eScore

thehersheycompany.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

The Hershey Company maintains a high-authority corporate digital presence that excels in serving its primary audience of investors and media with detailed financial and ESG reports. Its content authority and search alignment for corporate and financial terms are excellent. However, the site is heavily U.S.-centric, missing an opportunity to reflect its global operations, and the digital narrative lags behind its strategic business pivot towards salty snacks, showing a content gap in broader industry topics like 'future of snacking'.

Exceptional content authority and search intent alignment for investor relations and corporate governance topics, establishing the site as the definitive source for financial data and ESG reporting.

Develop a dedicated 'Future of Snacking' content hub that showcases innovation, diversification into salty snacks, and thought leadership on industry trends to better align the digital presence with the company's strategic business evolution.

Communication is flawlessly executed for its target audience of investors and media, with a consistent, authoritative, and formal corporate voice. However, there is a significant disconnect between the rational, data-driven corporate messaging and the emotional, consumer-facing brand promise of 'making moments of goodness'. This tonal dissonance prevents the formation of a cohesive, overarching brand narrative that connects the 'why' of the company to the 'what' of its business operations.

Impeccable messaging consistency and clarity for financial stakeholders, effectively communicating stability, market leadership, and transparent financial performance.

Restructure the homepage narrative to lead with a powerful statement that bridges the corporate identity with the consumer mission, organizing content under strategic pillars (e.g., Performance, Innovation, Responsibility) rather than a simple news feed.

The website provides a clear, intuitive navigation for top-level information, serving its primary audience's initial journey well. The 'conversion' goal for an investor—finding a financial report—is achievable, but the experience is severely degraded by poor design on data-heavy interior pages, which feature unstyled text and tables, creating high cognitive load and significant friction. While the site shows a strong commitment to accessibility, the jarring inconsistency between the homepage and deeper content significantly mars the overall user experience.

A strong, public commitment to accessibility, including WCAG 2.0 Level AA conformance goals and a dedicated contact for reporting issues, which reduces legal risk and improves usability for all.

Systematically apply the homepage's modern design system to all data-heavy pages, creating standardized, readable components for tables and long-form text to ensure a consistent, professional experience for critical investor audiences.

The Hershey Company demonstrates a world-class approach to credibility and risk mitigation through its digital presence. The website's legal and compliance infrastructure is exceptionally robust, with a sophisticated global privacy framework, strong accessibility statements, and meticulous SEC compliance features like 'Safe Harbor' statements in financial releases. This comprehensive approach builds significant trust with investors and partners while effectively minimizing legal and regulatory risk.

A best-in-class global privacy framework, featuring a detailed, multi-jurisdictional privacy policy and a granular, opt-in cookie consent manager that aligns with the highest international standards like GDPR.

Formalize and communicate a rigorous legal review process for all non-financial corporate communications, particularly ESG claims, to ensure all statements are substantiated and defensible against potential FTC or SEC scrutiny.

Hershey's competitive advantage is deeply entrenched, built upon a moat of iconic brands with immense consumer loyalty (Reese's, Hershey's), a dominant U.S. distribution network, and massive economies of scale. These advantages are highly sustainable and difficult for competitors to replicate. The primary vulnerability is the high exposure to cocoa price volatility, which the company is actively mitigating through strategic diversification into salty snacks, a move that is strengthening its overall competitive posture.

The iconic brand portfolio, particularly in North America, provides unparalleled brand equity and pricing power, creating a durable competitive moat that is extremely difficult to erode.

Accelerate the growth and integration of the salty snacks portfolio to build a second, equally strong pillar of the business that can effectively counterbalance the inherent volatility and risks of the cocoa-dependent confectionery segment.

The business model is highly scalable due to a strong operational foundation and extensive distribution network. However, growth is constrained by an over-reliance on the mature North American market and critical exposure to cocoa price volatility, which is currently pressuring profitability. The clear and aggressive expansion into the high-growth salty snacks category is a powerful strategic pivot that significantly enhances future scalability and de-risks the overall business model.

The strategic and successful acquisition of high-growth salty snack brands like SkinnyPop and Dot's Pretzels demonstrates a clear pathway for portfolio diversification and future growth.

Develop and execute a more aggressive, focused international expansion strategy in a few high-potential markets to reduce geographic concentration risk and establish new long-term growth vectors.

Hershey operates a highly coherent and resilient business model, effectively leveraging its iconic brands and distribution muscle to generate strong returns. The company is demonstrating excellent strategic focus by actively pivoting from a chocolate-centric manufacturer to a diversified 'snacking powerhouse' in response to market trends and commodity risks. This evolution shows strong market timing and a clear alignment of resources towards high-growth areas like salty snacks, positioning the model for future success.

A clear and well-executed strategic pivot towards becoming a 'leading snacking powerhouse,' supported by successful acquisitions and a focus on diversifying revenue streams beyond core confectionery.

Launch a Direct-to-Consumer (DTC) platform for exclusive and personalized products to capture valuable first-party data, build direct consumer relationships, and test innovations outside the traditional retail model.

Hershey wields significant market power, evidenced by its dominant and stable market share in the U.S. confectionery market. The company possesses strong pricing power, enabling it to implement price increases to offset inflation, a key capability in the current environment. Its iconic status and scale give it substantial leverage with retail partners and the ability to shape industry narratives, solidifying its position as a market leader.

Demonstrated pricing power, with the ability to successfully implement net price realization across its portfolio to manage inflation and protect margins, which is a clear indicator of strong market leadership.

Leverage its market influence to proactively lead the industry conversation on critical issues like cocoa sustainability and supply chain resilience, turning a defensive necessity into a platform for thought leadership.

Business Overview

Business Classification

Consumer Packaged Goods (CPG) Manufacturer

B2B2C (Business-to-Business-to-Consumer)

Food & Beverage

Sub Verticals

- •

Confectionery

- •

Salty Snacks

- •

Food Manufacturing

Mature

Maturity Indicators

- •

Over 125 years of operation (founded in 1894).

- •

Dominant market share in the North American confectionery market.

- •

Low single-digit annual revenue growth, with a focus on acquisitions for expansion.

- •

Emphasis on operational efficiency, cost management (e.g., 'Advancing Agility & Automation Initiative'), and shareholder returns (dividends).

- •

Long-standing, iconic brand portfolio with high consumer loyalty.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

North America Confectionery

Description:Sales of chocolate, sweets, mints, and gum products through wholesale channels to retailers in the U.S. and Canada. This segment includes iconic brands like Hershey's, Reese's, and Kit Kat and represents the core of the company's revenue.

Estimated Importance:Primary

Customer Segment:Mass-market consumers via Retail Partners

Estimated Margin:High

- Stream Name:

North America Salty Snacks

Description:Sales of salty snack products, such as popcorn and pretzels, primarily through the SkinnyPop and Dot's Homestyle Pretzels brands. This is a key growth area for Hershey, showing significant recent growth (35.9% increase in Q4 2024) and strategic focus.

Estimated Importance:Secondary

Customer Segment:Health-conscious and indulgence-seeking snackers via Retail Partners

Estimated Margin:Medium

- Stream Name:

International

Description:Sales of confectionery and snack products in markets outside of North America, with a focus on Mexico, EMEA, and India. This segment represents a long-term growth opportunity but is currently the smallest revenue contributor.

Estimated Importance:Tertiary

Customer Segment:International consumers via local Retail Partners

Estimated Margin:Low to Medium

Recurring Revenue Components

- •

High repeat purchase rates driven by brand loyalty.

- •

Consistent demand for impulse and indulgence products.

- •

Seasonal sales spikes (e.g., Halloween, Easter, Holidays).

Pricing Strategy

Value-Based Pricing

Mid-range

Opaque (Retailers set final consumer prices)

Pricing Psychology

- •

Brand prestige pricing

- •

Promotional pricing through retail partners

- •

Price pack architecture adjustments (i.e., changing product size to manage costs).

