eScore

westerndigital.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Western Digital demonstrates a powerful digital presence, commanding high authority and visibility in its core markets. Their content strategy effectively aligns with user intent for specific product categories (e.g., gaming, NAS), and they have a strong global footprint with localized sites. However, their content is weaker at the top of the funnel for emerging high-value topics like AI storage architecture, and voice search optimization appears to be a less developed capability.

Excellent domain authority and content segmentation that effectively funnels distinct customer personas (Cloud, Client, Consumer) toward relevant solutions.

Develop a dedicated thought leadership hub focused on emerging topics like AI storage, sustainable data centers, and hybrid cloud to capture high-intent, top-of-funnel search traffic.

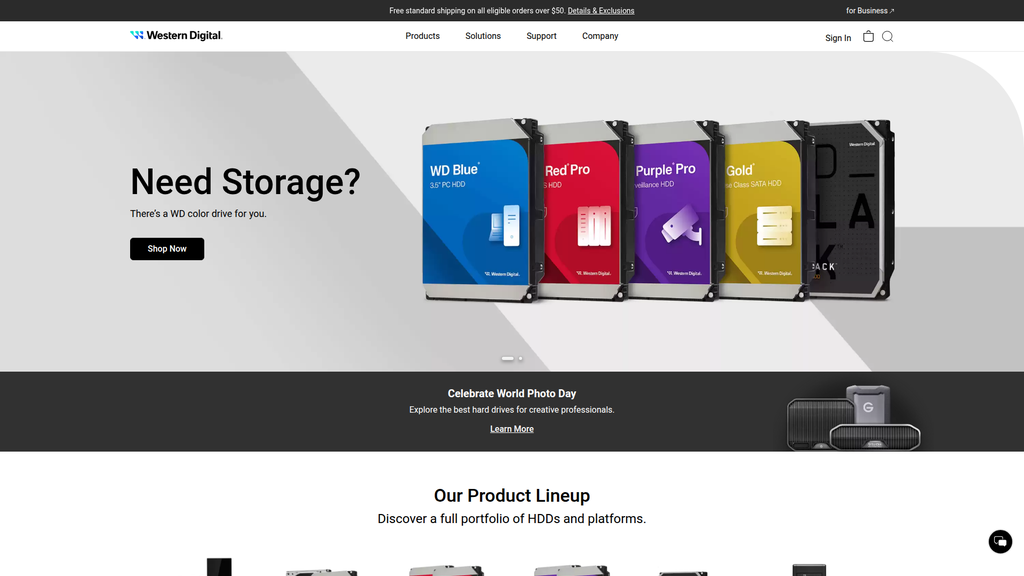

The company excels at tactical messaging for segmented audiences, with distinct and effective communication for gamers, students, and prosumers. The 'WD color drive' system is a brilliant messaging tool that simplifies complex choices. However, the overarching brand narrative is fragmented, lacking a cohesive story to unite its diverse B2C and B2B communications, and the brand voice shifts inconsistently between consumer-friendly and dense technical jargon.

The 'color-coded' drive system is a powerful and unique messaging device that simplifies the value proposition and purchasing decision for consumers.

Create a unifying, customer-facing brand story around the mission to 'unlock the potential of data,' using human-centric case studies to bridge the gap between consumer products and enterprise solutions.

The website provides a well-structured and visually clean user experience with clear navigation and a strong design system. Conversion elements for e-commerce are prominent, and there is a stated commitment to WCAG 2.1 AA accessibility, which is a significant asset. The primary weaknesses are an excessive amount of information on the homepage, leading to high cognitive load, and a lack of interactive or dynamic content to improve engagement.

A clear, intuitive design system, particularly the product color-coding, simplifies navigation and product selection for a complex portfolio.

Reduce homepage cognitive load by implementing a 'sticky' sub-navigation that appears on scroll, providing anchor links to key sections and improving usability on long pages.

Western Digital exhibits a highly mature and sophisticated approach to credibility and risk mitigation, which is a major strategic asset. Their legal compliance is world-class, with excellent privacy policies, granular cookie consent, and a public commitment to accessibility standards. The company effectively uses its 50+ year legacy as a trust signal and provides clear customer success evidence through its established brand reputation and industry leadership.

A comprehensive, geographically-specific, and user-friendly data privacy framework that meets global standards and builds significant customer trust.

Increase the visibility and clarity of warranty information and promotional terms directly at the point of sale to prevent any potential for customer confusion.

The company's competitive moat is deep and sustainable, built on three key pillars: vertical integration in both HDD and NAND flash, a comprehensive product portfolio covering nearly every market segment, and powerful brand equity (WD, SanDisk). This diversification provides resilience against shifts in any single market. The primary threat is the pace of innovation from direct competitors in next-generation technologies like HAMR.

Unique vertical integration in both HDD manufacturing and NAND flash (via a joint venture), providing significant control over technology roadmaps, cost, and supply that is very difficult to replicate.

Accelerate the development and market adoption of next-generation HDD technologies to counter competitors' narratives and maintain a long-term TCO advantage for hyperscale customers.

As a global leader, the business model is highly scalable, with high operational leverage tied to its manufacturing facilities. The company is strategically positioned to capitalize on the explosive data growth driven by AI and cloud computing. The planned separation of its HDD and Flash businesses is a bold move designed to unlock further focus and scalability for each distinct market.

Excellent product-market fit in the high-growth data center and cloud segments, which represent the largest and most profitable portion of the business.

Pilot and develop enterprise 'Storage-as-a-Service' (STaaS) offerings to create a recurring revenue stream, reducing dependence on cyclical hardware sales.

The business model is coherent and highly effective, with clearly defined revenue streams from Cloud, Client, and Consumer segments and a positioning strategy that uses sub-brands to target specific personas. The model is currently undergoing a significant strategic evolution with the planned business separation, which is a logical step to enhance focus. A key weakness is the lack of significant recurring revenue, which increases financial volatility.

A masterful market segmentation strategy using distinct brands (WD, SanDisk, WD_BLACK) to effectively align products and messaging with the specific pain points of diverse customer groups.

Ensure a flawless execution of the impending business separation to minimize market uncertainty and customer disruption, thereby unlocking the strategic coherence of two pure-play entities.

Western Digital wields significant market power as one of the top two players in the global HDD oligopoly, granting it considerable influence on pricing and industry standards. Its broad portfolio and established brands provide substantial leverage with channel partners and OEMs. The company's market share trajectory is stable and strong, particularly in the critical high-capacity data center segment.

Dominant and stable market share in the HDD oligopoly, which provides significant economies of scale, negotiating power with suppliers, and influence over the market.

Develop a stronger ecosystem around its hardware by investing in or acquiring data management software companies to increase customer switching costs and move up the value stack.

Business Overview

Business Classification

Hardware Manufacturer

Direct-to-Consumer (D2C) eCommerce

Data Storage Solutions

Sub Verticals

- •

Hard Disk Drives (HDDs)

- •

Flash Memory (NAND)

- •

Solid-State Drives (SSDs)

- •

Data Center & Cloud Storage

- •

Consumer Electronics & Peripherals

Mature

Maturity Indicators

- •

Long operating history (founded in 1970).

- •

Significant global market share in core product categories (HDDs and Flash).

- •

Strong brand recognition (Western Digital, WD, SanDisk).

- •

Major strategic restructuring underway (separation into two independent public companies).

- •

Established global manufacturing, supply chain, and distribution networks.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Cloud (Data Center Solutions)

Description:Sale of high-capacity, enterprise-grade HDDs (Nearline) and enterprise SSDs to hyperscale cloud providers and data center operators. This is the largest revenue segment, representing over 50% of total revenue in recent quarters.

Estimated Importance:Primary

Customer Segment:Enterprise/Hyperscale

Estimated Margin:High

- Stream Name:

Client (OEM & Client Devices)

Description:Sale of HDDs and SSDs to original equipment manufacturers (OEMs) for inclusion in desktops, laptops, and other client devices.

