eScore

truist.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

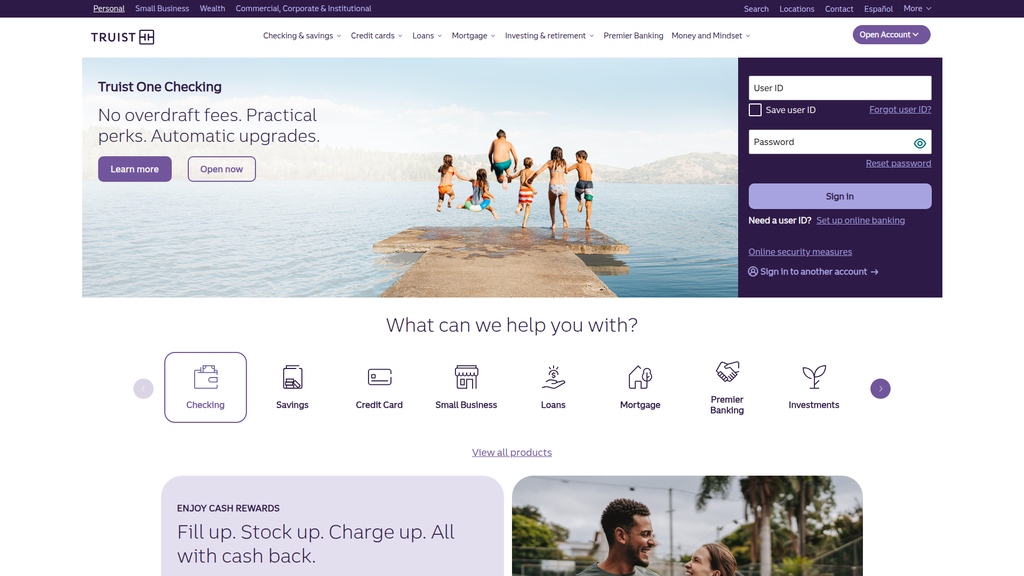

Truist has a strong digital foundation, with 43% of new accounts opened digitally and a clear focus on enhancing its platforms with AI-driven tools like Truist Assist. The website's information architecture is logical, supporting users who know what they want. However, its content authority is still developing, facing challenges in competing with the extensive digital ecosystems of larger national banks for broader, non-branded financial search terms. While its geographic reach is strong in the Southeast, its digital content strategy needs to better align with top-of-funnel search intent to capture new customers earlier in their research journey.

A clear, well-structured website optimized for users in the consideration and decision stages of the customer journey, supported by growing digital adoption.

Develop more in-depth, authoritative thought leadership content (e.g., proprietary research, market outlooks) to improve organic search rankings for non-branded, problem-aware search queries and compete with established national players.

Truist has successfully established a differentiated brand position centered on the concept of 'care,' which is consistently applied across its website, particularly for its high-value wealth management segment. The messaging is well-segmented for different audiences, shifting from transactional for retail to empathetic for wealth clients. However, there is a notable gap between the aspirational, purpose-driven brand messaging and the highly product-centric homepage experience, which fails to substantiate the 'care' promise with tangible proof points for everyday banking products.

A clear, consistent, and differentiated brand theme of 'care' that creates a warm and aspirational brand voice, which is unique in the conservative banking industry.

Revise the homepage message hierarchy to better balance the brand promise of 'care' with product offerings, and add a dedicated section with concrete proof points (e.g., 'No overdraft fees', '24/7 support') to make the abstract concept of 'care' tangible for all customer segments.

The website offers a clean, uncluttered layout and a logical information architecture, which reduces cognitive load for users. However, significant conversion friction exists due to inconsistent Call-to-Action (CTA) styling, where primary and secondary actions are visually ambiguous, potentially confusing users. While mobile responsiveness is good, the user journey has been negatively impacted by post-merger integration issues, leading to customer complaints about account access and service, which directly harms conversion and retention.

A clean, modern design with a logical site structure and intuitive navigation that makes it easy for users to find specific product information.

Standardize the CTA button hierarchy immediately. Use a solid, high-contrast style for all primary conversion actions ('Apply Now', 'Open Account') and a secondary style (e.g., outlined 'ghost' button) for non-conversion actions ('Learn More') to provide clear visual guidance.

As a top 10 U.S. commercial bank, Truist's credibility is institutionally strong, built on a mature and robust compliance framework governed by the Gramm-Leach-Bliley Act (GLBA). The website effectively displays key trust signals such as 'Member FDIC' and 'Equal Housing Lender' logos and has a comprehensive 'Fraud and Security Center.' Its public commitment to accessibility standards (WCAG, ADA) is a key strength, mitigating legal risk and enhancing brand inclusivity. While fundamentally strong, transparency could be improved with a more proactive and visible cookie consent mechanism.

A comprehensive and public commitment to digital accessibility (WCAG, ADA, Section 508), which mitigates legal risk, expands market reach, and reinforces the brand's message of 'care'.

Implement a prominent, interactive cookie consent banner on the website's initial entry point that requires affirmative user action before loading non-essential cookies to align with global privacy best practices.

Truist's most sustainable competitive advantage is its significant, defensible market share in the high-growth Southeastern U.S., a region where it holds a top-three deposit share in most major metro areas. This geographic focus, combined with economies of scale and an integrated full-service model, creates high switching costs for clients. However, the company faces major disadvantages related to post-merger integration challenges, which have led to operational inefficiencies, and it is outspent on technology by larger competitors like JPMorgan Chase and Bank of America.

Dominant market share and deep-rooted physical presence in the economically vibrant and fast-growing Southeastern U.S. markets.

Develop a clearer narrative and content strategy that showcases the combined capabilities and enhanced market position resulting from the BB&T and SunTrust merger, turning a point of confusion and weakness into a competitive strength.

Truist has high scalability potential, underpinned by a strong capital position and a clear strategic plan for expansion into high-growth markets like Texas and Florida. The company is actively investing in both physical (100 new branches) and digital channels, with 43% of new accounts being opened digitally. However, growth is constrained by significant technical debt from integrating two legacy core banking systems and operational bottlenecks in customer support, which have been exacerbated by the merger.

A clear, well-funded strategic growth initiative focused on expanding its physical and digital presence in high-growth U.S. markets.

Accelerate the modernization and unification of legacy IT systems to reduce technical debt, improve operational efficiency, and enable faster deployment of innovative digital products.

Truist operates on a highly diversified and coherent universal banking model, with strong revenue streams from both net interest income and fee-based services like wealth management. The strategic focus is clear: leverage its scale in key Southeastern markets while shifting towards a more efficient, digitally-enabled service model. However, the model's coherence has been tested by post-merger integration challenges and customer service issues, creating a disconnect between the stated brand purpose of 'care' and the actual customer experience.

A highly diversified revenue model with significant contributions from noninterest income (wealth management, investment banking), which provides resilience against interest rate fluctuations.

Launch targeted marketing and PR campaigns with tangible proof points (customer testimonials, service improvements) to rebuild trust and better align the customer's perception of the brand with the strategic mission of 'care'.

As a top 10 U.S. commercial bank, Truist wields significant market power, particularly within its core Southeastern footprint where it is a market leader. This dominant position provides a stable deposit base and a degree of pricing power through relationship-based offerings. The bank's diversified business model across retail, commercial, and wealth management limits dependency on any single customer segment. Its primary challenge is translating this regional physical power into national digital influence, where it still lags larger competitors.

Significant market share and pricing power in its core geographic footprint, allowing it to compete effectively with both national mega-banks and smaller regional players.

