more than just price.

Strategic Partnerships

- Partnership Type:

Insurtech Collaboration

Potential Partners

- •

AI Claims Processing Startups (e.g., Lemonade, Tractable)

- •

Telematics Data Providers

- •

Cyber Risk Modeling Firms

Expected Benefits:Accelerate technology adoption without building everything in-house; gain access to new capabilities, data sources, and talent.

- Partnership Type:

Smart Home/Auto Tech Companies

Potential Partners

- •

Ring, SimpliSafe (Home Security)

- •

Tesla, Ford (for telematics data)

- •

Moen, Phyn (Water leak detectors)

Expected Benefits:Gain access to new risk mitigation data, leading to better underwriting and discounts that attract safety-conscious customers. Create new value propositions around home and auto safety.

Growth Strategy

North Star Metric

Number of Policies in Force

This metric combines both customer acquisition (new policies) and retention (renewed policies), providing a holistic view of the company's health and market penetration. It encourages a focus on long-term customer relationships over short-term premium volume.

5-7% annual growth, outpacing overall market growth.

Growth Model

Hybrid: Partnership-Led, Direct-Response, and Product-Led

Key Drivers

- •

Deepening the AARP partnership (Partnership-Led).

- •

Optimizing the digital quote-to-bind funnel (Direct-Response).

- •

Driving multi-policy adoption (bundling) through the existing customer base (Product-Led).

Maintain and grow the AARP channel. Create a dedicated growth team to focus on improving the conversion rate of the digital direct channel. Implement automated, personalized campaigns to existing customers showcasing the value of bundling.

Prioritized Initiatives

- Initiative:

Digital Quote Funnel Optimization

Expected Impact:High

Implementation Effort:Medium

Timeframe:3-6 months

First Steps:Install full-funnel analytics. Conduct user testing to identify top 3 friction points. Begin A/B testing variations of the form and calls-to-action.

- Initiative:

Launch Bundled Small Business Cyber + BOP Product

Expected Impact:Medium

Implementation Effort:High

Timeframe:9-12 months

First Steps:Select an Insurtech partner for cyber underwriting. Define the bundled product offering and pricing. Develop a marketing campaign targeting existing BOP customers.

- Initiative:

Personalized Bundling Campaign for Single-Policy Holders

Expected Impact:High

Implementation Effort:Low

Timeframe:1-3 months

First Steps:Segment existing single-policy customers. Develop targeted email and in-app messages showing pre-calculated savings for adding a second policy. Launch a pilot campaign to a test segment.

Experimentation Plan

High Leverage Tests

- Hypothesis:

Reducing the number of initial questions in the auto quote funnel by 30% will increase quote starts by 15% without significantly impacting quote accuracy.

Area:Acquisition

- Hypothesis:

Proactively offering a home + auto bundle quote to existing auto-only policyholders via email will achieve a 5% conversion rate.

Area:Retention/Expansion

- Hypothesis:

Changing the primary call-to-action on the homepage from 'Start Quote' to 'See Your AARP Savings' will increase click-through rate by 20%.

Area:Acquisition

Use a standard framework like A/A testing for tool validation, followed by A/B/n testing. Key metrics: Conversion Rate, Cost Per Acquisition (CPA), Revenue Per Visitor (RPV), and statistical significance (p-value < 0.05).

Run at least 1-2 high-impact experiments concurrently at all times, with a weekly review of results and a monthly planning session for the next cycle of tests.

Growth Team

A cross-functional, mission-oriented team. Start with a team focused on a single objective, such as 'Improve online quote conversion rate.' The team should be empowered with its own budget and roadmap.

Key Roles

- •

Growth Product Manager (Team Lead)

- •

Digital Marketing Specialist (PPC, SEO)

- •

Data Analyst

- •

UX/UI Designer

- •

Dedicated Software Engineer(s)

Embed a culture of experimentation. Provide training on analytics tools and statistical analysis. Create a centralized 'playbook' of successful and failed experiments to foster organizational learning.

