eScore

ulta.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Ulta demonstrates a highly sophisticated digital presence, excelling in transactional search intent and multi-channel consistency through its site, app, and social platforms. Its strong domain authority is built on its massive product catalog and brand partnerships, though its content authority is weaker in educational or thought leadership topics. The company's digital strategy effectively supports its deep US market penetration with features like BOPIS, while initiatives like GLAMlab for virtual try-ons signal an embrace of modern digital engagement.

Excellent integration of its digital platforms (website, app) with its physical store network, creating a seamless omnichannel experience with features like 'Buy Online, Pickup In-Store'.

Develop a dedicated 'Beauty Education Hub' to capture top-of-funnel search traffic for informational queries (e.g., 'best moisturizer for dry skin'), building brand authority beyond product transactions.

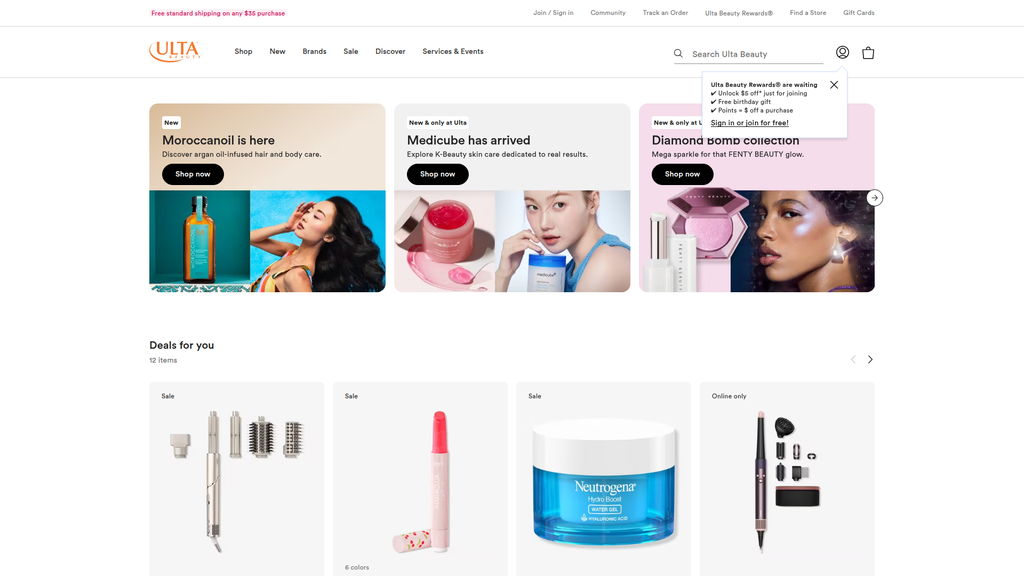

Ulta's messaging is exceptionally effective at driving direct-response actions, with a clear focus on promotions, new arrivals, and deals. It effectively segments messaging for 'deal seekers' and 'beauty enthusiasts' but under-communicates its unique value proposition of integrated salon services and the 'masstige' model. While competitively positioned against Sephora's luxury focus, the brand story and emotional connection are underdeveloped in favor of tactical, sales-driven communication.

Exceptional clarity and prominence of promotional messaging (e.g., '21 Days of Beauty,' 'Deals for you'), which effectively creates urgency and drives transactional behavior.

Dedicate a primary homepage module to brand-level storytelling that clearly articulates the 'All Things Beauty, All in One Place' value proposition, building long-term brand equity beyond promotions.

Ulta's conversion path is well-optimized from a technical standpoint, particularly its best-in-class mobile experience. However, the desktop site suffers from high cognitive load due to visual density and competing promotional messages, which can create friction and decision fatigue. While core conversion elements like 'Add to Bag' are effective, a lack of CTA consistency and a weak footer sign-up form present clear opportunities for improvement. The site's public commitment to WCAG 2.1 AA accessibility is a strength that positively impacts market reach.

A technically excellent and responsive mobile experience that gracefully adapts content and navigation, accounting for the majority of e-commerce traffic.

Reduce cognitive overload on the homepage by personalizing the experience for logged-in loyalty members, dynamically reordering modules to prioritize relevant categories and promotions.

Ulta has a mature and robust credibility framework, featuring a hierarchy of trust signals including prominent top-tier brands, transparent user reviews, and a strong public commitment to accessibility. The company employs sophisticated legal and compliance structures, such as a state-specific privacy policy and a user-friendly cookie consent manager. Despite this, its use of cutting-edge technology like virtual try-ons has exposed it to high-stakes litigation, representing a key risk area in an otherwise strong credibility profile.

Comprehensive and state-specific legal policies (Privacy, Terms of Service) with clear user controls, which build trust and mitigate regulatory risk in a complex legal landscape.

Implement an explicit, 'just-in-time' consent mechanism for the 'GLAMlab' virtual try-on tool to mitigate high-risk litigation concerning biometric data, moving beyond disclosure in the general privacy policy.

Ulta's competitive advantage is exceptionally strong and sustainable, built on a trifecta of defensible moats. The unique 'all-in-one' product assortment (mass, prestige, luxury), integrated in-store salon services, and an industry-leading loyalty program with over 45 million members create a holistic ecosystem that is difficult for any single competitor to replicate. While not a first-mover in technology, its investment in AR/VR tools like GLAMlab shows a commitment to innovation to maintain its edge.

The Ultamate Rewards loyalty program, which drives over 95% of sales, provides an unparalleled competitive moat through deep customer retention and a rich first-party data asset.

Proactively develop a strategy to counter the loss of the Target partnership in 2026, such as exploring smaller-format stores or new shop-in-shop concepts with non-competing retailers.

Ulta has a proven, scalable business model in the US and is now embarking on its next growth phase with a clear strategy for international expansion into Mexico and other markets. The upcoming launch of a third-party online marketplace powered by Mirakl will allow for rapid, asset-light expansion of its digital assortment. While facing some US market saturation, the 'Ulta Beauty Unleashed' strategy demonstrates a clear focus on new growth vectors, though scaling the in-store experience and training internationally will be a challenge.

A clear and funded strategy for international expansion using joint ventures and acquisitions, which unlocks significant new markets and addresses US market maturity.

Develop and formalize a retail media network to monetize its vast first-party loyalty data, creating a new, high-margin revenue stream that scales efficiently.

Ulta's business model is exceptionally coherent, with each component reinforcing the others to create a powerful flywheel. The broad product assortment drives traffic, the loyalty program retains customers and gathers data, and the in-store services create a sticky, high-value experience that online competitors cannot match. This integrated model is well-aligned with the major market trend of mass and prestige convergence and is supported by a clear strategic focus on driving loyalty member value.

The synergistic relationship between product retail, in-store services, and the loyalty program creates a virtuous cycle of customer acquisition, retention, and increasing lifetime value.

Increase the revenue contribution from high-margin salon services (currently only 3-4% of revenue) by better integrating service recommendations into the digital and physical retail journey.

As the largest beauty retailer in the US, Ulta wields significant market power, including substantial leverage with suppliers and the ability to influence trends through its merchandising choices. Its market share trajectory has been strong, though it recently faced its first loss of share, prompting a new strategic plan. While the company relies on promotions, its massive loyalty program gives it a degree of pricing power and insulation from competitors, solidifying its position as a market leader.

Maintains the largest market share in the US specialty beauty retail category, supported by a vast physical footprint and a dominant loyalty program.

Invest in creating more proprietary or exclusive brands and product collaborations to reduce dependency on national brands and better defend against competitors like Sephora and Amazon.

Business Overview

Business Classification

Omnichannel Retail

Services

Beauty & Personal Care

Sub Verticals

- •

Cosmetics

- •

Skincare

- •

Haircare

- •

Fragrance

- •

Salon Services

Mature

Maturity Indicators

- •

Large, established physical store footprint across all 50 states.

