eScore

tractorsupply.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Tractor Supply has a dominant digital presence rooted in its exceptional omnichannel strategy, where the website and physical stores are deeply integrated. Its content strongly aligns with the transactional and informational needs of its niche 'Life Out Here' audience, giving it high authority in the rural lifestyle sector. The company masterfully leverages its vast store network for a powerful hyper-local search advantage, capturing 'near me' intent for products and services, which constitutes a key competitive advantage. While its multi-channel presence is consistent, there's an opportunity to better connect its top-of-funnel informational content directly to commerce to further optimize the user journey.

Exceptional integration of their ~2,300 physical stores into their digital strategy, with 80% of online orders fulfilled in-store, creating a powerful local and omnichannel advantage that online-only competitors cannot replicate.

Systematically link 'how-to' and project-based content from the 'Life Out Here' blog to shoppable product lists and service appointment tools to reduce friction between customer research and conversion.

The company's brand communication is exceptionally effective due to its authentic and consistent 'Life Out Here' messaging, which resonates deeply with its clearly defined customer segments. This narrative creates a powerful emotional connection and differentiates the brand from generic big-box or online retailers. Messaging is skillfully tailored across personas like hobby farmers and pet enthusiasts, addressing their specific pain points and aspirations. While the brand voice is strong, the website's homepage relies more on implied value rather than a direct, declarative statement, which could be a missed opportunity for new visitors.

The 'Life Out Here' brand ethos is a masterclass in differentiation, creating a strong sense of community and identity that fosters intense customer loyalty and insulates the brand from price-based competition.

Implement a primary hero section on the homepage with a clear, concise headline that explicitly states the core value proposition (e.g., 'Your Partner for Life Out Here') to immediately frame the experience for new users.

Tractor Supply offers a functional and accessible conversion experience, underscored by a strong commitment to WCAG 2.1 AA standards and a seamless omnichannel journey for buy-online-pickup-in-store (BOPIS) customers. However, the user experience is significantly hampered by high visual clutter and information overload on key pages, leading to a heavy cognitive load for users. The inconsistent use of the color red for both calls-to-action and non-interactive elements like pricing dilutes the visual hierarchy and weakens conversion cues. The overall experience prioritizes function over form, missing opportunities for engaging micro-interactions.

The highly effective and popular Buy-Online-Pickup-In-Store (BOPIS) process is a major friction reducer, leveraging the physical store footprint to provide a convenient and cost-effective fulfillment option for customers.

Implement a standardized interaction color system. Define a primary action color (e.g., green or orange) to be used *exclusively* for 'Add to Cart' and 'Checkout' buttons to create an unambiguous visual path to purchase.

The company builds strong day-to-day credibility through immense social proof, with customer ratings and reviews prominently displayed on all products. Trust is further enhanced by the presence of well-known national brands and a large physical store network. However, this is severely undermined by a high-profile judicial enforcement action from the California Privacy Protection Agency (CPPA) for allegedly failing to honor consumer opt-out requests. This indicates a critical disconnect between their stated privacy policy and actual practice, representing a significant legal, financial, and reputational risk that damages overall credibility.

Overwhelming use of customer reviews and ratings on product pages serves as a powerful and continuous trust signal that guides purchasing decisions and validates product quality.

Urgently and transparently resolve the non-compliance issues raised by the CPPA. This requires an immediate internal audit of data processing, rectification of any failures in honoring consumer data rights, and a public reaffirmation of their commitment to customer privacy to rebuild trust.

Tractor Supply has constructed a formidable and highly sustainable competitive moat. This advantage is not based on one factor, but a reinforcing ecosystem of a dominant brand identity, a strategically located network of ~2,300 stores, integrated in-store services (e.g., PetVet clinics), a growing portfolio of high-margin private labels, and the powerful Neighbor's Club loyalty program with over 41 million members. This combination is exceptionally difficult for competitors—whether big-box, online-only, or regional—to replicate, giving them durable market power.

The Neighbor's Club loyalty program, with over 41 million members driving over 80% of sales, provides a massive data advantage for personalization and creates a powerful network effect that fosters deep customer retention.

Expand in-store services to include new, high-margin offerings like small-engine repair to further leverage the store footprint, drive repeat traffic, and create an even stickier customer relationship.

The company demonstrates high scalability and clear expansion potential, guided by its 'Life Out Here 2030' strategy. Growth is driven by a proven and profitable model for new store openings, with plans to increase the total footprint to 3,200 stores. Furthermore, Tractor Supply is intelligently expanding into new, high-margin verticals like B2B direct sales, a retail media network, and Pet Rx services, significantly increasing its total addressable market. Strong unit economics, fueled by repeat purchases of consumable goods and high customer lifetime value, provide a robust financial foundation for these growth investments.

A clear, multi-pronged growth strategy that includes expanding the proven store model while simultaneously launching new, high-margin business verticals like B2B sales and Pet Rx, expanding the company's total addressable market to $225 billion.

Invest in 'final mile' delivery logistics to support the B2B Direct Sales initiative and better compete with e-commerce rivals on the delivery of large and bulky items to rural locations.

Tractor Supply's business model is exceptionally coherent and strategically focused. Every element, from its curated product assortment and in-store services to its 'Neighbor's Club' loyalty program, is tightly aligned with serving the specific needs of the 'Life Out Here' customer. Resource allocation is disciplined, with strategic investments in store remodels, supply chain, and digital capabilities that directly support the core mission. The company has successfully layered new revenue streams (private labels, services, retail media) onto its retail foundation without losing its laser-like focus on its niche market.

An unwavering strategic focus on the 'rural lifestyle' niche, which informs every business decision and creates a highly integrated, defensible, and authentic business model.

More deeply integrate service offerings with product sales through bundled promotions (e.g., a discount on pet grooming supplies after a Pet Wash visit) to increase service utilization and average transaction value.

As the largest rural lifestyle retailer in the U.S., Tractor Supply wields significant market power. Its dominant market share, extensive store footprint, and strong brand recognition grant it substantial leverage with suppliers and influence over market trends within its niche. The company exhibits moderate pricing power, balanced by its 'everyday low prices' value proposition, but its high-margin private label brands are a key strength. With a highly diversified customer base of over 41 million loyalty members, the company faces very low customer dependency risk.

Dominant market share and brand leadership in a defensible niche gives Tractor Supply significant negotiating power with suppliers and the ability to influence industry trends.

Increase the penetration of exclusive and private-label brands to further improve gross margins, enhance pricing power, and create stronger differentiation from competitors.

Business Overview

Business Classification

Omni-channel Retail

Services Provider

Retail

Sub Verticals

- •

Rural Lifestyle

- •

Farm & Ranch Supply

- •

Pet Supply

- •

Home Improvement & Garden

Mature

Maturity Indicators

- •

Founded in 1938, demonstrating long-term operational history.

- •

Operates over 2,500 retail stores across 49 states.

- •

Publicly traded on NASDAQ (TSCO) and a component of the S&P 500.

- •

Consistent annual revenue growth, reaching nearly $14.9 billion in fiscal 2024.

- •

Established history of returning capital to shareholders through dividends and share repurchases.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Product Sales (In-Store & eCommerce)

Description:Direct sale of a wide range of products including livestock and pet supplies, hardware, tools, workwear, and lawn and garden items. This constitutes the vast majority of company revenue.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:Medium

- Stream Name:

In-Store Services

Description:Fee-based services offered at physical locations, including pet washing stations, PetVet clinics for basic veterinary care, propane refills, and trailer rentals.

Estimated Importance:Secondary

Customer Segment:Homeowners with Land, Pet & Animal Owners

Estimated Margin:Medium-High

- Stream Name:

Private Label & Exclusive Brands

Description:Sales from company-owned or exclusive brands such as 4health (pet food), Producer's Pride (feed), and Red Shed (decor), which typically offer higher margins than national brands.

