eScore

wecenergygroup.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

WEC Energy Group's digital presence is highly specialized and effective at aligning with the search intent of its primary audience: investors and financial analysts. Content authority is strong in this niche, evidenced by robust financial reporting and ESG data that attracts institutional attention. However, its multi-channel presence is weak, and the corporate site intentionally avoids broader thought leadership, delegating customer-facing interactions and general energy topics to its subsidiary websites. Voice search optimization is minimal as the content is not geared towards conversational queries.

The website demonstrates exceptional search intent alignment for its core investor audience, providing direct and easy access to financial reports, ESG data, and dividend information.

Develop a dedicated 'Innovation' or 'Future of Energy' content hub on the corporate site to capture a broader thought leadership audience and improve authority on non-branded keywords related to the energy transition.

Brand communication is exceptionally clear and consistent for its investor audience, emphasizing financial stability and responsible management. However, this singular focus makes the messaging ineffective for nearly all other segments, particularly potential top-tier talent. The messaging lacks an emotional journey and relies heavily on dense, downloadable reports, failing to articulate a compelling brand narrative on the website itself.

Messaging to the financial community is highly disciplined and effective, consistently reinforcing the core themes of reliability, financial prudence, and shareholder returns.

Humanize the brand by transforming the 'Sustainability' section from a simple link into a dynamic webpage featuring key proof points, data visualizations, and employee or community stories from the ESG report.

The conversion experience for the primary audience (investors downloading reports) is functional but lacks sophistication. Key conversion points, such as applying for a career, are treated as simple links with minimal persuasive design. The provided analysis indicates inconsistent CTA design and the absence of a corporate-level accessibility statement, which creates friction for some users and poses a legal risk. The cognitive load for its target user is low as the site architecture is simple and direct.

The information architecture is logical and intuitive for its target audience, allowing stakeholders to find specific reports and financial data with minimal friction.

Standardize all call-to-action (CTA) elements into a consistent design system and elevate critical user tasks, like 'Careers' or 'Shareholder Login,' with more prominent button-style treatments to improve visual hierarchy and guide user action.

Credibility among its core investor and regulatory audience is extremely high due to robust financial transparency, adherence to SEC regulations, and third-party validation through its inclusion in indices like the S&P High Yield Dividend Aristocrats. However, the provided analysis identifies significant digital risks, as the public website lags in modern compliance standards like CCPA and ADA, creating a trust gap with the general public and customers. The core business is built on a foundation of regulatory trust, but its digital front door is not aligned with this standard.

The company's commitment to financial transparency, with prominent display of earnings, dividend history, and comprehensive ESG reports, builds immense credibility with investors and financial markets.

Overhaul the website's Privacy Policy and cookie consent mechanism to align with modern standards like CCPA/CPRA, thereby mitigating legal risk and demonstrating to all stakeholders that its commitment to compliance is comprehensive.

WEC Energy Group's competitive advantage is exceptionally strong and sustainable due to its status as a regulated monopoly with ownership of critical, irreplaceable infrastructure. This creates nearly insurmountable barriers to entry and extremely high switching costs for customers. The primary competitive arena is for investment capital, where it competes with other utilities; here, its stable returns and large-scale, regulator-approved capital plan provide a powerful advantage. The moat is deep and well-protected by legal and regulatory frameworks.

The regulated monopoly model provides a highly sustainable competitive advantage, granting exclusive rights to serve a captive customer base of 4.7 million and ensuring stable, predictable revenue streams.

More effectively communicate the company's innovation and decarbonization narrative to compete for ESG-focused capital against rivals like NextEra Energy, who currently have a stronger brand perception as renewable energy leaders.

The business model is highly scalable through a Capital Deployment & Regulatory-Led Growth model. Growth is achieved by investing billions in new, regulated assets which expand the 'rate base' on which it earns a guaranteed return. The company has a massive $28 billion five-year capital plan, indicating a clear and robust pathway for growth. Expansion potential exists through acquiring smaller regional utilities and growing its non-regulated renewables business.

The ability to deploy large amounts of capital into a regulator-approved rate base ($28B plan from 2025-2029) provides a clear, predictable, and highly scalable engine for earnings growth.

Address operational bottlenecks identified in the analysis, such as supply chain constraints and skilled labor shortages, to ensure the massive capital plan can be executed on schedule to realize projected growth.

The business model as a regulated utility holding company is exceptionally coherent, mature, and proven. Revenue streams are stable and predictable, and resource allocation is strategically focused on large-scale capital investments that directly drive earnings growth through the regulatory framework. There is strong alignment between the interests of investors (stable returns), regulators (clean, reliable grid), and the company's strategic focus on decarbonization and modernization.

The cost-of-service regulatory model provides exceptional coherence by directly linking capital investment in necessary infrastructure (like renewables) to guaranteed, long-term shareholder returns, creating a powerful and self-reinforcing growth cycle.

Proactively develop new business models and rate structures to incorporate the rise of Distributed Energy Resources (DERs), such as rooftop solar, to address the primary long-term threat to the traditional one-way utility model.

As a regulated monopoly in its service territories, WEC Energy Group holds immense market power. Its market share is geographically fixed and protected, giving it significant pricing power as negotiated with regulators. The company has substantial leverage with suppliers due to its scale and large capital projects. While it is dependent on its customers, that customer base is captive and diversified across 4.7 million accounts, minimizing concentration risk.

The company's exclusive franchise to provide essential services in its territories gives it ultimate pricing power (subject to regulatory approval) and insulates it from direct market competition.

Increase market influence on a national scale by establishing a more prominent executive thought leadership platform, shaping policy discussions around the energy transition to create a more favorable long-term operating environment.

Business Overview

Business Classification

Regulated Utility Holding Company

Energy Infrastructure Investor

Energy & Utilities

Sub Verticals

- •

Electric Power Generation, Transmission & Distribution

- •

Natural Gas Distribution

- •

Renewable Energy Investment

Mature

Maturity Indicators

- •

Long-established company history (founded 1896).

- •

Consistent dividend payments and focus on shareholder returns.

- •

Large, stable customer base (4.7 million) in established service territories.

- •

Business operations are heavily governed by long-term regulatory frameworks.

- •

Focus on operational efficiency and large-scale, long-term capital projects rather than rapid market acquisition.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Regulated Sale of Electricity

Description:Generation, transmission, and distribution of electricity to residential, commercial, and industrial customers within defined service areas at rates approved by state public utility commissions. This represents the largest portion of the company's revenue.

Estimated Importance:Primary

Customer Segment:Residential, Commercial & Industrial (C&I)

Estimated Margin:Medium

- Stream Name:

Regulated Sale of Natural Gas

Description:Distribution of natural gas to residential, commercial, and industrial customers through a network of pipelines at regulated rates.

Estimated Importance:Primary

Customer Segment:Residential, Commercial & Industrial (C&I)

Estimated Margin:Medium

- Stream Name:

Non-Regulated Renewable Energy Generation

Description:Through its subsidiary WEC Infrastructure LLC, the company owns a fleet of renewable generation facilities and sells the energy produced to third parties via long-term offtake agreements.

Estimated Importance:Secondary

Customer Segment:Corporate & Other Utilities

Estimated Margin:Medium

- Stream Name:

Investment in Electric Transmission (ATC)

Description:WEC Energy Group owns a 60% stake in American Transmission Co. (ATC), which generates returns based on investments in the high-voltage transmission grid. This revenue is recognized via the equity method.

Estimated Importance:Tertiary

Customer Segment:N/A (Equity Investment)

Estimated Margin:High

Recurring Revenue Components

- •

Monthly utility payments from a captive customer base.

- •

Rate-based recovery of capital investments approved by regulators.

- •

Long-term power purchase agreements (PPAs) from non-regulated assets.

