eScore

thekrogerco.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Kroger possesses a formidable digital presence due to its sheer scale, high domain authority, and extensive consumer-facing platforms like Kroger.com and its mobile app. The corporate site, thekrogerco.com, effectively serves its primary audience (investors, media) with clear navigation to corporate information. However, the overall score is tempered by a significant strategic content gap; the site fails to adequately showcase Kroger's deep capabilities in data science and technology, a core competitive advantage. This under-positioning as a food-tech leader limits its authority in key industry conversations and talent attraction.

Massive consumer digital footprint with a highly-trafficked e-commerce site (kroger.com) and app, demonstrating a successful omnichannel strategy that drives significant digital sales.

Launch a dedicated 'Innovation' or 'Data & Technology' hub on the corporate website to showcase thought leadership from its 84.51° subsidiary, detailing advancements in AI, data analytics, and retail media to better reflect its identity as a food-tech leader.

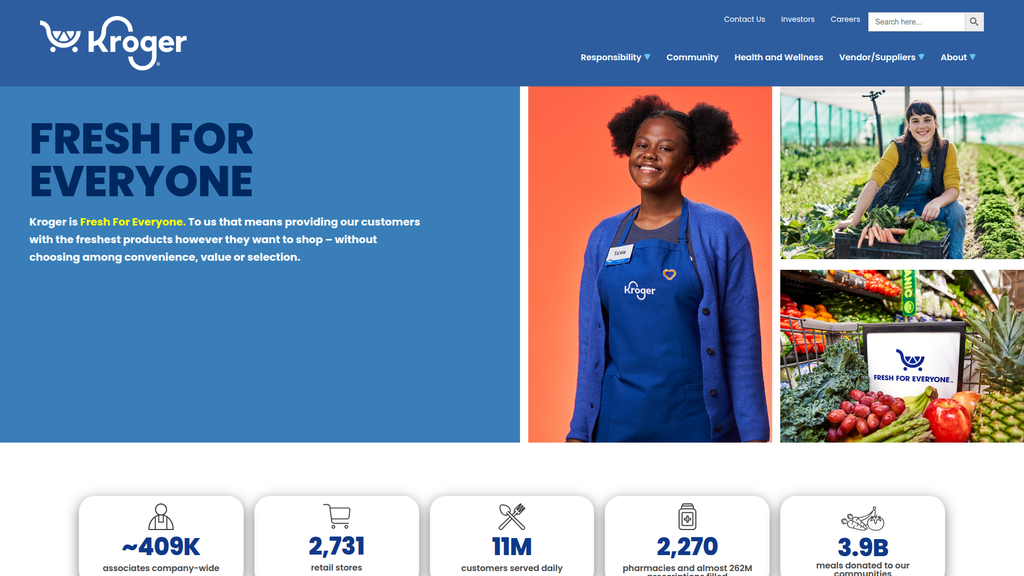

Kroger's brand communication is anchored by the clear, consistent, and effective primary message of 'Fresh for Everyone,' which is skillfully tailored to different corporate audiences. The messaging effectively communicates scale and community impact, using large, specific metrics to build trust. The primary weakness identified in the analysis is the underdeveloped narrative around its technological innovation and private label brand strength, which are critical business differentiators. The overall corporate tone is professional but could be more engaging to fully capture the brand's innovative spirit.

The core brand promise, 'Fresh for Everyone,' is exceptionally clear and consistently applied, serving as a strong foundation for all secondary messaging pillars like community impact and value.

Develop and integrate compelling narratives around the innovation within 'Our Brands' and the data science prowess of 84.51°, moving these from tertiary points to key supporting messages of the brand's value proposition.

For its intended corporate audience, the website's conversion experience is functional, with logical navigation to key information like investor reports and news releases. However, the analysis highlights significant friction points, including high information density and a generic design that increases cognitive load. While the company has a stated commitment to accessibility, the corporate site has execution gaps. The score reflects a site that is adequate for users with a specific goal but does little to guide or engage a browsing user, and misses opportunities for a modern, seamless experience.

The site's information architecture is logical, effectively segmenting content for its distinct corporate audiences (investors, media, job seekers), allowing users with clear intent to find relevant information efficiently.

Redesign content-heavy modules like 'News & Headlines' using a card-based layout with better visual hierarchy to reduce cognitive load and improve scannability, particularly on mobile devices.

Kroger as a corporation has high credibility, reinforced by its scale, long history, ESG reporting, and third-party awards. However, this score is significantly penalized by a critical and surprising governance failure on the corporate website itself. The provided legal analysis reveals a complete absence of essential legal links (Privacy Policy, Terms of Service, Your Privacy Choices) in the site's footer, creating a major transparency gap and unnecessary legal risk. This execution flaw undermines the company's otherwise mature compliance framework.

Strong third-party validation through ESG reports, industry awards, and a public commitment to corporate governance and social impact ('Zero Hunger | Zero Waste') builds significant brand trust and credibility.

Immediately implement a universal, legally-vetted footer across all web properties, especially thekrogerco.com, containing links to the Privacy Policy, Terms of Service, 'Your Privacy Choices,' and the Accessibility Statement to close a critical compliance and transparency gap.

Kroger possesses several powerful and sustainable competitive advantages that are very difficult to replicate. The most significant moat is its proprietary first-party data from over 60 million households, leveraged by its 84.51° analytics division to drive personalization and a high-margin retail media business. Its extensive portfolio of high-margin private label brands ('Our Brands') creates customer loyalty and financial benefits. These advantages, combined with its vast physical store network for omnichannel fulfillment, create a formidable competitive position despite intense pressure from rivals like Walmart.

The 84.51° data science and analytics division provides a deep, sustainable competitive moat, enabling hyper-personalization and powering the high-growth Kroger Precision Marketing (KPM) platform.

Further leverage the 'Our Brands' portfolio as a strategic asset by positioning it not just as a private label alternative, but as a portfolio of destination brands known for innovation and quality.

As a mature market leader, Kroger's growth is steady rather than explosive, focusing on efficiency and market share consolidation. Scalability is being driven by strategic investments in technology, particularly the Ocado partnership for automated e-commerce fulfillment, which aims to solve the profitability challenge of online grocery. The rapid growth of its high-margin retail media network provides a highly scalable revenue stream. However, growth is constrained by the capital-intensive nature of its physical stores and regulatory hurdles that limit large-scale acquisitions.

The retail media network (Kroger Precision Marketing) is a highly scalable, high-margin business that leverages existing assets (data and customer traffic) to create a significant new revenue stream.

Accelerate the rollout and optimization of Ocado-powered Customer Fulfillment Centers (CFCs) to create a more efficient, scalable, and profitable model for the growing e-commerce business, which currently faces profitability challenges.

Kroger's business model is highly coherent and demonstrates a powerful flywheel effect where its core grocery business fuels its data analytics and retail media arms. The company effectively balances its low-margin core retail operations with investments in high-growth, high-margin alternative profit streams like Kroger Precision Marketing. Strategic focus is clear, with resources allocated to key priorities like digital transformation and freshness. Stakeholder alignment is generally strong, though balancing shareholder returns with associate investment in a unionized environment remains a key challenge.

The business model features a virtuous cycle: retail scale generates massive first-party data, which powers a personalization engine and a high-margin media business, with profits reinvested to enhance the core customer value proposition.

Continue to evolve the loyalty program ('Boost' membership) into a more comprehensive ecosystem with exclusive benefits to increase recurring revenue and deepen the data moat.

Kroger holds a commanding position as the second-largest grocer in the U.S., demonstrating significant market power. This scale provides substantial leverage with suppliers and allows for significant influence over market trends, particularly through its powerful private label program. While it lacks the absolute pricing power of Walmart, its data-driven personalization allows it to compete on value rather than just price. The company's market share trajectory is stable in a highly competitive industry, and its ability to shape the future of retail through its data and media platforms is a key indicator of its market influence.

