eScore

walmart.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Walmart's digital presence is dominant, anchored by immense brand authority and a sophisticated omnichannel strategy that masterfully blends its physical and digital assets. Its website leverages a massive physical footprint for hyper-local search and fulfillment, a competitive moat that is difficult to replicate. The company's e-commerce is experiencing robust growth, surging 25% globally, demonstrating its successful integration of digital platforms with its vast store network. This creates a powerful 'clicks-to-bricks' ecosystem that captures a wide range of search intents, from broad product queries to immediate, location-based needs.

The seamless integration of over 4,600 physical stores as fulfillment and service hubs provides an unparalleled advantage in local search and rapid, convenient delivery options.

Develop more top-of-funnel, inspirational content (e.g., buying guides, lifestyle blogs) to capture customers earlier in their journey and build brand preference beyond just price.

Walmart's messaging is a masterclass in clarity and consistency, relentlessly focused on its core value proposition of "Save Money. Live Better." The communication effectively targets budget-conscious and convenience-seeking shoppers with direct, action-oriented language that drives conversion. However, the 'Live Better' aspect of the slogan is underdeveloped in homepage messaging, which is overwhelmingly transactional and price-focused, missing an opportunity to build a deeper emotional connection.

Exceptional clarity and focus on the core value proposition of low prices, which is consistently reinforced across all digital touchpoints, from promotional banners to help center articles.

A/B test homepage messaging that better balances the 'Save Money' and 'Live Better' promises to connect the functional benefit (low prices) to a tangible emotional outcome (a better life).

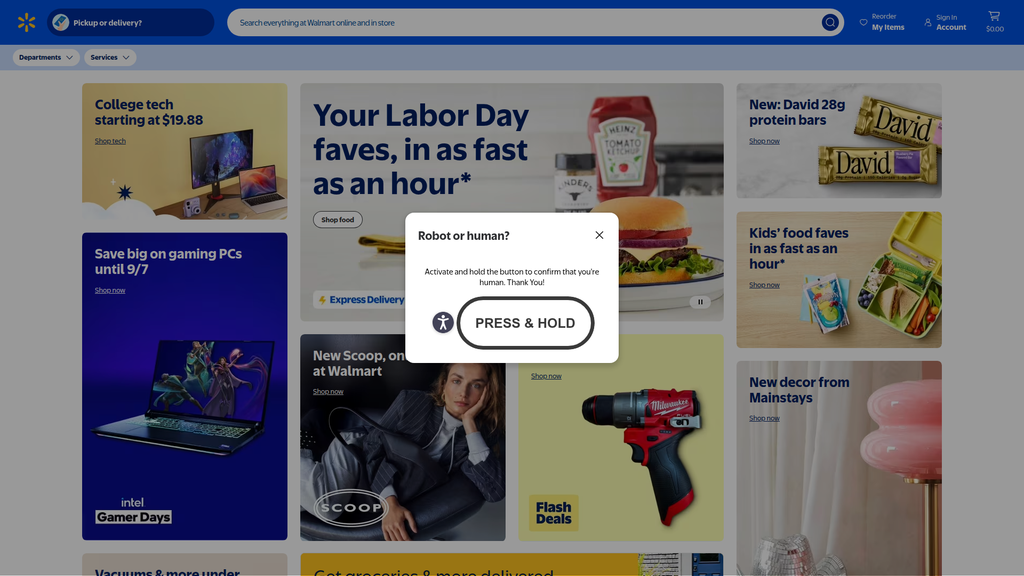

The website provides multiple, intuitive pathways for users through a robust mega menu and a prominent search bar, catering to both browsing and intent-driven shoppers. However, the high visual density of the homepage can create a moderate cognitive load for users, and certain elements, like the intrusive CAPTCHA, introduce significant friction. While the omnichannel journey is a strategic strength, the online-to-offline experience can have friction points, such as inconsistent product availability for grocery pickup.

A comprehensive and intuitive navigation system, combining a powerful search bar with a mega menu, effectively guides users through a vast product catalog.

Personalize the homepage grid using user data to reduce cognitive load by dynamically showcasing more relevant offers and categories, aligning the experience with individual user needs.

Walmart's credibility is anchored by its globally recognized brand, synonymous with value and reliability for millions of customers. The company demonstrates a sophisticated and mature legal compliance posture, with a highly granular, service-specific framework for areas like healthcare (HIPAA) and financial services. Trust is further enhanced by transparent and accessible help sections, clear terms of use, and a public commitment to standards like WCAG 2.1 Level AA for accessibility.

A world-class, segmented legal framework with separate, detailed policies for different business units (e.g., Wellness, Marketplace, Drone Delivery), which effectively manages complex compliance obligations and builds trust.

Develop a unified user privacy dashboard where customers can manage their data preferences and consents across all of Walmart's services (e-commerce, pharmacy, financial) in one centralized location.

Walmart's competitive moat is exceptionally strong and sustainable, built on the synergistic integration of its unmatched physical footprint and a hyper-efficient supply chain. This omnichannel model allows stores to act as fulfillment centers, creating a convenience and delivery advantage that digital-native players like Amazon find extremely difficult to replicate at scale. While its core business is low-margin, it's increasingly funding high-margin ventures in advertising and marketplace services, which strengthens its overall financial position.

The use of its vast network of physical stores as fulfillment centers for pickup and delivery, creating a highly defensible omnichannel moat that provides immense convenience to 90% of the US population.

Continue to invest in the digital user experience and curation of the third-party marketplace to better compete with rivals like Target and Amazon on factors other than just price.

Walmart's business model is highly scalable, leveraging its massive fixed-cost infrastructure to support rapidly growing, high-margin digital ventures. Its retail media network (Walmart Connect) and third-party marketplace are scaling exceptionally well, with advertising revenue growing 46% and marketplace sales surging 40%. Expansion into adjacent high-margin services like healthcare and financial services diversifies revenue and leverages existing store traffic, demonstrating strong potential for future growth.

The ability to build and rapidly scale high-margin digital businesses (Advertising, Marketplace, Memberships) on the foundation of its core retail traffic, fundamentally diversifying its profit mix.

Address the operational bottleneck of last-mile delivery economics by continuing to invest in route optimization, automation, and innovative solutions like drone delivery to reduce cost-to-serve.

Walmart has evolved into a highly coherent and synergistic ecosystem, where its low-margin core retail business acts as a massive customer acquisition engine for high-margin ventures. Profits from its burgeoning advertising (Walmart Connect), marketplace, and membership (Walmart+) businesses are reinvested to maintain price leadership, creating a powerful flywheel. The company has demonstrated strong strategic focus on its omnichannel strategy, successfully aligning its physical and digital resources to create a unified value proposition.

A powerful 'flywheel' effect where the massive scale of the core retail business acquires customers for high-margin digital services, with those profits then reinvested to fortify the core value proposition of low prices.

Continue to break down data silos between in-store, e-commerce, and service-based business units to create a single, unified view of the customer, enabling true personalization and more effective cross-selling.

As the world's largest retailer, Walmart wields immense market power, including significant leverage over suppliers to maintain its Everyday Low Price strategy. It has successfully secured its position as the #2 player in U.S. e-commerce and is gaining market share, demonstrating a strong competitive trajectory against its primary rival, Amazon. Its pricing power is foundational to its brand, and its ability to influence retail trends, particularly in omnichannel logistics and retail media, is shaping the entire industry.

Unmatched purchasing power and economies of scale, which allow it to negotiate favorable terms with suppliers, sustain its price leadership, and exert significant influence over the retail supply chain.

Mitigate the brand perception of being solely a 'value' retailer by elevating the quality and curation of its marketplace to attract and retain higher-income demographics.

Business Overview

Business Classification

Omnichannel Retail

Third-Party Marketplace & Digital Advertising Platform

Retail

Sub Verticals

- •

Grocery

- •

General Merchandise

- •

eCommerce

- •

Health & Wellness Services

- •

Financial Services

Mature

Maturity Indicators

- •

Dominant market share in core verticals (e.g., U.S. Grocery).