Monetization Assessment

Strengths

- •

Strong brand equity allows for premium pricing and successful price increases ('net price realization').

- •

Diversified portfolio across confectionery and salty snacks mitigates risk.

- •

Extensive distribution network ensures broad market penetration and sales volume.

Weaknesses

High vulnerability to volatile raw material costs, especially cocoa, which is severely pressuring 2025 earnings.

Heavy reliance on the North American market for the majority of sales.

Opportunities

- •

Aggressive expansion of the high-growth salty snacks portfolio.

- •

Further international expansion in emerging markets.

- •

Innovation in 'better-for-you' product lines to capture health-conscious consumers.

Threats

- •

Unprecedented volatility and record-high prices for cocoa severely impacting profitability.

- •

Intense competition from global players like Mars, Nestlé, and Mondelez International.

- •

Shifting consumer preferences towards healthier snacks and away from high-sugar confectionery.

Market Positioning

Market Leader in Confectionery

Leading share of the U.S. confectionery market (~29-44%).

Target Segments

- Segment Name:

Families and Household Shoppers

Description:Primary grocery shoppers, typically parents, buying multi-pack and sharing-size products for family consumption and special occasions.

Demographic Factors

- •

Adults aged 30-55

- •

Households with children

- •

Middle-income brackets

Psychographic Factors

- •

Value tradition and nostalgia

- •

Seek trusted, well-known brands

- •

Purchase for social sharing and celebrations

Behavioral Factors

- •

Planned purchases at supermarkets and mass merchandisers

- •

High brand loyalty

- •

Responsive to seasonal promotions

Pain Points

Finding affordable treats the whole family enjoys.

Balancing indulgence with healthy eating concerns.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Young Adults and Convenience Seekers (Millennials/Gen Z)

Description:Younger consumers purchasing single-serve items for immediate consumption or trying new, innovative flavors and brand collaborations.

Demographic Factors

- •

Ages 18-35

- •

Urban and suburban dwellers

- •

Students and young professionals

Psychographic Factors

- •

Value novelty and experiences (e.g., Reese's/Oreo collaboration)

- •

Influenced by social media and digital marketing

- •

Seek brands that align with their values

Behavioral Factors

- •

Impulse purchases at convenience stores and checkout counters

- •

High engagement with new product launches and limited-time offers

- •

Less brand-loyal, more variety-seeking

Pain Points

Boredom with standard product offerings.

Need for quick, accessible snacks on the go.

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Health-Conscious Snackers

Description:Consumers actively seeking 'better-for-you' options, including low/zero sugar products or snacks perceived as healthier, like popcorn and pretzels.

Demographic Factors

All ages, with a higher concentration in Millennials and Gen X

Higher-income and education levels

Psychographic Factors

- •

Prioritize health and wellness

- •

Read nutritional labels and ingredient lists

- •

Willing to pay a premium for healthier options

Behavioral Factors

- •

Purchase brands like SkinnyPop and other low-sugar alternatives

- •

Seek out products in health food aisles or online

- •

Influenced by wellness trends and health advocates

Pain Points

Limited availability of indulgent-tasting snacks that fit their dietary goals.

Distrust of 'diet' versions of classic brands.

Fit Assessment:Fair

Segment Potential:High

Market Differentiation

- Factor:

Iconic Brand Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive Distribution Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Manufacturing Scale and Efficiency

Strength:Strong

Sustainability:Sustainable

- Factor:

Innovation in Salty Snacks

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To provide iconic, high-quality, and widely accessible confectionery and snack products that create moments of goodness and connection for everyone.

Excellent

Key Benefits

- Benefit:

Trusted Taste and Quality

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Over a century of brand heritage

Consistent product experience

- Benefit:

Emotional Connection and Nostalgia

Importance:Important

Differentiation:Unique

Proof Elements

Multi-generational brand presence

Association with holidays and family moments

- Benefit:

Convenience and Accessibility

Importance:Critical

Differentiation:Common

Proof Elements

Ubiquitous presence in retail stores

Wide variety of product sizes and formats

Unique Selling Points

- Usp:

The unique and unreplicated taste of Reese's Peanut Butter Cups.

Sustainability:Long-term

Defensibility:Strong

- Usp:

The heritage and brand story of Milton Hershey and the town of Hershey, PA.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Strategic brand collaborations creating market buzz (e.g., Reese's & OREO).

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Craving for an indulgent, sweet treat.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Need for a convenient, shareable snack for social occasions.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Desire for a comforting, nostalgic experience.

Severity:Minor

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition is exceptionally well-aligned with the mass market's desire for indulgence, comfort, and trusted brands. Hershey's products are deeply embedded in consumer culture.

Medium

While alignment is excellent with their core family and convenience segments, it is weaker with the growing health-conscious segment. The strategic push into salty snacks is a direct attempt to address this gap.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Retailers (Supermarkets, Convenience Stores, Mass Merchandisers).

- •

Cocoa and other raw material suppliers.

- •

Co-branding partners (e.g., Mondelez for OREO collaboration).

- •

Licensing partners (e.g., Harry Potter, The Grinch).

- •

Logistics and distribution providers.

Key Activities

- •

Manufacturing and Operations.

- •

Brand Marketing and Advertising.

- •

Supply Chain Management and Procurement.

- •

Product Innovation and R&D.

- •

Sales and Retail Channel Management.

Key Resources

- •

Iconic brand portfolio and intellectual property.

- •

Extensive manufacturing and distribution infrastructure.

- •

Strong retail relationships.

- •

Proprietary product formulations.

Cost Structure

- •

Raw materials (especially cocoa and sugar).

- •

Manufacturing and labor costs.

- •

Selling, General & Administrative (SG&A) expenses.

- •

Marketing and advertising.

- •

Logistics and distribution.

Swot Analysis

Strengths

- •

Dominant portfolio of iconic, high-loyalty brands (Reese's, Hershey's, Kit Kat).

- •

Expansive and deeply entrenched distribution network across North America.

- •

Strong financial position and ability to invest in growth and return capital to shareholders.

- •

Proven success in strategic acquisitions and integration (e.g., SkinnyPop, Dot's).

Weaknesses

- •

Over-reliance on the mature North American market, limiting geographic diversification.

- •

Extreme exposure to cocoa price volatility, significantly impacting short-term profitability.

- •

Core portfolio is perceived as unhealthy, a vulnerability amid growing wellness trends.

- •

Lagging innovation pace in some core confectionery categories compared to agile competitors.

Opportunities

- •

Accelerate growth in the salty snacks category to become a true 'snacking powerhouse'.

- •

Expand presence in high-potential international markets.

- •

Innovate and acquire 'better-for-you' products to meet evolving consumer demands.

- •

Leverage brand collaborations and licensing to drive excitement and incremental sales.

Threats

- •

Sustained, historically high cocoa prices threatening gross margins and forcing difficult pricing decisions.

- •

Intense competition from Mars, Mondelez, Nestlé, Ferrero, and private label brands.

- •

Shifting consumer preferences away from sugar and towards healthier alternatives.

- •

Potential for increased government regulation on food labeling, sugar content, and marketing.

Recommendations

Priority Improvements

- Area:

Commodity Risk Management

Recommendation:Develop more sophisticated and diversified hedging strategies for cocoa to mitigate price volatility. Explore long-term partnerships and direct investments in sustainable cocoa origins to gain more supply chain control.

Expected Impact:High

- Area:

Portfolio Diversification

Recommendation:Aggressively scale the North America Salty Snacks division by investing in manufacturing capacity, expanding distribution, and driving brand awareness for Dot's and SkinnyPop to challenge category leaders.

Expected Impact:High

- Area:

International Expansion

Recommendation:Focus strategic investments on a limited number of high-potential international markets (e.g., Mexico, India) to achieve meaningful scale and market share, rather than broad but shallow global distribution.