As the #2 U.S. grocer, Kroger's immense scale provides significant leverage with suppliers, strong brand recognition, and the ability to influence industry trends.

Proactively use its data insights and corporate platform to publish proprietary research on consumer trends, establishing itself as the definitive thought leader in the American grocery landscape and further solidifying its market influence.

Business Overview

Business Classification

Omnichannel Retail

eCommerce

Grocery and Mass Market Retail

Sub Verticals

- •

Supermarkets

- •

Pharmacies

- •

Fuel Centers

- •

Retail Media

- •

Financial Services

Mature

Maturity Indicators

- •

Extensive physical store network (~2,800 stores).

- •

Strong brand recognition and long operating history (since 1883).

- •

Consistent financial performance with annual revenues of ~$150 billion.

- •

Significant market share in a highly competitive industry.

- •

Focus on operational efficiency, digital transformation, and shareholder returns.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

In-Store and Online Retail Sales

Description:The core revenue driver is the sale of perishable and non-perishable groceries, general merchandise, health/beauty products, and other items through its vast network of physical stores and digital platforms.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:Low

- Stream Name:

Private Label 'Our Brands' Sales

Description:Sales of Kroger's own brand portfolio (e.g., Simple Truth, Private Selection, Smart Way), which offer higher profit margins compared to national brands and foster customer loyalty. This stream accounts for a significant and growing portion of total sales.

Estimated Importance:Primary

Customer Segment:Budget-Conscious Families, Health-Conscious Consumers

Estimated Margin:Medium

- Stream Name:

Pharmacy Sales

Description:Revenue generated from filling prescriptions and selling over-the-counter medications and health products through its in-store pharmacies.

Estimated Importance:Secondary

Customer Segment:All Segments, particularly Seniors

Estimated Margin:Medium

- Stream Name:

Fuel Center Sales

Description:Revenue from gasoline sales at fuel centers located at supermarket locations, which also drives in-store traffic through the Fuel Points loyalty program.

Estimated Importance:Secondary

Customer Segment:Budget-Conscious Families, General Shoppers

Estimated Margin:Low

- Stream Name:

Retail Media (Kroger Precision Marketing)

Description:A high-growth, high-margin business selling targeted advertising and promotional placements to CPG brands, leveraging Kroger's vast first-party shopper data.

Estimated Importance:Tertiary

Customer Segment:Consumer Packaged Goods (CPG) Companies

Estimated Margin:High

- Stream Name:

Financial Services & Other

Description:Includes revenue from Kroger Personal Finance (credit cards, loans), gift card sales, and other ancillary services.

Estimated Importance:Tertiary

Customer Segment:General Shoppers

Estimated Margin:Medium

Recurring Revenue Components

Boost by Kroger Membership Fees

Pricing Strategy

Competitive Pricing & Loyalty-Based Discounts

Mid-range

Transparent

Pricing Psychology

- •

Tiered Private Label Pricing ('Smart Way' for value, 'Private Selection' for premium).

- •

Loyalty Program Discounts (Kroger Plus Card).

- •

Personalized Digital Coupons based on purchase history.

- •

Fuel Points Rewards Program to incentivize spending.

- •

Subscription Model (Boost by Kroger) for delivery savings.

Monetization Assessment

Strengths

- •

Diversified revenue streams beyond core grocery sales.

- •

High-margin private label portfolio ('Our Brands') drives profitability.

- •

Rapidly growing, high-margin retail media network (Kroger Precision Marketing).

- •

Massive loyalty program (62M+ households) provides a deep data moat for personalization and targeted promotions.

Weaknesses

- •

Primary revenue stream (grocery retail) operates on notoriously thin profit margins.

- •

High dependency on the US market, limiting geographic diversification.

- •

Revenue is sensitive to economic downturns and food price inflation.

Opportunities

- •

Expand the Boost membership program by adding more exclusive benefits to increase recurring revenue.

- •

Further scale the Kroger Precision Marketing platform, leveraging its first-party data advantage.

- •

Increase penetration and innovation within the premium private label tiers to capture higher margins.

- •

Utilize data analytics to optimize pricing and promotions in real-time for margin enhancement.

Threats

- •

Intense price competition from mass-market discounters (Walmart, Aldi) and warehouse clubs (Costco).

- •

Erosion of market share by online-first players like Amazon and Instacart.

- •

Shifting consumer preferences towards convenience and specialty food retailers.

- •

Regulatory scrutiny, as seen with the proposed Albertsons merger, could limit inorganic growth.

Market Positioning

Mainstream Differentiator: Offering a wide selection of products at competitive prices ('Fresh for Everyone'), while differentiating through a strong private label portfolio, a seamless omnichannel experience, and a sophisticated data-driven personalization engine.

Top-tier player, typically ranked as the second-largest food retailer in the U.S. by market share, behind Walmart. Holds an estimated 9.9% of the online grocery market.

Target Segments

- Segment Name:

Budget-Conscious Families

Description:Households with one or more children, focused on value, weekly stock-up trips, and stretching their budget. They are the primary users of the loyalty program and digital coupons.

Demographic Factors

- •

Middle-income households

- •

Suburban and rural locations

- •

Age 30-55

Psychographic Factors

- •

Price-sensitive

- •

Value-oriented

- •

Brand-loyal to trusted, affordable options

Behavioral Factors

- •

Regular weekly shoppers

- •

High usage of loyalty cards and digital coupons

- •

High affinity for private label brands ('Our Brands').

Pain Points

- •

Rising food costs and inflation

- •

Time constraints for meal planning and shopping

- •

Finding affordable, healthy options for their family

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Time-Strapped Omnichannel Shoppers

Description:Working professionals, millennials, and busy parents who prioritize convenience and leverage digital tools for shopping. They are the primary users of eCommerce services like pickup and delivery.

Demographic Factors

- •

Millennials and Gen X

- •

Urban and suburban locations

- •

Higher-than-average disposable income

Psychographic Factors

- •

Convenience-driven

- •

Tech-savvy

- •

Values seamless integration between digital and physical experiences

Behavioral Factors

- •

Frequent users of online ordering, pickup, and delivery

- •

High mobile app engagement

- •

Likely to subscribe to 'Boost by Kroger' membership

Pain Points

- •

Lack of time for in-store grocery shopping

- •

Difficulty in planning and executing large shopping trips

- •

Desire for fast and flexible fulfillment options

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Health-Conscious Consumers

Description:Shoppers who prioritize natural, organic, and health-focused products. They are the target audience for Kroger's 'Simple Truth' private label brand.

Demographic Factors

All age groups, with a higher concentration of Millennials and Gen X

Often higher education and income levels

Psychographic Factors

- •

Health and wellness-oriented

- •

Reads labels and is conscious of ingredients

- •

Willing to pay a premium for quality and organic options

Behavioral Factors

- •

High purchase frequency of fresh produce, organic, and plant-based items

- •

Strong affinity for the 'Simple Truth' brand

- •

Engages with health and wellness content and services

Pain Points

- •

High cost of organic and specialty health foods

- •

Finding a wide variety of healthy options in one place

- •

Trusting the quality and sourcing of 'natural' products

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Data-Driven Personalization at Scale

Strength:Strong

Sustainability:Sustainable

- Factor:

Vertically Integrated Private Label Portfolio ('Our Brands')

Strength:Strong

Sustainability:Sustainable

- Factor:

Omnichannel Fulfillment Network (Stores + Ocado CFCs)

Strength:Moderate

Sustainability:Sustainable

- Factor:

High-Margin Retail Media Network (Kroger Precision Marketing)

Strength:Strong

Sustainability:Sustainable

Value Proposition

To provide customers with fresh, high-quality products at an affordable price, through a convenient and personalized shopping experience, whether in-store or online.