- •

Significant brand recognition and market share in the U.S. beauty industry.

- •

Well-developed and highly effective loyalty program (Ulta Beauty Rewards) with over 44 million members.

- •

Consistent, albeit recently slowing, revenue growth and profitability.

- •

Publicly traded company with a long operational history since 1990.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Product Sales (Retail & eCommerce)

Description:The core revenue driver, comprising the sale of over 25,000 products from more than 600 brands, including mass-market, prestige, and luxury beauty items, as well as a private label, the Ulta Beauty Collection. Sales occur through physical stores and the ulta.com website/app.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:Medium

- Stream Name:

In-Store Salon Services

Description:Full-service salons located in nearly every store offering hair (cuts, color, styling), skin (facials), brow (waxing, tinting), and makeup application services. This stream drives significant foot traffic and higher overall customer spend.

Estimated Importance:Secondary

Customer Segment:Service-Oriented Shoppers, Beauty Enthusiasts

Estimated Margin:High

- Stream Name:

Co-branded Credit Card

Description:The Ulta Beauty Rewards® Credit Card program likely generates revenue through interchange fees and interest income, while deepening customer loyalty by offering enhanced rewards.

Estimated Importance:Tertiary

Customer Segment:Loyal, High-Frequency Shoppers

Estimated Margin:High

Recurring Revenue Components

- •

Replenish & Save (Auto-Replenishment Program)

- •

Repeat purchases driven by the Ulta Beauty Rewards loyalty program

- •

Recurring salon service appointments

Pricing Strategy

Value-based & Promotional

Mid-range (with Mass & Prestige options)

Transparent

Pricing Psychology

- •

Tiered pricing (Mass, Prestige, Luxury)

- •

Frequent promotions and sales events (e.g., 21 Days of Beauty)

- •

Coupon-based discounts (e.g., 20% off one item)

- •

Gift with purchase (GWP) offers

- •

Points-based rewards system creating perceived value

Monetization Assessment

Strengths

- •

Diversified revenue from both product sales and services.

- •

Loyalty program drives over 95% of total sales, ensuring a high rate of repeat business.

- •

Broad product assortment across price points captures a wide customer base.

Weaknesses

- •

Salon services represent a small percentage of total revenue (3-4%), indicating under-monetization potential.

- •

Reliance on promotional activity and coupons may condition customers to wait for sales, potentially eroding margins.

- •

High operating costs associated with maintaining a large physical retail footprint.

Opportunities

- •

Expand high-margin service offerings (e.g., advanced skin treatments, med-spa lite services).

- •

Introduce a premium tier to the loyalty program with exclusive paid benefits.

- •

Develop a retail media network to monetize website traffic and loyalty data through brand advertising.

Threats

- •

Intense competition from online retailers like Amazon and social commerce platforms like TikTok Shop could pressure pricing.

- •

Economic downturns may reduce consumer spending on discretionary beauty products.

- •

The end of the Target partnership in 2026 removes a key channel for mass-market customer acquisition.

Market Positioning

"All Things Beauty, All in One Place" - a comprehensive, accessible beauty destination offering a unique mix of mass, prestige, and luxury products combined with in-store salon services.

Market Leader (Largest U.S. beauty retailer, with an estimated 17.9% share in the Beauty, Cosmetics & Fragrance Stores industry).

Target Segments

- Segment Name:

The Beauty Enthusiast

Description:Highly engaged and knowledgeable consumers who view beauty as a hobby. They follow trends, experiment with new products, and shop across all price points. They are often active members of the Ulta Beauty Rewards program.

Demographic Factors

- •

Ages 16-45

- •

Primarily female

- •

Cross-income levels

Psychographic Factors

- •

Passionate about beauty

- •

Values variety and newness

- •

Influenced by social media and beauty influencers

- •

Enjoys the discovery process

Behavioral Factors

- •

High purchase frequency

- •

Shops both online and in-store

- •

Likely to use salon services

- •

High engagement with loyalty program

Pain Points

- •

Needing to visit multiple stores for different types of products (drugstore vs. high-end)

- •

Wanting to try products before buying

- •

Keeping up with new product launches and trends

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

The Practical Shopper

Description:Consumers who seek value, convenience, and reliability. They may be less trend-driven and more focused on restocking favorite products from trusted brands, often from the mass-market category.

Demographic Factors

- •

Ages 25-55+

- •

Suburban residents

- •

Budget-conscious

Psychographic Factors

- •

Values convenience and efficiency

- •

Brand loyal to specific products

- •

Seeks good value for money

Behavioral Factors

- •

Shops with a specific list

- •

Responds to promotions and coupons

- •

Utilizes buy-online-pickup-in-store (BOPIS) options

- •

Less likely to use salon services

Pain Points

- •

Time-consuming shopping trips

- •

Finding all necessary products in one location

- •

Paying full price for everyday items

Fit Assessment:Good

Segment Potential:Medium

- Segment Name:

The Service Seeker

Description:Customers primarily drawn to Ulta for its salon services. Their product purchases are often influenced by recommendations from their stylist or esthetician, making them high-value, loyal customers.

Demographic Factors

- •

All ages

- •

Local residents to a store

- •

Regular salon-goers

Psychographic Factors

- •

Values professional expertise and services

- •

Trusts recommendations from professionals

- •

Prioritizes convenience of combined shopping and service trips

Behavioral Factors

- •

Schedules regular appointments

- •

High in-store visit frequency (twice as often as retail-only customers)

- •

Spends significantly more than non-service guests.

Pain Points

- •

Finding a reliable and convenient salon

- •

Juggling separate appointments for hair, brows, etc.

- •

Getting professional advice on which products to use

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Broad Product Assortment (Mass & Prestige)

Strength:Strong

Sustainability:Sustainable

- Factor:

Integrated In-Store Salon Services

Strength:Strong

Sustainability:Sustainable

- Factor:

Industry-Leading Loyalty Program

Strength:Strong

Sustainability:Sustainable

- Factor:

Convenient, Off-Mall Store Locations

Strength:Moderate

Sustainability:Sustainable

Value Proposition

Ulta Beauty is the premier, all-in-one beauty destination offering an unmatched selection of mass, prestige, and luxury products, alongside professional salon services, all under one roof and powered by an exceptionally rewarding loyalty program.

Excellent

Key Benefits

- Benefit:

One-Stop Shopping

Importance:Critical

Differentiation:Unique

Proof Elements

Over 25,000 products from 600+ brands.

Mix of drugstore and high-end brands.

- Benefit:

Value & Accessibility

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Frequent promotions, coupons, and sales events.

Accessible price points across the assortment.

- Benefit:

Expert Services

Importance:Important

Differentiation:Unique

Proof Elements

Full-service salon in nearly every store.

Licensed beauty professionals for hair, skin, and brow services.

- Benefit:

Rewarding Loyalty Program

Importance:Critical

Differentiation:Unique

Proof Elements

Points redeemable for cash discounts on any product or service.

Tiered system with escalating benefits.

Unique Selling Points

- Usp:

The synergistic combination of multi-tiered retail (mass, prestige, luxury) and professional beauty services in a single, accessible format.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A highly 'gamified' and valuable loyalty program that drives over 95% of sales and fosters deep customer engagement and data collection.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Inconvenience of shopping at multiple retailers for different types of beauty products (e.g., department store for prestige, drugstore for mass).

Severity:Major

Solution Effectiveness:Complete

- Problem:

Difficulty in discovering new products and trying them before purchase, especially across different price points.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Finding trusted, professional beauty services (hair, brows, skin) in a convenient location.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The model directly addresses the modern beauty consumer's desire for variety, value, and experience. The blend of products and services creates a powerful ecosystem that encourages discovery and regular engagement.