- •

Extensive physical infrastructure and global supply chain.

- •

Significant brand recognition and established customer base.

- •

Strategic evolution into high-growth digital and service-based sectors.

- •

Consistent dividend payments and shareholder returns.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Retail Product Sales (In-Store & eCommerce)

Description:Direct sales of a vast array of products, including groceries, apparel, electronics, and home goods, through its physical stores and website. This is the company's foundational revenue stream.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:Low

- Stream Name:

Walmart+ Subscription Fees

Description:A recurring membership fee ($98/year or $12.95/month) offering benefits like free delivery, free shipping with no minimum, fuel discounts, and access to streaming services (Paramount+).

Estimated Importance:Secondary

Customer Segment:Convenience-Seeking Shoppers, Loyal Customers

Estimated Margin:High

- Stream Name:

Third-Party Marketplace Fees

Description:Commission/referral fees charged to over 200,000 third-party sellers for listing and selling products on Walmart.com. This segment is experiencing rapid growth.

Estimated Importance:Secondary

Customer Segment:eCommerce Businesses, Third-Party Sellers

Estimated Margin:High

- Stream Name:

Advertising (Walmart Connect)

Description:A rapidly growing, high-margin business where brands and marketplace sellers pay to advertise their products on Walmart's website, app, and in-store digital screens. The recent acquisition of VIZIO is set to accelerate this stream.

Estimated Importance:Secondary

Customer Segment:CPG Brands, Marketplace Sellers

Estimated Margin:High

- Stream Name:

Health & Wellness Services

Description:Revenue from pharmacy prescriptions, vision centers, and other health services. This is a strategic area of focus, integrating healthcare with core retail operations.

Estimated Importance:Tertiary

Customer Segment:All Segments

Estimated Margin:Medium

- Stream Name:

Financial Services & Other Income

Description:Includes revenue from services like money transfers, check cashing, credit cards, and income from Walmart Fulfillment Services (WFS).

Estimated Importance:Tertiary

Customer Segment:Budget-Conscious Consumers

Estimated Margin:Medium

Recurring Revenue Components

Walmart+ Membership Subscriptions

Pricing Strategy

Everyday Low Price (EDLP)

Budget

Transparent

Pricing Psychology

- •

Price Leadership: Establishing a perception of being the lowest-cost provider.

- •

Rollbacks: Temporary price reductions to create a sense of urgency and value.

- •

Bundling: Often seen in Walmart+ benefits, combining multiple services for a single fee.

Monetization Assessment

Strengths

- •

Massive scale of core retail business provides a foundation for all other streams.

- •

High-margin, fast-growing revenue streams (Advertising, Marketplace, Subscriptions) are diversifying the profit mix.

- •

Walmart+ creates a loyal, recurring revenue base and increases customer lifetime value.

- •

The physical store network acts as a fulfillment and service hub, creating a synergistic 'flywheel' effect.

Weaknesses

- •

Heavy reliance on low-margin grocery and general merchandise sales.

- •

Brand perception can be a barrier to attracting higher-income demographics for premium services.

- •

eCommerce profitability has historically been a challenge, though it is now improving.

Opportunities

- •

Aggressively scale the Walmart Connect advertising platform by leveraging first-party shopper data.

- •

Expand the third-party marketplace with higher-margin product categories and international sellers.

- •

Further integrate financial and health services into the Walmart+ bundle to increase stickiness and create a 'life services' ecosystem.

- •

Leverage AI and automation to further reduce operational costs and improve margins.

Threats

- •

Intense price competition from Amazon, Aldi, and other discount retailers.

- •

Economic downturns that reduce consumer spending on higher-margin discretionary items.

- •

Potential regulatory scrutiny over market power and data usage.

- •

Rising labor and supply chain costs impacting core retail margins.

Market Positioning

Cost Leadership & Omnichannel Convenience

Leader in U.S. Grocery; Distant but growing #2 in U.S. eCommerce behind Amazon.

Target Segments

- Segment Name:

Budget-Conscious Families

Description:Middle-to-lower income households, often in suburban and rural areas, focused on value, affordability, and one-stop shopping for all household needs.

Demographic Factors

- •

Middle-to-low household income

- •

Family with children

- •

Wide age range

- •

Often located in suburban or rural areas.

Psychographic Factors

- •

Price-sensitive and value-driven.

- •

Seeks practicality and efficiency in shopping.

- •

Brand loyal to trusted, affordable names.

Behavioral Factors

- •

Frequent, routine shoppers for groceries and essentials.

- •

Engages in price comparisons and seeks out deals ('Rollbacks').

- •

High usage of in-store shopping, with growing adoption of pickup services.

Pain Points

- •

Rising cost of living and inflation.

- •

Limited time for shopping at multiple stores.

- •

Need for durable, affordable products for the entire family.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Convenience-Seeking Omnichannel Shoppers

Description:A growing segment of digitally-savvy consumers who value time savings and a seamless experience between online and physical shopping. This group is more likely to subscribe to Walmart+.

Demographic Factors

- •

Broader income range, including middle-to-higher income households.

- •

Often younger, tech-savvy individuals and families.

- •

Typically located in suburban and urban areas.

Psychographic Factors

- •

Values time over money.

- •

Expects a seamless digital experience.

- •

Open to trying new services like drone delivery and in-home returns.

Behavioral Factors

- •

High usage of the Walmart app for online ordering, pickup, and delivery.

- •

Subscribes to services like Walmart+ for added benefits.

- •

Utilizes features like 'Scan & Go' for a faster in-store experience.

Pain Points

- •

Lack of time for traditional in-store shopping.

- •

Frustration with disjointed online-to-offline retail experiences.

- •

Desire for quick, reliable delivery of groceries and other goods.

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Unmatched Physical Footprint

Strength:Strong

Sustainability:Sustainable

- Factor:

Everyday Low Price (EDLP) Strategy

Strength:Strong

Sustainability:Sustainable

- Factor:

Integrated Omnichannel Logistics

Strength:Strong

Sustainability:Sustainable

- Factor:

Growing High-Margin Service Ecosystem (Ads, Marketplace, W+)

Strength:Moderate

Sustainability:Sustainable

Value Proposition

Walmart helps you save money and live better by offering the lowest prices on a wide selection of goods, available whenever and wherever you want to shop—in-store, online, for pickup, or delivered to your door.

Excellent

Key Benefits

- Benefit:

Low Prices

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

'Everyday Low Price' strategy

- •

'Rollbacks' and weekly ads

- •

Price matching policies

- Benefit:

Convenience & Accessibility

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Over 4,600 U.S. stores, reaching 90% of the population within 10 miles.

- •

Multiple fulfillment options: in-store, pickup, same-day delivery, drone delivery.

- •

Walmart+ subscription for streamlined services.

- Benefit:

One-Stop Shop

Importance:Important

Differentiation:Common

Proof Elements

- •

Vast product assortment from groceries to electronics.

- •

Integrated services like Pharmacy, Vision Center, and Auto Care.

- •

Expanded online marketplace with millions of third-party items.

Unique Selling Points

- Usp:

The synergistic combination of a massive physical store network used as fulfillment centers with a rapidly scaling, sophisticated digital e-commerce platform.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A growing, high-margin digital ecosystem (Advertising, Marketplace, Membership) built on the foundation of its high-volume, low-margin core retail business.

Sustainability:Long-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Financial strain from the high cost of living.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Lack of time for shopping and managing household needs.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Limited access to a wide variety of affordable goods, especially in rural areas.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

Walmart's value proposition of low prices and convenience is perfectly aligned with the needs of a broad market, particularly during times of economic uncertainty. Its omnichannel model addresses the evolving consumer demand for flexibility.

