eScore

verizon.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Verizon demonstrates a highly mature digital presence with immense brand authority and a sophisticated, dual-pronged content strategy for B2C and B2B audiences. Its massive paid search click share, estimated at 86.6%, showcases an aggressive and dominant customer acquisition model online. While its organic content effectively establishes thought leadership in the B2B space, its 5G availability (73.0%) lags behind competitors, indicating a slight gap between digital messaging and on-the-ground network reach in some areas.

Dominant paid search strategy, capturing an overwhelming majority of clicks in its category, which serves as a powerful customer acquisition engine.

Improve organic search visibility for the 'network reliability' narrative by creating a dedicated content hub with third-party validation and performance data to better align its core strength with user search intent.

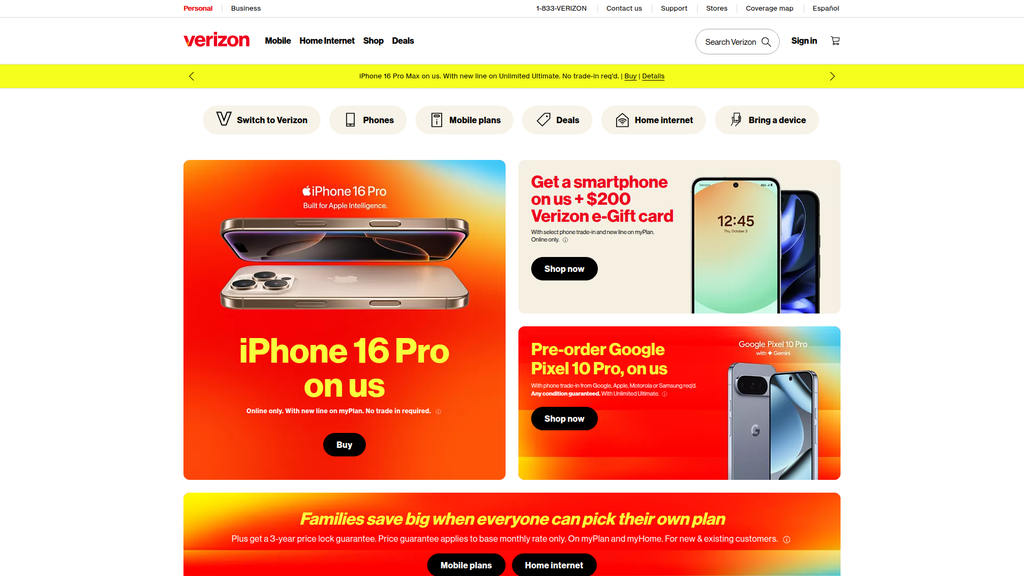

Verizon's messaging is a masterclass in tactical, conversion-focused communication, effectively segmenting its promotional B2C voice from its authoritative B2B voice. The consumer messaging is exceptionally clear on high-value hardware deals ('phone on us'), which drives acquisition. However, this aggressive promotional focus risks devaluing the brand's premium identity and fails to consistently weave in the broader brand narrative of empowerment and reliability on its main commercial pages.

Extremely effective audience segmentation, with a highly tailored, transactional voice for consumers and a distinct, educational, and consultative tone for business customers.

Integrate the core brand promise of 'unquestionable reliability' more prominently into the deal-driven B2C homepage messaging to reinforce value beyond price and build long-term brand equity.

The website is built on a mature design system with clear primary user journeys optimized for conversion, especially for new device purchases. However, the homepage can present a high cognitive load due to multiple competing offers, and the site faces significant legal and reputational risk from an ongoing class-action lawsuit alleging it is not fully accessible to blind and visually impaired users. This accessibility issue represents a critical friction point that directly impacts market reach and conversion rates for a segment of the population.

The information architecture effectively guides users toward primary conversion goals like purchasing a new phone, creating clear, direct paths for the most common user tasks.

Urgently conduct a third-party accessibility audit against WCAG 2.1/2.2 AA standards to remediate the issues cited in the 2024 lawsuit and ensure the conversion path is accessible to all users.

Verizon's credibility is anchored by its strong brand reputation, extensive history, and consistent third-party validation for network quality from firms like J.D. Power. The company demonstrates transparency through detailed legal and privacy portals. However, its risk profile is elevated due to a history of FCC enforcement actions and a recent ADA lawsuit, which indicates a gap between compliance policy and practical execution.

Consistently earns top rankings for network quality from independent evaluators like J.D. Power, providing powerful third-party validation of its core value proposition.

Strengthen internal controls and auditing for digital accessibility to ensure flawless execution of stated policies, mitigating the high legal and reputational risk highlighted by the recent class-action lawsuit.

Verizon's most sustainable competitive advantage is its extensive, owned network infrastructure and the resulting strong brand perception of premium quality and reliability. This moat is difficult to replicate due to immense capital costs and spectrum scarcity. While competitors, particularly T-Mobile, challenge Verizon on 5G speed and value, Verizon's deep entrenchment in the high-value enterprise market and consistent network performance awards provide a defensible position.

The ownership of a vast, nationwide network infrastructure and valuable spectrum licenses creates an extremely high barrier to entry and provides significant control over service quality and reliability.

Accelerate the deployment of mid-band 5G spectrum to close the speed and availability gap with T-Mobile, which currently leads in those specific 5G metrics, to neutralize a key competitive threat.

Verizon exhibits very high scalability and expansion potential, primarily driven by its strategic pivot to monetize its 5G network through Fixed Wireless Access (FWA). The FWA service leverages existing infrastructure to enter the massive home and business broadband market, with subscriber numbers already exceeding 5.1 million and a clear target of 8-9 million by 2028. This, combined with high-margin opportunities in Private 5G for enterprises, demonstrates a robust and capital-efficient path for future growth.

Aggressive and successful expansion of Fixed Wireless Access (FWA), which leverages the existing 5G network to efficiently capture a significant share of the broadband market.

Invest in specialized B2B sales and solution architecture talent to accelerate the adoption of complex, high-value enterprise solutions like Private 5G and MEC, which have longer sales cycles.

Verizon's business model is highly coherent, leveraging its core asset—a premium network—to generate stable, high-margin recurring revenue from postpaid wireless subscribers. The model is strategically evolving to monetize 5G investments through the high-growth vectors of FWA broadband and B2B enterprise solutions. This demonstrates strong strategic focus and efficient resource allocation, using a single network investment to attack multiple distinct markets.

Excellent strategic focus on monetizing its core 5G network asset through two clear growth engines: Fixed Wireless Access for broadband and advanced solutions for enterprise clients.

Simplify the 'myPlan' structure and improve billing transparency for consumers to reduce friction and churn, better aligning the customer experience with the premium brand promise.

As a dominant player in a telecom oligopoly, Verizon wields significant market power, demonstrated by its premium pricing strategy and a market share of around 34% at the end of 2024. The company consistently ranks at or near the top in network quality studies, reinforcing its brand and influencing industry standards. However, it faces intense pressure from T-Mobile, which has gained momentum in subscriber growth and 5G speed, slightly diminishing Verizon's pricing power and forcing a more reactive promotional stance.

Maintains a leading market share in the U.S. wireless industry and consistently earns top-tier network quality awards, which underpins its ability to command premium prices.

Develop a more proactive strategy to counter T-Mobile's value- and speed-focused narrative, potentially by shifting marketing from purely promotional deals to emphasizing the tangible ROI of superior network reliability for consumers and businesses.

Business Overview

Business Classification

Telecommunications Services Provider

Internet Service Provider (ISP) & Technology Solutions

Telecommunications

Sub Verticals

- •

Wireless Communications

- •

Broadband & Fiber Optic Services

- •

Internet of Things (IoT)

- •

Network as a Service (NaaS)

- •

Managed Security Services

Mature

Maturity Indicators

- •

Extensive nationwide infrastructure and brand recognition.

- •

Large, stable customer base with high market share.

- •

Focus on operational efficiency and shareholder returns (dividends).