Estimated Importance:Secondary

Customer Segment:All Segments

Estimated Margin:High

- Stream Name:

Tractor Supply Retail Media Network

Description:A newer initiative to generate revenue by offering brand partners advertising opportunities on its platforms, activating a new profit stream.

Estimated Importance:Tertiary

Customer Segment:Strategic Partners (B2B)

Estimated Margin:High

Recurring Revenue Components

Subscription-based 'Autoship' for consumables like pet food and feed, offering a 5% discount.

Neighbor's Club loyalty program, driving repeat purchases and customer retention, accounting for over 75% of sales.

Pricing Strategy

Value-Based Pricing

Mid-range

Transparent

Pricing Psychology

- •

Everyday Low Prices: Core to the company's mission statement to provide value.

- •

Promotional Pricing: Utilizes weekly deals, sales, and clearance events to drive traffic and sales.

- •

Loyalty Program Incentives: Tiered rewards and exclusive offers for Neighbor's Club members.

- •

Subscription Discounts: Encourages recurring purchases through automated delivery savings.

Monetization Assessment

Strengths

- •

Diversified product mix with a strong emphasis on needs-based, consumable products (C.U.E.), providing revenue stability.

- •

Highly successful loyalty program (Neighbor's Club) with over 38 million members, driving significant repeat business and valuable customer data.

- •

Growing portfolio of high-margin private label brands enhances profitability.

- •

Integration of services creates additional revenue streams and increases store traffic.

Weaknesses

- •

Susceptibility to economic downturns that affect consumer discretionary spending on big-ticket items.

- •

Heavy reliance on the economic health of rural and exurban communities.

- •

Margin pressure from rising SG&A costs related to strategic investments in stores, supply chain, and technology.

Opportunities

- •

Expansion of high-margin services like Pet and Animal Rx.

- •

Growth of the B2B 'Direct Sales' channel targeting larger farms and small businesses.

- •

Scaling the Tractor Supply Retail Media Network as a new, high-margin revenue stream.

- •

Leveraging loyalty program data for increased personalization and targeted promotions.

Threats

- •

Intense competition from big-box retailers (Home Depot, Lowe's), mass merchants (Walmart), and online specialists.

- •

Shifts in consumer behavior, such as a move away from rural living or towards pure-play eCommerce.

- •

Supply chain disruptions and inflationary pressures impacting cost of goods and consumer prices.

Market Positioning

Niche Market Leadership

Market Leader in the U.S. rural lifestyle retail sector, with an estimated 68.4% market share in the Farm Supply Stores industry.

Target Segments

- Segment Name:

Hobby Farmers & Ranchers

Description:Individuals and families who do not farm for their primary income but engage in small-scale farming and livestock care. They are passionate about a self-sufficient, hands-on lifestyle.

Demographic Factors

- •

Rural and exurban residents

- •

Landowners

- •

Middle-to-upper income

Psychographic Factors

- •

Values self-reliance, community, and tradition

- •

Enjoys working with their hands and being outdoors

- •

Sees farming/ranching as a passion or lifestyle

Behavioral Factors

- •

Frequent purchases of consumable goods (feed, animal health).

- •

Seasonal purchases of equipment and supplies (gardening, fencing).

- •

Seeks knowledgeable advice and reliable products.

Pain Points

- •

Lack of a single, convenient source for a wide variety of specific needs.

- •

Difficulty finding knowledgeable staff in generalist big-box stores.

- •

Need for durable, reliable products that can withstand outdoor use.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Homeowners with Land

Description:Suburban and rural homeowners with larger properties that require maintenance, landscaping, and outdoor power equipment. They may own pets or backyard chickens.

Demographic Factors

- •

Suburban and rural locations

- •

Property owners (1+ acres)

- •

Families

Psychographic Factors

- •

DIY (Do-It-Yourself) mindset

- •

Pride in property appearance and maintenance

- •

Enjoys outdoor living and recreation

Behavioral Factors

- •

Project-based purchasing (e.g., building a fence, starting a garden).

- •

Regular purchases of lawn care, pest control, and pet supplies.

- •

Values convenience and product availability.

Pain Points

- •

Need for heavy-duty equipment not always available at standard home improvement stores.

- •

Managing the upkeep of a large property.

- •

Transporting large or bulky items like mowers or fencing.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Pet & Animal Enthusiasts

Description:A broad segment that includes owners of domestic pets (dogs, cats) as well as equine, poultry, and other livestock. Their focus is on the health, care, and well-being of their animals. This segment increasingly overlaps with suburban customers.

Demographic Factors

Crosses rural, suburban, and exurban lines

High rate of pet ownership

Psychographic Factors

- •

View pets as members of the family ('pet humanization').

- •

Concerned with animal nutrition and health.

- •

Seeks specialized products and services (e.g., specific feed brands, vet clinics).

Behavioral Factors

- •

High frequency, recurring purchases of food and supplies.

- •

Willingness to spend on premium and specialized products.

- •

Utilizes services like pet wash stations and veterinary clinics.

Pain Points

- •

Finding specialty or large-quantity feed and supplies.

- •

High cost of veterinary care.

- •

Convenience of getting products and services in one location.

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Niche Specialization

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive Physical Store Footprint

Strength:Strong

Sustainability:Sustainable

- Factor:

Private & Exclusive Brands

Strength:Moderate

Sustainability:Sustainable

- Factor:

Integrated In-Store Services

Strength:Moderate

Sustainability:Sustainable

- Factor:

Neighbor's Club Loyalty Program

Strength:Strong

Sustainability:Sustainable

Value Proposition

Tractor Supply is the go-to, one-stop destination for the 'Life Out Here' lifestyle, providing a curated selection of essential, high-quality products and services for rural and suburban homeowners, farmers, and pet owners at everyday low prices, backed by legendary customer service.

Excellent

Key Benefits

- Benefit:

One-Stop Convenience

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Broad product assortment covering farm, pet, lawn, garden, and tools.

In-store services like propane refills, pet wash, and vet clinics.

- Benefit:

Specialized Product Assortment

Importance:Critical

Differentiation:Unique

Proof Elements

Carries items not found at typical big-box retailers (e.g., livestock feed, fencing, tractor parts).

Offers a wide range of private and exclusive brands tailored to customer needs.

- Benefit:

Knowledgeable Customer Service

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Emphasis on hiring team members who understand the rural lifestyle.

Mission of providing 'legendary service'.

- Benefit:

Value and Fair Pricing

Importance:Important

Differentiation:Common

Proof Elements

'Everyday low prices' commitment.

Price matching, weekly deals, and loyalty rewards.

Unique Selling Points

- Usp:

The authentic outfitter for the 'Life Out Here' rural lifestyle.

Sustainability:Long-term

Defensibility:Strong

- Usp:

An extensive network of conveniently located stores that serve as community hubs for a niche demographic.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A massive and highly engaged loyalty program that provides deep customer insights and drives repeat business.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Sourcing a wide range of specialized supplies for farm, home, and pets is inconvenient and requires multiple shopping trips.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Finding expert advice and durable products suited for a rural, hands-on lifestyle at generalist retailers.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Accessing basic animal care services (like vaccinations or grooming) conveniently and affordably.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition is exceptionally well-aligned with the needs of the growing rural lifestyle market, which values self-sufficiency, convenience, and specialized products.

High

The company deeply understands its core customer segments and has tailored its product mix, store experience, and marketing to resonate authentically with their values and needs.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Major brands (e.g., Purina, Carhartt, John Deere).

- •

Private label manufacturers.

- •

Service providers (e.g., PetVet clinics).

- •

Logistics and distribution partners.

- •

Financial partners for co-branded credit cards.

Key Activities

- •

Retail operations and store management.

- •

Merchandising and curated product sourcing.

- •

Supply chain and inventory management.

- •

eCommerce platform development and management.

- •

Marketing and brand building around the 'Life Out Here' ethos.

Key Resources

- •

Extensive physical store network (~2,500+ locations).

- •

Efficient distribution centers and logistics infrastructure.