Excellent

Key Benefits

- Benefit:

Value and Savings

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Competitive pricing

- •

Kroger Plus Card discounts

- •

Personalized digital coupons

- •

Fuel Points program

- Benefit:

Convenience and Accessibility

Importance:Critical

Differentiation:Common

Proof Elements

- •

Large network of physical stores

- •

Online shopping via website and app

- •

Multiple fulfillment options (in-store, pickup, delivery)

- Benefit:

Quality and Freshness

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

'Fresh for Everyone' brand promise

- •

Strong private label brands like 'Private Selection' and 'Simple Truth'

- •

Sourcing standards and partnerships with farmers

- Benefit:

Personalized Shopping Experience

Importance:Important

Differentiation:Unique

Proof Elements

- •

Targeted offers and recommendations based on purchase history

- •

Data science-driven personalization via 84.51°

- •

Customizable shopping lists and digital tools

Unique Selling Points

- Usp:

Proprietary Shopper Data Science: Leveraging data from 60M+ households via its 84.51° division to offer unparalleled personalization and power a leading retail media network.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Multi-Tiered 'Our Brands' Portfolio: A comprehensive and highly successful private label strategy that caters to every customer tier (from value to premium organic), driving both loyalty and higher margins.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Integrated Rewards Ecosystem: The combination of grocery savings, personalized digital coupons, and fuel points creates a sticky loyalty loop that is difficult for non-fuel competitors to replicate.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Managing the weekly grocery budget amidst rising costs.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Finding time for grocery shopping with a busy schedule.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Accessing affordable, high-quality fresh and organic food.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Feeling overwhelmed by choices and irrelevant promotions.

Severity:Minor

Solution Effectiveness:Partial

Value Alignment Assessment

High

Kroger's focus on value, convenience, and fresh products directly aligns with the core needs of the broad US grocery market. Its omnichannel and personalization strategies are well-aligned with modern consumer behavior.

High

The multi-tiered private label strategy, comprehensive loyalty program, and diverse fulfillment options effectively cater to the distinct needs of its core segments, from budget families to convenience-seeking professionals.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Ocado (for automated e-commerce fulfillment centers).

- •

Consumer Packaged Goods (CPG) companies (as clients for Kroger Precision Marketing).

- •

Instacart (for last-mile delivery services).

- •

Technology providers (e.g., Microsoft).

- •

Local farmers and national suppliers

Key Activities

- •

Supply Chain Management and Logistics

- •

Merchandising and Inventory Management

- •

Store Operations and Customer Service

- •

Data Science and Analytics (via 84.51°).

- •

Digital Platform (Website/App) Development and Maintenance

- •

Marketing and Retail Media Sales

Key Resources

- •

Extensive network of physical stores and distribution centers.

- •

Massive first-party customer purchase dataset (Kroger Plus Card).

- •

Strong brand equity and multiple retail banners.

- •

Vertically integrated food production facilities for private label brands.

- •

Large workforce of ~400k+ associates

Cost Structure

- •

Cost of Goods Sold (COGS)

- •

Employee wages and benefits

- •

Store operating expenses (rent, utilities, maintenance)

- •

Marketing and advertising expenditures

- •

Technology and infrastructure investments (e.g., Ocado CFCs)

- •

Supply chain and logistics costs

Swot Analysis

Strengths

- •

Massive scale and market presence provides significant economies of scale.

- •

Highly profitable and defensible private label portfolio ('Our Brands').

- •

Industry-leading data analytics and personalization capabilities through 84.51°.

- •

Strong customer loyalty driven by an effective rewards ecosystem.

- •

Diversified revenue streams including fuel, pharmacy, and a high-growth retail media network.

Weaknesses

- •

High operating costs and thin profit margins inherent to the grocery industry.

- •

Heavy dependence on the U.S. market, leading to a lack of geographic diversification.

- •

Vulnerability to supply chain disruptions and labor disputes.

- •

Large physical store footprint can be a liability and requires significant capital expenditure for modernization.

Opportunities

- •

Aggressively scale the Kroger Precision Marketing (KPM) retail media network into a major profit center.

- •

Enhance and expand the 'Boost by Kroger' paid membership program to create a more robust recurring revenue ecosystem.

- •

Leverage the Ocado partnership to build highly efficient, automated fulfillment centers, reducing long-term e-commerce costs.

- •

Continue innovation in private label brands, particularly in premium and health-focused categories.

- •

Utilize data insights to develop new, personalized services (e.g., meal planning, health & wellness).

Threats

- •

Intensifying competition from Walmart, Amazon, Costco, and hard discounters like Aldi.

- •

Macroeconomic pressures like inflation and recession impacting consumer spending habits.

- •

Evolving consumer behavior favoring convenience and digital-first experiences.

- •

Significant cybersecurity risks due to the vast amount of customer data handled.

- •

Potential for antitrust regulation to block future large-scale mergers and acquisitions.

Recommendations

Priority Improvements

- Area:

E-commerce Profitability

Recommendation:Accelerate the rollout of Ocado-powered Customer Fulfillment Centers (CFCs) to shift from less efficient in-store picking to a more scalable, lower-cost automated model, thereby improving margins on digital sales.

Expected Impact:High

- Area:

Loyalty Program Evolution

Recommendation:Evolve the 'Boost' membership beyond free delivery. Integrate exclusive benefits like higher-value personalized coupons, partnerships with other services (e.g., streaming, wellness apps), or enhanced financial product perks to increase member value and stickiness.

Expected Impact:Medium

- Area:

In-Store Experience Modernization

Recommendation:Invest in targeted store remodels and technology integration (e.g., smart carts, scan-and-go) in high-potential locations to bridge the gap between the seamless digital experience and the physical store, defending against competitors.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Kroger Health' ecosystem that integrates pharmacy services, the 'Simple Truth' brand, and personalized nutrition plans (based on purchase data) into a subscription service or a premium 'Boost' tier.

- •

Explore automated, small-format stores in dense urban areas where full-size supermarkets are not viable, leveraging technology to reduce operating costs.

- •

Launch a B2B data insights platform, offering anonymized and aggregated purchase trend data as a service to CPG companies, market researchers, and financial institutions, creating a new high-margin revenue stream from existing assets.

Revenue Diversification

- •

Aggressively expand the ad formats and measurement capabilities of Kroger Precision Marketing to capture a larger share of CPG marketing budgets, including off-site and connected TV advertising.

- •

Scale the Home Chef meal kit brand beyond a grocery add-on into a more direct competitor to services like Blue Apron, leveraging Kroger's supply chain for a cost advantage.

- •

Expand the Kroger Personal Finance offerings, potentially integrating features like cashback on grocery spend directly into branded checking or savings accounts to deepen customer relationships.

The Kroger Co. represents a mature, highly resilient business model that has successfully navigated the transition from a traditional brick-and-mortar grocer to a sophisticated omnichannel retailer. Its core strength lies in a powerful flywheel effect: a vast physical footprint drives massive customer traffic, which feeds a data-rich loyalty program. This data, processed by its 84.51° analytics arm, enables deep personalization that enhances customer loyalty and drives sales. Crucially, this data asset has been transformed into a high-margin, strategic growth engine through the Kroger Precision Marketing (KPM) retail media network, which differentiates it from less data-savvy competitors. The 'Our Brands' private label portfolio is another key pillar, serving as both a customer loyalty driver and a critical margin enhancer in a low-margin industry. This vertical integration provides a significant competitive advantage.