- •

Growth driven by incremental innovations (5G, FWA) rather than market creation.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Consumer Wireless Services

Description:Postpaid and prepaid mobile plans for individuals and families, including voice, text, and data services. This is Verizon's largest revenue segment.

Estimated Importance:Primary

Customer Segment:Consumer

Estimated Margin:High

- Stream Name:

Consumer Broadband & Video

Description:High-speed internet (Fios Fiber, 5G Home) and legacy video services for residential customers.

Estimated Importance:Secondary

Customer Segment:Consumer

Estimated Margin:Medium

- Stream Name:

Business Network & Technology Solutions

Description:A comprehensive suite of services for business clients including wireless, private networks, IoT, security, and managed network services.

Estimated Importance:Secondary

Customer Segment:Business & Public Sector

Estimated Margin:Medium-High

- Stream Name:

Wireless Equipment Sales

Description:Sale of smartphones, tablets, wearables, and accessories, often subsidized or financed through device payment plans to attract and retain subscribers.

Estimated Importance:Tertiary

Customer Segment:Consumer & Business

Estimated Margin:Low

Recurring Revenue Components

- •

Monthly Postpaid Mobile Plans

- •

Monthly Prepaid Mobile Plans

- •

Monthly Home Internet Subscriptions (Fios, 5G Home)

- •

Business Service Contracts (NaaS, Managed Services)

Pricing Strategy

Subscription (Tiered)

Premium

Semi-transparent

Pricing Psychology

- •

Bundling (Mobile + Home Internet discounts)

- •

Promotional Pricing (e.g., 'iPhone on us' with new line)

- •

Tiered Pricing ('myPlan' with different levels of data/perks)

- •

Price Anchoring (Highlighting savings on bundled services)

Monetization Assessment

Strengths

- •

Strong recurring revenue from a large postpaid subscriber base.

- •

High average revenue per account (ARPA) due to premium brand positioning.

- •

Successful bundling strategy increases customer lifetime value and reduces churn.

- •

Growing monetization of 5G infrastructure through Fixed Wireless Access (FWA).

Weaknesses

- •

High price point makes it vulnerable to aggressive pricing from competitors like T-Mobile.

- •

Complex plan structures and promotional offers can confuse some customers.

- •

Revenue from equipment sales is significant but operates on very low margins.

Opportunities

- •

Expand FWA to challenge cable dominance in the home broadband market.

- •

Develop and scale high-margin enterprise solutions based on 5G, MEC, and private networks.

- •

Integrate more value-added services (e.g., streaming, security) into plans to further increase ARPA.

- •

Leverage AI and data analytics for more personalized, high-conversion upselling.

Threats

- •

Intense price competition in the wireless market could erode margins.

- •

Market saturation in the U.S. postpaid phone segment limits organic growth.

- •

Regulatory changes affecting spectrum licenses or net neutrality.

- •

Capital-intensive nature of network upgrades (e.g., 6G) requires continuous heavy investment.

Market Positioning

Differentiation based on network quality, reliability, and performance.

Leading position in the U.S. wireless market, with an estimated share of around 34-38%.

Target Segments

- Segment Name:

High-Value Consumer

Description:Individuals and families who prioritize network reliability and performance over cost, often early adopters of new technology.

Demographic Factors

- •

Age 25-54

- •

Mid to high household income

- •

Urban/Suburban residents

Psychographic Factors

- •

Values quality and reliability

- •

Brand conscious

- •

Seeks premium products and services

Behavioral Factors

- •

High data usage

- •

Regularly upgrades to the latest devices

- •

Likely to bundle multiple services (mobile, home internet)

Pain Points

- •

Dropped calls or slow data in congested areas

- •

Poor customer service experiences

- •

Lack of seamless connectivity across all devices

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Small and Medium Business (SMB)

Description:Businesses requiring reliable connectivity for operations, including internet, mobile for employees, and specialized solutions like fleet management or IoT.

Demographic Factors

Varies by industry (e.g., professional services, retail, logistics)

Typically 10-500 employees

Psychographic Factors

Value proposition focused on ROI and operational uptime

Seeks scalable solutions that can grow with the business

Behavioral Factors

Purchases bundled service packages

Requires dedicated business support channels

Pain Points

- •

Network downtime impacting revenue

- •

Cybersecurity threats

- •

Managing a fleet of mobile devices for employees

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Enterprise & Public Sector

Description:Large corporations and government entities requiring complex, scalable, and secure networking solutions, including private 5G networks, edge computing, and advanced security.

Demographic Factors

Large organizations (>500 employees)

Spans multiple industries (finance, healthcare, manufacturing, government)

Psychographic Factors

Risk-averse, prioritizing security and reliability

Focus on digital transformation and operational efficiency

Behavioral Factors

- •

Long sales cycles

- •

Requires customized, integrated solutions

- •

High lifetime value

Pain Points

- •

Integrating legacy systems with new technology

- •

Ensuring data security and compliance

- •

Managing massive-scale IoT deployments

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Network Quality & Reliability

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Recognition & Trust

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive 5G Ultra Wideband Network

Strength:Strong

Sustainability:Temporary

- Factor:

Bundled Service Ecosystem (Mobile + FWA/Fios)

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To provide the most reliable, high-performance network and innovative solutions that empower customers to connect and thrive in the digital world.

Good

Key Benefits

- Benefit:

Superior Network Coverage and Reliability

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Repeated third-party network performance awards (e.g., J.D. Power, RootMetrics).

Marketing campaigns emphasizing network strength and coverage maps.

- Benefit:

High-Speed Connectivity (5G & Fios)

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Published speed test results and comparisons.

Specific branding for high-speed tiers (e.g., '5G Ultra Wideband').

- Benefit:

Simplified, Flexible Plans with Bundling Savings

Importance:Important

Differentiation:Common

Proof Elements

'myPlan' and 'myHome' offerings advertised on the website.

Explicit discounts for combining mobile and home internet services.

- Benefit:

Access to the Latest Devices and Technology

Importance:Important

Differentiation:Common

Proof Elements

Prominent homepage promotions for the newest iPhones, Pixels, and Samsung Galaxy devices.

Partnerships with leading device manufacturers.

Unique Selling Points

- Usp:

Consistently ranked as a top network for performance and reliability by independent evaluators.

Sustainability:Medium-term

Defensibility:Moderate

- Usp:

Extensive deployment of high-band (mmWave) 5G for ultra-fast speeds in dense urban areas and venues.

Sustainability:Medium-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Needing reliable mobile connectivity for work and personal life without interruption.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Requirement for high-speed, low-latency home internet for streaming, gaming, and remote work.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Businesses needing to connect and manage a wide array of devices securely and efficiently.

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

Verizon's focus on network quality and the expansion of 5G and FWA services directly aligns with the market's increasing demand for ubiquitous, high-speed connectivity.

High

The premium network positioning aligns perfectly with the values of their target segments, who prioritize performance and are willing to pay for it.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Device Manufacturers (Apple, Samsung, Google)

- •

Network Equipment Providers (Ericsson, Nokia)

- •

Cloud Service Providers (AWS, Microsoft Azure for MEC)

- •

Content & Service Partners (Disney, YouTube for NFL Sunday Ticket)

- •

Channel & Sales Partners (Telarus, Resellers)

Key Activities

- •

Network Infrastructure Development, Maintenance & Upgrades

- •

Sales, Marketing & Customer Acquisition

- •

Customer Service & Technical Support

- •

Research & Development in 5G, IoT, and Edge Computing

- •

Spectrum Acquisition and Management

Key Resources

- •

Extensive Wireless Spectrum Licenses (Low, Mid, and High-band)

- •

Nationwide Fiber Optic and Wireless Network Infrastructure

- •

Strong Brand Equity and Customer Trust

- •

Retail Store Footprint and Digital Sales Channels

- •

Skilled Engineering and Technical Workforce

Cost Structure

- •

Capital Expenditures (CAPEX) for network buildout and maintenance.