Invest in a proprietary economic index or data-driven research focused on the Southeastern U.S. economy to establish itself as the definitive thought leader for the region, generating high-quality media mentions and enhancing its market influence.

Business Overview

Business Classification

Financial Services Holding Company

Universal Bank

Banking & Financial Services

Sub Verticals

- •

Retail & Consumer Banking

- •

Commercial & Corporate Banking

- •

Wealth Management & Advisory

- •

Investment Banking & Capital Markets

- •

Mortgage Lending

- •

Insurance Brokerage

Mature

Maturity Indicators

- •

Formed from the merger of two large, established banks (BB&T and SunTrust).

- •

Ranked as a top 10 U.S. commercial bank by assets.

- •

Extensive physical branch network across 17 states and D.C.

- •

Comprehensive, diversified product and service offerings across multiple financial sectors.

- •

Subject to significant regulatory oversight as a systemically important financial institution.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Net Interest Income (NII)

Description:The core revenue driver, representing the difference between interest earned on assets (loans, securities) and interest paid on liabilities (deposits, debt). Profitability is highly sensitive to interest rate fluctuations.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:Medium

- Stream Name:

Wealth Management & Advisory Fees

Description:Fees generated from asset management, investment advisory, financial planning, and trust services for high-net-worth and institutional clients.

Estimated Importance:Secondary

Customer Segment:High-Net-Worth Individuals, Institutional Clients

Estimated Margin:High

- Stream Name:

Investment Banking & Capital Markets Fees

Description:Income from M&A advisory, debt and equity underwriting, and sales and trading activities for corporate and institutional clients.

Estimated Importance:Secondary

Customer Segment:Large Corporations, Institutional Clients

Estimated Margin:High

- Stream Name:

Service Charges on Deposit Accounts

Description:Fees for account maintenance, overdrafts, and other transactional services for consumer and small business accounts.

Estimated Importance:Tertiary

Customer Segment:Mass Market Retail, Small Businesses

Estimated Margin:High

- Stream Name:

Mortgage Banking Income

Description:Revenue from originating, selling, and servicing residential and commercial mortgage loans.

Estimated Importance:Secondary

Customer Segment:Mass Market Retail, Small Businesses, Commercial Real Estate

Estimated Margin:Medium

- Stream Name:

Card and Payment Fees

Description:Interchange fees from debit and credit card transactions, as well as annual card fees and merchant services revenue.

Estimated Importance:Secondary

Customer Segment:Mass Market Retail, Small & Medium Businesses

Estimated Margin:Medium

Recurring Revenue Components

- •

Interest income from loan and securities portfolios

- •

Asset-based wealth management fees

- •

Account maintenance and service fees

- •

Loan servicing fees

Pricing Strategy

Interest Rate Spread & Fee-for-Service

Mid-range

Semi-transparent

Pricing Psychology

- •

Relationship Pricing (offering better rates for clients with multiple products)

- •

Tiered Offerings (e.g., Premier Banking for higher-value clients)

- •

Promotional Rates (e.g., introductory APRs on credit cards)

Monetization Assessment

Strengths

- •

Highly diversified revenue model reduces dependency on any single income stream.

- •

Significant noninterest income provides a buffer against interest rate volatility.

- •

Large scale and customer base provide ample cross-selling opportunities.

Weaknesses

Net Interest Margin (NIM) is susceptible to compression in changing rate environments.

Fee income from investment banking can be cyclical and dependent on market conditions.

Opportunities

- •

Expanding fee-based businesses like wealth management and payments to further diversify revenue.

- •

Leveraging technology to offer premium, value-added digital services for a fee.

- •

Investing in high-growth markets to expand the loan and deposit base.

Threats

Intense price competition from other large banks and credit unions.

Fee compression from fintech startups offering low-cost alternatives for payments, lending, and investing.

Market Positioning

A purpose-driven, full-service financial institution combining large-bank capabilities with a community-focused, personal care approach.

Top 10 U.S. Commercial Bank.

Target Segments

- Segment Name:

Consumer & Small Business Banking

Description:Individuals, families, and small businesses requiring day-to-day banking, lending, and payment services. This forms the foundational deposit and loan base.

Demographic Factors

Broad range of ages and income levels

Geographically concentrated in the Southeastern and Mid-Atlantic U.S.

Psychographic Factors

Value convenience (digital and physical branches)

Seek a trusted, stable financial partner

Behavioral Factors

Utilize mobile/online banking for transactions

Visit branches for complex needs or problem resolution

Pain Points

- •

High bank fees

- •

Poor customer service

- •

Complex loan application processes

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Wealth & Premier Clients

Description:Mass-affluent to high-net-worth individuals and families requiring personalized financial advice, investment management, and specialized banking services.

Demographic Factors

Higher income and net worth

Often business owners or corporate executives

Psychographic Factors

Focused on wealth growth, preservation, and legacy planning

Value expertise and a dedicated relationship manager

Behavioral Factors

Engage with financial advisors

Utilize sophisticated investment and planning tools

Pain Points

- •

Lack of a holistic financial plan

- •

Navigating complex investment and estate regulations

- •

Receiving impersonal, generic advice

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Corporate & Commercial Clients

Description:Middle-market to large corporations and institutional entities requiring sophisticated financial solutions, including lending, treasury management, and capital markets access.

Demographic Factors

Varies by industry (healthcare, energy, technology, etc.).

Significant operations within Truist's geographic footprint

Psychographic Factors

Seek strategic financial partners to support growth

Value industry-specific expertise

Behavioral Factors

Engage in complex financing and cash management transactions

Rely on a team of banking specialists

Pain Points

- •

Access to capital

- •

Inefficient treasury and payment systems

- •

Managing financial risk

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Scale and Geographic Focus

Strength:Strong

Sustainability:Sustainable

- Factor:

Integrated Service Model

Strength:Moderate

Sustainability:Sustainable

- Factor:

Brand Positioning around 'Care'

Strength:Weak

Sustainability:Temporary

Value Proposition

To provide a comprehensive suite of financial solutions through a blend of advanced technology and personalized human touch, inspiring and building better lives and communities.

Good

Key Benefits

- Benefit:

One-Stop Shop for All Financial Needs

Importance:Critical

Differentiation:Common

Proof Elements

Comprehensive product list on website (checking, loans, investments, wealth management)

- Benefit:

Convenience through Digital and Physical Channels

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Mobile app with advanced features like Truist Assist.

Extensive network of over 1,900 branches and 2,800 ATMs.

- Benefit:

Personalized Advice and Relationships

Importance:Important

Differentiation:Common

Proof Elements

"Find an Advisor" feature for wealth management

Marketing focus on a "customer-centric approach".

Unique Selling Points

- Usp:

The 'Merger of Equals' scale, combining the strengths of BB&T and SunTrust to create a new premier financial institution.

Sustainability:Medium-term

Defensibility:Moderate

- Usp:

A stated purpose-driven mission to 'inspire and build better lives and communities,' integrated into its brand identity.

Sustainability:Long-term

Defensibility:Weak

Customer Problems Solved

- Problem:

Managing daily finances and transactions efficiently.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Accessing capital for major life purchases (home, car) or business growth.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Planning for long-term financial goals like retirement and wealth transfer.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

Truist's comprehensive service offerings are well-aligned with the needs of a broad financial services market, from individual consumers to large corporations.

Medium

While the product suite is aligned, the brand message of 'care' has been challenged by post-merger integration issues and customer service complaints, creating a potential disconnect with the desired value perception.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Technology Vendors (Core banking systems, AI, cybersecurity)

- •

Payment Networks (Visa, Mastercard)

- •

Fintech Companies (via Truist Ventures).