High

The value proposition strongly resonates with the core 'Beauty Enthusiast' segment by providing unparalleled choice and a rewarding experience. It also effectively serves practical shoppers and service seekers, demonstrating broad appeal.

Strategic Assessment

Business Model Canvas

Key Partners

- •

600+ beauty brands (e.g., Estée Lauder, L'Oréal, FENTY BEAUTY)

- •

Strategic retail partners (e.g., Target, though ending in 2026).

- •

Technology partners for e-commerce and AI personalization.

- •

Logistics and supply chain providers

Key Activities

- •

Merchandising and inventory management

- •

Omnichannel retail operations (in-store and online)

- •

Marketing, promotions, and loyalty program management

- •

Salon service delivery and stylist management

- •

Supply chain and distribution logistics

Key Resources

- •

Extensive physical store network (~1,385 stores).

- •

Robust e-commerce platform and mobile app

- •

Strong brand relationships and exclusive product partnerships

- •

Massive customer database from the Ulta Beauty Rewards program.

- •

Skilled workforce of retail associates and licensed beauty professionals

Cost Structure

- •

Cost of goods sold (inventory)

- •

Store operating expenses (rent, utilities, payroll)

- •

Selling, general & administrative (SG&A) expenses.

- •

Marketing and advertising expenditures

- •

Investment in technology and supply chain infrastructure

Swot Analysis

Strengths

- •

Unique business model combining multi-tiered product retail and services.

- •

Extremely successful and large loyalty program driving high customer retention.

- •

Strong brand recognition and large, convenient physical footprint.

- •

Robust omnichannel capabilities integrating physical and digital experiences.

Weaknesses

- •

High dependence on the U.S. market with limited international presence.

- •

Significant reliance on physical stores for revenue, exposing it to shifts in retail foot traffic.

- •

Perception as less luxurious than direct competitor Sephora, potentially limiting appeal to high-end consumers.

Opportunities

- •

International expansion into new geographic markets.

- •

Expansion of the high-margin wellness and conscious beauty categories.

- •

Leveraging loyalty data for advanced personalization and new revenue streams (e.g., retail media).

- •

Growth of in-store service offerings to capture a larger share of wallet.

Threats

- •

Intense and increasing competition from Sephora, Amazon, direct-to-consumer brands, and social commerce.

- •

Shifting consumer preferences and rapid trend cycles in the beauty industry.

- •

Vulnerability to economic downturns impacting discretionary spending.

- •

Supply chain disruptions affecting product availability.

- •

The impending termination of the Target partnership could impact customer acquisition.

Recommendations

Priority Improvements

- Area:

In-Store Experience & Service Integration

Recommendation:Further integrate services into the retail journey. Develop a plan to significantly increase the revenue contribution from services by expanding offerings (e.g., express treatments, tech-enabled skin analysis) and training retail staff to seamlessly cross-sell services.

Expected Impact:High

- Area:

Digital Personalization

Recommendation:Leverage the rich loyalty program data to move beyond segmented promotions to true 1:1 personalization on the app and website, using AI to predict replenishment needs and recommend new products based on cross-category behavior.

Expected Impact:High

- Area:

Post-Target Strategy

Recommendation:Proactively develop and launch a new strategy to counteract the loss of the Target partnership. This could include smaller-format stores in new types of locations or partnerships with non-competing retailers in different sectors (e.g., grocery, fitness).

Expected Impact:High

Business Model Innovation

- •

Launch an 'Ulta Beauty Marketplace' online to host emerging, independent, and niche brands, taking a commission on sales without holding inventory, thus expanding assortment with minimal risk.

- •

Develop an 'Ulta Pro' program targeting salon professionals, offering exclusive pricing and education, thereby turning a customer base into a B2B channel.

- •

Introduce a subscription box model curated by Ulta's beauty experts, leveraging loyalty data to personalize assortments and create a new recurring revenue stream.

Revenue Diversification

- •

Formalize and scale a retail media network, allowing brand partners to purchase premium ad placements and access anonymized customer insights for a fee.

- •

Expand into adjacent wellness categories, offering supplements, at-home spa devices, and other self-care products.

- •

Create paid, in-store beauty education classes and workshops, monetizing the expertise of in-house stylists and brand partners.

Ulta Beauty's business model represents a masterclass in omnichannel retail strategy, built upon the powerful and unique combination of product variety, service integration, and customer loyalty. Its core strategic advantage lies in its 'all things beauty, all in one place' proposition, which breaks down the traditional barriers between mass-market and prestige beauty, a differentiator that strongly resonates with a broad spectrum of consumers. The in-store salon is not just a secondary revenue stream but a critical driver of foot traffic and customer lifetime value, creating a stickiness that pure-play retailers cannot replicate.

The Ulta Beauty Rewards program is the central pillar of this model, functioning as a powerful engine for data collection, customer retention, and personalized marketing. Generating over 95% of sales, it provides an immense competitive moat, making its customer base difficult for rivals to penetrate.

However, the model faces evolving challenges. The business is mature and heavily concentrated in the U.S. market, making it vulnerable to domestic economic shifts and market saturation. The competitive landscape is intensifying, with pressure from the prestige positioning of Sephora, the convenience of Amazon, and the rise of agile direct-to-consumer brands. The upcoming termination of the valuable Target partnership in 2026 presents a significant headwind for mass-market customer acquisition.

Future evolution must focus on strategic transformation beyond traditional retail. The key opportunities for growth and defensibility lie in significantly expanding the high-margin services business, leveraging its unparalleled first-party data to build new revenue streams like a retail media network, and innovating the customer experience through hyper-personalization. By doubling down on its service-led, data-driven ecosystem, Ulta can evolve from a premier retailer into an indispensable beauty platform, solidifying its market leadership for the long term.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Brand Relationships & Exclusivity

Impact:High

- Barrier:

Economies of Scale & Supply Chain

Impact:High

- Barrier:

Customer Loyalty & Brand Recognition

Impact:High

- Barrier:

Capital Investment (Physical Stores & E-commerce)

Impact:Medium

- Barrier:

Marketing & Advertising Costs

Impact:Medium

Industry Trends

- Trend:

Hyper-Personalization with AI and AR

Impact On Business:Requires investment in technology like virtual try-on tools and personalized recommendation engines to meet consumer expectations for tailored experiences.

Timeline:Immediate

- Trend:

Convergence of Mass and Prestige Beauty

Impact On Business:This trend directly supports Ulta's core business model of offering both mass-market and luxury products, blurring traditional market lines.

Timeline:Immediate

- Trend:

Emphasis on Clean, Natural, and Sustainable Ingredients

Impact On Business:necessitates curating and promoting brands that align with conscious consumer values and potentially developing stricter internal standards for product assortments.

Timeline:Near-term

- Trend:

Growth of Social Commerce and Influencer Marketing

Impact On Business:Demands a strong, authentic presence on platforms like TikTok and Instagram, leveraging creator partnerships to drive brand discovery and sales.

Timeline:Immediate

- Trend:

Expansion of the Men's Beauty & Grooming Category

Impact On Business:Presents a significant growth opportunity to expand product selection and marketing efforts to capture a larger share of this growing demographic.

Timeline:Near-term

Direct Competitors

- →

Sephora

Market Share Estimate:A leading specialty beauty retailer, often cited as Ulta's primary competitor with a significant, comparable market share.

Target Audience Overlap:High

Competitive Positioning:Positions as a premium, luxury-focused beauty destination, emphasizing a curated selection of high-end brands and an immersive, trend-driven shopping experience.

Strengths

- •

Strong luxury brand image and exclusive partnerships with high-end brands.

- •

Global presence with over 3,000 stores in 35 countries.

- •

Perceived as more premium and trend-setting.

- •

Effective use of technology for a seamless omnichannel experience (e.g., Virtual Artist AR).

