eScore

travelers.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Travelers demonstrates a strong digital presence with excellent content authority, especially in specialized commercial insurance lines where it has deep topic coverage. Its multi-channel presence is consistent, leveraging social media for educational and awareness content. However, its search intent alignment is stronger for bottom-of-funnel commercial queries than for high-volume personal lines, where it faces intense competition, and voice search optimization appears to be an underdeveloped area.

Exceptional content authority and deep topic coverage in complex commercial and specialty insurance lines, positioning them as an expert.

Develop a more robust strategy for capturing top-of-funnel personal insurance search intent with consideration-stage content that bridges the gap between broad risk-awareness articles and final quote pages.

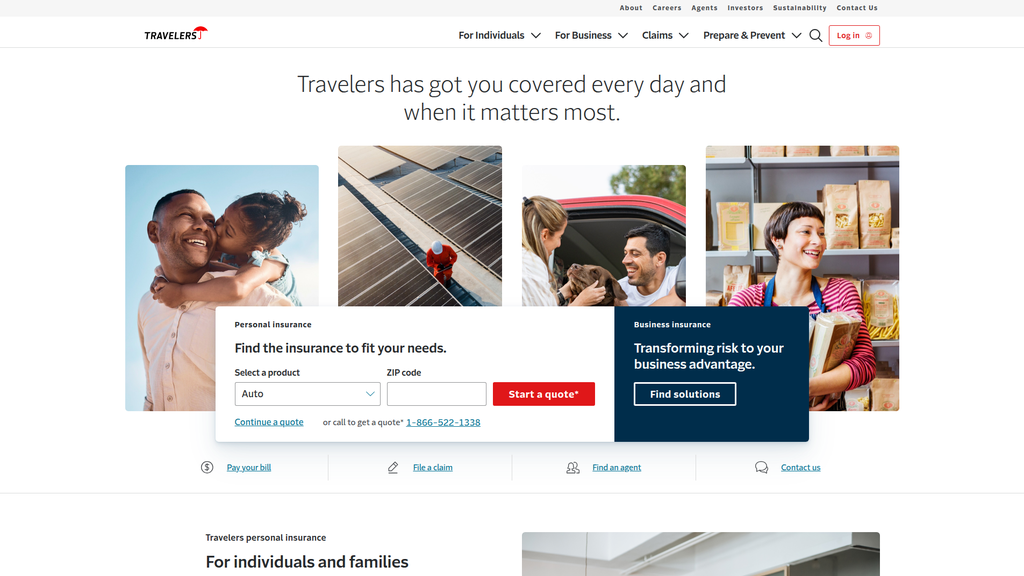

The brand communication is highly effective, with clear audience segmentation between personal and business lines directly on the homepage. The messaging is consistent, professional, and reassuring, successfully leveraging the brand's long history to build trust. While the messaging effectively drives users to 'Get a Quote' or 'Find an Agent', it lacks strong emotional hooks like customer testimonials, relying more on brand reputation than direct social proof.

Excellent audience segmentation in messaging, which immediately directs different personas (individuals vs. businesses) into relevant and tailored communication funnels.

Incorporate authentic customer testimonials and case studies more prominently on the website to validate the 'care' message and build a stronger emotional connection with prospective clients.

The website provides clear conversion paths for its primary goals, but the experience suffers from some key friction points. The primary 'Start a quote' CTA lacks sufficient visual prominence, creating competition with secondary actions and increasing cognitive load. While the cross-device experience is solid, the conversion process, particularly for direct-to-consumer personal lines, can be lengthy and is not as streamlined as digital-native competitors, representing a significant barrier.

The dual-path CTA strategy ('Start a quote' vs. 'Find an agent') is a major strength, effectively catering to both digitally-savvy users and those who prefer personalized guidance.

Redesign the primary CTA buttons using a unique, high-contrast color to create a clear visual hierarchy and immediately draw user attention to the most important conversion action, thereby increasing quote initiations.

Travelers scores exceptionally high in credibility due to its long-standing history (since 1853), strong financial ratings, and its status as a Dow Jones Industrial Average component. The website features a robust and transparent legal and compliance framework, with dedicated policies for different jurisdictions, fostering significant trust. Third-party validation is evident through its market leadership, although it could be enhanced with more direct customer success evidence like testimonials and ratings.

The company's long history, financial stability, and status as a Dow Jones component serve as powerful, undeniable trust signals that are difficult for competitors to replicate.

Proactively feature customer satisfaction scores, ratings, and detailed case studies with quantifiable outcomes to complement the trust built by brand legacy with more direct, relatable evidence of customer success.

Travelers' competitive advantages, or 'moats', are highly sustainable and formidable. Its vast independent agent network, deep underwriting expertise in complex commercial lines, and powerful brand reputation are built over decades and are very difficult for competitors to replicate. While strong, the company faces disadvantages in digital agility and a higher cost structure compared to direct-to-consumer insurtechs, which represents a key challenge to its long-term dominance.

The vast, entrenched network of over 12,700 independent agents and brokers provides a powerful and loyal distribution channel that is highly defensible against both traditional and insurtech competitors.

Address the strategic disadvantage of legacy technology by investing in a unified digital platform that empowers agents with AI-driven tools while also enhancing the direct-to-consumer experience to fend off digital-native threats.

As a mature enterprise, Travelers has proven scalability, evidenced by its consistent growth in net written premiums. However, its operational leverage is constrained by a partial reliance on human-intensive processes (agent network, complex underwriting) and legacy systems. Significant expansion potential exists in digital channels, particularly by developing a self-service platform for small businesses and pursuing embedded insurance partnerships, though these are currently underdeveloped.

A diversified business model across personal, business, and specialty lines provides multiple avenues for stable, incremental growth and mitigates risk from any single market segment.

Aggressively pursue embedded insurance partnerships by developing a robust API platform. This would create a highly scalable, low-cost acquisition channel by offering insurance at the point of need in third-party ecosystems.

Travelers' business model is exceptionally coherent and proven, generating revenue from a balanced mix of underwriting premiums and investment income. Its strategic focus on leveraging its agent network for complex commercial lines while building out direct capabilities for personal lines is well-aligned with its core strengths. The company demonstrates strong resource allocation, investing in technology and innovation to maintain its competitive advantages in a changing market.

The hybrid distribution model, which combines the strength of its independent agent network with growing direct-to-consumer capabilities, is a highly coherent and effective strategy for serving a diverse customer base.

Resolve the potential for channel conflict by creating clearer guidelines and digital tools that enable seamless collaboration between the direct channel and agents (e.g., passing digitally-sourced complex leads to local agents).

Travelers wields significant market power, consistently ranking as a top writer of commercial property and casualty insurance in the U.S. This market leadership, particularly in workers' compensation and commercial multi-peril lines, grants it considerable pricing power and influence. While its market share in the hyper-competitive personal lines space is smaller, its strong brand and agent relationships provide substantial leverage with partners and suppliers.

Dominant market share in key commercial lines, such as being the number one writer of workers' compensation, gives Travelers significant pricing power and influence over industry standards.

Develop and market more innovative, usage-based insurance (UBI) products for personal lines to better compete on factors other than price and to capture data from lower-risk drivers who are currently drawn to competitors like Progressive.

Business Overview

Business Classification

Insurance Provider

Financial Services

Property & Casualty (P&C) Insurance

Sub Verticals

- •

Personal Lines (Auto, Home, etc.)

- •

Commercial Lines (Business Insurance)

- •

Bond & Specialty Insurance

Mature

Maturity Indicators

- •

Founded in 1853, demonstrating a very long operating history.

- •

Consistently a component of the Dow Jones Industrial Average.