Pricing Strategy

Cost-of-Service Regulation

N/A (Regulated Monopoly)

Opaque to Consumer, Transparent to Regulators

Pricing Psychology

Price Stability: Rates are set in advance through regulatory processes, protecting consumers from market volatility.

Fairness: Rates are determined by public utility commissions to ensure they are fair and allow the company to earn a reasonable, but not excessive, return on investment.

Monetization Assessment

Strengths

- •

Predictable Revenue: The regulated monopoly model ensures highly stable and predictable revenue streams, insulating the company from economic cycles.

- •

Guaranteed Return on Equity (ROE): Regulators allow WEC to earn a specified rate of return on its capital investments (rate base), incentivizing infrastructure spending.

- •

Captive Customer Base: Customers within the service territories have no alternative for grid-supplied energy, ensuring consistent demand.

Weaknesses

- •

Regulatory Lag: There is often a time delay between when the company incurs costs and when it can recover them through rate adjustments.

- •

Limited Pricing Power: Inability to set prices freely based on market conditions; pricing is entirely dependent on regulatory approval.

- •

Disallowed Costs: Risk that regulators may disallow certain investments or expenses from being recovered through rates, directly impacting profitability.

Opportunities

- •

Large-Scale Capital Investment: The energy transition requires massive investment in renewables, grid modernization, and EV infrastructure, expanding the rate base on which WEC can earn a return. The company has a $28 billion capital plan for 2025-2029.

- •

Performance-Based Regulation (PBR): A shift towards PBR could allow utilities to earn incentives for achieving specific policy outcomes (e.g., reliability, decarbonization), creating new profit opportunities beyond capital investment.

- •

Growth in Non-Regulated Renewables: Expanding the portfolio of non-regulated solar and wind assets to serve corporate customers with clean energy goals.

Threats

- •

Adverse Regulatory Decisions: Unfavorable outcomes in rate cases can significantly reduce profitability and shareholder returns.

- •

Distributed Energy Resources (DERs): The growth of rooftop solar and battery storage could lead to flat or declining electricity sales (load defection), challenging the traditional sales-based revenue model.

- •

Energy Efficiency Mandates: Regulatory mandates for energy efficiency can reduce overall energy consumption, impacting revenue if decoupling mechanisms are not in place.

Market Positioning

Regulated Regional Monopoly

Dominant/Exclusive provider within its designated service territories across Wisconsin, Illinois, Michigan, and Minnesota.

Target Segments

- Segment Name:

Residential Customers

Description:Individual households and multi-family dwellings requiring electricity and/or natural gas for heating, cooling, lighting, and appliances.

Demographic Factors

Located within WEC's service territories.

Psychographic Factors

Value reliability and affordability above all.

Increasing interest in energy efficiency and green energy options.

Behavioral Factors

Consistent, predictable energy consumption patterns, with seasonal peaks.

Non-discretionary spending on utility services.

Pain Points

- •

Rising energy bills and impact on household budgets.

- •

Power outages, especially during severe weather.

- •

Complexity of understanding energy usage and billing.

Fit Assessment:Excellent

Segment Potential:Low

- Segment Name:

Commercial & Industrial (C&I) Customers

Description:Businesses ranging from small commercial enterprises to large manufacturing and industrial facilities with significant energy needs.

Demographic Factors

Varying sizes and industries, including manufacturing, healthcare, and retail.

Psychographic Factors

Highly sensitive to energy costs as a major operational expense.

Focused on power reliability and quality to avoid costly downtime.

Behavioral Factors

High, often constant, energy load profiles.

Increasingly seeking customized energy solutions and sustainability partnerships (e.g., for data centers).

Pain Points

- •

Volatility of energy costs impacting business planning.

- •

Need for uninterrupted, high-quality power for sensitive operations.

- •

Pressure to meet corporate sustainability and ESG goals.

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

Exclusive Service Territory

Strength:Strong

Sustainability:Sustainable

- Factor:

Operational Scale and Efficiency

Strength:Strong

Sustainability:Sustainable

- Factor:

Proactive Decarbonization Strategy

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To provide affordable, reliable, and clean energy to customers in the Midwest.

Excellent

Key Benefits

- Benefit:

Reliable Energy Supply

Importance:Critical

Differentiation:Common

Proof Elements

Industry awards for emergency response and reliability.

Continuous investment in grid modernization and maintenance.

- Benefit:

Affordable and Stable Rates

Importance:Critical

Differentiation:Common

Proof Elements

Rates are set through a public, regulated process designed to be fair.

Focus on operational efficiency to manage costs.

- Benefit:

Transition to Cleaner Energy

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Aggressive, publicly stated goals for carbon reduction (net-zero electricity by 2050, exit coal by 2032).

A $28 billion, five-year capital plan with over $9.1 billion dedicated to new renewables.

Unique Selling Points

- Usp:

Industry-Leading Decarbonization Goals

Sustainability:Long-term

Defensibility:Moderate

- Usp:

Diversified Regulated Asset Base

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Need for a constant, non-interruptible supply of energy for daily life and business operations.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Protection from volatile wholesale energy price spikes.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Desire for a cleaner energy mix without sacrificing reliability or affordability.

Severity:Minor

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition directly addresses the fundamental, non-negotiable needs of energy consumers and aligns with increasing societal and regulatory pressure for decarbonization.

High

Residential and C&I customers prioritize reliability and stable pricing, which are core tenets of the proposition. The 'clean' aspect increasingly aligns with the ESG goals of C&I customers and the values of residential customers.

Strategic Assessment

Business Model Canvas

Key Partners

- •

State Regulators: (e.g., Public Service Commission of Wisconsin, Illinois Commerce Commission) who approve rates and investments.

- •

Federal Regulators: (e.g., FERC, EPA) who oversee transmission and environmental compliance.

- •

Equipment & Technology Suppliers: (e.g., GE, Siemens, solar panel manufacturers).

- •

Fuel Suppliers: (Natural gas producers and transporters).

- •

Engineering & Construction Firms: For building new generation and grid infrastructure.

- •

Labor Unions: Representing a significant portion of the skilled workforce.

Key Activities

- •

Power Generation & Fuel Procurement: Operating and maintaining a diverse fleet of power plants.

- •

Grid Maintenance & Modernization: Ensuring the reliability and resilience of transmission and distribution networks.

- •

Regulatory & Compliance Management: Navigating complex rate cases and adhering to state and federal regulations.

- •

Capital Project Execution: Managing large-scale construction of new energy infrastructure, such as solar farms and natural gas plants.

- •

Customer Service & Billing

Key Resources

- •

Physical Assets: Power plants (natural gas, solar, wind, battery), transmission lines, distribution networks, pipelines.

- •

Regulatory Licenses: Exclusive rights to operate in specific geographic areas.

- •

Skilled Workforce: Engineers, lineworkers, plant operators, regulatory experts.

- •

Financial Capital: Access to capital markets to fund massive infrastructure investments.

Cost Structure

- •

Capital Expenditures (CapEx): Investments in new power plants, grid upgrades, and renewable projects.

- •

Fuel Costs: Primarily natural gas.

- •

Operations & Maintenance (O&M): Labor, materials, and services for upkeep of assets.

- •

Depreciation: On the large base of physical assets.

- •

Financing Costs: Interest on debt used to fund capital projects.

Swot Analysis

Strengths

- •

Stable, predictable earnings from a regulated monopoly business model.

- •

Geographically diverse service territories across four states.

- •

Strong balance sheet and access to capital for large-scale investments.

- •

Clear and ambitious long-term decarbonization strategy, aligning with policy trends.

Weaknesses

- •

High dependence on favorable regulatory outcomes.

- •

Significant capital intensity and long investment cycles.

