eScore

yum.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

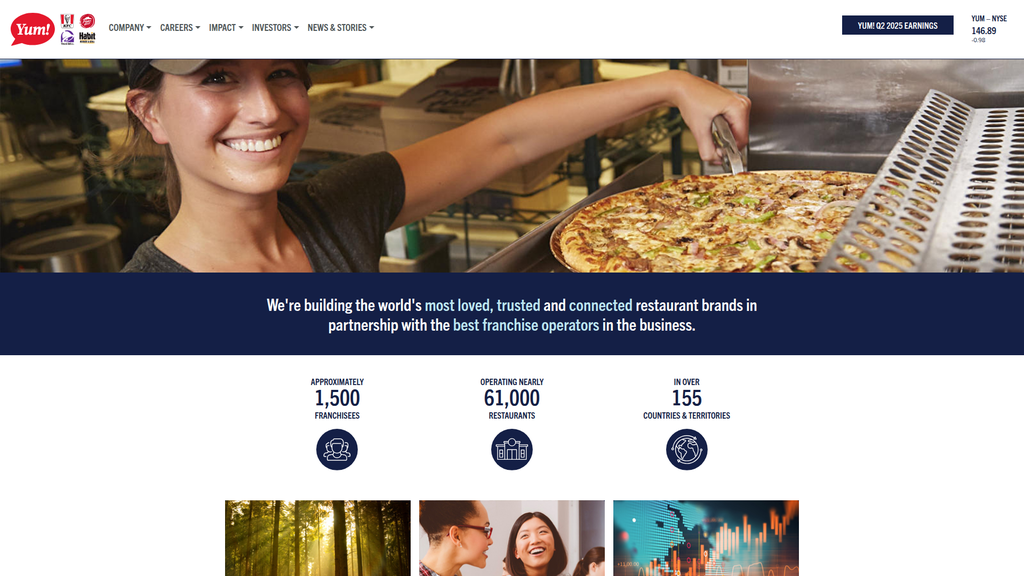

Yum! Brands demonstrates a highly intelligent digital presence by precisely targeting its corporate audience of investors, franchisees, and talent, rather than end-consumers. The content on yum.com aligns perfectly with the search intent of these groups, featuring prominent investor relations data, franchising information, and career portals. Its content authority is exceptionally high due to its market leadership position and global brand recognition, though its direct backlink profile is more corporate than commercial. The company's digital strategy effectively communicates its massive global reach and is beginning to leverage its tech platforms, like Byte by Yum!, to showcase innovation.

Excellent search intent alignment for its core corporate audiences (investors, potential franchisees), providing direct, frictionless paths to relevant information.

Create a dedicated thought leadership hub ('The Future of QSR') to consolidate innovation stories (like 'Saucy by KFC') and technology insights, enhancing its authority and attracting top-tier talent and partners.

The brand's messaging architecture is world-class in its clarity and segmentation for investors and potential employees, using an authoritative and aspirational tone. It effectively uses large-scale statistics as social proof to convey market dominance. However, the communication lacks a crucial element: the direct voice of its franchisees. While the company speaks *about* its successful partnerships, the absence of franchisee testimonials or case studies is a significant gap in persuading its most important customer.

Flawless audience segmentation in its messaging and site structure, creating clear, distinct communication pathways for investors, media, and job seekers.

Integrate a 'Franchisee Spotlight' or success story series directly on the homepage to provide powerful social proof and a more authentic voice to the partnership value proposition.

For its target audience, the website provides a low-friction path to 'convert' on informational goals, thanks to an intuitive navigation and clear information architecture. The cognitive load is light, and the primary CTAs for key sections are effective. The score is held back by a significant lack of accessibility features, including no visible accessibility statement, which poses a major business risk. Furthermore, the experience is very static, with generic secondary CTAs and a lack of micro-interactions to improve engagement and user feedback.

The intuitive information architecture allows key user groups to quickly and efficiently find critical information like financial reports or franchising details with minimal friction.

Conduct a full WCAG 2.1 AA audit and publish a formal Accessibility Statement with a remediation roadmap to mitigate significant legal risk and expand market reach.

Yum! Brands builds strong credibility through a hierarchy of trust signals, including transparent leadership pages, comprehensive investor data, and the showcasing of iconic global brands. However, its overall risk profile is elevated due to significant, high-severity issues identified in the analysis. A recent ransomware attack exposed a critical gap between data protection policies and their actual implementation, creating legal and reputational damage. This, combined with the high risk of ADA-related litigation due to the lack of a web accessibility statement, significantly tempers the credibility score.

Excellent third-party validation and transparency through its comprehensive 'Investors' section, which provides easy access to SEC filings, financial reports, and governance documents.

Urgently commission an independent, third-party cybersecurity audit to address the gap between data protection policy and practice, and publicly communicate the steps taken to rebuild trust after the recent breach.

Yum! Brands' competitive moat is exceptionally strong and sustainable, built on a diversified portfolio of iconic, category-leading global brands. This diversification mitigates risks from shifts in consumer taste in any single category. Its asset-light franchise model enables massive global scale and provides significant economies of scale in supply chain and marketing that are nearly impossible for competitors to replicate. The development of proprietary technology like 'Byte by Yum!' is actively deepening this moat against competitors.

The diversified global portfolio of iconic brands (KFC, Taco Bell, Pizza Hut) creates a highly sustainable advantage, buffering the company against category-specific downturns and competitive pressures.

More aggressively position the 'Byte by Yum!' technology platform as a key competitive differentiator in franchisee recruitment materials to attract the most sophisticated and capable operators away from rivals.

The business is built for massive scale, evidenced by its 98% franchisee-led model which allows for capital-efficient global expansion. Its unit economics are healthy at the corporate level, relying on high-margin royalty streams. The company shows strong automation maturity through its heavy investment in the 'Byte by Yum!' AI platform, which aims to streamline operations across its nearly 61,000 restaurants. With a presence in over 155 countries and a proven model for entering new markets, its expansion potential remains immense.

The asset-light, 98% franchised business model provides enormous operational leverage and capital efficiency, allowing for rapid and sustainable global unit growth.

Develop a tiered incentive program to accelerate the adoption of the full 'Byte by Yum!' tech stack across all franchisees, overcoming the primary barrier to unlocking full system-wide efficiencies.

Yum! Brands' business model is exceptionally coherent and time-tested, centered on franchising iconic QSR brands. The revenue model, based on royalties, is perfectly aligned with its asset-light approach. The strategic focus is clear and sharp: evolving from a traditional franchisor into an AI-first technology platform to drive franchisee profitability and efficiency. Resource allocation is heavily and appropriately skewed towards this digital transformation, demonstrating strong alignment between strategy, investment, and market opportunity.

Excellent strategic focus on transforming into an 'AI-first' company, with clear resource allocation towards building a proprietary technology platform ('Byte by Yum!') to power future growth.

Address the potential for franchisee misalignment by creating a formal 'Franchisee Tech Council' to ensure new technology mandates are developed collaboratively, balancing corporate strategy with on-the-ground operational realities.

As one of the world's largest restaurant companies, Yum! Brands wields immense market power. Its brands hold leading or dominant market share in their respective categories (chicken, pizza, Mexican-inspired) globally. This scale gives it significant leverage with suppliers and partners, and its iconic brands grant it considerable pricing power. The company actively influences market direction through menu innovation (Taco Bell) and new concept development ('Saucy by KFC'), shaping consumer trends rather than just following them.

Dominant market share in multiple QSR categories (chicken, pizza, Mexican-inspired) on a global scale, which provides immense negotiating leverage and brand power.

Revitalize the competitive power of Pizza Hut, which has lost ground to more tech-focused competitors like Domino's, by applying the agile innovation model used for recent KFC and Taco Bell successes.