- •

Large, stable revenue base with over $46 billion in 2024.

- •

Strong brand recognition and established market position.

- •

Consistent return of capital to shareholders through dividends and share repurchases.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Premiums from Business Insurance

Description:Premiums collected from a wide range of commercial P&C insurance products sold to businesses of all sizes, including workers' compensation, commercial auto, property, and general liability.

Estimated Importance:Primary

Customer Segment:Businesses (Small, Mid-sized, Large Corporations)

Estimated Margin:Medium

- Stream Name:

Premiums from Personal Insurance

Description:Premiums collected from individuals and families for auto, home, condo, renters, and other personal property insurance.

Estimated Importance:Primary

Customer Segment:Individuals & Families

Estimated Margin:Medium

- Stream Name:

Net Investment Income

Description:Income generated by investing the 'float' – premiums collected before claims are paid out – in a diverse portfolio of assets like bonds and stocks. This is a critical revenue and profit driver for all insurance companies.

Estimated Importance:Primary

Customer Segment:N/A - Internal financial operations

Estimated Margin:High

- Stream Name:

Premiums from Bond & Specialty Insurance

Description:Premiums from specialized products such as surety bonds, fidelity, management liability, and cyber insurance.

Estimated Importance:Secondary

Customer Segment:Businesses with specialized needs

Estimated Margin:High

Recurring Revenue Components

- •

Policy Renewals (Personal Lines)

- •

Policy Renewals (Commercial Lines)

- •

Service and Fee Income

Pricing Strategy

Risk-Based Dynamic Pricing

Mid-range to Premium

Opaque

Pricing Psychology

- •

Bundling Discounts (e.g., Auto + Home)

- •

Tiered Coverage Options (Good/Better/Best)

- •

Loyalty Discounts

Monetization Assessment

Strengths

- •

Diversified revenue across multiple insurance segments (Personal, Business, Specialty).

- •

Significant and stable income from the investment float, mitigating underwriting volatility.

- •

Strong renewal rates driven by brand loyalty and agent relationships.

Weaknesses

- •

High sensitivity to catastrophic events which can lead to significant underwriting losses.

- •

Pricing is heavily regulated, limiting flexibility in some markets.

- •

Dependence on investment market performance can create earnings volatility.

Opportunities

- •

Leveraging data analytics and AI for more sophisticated, personalized pricing (telematics, IoT).

- •

Expanding high-margin specialty lines like cyber insurance.

- •

Offering value-added, fee-based risk management services to commercial clients.

Threats

- •

Intense price competition from direct-to-consumer insurers (e.g., Progressive, GEICO).

- •

Rising claims costs due to inflation and supply chain issues ('social inflation').

- •

Emergence of insurtech startups disintermediating traditional channels.

Market Positioning

Broad Differentiation

Leading Player (ranked 6th in the U.S. P&C market with approximately 3.96% market share in 2024).

Target Segments

- Segment Name:

Individuals & Families

Description:Homeowners, car owners, and renters seeking reliable protection for their personal assets.

Demographic Factors

- •

Age 25-60

- •

Middle to upper-middle income

- •

Owns significant assets (home, multiple vehicles)

Psychographic Factors

- •

Values security, stability, and peace of mind.

- •

Prefers trusted, well-known brands.

- •

May value the guidance of a professional agent over the lowest possible price.

Behavioral Factors

- •

Likely to bundle multiple policies (auto, home).

- •

Researches online but may purchase through an agent.

- •

Values responsive customer service, especially during claims.

Pain Points

- •

Complexity of insurance products.

- •

Fear of not having enough coverage.

- •

Hassle and stress of the claims process.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Small to Mid-Sized Businesses (SMBs)

Description:Businesses requiring standard P&C coverage like Business Owner's Policies (BOP), workers' compensation, and commercial auto.

Demographic Factors

Varies by industry (e.g., construction, retail, professional services).

Typically 10-500 employees.

Psychographic Factors

- •

Risk-averse; focused on business continuity.

- •

Seeks a reliable partner to manage complex risks.

- •

Values expertise and industry-specific knowledge.

Behavioral Factors

- •

Relies heavily on independent agents or brokers for advice.

- •

Purchases multiple commercial policies.

- •

Seeks value-added services like risk control and loss prevention.

Pain Points

- •

Navigating complex regulatory requirements (e.g., workers' comp).

- •

Managing cash flow and insurance costs.

- •

Protecting the business from unforeseen liabilities.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Large Corporations & Specialized Industries

Description:Large, often multinational, companies with complex and unique risk profiles requiring tailored insurance solutions, such as inland marine, cyber, or global coverage.

Demographic Factors

Industry-specific: Manufacturing, Energy, Technology, Financial Institutions.

Large employee base and significant revenue.

Psychographic Factors

- •

Sophisticated buyers of insurance.

- •

Focus on strategic risk management and transfer.

- •

Highly value deep industry expertise and specialized underwriting.

Behavioral Factors

- •

Works through large, sophisticated brokerage firms.

- •

Requires customized, manuscript policies.

- •

Engages deeply with the insurer's risk control and claims teams.

Pain Points

- •

Emerging and complex risks (e.g., cyber threats, climate change).

- •

Managing global insurance programs.

- •

Large-scale liability and catastrophic property risks.

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Extensive Independent Agent Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Reputation and Financial Stability

Strength:Strong

Sustainability:Sustainable

- Factor:

Specialized Risk Control and Claims Services

Strength:Moderate

Sustainability:Sustainable

- Factor:

Broad and Diversified Product Portfolio

Strength:Strong

Sustainability:Sustainable

Value Proposition

To provide comprehensive, tailored insurance solutions and expert risk management for individuals and businesses, delivered through a trusted network of agents and backed by a 165+ year legacy of financial strength and customer care.

Good

Key Benefits

- Benefit:

Financial Protection & Peace of Mind

Importance:Critical

Differentiation:Common

Proof Elements

- •

High financial strength ratings (e.g., from A.M. Best, S&P).

- •

Long history of paying claims.

- •

Testimonials and customer stories.

- Benefit:

Expert Guidance through Independent Agents

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Vast network of ~13,500 independent agents.

- •

Agent locator tool on the website.

- •

Emphasis on agent partnerships in corporate communications.

- Benefit:

Specialized Risk Mitigation Services

Importance:Important

Differentiation:Unique

Proof Elements

- •

Dedicated Risk Control division.

- •

Industry-specific safety resources and consulting.

- •

Patented loss mitigation processes like the 'Inland Marine Network'.

Unique Selling Points

- Usp:

Hybrid Distribution Model: Combining the reach and expertise of a massive independent agent network with growing direct-to-consumer digital capabilities.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Deep Specialization in Commercial Lines: Offering highly tailored products and risk control services for specific industries, a capability smaller competitors lack.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Managing and mitigating complex financial risks.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Navigating the complexity of choosing the right insurance coverage.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Recovering financially and operationally after an unexpected loss.

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

The value proposition is well-aligned with the needs of a market that values stability, trust, and expertise, particularly in the complex commercial insurance space.

High

The proposition strongly resonates with customers (both personal and business) who prefer guidance and a relationship-based approach to purchasing insurance, which is the core of the independent agent channel.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Independent insurance agents and brokers (~13,500 strong).

- •

Reinsurance companies (e.g., Munich Re, Swiss Re).

- •

Technology providers (e.g., Google Cloud for data analytics, Guidewire for claims).

- •

Niche insurance providers for specific products (e.g., Neptune Flood, Dairyland).

Key Activities

- •

Underwriting and Risk Assessment.

- •

Claims Processing and Management.

- •

Investment Management of Premium Float.

- •

Distribution and Agent Relationship Management.