Estimated Importance:Secondary

Customer Segment:OEMs/Business

Estimated Margin:Medium

- Stream Name:

Consumer (Client Solutions)

Description:Sale of branded consumer storage products, including portable HDDs/SSDs, internal drives for personal use (e.g., gaming), and flash memory products like memory cards and USB drives through retail and D2C channels.

Estimated Importance:Tertiary

Customer Segment:Consumers/Prosumers

Estimated Margin:Medium

Recurring Revenue Components

Largely absent; the business model is predominantly transactional hardware sales.

Potential for future software/service-based recurring revenue, but not a current core component.

Pricing Strategy

Transactional Product Sales & Volume-based Enterprise Pricing

Multi-tiered

Transparent (for consumer products) / Opaque (for enterprise/OEM contracts)

Pricing Psychology

- •

Tiered Pricing (based on capacity and performance, e.g., WD Blue, Black, Red).

- •

Promotional Pricing (e.g., student discounts shown on the website).

- •

Charm Pricing (e.g., $99.99).

Monetization Assessment

Strengths

- •

Diversified revenue across Cloud, Client, and Consumer segments provides resilience.

- •

Strong position in the high-margin, high-growth cloud and data center market.

- •

Direct-to-consumer channel captures higher margins for consumer products.

Weaknesses

- •

High dependence on the cyclical and often volatile memory and storage markets.

- •

Lack of significant recurring revenue streams, leading to revenue predictability challenges.

- •

Intense price competition, especially in the consumer and client segments, can compress margins.

Opportunities

- •

The impending company split allows for more focused monetization strategies for both the HDD and Flash businesses.

- •

Developing Storage-as-a-Service (STaaS) models for enterprise customers.

- •

Bundling hardware with value-added software or data management services to create new revenue streams.

Threats

- •

Aggressive pricing from competitors like Seagate in HDDs and Samsung in SSDs.

- •

Rapid technological shifts (e.g., new memory technologies) could disrupt existing product lines.

- •

Geopolitical risks impacting global supply chains and manufacturing costs.

Market Positioning

Broad Differentiation through Segment-Specific Brands

One of the top two global leaders in the HDD market (along with Seagate) and a major player in the NAND flash/SSD market.

Target Segments

- Segment Name:

Hyperscale Cloud Providers & Data Centers

Description:Large-scale cloud service providers (e.g., AWS, Azure) and enterprise data centers requiring mass capacity, cost-effective, and reliable storage. This segment is the primary driver of high-capacity HDD demand.

Demographic Factors

Global enterprise-level organizations

Psychographic Factors

Focus on Total Cost of Ownership (TCO)

High value placed on reliability and energy efficiency

Behavioral Factors

- •

Large volume purchasing contracts

- •

Long qualification cycles for new hardware

- •

Demand driven by data growth and AI workloads.

Pain Points

- •

Exponential data growth

- •

Managing power consumption and cooling at scale

- •

Ensuring data reliability and availability

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

PC Gamers & Performance Enthusiasts

Description:Individuals who build or buy high-performance PCs for gaming and other demanding applications, prioritizing speed and responsiveness.

Demographic Factors

Predominantly male, aged 25-44.

Psychographic Factors

- •

Value cutting-edge technology

- •

Brand loyal

- •

Seek competitive advantages

Behavioral Factors

- •

Frequent hardware upgraders

- •

Influenced by tech reviews and benchmarks

- •

Willing to pay a premium for performance (WD_BLACK line).

Pain Points

- •

Slow game loading times

- •

Running out of storage space for large game libraries

- •

System bottlenecks impacting performance

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Creative Professionals

Description:Photographers, videographers, and digital artists who handle large files and require reliable, high-speed, and often portable storage solutions.

Demographic Factors

Professionals in media and entertainment industries.

Psychographic Factors

Value reliability above all else

Aesthetics and durability are important (SanDisk Professional line).

Behavioral Factors

Need for ruggedized drives for on-location work

Demand for fast transfer speeds to minimize workflow delays

Pain Points

- •

Data loss due to drive failure

- •

Slow file transfers interrupting creative flow

- •

Insufficient storage capacity for high-resolution content (4K/8K video).

Fit Assessment:Good

Segment Potential:Medium

- Segment Name:

NAS/Home Server Users (Prosumers)

Description:Tech-savvy consumers and small businesses using Network Attached Storage (NAS) systems for centralized file storage, media streaming, and backups.

Demographic Factors

Homeowners, small business owners, tech hobbyists.

Psychographic Factors

DIY mentality

Value data security and personal control

Behavioral Factors

Purchase drives specifically designed for 24/7 operation (WD Red line).

Focus on reliability and compatibility with NAS systems.

Pain Points

- •

Data loss from non-RAID rated drive failures

- •

Complex setup and management

- •

Need for scalable storage capacity

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

Vertical Integration

Strength:Strong

Sustainability:Sustainable

- Factor:

Comprehensive Product Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Equity & Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Strategic Business Separation

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To provide a comprehensive portfolio of reliable, high-performance data storage solutions that unlock the potential of data for every need, from individual consumers to the world's largest data centers.

Good

Key Benefits

- Benefit:

Tailored Solutions for Specific Use Cases

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Color-coded drive families (Red for NAS, Black for Gaming, Purple for Surveillance, etc.)

- Benefit:

High Capacity & Cost-Effectiveness at Scale

Importance:Critical

Differentiation:Common

Proof Elements

Industry-leading HDD capacities (e.g., 26TB, 32TB).

Focus on TCO for data center customers.

- Benefit:

Brand Trust and Reliability

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

50+ year company history.

- •

Established brands like WD and SanDisk.

- •

Extended warranty offers on direct purchases.

Unique Selling Points

- Usp:

Vertically integrated manufacturing of both HDDs and NAND flash memory, providing control over technology roadmaps, cost, and supply.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A uniquely broad portfolio of trusted brands (Western Digital, SanDisk, WD_BLACK) that cover nearly every segment of the data storage market.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Strategic separation into two pure-play companies, enabling each to have greater strategic focus, operational efficiency, and tailored capital structures.

Sustainability:Long-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Managing the exponential growth of data within budget constraints.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Finding the right type of storage for a specific, demanding application (e.g., gaming, surveillance, NAS).

Severity:Major

Solution Effectiveness:Complete

- Problem:

Risk of data loss due to unreliable storage hardware.

Severity:Critical

Solution Effectiveness:Partial

Value Alignment Assessment

High

The product portfolio directly addresses the primary market trends: mass capacity storage for AI/cloud and high-performance storage for client/consumer applications.

High

The segmented branding strategy (WD color drives, SanDisk) effectively communicates specific value propositions to distinct customer personas, from gamers to data center architects.

Strategic Assessment

Business Model Canvas

Key Partners

- •

OEMs (Dell, HP, etc.)

- •

Hyperscale Cloud Providers (AWS, Google Cloud, Azure).

- •

Distributors & Resellers (Ingram Micro, etc.)

- •

Retailers (Amazon, Best Buy, etc.)

- •

Technology Partners (e.g., joint venture with Kioxia for NAND manufacturing).

Key Activities

- •

Research & Development (e.g., HAMR, SMR, 3D NAND).

- •

High-volume, precision manufacturing.

- •

Global supply chain management.

- •

Sales & Marketing (B2B and B2C channels).

- •

Strategic Planning (executing the company separation).

Key Resources

- •

Intellectual Property (patents in storage technology).

- •

Manufacturing facilities (fabs and assembly plants).

- •

Global distribution network.

- •

Strong brand equity (WD, SanDisk).

- •

Engineering talent.

Cost Structure

- •

High capital expenditures for manufacturing facilities.

- •

Significant R&D investment.

- •

Cost of goods sold (raw materials, components).