Business Overview

Business Classification

Franchisor Holding Company

Quick Service Restaurant (QSR) Operator

Restaurants & Food Service

Sub Verticals

- •

Quick Service Restaurants (QSR)

- •

Fast Casual

- •

Chicken

- •

Pizza

- •

Mexican-Inspired

- •

Burgers

Mature

Maturity Indicators

- •

Vast global footprint in over 155 countries with nearly 61,000 restaurants.

- •

Highly developed and optimized franchise-led business model (98% franchised).

- •

Focus on incremental growth, operational efficiency, and technological integration rather than establishing market fit.

- •

Proactive innovation through internal labs (Collider Lab) and new concept testing ('Saucy by KFC') to capture new growth segments.

- •

Consistent financial performance and shareholder returns (dividends, buybacks).

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Franchise Royalties and Fees

Description:Yum! Brands' primary source of income is derived from fees paid by its franchisees. This includes initial fees to open a restaurant and ongoing royalty fees, which are typically a percentage of the franchisee's gross sales. This model provides a stable, recurring, and scalable revenue stream.

Estimated Importance:Primary

Customer Segment:Franchisees

Estimated Margin:High

- Stream Name:

Company-Owned Restaurant Sales

Description:A smaller portion of revenue comes from the direct sale of food and beverages at the ~2% of restaurants that are owned and operated by Yum! Brands directly. While a direct revenue source, this is not the strategic focus.

Estimated Importance:Secondary

Customer Segment:End Consumers

Estimated Margin:Medium

- Stream Name:

Franchise Advertising Contributions

Description:Franchisees contribute to a collective advertising fund, which Yum! Brands manages to execute large-scale marketing campaigns. While often managed in a separate fund, it represents a significant cash flow managed by the corporation.

Estimated Importance:Tertiary

Customer Segment:Franchisees

Estimated Margin:Low

Recurring Revenue Components

- •

Franchise royalties based on a percentage of sales

- •

Ongoing franchise license fees

- •

Lease payments from franchisees in properties owned/controlled by Yum!

Pricing Strategy

Value-Based & Competitive Pricing

Mid-range to Budget

Transparent

Pricing Psychology

- •

Value Menus (e.g., Taco Bell's Cravings Value Menu)

- •

Product Bundling (Combo Meals)

- •

Promotional Pricing and Limited-Time Offers (LTOs)

Monetization Assessment

Strengths

- •

Highly scalable and capital-light franchise model minimizes operational risk and capital expenditure.

- •

Predictable, recurring revenue from franchise royalties provides financial stability.

- •

Diversified across multiple brands and over 155 countries, reducing dependence on any single market.

Weaknesses

- •

Over-reliance on the financial health and operational execution of franchisees.

- •

Brand reputation is vulnerable to issues at the individual franchise level.

- •

Slower to implement system-wide changes compared to a fully company-owned model.

Opportunities

- •

Monetizing their proprietary technology stack ('Byte by Yum!') by offering it as a SaaS product to a wider market.

- •

Leveraging AI and data analytics to optimize franchisee performance, thereby increasing royalty revenue.

- •

Expanding new, high-growth concepts like 'Saucy by KFC' to attract younger demographics and create new franchising opportunities.

Threats

- •

Intense competition from global QSR giants like McDonald's and Restaurant Brands International.

- •

Economic downturns impacting consumer discretionary spending and franchisee profitability.

- •

Shifting consumer preferences towards healthier options and fast-casual dining.

Market Positioning

Multi-Brand Portfolio Dominance

Market Leader in respective categories (e.g., chicken, pizza, Mexican-inspired QSR), and a top-tier global competitor in the overall fast-food industry.

Target Segments

- Segment Name:

The Value-Seeking Innovator (Taco Bell)

Description:Primarily Gen Z and younger Millennials who are digitally native, seek novelty and customization, and are highly sensitive to value.

Demographic Factors

Age 18-34

Psychographic Factors

- •

Adventurous eaters

- •

Trend-conscious

- •

Value-driven

- •

Active on social media

Behavioral Factors

- •

Frequent use of mobile ordering

- •

Prone to late-night purchases

- •

High engagement with loyalty programs and LTOs

Pain Points

- •

Limited budgets

- •

Boredom with standard fast-food options

- •

Desire for quick, convenient, and shareable experiences

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

The Traditional Family (KFC)

Description:Families and individuals seeking familiar, convenient, and comforting meal solutions, often for shared occasions.

Demographic Factors

Broad age range, often with children

Psychographic Factors

- •

Values tradition and convenience

- •

Seeks comfort food

- •

Budget-conscious for family meals

Behavioral Factors

- •

Purchases multi-person meals (e.g., buckets)

- •

Often uses drive-thru

- •

Less digitally engaged than younger segments

Pain Points

- •

Need for quick and easy dinner solutions

- •

Finding affordable meals to feed a group

- •

Pleasing multiple tastes within a family

Fit Assessment:Good

Segment Potential:Medium

- Segment Name:

The Modern 'Vibe' Chaser (Saucy by KFC)

Description:A new target segment of Gen Z and younger consumers who prioritize the overall 'vibe' and experience, including aesthetics, customization, and authenticity, over just the food.

Demographic Factors

Age 16-28

Psychographic Factors

- •

Culture chasers

- •

Seek individuality and personalization

- •

Value authentic, non-scripted interactions

- •

Drawn to modern, 'Instagrammable' aesthetics

Behavioral Factors

- •

High use of digital ordering kiosks and mobile apps

- •

Influenced by social media trends

- •

Prefers brands that reflect their personality

Pain Points

- •

Feeling that traditional fast-food is 'basic' or lacks personality

- •

Desire for more flavor options and control over their meal

- •

Looking for experiences, not just transactions

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Iconic, Category-Defining Brand Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Unmatched Global Scale and Franchise Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Proprietary, AI-Driven Technology Platform ('Byte by Yum!')

Strength:Moderate

Sustainability:Sustainable

- Factor:

Systematic Innovation Engine (Collider Lab & Concept Testing)

Strength:Moderate

Sustainability:Temporary

Value Proposition

For Franchisees: A partnership to grow iconic, globally recognized restaurant brands with world-class operational, marketing, and technology support. For Consumers: Craveable, convenient, and affordable food from trusted and loved brands.

Excellent

Key Benefits

- Benefit:

Access to established, world-famous brands with built-in consumer demand.

Importance:Critical

Differentiation:Unique

Proof Elements

Decades of brand history and marketing

Nearly 61,000 global locations

- Benefit:

Proven operational playbooks and a global supply chain.

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Standardized training programs

Large-scale purchasing co-op for cost savings

- Benefit:

Cutting-edge, proprietary technology stack to enhance efficiency and customer experience.

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Rollout of 'Byte by Yum!' platform to 25,000+ restaurants

Investment in AI for ordering, inventory, and labor management

Unique Selling Points

- Usp:

The world's largest restaurant company by unit count, offering unparalleled scale and market presence.

Sustainability:Long-term

Defensibility:Strong

- Usp:

An agile, internal innovation model ('corporate rebels' and Collider Lab) within a mature enterprise, enabling rapid development of new concepts like 'Saucy by KFC'.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

For Franchisees: Reducing the immense risk and complexity of starting and scaling a restaurant business from scratch.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

For Consumers: The need for fast, reliable, and affordable meal options that cater to specific cravings.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

The business model is well-aligned with the global demand for convenient, value-oriented food service. The company is actively adapting to market shifts towards digital engagement and personalization.

High

The multi-brand portfolio effectively targets diverse consumer segments. Strategic initiatives like Taco Bell's marketing and the 'Saucy by KFC' concept show a clear and successful alignment with younger, high-growth demographics.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Franchisees (~1,500 partners)

- •

Global food and packaging suppliers (e.g., Sysco, Keystone Foods)

- •

Technology partners (e.g., for AI, delivery platforms)

Key Activities

- •

Brand Management & Global Marketing

- •

Franchise Development & Support

- •

Supply Chain Management

- •

Technology & Digital Platform Development ('Byte by Yum!')