- •

Strong engagement with younger, urban demographics (Gen Z and Millennials).

Weaknesses

- •

Less diverse price point selection, primarily focusing on prestige brands.

- •

Rewards program is often perceived as less generous than Ulta's.

- •

Limited offering of mass-market/drugstore brands, forcing some customers to shop elsewhere.

- •

Recent declines in organic search traffic in key categories like makeup and skincare.

Differentiators

- •

Exclusive 'Clean at Sephora' program.

- •

Store-in-store partnership with Kohl's.

- •

Focus on luxury and emerging high-end brands.

- →

Target

Market Share Estimate:A major mass-market retailer with a rapidly growing share of the beauty market, enhanced by its partnership with Ulta.

Target Audience Overlap:Medium

Competitive Positioning:A convenient, one-stop-shop for a wide range of consumer goods, positioning beauty as an accessible and integrated part of the everyday shopping trip.

Strengths

- •

High foot traffic and customer frequency.

- •

Strategic partnership with Ulta Beauty for 'shop-in-shop' experiences.

- •

Strong private-label brands and focus on 'clean' beauty at accessible price points.

- •

Convenience of purchasing beauty alongside groceries, apparel, and home goods.

Weaknesses

- •

Limited selection of prestige and luxury brands outside of the Ulta partnership.

- •

Lack of specialized, expert beauty staff compared to specialty retailers.

- •

In-store experience is less focused on beauty discovery and services.

Differentiators

Integration of beauty into a broader, multi-category shopping experience.

The 'Ulta Beauty at Target' collaboration, which is both a partnership and a competitive factor.

- →

Department Stores (Macy's, Nordstrom)

Market Share Estimate:Collectively hold a significant share of the prestige beauty market, though this has been declining.

Target Audience Overlap:Medium

Competitive Positioning:Traditional retailers of prestige beauty, positioning brands within a broader luxury and fashion context.

Strengths

- •

Long-standing relationships with established luxury beauty brands.

- •

Established, older customer base with high loyalty.

- •

Opportunity for cross-selling with fashion and accessories.

- •

Nordstrom is noted for strong customer service.

Weaknesses

- •

Slower to adapt to new digital trends and emerging indie brands.

- •

In-store experience can feel dated compared to specialty retailers.

- •

Less appeal to younger, digitally-native consumers.

- •

Limited or no offerings of mass-market brands.

Differentiators

Legacy brand reputation and exclusive gift sets, particularly during holiday seasons.

Integration with high-end fashion and apparel.

Indirect Competitors

- →

Amazon

Description:The largest online retailer, offering a vast, uncurated selection of beauty products from mass to prestige, with a focus on price, convenience, and fast shipping.

Threat Level:High

Potential For Direct Competition:Amazon is already a dominant force in online beauty retail, holding a market share nearly three times that of Ulta online and is projected to become the largest overall US beauty retailer.

- →

Direct-to-Consumer (DTC) Brands

Description:Brands like Glossier, ColourPop, and Drunk Elephant that sell directly to consumers through their own e-commerce sites, fostering strong brand communities.

Threat Level:Medium

Potential For Direct Competition:While they bypass traditional retail, many successful DTC brands eventually seek partnerships with retailers like Ulta to scale, making them both competitors and potential partners.

- →

Subscription Boxes (Ipsy, Birchbox)

Description:Services that offer curated boxes of sample-sized products for a monthly fee, focusing on product discovery rather than direct purchase.

Threat Level:Low

Potential For Direct Competition:Their primary business model is different, but they compete for consumer spending on beauty discovery and can influence future full-size purchases.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

All-in-One Product Assortment (Mass, Prestige, Luxury)

Sustainability Assessment:Ulta's unique model of offering products across all price points under one roof is a core, durable advantage that caters to a broad customer base and encourages consolidated shopping trips.

Competitor Replication Difficulty:Hard

- Advantage:

Ultamate Rewards Loyalty Program

Sustainability Assessment:With over 42 million members accounting for over 95% of sales, this highly effective, points-based program drives exceptional customer retention and repeat purchases.

Competitor Replication Difficulty:Hard

- Advantage:

Integrated Salon Services

Sustainability Assessment:In-store salons create a unique, service-based differentiator that drives regular foot traffic, increases customer spending, and provides a hands-on way for customers to experience products.

Competitor Replication Difficulty:Medium

- Advantage:

Strategic Store Footprint

Sustainability Assessment:A large network of over 1,300 stores, primarily in convenient, off-mall suburban locations, provides a significant physical reach that is difficult to replicate.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Exclusive Brand Launches & Products', 'estimated_duration': '6-24 months'}

{'advantage': 'Promotional Events (e.g., 21 Days of Beauty)', 'estimated_duration': 'Short-term / Recurring'}

Disadvantages

- Disadvantage:

Limited International Presence

Impact:Major

Addressability:Difficult

- Disadvantage:

Perception as Less Prestigious than Sephora

Impact:Minor

Addressability:Moderately

- Disadvantage:

Increasing Competition in Prestige Category

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch Targeted Social Commerce Campaigns on TikTok

Expected Impact:High

Implementation Difficulty:Easy

- Recommendation:

Enhance App-Exclusive Offers for Ultamate Rewards Members

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Prominently Feature 'Clean' and 'Sustainable' Product Filters and Collections Online

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Expand the 'Wellness' and 'Dermocosmetics' Categories

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Integrate AI for Hyper-Personalized Salon and Skincare Service Recommendations

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Further Invest in Omnichannel Capabilities, such as Real-Time Inventory Visibility and BOPIS enhancements.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Develop a Phased International Expansion Strategy

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in and Acquire Emerging Beauty Tech Startups

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Build a Formalized 'Circular Beauty' Program for Recycling and Refills

Expected Impact:Medium

Implementation Difficulty:Difficult

Solidify and message its position as the most inclusive and accessible premier beauty destination, leveraging its unparalleled assortment from drugstore to luxury to serve all beauty enthusiasts, regardless of budget or expertise.

Continue to lean into the unique trifecta of a comprehensive product range, integrated professional services, and a best-in-class loyalty program, creating a holistic beauty ecosystem that competitors cannot easily replicate.

Whitespace Opportunities

- Opportunity:

Personalized Beauty Subscription Box for Loyalty Members

Competitive Gap:Combines Ulta's vast product assortment and rich customer data with the discovery model of subscription services, creating a more personalized offering than existing players.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Dedicated In-Store and Online Hub for Men's Grooming and Skincare

Competitive Gap:The men's beauty market is underserved by specialized retail experiences. Ulta can create a dedicated, educational space that goes beyond what Sephora or department stores currently offer.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Advanced At-Home Beauty Tech and Devices Category

Competitive Gap:While some retailers sell devices, there is a gap for a trusted retailer to become the go-to destination for curating, educating, and integrating high-tech beauty tools and personalized devices.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Live-Stream Shopping Events with In-House Salon Professionals

Competitive Gap:Leverages Ulta's unique access to thousands of licensed professionals to provide authentic, expert-led tutorials and live shopping experiences, a more credible approach than relying solely on influencers.

Feasibility:High

Potential Impact:Medium

Ulta Beauty has established a dominant position in the U.S. beauty retail market by successfully executing a broad differentiation strategy. Its core competitive advantage lies in its unique 'all things beauty, all in one place' model, which masterfully blends mass-market, prestige, and luxury products under one roof, complemented by in-store salon services. This approach, combined with an industry-leading loyalty program boasting over 42 million members, creates a powerful and sustainable moat that is difficult for competitors to replicate.

The competitive landscape is mature and moderately concentrated, with Sephora as Ulta's primary direct competitor. The rivalry is defined by a distinct positioning dichotomy: Ulta champions accessibility and variety, while Sephora focuses on a curated, luxury-first experience. While Sephora leads in premium brand perception and global reach , Ulta's strengths lie in its broader customer appeal, suburban footprint, and a more financially rewarding loyalty program.