Expected Impact:Medium

Business Model Innovation

- •

Launch a Direct-to-Consumer (DTC) platform for exclusive items, personalized gifts, and new product testing to capture valuable first-party data and higher margins.

- •

Develop a distinct 'Better-for-You' sub-brand or acquire a strong existing player in the space to build credibility with health-conscious consumers without diluting the indulgent identity of core brands.

- •

Explore a 'Snack Subscription Box' model, curating new and classic products to drive recurring revenue and deeper customer engagement.

Revenue Diversification

- •

Continue strategic, bolt-on acquisitions in adjacent snacking categories (e.g., cookies, snack bars) where Hershey's distribution muscle can be leveraged.

- •

Expand brand licensing into new food categories, such as baking mixes, ice cream, and coffee flavorings, through partnerships with category leaders.

- •

Further develop the foodservice business, supplying ingredients and co-branded products to restaurant chains and other institutional customers.

The Hershey Company operates a mature, highly profitable, and resilient business model anchored by an iconic brand portfolio and a dominant position in the North American confectionery market. Its primary strengths lie in its immense brand equity, manufacturing scale, and an unparalleled distribution network, which create a significant competitive moat. However, the model is currently facing a pivotal moment of strategic evolution. The core confectionery business, while a powerful cash generator, is under severe pressure from unprecedented cocoa price volatility, which threatens profitability and necessitates potentially alienating price increases. Furthermore, its reliance on this segment exposes it to long-term risks from shifting consumer preferences towards healthier snacking.

The strategic imperative for Hershey is the aggressive transformation from a chocolate-centric manufacturer into a diversified 'snacking powerhouse.' The company has correctly identified this and is executing against it, primarily through the successful acquisition and scaling of its Salty Snacks division. This segment represents the most critical engine for future growth, offering diversification away from cocoa dependency and aligning with modern consumer behavior. The recent change in CEO to Kirk Tanner, with his extensive experience at PepsiCo, signals an intent to accelerate this transformation. Future success will be defined by three key factors: (1) navigating the immediate cocoa crisis through savvy pricing and cost management, (2) rapidly scaling the salty snacks business to become a co-equal pillar of the company, and (3) methodically expanding internationally to de-risk its heavy North American concentration. The challenge lies in executing this evolution while preserving the brand magic and profitability of its legacy chocolate business.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Brand Equity & Consumer Loyalty

Impact:High

- Barrier:

Extensive Distribution Networks & Retail Relationships

Impact:High

- Barrier:

Economies of Scale in Manufacturing & Procurement

Impact:High

- Barrier:

Significant Capital Investment for Production and Marketing

Impact:High

- Barrier:

Navigating Complex Supply Chains (e.g., Cocoa)

Impact:Medium

Industry Trends

- Trend:

Health & Wellness Consciousness

Impact On Business:Drives demand for low-sugar, organic, and 'better-for-you' snack options, requiring R&D and portfolio diversification.

Timeline:Immediate

- Trend:

Input Cost Volatility (especially Cocoa)

Impact On Business:Extreme price surges directly impact cost of goods sold and profitability, forcing price increases and margin pressure, as noted in Hershey's 2025 outlook.

Timeline:Immediate

- Trend:

Premiumization and Indulgence

Impact On Business:Consumers are willing to pay more for high-quality, artisanal, or unique flavor experiences, creating opportunities for value-added products.

Timeline:Immediate

- Trend:

Sustainability and Ethical Sourcing

Impact On Business:Increasing consumer and regulatory pressure for transparent and ethical supply chains, particularly for cocoa, impacting brand reputation and operational complexity.

Timeline:Near-term

- Trend:

Rise of E-commerce and Digital Channels

Impact On Business:Shifts marketing and distribution strategies, opening avenues for direct-to-consumer models and data-driven consumer engagement.

Timeline:Near-term

Direct Competitors

- →

Mars, Incorporated (Mars Wrigley)

Market Share Estimate:Major global competitor, often cited as Hershey's closest rival, particularly in the U.S. confectionery market.

Target Audience Overlap:High

Competitive Positioning:Global confectionery and food giant with an iconic portfolio of brands positioned for mass-market appeal and impulse purchases.

Strengths

- •

Extremely strong global brand portfolio (M&M's, Snickers, Twix, Skittles, Orbit).

- •

Vast global distribution network and significant presence in emerging markets.

- •

Private ownership allows for long-term strategic planning without shareholder pressure.

- •

Diversified business including a massive pet care division, providing financial stability.

Weaknesses

- •

Has faced product recalls which can tarnish brand image.

- •

Perceived as having a slower innovation cycle for some core brands.

- •

High competition can lead to brand switching and limit market share growth in mature markets.

Differentiators

Dominance in non-chocolate confections (gums and mints with Wrigley) and global brand recognition of M&M's and Snickers.

- →

Mondelez International

Market Share Estimate:A leading global player in snacks, particularly strong in biscuits and international chocolate markets.

Target Audience Overlap:High

Competitive Positioning:Global snacking powerhouse with a strategic focus on biscuits (Oreo), chocolate (Cadbury, Milka), and expanding into broader snack categories.

Strengths

- •

Dominant global brands in biscuits (Oreo) and chocolate outside the U.S. (Cadbury).

- •

Extensive international distribution network, especially strong in Europe and emerging markets.

- •

Proven ability to innovate and adapt brands to local tastes.

- •

Strong focus and investment in e-commerce and digital marketing channels.

Weaknesses

- •

Less dominant in the core U.S. chocolate market compared to Hershey.

- •

Portfolio is still heavily reliant on traditional, less healthy snack options.

- •

Faces the same commodity price pressures as other major players.

Differentiators

Unmatched global leadership in the biscuit category with Oreo, providing significant cross-promotional power (e.g., Hershey's Reese's/Oreo collaboration).

Stronghold on the iconic Cadbury brand in many international markets.

- →

Ferrero Group

Market Share Estimate:A major global player, ranked as the third-largest chocolate company, with aggressive expansion in North America.

Target Audience Overlap:Medium

Competitive Positioning:Positions its core brands (Ferrero Rocher, Nutella, Kinder) as premium, indulgent treats, while expanding into the mainstream U.S. market through acquisitions.

Strengths

- •

Iconic, high-margin brands with a premium reputation (Ferrero Rocher, Nutella).

- •

Strong global presence and rapid growth through strategic acquisitions (e.g., Nestlé's former U.S. candy brands, Wells Enterprises).

- •

Family-owned structure enabling long-term vision and investment.

- •

Vertically integrated supply chain for key ingredients like hazelnuts.

Weaknesses

- •

Historically smaller presence in the mainstream U.S. checkout aisle compared to Hershey and Mars.

- •

Integration of acquired mass-market brands (like Butterfinger) into a premium portfolio can be challenging.

- •

Heavy reliance on a few key brands in its core portfolio.

Differentiators

Mastery of the premium, giftable chocolate segment.

Global dominance of the hazelnut spread category with Nutella.

Indirect Competitors

- →

Private Label Brands (e.g., Kirkland Signature, Great Value)

Description:Store-brand confectionery and salty snacks that compete directly on price, offering a value alternative to branded products.

Threat Level:Medium

Potential For Direct Competition:Already direct competitors, threat level depends on economic conditions and consumer price sensitivity.

- →

Healthy Snack Bar Companies (e.g., Kind, Clif Bar)

Description:Offerings that fulfill snacking occasions with a health-focused value proposition (protein, fiber, low sugar), competing for share of stomach.

Threat Level:Medium

Potential For Direct Competition:Low, as their core positioning is health, not indulgence, but they are a key substitute.

- →

Salty Snack Giants (where Hershey is smaller)

Description:Companies like PepsiCo (Frito-Lay) dominate the salty snacks category where Hershey is a challenger brand with SkinnyPop and Dot's.