- •

Strong brand reputation and customer loyalty.

- •

Neighbor's Club customer data.

- •

Knowledgeable employee base ('Team Members').

Cost Structure

- •

Cost of Goods Sold (COGS).

- •

Selling, General & Administrative (SG&A) expenses, including employee wages, store leases, and marketing.

- •

Capital expenditures for new stores, remodels (Project Fusion), and technology.

- •

Investment in supply chain and distribution infrastructure.

Swot Analysis

Strengths

- •

Dominant market leader in a defensible niche.

- •

Strong brand loyalty and a massive, data-rich loyalty program.

- •

Resilient business model with a high mix of essential, needs-based products.

- •

Proven ability to grow store footprint and comparable store sales.

- •

Successful integration of physical stores, e-commerce, and services.

Weaknesses

- •

Performance is linked to the economic health of rural America, which can be volatile.

- •

Lower brand recognition in dense urban centers, limiting expansion potential there.

- •

Rising operating expenses from investments in wages, supply chain, and technology could pressure margins.

Opportunities

- •

Expand total addressable market through new strategic initiatives like Pet Rx and B2B Direct Sales.

- •

Increase penetration of high-margin private and exclusive brands.

- •

Leverage customer data to enhance personalization and drive online sales growth.

- •

Further expansion of in-store services to drive traffic and create new revenue streams.

- •

Capitalize on the growing trend of homesteading and self-sufficiency.

Threats

- •

Intensifying competition from big-box retailers, e-commerce pure-plays, and other farm stores.

- •

Potential for economic downturns to reduce spending on higher-ticket, discretionary items.

- •

Changes in consumer behavior or land use patterns that diminish the rural lifestyle trend.

- •

Risks associated with supply chain disruptions, tariffs, and inflation.

Recommendations

Priority Improvements

- Area:

Digital Experience & Personalization

Recommendation:Leverage the 38M+ member Neighbor's Club dataset to create a hyper-personalized online and in-app experience. Offer customized promotions, product recommendations, and content based on purchase history and stated interests (e.g., 'poultry owner,' 'gardener').

Expected Impact:High

- Area:

Service Integration

Recommendation:More deeply integrate services with product sales. For example, offer a discount on grooming supplies after a Pet Wash visit or a bundled deal on trailer accessories with a trailer rental. Promote these service offerings more aggressively through digital channels.

Expected Impact:Medium

- Area:

Supply Chain Optimization

Recommendation:Continue to invest in final-mile delivery solutions to support the B2B 'Direct Sales' initiative and compete with e-commerce rivals. Focus on improving visibility and reliability for bulk and large-item deliveries.

Expected Impact:High

Business Model Innovation

- •

Develop a 'Tractor Supply Services Marketplace' that connects customers with vetted local service providers for tasks like fence installation, equipment repair, or land clearing, taking a commission on referrals.

- •

Launch in-store workshops and community events (e.g., chicken-raising 101, canning basics, sustainable gardening) to solidify the store's role as a community hub and drive traffic, potentially as a premium, paid offering.

- •

Create curated subscription boxes ('Homesteader Box,' 'New Pet Owner Kit') that bundle private label products and partner brands to generate a new recurring revenue stream.

Revenue Diversification

- •

Aggressively scale the 'Pet and Animal Rx' program to capture a larger share of the high-margin animal pharmacy market.

- •

Expand the B2B 'Direct Sales' program with dedicated account managers and a tailored product/pricing catalog to serve larger agricultural and commercial customers.

- •

Further build out the 'Tractor Supply Retail Media Network' as a significant, high-margin revenue stream by offering more sophisticated advertising and data products to vendor partners.

Tractor Supply Company has masterfully evolved its business model from a traditional farm supply store into a dominant, omni-channel rural lifestyle brand. The company's core strength lies in its deep, unwavering focus on a niche market it brands as 'Life Out Here.' This strategic clarity informs every aspect of the business, from its curated product assortment—which skillfully blends needs-based consumables with discretionary items—to its physical store locations that serve as vital hubs in rural and exurban communities.

The business model demonstrates exceptional resilience, underpinned by a high mix of non-discretionary products and a powerful loyalty program, the 'Neighbor's Club,' which boasts over 38 million members and accounts for the majority of sales. This program is a significant competitive moat, providing invaluable data for personalization while fostering a level of customer retention that is difficult for generalist competitors to replicate.

Strategically, Tractor Supply is not resting on its laurels. The company is in a phase of calculated evolution, expanding its addressable market by layering high-margin services (PetVet, Pet Wash) and new growth initiatives (Pet Rx, B2B Direct Sales, Retail Media Network) onto its robust retail foundation. This evolution from a pure product seller to a solutions provider is critical for future growth and margin expansion. The emphasis on private and exclusive brands further strengthens its value proposition and profitability.

The primary challenge moving forward will be navigating a competitive landscape that includes formidable big-box retailers and agile online players, all while managing the inherent risks of economic cyclicality in its target markets. However, the company's clear strategic vision, 'Life Out Here 2030,' demonstrates a proactive approach to addressing these challenges by doubling down on its niche, expanding its service offerings, and investing in its supply chain and digital capabilities. By continuing to execute this strategy, Tractor Supply is well-positioned to maintain its market leadership and deliver sustained, steady growth.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Economies of Scale and Supply Chain

Impact:High

- Barrier:

Strong Brand Recognition and Customer Loyalty

Impact:High

- Barrier:

Capital Investment for Store Footprint

Impact:High

- Barrier:

Specialized Product Curation and Knowledge

Impact:Medium

- Barrier:

Exclusive Supplier and Private Label Relationships

Impact:Medium

Industry Trends

- Trend:

Omnichannel Integration (Buy Online, Pickup In-Store, Same-Day Delivery)

Impact On Business:Critical for meeting customer expectations for convenience and requires significant investment in digital infrastructure and store process alignment.

Timeline:Immediate

- Trend:

Growth in Hobby Farming, Homesteading, and Outdoor Activities

Impact On Business:Directly expands the core customer base and increases demand for Tractor Supply's niche product categories.

Timeline:Immediate

- Trend:

Increased Spending on Pets ('Pet Humanization')

Impact On Business:Drives growth in high-margin pet categories, including premium food, healthcare services (PetVet), and supplies.

Timeline:Immediate

- Trend:

Demand for Sustainable and Organic Products

Impact On Business:Creates an opportunity to attract new customer segments and enhance brand image, but requires new sourcing and marketing strategies.

Timeline:Near-term

- Trend:

Personalization through Data Analytics

Impact On Business:Enhances the effectiveness of loyalty programs like Neighbor's Club and allows for tailored marketing, increasing customer lifetime value.

Timeline:Near-term

Direct Competitors

- →

Rural King

Market Share Estimate:Significantly smaller than Tractor Supply, but a strong regional player.

Target Audience Overlap:High

Competitive Positioning:Positions as 'America's Farm and Home Store' with a strong emphasis on value pricing and a quirky, friendly in-store experience (e.g., free popcorn).

Strengths

- •

Aggressive value-based pricing.

- •

Broader selection of firearms and ammunition.

- •

Unique in-store experience that builds a loyal following.

- •

Strong brand identity in its core regions.

Weaknesses

- •

Less developed e-commerce and omnichannel capabilities compared to Tractor Supply.

- •

Smaller store footprint and national presence.

- •

Brand recognition is lower outside of its primary operating regions.

- •

Potentially less sophisticated data analytics and personalization efforts.

Differentiators

- •

Emphasis on a 'country store' atmosphere.

- •

Free popcorn for customers.

- •

Often carries a wider variety of groceries and everyday household goods.

- →

Fleet Farm

Market Share Estimate:Strong competitor in the Upper Midwest, but smaller overall than Tractor Supply.

Target Audience Overlap:High

Competitive Positioning:A one-stop shop for 'life in the Midwest,' serving farm, outdoor, and suburban communities with a broad merchandise mix.