- •

Legacy fossil fuel assets that require managed retirement and replacement.

- •

Revenue growth is largely tied to CapEx, not organic customer or market growth.

Opportunities

- •

Electrification: Growth in electric vehicles (EVs) and electric heating will significantly increase electricity demand.

- •

Grid Modernization: Investment in smart grids, energy storage, and resilient infrastructure provides significant rate base growth.

- •

Federal Incentives: Programs like the Inflation Reduction Act (IRA) provide tax credits that lower the cost of renewable energy projects.

- •

Data Center Growth: Serving the immense and growing electricity needs of large data centers (e.g., Microsoft).

Threats

- •

Climate Change: Increased frequency of extreme weather events threatens grid infrastructure and reliability.

- •

Cybersecurity: Critical infrastructure is a prime target for sophisticated cyber attacks.

- •

Rising Interest Rates: Increases the cost of capital for funding large infrastructure projects.

- •

Technological Disruption: Advances in distributed generation and energy storage could empower customers to become more self-sufficient, eroding the traditional utility model.

Recommendations

Priority Improvements

- Area:

Business Model Evolution

Recommendation:Proactively develop and pilot new business models and rate structures that accommodate and monetize Distributed Energy Resources (DERs). This includes developing platforms for managing DERs (a 'distribution system operator' or DSO model) and creating tariffs that value grid services provided by customer-sited assets.

Expected Impact:High

- Area:

Operational Efficiency

Recommendation:Accelerate investment in grid automation, predictive analytics, and AI for asset management to improve reliability, reduce O&M costs, and enhance resilience against climate-related threats.

Expected Impact:Medium

- Area:

Customer Engagement

Recommendation:Develop more sophisticated customer-facing programs and digital tools that promote beneficial electrification (e.g., EV managed charging, smart heat pump incentives) to manage new sources of load growth effectively.

Expected Impact:Medium

Business Model Innovation

- •

Energy-as-a-Service (EaaS) for C&I Customers: Create a non-regulated or specialized regulated offering that provides large customers with a comprehensive energy solution, including on-site generation (solar), battery storage, EV charging infrastructure, and energy management, all for a fixed monthly fee.

- •

Grid Services Platform: Invest in or partner with technology firms to build a platform that allows the utility to orchestrate and compensate customer-owned assets (rooftop solar, batteries, smart thermostats) for providing grid stabilization services, turning a threat into a resource.

- •

Hydrogen Hub Development: Leverage expertise in natural gas infrastructure to pioneer pilot projects for green hydrogen production and distribution, positioning the company for a key role in the long-term decarbonization of hard-to-abate sectors.

Revenue Diversification

- •

Expand Non-Regulated Renewables: Aggressively grow the WEC Infrastructure subsidiary by developing and acquiring renewable energy projects outside the regulated service territory to serve the voluntary clean energy demand from large corporations.

- •

EV Charging Infrastructure: Explore business models beyond the meter for owning and operating public DC fast-charging networks, potentially as a non-regulated venture or in partnership with private companies.

- •

Broadband-as-a-Utility: Evaluate the strategic potential of leveraging existing rights-of-way and infrastructure to deploy fiber optic networks, providing broadband services in underserved areas of the service territory.

WEC Energy Group exemplifies a mature, well-managed regulated utility navigating a profound industry transformation. Its core business model is built on the stable and predictable foundation of cost-of-service regulation, which provides a near-guaranteed return on massive capital investments in exchange for reliable and affordable energy. This model's strength lies in its resilience and financial stability, making it an attractive, low-volatility investment.

However, this traditional model faces existential challenges from decarbonization, decentralization, and electrification. The company's strategic evolution hinges on its ability to execute its ambitious $28 billion ESG Progress Plan, which aims to replace its legacy fossil fuel fleet with a portfolio of renewable and low-carbon assets. This strategy wisely leverages the existing business model by massively expanding the rate base, which is the primary driver of earnings growth.

The key strategic imperative is to transition from a one-way commodity provider to a dynamic network operator. The rise of distributed energy resources (DERs) like rooftop solar and batteries is the most significant long-term threat to the current model. The company's future competitive advantage will depend not just on building large-scale renewables but on its ability to integrate and orchestrate these customer-sited resources. The recommendations focus on proactively developing new business models (e.g., Energy-as-a-Service, a DSO platform) that transform this threat into a new revenue opportunity and a valuable grid management tool. By embracing this shift, WEC can evolve from simply delivering electrons to orchestrating a complex, multi-directional energy system, ensuring its central role in the clean energy future.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Intensity

Impact:High

- Barrier:

Regulatory Hurdles & Licensing

Impact:High

- Barrier:

Incumbent Infrastructure Ownership

Impact:High

- Barrier:

Economies of Scale

Impact:High

Industry Trends

- Trend:

Decarbonization and Clean Energy Transition

Impact On Business:Requires significant capital investment in renewables (solar, wind) and retirement of fossil fuel assets (coal). Creates opportunities for leadership in green energy.

Timeline:Immediate

- Trend:

Electrification of Transportation and Buildings

Impact On Business:Drives significant load growth, requiring grid upgrades and investment in new infrastructure like EV charging networks. Represents a major new revenue opportunity.

Timeline:Near-term

- Trend:

Grid Modernization and Resilience

Impact On Business:Demands investment in smart grid technology, energy storage, and hardening infrastructure against extreme weather to ensure reliability and accommodate distributed energy resources.

Timeline:Immediate

- Trend:

Rise of Distributed Energy Resources (DERs)

Impact On Business:Challenges the traditional centralized utility model by introducing customer-owned generation (rooftop solar) and storage, potentially reducing revenue from energy sales but creating opportunities in grid management services.

Timeline:Near-term

- Trend:

Increased Data Center and AI-driven Energy Demand

Impact On Business:Creates pockets of intense, high-reliability energy demand, requiring utilities to plan for substantial and rapid load growth in specific areas.

Timeline:Immediate

Direct Competitors

- →

Alliant Energy

Market Share Estimate:Significant overlap in Wisconsin service territory.

Target Audience Overlap:High

Competitive Positioning:Positions as a leader in clean energy transition, heavily promoting its large-scale solar projects in Wisconsin and its 'Clean Energy Blueprint'.

Strengths

- •

Aggressive and well-publicized investment in utility-scale solar, tripling their solar capacity with new projects.

- •

Strong ESG (Environmental, Social, Governance) branding with sustainability awards for its solar projects.

- •

Proactive development of community solar programs.

- •

Focused service area in Wisconsin and Iowa, allowing for concentrated investment.

Weaknesses

- •

Smaller overall scale and market capitalization compared to WEC Energy Group.

- •

Similar exposure to regulatory risks within the same state (Wisconsin).

- •

Brand recognition may be lower than WEC's subsidiary 'We Energies' in certain parts of Wisconsin.

Differentiators

Emphasis on being a 'hometown' utility with a strong focus on community-level projects and partnerships in Wisconsin.

Public relations focus on the successful and rapid deployment of a large portfolio of solar projects.

- →

Xcel Energy

Market Share Estimate:Operates in adjacent territories, including parts of Minnesota, Michigan, and Wisconsin.

Target Audience Overlap:Medium

Competitive Positioning:Positions as a national leader in the clean energy transition, being one of the first major U.S. utilities to announce a vision for 100% carbon-free electricity.

Strengths

- •

Early mover advantage and strong brand recognition as a clean energy leader.

- •

Geographically diverse service area across eight states, reducing risk from regional economic or weather events.

- •

Significant experience with integrating large amounts of wind power into their grid.

- •

Clear and ambitious carbon reduction goals (80% by 2030, 100% carbon-free by 2050).

Weaknesses

- •

Faces public and regulatory pushback on rate increases associated with the clean energy transition.