- •

Risk Control and Loss Prevention Services.

Key Resources

- •

Substantial Financial Capital (Float).

- •

Strong Brand Reputation and Trust.

- •

Vast Independent Agent Distribution Network.

- •

Proprietary Actuarial Data and Analytics.

- •

Specialized Underwriting and Claims Expertise.

Cost Structure

- •

Payment of Policyholder Claims (Losses).

- •

Agent and Broker Commissions.

- •

Employee Salaries and Operating Expenses.

- •

Technology and Data Infrastructure Investment.

- •

Marketing and Advertising.

Swot Analysis

Strengths

- •

Dominant market position and strong brand equity built over 165+ years.

- •

Highly diversified portfolio across personal, commercial, and specialty lines.

- •

Superior distribution network through entrenched relationships with independent agents.

- •

Significant expertise in complex commercial underwriting and risk control.

- •

Robust financial position and significant investment income stream.

Weaknesses

- •

Higher cost structure compared to direct-to-consumer competitors due to agent commissions.

- •

Potential for channel conflict between direct and agent-based sales.

- •

Legacy technology systems can slow down innovation and operational efficiency.

- •

Limited international presence compared to some global competitors like Chubb or AIG.

Opportunities

- •

Accelerate digital transformation to enhance both agent tools and direct customer experience.

- •

Leverage AI and big data for more precise underwriting, dynamic pricing, and fraud detection.

- •

Expand in high-growth specialty markets like cyber insurance, as seen with the Corvus acquisition.

- •

Develop an ecosystem of services around core insurance products (e.g., IoT-based risk prevention).

Threats

- •

Aggressive competition from insurtech startups and direct-to-consumer giants (e.g., Progressive, GEICO).

- •

Increasing frequency and severity of catastrophic weather events due to climate change.

- •

Persistently low-interest rates can negatively impact investment income.

- •

Evolving customer expectations for seamless, digital-first experiences.

- •

Changes in the regulatory landscape.

Recommendations

Priority Improvements

- Area:

Digital Transformation & Agent Enablement

Recommendation:Invest heavily in a unified digital platform that provides agents with AI-powered underwriting tools, real-time data insights, and a streamlined quoting process, while simultaneously enhancing the self-service capabilities for direct customers.

Expected Impact:High

- Area:

Data Analytics & AI Integration

Recommendation:Expand the partnership with Google Cloud to move beyond underwriting and implement AI/ML models across the value chain, focusing on claims automation, personalized marketing, and proactive risk identification for customers.

Expected Impact:High

- Area:

Customer Experience Personalization

Recommendation:Develop and launch usage-based insurance (UBI) products for personal auto and IoT-enabled solutions for homeowners to offer more personalized pricing and proactive loss prevention services, thereby improving retention and attracting new segments.

Expected Impact:Medium

Business Model Innovation

- •

Transition from 'indemnify and repair' to 'predict and prevent' by creating a service-based model. Offer commercial clients a 'Risk Management as a Service' (RMaaS) subscription that bundles insurance with continuous monitoring, consulting, and technology solutions.

- •

Launch a dedicated digital-first brand to compete directly with insurtechs for price-sensitive, digitally native customers, thereby capturing a different market segment without disrupting the core agent channel.

- •

Develop an open API platform to foster an ecosystem of partners, allowing third-party services (e.g., home security, fleet telematics) to integrate directly with Travelers' policies, creating added value and new data streams.

Revenue Diversification

- •

Expand the fee-for-service risk control consulting to businesses that may not be direct insurance customers.

- •

Monetize anonymized, aggregated data insights for specific industries (e.g., construction, transportation) to help them benchmark their own risk profiles.

- •

Further build out the specialty insurance portfolio, both organically and through acquisition, focusing on emerging risks with higher margin potential like renewable energy, AI liability, and climate risk.

The Travelers Companies, Inc. represents a mature, highly successful, and resilient business model deeply entrenched in the U.S. property and casualty insurance market. Its core competitive advantages—a powerful brand, a vast independent agent network, and deep underwriting expertise, particularly in commercial lines—create a formidable economic moat. The business model's foundation rests on a dual-revenue architecture of underwriting profits and investment income, providing stability and significant financial strength.

The primary strategic challenge facing Travelers is not one of survival, but of evolution. The company operates in an industry being fundamentally reshaped by technology and shifting customer expectations. Its reliance on the traditional agent channel, while a current strength, also presents a potential vulnerability and a higher-cost structure compared to digital-native competitors. The key to future success lies in skillfully navigating a 'Perform & Transform' strategy: continuing to empower its existing agent network with superior digital tools while simultaneously building a compelling direct-to-consumer experience. Investments in AI, data analytics, and cloud infrastructure are not just operational improvements but are central to the future business model, enabling more sophisticated risk selection, pricing, and claims handling.

The strategic imperative is to evolve from a traditional risk transfer entity into a data-driven risk management partner. By leveraging its vast data resources and expertise, Travelers can shift towards a 'predict and prevent' model, offering proactive services that reduce losses for both the customer and the company. This evolution will allow Travelers to defend its market leadership, improve margins, and create a more sustainable, service-oriented relationship with its customers in the face of increasing digital disruption.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Capital and Solvency Requirements

Impact:High

- Barrier:

Regulatory Compliance and Licensing

Impact:High

- Barrier:

Brand Recognition and Trust

Impact:High

- Barrier:

Distribution Network (Agent Relationships)

Impact:Medium

- Barrier:

Underwriting Expertise and Historical Data

Impact:High

Industry Trends

- Trend:

Digital Transformation and Insurtech Adoption

Impact On Business:Requires significant investment in modernizing legacy systems and developing digital-first customer experiences to compete with agile newcomers.

Timeline:Immediate

- Trend:

AI and Advanced Data Analytics

Impact On Business:AI is transforming core processes like underwriting, claims processing, and fraud detection, creating opportunities for increased efficiency and more accurate risk pricing.

Timeline:Immediate

- Trend:

Embedded Insurance

Impact On Business:Creates new distribution channels by offering insurance at the point of sale (e.g., auto purchase, home mortgage), threatening traditional agent models but offering partnership opportunities.

Timeline:Near-term

- Trend:

Climate Change and Catastrophe Modeling

Impact On Business:Increases the frequency and severity of claims, requiring more sophisticated risk modeling, pricing adjustments, and a potential reduction of coverage in high-risk areas.

Timeline:Immediate

- Trend:

Evolving Customer Expectations

Impact On Business:Customers now expect seamless, personalized, and digital-first interactions, similar to experiences in retail and banking, pushing insurers to improve their customer journey.

Timeline:Immediate

Direct Competitors

- →

Progressive

Market Share Estimate:7.18% (P&C).

Target Audience Overlap:High

Competitive Positioning:Technology-driven insurer focused on innovation, competitive pricing, and a strong direct-to-consumer model.

Strengths

- •

Superior direct-to-consumer (DTC) digital experience.

- •

Pioneer and leader in telematics (Snapshot).

- •

Strong brand recognition and effective marketing strategies.

- •

Agile data analytics for sophisticated pricing and underwriting.

Weaknesses

- •

Less emphasis on the independent agent channel compared to Travelers.

- •

Brand perception is more transactional and price-focused than relationship-oriented.

- •

High dependency on the US auto insurance market.

Differentiators

- •

Usage-Based Insurance (UBI) through its Snapshot program.

- •

Name Your Price® tool and comparison rates.

- •

Advanced digital marketing and customer acquisition engine.

- →

GEICO (Berkshire Hathaway)

Market Share Estimate:5.98% (P&C, via Berkshire Hathaway Group).