- •

Community Organizations & Non-profits

Key Activities

- •

Deposit Gathering & Lending

- •

Wealth & Asset Management

- •

Payment Processing

- •

Risk Management & Compliance

- •

Technology Integration & Development

Key Resources

- •

Banking Charters & Licenses

- •

Significant Capital Base

- •

Extensive Branch and ATM Network.

- •

Digital Banking Platforms

- •

Brand Equity & Customer Relationships

Cost Structure

- •

Employee Compensation & Benefits

- •

Interest Expense on Deposits

- •

Technology & Infrastructure Costs

- •

Provision for Credit Losses

- •

Marketing & Advertising

Swot Analysis

Strengths

- •

Significant market share and scale as a top 10 U.S. bank.

- •

Diversified business model across multiple banking and financial segments.

- •

Strong capital position with a robust CET1 ratio.

- •

Leading presence in high-growth Southeastern and Mid-Atlantic markets.

Weaknesses

- •

Ongoing challenges and costs associated with the BB&T and SunTrust merger integration.

- •

Customer service issues and reputational damage following system conversions.

- •

Efficiency ratio may lag peers as merger synergies are fully realized.

- •

Brand identity is still solidifying compared to more established national competitors.

Opportunities

- •

Leverage Truist Ventures to invest in and partner with fintechs to drive innovation.

- •

Deepen wallet share by cross-selling products to the combined legacy customer base.

- •

Continued investment in digital transformation and AI to enhance customer experience and efficiency.

- •

Physical branch expansion and renovation in key high-growth markets.

Threats

- •

Intense competition from money-center banks (JPMorgan Chase, Bank of America), regional banks, and fintech disruptors.

- •

Macroeconomic uncertainty, including interest rate fluctuations and potential economic downturns.

- •

Increasingly stringent regulatory and capital requirements.

- •

Persistent cybersecurity risks targeting financial data and infrastructure.

Recommendations

Priority Improvements

- Area:

Digital Customer Experience

Recommendation:Accelerate the unification and enhancement of digital platforms to create a seamless, intuitive, and error-free experience, directly addressing post-merger integration pain points.

Expected Impact:High

- Area:

Operational Efficiency

Recommendation:Aggressively pursue remaining cost synergies from the merger by streamlining back-office functions, optimizing the branch footprint based on new data, and automating manual processes.

Expected Impact:High

- Area:

Brand & Reputation Management

Recommendation:Launch targeted marketing and PR campaigns with tangible proof points of the 'care' value proposition to rebuild trust and mitigate negative sentiment from the merger integration.

Expected Impact:Medium

Business Model Innovation

- •

Develop a Banking-as-a-Service (BaaS) offering to embed Truist's regulated products within non-financial platforms, creating a new B2B revenue stream.

- •

Create hyper-personalized, AI-driven financial wellness and advisory services delivered through the mobile app to differentiate from competitors and improve client retention.

- •

Explore strategic acquisitions of specialized fintech firms that can accelerate digital capabilities in key growth areas like payments or small business banking.

Revenue Diversification

- •

Further expand the wealth management and advisory businesses, which generate stable, fee-based income less correlated with interest rate cycles.

- •

Increase investment in Truist Ventures to not only drive innovation but also generate financial returns from equity stakes in successful startups.

- •

Develop and scale specialized lending and banking solutions for high-growth industry verticals like renewable energy, healthcare tech, and logistics.

Truist Financial Corporation represents a formidable player in the U.S. banking industry, born from the strategic 'merger of equals' between BB&T and SunTrust. Its business model is mature, diversified, and anchored by a strong presence in high-growth markets. The primary revenue driver remains traditional net interest income, but the bank has substantial and growing contributions from fee-based services like wealth management and investment banking, which provide a crucial hedge against interest rate volatility. The core strategic challenge and opportunity for Truist lies in the execution of its post-merger strategy. While the combination created immense scale, it also introduced significant integration complexities, which have manifested in operational inefficiencies and customer service challenges that have, at times, undermined its brand promise of 'care.' The bank's future success hinges on its ability to fully realize projected synergies, create a unified and superior digital client experience, and leverage its vast customer data to deepen relationships and cross-sell effectively. Strategic investments in technology, digital channels, and targeted branch modernizations are positive indicators of a forward-looking approach. The evolution of its business model should focus on shifting from a scale-driven entity to a technology-enabled, client-centric powerhouse. Success will be measured by its ability to compete not only with traditional banking giants but also with agile fintech disruptors by proving that its blend of 'touch and technology' can deliver a genuinely differentiated value proposition.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Regulatory Capital Requirements & Compliance

Impact:High

- Barrier:

Brand Trust and Reputation

Impact:High

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Existing Physical and Digital Infrastructure

Impact:Medium

Industry Trends

- Trend:

Hyper-Personalization through AI

Impact On Business:Critical for improving customer experience and offering tailored financial advice, which aligns with Truist's 'care' positioning. Banks are leveraging AI to analyze transaction data for real-time, individualized insights.

Timeline:Immediate

- Trend:

Digital Transformation and Mobile-First Banking

Impact On Business:The mobile app is becoming the primary entry point for all banking services. Truist must ensure its app is a seamless, intuitive, and comprehensive financial hub to compete.

Timeline:Immediate

- Trend:

Competition from Non-Bank and Fintech Lenders

Impact On Business:Agile digital players are capturing market share in specific profitable areas like mortgages and personal loans, pressuring traditional revenue streams.

Timeline:Immediate

- Trend:

Focus on ESG (Environmental, Social, Governance)

Impact On Business:Growing customer and investor demand for sustainable banking practices requires strategic alignment and transparent reporting to maintain brand reputation and attract capital.

Timeline:Near-term

- Trend:

Real-Time Payments (RTP)

Impact On Business:Consumer and business demand for immediate fund availability is becoming standard. Failure to adopt and integrate RTP systems can lead to customer attrition.

Timeline:Near-term

Direct Competitors

- →

Bank of America

Market Share Estimate:Top 4 US Bank by assets.

Target Audience Overlap:High

Competitive Positioning:Global financial powerhouse with a vast array of services for consumers, small businesses, and large corporations, emphasizing digital innovation.

Strengths

- •

Massive global presence and brand recognition.

- •

Advanced and widely adopted digital/mobile banking platform.

- •

Strong position in wealth management (Merrill Lynch) and investment banking.

- •

Diversified revenue streams across multiple countries and service lines.

Weaknesses

- •

Heavy dependence on the US market for revenue (over 90%), creating vulnerability to domestic economic downturns.

- •

Reputational damage from past lawsuits and controversies.

- •

Can be perceived as less nimble and more bureaucratic than smaller competitors.

Differentiators

- •

Scale of global operations.

- •

Integrated wealth management services with Merrill Lynch.

- •

Significant investment in proprietary financial technology.

- →

Wells Fargo

Market Share Estimate:Top 4 US Bank by assets.

Target Audience Overlap:High

Competitive Positioning:Nationwide bank focusing on community-based banking and relationships, with a diversified product set for individuals, small businesses, and commercial clients.

Strengths

- •

Extensive domestic branch and ATM network.

- •

Strong market share in middle-market commercial banking.

- •

Early adopter of digital technologies like online banking.

- •

Diversified service offerings catering to a very broad customer base.

Weaknesses

- •

Significant, long-lasting reputational damage from numerous scandals (e.g., fake accounts, mortgage issues).

- •

Ongoing regulatory scrutiny and consent orders that can limit growth and increase compliance costs.

- •

Lagging behind leaders in mobile app innovation and user experience in recent years.

Differentiators

- •

Focus on cross-selling a wide array of products to existing customers.