- •

Menu & Concept Innovation (Collider Lab)

Key Resources

- •

Portfolio of iconic brands (KFC, Taco Bell, Pizza Hut, The Habit)

- •

Extensive global franchise network

- •

Proprietary recipes and operational procedures

- •

Proprietary AI and digital technology stack

Cost Structure

- •

General & Administrative Expenses (corporate overhead)

- •

Marketing & Brand Investment

- •

Investment in Digital & Technology Infrastructure

- •

Costs related to company-owned restaurants

Swot Analysis

Strengths

- •

Asset-light, high-margin franchise model that is resilient to inflation.

- •

Dominant and globally diversified brand portfolio with immense brand equity.

- •

Massive scale provides significant advantages in purchasing, marketing, and data collection.

- •

Increasingly sophisticated proprietary technology ecosystem driving digital sales and operational efficiency.

Weaknesses

- •

High dependence on the performance of a few core brands, particularly KFC and Pizza Hut.

- •

Perception of some brands (e.g., Pizza Hut) as lagging behind more innovative competitors.

- •

Complex international operations subject to geopolitical and currency risks.

Opportunities

- •

Further expansion and penetration in high-growth emerging markets.

- •

Leverage the 'Saucy by KFC' model to launch other agile, sub-brand concepts targeting niche demographics.

- •

Utilize their vast data assets for hyper-personalization and franchisee performance optimization.

- •

Continued investment in AI to further reduce operational costs and improve service speed.

Threats

- •

Intensifying competition from both global QSR players and agile local competitors.

- •

Evolving consumer preferences towards health, wellness, and sustainability.

- •

Global supply chain disruptions and rising commodity costs impacting franchisee profitability.

- •

Potential for franchisee discontent or disputes over technology mandates or fee structures.

Recommendations

Priority Improvements

- Area:

Brand Revitalization

Recommendation:Accelerate the modernization and innovation pipeline for Pizza Hut to address its competitive lag, potentially by adopting the agile 'Collider Lab' approach used for 'Saucy by KFC'.

Expected Impact:High

- Area:

Franchisee Technology Adoption

Recommendation:Develop a tiered support and incentive program to accelerate the adoption of the full 'Byte by Yum!' tech stack across all global franchisees, ensuring system-wide data consistency and efficiency.

Expected Impact:High

- Area:

Supply Chain Resilience

Recommendation:Diversify key supplier relationships on a regional basis and invest in predictive analytics to better anticipate and mitigate potential supply chain disruptions.

Expected Impact:Medium

Business Model Innovation

- •

Pilot a 'dark kitchen' or virtual brand incubator program, leveraging existing franchisee kitchens to launch new, delivery-only concepts with minimal capital investment.

- •

Explore a tiered franchising model where top-performing franchisees get exclusive first access to new concepts like 'Saucy by KFC' or opportunities in premium locations.

- •

Develop a 'Yum! Ventures' arm to make strategic minority investments in emerging food tech and restaurant startups to stay ahead of market trends.

Revenue Diversification

- •

Expand the Consumer Packaged Goods (CPG) footprint by launching more branded products (e.g., Pizza Hut frozen pizzas, KFC seasonings) into retail channels globally.

- •

Create a premium data and analytics service for franchisees, offering deeper, store-specific insights and performance benchmarks for an additional subscription fee.

- •

License the 'Byte by Yum!' technology platform to independent, non-competing restaurant chains, creating a new B2B SaaS revenue stream.

Yum! Brands represents a mature, highly optimized business model centered on the global franchising of iconic QSR brands. Its core strength lies in its asset-light structure, which generates predictable, high-margin revenue streams and insulates the corporation from direct operational and inflationary pressures. The company is in a pivotal phase of strategic evolution, transitioning from a traditional fast-food franchisor to a technology-driven platform. The development of the proprietary 'Byte by Yum!' AI-powered ecosystem is central to this transformation, aiming to drive efficiency, enhance customer experience, and unlock new value from its immense data assets.

The 'Saucy by KFC' initiative, as detailed on their website, serves as a powerful case study for the company's future direction. It demonstrates a shift towards more agile, targeted innovation designed to capture specific, high-growth demographics like Gen Z. This 'corporate rebel' approach—leveraging an in-house innovation lab to move quickly and test disruptive concepts—is a critical capability for a mature enterprise seeking to maintain relevance and drive new growth. Future success will be contingent on Yum!'s ability to replicate this agile innovation model across its other brands, particularly to revitalize lagging performers like Pizza Hut, while effectively scaling its technology platform across its vast global network of franchisees. The primary strategic challenge is no longer just selling food, but providing a comprehensive, technology-enabled platform that ensures franchisee profitability and delivers a modern, personalized experience for the end consumer.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Brand Recognition & Equity

Impact:High

- Barrier:

Global Supply Chain & Logistics Networks

Impact:High

- Barrier:

Real Estate and Location Access

Impact:High

- Barrier:

Capital Investment for Scale

Impact:High

- Barrier:

Franchisee Network Development

Impact:Medium

Industry Trends

- Trend:

Digital Transformation & AI Integration

Impact On Business:Critical for operational efficiency (AI order-taking, smart POS), personalizing customer experience (loyalty programs, targeted promotions), and streamlining delivery.

Timeline:Immediate

- Trend:

Health & Wellness Consciousness

Impact On Business:Increasing demand for healthier, plant-based, and customizable menu options requires continuous R&D and supply chain adaptation.

Timeline:Immediate

- Trend:

Sustainability & Ethical Sourcing

Impact On Business:Growing consumer expectation for sustainable packaging, reduced waste, and ethically sourced ingredients impacts brand reputation and operational costs.

Timeline:Near-term

- Trend:

Value and Affordability Focus

Impact On Business:In an inflationary environment, consumers are highly sensitive to price, forcing competitive value meal offerings and promotions to drive traffic.

Timeline:Immediate

- Trend:

Labor Shortages & Automation

Impact On Business:Drives investment in labor-saving technologies like self-service kiosks and automated kitchen equipment to manage rising labor costs and ensure service consistency.

Timeline:Near-term

Direct Competitors

- →

McDonald's Corporation

Market Share Estimate:Leading global market share (>10%)

Target Audience Overlap:High

Competitive Positioning:Global leader in convenience, value, and family-friendly fast food, focusing on core menu items and digital integration.

Strengths

- •

Unmatched global brand recognition and real estate footprint.

- •

Highly efficient and standardized supply chain and operations.

- •

Significant marketing budget and global campaign execution.

- •

Advanced digital ecosystem (mobile app, loyalty program).

- •

Strong focus on value offerings to attract price-sensitive consumers.

Weaknesses

- •

Perceived lower quality compared to fast-casual competitors.

- •

Slower to innovate on menu items compared to more nimble rivals.

- •

Vulnerable to negative public perception regarding health and sustainability.

- •

Recent declines in customer traffic among key demographics.

Differentiators

- •

Iconic core menu items (Big Mac, McNuggets, Fries).

- •

Breakfast daypart dominance.

- •

Global consistency and operational speed.

- →

Restaurant Brands International (RBI)

Market Share Estimate:Significant global player, a top 5 QSR company.

Target Audience Overlap:High

Competitive Positioning:A multi-brand powerhouse leveraging a heavily franchised model to compete across multiple QSR segments (burgers, chicken, coffee).

Strengths

- •

Diverse portfolio with strong brands in key categories (Popeyes, Burger King).

- •

Aggressive global expansion strategy.

- •

Popeyes' strong brand equity and menu innovation, especially the chicken sandwich, which has gained market share from KFC.

- •

Focus on improving franchisee profitability and digital integration.

Weaknesses

- •

Burger King has struggled with brand perception and consistency in the U.S.

- •

Potential for brand cannibalization within their portfolio.

- •

Slower to adapt to health and wellness trends compared to some competitors.

Differentiators

- •

Popeyes' authentic Louisiana-style chicken flavor profile.

- •

Burger King's flame-grilled positioning.

- •

Asset-light business model focused on acquisitions.

- →

Domino's Pizza, Inc.