- •

More geographically dispersed operations can lead to less concentrated investment in any single state.

- •

Complex regulatory environments across multiple states.

Differentiators

Ambitious 100% carbon-free by 2050 goal sets a high bar for the industry.

Strong focus on customer programs for renewable energy choices and EV infrastructure.

- →

DTE Energy

Market Share Estimate:Primary competitor in Michigan, where WEC also has operations.

Target Audience Overlap:Medium

Competitive Positioning:Focuses on a 'CleanVision' plan for Michigan, emphasizing accelerated coal plant retirements and investment in renewables made in Michigan.

Strengths

- •

Dominant market position in Southeast Michigan.

- •

Clear, accelerated timeline for coal plant retirements (ending use by 2032).

- •

Diversified portfolio including non-regulated energy businesses.

- •

Aggressive interim carbon reduction goals (e.g., 65% by 2028).

Weaknesses

- •

Criticism for continued investment in natural gas as a transition fuel.

- •

Reliability issues and customer satisfaction challenges in their core service territory.

- •

Geographically concentrated in Michigan, making it vulnerable to state-specific economic and regulatory shifts.

Differentiators

Strong 'Michigan-made' branding for its clean energy investments.

One of the most accelerated coal retirement timelines in the Midwest.

- →

Exelon

Market Share Estimate:Major competitor in Illinois through its subsidiary ComEd, where WEC operates Peoples Gas and North Shore Gas.

Target Audience Overlap:Medium

Competitive Positioning:Positions as a pure-play transmission and distribution (T&D) utility focused on grid modernization, reliability, and enabling clean energy for customers.

Strengths

- •

Largest utility in the U.S. by customer count, providing significant scale.

- •

Pure T&D focus after spinning off its generation assets, allowing for concentrated investment in the grid.

- •

Extensive experience with smart grid technology and energy efficiency programs.

- •

Operates in major metropolitan areas like Chicago, Philadelphia, and Washington D.C.

Weaknesses

- •

Does not own generation, making it reliant on wholesale markets for power supply.

- •

Legacy reputational issues in Illinois related to lobbying practices.

- •

Manages multiple urban and dense service territories, which present unique operational challenges.

Differentiators

Exclusive focus on transmission and distribution allows it to position as an unbiased enabler of clean energy, regardless of the generation source.

Heavy investment and messaging around grid modernization and creating 'Connected Communities'.

Indirect Competitors

- →

Rooftop Solar Installers (e.g., Sunrun, SunPower, local installers)

Description:Companies that install solar panels on residential and commercial properties, allowing customers to generate their own electricity and reduce reliance on the utility grid.

Threat Level:Medium

Potential For Direct Competition:Low, but they directly reduce WEC's energy sales revenue and can challenge the utility's relationship with its customers.

- →

Community Solar Developers (e.g., Nexamp, Solstice)

Description:Develop and operate local solar farms, allowing customers who cannot install rooftop solar (e.g., renters, condo owners) to subscribe and receive credits on their utility bills.

Threat Level:Medium

Potential For Direct Competition:Medium, as utilities like Alliant are also entering the community solar space. These developers compete for customers seeking renewable energy options.

- →

Energy Storage Providers (e.g., Tesla Energy, Generac)

Description:Sell battery systems that store energy from the grid or from rooftop solar, providing backup power and enabling customers to optimize their energy usage, further reducing reliance on the utility.

Threat Level:Low

Potential For Direct Competition:Low, but their technology is a key enabler for grid independence and a challenge to the traditional utility business model.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Regulated Monopoly in Service Territories

Sustainability Assessment:Highly sustainable due to legal and regulatory frameworks that grant exclusive rights to serve customers within a geographic area.

Competitor Replication Difficulty:Hard

- Advantage:

Ownership of Critical Infrastructure

Sustainability Assessment:Highly sustainable. The vast network of transmission lines, distribution poles, and natural gas pipelines is prohibitively expensive and complex for a new entrant to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Diversified Utility Operations

Sustainability Assessment:Sustainable. Operating both electric and natural gas utilities across multiple states provides revenue stability and hedges against risks affecting a single commodity or region.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Favorable Regulatory Environment', 'estimated_duration': '1-5 years, subject to political and regulatory commission changes.'}

{'advantage': 'Established Brand Trust (We Energies)', 'estimated_duration': '5-10 years, but can be eroded by reliability issues, rate hikes, or poor customer service.'}

Disadvantages

- Disadvantage:

Significant Portfolio of Carbon-Intensive Generation Assets

Impact:Major

Addressability:Moderately

- Disadvantage:

Slower Perceived Pace of Renewable Adoption vs. Peers

Impact:Minor

Addressability:Easily

- Disadvantage:

Vulnerability to Regional Economic and Climate Events

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted digital marketing campaign highlighting specific clean energy projects and their community benefits to counter the strong ESG narratives of competitors like Alliant Energy.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Enhance the investor relations section of the website with more dynamic content and clearer data visualizations of progress towards the 2050 net-zero goal.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Accelerate investment in utility-owned, large-scale solar and battery storage projects to close the perceived gap with competitors and capture favorable federal incentives.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop and market a comprehensive suite of EV charging solutions for residential, commercial, and fleet customers to establish a dominant position in this growing market.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Transition business model to become a Distributed Energy Resource (DER) orchestrator, offering services to manage and optimize customer-owned solar and battery systems for grid stability.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in pilot programs for emerging technologies like green hydrogen and advanced nuclear to secure long-term, carbon-free generation options.

Expected Impact:High

Implementation Difficulty:Difficult

Reposition WEC Energy Group from a reliable, traditional utility to a forward-looking 'Energy Platform Orchestrator' that is actively building the clean, electrified, and resilient grid of the future. The messaging should balance the core mission of affordability and reliability with a more aggressive and visible commitment to innovation and decarbonization.

Differentiate by focusing on operational excellence in the energy transition. While competitors lead with aspirational goals, WEC can win by demonstrating superior project execution, grid reliability amidst rising renewable penetration, and tangible cost management that keeps rates competitive during the transition.

Whitespace Opportunities

- Opportunity:

Develop an 'Energy-as-a-Service' offering for large commercial and industrial customers.

Competitive Gap:Most regional utilities still focus on selling kilowatt-hours rather than providing holistic energy management, efficiency, on-site generation, and resiliency solutions.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Become the premier provider of grid infrastructure for the growing data center alley in the Midwest.

Competitive Gap:While all utilities are reacting to data center demand, a proactive strategy to pre-build robust, renewable-powered infrastructure in strategic locations could attract major tech investment.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Lead in the electrification of industrial processes.

Competitive Gap:Most utility electrification efforts are focused on transport and residential heating. There is a significant untapped market in partnering with industrial customers to convert their processes from fossil fuels to electricity.

Feasibility:Low

Potential Impact:High

WEC Energy Group operates in a mature, highly regulated, and capital-intensive utility industry. Its primary competitive advantage is its status as a regulated monopoly with ownership of critical infrastructure, which creates exceptionally high barriers to entry. The market is a regional oligopoly, with direct competition occurring at the holding company level for investment capital and in overlapping service territories with other investor-owned utilities like Alliant Energy, Xcel Energy, and DTE Energy.

The competitive landscape is being reshaped by several powerful trends, most notably the transition to clean energy, grid modernization, and the electrification of the broader economy. WEC's direct competitors, particularly Alliant Energy and Xcel Energy, are aggressively positioning themselves as leaders in this transition. Alliant Energy has made significant, highly visible investments in Wisconsin-based solar projects , while Xcel Energy maintains a strong national brand as a pioneer in decarbonization goals. DTE Energy is pursuing an accelerated coal retirement schedule in the adjacent Michigan market. This places competitive pressure on WEC to not only meet its own 2050 net-zero goal but also to effectively communicate its progress to investors and stakeholders who are increasingly focused on ESG performance.

