eScore

wellsfargo.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Wells Fargo has a commanding digital presence for branded search terms due to its immense brand recognition and high domain authority. Its multi-channel presence is consistent for core banking products, and its website is a content-rich hub for existing customers. However, the site underperforms in capturing non-branded, top-of-funnel search intent, as its educational and thought leadership content is not as deep or authoritative as key competitors, limiting organic customer acquisition potential.

Excellent visibility and authority for branded and commercial-intent keywords, effectively capturing high-intent customers actively searching for Wells Fargo products.

Invest in creating deep, authoritative thought leadership content (e.g., proprietary economic reports, small business guides) to capture valuable, non-branded search traffic and rebuild brand credibility.

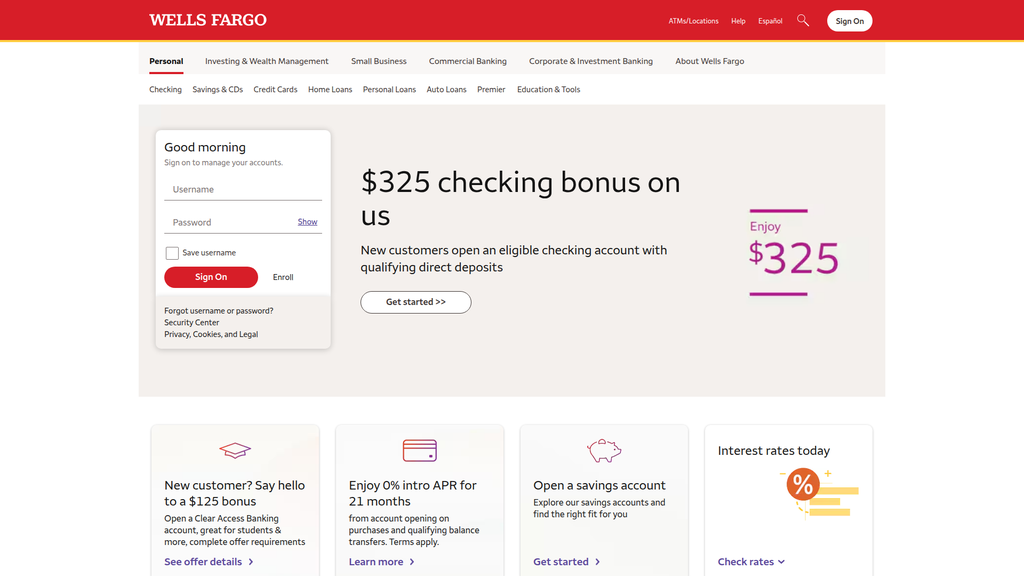

The brand's communication is highly effective at the tactical level, clearly articulating promotional offers like sign-up bonuses to drive immediate customer acquisition. However, it suffers from a strategic disconnect; the overarching brand narrative is weak and inconsistent, vacillating between transactional offers and generic claims of community support. This fails to create a differentiated brand identity or effectively address the significant trust deficit from past scandals, leaving the core 'Why Wells Fargo?' question unanswered.

Messaging for new customer acquisition is exceptionally clear and compelling, with prominent, high-value promotional offers that effectively drive conversions.

Develop a unified, authentic brand narrative focused on rebuilding trust. This message must be integrated across all communications to bridge the gap between transactional product ads and the desired image of a trusted financial partner.

The website's homepage offers a clear, logical experience, effectively segmenting existing and new customers. However, the conversion journey is hampered by notable inconsistencies in design and user interface quality between the modern homepage and dated, utilitarian interior pages like the location finder. Key calls-to-action are often styled as simple text links rather than prominent buttons, reducing their visual affordance and potentially suppressing conversion rates for primary business goals.

A well-structured homepage hierarchy that immediately serves the needs of existing customers (login) while simultaneously presenting clear acquisition offers to prospective clients.

Convert all primary, conversion-oriented calls-to-action from text links (e.g., 'Get started >>') to high-contrast, solid-background buttons to increase visual prominence and improve click-through rates.

Wells Fargo demonstrates a mature and sophisticated approach to legal and regulatory compliance, with comprehensive privacy policies and clear industry-required disclosures like 'Member FDIC'. This foundational credibility is, however, severely undermined by the lingering reputational damage from past scandals, which creates a significant trust deficit in the market. While the site is rich with trust signals like security guarantees, it lacks crucial social proof elements like customer testimonials, which are vital for rebuilding credibility.

Robust and multi-layered legal compliance framework, including tailored privacy policies (GLBA, CCPA) and prominent, industry-specific disclosures that meet regulatory requirements.

Systematically integrate social proof, such as customer testimonials and success stories, onto key product pages to humanize the brand and provide third-party validation, which is crucial for rebuilding trust.

The company's competitive moat is built on traditional, hard-to-replicate assets: a massive, diversified customer base with high switching costs and one of the largest physical branch networks in the U.S. This provides a durable advantage against digital-only competitors. However, this strength is counterbalanced by a significant disadvantage in brand reputation and a perceived lag in digital innovation compared to direct competitors like JPMorgan Chase.

The combination of a vast physical branch network and a massive, entrenched customer base creates high switching costs and a defensive moat that is difficult for fintechs and neobanks to overcome.

Address the perceived lag in digital innovation by accelerating investment in the mobile app's user experience to achieve feature and design parity with technology-leading competitors.

As one of the largest banks in the U.S., Wells Fargo's business model is inherently scalable, with high operational leverage in its digital offerings and a well-capitalized foundation. The bank is actively pursuing market expansion in high-margin areas like wealth management and SMB banking. However, scalability is constrained by significant operational overhead from legacy technology systems and a complex regulatory environment that can slow down innovation and new product deployment.

A highly scalable business model with high operational leverage, allowing for profitable growth as more customers are served through efficient digital channels with low marginal costs.

Invest in 'RegTech' (Regulatory Technology) to automate compliance processes, which would reduce a major operational bottleneck and free up capital and human resources for growth-focused initiatives.

Wells Fargo operates a highly diversified and resilient business model, with strong revenue streams from both net interest income and fee-based services across various segments. The strategic focus under the current leadership on improving efficiency and risk management is sound. However, the model's coherence is weakened by a misalignment between its traditional, branch-centric history and the market's accelerating demand for digital-first experiences and genuine brand trustworthiness.

A highly diversified business model with four major segments (Consumer, Commercial, Corporate & Investment, Wealth Management) provides multiple, resilient revenue streams that reduce dependency on any single market condition.

Accelerate the transformation of physical branches from transactional centers to 'Omnichannel Advisory' hubs, better aligning this key resource with a modern, advice-oriented value proposition.

As one of the 'Big Four' U.S. banks, Wells Fargo possesses immense market power, holding a top-tier market share in deposits, mortgages, and commercial banking. This scale provides significant leverage with partners and the ability to influence market standards. This power is currently constrained by weakened pricing power due to reputational issues, forcing a reliance on promotional offers, and intense competition from both large banks and agile fintechs that are eroding market share in specific segments.

Maintains a dominant market share in core U.S. banking segments, including being one of the largest retail mortgage originators and commercial banks, which provides immense stability and market influence.

Develop and launch a suite of integrated digital tools specifically for small businesses to create a competitive moat against fintechs like Square and Block, thereby protecting and growing share in this lucrative market.

Business Overview

Business Classification

Diversified Financial Services

Retail and Commercial Banking

Financial Services

Sub Verticals

- •

Consumer Banking & Lending

- •

Commercial Banking

- •

Corporate & Investment Banking

- •

Wealth & Investment Management

Mature

Maturity Indicators

- •

Established brand with over 150 years of history.