- •

Sales, General & Administrative (SG&A) expenses.

Swot Analysis

Strengths

- •

Leading market position in HDDs and a strong contender in Flash.

- •

Vertical integration provides technological and cost advantages.

- •

Diversified portfolio addressing a wide range of end markets.

- •

Strong brand recognition and established global sales channels.

Weaknesses

- •

Exposure to the high volatility and cyclicality of the memory market.

- •

Lack of a significant software or recurring revenue business model.

- •

The HDD business faces long-term cannibalization from SSDs in certain segments.

Opportunities

- •

The separation of HDD and Flash businesses to unlock shareholder value and increase strategic focus.

- •

Explosive growth in data generated by AI, IoT, and cloud computing driving demand for mass capacity storage.

- •

Expansion of enterprise SSD portfolio to capture more value in data centers.

- •

Development of next-generation HDD technologies (e.g., HAMR) to maintain a TCO advantage.

Threats

- •

Intense competition from Seagate (HDDs) and Samsung/Micron (Flash/SSDs).

- •

Price erosion and margin pressure due to the commodity-like nature of some products.

- •

Global supply chain disruptions and geopolitical tensions.

- •

A faster-than-expected transition from HDD to SSD in the enterprise market.

Recommendations

Priority Improvements

- Area:

Strategic Communication

Recommendation:Clearly articulate the post-separation strategy for both the HDD (Western Digital) and Flash (SanDisk) entities to investors, customers, and partners to minimize uncertainty and build confidence.

Expected Impact:High

- Area:

Customer Experience (D2C)

Recommendation:Enhance the direct-to-consumer e-commerce experience by improving personalization, offering exclusive product bundles, and building a community around key segments like gaming and creative professionals.

Expected Impact:Medium

- Area:

Operational Execution

Recommendation:Ensure a seamless execution of the business separation with minimal disruption to customers, supply chains, and employee morale.

Expected Impact:High

Business Model Innovation

- •

Develop and pilot enterprise 'Storage-as-a-Service' (STaaS) offerings, shifting from pure CapEx sales to OpEx-based recurring revenue models for large customers.

- •

Create a software and services layer on top of hardware products, focusing on data management, security, and analytics to increase customer lifetime value.

- •

Explore partnerships with AI and machine learning platforms to offer optimized, integrated hardware/software storage solutions for specific AI workloads.

Revenue Diversification

- •

Expand the 'Western Digital for Business' program into a more comprehensive service offering, including data recovery, managed backup, and IT consulting services for SMBs.

- •

Monetize intellectual property through licensing agreements in non-competing adjacent markets.

- •

Invest in or acquire companies in the data management software space to build out a services portfolio and reduce dependency on hardware sales cycles.

Western Digital stands as a mature, vertically integrated leader in the data storage industry, possessing a formidable portfolio of products and brands. The company's business model is currently at a pivotal strategic inflection point, defined by the impending separation of its HDD and Flash memory businesses. This move is a logical and necessary evolution to address the divergent market dynamics of a mature, cash-generating HDD market (driven by cloud/AI capacity needs) and a high-growth, yet volatile, Flash market. The primary revenue drivers are transactional hardware sales, with the Cloud segment being the most critical for profitability and growth. While this model has been successful, it exposes the company to market cyclicality and lacks the stability of recurring revenue. The website content reflects a strong push towards the Direct-to-Consumer market for its consumer and prosumer segments, utilizing targeted branding (e.g., WD_BLACK for gaming) to communicate value effectively. For future growth and sustainability, the key challenge and opportunity lies in the successful execution of the business separation. Post-split, the new Western Digital (HDD) must continue innovating in capacity and TCO to defend its core market against the long-term encroachment of SSDs. The new SanDisk (Flash) entity will need to navigate intense competition and price volatility while capitalizing on growth in mobile, client, and enterprise SSDs. Innovation should not be limited to hardware; a strategic imperative for both future companies will be to build service-based, recurring revenue streams on top of their hardware foundation to enhance customer value, improve financial predictability, and create more defensible competitive advantages.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Investment

Impact:High

- Barrier:

Intellectual Property & Patents

Impact:High

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Complex Supply Chain & Manufacturing Expertise

Impact:High

Industry Trends

- Trend:

Explosive Data Growth

Impact On Business:Massive demand for high-capacity storage, benefiting both HDD for cost-effective mass storage and SSDs for rapid data access.

Timeline:Immediate

- Trend:

AI and Machine Learning Adoption

Impact On Business:Drives demand for high-performance, low-latency storage (NVMe SSDs) for training models and high-capacity HDDs for storing vast datasets.

Timeline:Immediate

- Trend:

Cloud Storage Dominance

Impact On Business:Shifts a significant portion of the customer base from direct consumers/enterprises to hyperscale cloud providers (AWS, Azure, Google Cloud), who become the primary buyers of high-capacity drives.

Timeline:Immediate

- Trend:

Shift from HDD to SSD for Performance

Impact On Business:SSDs are replacing HDDs in client devices (laptops, PCs) and performance-critical enterprise applications, requiring a strong portfolio in NAND flash technology to remain competitive.

Timeline:Near-term

- Trend:

Focus on Sustainability and Energy Efficiency

Impact On Business:Data centers are increasingly focused on TCO (Total Cost of Ownership), including power consumption. Energy-efficient drives can become a key differentiator.

Timeline:Near-term

Direct Competitors

- →

Seagate Technology

Market Share Estimate:HDD Market Share (Q2 2025): ~41%

Target Audience Overlap:High

Competitive Positioning:A leading provider of mass-capacity data storage solutions, with a strong focus on the enterprise, cloud, and surveillance markets.

Strengths

- •

Strong brand recognition and long-standing market presence.

- •

Leadership in high-capacity HDD technology, particularly with Heat-Assisted Magnetic Recording (HAMR).

- •

Deep relationships with major cloud service providers and OEMs.

- •

Diverse product portfolio covering consumer, enterprise, and specialized applications.

Weaknesses

- •

High reliance on the cyclical HDD market.

- •

Perceived higher failure rates in some consumer drive models compared to Western Digital, according to some user reports.

- •

Less vertically integrated in NAND flash compared to competitors like Samsung or WD.

Differentiators

- •

Pioneering HAMR technology for next-generation high-capacity HDDs.

- •

Strong focus on data recovery services (LaCie brand).

- •

Lyve Cloud storage-as-a-service platform, extending beyond hardware.

- →

Micron Technology

Market Share Estimate:NAND Flash Market Share: Highly variable, but a top 5 player.

Target Audience Overlap:Medium

Competitive Positioning:A global leader in memory and storage solutions, specializing in DRAM and NAND flash memory for a wide range of end markets, including data centers, mobile, and automotive.

Strengths

- •

Strong R&D capabilities and vertical integration in memory manufacturing.

- •

Diversified portfolio across DRAM, NAND, and NOR flash, reducing dependence on a single market.

- •

Leading-edge technology in memory and storage (e.g., high-layer 3D NAND).

- •

Strong financial position and ability to make significant capital investments.

Weaknesses

- •

High exposure to the volatile and cyclical semiconductor market.

- •

Does not manufacture HDDs, limiting its portfolio for mass cold storage.

- •

Intense competition from other large semiconductor manufacturers.

Differentiators

- •

Focus on providing memory solutions for emerging technologies like AI, 5G, and autonomous vehicles.

- •

Crucial brand has strong recognition in the consumer/prosumer PC component market.

- •

Deep integration with server and client computing ecosystems as a primary memory supplier.

- →

Samsung Electronics

Market Share Estimate:NAND Flash Market Share: #1 with ~31%

Target Audience Overlap:High

Competitive Positioning:The undisputed market leader in NAND flash and SSDs, leveraging immense scale, vertical integration, and brand power to dominate consumer and enterprise markets.

Strengths

- •

Dominant market share and brand recognition in SSDs (consumer and enterprise).