However, the market is dynamic and facing significant disruption. The primary threats come from the digital realm, specifically from Amazon, whose aggressive expansion into beauty e-commerce poses a high-level threat due to its vast selection, logistical prowess, and price competitiveness. Additionally, the rise of agile Direct-to-Consumer (DTC) brands and increasing competition for prestige brands from players like Target (through the Ulta partnership itself) and an expanding Sephora presence in Kohl's stores are intensifying pressure.

Key industry trends such as the demand for personalization, clean and sustainable products, and the convergence of beauty and wellness align well with Ulta's existing model and present clear avenues for growth. The analysis of Ulta's website reveals a clear focus on newness, exclusivity ('Only at Ulta'), and value-driven promotions, which are effective tactics for driving traffic and reinforcing its value proposition.

Strategic whitespace opportunities exist in expanding the men's grooming category, pioneering a more integrated approach to beauty technology, and leveraging its in-house professional talent for more authentic digital content. To maintain its leadership, Ulta must continue to enhance its omnichannel experience, invest in personalization technologies like AI and AR , and consider a strategic approach to international expansion to counter its current U.S. dependency. By doubling down on its core differentiators while strategically innovating in these growth areas, Ulta can fortify its position against a complex and evolving competitive field.

Messaging

Message Architecture

Key Messages

- Message:

Discover what's new and exclusive from top beauty brands.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Carousel

- Message:

Find great deals and savings on your favorite beauty products.

Prominence:Primary

Clarity Score:High

Location:Homepage 'Deals for you' & 'Today's Deals' sections

- Message:

The 21 Days of Beauty Event is a major savings opportunity.

Prominence:Secondary

Clarity Score:High

Location:Dedicated promotional banner on homepage

- Message:

Ulta Beauty offers professional salon services for hair, skin, and more.

Prominence:Tertiary

Clarity Score:Medium

Location:Lower section of the homepage

The message hierarchy is exceptionally clear and commercially driven. It prioritizes newness and promotions above all else, effectively driving immediate transactional behavior. Brand-level or service-oriented messages are deprioritized, appearing much lower on the page, indicating a focus on product sales over brand building on the homepage.

Messaging is highly consistent in its transactional nature. Across all sections, the focus remains on products, brands, and price. Language is direct and action-oriented. There is a consistent emphasis on discovery ('New', 'latest') and value ('Deals', 'Sale', '20% off').

Brand Voice

Voice Attributes

- Attribute:

Enthusiastic & Trendy

Strength:Strong

Examples

- •

PATTERN Body just dropped

- •

Juicy and joyful hydration

- •

Mega sparkle for that FENTY BEAUTY glow

- Attribute:

Direct & Promotional

Strength:Strong

Examples

- •

Deals for you

- •

20% off one qualifying item

- •

Today only

- •

Free makeup gift

- Attribute:

Authoritative & Informative

Strength:Moderate

Examples

Dermatologist-recommended hair growth products

Explore K-Beauty skin care dedicated to real results

Tone Analysis

Promotional

Secondary Tones

- •

Excited

- •

Urgent

- •

Helpful

Tone Shifts

Shifts from an exciting, trend-focused tone in the hero section to a direct, value-focused tone in the deals sections.

Voice Consistency Rating

Good

Consistency Issues

The voice is consistently commercial, but lacks a strong, unifying brand personality. The emotional connection promised in the corporate mission ('power of beauty,' 'possibilities within each of us') is largely absent from the homepage's direct-response-focused voice.

Value Proposition Assessment

Ulta Beauty is the ultimate destination for 'All Things Beauty, All in One Place,' offering an unmatched selection of products across all categories and price points, from drugstore to luxury, combined with compelling value and accessible salon services.

Value Proposition Components

- Component:

Unparalleled Product Assortment

Clarity:Clear

Uniqueness:Unique

- Component:

Value and Accessibility (Sales & Deals)

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Discovery of New & Exclusive Brands

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Integrated Salon Services

Clarity:Somewhat Clear

Uniqueness:Unique

Ulta's primary differentiation is its unique ability to house both mass-market/drugstore brands (e.g., Neutrogena, e.l.f.) and prestige brands (e.g., FENTY BEAUTY, Dior) under one roof, a strategy competitors like Sephora do not fully replicate. This 'masstige' positioning, combined with frequent promotions and a powerful loyalty program, creates a highly effective value proposition that appeals to a broader demographic of 'beauty enthusiasts' who shop across price points.

The messaging positions Ulta as a practical, comprehensive, and value-oriented beauty superstore. Compared to Sephora, which cultivates a more premium, curated, and exclusive brand image, Ulta's messaging is more democratic and accessible. It competes less on brand aspiration and more on breadth of choice, convenience, and tangible rewards.

Audience Messaging

Target Personas

- Persona:

The 'Beauty Enthusiast'

Tailored Messages

- •

New & only at Ulta

- •

The latest from Miu Miu

- •

Diamond Bomb collection

- •

21 Days of Beauty Event is coming!

Effectiveness:Effective

- Persona:

The 'Deal Seeker'

Tailored Messages

- •

Deals for you

- •

Sale

- •

20% off one qualifying item with code

- •

Free makeup gift with any $80 online purchase

Effectiveness:Effective

- Persona:

The 'Brand-Loyal Shopper'

Tailored Messages

- •

Moroccanoil is here

- •

Just in from Nutrafol

- •

The latest from Miu Miu

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

Budget constraints ('Sale', '20% off', 'Deals')

- •

Desire for convenience (One-stop shop for mass and prestige)

- •

Fear of missing out (FOMO) on new trends ('New', 'just dropped', 'has arrived')

Audience Aspirations Addressed

- •

Achieving a trendy look ('Glazed skin must-haves', 'FENTY BEAUTY glow')

- •

Expressing personal style ('effortlessly cool fragrance')

- •

Solving specific beauty concerns ('hair growth products', 'K-Beauty skin care dedicated to real results')

Persuasion Elements

Emotional Appeals

- Appeal Type:

Excitement/Novelty

Effectiveness:High

Examples

- •

New & only at Ulta

- •

Medicube has arrived

- •

PATTERN Body just dropped

- Appeal Type:

Anticipation

Effectiveness:High

Examples

21 Days of Beauty Event is coming!

Preview now

Social Proof Elements

{'proof_type': 'Ratings and Reviews', 'impact': 'Strong'}

{'proof_type': 'Expert Endorsement', 'impact': 'Moderate'}

Trust Indicators

- •

Prominent display of trusted brand names (Dyson, Tarte, Charlotte Tilbury)

- •

Specific claims like 'Dermatologist-recommended'

- •

Clear contact options like 'CHAT NOW'

Scarcity Urgency Tactics

- •

Time-limited offers ('Today only', 'Ends Aug 30')

- •

Event-based promotions ('21 Days of Beauty Event is coming!')

- •

Exclusive offers ('app exclusive', 'Exclusive weekly gift')

Calls To Action

Primary Ctas

- Text:

Shop now

Location:Hero Carousel

Clarity:Clear

- Text:

Add to bag

Location:Product listings

Clarity:Clear

- Text:

Preview now

Location:21 Days of Beauty banner

Clarity:Clear

- Text:

Book now

Location:The salon at ulta beauty section

Clarity:Clear

The CTAs are highly effective for their intended purpose: driving immediate e-commerce transactions. They are clear, concise, and consistently use action-oriented language. There is little ambiguity, which reduces friction and encourages clicks. The variety ('Shop', 'Add', 'Preview', 'Book') is well-matched to the context of each section.

Messaging Gaps Analysis

Critical Gaps

Lack of Brand Storytelling: The messaging is almost entirely tactical (what to buy, how to save) and fails to communicate a larger brand narrative or purpose. The inspiring corporate mission is not translated into customer-facing messaging.