Threat Level:High

Potential For Direct Competition:Already direct competitors in the salty snack aisle.

- →

Premium/Artisanal Chocolate Makers (e.g., Lindt & Sprüngli, Godiva)

Description:Focus on high-quality ingredients and a gourmet experience, competing for the premium indulgence occasion and gifting market.

Threat Level:Low

Potential For Direct Competition:Low in the mass market, but they set the bar for quality and influence the 'premiumization' trend.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Iconic Brand Portfolio & High Consumer Loyalty

Sustainability Assessment:Highly sustainable; brands like Reese's, Hershey's, and Kisses have generations of brand equity and are cultural mainstays in North America.

Competitor Replication Difficulty:Hard

- Advantage:

Dominant U.S. Market Share & Distribution Network

Sustainability Assessment:Highly sustainable; extensive, efficient distribution and deep relationships with retailers create a significant moat.

Competitor Replication Difficulty:Hard

- Advantage:

Economies of Scale in Manufacturing

Sustainability Assessment:Sustainable, as it provides a cost advantage and allows for investment in innovation and marketing.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': "High-Profile Brand Collaborations (e.g., Reese's & OREO)", 'estimated_duration': '1-2 years'}

{'advantage': 'First-Mover on a specific flavor or product innovation', 'estimated_duration': '6-18 months'}

Disadvantages

- Disadvantage:

Over-reliance on the North American Market

Impact:Major

Addressability:Moderately

- Disadvantage:

High Exposure to Cocoa Price Volatility

Impact:Critical

Addressability:Difficult

- Disadvantage:

Challenger Position in the Salty Snacks Category

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Aggressively market and scale successful innovations like the Reese's/OREO collaboration to maximize near-term revenue and market buzz.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Leverage pricing power, enabled by competitors' price increases, to offset commodity costs while communicating a value message to consumers.

Expected Impact:High

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Accelerate the growth of the Salty Snacks portfolio through targeted marketing and innovation for Dot's and SkinnyPop to continue diversifying away from cocoa dependence.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand proven U.S. brands into key international markets with high growth potential, tailoring products and marketing to local preferences.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in R&D for 'better-for-you' confectionery that reduces sugar without sacrificing indulgence, leveraging existing brand trust.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Develop and invest in long-term, resilient cocoa supply chains through sustainable farming initiatives and R&D into alternative cocoa sources or technologies.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Strategically acquire companies in adjacent high-growth snacking categories (e.g., functional snacks, premium baked goods) to further solidify market position as a holistic snacking leader.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify the position as America's leading snacking powerhouse by balancing the defense of the core confectionery market with the aggressive expansion of the salty snack portfolio.

Differentiate through unparalleled brand heritage and consumer trust in the core U.S. market, while using innovation and strategic partnerships (like the Oreo collaboration) to generate excitement and counter global competitors.

Whitespace Opportunities

- Opportunity:

Develop a 'Functional Indulgence' product line under a trusted brand (e.g., Hershey's with added protein or vitamins).

Competitive Gap:Few competitors effectively bridge the gap between pure indulgence and functional health benefits in the mass-market confectionery space.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Launch a Direct-to-Consumer (DTC) platform for personalized or exclusive products (e.g., custom Kisses, limited-edition Reese's).

Competitive Gap:Major CPG competitors have not fully cracked the DTC model, which allows for direct consumer relationships and valuable data collection.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Expand further into the 'sweet and salty' snack category by creating innovative mashups between confectionery and salty snack brands.

Competitive Gap:While some products exist, there is an opportunity to own this sub-category by leveraging the powerful combination of Hershey's chocolate brands and its growing salty snack portfolio.

Feasibility:High

Potential Impact:High

The Hershey Company operates from a position of immense strength within the mature, oligopolistic global confectionery and snacking industry. Its primary competitive advantage is the unparalleled brand equity and market dominance of its core chocolate brands, particularly Reese's and Hershey's, within North America. This creates a formidable barrier to entry and a stable foundation for the business.

The competitive landscape is fiercely contested by a few global giants. Mars, Incorporated is Hershey's most direct and formidable rival, competing brand-for-brand in the checkout aisle. Mondelez International poses a significant threat through its global scale, dominance in the biscuit category with Oreo, and ownership of powerful international chocolate brands like Cadbury. Ferrero Group is an increasingly aggressive player, leveraging its premium positioning and strategic acquisitions to gain U.S. market share.

Hershey's primary strategic challenge, as highlighted in its own financial reporting, is the extreme volatility in cocoa prices. This elevates the importance of its strategic diversification into the salty snacks market with brands like SkinnyPop and Dot's Pretzels, which serves as a critical hedge against this commodity risk. However, in this segment, Hershey is a challenger to established leaders like PepsiCo's Frito-Lay. Another key vulnerability is its relative over-dependence on the North American market compared to the more globally diversified portfolios of Mars and Mondelez.

Key opportunities for Hershey lie in leveraging its trusted brand names to expand into 'better-for-you' and functional snacking categories, a major industry trend. Strategic collaborations, such as the recently announced Reese's and OREO partnership, demonstrate a savvy approach to generating market excitement and leveraging a competitor's strength to create a mutual win. Future success will depend on three pillars: 1) Defending its dominant U.S. confectionery position through innovation and brand building; 2) Aggressively growing its salty snacks division to scale and profitability; and 3) Mitigating supply chain risks through long-term sustainability investments and continued strategic diversification.

Messaging

Message Architecture

Key Messages

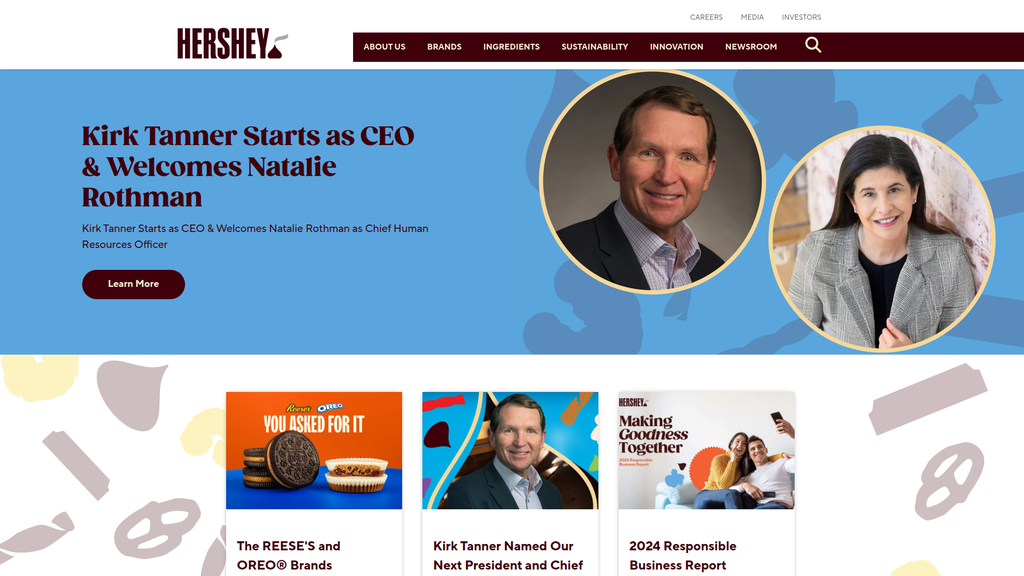

- Message:

Leadership transition and corporate governance updates.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Brand innovation and strategic collaborations drive market leadership (e.g., REESE'S and OREO®).

Prominence:Primary

Clarity Score:High

Location:Homepage News Carousel & Sections

- Message:

Commitment to responsible business practices and corporate citizenship.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage News Carousel (via 2024 Responsible Business Report)

- Message:

Investing in domestic manufacturing and operational capabilities.