- •

Marketing and Sales Expenses (including device subsidies)

- •

Operating Expenses (OPEX) for network operations

- •

Employee Salaries and Benefits

- •

Spectrum acquisition costs

Swot Analysis

Strengths

- •

Leading brand recognition and reputation for network quality.

- •

Extensive and robust network infrastructure, including a significant 5G footprint.

- •

Large, loyal postpaid customer base providing stable recurring revenue.

- •

Diversified revenue streams across consumer and business segments.

Weaknesses

- •

Premium pricing model can be a disadvantage in a price-sensitive market.

- •

High debt levels resulting from significant investments in spectrum and infrastructure.

- •

Primarily dependent on the mature and highly competitive U.S. market.

- •

High operational costs associated with maintaining a leading network.

Opportunities

- •

Aggressive expansion of 5G Fixed Wireless Access (FWA) to capture broadband market share.

- •

Monetize 5G and Mobile Edge Computing (MEC) through advanced enterprise solutions (e.g., private networks, IoT).

- •

Further integration of services to create a stickier customer ecosystem (e.g., bundling finance, security, and entertainment).

- •

Leverage AI to improve network management, operational efficiency, and customer experience.

Threats

- •

Intense price and network competition from AT&T and T-Mobile.

- •

Potential for market disruption from new technologies (e.g., LEO satellites).

- •

Evolving cybersecurity threats targeting critical network infrastructure.

- •

Economic downturns could lead consumers and businesses to seek lower-cost alternatives.

Recommendations

Priority Improvements

- Area:

Customer Experience & Simplification

Recommendation:Streamline the 'myPlan' structure and improve billing transparency to reduce customer friction and churn. Invest further in AI-powered customer service tools to improve resolution times and satisfaction.

Expected Impact:Medium

- Area:

Mid-Market Business Segment Penetration

Recommendation:Develop more aggressively priced, bundled service packages specifically for the SMB segment to better compete with cable providers and T-Mobile for Business.

Expected Impact:High

- Area:

Capital Efficiency

Recommendation:Continue to focus on disciplined capital expenditures, prioritizing network investments in high-growth areas like FWA expansion and enterprise 5G use cases to maximize return on investment.

Expected Impact:High

Business Model Innovation

- •

Develop a 'Network-as-a-Service' (NaaS) platform for enterprises, allowing them to dynamically manage and scale their connectivity, security, and private network needs through a single portal, shifting from a traditional telco model to a flexible, cloud-like consumption model.

- •

Create vertical-specific IoT solutions platforms (e.g., for healthcare, logistics, manufacturing) that bundle connectivity, hardware, and data analytics into a single, recurring-revenue service offering.

- •

Explore strategic partnerships to offer satellite-to-cellular backup connectivity for consumers and businesses in remote areas, creating a fail-safe network offering.

Revenue Diversification

- •

Accelerate the rollout of Fixed Wireless Access (FWA) in both residential and business markets to establish a new, significant revenue stream outside of mobile.

- •

Build a robust private 5G network practice, targeting large enterprise clients in manufacturing, logistics, and healthcare for dedicated, high-performance campus networks.

- •

Expand the value-added services portfolio available through the '+play' hub and 'myPlan' perks, taking a larger share of the customer's digital services wallet beyond core connectivity.

Verizon's business model is a prime example of a mature, incumbent leader navigating a highly competitive and capital-intensive industry. Its foundation is built upon a differentiation strategy, leveraging a superior network quality and strong brand to command premium pricing. The core revenue engine remains the high-margin consumer postpaid wireless segment, which provides the stable cash flow necessary for massive network investments.

The primary evolution of Verizon's business model is the strategic pivot to monetize its extensive 5G investments. This is unfolding on two main fronts: challenging the cable duopoly in the broadband market with Fixed Wireless Access (FWA), and building a new growth engine with advanced B2B solutions like private networks and Mobile Edge Computing (MEC). The FWA initiative represents a significant opportunity to leverage a single network infrastructure to serve both mobile and fixed broadband customers, creating substantial capital efficiency. The enterprise solutions path, while having a longer sales cycle, promises higher margins and deeper integration into client operations, creating a stickier, more valuable customer relationship.

However, this evolution is not without challenges. Verizon faces relentless pressure from T-Mobile on price and network coverage perception, and from AT&T's converged fiber/wireless strategy. The company's high-cost structure and dependence on the saturated U.S. market are key vulnerabilities. Future success hinges on Verizon's ability to execute its 5G monetization strategy effectively, demonstrating a clear return on its massive capital outlays. This requires not just technological superiority, but a transformation into a more agile, solutions-oriented partner for its business customers, and a continued defense of its premium brand value in the consumer space through innovation and superior customer experience.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Expenditure & Sunk Costs

Impact:High

Description:Building and maintaining a national wireless and fiber network requires billions in continuous investment for infrastructure, upgrades, and spectrum licenses. These are significant sunk costs that deter new entrants.

- Barrier:

Spectrum Scarcity and Licensing

Impact:High

Description:Wireless spectrum is a finite resource auctioned by the government (FCC) at high costs. Incumbents like Verizon hold significant portions of valuable spectrum, making it difficult for new national carriers to emerge.

- Barrier:

Regulatory & Legal Hurdles

Impact:Medium

Description:The telecommunications industry is heavily regulated, involving complex compliance with federal and state laws regarding issues like net neutrality, privacy, and infrastructure deployment (e.g., wayleave approvals).

- Barrier:

Brand Recognition & Customer Loyalty

Impact:Medium

Description:Incumbents like Verizon have established strong brand recognition and trust over decades. New entrants must spend heavily on marketing to build a comparable level of consumer confidence.

Industry Trends

- Trend:

5G Network Expansion & Monetization

Impact On Business:Critical for maintaining network leadership and enabling new revenue streams like Fixed Wireless Access (FWA) and IoT.

Timeline:Immediate

- Trend:

Fixed Wireless Access (FWA) as a Broadband Competitor

Impact On Business:A major growth area for Verizon (5G Home Internet), allowing it to compete with cable and fiber providers outside its Fios footprint, but also a source of new competition.

Timeline:Immediate

- Trend:

Convergence of Mobile, Home, and Business Services

Impact On Business:Increased pressure to bundle mobile and home internet to improve customer retention (stickiness) and increase lifetime value. This is a key strategy visible on Verizon's homepage.

Timeline:Immediate

- Trend:

AI and Automation in Network Management

Impact On Business:Opportunity to improve network efficiency, predict outages, enhance security, and personalize customer experiences.

Timeline:Near-term

- Trend:

Enterprise Solutions (Private 5G, IoT, Edge Computing)

Impact On Business:Significant growth opportunity beyond the saturated consumer market, leveraging Verizon's B2B expertise and network capabilities.

Timeline:Near-term

Direct Competitors

- →

T-Mobile

Market Share Estimate:35% (leading in postpaid subscribers as of late 2024/early 2025)

Target Audience Overlap:High

Competitive Positioning:Positions itself as the 'Un-carrier,' disrupting industry norms with a focus on value, simplicity (no contracts, transparent pricing), and 5G network leadership in speed and coverage.

Strengths

- •

Dominant 5G Network Performance: Consistently leads in 5G download speeds, availability, and consistency in independent tests.

- •

Aggressive 'Un-carrier' Brand Identity: Strong, customer-centric brand that resonates with consumers tired of traditional carrier practices.

- •

Strong Subscriber Growth: Leads the industry in postpaid phone net additions, indicating strong market momentum.

- •

Value-Oriented Pricing: Often perceived as offering more value and perks (like Netflix on Us) for the price compared to Verizon.

Weaknesses

- •

Perception of Lower Network Reliability: Despite performance gains, Verizon still holds a stronger historical reputation for overall network reliability and coverage in the most remote areas.

- •

Less Diversified Revenue: More heavily reliant on its consumer wireless segment compared to AT&T and Verizon, which have larger enterprise and wireline operations.