- •

Complete vertical integration, from NAND chip manufacturing to controller design and firmware.

- •

Massive R&D budget and technological leadership in V-NAND architecture.

- •

Broad distribution channels and strong relationships with OEMs and retail.

Weaknesses

- •

Exited the HDD business (sold to Seagate), creating a portfolio gap for mass storage.

- •

Can be slower to innovate in niche enterprise storage segments compared to focused players.

- •

Brand perception is heavily tied to consumer electronics, which can sometimes overshadow its enterprise-grade offerings.

Differentiators

- •

Best-in-class performance and reliability in the consumer SSD market (EVO and PRO series).

- •

Extensive portfolio of storage solutions, from microSD cards to high-performance data center SSDs.

- •

Synergies with its vast electronics empire, providing a captive market and deep system-level knowledge.

- →

Toshiba (Kioxia)

Market Share Estimate:HDD Market Share (Q2 2025): ~17%

Target Audience Overlap:Medium

Competitive Positioning:A significant player in both the HDD and NAND flash markets (as Kioxia), with a strong focus on enterprise and data center applications.

Strengths

- •

Holds the #3 position in the HDD market oligopoly.

- •

Inventor of NAND flash memory (as Toshiba), with deep technological expertise.

- •

Strong joint venture partnership with Western Digital for NAND flash development and manufacturing.

Weaknesses

- •

Lower brand recognition in the consumer space compared to WD, Seagate, and Samsung.

- •

Smaller market share in HDDs, leading to less pricing power and scale.

- •

Corporate restructuring and changes have created market uncertainty in the past.

Differentiators

- •

Strong focus on high-reliability HDDs for enterprise and NAS applications.

- •

Kioxia's development of innovative flash memory technologies (e.g., BiCS FLASH™).

- •

Deep integration in the Japanese and broader Asian markets.

Indirect Competitors

- →

Amazon Web Services (AWS)

Description:Offers a comprehensive suite of cloud storage services, including object storage (S3), block storage (EBS), and archival storage (Glacier), effectively replacing the need for on-premise hardware for many businesses.

Threat Level:High

Potential For Direct Competition:Low (Unlikely to manufacture hardware, but is a major customer and market driver).

- →

Microsoft Azure

Description:Provides scalable and secure cloud storage solutions like Azure Blob Storage, Azure Disk Storage, and Azure Files, competing directly with the 'job-to-be-done' of physical storage devices.

Threat Level:High

Potential For Direct Competition:Low (A primary customer for enterprise drives, not a hardware competitor).

- →

Google Cloud Platform

Description:Delivers unified object storage (Cloud Storage) and persistent disk for virtual machines, offering a powerful alternative to capital expenditures on physical storage infrastructure.

Threat Level:High

Potential For Direct Competition:Low (A key partner and customer that influences storage technology roadmaps).

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Broad & Diversified Portfolio

Sustainability Assessment:Western Digital's extensive product line, spanning from consumer microSD cards (SanDisk) to high-capacity enterprise HDDs and high-performance NVMe SSDs, provides resilience against market shifts in any single segment.

Competitor Replication Difficulty:Hard

- Advantage:

Vertical Integration in NAND Flash

Sustainability Assessment:The joint venture with Kioxia gives Western Digital direct control over NAND flash production, ensuring supply, influencing technology roadmaps, and providing cost advantages. Only Samsung and Micron have similar capabilities.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Brand Equity

Sustainability Assessment:Brands like WD, WD_BLACK, WD Red, and SanDisk have powerful recognition and trust in their respective consumer, gaming, NAS, and removable storage markets, creating a loyal customer base.

Competitor Replication Difficulty:Medium

- Advantage:

Established Global Distribution Channels

Sustainability Assessment:Long-standing relationships with OEMs, distributors, and a strong retail presence (both online and brick-and-mortar) create a significant barrier for new entrants.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Promotional Pricing and Bundles', 'estimated_duration': 'Short-term (per campaign)'}

{'advantage': 'Time-to-Market with New Technology', 'estimated_duration': '6-18 months'}

Disadvantages

- Disadvantage:

Technology Lag in Next-Gen HDDs

Impact:Major

Addressability:Difficult

- Disadvantage:

Brand Perception vs. Samsung in SSDs

Impact:Minor

Addressability:Moderately

- Disadvantage:

Dependence on Cyclical Memory Market

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns highlighting the TCO and energy efficiency of high-capacity HDDs for data centers.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Expand the 'Color Drives' marketing concept to SSDs more explicitly to simplify the buying process for consumers.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Create bundled promotions pairing WD_BLACK gaming drives (SSD + HDD) to capture both performance and capacity needs of gamers.

Expected Impact:Low

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Aggressively market and sample next-generation MAMR/ePMR HDDs to all major cloud service providers to counter Seagate's HAMR narrative.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop and market specialized SSD product lines for AI/ML workloads, focusing on endurance, low latency, and consistent performance.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Strengthen the SanDisk Professional brand with integrated software solutions for creative professionals to create a stickier ecosystem.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Invest in R&D for post-flash memory technologies (e.g., storage-class memory) to create a defensible long-term advantage.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore opportunities in computational storage, integrating processing capabilities directly onto storage devices to serve edge computing and AI markets.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Consider strategic acquisitions of software companies specializing in data management, security, or orchestration to move up the value stack.

Expected Impact:High

Implementation Difficulty:Difficult

Position Western Digital as the most comprehensive and versatile data storage partner, uniquely capable of providing optimized solutions from the edge to the core cloud with both leading HDD and flash technologies.

Differentiate through portfolio breadth and application-specific optimization. While competitors may lead in a single technology (e.g., Seagate's HAMR, Samsung's SSDs), Western Digital's strength is its ability to architect end-to-end data infrastructure using the best technology for each workload, from high-performance flash to cost-effective capacity HDDs.

Whitespace Opportunities

- Opportunity:

Develop turn-key, private cloud infrastructure solutions for Small and Medium-sized Businesses (SMBs).

Competitive Gap:Hyperscalers (AWS, Azure) can be complex and expensive for SMBs, while direct competitors are focused on selling components, not integrated solutions. This bridges the gap.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create a 'Sustainability' product line of drives for data centers, certified for low power consumption and built with recycled materials.

Competitive Gap:Competitors are not yet using sustainability as a primary marketing and product differentiator for their enterprise product lines.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Launch industry-specific storage solutions (e.g., for genomics, media & entertainment post-production, autonomous vehicle data logging) with certified partner software.

Competitive Gap:Most competitors offer general-purpose drives. A certified solution offers a higher-value proposition and creates stickiness.

Feasibility:High

Potential Impact:Medium

Western Digital operates in the mature, oligopolistic data storage industry, which is defined by high barriers to entry due to massive capital requirements and deep technological expertise. The market is dominated by a few key players: Seagate in the HDD space, and Samsung and Micron in the NAND flash/SSD space. For calendar year 2025, Western Digital holds a leading ~42% market share in HDD units shipped, slightly ahead of Seagate's ~41%, with Toshiba at ~17-18%. This demonstrates a strong, stable position in the mass capacity storage market.

The primary competitive tension is the technological transition from HDDs to SSDs for performance-sensitive applications, a trend that pits Western Digital against flash memory specialists like Samsung and Micron. Simultaneously, the insatiable demand for mass data storage from cloud hyperscalers and AI applications keeps the high-capacity HDD market highly relevant and lucrative. Western Digital's core competitive advantage lies in its unique, balanced portfolio, possessing top-tier positions in both HDD and NAND flash markets, a feat only matched by a handful of global firms. This vertical integration in flash (via its Kioxia partnership) and its extensive brand portfolio (WD, SanDisk) are sustainable advantages that are difficult for competitors to replicate.