High

The core proposition of 'Save Money' resonates powerfully with its traditional budget-conscious base, while the evolving 'Live Better' through convenience and services increasingly aligns with its growth segment of time-crunched omnichannel shoppers.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Product Suppliers & CPG Brands

- •

Third-Party Marketplace Sellers

- •

Logistics & Delivery Partners (e.g., DroneUp)

- •

Technology Partners (e.g., The Trade Desk for Walmart DSP)

- •

Financial Service Providers

- •

VIZIO (for CTV advertising)

Key Activities

- •

Global Sourcing & Procurement

- •

Supply Chain Management & Logistics

- •

Store & eCommerce Operations

- •

Merchandising & Pricing

- •

Technology Development (App, AI, Automation).

- •

Marketing & Advertising Sales (Walmart Connect)

Key Resources

- •

Extensive network of physical stores and distribution centers

- •

Strong brand equity and customer trust

- •

Vast first-party customer shopping data

- •

Global supply chain infrastructure

- •

Large employee base

- •

Proprietary technology platforms

Cost Structure

- •

Cost of Goods Sold (COGS)

- •

Employee wages and benefits

- •

Logistics and transportation costs

- •

Store operations and maintenance

- •

Technology and infrastructure investment

- •

Marketing and sales expenses

Swot Analysis

Strengths

- •

Unparalleled scale and purchasing power driving cost leadership.

- •

Dominant physical retail footprint that doubles as a strategic logistics network.

- •

Strong brand recognition and a massive, loyal customer base.

- •

Rapidly growing, high-margin businesses in advertising, marketplace, and subscriptions are improving overall profitability.

- •

Deep trove of first-party data on consumer purchasing behavior.

Weaknesses

- •

Lower profit margins in core retail business compared to competitors in other sectors.

- •

Brand perception can be a hurdle in attracting and retaining higher-income consumers.

- •

Historically lagged behind Amazon in digital innovation and user experience.

- •

Complex global operations can be vulnerable to geopolitical and supply chain disruptions.

Opportunities

- •

Further scale the Walmart Connect advertising business, especially with VIZIO integration.

- •

Expand the third-party marketplace to rival Amazon's selection and seller services.

- •

Deepen the integration of health and financial services to create a comprehensive life-services ecosystem.

- •

Leverage AI and automation to enhance supply chain efficiency and personalize the customer experience.

- •

Continue to grow the Walmart+ membership base, increasing recurring revenue and customer loyalty.

Threats

- •

Intense and continuous competition from Amazon in eCommerce and from discount grocers like Aldi and Lidl in brick-and-mortar.

- •

Economic downturns that could compress consumer spending, even on essentials.

- •

Rising operational costs, including labor, fuel, and materials.

- •

Evolving data privacy regulations that could limit the use of customer data for advertising and personalization.

Recommendations

Priority Improvements

- Area:

Digital User Experience (UX)

Recommendation:Continue investing in the website and mobile app's user interface, search functionality, and personalization engine to reduce friction and create a more intuitive, engaging experience that rivals pure-play eCommerce leaders.

Expected Impact:High

- Area:

Marketplace Seller Tools & Services

Recommendation:Enhance the suite of tools for third-party sellers, focusing on improved analytics, streamlined onboarding, and more sophisticated advertising options to attract a higher-quality and more diverse seller base.

Expected Impact:High

- Area:

Brand Perception Marketing

Recommendation:Launch targeted marketing campaigns to shift brand perception beyond just 'low prices,' highlighting the quality of private-label brands (e.g., Better Goods), the technological innovation, and the convenience benefits for higher-income demographics.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Walmart Prime' competitor by bundling a more comprehensive suite of services into Walmart+, such as financial products (e.g., higher cashback credit card), advanced health services (e.g., telehealth subscriptions), and exclusive product lines.

- •

Create a 'Data-as-a-Service' (DaaS) platform that provides anonymized, aggregated consumer purchasing trend data to CPG partners and suppliers for a subscription fee, creating a new high-margin B2B revenue stream.

- •

Pilot and scale 'hyper-personalized' automated stores where AI predicts and stocks local inventory based on real-time neighborhood data, and the shopping experience is highly automated.

Revenue Diversification

- •

Aggressively expand Walmart Fulfillment Services (WFS) to become a major third-party logistics (3PL) competitor to Amazon FBA, leveraging Walmart's existing supply chain infrastructure.

- •

Further develop the in-house financial services arm, potentially offering small business loans to marketplace sellers or other fintech products to its consumer base.

- •

Expand the advertising offerings of Walmart Connect into more off-site and in-store digital formats, leveraging the VIZIO acquisition to build a powerful connected TV (CTV) advertising network.

Walmart has successfully executed one of the most significant business model evolutions in modern retail, transforming from a traditional brick-and-mortar behemoth into a formidable omnichannel powerhouse. The company's core strategy now hinges on a synergistic 'flywheel' where its massive physical footprint supports and accelerates its digital ambitions. The stores act as fulfillment centers, pickup points, and service hubs, creating a defensible competitive advantage that pure-play e-commerce rivals like Amazon cannot easily replicate.

The strategic genius of Walmart's current model lies in its diversification into high-margin, asset-light revenue streams that are built upon the foundation of its low-margin core retail business. The rapid growth of the third-party Marketplace, the high-profit Walmart Connect advertising platform, and the recurring revenue from Walmart+ subscriptions are fundamentally changing the company's profit structure. These new ventures allow Walmart to fund its famous 'Everyday Low Price' strategy while simultaneously expanding overall operating margins.

However, the evolution is not complete. The primary challenge and opportunity moving forward is to seamlessly integrate these disparate parts into a single, cohesive customer ecosystem. Success will be defined by Walmart's ability to leverage its vast repository of first-party data to create a truly personalized shopping experience, further grow its high-margin service businesses, and continue to innovate in supply chain and fulfillment automation. By doing so, Walmart is not just competing with other retailers; it is building a diversified technology, advertising, and services company that positions it for sustained, profitable growth in the next decade.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Economies of Scale & Supply Chain

Impact:High

- Barrier:

Brand Recognition & Customer Loyalty

Impact:High

- Barrier:

Capital Investment Requirements

Impact:High

- Barrier:

Logistics & Distribution Networks

Impact:High

- Barrier:

Regulatory & Compliance Hurdles

Impact:Medium

Industry Trends

- Trend:

Omnichannel Integration

Impact On Business:Critical for leveraging physical stores as fulfillment centers, enhancing customer convenience with options like BOPIS (Buy Online, Pick Up In-Store) and curbside pickup. This is a core pillar of Walmart's strategy.

Timeline:Immediate

- Trend:

AI-Powered Personalization & Operations

Impact On Business:AI is crucial for optimizing supply chains, personalizing customer experiences, and improving operational efficiency. Walmart is investing heavily in automation to reduce costs and improve delivery times.

Timeline:Immediate

- Trend:

Rise of Retail Media Networks

Impact On Business:Provides a high-margin revenue stream by allowing brands to advertise on Walmart's digital platforms. Walmart Connect is a key growth area.

Timeline:Near-term

- Trend:

Social & Voice Commerce

Impact On Business:New sales channels are emerging on social media platforms and through voice assistants, requiring adaptation in marketing and sales strategies to capture younger demographics.

Timeline:Near-term

- Trend:

Sustainability & Ethical Sourcing

Impact On Business:Increasing consumer demand for sustainable products and transparent supply chains impacts brand reputation and can be a competitive differentiator.

Timeline:Long-term

Direct Competitors

- →

Amazon

Market Share Estimate:Leading US e-commerce market share (~37-40%).

Target Audience Overlap:High

Competitive Positioning:Digital-native e-commerce leader focused on vast selection, convenience, and a powerful subscription ecosystem (Prime).

Strengths

- •

Dominant e-commerce market share.

- •

Advanced logistics and fulfillment network (FBA).

- •

Massive product selection and third-party marketplace.