- •

Lower Brand Loyalty Among High-Value Customers: Their value-focused strategy can sometimes struggle to attract and retain the highest-spending customers who prioritize premium network quality above all else.

Differentiators

- •

No-contract, simple plans

- •

Leading 5G speed and availability

- •

Bundled perks and value-adds

- •

Customer-first, anti-carrier marketing

- →

AT&T

Market Share Estimate:27% (as of late 2024)

Target Audience Overlap:High

Competitive Positioning:Positions as a reliable, established provider with a vast, converged network, leveraging its massive fiber footprint for both home internet and wireless backhaul.

Strengths

- •

Extensive Fiber Network: Largest fiber internet provider in the U.S., which is a key advantage for bundling high-speed home and mobile services.

- •

Strong Brand Recognition & Trust: Long-standing reputation as a primary, dependable telecommunications provider.

- •

Large Enterprise and Government Client Base: Deeply entrenched in the B2B and public sector markets, providing a stable revenue base.

- •

Powerful and Diverse Plans: Offers plans with significant high-speed data and perks, appealing to heavy data users.

Weaknesses

- •

Slower 5G Rollout: Has lagged behind T-Mobile in mid-band 5G deployment and overall 5G performance metrics.

- •

High Debt Load: Significant debt from past acquisitions can constrain financial flexibility.

- •

Brand Perception Issues: Can be perceived as expensive, bureaucratic, and less innovative compared to T-Mobile.

- •

Declining Legacy Businesses: Faces challenges from cord-cutting in its traditional pay-TV segments.

Differentiators

- •

Market-leading fiber broadband footprint

- •

Strong B2B and public sector relationships

- •

Legacy brand trust and reliability

- •

Bundling of wireless with DirecTV and AT&T Fiber

Indirect Competitors

- →

Cable Companies (Comcast Xfinity Mobile, Charter Spectrum Mobile)

Description:Cable giants operating as Mobile Virtual Network Operators (MVNOs), primarily on Verizon's own network. They leverage their existing broadband customer base to offer aggressively priced mobile plans as part of a bundle.

Threat Level:High

Potential For Direct Competition:They are already competing directly for mobile subscribers, and their success is a significant threat. They are successfully acquiring subscribers, sometimes at the expense of their host network, Verizon.

- →

Value MVNOs (Mint Mobile, Google Fi, Visible)

Description:Prepaid and low-cost carriers that appeal to budget-conscious consumers by offering simpler plans without the overhead of physical stores. Notably, Visible is owned by Verizon itself to compete in this segment.

Threat Level:Medium

Potential For Direct Competition:They primarily erode the low-end, prepaid market share. While they increase price pressure, they lack the infrastructure and premium brand positioning to compete for the high-value postpaid customers Verizon targets.

- →

Big Tech (Amazon, Google, Apple)

Description:Tech giants are encroaching on the connectivity space. Examples include Amazon's Project Kuiper for satellite internet, Google's investments in fiber and Fi, and Apple's ecosystem lock-in (iMessage, potential satellite features).

Threat Level:Low

Potential For Direct Competition:High (Long-term). A tech giant could acquire an existing carrier or leverage their massive resources to build a new type of network, posing a significant disruptive threat in the future.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Premium Network Quality and Reliability Perception

Sustainability Assessment:Highly sustainable due to decades of brand building and consistent investment in network infrastructure. J.D. Power consistently rates Verizon high for network quality.

Competitor Replication Difficulty:Hard

- Advantage:

Extensive Owned Network Infrastructure

Sustainability Assessment:Highly sustainable. Owning the physical infrastructure (towers, fiber) provides cost control and performance advantages that are extremely capital-intensive to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Position in Enterprise and Public Sector

Sustainability Assessment:Sustainable due to long-term contracts, deep integration into client operations, and high switching costs for large organizations.

Competitor Replication Difficulty:Medium

Temporary Advantages

- Advantage:

Exclusive Handset Deals and Promotions

Estimated Duration:3-12 months

Description:Offers like 'iPhone 16 Pro on us' are powerful for customer acquisition but are often matched by competitors during the next device launch cycle.

- Advantage:

Specific High-Band (mmWave) 5G Speed Leadership

Estimated Duration:1-3 years

Description:Verizon's early lead in mmWave 5G offers incredible speeds in dense urban areas, but its limited coverage makes it a niche advantage as competitors focus on broader mid-band 5G.

- Advantage:

Bundled Content Perks (e.g., NFL Sunday Ticket)

Estimated Duration:1-2 years (dependent on contract)

Description:Content partnerships are effective differentiators but are subject to renegotiation and can be replicated by competitors with other content providers.

Disadvantages

- Disadvantage:

Premium Price Perception

Impact:Major

Addressability:Difficult

Description:Verizon is often perceived as the most expensive carrier, which can be a significant hurdle for price-sensitive customers, especially with the aggressive pricing from T-Mobile and MVNOs.

- Disadvantage:

Lagging in Mid-Band 5G Coverage/Speed vs. T-Mobile

Impact:Major

Addressability:Moderately

Description:While improving, Verizon has been playing catch-up to T-Mobile's extensive mid-band 5G network, which is the 'sweet spot' for speed and coverage. This impacts the 5G speed narrative.

- Disadvantage:

Complexity in Plan Offerings

Impact:Minor

Addressability:Easily

Description:The 'myPlan' structure, while flexible, can be complex for consumers to understand compared to T-Mobile's more straightforward 'all-in' approach. Customer satisfaction across the industry is declining due to complexity.

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a 'Network Reliability' Marketing Campaign

Expected Impact:Medium

Implementation Difficulty:Easy

Description:Shift marketing focus from generic 'on us' device deals to specific use cases where reliability trumps speed (e.g., remote work, telehealth, first responders). Directly counter T-Mobile's speed-focused narrative by reinforcing Verizon's core strength.

- Recommendation:

Simplify 'myPlan' Value Proposition

Expected Impact:Medium

Implementation Difficulty:Easy

Description:Create clearer, pre-packaged 'myPlan' bundles for common user profiles (e.g., 'The Streamer,' 'The Traveler,' 'The Family') to reduce decision fatigue and better communicate the value of the customizable perks.

Medium Term Strategies

- Recommendation:

Aggressively Expand and Bundle FWA/Fios

Expected Impact:High

Implementation Difficulty:Moderate

Description:Create deeper discounts and seamless onboarding for customers who combine Verizon Wireless with 5G Home or Fios internet. Market this bundle as the ultimate reliable 'work and play from home' solution.

- Recommendation:

Develop Turnkey 'Small Business in a Box' Solutions

Expected Impact:High

Implementation Difficulty:Moderate

Description:Leverage the B2B expertise shown in the website's content to create an easy-to-deploy package for small businesses bundling 5G Business Internet, mobile lines, security, and a VPN. This addresses a market gap between consumer and large enterprise offerings.

Long Term Strategies

- Recommendation:

Invest in the 'Network of the Future'

Expected Impact:High

Implementation Difficulty:Difficult

Description:Publicly champion and invest in next-generation technologies like 6G, edge computing, and quantum networking to solidify the brand's position as the foremost network innovator, ensuring the 'reliability' advantage persists for the next decade.

- Recommendation:

Build an Open Ecosystem of Partners

Expected Impact:High

Implementation Difficulty:Difficult

Description:Shift from exclusive content deals to creating an open platform where various services (streaming, gaming, security, cloud) can integrate with Verizon plans. This creates a more defensible ecosystem than relying on a single, temporary content partner.

Reinforce the position as the premium, ultra-reliable network provider for customers and businesses for whom connectivity failure is not an option. Shift the narrative from a 'race for speed' to a 'guarantee of performance.'

Differentiate through guaranteed network performance and integrated home/business solutions, rather than competing solely on price or device promotions. Focus on the total value of a reliable, bundled ecosystem for a seamless connected life.

Whitespace Opportunities

- Opportunity:

Targeted Connectivity for Specific Verticals

Competitive Gap:Competitors offer generic business plans. There's a gap for industry-specific solutions (e.g., ultra-reliable, low-latency networks for healthcare clinics; robust fleet management and IoT for logistics companies).