- •

Strategic emphasis on cost leadership to attract price-sensitive consumers.

- •

Strong historical ties to community and small business banking.

- →

PNC Financial Services Group

Market Share Estimate:Top 10 US Bank, very close to Truist in asset size.

Target Audience Overlap:High

Competitive Positioning:Large, diversified super-regional bank with a strong presence in retail, corporate banking, and asset management, known for its Virtual Wallet product.

Strengths

- •

Strong brand reputation and customer-centric focus.

- •

Innovative retail products like the Virtual Wallet, which integrates checking and savings with budgeting tools.

- •

Significant market presence in the Midwest and East Coast.

- •

Well-diversified business model including a large treasury management business.

Weaknesses

- •

Geographic footprint is less concentrated in the high-growth Southeastern markets compared to Truist.

- •

Less global brand recognition than the 'Big Four' banks.

- •

Digital offerings, while solid, do not always lead the market in cutting-edge features.

Differentiators

- •

'Virtual Wallet' product is a key differentiator in the checking account space.

- •

Substantial small business lending operations (one of the largest SBA lenders).

- •

Growth-through-acquisition strategy, including the recent purchase of BBVA USA.

- →

U.S. Bancorp (U.S. Bank)

Market Share Estimate:Top 10 US Bank, larger than Truist by assets.

Target Audience Overlap:High

Competitive Positioning:Major super-regional bank with a strong focus on digital services, payments processing, and corporate banking.

Strengths

- •

Leader in the payments industry (credit card processing and money transferring).

- •

Strong financial performance and consistent profitability.

- •

Highly-rated mobile banking app and digital user experience.

- •

Diversified business mix with significant non-interest income from its payments division.

Weaknesses

- •

Branch network is more concentrated in the Midwest and West, with less overlap in Truist's core Southeastern markets.

- •

Can be perceived as less focused on relationship-based retail banking compared to community-focused brands.

- •

Brand recognition is lower than the 'Big Four'.

Differentiators

- •

Integrated payments ecosystem is a significant competitive advantage.

- •

Strategic partnerships with fintech companies to enhance service offerings.

- •

Strong focus on providing a seamless omnichannel customer experience.

Indirect Competitors

- →

SoFi (Social Finance, Inc.)

Description:A digital-first financial services company offering student loan refinancing, personal loans, mortgages, investing, and banking products through a single app-based platform.

Threat Level:Medium

Potential For Direct Competition:High

- →

Chime

Description:A leading neobank that provides fee-free mobile banking services, including checking and savings accounts, aimed at millennials and younger consumers.

Threat Level:Medium

Potential For Direct Competition:Medium

- →

Wealthfront / Betterment

Description:Leading robo-advisors that provide automated, algorithm-driven investment and wealth management services with low fees, targeting mass-affluent and younger investors. The robo-advisory market is projected to grow significantly.

Threat Level:Medium

Potential For Direct Competition:Low

- →

Rocket Mortgage

Description:A dominant online mortgage lender that has disrupted the traditional mortgage process with a streamlined, digital-first application and approval system.

Threat Level:High

Potential For Direct Competition:Low

- →

Block, Inc. (Square) / PayPal

Description:Fintech giants providing comprehensive payment processing, point-of-sale systems, and financial services (loans, banking) to small and medium-sized businesses.

Threat Level:High

Potential For Direct Competition:Medium

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Significant Market Share in High-Growth Regions

Sustainability Assessment:The post-merger footprint in the Southeastern U.S. provides a strong, defensible position in economically vibrant markets.

Competitor Replication Difficulty:Hard

- Advantage:

Full-Service Integrated Banking Model

Sustainability Assessment:Ability to serve a client's complete financial needs (retail, wealth, business, insurance) creates high switching costs and deepens relationships.

Competitor Replication Difficulty:Hard

- Advantage:

Economies of Scale

Sustainability Assessment:As a top 10 bank, Truist benefits from scale in marketing, technology investment, and regulatory compliance, which smaller competitors cannot match.

Competitor Replication Difficulty:Hard

Temporary Advantages

- Advantage:

Brand Positioning around 'Care'

Estimated Duration:1-3 Years

Sustainability Assessment:The 'care' message is a powerful differentiator if executed authentically, but it is easily replicable in marketing and relies heavily on consistent customer experience delivery, which can be challenging at scale.

Disadvantages

- Disadvantage:

Post-Merger Integration Challenges

Impact:Major

Addressability:Moderately

Description:Integrating the cultures, technologies, and customer bases of BB&T and SunTrust is a massive, ongoing undertaking that can lead to operational inefficiencies, inconsistent customer experiences, and brand confusion.

- Disadvantage:

Competition with Larger Tech Budgets

Impact:Major

Addressability:Difficult

Description:Mega-banks like JPMorgan Chase and Bank of America have significantly larger technology and innovation budgets, allowing them to outspend Truist on AI, digital features, and cybersecurity.

- Disadvantage:

Perception as a 'Regional' Player

Impact:Minor

Addressability:Moderately

Description:Despite its size, Truist may lack the national and global brand recognition of the 'Big Four', which can be a disadvantage in attracting certain corporate clients or wealth management customers.

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted marketing campaign highlighting the 'no overdraft fees' feature of Truist One Checking.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Simplify the user journey on the website to find and compare key products like credit cards and loans.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Prominently feature customer testimonials that validate the 'care' positioning across the website and social media.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Invest heavily in hyper-personalization using AI to provide proactive financial advice and product recommendations through the mobile app.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop specialized digital banking solutions for key small business niches within the Southeastern footprint (e.g., healthcare, logistics).

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Forge strategic partnerships with fintech companies to integrate innovative services (e.g., advanced budgeting tools, international payments) rather than building everything in-house.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Build out a hybrid robo-advisor and human wealth management platform to capture the mass affluent market being targeted by disruptors.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Establish Truist Ventures as a leading partner for fintech startups, creating an ecosystem of innovation that benefits the core bank.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Continue to rationalize and optimize the physical branch network, transforming locations from transactional hubs into advisory centers.

Expected Impact:Medium

Implementation Difficulty:Difficult

Position Truist as the premier 'main street' super-regional bank that combines the scale and product breadth of a national player with the authentic customer care and community focus of a smaller institution. Emphasize the tangible benefits of 'care' through superior, personalized service and community investment.

Differentiate through 'Relationship-Tech': Blend high-tech, personalized digital experiences with high-touch, empathetic human advice. While mega-banks focus on tech scale and fintechs focus on niche digital UX, Truist can own the space in the middle, making it the most accessible and supportive full-service bank.

Whitespace Opportunities

- Opportunity:

Develop a comprehensive 'Financial Wellness' platform for small business owners.

Competitive Gap:Most competitors offer discrete business banking products. A holistic platform integrating business banking, payroll, personal retirement planning (SEP IRA), and investment advice for the owner is a significant gap.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Targeted banking and wealth management services for emerging industries in the Southeast.

Competitive Gap:While banks have industry-specific groups, few offer integrated solutions for emerging sectors like renewable energy, biotech, and advanced manufacturing that are booming in Truist's core geographic footprint.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create a 'Family Office Lite' service for mass affluent clients.

Competitive Gap:True family office services are reserved for the ultra-wealthy. A scaled-down, digitally-enabled version offering consolidated reporting, basic trust/estate planning, and lending solutions for clients with $1M-$5M in assets is an underserved market.

Feasibility:Medium

Potential Impact:Medium

Truist Financial operates in the mature and oligopolistic US banking industry, where it is positioned as a top 10 commercial bank. Its creation from the merger of BB&T and SunTrust has given it a formidable market presence, particularly in the high-growth Southeastern United States. This geographic concentration is a core sustainable advantage.