Prominence:Secondary

Clarity Score:High

Location:Homepage Content Blocks

- Message:

The company has a strong financial performance and a strategic outlook for investors.

Prominence:Tertiary

Clarity Score:High

Location:Press Release pages, linked from Homepage

- Message:

Honoring the legacy of founder Milton S. Hershey.

Prominence:Tertiary

Clarity Score:Medium

Location:Homepage Content Block

The message hierarchy is event-driven and news-oriented, prioritizing recent corporate announcements like leadership changes, financial results, and product launches. This serves an investor and media audience well but subordinates the overarching brand story and mission. The core purpose of 'Making more moments of goodness' is not the primary message; instead, the messages are tactical updates about the business behind the goodness.

Messaging is highly consistent in its corporate focus. The content consistently addresses stakeholders such as investors, media, potential employees, and business partners. There is a clear demarcation between this corporate site and consumer-facing brand websites. All sections reinforce the image of a large, publicly-traded CPG company.

Brand Voice

Voice Attributes

- Attribute:

Corporate & Formal

Strength:Strong

Examples

- •

Hershey Reports Fourth-Quarter and Full-Year 2024 Financial Results; Provides 2025 Outlook.

- •

Tanner to Lead Global Growth and Innovation, Succeeding Retiring Michele Buck.

- •

Consolidated net sales of $2,887.5 million, an increase of 8.7%.

- Attribute:

Authoritative & Confident

Strength:Strong

Examples

Read how Hershey is leading where we can make the biggest impact...

a two-way collaboration between America's #1 Candy and #1 Cookie.

- Attribute:

Financial & Analytical

Strength:Strong

Examples

- •

Organic, constant currency net sales increased 9.0%.

- •

Adjusted earnings per share-diluted of $2.69, an increase of 33.2%.

- •

The gap between the reported and adjusted earnings per share growth outlooks primarily reflects a large derivative mark-to-market gain...

- Attribute:

Legacy-Oriented

Strength:Weak

Examples

Milton S. Hershey left us with a legacy of goodness—a legacy that lives on today...

Tone Analysis

Informational

Secondary Tones

- •

Financial

- •

Professional

- •

Pragmatic

Tone Shifts

The tone shifts slightly from formal corporate news on the main page to a more historical and reverent tone in the section about Milton S. Hershey.

The financial press release adopts a highly technical and analytical tone filled with financial jargon, appropriate for its target audience.

Voice Consistency Rating

Excellent

Consistency Issues

The brand voice is exceptionally consistent for its intended corporate audience. It does not attempt to adopt a consumer-friendly or playful tone, which maintains clarity of purpose for the website.

Value Proposition Assessment

For its key stakeholders (investors, partners, employees), The Hershey Company's value proposition is that of a resilient, innovative, and responsible leader in the snacking industry, leveraging iconic brands and operational excellence to deliver sustained growth and long-term value.

Value Proposition Components

- Component:

Financial Strength & Growth

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Iconic, Market-Leading Brand Portfolio

Clarity:Clear

Uniqueness:Unique

- Component:

Innovation and Strategic Partnerships

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Commitment to Responsibility & Legacy

Clarity:Somewhat Clear

Uniqueness:Unique

The messaging differentiates Hershey from competitors like Mars and Mondelez by subtly leaning on its unique American heritage and the powerful legacy of its founder, Milton S. Hershey. While competitors also focus on financial performance and brand strength, the 'legacy of goodness' is a unique Hershey narrative. The strength of its core brands, particularly the explicit mention of 'America's #1 Candy' (Reese's), is a key differentiator communicated effectively.

The messaging positions The Hershey Company as a stable, blue-chip CPG leader. It is not positioned as an aggressive disruptor but as a steady, reliable powerhouse focused on incremental growth, operational efficiency, and shareholder returns. The focus on domestic manufacturing and leadership news reinforces its image as a cornerstone of American business.

Audience Messaging

Target Personas

- Persona:

Investors & Financial Analysts

Tailored Messages

- •

Hershey Reports Fourth-Quarter and Full-Year 2024 Financial Results...

- •

Kirk Tanner Starts as CEO...

- •

2025 Full-Year Financial Outlook Summary

- •

Investor Relations

Effectiveness:Effective

- Persona:

Media & Journalists

Tailored Messages

- •

The REESE'S and OREO® Brands Announce Iconic Collaboration

- •

Kirk Tanner Named Our Next President and Chief Executive Officer

- •

Media

Effectiveness:Effective

- Persona:

Potential Corporate Employees & B2B Partners

Tailored Messages

- •

Retail Partners Invited to Collaborate and Unlock Growth

- •

Investing in Domestic Manufacturing and New Capabilities

- •

Celebrating employees at our West Hershey Manufacturing Facility

- •

Careers

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

For Investors: Uncertainty around leadership transitions (addressed by CEO announcements).

- •

For Investors: Concern over commodity price volatility (addressed directly in the financial outlook).

- •

For Partners: Need for collaborative growth opportunities (addressed in blog post).

Audience Aspirations Addressed

- •

For Investors: Desire for stable, long-term growth from a market leader.

- •

For Employees: Aspiration to work for a reputable, stable company with a positive legacy.

- •

For Partners: Aspiration to align with an innovative, category-leading brand.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Legacy & Tradition

Effectiveness:Medium

Examples

The Man Behind Good Chocolate and Good Business

Milton S. Hershey left us with a legacy of goodness—a legacy that lives on today...

- Appeal Type:

Pride & Leadership

Effectiveness:High

Examples

...a two-way collaboration between America's #1 Candy and #1 Cookie.

Read how Hershey is leading where we can make the biggest impact...

Social Proof Elements

- Proof Type:

Market Leadership

Impact:Strong

Examples

America's #1 Candy and #1 Cookie

- Proof Type:

Expertise & Authority

Impact:Strong

Examples

Detailed financial reports and forward-looking statements.

Hershey’s Global Customer Insights Center invites retail partners to collaborate...

Trust Indicators

- •

Detailed, transparent financial reporting.

- •

Prominent links to Investor Relations and Media contacts.

- •

Showcasing leadership team changes.

- •

Reference to the company's long history and founder's legacy.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Learn More

Location:Homepage (Multiple locations)

Clarity:Somewhat Clear

- Text:

Investor Relations

Location:Footer

Clarity:Clear

- Text:

Careers

Location:Footer

Clarity:Clear

- Text:

Learn More About Manufacturing Careers at Hershey

Location:Homepage Content Block

Clarity:Clear

The CTAs are functional but lack persuasive power. The ubiquitous 'Learn More' is generic and could be more descriptive and benefit-oriented (e.g., 'Read Our Report,' 'Explore the Partnership,' 'Meet Our New CEO'). The primary goal of the CTAs is to guide specific audiences to deeper informational content, and in that, they are clear but not compelling. They effectively serve a navigational purpose for an already-interested user.

Messaging Gaps Analysis

Critical Gaps

The corporate mission, 'Making more moments of goodness', is completely disconnected from the website's content. The site explains the 'what' (financials, news) but fails to connect it to the 'why' (goodness, happiness).

There is no clear, overarching brand narrative on the homepage that synthesizes the various news items into a cohesive story about where Hershey is headed.

Contradiction Points

There's a significant tonal dissonance between the emotional, consumer-centric mission ('moments of goodness') and the rational, analytical, and business-focused execution of the website. It feels like two different companies.

The message of being a collaborative partner is present but buried in a single news item, contradicting its potential strategic importance.

Underdeveloped Areas

The ESG (Environmental, Social, and Governance) story is underdeveloped. It's relegated to a downloadable report rather than being an integrated, engaging part of the site narrative.

The narrative around Milton Hershey's legacy is a powerful differentiator but is currently confined to a small, static panel. This story could be a central pillar of the entire corporate brand identity.

Messaging Quality

Strengths

- •

Excellent clarity and focus for its primary audiences: investors and media.