- •

Extensive nationwide physical presence with thousands of branches and ATMs.

- •

Subject to significant and ongoing regulatory oversight, typical for a systemically important financial institution.

- •

Focus on operational efficiency and cost reduction rather than purely aggressive growth.

- •

Long history of dividend payments and share repurchase programs.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Net Interest Income

Description:The core revenue driver, representing the difference between interest earned on assets (like loans and securities) and interest paid on liabilities (like deposits). This stream is directly influenced by the volume of loans (mortgages, auto, commercial) and prevailing interest rates.

Estimated Importance:Primary

Customer Segment:All Segments (Consumer, Commercial, Corporate)

Estimated Margin:Medium

- Stream Name:

Noninterest Income (Fee-Based)

Description:Generated from a wide array of fees for services, including account maintenance fees, overdraft fees, card fees (interchange), wealth and investment management fees, mortgage servicing fees, and investment banking advisory fees.

Estimated Importance:Primary

Customer Segment:All Segments (Consumer, Commercial, Corporate, Wealth Management)

Estimated Margin:High

- Stream Name:

Community Banking Revenue

Description:Represents the largest single segment, encompassing revenue from retail customers and small businesses, including deposits, loans (mortgages, credit cards, auto), and various service charges.

Estimated Importance:Primary

Customer Segment:Retail Consumers & Small Businesses

Estimated Margin:Medium

- Stream Name:

Wealth and Investment Management

Description:Fee-based revenue from managing assets for high-net-worth individuals and institutions, providing financial planning, private banking, and investment advisory services.

Estimated Importance:Secondary

Customer Segment:High-Net-Worth Individuals & Institutions

Estimated Margin:High

Recurring Revenue Components

- •

Net interest income from outstanding loan portfolios

- •

Monthly/annual account maintenance fees

- •

Asset-based fees from wealth and investment management

- •

Loan and mortgage servicing fees

- •

Credit card annual fees and interest

Pricing Strategy

Hybrid (Interest Spread, Fee-for-Service, Asset-Based Fees)

Mid-range

Semi-transparent

Pricing Psychology

- •

Tiered Pricing (e.g., Premier Checking with added benefits for higher balances)

- •

Promotional Pricing (e.g., introductory bonuses for new checking accounts or credit cards)

- •

Relationship-based pricing (fee waivers or better rates for customers with multiple products)

Monetization Assessment

Strengths

- •

Highly diversified revenue model across multiple business lines, reducing dependence on any single stream.

- •

Massive customer base provides a stable source of both interest and noninterest income.

- •

Strong position in core lending markets like mortgages and commercial loans provides significant interest income.

Weaknesses

- •

High sensitivity to interest rate fluctuations, which can compress net interest margins.

- •

Reputational damage has led to customer attrition and may hinder the ability to attract new, high-value clients.

- •

Regulatory caps on asset growth have historically limited the expansion of its primary revenue-generating activities.

Opportunities

- •

Aggressively expanding the wealth management business to capture more stable, high-margin fee revenue.

- •

Growing the investment banking division to better compete with peers and diversify fee income.

- •

Developing and monetizing new digital services and capabilities to meet evolving customer expectations and compete with fintechs.

Threats

- •

Intense competition from other large banks (JPMorgan Chase, Bank of America) and agile fintech companies.

- •

Economic downturns leading to increased loan defaults and reduced borrowing demand.

- •

Continued regulatory scrutiny could lead to further fines and restrictions, impacting profitability.

Market Positioning

Diversified, community-focused universal bank aiming to be a one-stop-shop for a broad spectrum of financial needs, from individual consumers to large corporations.

One of the 'Big Four' US banks, holding a top-tier market share in consumer deposits, commercial banking, and mortgage lending.

Target Segments

- Segment Name:

Retail Consumers

Description:Individuals and families across the income spectrum seeking everyday banking services like checking/savings accounts, credit cards, mortgages, and auto loans.

Demographic Factors

- •

Broad age range (students to retirees)

- •

Varying income levels

- •

Nationwide geographic distribution

Psychographic Factors

- •

Value convenience and accessibility (both physical and digital)

- •

Seek security and stability from a large, established institution

- •

May be price-sensitive regarding fees and interest rates

Behavioral Factors

- •

Utilize both branch banking and digital platforms (online/mobile)

- •

Tend to bundle multiple financial products with one provider

- •

Engage in frequent, low-value transactions (debit/credit card usage)

Pain Points

- •

Complex fee structures

- •

Perceived lack of personalized service

- •

Navigating the process for large loans (e.g., mortgages)

Fit Assessment:Good

Segment Potential:Medium

- Segment Name:

Small and Medium Enterprises (SMEs)

Description:Businesses requiring services like business checking, commercial loans, lines of credit, treasury management, and merchant services.

Demographic Factors

Annual revenues typically up to $5 million for small business, higher for middle-market.

Across various industries (retail, services, manufacturing)

Psychographic Factors

- •

Value relationships with bankers

- •

Seek a financial partner who understands their business needs

- •

Desire streamlined and efficient financial management tools

Behavioral Factors

- •

Need for flexible credit and financing options

- •

Regularly use treasury and cash management services

- •

May require specialized industry expertise

Pain Points

- •

Access to capital and credit

- •

Complexity of cash flow management

- •

Time spent on banking and financial administration

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Wealth Management Clients

Description:High-net-worth individuals and families needing sophisticated financial planning, investment management, trust, and private banking services.

Demographic Factors

- •

High income and significant investable assets

- •

Often business owners, executives, or inheritors of wealth

- •

Typically older, but with a growing segment of younger, tech-savvy wealthy individuals

Psychographic Factors

- •

Focused on wealth preservation and growth

- •

Value expertise, trust, and personalized advice

- •

Concerned with estate planning and intergenerational wealth transfer

Behavioral Factors

- •

Seek a dedicated relationship manager or team of specialists.

- •

Engage in complex investment strategies

- •

Utilize specialized credit and lending solutions

Pain Points

- •

Navigating complex financial markets and tax implications

- •

Ensuring long-term financial security for their family

- •

Finding a trustworthy and competent advisor

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Extensive Branch and ATM Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Recognition and Longevity

Strength:Moderate

Sustainability:Sustainable

- Factor:

Diversified Product Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Trust and Reputation

Strength:Weak

Sustainability:Temporary

Value Proposition

To provide a comprehensive and convenient range of financial products and services for all customer segments, backed by the stability and reach of a major national bank, aiming to satisfy all of our customers' financial needs and help them succeed financially.

Good

Key Benefits

- Benefit:

Comprehensive Financial Solutions

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Wide array of products: checking, savings, credit cards, mortgages, auto loans, investing.

- Benefit:

Accessibility and Convenience

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

One of the largest branch and ATM networks in the U.S.

Robust online and mobile banking platforms.

- Benefit:

Stability and Security

Importance:Critical

Differentiation:Common

Proof Elements

FDIC insurance

Long-standing history as a major U.S. financial institution.

Unique Selling Points

- Usp:

Integrated 'Bricks-and-Clicks' Model

Sustainability:Long-term

Defensibility:Strong

- Usp:

Leading Position in U.S. Middle-Market Commercial Banking

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Need for a single provider for all financial services

Severity:Major

Solution Effectiveness:Complete

- Problem:

Requirement for convenient access to cash and in-person banking services

Severity:Major

Solution Effectiveness:Complete

- Problem:

Difficulty in obtaining large-scale financing (mortgage or business loans)

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

Medium

The model is well-aligned with traditional banking needs but is adapting more slowly than competitors to the demand for seamless, digital-first experiences and is misaligned with market sentiment regarding trust and ethics.