The Hartford is a well-established leader in the mature insurance market with a formidable brand and a powerful, defensible moat in its exclusive partnership with AARP. This provides a strong foundation of profitability and stability. Recent financial results confirm a healthy core business with strong underwriting performance and premium growth. However, the company faces significant headwinds from intense competition, the threat of digital disruption, and a brand perception heavily skewed towards an older demographic. The primary barrier to accelerated growth is the classic innovator's dilemma: a reliance on legacy systems and traditional business models that are profitable today but may not be competitive tomorrow. The most significant growth opportunities lie in bridging this gap. First, by aggressively optimizing the direct-to-consumer digital acquisition engine to attract and convert customers outside the AARP ecosystem. Second, by leveraging its existing customer base and trusted brand to expand into new product areas, with small business cyber insurance representing a prime, high-potential adjacency. Third, by systematically embracing a product-led growth model focused on increasing policies per household through intelligent, data-driven bundling campaigns. A strategic pivot towards a more agile, experimental, and digitally-native mindset, starting with the formation of a dedicated growth team, is the critical next step to unlock new growth vectors and ensure long-term market leadership in a rapidly evolving industry.

Legal Compliance

The Hartford's Privacy Policy is comprehensive and well-structured, reflecting a mature approach to data governance required in the financial services sector. It is easily accessible from the website footer. The policy clearly delineates between general website privacy and the specific, stricter requirements of the Gramm-Leach-Bliley Act (GLBA), providing a separate GLBA Notice for customers. It effectively discloses the types of personal information collected, the purposes for collection, and sharing practices. Crucially, it addresses the requirements of multiple state privacy laws, including the CCPA/CPRA, by detailing consumer rights such as the right to know, delete, and correct information. The integration of a dedicated 'Your Privacy Choices' portal is a best-practice implementation that centralizes control for users, enhancing transparency and trust.

The Hartford's 'Legal Notice' serves as its terms of service and is readily available in the site footer. The terms are robust, containing standard clauses appropriate for a large corporation, including disclaimers of liability, intellectual property protections for their logos and content, and a governing law clause specifying the State of Connecticut. The language is clear and professionally drafted. It sets appropriate expectations for website use and effectively manages legal risk associated with the content and services presented online.

The website deploys a cookie consent banner upon a user's first visit. The banner informs users about the use of cookies and provides a link to a detailed 'Cookie Notice' and an 'Accept' button. While this meets baseline requirements in the U.S., it could be improved by adding a more prominent 'Decline' or 'Manage Settings' option on the initial banner to align with global best practices. However, this minor gap is largely mitigated by the comprehensive 'Your Privacy Choices' portal, which allows users to exercise control over their data, including opting out of sales or sharing that may be facilitated by cookies.

The Hartford demonstrates a strong commitment to data protection, particularly concerning U.S. state privacy laws. The presence of a conspicuous 'Your Privacy Choices' link in the footer, complete with the official CCPA opt-out icon, is a key strength. This portal provides a clear, user-friendly interface for consumers in California and other states with similar laws to exercise their privacy rights, such as opting out of the 'sale' or 'sharing' of their personal information and limiting the use of sensitive personal information. This goes beyond mere compliance and positions data protection as a core part of their customer relationship, which is critical for a business built on trust.

The Hartford shows a strong, public commitment to digital accessibility. They provide a dedicated 'Accessibility Statement' clearly stating their goal to conform to the Web Content Accessibility Guidelines (WCAG) 2.1 Level AA, which is the recognized standard for ADA compliance. The statement also provides a dedicated email address for accessibility-related questions or issues, which is a best practice. This proactive stance not only reduces the legal risk of ADA-related lawsuits but also broadens their market access to include individuals with disabilities, aligning well with their partnership with AARP, which serves an older demographic that may have a higher incidence of accessibility needs.