Community and Experience: While 'Community' and 'in-store events' are mentioned at the bottom, there is no messaging that fosters a sense of belonging or highlights the in-store experience as a key differentiator beyond salon services.

Contradiction Points

No itemsUnderdeveloped Areas

Services Messaging: 'The salon at ulta beauty' is a unique differentiator but its messaging ('See you in the chair') is generic. It lacks detail on the expertise, range of services, or benefits, making it feel like an afterthought.

Loyalty Program Value: While the loyalty program is a core business driver, its value proposition is not clearly articulated on the homepage. The focus is on credit card acquisition rather than the benefits of the Ultamate Rewards program itself.

Messaging Quality

Strengths

- •

Exceptional clarity on promotions and new products, driving urgency and conversion.

- •

Powerful use of social proof (ratings/reviews) at the product level to build trust and reduce purchase anxiety.

- •

Effective message hierarchy that guides users toward immediate commercial actions.

- •

Clear, direct, and unambiguous Calls-to-Action.

Weaknesses

- •

Overly transactional focus erodes brand differentiation beyond price and selection.

- •

Lack of emotional connection and brand storytelling.

- •

Weak communication of key differentiators like salon services and the 'masstige' model.

- •

Minimal messaging tailored to building a long-term community or brand relationship.

Opportunities

- •

Integrate brand mission messaging into homepage content to build an emotional connection.

- •

Elevate the messaging around salon services to position Ulta as a beauty services leader, not just a retailer.

- •

Create content-driven messaging around beauty education and advice to build authority and trust.

- •

Develop clearer messaging around the Ultamate Rewards program to highlight its benefits beyond just earning points.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Hero Messaging

Recommendation:Dedicate one of the primary hero slots to a brand-level message that communicates the core value proposition, such as 'Prestige, drugstore, and everything in between. It's all at Ulta Beauty.' This builds brand equity beyond the current promotion.

Expected Impact:High

- Area:

Salon Services Section

Recommendation:Revamp the Salon messaging to be more benefit-oriented. Instead of 'See you in the chair,' use copy like 'Expert Stylists. Personalized Treatments. Your Best Hair Day Awaits.' and include visuals of the salon experience.

Expected Impact:Medium

- Area:

Brand Storytelling

Recommendation:Create a new homepage module titled 'The Possibilities of Beauty' featuring user-generated content or short stories that align with the brand mission, connecting product with empowerment and self-expression.

Expected Impact:High

Quick Wins

- •

Add a sub-headline under the main logo that reinforces the value proposition, e.g., 'All Beauty. All in One Place.'

- •

In the 'Deals for you' section, add a small message like 'Curated for our Ultamate Rewards members.' to reinforce the value of the loyalty program.

- •

Change the generic 'Learn more' CTA for the Salon to a more engaging 'Explore Services'.

Long Term Recommendations

- •

Develop a comprehensive content strategy around beauty education, advice, and tutorials that is integrated into the shopping experience, positioning Ulta as a helpful expert.

- •

Shift the messaging balance over time to be 60% transactional and 40% brand/community-focused, creating a more durable brand that is less reliant on promotions.

- •

Invest in personalized messaging that leverages loyalty program data to create a homepage experience that feels individually curated, beyond just the 'We think you'll like' product carousel.

Ulta Beauty's website messaging is a masterclass in high-conversion, direct-response e-commerce. The communication strategy is exceptionally effective at driving short-term business outcomes: highlighting new products to create excitement and showcasing deals to stimulate immediate purchases. The messaging architecture is clear and unapologetically commercial, prioritizing product and price above all. Persuasion techniques like social proof (via ubiquitous star ratings) and urgency (time-limited deals) are expertly woven into the user experience, maximizing the likelihood of conversion.

However, this intense focus on the transactional element comes at a strategic cost. The messaging fails to build a deeper, more resilient brand identity. The brand's powerful mission of enabling possibilities through beauty is entirely absent, leaving a significant gap between the corporate vision and the customer experience. Key strategic differentiators, such as the unique mass-plus-prestige ('masstige') product model and in-store salon services, are undersold. The result is a brand that feels more like an efficient, value-driven marketplace than an inspiring beauty destination.

From a business perspective, this positions Ulta as vulnerable to competitors who can match them on price or logistics. The current messaging strategy builds customer habits (shopping for deals) but does not foster deep brand loyalty or an emotional connection that transcends price. The primary opportunity for Ulta is to evolve its messaging to strike a better balance between driving transactions and building the brand. By infusing the site with its brand purpose, better articulating its unique value proposition, and fostering a sense of community, Ulta can build a more durable competitive advantage and transition from being a place people shop for beauty to being the brand people love for beauty.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Annual revenue exceeding $11 billion demonstrates significant market demand.

- •

A differentiated model offering a mix of mass, prestige, and luxury brands under one roof, appealing to a broad demographic.

- •

Highly successful 'Ultamate Rewards' loyalty program with over 45 million active members, driving an estimated 95% of total sales.

- •

Extensive physical footprint with over 1,374 stores across all 50 states, complemented by a robust e-commerce platform.

- •

Integration of in-store salon and beauty services, creating a unique, experience-driven value proposition.

Improvement Areas

- •

Further curation of exclusive brands to defend against competitors like Sephora and DTC models.

- •

Enhancing the in-store experience to be more educational and less overwhelming for shoppers.

- •

Deepening the integration of wellness products and services as a core category.

Market Dynamics

Low-to-mid single digits. The US prestige beauty market grew 2% and the mass market grew 4% in the first half of 2025.

Mature

Market Trends

- Trend:

Convergence of Mass and Prestige Markets

Business Impact:Ulta's 'all things beauty, all in one place' model is perfectly positioned for this trend, but it also increases competition from mass retailers like Target and Walmart who are upgrading their beauty sections.

- Trend:

Rise of Wellness & 'Clean Beauty'

Business Impact:Presents a significant product expansion opportunity. Ulta is actively growing its 'Wellness Shop' but must compete with specialized retailers.

- Trend:

Hyper-Personalization and AI

Business Impact:Customers expect tailored recommendations. Ulta is investing in this, but it requires significant data infrastructure and capabilities to do it effectively at scale.

- Trend:

Dominance of E-commerce and Omnichannel Experience

Business Impact:Requires seamless integration between online and offline channels, including inventory management, loyalty programs, and customer data. This is a core strength for Ulta but also a continuous area for investment and improvement.

Favorable, but challenging. The market is growing, but at a slower pace than previous years. Ulta's growth is moderating, and it recently lost market share for the first time, necessitating a strategic evolution ('Ulta Beauty Unleashed') to capture new opportunities like international expansion.

Business Model Scalability

High

Moderately scalable structure with high fixed costs for physical stores, but a highly scalable e-commerce platform and asset-light international expansion models (joint ventures).

Strong. Ulta has demonstrated an ability to leverage fixed costs as sales grow, although recent results show some pressure from investments and a promotional environment.

Scalability Constraints

- •

Dependence on physical store rollouts for a significant portion of growth in the US market.

- •

Complexity of managing inventory across a large, distributed network of stores and e-commerce.

- •

Scaling personalized customer experiences consistently across all touchpoints.

- •

Maintaining brand compliance and experience in partnership models (e.g., Target shop-in-shops, international JVs).

Team Readiness

Strong, with recent C-suite changes indicating a proactive approach to addressing market shifts. The appointment of a new CEO and the launch of the 'Ulta Beauty Unleashed' strategy signal readiness for the next growth phase.

Mature corporate structure suitable for a large public retail company. The creation of a dedicated strategy for international expansion is a positive sign.

Key Capability Gaps

- •

International Market Entry & Operations: Requires new expertise in navigating diverse regulatory, cultural, and logistical landscapes.