Feasibility:High

Potential Impact:High

- Opportunity:

Gamified Loyalty & 'Perk' Marketplace

Competitive Gap:Loyalty programs are passive. A gamified system where users earn points for timely payments or data-saving habits, which can be spent in a marketplace of digital perks (streaming trials, cloud storage, app subscriptions), would increase engagement and stickiness beyond what T-Mobile Tuesdays offers.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Rural and Underserved Market Leadership with FWA

Competitive Gap:While all carriers are targeting rural areas with FWA, Verizon can leverage its brand trust and reliability narrative to become the premier provider for these communities where wired broadband is unavailable or unreliable.

Feasibility:Medium

Potential Impact:High

The U.S. telecommunications landscape in 2025 is a mature oligopoly, dominated by the intense rivalry between Verizon, T-Mobile, and AT&T. Verizon's strategic position is that of the premium, high-reliability provider, a brand identity built over decades and backed by a robust, owned network infrastructure. This remains its most sustainable competitive advantage.

However, this premium position is under significant assault. T-Mobile, its primary direct competitor, has successfully executed its 'Un-carrier' strategy to seize leadership in 5G network speed and availability, while simultaneously winning the value narrative. T-Mobile's consistent lead in subscriber growth underscores the effectiveness of this strategy. AT&T competes with its vast fiber network, offering a powerful bundling proposition for home and mobile, though it lags in 5G performance.

The analysis of verizon.com clearly reflects its current tactical response: an aggressive customer acquisition strategy heavily reliant on device promotions ('on us' deals for the latest smartphones) and value-added perks like NFL Sunday Ticket. This is aimed squarely at attracting and locking in new lines of service to counter T-Mobile's momentum. Furthermore, the prominence of 'Mobile & Home Internet' bundling and extensive B2B content marketing highlights Verizon's strategic imperatives: increasing customer 'stickiness' through converged services and expanding into the lucrative enterprise market for private 5G and IoT.

A critical emerging threat comes from indirect competitors, specifically cable companies like Comcast and Charter. Operating as MVNOs on Verizon's own network, they are leveraging their existing broadband relationships to capture a significant number of mobile subscribers, creating a paradoxical situation where Verizon's wholesale business fuels one of its biggest retail threats.

Verizon's primary disadvantages are its premium price perception and the performance gap in mid-band 5G compared to T-Mobile. To succeed, Verizon must shift the competitive narrative from a head-to-head battle on 5G speed—a fight T-Mobile is currently winning—to a broader value proposition centered on unquestionable reliability across its entire ecosystem (mobile, home, and business). Opportunities lie in simplifying its offerings, doubling down on the FWA-driven convergence strategy to lock in households, and creating specialized, high-margin solutions for business verticals where its network quality is a mission-critical differentiator.

Messaging

Message Architecture

Key Messages

- Message:

Get the latest smartphones (iPhone, Google Pixel, Samsung Galaxy) 'on us'.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section & Deals Section

- Message:

Switch to Verizon and get a monetary incentive (e.g., '$200 Verizon e-Gift card', 'up to $360').

Prominence:Primary

Clarity Score:High

Location:Homepage Banners

- Message:

Families save by choosing individual plans, backed by a 3-year price lock guarantee.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage Mid-page Section

- Message:

Get bundled perks and discounts, including 'NFL Sunday Ticket from YouTube, on us'.

Prominence:Secondary

Clarity Score:High

Location:Deals Section

- Message:

Verizon provides reliable, nationwide coverage for Mobile and Home Internet.

Prominence:Tertiary

Clarity Score:Medium

Location:Stay connected & save Section

- Message:

Verizon Business offers expert insights and a comprehensive suite of networking solutions (LAN, WAN, VPN, etc.).

Prominence:Primary

Clarity Score:High

Location:Business 'Learn' Section

The message hierarchy on the consumer homepage is exceptionally clear and aggressive. It prioritizes customer acquisition through high-value hardware deals ('phone on us') above all else. Secondary messages focus on plan savings and value-adds. The core brand value of network quality is present but tertiary, suggesting a strategy focused on converting shoppers motivated by immediate financial incentives. The B2B section has a completely separate and appropriate hierarchy, prioritizing educational content and thought leadership to build trust before introducing solutions.

Messaging is highly consistent within its respective silos (B2C vs. B2B). The consumer-facing pages uniformly hammer home deals, value, and new devices. The business-facing content consistently adopts an educational, authoritative tone. There is little to no crossover, creating two distinct but internally consistent messaging worlds under one parent brand.

Brand Voice

Voice Attributes

- Attribute:

Promotional

Strength:Strong

Examples

- •

iPhone 16 Pro on us

- •

Get a smartphone on us + $200 Verizon e-Gift card

- •

Families save big

- Attribute:

Urgent

Strength:Moderate

Examples

- •

Online only.

- •

Pre-order Google Pixel 10 Pro

- •

for a limited time only

- Attribute:

Simple & Direct

Strength:Strong

Examples

- •

Buy

- •

Shop now

- •

Get started

- Attribute:

Authoritative & Educational (B2B)

Strength:Strong

Examples

- •

A computer network connects different laptops, desktops, mobile devices...

- •

A local area network (LAN) allows computers and devices to connect...

- •

Network management is important for ensuring proper configurations, security, access and performance...

Tone Analysis

Transactional

Secondary Tones

Value-driven

Incentivizing

Tone Shifts

A significant and intentional tone shift occurs when moving from the consumer (B2C) homepage to the Verizon Business (B2B) content. The tone shifts from highly promotional and transactional to professional, educational, and consultative.

Voice Consistency Rating

Good

Consistency Issues

The primary 'issue' is the stark bifurcation of voice between B2C and B2B, which is a deliberate strategy. While effective for segmentation, it results in a lack of a single, unified brand voice across the entire digital presence. The aspirational brand voice of empowerment and connection is more evident in high-level brand campaigns than on the direct-response-focused website.

Value Proposition Assessment

Get the latest technology and entertainment on America's most reliable network, made affordable through aggressive deals and bundling.

Value Proposition Components

- Component:

Access to new devices for free or at a steep discount.

Clarity:Clear

Uniqueness:Common

- Component:

Price stability and savings for families.

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Reliable, nationwide network coverage.

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

- Component:

Exclusive bundled content (NFL Sunday Ticket).

Clarity:Clear

Uniqueness:Unique

- Component:

Comprehensive, scalable network solutions for businesses.

Clarity:Clear

Uniqueness:Somewhat Unique

Verizon's primary differentiation in its consumer messaging is not based on a unique value proposition, but on the aggressiveness and perceived value of its promotions. While competitors also offer phone deals, Verizon's 'on us' messaging is direct and powerful. The '3-year price lock guarantee' is a strong differentiator against competitors often criticized for price hikes. For B2B, differentiation comes from the scale of its offerings and leveraging the brand's reputation for network reliability into business-grade solutions.

Against competitors like T-Mobile, known for its 'Un-carrier' disruptive pricing, and AT&T, which often competes on bundling, Verizon positions itself as the premium, reliable network where you can still get an aggressive deal. The messaging implies you don't have to sacrifice network quality for a good price. This strategy aims to capture value-conscious customers who are risk-averse about network performance.

Audience Messaging

Target Personas

- Persona:

The New-Device Seeker / Switcher

Tailored Messages

- •

iPhone 16 Pro on us

- •

Pre-order Google Pixel 10 Pro, on us

- •

Bring your phone and get up to $360, when you switch

Effectiveness:Effective

- Persona:

The Value-Conscious Family

Tailored Messages

- •

Families save big when everyone can pick their own plan

- •

Plus get a 3-year price lock guarantee.

- •

Bundle your mobile & home internet for exclusive benefits.

Effectiveness:Effective

- Persona:

The IT/Business Decision-Maker

Tailored Messages

- •

10 types of computer networks

- •

A virtual private network (VPN) creates a secure connection between a user's device and a network server.