Indirect competition is emerging from decentralized technologies. Rooftop solar installers, community solar developers , and energy storage providers are eroding the utility's traditional monopoly on energy generation. While not an immediate existential threat, this trend challenges the core business model by reducing energy sales and shifting the customer relationship.

Strategically, WEC's strengths lie in its operational scale and diversified portfolio of electric and gas utilities. However, a key vulnerability is its large base of legacy fossil fuel generation, which requires a costly and complex transition. To maintain its competitive edge, WEC must accelerate its investment in utility-scale renewables and grid modernization. Opportunities exist to move beyond the traditional role of an energy provider and become an enabler of electrification, offering comprehensive EV charging solutions and sophisticated energy management services for large customers. The key to future success will be balancing the immense capital requirements of the clean energy transition with the core mission of providing affordable and reliable power.

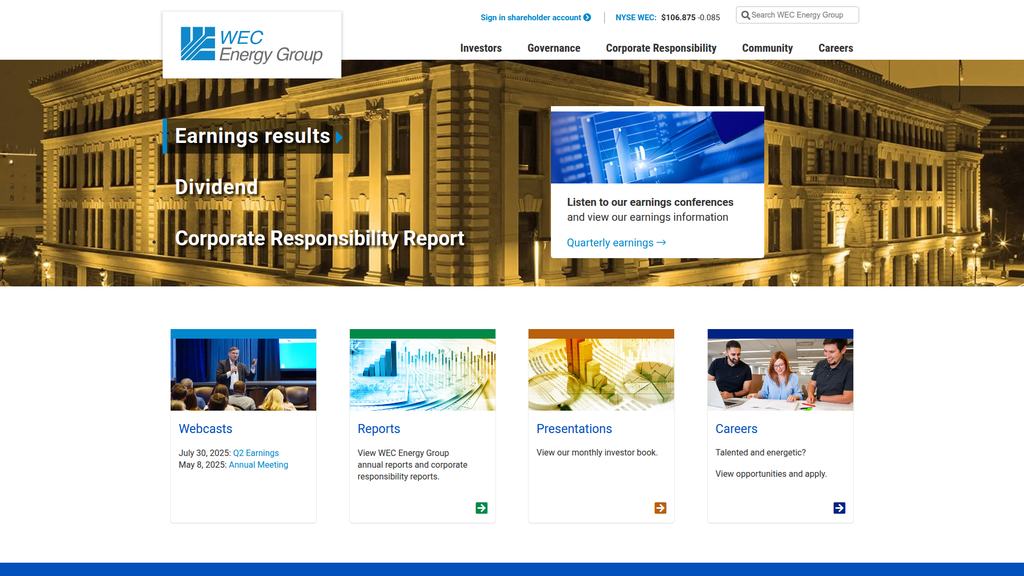

Messaging

WEC Energy Group's corporate website is a specialized communications tool precision-engineered for a narrow but critical audience: investors and the financial community. The messaging is clear, professional, and highly functional, prioritizing the delivery of financial data and corporate governance information over brand storytelling or broad public engagement. The primary messages of financial performance (earnings, dividends) and corporate responsibility (sustainability reports) are communicated with high clarity and prominence, establishing a brand voice that is formal, authoritative, and trustworthy. The value proposition is centered on financial stability, reliable shareholder returns, and a pragmatic, well-documented approach to the energy transition. This messaging strategy is effective for its intended audience, who value data over narrative and require easy access to due diligence materials. However, this singular focus creates significant messaging gaps for other important stakeholders, such as potential top-tier talent, community partners, and policymakers. The site lacks emotional appeal and a compelling narrative about the company's purpose beyond financial metrics and mandated ESG reporting. It communicates what WEC Energy Group does, but largely fails to articulate why it matters in a human or societal context. The overwhelming reliance on linking to dense PDF reports means the core story of innovation, community impact, and the human side of the energy transition remains buried. While strategically sound for investor relations, this approach positions the brand as a stoic, impersonal entity, potentially hindering talent acquisition and broader public perception in an industry where trust and a shared vision for the future are increasingly important.

Business Model Overview

WEC Energy Group is one of the largest electric generation, distribution, and natural gas delivery holding companies in the United States. It serves approximately 4.7 million customers across Wisconsin, Illinois, Michigan, and Minnesota through its various subsidiaries. Its revenue is primarily generated through the regulated sale of electricity and natural gas. The business model focuses on operational efficiency, reliable service, and delivering shareholder value through stable returns and dividends.

Key Subsidiaries

- •

We Energies

- •

Wisconsin Public Service

- •

Peoples Gas

- •

North Shore Gas

- •

Minnesota Energy Resources

- •

Michigan Gas Utilities

Regulated Electric & Gas Utility

Message Architecture

Key Messages

- Message:

Consistent and strong financial performance for investors (Earnings, Dividends).

Prominence:Primary

Clarity Score:High

Location:Hero Section (Tabs 1 & 2)

- Message:

Commitment to corporate responsibility and sustainability.

Prominence:Primary

Clarity Score:High

Location:Hero Section (Tab 3), Main Heading 'Creating a bright, sustainable future'

- Message:

Accessibility of key corporate and financial reports.

Prominence:Secondary

Clarity Score:High

Location:Reports & Presentations sections

- Message:

Our mission is 'affordable, reliable, and clean' energy.

Prominence:Tertiary

Clarity Score:Medium

Location:Implicit in report titles, explicitly stated in deeper company materials.

The message hierarchy is exceptionally clear and deliberate. The most prominent, 'above the fold' real estate is dedicated to investors, with earnings and dividends listed first. Corporate responsibility is given equal prominence but is positioned as a supporting theme. This hierarchy strongly indicates that the primary audience and strategic objective of this website is to build and maintain investor confidence. All other messages are secondary and support this core objective.

Messaging is highly consistent across the homepage. The themes of financial stewardship and responsible governance are interwoven and mutually reinforcing. There are no contradictory messages; the site maintains a singular focus on communicating corporate stability and forward-looking planning to a financially-savvy audience.

Brand Voice

Voice Attributes

- Attribute:

Formal

Strength:Strong

Examples

- •

Board declares quarterly dividend

- •

View our monthly investor book.

- •

View our Corporate Responsibility Report

- Attribute:

Financial/Corporate

Strength:Strong

Examples

- •

Listen to our earnings conferences

- •

Cash dividend of 89.25 cents per share

- •

WEC Stock Chart

- Attribute:

Impersonal

Strength:Strong

Examples

The language is entirely functional and devoid of personality, narrative, or human elements.

- Attribute:

Responsible

Strength:Moderate

Examples

Creating a bright, sustainable future

Learn about our progress and sustainability goals

Tone Analysis

Authoritative & Informational

Secondary Tones

Financial

Formal

Tone Shifts

There are no discernible tone shifts on the homepage. The voice remains consistently formal and corporate from top to bottom.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

For investors: WEC Energy Group is a stable, reliable, and well-managed utility investment that delivers consistent shareholder returns while proactively managing ESG responsibilities and the clean energy transition. For the public/regulators: We are a responsible energy provider committed to an 'affordable, reliable, and clean' future.

Value Proposition Components

- Component:

Shareholder Returns (Dividends)

Clarity:Clear

Uniqueness:Common

- Component:

Financial Stability (Earnings)

Clarity:Clear

Uniqueness:Common

- Component:

ESG Leadership (Sustainability Reporting)

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Reliability & Affordability

Clarity:Somewhat Clear

Uniqueness:Common

The core value proposition of being a stable, dividend-paying utility is not unique; it's table stakes in the sector. Differentiation is attempted through the emphasis on their 'aggressive' and 'industry-leading' ESG goals, such as achieving an 80% reduction in carbon emissions by 2030 and net-zero by 2050. However, the homepage itself does not provide proof points for this leadership, relying on the user to download a full report. Competitors like NextEra Energy and Duke Energy often have similar goals, making differentiation on the claim alone difficult without prominent, digestible evidence.