High

The value proposition strongly aligns with its core target audiences who prioritize stability, convenience of a national branch network, and a comprehensive product suite over cutting-edge digital features or niche services.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Payment Networks (Visa, Mastercard, American Express)

- •

Technology Providers (e.g., Google for Cloud, Microsoft Azure).

- •

Fintech companies (for specific service integrations).

- •

Auto Dealerships (for indirect auto lending)

- •

Correspondent Banks

Key Activities

- •

Lending and Credit Underwriting

- •

Deposit Taking and Management

- •

Payment Processing

- •

Wealth and Asset Management

- •

Risk Management and Regulatory Compliance

- •

Investment Banking and Advisory.

Key Resources

- •

Federal Banking Charter

- •

Significant Capital Base

- •

Extensive Branch and ATM Network.

- •

Brand Name and Customer Base.

- •

Proprietary Technology and Customer Data

- •

Large Employee Base

Cost Structure

- •

Employee Compensation and Benefits

- •

Interest Expense on Deposits

- •

Technology and Infrastructure Costs.

- •

Regulatory Compliance and Legal Expenses

- •

Physical Branch and Office Leases

- •

Marketing and Advertising

Swot Analysis

Strengths

- •

Diversified business model across multiple financial service sectors.

- •

Vast customer base and one of the largest branch networks in the US.

- •

Strong brand recognition and long operating history.

- •

Significant market share in key segments like commercial banking and mortgages.

Weaknesses

- •

Severe reputational damage from numerous scandals, eroding customer trust.

- •

Ongoing regulatory scrutiny and consent orders, including a restrictive asset cap that has hampered growth.

- •

Lagging peers in certain high-growth areas like investment banking.

- •

Perceived as less innovative compared to fintech startups and some large bank rivals.

Opportunities

- •

Accelerate digital transformation to enhance customer experience and improve efficiency.

- •

Expand wealth and investment management services to grow stable, fee-based income.

- •

Rebuild brand trust through transparent and ethical practices to win back customers.

- •

Leverage AI and data analytics to offer hyper-personalized services and improve risk management.

Threats

- •

Intense competition from traditional 'Big Four' banks, regional banks, and agile fintech companies.

- •

Stringent and evolving regulatory landscape increasing compliance costs and operational complexity.

- •

Potential for economic downturns to increase credit losses and reduce loan demand.

- •

Cybersecurity risks and data breaches targeting large financial institutions.

Recommendations

Priority Improvements

- Area:

Reputation and Trust Management

Recommendation:Launch a sustained, transparent marketing and public relations campaign focused on demonstrating concrete changes in corporate culture, ethical practices, and customer-centricity. Go beyond apologies to showcase tangible actions and customer restitution.

Expected Impact:High

- Area:

Digital Customer Experience

Recommendation:Overhaul the digital onboarding process for all core products to be a 100% mobile-first, seamless experience. Invest heavily in UI/UX to create a simpler, more intuitive digital banking platform that rivals leading fintech applications.

Expected Impact:High

- Area:

Regulatory Compliance and Risk Management

Recommendation:Continue to invest aggressively in risk management infrastructure and compliance technology to fully resolve all outstanding consent orders and prevent future lapses. Position the bank as a leader in regulatory compliance to fully remove the asset cap and restore regulator confidence.

Expected Impact:High

Business Model Innovation

- •

Develop a 'Banking-as-a-Platform' model by exposing APIs for third-party fintechs to build services on top of Wells Fargo's infrastructure, creating a new revenue stream and fostering an innovation ecosystem.

- •

Create hyper-personalized financial wellness platforms powered by AI that proactively offer advice, savings tools, and investment opportunities based on a customer's complete financial picture.

- •

Launch a standalone digital bank brand to attract younger, digital-native customers who may be hesitant to engage with the core Wells Fargo brand, allowing for more agile product development and a different value proposition.

Revenue Diversification

- •

Accelerate the strategic push into investment banking to capture a larger share of corporate advisory and capital markets fees.

- •

Build out a suite of subscription-based financial planning and data analytics tools for small businesses, moving beyond traditional lending.

- •

Expand into adjacent fee-generating services, such as specialized insurance products or ESG (Environmental, Social, and Governance) investment advisory services.

Wells Fargo operates as a mature, diversified financial services behemoth, anchored by a traditional, interest-spread-based business model. Its core strengths lie in its immense scale, nationwide physical footprint, and entrenched position across key consumer and commercial banking segments. However, the institution is at a critical inflection point. The business model, while historically successful, has been severely hampered by the fallout from a series of profound risk management and cultural failures. These scandals have not only led to significant financial penalties and a growth-limiting asset cap but have also deeply eroded the most critical asset for any bank: trust. Consequently, the primary strategic imperative for Wells Fargo is not merely optimization but a fundamental transformation centered on rebuilding its reputation and accelerating its adaptation to the digital era.

The current business model faces significant threats from two fronts: agile, customer-centric fintech competitors who excel at digital user experience, and larger banking peers like JPMorgan Chase and Bank of America, who have arguably been more successful in navigating digital transformation and expanding into higher-growth areas like investment banking. Wells Fargo's evolution depends on its ability to leverage its scale and customer base while radically improving its technology stack, digital offerings, and internal control environment. Strategic opportunities in wealth management and investment banking offer pathways to higher-margin, less capital-intensive revenue streams, which are crucial for future growth. The ultimate success of Wells Fargo's business model evolution will be measured by its ability to resolve its regulatory issues, transition from a product-centric to a truly customer-centric and digitally-native organization, and convince the market and its customers that it has genuinely transformed its culture.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Regulatory Compliance & Licensing

Impact:High

- Barrier:

High Capital Requirements

Impact:High

- Barrier:

Brand Recognition and Customer Trust

Impact:High

- Barrier:

Existing Physical and Digital Infrastructure

Impact:High

Industry Trends

- Trend:

Digital Transformation and AI Integration

Impact On Business:Requires significant investment in technology to enhance customer experience, personalize services, and improve operational efficiency to keep pace with digitally native competitors.

Timeline:Immediate

- Trend:

Rise of Fintech and Embedded Finance

Impact On Business:Erodes traditional revenue streams as non-bank players offer specialized, user-friendly financial products, increasing competition for customer relationships and transactions.

Timeline:Immediate

- Trend:

Heightened Cybersecurity Threats

Impact On Business:Increased risk of sophisticated fraud, data breaches, and AI-driven attacks necessitates continuous and escalating investment in security infrastructure to maintain customer trust and regulatory compliance.

Timeline:Immediate

- Trend:

Focus on ESG (Environmental, Social, Governance)

Impact On Business:Growing pressure from investors and customers to demonstrate commitment to sustainable and ethical practices, impacting lending policies, investment strategies, and corporate reputation.

Timeline:Near-term

Direct Competitors

- →

JPMorgan Chase & Co.

Market Share Estimate:Leading market share in the U.S.

Target Audience Overlap:High

Competitive Positioning:Positions itself as a premium, technology-forward, full-service financial powerhouse, catering to a broad spectrum from mass-market consumers to high-net-worth individuals and large corporations.

Strengths

- •

Largest U.S. bank by assets with a 'fortress balance sheet'.

- •

Industry leader in digital and mobile banking technology and innovation.

- •

Highly diversified business model including strong consumer, commercial, and investment banking arms.

- •

Strong brand reputation and high consideration among potential new customers, especially higher-income earners.

- •

Excellent credit card offerings with popular rewards programs.

Weaknesses

- •

Faces significant regulatory scrutiny due to its size and systemic importance.