However, the business faces substantial strategic challenges. The core grocery business is under constant margin pressure from formidable competitors like Walmart and Aldi, while the imperative to invest in technology and e-commerce fulfillment is capital-intensive. The exclusive partnership with Ocado is a forward-looking strategic bet to solve the long-term profitability puzzle of online grocery, but it requires significant upfront investment and time to scale. The evolution of its business model hinges on its ability to transition from a company that sells groceries and happens to have data, to a data-first company that uses grocery as its customer acquisition and data-generation engine. Future success will be defined by three key areas: 1) Winning the e-commerce battle profitably by leveraging automation; 2) Scaling its high-margin alternative profit streams, particularly KPM; and 3) Deepening customer loyalty by evolving its 'Boost' membership into an indispensable lifestyle ecosystem. Kroger is well-positioned, but sustained execution and innovation are critical to maintaining its market leadership in a rapidly transforming retail landscape.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Supply Chain & Logistics Infrastructure

Impact:High

- Barrier:

Brand Recognition & Customer Loyalty

Impact:High

- Barrier:

Prime Real Estate Locations

Impact:Medium

- Barrier:

High Capital Investment

Impact:High

Industry Trends

- Trend:

Digital Integration & Omnichannel Shopping

Impact On Business:Kroger must continue investing heavily in its e-commerce platform, delivery/pickup services (like the Ocado partnership), and mobile app to meet customer expectations for convenience.

Timeline:Immediate

- Trend:

Price Sensitivity & Focus on Value

Impact On Business:Intensified price competition from discounters (Aldi, Lidl) and value leaders (Walmart) requires Kroger to optimize its pricing strategies, loyalty programs, and private label offerings to retain budget-conscious shoppers.

Timeline:Immediate

- Trend:

Growth of Private Label Brands

Impact On Business:This is a major opportunity. Kroger's strong 'Our Brands' portfolio (like Simple Truth) drives higher margins and customer loyalty. Continued innovation is key to differentiation.

Timeline:Immediate

- Trend:

AI-Powered Personalization & Data Analytics

Impact On Business:Leveraging its vast loyalty card data through its 84.51° subsidiary is a core advantage. AI can further optimize supply chains, personalize promotions, and improve customer experience.

Timeline:Near-term

- Trend:

Health, Wellness & Sustainability Focus

Impact On Business:Consumers increasingly choose brands that align with their values. Kroger's 'Zero Hunger | Zero Waste' initiative and focus on fresh, organic products (Simple Truth) cater to this trend, enhancing brand reputation.

Timeline:Near-term

Direct Competitors

- →

Walmart

Market Share Estimate:~23.6%

Target Audience Overlap:High

Competitive Positioning:Price leadership and one-stop-shop convenience.

Strengths

- •

Unmatched economies of scale driving 'Everyday Low Prices'.

- •

Vast physical footprint and extensive supply chain.

- •

Strong brand recognition and large customer base.

- •

Growing e-commerce and omnichannel capabilities.

Weaknesses

- •

Perception of lower quality in fresh produce compared to traditional grocers.

- •

Inconsistent in-store customer service experience.

- •

Less sophisticated personalization and loyalty program compared to Kroger.

- •

Negative public perception regarding labor practices.

Differentiators

- •

Absolute price leadership.

- •

Combination of full grocery with extensive general merchandise.

- •

Massive global scale and supply chain efficiency.

- →

Costco Wholesale

Market Share Estimate:~8.5%

Target Audience Overlap:Medium

Competitive Positioning:Bulk purchasing, high value, and exclusive membership model.

Strengths

- •

Extremely loyal customer base via membership model.

- •

Strong private label (Kirkland Signature) known for high quality and value.

- •

High operational efficiency and low overheads.

- •

High employee satisfaction leading to better customer service.

Weaknesses

- •

Limited product selection (fewer SKUs).

- •

Requires paid membership, a barrier for some customers.

- •

Less developed e-commerce and delivery infrastructure.

- •

Fewer store locations, limiting convenience.

Differentiators

- •

Membership-only warehouse club model.

- •

Bulk product sizes.

- •

Treasure-hunt shopping experience with rotating inventory.

- →

Albertsons Companies

Market Share Estimate:~5.3%

Target Audience Overlap:High

Competitive Positioning:Traditional full-service supermarket with strong regional banners (Safeway, Vons).

Strengths

- •

Large network of stores with strong local and regional brand recognition.

- •

Robust private label portfolio (O Organics, Signature Select).

- •

Strong pharmacy and fuel rewards programs.

- •

Increasing investment in digital and omnichannel capabilities.

Weaknesses

- •

Lags behind Kroger in digital innovation and process centralization.

- •

Faces intense price pressure from larger competitors.

- •

Perceived as having a less differentiated brand identity on a national level.

- •

Weaker identical sales growth compared to the market average.

Differentiators

Portfolio of well-established regional supermarket banners.

Emphasis on a traditional, full-service grocery experience.

- →

Amazon (including Whole Foods)

Market Share Estimate:N/A (Significant online, smaller physical)

Target Audience Overlap:High

Competitive Positioning:Digital convenience, vast selection, and premium organic/natural focus (Whole Foods).

Strengths

- •

Dominant e-commerce platform and logistics network.

- •

Massive Prime subscriber base.

- •

Strong brand reputation in technology and convenience.

- •

Whole Foods brand provides credibility in the premium/organic segment.

Weaknesses

- •

Limited physical store footprint compared to traditional grocers.

- •

Challenges in integrating online and offline grocery operations seamlessly.

- •

Higher price perception, especially for Whole Foods.

- •

Struggles with fresh food logistics at scale for online delivery.

Differentiators

- •

Technology-first approach to grocery shopping.

- •

Integration with the broader Amazon Prime ecosystem (media, shipping, etc.).

- •

Pioneer in online grocery delivery and fulfillment models.

Indirect Competitors

- →

Instacart

Description:A technology platform that provides grocery pickup and delivery services by connecting customers with personal shoppers. It partners with, but also competes against, traditional grocers' own services.

Threat Level:High

Potential For Direct Competition:Acts as both a partner and a competitor ('frenemy'), potentially disintermediating the customer relationship.

- →

Discount Grocers (Aldi, Lidl)

Description:Hard discounters offering a limited assortment of high-quality private-label products at very low prices.

Threat Level:High

Potential For Direct Competition:Already a direct competitor on price, and they are rapidly expanding their footprint and product offerings, including fresh and organic items.

- →

Meal Kit Services (HelloFresh, Blue Apron)

Description:Subscription services that deliver pre-portioned ingredients and recipes for home cooking, competing for the 'share of stomach'.

Threat Level:Medium

Potential For Direct Competition:Low, but they capture a portion of at-home food spending by offering a convenient alternative to grocery shopping.

- →

Dollar Stores (Dollar General, Dollar Tree)

Description:Expanding their grocery and consumables sections, offering low-cost alternatives for staple items in convenient, small-format stores.

Threat Level:Medium

Potential For Direct Competition:Increasing, especially in rural and low-income areas where they are a primary shopping destination.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Customer Data & Personalization Engine (84.51°)

Sustainability Assessment:Highly sustainable. The first-party data from over 62 million households is a proprietary asset that is very difficult to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Private Label Portfolio ('Our Brands')

Sustainability Assessment:Sustainable. Brands like 'Simple Truth' have built significant brand equity and consumer trust, offering higher margins and differentiation.

Competitor Replication Difficulty:Medium

- Advantage:

Extensive Physical Store Footprint

Sustainability Assessment:Sustainable. The large network of ~2,700 stores serves as a crucial asset for brand presence, customer convenience, and omnichannel fulfillment (pickup/delivery).

Competitor Replication Difficulty:Hard

- Advantage:

Supply Chain & Logistics Scale

Sustainability Assessment:Sustainable. Decades of investment have created an efficient and complex supply chain that supports a vast product assortment and store network.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Exclusive Digital Coupons & Promotions', 'estimated_duration': 'Short-term'}

{'advantage': 'Partnership with Ocado for Automated Fulfillment', 'estimated_duration': 'Medium-term, as competitors can seek similar automation partners.'}

Disadvantages

- Disadvantage:

Price Perception vs. Walmart and Discounters

Impact:Major

Addressability:Moderately

- Disadvantage:

Geographic Concentration

Impact:Minor

Addressability:Difficult

- Disadvantage:

Complexity of Managing Multiple Store Banners

Impact:Minor

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch hyper-targeted promotional campaigns using 84.51° data to counter price sensitivity on key value items (KVIs).