- •

Advanced Data Science & AI: To move from segmentation to true 1:1 personalization and optimize for customer lifetime value.

- •

Marketplace Management: Building and managing a third-party online marketplace requires new skills in vendor management, platform governance, and logistics.

Growth Engine

Acquisition Channels

- Channel:

Physical Stores & In-Store Experience

Effectiveness:High

Optimization Potential:Medium

Recommendation:Evolve stores into experience hubs with more service offerings, educational events, and community-building activities to combat declining foot traffic trends.

- Channel:

Ultamate Rewards Loyalty Program

Effectiveness:High

Optimization Potential:High

Recommendation:Leverage the massive first-party dataset to drive hyper-personalization in offers and communications, moving beyond tiered discounts to value-added experiences.

- Channel:

Digital Marketing (SEO, SEM, Social)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Increase investment in social commerce and live shopping features to capture impulse purchases and engage younger demographics more effectively.

- Channel:

Brand Partnerships & Exclusives

Effectiveness:High

Optimization Potential:High

Recommendation:Aggressively pursue exclusive partnerships with emerging indie and international brands to create a 'treasure hunt' discovery experience that drives traffic and loyalty.

Customer Journey

Well-optimized omnichannel path. Customers seamlessly move between app, website, and physical stores, with integrated loyalty points and inventory visibility.

Friction Points

- •

Choice paralysis from an overwhelming number of SKUs, especially in-store.

- •

Inconsistent service levels between different store locations.

- •

Disconnect between the online personalized experience and the more generalized in-store experience.

Journey Enhancement Priorities

{'area': 'Online-to-Offline (O2O) Integration', 'recommendation': "Improve 'Buy Online, Pick Up In-Store' (BOPIS) experience and empower store associates with customer data to offer personalized recommendations based on online browsing history."}

{'area': 'Post-Purchase Engagement', 'recommendation': 'Develop a richer post-purchase content strategy focused on product usage, tutorials, and community engagement to increase product satisfaction and drive repeat purchases. '}

Retention Mechanisms

- Mechanism:

Ultamate Rewards Program (Points & Tiers)

Effectiveness:High

Improvement Opportunity:Introduce non-monetary rewards such as exclusive access to events, early access to new products, and personalized consultations to deepen emotional loyalty.

- Mechanism:

Personalized Promotions & Email Marketing

Effectiveness:Medium

Improvement Opportunity:Utilize AI to advance from segment-based promotions to 1:1 personalized offers based on predictive analytics of a customer's next likely purchase.

- Mechanism:

In-Store Salon & Services

Effectiveness:Medium

Improvement Opportunity:Integrate service history into the customer's digital profile to recommend products used during services, creating a powerful cross-sell engine.

- Mechanism:

Ulta Beauty Rewards Credit Card

Effectiveness:High

Improvement Opportunity:Create exclusive cardholder events and offers that are deeply integrated with the top loyalty tiers to drive both spend and program engagement.

Revenue Economics

Strong. As a mature public company, Ulta demonstrates profitable unit economics, though margins are facing pressure from a promotional environment and strategic investments.

Assumed High. The loyalty program's ability to drive 95% of sales indicates a high lifetime value (LTV) and efficient customer acquisition cost (CAC) for repeat buyers.

High, but moderating. Recent sales growth has slowed, indicating a need for new growth vectors to maintain high efficiency.

Optimization Recommendations

- •

Increase purchase frequency through personalized replenishment reminders and subscription options.

- •

Drive higher Average Order Value (AOV) by intelligently bundling products and promoting service add-ons during checkout.

- •

Optimize promotional spend by shifting from broad-based discounts to targeted, high-margin offers for specific customer segments.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Enterprise Systems

Impact:Medium

Solution Approach:Continue the ongoing ERP system upgrade (Project SOAR) to enhance data management, inventory visibility, and enable more agile decision-making.

- Limitation:

Scalability of Personalization Engine

Impact:High

Solution Approach:Invest in a state-of-the-art AI/ML platform that can process vast datasets in real-time to deliver true 1:1 personalization across all channels.

Operational Bottlenecks

- Bottleneck:

Supply Chain Complexity

Growth Impact:Managing inventory for 1,300+ stores, e-commerce, and new international markets is a major constraint on agility and profitability.

Resolution Strategy:Invest in predictive analytics for demand forecasting and optimize fulfillment networks, potentially using more stores as micro-fulfillment centers.

- Bottleneck:

In-Store Associate Training & Retention

Growth Impact:The quality of the in-store experience, a key differentiator, is dependent on knowledgeable and engaged staff, which is a major challenge in the current labor market.

Resolution Strategy:Develop enhanced training programs focused on consultative selling and specific brand knowledge. Improve compensation and career pathing to reduce turnover.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Double down on differentiators: the unique mass-to-luxury assortment, in-store services, and the loyalty program. Compete aggressively for exclusive brand partnerships.

- Challenge:

US Market Saturation

Severity:Major

Mitigation Strategy:Focus on driving comparable store sales through enhanced experiences and personalization. The primary mitigation is the newly-launched international expansion strategy.

- Challenge:

Rise of DTC and Social Commerce

Severity:Major

Mitigation Strategy:Launch an online marketplace to bring emerging DTC brands onto the Ulta platform. Enhance social commerce features to become a point of purchase, not just discovery.

Resource Limitations

Talent Gaps

- •

International Business Development and Operations

- •

AI/ML Engineering and Data Science

- •

Marketplace and Platform Management

Significant capital will be required for international store build-outs (even with JV models), continued technology investment, and potential acquisitions.

Infrastructure Needs

- •

Global supply chain and logistics network.

- •

Scalable, cloud-native data and e-commerce platforms.

- •

Upgraded in-store technology for clienteling and operational efficiency.

Growth Opportunities

Market Expansion

- Expansion Vector:

International Expansion (Mexico, UK, Middle East)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Continue the current strategy of using joint ventures (Axo in Mexico) and acquisitions (Space NK in the UK) to enter new markets with local expertise and an established footprint, minimizing initial risk.

- Expansion Vector:

Deeper Penetration of the Men's Grooming Market

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Curate a dedicated 'Men's Shop' within stores and online, supported by targeted marketing campaigns that speak directly to male consumers.

Product Opportunities

- Opportunity:

Expansion of 'The Wellness Shop'

Market Demand Evidence:Growing consumer trend of linking beauty with overall health and wellness.

Strategic Fit:High

Development Recommendation:Expand assortment into categories like supplements, relaxation aids, and tech-enabled wellness devices. Partner with credible wellness influencers and experts.

- Opportunity:

Launch of Third-Party Online Marketplace

Market Demand Evidence:Proliferation of niche and indie brands that consumers want to discover; a response to slowing sales growth.

Strategic Fit:High

Development Recommendation:Launch the Mirakl-powered platform to rapidly expand online SKU count without inventory risk. Focus on curating unique and emerging brands that complement the core assortment.

- Opportunity:

Private Label (Ulta Beauty Collection) Innovation

Market Demand Evidence:Consumer demand for value and retailer desire for higher-margin products.

Strategic Fit:High

Development Recommendation:Focus on developing 'dupes' of trending high-end products and expanding into adjacent categories like tools and wellness to capture price-sensitive consumers.

Channel Diversification

- Channel:

Enhanced Social Commerce

Fit Assessment:High

Implementation Strategy:Integrate checkout capabilities directly within platforms like TikTok and Instagram. Leverage live streaming events hosted by influencers to drive direct sales.

- Channel:

Reimagined Store-in-Store Concepts

Fit Assessment:Medium

Implementation Strategy:With the Target partnership ending in 2026, explore new, potentially more upscale, partnerships with retailers that align with a premium or wellness-focused strategy.