- •

Strong customer loyalty through Amazon Prime.

- •

Leader in cloud computing (AWS), providing massive financial strength.

Weaknesses

- •

Limited physical store presence for immediate pickup/returns.

- •

Growing concerns over third-party seller quality and counterfeits.

- •

Negative sentiment regarding labor practices and impact on small businesses.

- •

Less competitive in the fresh grocery segment compared to Walmart.

Differentiators

- •

Prime membership benefits (fast shipping, streaming, etc.).

- •

Proprietary technology ecosystem (Alexa, Kindle, AWS).

- •

Highly personalized, data-driven recommendation engine.

- →

Target

Market Share Estimate:Significantly smaller e-commerce share than Walmart (~1.6%).

Target Audience Overlap:Medium

Competitive Positioning:Offers a more curated, 'cheap-chic' shopping experience, focusing on style, quality, and exclusive private labels.

Strengths

- •

Strong brand image and loyal customer base.

- •

Successful private label brands (e.g., Good & Gather, Cat & Jack).

- •

Pleasant and clean in-store and online shopping experience.

- •

Highly effective omnichannel services (Drive Up, Shipt).

Weaknesses

- •

Higher price points on average compared to Walmart.

- •

Smaller overall product selection.

- •

Less developed third-party marketplace.

- •

Lacks the scale and logistical prowess of Walmart and Amazon.

Differentiators

- •

Curated product assortment with a focus on design and trends.

- •

Exclusive partnerships with designers and brands.

- •

Stronger appeal to millennial and Gen Z shoppers seeking a specific lifestyle aesthetic.

- →

Costco

Market Share Estimate:Primarily a brick-and-mortar model with a growing but secondary e-commerce presence.

Target Audience Overlap:Medium

Competitive Positioning:Membership-only warehouse club offering bulk products at low prices, with a focus on quality.

Strengths

- •

Extremely loyal customer base via membership model.

- •

Strong reputation for high-quality private label products (Kirkland Signature).

- •

Excellent value proposition on bulk items.

- •

High employee satisfaction and low turnover.

Weaknesses

- •

Limited online product selection compared to competitors.

- •

Less sophisticated e-commerce user experience and fulfillment options.

- •

Requires paid membership, creating a barrier for some shoppers.

- •

Physical stores can be crowded and overwhelming.

Differentiators

- •

Membership model creates a loyal 'treasure hunt' shopping culture.

- •

Bulk purchasing format.

- •

Focus on a limited number of high-quality SKUs.

Indirect Competitors

- →

Temu & Shein

Description:Ultra-low-price online marketplaces shipping directly from China, focusing on fast fashion, home goods, and a wide variety of small items. They compete aggressively on price and digital advertising.

Threat Level:High

Potential For Direct Competition:They are already direct competitors in specific, price-sensitive categories. Their aggressive marketing tactics, like bidding on Walmart-related keywords, increase digital advertising costs for all retailers.

- →

Dollar General & Dollar Tree

Description:Deep discount brick-and-mortar retailers with a rapidly growing footprint, especially in rural and low-income areas. They focus on convenience and extreme value on essential items.

Threat Level:Medium

Potential For Direct Competition:High in the physical retail space, particularly for grocery and consumable goods. Their growing store count is fragmenting the physical retail market share.

- →

The Kroger Co.

Description:One of the largest grocery retailers in the U.S., competing directly with Walmart's largest product category. Kroger is increasingly investing in its own digital and delivery capabilities.

Threat Level:Medium

Potential For Direct Competition:Very high in the grocery sector, which is a cornerstone of Walmart's business. As Kroger expands its non-grocery offerings, the overlap will increase.

- →

Specialty Retailers (e.g., Best Buy, The Home Depot)

Description:Category-specific leaders that offer deep product selection and expert knowledge in their respective niches (e.g., electronics, home improvement).

Threat Level:Low

Potential For Direct Competition:Low, as they compete on expertise and depth rather than breadth. They are primarily competitors within specific departments of Walmart's business.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Unmatched Physical Footprint & Omnichannel Integration

Sustainability Assessment:Highly sustainable. Stores serve as fulfillment centers, return locations, and service hubs, creating a hybrid model that is extremely difficult for digital-native players to replicate at scale.

Competitor Replication Difficulty:Hard

- Advantage:

Economies of Scale & Supply Chain Mastery

Sustainability Assessment:Highly sustainable. Decades of investment have created a hyper-efficient supply chain and immense purchasing power, enabling its 'Every Day Low Price' strategy.

Competitor Replication Difficulty:Hard

- Advantage:

Brand Recognition for Value

Sustainability Assessment:Sustainable. The Walmart brand is globally synonymous with low prices, making it the default choice for budget-conscious consumers.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Exclusive Product Lines or Brand Partnerships', 'estimated_duration': '1-3 Years'}

{'advantage': "Promotional Pricing & 'Rollbacks'", 'estimated_duration': 'Short-term (Weeks to Months)'}

Disadvantages

- Disadvantage:

Brand Perception & Quality Image

Impact:Major

Addressability:Difficult

- Disadvantage:

Lagging in Pure-Play E-commerce Technology vs. Amazon

Impact:Major

Addressability:Moderately

- Disadvantage:

Over-reliance on the US Market

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Optimize Website/App UI for Discovery & Curation

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch Targeted Marketing Campaigns Highlighting Omnichannel Convenience

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Prominently Feature High-Quality Private Label Brands Online

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Aggressively Expand & Curate Third-Party Marketplace

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Enhance Walmart+ with Unique, Non-Retail Benefits

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in 'Store of the Future' Concepts

Expected Impact:Medium

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Lead in Supply Chain Automation and Predictive Analytics

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand into Adjacent High-Margin Services (Healthcare, Financial Services)

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Strategic International E-commerce Expansion

Expected Impact:High

Implementation Difficulty:Difficult

Solidify Walmart's position as the undisputed leader in omnichannel retail by seamlessly blending the value and convenience of its physical stores with a progressively sophisticated and personalized digital experience.

Differentiate from Amazon on physical convenience (immediate pickup/returns) and grocery expertise. Differentiate from Target by leveraging superior scale for lower prices and a broader selection, while selectively elevating the digital experience for key product categories.

Whitespace Opportunities

- Opportunity:

Hyper-Local Commerce & Services

Competitive Gap:Amazon lacks the physical footprint to offer hyper-local services (e.g., in-store classes, local artisan marketplaces, complex assembly services) at scale.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Expansion of Health and Wellness Services

Competitive Gap:Competitors have less integrated healthcare offerings. Walmart can leverage its pharmacies, vision centers, and growing clinic network to create a comprehensive, affordable health ecosystem.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Sustainable & Affordable Product Lines

Competitive Gap:There is a growing market for sustainable goods, but they often come at a premium. Walmart can leverage its scale to make sustainable choices affordable for the mass market.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

B2B Services for Small & Medium Businesses (SMBs)

Competitive Gap:Amazon Business is a strong competitor, but Walmart's Sam's Club provides a strong foundation. Leveraging Walmart's logistics for B2B fulfillment could serve SMBs underserved by other giants.

Feasibility:Low

Potential Impact:High

Walmart operates in a mature, oligopolistic retail market, where its primary digital competitor is Amazon, with Target occupying a differentiated, style-focused niche. Walmart's core competitive advantage is its unparalleled physical store network, which it has successfully transformed into a powerful omnichannel asset for fulfillment, delivery, and returns—a moat that is exceedingly difficult for digital-native competitors to replicate. This, combined with its legendary supply chain efficiency and economies of scale, cements its 'Every Day Low Price' value proposition.

The company's digital transformation has been aggressive and largely successful, positioning it as the clear number two in U.S. e-commerce. Its growth in online sales, particularly in grocery, demonstrates its ability to leverage its physical infrastructure to compete effectively with Amazon. The Walmart+ subscription service is a direct answer to Amazon Prime, aiming to foster loyalty and increase customer lifetime value through a blend of online and in-store perks.