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Feature and promote 'Simple Truth' and other private label products more aggressively in the app and in-store to drive high-margin sales.

Expected Impact:High

Implementation Difficulty:Easy

- Recommendation:

Optimize in-store pickup processes to reduce wait times and improve customer satisfaction, a key omnichannel battleground.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Expand the Retail Media Network, leveraging first-party data to create a high-margin revenue stream that rivals those of competitors.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Deepen the integration of Kroger Health (pharmacy, clinics) with grocery, offering personalized nutrition plans and 'food as medicine' programs.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Continue the rollout of Ocado-powered automated fulfillment centers to improve efficiency and profitability of online orders.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Invest in next-generation in-store technology (e.g., smart carts, AI-driven inventory management, frictionless checkout) to enhance the customer experience and improve operational efficiency.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore new, smaller-format stores tailored to dense urban environments to capture new customer segments and expand geographic reach.

Expected Impact:Medium

Implementation Difficulty:Difficult

- Recommendation:

Build a comprehensive digital ecosystem beyond groceries, integrating financial services, health, and loyalty into a single, seamless platform.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify Kroger's position as the leading data-driven, omnichannel grocer, emphasizing 'Fresh, Affordable, and Personalized' shopping. Avoid direct price wars with Walmart, instead focusing on superior value through personalization, quality private labels, and a seamless digital experience.

Hyper-personalization at scale. Use the 84.51° data advantage to deliver unique value to every customer through tailored offers, product recommendations, and health-centric content, creating a level of personalization that scale-focused competitors cannot easily match.

Whitespace Opportunities

- Opportunity:

Personalized Meal Planning & Shoppable Recipes

Competitive Gap:While some competitors offer recipes, none fully integrate dietary preferences, health data (from pharmacy), and budget constraints into a dynamically generated, shoppable weekly meal plan.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Subscription Service for Private Label Staples

Competitive Gap:Amazon has 'Subscribe & Save' for national brands, but no major grocer has perfected a subscription model for their own high-quality, high-margin private label staples (e.g., Simple Truth organic milk, coffee, etc.).

Feasibility:High

Potential Impact:Medium

- Opportunity:

Enhanced In-Store Health & Wellness Services

Competitive Gap:Leverage in-store pharmacy and clinic space to offer dietitian consultations, cooking classes for healthy eating, and other wellness services that drive foot traffic and reinforce the 'Fresh' and 'Health' brand pillars.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Gamified Loyalty Program

Competitive Gap:Current loyalty programs are transactional (points for spend). A gamified app experience with challenges, badges, and rewards for trying new products or sustainable shopping could significantly increase engagement.

Feasibility:High

Potential Impact:Medium

The U.S. grocery industry is a mature, oligopolistic market defined by intense competition and thin margins. The Kroger Co. is strongly positioned as the second-largest player, successfully navigating the battlefield between the undisputed price leader, Walmart, and value-driven club models like Costco.

Kroger's primary sustainable competitive advantage is not its scale alone, but its sophisticated use of first-party customer data through its 84.51° subsidiary. This enables a level of personalization in promotions and customer experience that is difficult for competitors to replicate. This data-driven strategy, combined with a robust portfolio of high-margin private label brands like 'Simple Truth', and a vast network of physical stores crucial for omnichannel fulfillment, forms the core of its competitive moat.

Direct competition remains fierce. Walmart competes relentlessly on price, leveraging its massive scale. Costco commands unparalleled customer loyalty through its membership model and high-quality private label. Albertsons competes as a traditional grocer with strong regional banners, while Amazon represents a long-term technological threat with its deep e-commerce expertise. The landscape is further complicated by high-growth indirect competitors, particularly hard discounters like Aldi and platform players like Instacart, which erode market share by targeting value-conscious consumers and convenience-seekers, respectively.

The key industry trends all play to Kroger's strategic focus: the pivot to omnichannel retail, the rise of private labels, and the demand for personalization. Kroger's 'Restock Kroger' initiative and partnerships, particularly with Ocado for automated fulfillment, demonstrate a clear commitment to leading in the digital transformation of the grocery space.

Opportunities for Kroger lie in deepening its ecosystem by further integrating its health and wellness services with its core grocery business, expanding its high-margin retail media network, and leveraging technology to create an even more seamless and personalized shopping journey. The primary threats are continued price pressure from value players and the risk of being out-innovated by tech giants like Amazon. Kroger's future success hinges on its ability to continue leveraging its data intelligence to prove that 'value' is not just about the lowest price, but about the best, most personalized, and convenient customer experience.

Messaging

Message Architecture

Key Messages

- Message:

FRESH FOR EVERYONE

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner, repeated throughout

- Message:

Kroger provides fresh products without choosing among convenience, value or selection.

Prominence:Secondary

Clarity Score:High

Location:Homepage, supporting the 'FRESH FOR EVERYONE' tagline

- Message:

We have the highest standards for the fresh products we offer customers.

Prominence:Secondary

Clarity Score:High

Location:Homepage, 'Fresh' section

- Message:

We build stronger communities through our Zero Hunger | Zero Waste impact plan.

Prominence:Secondary

Clarity Score:High

Location:Homepage, 'Community Impact' and 'Our Communities' sections

- Message:

We are experts at saving customers time and money through data science and personalization.

Prominence:Tertiary

Clarity Score:Medium

Location:Homepage, 'Personalization' section

- Message:

Kroger is a place where everyone can discover a career they love.

Prominence:Tertiary

Clarity Score:High

Location:Homepage, 'Build your Career' section

The message hierarchy is clear and effective. The primary brand promise, 'FRESH FOR EVERYONE,' is established immediately and acts as an umbrella for all supporting messages. Secondary messages logically break down this promise into tangible pillars: product quality (Fresh), community impact (Everyone), convenience (Seamless), and innovation (Our Brands, Personalization). The structure successfully communicates the company's core strategy to its corporate audience.

Messaging is highly consistent across the provided content. The 'FRESH FOR EVERYONE' tagline is repeated verbatim. Core concepts like 'fresh,' 'community,' and 'seamless' are consistently used in their respective sections, reinforcing the key strategic pillars. This consistency is crucial for a corporate site aiming to project a stable and focused business strategy.

Brand Voice

Voice Attributes

- Attribute:

Corporate & Authoritative

Strength:Strong

Examples

- •

We have the highest standards for the fresh products we offer customers.

- •

Our data science teams use predictive sciences...

- •

Kroger is committed to creating healthier, thriving neighborhoods...

- Attribute:

Customer-Centric & Empathetic

Strength:Moderate

Examples

- •

We know our customers are busy...

- •

To us that means providing our customers with the freshest products however they want to shop...

- •

Willie Mae Finds Connection with Customers

- Attribute:

Community-Focused & Responsible

Strength:Strong

Examples

- •

Kroger’s Zero Hunger | Zero Waste impact plan expresses our mission to end hunger and waste...

- •

3.9B meals donated to our communities

- •

We build stronger communities by growing our business...

Tone Analysis

Professional

Secondary Tones

- •

Purpose-driven

- •

Confident

- •

Caring

Tone Shifts

Shifts from a high-level corporate tone on the main page to a more personal and human tone in blog posts like the one featuring 'Willie Mae'.

Voice Consistency Rating

Good

Consistency Issues

The primary corporate voice, while consistent, is quite formal. This can feel slightly disconnected from the more emotional and personal stories shared in the blog/stories section. Bridging this gap could create a more unified brand persona.

Value Proposition Assessment

For stakeholders (investors, employees, partners), Kroger is a large-scale, socially responsible, and innovative leader in the American grocery industry, committed to delivering on its customer-facing promise of 'Fresh for Everyone'.