Market Share Estimate:Leading global pizza delivery chain.

Target Audience Overlap:Medium

Competitive Positioning:Technology-focused leader in the pizza delivery market, emphasizing speed, convenience, and value.

Strengths

- •

Superior digital ordering and delivery technology infrastructure.

- •

Highly efficient, vertically integrated supply chain.

- •

Strong brand recognition and customer loyalty.

- •

Effective value-based promotions and marketing.

- •

Extensive global presence with a successful franchise model.

Weaknesses

- •

Heavily reliant on the pizza category, vulnerable to shifts in consumer preference.

- •

Faces intense competition from local pizzerias and third-party delivery apps offering wider choice.

- •

Perceived as a value option, which can make it difficult to command premium prices.

Differentiators

- •

Pioneering technology in ordering and delivery (Domino's Tracker).

- •

Focus on operational efficiency for fast delivery times.

- •

Own delivery network reduces reliance on third-party aggregators.

- →

Chipotle Mexican Grill

Market Share Estimate:Leader in the fast-casual Mexican segment.

Target Audience Overlap:Medium

Competitive Positioning:A fast-casual leader positioned on 'Food with Integrity,' offering higher-quality, customizable Mexican cuisine.

Strengths

- •

Strong brand perception for fresh, high-quality ingredients.

- •

Simple, customizable menu that allows for high throughput.

- •

Cult-like following and strong brand loyalty.

- •

Successful digital and drive-thru ('Chipotlane') implementation.

Weaknesses

- •

Higher price point compared to traditional QSRs like Taco Bell.

- •

Past food safety issues have impacted brand trust, requiring ongoing vigilance.

- •

Limited menu variety can be a drawback for some consumers.

Differentiators

- •

Commitment to non-GMO, responsibly sourced ingredients.

- •

Fast-casual service model offers a more premium experience than traditional fast food.

- •

Strong corporate identity and values-based marketing.

Indirect Competitors

- →

Food Delivery Aggregators (DoorDash, Uber Eats)

Description:Technology platforms that offer consumers a vast selection of restaurant options for delivery, positioning themselves as the primary interface for ordering food.

Threat Level:High

Potential For Direct Competition:Increasingly launching their own virtual brands and ghost kitchens, which could directly compete with Yum's offerings.

- →

Starbucks Corporation

Description:Global coffeehouse chain that also offers a range of pastries, sandwiches, and snacks, competing for share of stomach, particularly in the breakfast and lunch dayparts.

Threat Level:Medium

Potential For Direct Competition:Unlikely to enter core QSR categories like fried chicken or pizza, but continues to expand its food offerings, increasing overlap.

- →

Grocery & Convenience Stores (Prepared Foods sections)

Description:Retailers like Walmart, Kroger, and 7-Eleven are expanding their high-quality, convenient prepared food and 'take-and-bake' options, competing on price and convenience for at-home meals.

Threat Level:Medium

Potential For Direct Competition:Low, but they are a significant alternative for quick and easy meal solutions.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Diversified Global Brand Portfolio

Sustainability Assessment:Highly sustainable. Owning leading brands in different food categories (chicken, pizza, Mexican) and geographies mitigates risks from changing consumer tastes and regional economic downturns.

Competitor Replication Difficulty:Hard

- Advantage:

Asset-Light Franchise Model

Sustainability Assessment:Highly sustainable. Enables rapid global expansion with lower capital expenditure, providing a stable, royalty-based revenue stream.

Competitor Replication Difficulty:Hard

- Advantage:

Economies of Scale

Sustainability Assessment:Sustainable. Massive scale provides significant purchasing power, supply chain efficiencies, and marketing leverage that smaller competitors cannot match.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Innovative New Concepts (e.g., Saucy by KFC)', 'estimated_duration': '1-3 years. Provides a first-mover advantage and generates significant media buzz, but successful concepts will eventually be copied by competitors.'}

{'advantage': 'High-Impact Marketing Campaigns', 'estimated_duration': "6-18 months. Campaigns like Taco Bell's 'Live Más' or special promotions can drive significant short-to-medium term sales lifts but require constant reinvention to remain effective."}

Disadvantages

- Disadvantage:

Inconsistent Brand Performance

Impact:Major

Addressability:Moderately

- Disadvantage:

Dependence on Franchisee Execution

Impact:Major

Addressability:Difficult

- Disadvantage:

Brand Fatigue for Legacy Brands

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch Cross-Brand Loyalty Promotions

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Amplify Digital Storytelling around 'Saucy by KFC'

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop and Scale 'First-Party' Delivery Capabilities

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Modernize Pizza Hut's Dine-In and Digital Experience

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Aggressively Expand The Habit Burger Grill's Footprint

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Establish an In-House 'Ghost Kitchen' Incubator

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Acquire a High-Growth Brand in a New Category (e.g., Health-Focused, Bowls)

Expected Impact:High

Implementation Difficulty:Difficult

Position Yum! Brands as the leading portfolio of culturally relevant, digitally-forward QSR brands. Shift from a holding company of distinct chains to an interconnected ecosystem where digital identity and loyalty are shared, enhancing customer lifetime value.

Differentiate through 'Category-of-One' brand experiences. For Taco Bell, it's cultural leadership. For KFC, it's culinary innovation (like 'Saucy'). For Pizza Hut, it must become technology-led convenience. For Habit Burger, it's fast-casual quality at QSR speed. This specialized focus prevents internal brand dilution and creates clearer competitive moats against rivals.

Whitespace Opportunities

- Opportunity:

Integrated Cross-Brand Subscription Service

Competitive Gap:No major QSR competitor offers a portfolio-wide subscription model. This could lock in customers and increase visit frequency across brands.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Lead in Sustainable 'Fast Food'

Competitive Gap:While many competitors are making sustainability claims, none have made it a core, visible part of their brand identity across all customer touchpoints. There is an opportunity to be the definitive leader.

Feasibility:Low

Potential Impact:High

- Opportunity:

AI-Powered Hyper-Personalized Menus

Competitive Gap:Current digital personalization is limited to past orders and basic recommendations. True AI could dynamically create personalized value combos or suggest new item pairings based on a user's comprehensive data profile, a step beyond what competitors are currently doing.

Feasibility:Medium

Potential Impact:High

Yum! Brands operates within a mature, oligopolistic Quick Service Restaurant (QSR) industry characterized by intense competition and high barriers to entry. Its primary strength lies in its diversified portfolio of globally recognized brands—KFC, Taco Bell, Pizza Hut, and The Habit Burger Grill—which compete across key food categories. This diversification provides a resilient buffer against category-specific downturns and shifting consumer preferences.

Direct competition is fierce. McDonald's remains the undisputed global leader, leveraging immense scale, brand equity, and an advanced digital ecosystem. Restaurant Brands International (RBI) poses a significant threat, particularly with Popeyes, which has successfully challenged KFC's dominance in the U.S. chicken segment through menu innovation and savvy marketing. In the pizza category, Pizza Hut faces relentless pressure from Domino's, a competitor that has built its entire business model on technological superiority and delivery efficiency, areas where Pizza Hut has historically lagged. Taco Bell's main competitor is Chipotle, which operates in the fast-casual space but competes for the same share of stomach with a higher-quality, 'healthier' positioning.

Yum's sustainable competitive advantages are its global scale, diversified portfolio, and asset-light franchise model. These are difficult for any competitor to replicate. However, the company faces significant disadvantages, including inconsistent performance across its brands, particularly the revitalization challenges at Pizza Hut and the competitive pressures on KFC in the U.S. Furthermore, its reliance on a franchise model, while financially advantageous, creates challenges in maintaining consistent quality and customer experience across nearly 61,000 locations.