- •

Cloud-based network management relies on cloud computing resources and services to manage and monitor computer networks.

Effectiveness:Effective

Audience Pain Points Addressed

- •

High cost of new smartphones ('on us')

- •

Fear of unexpected price increases ('3-year price lock guarantee')

- •

Complexity of family plans ('pick their own plan')

- •

Poor internet reliability ('Enjoy reliable home internet')

- •

Network security for businesses ('Virtual private network', 'Enterprise private network')

Audience Aspirations Addressed

- •

Having the latest and greatest technology

- •

Staying connected to entertainment (NFL Sunday Ticket)

- •

Ensuring business continuity and scalability

Persuasion Elements

Emotional Appeals

- Appeal Type:

Financial Relief / Gain

Effectiveness:High

Examples

- •

'on us' (implies zero cost)

- •

'save big'

- •

'$200 Verizon e-Gift card'

- Appeal Type:

Security / Peace of Mind

Effectiveness:Medium

Examples

- •

'3-year price lock guarantee'

- •

'reliable home internet'

- •

'nation-wide mobile coverage'

- Appeal Type:

Exclusivity

Effectiveness:Medium

Examples

'Online only.'

'exclusive benefits'

Social Proof Elements

{'proof_type': 'Brand Authority', 'impact': 'Strong'}

Trust Indicators

- •

The Verizon brand name itself, which has a long-standing reputation for network quality.

- •

Specific guarantees like the '3-year price lock guarantee'.

- •

Detailed, expert-level content in the Verizon Business section.

Scarcity Urgency Tactics

- •

'Online only' offers.

- •

'Pre-order' calls for new devices.

- •

'for a limited time only' phrasing.

Calls To Action

Primary Ctas

- Text:

Shop now

Location:Homepage Banners

Clarity:Clear

- Text:

Buy

Location:Homepage Hero Section

Clarity:Clear

- Text:

Get started

Location:Service Category Sections (Mobile, Home Internet)

Clarity:Clear

- Text:

Contact sales

Location:Business Content Pages

Clarity:Clear

The CTAs are highly effective due to their simplicity, directness, and context-appropriateness. On the B2C pages, they are action-oriented and transactional, designed to move users immediately into the purchase funnel. On the B2B pages, they are lead-oriented, guiding users toward a consultation. There is no ambiguity.

Messaging Gaps Analysis

Critical Gaps

Lack of a unifying brand story on the homepage. The messaging is almost entirely tactical (deals, offers) and misses the opportunity to communicate the broader brand mission of 'powering and empowering'.

Weak emotional connection beyond financial incentives. The messaging successfully appeals to the wallet but does little to build a deeper, more resilient brand-customer relationship.

Contradiction Points

There are no overt contradictions, but there's a significant tension between the high-level brand identity (a premium, innovative technology company) and the ground-level website messaging (a highly promotional, deal-driven retailer).

Underdeveloped Areas

Benefits-driven storytelling. The site excels at telling you what you get (a free phone), but is less effective at communicating the ultimate benefit why that matters (e.g., connecting with loved ones, capturing memories, powering your ambitions).

Community and social impact messaging. While likely present elsewhere, the main commercial pages lack messaging about Verizon's role in the community or broader societal contributions, which can be a key differentiator for some consumer segments.

Messaging Quality

Strengths

- •

Exceptional clarity on promotional offers, leaving no room for misinterpretation.

- •

Strong, logical message hierarchy that drives users toward conversion.

- •

Effective audience segmentation between consumer and business, with highly tailored messaging for each.

- •

Direct and compelling calls-to-action.

Weaknesses

- •

Over-reliance on price and promotions, which can devalue the brand and attract less loyal, price-sensitive customers.

- •

A weak connection between the tactical website messaging and the company's aspirational mission statement.

- •

Lack of emotional storytelling on the core product pages, which are dominated by features and offers.

Opportunities

- •

Integrate more brand-level, emotional storytelling into the homepage to complement the promotional messaging.

- •

Develop a messaging layer focused on the 'why' behind the technology – how Verizon's network and services tangibly improve customers' lives.

- •

Create a more seamless narrative bridge between the consumer and business brands, highlighting how Verizon powers all aspects of life, from home to enterprise.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Hero Section

Recommendation:A/B test the current deal-focused headline ('iPhone 16 Pro on us') against a more benefit-oriented headline that incorporates the deal (e.g., 'Capture every moment on the network you trust. And get the iPhone 16 Pro on us.').

Expected Impact:Medium

- Area:

Value Proposition Communication

Recommendation:Create a dedicated content block on the homepage that visually and textually explains the 'Why Verizon' story, focusing on network reliability, security, and innovation, before diving into the deals.

Expected Impact:High

- Area:

Brand Voice

Recommendation:Infuse small elements of the aspirational, 'empowering' brand voice into the transactional copy to soften the purely promotional feel and build more brand affinity.

Expected Impact:Medium

Quick Wins

Add sub-headings under main promotional banners that briefly touch on a network benefit (e.g., 'iPhone 16 Pro on us. On our fastest 5G network ever.').

In the 'Stay connected & save' section, change the headline from a feature ('Mobile') to a benefit ('Connect with who matters most').

Long Term Recommendations

Develop a comprehensive messaging framework that maps specific brand pillars (e.g., Reliability, Innovation, Empowerment) to different stages of the customer journey, ensuring a consistent narrative is told beyond just the initial promotion.

Invest in customer story content (testimonials, case studies) that is prominently featured on the homepage, shifting some focus from 'what we offer' to 'what our customers achieve'.

Verizon's website messaging strategy is a masterclass in tactical, conversion-focused communication, particularly for its consumer segment. The messaging architecture is ruthlessly efficient, prioritizing high-value, time-sensitive hardware deals to drive immediate customer acquisition. This approach is clear, direct, and highly effective for a market where device subsidies are a primary driver of switching behavior. The brand voice is transactional and urgent, aligning perfectly with the goal of getting users to 'Shop now'.

Simultaneously, Verizon executes a completely different, and equally appropriate, strategy for its business audience. Here, the messaging is educational, authoritative, and consultative, designed to build trust and establish expertise in a complex B2B buying cycle. This bifurcation is logical and well-executed, ensuring each audience receives a tailored and relevant message.

The primary strategic weakness, however, lies in what is absent. The homepage is so heavily weighted toward promotions that it almost entirely neglects to communicate a broader brand narrative. The aspirational mission of 'powering and empowering' is lost. This creates a significant gap between the brand's high-level identity and its primary digital storefront's personality. While the current strategy is likely very effective at hitting short-term sales targets, it risks positioning Verizon as a transactional utility rather than an indispensable technology partner in the customer's mind. The key opportunity for optimization is not to replace the effective promotional messaging, but to weave a stronger, more emotional brand story around it, building long-term brand equity to complement its potent short-term acquisition engine.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Massive subscriber base with 92.9 million retail postpaid phone customers, making it a market leader in the U.S.

- •

High brand recognition and reputation for network reliability and speed, which is a key differentiator in the telecom industry.

- •

Consistent growth in wireless service revenue for 18 consecutive quarters, indicating sustained customer demand and spending.

- •

Successful introduction and adoption of new plan structures like 'myPlan', with a high uptake of premium tiers, demonstrating alignment with customer value perception.

Improvement Areas

- •

Address postpaid phone subscriber churn, which is higher than key competitors like AT&T.

- •

Improve billing transparency and customer service to reduce friction and enhance trust, mitigating a known brand weakness.

- •

Simplify the complexity of plans and promotional offers presented on the website to reduce confusion and improve the conversion path for new customers.

Market Dynamics

The U.S. telecom services market is projected to grow at a CAGR of 6.9% from 2026 to 2030.

Mature

Market Trends

- Trend:

Widespread 5G Adoption and Expansion

Business Impact:Drives demand for 5G-enabled devices and services, opening new revenue streams from Fixed Wireless Access (FWA), IoT, and enterprise solutions.