Value Proposition Components

- Component:

Scale & Market Leadership

Clarity:Clear

Uniqueness:Somewhat Unique

Details:Communicated via large metrics (2,731 stores, 11M customers daily). While other competitors are large, these numbers establish Kroger as a top-tier player.

- Component:

Commitment to Freshness

Clarity:Clear

Uniqueness:Common

Details:A core promise, but 'fresh' is a common claim in the grocery industry. The emphasis on 'highest standards' and farmer relationships attempts to add depth.

- Component:

Social & Community Impact

Clarity:Clear

Uniqueness:Somewhat Unique

Details:The 'Zero Hunger | Zero Waste' plan is a specific and measurable initiative that provides a unique angle compared to generic corporate responsibility claims.

- Component:

Data-Driven Personalization & Convenience

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Details:Mentioning 'data science' and 'predictive sciences' signals innovation, positioning Kroger as a tech-forward retailer in a traditional industry. However, the benefit is stated more than it is shown.

The messaging strategy effectively differentiates Kroger by combining the aspirational goal of 'Fresh' with the inclusive and accessible promise of 'for Everyone'. This positions the brand in a sweet spot between value-focused competitors like Walmart and premium/specialty grocers. The heavy emphasis on its measurable social impact plan, 'Zero Hunger | Zero Waste,' serves as a key brand differentiator aimed at building trust and emotional connection.

The corporate messaging positions Kroger as a stable, forward-thinking incumbent. By highlighting its massive scale, it projects reliability to investors. By focusing on data science and seamless digital experiences, it counters the narrative of being disrupted by tech-focused competitors like Amazon. The 'Fresh for Everyone' tagline is a direct attempt to cut through the 'sea of sameness' in grocery advertising and establish a clear, human-centric market position.

Audience Messaging

Target Personas

- Persona:

Investors & Financial Community

Tailored Messages

- •

~409K associates company-wide

- •

2,731 retail stores

- •

11M customers served daily

- •

News & Headlines section with press releases on financial settlements and leadership changes.

Effectiveness:Effective

- Persona:

Potential Employees & Talent

Tailored Messages

- •

Build your Career: Kroger respects and appreciates everyone in our communities...

- •

Kroger Recognized as a 'Best Place to Work for Disability Inclusion' for Sixth Consecutive Year

- •

Willie Mae Finds Connection with Customers

Effectiveness:Effective

- Persona:

Media & Public Relations

Tailored Messages

- •

News & Headlines section

- •

Sign Up to Receive the Latest Kroger News and Releases

- •

Sharing What We’ve Learned: A Blueprint for Businesses

Effectiveness:Effective

- Persona:

Community & Non-Profit Partners

Tailored Messages

- •

3.9B meals donated to our communities

- •

Kroger’s Zero Hunger | Zero Waste impact plan expresses our mission to end hunger and waste...

- •

We build stronger communities by growing our business...

Effectiveness:Effective

Audience Pain Points Addressed

- •

For Investors: Concern about industry competition and growth is addressed by highlighting massive scale, digital innovation (personalization, seamless), and a clear brand strategy.

- •

For Communities: Food insecurity and waste are directly addressed by the 'Zero Hunger | Zero Waste' plan.

- •

For Job Seekers: The need for a stable, inclusive, and purpose-driven workplace is addressed through career sections and stories of employee recognition.

Audience Aspirations Addressed

The aspiration to work for or partner with a company that has a positive societal impact.

The desire for a reliable, large-scale business partner or investment.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Community & Belonging

Effectiveness:High

Examples

- •

We build stronger communities...

- •

3.9B meals donated to our communities

- •

Willie Mae Finds Connection with Customers

- Appeal Type:

Trust & Security

Effectiveness:Medium

Examples

We have the highest standards...

Kroger is Fresh For Everyone.

Social Proof Elements

- Proof Type:

Scale (Numbers)

Impact:Strong

Details:Quantifiable data (~409K associates, 2,731 stores, 11M customers, 3.9B meals donated) is used prominently to demonstrate market leadership and impact.

- Proof Type:

Awards & Recognition

Impact:Moderate

Details:The news headline 'Kroger Recognized as a "Best Place to Work for Disability Inclusion"' serves as third-party validation of company culture.

Trust Indicators

- •

Prominent display of large, specific operational metrics

- •

Dedicated sections for Community Impact

- •

Regularly updated News & Headlines section

- •

Clear contact information and corporate address

Scarcity Urgency Tactics

None observed. These tactics are not appropriate for a corporate website's primary objectives and are rightly absent.

Calls To Action

Primary Ctas

- Text:

LEARN ABOUT FRESH

Location:Homepage

Clarity:Clear

- Text:

START SHOPPING TODAY

Location:Homepage

Clarity:Clear

- Text:

SEE HOW WE IMPACT OUR COMMUNITY

Location:Homepage

Clarity:Clear

- Text:

FIND YOUR CAREER

Location:Homepage

Clarity:Clear

The CTAs are effective and well-aligned with the audience segmentation. They clearly direct different user personas (investors, job seekers, community partners, and potential shoppers) to the most relevant information. The strategic use of CTAs that link to the consumer site ('START SHOPPING TODAY') versus those that keep the user on the corporate site ('LEARN ABOUT FRESH') shows a clear understanding of the site's dual role.

Messaging Gaps Analysis

Critical Gaps

Lack of a clear, forward-looking 'Vision' or 'Innovation' section. While 'Personalization' is mentioned, there isn't a dedicated narrative around the future of grocery, such as sustainability beyond food waste (e.g., packaging, sourcing) or technological advancements like their Ocado partnership.

Contradiction Points

The tagline 'Fresh for Everyone' implies a focus on all people, but the primary audience of the corporate site is clearly business-oriented. A user landing here to shop might feel a disconnect, although this is a structural issue of having separate corporate/consumer sites rather than a messaging contradiction.

Underdeveloped Areas

The 'Personalization' message is underdeveloped. It states that Kroger uses data science but fails to provide compelling examples or stories of how this tangibly benefits customers, making the claim abstract.

The 'Our Brands' message is mentioned but not deeply explored. There's an opportunity to showcase the innovation and value of Kroger's private-label products, which is a key part of their business strategy and a differentiator.

Messaging Quality

Strengths

- •

A strong, memorable, and unifying brand promise: 'FRESH FOR EVERYONE'.

- •

Excellent use of quantifiable data to establish scale, credibility, and social impact.

- •

Clear content structure that caters to distinct corporate audiences (investors, media, talent, partners).

- •

The social impact message ('Zero Hunger | Zero Waste') is specific, branded, and compelling.

Weaknesses

- •

The overall tone is heavily corporate and lacks a distinct personality, which could be more engaging.

- •

Key strategic initiatives like technology partnerships (e.g., Ocado) and the strength of private-label brands are not prominently featured in the messaging.

- •

The site does not explicitly orient first-time visitors, potentially causing confusion between the corporate purpose of

thekrogerco.comand the consumer purpose ofkroger.com.

Opportunities

- •

Create more compelling narratives and storytelling around the 'Fresh' promise, such as featuring stories of farmers and suppliers.

- •

Develop a dedicated 'Innovation' or 'Future of Retail' section to showcase technological advancements and solidify their position as an industry leader.

- •

Better integrate the 'Our Brands' story to highlight the quality, innovation, and value they provide, which is a major business driver.

Optimization Roadmap

Priority Improvements

- Area:

Innovation Messaging

Recommendation:Create a new top-level navigation item for 'Innovation' that details the company's strategy on data science, supply chain automation (Ocado), and sustainability. Use case studies or videos to make the concepts tangible.

Expected Impact:High

- Area:

Value Proposition Substantiation

Recommendation:Expand the 'Personalization' and 'Our Brands' sections with specific examples, customer testimonials (if appropriate for a corporate context), or statistics that prove the claims being made.