Seagate poses the most direct threat, particularly with its aggressive roadmap for HAMR technology, which could give it a capacity and cost advantage in next-generation HDDs. Samsung remains the benchmark for SSD performance and market share, against which Western Digital's own SSD offerings are constantly measured. Indirectly, the massive growth of public cloud providers like AWS and Azure represents both the largest opportunity and a threat; they are the primary customers for enterprise drives but also obviate the need for many businesses to purchase their own storage hardware.

Strategic opportunities for Western Digital lie in leveraging its dual-technology expertise. There is significant whitespace in providing integrated, industry-specific solutions that combine the performance of flash with the economics of disk. By focusing on application-specific value (e.g., AI workloads, SMB private cloud, M&E workflows) rather than just component sales, Western Digital can differentiate itself from more specialized competitors and create a stickier, higher-margin business.

Messaging

Message Architecture

Key Messages

- Message:

Need Storage? There’s a WD color drive for you.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Carousel

- Message:

Get the Tech, Get the Grade. Success starts with storage and backup you can trust.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Carousel

- Message:

HDDs Are the Past, Present, and Future of the Data Center

Prominence:Secondary

Clarity Score:Medium

Location:Homepage Content Section

- Message:

Game Beyond Limits. Don’t play favorites. Play and store it all.

Prominence:Secondary

Clarity Score:High

Location:Homepage Content Section

- Message:

A Legacy in Technology and Innovation. We’ve been redefining storage with game-changing technologies for 50-plus years.

Prominence:Tertiary

Clarity Score:High

Location:Homepage Lower Section

The message hierarchy is fragmented and audience-driven rather than unified by a central brand promise. The homepage acts as a portal, rotating primary messages for different consumer segments (general users, students) in the hero section, while secondary messages target more specific personas (gamers, data center professionals) below. This approach ensures relevance for multiple audiences but sacrifices a singular, powerful first impression of the overall Western Digital brand.

Messaging is thematically inconsistent across the homepage, jumping from simple consumer needs ('Need Storage?') to highly technical, enterprise-level topics ('Implementing SMR') with little transition. While each message is consistent within its own module, the overall user journey lacks a cohesive narrative thread, creating a disjointed experience.

Brand Voice

Voice Attributes

- Attribute:

Direct & Simple

Strength:Strong

Examples

Need Storage?

There’s a WD color drive for you.

- Attribute:

Aspirational & Benefit-Oriented

Strength:Moderate

Examples

Get the Tech, Get the Grade

Game Beyond Limits

- Attribute:

Authoritative & Corporate

Strength:Strong

Examples

- •

A Legacy in Technology and Innovation

- •

HDDs Are the Past, Present, and Future of the Data Center

- •

Western Digital Validates Real-World AI Storage Performance

Tone Analysis

Informational

Secondary Tones

- •

Promotional

- •

Aspirational

- •

Technical

Tone Shifts

Shifts abruptly from a simple, helpful consumer tone in the hero section to a technical, authoritative tone in the data center and innovation sections.

Voice Consistency Rating

Fair

Consistency Issues

The voice lacks a consistent personality, morphing significantly to fit the target audience of each specific content block.

The shift between B2C-friendly language and B2B technical jargon is jarring and lacks a unifying brand character to bridge the gap.

Value Proposition Assessment

Western Digital provides a specialized, high-performance storage solution for every conceivable need, from everyday consumers and gamers to the world's largest data centers, backed by 50+ years of technological innovation.

Value Proposition Components

- Component:

Comprehensive Portfolio for All Needs

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Simplified Product Selection (Color-Coding)

Clarity:Clear

Uniqueness:Unique

- Component:

Performance Leadership for Niche Segments (Gaming, NAS, etc.)

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Enterprise-Grade Reliability & Innovation

Clarity:Somewhat Clear

Uniqueness:Common

- Component:

Trust & Longevity (50+ Years)

Clarity:Clear

Uniqueness:Common

The most effective differentiation is the 'WD color drive' system. It simplifies a complex purchasing decision for consumers and prosumers, creating a strong, unique brand asset. For other segments like gaming (WD_BLACK) and enterprise, the differentiation is based on performance and reliability, which is a common battleground with competitors like Seagate and Samsung. The messaging doesn't sufficiently elevate what makes their performance uniquely better.

The messaging positions Western Digital as an established, comprehensive, and innovative leader catering to the entire market spectrum. They aim to be a 'trusted leader' by showcasing a diverse range of products for all use cases, from consumer to enterprise cloud. This 'something for everyone' approach positions them as a foundational pillar of the data storage industry.

Audience Messaging

Target Personas

- Persona:

General Consumers

Tailored Messages

Need Storage? There’s a WD color drive for you.

Effectiveness:Effective

- Persona:

Students & Educators

Tailored Messages

Get the Tech, Get the Grade

Students and teachers save 20%*.

Effectiveness:Effective

- Persona:

Gamers

Tailored Messages

Game Beyond Limits

Don’t play favorites. Play and store it all.

Effectiveness:Effective

- Persona:

Creative Professionals

Tailored Messages

Celebrate World Photo Day

Explore the best hard drives for creative professionals.

Effectiveness:Somewhat

- Persona:

Enterprise / Data Center Professionals

Tailored Messages

HDDs Are the Past, Present, and Future of the Data Center

Western Digital Validates Real-World AI Storage Performance

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

Running out of storage space

- •

Fear of data loss ('backup you can trust')

- •

Difficulty choosing the right drive for a specific need

- •

Performance limitations in gaming

Audience Aspirations Addressed

- •

Academic success ('Get the Grade')

- •

Unlimited gaming experience ('Game Beyond Limits')

- •

Professional creativity and workflow efficiency

- •

Building and maintaining future-proof data centers

Persuasion Elements

Emotional Appeals

- Appeal Type:

Aspiration

Effectiveness:Medium

Examples

Success starts with storage and backup you can trust.

Game Beyond Limits

- Appeal Type:

Security / Peace of Mind

Effectiveness:Medium

Examples

storage and backup you can trust

- Appeal Type:

Simplicity / Ease

Effectiveness:High

Examples

Need Storage? There’s a WD color drive for you.

Social Proof Elements

- Proof Type:

Product Ratings & Reviews

Impact:Moderate

Examples

3.6 (292)

3.8 (155)

Trust Indicators

- •

Longevity statement ('50-plus years')

- •

'Industry News' section with press releases and blogs

- •

Extended warranty offers ('we will automatically upgrade the limited warranty period')

- •

Explicitly targeting business customers with 'Western Digital for Business'

Scarcity Urgency Tactics

Time-bound offers ('valid between July 29, 2025 and August 31, 2025')

Seasonal promotions ('Back-to-School')

Calls To Action

Primary Ctas

- Text:

Shop Now

Location:Multiple Hero Banners and Product Sections

Clarity:Clear

- Text:

Learn More

Location:Multiple Hero Banners and Product Sections

Clarity:Clear

- Text:

The Numbers Tell the Story

Location:Data Center Section

Clarity:Somewhat Clear

- Text:

Read More

Location:Blog Section

Clarity:Clear

The CTAs are generally clear and direct. However, the homepage presents too many competing CTAs without a clear visual hierarchy, potentially leading to choice paralysis. For example, the 'Gaming' section has both 'Learn More' and 'Shop Now' with equal weight, dividing user intent rather than guiding it down a preferred path.

Messaging Gaps Analysis

Critical Gaps

- •

A unifying brand story or tagline that connects the diverse product lines and audiences. The mission 'To unlock the potential of data' is not translated into a compelling, customer-facing message.

- •

Human-centric storytelling. The site lacks customer testimonials, case studies, or narratives that show how real people or businesses benefit from their products, a strategy that could bridge the B2C and B2B gap.

- •

Emotional connection. The messaging is highly functional and product-focused, missing opportunities to connect with the deeper reasons customers need storage—preserving memories, building a business, creating art.