The key to future success lies in leveraging its portfolio's scale while fostering innovation and cultural relevance within each brand. The development of 'Saucy by KFC' is a prime example of this strategy: using the resources of a legacy brand to launch a nimble, trend-focused sub-brand targeting younger demographics. Key industry trends, including digitalization, the demand for value, and health and sustainability, will dictate the competitive dynamics. Yum's ability to innovate its digital and delivery channels, modernize legacy brands, and identify strategic whitespace—such as integrated loyalty programs or leadership in sustainability—will be critical to defending and growing its market share against formidable global competitors.

Messaging

Message Architecture

Key Messages

- Message:

We're building the world's most loved, trusted and connected restaurant brands in partnership with the best franchise operators in the business.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section

- Message:

We have a recipe for good growth.

Prominence:Secondary

Clarity Score:High

Location:Homepage, linked under 'Impact'

- Message:

Be your best self at Yum!

Prominence:Secondary

Clarity Score:High

Location:Homepage, linked under 'Careers'

- Message:

Yum! Brands is a global leader in the restaurant industry, with a portfolio of iconic brands.

Prominence:Tertiary

Clarity Score:High

Location:Implied throughout, supported by stats (restaurants, countries)

The message hierarchy is exceptionally clear. The primary message, an aspirational vision statement, occupies the most prominent position on the homepage. Secondary messages are neatly segmented into clickable sections (Impact, Careers, Investors), effectively directing different audience personas to the information most relevant to them. Tertiary messages of scale and leadership are reinforced by large, easily digestible statistics.

Messaging is highly consistent across the corporate sections of the site. The themes of 'growth', 'partnership', and being a 'loved, trusted' entity are woven throughout the main navigation and footer. The 'Trending News' section, particularly the story on 'Saucy by KFC', supports the main messages by providing concrete examples of innovation and brand evolution, which are key components of 'good growth'.

Brand Voice

Voice Attributes

- Attribute:

Corporate & Professional

Strength:Strong

Examples

- •

Check out our latest earnings release

- •

Senior Vice President Finance and Corporate Controller

- •

Our Good Growth Strategy guides how we move our company forward.

- Attribute:

Aspirational & Confident

Strength:Strong

Examples

- •

We're building the world's most loved, trusted and connected restaurant brands

- •

Our bold vision is to grow the most loved, trusted and connected restaurant brands globally

- •

Be your best self at Yum!

- Attribute:

Innovative & Forward-Looking

Strength:Moderate

Examples

- •

Yum! Digital & Tech

- •

The secret is in the sauce at Yum Brands executives believe that flavorful condiments are its future.

- •

Saucy doesn’t replace that — it remixes it for a new generation.

Tone Analysis

Authoritative

Secondary Tones

- •

Optimistic

- •

Reassuring

- •

Inspirational

Tone Shifts

The 'Trending Yum! News' section shifts to a more journalistic, storytelling tone, which is appropriate for that content format. For example, the 'Saucy by KFC' article is narrative and conversational ('If you’re wondering how we got here, you’re not alone.').

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Yum! Brands offers a stable and profitable partnership for growth by leveraging a portfolio of world-renowned restaurant brands, a massive global scale, and a proven franchise-centric business model.

Value Proposition Components

- Component:

Portfolio of Iconic Brands (KFC, Taco Bell, Pizza Hut, Habit Burger)

Clarity:Clear

Uniqueness:Unique

- Component:

Global Scale and Reach

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Franchisee Partnership Model

Clarity:Clear

Uniqueness:Common

- Component:

Commitment to 'Good Growth' (ESG)

Clarity:Clear

Uniqueness:Common

The primary differentiation stems not from the franchise model itself, but from the specific portfolio of iconic, category-leading brands. While competitors like Restaurant Brands International also have a multi-brand franchise model, the combination of KFC, Taco Bell, and Pizza Hut is unique to Yum!. The messaging effectively leverages this by showcasing the logos and providing large-scale statistics (nearly 61,000 restaurants) that few competitors can match.

The messaging positions Yum! Brands as a dominant, stable, and forward-thinking leader in the global QSR industry. It competes with companies like McDonald's, Restaurant Brands International, and Starbucks. The emphasis on a portfolio of brands, innovation (like 'Saucy'), and a defined 'Good Growth' strategy is designed to appeal to investors and franchisees looking for diversified and responsible growth, rather than reliance on a single brand.

Audience Messaging

Target Personas

- Persona:

Investors & Financial Analysts

Tailored Messages

- •

Check out our latest earnings release

- •

We have a recipe for good growth

- •

The site features a comprehensive 'Investors' section with SEC filings, annual reports, and dividend history.

Effectiveness:Effective

- Persona:

Potential & Current Franchisees

Tailored Messages

- •

in partnership with the best franchise operators in the business

- •

Approximately 1,500 franchisees

- •

Our brands have scale, and we use that scale to help our franchisees.

Effectiveness:Somewhat Effective

- Persona:

Job Seekers & Potential Employees

Tailored Messages

- •

Be your best self at Yum!

- •

Unrivaled Culture & Talent

- •

Comprehensive 'Careers' section detailing culture, functions, and development.

Effectiveness:Effective

- Persona:

Media & Corporate Responsibility Watchdogs

Tailored Messages

- •

We have a recipe for good growth

- •

Detailed 'Impact' section covering People, Food, and Planet.

- •

Press releases and company stories in the 'News & Stories' section.

Effectiveness:Effective

Audience Pain Points Addressed

- •

Investment Risk (addressed by showcasing scale, stability, and growth)

- •

Career Stagnation (addressed by messages of professional development and culture)

- •

Brand Relevance (addressed by innovation stories like 'Saucy by KFC')

Audience Aspirations Addressed

- •

Financial Growth & Returns (for investors and franchisees)

- •

Building a Successful Business (for franchisees)

- •

Meaningful Career & Impact (for employees)

- •

Corporate Responsibility & Sustainability (for the public and media)

Persuasion Elements

Emotional Appeals

- Appeal Type:

Aspiration

Effectiveness:High

Examples

Be your best self at Yum!

building the world's most loved, trusted and connected restaurant brands

- Appeal Type:

Trust/Security

Effectiveness:High

Examples

We have a recipe for good growth

The emphasis on leadership, governance, and detailed financial reporting.

Social Proof Elements

- Proof Type:

Scale in Numbers

Impact:Strong

Examples

- •

Approximately 1,500 franchisees

- •

Operating nearly 61,000 restaurants

- •

In over 155 countries & territories

Trust Indicators

- •

Detailed 'Leadership' and 'Board of Directors' pages

- •

Comprehensive 'Investors' section with transparent financial data

- •

In-depth 'Impact' section detailing ESG initiatives

- •

Showcasing iconic, globally recognized brand logos

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Learn more

Location:Under each of the four brand logos on the homepage

Clarity:Clear

- Text:

Check out our latest earnings release

Location:Homepage link to 'Investors' section

Clarity:Clear

- Text:

Search Jobs

Location:Footer, under 'Careers'

Clarity:Clear

- Text:

SIGN UP

Location:Email newsletter signup in the footer

Clarity:Clear

The CTAs are highly effective for a corporate website. They are not designed for direct sales but for audience segmentation. Each primary CTA cleanly directs a specific persona (potential franchisee, investor, job seeker) to the most relevant information hub. The language is direct, unambiguous, and aligns with the professional tone of the site.

Messaging Gaps Analysis

Critical Gaps

Lack of direct franchisee voice. While the company speaks about its partnership with franchisees, there are no testimonials, success stories, or direct quotes from operators, which would significantly strengthen the value proposition for that key audience.

No centralized 'Innovation' narrative. The 'Saucy by KFC' story is powerful but is buried in 'Trending News'. There isn't a dedicated section that frames Yum! as an innovation leader in food, tech, and operations, which is a missed opportunity.

Contradiction Points

No itemsUnderdeveloped Areas

Franchisee-facing messaging could be more robust. The 'Franchising & Real Estate' link in the footer leads to a page that isn't included in the scrape, but the homepage messaging for this audience is less developed than for investors or employees.

The message of being 'connected' is mentioned in the primary headline but is not clearly defined or supported with specific examples on the main page. It's an abstract concept that could be made more concrete.