Direct competition is fierce, primarily from two tiers: the 'Big Four' mega-banks (JPMorgan Chase, Bank of America, Wells Fargo) and fellow super-regional banks (PNC, U.S. Bank). The mega-banks compete with superior scale, global reach, and massive technology budgets. In contrast, super-regional peers like PNC and U.S. Bank are Truist's most direct competitors, often vying for the same customers with similar product suites. Truist's key challenge is to fully integrate its legacy systems and cultures to present a unified, efficient front against these established players. Its brand positioning around 'care' is a strategic attempt to differentiate itself from the perceived impersonal nature of larger banks and the transactional feel of digital-only players. However, the authenticity of this claim must be consistently proven through customer experience to be sustainable.

The most significant threats are emerging not from traditional competitors but from a fragmented landscape of indirect and fintech disruptors. Neobanks like Chime are capturing younger demographics with fee-free, mobile-first products. Specialized online lenders like Rocket Mortgage are eroding the profitable mortgage market, and robo-advisors such as Wealthfront are attracting investment assets from the mass affluent. These companies attack the traditional banking model by unbundling services and offering a superior user experience in a single vertical.

Strategic opportunities for Truist lie in leveraging its primary competitive advantages—its integrated service model and strong regional footprint. There is a clear whitespace for providing holistic, digitally-enabled financial guidance to small business owners, an area where competitors are often siloed. By blending its technological capabilities with its 'care' ethos to create a 'Relationship-Tech' model, Truist can carve out a defensible niche that larger banks are too bureaucratic to fill and smaller fintechs lack the product breadth to address. The success of this strategy will depend on flawless execution of its post-merger integration and sustained, focused investment in personalized digital experiences.

Messaging

Message Architecture

Key Messages

- Message:

Truist One Checking: No overdraft fees. Practical perks. Automatic upgrades.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

At Truist, our purpose is to inspire and build better lives and communities. That happens through real care to make things better.

Prominence:Primary

Clarity Score:Medium

Location:About Us Page, Brand Narrative

- Message:

Leaders in banking. Unwavering in care.

Prominence:Secondary

Clarity Score:High

Location:Homepage, Video End Card Tagline

- Message:

Your life is unique... We think your financial plan should reflect that.

Prominence:Secondary

Clarity Score:High

Location:Wealth Management Page Hero

- Message:

Crystal clear—created with care. Meet the Truist app.

Prominence:Tertiary

Clarity Score:High

Location:Homepage Mobile App Section

The message hierarchy is heavily weighted towards transactional, product-level messaging on the homepage (e.g., 'Truist One Checking', 'Enjoy Cash credit card'). The overarching brand message of 'care' is present but secondary, often delivered through emotional video content or on the 'About Us' page. This creates a disconnect between the brand's stated purpose and the user's initial experience, which is very product-centric. The hierarchy effectively funnels users to product pages but does less to build an immediate emotional connection to the brand's core differentiator.

The core theme of 'care' is consistently woven through all sections, from personal banking to wealth management and corporate identity. The 'About Us' page establishes the 'why' ('inspire and build better lives'). The 'Wealth' page translates 'care' into a tangible service promise ('Real care from a true advisor'). The homepage uses 'care' as a soft, emotional wrapper ('Let your light shine') around hard product offerings. While the word is consistent, its application varies in intensity, shifting from a broad community-focused concept to a direct client-advisor relationship promise.

Brand Voice

Voice Attributes

- Attribute:

Caring/Empathetic

Strength:Strong

Examples

- •

Real care from a true advisor. Really.

- •

Listening between the lines. Hearing what you say. Picking up on what you don’t.

- •

Hit all the right notes with someone by your side who knows a lot and cares even more.

- Attribute:

Optimistic/Aspirational

Strength:Strong

Examples

- •

Let your light shine.

- •

Start feeling unstoppable with your goals.

- •

It’s time to upgrade your money mindset.

- Attribute:

Direct/Action-Oriented

Strength:Moderate

Examples

- •

Apply now

- •

Open now

- •

Check for offers

- Attribute:

Professional/Knowledgeable

Strength:Moderate

Examples

- •

Leaders in banking.

- •

Get direct access to economic and market strategy insights from our team of seasoned investment analysts.

- •

We're a top 10 U.S. commercial bank

Tone Analysis

Supportive

Secondary Tones

- •

Reassuring

- •

Inspirational

- •

Pragmatic

Tone Shifts

Shifts from a transactional, benefit-driven tone in product sections on the homepage to a more sophisticated, empathetic, and relational tone on the Truist Wealth page.

The 'About Us' section adopts a more formal, corporate, and purpose-driven tone compared to the consumer-facing pages.

Voice Consistency Rating

Good

Consistency Issues

The highly aspirational and emotional 'Let your light shine' message feels slightly disconnected from the very direct, feature-focused product messaging that dominates the homepage.

Value Proposition Assessment

Truist combines the scale and expertise of a top 10 U.S. bank with a genuine, personalized sense of care, empowering clients to achieve financial confidence and feel 'unstoppable'.

Value Proposition Components

- Component:

Human-Centric Service ('Care')

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Comprehensive Financial Expertise & Products

Clarity:Clear

Uniqueness:Common

- Component:

Simplified Banking Experience (e.g., No Overdraft Fees)

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Empowerment & Financial Wellness

Clarity:Somewhat Clear

Uniqueness:Common

Truist's primary differentiator is the explicit and repeated emphasis on 'care'. While other banks mention customer service, Truist attempts to elevate 'care' to a core brand purpose. This is a strong strategic choice in an industry often perceived as impersonal. The campaign message 'Leaders in banking. Unwavering in care' directly communicates this dual value proposition. The challenge lies in substantiating this claim against competitors who focus on technology (like Chase's mobile app) or scale (like Bank of America). Truist's differentiation is stronger in the Wealth Management space, where the promise of a 'true advisor' relationship is more tangible and resonant.

Truist positions itself as the more empathetic and purpose-driven alternative to the other 'big banks' (like Chase, Wells Fargo, Bank of America). It aims to occupy a unique space that is not solely about digital convenience or the lowest fees, but about a supportive partnership. This positioning appeals to customers who feel overlooked by larger institutions and seek a blend of digital tools and human guidance.

Audience Messaging

Target Personas

- Persona:

Everyday Consumer

Tailored Messages

- •

Truist One Checking: No overdraft fees.

- •

Enjoy cash rewards

- •

Banking made easy.

Effectiveness:Effective

- Persona:

Small Business Owner

Tailored Messages

Get an answer on your application—fast.

Accelerate your goals with a vehicle or equipment loan to keep your business moving forward.

Effectiveness:Somewhat Effective

- Persona:

High-Net-Worth Individual (Wealth Client)

Tailored Messages

- •

Your life is unique. Your vision, values, and aspirations are your own.

- •

Real care from a true advisor. Really.

- •

Outcomes over income.

Effectiveness:Effective

Audience Pain Points Addressed

- •

Unexpected banking fees ('No overdraft fees')

- •

Feeling like just a number to a large bank ('Real care from a true advisor')

- •

Complexity of managing finances ('Banking made easy')

- •

Debt consolidation ('Clean up your debt and take back control')

Audience Aspirations Addressed

- •

Financial confidence and control ('Start feeling unstoppable')

- •

Achieving life goals ('take control of your finances')

- •

Building a legacy ('Trust and estate planning')

- •

Living a values-aligned life ('Your vision, values, and aspirations are your own')

Persuasion Elements

Emotional Appeals

- Appeal Type:

Care & Belonging

Effectiveness:High

Examples

When you work with someone who knows a lot and cares even more…you’re unstoppable.