Strengths

- •

Strong brand loyalty in the Upper Midwest.

- •

Often includes gas stations, car washes, and auto repair services, increasing store traffic.

- •

Deep product selection in fishing, hunting, and automotive categories.

- •

Investing in digital transformation and customer data platforms to enhance personalization.

Weaknesses

- •

Geographically concentrated, limiting national reach.

- •

The brand message may not resonate as strongly outside the Midwest.

- •

Historically slower to expand and adapt new retail technologies compared to Tractor Supply.

Differentiators

- •

Inclusion of full-service auto centers.

- •

Stronger emphasis on fishing and marine products.

- •

Cat-and-dog-mascot branding is distinct and memorable.

- →

Atwood's Ranch & Home

Market Share Estimate:A niche regional player, primarily in Oklahoma, Texas, and surrounding states.

Target Audience Overlap:High

Competitive Positioning:Family-owned business providing farm and ranch supplies at discount prices with a family-friendly atmosphere.

Strengths

- •

Deeply rooted in its local communities with a loyal customer base.

- •

Strong private-label offerings.

- •

Focus on core farm and ranch supplies.

Weaknesses

- •

Limited geographic footprint.

- •

Significantly smaller revenue and scale, leading to less purchasing power.

- •

Less sophisticated digital presence and marketing capabilities.

- •

Vulnerable to aggressive expansion by larger competitors like Tractor Supply.

Differentiators

Emphasizes its family-owned heritage.

Product assortment is highly tailored to its specific Southwest region.

Indirect Competitors

- →

The Home Depot & Lowe's

Description:Big-box home improvement retailers that compete directly in several key categories like lawn & garden, outdoor power equipment, tools, and fencing.

Threat Level:High

Potential For Direct Competition:Low (Unlikely to adopt the full rural lifestyle product mix, but will continue to be fierce competitors in overlapping categories).

- →

Chewy, Petco, & PetSmart

Description:Specialty pet supply retailers (both online and brick-and-mortar) that compete for the highly profitable pet food, supplies, and services market. Chewy is a major digital disruptor.

Threat Level:High

Potential For Direct Competition:Low (Focused exclusively on pets, will not expand into farm and ranch).

- →

Walmart & Amazon

Description:Mass-market retailers offering a wide array of products, including pet food, workwear, basic tools, and outdoor living items, often at lower prices.

Threat Level:Medium

Potential For Direct Competition:Low (Lack the specialized product assortment, in-store services, and expert staff to serve the core rural customer's needs).

- →

Local Farm & Feed Stores / Co-ops

Description:Independent, locally-owned stores that offer deep community ties and specialized knowledge, particularly for livestock feed and farm-specific needs.

Threat Level:Low

Potential For Direct Competition:N/A (Represents fragmented competition, not a single entity that could scale).

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Dominant Brand Identity and 'Life Out Here' Lifestyle Marketing

Sustainability Assessment:Highly sustainable; deeply resonates with a loyal, niche customer base that is difficult for broad-market retailers to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Extensive and Strategically Located Store Footprint

Sustainability Assessment:Highly sustainable; stores are conveniently located for rural and suburban customers, creating a physical moat that is expensive and time-consuming to copy.

Competitor Replication Difficulty:Hard

- Advantage:

Integrated In-Store Services (PetVet, Pet Wash, Propane)

Sustainability Assessment:Sustainable; these services drive repeat foot traffic and cannot be replicated by online-only competitors, creating a sticky customer relationship.

Competitor Replication Difficulty:Medium

- Advantage:

Strong Portfolio of Exclusive Private-Label Brands

Sustainability Assessment:Sustainable; brands like 4health and Producer's Pride drive customer loyalty, improve profit margins, and are not available elsewhere.

Competitor Replication Difficulty:Medium

- Advantage:

Neighbor's Club Loyalty Program and Customer Data

Sustainability Assessment:Highly sustainable; with over 38 million members, the program provides valuable data for personalization and drives significant repeat business.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Exclusive Short-Term Product Offerings', 'estimated_duration': '1-2 years'}

{'advantage': "Promotional Pricing and Seasonal Events like 'Chick Days'", 'estimated_duration': 'Seasonal/Event-based'}

Disadvantages

- Disadvantage:

Price Perception on Commodity Items vs. Mass Merchants

Impact:Major

Addressability:Moderately

- Disadvantage:

Limited Appeal in Dense Urban Markets

Impact:Minor

Addressability:Difficult

- Disadvantage:

Vulnerability to Economic Downturns in Rural Economies

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted digital marketing campaigns promoting in-store services (Pet Wash, Trailer Rental) to existing Neighbor's Club members.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Optimize the website and app to prominently feature 'Buy Online, Pickup In-Store' for heavy and bulky items, highlighting the convenience factor over competitors.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Create and promote product bundles for common projects (e.g., 'New Chicken Coop Starter Kit', 'Fall Lawn Care Package') to increase average order value.

Expected Impact:Low

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Expand the in-store PetVet clinic offerings to include more advanced services, creating a stronger healthcare destination for pets and livestock.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in a dedicated content platform ('Life Out Here University') with expert-led video tutorials and guides to become the definitive resource for hobby farmers and rural homeowners.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Further develop private label brands by expanding into adjacent categories like higher-end workwear, outdoor recreation gear, and sustainable farming supplies.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Develop and pilot a small-engine repair service in select stores to create a new high-margin revenue stream and drive loyalty from equipment purchasers.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore strategic acquisitions of smaller, regional competitors to accelerate market penetration and consolidate the rural lifestyle retail space.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Launch a 'Tractor Supply Retail Media Network' to monetize website traffic and customer data by selling ad space to non-competing brand partners.

Expected Impact:Medium

Implementation Difficulty:Moderate

Solidify Tractor Supply's position as the indispensable 'Lifestyle Partner' for rural America, moving beyond retail transactions to build a community centered on expertise, service, and shared values.

Differentiate through an unparalleled ecosystem of specialized products (especially private label), essential services (pet care, rentals, repair), and community engagement that generalist retailers cannot economically or authentically replicate.

Whitespace Opportunities

- Opportunity:

In-Store Small Engine & Equipment Repair Service

Competitive Gap:Home Depot and Lowe's have limited repair services, and local independent shops are disappearing. This service would lock in customers who purchase mowers, chainsaws, etc.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Educational Workshops and Community Events

Competitive Gap:No major competitor consistently offers hands-on education. Workshops on topics like 'Raising Chickens 101' or 'Canning & Preserving' would build community and reinforce brand expertise.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Expansion of Sustainable & Regenerative Agriculture Supplies

Competitive Gap:The market for small-scale sustainable and organic farming is growing, but supplies are fragmented. Tractor Supply could become the go-to source for this motivated customer base.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Livestock and Equine Telehealth Services

Competitive Gap:The human and small pet telehealth market is mature, but large animal care is underserved. A partnership or proprietary service could leverage the PetVet brand and customer trust.

Feasibility:Low

Potential Impact:High

Tractor Supply Company (TSC) has masterfully carved out and defended a dominant position within the mature and moderately concentrated rural lifestyle retail market. Its competitive moat is not built on a single advantage, but on a reinforcing ecosystem of strategic store locations, a deeply resonant brand identity, a curated product assortment with high-margin private labels, and a suite of in-store services that drive repeat traffic.

The competitive landscape is defined by two primary fronts. Direct competitors like Rural King and Fleet Farm vie for the same core customer but are largely regional players with less sophisticated omnichannel capabilities and smaller scale. Indirectly, TSC faces immense pressure from category killers: Home Depot/Lowe's in lawn and garden, Chewy/Petco in the lucrative pet market, and Walmart/Amazon on price for commodity goods.

TSC's sustainable advantage lies in its holistic understanding of the 'Life Out Here' customer. While a competitor might win on a single product or price, they cannot easily replicate TSC's one-stop credibility, which combines the sale of a new zero-turn mower with the convenience of an on-site PetVet clinic and a propane tank refill. The Neighbor's Club loyalty program is a critical asset, providing rich data that fuels personalization and deepens customer relationships, making the shopping experience stickier than competitors'.