- •

Can be perceived as large and bureaucratic, potentially leading to less personalized customer service.

- •

Higher fees on certain products compared to smaller banks and fintechs.

Differentiators

- •

Superior digital banking experience and features.

- •

Dominant position in investment banking and wealth management.

- •

Extensive and well-integrated product ecosystem.

- →

Bank of America

Market Share Estimate:Second-largest bank in the U.S. by assets.

Target Audience Overlap:High

Competitive Positioning:A ubiquitous, accessible bank for the American mass-market, with a strong emphasis on its nationwide physical presence and integrated wealth management services through Merrill Lynch.

Strengths

- •

Vast nationwide network of branches and ATMs, providing broad accessibility.

- •

Strong digital banking platform with high user adoption and innovative features like the AI assistant 'Erica'.

- •

Diverse service offerings catering to individuals, small businesses, and large corporations.

- •

Strong brand recognition and high consideration among middle-income consumers.

Weaknesses

- •

Vulnerability to cybersecurity breaches and reputational damage from past incidents.

- •

Can have inconsistent customer service experiences across its large network.

- •

Slightly less dominant in the premium credit card space compared to Chase.

Differentiators

- •

Integration of Merrill Lynch wealth management provides a key advantage in serving affluent customers.

- •

Massive physical footprint is a key asset for customers who value in-person banking.

- •

Focus on providing a versatile range of products tailored to different customer segments.

- →

Citigroup

Market Share Estimate:Fourth-largest bank in the U.S. by assets.

Target Audience Overlap:Medium

Competitive Positioning:A globally-focused bank strategically simplifying its retail presence to concentrate on wealth management and institutional services in key urban hubs.

Strengths

- •

Significant global presence and expertise in international banking.

- •

Strong credit card business with major partnerships.

- •

Focused strategy on high-growth areas like wealth management and institutional banking.

- •

Concentrated branch presence in major, high-net-worth U.S. metropolitan areas.

Weaknesses

- •

Smaller U.S. retail branch network compared to other 'Big Four' banks, limiting mass-market reach.

- •

Ongoing strategic overhaul and exit from many international consumer markets creates business disruption and uncertainty.

- •

Brand perception in U.S. retail banking is less prominent than Chase or Bank of America.

Differentiators

- •

Unparalleled global network for institutional clients.

- •

Strategic focus on wealth management hubs.

- •

Simplified retail product offerings based on relationship tiers.

Indirect Competitors

- →

Chime

Description:A leading U.S. neobank offering fee-free checking and savings accounts, early direct deposit, and a credit-builder card, primarily through a mobile app.

Threat Level:High

Potential For Direct Competition:Increasingly becoming a primary banking choice for a significant portion of the U.S. population, especially younger and lower-to-middle income demographics.

- →

Apple (Financial Services)

Description:Offers financial products like the Apple Card (credit card) and Apple Savings, deeply integrated into its iOS ecosystem. Leverages its massive user base and brand loyalty.

Threat Level:Medium

Potential For Direct Competition:High. Apple's seamless integration of financial services into its hardware and software ecosystem poses a significant long-term threat of disintermediating traditional banks from the customer payment experience.

- →

PayPal / Venmo

Description:Dominant digital payment platforms that have expanded into other financial services, including debit cards, credit cards, savings accounts, and cryptocurrency trading.

Threat Level:Medium

Potential For Direct Competition:Already competes directly in payments and is expanding its portfolio. Its large, active user base makes it a formidable competitor for a share of the customer's financial life.

- →

Block (formerly Square)

Description:Started with payment processing for small businesses and expanded into a broad ecosystem including business banking, loans (Square Capital), and consumer finance (Cash App).

Threat Level:High

Potential For Direct Competition:Cash App is a major competitor to Venmo and neobanks for the consumer segment, while its merchant services directly compete with traditional small business banking.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Vast Physical Footprint

Sustainability Assessment:While diminishing in importance, the extensive branch and ATM network remains a key advantage for certain demographics, small businesses, and complex transactions.

Competitor Replication Difficulty:Hard

- Advantage:

Massive, Diversified Customer Base

Sustainability Assessment:High customer switching costs and a broad portfolio of products (banking, mortgage, wealth management) create a sticky customer relationship that is difficult for specialized competitors to fully displace.

Competitor Replication Difficulty:Hard

- Advantage:

Established Brand Recognition

Sustainability Assessment:Despite reputational damage, the Wells Fargo brand is deeply entrenched in the American financial landscape, conveying a sense of stability that newer entrants lack.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Promotional Offers and Bonuses', 'estimated_duration': "Short-term (3-6 months per campaign). As seen on the homepage, offers like a '$325 checking bonus' can attract new customers but are easily matched or surpassed by competitors."}

Disadvantages

- Disadvantage:

Significant Reputational Damage

Impact:Critical

Addressability:Difficult

- Disadvantage:

Perceived Lag in Digital Innovation

Impact:Major

Addressability:Moderately

- Disadvantage:

Ongoing Regulatory Scrutiny

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted marketing campaign focused on trust and transparency, directly addressing past issues and highlighting new customer protection policies.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Simplify the fee structure for basic checking and savings accounts to be more competitive with neobank offerings.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Prominently feature and promote the 'Fargo' AI assistant across all digital channels to counter competitors' tech-forward image.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Accelerate investment in UX/UI for the mobile app and online banking to achieve parity or superiority over direct competitors like Chase.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop and launch a suite of integrated digital tools specifically for small businesses, combining banking, payments, and expense management to compete with Square and fintechs.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Establish strategic partnerships with fintech companies to quickly integrate innovative features, rather than relying solely on in-house development.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Invest in building a leadership position in a specific high-growth area, such as sustainable finance or banking services for the creator economy, to create a new narrative for the brand.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore a Banking-as-a-Service (BaaS) model to leverage its banking charter and infrastructure, powering other non-financial companies' embedded finance offerings.

Expected Impact:High

Implementation Difficulty:Difficult

Reposition from a traditional, scandal-tarnished institution to a forward-looking 'financial wellness partner,' emphasizing a hybrid approach that combines best-in-class digital tools for daily banking with accessible human expertise for major life moments.

Differentiate on the basis of 'accessible expertise.' Leverage the physical branch network not just for transactions, but as community hubs for financial education and personalized advice, creating a tangible advantage that digital-only competitors cannot replicate.

Whitespace Opportunities

- Opportunity:

Integrated Financial Planning for the Mass Market

Competitive Gap:While competitors offer sophisticated wealth management for high-net-worth individuals, there is a gap in providing truly integrated, AI-driven financial planning and wellness tools for the mass-market consumer.

Feasibility:High

Potential Impact:High

- Opportunity:

Small Business (SMB) Operational Ecosystem

Competitive Gap:Traditional banks offer siloed products for SMBs (checking, loans, credit cards). A fully integrated platform combining banking, invoicing, payroll, and inventory management could capture significant market share from fintechs.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Banking Services for the Aging Population

Competitive Gap:Develop specialized digital tools and in-person services designed for seniors, focusing on security, simplicity, and elder fraud protection—a large and underserved demographic.

Feasibility:High

Potential Impact:Medium

Wells Fargo operates in a mature, oligopolistic U.S. banking industry, where it competes fiercely with other giants like JPMorgan Chase and Bank of America. Its primary challenge is overcoming the significant, lingering reputational damage from past scandals, which has eroded customer trust. This disadvantage is compounded by a market perception that it lags direct competitors, particularly JPMorgan Chase, in digital innovation and user experience.