The messaging positions WEC Energy Group as a prudent, fiscally conservative, and forward-looking leader in the utility sector. It avoids hype and focuses on tangible financial metrics and comprehensive reporting, positioning itself as a trusted, blue-chip entity for long-term investors and a responsible partner for regulators.

Audience Messaging

Target Personas

- Persona:

Investor / Financial Analyst

Tailored Messages

- •

Earnings results

- •

Board declares quarterly dividend

- •

Listen to our earnings conferences

- •

View our monthly investor book.

Effectiveness:Effective

- Persona:

ESG Analyst / Regulator / Policy Maker

Tailored Messages

- •

Corporate Responsibility Report

- •

Learn about our progress and sustainability goals

- •

Creating a bright, sustainable future

Effectiveness:Somewhat Effective

- Persona:

High-Level Job Seeker / Potential Executive

Tailored Messages

Careers: Talented and energetic? View opportunities and apply.

Effectiveness:Ineffective

Audience Pain Points Addressed

- •

For Investors: The need for clear, timely, and transparent financial performance data.

- •

For Investors: The risk associated with ESG factors and the energy transition.

- •

For Regulators: The need for comprehensive documentation on corporate responsibility and sustainability progress.

Audience Aspirations Addressed

For Investors: Achieving stable, long-term financial growth and reliable dividend income.

For ESG-focused Stakeholders: The desire for a cleaner, sustainable energy future.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Stability

Effectiveness:High

Examples

Board declares quarterly dividend

Consistent presentation of earnings and financial reports.

- Appeal Type:

Responsibility & Optimism

Effectiveness:Low

Examples

Creating a bright, sustainable future

Social Proof Elements

No itemsTrust Indicators

- •

Direct links to official reports (Annual Report, Corporate Responsibility Report)

- •

Listing of Board of Directors and Management Team

- •

Prominent display of financial data (earnings, dividends)

- •

New York Stock Exchange ticker symbol (WEC) mentioned in investor section.

Calls To Action

Primary Ctas

- Text:

Listen to our earnings conferences

Location:Hero Section

Clarity:Clear

- Text:

View our Corporate Responsibility Report

Location:Hero Section & Main Body

Clarity:Clear

- Text:

View our monthly investor book.

Location:Presentations Section

Clarity:Clear

- Text:

View opportunities and apply.

Location:Careers Section

Clarity:Clear

The CTAs are clear, direct, and highly effective for their target audience of investors and analysts who arrive with pre-existing intent. They function as navigational signposts to deeper content. However, they are not persuasive and do little to encourage exploration from a less-informed or casual visitor. They are functional, not aspirational.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of a compelling brand narrative or storytelling. The human impact and the 'why' behind the company's mission are absent.

- •

No clear Employer Value Proposition (EVP) or messaging to attract top talent beyond a simple 'Careers' link.

- •

Absence of customer-centric messaging. While this is a corporate site, there is no sense of the 4.7 million people they serve.

- •

No messaging track for potential business or innovation partners.

Contradiction Points

No itemsUnderdeveloped Areas

The 'Creating a bright, sustainable future' message is underdeveloped. It's a headline without a story or immediate proof points, relying entirely on a link to a dense report.

The 'Careers' section is a missed opportunity. There's no messaging about company culture, employee benefits, or the impact one can make by working there.

Messaging Quality

Strengths

- •

Exceptional clarity and focus on the primary investor audience.

- •

Professional, trustworthy, and authoritative voice.

- •

Efficient information architecture for users seeking specific financial or ESG documents.

- •

Consistent and disciplined messaging.

Weaknesses

- •

Overly dry, impersonal, and lacking in emotional connection.

- •

Fails to engage or provide a clear narrative for non-investor audiences.

- •

Over-reliance on PDF reports to tell the story, hiding key achievements from casual view.

- •

Weak communication of brand purpose beyond financial and regulatory obligations.

Opportunities

- •

Humanize the brand by featuring employee stories or community impact projects.

- •

Create a more dynamic and engaging 'Sustainability' or 'Our Impact' web section that summarizes key achievements from the report with data visualizations, videos, and project highlights.

- •

Develop a dedicated 'Careers' section with a clear EVP to compete for top talent.

- •

Craft a compelling origin or mission story to build a stronger brand identity.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Narrative

Recommendation:Transform the 'Creating a bright, sustainable future' section. Instead of just a link, feature 3-4 key proof points with icons and stats (e.g., '54% carbon reduction since 2005,' 'Investing $23.7B in clean energy,' 'Net-zero coal by 2032'). This brings the story to life instantly.

Expected Impact:High

- Area:

Talent Acquisition Messaging

Recommendation:Build out the 'Careers' link into a dedicated landing page. Articulate the company's EVP, showcasing culture, opportunities for impact in the energy transition, and employee testimonials.

Expected Impact:High

- Area:

Value Proposition Articulation

Recommendation:Add a concise 'Who We Are' or 'Our Mission' section on the homepage that clearly states the 'affordable, reliable, clean' mission and briefly explains how they deliver on it for their 4.7 million customers.

Expected Impact:Medium

Quick Wins

- •

Rewrite the 'Careers' link text from 'Talented and energetic?' to something more compelling like 'Power the Future: Join Our Team'.

- •

Add the NYSE ticker symbol 'WEC' prominently near the top of the page as a key trust indicator for investors.

- •

In the hero section, change the static tab 'Corporate Responsibility Report' to something more active and benefit-oriented, like 'Our Clean Energy Progress'.

Long Term Recommendations

- •

Develop a content strategy that includes storytelling assets (videos, articles, infographics) showcasing innovation, employee contributions, and community impact, to be featured in a dedicated 'Impact' or 'Stories' section of the site.

- •

Create distinct messaging pathways on the website for key audiences (Investors, Talent, Community/Policy) to provide a more tailored and relevant user experience.

- •

Invest in data visualization to make the information in the dense corporate reports more accessible and engaging for a broader audience.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Operates as a regulated utility, providing essential electricity and natural gas services to approximately 4.7 million customers in defined service territories.

- •

Effectively a monopoly in its core service areas, ensuring a consistent and captive customer base.

- •

Long history of operations (founded in 1896) indicates deep market integration and established infrastructure.

- •

Consistently strong financial performance and dividend growth reflect stable demand and successful regulatory outcomes.

Improvement Areas

- •

Enhance customer engagement around new energy products and services (e.g., EV charging programs, energy efficiency solutions) to move beyond a purely transactional relationship.

- •

Improve digital customer service platforms to meet modern consumer expectations for self-service and real-time information.

- •

Increase public awareness and support for the necessity of large-scale capital investments in grid modernization and renewables.

Market Dynamics

1-2% annually for traditional demand, with significant upside from electrification and data centers.

Mature

Market Trends

- Trend:

Energy Transition & Decarbonization

Business Impact:Massive capital investment is required to shift from coal to renewables (solar, wind, battery storage), driving significant growth in the company's rate base.

- Trend:

Electrification

Business Impact:Growth in electric vehicles (EVs) and the electrification of buildings (heat pumps) is creating new, sustained electricity demand after decades of flat growth.

- Trend:

Grid Modernization & Resilience

Business Impact:Aging infrastructure and the need to integrate intermittent renewables necessitates major investments in smart grid technologies, transmission lines, and grid hardening, which expands the asset base for regulated returns.