The primary vulnerabilities are price sensitivity on items where TSC's specialized value is less apparent and a reliance on the economic health of rural communities. Strategic imperatives must focus on doubling down on what makes TSC unique. Expanding in-store services (like small engine repair), growing the penetration of exclusive brands, and becoming a hub for community education are key to widening the moat. Digital transformation, particularly in creating a seamless omnichannel experience for bulky goods, will be crucial in fending off both e-commerce and big-box threats. By continuing to execute its 'Life Out Here' strategy, TSC is well-positioned to not only defend but also grow its market share in this fragmented yet valuable retail segment.

Messaging

Message Architecture

Key Messages

- Message:

Tractor Supply is the one-stop shop for the 'Life Out Here' lifestyle.

Prominence:Primary

Clarity Score:Medium

Location:Implied through branding like '#LifeOutHere', the 'Life Out Here Blog', and the entire product mix. It is not stated as a direct headline.

- Message:

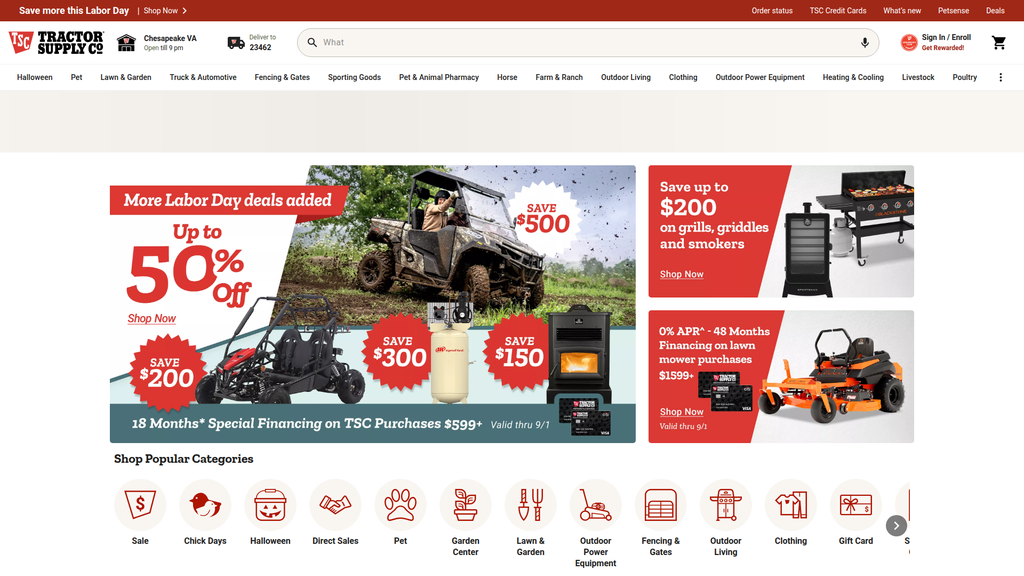

We offer a vast selection of products for farm, pet, home, and garden.

Prominence:Primary

Clarity Score:High

Location:Homepage navigation, 'Shop Popular Categories' section.

- Message:

Access convenient, in-store services like propane refills, pet washes, and trailer rentals.

Prominence:Secondary

Clarity Score:High

Location:Homepage 'Store Services' section, main navigation.

- Message:

Get value through weekly deals, clearance, and the Neighbor's Club rewards program.

Prominence:Tertiary

Clarity Score:High

Location:Header navigation ('Savings and Offers'), promotional banners.

The messaging hierarchy is strongly product- and category-driven, which is typical and effective for a large retailer. The homepage immediately funnels users into shopping categories. However, the overarching brand message of enabling the 'Life Out Here' lifestyle is more implicit and serves as a thematic container rather than a leading statement. This could be a missed opportunity to frame the user experience from the very first impression.

Messaging is exceptionally consistent. The 'Life Out Here' ethos permeates all aspects of the site, from the core product categories (Farm & Ranch, Livestock) to seasonal offerings. The Halloween page, for example, features unique items like a 'Rooster Skeleton' and 'Metal Ghost Cow Statue' that perfectly align with the brand's rural, farm-centric identity, reinforcing it rather than diluting it.

Brand Voice

Voice Attributes

- Attribute:

Practical & Straightforward

Strength:Strong

Examples

- •

Refilling your propane tank at your local Tractor Supply is convenient and economical.

- •

Tough job to tackle? Transporting your purchase home? Rent a trailer and get it done!

- •

Thick Rubber Stall Mat, 4 ft. x 6 ft.

- Attribute:

Community-Oriented & Friendly

Strength:Strong

Examples

- •

LifeOutHere - Your Way

- •

Earn Rewards with Neighbor's Club

- •

Howdy Ghouls Coir Halloween Doormat

- Attribute:

Authentic & Down-to-Earth

Strength:Strong

Examples

- •

Life Out Here Blog

- •

Producer's Pride Scratch Grains Poultry Feed

- •

The brand's entire aesthetic avoids corporate jargon and slick marketing language.

Tone Analysis

Helpful and Transactional

Secondary Tones

- •

Promotional

- •

Inspirational (Lifestyle-focused)

- •

Festive/Playful (Seasonal)

Tone Shifts

The tone shifts from highly functional in product listings and service descriptions to more inspirational in brand-level messaging like '#LifeOutHere'.

A noticeable shift to a playful and festive tone occurs on seasonal pages like 'Halloween'.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Tractor Supply is the dedicated retailer for the rural lifestyle, providing a comprehensive and curated selection of necessary goods, practical services, and community connection for those who live and love 'Life Out Here'.

Value Proposition Components

- Component:

Niche & Comprehensive Product Selection

Clarity:Clear

Uniqueness:Unique

Details:Offers products that big-box stores like Home Depot don't, such as livestock feed, fencing, and equine supplies, all in one place.

- Component:

In-Store Services & Convenience

Clarity:Clear

Uniqueness:Somewhat Unique

Details:Services like propane refills, pet vet clinics, and trailer rentals create a strong local hub and differentiate from online-only retailers.

- Component:

Lifestyle & Community Hub

Clarity:Somewhat Clear

Uniqueness:Unique

Details:The '#LifeOutHere' branding and 'Neighbor's Club' foster a sense of belonging among a specific customer segment that is passionate about their lifestyle.

- Component:

Value and Price

Clarity:Clear

Uniqueness:Common

Details:Messaging around 'Weekly Deals', 'Sale', 'Clearance', and the company mission ('everyday low prices') communicates a focus on affordability.

Tractor Supply's messaging strategy achieves strong differentiation by focusing intensely on a specific psychographic: the rural and suburban 'do it yourself' customer. Instead of competing head-on with home improvement giants on their terms, it carves out a defensible niche in farm, ranch, and pet supplies. The 'Life Out Here' tagline is a powerful strategic asset that transforms the brand from a simple retailer into a lifestyle enabler, creating an emotional connection that competitors lack.

The messaging positions Tractor Supply as more specialized and authentic for the rural customer than big-box competitors (Home Depot, Lowe's) and more convenient and service-oriented than online retailers. It is positioned as the definitive brand for the 'Life Out Here' lifestyle.

Audience Messaging

Target Personas

- Persona:

Hobby Farmers & Homesteaders

Tailored Messages

- •

Product categories like 'Farm & Ranch', 'Livestock', and 'Poultry'.

- •

Highlighting products such as '16 ft. x 50 in. Max 50 Feedlot 10-Line Galvanized Cattle Fence Panel'.

- •

Unique seasonal decor like 'Rooster Skeleton' appeals directly to this aesthetic.

Effectiveness:Effective

- Persona:

Suburban Homeowners with Large Properties

Tailored Messages

- •

Categories like 'Lawn & Garden' and 'Outdoor Power Equipment'.