Target Audience Overlap:High

Competitive Positioning:Low-cost provider with massive brand recognition, focused on a direct-to-consumer model for personal auto insurance.

Strengths

- •

Exceptional brand recognition fueled by a massive advertising budget.

- •

Strong reputation for competitive pricing and low operational costs.

- •

Financial stability backed by Berkshire Hathaway.

- •

Simple and efficient online quoting process.

Weaknesses

- •

Less diversified product portfolio, heavily reliant on auto insurance.

- •

Limited physical agent presence, which may deter customers seeking in-person advice.

- •

Customer service experiences can be variable.

Differentiators

- •

Iconic and ubiquitous marketing campaigns (Gecko, Caveman).

- •

Focus on specific affinity groups (e.g., military, federal employees) for discounts.

- •

Streamlined, low-touch direct sales model.

- →

Allstate

Market Share Estimate:5.28% (P&C).

Target Audience Overlap:High

Competitive Positioning:Trusted, full-service provider with a strong brand and a large network of captive agents, balancing agent relationships with growing direct capabilities.

Strengths

- •

Strong brand name and reputation for reliability ("You're in Good Hands").

- •

Extensive network of local captive agents providing personalized service.

- •

Diversified product portfolio across personal and commercial lines.

- •

Solid financial position and strong market presence.

Weaknesses

- •

Higher cost structure due to the captive agent network.

- •

Can be slower to innovate digitally compared to DTC leaders like Progressive.

- •

Significant exposure to catastrophe losses, particularly in homeowners insurance.

Differentiators

- •

Hybrid distribution model with a strong emphasis on the agent relationship.

- •

Telematics programs like Drivewise® and Milewise®.

- •

Strong focus on bundling policies (e.g., home and auto).

- →

Chubb

Market Share Estimate:3.15% (P&C).

Target Audience Overlap:Medium

Competitive Positioning:Premier underwriter for high-net-worth individuals and complex commercial/specialty risks, focused on superior service and claims handling.

Strengths

- •

Market leader in high-net-worth personal lines and specialty commercial insurance.

- •

Exceptional reputation for claims service and underwriting expertise.

- •

Extensive global footprint, serving multinational corporations.

- •

Strong relationships with independent agents and brokers who serve affluent and corporate clients.

Weaknesses

- •

Not price-competitive in the mass-market personal lines space.

- •

Less brand recognition among the general public compared to GEICO or Progressive.

- •

Complex products are not well-suited for a direct-to-consumer model.

Differentiators

- •

Focus on a premium, service-oriented value proposition.

- •

Specialized underwriting for unique and complex risks (e.g., aviation, marine, cyber).

- •

Masterpiece® policies for high-value homes and assets.

Indirect Competitors

- →

Lemonade

Description:An Insurtech company that uses AI and a digital-native platform to offer renters, homeowners, pet, and term life insurance, appealing to younger, tech-savvy consumers.

Threat Level:Medium

Potential For Direct Competition:High, as it expands its product offerings and customer base.

- →

Root Insurance

Description:A mobile-first auto insurer that bases rates primarily on telematics data gathered through a smartphone app during a 'test drive' period.

Threat Level:Medium

Potential For Direct Competition:Medium, primarily in the personal auto segment.

- →

Embedded Insurance Providers (e.g., Tesla Insurance)

Description:Companies offering insurance directly at the point of sale for a related product or service. For example, Tesla offers insurance tailored to its vehicles, leveraging vehicle data.

Threat Level:Medium

Potential For Direct Competition:High, as this model bypasses traditional distribution channels.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Vast Independent Agent Network

Sustainability Assessment:Highly sustainable. Deep, long-standing relationships are difficult and time-consuming for competitors to build.

Competitor Replication Difficulty:Hard

- Advantage:

Deep Underwriting Expertise in Commercial and Specialty Lines

Sustainability Assessment:Highly sustainable. Built on decades of proprietary data and specialized human talent.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Brand Reputation and Financial Stability

Sustainability Assessment:Sustainable. A long history (founded in 1864) builds a level of trust that is difficult for new entrants to achieve quickly.

Competitor Replication Difficulty:Hard

- Advantage:

Comprehensive and Diversified Product Portfolio

Sustainability Assessment:Sustainable. The ability to serve both personal and complex business needs creates sticky customer relationships and cross-selling opportunities.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Specific Product Features or Pricing', 'estimated_duration': '1-2 years, as competitors can replicate innovative policy features or adjust pricing models.'}

Disadvantages

- Disadvantage:

Potential for Slower Digital Innovation

Impact:Major

Addressability:Moderately

- Disadvantage:

Perception as a 'Traditional' Insurer

Impact:Minor

Addressability:Easily

- Disadvantage:

Legacy Technology Infrastructure

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Optimize Digital Quoting for Key Personal Lines

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch Targeted Content Marketing Campaigns

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Enhance Digital Tools for Independent Agents

Expected Impact:High

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Invest in Core Systems Modernization

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand API Capabilities for Embedded Insurance Partnerships

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Leverage AI for Claims Automation and Underwriting

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Develop Proactive Risk Mitigation Services

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Establish a Venture Arm for Insurtech Investments

Expected Impact:Medium

Implementation Difficulty:Moderate

Reinforce the position as the premier 'expert consultant' insurer, blending deep human expertise (via agents and underwriters) with increasingly sophisticated digital tools for a superior, hybrid customer experience.

Differentiate by focusing on the 'and' proposition: deep expertise AND digital convenience. While competitors focus on being either the cheapest/fastest (GEICO/Progressive) or the most premium (Chubb), Travelers can own the space of being the most holistically reliable partner for complex personal and business needs, accessible through any channel.

Whitespace Opportunities

- Opportunity:

Targeted Insurance Products for the Gig Economy and Solopreneurs

Competitive Gap:Many traditional small business policies are not tailored to the unique, fluctuating needs of freelancers, independent contractors, and gig workers.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Proactive IoT-based Risk Mitigation Services for Homes and Businesses

Competitive Gap:Most insurers focus on indemnifying loss after it occurs. There is a gap in offering services (e.g., smart water sensors, cybersecurity monitoring) that actively prevent the loss from happening.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Parametric Insurance for Specific, Niche Risks

Competitive Gap:Traditional claims processes are slow. Parametric policies (which pay out automatically based on a predefined trigger, like a specific wind speed in a hurricane) are underdeveloped in the mainstream market.

Feasibility:Medium

Potential Impact:Medium

The Travelers Companies, Inc. is a formidable incumbent in the mature and moderately concentrated U.S. Property & Casualty insurance market. Its primary competitive advantages are deeply entrenched and difficult to replicate: a vast network of independent agents, a trusted brand built over 165 years, and profound underwriting expertise, particularly in complex commercial and specialty lines. This positions Travelers as a stable and reliable choice for a wide range of personal and business customers.

The competitive landscape is bifurcated. On one side, Travelers faces direct competition from giants like Progressive, GEICO, and Allstate. Progressive and GEICO are digital-first, direct-to-consumer powerhouses that compete aggressively on price and technological innovation, particularly in the personal auto segment. Allstate represents a more traditional, agent-focused model, similar to Travelers but with a captive agent force. On the other side, Travelers faces a growing threat from agile, digital-native Insurtech startups like Lemonade and Root, which appeal to younger demographics with their seamless user experience and innovative business models. These companies, along with the rise of embedded insurance, are disrupting traditional distribution channels and customer expectations.

Travelers' key challenge is to navigate this digital disruption without alienating its core agent channel or compromising its underwriting discipline. The company's website demonstrates a clear effort to build a hybrid model, offering direct quoting for simple personal lines while guiding more complex business inquiries toward its agent network. This is the correct strategic direction.