However, significant threats remain. Amazon continues to dominate the overall e-commerce landscape with superior technology, a more mature marketplace, and a deeply entrenched customer ecosystem. Target, while smaller, poses a threat by capturing a more affluent demographic with its curated, quality-focused branding, which can erode Walmart's share in higher-margin categories like apparel and home goods. Furthermore, a new wave of indirect competitors, namely ultra-low-cost marketplaces like Temu and Shein, are creating significant disruption by competing fiercely on price and aggressively driving up digital marketing costs for all players.

Strategic whitespace for Walmart lies in further integrating its physical and digital assets. Opportunities in hyper-local services, expanding its health and wellness ecosystem, and making sustainable products accessible to the mass market are key areas for future growth. To sustain its competitive edge, Walmart must continue to invest heavily in technology to close the gap with Amazon in personalization and data analytics, while simultaneously enhancing its in-store and online experience to defend against Target's appeal. The key to winning is not to be a better Amazon, but to be the best Walmart, leveraging its unique omnichannel capabilities to offer a value and convenience proposition that no competitor can fully match.

Messaging

Message Architecture

Key Messages

- Message:

Save Money. Live better.

Prominence:Primary

Clarity Score:High

Location:Header Logo

- Message:

Low prices & savings on specific categories/events (e.g., 'Labor Day savings', '1,000s of Rollbacks', 'College tech starting at $19.88')

Prominence:Secondary

Clarity Score:High

Location:Homepage Banners, Promotional Sections

- Message:

Convenience and speed (e.g., 'Pickup or delivery?', 'Get it in as fast as an hour*')

Prominence:Tertiary

Clarity Score:High

Location:Sub-headings, Promotional Tiles

- Message:

Membership benefits (e.g., 'Get groceries & more delivered free with Walmart+')

Prominence:Tertiary

Clarity Score:Medium

Location:Dedicated promotional banner

The message hierarchy is exceptionally clear and effective. The primary brand slogan, 'Save Money. Live Better.', anchors the brand promise. However, the operational messaging on the homepage heavily prioritizes the 'Save Money' aspect through a constant barrage of deals, rollbacks, and low price points. The 'Live Better' component is largely implied rather than explicitly communicated. Messages about convenience and speed are present but subordinate to price.

Messaging is highly consistent in its focus on value and savings across the homepage. The tone shifts appropriately from promotional on the homepage to functional and direct on the help pages. While the tone changes, the underlying brand promise of being a comprehensive, helpful resource for customers remains consistent.

Brand Voice

Voice Attributes

- Attribute:

Value-Oriented

Strength:Strong

Examples

- •

Save big on gaming PCs

- •

Vacuums & more under $150

- •

1,000s of Rollbacks & more

- Attribute:

Direct and Action-Oriented

Strength:Strong

Examples

- •

Shop now

- •

Shop tech

- •

Try Walmart+ for free

- Attribute:

Helpful and Straightforward

Strength:Strong

Examples

- •

Track your order on Walmart.com:

- •

Need more help?

- •

You can track your order from your shipping confirmation email or by visiting Walmart.com.

- Attribute:

Friendly and Accessible

Strength:Moderate

Examples

Your Labor Day faves...

Dinner made easy with delivery

Tone Analysis

Promotional

Secondary Tones

- •

Urgent

- •

Convenient

- •

Functional

Tone Shifts

The tone shifts distinctly from highly promotional and sales-driven on the homepage to purely functional, direct, and helpful on the customer support pages. This shift is appropriate and well-executed for the context of each page.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Walmart is the one-stop shop where you can get everything you need at the lowest possible price, making your life easier and more affordable.

Value Proposition Components

- Component:

Everyday Low Prices (EDLP)

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

One-Stop Shop / Broad Assortment

Clarity:Clear

Uniqueness:Common

- Component:

Convenience (Pickup, Delivery, Speed)

Clarity:Clear

Uniqueness:Common

- Component:

Omnichannel Experience

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Walmart's messaging relentlessly reinforces its core differentiator: being the undisputed low-price leader. While competitors like Amazon compete on speed and selection, and Target competes on a curated, 'trendier' experience, Walmart's messaging architecture is laser-focused on cost savings. The slogan 'Save Money. Live Better.' is a powerful differentiator that connects the functional benefit (low prices) to an emotional outcome (a better life), a connection that is unique in its simplicity and directness.

The messaging positions Walmart as the most practical, budget-conscious choice for a broad audience. It competes with Amazon by emphasizing its physical store footprint for pickup and immediate delivery, and with Target by focusing purely on price over style or curation. The messaging for Walmart+ is a direct competitive response to Amazon Prime, focusing on similar benefits like free delivery.

Audience Messaging

Target Personas

- Persona:

Budget-Conscious Families

Tailored Messages

- •

Kids’ food faves in as fast as an hour*

- •

1,000s of Rollbacks & more

- •

Dinner made easy with delivery

Effectiveness:Effective

- Persona:

Value-Seeking Students

Tailored Messages

College tech starting at $19.88

Effectiveness:Effective

- Persona:

Convenience-Oriented Shoppers

Tailored Messages

- •

Pickup or delivery?

- •

Get it in as fast as an hour*

- •

Get groceries & more delivered free with Walmart+

Effectiveness:Effective

Audience Pain Points Addressed

- •

High cost of everyday essentials

- •

Limited budget for discretionary items

- •

Lack of time for shopping trips

- •

Need for items quickly and conveniently

Audience Aspirations Addressed

- •

Providing for one's family without financial stress

- •

Making life easier and less stressful

- •

Being able to afford more of what they want, not just what they need

- •

Celebrating holidays and seasons affordably (e.g., 'Labor Day faves')

Persuasion Elements

Emotional Appeals

- Appeal Type:

Relief & Security

Effectiveness:High

Examples

Save Money. Live better.

Dinner made easy with delivery

- Appeal Type:

FOMO (Fear Of Missing Out)

Effectiveness:Medium

Examples

Save big on gaming PCs until 9/7

Labor Day savings

Social Proof Elements

{'proof_type': 'Brand Authority', 'impact': 'Strong'}

Trust Indicators

- •

The globally recognized 'Walmart' brand name

- •

Clear, comprehensive, and easily accessible help section

- •

Transparent policy and terms of use documentation

Scarcity Urgency Tactics

- •

Time-limited deals: 'until 9/7'

- •

Event-based savings: 'Labor Day savings'

- •

Flash Deals messaging: 'Up to 35% off'

Calls To Action

Primary Ctas

- Text:

Shop now

Location:Multiple promotional banners (Gaming PCs, Vacuums, Labor Day, etc.)

Clarity:Clear

- Text:

Shop tech

Location:College tech promotional banner

Clarity:Clear

- Text:

Shop food

Location:Labor Day and Dinner promotional tiles

Clarity:Clear

- Text:

Try Walmart+ for free

Location:Walmart+ promotional banner

Clarity:Clear

The CTAs are highly effective. They are consistently direct, concise, and use strong action verbs. Their placement is logical, immediately following a value proposition or offer, which effectively guides the user journey from interest to a specific product category or service page.

Messaging Gaps Analysis

Critical Gaps

- •

The 'Live Better' part of the brand promise is significantly underdeveloped on the homepage. The messaging is almost entirely transactional ('Save Money') with very little content demonstrating how those savings lead to a better life.

- •

There is a lack of brand storytelling that could build a deeper emotional connection. The communication focuses on what Walmart sells, not the role it plays in customers' lives.

- •

Messaging around product quality, sustainability, or ethical sourcing is absent, which are areas competitors use for differentiation and which are increasingly important to consumers.

Contradiction Points

No itemsUnderdeveloped Areas

Value proposition of Walmart+: Beyond 'free delivery,' the full suite of benefits (fuel, streaming, etc.) is not clearly messaged on the homepage.