Messaging Quality

Strengths

- •

Exceptional clarity in audience segmentation and navigation.

- •

Strong use of large numbers and statistics as social proof to convey scale and success.

- •

A consistent and professional corporate voice that builds confidence and authority.

- •

Effective use of storytelling in the news section to illustrate key strategic pillars like innovation.

Weaknesses

- •

The corporate messaging can feel impersonal and lacks a human element, particularly regarding the franchisee experience.

- •

Over-reliance on corporate jargon like 'Good Growth Strategy' which, while internally meaningful, may not resonate as strongly with external audiences without further context.

- •

The core value proposition for franchisees is implied rather than explicitly and persuasively stated on the homepage.

Opportunities

- •

Feature a rotating 'Franchisee Spotlight' on the homepage to humanize the partnership message and provide powerful social proof.

- •

Create an 'Innovation at Yum!' or 'The Future of Food' content hub to showcase stories like 'Saucy', tech advancements, and market insights.

- •

Explicitly define what 'connected restaurant brands' means, perhaps through case studies on digital integration, loyalty programs, or community engagement.

Optimization Roadmap

Priority Improvements

- Area:

Franchisee Value Proposition

Recommendation:Integrate a dedicated 'Franchisee Success Stories' module on the homepage and create a content series featuring interviews and testimonials from diverse franchise operators.

Expected Impact:High

- Area:

Innovation Narrative

Recommendation:Develop a new top-level navigation item or a prominent homepage section for 'Innovation'. Consolidate stories about new concepts (Saucy), digital technology (AI, data analytics), and operational improvements to position Yum! as a forward-thinking industry leader.

Expected Impact:High

- Area:

Clarify Key Messaging

Recommendation:Add a sub-headline or a small descriptive text block below the main hero message that explains what 'connected' means in the context of Yum! Brands' strategy (e.g., '...connected through digital innovation, community impact, and shared growth.').

Expected Impact:Medium

Quick Wins

- •

Add a powerful, authentic quote from a franchisee directly below the '1,500 franchisees' statistic on the homepage.

- •

Re-label the 'Impact' homepage link to 'Our Recipe for Good Growth' to be more descriptive and engaging.

- •

Feature the 'How Saucy by KFC launched in record time' story more prominently on the homepage as a proof point for agility and innovation.

Long Term Recommendations

Evolve the corporate narrative to focus more on Yum! as a technology and platform company that enables franchisee success, not just a holding company for restaurant brands.

Develop a more distinct and less generic messaging framework than 'People, Food, Planet' for the ESG/Impact story, one that is uniquely tied to Yum!'s specific business and mission.

Yum! Brands' corporate website executes a world-class communication strategy for its primary audiences: investors, potential employees, and the media. The messaging is built on a foundation of authority, stability, and immense scale. The information architecture is flawless, creating clear, frictionless pathways for each target persona. The brand voice is professional, confident, and consistently applied.

The core value proposition is powerfully, if implicitly, communicated through staggering statistics of its global reach. For an investor, the message of a well-managed, growing, and diversified portfolio is crystal clear and reassuring. For a job seeker, the message of a culture-first organization with opportunities for growth is compelling.

The primary weakness lies in its communication to its other critical partner: the franchisee. The messaging about franchisees is positive, but it lacks the direct voice of the franchisees. This creates a gap in emotional connection and proof for prospective operators. While the company is presented as a powerful and successful entity, the story of how it creates success for its partners is told from the corporate perspective only.

The 'Saucy by KFC' news story is a standout piece of content, effectively functioning as a case study in innovation, agility, and internal culture ('corporate rebels'). However, its placement as just another news item misses a strategic opportunity. This story, and others like it, should be elevated into a core pillar of the Yum! narrative, demonstrating a proactive strategy to stay relevant and drive future growth. By strengthening the franchisee voice and building a more prominent platform for its innovation stories, Yum! Brands can evolve its messaging from being a successful operator of legacy brands to being the definitive platform for the future of the restaurant industry.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Portfolio of iconic, globally recognized brands (KFC, Taco Bell, Pizza Hut) with decades of market presence and brand equity.

- •

Nearly 61,000 restaurants in over 155 countries, indicating widespread and sustained consumer demand.

- •

Consistently strong performance from key brands; Taco Bell U.S. delivered 4% same-store sales growth in Q2 2025, outperforming the QSR category.

- •

Demonstrated ability to innovate and adapt to changing consumer tastes with the launch of new concepts like 'Saucy by KFC' to target younger demographics.

- •

KFC International is a major profit driver, contributing 85% of international operating profit and showing strong growth in key markets.

Improvement Areas

- •

Address transaction softness and strengthen value messaging at Pizza Hut U.S. to regain momentum.

- •

Continue to scale and define the growth trajectory for The Habit Burger Grill, the newest and smallest brand in the portfolio.

- •

Accelerate menu innovation to cater to rising demand for healthier options and plant-based alternatives.

Market Dynamics

Moderate (Global QSR market CAGR projected at ~2-4%).

Mature

Market Trends

- Trend:

Digitalization and AI Integration

Business Impact:Shift to digital ordering, delivery, and AI-powered operations (e.g., voice ordering, predictive analytics) is critical for efficiency and customer experience. Yum!'s digital sales mix reached a record 57% in Q2 2025, showing strong adoption.

- Trend:

Focus on Value and Convenience

Business Impact:In an inflationary environment, consumers are price-sensitive. Strong value propositions are essential for driving traffic, especially for brands like Pizza Hut.

- Trend:

Gen Z and Millennial Influence

Business Impact:Younger consumers are driving QSR growth, prioritizing customization, unique flavors, digital experiences, and brand values. The 'Saucy by KFC' concept is a direct response to this trend.

- Trend:

Rise of Smaller, Tech-Enabled Footprints

Business Impact:Shift towards delivery-first, drive-thru-only, and ghost kitchen formats to improve operational efficiency and reduce overhead.

Excellent. As a market leader, Yum! is well-positioned to capitalize on the industry's digital transformation. Its scale allows for significant investment in technology and innovation, creating a competitive advantage in a rapidly evolving market.

Business Model Scalability

High

Highly scalable due to the franchise-led model (98% of restaurants). Yum! Brands' revenue is primarily from high-margin franchise fees and royalties, minimizing capital-intensive restaurant operations.

High. Growth in system-wide sales directly translates to high-margin revenue for the parent company with minimal incremental corporate cost.

Scalability Constraints

- •

Maintaining brand standards and operational consistency across a vast network of ~1,500 franchisees.

- •

Ensuring franchisee profitability, as their financial health is critical for reinvestment and new unit development.

- •

Complexity of managing global supply chains and adapting to diverse international regulations and consumer preferences.

Team Readiness

Strong. Experienced executive team with dedicated C-level roles for Digital & Technology, Marketing, and Operations. A planned CEO transition suggests proactive succession planning.

Effective. A corporate holding structure with dedicated leadership for each brand allows for focused execution. The creation of internal innovation hubs like 'Collider Lab' and 'corporate rebel' teams for new concepts like 'Saucy by KFC' demonstrates an agile approach to growth within a large corporation.

Key Capability Gaps

Need for deeper talent in AI, machine learning, and data science to fully leverage the vast amounts of data generated across the system.

Change management expertise to accelerate the adoption of new technology platforms (like Byte by Yum!) across the franchisee base.

Growth Engine

Acquisition Channels

- Channel:

Global Brand Marketing & Advertising

Effectiveness:High

Optimization Potential:Medium

Recommendation:Increase personalization of marketing messages using data from digital channels. Localize campaigns to resonate more deeply in high-growth international markets.

- Channel:

Digital Channels (Brand Apps, Website)

Effectiveness:High

Optimization Potential:High

Recommendation:Continue to enhance loyalty programs and integrate AI for personalized offers to drive frequency. Streamline the user experience across all brand apps for a consistent feel.