- Trend:

Growth of Fixed Wireless Access (FWA)

Business Impact:FWA is a primary growth engine, capturing significant share of the home broadband market and competing directly with traditional cable and fiber providers.

- Trend:

AI Integration in Network Management and Customer Experience

Business Impact:AI is being used to optimize network performance, predict outages, and personalize customer service through chatbots, aiming to reduce operational costs and improve satisfaction.

- Trend:

Rise of Private 5G Networks for Enterprise

Business Impact:Creates a high-value B2B opportunity by offering secure, customized networks for industries like manufacturing, logistics, and healthcare.

- Trend:

Industry Consolidation and Strategic Partnerships

Business Impact:Intensifying competition and high capital costs are driving M&A and partnerships to scale operations, expand service offerings, and mitigate risks.

Excellent for new growth vectors. While the core mobile market is saturated, the timing is ideal to capitalize on the mainstream adoption of 5G-enabled services like FWA, private networks, and edge computing.

Business Model Scalability

High

Characterized by extremely high fixed costs (network infrastructure, spectrum licenses) and relatively low variable costs per subscriber, creating significant operating leverage once infrastructure is built.

High. Each additional customer on the existing network adds substantial revenue with minimal incremental cost, driving profitability.

Scalability Constraints

- •

Massive capital expenditures (CapEx) required for 5G network buildout and fiber deployment.

- •

Physical limitations on the pace of network infrastructure upgrades and expansion.

- •

Finite spectrum availability, which is essential for network capacity and performance.

- •

High operational costs related to maintaining a vast network and large workforce.

Team Readiness

Experienced leadership team adept at managing a large, complex organization in a mature industry. Demonstrates strategic focus on key growth areas like FWA and 5G monetization.

Traditional hierarchical structure suitable for managing large-scale infrastructure but may face challenges in agility and rapid innovation compared to tech-native competitors.

Key Capability Gaps

- •

Agile product development for digital services to compete with more nimble software-defined companies.

- •

Specialized B2B sales and solution architecture talent for complex private network and edge computing deals.

- •

Data science and AI talent to fully leverage network and customer data for personalization and operational efficiency.

Growth Engine

Acquisition Channels

- Channel:

Direct Online (Website)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Simplify the user journey for plan selection and checkout. Implement more sophisticated personalization to surface the most relevant device deals and service bundles based on user behavior.

- Channel:

Retail Stores

Effectiveness:High

Optimization Potential:Medium

Recommendation:Integrate the online and in-store experience more seamlessly (e.g., improved 'buy online, pick up in-store' processes) and equip staff with better digital tools for complex consultations.

- Channel:

B2B Direct Sales & Content Marketing

Effectiveness:Medium

Optimization Potential:High

Recommendation:Scale content marketing efforts to generate qualified leads for high-value enterprise solutions like Private 5G. Develop industry-specific sales funnels and case studies to demonstrate ROI.

Customer Journey

The consumer path is heavily promotion-driven, focused on new device offers ('on us'), trade-ins, and switching incentives. The business path is education-focused, driving leads to sales.

Friction Points

- •

Complexity and potential confusion in comparing 'myPlan' options and bundled perks.

- •

The necessity of trade-ins or specific plan commitments for the best deals can be a barrier.

- •

Transition from educational B2B content to a direct sales conversation can be disjointed.

Journey Enhancement Priorities

{'area': 'Offer Personalization', 'recommendation': 'Use AI to dynamically present the most compelling bundles and offers to individual users, moving beyond generic homepage promotions.'}

{'area': 'B2B Lead Nurturing', 'recommendation': 'Implement a more robust marketing automation sequence to nurture leads generated from content, providing progressively detailed information before a sales handoff.'}

Retention Mechanisms

- Mechanism:

Bundling (Mobile + Home Internet)

Effectiveness:High

Improvement Opportunity:Proactively offer bundling discounts to existing mobile-only customers in FWA-eligible areas to increase stickiness and lifetime value.

- Mechanism:

Device Upgrade Programs & Loyalty Offers

Effectiveness:Medium

Improvement Opportunity:Increase personalization of upgrade offers based on customer tenure and value, rather than one-size-fits-all promotions.

- Mechanism:

Premium Plan Perks (e.g., NFL Sunday Ticket, Disney Bundle)

Effectiveness:High

Improvement Opportunity:Continuously refresh and test new value-added services to maintain the appeal of higher-tier, higher-ARPU plans.

Revenue Economics

Unit economics are strong, characterized by high Average Revenue Per User (ARPU) and long customer lifetimes, but are pressured by intense competition and high Customer Acquisition Costs (CAC).

Estimated to be healthy (likely above the 3:1 benchmark) due to the recurring revenue model, but requires continuous management due to competitive pressures on both CAC (promotions) and LTV (churn).

Good, with consistent growth in wireless service revenue and ARPU. However, postpaid subscriber losses to competitors indicate efficiency challenges in the core market.

Optimization Recommendations

- •

Focus on increasing ARPU through upselling customers to premium 5G plans and value-added services.

- •

Drive adoption of FWA, which leverages existing network assets to acquire broadband customers at a lower incremental cost than building fiber to every home.

- •

Improve customer retention to increase LTV and reduce the need for costly re-acquisition.

Scale Barriers

Technical Limitations

- Limitation:

Legacy BSS/OSS Systems

Impact:Medium

Solution Approach:Continue modernization efforts towards a more flexible, cloud-native architecture to accelerate the launch of new services and improve operational efficiency.

- Limitation:

Network Capacity Management

Impact:Medium

Solution Approach:Strategically manage network load, particularly with high-consumption FWA users, by leveraging C-Band spectrum assets and localized load balancing to maintain performance for all users.

Operational Bottlenecks

- Bottleneck:

Customer Service Scalability

Growth Impact:Negative customer experiences can increase churn, especially during promotional periods or network issues.

Resolution Strategy:Further invest in AI-powered customer service tools and digital self-service options to handle common inquiries efficiently, freeing up human agents for complex issues.

- Bottleneck:

Field Operations for Fiber & FWA Installation

Growth Impact:The speed of broadband subscriber growth is constrained by the physical capacity to perform installations.

Resolution Strategy:Optimize technician scheduling and routing with AI; enhance 'self-install' kits and digital instructions to reduce the need for professional appointments.

Market Penetration Challenges

- Challenge:

Saturated and Hyper-Competitive Wireless Market

Severity:Critical

Mitigation Strategy:Shift focus from pure subscriber growth to ARPU growth and retention. Differentiate on network quality and exclusive partnerships rather than just price.

- Challenge:

Aggressive Competition from T-Mobile

Severity:Major

Mitigation Strategy:Counter T-Mobile's growth by emphasizing network reliability and expanding FWA and enterprise services where Verizon has a strong competitive advantage.

- Challenge:

Pressure on Legacy Wireline Business

Severity:Major

Mitigation Strategy:Accelerate the transition of customers from legacy services (like DSL) to fiber and FWA. Focus the business wireline segment on high-growth areas like private networks and SD-WAN.

Resource Limitations

Talent Gaps

- •

Enterprise solutions architects specializing in private networks and MEC.

- •

AI/ML engineers for network automation and customer personalization.

- •

Cybersecurity experts to address evolving threats in 5G and IoT ecosystems.

Extremely high and ongoing. Continued significant investment is needed for 5G network densification, C-band spectrum deployment, and fiber expansion.

Infrastructure Needs

- •

Continued buildout of mid-band (C-Band) 5G spectrum to enhance coverage and capacity.

- •

Expansion of fiber optic networks to support both Fios and wireless backhaul.

- •

Deployment of edge computing data centers to enable low-latency applications.

Growth Opportunities

Market Expansion

- Expansion Vector:

5G Fixed Wireless Access (FWA) for Home & Business Broadband

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Aggressively market FWA as a primary growth driver, targeting both consumer and small business segments in areas with available network capacity. Revise subscriber goals upward based on strong current momentum.