Direct competitors like JPMorgan Chase and Bank of America have strong brand equity and are leaders in digital banking, setting a high bar for customer expectations. Indirectly, Wells Fargo faces an existential threat from agile fintechs and neobanks like Chime and Cash App, which are rapidly capturing market share, especially among younger demographics, with fee-free models and superior mobile experiences. Big tech firms like Apple are also encroaching on the financial services space, further disintermediating traditional banks from their customers.

Wells Fargo's sustainable advantages—its vast branch network and massive, entrenched customer base—provide a defensive moat. However, the industry's trajectory is clearly toward digital-first engagement. The strategic imperative for Wells Fargo is twofold: first, to aggressively and authentically rebuild trust through transparent practices and customer-centric policies; and second, to accelerate its digital transformation to not only match but exceed competitor offerings in key areas. Opportunities exist in leveraging its physical presence for high-value advisory services and in targeting underserved segments like small businesses with integrated digital solutions. Failure to address its reputational and technological gaps will risk a slow erosion of its market position as customers migrate to more trusted and technologically adept providers.

Messaging

Message Architecture

Key Messages

- Message:

$325 checking bonus on us. New customers open an eligible checking account with qualifying direct deposits.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Serving our customers and communities. It doesn't happen with one transaction... It's earned relationship by relationship.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage Mid-Section

- Message:

Enjoy 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers.

Prominence:Primary

Clarity Score:High

Location:Homepage Promotional Tile

- Message:

A comprehensive suite of financial products including Checking, Savings, Credit Cards, Home Loans, and Investing.

Prominence:Tertiary

Clarity Score:High

Location:Main Navigation Menu and throughout the site structure

The message hierarchy is heavily skewed towards new customer acquisition. Transactional, high-value offers (e.g., '$325 bonus') are given the most prominent visual real estate. Relationship-building and trust-oriented messages ('Serving our communities') are present but are secondary and feel more like corporate talking points than a core part of the value proposition. The site's structure is fundamentally product-driven, reinforcing a transactional relationship.

Messaging is highly consistent within product silos. A checking account page consistently discusses daily financial management, while a mortgage page consistently discusses homeownership. However, the overarching brand message is inconsistent. The homepage promotes aggressive, short-term offers while also featuring a section on long-term community relationships, creating a messaging disconnect between 'what we sell' and 'who we are'.

Brand Voice

Voice Attributes

- Attribute:

Transactional

Strength:Strong

Examples

- •

Get started >>

- •

Learn more

- •

See offer details

- •

Open a savings account

- Attribute:

Helpful

Strength:Moderate

Examples

- •

How can we help?

- •

An account that helps you spend only what you have in it

- •

Kick off your savings journey with the right tips and tools

- Attribute:

Formal/Corporate

Strength:Moderate

Examples

- •

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control.

- •

Our most popular account for managing day-to-day financial needs

- •

An interest-bearing account with our premier level of relationship banking benefits

- Attribute:

Aspirational

Strength:Weak

Examples

Make your dream of homeownership a reality

Elevate your financial expectations

Tone Analysis

Direct and Utilitarian

Secondary Tones

- •

Promotional

- •

Informational

- •

Reassuring

Tone Shifts

Shifts from highly promotional and urgent ('$325 bonus') on the homepage to a more subdued, corporate, and trust-focused tone in the 'Serving our communities' section.

The tone becomes more aspirational and exclusive when discussing 'Premier' services compared to standard checking accounts.

Voice Consistency Rating

Fair

Consistency Issues

- •

The voice lacks a singular, recognizable personality. It vacillates between a direct-response marketer and a formal corporate institution.

- •

The attempt to sound community-oriented feels disconnected from the overwhelmingly transactional nature of the rest of the site's content.

- •

There is minimal emotional warmth or empathy in the language, which is a missed opportunity for a brand needing to rebuild trust.

Value Proposition Assessment

Wells Fargo is a comprehensive, one-stop-shop for all personal and business financial products, offering competitive incentives for new customers.

Value Proposition Components

- Component:

Breadth of Products

Clarity:Clear

Uniqueness:Common

- Component:

New Customer Incentives

Clarity:Clear

Uniqueness:Common

- Component:

Convenience (Digital & Physical)

Clarity:Somewhat Clear

Uniqueness:Common

- Component:

Financial Guidance & Tools

Clarity:Somewhat Clear

Uniqueness:Common

- Component:

Community Commitment

Clarity:Unclear

Uniqueness:Common

Differentiation is extremely weak. The value proposition is based on product parity and promotional offers, which is the standard for the 'Big Four' US banks. There is no compelling, unique reason communicated for why a customer should choose Wells Fargo over Chase, Bank of America, or Citibank, other than the specific cash bonus available at that moment. The messaging fails to leverage the bank's history or community efforts into a tangible differentiator.

The messaging positions Wells Fargo as a direct, feature-for-feature competitor to other major national banks. It competes primarily on price (bonuses, intro APRs) and breadth of services. It does not effectively position itself as a leader in digital experience (a space often claimed by Chase) or as a trusted advisor (a position smaller banks and credit unions strive for). The brand's tarnished reputation is a significant unaddressed factor in its competitive positioning.

Audience Messaging

Target Personas

- Persona:

The 'Rate Shopper' / New Customer

Tailored Messages

- •

$325 checking bonus on us

- •

New customer? Say hello to a $125 bonus

- •

Enjoy 0% intro APR for 21 months

Effectiveness:Effective

- Persona:

The 'Life Stage' Borrower (Home, Auto, Personal)

Tailored Messages

- •

A home of your own. With low down payment options...

- •

Learn how a personal loan can help you with funds for life events

- •

Combine your higher-interest debt into one manageable payment

Effectiveness:Somewhat Effective

- Persona:

The Student / Teen

Tailored Messages

Open a Clear Access Banking account, great for students & more

An account that helps you spend only what you have in it

Effectiveness:Effective

- Persona:

The Affluent / 'Premier' Customer

Tailored Messages

Elevate your financial expectations

An interest-bearing account with our premier level of relationship banking benefits

Effectiveness:Somewhat Effective

Audience Pain Points Addressed

- •

Cost of banking (addressed by bonuses and fee-avoidance options)

- •

Managing day-to-day finances

- •

High-interest debt (addressed by consolidation loans)

- •

Making large purchases (addressed by personal loans and home loans)

- •

Getting started with saving or investing

Audience Aspirations Addressed

- •

Homeownership

- •

Financial success for children

- •

Achieving financial goals (saving, investing)

Persuasion Elements

Emotional Appeals

- Appeal Type:

Financial Gain / Greed

Effectiveness:High

Examples

$325 checking bonus on us

$125 bonus

- Appeal Type:

Security / Peace of Mind

Effectiveness:Medium

Examples

Provide a guaranteed rate of return, even during uncertain times (CDs)

Start securing your financial future with the help of our advice

- Appeal Type:

Achievement / Aspiration

Effectiveness:Low

Examples

Make your dream of homeownership a reality

Elevate your financial expectations

Social Proof Elements

No itemsTrust Indicators

- •

Security Center link on sign-on

- •

Explicit mentions of 'Security and fraud' in menus

- •

Use of registered trademarks (®)

- •

Subtle, but present, messaging around community service and history ('Serving our customers and communities')

Scarcity Urgency Tactics

The promotional offers imply a limited-time nature, though no explicit deadline is stated on the main page, which is a standard tactic to drive immediate action.