We believe in the power of what we can achieve together.

- Appeal Type:

Empowerment & Optimism

Effectiveness:Medium

Examples

- •

Let your light shine.

- •

Reach your goals. Feel good doing it.

- •

I’m just getting started. / Well, I’m here to help.

Social Proof Elements

- Proof Type:

Awards & Recognition

Impact:Weak

Examples

A dedicated 'Awards' page with the message 'We’re flattered—but focused.'

- Proof Type:

Expert Endorsement (Implied)

Impact:Moderate

Examples

Featuring NFL players Bradley Chubb and Bijan Robinson in community stories ('See the power of care').

- Proof Type:

Customer Stories

Impact:Moderate

Examples

The 'Small Business, Big Heart' web series.

Trust Indicators

- •

Prominent 'Fraud and security' sections

- •

Explicit mention of 'Member FDIC'

- •

Emphasis on building a 'meaningful relationship' with an advisor

- •

Corporate Responsibility messaging on the 'About Us' page

Scarcity Urgency Tactics

Special introductory variable rate as low as Prime minus 1.51% for 9 months...

Calls To Action

Primary Ctas

- Text:

Open now

Location:Homepage Hero (Checking account)

Clarity:Clear

- Text:

Apply now

Location:Homepage (Loans, Small Business)

Clarity:Clear

- Text:

Find an advisor

Location:Wealth Management Page

Clarity:Clear

- Text:

Learn more

Location:Multiple product sections

Clarity:Clear

The CTAs are clear, direct, and contextually relevant. Transactional CTAs like 'Open now' and 'Apply now' are prominently displayed for consumer products, facilitating quick conversion. Relational CTAs like 'Find an advisor' are appropriately used for high-consideration services like wealth management. The use of dual CTAs ('Learn more' and 'Apply now') for most products effectively caters to users at different stages of the decision-making process.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of tangible, everyday proof points for the 'care' message on the homepage. The concept is presented emotionally but not substantiated with concrete examples of 'how' Truist cares for its standard checking or credit card customers beyond fee structures.

- •

The messaging doesn't fully capitalize on the unique origin story of the BB&T and SunTrust merger. It's mentioned as a fact but not leveraged to tell a story about combining strengths.

- •

Insufficient competitive comparison. The messaging doesn't explicitly state why its version of 'care + knowledge' is superior to what competitors offer.

Contradiction Points

No itemsUnderdeveloped Areas

Small Business messaging is generic and lacks the emotional depth and tailored value propositions seen in the Personal Banking and Wealth sections.

The 'Money and Mindset' content feels like a standard financial literacy blog and isn't deeply integrated with the core brand message of 'unstoppable' or 'care'. The narrative connection could be much stronger.

Messaging Quality

Strengths

- •

A strong, consistent, and differentiated brand theme ('care') is present across all pages.

- •

The brand voice is warm and aspirational, which stands out in the typically conservative banking industry.

- •

Clear segmentation in messaging between general consumers and high-net-worth wealth clients.

- •

Effective use of storytelling in video content to convey emotional benefits.

Weaknesses

- •

The homepage prioritizes a transactional, product-focused experience over establishing the core brand message of 'care'.

- •

The link between the high-level aspirational slogans ('Let your light shine') and the tangible product features is often weak.

- •

Social proof is underdeveloped; relies on celebrity stories and awards rather than testimonials from diverse, everyday customers.

Opportunities

- •

Integrate more authentic customer testimonials (video and text) on the homepage to make the 'care' promise more tangible.

- •

Develop more robust, persona-based messaging for Small Business owners that addresses their specific pain points with the same level of empathy as the Wealth messaging.

- •

Create a stronger narrative bridge between the 'Money and Mindset' content and the core value proposition, showing how this knowledge helps clients become 'unstoppable'.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Message Hierarchy

Recommendation:Revise the homepage hero section to lead with a message that balances the brand promise of 'care' with the primary product offering. For example: 'Banking that cares about your progress. Meet Truist One Checking, with no overdraft fees.'

Expected Impact:High

- Area:

Value Proposition Substantiation

Recommendation:Add a dedicated section on the homepage titled 'How We Show Care' featuring 3-4 concrete proof points (e.g., 'No overdraft fees,' '24/7 support,' 'Financial confidence planning tools') to make the abstract concept tangible.

Expected Impact:High

- Area:

Small Business Messaging

Recommendation:Overhaul the Small Business messaging to mirror the empathetic, problem-solving approach of the Wealth section. Develop content and value propositions around key challenges like cash flow management, growth financing, and employee benefits.

Expected Impact:Medium

Quick Wins

Integrate customer quotes/testimonials directly into relevant product sections on the homepage.

A/B test CTA button copy to include benefit-oriented language (e.g., 'Start Banking with Care' vs. 'Open now').

Long Term Recommendations

Invest in a comprehensive content strategy that features a diverse range of customer success stories, moving beyond athletes and small businesses to showcase everyday individuals.

Develop an interactive tool that helps potential customers identify their 'money mindset' and connects them to relevant content and product solutions, fully integrating the brand narrative with the product ecosystem.

Truist has successfully established a clear and differentiated brand position centered on the concept of 'care.' This strategic choice to humanize the banking experience is a powerful differentiator in a crowded and often impersonal market. The brand's voice is consistently warm, supportive, and aspirational, effectively applied across different audience segments, especially in the high-touch Wealth Management division where the message of a 'true advisor' is highly resonant. However, a significant strategic gap exists between the brand's purpose-driven identity and the website's primary user experience. The homepage is heavily product-and-transaction-focused, pushing the core 'care' message into a secondary, more atmospheric role. This hierarchy prioritizes short-term conversion over long-term brand building. To improve effectiveness, Truist must bridge this gap by more explicitly connecting the 'how' (product features like no overdraft fees) with the 'why' (because we care about your financial well-being). By substantiating its abstract promise of 'care' with tangible, everyday proof points at the top of the funnel, Truist can more effectively convert brand affinity into measurable business outcomes and solidify its unique market position.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established as a top 10 U.S. commercial bank with a significant market presence across 17 states.

- •

Comprehensive product suite serving ~15 million clients across retail, small business, commercial, and wealth management segments.

- •

Strong brand equity and large customer base resulting from the merger of BB&T and SunTrust.

- •

Highly-rated mobile application on both iOS and Android, indicating a functional fit with digitally-inclined customers.

Improvement Areas

- •

Addressing lower-than-average customer satisfaction scores compared to peers, which may indicate a gap between brand promise and service delivery.

- •

Improving the digital customer journey to reduce friction, particularly in onboarding and resolving service issues that arose post-merger.

- •

Enhancing product personalization using AI and data analytics to compete with agile fintech offerings.

Market Dynamics

US Retail Banking: ~6.7% CAGR (2025-2032). US Wealth Management: ~7.0-7.7% CAGR (2023-2028).

Mature

Market Trends

- Trend:

Digital Transformation and AI Personalization

Business Impact:Shift to mobile-first banking and AI-driven advice is critical for customer acquisition and retention. Legacy systems can be a barrier to innovation.

- Trend:

Intensifying Competition from Fintechs and Neobanks

Business Impact:Fintechs are gaining market share in specific verticals like payments and personal loans, forcing traditional banks to innovate, partner, or acquire to stay competitive.

- Trend:

Embedded Finance and Open Banking

Business Impact:Creates opportunities to offer banking services through non-financial platforms, but also threatens direct customer relationships if not adopted strategically.