Community and Social Impact: While Walmart engages in these activities, this messaging is not present on its primary commercial platform, representing a missed opportunity to build brand affinity.

Messaging Quality

Strengths

- •

Exceptional clarity and focus on the core value proposition of low prices.

- •

Strong, direct calls-to-action that drive user behavior.

- •

Effective use of seasonal and promotional themes to create relevance and urgency.

- •

Clear and helpful tone in customer support sections, building trust in post-purchase scenarios.

Weaknesses

- •

Over-reliance on price can risk brand commoditization and de-emphasize other important factors like quality and experience.

- •

Lack of emotional storytelling and lifestyle-oriented content, making the brand feel more transactional than relational.

- •

The 'Live Better' promise feels like an afterthought in the current execution.

Opportunities

- •

Develop content that explicitly connects savings with life improvements (e.g., 'The money you saved on groceries this month could mean a family movie night').

- •

Integrate user-generated content or customer testimonials to bring the 'Live Better' story to life authentically.

- •

Create more thematic and curated shopping experiences that go beyond just category and price, similar to Target's approach but with a Walmart value spin.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition

Recommendation:A/B test homepage banners that balance the 'Save Money' and 'Live Better' messages. For example, instead of 'Vacuums & more under $150', test 'A cleaner home for less. Vacuums & more under $150' to connect the product to the outcome.

Expected Impact:High

- Area:

Brand Storytelling

Recommendation:Introduce a small, rotating module on the homepage featuring a customer story, a community impact highlight, or a 'product of the month' that shows how a specific item helps people 'live better.'

Expected Impact:Medium

- Area:

Walmart+ Messaging

Recommendation:Enhance the Walmart+ banner to dynamically showcase more than one benefit, such as 'Free delivery, fuel savings & more.' This broadens the perceived value beyond a single feature.

Expected Impact:Medium

Quick Wins

Update CTA button microcopy to include benefit-oriented language where possible (e.g., 'Shop Savings' instead of just 'Shop now').

Add a sub-headline to the homepage that reinforces the dual promise, such as: 'Everyday Low Prices for Everything You Need to Live Your Best Life.'

Long Term Recommendations

- •

Develop a dedicated content marketing strategy focused on the 'Live Better' theme, creating blog posts, videos, and guides on topics like budget-friendly family activities, healthy eating on a budget, and DIY home projects, all featuring Walmart products.

- •

Launch brand campaigns that feature real families and individuals talking about what the savings from Walmart have enabled them to do.

- •

Integrate more robust personalization that shows customers how much they have saved over time, directly tying their shopping behavior back to the core value proposition.

Walmart's website messaging is a masterclass in strategic focus and clarity. It flawlessly executes on its primary business objective: to be the undisputed leader in low prices. The message architecture is built on a powerful, memorable slogan, 'Save Money. Live Better.', and every element on the homepage relentlessly supports the 'Save Money' pillar. The use of direct, urgent, and value-oriented language, combined with clear calls-to-action, creates a highly effective transactional engine that drives sales for a price-sensitive target audience. The brand voice is consistent, shifting appropriately from promotional to functional where needed, maintaining trust throughout the user journey.

However, this singular focus creates a significant messaging gap and a strategic opportunity. The 'Live Better' component of the value proposition is almost entirely absent from the communication. The website tells customers what they can buy and how much they can save, but it fails to tell the story of why it matters. This leaves the brand feeling transactional rather than relational, potentially hindering the development of deeper brand loyalty. While competitors like Target build a lifestyle brand around curation and Amazon builds one around ultimate convenience, Walmart has an opportunity to build a powerful lifestyle brand around financial empowerment and attainable quality of life. The optimization roadmap should focus on elevating the narrative, transforming the message from simply 'low prices' to 'low prices that unlock a better life.' By activating this dormant half of its powerful slogan, Walmart can evolve its brand perception, deepen customer relationships, and fortify its market leadership beyond just the price tag.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Dominant market share in U.S. grocery and a rapidly growing e-commerce presence, second only to Amazon.

- •

Successfully serves a massive, value-conscious consumer base with its 'Everyday Low Prices' (EDLP) strategy.

- •

Strong omnichannel adoption, with the majority of shoppers using multiple channels.

- •

Rapid growth of Walmart+, indicating resonance of its membership-based convenience and value proposition.

- •

Q2 2025 revenue of $177.4 billion, beating expectations and demonstrating resilience in a challenging economic environment.

Improvement Areas

- •

Enhancing product assortment and perceived quality in non-grocery categories (e.g., fashion, home goods) to better compete for higher-income demographics.

- •

Improving the third-party marketplace experience to match Amazon's selection, seller quality, and customer service standards.

- •

Elevating the in-store and digital user experience to move beyond a purely price-based value proposition.

Market Dynamics

Global retail e-commerce is projected to grow steadily, with specific segments like online grocery showing high CAGRs (e.g., 17.3% from 2022-2025). Walmart's own e-commerce is growing at 25% globally.

Mature

Market Trends

- Trend:

Omnichannel Integration

Business Impact:Strengthens Walmart's primary competitive advantage over pure-play e-commerce rivals by leveraging its vast physical store footprint for fulfillment, returns, and customer engagement.

- Trend:

Rise of Retail Media Networks

Business Impact:Creates a high-margin revenue stream through Walmart Connect, which leverages first-party shopper data to sell targeted advertising, growing at over 30%.

- Trend:

AI and Personalization

Business Impact:Opportunity to drive significant efficiencies in supply chain, optimize pricing, and deliver hyper-personalized customer experiences online and in-store.

- Trend:

Expansion into Services (Health & Financial)

Business Impact:Diversifies revenue into higher-margin sectors, increases customer stickiness, and leverages existing store traffic and brand trust.

- Trend:

Sustainability and Ethical Consumption

Business Impact:Growing consumer preference for sustainable products and practices requires transparent supply chains and eco-friendly initiatives to maintain brand loyalty.

Excellent. While the core retail market is mature, Walmart is well-timed to capitalize on the growth of omnichannel shopping, retail media, and the integration of technology like AI into the retail experience. Its focus on value positions it well during periods of economic uncertainty.

Business Model Scalability

High

High fixed costs associated with physical stores and distribution centers, but this infrastructure provides massive leverage for scaling e-commerce fulfillment (store-fulfilled delivery grew nearly 50%). Digital offerings (Marketplace, Advertising, Membership) have low variable costs and scale exceptionally well.

High. The existing network of over 4,600 U.S. stores acts as a fulfillment hub, reducing the need for new, dedicated e-commerce warehouses and enabling rapid delivery services.

Scalability Constraints

- •

Supply chain complexity and managing inventory across a vast, integrated physical and digital network.

- •

Maintaining a consistent customer experience at scale across tens of thousands of third-party marketplace sellers.

- •

Labor availability and costs for in-store and last-mile delivery operations.

Team Readiness

Experienced leadership team successfully navigating the shift from a traditional brick-and-mortar retailer to a tech-powered omnichannel leader. Significant investments in attracting tech talent (e.g., Silicon Valley office expansion) demonstrate strategic commitment.

Massive and complex. While organized into clear divisions (Walmart U.S., Sam's Club, International, Global Tech), agility can be a challenge. The focus on creating integrated platforms (e.g., fulfillment, advertising) is a positive step towards breaking down silos.

Key Capability Gaps

- •

Top-tier AI and Machine Learning talent to compete with tech-native companies like Amazon.

- •

User Experience (UX) design and product management to create more intuitive and engaging digital experiences.

- •

International marketplace management and cross-border logistics expertise to scale the third-party seller model globally.

Growth Engine

Acquisition Channels

- Channel:

Physical Stores

Effectiveness:High

Optimization Potential:Medium

Recommendation:Continue leveraging stores as acquisition funnels for Walmart+ memberships, financial services, and health clinics. Enhance in-store digital integration (e.g., Scan & Go, app-based promotions) to seamlessly transition offline customers to omnichannel users.