Calls To Action

Primary Ctas

- Text:

Get started >>

Location:Homepage Hero Banner (Checking Bonus)

Clarity:Clear

- Text:

Learn more

Location:Homepage Promotional Tile (Credit Card Offer)

Clarity:Clear

- Text:

See offer details

Location:Homepage Promotional Tile (Student Bonus)

Clarity:Clear

- Text:

Sign on

Location:Homepage Login Box

Clarity:Clear

The CTAs are clear, concise, and action-oriented. Their effectiveness for driving clicks on promotional offers is likely high due to their prominence and the compelling nature of the offers themselves. They are functional and leave no ambiguity for the user. However, they are entirely transactional ('Get', 'See', 'Learn') and do little to advance a relationship-oriented brand narrative.

Messaging Gaps Analysis

Critical Gaps

- •

A compelling 'Why Wells Fargo?' narrative: The site is a catalog of products, not a story of a trusted financial partner. Given the brand's history of public trust issues, the absence of a strong, authentic, and integrated message about why customers should trust them now is a major strategic failure.

- •

Lack of Social Proof: There are no customer testimonials, success stories, or ratings. This is a significant missed opportunity to build credibility and humanize the brand.

- •

Human Element: The messaging is devoid of a human touch. There is no mention of bankers, advisors, or the people who make up the company. It feels like interacting with a utility, not a partner.

Contradiction Points

The message of being a long-term, relationship-focused community partner ('Serving our customers and communities') directly contradicts the primary messaging strategy of short-term, transactional cash bonuses to acquire new customers.

Underdeveloped Areas

- •

Trust and Rebuilding: The messaging about 'serving communities' is generic corporate responsibility speak. It needs to be developed into a tangible narrative with proof points that directly and humbly address the need to re-earn customer trust.

- •

Guidance and Partnership: The 'Education & Tools' sections are presented as resource links rather than a core part of the value proposition. The message of being a source of financial guidance is underdeveloped.

- •

Digital Innovation: While digital tools are mentioned (e.g., Fargo AI assistant), the messaging does not build a narrative around technological leadership or a superior digital experience, which is a key battleground for competitors like Chase.

Messaging Quality

Strengths

- •

Clarity on Product Features: The descriptions of individual accounts and loans are straightforward and easy to understand.

- •

Strong Acquisition Focus: The messaging is highly effective at its primary goal: communicating compelling offers to attract new customers.

- •

Clear Navigation and Site Structure: The product-based information architecture makes it easy for users to find the specific product they are looking for.

Weaknesses

- •

Lack of a Differentiated Brand Story: The messaging fails to create a unique and memorable brand identity.

- •

Overly Transactional Tone: The focus on offers and products undermines any attempt to build a deeper, trust-based relationship.

- •

Absence of an Emotional Connection: The language is functional and corporate, failing to connect with customers on a human level.

Opportunities

- •

Develop a Unified Brand Narrative: Create a central messaging theme around 'rebuilding,' 'partnership,' or 'progress' that can be woven through all product and corporate communications to address the trust deficit head-on.

- •

Integrate Customer Stories: Use authentic testimonials and case studies to provide social proof and demonstrate the positive impact the bank has on its customers' lives.

- •

Humanize the Brand Voice: Shift the tone from being purely transactional to more advisory and empathetic. Lead with customer needs and goals, not just product features.

- •

Elevate 'Guidance' as a Key Differentiator: Frame the bank not just as a provider of products, but as a proactive partner in customers' financial health and success.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Messaging Hierarchy

Recommendation:A/B test a new hero section that leads with a value proposition based on trust and partnership, placing the transactional bonus offer in a secondary position. Measure the impact on both immediate conversions and brand perception metrics.

Expected Impact:High

- Area:

Value Proposition

Recommendation:Develop and clearly articulate a unique value proposition that goes beyond product parity. This should be a strategic initiative to define 'Why Wells Fargo?' in a post-scandal era and should be reflected in a new brand tagline and key messaging pillars.

Expected Impact:High

- Area:

Brand Voice and Tone

Recommendation:Create and implement new brand voice guidelines that emphasize empathy, support, and partnership. Rewrite key product and service pages to reflect this new voice, focusing on customer benefits and outcomes rather than just features.

Expected Impact:Medium

Quick Wins

- •

Integrate customer testimonials or positive review snippets onto key product pages.

- •

Rewrite the 'Serving our communities' copy to be more specific and impactful, using concrete data and stories instead of vague platitudes.

- •

Change generic CTAs like 'Learn More' to more benefit-oriented language, such as 'Start Building Your Savings' or 'Plan Your Home Purchase'.

Long Term Recommendations

- •

Launch a major brand campaign centered on the new, trust-focused value proposition.

- •

Invest in a content marketing strategy that provides genuine financial guidance and tells stories of customer success, positioning Wells Fargo as a thought leader and trusted advisor.

- •

Fundamentally shift the website architecture from being purely product-led to being more audience-need or goal-led (e.g., 'Planning for Retirement', 'Buying My First Home').

Wells Fargo's website messaging is a study in functional efficiency at the expense of brand building. The communication strategy is overwhelmingly tactical, focused on driving near-term customer acquisition through aggressive and clear promotional offers. From a direct-response marketing perspective, it is competent. However, as a strategic communication platform for one of the nation's largest banks—a bank with a well-documented and severe trust deficit—the messaging is a critical failure.

The core issue is the chasm between the brand Wells Fargo needs to be (a trustworthy, reliable partner) and the brand its messaging projects (a transactional, undifferentiated commodity product seller). The attempts to bridge this gap with sections on 'community service' feel superficial and are completely overshadowed by the loud, transactional nature of the primary messages. The brand voice is impersonal, the value proposition is generic, and there is a complete absence of social proof or emotional connection.

Competitors are staking out clearer positions: Chase on digital innovation and scale, Bank of America on nationwide presence and integrated services, and countless smaller institutions on personalized relationships. Wells Fargo's messaging leaves it stuck in the middle, competing solely on the size of its latest checking account bonus. To move forward, the company must pivot its entire messaging strategy from 'what we sell' to 'why you should trust us,' building a compelling, authentic, and consistent narrative that addresses its past and provides a credible vision for its future relationship with customers. Without this strategic shift, the brand will continue to acquire customers based on price, but will fail to build the loyalty and brand equity necessary for long-term, sustainable success.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Comprehensive Product Suite: Offers a full spectrum of financial services including retail banking, lending (mortgage, auto, personal), credit cards, wealth management, and investment banking, catering to a wide range of customer segments from students to high-net-worth individuals.

- •

Large Customer Base: As one of the largest banks in the U.S., it has a massive existing customer base, indicating widespread market acceptance and deep penetration.

- •

Digital Product Adoption: Reports a 6% increase in active mobile customers and significant engagement with its AI assistant, 'Fargo', demonstrating relevance in the digital-first banking era.

- •

Wealth Management Growth: Client assets in the Wealth and Investment Management division have shown strong growth, reaching over $2 trillion, indicating a strong fit with affluent and high-net-worth clients.

Improvement Areas

- •

Brand Trust and Reputation: Must continue to rebuild trust and repair reputational damage from past scandals, which can hinder the attraction of new, discerning customers.

- •

Gen Z / Millennial Appeal: Needs to enhance digital-native product offerings and marketing to better compete with fintechs and neobanks for younger demographics.

- •

Onboarding Experience: Digital account opening processes are a known friction point across the industry, with high abandonment rates if not seamless and quick.

Market Dynamics

Modest; US Retail Banking market projected to grow at a CAGR of 4.2% between 2024 and 2029. Overall US GDP growth is expected to decelerate to around 1.5-2.0% in 2025.

Mature

Market Trends

- Trend:

Digital Transformation and AI Integration

Business Impact:Essential for operational efficiency, enhanced customer experience, and competitive parity. Banks are heavily investing in AI for personalization, fraud detection, and virtual assistants.