- Trend:

Focus on Hyper-Personalization and Customer Experience (CX)

Business Impact:Generic product offerings are becoming less effective. Banks must use data to provide tailored advice and solutions to differentiate and build loyalty.

Good. The market is in a state of significant technological flux, providing a window of opportunity for large, well-capitalized players like Truist to leverage their scale and invest in transformation to capture share from both smaller regional banks and less agile large competitors.

Business Model Scalability

High

High fixed costs associated with a large branch network and legacy IT infrastructure, but digital platforms offer highly scalable, low-variable-cost growth vectors.

Moderate. Potential for high leverage exists through digital channel growth and realizing post-merger efficiencies, but it is currently constrained by ongoing integration costs and the need for significant technology investment.

Scalability Constraints

- •

Complexity of integrating legacy IT systems from the BB&T and SunTrust merger.

- •

Regulatory compliance and overhead, which increases with scale.

- •

Maintaining a consistent customer experience and culture across a vast physical and digital footprint.

Team Readiness

Experienced executive team that has managed one of the largest financial mergers in recent history. Strong focus on strategic growth initiatives, including digital transformation and branch network optimization.

Traditional, siloed structure typical of large banks. While effective for managing risk, it may slow down the agility needed for rapid digital product development and innovation.

Key Capability Gaps

- •

Agile software development and product management talent to accelerate innovation cycles.

- •

Data science and AI/ML engineering expertise to build and deploy personalization engines at scale.

- •

Customer experience (CX) design and journey mapping to create seamless omnichannel experiences.

Growth Engine

Acquisition Channels

- Channel:

Digital Marketing (SEO, PPC, Social)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Increase investment in performance marketing focused on high-value products like mortgages and wealth management. Use data to create highly targeted campaigns for specific customer segments.

- Channel:

Physical Branch Network (~1,900 locations)

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Repurpose branches from transactional hubs to advisory centers, focusing on complex needs like small business loans, mortgages, and wealth planning. Continue strategic openings in high-growth markets.

- Channel:

Cross-sell / Upsell to Existing Customers

Effectiveness:High

Optimization Potential:High

Recommendation:Implement an AI-powered 'next best offer' engine within the mobile app and online banking to provide personalized, relevant product recommendations based on customer data.

- Channel:

Brand Advertising & Sponsorships (e.g., NFL)

Effectiveness:Medium

Optimization Potential:Low

Recommendation:Maintain for brand awareness but ensure messaging aligns with the evolving digital and personalized customer experience to build authentic brand equity.

Customer Journey

The journey is fragmented, with separate paths for digital self-service and in-person/advisor-led sales. Digital account opening is growing, accounting for 43% of new accounts, but post-merger integration has caused friction points.

Friction Points

- •

Inconsistent experience when moving between digital channels (app, website) and human touchpoints (branch, call center).

- •

Reported issues with debit card activation, account access, and long call-center wait times following the core system conversion.

- •

Onboarding process for complex products like mortgages and investment accounts may still require significant manual intervention.

Journey Enhancement Priorities

{'area': 'Unified Digital Onboarding', 'recommendation': 'Create a single, seamless digital onboarding process for all core retail products (checking, savings, credit cards) that can be completed in under 5 minutes on mobile.'}

{'area': 'Proactive Customer Support', 'recommendation': "Use AI tools like 'Truist Client Pulse' to analyze feedback in real-time and proactively address common issues before they result in customer complaints and churn. "}

Retention Mechanisms

- Mechanism:

Product Bundling and Relationship Pricing

Effectiveness:High

Improvement Opportunity:Automate the identification of bundling opportunities and present them proactively to customers through digital channels.

- Mechanism:

High Switching Costs

Effectiveness:High

Improvement Opportunity:Increase stickiness by integrating more third-party services (e.g., bill pay, financial planning tools) into the primary banking app, making it the central hub of a customer's financial life.

- Mechanism:

Digital Engagement (Mobile App)

Effectiveness:Medium

Improvement Opportunity:Move beyond transactional features to offer personalized financial insights, savings goals, and budgeting tools that increase daily user engagement and perceived value.

Revenue Economics

Solid. As a large bank, Truist benefits from a low cost of capital (deposits) and diversified revenue streams (net interest income and fee income). Recent financial results show a healthy net interest margin and a focus on managing the efficiency ratio.

Indeterminable publicly, but likely healthy for 'primary bank' customers due to high retention and multiple product cross-sells. Less favorable for single-product, digitally-acquired customers.

Moderate. The efficiency ratio of ~59.9% is competitive but has room for improvement as merger synergies are fully realized and digital transformation reduces operating costs.

Optimization Recommendations

- •

Accelerate the shift of routine transactions to digital channels to lower cost-to-serve.

- •

Focus acquisition efforts on securing 'primary bank' relationships, which have a significantly higher lifetime value.

- •

Leverage technology to automate underwriting and processing for consumer and small business loans to improve efficiency.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Core Banking Systems

Impact:High

Solution Approach:Continue the cloud migration strategy to modernize the core infrastructure. Adopt an API-first approach to decouple new digital services from legacy systems, enabling faster innovation.

- Limitation:

Post-Merger Technology Integration Debt

Impact:High

Solution Approach:Dedicate specific 'strike teams' to decommission redundant systems from the BB&T/SunTrust merger to reduce complexity, lower maintenance costs, and free up development resources.

Operational Bottlenecks

- Bottleneck:

Harmonizing Post-Merger Cultures and Processes

Growth Impact:Can lead to inconsistent customer service, internal friction, and slower execution of strategic initiatives.

Resolution Strategy:Double down on the unified 'Truist' culture through leadership training and standardized processes. Empower cross-functional teams to redesign key workflows based on 'best-of-both' principles rather than preserving legacy approaches.

- Bottleneck:

Call Center and Customer Support Capacity

Growth Impact:Long wait times and unresolved issues lead directly to customer churn, especially following technical glitches.

Resolution Strategy:Invest heavily in AI-powered chatbots (like Truist Assist) and self-service tools to handle common inquiries, freeing up human agents for more complex issues.

Market Penetration Challenges

- Challenge:

Intense Competition from Megabanks and Fintechs

Severity:Critical

Mitigation Strategy:Differentiate on the 'T3' (Tech + Touch = Trust) promise by delivering a superior, personalized hybrid experience that nimble fintechs (lacking human touch) and slower megabanks (lacking personal feel) cannot easily replicate.

- Challenge:

Negative Customer Sentiment Post-Merger

Severity:Major

Mitigation Strategy:Launch a targeted 'win-back' and reassurance campaign focused on service improvements. Proactively address negative reviews and use customer feedback to visibly improve digital products and services.

Resource Limitations

Talent Gaps

- •

Senior Product Managers with experience in AI-driven products.

- •

UX/UI designers specialized in mobile-first financial applications.

- •

Cloud security and DevOps engineers to support the ongoing technology migration.

Sufficient. The recent sale of Truist Insurance Holdings significantly boosted capital ratios, providing ample resources for strategic investments in technology and growth initiatives.

Infrastructure Needs

A unified customer data platform (CDP) to create a single view of the customer across all legacy systems.

Further investment in cloud infrastructure to support advanced analytics and AI model training.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion into High-Growth Markets

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Continue the announced strategy of opening new, digitally-enabled branches in fast-growing markets like Texas and Pennsylvania to capture population and business growth.

- Expansion Vector:

Demographic Targeting of Affluent & Premier Clients

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Develop a premium, digitally-augmented service model for mass affluent and premier clients, combining dedicated advisors with sophisticated digital wealth management and planning tools.