- Trend:

Surging Data Center Demand

Business Impact:Unprecedented demand growth from AI and data centers creates a significant opportunity for utilities to expand generation capacity and serve large, consistent industrial loads.

- Trend:

Supportive Regulatory & Policy Environment

Business Impact:Federal incentives like the Inflation Reduction Act (IRA) and state-level clean energy mandates create a favorable environment for capital deployment in clean energy projects.

Excellent. WEC Energy Group is positioned at the nexus of several powerful, long-term trends (decarbonization, electrification) that require exactly the kind of large-scale capital investment that drives a utility's growth.

Business Model Scalability

High

Highly capital-intensive with significant fixed costs (power plants, grid infrastructure). Growth is achieved by investing in new, regulated assets, thereby increasing the 'rate base' on which it earns a regulated return.

High. Once infrastructure is built, the incremental cost of serving additional demand is relatively low. The primary growth lever is deploying capital into new, regulator-approved projects.

Scalability Constraints

- •

Regulatory Approval: All major investments and rate changes require approval from public service commissions, which can be a lengthy and complex process.

- •

Capital Intensity: The company's growth is directly tied to its ability to raise and deploy massive amounts of capital ($28 billion planned for 2025-2029).

- •

Permitting and Siting: Building new generation and transmission infrastructure often faces challenges related to permitting timelines and public opposition.

- •

Supply Chain: Availability of key components like transformers, solar panels, and batteries can constrain the pace of project execution.

Team Readiness

Strong. The leadership team demonstrates deep industry expertise in utility operations, finance, and regulatory affairs, which are critical for executing its capital-intensive growth plan.

Traditional, functional structure well-suited for a mature utility. However, may need more agile, cross-functional teams dedicated to emerging growth areas like commercial renewables or EV infrastructure partnerships.

Key Capability Gaps

- •

Innovation in Consumer Technology: Developing expertise in customer-facing digital products and services to capitalize on distributed energy resources (DERs) and smart home technology.

- •

Large-Scale Project Management for Renewables: Scaling project management capabilities to execute a historic number of concurrent solar, wind, and battery storage projects.

- •

Data Analytics & AI: Building advanced capabilities in data analytics for predictive grid maintenance, load forecasting, and optimizing renewable generation.

Growth Engine

Acquisition Channels

- Channel:

Economic Development Partnerships

Effectiveness:High

Optimization Potential:High

Recommendation:Proactively partner with state and local economic development agencies to attract energy-intensive industries (e.g., data centers, advanced manufacturing) to the service territory by offering reliable, clean energy solutions and specialized rates.

- Channel:

Customer Program Adoption (Energy Efficiency, EV Rates)

Effectiveness:Moderate

Optimization Potential:High

Recommendation:Utilize targeted digital marketing and customer portal notifications to increase enrollment in value-added programs. Simplify enrollment processes to reduce friction.

- Channel:

Mergers & Acquisitions

Effectiveness:Moderate

Optimization Potential:Medium

Recommendation:Continuously evaluate opportunities to acquire smaller utilities in adjacent territories to expand the regulated footprint, contingent on favorable regulatory approval.

Customer Journey

The 'conversion path' for a utility is about customer adoption of new programs. The current path likely relies on bill inserts and website information, which can be passive.

Friction Points

- •

Lack of awareness of new programs and rate plans (e.g., time-of-use rates for EV charging).

- •

Complex enrollment processes for energy efficiency rebates or renewable energy programs.

- •

Limited digital self-service options for complex inquiries or service changes.

Journey Enhancement Priorities

{'area': 'Digital Onboarding for New Programs', 'recommendation': "Create a seamless, one-click enrollment process within the customer's online account for all new services and rate plans."}

{'area': 'Proactive Customer Communication', 'recommendation': 'Use data analytics to identify customers who would benefit most from specific programs (e.g., high-consumption users for efficiency programs) and target them with personalized outreach.'}

Retention Mechanisms

- Mechanism:

Regulated Monopoly Status

Effectiveness:High

Improvement Opportunity:Not applicable; retention is structurally guaranteed in core business. Focus shifts to customer satisfaction to ensure positive regulatory and community relations.

- Mechanism:

Service Reliability & Storm Response

Effectiveness:High

Improvement Opportunity:Continue investment in grid hardening and predictive maintenance to minimize outage duration and frequency, a key driver of customer satisfaction.

- Mechanism:

Customer Satisfaction & Support

Effectiveness:Moderate

Improvement Opportunity:Invest in modernizing call center technology and expanding digital self-service capabilities to improve the overall customer experience.

Revenue Economics

Highly predictable and stable, based on regulator-approved rates and a guaranteed return on equity (ROE) on invested capital (the rate base).

Not applicable in the traditional sense. Customer acquisition cost is near-zero. The key metric is maximizing the lifetime regulated return from capital deployed to serve that customer.

High, driven by a stable revenue stream from a captive customer base and a clear, regulatory-approved framework for profitability.

Optimization Recommendations

- •

Optimize the capital investment mix towards projects with the most favorable regulatory treatment and highest contribution to rate base growth.

- •

Aggressively pursue operational efficiencies to earn returns above the approved ROE, where regulations allow for sharing of such gains.

- •

Develop new, unregulated revenue streams in adjacent markets (e.g., commercial renewable projects) that can supplement regulated earnings.

Scale Barriers

Technical Limitations

- Limitation:

Aging Grid Infrastructure

Impact:High

Solution Approach:Accelerate capital investment in grid modernization, including smart meters, automated substations, and advanced distribution management systems, as outlined in the capital plan.

- Limitation:

Interconnection Queues for Renewables

Impact:Medium

Solution Approach:Proactively invest in transmission upgrades to unlock capacity for new renewable projects and streamline the interconnection study process.

- Limitation:

Cybersecurity Threats

Impact:High

Solution Approach:Continuously invest in advanced cybersecurity measures to protect critical infrastructure from evolving threats, a key focus for grid modernization.

Operational Bottlenecks

- Bottleneck:

Permitting and Siting for New Infrastructure

Growth Impact:Can significantly delay the timeline of capital projects, deferring revenue and earnings growth.

Resolution Strategy:Implement a proactive community and regulatory engagement strategy early in the project lifecycle. Develop programmatic approaches for siting common infrastructure like solar farms.

- Bottleneck:

Supply Chain for Critical Equipment

Growth Impact:Shortages of transformers, switchgear, and renewable energy components can halt project construction.

Resolution Strategy:Develop long-term strategic partnerships with key suppliers. Diversify the supplier base where possible and improve inventory management and demand forecasting.

- Bottleneck:

Skilled Labor Shortage

Growth Impact:Lack of qualified engineers, project managers, and lineworkers can constrain the ability to execute the large-scale capital plan.

Resolution Strategy:Invest in internal training programs, apprenticeships, and partnerships with technical colleges and universities to build a talent pipeline.

Market Penetration Challenges

- Challenge:

Regulatory Lag and Rate Case Risk

Severity:Critical

Mitigation Strategy:Maintain constructive relationships with regulators through transparent communication. File well-justified rate cases that align with state policy goals (clean energy, reliability) to maximize the likelihood of favorable outcomes.

- Challenge:

Customer Affordability & Rate Pressure

Severity:Major

Mitigation Strategy:Balance large capital investments with a focus on operational efficiency to mitigate the impact on customer bills. Emphasize how investments in clean energy can reduce long-term fuel cost volatility.

- Challenge:

Competition from Distributed Generation (e.g., Rooftop Solar)

Severity:Minor

Mitigation Strategy:Develop utility-owned community solar programs. Offer rates and services that complement customer-owned generation, such as battery storage programs or specialized EV charging rates.

Resource Limitations

Talent Gaps

- •

Renewable Energy Project Development & Management

- •

Grid Data Scientists and Analysts

- •

Cybersecurity Specialists for Operational Technology

Significant and continuous access to capital markets (debt and equity) is required to fund the $28 billion 2025-2029 capital plan.