- Trend:

Competition from Fintech and Neobanks

Business Impact:Increased pressure on traditional banks to innovate, offer lower fees, and provide superior digital experiences.

- Trend:

Embedded Finance and Banking-as-a-Service (BaaS)

Business Impact:Creates new revenue streams by allowing non-financial companies to integrate Wells Fargo's banking services via APIs, but also introduces new competitors.

- Trend:

Macroeconomic Headwinds

Business Impact:Slower economic growth, potential interest rate cuts, and high consumer debt levels may squeeze net interest margins and increase credit risk in 2025.

- Trend:

Heightened Cybersecurity and Regulatory Scrutiny

Business Impact:Increased operational costs and significant risk associated with data security and compliance with complex regulations like KYC and AML.

Challenging but opportune. The market is mature and facing economic headwinds, but the accelerated shift to digital and AI presents a critical window for large, well-capitalized players like Wells Fargo to solidify their market position by leveraging technology at scale.

Business Model Scalability

High

High fixed costs associated with a large physical branch network, legacy IT infrastructure, and regulatory compliance. Digital transformation aims to shift this towards a more variable and scalable cost model.

High. Once fixed costs are covered, the marginal cost of serving an additional digital customer or cross-selling a product is low, providing significant profit potential from increased volume.

Scalability Constraints

- •

Regulatory Asset Cap: Historically, the Federal Reserve has imposed an asset cap, which directly constrains balance sheet growth, although wealth management growth is a key workaround.

- •

Legacy Technology: Core banking systems can be decades old, making it complex and costly to launch new products or integrate with modern fintech solutions quickly.

- •

Operational Overhead: The sheer size and complexity of the organization can slow down decision-making and innovation compared to more nimble competitors.

Team Readiness

Experienced leadership team under CEO Charlie Scharf is focused on risk management, operational efficiency, and a strategic shift towards technology and wealth management.

Traditional, siloed banking structure. The challenge is fostering agility and cross-functional collaboration required for rapid digital product development and an omnichannel customer experience.

Key Capability Gaps

- •

Agile Product Development: Needs to continue embedding agile methodologies at scale to reduce time-to-market for new digital features.

- •

Data Science & AI at Scale: While investing heavily, requires ongoing talent acquisition and upskilling to fully leverage AI and machine learning for hyper-personalization and predictive analytics across all business lines.

- •

Fintech Partnership & Integration: Requires specialized teams to identify, vet, and integrate with fintech partners to accelerate innovation without compromising security or compliance.

Growth Engine

Acquisition Channels

- Channel:

Digital Marketing (Paid Search, SEO, Social Media)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Focus on hyper-personalized ad campaigns using AI and first-party data. Optimize for local SEO ('bank near me') and target niche segments (e.g., small business owners, specific professions) with tailored value propositions.

- Channel:

Branch Network & In-Person Sales

Effectiveness:High (for trust-based, complex sales)

Optimization Potential:Medium

Recommendation:Transform branches from transactional hubs to advisory centers. Equip bankers with better digital tools to seamlessly onboard customers and demonstrate digital product value. Optimize physical footprint based on demographic shifts.

- Channel:

Referral Programs & Sign-Up Bonuses

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage referral programs which can generate significantly higher sales than paid ads. A/B test bonus offers to optimize for high-value customer acquisition, not just account volume.

- Channel:

Cross-sell to Existing Customers

Effectiveness:Medium

Optimization Potential:High

Recommendation:Utilize AI-powered recommendation engines (like Pega Customer Decision Hub) to predict the 'next best product' for existing customers based on their transaction history and life events, significantly increasing engagement.

Customer Journey

Omnichannel path that is often complex. A customer might start researching online, visit a branch for advice, and complete an application on their mobile device. The website shows clear funnels for each product line (Checking, Loans, etc.).

Friction Points

- •

Digital Onboarding: The application process for products like mortgages or business accounts can be lengthy and require documentation uploads, leading to high drop-off rates.

- •

Channel Handoffs: Lack of seamless data transfer when a customer moves from the mobile app to the call center or a physical branch, requiring them to repeat information.

- •

Complex Product Comparison: The sheer number of account types and credit cards can be overwhelming, making it difficult for users to choose the best option without direct assistance.

Journey Enhancement Priorities

{'area': 'Streamlined Digital Account Opening', 'recommendation': 'Invest further in technology to minimize manual data entry, use identity verification APIs, and reduce the time to open a basic account to under 5 minutes, as this is a major competitive battleground. '}

{'area': 'Unified Customer Profile', 'recommendation': 'Create a single, 360-degree view of the customer that is accessible across all channels (web, mobile, branch, call center) to enable personalized, context-aware service.'}

Retention Mechanisms

- Mechanism:

High Switching Costs

Effectiveness:High

Improvement Opportunity:Increase product stickiness by bundling services (e.g., checking with mortgage discounts) and integrating essential features like bill pay and direct deposit, which are difficult for customers to move.

- Mechanism:

Digital Banking & Mobile App Features

Effectiveness:Medium

Improvement Opportunity:Continuously innovate on the mobile app, adding valuable features like the 'Fargo' AI assistant, personalized spending insights, and proactive financial advice to make the app an indispensable daily tool.

- Mechanism:

Relationship Banking (Premier Services)

Effectiveness:High

Improvement Opportunity:Expand access to dedicated financial advisors and personalized services, leveraging technology to deliver high-touch service at a greater scale for the mass affluent segment.

Revenue Economics

Complex and varies by product. Generally characterized by a high Customer Lifetime Value (CLV) due to long-term relationships and cross-selling opportunities, but facing high Customer Acquisition Costs (CAC) in a competitive market.

Estimated to be healthy for established brands. While CAC can be $200-$500 per new retail customer, CLV can be in the thousands ($2,000-$4,500 for digital banking). The key is acquiring 'primary banking' relationships, not single-product users.

Moderate. Efficiency is improving through cost-cutting and digital transformation, but remains burdened by the high overhead of its branch network and regulatory compliance costs.

Optimization Recommendations

- •

Focus marketing spend on acquiring customers with high potential for cross-selling (e.g., young professionals likely to need a mortgage in the future).

- •

Invest in marketing automation and AI to lower the per-customer acquisition cost in digital channels.

- •

Drive 'share of wallet' growth by making it seamless for existing customers to add new products, thus increasing LTV without incremental acquisition costs.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Core Banking Systems

Impact:High

Solution Approach:Adopt a two-speed IT architecture: maintain stable legacy systems for core processing while building a flexible, API-driven layer on top for rapid innovation and fintech integration. Accelerate the multi-cloud strategy with Azure and Google Cloud to enhance agility.

- Limitation:

Data Silos

Impact:Medium

Solution Approach:Invest in a unified data platform to break down silos between business lines (e.g., retail banking, wealth management, mortgage). This is critical for creating a 360-degree customer view and enabling effective AI/ML models.

Operational Bottlenecks

- Bottleneck:

Regulatory and Compliance Overhead

Growth Impact:Slows down product development and innovation due to extensive legal and compliance reviews. High costs divert resources from growth initiatives.

Resolution Strategy:Invest in 'RegTech' (Regulatory Technology) to automate compliance processes, monitor transactions in real-time, and reduce the manual effort required for reporting.

- Bottleneck:

Manual Back-Office Processes

Growth Impact:Increases operating costs and creates potential for errors in areas like loan processing and contract reviews.