Expected Impact:Medium

Quick Wins

Add a small, persistent banner or header element that clarifies the site's purpose, e.g., 'Welcome to the corporate home of The Kroger Co. To shop online, please visit kroger.com.'

In the 'Fresh' section, embed a short video that tells a compelling farmer or supplier story to add an emotional, human element.

Long Term Recommendations

Evolve the brand voice to be slightly more conversational and less formal to bridge the gap between the corporate narrative and the personal stories, creating a more unified and authentic persona.

Develop an integrated content strategy that uses the blog to consistently tell stories that support each of the core messaging pillars (Fresh, Seamless, Personalization, Community) in a humanized way.

The strategic messaging on The Kroger Co.'s corporate website is disciplined, clear, and highly effective for its intended audience of investors, media, talent, and community partners. The architecture is built around the powerful and inclusive brand promise, 'FRESH FOR EVERYONE,' which is consistently supported by logical pillars: Freshness, Seamless Convenience, Community Impact, and Innovation. The company excels at using large-scale metrics as social proof to project an image of market leadership, stability, and significant social contribution. The messaging successfully positions Kroger as a reliable industry titan that is also purpose-driven and adapting to the future.

The primary weaknesses are not in what is said, but what is underdeveloped. Key business differentiators, such as the innovation within their private label 'Our Brands' portfolio and their significant investments in technology and automation, are mentioned but lack the narrative depth required to be truly persuasive. The brand voice, while professional, is staunchly corporate and misses opportunities for greater emotional connection and personality. The largest opportunity for optimization lies in substantiating its innovation claims with more compelling proof points and stories, which would strengthen its competitive positioning as a forward-thinking leader in the rapidly evolving grocery landscape.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Massive scale with 2,731 retail stores and serving approximately 11 million customers daily.

- •

Significant market share, trailing only Walmart in U.S. grocery sales.

- •

Strong brand recognition and loyalty, demonstrated by a large customer base and high penetration of its 'Our Brands' private label products in over 90% of customer households.

- •

Consistent identical sales growth (excluding fuel), indicating sustained customer demand.

- •

Substantial digital business with over $13 billion in annual digital sales, showing adaptation to evolving consumer behavior.

Improvement Areas

- •

Enhancing the seamless integration between in-store and digital experiences to capture more of the omnichannel shopper's wallet.

- •

Improving online order profitability by optimizing fulfillment costs through the Ocado partnership and other initiatives.

- •

Further differentiating the in-store experience to compete with the rapid expansion of discounters (e.g., Aldi) and specialty grocers.

Market Dynamics

Low Single Digits (approx. 3.1% - 4% forecast for 2025).

Mature

Market Trends

- Trend:

Omnichannel and E-commerce Growth

Business Impact:Continued investment in digital capabilities, delivery, and pickup is critical for market share. E-commerce is a key growth driver, with Kroger's digital sales growing 11% recently.

- Trend:

Rise of Private Label Brands

Business Impact:Increasing consumer price sensitivity makes a strong private label portfolio a key competitive advantage. Kroger's 'Our Brands' generate over $30 billion annually and are a major differentiator and margin driver.

- Trend:

Intensifying Competition from Discounters and Mass Merchandisers

Business Impact:Requires a clear value proposition balancing price, quality, and convenience to defend market share against players like Walmart, Amazon, and Aldi.

- Trend:

Focus on Health, Wellness, and Sustainability

Business Impact:Opportunity to expand organic (Simple Truth brand), fresh food offerings, and sustainable practices to attract and retain health-conscious consumers.

- Trend:

Growth of Retail Media Networks

Business Impact:Kroger Precision Marketing (KPM) is a high-margin alternative profit business, leveraging first-party data to generate significant advertising revenue.

Challenging but Favorable for Prepared Incumbents. The market is mature with slow growth, but the shift to digital and data monetization creates significant opportunities for scaled players like Kroger to consolidate their position.

Business Model Scalability

Medium

High fixed costs associated with physical stores, distribution centers, and manufacturing plants. Scaling digitally through automated Customer Fulfillment Centers (CFCs) with Ocado aims to shift the cost structure for e-commerce.

Moderate. Significant operating leverage can be achieved through increased sales volume in existing stores (same-store sales growth) and optimizing supply chain and merchandising costs. Digital and retail media businesses offer higher-leverage growth.

Scalability Constraints

- •

Physical store expansion is capital-intensive and slow in a mature market.

- •

Heavy reliance on a large workforce (~409K associates) makes scaling labor-intensive and subject to wage pressures and union negotiations.

- •

Supply chain complexity increases with scale, especially for fresh and perishable goods.

- •

The proposed merger with Albertsons, currently facing legal challenges, was the primary strategy for large-scale expansion.

Team Readiness

Experienced. The leadership team has a deep understanding of the grocery industry. The recent creation of a dedicated eCommerce business unit under a Chief Digital Officer indicates a strategic focus on adapting to new growth drivers.

Adapting. Kroger is evolving from a traditional retail structure to a more integrated omnichannel organization. The unification of retail media, insights, and loyalty marketing under Kroger Precision Marketing is a positive step toward breaking down silos.

Key Capability Gaps

- •

Agility in responding to rapid technological changes and competitive moves from digital-native companies.

- •

Deepening talent pool in high-demand areas like data science, AI/ML engineering, and digital marketing to fully leverage their data advantage.

- •

Change management capabilities to effectively integrate new technologies (e.g., Ocado automation) and processes across a massive workforce.

Growth Engine

Acquisition Channels

- Channel:

Physical Stores (Foot Traffic)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Enhance the in-store experience with better product discovery, personalized promotions, and integration with the digital app to increase basket size and visit frequency.

- Channel:

Digital (Website/App)

Effectiveness:High

Optimization Potential:High

Recommendation:Leverage AI-driven personalization to improve product recommendations and promotions. Streamline the checkout process and improve the user experience for both pickup and delivery orders.

- Channel:

Digital Marketing (SEO/SEM/Paid Social)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Utilize first-party data from 84.51° to create highly targeted acquisition campaigns, focusing on converting competitor shoppers and attracting new households to Kroger's digital ecosystem.

Customer Journey

The journey is increasingly omnichannel, with customers moving between the app, website, and physical stores. The goal is a 'seamless' experience, but friction can exist between these touchpoints.

Friction Points

- •

Inconsistent product availability between online selection and in-store stock for pickup orders.

- •

Clunky transition from online basket building to in-store shopping list/navigation.

- •

Varying customer service experiences between in-store, delivery, and third-party fulfillment partners.

Journey Enhancement Priorities

{'area': 'Unified Shopping Cart', 'recommendation': 'Develop a truly unified cart that syncs in real-time between the app and website, and can be used as an intelligent shopping list in-store with aisle locations.'}

{'area': 'Post-Pickup/Delivery Experience', 'recommendation': 'Improve the process for handling order issues (missing items, wrong products) with easier, app-based resolution options to build trust in the digital service.'}

Retention Mechanisms

- Mechanism:

Loyalty Program (Boost Membership)

Effectiveness:High

Improvement Opportunity:Expand exclusive benefits for Boost members, such as early access to new 'Our Brands' products or unique digital coupons, to increase enrollment and long-term loyalty. The addition of streaming benefits is a good step.

- Mechanism:

Personalization (Digital Coupons & Offers)

Effectiveness:High

Improvement Opportunity:Deepen personalization using AI/ML to predict future customer needs rather than just reacting to past purchases. Offer proactive recommendations and meal planning solutions.

- Mechanism:

Private Label 'Our Brands'

Effectiveness:High

Improvement Opportunity:Continue to innovate with new products and premium tiers (like Private Selection) that act as destination items, making Kroger a required shopping trip for those specific products.

Revenue Economics

Complex and generally strong for a low-margin industry. Profitability is driven by high volume, supply chain efficiency, and the growing contribution of high-margin alternative profits (retail media, Kroger Personal Finance).