- Channel:

Third-Party Delivery Aggregators

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Negotiate favorable terms to protect franchisee margins. Focus on strategies to convert aggregator customers to first-party digital channels where data can be captured.

- Channel:

In-Store / Drive-Thru Presence

Effectiveness:High

Optimization Potential:High

Recommendation:Invest heavily in AI-powered drive-thrus to improve speed and order accuracy, which are key drivers of customer satisfaction.

Customer Journey

Increasingly multi-channel, shifting from purely physical (in-store, drive-thru) to a digitally-integrated experience (mobile order-ahead, delivery, kiosks).

Friction Points

- •

Inconsistent customer experience between different franchisee-operated locations.

- •

Potential for long wait times at drive-thrus during peak hours.

- •

Usability gaps or performance issues in older versions of brand mobile apps.

Journey Enhancement Priorities

- Area:

Digital Ordering

Recommendation:Deploy the unified 'Byte by Yum!' SaaS platform across all brands and regions to create a seamless and data-rich digital ecosystem.

- Area:

Drive-Thru Experience

Recommendation:Accelerate rollout of AI voice ordering and computer vision to optimize traffic flow and upsell opportunities, as piloted with NVIDIA.

- Area:

Personalization

Recommendation:Leverage AI and the massive dataset from digital orders to provide personalized menu recommendations and promotions, increasing order value and visit frequency.

Retention Mechanisms

- Mechanism:

Brand-Specific Loyalty Programs

Effectiveness:Medium

Improvement Opportunity:Increase the value proposition of loyalty programs by offering more personalized and exclusive rewards. Data shows loyalty members have a 12% higher visit frequency.

- Mechanism:

Limited-Time Offers (LTOs) & Menu Innovation

Effectiveness:High

Improvement Opportunity:Utilize predictive analytics to forecast demand for LTOs more accurately, reducing waste and optimizing supply chains. This is a key driver for Taco Bell's success.

- Mechanism:

Value Offerings

Effectiveness:High

Improvement Opportunity:Dynamically adjust value offerings based on regional economic conditions and competitive pressures to drive traffic without eroding margins.

Revenue Economics

Strong at the corporate level due to the high-margin franchise model. Franchisee-level unit economics are subject to pressures from labor, commodity costs, and rent.

Not Applicable (Focus is on system-wide sales growth and franchisee profitability).

High. Yum! consistently generates significant free cash flow from its asset-light business model, enabling reinvestment in technology and shareholder returns.

Optimization Recommendations

- •

Drive adoption of cost-saving technologies (e.g., automated inventory management, AI-driven scheduling) to improve franchisee profitability.

- •

Increase the mix of high-margin digital sales, which have been growing at 18% and now represent 57% of the total.

- •

Focus on growing beverage and add-on sales, which carry higher margins, through smarter upselling via digital channels and AI.

Scale Barriers

Technical Limitations

- Limitation:

Fragmented Franchisee Tech Stacks

Impact:High

Solution Approach:Aggressively roll out the standardized 'Byte by Yum!' platform to unify POS, e-commerce, and data systems across the network.

- Limitation:

Data Integration and Governance

Impact:Medium

Solution Approach:Establish a centralized data governance framework to ensure data from nearly 61,000 restaurants is clean, accessible, and usable for AI/ML applications.

Operational Bottlenecks

- Bottleneck:

Labor Shortages and Training

Growth Impact:Constrains store hours and service speed, impacting revenue. Labor challenges are cited as a primary growth obstacle by 91% of QSR operators.

Resolution Strategy:Implement AI and automation for repetitive tasks (e.g., order taking, kitchen prep) to make jobs easier and reduce employee attrition. Simplify operations, as seen with the 'Saucy by KFC' model where staff can be trained in two hours.

- Bottleneck:

Supply Chain Complexity

Growth Impact:Vulnerable to disruptions and inflation, impacting franchisee costs and menu consistency.

Resolution Strategy:Leverage AI for predictive demand forecasting to optimize inventory and logistics. Diversify supplier base in key international markets.

- Bottleneck:

New Restaurant Opening Pipeline

Growth Impact:Real estate availability and construction costs can slow down unit growth, which is a key part of the growth algorithm.

Resolution Strategy:Prioritize smaller, digital-first prototypes that are cheaper and faster to build and can fit into more diverse real estate locations.

Market Penetration Challenges

- Challenge:

Intense Competition in Mature Markets

Severity:Critical

Mitigation Strategy:Differentiate through brand innovation (e.g., 'Saucy by KFC', 'Live Más Café') and superior digital customer experience. Focus on value to compete for price-sensitive consumers.

- Challenge:

Geopolitical and Economic Instability

Severity:Major

Mitigation Strategy:Maintain a diversified global portfolio to mitigate risk from any single market. Empower local leadership to adapt marketing and menu strategies to local conditions.

- Challenge:

Evolving Consumer Health Perceptions

Severity:Minor

Mitigation Strategy:Continue to introduce and market 'better-for-you' options and plant-based alternatives across all brands to cater to health-conscious segments.

Resource Limitations

Talent Gaps

- •

AI and Machine Learning Engineers

- •

Data Scientists

- •

Digital Product Managers

Low for corporate expansion due to franchise model. Capital is primarily needed for strategic technology investments (e.g., AI platforms, digital infrastructure) and potential acquisitions.

Infrastructure Needs

Scalable cloud infrastructure to support the 'Byte by Yum!' platform and centralized data analytics.

Robust cybersecurity measures to protect customer data across a massive digital ecosystem.

Growth Opportunities

Market Expansion

- Expansion Vector:

International Growth in Emerging Markets

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Continue aggressive unit expansion for KFC in markets like Africa and the Middle East. Systematically expand Taco Bell's international footprint, which is a key growth driver.

- Expansion Vector:

Development of New Restaurant Formats

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Scale smaller, digital-centric formats like drive-thru-only and ghost kitchens to increase market density with lower capital investment.

- Expansion Vector:

Habit Burger & Grill Expansion

Potential Impact:Medium

Implementation Complexity:High

Recommended Approach:Develop a clear international expansion strategy for Habit Burger, leveraging Yum!'s existing global franchise network and supply chain expertise.

Product Opportunities

- Opportunity:

Launch New, Digitally-Native Sub-Brands

Market Demand Evidence:The rapid development and initial success of 'Saucy by KFC' shows a clear demand from younger consumers for new, focused concepts.

Strategic Fit:High. Leverages existing brand equity, supply chains, and operational expertise while targeting new customer segments and dayparts.

Development Recommendation:Replicate the 'Collider Lab' innovation model to rapidly prototype and test new concepts for Taco Bell and Pizza Hut.

- Opportunity:

Expand Plant-Based Menu Offerings

Market Demand Evidence:Growing consumer trend towards flexitarian, vegetarian, and vegan diets, particularly among Gen Z.

Strategic Fit:Medium. Aligns with ESG goals and attracts a growing customer segment, but requires careful supply chain and operational planning.

Development Recommendation:Partner with leading plant-based suppliers to co-develop exclusive menu items for each brand, marketed through targeted campaigns.

Channel Diversification

- Channel:

Virtual Brands

Fit Assessment:High

Implementation Strategy:Launch delivery-only brands from existing KFC or Pizza Hut kitchens to maximize asset utilization without requiring new real estate. Test concepts based on popular menu items (e.g., a wings-only brand).

- Channel:

Consumer Packaged Goods (CPG)

Fit Assessment:Medium

Implementation Strategy:Expand licensing partnerships for signature products (e.g., Taco Bell sauces, KFC seasonings) in retail channels to increase brand presence and create a new revenue stream.

Strategic Partnerships

- Partnership Type:

Technology & AI

Potential Partners

- •

NVIDIA

- •

IBM

- •

Leading cloud providers (AWS, Google Cloud, Azure)

Expected Benefits:Accelerate development and deployment of cutting-edge AI for operations, personalization, and efficiency. Gain access to specialized talent and technology.