- Channel:

Organic Search (SEO)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Focus on programmatic SEO for the massive product catalog from marketplace sellers. Optimize for local search to drive foot traffic to stores for services like auto care and health clinics.

- Channel:

Paid Search & Shopping Ads

Effectiveness:High

Optimization Potential:High

Recommendation:Leverage first-party data to improve targeting and ROI on external ad platforms. Integrate ad spend with internal promotional calendars for maximum impact during key retail seasons.

- Channel:

Social Commerce & Influencer Marketing

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand shoppable content on platforms like TikTok and Instagram, particularly for fashion and home goods. Develop a scalable influencer program to promote private label brands and marketplace items.

Customer Journey

Highly varied and omnichannel. Journeys include pure in-store, pure e-commerce, buy online pickup in-store (BOPIS), ship-from-store, and increasingly, app-based ordering for grocery and essentials. The path is functional but can lack seamlessness between digital and physical experiences.

Friction Points

- •

Inconsistent product availability and substitution experiences for online grocery orders.

- •

Navigating the massive product selection, particularly differentiating between first-party and third-party marketplace items.

- •

Customer service experience for issues with marketplace orders, which can be less consistent than for items sold directly by Walmart.

Journey Enhancement Priorities

- Area:

Unified User Profile

Recommendation:Create a single view of the customer across all touchpoints (in-store, online, app, pharmacy, Walmart+) to enable true personalization and predictive recommendations.

- Area:

Marketplace Integration

Recommendation:Improve filtering, seller ratings, and return processes for third-party items to build trust and streamline the experience.

- Area:

Post-Purchase Experience

Recommendation:Enhance order tracking, communication for delivery/pickup, and simplify the returns process, especially for omnichannel transactions.

Retention Mechanisms

- Mechanism:

Walmart+ Membership

Effectiveness:High

Improvement Opportunity:Expand the value proposition beyond free delivery and gas discounts. Integrate more high-value services like exclusive access to deals, financial product benefits, or preferred scheduling at Walmart Health clinics. Membership is growing double-digits, indicating strong traction.

- Mechanism:

Everyday Low Prices (EDLP)

Effectiveness:High

Improvement Opportunity:Use data and AI to implement more dynamic and personalized pricing/promotions for logged-in users and app customers, complementing the broad EDLP strategy without undermining it.

- Mechanism:

Omnichannel Convenience

Effectiveness:High

Improvement Opportunity:Reduce friction in BOPIS and curbside pickup processes. Expand last-mile delivery options like drone and InHome delivery to increase convenience and lock-in.

Revenue Economics

Complex and shifting. Core retail operates on thin margins, subsidized by high-margin growth areas. The key is to leverage the low-margin retail business to acquire customers for the highly profitable advertising, marketplace, and membership businesses.

Qualitatively High. With 90% of the U.S. population within 10 miles of a store, the cost of acquiring a marginal customer is relatively low. The push into recurring revenue (Walmart+) and high-margin services significantly increases potential LTV.

High and Improving. The ability to grow global advertising revenue by 46% and e-commerce by 25% demonstrates strong efficiency in monetizing its existing customer base and assets.

Optimization Recommendations

- •

Aggressively scale Walmart Connect (Advertising) by improving ad tools for marketplace sellers and expanding off-site and in-store ad inventory.

- •

Increase the take-rate and value-added services (like WFS) for the third-party marketplace, which grew 40% in Q2.

- •

Drive higher adoption of Walmart+, as members spend more and are more engaged than non-members.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Technology Stack

Impact:Medium

Solution Approach:Continue migrating to a modern, cloud-native architecture. Use an API-first strategy to decouple systems and enable faster innovation. The significant investment in a new Silicon Valley tech office is a positive indicator of this effort.

- Limitation:

Data Silos

Impact:High

Solution Approach:Invest in a unified data platform that consolidates data from in-store POS, e-commerce, supply chain, and ancillary businesses to create a single view of the customer and operations.

Operational Bottlenecks

- Bottleneck:

Last-Mile Delivery Economics

Growth Impact:Limits profitability of the rapidly growing online delivery business.

Resolution Strategy:Optimize delivery routes with AI, expand lower-cost delivery methods (e.g., store associates, Spark Driver platform), and scale innovative solutions like drone and in-garage delivery to reduce cost-to-serve.

- Bottleneck:

In-Store Fulfillment Capacity

Growth Impact:During peak times, in-store picking for online orders can congest aisles and strain store associates, impacting both online and in-store customer experiences.

Resolution Strategy:Continue investing in micro-fulfillment centers (MFCs) and automated picking solutions within or adjacent to existing stores to increase throughput and efficiency.

Market Penetration Challenges

- Challenge:

Intense Competition from Amazon

Severity:Critical

Mitigation Strategy:Double down on the omnichannel advantage. Compete not just on price or selection, but on the convenience of an integrated physical-digital network for immediate pickup, returns, and services (e.g., health, auto).

- Challenge:

Perception as a 'Value' Brand

Severity:Major

Mitigation Strategy:Improve the marketplace by attracting premium brands and sellers. Enhance the quality and design of private label brands (e.g., 'bettergoods') to appeal to a broader demographic. Invest in a superior user experience on the website and app.

- Challenge:

International Market Complexity

Severity:Major

Mitigation Strategy:Focus on key growth markets (e.g., India via Flipkart, Mexico) with tailored strategies rather than a one-size-fits-all approach. Leverage the marketplace model to expand internationally with lower capital investment.

Resource Limitations

Talent Gaps

- •

Generative AI Researchers and Engineers

- •

Senior Product Managers with experience in building large-scale consumer tech platforms.

- •

Data Scientists specializing in personalization and supply chain optimization.

Low. Walmart generates massive free cash flow ($6.9 billion in Q2 2025). Capital is not a constraint; the challenge is allocating it to the highest-return initiatives, such as technology and supply chain automation.

Infrastructure Needs

- •

Continued investment in supply chain automation and robotics.

- •

Upgrades to in-store technology to support omnichannel operations.

- •

Expansion of data center and cloud computing capacity to power AI and data analytics initiatives.

Growth Opportunities

Market Expansion

- Expansion Vector:

Higher-Income Demographics

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Curate a more premium assortment on the marketplace, improve the digital user experience, and market Walmart+ benefits that appeal to time-crunched, higher-income households.

- Expansion Vector:

Healthcare Services

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Continue the measured rollout of Walmart Health centers, focusing on underserved communities. Develop a robust digital health platform that integrates virtual care with in-person services, pharmacy, and OTC products, creating a comprehensive health ecosystem.

- Expansion Vector:

Financial Services

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Scale the 'ONE' fintech platform by offering a wider range of services like checking/savings accounts, remittances, and potentially lending products, leveraging the trust and traffic of the Walmart brand.

Product Opportunities

- Opportunity:

Retail Media Network (Walmart Connect) Expansion

Market Demand Evidence:Rapid growth in the retail media market. Walmart Connect revenue is growing over 30% annually, with ad sales from marketplace sellers up nearly 50%.

Strategic Fit:High

Development Recommendation:Invest in better self-service tools for advertisers, expand off-site advertising capabilities through partnerships, and fully integrate Vizio's ad platform.

- Opportunity:

Third-Party Marketplace Growth

Market Demand Evidence:Explosive seller growth, surpassing 200,000 sellers in mid-2025, with a 25% YoY increase. Marketplace items now account for 95% of the 420 million products on Walmart.com.

Strategic Fit:High

Development Recommendation:Improve seller tools, analytics, and support. Streamline onboarding for international sellers while ensuring quality control. Expand Walmart Fulfillment Services (WFS) to more sellers.

- Opportunity:

Generative AI-Powered Services

Market Demand Evidence:High consumer willingness to use AI tools. Significant potential for operational efficiency and creating hyper-personalized shopping experiences.