Contradiction Points

There are no direct contradictions, but there is a significant 'tonal dissonance' between the very simple, consumer-friendly messaging and the dense, technical enterprise-focused content on the same page.

Underdeveloped Areas

The 'Legacy in Technology' message is stated but not demonstrated with compelling stories or a visual timeline.

The value proposition for creative professionals is underdeveloped compared to the detailed messaging for gamers and data centers.

Messaging Quality

Strengths

- •

Excellent audience segmentation, with clear, dedicated messaging for key personas like students, gamers, and enterprises.

- •

The 'color drive' concept is a powerful and simple messaging tool that clarifies the value proposition for the consumer segment.

- •

Clear, benefit-oriented headlines for targeted promotions (e.g., 'Get the Tech, Get the Grade').

Weaknesses

- •

Lack of a cohesive, overarching brand message on the homepage, leading to a fragmented user experience.

- •

Over-reliance on technical specifications and product categories rather than customer-centric solutions and stories.

- •

Inconsistent brand voice that shifts to match the audience rather than adapting a core brand personality for each audience.

Opportunities

- •

Develop a central brand campaign around the theme of 'unlocking potential' to unify the different product segments.

- •

Incorporate user-generated content or customer stories to build social proof and emotional connection.

- •

Create a smoother content journey that guides users from general needs to specific, high-tech solutions, effectively bridging the gap between consumer and enterprise messaging.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Message Hierarchy

Recommendation:Establish a single, powerful, and persistent headline message at the top of the page that encapsulates the core brand promise for all audiences. Sub-messaging can then guide specific segments.

Expected Impact:High

- Area:

Brand Storytelling

Recommendation:Create a dedicated content block on the homepage for customer stories (video or short-form articles) showcasing diverse use cases, from a photographer backing up a shoot to a data center managing AI workloads.

Expected Impact:High

- Area:

Voice & Tone

Recommendation:Define a core set of brand voice attributes (e.g., 'Empowering, Precise, Human') and create a style guide on how to adapt this core voice for different audiences without losing its essential character.

Expected Impact:Medium

Quick Wins

- •

A/B test the CTA buttons. For sections with two CTAs ('Learn More' vs. 'Shop Now'), test a single, more directive CTA like 'Explore Gaming Drives' to reduce friction.

- •

Make the 'WD Color Drive' explainer more interactive and prominent on the homepage to leverage this key differentiator.

- •

Rewrite the 'A Legacy in Technology' headline to be more benefit-oriented, such as '50 Years of Innovation, Protecting What Matters Most.'

Long Term Recommendations

- •

Restructure the site architecture around 'Solutions for...' rather than just product categories to better align with customer intent.

- •

Invest in a content marketing hub that tells the story of data in the modern world, positioning WD as a thought leader beyond just a hardware manufacturer.

- •

Develop a personalization strategy for the website that serves more relevant messaging to returning visitors based on their previous browsing behavior.

Western Digital's website messaging is tactically effective but strategically fragmented. The company excels at segmenting its audience and delivering clear, functional messages tailored to specific groups like students, gamers, and data center managers. The 'WD color drive' system is a standout example of simplifying a complex value proposition. However, the homepage fails to weave these disparate threads into a cohesive brand narrative. It functions more like a digital storefront with different departments than a unified brand experience. The brand voice shifts dramatically between a simple consumer tone and a dense, technical B2B voice, creating a jarring journey for users who don't fit neatly into one box. The core brand mission, 'To unlock the potential of data,' is a powerful idea that remains largely unexpressed in customer-facing messaging. The key opportunity lies in elevating the communication from a product-centric catalog to a brand-centric story. By building a narrative around how WD's legacy of innovation empowers all its customers—from the student to the enterprise—to achieve their goals, the company can create a stronger emotional connection, improve brand recall, and better differentiate itself in a competitive market.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established market leadership in the Hard Disk Drive (HDD) market, particularly for data center and nearline storage.

- •

Broad product portfolio catering to diverse segments, including consumer, client computing, and enterprise data centers, under well-known brands like WD, SanDisk, and G-Technology.

- •

Strong, long-standing relationships with major OEMs and hyperscale cloud providers who are primary consumers of high-capacity HDDs.

- •

Recent financial performance exceeded analyst expectations, indicating robust demand for their products in key segments like cloud.

Improvement Areas

- •

Strengthen competitive positioning in the enterprise Solid-State Drive (SSD) market against dominant players like Samsung and Micron.

- •

Accelerate the development and market adoption of next-generation HDD technologies like Heat-Assisted Magnetic Recording (HAMR) to maintain a cost-per-terabyte advantage.

- •

Enhance product differentiation in the consumer market, where SSDs are increasingly cannibalizing HDD sales.

Market Dynamics

Data Storage Market CAGR projected at 12-14% through 2029; AI Powered Storage market CAGR at ~25%.

Mature

Market Trends

- Trend:

Explosive Data Growth Driven by AI and Cloud

Business Impact:Massive demand driver for high-capacity, cost-effective storage. Global data generation is expected to triple by 2028, creating a significant tailwind for WD's core HDD business targeting data centers and cloud providers.

- Trend:

HDD vs. SSD Cannibalization and Coexistence

Business Impact:SSDs are replacing HDDs in client devices (laptops, PCs), but HDDs remain dominant for mass capacity storage in data centers due to a significant cost-per-terabyte advantage. This bifurcation requires a dual-focused strategy.

- Trend:

Strategic Company Separation

Business Impact:WD's plan to separate its HDD and Flash businesses into two independent companies is a pivotal event. This move aims to unlock shareholder value by allowing each entity to focus on its distinct market dynamics, capital needs, and growth opportunities.

- Trend:

Sustainability and Energy Efficiency in Data Centers

Business Impact:Growing pressure on data centers to reduce their environmental footprint creates an opportunity for energy-efficient storage solutions. Lower power consumption per terabyte can become a key competitive differentiator.

Excellent. The surge in AI-related data generation and cloud expansion provides a strong, immediate growth catalyst for Western Digital's high-capacity storage solutions.

Business Model Scalability

High

High fixed costs associated with R&D and manufacturing facilities (fabs), leading to significant operating leverage at high utilization rates.

High. Profitability is highly sensitive to manufacturing volume and capacity utilization. Small changes in demand or pricing can have a large impact on margins.

Scalability Constraints

- •

High capital expenditure required for building and maintaining advanced manufacturing facilities.

- •

Complex global supply chain susceptible to geopolitical risks and disruptions.

- •

Long lead times for capacity expansion, requiring accurate long-term demand forecasting.

Team Readiness

Experienced leadership team navigating a complex industry and a major corporate separation. The appointment of separate CEOs for the upcoming HDD and Flash entities demonstrates proactive planning for the transition.

Currently undergoing a fundamental transformation with the planned company split. Post-separation, the more focused structures are expected to enhance agility and market alignment.

Key Capability Gaps

- •

Post-split, the standalone Flash company will need to build out corporate functions that were previously shared.

- •

Ensuring minimal disruption to customer relationships and supply chains during the separation process will be a critical operational challenge.

- •

Attracting and retaining specialized engineering talent for next-generation technologies like HAMR and advanced 3D NAND is a perpetual challenge.

Growth Engine

Acquisition Channels

- Channel:

Enterprise & Cloud Direct Sales

Effectiveness:High

Optimization Potential:High

Recommendation:Deepen strategic co-development partnerships with top 5 hyperscalers to align product roadmaps (e.g., HAMR adoption) and secure long-term purchase agreements.

- Channel:

OEM Partnerships (e.g., Dell, HP)

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Develop bundled solutions and joint marketing programs focused on specific high-growth workloads like AI workstations and edge computing servers.

- Channel:

Channel Partners & Distributors

Effectiveness:High

Optimization Potential:Medium

Recommendation:Create specialized training and incentive programs for partners focused on selling solutions for NAS, surveillance, and data center applications.