Strategic Partnerships

- Partnership Type:

Technology & AI

Potential Partners

Leading AI/ML Platform Providers (e.g., Databricks, Snowflake)

AR/VR Beauty Tech companies (e.g., Perfect Corp)

Expected Benefits:Accelerate development of hyper-personalization, improve demand forecasting, and enhance virtual try-on capabilities to drive conversion.

- Partnership Type:

Indie Brand Incubator

Potential Partners

Venture Capital Firms in the beauty space

Beauty Accelerators

Expected Benefits:Gain early access to and exclusive distribution rights for the next wave of high-growth beauty brands, creating a competitive moat.

Growth Strategy

North Star Metric

Average Revenue Per Loyalty Member (ARPLM)

This metric combines customer value (spend) with loyalty program engagement. Growing this number ensures Ulta is increasing the value of its most critical asset: its 45M+ member base. It aligns incentives across merchandising, marketing, and operations.

Increase ARPLM by 5-7% annually by driving higher purchase frequency and AOV.

Growth Model

Loyalty-Fueled Omnichannel Expansion

Key Drivers

- •

New Loyalty Member Acquisition

- •

Increased Spend & Frequency of Existing Members

- •

Successful International Market Entry

- •

Growth of E-commerce and Marketplace channels

Focus all strategic initiatives on their ability to either acquire a new loyalty member or increase the value of an existing one. Use the loyalty program as the central hub for the customer relationship across all channels and geographies.

Prioritized Initiatives

- Initiative:

Execute International Launch in Mexico

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Finalize initial store locations, establish supply chain routes with JV partner Axo, and develop a localized marketing launch plan.

- Initiative:

Launch & Scale Online Marketplace

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Onboard the first cohort of third-party sellers, focusing on unique and high-demand indie brands. Integrate the marketplace experience seamlessly into the main Ulta website and app.

- Initiative:

Develop and Deploy Hyper-Personalization Engine v1

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Create a cross-functional 'personalization pod' with data science, engineering, and marketing. Launch an initial experiment focused on personalized product recommendations on the homepage and in email.

Experimentation Plan

High Leverage Tests

- Test:

Personalized vs. Tier-Based Promotions

Hypothesis:AI-driven personalized offers will generate a higher ROI (revenue per marketing dollar) than broad, tier-based discounts.

- Test:

New In-Store Service Offerings

Hypothesis:Offering new, quick-service treatments (e.g., skin analysis, express facials) in select stores will increase foot traffic and drive higher in-store conversion.

- Test:

International Brand Exclusivity

Hypothesis:Securing exclusive US distribution rights for a popular international brand will drive significant new customer acquisition.

Utilize A/B testing platforms to measure incremental lift in conversion, AOV, and customer lifetime value. Track holdback groups to measure the true impact of personalization.

Implement a bi-weekly experimentation cycle for digital initiatives and a quarterly cycle for in-store or larger strategic tests.

Growth Team

A centralized Growth Team led by a Chief Growth Officer, with decentralized 'pods' or 'squads' focused on key growth levers: International Expansion, Marketplace, Personalization & Loyalty, and New Channel Development.

Key Roles

- •

Head of International Growth

- •

Director of Marketplace Strategy

- •

Lead Data Scientist, Personalization

- •

Growth Product Manager

A mix of hiring external experts, especially for international and marketplace roles, and upskilling internal talent through dedicated training in data analytics, product management, and growth marketing methodologies.

Ulta Beauty possesses a formidable growth foundation built upon strong product-market fit, a highly scalable business model, and an industry-leading loyalty program that serves as a powerful competitive moat. The company's unique value proposition of offering mass, prestige, and luxury beauty products, combined with in-store services, positions it perfectly to capitalize on the ongoing convergence of these market segments.

However, after years of rapid expansion, Ulta is entering a new phase of maturity. Growth in the saturated US market is slowing, and the company has recently experienced its first-ever loss of market share amidst intense competition. This has correctly prompted a necessary strategic pivot, 'Ulta Beauty Unleashed,' which focuses on reigniting growth through new vectors.

The most significant growth opportunities lie in international expansion and digital evolution. The planned entries into Mexico, the UK, and the Middle East represent a substantial untapped market, though they come with significant executional complexity and risk. The launch of a third-party online marketplace is a shrewd defensive and offensive move, allowing Ulta to embrace the long tail of indie and DTC brands, expand its online assortment without inventory risk, and capture a larger share of the e-commerce market.

The primary barriers to scale are operational and competitive. Managing a global supply chain, fending off aggressive competitors like Sephora and Amazon, and avoiding the pitfalls of previous retail partnerships (like the impending end of the Target collaboration) will be critical. Furthermore, meeting rising consumer expectations for hyper-personalization requires a significant and sustained investment in data science and AI capabilities.

Strategic Recommendation:

Ulta's growth strategy should be a disciplined, two-pronged approach:

-

Core Optimization: Double down on the loyalty program as the central engine for growth in the US market. The focus must shift from simply acquiring members to increasing the Average Revenue Per Loyalty Member (ARPLM). This will be achieved by leveraging its vast data to drive hyper-personalization, increasing purchase frequency, and cross-selling higher-margin services and private-label products.

-

Vector Expansion: Execute a phased and deliberate international expansion, using the asset-light JV and acquisition models as a template. Simultaneously, rapidly scale the online marketplace to become the definitive destination for beauty discovery. These two initiatives represent the most potent sources of net-new revenue and market share gain.

By successfully optimizing its core business while strategically expanding into new markets and channels, Ulta can navigate its current challenges and cement its position as a global leader in beauty retail for the next decade.

Legal Compliance

Ulta.com's Privacy Policy is comprehensive, mature, and explicitly tailored to the complex patchwork of U.S. state privacy laws. It includes specific sections for California (CCPA/CPRA), Colorado, Connecticut, Utah, and Virginia, detailing consumer rights like the Right to Know, Delete, and Correct. The policy clearly identifies the categories of personal information collected (from identifiers and payment information to 'Health Information' like skin conditions) and the purposes for its use. It acknowledges that the use of certain online tracking technologies constitutes a 'sale' or 'sharing' of data under laws like the CPRA and provides clear mechanisms for users to opt out via 'Do Not Sell or Share My Personal Information' and 'Your Privacy Choices' links in the site footer. However, the company has faced litigation concerning its data collection practices, including class action lawsuits over 'session replay' software and the biometric data collected by its virtual try-on tools, alleging violations of the California Invasion of Privacy Act and Illinois' BIPA, respectively. While these suits highlight the high-risk nature of their innovative features, the public-facing policy itself appears robust and designed to meet statutory requirements.

The Terms & Conditions are prominently accessible from the website footer and are legally robust. The terms clearly define the scope of the agreement, user obligations, and limitations on the use of the site. Key provisions include a limitation of liability, a disclaimer of warranties, and rules governing user-generated content. Crucially, the terms include a binding arbitration clause and a class action waiver, which is a strategic legal maneuver to manage litigation risk by preventing large-scale consumer lawsuits. The agreement also specifies an age requirement of 13 years or older, with parental involvement for users under 18, addressing COPPA considerations. The terms grant Ulta significant latitude in modifying the agreement and reserve the right to refuse service and limit purchase quantities for personal use, protecting against unauthorized commercial resale.

Ulta.com employs a sophisticated cookie consent mechanism that aligns with modern privacy standards. Upon the first visit, a clear banner appears, offering distinct 'Accept' and 'Manage Cookies' options. This granular approach, allowing users to manage non-essential cookies, is superior to a simple 'accept-only' banner. The banner language appropriately informs users that their experience may be affected if they reject optional cookies and links directly to a detailed Cookie Policy. This implementation reflects an understanding of the opt-out requirements of U.S. state laws and moves towards the opt-in spirit of regulations like GDPR, enhancing user trust and providing meaningful control over their data.