Product Opportunities

- Opportunity:

AI-Powered Financial Wellness Platform

Market Demand Evidence:Growing consumer demand for personalized financial advice and automated tools for budgeting, saving, and investing.

Strategic Fit:Directly aligns with the 'Care' mission and the 'T3' strategy, moving the bank from a transactional utility to a trusted advisor.

Development Recommendation:Build upon existing tools like 'Truist Assist' and 'Truist Insights' to create a unified, proactive financial wellness experience within the main mobile app.

- Opportunity:

Expanded Digital Solutions for Small and Midsize Businesses (SMBs)

Market Demand Evidence:SMBs increasingly expect consumer-grade digital experiences for their business banking, including integrated payments, invoicing, and cash flow management.

Strategic Fit:Strengthens a core and profitable customer segment, creating stickier relationships.

Development Recommendation:Enhance the 'Truist Merchant Engage' platform and integrate it seamlessly with business checking and lending to provide an all-in-one financial dashboard for SMBs.

Channel Diversification

- Channel:

Embedded Finance / Banking-as-a-Service (BaaS)

Fit Assessment:Medium

Implementation Strategy:Leverage Truist's scale and regulatory expertise to offer specific capabilities (e.g., lending, payments) via APIs to non-financial partners. Start with a pilot program in a specific vertical like retail or healthcare.

- Channel:

Fintech Partnerships

Fit Assessment:High

Implementation Strategy:Actively use Truist Ventures to invest in and partner with fintechs that provide niche capabilities (e.g., alternative underwriting, specialized wealth tools) that can be integrated into the Truist ecosystem to accelerate innovation.

Strategic Partnerships

- Partnership Type:

Technology & Data Partnerships

Potential Partners

- •

Major Cloud Providers (AWS, Google Cloud, Azure)

- •

AI/ML Platform providers (e.g., Databricks)

- •

Data Aggregators (e.g., Plaid)

Expected Benefits:Accelerate cloud migration, enhance data analytics capabilities, and enable more seamless integration of external financial accounts for a holistic customer view.

- Partnership Type:

Vertical-Specific Fintech Integrations

Potential Partners

- •

Wealthtech platforms

- •

SMB accounting software companies

- •

Point-of-sale financing providers

Expected Benefits:Rapidly expand product offerings and provide more integrated, value-added services to key customer segments without having to build all capabilities in-house.

Growth Strategy

North Star Metric

Primary Client Relationships

This metric focuses on depth of relationship rather than volume of accounts. A 'primary client' (defined, for example, as having a checking account with direct deposit plus one other product) is more profitable, has higher retention, and generates more cross-sell opportunities.

Increase the percentage of new checking accounts with 'primary' status from 82% to 90% within 18 months.

Growth Model

Hybrid: Product-Led & Relationship-Driven

Key Drivers

- •

Digital Product Experience: A frictionless, engaging mobile app that drives self-service acquisition and deepens engagement.

- •

Advisor-Led Cross-Sell: Empowering branch and wealth advisors with data and tools to identify and act on client needs.

- •

Targeted Marketing: Efficiently acquiring high-potential customers in key growth markets.

Focus on making the digital product so compelling that it becomes the primary driver of initial acquisition and daily engagement. Use the data generated from digital interactions to arm relationship managers with insights to build deeper, more profitable relationships.

Prioritized Initiatives

- Initiative:

Project Seamless: The 5-Minute Mobile Onboarding

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Form a dedicated cross-functional pod (product, engineering, design, legal) to map the existing journey, identify all friction points, and develop a streamlined future-state prototype for user testing.

- Initiative:

Personalized Insights Engine

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Launch 3-5 initial 'insight' use cases (e.g., 'Unusual Spending Alert,' 'Savings Opportunity Identified') within the mobile app to test user engagement and value.

- Initiative:

Advisor 360 Dashboard

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12 months

First Steps:Develop a pilot dashboard for a select group of branch managers and wealth advisors that integrates customer data from 2-3 key systems to provide a unified client view and next-best-action prompts.

Experimentation Plan

High Leverage Tests

{'test': 'A/B test different value propositions and calls-to-action in digital ads for the Truist One Checking account.', 'hypothesis': "Focusing on 'No Overdraft Fees' will have a higher conversion rate than messaging focused on 'Practical Perks'."}

{'test': 'Multivariate testing of the in-app loan application interface to identify and remove points of user drop-off.', 'hypothesis': 'A simplified, multi-step form will have a higher completion rate than a single long-form application.'}

Utilize an A/B testing platform integrated with product analytics tools. Track core metrics like conversion rate, drop-off rate, time-to-complete, and subsequent customer LTV for winning variants.

Bi-weekly sprint cycles for the digital product teams, with a goal of running at least one significant experiment per team per month.

Growth Team

A hybrid model with a central 'Growth Center of Excellence' responsible for data, tools, and strategy, and decentralized 'Growth Pods' embedded within key business units (e.g., Retail Digital, Wealth Management, SMB Banking).

Key Roles

- •

Head of Growth

- •

Product Marketing Manager

- •

Data Scientist/Analyst

- •

Conversion Rate Optimization (CRO) Specialist

- •

Lifecycle Marketing Manager

Invest in continuous training on experimentation, data analysis, and agile methodologies. Use the Truist Leadership Institute to cultivate a growth mindset among mid-level and senior managers.

Truist is at a critical inflection point. The monumental task of the BB&T and SunTrust merger has established a financial services powerhouse with significant scale and a strong presence in high-growth US markets. This provides a solid foundation for future expansion. However, the merger's execution has created significant operational and technical debt, manifesting in inconsistent customer experiences and lagging satisfaction scores. The primary challenge—and greatest opportunity—for Truist is to accelerate its transformation from a traditional, branch-centric bank into a digitally-native, relationship-driven institution.

The market is unforgiving, with intense pressure from both larger, technology-focused incumbents and a swarm of agile fintech disruptors. Truist's stated strategy of combining 'Tech and Touch' is the correct one, but its ability to execute will be the sole determinant of its success. Growth will not come from simply opening more branches or traditional marketing; it will be driven by creating a seamless, personalized, and proactive digital experience that makes customers' financial lives easier. This digital platform must then empower human advisors to deliver high-value, personalized guidance that fintechs cannot replicate.

Immediate priorities should be to resolve the remaining post-merger integration friction, stabilize the customer experience, and aggressively invest in the digital product roadmap. Initiatives like a truly seamless mobile onboarding process and an AI-powered insights engine are not 'nice-to-haves' but are fundamental to competing for the next generation of primary banking relationships. By leveraging its strong capital position to invest in technology and talent, Truist can successfully transition from a merger of equals into a formidable leader in the future of banking.

Legal Compliance

Truist's privacy posture is mature and built around the stringent requirements of the Gramm-Leach-Bliley Act (GLBA), which governs how U.S. financial institutions handle nonpublic personal information (NPI). The 'Consumer Privacy Notice' is GLBA-compliant, clearly outlining what personal information is collected, the reasons for sharing it (e.g., everyday business purposes, marketing), and whether consumers can limit that sharing. The notice explicitly states it is provided by Truist Bank and its financial affiliates, which is a key GLBA requirement. Truist also addresses state-specific requirements, including a detailed section for California residents under the CCPA/CPRA, and mentions limitations on data sharing for Vermont and Nevada residents. The policy details the collection of information from users and other sources like credit bureaus. It correctly notes that federal law gives consumers the right to limit some but not all sharing and provides clear opt-out mechanisms via a toll-free number and an online privacy center. Crucially, it distinguishes between sharing for affiliates' 'everyday business purposes' based on creditworthiness (which can be limited) versus transactions and experiences (which cannot).