- •

Featuring brands like Cub Cadet and Bad Boy mowers.

- •

Services like 'Trailer Rental' for property maintenance tasks.

Effectiveness:Effective

- Persona:

Passionate Pet & Animal Owners

Tailored Messages

- •

Prominent 'Pet' category and 'Pet & Animal Pharmacy'.

- •

Featuring top-selling items like '4health' dog food and 'Producer's Pride' chicken feed.

- •

Services like 'PetVet Clinic' and 'Pet Wash Station'.

Effectiveness:Effective

Audience Pain Points Addressed

- •

Difficulty finding specialized farm and animal supplies at general retailers.

- •

Need for durable, practical products that can withstand outdoor use.

- •

Lack of convenient, local services for things like propane or veterinary care.

Audience Aspirations Addressed

- •

Living a self-sufficient, hands-on lifestyle.

- •

A deep connection to land, animals, and community.

- •

Pride in maintaining one's property and caring for animals.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Belonging & Identity

Effectiveness:High

Examples

'#LifeOutHere - Your Way' creates a sense of a shared community and lifestyle.

'Neighbor's Club' reinforces the idea of being part of a local group with shared values.

- Appeal Type:

Nostalgia & Authenticity

Effectiveness:Medium

Examples

The brand aesthetic evokes a simpler, more traditional way of life.

Featuring brands like Carhartt taps into a heritage of hard work and durability.

- Appeal Type:

Fun & Festivity

Effectiveness:High

Examples

The entire Halloween section, with its playful and unique farm-themed decor like 'Animated Deviled Eggs' and a '7.9 ft. Buck Skeleton'.

Social Proof Elements

- Proof Type:

Customer Reviews & Ratings

Impact:Strong

Details:Nearly every product prominently displays a star rating and the number of reviews, often in the thousands (e.g., '4.8 out of 5 stars with 8021 reviews').

- Proof Type:

User-Generated Content

Impact:Moderate

Details:The '#LifeOutHere' Instagram feed showcases real customers living the lifestyle the brand promotes.

- Proof Type:

Bestseller Lists

Impact:Moderate

Details:Sections like 'Top Sellers' and 'Top Rated' guide customer choice by highlighting popular items.

Trust Indicators

- •

Prominent display of trusted, well-known brands (Purina, DeWalt, Carhartt).

- •

Physical store locations provide a sense of stability and local presence.

- •

Clear, upfront pricing on all products.

- •

Detailed product information and customer reviews.

Scarcity Urgency Tactics

Time-bound offers ('Valid 8/18/25-9/1/25').

Highlighting 'Weekly Deals', 'Sale', and 'Clearance' sections to encourage immediate purchase.

Calls To Action

Primary Ctas

- Text:

Add to Cart

Location:Product listings on homepage and category pages

Clarity:Clear

- Text:

Choose Options

Location:Product listings for items with variations (size, color)

Clarity:Clear

- Text:

Shop Now

Location:Promotional banners and user-generated content modules

Clarity:Clear

- Text:

Learn More

Location:Promotional banners for services or credit cards

Clarity:Clear

The CTAs are highly effective due to their clarity, consistent placement, and action-oriented language. They are designed to facilitate a seamless transactional journey. There is no ambiguity about the action the user is expected to take, which is critical for an e-commerce platform of this scale.

Messaging Gaps Analysis

Critical Gaps

The homepage lacks a clear, concise headline that immediately articulates the brand's core value proposition. It dives straight into product categories without first establishing the 'Why'—the 'Life Out Here' promise.

Contradiction Points

No itemsUnderdeveloped Areas

The storytelling around the 'Neighbor's Club' could be enhanced. While it's promoted as a rewards program, its potential as a true community-building platform is underdeveloped in the site's messaging.

The strategic value of their extensive network of physical stores and in-store services could be more forcefully communicated as a key differentiator against online-only competitors. The message is there, but it's not framed as a core competitive advantage.

Messaging Quality

Strengths

- •

Authentic Brand Voice: The messaging feels genuine and perfectly aligned with its target audience's values.

- •

Powerful Niche Positioning: The 'Life Out Here' framework is a masterclass in differentiation, creating a strong emotional bond with customers.

- •

Excellent Audience-Message Fit: The product selection, promotions, and even seasonal content are expertly tailored to the interests of the rural and hobbyist customer.

- •

Strong Use of Social Proof: Prominent and abundant customer reviews build immense trust and guide purchasing decisions.

Weaknesses

Over-reliance on Implied Value Proposition: The core brand promise is demonstrated rather than explicitly stated on the homepage, potentially weakening the initial impact for new visitors.

Transactional Focus Over Brand Story: The user journey is immediately pushed towards categories and products, with less emphasis on brand storytelling upfront.

Opportunities

- •

Homepage Hero Message: Introduce a strong hero banner on the homepage with a clear value proposition like 'Your Partner for Life Out Here' to frame the entire customer experience.

- •

Elevate 'Services' as a Strategic Advantage: Create a dedicated messaging block on the homepage that frames their in-store services not just as offerings, but as a core reason to choose Tractor Supply for convenience and expertise.

- •

Develop Persona-Based Content Hubs: Create dedicated landing pages or content sections for key personas (e.g., 'The New Homesteader,' 'The Backyard Chicken Keeper') that blend expert advice, community stories, and relevant products to deepen engagement.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Messaging Hierarchy

Recommendation:Implement a primary hero section at the top of the homepage that features a compelling image and a clear headline articulating the 'Life Out Here' value proposition before showing product categories.

Expected Impact:High

- Area:

Community Building

Recommendation:Expand the 'Neighbor's Club' messaging beyond just points and rewards. Add sections highlighting member stories, local events, or expert Q&As to foster a stronger sense of community.

Expected Impact:Medium

Quick Wins

Add a sub-headline to the 'Store Services' section on the homepage, such as 'More Than a Store. Your Local Hub.' to immediately elevate its perceived value.

Feature a 'Story of the Month' from the '#LifeOutHere' feed more prominently to better integrate user-generated content and brand storytelling.

Long Term Recommendations

Invest in a more robust content strategy that builds on the 'Life Out Here Blog', creating comprehensive guides, tutorials, and video series that position Tractor Supply as the definitive expert in the rural lifestyle space.

Develop a more personalized web experience that surfaces content and products based on a user's affiliation with a target persona (e.g., horse owner vs. gardener), leveraging data from the Neighbor's Club.

Tractor Supply Company's strategic messaging is a powerful example of successful niche marketing and authentic brand building. The company has masterfully crafted a distinct identity around the 'Life Out Here' concept, which resonates deeply with its target audience of rural and suburban homeowners, hobby farmers, and animal enthusiasts. This is not just a slogan; it is the central organizing principle for their product curation, brand voice, and community engagement.

The brand voice is consistently practical, friendly, and straightforward, avoiding the slick, corporate feel of many national retailers. This authenticity builds significant trust. The website's architecture is highly functional, prioritizing a clear path to purchase through well-organized categories. Persuasion is achieved not through aggressive tactics, but through overwhelming social proof (customer reviews are everywhere), a sense of shared identity ('Neighbor's Club'), and a product selection that signals a deep understanding of the customer's needs.

However, the primary messaging weakness lies in its subtlety. The homepage is functionally an e-commerce portal, and while the brand ethos is present, it is not explicitly stated upfront. A new visitor might see a list of product categories and miss the powerful 'why' behind the brand. The core value proposition is implied, not declared.

The key opportunity for Tractor Supply is to bridge this gap by introducing a stronger, brand-led message at the top of the user journey. By explicitly stating its purpose as the enabler of the 'Life Out Here' lifestyle, it can frame the entire shopping experience, enhance brand recall, and further solidify its position as a beloved lifestyle brand, not just a retailer of goods.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Dominant Market Position: As the largest rural lifestyle retailer in the U.S., Tractor Supply has a proven and resilient business model.