Strategic Fit:High

Development Recommendation:Develop customer-facing generative AI tools for shopping assistance and meal planning (like 'Sparky'). Internally, deploy AI for supply chain forecasting, dynamic pricing, and automating store operations.

Channel Diversification

- Channel:

Social Commerce Integration

Fit Assessment:High

Implementation Strategy:Deepen partnerships with platforms like TikTok, Pinterest, and Instagram to create fully shoppable experiences within their apps, leveraging Walmart's API for real-time inventory and checkout.

- Channel:

Conversational Commerce

Fit Assessment:Medium

Implementation Strategy:Pilot AI-powered conversational agents via SMS, WhatsApp, and smart home devices for reordering common items, checking order status, and customer service inquiries.

Strategic Partnerships

- Partnership Type:

Technology & AI

Potential Partners

- •

Microsoft (existing cloud partner)

- •

NVIDIA (for AI hardware/software)

- •

Leading AI startups

Expected Benefits:Accelerate development of proprietary AI models, enhance cloud capabilities, and access cutting-edge technology for logistics and customer experience.

- Partnership Type:

Healthcare Providers & Insurers

Potential Partners

- •

UnitedHealth Group (existing partner)

- •

Regional hospital systems

- •

Telehealth platform providers

Expected Benefits:Expand the scope of services offered at Walmart Health, create integrated care networks, and drive patient volume through insurance partnerships.

- Partnership Type:

Content & Media

Potential Partners

- •

Paramount+ (existing partner)

- •

Other streaming services

- •

Digital publishers

Expected Benefits:Enhance the Walmart+ value proposition with bundled media subscriptions. Create co-branded content to drive sales of related merchandise.

Growth Strategy

North Star Metric

Omnichannel Customer Lifetime Value (LTV)

This metric shifts focus from single-transaction value to the long-term profitability of a customer across all of Walmart's offerings (retail, marketplace, membership, health, financial services). It correctly values a customer who buys groceries, uses the pharmacy, holds a Walmart+ membership, and sees ads via Walmart Connect.

Increase Omnichannel Customer LTV by 15% annually by driving adoption of multiple offerings per customer.

Growth Model

Ecosystem Flywheel Model

Key Drivers

- •

Core retail (EDLP and convenience) acquires a massive customer base.

- •

Omnichannel capabilities (delivery, pickup) increase engagement and frequency.

- •

Walmart+ membership locks in high-value customers with recurring revenue.

- •

High-margin businesses (Marketplace, Advertising, Health, Financial Services) monetize the engaged customer base, generating profits.

- •

Profits are reinvested into improving the core value proposition (lower prices, better tech), which attracts more customers, spinning the flywheel faster.

Focus on seamlessly cross-promoting services within the ecosystem. For example, offer Walmart+ discounts to frequent pharmacy customers or preferred ad rates to marketplace sellers who also use Walmart Fulfillment Services.

Prioritized Initiatives

- Initiative:

Scale Walmart Connect (Retail Media Network)

Expected Impact:High

Implementation Effort:Medium

Timeframe:12-18 Months

First Steps:Launch a concerted campaign to increase the percentage of marketplace sellers who also advertise on Walmart Connect from 50% to 75%. Roll out enhanced self-service ad management tools.

- Initiative:

Accelerate Third-Party Marketplace Quality & Growth

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 Months

First Steps:Implement a 'Pro Seller' badge program to highlight top-rated sellers. Invest in better translation and logistics support for high-potential international sellers to improve listing quality.

- Initiative:

Enhance Walmart+ Value Proposition

Expected Impact:High

Implementation Effort:Medium

Timeframe:Ongoing

First Steps:Pilot and launch at least two new, non-delivery-related benefits for Walmart+ members within the next year (e.g., exclusive access to new products, bundled home services).

- Initiative:

Develop a Unified Customer Data Platform

Expected Impact:High

Implementation Effort:High

Timeframe:24-36 Months

First Steps:Form a cross-functional team to define the architecture and governance for a unified data platform. Begin by integrating e-commerce and Walmart+ data as the foundational layer.

Experimentation Plan

High Leverage Tests

- Test:

Personalized homepage and app interface based on omnichannel shopping history.

Hypothesis:A personalized interface will increase conversion rates and average order value by showcasing more relevant products and services.

- Test:

Dynamic bundling of Walmart+ with other services (e.g., a free month for signing up for auto-refill on prescriptions).

Hypothesis:Bundling will increase the conversion rate for Walmart+ sign-ups among targeted customer segments.

- Test:

A/B testing of different seller fee structures or incentive programs on the marketplace.

Hypothesis:Incentivizing faster shipping or better customer service through fee adjustments will improve the overall marketplace experience and customer satisfaction.

Utilize a robust A/B testing platform to measure impact on key metrics: conversion rate, average order value (AOV), customer lifetime value (LTV), Walmart+ sign-ups, and Net Promoter Score (NPS).

Run concurrent experiments on a weekly or bi-weekly sprint cycle, with a dedicated growth team reviewing results and planning the next iteration.

Growth Team

A hybrid model with a central 'Ecosystem Growth' team responsible for the overall flywheel and North Star Metric, and embedded 'Growth Pods' within key business units (e.g., Marketplace, Walmart+, Health, Connect) that focus on optimizing their specific part of the ecosystem.

Key Roles

- •

Head of Ecosystem Growth

- •

Data Scientist / Growth Analyst

- •

Product Manager, Growth

- •

Marketing Automation Specialist

- •

UX Researcher

Establish a formal 'Experimentation Center of Excellence' to provide training, tools, and best practices to teams across the organization. Aggressively recruit senior product and data talent from leading tech companies.

Walmart's growth readiness is exceptionally strong, but its future success hinges on a fundamental transformation from a retail giant into a dominant digital ecosystem. The company has successfully established a powerful foundation with unparalleled product-market fit in value retail and a highly scalable omnichannel business model. Recent financial performance, including robust e-commerce growth of 25% and soaring advertising revenue, confirms that its strategic pivot is yielding significant results.

The primary growth engine is no longer just selling goods; it's a powerful flywheel where the massive scale of the core retail business acquires customers for a suite of high-margin digital and service-based offerings. Walmart Connect (advertising), the third-party Marketplace, and the Walmart+ subscription program are the new epicenters of profitability and customer lock-in. These businesses are not just ancillary revenue streams; they are becoming the economic engine that allows Walmart to maintain its price leadership while investing in technology and innovation.

However, significant barriers remain. The primary challenge is not competition on price, but on experience, technology, and talent. To win the next decade, Walmart must overcome the perception of being just a 'value' brand by curating a higher-quality marketplace and delivering a seamless, personalized digital experience that rivals tech-native competitors. Operationally, managing the immense complexity of a global supply chain and last-mile delivery at scale remains a critical hurdle. Attracting and retaining elite AI and product talent is paramount to closing the innovation gap with competitors like Amazon.

The most significant growth opportunities lie in leveraging brand trust and physical footprint to expand into higher-margin services. Walmart Health and the ONE financial super-app represent massive, multi-billion dollar markets where Walmart has a unique 'right to win'. These initiatives, combined with the continued hyper-scaling of the marketplace and advertising businesses, form the core of a multi-vector growth strategy.

Our recommendation is to adopt an 'Ecosystem Flywheel' model, guided by the North Star Metric of 'Omnichannel Customer Lifetime Value'. This model prioritizes initiatives that drive customers to engage with multiple facets of the Walmart ecosystem. The highest-impact priorities are: 1) Aggressively scaling the Walmart Connect advertising platform, 2) Curating a higher-quality third-party marketplace, and 3) Deepening the value proposition of Walmart+. Executing this strategy will require a relentless focus on building a unified data infrastructure and fostering a culture of rapid experimentation, transforming Walmart into a people-led, tech-powered platform that dominates the future of commerce and consumer services.

Legal Compliance