The primary opportunity lies in doubling down on its 'expert consultant' positioning. Travelers can win by providing both sophisticated digital tools that empower customers AND agents, and by leveraging its deep data and human expertise to offer proactive risk management, not just reactive claims payment. Strategic priorities should include modernizing core technology to improve efficiency, expanding API capabilities to participate in the embedded insurance ecosystem, and developing new products for underserved markets like the gig economy. By successfully blending its traditional strengths of trust and expertise with modern digital capabilities, Travelers can solidify its position as a resilient market leader.

Messaging

Message Architecture

Key Messages

- Message:

Travelers has got you covered every day and when it matters most.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Transforming risk to your business advantage.

Prominence:Secondary

Clarity Score:High

Location:Homepage - Business Insurance Section

- Message:

Care when it matters most. And to us, it always matters.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage - Featured Content

- Message:

Find the insurance to fit your needs.

Prominence:Tertiary

Clarity Score:High

Location:Homepage - Personal Insurance Section

The messaging hierarchy is logical and effective. The homepage immediately establishes a clear bifurcation between 'Personal' and 'Business' insurance, which is the most critical user segmentation. Above this, the primary brand promise of 'got you covered' acts as a unifying theme. Sub-pages, like the 'Inland Marine' example, correctly prioritize highly specific, technical messaging for a niche audience, demonstrating a well-considered hierarchy that adapts to user intent.

Messaging is highly consistent. The core themes of protection, risk management, and reliability are present on both the general homepage and the specific business insurance page. The tone shifts appropriately from broad and reassuring (homepage) to specific and expert (product page), but the underlying message of providing dependable coverage remains constant.

Brand Voice

Voice Attributes

- Attribute:

Reassuring

Strength:Strong

Examples

Travelers has got you covered every day and when it matters most.

This coverage provides peace of mind, allowing mobile equipment dealers to focus on growing their business.

- Attribute:

Professional

Strength:Strong

Examples

Travelers helps manage those risks.

Our knowledgeable Claim professionals will respond to your needs with speed, compassion, integrity and professionalism.

- Attribute:

Expert

Strength:Moderate

Examples

Travelers has deep expertise in mobile equipment dealers’ business risks and provides specialized coverage solutions to address them.

With more than a century of expertise and more than 600 Risk Control consultants, Travelers has the experience and technical proficiency to help businesses manage their risks.

- Attribute:

Caring

Strength:Moderate

Examples

You care about life's important moments. Travelers cares about protecting them.

Here are stories of life-changing care from real Travelers employees, inspired by true events.

Tone Analysis

Professional & Reassuring

Secondary Tones

Knowledgeable

Empathetic

Tone Shifts

The tone shifts from broad, consumer-focused reassurance on the homepage to a more technical, expert-driven tone on specialized business insurance pages.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Travelers provides comprehensive, reliable insurance coverage and expert risk management, built on a long history of stability and customer care, to give individuals and businesses peace of mind.

Value Proposition Components

- Component:

Comprehensive Product Range

Clarity:Clear

Uniqueness:Common

- Component:

Risk Management Expertise (for Business)

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Customer Care & Support

Clarity:Somewhat Clear

Uniqueness:Common

- Component:

Brand Stability & Longevity

Clarity:Clear

Uniqueness:Unique

Travelers differentiates itself not on price, but on stability, expertise, and a legacy of trust symbolized by its iconic red umbrella. While competitors like Geico and Progressive focus on cost-savings and ease of purchase, Travelers' messaging targets customers who prioritize comprehensive coverage and a reliable partner, especially for complex business or personal needs. The emphasis on 'care' is an attempt to emotionally differentiate in a commoditized market.

Travelers positions itself as a premium, full-service insurer. For personal lines, it competes with giants like State Farm and Allstate by emphasizing reliability over discounts. For business insurance, it leverages its deep industry-specific expertise to position itself as a strategic risk-management partner, a more sophisticated positioning than many competitors who focus on generic small business owner policies.

Audience Messaging

Target Personas

- Persona:

Individuals & Families

Tailored Messages

Find the insurance to fit your needs.

You care about life's important moments. Travelers cares about protecting them.

Effectiveness:Effective

- Persona:

Businesses & Organizations

Tailored Messages

Transforming risk to your business advantage.

You face risks to grow your business and protect your organization. Travelers helps manage those risks.

Effectiveness:Effective

- Persona:

Niche Business Owners (e.g., Mobile Equipment Dealers)

Tailored Messages

Operating in the mobile equipment market poses unique challenges for dealers.

Insurance tailored for mobile equipment dealers protects against potential financial losses...

Effectiveness:Highly Effective

Audience Pain Points Addressed

- •

Fear of financial loss from unexpected events (theft, fire, weather).

- •

Complexity of managing business-specific risks.

- •

Vulnerability to fraud ('False pretense coverage').

- •

Protecting important assets (home, car, business equipment).

Audience Aspirations Addressed

- •

Gaining peace of mind to focus on personal life or growing a business.

- •

Achieving a competitive advantage by effectively managing business risks.

- •

Ensuring stability and continuity for one's family or organization.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Peace of Mind

Effectiveness:High

Examples

Travelers has got you covered every day and when it matters most.

Travelers helps manage those risks.

- Appeal Type:

Care & Empathy

Effectiveness:Medium

Examples

Care when it matters most. And to us, it always matters.

Here are stories of life-changing care from real Travelers employees, inspired by true events.

Social Proof Elements

{'proof_type': 'Longevity & History', 'impact': 'Strong'}

{'proof_type': 'Thought Leadership (Resource Articles)', 'impact': 'Moderate'}

Trust Indicators

- •

The iconic and long-standing red umbrella logo.

- •

Explicit mention of company values (Sustainability, D&I, Community).

- •

Clear, accessible contact information and agent finders.

- •

Detailed explanations of coverage and risk control services.

- •

Being a component of the Dow Jones Industrial Average.

Scarcity Urgency Tactics

None observed. This is appropriate for the industry, which builds trust through stability, not high-pressure sales tactics.

Calls To Action

Primary Ctas

- Text:

Start a quote

Location:Homepage Hero (Personal Insurance)

Clarity:Clear

- Text:

Find an agent

Location:Homepage Hero and throughout site

Clarity:Clear

- Text:

Find solutions

Location:Homepage (Business Insurance)

Clarity:Clear

- Text:

File a claim

Location:Main Navigation/Utility Links

Clarity:Clear

The CTAs are highly effective. They are clear, concise, and contextually relevant. The dual-path approach of 'Start a quote' (for direct, digitally-savvy users) and 'Find an agent' (for users who prefer a personal touch) is a key strategic strength, catering to different buying preferences within their target audience.

Messaging Gaps Analysis

Critical Gaps

Lack of customer testimonials and direct social proof. The site relies on 'stories inspired by true events' but lacks the powerful voice of the actual customer.

No direct price or value comparison messaging. While positioning as a premium brand is intentional, there is no content to help users understand the value they receive for the potential higher cost versus discount insurers.

Contradiction Points

No itemsUnderdeveloped Areas

The 'Care' narrative is somewhat siloed. While present in 'Featured content', this emotional hook could be more effectively woven into the product and service descriptions themselves.

Agent-focused content. While 'Find an agent' is a primary CTA, there is little messaging that builds the value proposition of why a customer should use a Travelers agent over going direct or using a competitor's agent.

Messaging Quality

Strengths

- •

Excellent audience segmentation between personal and business lines right from the homepage.

- •

Strong brand voice that is consistent, professional, and reassuring.

- •

Clear and effective Calls-to-Action that cater to different user journeys (direct vs. agent).

- •

Leverages brand heritage and stability as a key differentiator.