- Channel:

Direct-to-Consumer (D2C) E-commerce

Effectiveness:Medium

Optimization Potential:High

Recommendation:Improve site personalization and product recommendation engines. Use content marketing (e.g., 'The Numbers Tell the Story') to educate users on specific use cases (Gaming, Creative Pro) and guide purchasing decisions.

Customer Journey

For D2C, the path is relatively standard: Homepage > Category (e.g., Gaming) > Product Listing > Product Detail > Cart. For Enterprise, it's a long, relationship-based sales cycle.

Friction Points

- •

Product differentiation can be confusing for non-technical consumers (e.g., understanding the WD 'color' system).

- •

For enterprise customers, the qualification and testing cycle for new technologies can be lengthy and complex.

- •

The website occasionally experiences server errors, as noted in the provided content ('Internet Server Error'), which can disrupt the user journey.

Journey Enhancement Priorities

{'area': 'D2C Product Education', 'recommendation': 'Implement interactive tools and wizards on the website to help users select the right drive based on their specific needs and devices.'}

{'area': 'Enterprise Sales Enablement', 'recommendation': 'Develop a robust resource center with technical whitepapers, TCO calculators, and performance benchmarks to help enterprise clients justify and accelerate procurement decisions.'}

Retention Mechanisms

- Mechanism:

Product Reliability & Brand Reputation

Effectiveness:High

Improvement Opportunity:Proactively market long-term reliability data and low failure rates, especially for enterprise-grade drives, to reinforce brand trust.

- Mechanism:

Ecosystem Lock-in (for NAS/RAID)

Effectiveness:Medium

Improvement Opportunity:Develop enhanced software and management tools for WD NAS and enterprise systems to create a more integrated and sticky user experience.

- Mechanism:

Warranty and Customer Support

Effectiveness:Medium

Improvement Opportunity:Promote the extended warranty offer (mentioned on the website) more prominently as a key purchase driver and value-add for D2C customers.

Revenue Economics

Classic manufacturing economics: driven by maximizing fab/plant utilization, managing supply chain costs, and optimizing product mix between high-margin enterprise products and lower-margin consumer products. Subject to cyclicality in both pricing and demand.

Primarily relevant for the D2C segment. Likely moderate. For the core Enterprise business, the focus is on the total contract value of large, recurring orders.

High, given the company's scale and market position, but profitability is volatile due to market dynamics. Recent strong financial results suggest improving efficiency.

Optimization Recommendations

- •

Increase the sales mix of high-margin, high-capacity nearline HDDs and enterprise SSDs.

- •

Implement dynamic pricing strategies in the channel and D2C segments to better respond to market fluctuations.

- •

Drive manufacturing cost reductions through process innovation and scaling next-generation technologies.

Scale Barriers

Technical Limitations

- Limitation:

HDD Areal Density Limits

Impact:High

Solution Approach:Aggressively invest in and commercialize next-generation technologies like HAMR to continue increasing storage capacity per platter and maintain cost leadership.

- Limitation:

NAND Flash Scaling

Impact:High

Solution Approach:Continued R&D in 3D NAND layering (BiCS) and new memory technologies to improve density, performance, and endurance for the Flash business.

Operational Bottlenecks

- Bottleneck:

Supply Chain Complexity & Volatility

Growth Impact:Disruptions can impact production, increase costs, and lead to missed revenue opportunities, a persistent risk for the industry.

Resolution Strategy:Diversify supplier base for key components, increase supply chain visibility with advanced analytics, and engage in strategic long-term agreements for critical materials.

- Bottleneck:

Execution Risk of Company Separation

Growth Impact:The process of splitting into two public companies is immensely complex and could distract leadership, disrupt operations, and confuse customers if not managed perfectly.

Resolution Strategy:Maintain dedicated separation management teams with clear mandates, ensure constant communication with employees, customers, and partners, and establish clear operational plans for 'Day 1' of the new entities.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:In HDDs, compete with Seagate on technology leadership and TCO for hyperscalers. In SSDs, focus on specific high-value enterprise niches where WD can differentiate, rather than competing solely on price in the commoditized consumer segment.

- Challenge:

Price Erosion

Severity:Major

Mitigation Strategy:Focus innovation and marketing on total cost of ownership (TCO) for enterprise customers, including power, cooling, and reliability, rather than just the upfront cost per gigabyte.

- Challenge:

Dominance of Cloud Storage Services

Severity:Minor

Mitigation Strategy:This is primarily a threat to the client/consumer storage business, but a massive opportunity for the enterprise business. Position WD as the primary hardware supplier and partner to the leading cloud providers (AWS, Azure, Google Cloud).

Resource Limitations

Talent Gaps

- •

Top-tier engineers specializing in next-generation storage technologies (HAMR, new memory types).

- •

Enterprise solutions architects who can work with hyperscale clients to design custom storage solutions.

- •

Post-split, potential need for duplicated executive and administrative roles for each new company.

Extremely high. Constant, large-scale investment is required for R&D to stay competitive and for building/upgrading fabrication plants. The business separation will also incur significant one-time costs.

Infrastructure Needs

Continued investment in state-of-the-art manufacturing and testing facilities.

Potential duplication of IT systems and corporate infrastructure to support two independent public companies.

Growth Opportunities

Market Expansion

- Expansion Vector:

Vertical Focus on AI Infrastructure

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Create a dedicated business unit and product portfolio (both HDD and SSD) specifically optimized, certified, and marketed for AI/ML workloads, which have unique and massive data storage requirements.

- Expansion Vector:

Geographic Expansion in Emerging Markets

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Expand channel partnerships and build out sales infrastructure in high-growth regions in Asia-Pacific and Latin America, focusing on data center and smart city projects.

Product Opportunities

- Opportunity:

High-Capacity, Energy-Efficient 'Green' HDDs

Market Demand Evidence:Increasing focus on sustainability and reducing power consumption (PUE) in data centers.

Strategic Fit:High

Development Recommendation:Market and brand a specific product line of HDDs that offers the lowest watts-per-terabyte, appealing to environmentally conscious hyperscalers and enterprises.

- Opportunity:

Specialized Enterprise SSDs for AI

Market Demand Evidence:AI training and inference workloads require extremely high-performance storage for data pipelines.

Strategic Fit:High

Development Recommendation:Post-split, the Flash company should develop and co-engineer SSDs with AI accelerator companies (like NVIDIA) to create optimized solutions for specific AI models and frameworks.

Channel Diversification

- Channel:

Expanded Cloud Marketplace Presence

Fit Assessment:Good

Implementation Strategy:Partner with major cloud providers to offer Western Digital's storage solutions (e.g., for hybrid cloud) directly through their marketplaces, simplifying procurement for enterprise IT.

Strategic Partnerships

- Partnership Type:

AI & Machine Learning Ecosystem

Potential Partners

- •

NVIDIA

- •

AMD

- •

AI software platforms (e.g., Databricks)

Expected Benefits:Certify storage solutions for popular AI hardware and software stacks, creating a stronger value proposition and a technical moat.

- Partnership Type:

Cloud Service Providers (CSP)

Potential Partners

- •

Amazon Web Services (AWS)

- •

Microsoft Azure

- •

Google Cloud

Expected Benefits:Move beyond a simple supplier relationship to become a strategic partner in designing next-generation cloud data center storage architectures.

Growth Strategy

North Star Metric

Total Exabytes Shipped

This metric is the ultimate measure of market share, manufacturing scale, and relevance in the data storage industry. It directly reflects how much of the world's growing data is being stored on Western Digital products.

Achieve a CAGR of >20% in total exabytes shipped, with a specific focus on growing nearline HDD exabyte shipments at a rate exceeding the market average.

Growth Model

Hybrid: Product-Led & Enterprise Sales-Led

Key Drivers

- •

Technological Innovation (delivering higher capacities and better TCO).