- Expansion Vector:

Enterprise Private 5G Networks

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop industry-specific, turnkey private network solutions (e.g., for manufacturing, logistics, healthcare). Build a specialized sales and engineering team to capture this high-margin market.

- Expansion Vector:

Mobile Edge Computing (MEC) Services

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Partner with major cloud providers (AWS, Azure, Google Cloud) to offer MEC services, enabling low-latency applications for businesses in areas like autonomous vehicles, AR/VR, and real-time analytics.

Product Opportunities

- Opportunity:

IoT Connectivity & Management Platforms

Market Demand Evidence:Explosive growth of connected devices across consumer and industrial sectors.

Strategic Fit:High

Development Recommendation:Expand beyond simple connectivity to offer robust platforms for device management, security, and data analytics, targeting key verticals like fleet management, smart cities, and healthcare.

- Opportunity:

Network as a Service (NaaS)

Market Demand Evidence:Enterprises are shifting from owning and managing network hardware to consumption-based models.

Strategic Fit:High

Development Recommendation:Further develop and market the NaaS portfolio, offering businesses flexible, scalable, and managed network solutions on a subscription basis, bundling security and SD-WAN capabilities.

Channel Diversification

- Channel:

Third-Party Resellers & System Integrators (for B2B)

Fit Assessment:High

Implementation Strategy:Expand the partner network program to empower system integrators to sell and implement Verizon's private network and IoT solutions as part of larger digital transformation projects.

- Channel:

Digital Marketplaces

Fit Assessment:Medium

Implementation Strategy:Explore listing pre-packaged small business internet (FWA) and mobile plans on B2B software and hardware marketplaces to reach a wider audience of SMBs.

Strategic Partnerships

- Partnership Type:

Technology & Cloud Providers

Potential Partners

- •

Amazon Web Services (AWS)

- •

Microsoft Azure

- •

Google Cloud

Expected Benefits:Co-develop and co-market Mobile Edge Computing (MEC) and private 5G solutions, leveraging their enterprise relationships and cloud infrastructure.

- Partnership Type:

Industry-Specific Application Developers

Potential Partners

- •

Industrial automation companies (e.g., Siemens, Rockwell)

- •

Healthcare tech platforms

- •

Logistics and supply chain software providers

Expected Benefits:Create pre-integrated, certified solutions running on Verizon's 5G network to accelerate adoption of private networks and IoT in specific verticals.

- Partnership Type:

Content & Media Companies

Potential Partners

- •

Streaming services

- •

Gaming platforms

- •

Sports leagues

Expected Benefits:Secure exclusive content and bundling deals to drive adoption of premium, high-ARPU mobile and home internet plans, as seen with NFL Sunday Ticket.

Growth Strategy

North Star Metric

Broadband Subscribers (FWA and Fios)

This metric represents the most significant near-term growth opportunity, leveraging the 5G network asset to penetrate a new market (home/business internet) and increase customer LTV through bundling. It shifts focus from the saturated mobile market to the highest potential expansion vector.

Achieve the revised company goal of 8-9 million FWA subscribers by 2028, implying a doubling of the current base.

Growth Model

Hybrid: 'Asset Leverage' & 'Sales-Led' Growth

Key Drivers

- •

Leveraging the existing 5G network asset to launch a competitive broadband product (FWA).

- •

Aggressive performance marketing and promotional offers for consumer FWA and mobile acquisition.

- •

A specialized, high-touch direct sales force for high-value enterprise solutions (Private 5G, NaaS).

Run two distinct but coordinated growth motions: a high-volume, marketing-driven engine for consumer services, and a value-focused, consultative sales engine for the business segment.

Prioritized Initiatives

- Initiative:

Scale FWA Marketing & Onboarding

Expected Impact:High

Implementation Effort:Medium

Timeframe:Ongoing (next 12-18 months)

First Steps:Launch geo-targeted marketing campaigns in areas with high C-Band capacity and strong competitive broadband pricing. Simplify the online eligibility check and self-installation process.

- Initiative:

Develop Vertical-Specific Private 5G 'Solution-in-a-Box'

Expected Impact:High

Implementation Effort:High

Timeframe:12-24 months

First Steps:Identify the top 2-3 industry verticals with the most pressing need for private networks. Form a cross-functional team to develop a standardized, repeatable solution architecture and go-to-market plan for the first vertical.

- Initiative:

Implement Proactive Bundling Engine

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Analyze the existing mobile customer base to identify and target FWA-eligible households with personalized, pre-approved bundling offers via digital channels.

Experimentation Plan

High Leverage Tests

- Test Name:

FWA Competitive Pricing Tiers

Hypothesis:Offering different speed/price tiers for FWA (vs. a single tier) will increase conversion rates by appealing to different customer segments.

Key Metrics:Conversion Rate, ARPU, Churn

- Test Name:

B2B Content Funnel Optimization

Hypothesis:Gating high-value content like technical whitepapers and ROI calculators will generate more qualified sales leads for private networks than purely open-access content.

Key Metrics:Lead-to-Opportunity Conversion Rate, Sales Cycle Length

Use a combination of A/B testing platforms for digital experiments and cohort analysis for measuring the long-term impact on ARPU and churn.

Continuous bi-weekly sprints for consumer digital channels; quarterly strategic tests for B2B go-to-market approaches.

Growth Team

Establish dedicated, cross-functional 'Growth Pods' for each major opportunity: 1) Consumer Broadband (FWA), 2) Enterprise Solutions (Private 5G/MEC), and 3) Core Mobile (ARPU & Retention). These pods should include members from marketing, product, network engineering, and finance.

Key Roles

- •

Head of Broadband Growth

- •

Enterprise GTM (Go-to-Market) Lead

- •

Data Scientist / Growth Analyst

- •

Product Marketing Manager (for each growth pod)

Invest in training for the B2B sales team on consultative selling for complex solutions. Hire external talent with experience in scaling B2B SaaS or platform products to lead the Enterprise Solutions pod.

Verizon possesses a strong foundation for growth, anchored by its market-leading brand, extensive network infrastructure, and a scalable business model. While the core mobile subscriber market is mature and hyper-competitive, Verizon is well-positioned to pivot towards new growth vectors. The company's most significant and immediate opportunity lies in aggressively scaling its 5G Fixed Wireless Access (FWA) service, which leverages its primary network asset to penetrate the massive U.S. home and business broadband market. This initiative serves as the primary engine for near-term subscriber and revenue growth. Concurrently, Verizon has a transformative, high-margin opportunity in the enterprise sector with Private 5G networks and Mobile Edge Computing (MEC). Capturing this market requires a strategic shift from selling connectivity to providing integrated, industry-specific solutions, demanding investment in specialized sales talent and strategic partnerships with tech giants. Key barriers to scale are not product-market fit, but rather the intense capital requirements for network expansion, fierce price competition from rivals like T-Mobile, and the operational complexity of managing legacy systems while innovating. The recommended growth strategy is a dual-pronged approach: a marketing-led, high-velocity model to win the consumer broadband race with FWA, and a sophisticated, sales-led model to establish leadership in the nascent enterprise 5G solutions market. Success will be defined by the ability to execute on these new fronts while defending its core mobile business through superior network quality and effective retention strategies.

Legal Compliance

Verizon's website demonstrates a mature and detailed approach to privacy, which is strategically necessary for a company of its scale in the heavily regulated telecommunications industry. The footer prominently features a main 'Privacy Policy' link, supplemented by specific notices for 'California Privacy Notice' and 'Health Privacy Notice.' This segmentation is a key strength, enhancing clarity for users in different jurisdictions and contexts. The policy details the types of information collected (including highly sensitive Customer Proprietary Network Information - CPNI), its usage for service delivery and marketing, and disclosure practices. The presence of a 'Your Privacy Choices' portal is a critical component, providing users with mechanisms to opt-out of certain data uses, which aligns with requirements under CCPA/CPRA and other state laws. However, the complexity and length of these policies can be overwhelming for the average consumer, potentially obscuring key details despite the clear structure.