- •

Strong, consistent corporate voice that conveys authority and stability.

- •

Content is timely, relevant, and transparent, especially regarding financial performance and leadership.

- •

Effectively leverages the market dominance of its hero brands (e.g., Reese's) as proof of corporate strength.

Weaknesses

- •

Fails to bridge the corporate identity with the consumer brand promise, making the mission statement feel like an appendage rather than a core driver.

- •

Over-reliance on a news-feed structure for the homepage, which lacks a strategic, top-level narrative.

- •

Generic CTAs that reduce engagement and persuasive impact.

Opportunities

- •

Integrate the 'goodness' mission into corporate announcements. For example, frame manufacturing investments as 'creating goodness for communities through jobs and economic growth.'

- •

Develop a more robust, interactive section dedicated to the 'Shared Goodness Promise' to bring the CSR report to life and make it a central brand pillar.

- •

Elevate the messaging for B2B partners and talent acquisition to be more prominent, moving it from tertiary news items to primary navigation elements.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Messaging Hierarchy

Recommendation:Restructure the homepage to lead with a powerful statement that connects the business to the mission. E.g., 'A Legacy of Goodness. A Future of Growth.' Then, organize content under strategic pillars (Our Performance, Our Innovation, Our Responsibility, Our People) instead of just a chronological news feed.

Expected Impact:High

- Area:

Value Proposition Clarity

Recommendation:Create a dedicated 'About Us' or 'Our Strategy' page that explicitly states the company's value proposition for its different stakeholders, translating the 'moments of goodness' mission into tangible business objectives and outcomes.

Expected Impact:High

- Area:

ESG / CSR Communication

Recommendation:Transform the 'Responsible Business Report' from a PDF link into a dynamic, engaging section of the website with key metrics, stories, and infographics that demonstrate the 'goodness' mission in action.

Expected Impact:Medium

Quick Wins

Replace generic 'Learn More' CTAs with more specific and action-oriented text (e.g., 'See Financial Results,' 'Explore the Collaboration,' 'Read Our 2024 Report').

Add the corporate mission statement ('Making more moments of goodness') directly below the main hero image on the homepage to provide immediate context.

Long Term Recommendations

- •

Develop a unified messaging framework that equips company leaders to consistently connect financial and operational news back to the core mission of 'goodness.'

- •

Invest in creating content (videos, articles, infographics) that tells the stories behind the numbers, focusing on employees, community impact, and innovation.

- •

Conduct audience research with key stakeholder groups (beyond investors) to identify messaging gaps and opportunities for building a stronger emotional connection to the corporate brand.

The Hershey Company's corporate website is a masterclass in effective communication—but only for a narrow, financially-oriented audience. The messaging architecture, voice, and content are impeccably tailored to the needs of investors, analysts, and the media. It communicates financial stability, market leadership, and prudent governance with high clarity and authority. The financial press release is detailed, transparent, and provides exactly the kind of data this audience requires.

However, this singular focus creates a significant strategic gap. The brand's core mission—'Making more moments of goodness'—is almost entirely absent from the user experience. This creates a jarring disconnect between the warm, emotional promise of the Hershey consumer brand and the cold, rational presentation of its corporate parent. The site successfully reports on the business of Hershey but fails to tell the story of Hershey.

The key differentiation opportunity lies in weaving its unique legacy and commitment to 'goodness' into the corporate narrative. Currently, the story of Milton Hershey and the company's CSR efforts are treated as side notes rather than the central theme that underpins its financial success. Competitors also report earnings, but none have the unique founding story of Hershey. By failing to bridge this gap, the company misses an opportunity to build a more resilient corporate reputation and a deeper connection with a broader set of stakeholders, including potential employees, partners, and policymakers, who are increasingly motivated by purpose, not just profit.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Iconic, multi-generational brands like Hershey's, Reese's, and Kisses with extremely high brand recognition and consumer loyalty.

- •

Dominant market share in the U.S. chocolate and confectionery market.

- •

Consistent revenue generation, exceeding $11 billion annually, demonstrating sustained consumer demand.

- •

Successful expansion into the high-growth salty snacks category with brands like SkinnyPop and Dot's Homestyle Pretzels.

Improvement Areas

- •

Accelerate development of 'better-for-you' (BFY) product lines (e.g., lower sugar, organic, plant-based) to capture the health-conscious consumer segment.

- •

Expand premium and artisanal chocolate offerings to compete with brands like Lindt and capitalize on the premiumization trend.

- •

Increase portfolio diversification to reduce heavy dependence on the North American confectionery market.

Market Dynamics

Global confectionery market: ~5.7% CAGR; Global salty snacks market: ~5.8-6.0% CAGR.

Mature

Market Trends

- Trend:

Health and Wellness Focus

Business Impact:Growing consumer demand for snacks with functional benefits, clean labels, and reduced sugar content creates both a threat to legacy products and a significant opportunity for innovation in the BFY space.

- Trend:

Premiumization and Indulgence

Business Impact:Consumers are willing to pay more for high-quality, artisanal, and indulgent treats, creating an opportunity for margin expansion through premium product lines.

- Trend:

Sustainability and Ethical Sourcing

Business Impact:Increased consumer scrutiny on supply chains, particularly for cocoa, necessitates transparent and ethical sourcing practices to maintain brand reputation and appeal to conscious consumers.

- Trend:

Snackification and Convenience

Business Impact:Consumers are replacing traditional meals with snacks, driving growth in the overall snacking category and creating demand for portable, convenient options. This trend supports Hershey's expansion into salty snacks.

Challenging yet Favorable. The timing is challenging due to unprecedented cocoa price volatility, which is severely pressuring margins. However, it is favorable for portfolio diversification into the rapidly growing salty snacks category and for capturing the 'affordable indulgence' segment during periods of economic uncertainty.

Business Model Scalability

High

Characterized by high fixed costs in manufacturing and distribution, but significant variable costs tied to raw materials (especially cocoa), making it vulnerable to commodity price shocks.

High. Established global supply chains, manufacturing footprint, and distribution networks allow for economies of scale. The 'Advancing Agility & Automation' initiative aims to further improve operational leverage.

Scalability Constraints

- •

Extreme volatility in cocoa prices, directly impacting cost of goods sold and profitability.

- •

Dependence on agricultural commodities subject to climate change and geopolitical risks.

- •

Complex global supply chain with potential for disruptions.

- •

Manufacturing capacity constraints for high-growth salty snack brands.

Team Readiness

Strong. A recent CEO transition brings in Kirk Tanner, a seasoned CPG executive from PepsiCo with deep experience in beverages and snacks, signaling a strategic focus on diversification and growth. The existing leadership team has a proven track record of managing a large, complex organization.

Well-established functional structure suitable for a mature CPG company. Segmented focus on North America Confectionery, North America Salty Snacks, and International allows for specialized strategies.

Key Capability Gaps

- •

Agile innovation capabilities to rapidly develop and launch products in emerging sub-categories like 'better-for-you'.

- •

Advanced data analytics for real-time consumer trend prediction and supply chain optimization.

- •

Deep expertise in nascent international markets with high growth potential but different consumer preferences.

Growth Engine

Acquisition Channels

- Channel:

Retail Distribution (Supermarkets, C-Stores, Mass Merchandisers)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage the Global Customer Insights Center to deepen retail partnerships, optimize shelf placement, and drive in-store promotional effectiveness through data-driven collaboration.

- Channel:

E-commerce (Retailer sites, Pure-play)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest in a more robust direct-to-consumer (DTC) platform for personalized offerings and subscription services. Enhance digital marketing and data capture capabilities to improve online conversion.

- Channel:

Food Service

Effectiveness:Low

Optimization Potential:High

Recommendation:Expand partnerships with quick-service restaurants (QSRs) and other food service outlets for use of Hershey products as ingredients and toppings (e.g., Reese's in milkshakes).