Infrastructure Needs

- •

Upgraded high-voltage transmission lines to support new renewable generation hubs.

- •

Advanced Metering Infrastructure (AMI) and supporting communications networks.

- •

Grid-scale battery storage facilities to manage renewable intermittency.

Growth Opportunities

Market Expansion

- Expansion Vector:

Acquisition of Regional Utilities

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Identify and target smaller, neighboring electric or gas utilities where operational synergies and a clear path to regulatory approval exist.

- Expansion Vector:

Expansion of Unregulated Renewable Development

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Leverage the WEC Infrastructure segment to develop and own renewable projects for commercial and industrial customers outside the regulated service territory.

Product Opportunities

- Opportunity:

Grid-Scale Battery Storage Solutions

Market Demand Evidence:Increasing need for grid stability and capacity as intermittent renewable penetration grows.

Strategic Fit:High. These are regulated assets that can be added to the rate base while enabling further renewable deployment.

Development Recommendation:Aggressively pursue development and ownership of battery storage projects, integrating them with new and existing solar and wind facilities.

- Opportunity:

Electric Vehicle (EV) Charging Infrastructure Programs

Market Demand Evidence:Rapidly growing EV adoption creates demand for residential, commercial, and public charging solutions.

Strategic Fit:High. Drives electricity sales and provides opportunities for new regulated investments in grid upgrades to support charging loads.

Development Recommendation:Launch a portfolio of EV programs, including 'make-ready' infrastructure investments, special charging rates, and potentially utility-owned public fast-charging networks.

- Opportunity:

Renewable Natural Gas (RNG) & Green Hydrogen

Market Demand Evidence:Emerging demand for decarbonized gas solutions for hard-to-electrify industrial processes and heating.

Strategic Fit:Medium. Aligns with decarbonization goals and leverages existing gas infrastructure and expertise.

Development Recommendation:Initiate pilot projects for RNG interconnection and green hydrogen production to build operational experience and test the business case.

Channel Diversification

- Channel:

Partnerships with EV Manufacturers and Dealerships

Fit Assessment:High

Implementation Strategy:Develop co-branded marketing initiatives to offer customers who purchase an EV seamless enrollment in special charging rates and smart charging programs at the point of sale.

- Channel:

Collaboration with Large Real Estate Developers

Fit Assessment:High

Implementation Strategy:Partner with developers of new residential and commercial properties to pre-install EV-ready infrastructure and smart home energy management systems, incorporating these costs into the regulated asset base.

Strategic Partnerships

- Partnership Type:

Technology (Smart Grid & AI)

Potential Partners

- •

Siemens

- •

General Electric

- •

Schneider Electric

- •

Specialized AI/ML providers

Expected Benefits:Accelerate the deployment of advanced grid management technologies, improve operational efficiency through predictive analytics, and enhance grid resilience.

- Partnership Type:

Large Industrial Customers

Potential Partners

- •

Microsoft

- •

Google

- •

Major manufacturing companies

Expected Benefits:Co-develop new generation resources and innovative rate structures (e.g., 'green tariffs') to meet the massive, 24/7 clean energy needs of data centers and industrial facilities, securing long-term load growth.

Growth Strategy

North Star Metric

Regulated Rate Base Growth

For a regulated utility, earnings growth is almost entirely a function of growing the asset base upon which it can earn a regulator-approved return. All strategic initiatives should be evaluated on their contribution to prudently investing capital that expands the rate base.

Achieve a compound annual growth rate (CAGR) in the rate base that supports the publicly stated 6.5%-7.0% annual EPS growth target.

Growth Model

Capital Deployment & Regulatory-Led Growth

Key Drivers

- •

Identification of large-scale capital investment needs aligned with public policy (clean energy, reliability).

- •

Successful execution of regulatory strategy to gain timely approval for projects and cost recovery.

- •

Efficient project management and construction to bring new assets into service on time and on budget.

- •

Disciplined operational and maintenance (O&M) cost control.

Systematically execute the 5-year, $28 billion capital plan, focusing on the announced investments in renewables, natural gas generation, and grid modernization. Maintain a proactive and transparent relationship with regulators in all jurisdictions.

Prioritized Initiatives

- Initiative:

Execute $9.1B+ Renewable Generation Transition

Expected Impact:High

Implementation Effort:High

Timeframe:2025-2029

First Steps:Secure all necessary permits and long-lead time equipment for the announced 4,300 MW of new solar, wind, and battery projects. Finalize engineering, procurement, and construction (EPC) contracts.

- Initiative:

Implement Grid Modernization & Hardening Program

Expected Impact:High

Implementation Effort:High

Timeframe:Ongoing (multi-year)

First Steps:Finalize detailed deployment plans for advanced metering, distribution automation, and transmission upgrades. File for regulatory approval of modernization programs and associated cost recovery mechanisms.

- Initiative:

Develop and Launch Large Customer 'Green Tariff' Program

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12-18 Months

First Steps:Engage with top industrial customers and data center operators to understand their clean energy needs. Design and file a new tariff structure with the public service commission that allows these customers to subscribe to dedicated renewable energy projects.

Experimentation Plan

High Leverage Tests

- Experiment:

Vehicle-to-Grid (V2G) Pilot Program

Hypothesis:A V2G pilot can demonstrate the feasibility of using EV batteries as a distributed energy resource to provide grid services, potentially creating a new value stream and reducing peak demand.

Success Metric:Number of participants, total MW capacity provided back to the grid, customer satisfaction.

- Experiment:

Community Geothermal Pilot

Hypothesis:A networked geothermal system for a new residential development can be a highly efficient way to decarbonize heating and cooling, offering a potential new regulated business line.

Success Metric:System efficiency (COP), reduction in electricity/gas usage, customer adoption rate.

For each pilot, establish clear technical, financial, and customer adoption KPIs. Measure against a baseline and control group where applicable. Focus on scalability and the potential for inclusion in future rate cases.

Launch 1-2 strategic pilot programs annually, focusing on emerging technologies with high potential for future large-scale capital deployment.

Growth Team

A centralized 'Energy Transition Strategy' group that works cross-functionally with Regulation, Corporate Development, Engineering, and Customer Solutions to ensure cohesive execution of the growth plan.

Key Roles

- •

Director of Energy Transition Strategy

- •

Manager of Electrification & New Technologies

- •

Lead, Strategic Partnerships (Industrial & Technology)

- •

Regulatory Strategy Manager for New Investments

Invest in training and external hiring to build expertise in emerging areas like renewable project finance, EV grid integration, and AI-based grid analytics. Foster a culture that supports strategic pilot programs and disciplined innovation.

WEC Energy Group is exceptionally well-positioned for sustained, long-term growth. Its foundation as a regulated utility in a stable regulatory environment provides a secure platform for earnings. The company's growth readiness is strong, not because of traditional customer acquisition, but due to its direct alignment with the multi-trillion-dollar global energy transition. The primary growth engine is a massive, regulator-supported capital deployment cycle focused on decarbonization and grid modernization. The company has a clear strategy, articulated through its $28 billion five-year capital plan, to replace its coal fleet with a portfolio of solar, wind, battery storage, and modern natural gas generation.

The key opportunities—and indeed, imperatives—are to execute this large-scale transformation efficiently, on time, and on budget. The surging demand from data centers and broader electrification provides a powerful tailwind, creating a clear need for the new infrastructure WEC plans to build. The principal barriers are not market competition but are operational and regulatory in nature: navigating complex permitting processes, managing supply chain constraints for critical equipment, attracting skilled labor, and maintaining constructive relationships with regulators to ensure timely cost recovery and attractive returns on investment.