- •

Loyal Customer Base: The 'Neighbor's Club' loyalty program is a significant driver of sales, with 41 million members accounting for approximately 80% of total sales.

- •

Targeted Niche: Deeply understands and caters to the specific needs of recreational farmers, ranchers, and rural homeowners—a demographic it calls 'Life Out Here'.

- •

Broad, Relevant Assortment: Offers a comprehensive range of products from livestock feed and pet supplies to outdoor equipment and apparel, serving as a one-stop shop.

- •

Strong Private Label Penetration: Exclusive brands like 4health and Producer's Pride account for a significant portion of sales, driving customer loyalty and higher margins.

Improvement Areas

- •

Enhance digital personalization for Neighbor's Club members based on purchase history and location.

- •

Expand in-store experiences and workshops to further solidify community hub status.

- •

Improve BOPIS (Buy Online, Pick-up In Store) and curbside pickup efficiency to match rising customer expectations.

Market Dynamics

The rural activities and farm supply market is projected to grow at a CAGR of ~6-7% annually.

Mature

Market Trends

- Trend:

Growth of Hobby Farming & Homesteading

Business Impact:Increases demand for small-scale farming equipment, animal feed, and gardening supplies, directly aligning with TSC's core offerings.

- Trend:

Pet Humanization & Premiumization

Business Impact:Drives growth in the high-margin pet food, supplies, and services (e.g., PetVet clinics) categories. TSC's 4health brand is a key asset here.

- Trend:

Omnichannel Retail Expectations

Business Impact:Requires seamless integration between the website, mobile app, and physical stores for services like BOPIS, which drives 80% of digital transactions.

- Trend:

Demand for Sustainable & High-Tech Farm Supplies

Business Impact:Creates an opportunity to introduce more eco-friendly products and technologically advanced farming tools for the next generation of farmers.

Excellent. Tractor Supply is well-positioned to capitalize on enduring post-pandemic trends like rural migration, DIY projects, and increased pet ownership.

Business Model Scalability

High

Classic retail model with significant fixed costs (stores, distribution centers) but scalable variable costs. Expansion is capital-intensive but proven.

Strong. As comparable store sales increase, the company can leverage its fixed costs to improve operating margins.

Scalability Constraints

- •

Physical store footprint expansion requires significant capital and time for site selection and construction.

- •

Supply chain complexity increases with a broader product mix and geographic reach.

- •

Maintaining a consistent 'legendary service' culture across thousands of stores during rapid growth.

Team Readiness

Strong. Experienced executive team with a clear long-term growth strategy ('Life Out Here 2030').

Well-established corporate structure for a large-scale retailer. The 'ONETractor' strategy indicates a focus on cross-functional integration between digital and physical operations.

Key Capability Gaps

Advanced Data Science & AI: Deeper expertise needed to fully leverage the 41 million Neighbor's Club members' data for predictive analytics and hyper-personalization.

Digital Product Management: Continued investment in talent to enhance mobile app and e-commerce platform capabilities beyond transactional features.

Growth Engine

Acquisition Channels

- Channel:

Physical Stores

Effectiveness:High

Optimization Potential:Medium

Recommendation:Continue strategic store expansion (targeting 3,200 total stores) and implement 'Project Fusion' remodels to enhance the in-store experience and serve as local hubs.

- Channel:

Search Engine Optimization (SEO)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Develop more localized SEO content around specific rural needs (e.g., 'best chicken feed for cold climates') and build out the 'Life Out Here' blog to capture top-of-funnel interest.

- Channel:

Paid Search / SEM

Effectiveness:Medium

Optimization Potential:High

Recommendation:Implement more sophisticated bidding strategies based on customer LTV and product margin. Target competitor keywords more aggressively (e.g., Rural King, Lowe's gardening).

- Channel:

Social Media & Content Marketing

Effectiveness:Medium

Optimization Potential:High

Recommendation:Leverage user-generated content from the '#LifeOutHere' campaign more effectively. Partner with rural lifestyle influencers and expand video content (DIY tutorials, farm tours).

Customer Journey

Omnichannel-centric. The journey often involves online research (website/app) followed by an in-store purchase or BOPIS, which accounts for 80% of e-commerce orders.

Friction Points

- •

Potential for inventory discrepancies between online and physical stores.

- •

Navigating the vast product catalog on the mobile app can be overwhelming for new users.

- •

Last-mile delivery logistics and costs for bulky items in remote rural areas.

Journey Enhancement Priorities

{'area': 'Mobile App Experience', 'recommendation': "Incorporate personalized recommendations on the app's home screen and simplify reordering of consumable products (e.g., feed, pet food)."}

{'area': 'Final Mile Delivery', 'recommendation': "Expand and optimize the 'Final Mile' delivery initiative to provide greater reliability and visibility for large-item orders, unlocking B2B sales potential. "}

Retention Mechanisms

- Mechanism:

Neighbor's Club Loyalty Program

Effectiveness:High

Improvement Opportunity:Introduce more experiential rewards (e.g., exclusive access to workshops, early access to new products) and personalize offers based on member tier and purchase history.

- Mechanism:

Private Label Brands (e.g., 4health)

Effectiveness:High

Improvement Opportunity:Expand private label offerings into new high-margin categories and heavily promote them as a key member benefit. The retention rate for private-label customers is 65% higher.

- Mechanism:

In-Store Services (PetVet, Propane, etc.)

Effectiveness:Medium

Improvement Opportunity:Promote services more heavily through digital channels. Bundle product and service offers (e.g., 'buy a new grill, get your first propane refill free').

- Mechanism:

Subscription / Autoship

Effectiveness:Medium

Improvement Opportunity:Expand the range of products eligible for subscription and offer tiered discounts for subscribing to multiple items to increase adoption and predictable revenue.

Revenue Economics

Strong. The business model is built on repeat purchases of consumable goods (feed, pet food, etc.), which creates a high customer lifetime value.

Estimated High. While precise figures are internal, a massive, loyal customer base (80% of sales from members) and high retention for private brands suggest a very healthy ratio.

High. The company has a strong track record of sales growth, profitability, and positive comparable store sales.

Optimization Recommendations

- •

Increase the penetration of high-margin private label brands from ~29% of sales towards a higher target.

- •

Drive higher transaction frequency through personalized, timely reminders for consumable purchases via the mobile app.

- •

Expand high-margin service offerings like Pet Rx and B2B Direct Sales.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Retail Systems

Impact:Medium

Solution Approach:Continue phased modernization of core merchandising, inventory, and POS systems. Adopt a composable commerce architecture for greater flexibility.

- Limitation:

Personalization Engine

Impact:Medium

Solution Approach:Invest in a more advanced Customer Data Platform (CDP) and AI/ML capabilities to move from rule-based promotions to predictive, one-to-one marketing.

Operational Bottlenecks

- Bottleneck:

Supply Chain for Large/Bulky Items

Growth Impact:Constrains e-commerce growth for categories like fencing, large equipment, and trailers.

Resolution Strategy:Scale the 'Final Mile' delivery network and explore partnerships with specialized LTL (less-than-truckload) carriers for rural routes.

- Bottleneck:

In-Store Labor & Expertise

Growth Impact:Maintaining 'legendary' product expertise across 50,000+ team members is a challenge.

Resolution Strategy:Invest heavily in continuous training programs, specialist roles for key departments (e.g., pet, garden), and digital tools to assist team members on the floor.

Market Penetration Challenges

- Challenge:

Intensifying Competition

Severity:Major

Mitigation Strategy:Double down on the 'Life Out Here' niche. Differentiate through exclusive brands, community-focused services, and expert advice that big-box retailers like Home Depot/Lowe's and online players like Amazon cannot replicate.

- Challenge:

Reaching Younger, 'Modern Homesteader' Demographics

Severity:Minor

Mitigation Strategy:Increase investment in digital channels and influencer marketing (e.g., Molly Yeh collaboration). Curate product assortments and content that appeal to this tech-savvy, sustainability-focused group.