Customer Journey

Primarily an impulse-driven, in-person retail purchase. The path is short: see product, recognize brand, purchase. The online path is more complex, involving search, comparison, and shipping.

Friction Points

- •

Out-of-stock situations on retail shelves for popular items.

- •

Price sensitivity, especially in response to price increases driven by commodity costs.

- •

Lack of sufficient 'better-for-you' options for health-conscious consumers in the core portfolio.

Journey Enhancement Priorities

{'area': 'In-Store Experience', 'recommendation': 'Utilize data analytics to optimize product assortment and promotional strategies for specific retail environments and shopper demographics.'}

{'area': 'Digital Engagement', 'recommendation': 'Create engaging digital content around recipes, brand heritage, and new product innovations to build a stronger direct relationship with consumers beyond the point of sale.'}

Retention Mechanisms

- Mechanism:

Brand Loyalty & Nostalgia

Effectiveness:High

Improvement Opportunity:Reinforce brand heritage through marketing campaigns while simultaneously introducing modern product variations to appeal to younger demographics.

- Mechanism:

Product Innovation & Line Extensions

Effectiveness:High

Improvement Opportunity:Increase the cadence of high-impact, limited-time-only (LTO) offerings and co-branded collaborations (e.g., Reese's & Oreo) to generate recurring consumer excitement and media buzz.

- Mechanism:

Seasonal Offerings

Effectiveness:High

Improvement Opportunity:Expand beyond major holidays (Halloween, Easter, Christmas) to create 'micro-seasons' or event-based products to drive incremental purchasing occasions.

Revenue Economics

Traditionally strong, but currently under severe pressure due to record-high cocoa prices, which are squeezing gross margins despite price increases. Salty snacks likely have more stable, albeit different, unit economics.

N/A - This metric is less relevant for a mass-market CPG company. More appropriate metrics are household penetration, purchase frequency, and market share.

Moderate. While revenue is massive, the 2025 outlook for a mid-30% decline in adjusted EPS indicates significant short-term inefficiency driven by external cost factors. [Financials]

Optimization Recommendations

- •

Implement strategic net price realization to offset commodity inflation without excessively impacting volume.

- •

Aggressively pursue cost savings through the 'Advancing Agility & Automation' initiative.

- •

Shift product mix towards higher-margin offerings, including premium chocolates and the salty snacks portfolio.

Scale Barriers

Technical Limitations

- Limitation:

Manufacturing Agility

Impact:Medium

Solution Approach:Invest in flexible manufacturing lines and automation (as planned with the 'Advancing Agility & Automation' initiative) to enable faster switching between products and more efficient production of smaller batches for LTOs and new product trials.

Operational Bottlenecks

- Bottleneck:

Cocoa Sourcing and Price Volatility

Growth Impact:This is the most critical barrier to profitable growth in the core confectionery business, directly threatening earnings and forcing difficult pricing decisions.

Resolution Strategy:Employ sophisticated hedging strategies, diversify cocoa sourcing origins, invest in sustainable farming practices to improve long-term yields, and explore product reformulations where feasible.

- Bottleneck:

Supply Chain Integration for Acquisitions

Growth Impact:Integrating newly acquired snack brands (like Dot's, LesserEvil) into Hershey's massive supply chain can create short-term inefficiencies.

Resolution Strategy:Standardize ERP systems and logistics processes while retaining the acquired brand's agile operational model where it provides a competitive advantage.

Market Penetration Challenges

- Challenge:

Intense Competition in a Mature Market

Severity:Critical

Mitigation Strategy:Compete against major players like Mars, Mondelez, and Nestlé through superior brand marketing, relentless innovation in core brands, and strategic M&A to enter new sub-segments.

- Challenge:

Shifting Consumer Preferences Toward Healthier Options

Severity:Major

Mitigation Strategy:Accelerate the 'better-for-you' strategy through both in-house R&D and acquisitions (e.g., Lily's, LesserEvil) to build a credible portfolio that meets this demand.

- Challenge:

Limited International Foothold

Severity:Major

Mitigation Strategy:Develop a more aggressive and tailored international expansion strategy, potentially through partnerships or acquisitions, focusing on high-potential emerging markets like India and Brazil.

Resource Limitations

Talent Gaps

- •

International market development experts with experience in Asia and Latin America.

- •

Food scientists and R&D talent specializing in plant-based and low-sugar formulations.

- •

Data scientists to translate consumer insights into actionable growth strategies.

Sufficient for ongoing operations and moderate acquisitions, but significant margin compression from cocoa costs could constrain capital available for large-scale, transformative M&A in the short term.

Infrastructure Needs

- •

Modernization and automation of existing manufacturing facilities.

- •

Expansion of manufacturing capacity for the rapidly growing salty snacks portfolio.

- •

Investment in a robust, scalable DTC e-commerce platform.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in Asia-Pacific & Latin America

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Utilize a phased market-entry strategy, starting with core brands adapted for local tastes. Consider joint ventures or acquiring local 'beachhead' brands to accelerate penetration.

- Expansion Vector:

Demographic Expansion to Health-Conscious Adults

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Create and aggressively market a distinct 'better-for-you' sub-brand or portfolio (building on Lily's and LesserEvil) that addresses demands for organic, low-sugar, and functional snacks.

Product Opportunities

- Opportunity:

Aggressively Scale the Salty Snacks Portfolio

Market Demand Evidence:The North America Salty Snacks segment is Hershey's fastest-growing division (35.9% sales increase in Q4 2024). The global market is growing at a strong CAGR. [Financials, 27]

Strategic Fit:High - Aligns with the 'Leading Snacking Powerhouse' vision and diversifies revenue away from cocoa-dependent products.

Development Recommendation:Prioritize investment in capacity expansion, brand building for Dot's and SkinnyPop, and further acquisitions in the space.

- Opportunity:

Launch a Premium/Artisanal Chocolate Line

Market Demand Evidence:The premium chocolate segment is growing, driven by consumer interest in high-quality ingredients, unique flavors, and ethical sourcing.

Strategic Fit:Medium - Leverages core chocolate expertise but requires a different branding and marketing approach than mass-market products.

Development Recommendation:Develop a new, distinct brand or leverage an acquired one (like Scharffen Berger) to target this segment, focusing on a strong origin story and superior quality.

Channel Diversification

- Channel:

Direct-to-Consumer (DTC) E-commerce

Fit Assessment:High

Implementation Strategy:Build a centralized DTC platform offering exclusive products, personalized bundles, and subscription options. Use the channel to gather first-party consumer data for product development.

- Channel:

Strategic Vending & Micro-Markets

Fit Assessment:Medium

Implementation Strategy:Partner with corporate wellness programs and automated retail providers to place a curated mix of indulgent and 'better-for-you' snacks in offices, airports, and universities.

Strategic Partnerships

- Partnership Type:

Co-Branding and Ingredient Licensing

Potential Partners

- •

Coffee chains (e.g., Starbucks, Dunkin')

- •

Ice cream brands (e.g., Ben & Jerry's)

- •

QSRs (e.g., McDonald's for McFlurry)

Expected Benefits:Increased brand visibility, royalty revenue, and reaching consumers in new consumption occasions. The Reese's/Oreo collaboration is a prime example of this model's success.

- Partnership Type:

Technology & Data Analytics

Potential Partners

AI-powered consumer insights platforms

Supply chain optimization software companies

Expected Benefits:Enhanced ability to forecast trends, optimize marketing spend, and improve supply chain resilience against commodity shocks.

Growth Strategy

North Star Metric

Share of Snacking Occasions

This metric aligns with the 'Leading Snacking Powerhouse' vision, moving beyond just confectionery market share. It forces a holistic view across all product categories (chocolate, sweets, salty snacks, protein bars) and focuses on capturing a larger slice of the consumer's total snacking behavior.