Resolution Strategy:Implement Robotic Process Automation (RPA) and AI to automate repetitive, rules-based tasks in the back office, freeing up human capital for higher-value activities.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Differentiate on trust, omnichannel experience, and the breadth of integrated services. Compete with fintechs on user experience and with large banks on relationship depth and product variety.

- Challenge:

Brand Perception and Trust Deficit

Severity:Major

Mitigation Strategy:Sustain a multi-year marketing and PR campaign focused on community involvement, transparency, and customer-centric actions. Proactively use technology to enhance security and build digital trust.

- Challenge:

Attracting Younger Demographics

Severity:Major

Mitigation Strategy:Develop specific digital-first products tailored to Gen Z/Millennials (e.g., subscription management, micro-investing). Use authentic marketing channels like social media influencers and content marketing to reach them.

Resource Limitations

Talent Gaps

- •

AI/ML Engineers and Data Scientists: High demand across all industries for talent that can build and deploy sophisticated predictive models.

- •

Cybersecurity Experts: A constant need for top-tier talent to defend against increasingly sophisticated threats.

- •

Digital Product Managers: Experienced professionals who can blend customer empathy, technical knowledge, and business acumen to drive the digital product roadmap.

Well-capitalized, but growth initiatives compete for budget against massive compliance and technology maintenance spending. The reported $4 billion annual ICT spend indicates significant investment capacity.

Infrastructure Needs

Continued investment in cloud infrastructure to fully migrate from on-premise data centers.

Modernization of the branch network to reflect the shift towards advisory services.

Growth Opportunities

Market Expansion

- Expansion Vector:

Wealth Management for the Mass Affluent

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Develop a hybrid 'robo-advisor' plus human support model to provide personalized investment advice at a lower cost. This segment is a key growth area for fee-based income.

- Expansion Vector:

Small and Medium Business (SMB) Banking

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Create a deeply integrated digital ecosystem for SMBs that combines checking, lending, payroll, and treasury management. Leverage data to offer proactive financing and cash flow advice.

Product Opportunities

- Opportunity:

Embedded Finance / Banking-as-a-Service (BaaS)

Market Demand Evidence:The BaaS market is projected to grow at a CAGR of over 15%, reaching over $70 billion by 2034.

Strategic Fit:Leverages Wells Fargo's banking license, regulatory expertise, and robust infrastructure to create a new B2B revenue stream.

Development Recommendation:Develop a suite of developer-friendly APIs for core banking functions (e.g., account creation, payments, lending). Partner with large e-commerce platforms, software companies, or retailers to embed Wells Fargo products into their ecosystems.

- Opportunity:

AI-Powered Personal Financial Management (PFM) Tools

Market Demand Evidence:Customers, especially younger ones, expect proactive financial guidance. Fintechs like Chime and Revolut have proven the demand.

Strategic Fit:Deepens customer engagement and positions the bank as a trusted financial advisor, increasing retention and share of wallet.

Development Recommendation:Integrate advanced PFM features into the main mobile app, using AI to provide personalized savings goals, debt reduction plans, investment recommendations, and subscription management.

Channel Diversification

- Channel:

Fintech Partnerships and App Marketplaces

Fit Assessment:High

Implementation Strategy:Establish a formal partnership program and an API marketplace (similar to the Wells Fargo Startup Accelerator) to allow vetted fintechs to integrate their services (e.g., specialized lending, budgeting tools) with Wells Fargo accounts, offering customers more choice.

- Channel:

Content & Financial Education Platforms (e.g., YouTube, Podcasts)

Fit Assessment:High

Implementation Strategy:Expand the existing 'Financial Education & Tools' into a multi-platform content engine. Create high-quality, SEO-optimized content on topics like first-time home buying, investing basics, and starting a business to attract new customers early in their financial journey.

Strategic Partnerships

- Partnership Type:

Big Tech Collaboration (Cloud & AI)

Potential Partners

Microsoft (Azure)

Google (Cloud, AI)

Expected Benefits:Already underway, these partnerships accelerate digital transformation, provide access to cutting-edge AI/ML tools, and improve scalability and security.

- Partnership Type:

BaaS and Embedded Finance Partners

Potential Partners

- •

Large Retailers

- •

E-commerce Marketplaces

- •

Vertical SaaS companies

Expected Benefits:Open new, low-cost customer acquisition channels and generate high-margin, fee-based revenue by providing the financial infrastructure for other businesses.

Growth Strategy

North Star Metric

Growth in Primary Customer Relationships

This metric focuses on customers who consider Wells Fargo their main bank (e.g., have their direct deposit with WF). These customers are significantly more profitable, have higher retention, and are more likely to use multiple products. It shifts the focus from simple account openings to deep, valuable relationships.

Increase the percentage of new checking account customers who set up direct deposit within 90 days by 15% year-over-year.

Growth Model

Hybrid: Cross-Sell & Engagement Model

Key Drivers

- •

New Primary Customer Acquisition: Attracting high-quality new customers through targeted digital marketing and compelling onboarding offers.

- •

Product Deepening (Cross-Sell): Increasing the number of products per customer.

- •

Digital Engagement: Driving frequent, valuable interactions within the mobile and online banking platforms.

- •

Advisor-Led Growth (Wealth & Commercial): High-touch, relationship-based sales for complex financial needs.

Focus marketing on acquiring primary relationships. Implement an AI-driven 'next best offer' system to drive cross-selling. Continuously add features to the mobile app to increase daily utility and engagement.

Prioritized Initiatives

- Initiative:

Launch a 'Gen Z / Student' Digital Banking Bundle

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Conduct market research with target demographics to define features. Form a cross-functional 'pod' with product, marketing, and engineering to develop and launch an MVP.

- Initiative:

Develop a BaaS API Platform for Payments and Account Verification

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Create a dedicated business unit for BaaS. Define the initial API product set and identify a pilot partner from the fintech or retail sector.

- Initiative:

Deploy AI-Powered Hyper-Personalization Across Digital Channels

Expected Impact:High

Implementation Effort:Medium

Timeframe:Ongoing (phased rollout)

First Steps:Expand the use of existing tools like Pega to personalize website content, mobile app notifications, and email marketing based on user behavior and financial goals.

Experimentation Plan

High Leverage Tests

- Test:

A/B Testing Digital Onboarding Funnels

Hypothesis:Reducing the number of fields in the initial application form will increase completion rates by over 10%.

- Test:

Personalized 'Next Best Product' Recommendations

Hypothesis:Using AI to suggest the most relevant next product (e.g., a credit card for a customer with high debit card spend) will increase cross-sell conversion rates by 5%.

- Test:

Value Proposition Testing for Sign-Up Bonuses

Hypothesis:A bonus tied to setting up direct deposit will attract higher-LTV customers than a simple cash bonus for opening an account.

Use a combination of A/B testing platforms (e.g., Optimizely, Adobe Target) and internal data analytics. Track key metrics like conversion rate, drop-off rate, customer lifetime value (by cohort), and product adoption rate.

Run multiple, concurrent experiments on a bi-weekly sprint cycle within dedicated growth 'pods' for each key customer journey (e.g., Onboarding, Cross-Sell, Retention).

Growth Team

Decentralized 'Pods' Model. Create cross-functional teams (pods) aligned to specific KPIs or customer journeys (e.g., 'New Customer Onboarding', 'Mortgage Application Experience'). Each pod should contain a product manager, marketer, engineer, data analyst, and designer.

Key Roles

- •

Head of Growth (to oversee strategy and resource allocation)

- •

Product Manager - Growth (to lead individual pods)

- •

Data Scientist - Marketing (to analyze experiments and build personalization models)

- •

Lifecycle Marketing Manager (to manage engagement and retention campaigns)