Weaknesses

- •

Over-reliance on telling rather than showing (e.g., claims of 'care' without customer testimonials).

- •

The messaging can feel conservative and corporate, potentially lacking appeal for younger demographics who are drawn to more modern, tech-forward brands.

- •

Weak on quantifiable value propositions (e.g., average claim satisfaction score, response time).

Opportunities

- •

Integrate authentic customer stories and video testimonials to bring the 'care' message to life.

- •

Develop content that explains the 'why' behind their coverage—helping users understand the value of comprehensive insurance over cheaper, bare-bones alternatives.

- •

Create dedicated content to humanize and showcase the expertise of their independent agents, strengthening that channel.

Optimization Roadmap

Priority Improvements

- Area:

Social Proof

Recommendation:Launch a 'Customer Stories' initiative. Actively solicit and feature short, impactful video and text testimonials on the homepage and relevant product pages, focusing on positive claim experiences.

Expected Impact:High

- Area:

Value Proposition

Recommendation:Develop a 'The Travelers Difference' section or a series of blog posts that transparently explains the value of their coverage, risk control services, and agent expertise, justifying the premium positioning against low-cost competitors.

Expected Impact:High

- Area:

Emotional Connection

Recommendation:Integrate the 'care' messaging more directly into product pages. For example, on the Home Insurance page, instead of just listing features, frame them with headlines like 'Caring for your biggest investment.'

Expected Impact:Medium

Quick Wins

- •

Add a 'Rated X/5 stars by Y customers' element near the 'Get a quote' CTA if such data exists.

- •

On the 'Find an agent' page, add a headline that reinforces the benefit, such as 'Get Personalized Advice from a Local Expert.'

- •

In the resource articles, embed CTAs that are more contextually relevant to the article's content, rather than a generic 'Find an agent' link.

Long Term Recommendations

Invest in a content marketing strategy focused on risk prevention and education, solidifying the brand's position as a proactive partner, not just a reactive insurer.

Develop a more distinct voice for personal vs. business lines. While consistency is good, the personal lines voice could be warmer and more relatable, while the business voice can lean even more heavily into data-driven expertise.

Travelers' strategic messaging is a masterclass in positioning a legacy brand based on stability, comprehensive coverage, and trust. The website's architecture is exceptionally clear, immediately and effectively segmenting users into 'Personal' and 'Business' funnels. The brand voice is professional, reassuring, and consistent, perfectly aligning with a risk-averse customer's expectations. The core value proposition—being the reliable, expert choice in an uncertain world—is communicated effectively and serves as a strong differentiator against competitors who lead with price and humor.

The primary weakness lies in a significant 'say-show' gap. The brand says it cares, but it fails to show this through the most credible channel: the voice of its customers. The near-total absence of testimonials, customer stories, or ratings is a major missed opportunity to build emotional connection and validate its core 'care' message. While the site excels at communicating with a rational, risk-focused mindset, it underutilizes the emotional storytelling needed to build a deeper brand affinity. The calls-to-action are clear and well-executed, smartly offering both direct-to-consumer and agent-based paths to purchase. Overall, the messaging strategy is strong and well-aligned with its business objectives, but it could be significantly amplified by incorporating authentic social proof and weaving its emotional 'care' narrative more deeply into the entire digital experience.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

A component of the Dow Jones Industrial Average, Travelers is a leading provider of property casualty insurance for auto, home, and business with over 30,000 employees and revenues exceeding $41 billion in 2023.

- •

Offers a comprehensive and diversified portfolio of insurance products covering both personal (Auto, Home, Pet, etc.) and business (Cyber, General Liability, Workers Comp, etc.) lines, as detailed on its website.

- •

Demonstrates long-term market presence and premium growth, reporting record net written premiums of over $40 billion in 2023, the 14th consecutive year of growth.

- •

Strong financial performance, with recent earnings per share significantly topping consensus estimates, indicating robust demand and operational efficiency.

Improvement Areas

- •

Modernizing the user experience for direct-to-consumer digital channels to better compete with insurtech startups like Lemonade and Hippo.

- •

Developing more personalized, usage-based insurance (UBI) products by integrating telematics and IoT data to meet evolving customer expectations.

- •

Simplifying policy language and the claims process to enhance transparency and customer satisfaction.

Market Dynamics

The U.S. Property and Casualty (P&C) insurance market is projected to grow at a CAGR of 3.96% to 8.54%, depending on the source and scope, reaching over $1.3 trillion by 2030.

Mature

Market Trends

- Trend:

Digital Transformation and Insurtech

Business Impact:Traditional insurers must adopt AI, ML, and automation to improve underwriting, claims processing, and customer experience to stay competitive with agile insurtechs.

- Trend:

Embedded Insurance

Business Impact:A major shift in distribution, where insurance is offered at the point of sale (e.g., with a car or home purchase). This creates a significant opportunity to reach new customers but also threatens traditional agent-based channels.

- Trend:

Climate Change and Catastrophe Risk

Business Impact:Increasing frequency and severity of natural disasters are driving up claims costs, necessitating more sophisticated risk modeling and pricing adjustments.

- Trend:

Rising Demand for Cyber Insurance

Business Impact:The cyber insurance market is experiencing rapid growth (projected CAGR of 14-22%) due to increasing cyber threats and regulations, presenting a major growth opportunity for carriers like Travelers.

Challenging but Necessary. The mature P&C market is highly competitive, but the rapid technological and distribution shifts create a critical window for established players like Travelers to innovate and capture new growth vectors before being disrupted.

Business Model Scalability

Medium

The model has significant fixed costs (IT infrastructure, corporate overhead) and variable costs tied to growth (agent commissions, claims processing). Digital channels can lower variable costs per policy, improving scalability.

Moderate. Operational leverage is achieved through disciplined underwriting and efficient claims management. AI and automation in these areas can significantly increase leverage.

Scalability Constraints

- •

Heavy reliance on the traditional independent agent channel, which is less scalable than direct digital models.

- •

Legacy IT systems can hinder the rapid development and deployment of new, digitally-native products.

- •

Regulatory compliance across numerous jurisdictions adds complexity and cost to scaling new offerings.

- •

Claims processing remains a human-intensive operation, limiting scalability during high-volume events.

Team Readiness

Experienced and stable, with a clear focus on delivering shareholder value through underwriting discipline and leveraging competitive advantages like scale and data.

A traditional, siloed structure (Personal, Business, Bond & Specialty lines) that is effective for managing a diversified portfolio but may slow down cross-functional digital initiatives.

Key Capability Gaps

- •

Digital Product Management: Need for talent to design and manage end-to-end digital customer journeys.

- •

Data Science & AI/ML Engineering: While possessing strong actuarial talent, a deeper bench in modern data science is needed for advanced pricing, underwriting, and fraud detection models.

- •

Partnership and Ecosystem Management: Requires dedicated teams to build and manage embedded insurance and insurtech partnerships.

Growth Engine

Acquisition Channels

- Channel:

Independent Agents & Brokers

Effectiveness:High

Optimization Potential:Medium

Recommendation:Empower agents with better digital tools for quoting, binding, and servicing to improve efficiency and create a more seamless agent-customer experience.

- Channel:

Direct-to-Consumer (D2C) Website

Effectiveness:Medium

Optimization Potential:High

Recommendation:Overhaul the online quoting and purchasing funnel. Simplify the user interface, reduce friction, and provide a fully digital, self-service binding process to compete with digital-native insurers.

- Channel:

Content Marketing & SEO

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Expand the existing resource center content. Target higher-intent keywords related to specific insurance needs (e.g., 'cyber insurance for small business') and optimize for lead capture.