- Partnership Type:

Lifestyle & Entertainment

Potential Partners

- •

Gaming companies

- •

Streaming services

- •

Music festivals

Expected Benefits:Embed brands in the cultural zeitgeist of younger consumers through authentic integrations and co-branded promotions, driving cultural relevance.

Growth Strategy

North Star Metric

Weekly Active Digital Users

This metric encapsulates customer acquisition, retention, and frequency within the highest-margin and most data-rich channels. Growth in this metric directly correlates with the success of the digital transformation strategy and predicts future system-wide sales growth.

15-20% Year-over-Year Growth

Growth Model

Portfolio Innovation & Digital Scale

Key Drivers

- •

Digital channel adoption (first-party apps)

- •

New concept incubation (like 'Saucy by KFC')

- •

International unit development

- •

Operational efficiency through AI

A dual approach: 1) Systematically scale core digital and AI platforms (like Byte) across the global system to drive efficiency. 2) Protect and fund agile, independent innovation teams ('Collider Lab') to rapidly test and launch new growth vectors.

Prioritized Initiatives

- Initiative:

Accelerate Global Deployment of 'Byte by Yum!' Platform

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Create a dedicated franchisee onboarding and support team to facilitate migration. Prioritize rollout in high-volume, digitally mature markets.

- Initiative:

Launch 'Collider Lab' Incubator for Taco Bell

Expected Impact:High

Implementation Effort:Medium

Timeframe:6 months to first concept test

First Steps:Appoint a dedicated 'Chief New Concept Officer' for Taco Bell. Assemble a cross-functional 'corporate rebel' team. Define the first growth target (e.g., a new breakfast concept, a beverage-focused format).

- Initiative:

Develop an AI-Powered Franchisee Operations Toolkit

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12 months

First Steps:Pilot AI-driven tools for automated inventory, staff scheduling, and predictive maintenance in a select group of franchisee restaurants. Measure ROI in terms of cost savings and efficiency gains.

Experimentation Plan

High Leverage Tests

- Test Name:

Dynamic AI-Powered Menus

Hypothesis:AI-driven menu boards that change based on weather, time of day, and traffic can increase average check size by 5-7%.

Success Metric:Average check size, conversion rate on upsell items.

- Test Name:

Gamified Loyalty Challenges

Hypothesis:Introducing app-based challenges (e.g., 'Try all 3 new LTOs this month') will increase visit frequency by 10% among engaged loyalty members.

Success Metric:Visit frequency, LTO purchase rate.

Utilize A/B testing within the digital ecosystem, comparing test cohorts against control groups. Track key metrics such as order value, frequency, churn, and franchisee-reported profitability.

Run brand-level experiments on a bi-weekly sprint cycle. Corporate innovation lab tests on a quarterly cycle.

Growth Team

A centralized 'Yum! Growth & Innovation' team that supports decentralized, brand-specific growth pods. The central team owns the core technology platforms and experimentation frameworks, while the brand pods focus on specific market and customer initiatives.

Key Roles

- •

Head of New Ventures

- •

Director of AI & Automation

- •

Franchisee Technology Adoption Partner

- •

Lead Data Scientist

Continue to invest in internal training programs, like the AI curriculum developed with Harvard. Actively acquire small, strategic tech companies ('acqui-hires') to bring in specialized talent and technology.

Yum! Brands possesses a formidable growth foundation, built upon a portfolio of iconic global brands and a highly scalable, cash-generative franchise model. The company's future growth trajectory is not one of finding product-market fit, but of strategic evolution to dominate in a digitally-driven QSR landscape.

The primary growth engine is a dual-pronged strategy: aggressive digital transformation of its core business and agile innovation at the portfolio's edge. The push towards a unified digital ecosystem with the 'Byte by Yum!' platform and heavy investment in AI for operational efficiency are critical defensive and offensive moves. These initiatives will unlock new levels of efficiency, enhance the customer experience, and provide a trove of data for personalization.

Simultaneously, the 'Saucy by KFC' concept launch serves as a powerful blueprint for future growth. It demonstrates an ability to innovate rapidly, target new demographics like Gen Z, and leverage existing operational strengths. This 'corporate rebel' model should be replicated across other brands, particularly Taco Bell, to explore new formats and dayparts.

The most significant scale barriers are not capital, but complexity and culture. The core challenge is driving rapid, consistent adoption of new technologies and operational models across a decentralized network of nearly 61,000 franchise locations. Overcoming this will require a masterful blend of technological prowess and franchisee relationship management.

Key growth opportunities lie in three areas: 1) Continued, focused international expansion of KFC and Taco Bell. 2) The incubation of new, high-growth concepts that can become the next pillar of the Yum! portfolio. 3) Deepening the digital relationship with customers to drive frequency and lifetime value.

Recommendation: The strategic imperative is to accelerate the transition to becoming an 'AI-first' restaurant company, as stated by leadership. The North Star Metric should shift to 'Weekly Active Digital Users' to reflect this focus. The highest-impact initiative is the rapid, global deployment of the 'Byte by Yum!' platform, which will serve as the central nervous system for all future growth, from AI-powered drive-thrus to personalized mobile offers. Success for Yum! Brands in the next decade will be defined by its ability to scale digital innovation as effectively as it has scaled restaurants for the last fifty years.

Legal Compliance

Yum! Brands provides a comprehensive, centralized Privacy Policy that covers its global subsidiaries and affiliate brands (KFC, Pizza Hut, Taco Bell, etc.). The policy is reasonably accessible via footer links on its corporate and brand websites. It details the types of personal information collected, purposes for collection (e.g., marketing, service improvement, security), and how it is shared with brands, franchisees, and third-party service providers. The policy explicitly states that data may be transferred to and processed in the United States, which has different data protection laws than other regions. It includes specific sections for residents of various jurisdictions, indicating a structured approach to global compliance. However, the complexity of a single policy covering numerous brands and services could be confusing for a typical consumer trying to understand the practices of a specific brand they interact with. The policy also confirms the 'sale' or 'sharing' of personal information with advertising and business partners, a critical disclosure under modern privacy laws.

A 'Terms of Use' or 'Terms & Conditions' document is present and accessible on the Yum! Brands website. The terms cover essential areas such as intellectual property rights, explicitly stating that graphic images, buttons, and text are the exclusive property of Yum! Brands. It includes a standard disclaimer of liability, stating Yum! will not be liable for damages caused by the use of the website, such as viruses. The terms also contain clauses regarding the unauthorized use of materials, which may violate civil or criminal laws. While standard, the enforceability of certain broad liability disclaimers can be challenged depending on the jurisdiction. The document appears to be geared towards the corporate site's users (investors, media, potential franchisees) rather than end consumers making purchases, for whom separate terms would likely apply on brand-specific transactional sites.

The website employs a cookie consent mechanism that appears upon the first visit. The banner offers options to 'accept all' or manage 'settings,' which aligns with the GDPR requirement for granular consent. A dedicated 'Cookie and Ads Policy' is available, which explains the use of first-party and third-party cookies (like Google Analytics) for purposes such as analytics and remembering user details for forms. The policy provides links and instructions on how to manage or disable cookies in major browsers. This demonstrates a strong foundational approach to cookie compliance. However, the effectiveness hinges on the user interface of the 'settings' panel and whether it defaults to a privacy-protective state (i.e., non-essential cookies are off by default).

Yum! Brands demonstrates a mature approach to data protection by maintaining a global privacy policy with jurisdiction-specific addendums, notably for California (CCPA/CPRA) and Europe (GDPR). The policy addresses key rights such as access and deletion. For California residents, there is a specific 'California Privacy Notice' that details rights under the CCPA, including the right to opt-out of the sale/sharing of personal information. For European data subjects, the policy mentions individual rights under GDPR. However, the company's data protection posture has been tested by significant security incidents, including a January 2023 ransomware attack that exposed employee personal information and resulted in class-action lawsuits. This highlights a critical gap between policy and practice, where the operational security measures in place were insufficient to prevent a major breach, creating substantial legal and reputational risk.