- •

Deep relationships with a concentrated set of hyperscale and OEM customers.

- •

Manufacturing scale and cost efficiency.

The HDD business must be intensely focused on a sales-led model targeting the largest data creators. The Flash business will need a broader approach, combining enterprise sales with strong channel and D2C marketing.

Prioritized Initiatives

- Initiative:

Successfully Execute Company Separation

Expected Impact:High

Implementation Effort:Very High

Timeframe:6-9 months

First Steps:Finalize leadership teams, complete all regulatory filings, and execute a clear communication plan for customers, partners, and employees on the transition.

- Initiative:

Win the AI Storage Market

Expected Impact:High

Implementation Effort:High

Timeframe:12-24 months

First Steps:Establish a cross-functional team to define the AI storage portfolio. Launch a pilot program with 2-3 key AI companies to co-develop and validate the new solutions.

- Initiative:

Scale HAMR HDD Production

Expected Impact:High

Implementation Effort:High

Timeframe:18-36 months

First Steps:Complete successful testing and qualification with major hyperscale customers and begin ramping up manufacturing capacity for HAMR-based drives.

Experimentation Plan

High Leverage Tests

{'test_name': 'TCO-based Enterprise Marketing', 'hypothesis': 'Marketing campaigns focused on Total Cost of Ownership (power, cooling, density) will generate more qualified enterprise leads than campaigns focused on upfront drive price.'}

{'test_name': 'D2C Website Persona-based Journeys', 'hypothesis': "Creating distinct website paths and content for 'Gamers' vs. 'Creative Pros' will increase conversion rates for those segments."}

Use a combination of business intelligence data (sales mix, margin analysis) for major initiatives and standard digital marketing metrics (lead quality, conversion rate, AOV) for D2C experiments.

Continuous A/B testing on the D2C website. Quarterly reviews of pilot programs with enterprise partners for new technologies.

Growth Team

Post-separation, each company should have its own focused growth team. HDD Co: A 'Strategic Accounts Growth Team' focused on co-development with hyperscalers. Flash Co: A more traditional structure with leads for Product Marketing, Demand Generation, and Channel Marketing.

Key Roles

- •

Head of AI Storage Solutions

- •

Director of Hyperscale Partnerships

- •

Senior Product Manager, Next-Gen Technology (HAMR/Flash)

- •

Head of D2C E-commerce

Invest in training for the sales team on consultative, TCO-based selling. Build deep technical expertise in AI workloads and their specific storage demands.

Western Digital is at a pivotal moment, poised for significant growth but also navigating substantial transformation. The company exhibits a strong growth foundation, anchored by its dominant position in the HDD market which is experiencing a renaissance driven by the explosive data demands of AI and cloud computing. The market timing is excellent, with massive tailwinds from these technology trends. However, the company faces critical challenges, including intense competition across both HDD and SSD segments, the inherent cyclicality and capital intensity of the industry, and the significant execution risk associated with its impending separation into two independent companies.

The primary growth opportunity lies in becoming the undisputed storage leader for AI infrastructure. This requires a focused strategy to provide cost-effective, high-capacity HDDs for data lakes and high-performance SSDs for AI training and inference. The planned separation is a strategic catalyst that should unlock focus and allow each business to tailor its strategy and capital allocation to its unique market. The HDD entity can double down on its relationship with hyperscalers and its TCO advantage, while the Flash entity can be more agile in the fast-moving SSD market.

The recommended growth strategy is to successfully execute the separation while simultaneously launching a concerted effort to win the AI storage market. The North Star Metric should be 'Total Exabytes Shipped,' as this holistically captures market share and relevance. Success will hinge on continued technological innovation (especially scaling HAMR), deepening strategic partnerships with cloud and AI leaders, and flawlessly managing the operational complexity of the corporate split. If executed well, Western Digital can emerge as two more focused, formidable, and high-growth companies.

Legal Compliance

Western Digital Corporation

https://www.westerndigital.com

2025-08-26

Data Storage Solutions Provider (Hardware, Software, and Services)

Technology Hardware & Storage

Consumers, Creative Professionals, Businesses (SMB to Enterprise), Data Centers

Global

Western Digital maintains a comprehensive and easily accessible 'Privacy Statement'. The policy is well-structured, detailing the types of personal information collected (e.g., identifiers, commercial information, internet activity), the sources of this information, and the purposes for its use, including product fulfillment, marketing, and analytics. It provides specific sections for major global regulations, including dedicated information for residents of the EEA, UK, Switzerland, and California, which demonstrates a strong understanding of its global compliance obligations. The policy clearly outlines user rights such as access, deletion, and opt-out, and provides clear mechanisms to exercise these rights via a dedicated privacy portal. The level of detail is appropriate for a global technology company that handles significant amounts of customer data through sales, support, and account management.

The website provides 'Terms of Sale' for direct purchases, which are distinct from broader 'Terms of Use' for website interaction. The Terms of Sale are detailed, covering orders, pricing, payment, shipping, and return policies. For business customers and partners, more complex agreements likely govern relationships, but the consumer-facing terms are clear and enforceable for e-commerce transactions. Key clauses regarding limitations of liability, warranty information (which is a critical component for hardware), and dispute resolution are present. The language is formal but generally understandable for a consumer audience. The separation of sales terms from general use terms is a good practice for clarity.

Western Digital employs a sophisticated cookie consent banner upon the first visit. The banner provides clear options to 'Accept All Cookies' or 'Reject All', with a third option to 'Manage Cookies'. This granular control allows users to opt-in or opt-out of specific categories (e.g., Functional, Performance, Targeting), which aligns with the requirements of GDPR. The mechanism is a clear example of an opt-in system, rather than a less compliant 'browse-to-consent' model. A persistent link to manage cookie preferences is typically available in the website footer, providing ongoing user control. This represents a robust and compliant approach to cookie management.

As a data storage company, Western Digital's brand reputation is intrinsically linked to data security and protection. The privacy statement outlines security measures taken to protect personal information. For its cloud and enterprise products, the company provides extensive documentation on security protocols and compliance with standards like ISO/IEC 27001 and SOC 2, although this is more product-specific than website compliance. The website itself uses HTTPS to encrypt data in transit. The company's overall data protection posture appears strong, reflecting the critical nature of data in its industry. The privacy policy explicitly states that they do not sell personal information in the traditional sense but may share it for cross-context behavioral advertising, with clear opt-out rights provided as required by CCPA/CPRA.

A dedicated 'Accessibility' statement is present and linked in the website footer. The statement affirms Western Digital's commitment to digital accessibility and its goal of conforming to the Web Content Accessibility Guidelines (WCAG) 2.1 Level AA. This is a crucial public commitment that reduces legal risk under laws like the Americans with Disabilities Act (ADA). The statement also provides a contact method (email and phone number) for users who encounter accessibility barriers. While a full audit was not performed, the presence of this policy and the standard structure of the site (e.g., use of headings, clear navigation) suggest a proactive approach to accessibility. However, continuous monitoring and testing are necessary to ensure ongoing compliance.

For a hardware manufacturer, compliance extends far beyond website policies. Key industry-specific regulations include:

- Environmental & E-Waste: Compliance with regulations like the EU's WEEE (Waste Electrical and Electronic Equipment) and RoHS (Restriction of Hazardous Substances) directives is critical for market access in Europe and other regions. The company addresses this through its Corporate Responsibility reporting.

- Supply Chain & Conflict Minerals: As a major electronics company, Western Digital is subject to regulations regarding the sourcing of 'conflict minerals' (tin, tantalum, tungsten, and gold). It is required to conduct supply chain due diligence and report on its efforts, a key area of scrutiny for investors and regulators.

- Consumer Protection & Warranty Law: The company must adhere to various national and state laws regarding product warranties. The promotional pop-ups mentioning 'extended warranty' highlight this, and the Terms of Sale must accurately reflect these legal obligations.