Resource Limitations

Talent Gaps

- •

Data Scientists & AI/ML Engineers

- •

E-commerce & Digital Experience Strategists

- •

Supply Chain & Logistics Optimization Experts

Sufficient. As a profitable, publicly traded company, capital is not a primary constraint. The key is disciplined allocation towards strategic initiatives like new stores, supply chain, and technology.

Infrastructure Needs

Expansion of distribution centers to support store growth and e-commerce fulfillment.

Continued investment in in-store technology (upgraded POS, mobile tools for staff, etc.).

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Store Expansion

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Execute on the stated plan to grow from ~2,300 to 3,200 stores, focusing on underserved rural and exurban markets, particularly in the western U.S.

- Expansion Vector:

B2B / Direct Sales

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Build a dedicated sales and service team to target larger farms, small businesses, and municipalities, leveraging the 'Final Mile' delivery infrastructure for fulfillment.

Product Opportunities

- Opportunity:

Expand Pet and Animal Rx Services

Market Demand Evidence:The pet wellness market is a massive, growing category. The acquisition of Allivet and the launch of Pet Rx are strategic moves to capture this.

Strategic Fit:Excellent. Deepens relationships with a core customer segment and drives recurring revenue.

Development Recommendation:Integrate Pet Rx services seamlessly into the Neighbor's Club app and in-store PetVet clinics to create a comprehensive pet wellness ecosystem.

- Opportunity:

Increase Private Label Penetration

Market Demand Evidence:Private label customers have a 65% higher retention rate, and several exclusive brands already exceed $300-500 million in annual sales.

Strategic Fit:Excellent. Improves gross margins, increases customer loyalty, and differentiates from competitors.

Development Recommendation:Launch new private brands in growth categories like outdoor power equipment, organic gardening, and specialty pet foods.

- Opportunity:

Apparel & Lifestyle Collaborations

Market Demand Evidence:Successful collaboration with Molly Yeh demonstrates demand for apparel that blends rural utility with modern style.

Strategic Fit:Good. Positions the brand as a lifestyle curator, not just a hardware and feed store.

Development Recommendation:Pursue further limited-edition collaborations with authentic figures in the rural, outdoor, and culinary spaces to drive traffic and brand excitement.

Channel Diversification

- Channel:

Retail Media Network

Fit Assessment:Excellent

Implementation Strategy:Scale the existing platform to allow brand partners to purchase targeted advertising on TSC's digital properties, creating a new, high-margin revenue stream.

- Channel:

Enhanced Mobile App

Fit Assessment:Excellent

Implementation Strategy:Transform the app from a simple shopping tool into a personalized 'Life Out Here' companion with content, community features, and proactive service reminders.

Strategic Partnerships

- Partnership Type:

Agricultural Technology

Potential Partners

John Deere

Agri-tech startups

Expected Benefits:Offer exclusive smart farming tools or integrated repair services. Position TSC as a hub for both traditional and modern farming needs.

- Partnership Type:

Community & Education

Potential Partners

- •

4-H

- •

Future Farmers of America (FFA)

- •

Local agricultural extension offices

Expected Benefits:Solidify community ties, build brand loyalty with the next generation of customers, and drive traffic through in-store workshops and events.

Growth Strategy

North Star Metric

Weekly Active Neighbor's Club Members

This metric focuses on the most valuable customer segment and measures both engagement (activity) and loyalty (membership). Growing this number ensures the core of the business is healthy and expanding.

Increase by 15% year-over-year through enhanced personalization and member-exclusive benefits.

Growth Model

Hybrid: Community-Led + Omnichannel Sales

Key Drivers

- •

Store expansion and experience (Community hubs)

- •

Neighbor's Club loyalty and data (Retention)

- •

Exclusive private brands (Margin & Loyalty)

- •

Seamless digital-to-physical journey (Omnichannel)

Focus on making physical stores destinations for expertise and community, while using digital channels to drive personalized, convenient transactions and deepen customer relationships.

Prioritized Initiatives

- Initiative:

Scale 'Final Mile' & B2B Direct Sales Program

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Pilot the direct sales model in 3-5 key agricultural regions to refine the service offering and logistics before a national rollout.

- Initiative:

Hyper-Personalize the Neighbor's Club Experience

Expected Impact:High

Implementation Effort:Medium

Timeframe:12 months

First Steps:Implement a Customer Data Platform (CDP) to unify customer data and launch three initial personalized campaign experiments (e.g., predictive replenishment, category expansion).

- Initiative:

Expand Pet Rx & Wellness Services

Expected Impact:High

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Launch a targeted marketing campaign to existing pet food buyers promoting the benefits and convenience of the new Pet Rx service.

- Initiative:

Accelerate Private Brand Development

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:Ongoing

First Steps:Identify two new product categories for private label expansion based on sales data and competitive analysis, and begin the sourcing process.

Experimentation Plan

High Leverage Tests

- Test:

In-App Offer PersonalizationHypothesis:AI-driven personalized offers in the mobile app will increase average order value by 10% compared to standard segment-based offers.

- Test:

Service Bundling PromotionsHypothesis:Offering a discount on a service (e.g., pet wash) with a related product purchase will increase the adoption rate of in-store services by 25%.

- Test:

New Store FormatHypothesis:Testing a smaller-footprint 'Tractor Supply Essentials' store in a new exurban market can reduce setup costs and time-to-profitability.

Use A/B testing methodologies for digital experiments and matched-market testing for in-store initiatives. Key metrics: Conversion Rate, Average Order Value (AOV), Customer Lifetime Value (LTV), and Service Attachment Rate.

Run weekly sprints for digital experiments and quarterly reviews for larger in-store or strategic tests.

Growth Team

Cross-functional 'Growth Pods' aligned to key strategic objectives.

Key Roles

- •

Head of Loyalty & Personalization - •

Director of B2B/Direct Sales - •

Senior Product Manager, Omnichannel Experience - •

Data Scientist, Customer Analytics

Invest in a dedicated budget for growth experimentation. Foster a 'test and learn' culture by publicly sharing results (both successes and failures) across the organization. Acquire talent in data science and digital product management.

Tractor Supply Company (TSC) possesses an exceptionally strong foundation for future growth, anchored by a powerful brand, a loyal customer base, and a dominant position in the resilient rural lifestyle market. The company has successfully established a deep product-market fit, which it reinforces through its 'Neighbor's Club' loyalty program and a growing portfolio of high-margin private label brands. The overarching 'Life Out Here' strategy is not just marketing; it's a clear roadmap that guides assortment, services, and expansion, creating a formidable competitive moat.

The primary growth engine is a well-oiled omnichannel machine. TSC's strategic decision to use its stores as fulfillment hubs for 80% of online orders is a critical advantage, turning its physical footprint into a key digital asset. The most significant growth opportunities lie in evolving from a best-in-class retailer into a comprehensive ecosystem for the rural lifestyle. The strategic initiatives outlined in the 'Life Out Here 2030' plan—specifically Pet and Animal Rx, a B2B Direct Sales arm, and a Retail Media Network—are the right vectors to unlock substantial, high-margin growth. These initiatives will deepen customer relationships, capture a greater share of wallet, and create new revenue streams.

The key barriers to scale are not capital but complexity and capability. Managing an increasingly intricate supply chain, especially for 'final mile' delivery of bulky goods, and building the in-house data science talent to truly personalize the experience for 41 million members are the most critical challenges.

Recommendations:

1. Double Down on Personalization: The highest-leverage opportunity is to translate the immense data from the Neighbor's Club into a truly personalized, predictive customer experience via the mobile app and email. This will drive frequency, increase basket size, and fortify the company's competitive advantage against generic retailers.

2. Aggressively Scale New Ventures: The Direct Sales and Pet Rx initiatives should be treated as high-growth startups within the larger organization, with dedicated teams, aggressive targets, and the resources to scale quickly. They represent the future of TSC's margin expansion.