Undeterminable from public data, but likely very high for loyal customers given the recurring nature of grocery purchases. The focus is on increasing share of wallet and lifetime value rather than initial acquisition cost.

High. Kroger's massive revenue base and consistent free cash flow demonstrate a highly efficient revenue model. Gross margin expansion indicates improving efficiency.

Optimization Recommendations

- •

Continue to drive down the cost-to-serve for digital orders through Ocado CFC automation and improved last-mile logistics.

- •

Increase the penetration of high-margin private label products, which improves the margin on every basket.

- •

Aggressively scale the retail media business (KPM), as it represents a high-margin revenue stream that leverages existing customer traffic and data.

Scale Barriers

Technical Limitations

- Limitation:

Legacy IT Infrastructure

Impact:Medium

Solution Approach:Continued investment in modernizing core systems (supply chain, merchandising, POS) and migrating to cloud platforms (like Google Cloud partnership) to increase agility and data processing capabilities.

- Limitation:

Ocado CFC Rollout Pace

Impact:High

Solution Approach:The partnership is behind its initial target of 20 CFCs. Accelerating the rollout and optimization of existing CFCs is critical to scaling e-commerce profitability and reach.

Operational Bottlenecks

- Bottleneck:

Supply Chain Disruptions & Complexity

Growth Impact:Disruptions can lead to out-of-stocks, impacting customer experience and sales. Managing fresh inventory at scale is a constant challenge.

Resolution Strategy:Invest in AI-driven demand forecasting and supply chain optimization tools. Diversify supplier base and enhance logistics partnerships to build resilience.

- Bottleneck:

Labor Attraction and Retention

Growth Impact:Labor shortages and turnover can negatively impact in-store experience and fulfillment efficiency. Rising labor costs pressure already thin margins.

Resolution Strategy:Continue investing in competitive wages and benefits. Implement better tools and technology to simplify associate tasks and improve productivity. Foster a strong company culture to improve retention.

Market Penetration Challenges

- Challenge:

Intense Price Competition

Severity:Critical

Mitigation Strategy:Leverage data science for dynamic and personalized pricing. Emphasize the value proposition of 'Our Brands' to offer quality at a lower price than national brands.

- Challenge:

Market Dominance of Walmart & Amazon

Severity:Critical

Mitigation Strategy:Differentiate on 'Fresh' and quality of private labels. Build a superior, seamless omnichannel experience that integrates digital convenience with a strong local store presence. The blocked Albertsons merger makes organic differentiation more critical.

- Challenge:

Regulatory Scrutiny

Severity:Major

Mitigation Strategy:The failure of the Albertsons merger demonstrates that large-scale M&A is a difficult growth path. Future growth must focus on organic initiatives, strategic partnerships, and smaller, targeted acquisitions that are less likely to face regulatory hurdles.

Resource Limitations

Talent Gaps

- •

E-commerce & Logistics Specialists: Experts in optimizing automated fulfillment and last-mile delivery.

- •

Data Scientists & AI Engineers: To build more sophisticated personalization, pricing, and supply chain models.

- •

Digital Product Managers: To innovate on the customer-facing app and website.

Significant. Continued high capital expenditures ($3.6B - $3.8B projected for 2025) are needed for store remodels, new stores in high-growth areas, and technology investments like the Ocado CFCs.

Infrastructure Needs

- •

Expansion of the Ocado Customer Fulfillment Center (CFC) network to cover more geographies efficiently.

- •

Upgrades to in-store technology to support omnichannel operations (e.g., enhanced capabilities for pickers, smarter shelves).

- •

Modernization of distribution centers to improve efficiency and speed.

Growth Opportunities

Market Expansion

- Expansion Vector:

Alternative Formats

Potential Impact:Medium

Implementation Complexity:High

Recommended Approach:Pilot smaller, urban-focused store formats that cater to convenience and grab-and-go shoppers, leveraging data to tailor assortment to local demographics.

- Expansion Vector:

Underserved Demographics

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Expand culturally relevant product assortments, such as the 'Mercado' brand for Hispanic customers, and use targeted marketing to win share in growing demographic segments.

Product Opportunities

- Opportunity:

Expansion of 'Our Brands'

Market Demand Evidence:Consumers are increasingly trading down to private labels. 'Our Brands' already generate over $30B in annual sales and are a key differentiator.

Strategic Fit:High

Development Recommendation:Accelerate new product development in premium (Private Selection) and plant-based/organic (Simple Truth) tiers. Use data insights to identify unmet needs and white space in the market.

- Opportunity:

Growth of Kroger Health & Wellness Services

Market Demand Evidence:Growing consumer focus on health, and an aging population. Kroger already operates 2,270 pharmacies.

Strategic Fit:High

Development Recommendation:Expand clinic services, nutrition counseling, and partnerships with healthcare providers to position Kroger as a holistic health destination, driving both pharmacy scripts and healthy grocery sales.

- Opportunity:

Ready-to-Eat / Ready-to-Heat Meal Solutions

Market Demand Evidence:High consumer demand for convenience and meal solutions.

Strategic Fit:High

Development Recommendation:Invest in in-store kitchens and expand the portfolio of high-quality, fresh meal kits and prepared foods, leveraging 'Our Brands' for unique offerings.

Channel Diversification

- Channel:

Retail Media Network (Kroger Precision Marketing)

Fit Assessment:Excellent

Implementation Strategy:Continue aggressive expansion by unifying data and loyalty services, offering more self-service tools for advertisers, and expanding into new ad formats like Connected TV to capture a larger share of CPG advertising budgets.

- Channel:

Direct-to-Consumer (for select 'Our Brands' products)

Fit Assessment:Medium

Implementation Strategy:Experiment with a DTC subscription service for popular, shelf-stable 'Our Brands' items (e.g., Simple Truth snacks, Private Selection coffee) to build a direct relationship outside of the core grocery shop.

Strategic Partnerships

- Partnership Type:

Technology & AI

Potential Partners

- •

NVIDIA

- •

Google Cloud

- •

AI-driven supply chain startups

Expected Benefits:Enhance personalization engines, optimize supply chain logistics, and improve operational efficiency through advanced AI and machine learning capabilities.

- Partnership Type:

Last-Mile Delivery

Potential Partners

- •

Instacart

- •

DoorDash

- •

Autonomous vehicle companies

Expected Benefits:Offer customers more delivery speed options (e.g., 30-minute delivery) and test new, lower-cost delivery technologies to complement the Ocado hub-and-spoke model.

- Partnership Type:

Healthcare & Insurance

Potential Partners

Major health insurers

Corporate wellness programs

Expected Benefits:Integrate Kroger Health services into insurance networks, offering 'food as medicine' programs and preferred pharmacy status to drive traffic and build a healthcare ecosystem.

Growth Strategy

North Star Metric

Omnichannel Customer Share of Wallet

This metric shifts the focus from simple transactions to owning a larger portion of a household's total food and wellness spending. It captures success across physical stores, digital channels, and alternative businesses like fuel and pharmacy, reflecting the 'flywheel' strategy.

Increase share of wallet for digitally-engaged households by 10% annually.

Growth Model

Retention & Expansion Flywheel Model

Key Drivers

- •

Winning customers in the core supermarket business (value, fresh).

- •

Engaging customers digitally through a seamless omnichannel experience.

- •

Leveraging data (84.51°) to personalize value and drive loyalty.

- •

Growing high-margin alternative profit streams (Retail Media, Health).

- •

Reinvesting profits back into the core customer value proposition.

Focus on initiatives that strengthen the connections between the flywheel components, such as using retail media insights to inform private label product development or integrating health services into the loyalty app.

Prioritized Initiatives

- Initiative:

Accelerate 'Our Brands' Innovation and Penetration

Expected Impact:High

Implementation Effort:Medium

Timeframe:Ongoing