- Channel:

Partnerships (Affinity & Co-branded)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand partnerships beyond niche products (pet, travel) to core offerings. Develop an 'embedded insurance' strategy to integrate offerings into third-party digital ecosystems.

Customer Journey

Primarily multi-channel. The website facilitates direct quotes for personal lines but heavily promotes finding an agent for both personal and complex business lines, indicating a hybrid online-to-offline journey.

Friction Points

- •

Lengthy and complex online quote forms for personal lines.

- •

Lack of a fully online 'bind and buy' capability for many products, requiring a handoff to an agent or call center.

- •

Navigating the claims process can be perceived as cumbersome and opaque despite digital tools being available.

Journey Enhancement Priorities

{'area': 'Digital Quoting', 'recommendation': "Implement a 'quick quote' feature using minimal data inputs, followed by a more detailed process. Leverage data pre-fill services to reduce manual entry."}

{'area': 'Claims Experience', 'recommendation': 'Enhance the claims portal with real-time status updates, proactive communication (SMS/push notifications), and AI-powered tools for faster damage assessment (e.g., photo-based estimates).'}

Retention Mechanisms

- Mechanism:

Multi-Policy Discounts (Bundling)

Effectiveness:High

Improvement Opportunity:Proactively identify and market bundling opportunities to single-policy customers using data analytics.

- Mechanism:

Agent Relationships

Effectiveness:High

Improvement Opportunity:Provide agents with data-driven insights about their clients' changing needs to facilitate proactive outreach and cross-selling.

- Mechanism:

Brand Trust and Financial Stability

Effectiveness:High

Improvement Opportunity:Reinforce brand messaging around reliability and long-term commitment, especially during periods of market volatility.

Revenue Economics

Strong. As a leading incumbent, Travelers leverages scale to achieve underwriting profitability. Recent results show an excellent underlying combined ratio of 84.7%, indicating strong profitability on its policies before investment income.

Not publicly available, but the industry goal is to maximize lifetime value through multi-year retention and cross-selling (bundling), which is a core part of Travelers' model.

High. Consistent growth in net written premiums and strong core income demonstrate an efficient revenue engine.

Optimization Recommendations

- •

Invest in digital acquisition channels to lower the blended Customer Acquisition Cost (CAC).

- •

Use AI and advanced analytics to refine underwriting and pricing, improving the loss ratio component of the combined ratio.

- •

Automate routine claims and administrative tasks to reduce the expense ratio.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Core Systems

Impact:High

Solution Approach:Adopt a two-speed IT architecture. Maintain stable legacy systems for core policy administration while building agile, API-driven digital layers for customer-facing applications and new product launches.

Operational Bottlenecks

- Bottleneck:

Manual Underwriting for Complex Risks

Growth Impact:Slows down quoting for business insurance and can lead to inconsistent decision-making.

Resolution Strategy:Implement an AI-augmented underwriting workbench that automates data ingestion, flags risks, and provides recommendations to human underwriters.

- Bottleneck:

Claims Processing during Catastrophic Events

Growth Impact:Can lead to customer dissatisfaction and operational strain, damaging brand reputation.

Resolution Strategy:Invest in drone technology, satellite imagery analysis, and AI-powered damage assessment tools to accelerate processing and resource allocation during major events.

Market Penetration Challenges

- Challenge:

Intense Price Competition

Severity:Critical

Mitigation Strategy:Compete on value, not just price. Emphasize superior claims service, risk management expertise (especially for businesses), and digital convenience. Use sophisticated data analysis for more accurate, personalized pricing.

- Challenge:

Disruption from Insurtech Startups

Severity:Major

Mitigation Strategy:Adopt a 'build, partner, or buy' strategy. Develop in-house digital capabilities, partner with insurtechs for specific technologies (e.g., telematics, AI claims), and selectively acquire startups that offer strategic advantages.

Resource Limitations

Talent Gaps

- •

Digital Customer Experience (CX) Designers

- •

AI/ML Engineers

- •

Cloud Infrastructure Architects

- •

Business Development Managers for Embedded Insurance

Low. As a large, profitable company, capital is not a primary constraint. The challenge is allocating capital effectively towards innovation and digital transformation projects with long-term ROI.

Infrastructure Needs

Modern, cloud-based data platform to unify data from various silos for advanced analytics.

API gateway to facilitate secure and scalable integrations with third-party partners (insurtechs, embedded partners).

Growth Opportunities

Market Expansion

- Expansion Vector:

Micro and Small Businesses (SMBs)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Develop a fully digital, self-service platform for Business Owner's Policies (BOP) and other standard SMB coverages, leveraging the direct channel to reduce acquisition costs.

Product Opportunities

- Opportunity:

Expansion of Cyber Insurance Offerings

Market Demand Evidence:The global cyber insurance market is projected for explosive growth (14%+ CAGR) driven by rising cyber threats and regulations.

Strategic Fit:High. Leverages existing expertise in commercial lines and risk management.

Development Recommendation:Develop tiered cyber products for different business sizes, including proactive risk mitigation services (e.g., threat monitoring, employee training) as a value-add.

- Opportunity:

Usage-Based Insurance (UBI) for Auto

Market Demand Evidence:Competitors like Progressive have seen high adoption rates for telematics programs, as behavior-based pricing appeals to consumers.

Strategic Fit:High. Aligns with personal auto as a core product line.

Development Recommendation:Launch a mobile-app-based telematics program, focusing on a simple user experience and clear communication of how driving behavior translates into premium savings.

Channel Diversification

- Channel:

Embedded Insurance

Fit Assessment:High

Implementation Strategy:Establish a dedicated partnership team to target platforms in automotive (dealerships, financing), real estate (mortgage lenders, property management), and B2B SaaS to embed relevant insurance products at the point of need.

Strategic Partnerships

- Partnership Type:

Insurtech Collaboration

Potential Partners

- •

AI Claims Processing startups (e.g., Tractable, Snapsheet)

- •

Telematics Data Providers (e.g., Cambridge Mobile Telematics)

- •

Cyber Risk Analytics Firms

Expected Benefits:Accelerate technology adoption without extensive in-house development, improve operational efficiency, and access new data sources for underwriting.

Growth Strategy

North Star Metric

Policies in Force per Customer

In a mature market, deepening customer relationships is more profitable than solely acquiring new ones. This metric incentivizes cross-selling (bundling), improves retention, and increases overall Customer Lifetime Value (CLV).

Increase the ratio by 10% over the next 24 months.

Growth Model

Hybrid: Agent-Led, Digital-Direct, and Ecosystem-Driven

Key Drivers

- •

Agent Productivity & Digital Enablement

- •

Direct-to-Consumer Conversion Rate Optimization

- •

Number and scale of Embedded Insurance Partnerships

Run three parallel growth streams: 1) Equip the agent channel with superior digital tools. 2) Aggressively optimize the direct digital funnel. 3) Build a scalable API platform to enable ecosystem/embedded partnerships.

Prioritized Initiatives

- Initiative:

Launch a fully digital, self-serve Small Business Insurance Platform

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Conduct market research with small business owners to identify key pain points. Develop an MVP (Minimum Viable Product) for a Business Owner's Policy (BOP).

- Initiative:

Develop an Embedded Insurance API Platform and Partnership Program

Expected Impact:High

Implementation Effort:Medium

Timeframe:12 months

First Steps:Identify the top 3-5 initial use cases (e.g., auto insurance at point of vehicle sale). Build a set of robust, well-documented APIs for quoting and binding. Hire a business development lead for partnerships.

- Initiative:

Redesign the Personal Lines Direct-to-Consumer Quote-to-Bind Funnel

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Map the current user journey and identify key drop-off points. Begin A/B testing simplified form designs and value propositions on the highest-traffic pages.