Increase share by 200 basis points over the next 3 years.

Growth Model

Portfolio Diversification & Core Optimization

Key Drivers

- •

Aggressive growth in the Salty Snacks portfolio.

- •

Strategic acquisitions in 'better-for-you' and other adjacent snacking categories.

- •

Profitability management and innovation within the core Confectionery business.

- •

Targeted international expansion.

Establish a dual-focus strategy: allocate significant growth capital (both organic and M&A) to the Salty Snacks division, while the Confectionery division focuses on margin protection, brand defense, and high-impact innovation.

Prioritized Initiatives

- Initiative:

Scale Salty Snacks Operations

Expected Impact:High

Implementation Effort:High

Timeframe:12-24 months

First Steps:Authorize capital expenditure for new manufacturing lines for SkinnyPop and Dot's. Launch a national marketing campaign for Dot's to increase brand awareness.

- Initiative:

Launch 'Hershey's BFY' Platform

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:9-18 months

First Steps:Consolidate Lily's, LesserEvil, and other BFY assets under a unified marketing umbrella. Task R&D with developing three new low-sugar or plant-based SKUs for pilot testing.

- Initiative:

Implement Cocoa Price Mitigation Plan

Expected Impact:High (on profitability)

Implementation Effort:Medium

Timeframe:Ongoing

First Steps:Execute a full-scale review of hedging strategy, supply contracts, and opportunities for reformulation or pack-size adjustments to protect 2025 margins.

Experimentation Plan

High Leverage Tests

- Test:

DTC Exclusive Flavor Drops

Hypothesis:Limited-edition, online-only flavors can drive high-margin sales and collect valuable data on emerging taste profiles.

- Test:

International Flavor Profiling

Hypothesis:A/B testing different flavor variations of core products (e.g., less sweet Reese's) in target international markets can identify winning formulas for expansion.

- Test:

Subscription Box for BFY Snacks

Hypothesis:A curated subscription service for healthy snacks can create a recurring revenue stream and build loyalty among health-conscious consumers.

Use an A/B testing framework measuring conversion rates, average order value (AOV), customer lifetime value (LTV), and repeat purchase rate for DTC experiments. For retail tests, use point-of-sale data to measure incremental lift and market share change in test vs. control markets.

Run monthly digital experiments and quarterly in-market retail pilots.

Growth Team

A centralized 'Growth & Innovation' team that works across business units, complemented by dedicated growth marketing roles within each major brand portfolio (Confectionery, Salty Snacks, BFY).

Key Roles

- •

Head of Salty Snacks Growth

- •

Director of 'Better-For-You' Innovation

- •

Head of International Market Development

- •

Lead Consumer Data Scientist

Acquire talent from faster-moving CPG categories and digitally native brands. Implement a culture of rapid testing and learning, empowering teams to run small-scale experiments without extensive bureaucracy.

The Hershey Company stands on a remarkably strong foundation, built upon iconic brands and dominant market share in its core North American confectionery business. However, it faces a pivotal moment. The unprecedented surge in cocoa prices represents a critical, near-term threat to profitability, as evidenced by the stark 2025 earnings outlook. This external shock, combined with the secular consumer trend towards healthier snacking, creates a compelling catalyst for strategic evolution.

The company's growth readiness is a tale of two portfolios. The mature confectionery business, while the cash engine, is now a defensive asset where growth must come from masterful price/mix management, cost optimization, and clever innovation to maintain share. In contrast, the burgeoning Salty Snacks division is the clear growth engine, displaying explosive momentum and offering a vital hedge against cocoa volatility.

Key growth opportunities lie in aggressively scaling this salty snacks portfolio, making a more concerted push into the 'better-for-you' category through its recent acquisitions, and pursuing disciplined international expansion. The recent appointment of CEO Kirk Tanner, with his extensive background at PepsiCo, is a strong signal that this diversification strategy will be central to Hershey's future.

To succeed, Hershey must navigate the immediate margin pressures in its core business while allocating sufficient capital and talent to fuel its high-growth ventures. The primary challenge is not one of potential, but of execution: transforming from a chocolate-centric giant into a truly diversified 'Leading Snacking Powerhouse'.

Legal Compliance

The Hershey Company maintains a comprehensive and robust Privacy Policy, prominently accessible from the website's footer. The policy is exemplary in its clarity and scope, specifically addressing the rights of consumers under various international and US state-level data privacy laws, including GDPR (for EEA, UK, Switzerland), and specific provisions for residents of California (CCPA/CPRA), Virginia, Colorado, Connecticut, Utah, Nevada, Brazil, Canada, Mexico, and India. It clearly outlines the categories of personal information collected, the purposes for its use, and the categories of third parties with whom it is shared. The policy details the legal bases for processing data, such as consent and contractual necessity, which aligns with GDPR principles. This demonstrates a sophisticated and proactive approach to managing a complex web of global privacy regulations, positioning the company well to maintain market access and customer trust.

The website's terms of use, referred to as 'Legal Information' and accessible from the footer, are clearly written and cover essential areas for a corporate site. They establish a binding agreement, define intellectual property rights over website content, disclaim liability, and include a policy on unsolicited idea submissions. The terms are standard for a large corporation and effectively manage legal risk by setting clear expectations for website use. They are enforceable and provide a solid legal framework governing the use of the company's digital corporate assets.

The Hershey Company has implemented a sophisticated cookie consent mechanism, likely through a third-party consent management platform. Upon visiting the site, users are presented with a clear banner that provides options to 'Accept All Cookies' or manage 'Cookie Settings'. This granular control allows users to opt-in or out of different categories of cookies (e.g., Performance, Functional, Targeting), which is in line with the stringent requirements of GDPR. This approach is a best practice, as it respects user autonomy and is essential for compliance in the European Union and other regions with similar opt-in consent laws. The use of a preference center demonstrates a mature approach to cookie compliance.

The company's data protection framework is exceptionally strong, reflecting its global footprint. For GDPR, the privacy policy identifies a specific EU representative and outlines the legal bases for data processing. For CCPA/CPRA, the policy provides detailed disclosures required by California law and facilitates consumer rights requests through a 'Your Privacy Choices' link in the footer. This portal allows users to opt-out of the 'sale' or 'sharing' of their personal information and exercise other rights. The company also states its recognition of browser-based opt-out signals like the Global Privacy Control (GPC), which is a progressive and compliant feature under CPRA. This comprehensive and multi-jurisdictional approach significantly mitigates regulatory risk and enhances consumer trust.

The Hershey Company demonstrates a strong and public commitment to web accessibility. The website explicitly states its goal to conform to the Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. It provides features like a 'high contrast' mode toggle and 'skip to main content' links. More importantly, the company has a dedicated accessibility page and provides an email address ([email protected]) for users to report issues, indicating an active and responsive policy. This proactive stance is critical for complying with the Americans with Disabilities Act (ADA), which applies to websites as places of public accommodation, and helps mitigate the significant legal risk associated with accessibility lawsuits.

As a publicly-traded food and beverage company, The Hershey Company's corporate website correctly prioritizes compliance with SEC and FTC regulations. The financial press releases contain a detailed 'Safe Harbor Statement' that addresses forward-looking statements, which is a critical requirement of the Private Securities Litigation Reform Act of 1995 to mitigate securities litigation risk. The detailed reconciliation of GAAP to non-GAAP financial measures is also in line with SEC requirements. From an FTC/FDA perspective, the corporate site is careful not to make specific health or product claims that would require substantiation. The information in the 'Responsible Business Report' and other corporate communications appears to be carefully vetted to avoid misleading statements, which is crucial as both the FTC and SEC increase scrutiny on ESG (Environmental, Social, and Governance) claims.

Compliance Gaps

No significant structural compliance gaps were identified on the corporate website. The legal and privacy infrastructure is mature and comprehensive.

Compliance Strengths

- •