Experimentation Plan

High Leverage Tests

{'area': 'Digital Quoting', 'experiment': "Test a simplified 3-field 'Quick Quote' vs. the traditional detailed form on the homepage to measure lead capture rates."}

{'area': 'Cross-Selling', 'experiment': 'Pilot a program where claims adjusters are trained and incentivized to identify and refer potential cross-sell opportunities to agents during the claims process.'}

Utilize a combination of web analytics (conversion rates, funnel drop-off), business intelligence (policy-in-force, combined ratio by channel), and customer feedback (NPS, CSAT).

Bi-weekly sprints for digital product teams; quarterly reviews for larger strategic initiatives.

Growth Team

A centralized Growth & Innovation office reporting to a C-level executive, with embedded digital product managers and analysts within each major business line (Personal, Business) to ensure alignment and execution.

Key Roles

- •

Head of Digital Transformation

- •

Director of Ecosystem Partnerships

- •

Principal Data Scientist

- •

Head of Customer Experience (CX)

Establish a 'Digital Academy' for internal training. Actively recruit talent from tech and insurtech sectors. Foster a culture of experimentation by celebrating learning from both successful and failed tests.

The Travelers Companies, Inc. exhibits a strong growth foundation, characterized by dominant product-market fit, a powerful brand, and consistent financial performance. As a market leader in the mature P&C insurance industry, its primary challenge is not survival, but adaptation. The company operates from a position of strength, with its diversified business lines and formidable independent agent channel providing a stable base.

The most significant barriers to accelerated growth are internal inertia, reliance on legacy technology, and the operational complexities of its traditional, agent-centric business model. The market is being fundamentally reshaped by external forces, chiefly digital transformation, the rise of agile insurtech competitors, and a shift in distribution toward embedded insurance. Competitors like Progressive are aggressively pursuing growth through direct channels and cost efficiencies, highlighting the competitive pressure.

Travelers' greatest growth opportunities lie in embracing these disruptive trends. The path to sustainable, long-term growth involves a multi-pronged strategy:

- Digital Channel Evolution: Transforming the direct-to-consumer channel from a lead generator for agents into a seamless, end-to-end digital purchasing and service platform.

- Ecosystem Integration: Aggressively pursuing embedded insurance partnerships to open new, highly scalable distribution channels. This is arguably the most critical long-term growth vector, as it positions Travelers to be present wherever insurance is needed, rather than waiting for customers to seek it out.

- Product Innovation: Leveraging data and technology to create more personalized and proactive products, particularly in high-growth areas like cyber insurance and usage-based auto insurance.

Successfully executing this strategy requires a cultural shift towards agility and experimentation, significant investment in modern technology infrastructure and digital talent, and a willingness to evolve its historic business model. The strategic priority should be to leverage its existing scale and data advantages to build a digital-first, multi-channel insurance powerhouse, effectively bridging the gap between its traditional strengths and the future of insurance distribution.

Legal Compliance

Travelers maintains a comprehensive set of privacy policies and disclosures, segmented for different jurisdictions and legal frameworks. The main 'Online Privacy Statement' is robust, detailing the types of Personal Information collected (e.g., identifiers, financial data, telematics information), the purposes for collection (e.g., underwriting, claims processing, fraud prevention), and sharing practices with affiliates and third-party service providers. Crucially, it acknowledges its status as a financial institution under the Gramm-Leach-Bliley Act (GLBA), which governs the handling of nonpublic personal financial information. The site also features a dedicated 'California Consumer Privacy Act Disclosure,' which outlines rights specific to California residents under CCPA/CPRA, including the right to access, delete, and correct personal information, and explicitly states that it may 'sell' or 'share' personal information like identifiers and internet activity for cross-context behavioral advertising. For its European operations, a separate, detailed privacy policy addresses GDPR requirements, identifying Travelers Europe as the data controller and mentioning the processing of special categories of data like health information, with a designated Data Protection Officer. This demonstrates a sophisticated, jurisdiction-aware approach to privacy compliance.

The 'Terms of Service' are clearly accessible and establish a binding agreement between the user and The Travelers Indemnity Company. The terms are comprehensive, covering rules of conduct, intellectual property rights, and disclaimers. Key provisions include a strong disclaimer of warranties ('AS IS' basis) and a significant limitation of liability, capping aggregate liability at a nominal amount ($50.00), which is a standard but aggressive legal posture. The terms also address mobile app usage through a limited license agreement. For European users, a separate set of 'Terms and Conditions' is available, which includes clauses on acceptable use and registration requirements for accessing specific site functions, indicating a tailored legal approach for different markets. Overall, the terms are clear, legally robust, and designed to minimize the company's legal exposure.

Upon visiting travelers.com, a cookie consent banner is immediately displayed, providing clear options to 'Accept All Cookies,' 'Reject All,' or access 'Cookie Settings.' This granular control is a best practice for compliance with regulations like GDPR. The 'Cookie Settings' interface allows users to toggle consent for different categories of cookies (e.g., Functional, Performance, Targeting). The presence of this mechanism indicates a strong understanding of modern privacy expectations and legal requirements for obtaining user consent before deploying non-essential trackers. The policy also explicitly mentions the use of cookies, web beacons, and other tracking technologies to collect information like IP addresses and browser details, linking this practice to their broader privacy statement.

Travelers demonstrates a mature data protection framework, heavily influenced by its obligations as a financial institution and insurer. The primary governing US federal law is the Gramm-Leach-Bliley Act (GLBA), which mandates the protection of nonpublic personal financial information. State-level insurance regulations, many based on the NAIC Insurance Data Security Model Law, further require a comprehensive information security program, risk assessments, and incident response planning. For operations in New York, Travelers is subject to the stringent NYDFS Cybersecurity Regulation (23 NYCRR 500), which sets prescriptive standards for cybersecurity programs, including access controls, encryption, and annual compliance certifications. Compliance with CCPA/CPRA is explicitly managed through a dedicated disclosure and request portal for California residents. For European operations, GDPR compliance is managed through a separate policy, acknowledging its extraterritorial scope and appointing a DPO. This multi-layered approach, combining federal, state, and international standards, reflects a sophisticated strategy to manage data protection risk across its operational footprint.

Travelers shows a strong and public commitment to digital accessibility. The website features a dedicated 'Digital Accessibility Statement' that affirms its goal of making its website accessible to the 'widest possible audience, regardless of ability or technology.' Crucially, the company provides a direct point of contact—both a phone number (866.336.2077) and an email address ([email protected])—for users who encounter accessibility barriers, offering to provide services through alternative means. This is a key component of ADA compliance, as it provides an immediate recourse for users with disabilities. The website's code also includes 'skip to main content' links, a fundamental feature for users of screen readers. While a full audit is required for definitive WCAG conformance, these public-facing commitments and features represent a strong legal positioning on accessibility.

As a major insurer, Travelers' legal positioning is dominated by industry-specific regulations. Insurance in the U.S. is regulated at the state level, meaning Travelers must comply with the laws of each state in which it operates, covering everything from agent licensing to policy forms and solvency requirements. A critical framework is the NAIC Insurance Data Security Model Law, adopted by numerous states, which mandates a formal information security program and breach notification procedures to state commissioners. At the federal level, the Gramm-Leach-Bliley Act (GLBA) imposes strict privacy and data security rules on insurance companies as 'financial institutions.' Furthermore, operations in states like New York require adherence to the NYDFS Cybersecurity Regulation, one of the most demanding in the nation. The website includes necessary disclosures, such as noting states where quotes are unavailable (e.g., AK, FL, HI), which is a direct reflection of these state-by-state licensing and regulatory constraints.

Compliance Gaps